Economic Growth for Sustainable Development: The COVID-19

Pandemic and Tax Instruments

Karlygash Kurbanova

1a

, Gulnara Annakuliyeva

2b

and Tolkyn Zhumadilova

1c

1

Al-Farabi Kazakh National University, 71 al-Farabi ave., Almaty, Republic of Kazakhstan

2

University of International Business, 8A Abai ave., Almaty, Republic of Kazakhstan

Keywords: Tax Policy, Digital Economy, Tax Wallet, Area of Fiscal Contradictions, COVID-19.

Abstract: This article examines the development of the information and communication technologies sector, which

leads to significant to significant changes in economic activity, which requires the introduction of appropriate

government regulation instruments, including tax and customs tariffs. At the current stage, it is significant for

the state to guarantee tax assessment from changing business measures and monetary exchanges.

Simultaneously, computerized innovations are being brought into crafted by assessment and customs

specialists. Taxes increasingly penetrate the digital economy, and digital technologies - into taxation (tax

administration and tax control) in the condition of the COVID-19 pandemic. These correlative and reliant

cycles are outlined by patterns in the advancement of the online exchange area and instances of crafted by

assessment and customs experts in Kazakhstan. This article also examines the Laffer production curve and

the ascending branch of the Laffer tax curve by the value of the area of fiscal contradictions.

1 INTRODUCTION

The current stage in the development of the world

economy is characterized by an increase in the

importance of technology. Technology is

increasingly penetrating the economy, as is the

economy in technology. This new stage is called the

digital economy today.

Currently, digital markets are characterized by

high rates of investment and innovation, leading to

rapid technological advances in industries. The digital

(electronic) economy, characterized as an economy

described by the greatest fulfillment of the

requirements of every one of its members using data,

including individual data, ended up being

exceptionally important in 2020, when the worldwide

local area confronted the COVID-19 pandemic.

Because of the advancement of data, correspondence

and monetary advances, just as the accessibility of

framework, which together give the chance of full

collaboration in a half and half universe of all

members in financial action: subjects and objects of

the cycle of creation, dissemination, trade and

a

https://orcid.org/0000-0003-3380-0488

b

https://orcid.org/0000-0002-8484-9743

c

https://orcid.org/0000-0002-0903-4819

utilization of products and ventures, states have

managed to maintain a certain stability.

The arrangement of the advanced economy

decides the requirement for suitable turn of events

and improvement of the cycles and instruments of

state guideline. World Bank specialists think about

the computerized economy (in the wide feeling of the

word) as “a system of economic, social and cultural

relations based on the use of digital information and

communication technologies” (World Bank, 2016).

The main features of the digital economy are

determined by the following: - economic activity is

focused on the platforms of the “digital” economy; -

personalized service models; - direct interaction

between producers and consumers; - the spread of the

sharing economy; - the significant role of the

contribution of individual participants (Keshelava et

al., 2017).

The USA, European developed countries and the

BRICS nations are sequentially in front of

Kazakhstan in the authoritative and administrative

guideline of projects for the computerized change of

the economy overall by 2-3 years or more. The state

130

Kurbanova, K., Zhumadilova, T. and Annakuliyeva, G.

Economic Growth for Sustainable Development: The COVID-19 Pandemic and Tax Instruments.

DOI: 10.5220/0010587201300137

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 130-137

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

program "Digital Economy of the Republic of

Kazakhstan" was approved in 2017. Accordingly,

there is a lead in the combination and usage of

instruments of state guideline of the economy

changing towards digitalization (advancement of data

and correspondence innovations) (Decree, 2017).

Epistemologically, notwithstanding, just as

ontologically, a brought together way to deal with the

meaning of the advanced economy has not been

framed. Presumably, it can't be framed, however the

current methodologies are fairly obscure. It is

imperative that alongside the expression “digital

economy”, today such definitions as electronic

economy, information economy, network economy,

Internet economy are in use.

Ontos qualifies the computerized economy as a

different area of the economy, where conventional

monetary relations are adjusted with the assistance of

new electronic, data and correspondence

advancements, better approaches for getting sorted

out creation, plans of action are presented, business

measures are changed, and electronic merchandise

and enterprises show up. The zone of tax collection,

charge strategy and customs and levy guideline is no

special case, and even, despite what is generally

expected, requires need consideration. Assessments,

expenses and customs obligations, just as systems for

their organization, should be predictable with the

changing industry cycles and advances of monetary

exchanges. In most countries, the COVID-19

coronavirus pandemic has resulted in a significant

reduction in tax revenues. This is directly related to

the decline in economic activity, and indirectly to the

response measures of tax policy and administration.

The impacts faced by households and businesses are

leading to a disruption in economic activity that is

unique to the current crisis. For example, the need for

social distancing is reflected in different ways in the

tax base, tax administration and tax compliance by

taxpayers. In addition, a pandemic could have a more

lasting impact on the structure of the economy. The

external sectors of the economy of some countries

may also be hit, leading to depreciation or devaluation

of currencies, and possibly affecting tax revenues.

The manifestation of this impact will depend on the

structure of the economy.

In the field of tax policy and customs and tariff

regulation of the digital economy, it is necessary to

highlight two key areas: 1) taxation and customs and

tariff regulation of activities in the advanced economy

and 2) the presentation of advanced innovations in

expense and customs organization and control. We

will investigate these zones.

In Kazakhstan, computerized advances are being

presented in assessment and customs organization in

order to create comfortable conditions for taxpayers,

reduce corruption and ensure revenues to the

country's state budget.

Long before the start of the pandemic, the State

Revenue Committee of the Ministry of Finance of the

Republic of Kazakhstan and its territorial bodies in

the course of tax administration began to widely use

various online tools and resources, that allowed:

contactless exchange of documents with

taxpayers via telecommunication channels

(TCh), including receipt of tax returns, sending

requests for documents and receiving answers to

them with documents, as well as many other

operations;

provide an effective and contactless interaction

via telecommunication channels (TCh) between

tax authorities and banks;

carry out non-contact tax control for a number of

taxpayers in the form of tax monitoring, which is

a method of extended information interaction

based on remote access to the taxpayer's

information systems, which, inter alia, provides

the tax authority with current access to

accounting and tax accounting data, taxpayer

reporting in agreed formats.

In general, online tools and resources allow to use

the automated information system (AIS) of tax

administration, which ensures the automation of the

activities of the SRC of the Ministry of Finance of the

Republic of Kazakhstan for all functions performed,

including the constant pre-verification analysis in

order to promptly identify signs of tax violations. The

work of the system is aimed, among other things, at

the crossing of commodity and cash flows, tracing

family, corporate and labor ties, the repeatability of

IP addresses, and identifying other signs of

connectedness of participants in civil circulation.

During the fight against the pandemic, the State

Revenue Committee of the Ministry of Finance of the

Republic of Kazakhstan also quickly launched new

online services that allow:

- to find out information on what kind of help a

business can get (this is only required to enter the

taxpayer's IIN);

- to be able to check the existence of reasons for

obtaining a deferral or installment plan for the

payment of taxes;

- to check the taxpayer for the extension of the

moratorium on bankruptcy;

Economic Growth for Sustainable Development: The COVID-19 Pandemic and Tax Instruments

131

- to read the answers to frequently asked questions

about tax deferrals / installments related with

COVID-19.

As Ruslan Ensebayev said, “Today, thanks to the

systematic work carried out by the Ministry of

Finance of the Republic of Kazakhstan, there is an

opportunity to pay taxes alternatively by replenishing

the “Tax Wallet”. This service provides the taxpayer

with information about his current and forthcoming

obligations with the budget. Money from the “Tax

Wallet” is automatically credited to the

corresponding taxes for which tax liabilities have

arisen. At the same time, the details of payment of

taxes are filled in automatically without being

indicated by the taxpayer, which ensures their

guaranteed delivery” (Official information resource

of the Prime Minister of the Republic of Kazakhstan,

2019).

The new service, in contrast to the existing

services for debt or upcoming payments, makes it

possible to replenish funds to uniform details, enable

the option of automatically debiting funds from the

“Tax Wallet” balance and receive notifications about

debiting. The mobile version of the “Tax Wallet”

operates on the e-Salyq platform of the State Revenue

Committee of the Ministry of Finance of the Republic

of Kazakhstan, and will also be launched on the

electronic government portal (egov.kz) and in the

mobile application of Halyk Bank of Kazakhstan JSC

(Homebank), and this service will also be

implemented in the Kaspi.kz mobile application (BIC

– Capital, 2019).

The advancement of advances today leads in the

field of tax collection to two reciprocal, however

inverse in heading, measures: from one viewpoint,

there is a decrease in the shadow area because of the

mechanical improvement of expense control and duty

organization, and on the other, an expansion in the

volume of this shadow area in uncontrolled or

inadequately controlled structures exercises.

The expanded volume of advanced exchanges and

administrations in electronic structure, the rise of

digital currencies, semi cash, the improvement of the

Internet of Things right now without fundamental and

adequate government guideline lead to an increment

in the volume of the shadow area of the economy,

which contrarily influences the income segment of

the spending plan. Truth be told, today it is the

advanced economy that can be perhaps the most hazy

areas of the economy, alongside even criminal

operations (Pugachev, 2016).

Notwithstanding, it is absolutely the advancement

of information preparing innovations, the rise of

blockchain that open up promising circumstances for

utilizing worked in apparatuses for state guideline of

the economy, specifically burdens, charges, customs

obligations. For instance, today the blockchain

permits the usage of supposed shrewd agreements, or

keen agreements, or, all in all, gets, the end and

execution of which happens naturally just upon the

event of foreordained conditions. In such manner, the

truth of the exceptionally not so distant future might

be the programmed assortment of assessments,

expenses and customs obligations speedily at the hour

of usage of smart agreements. The acquaintance of

this innovation contributes with an adjustment in the

key standard of assessment assortment: the estimation

and installment of duties will happen naturally at the

hour of the exchange or exchange on the web, and not

during the expense time frame. These possibilities

will diminish the expenses of assessment

organization and duty bookkeeping, both for the state

and for citizens. The last won't need to compute

charge bases, produce affirmations, round out

installment orders toward the finish of the time frame,

or affirm the need to give an allowance. Tax

avoidance will get incomprehensible, and tax

assessment overall will turn out to be more

straightforward and require lower costs for the state

and business.

An integral element of tax forecasting is the

economic analysis of tax revenues both in general and

by their individual types, the subject of which is not

only the amount of taxes received and their dynamics.

It is more important to analyze trends in the

development of the tax base and its constituent

elements, and the structure of taxpayers. It should be

borne in mind that each tax has its own, special

elements of the taxable base and its defining

indicators, but individual elements of the taxable base

are inherent in two or more types of taxes at once. Tax

forecasting is based on a factor analysis of the

dynamics and trends of the tax base as a whole and

individual elements that make up it.

The changes taking place in the country's

economy, its exit from the crisis, the solution of the

problems of non-payments to the budget and

economic entities to each other predetermine the

possibility of clarifying the accents in the assessment

of factors affecting the taxable base, the appearance

of its other elements and characteristics. So, in 2003

E. Balatsky suggested that the fiscal Laffer curve,

which describes the dependence of the volume of tax

revenues on the tax burden, is not sufficient to

understand the effectiveness of fiscal (tax) policy

(Balatsky, 2003). The area of fiscal contradictions

(AFC) is the symbolic distance between the Laffer

points of the 1st and 2nd kind.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

132

For a deeper analysis, it is necessary to consider

another curve - the production Laffer curve, which

describes the dependence of the volume of production

(GDP) on the tax burden. A joint examination of the

two curves provides a fresh look at the effectiveness

of fiscal policy (Shcherbakov, 2019).

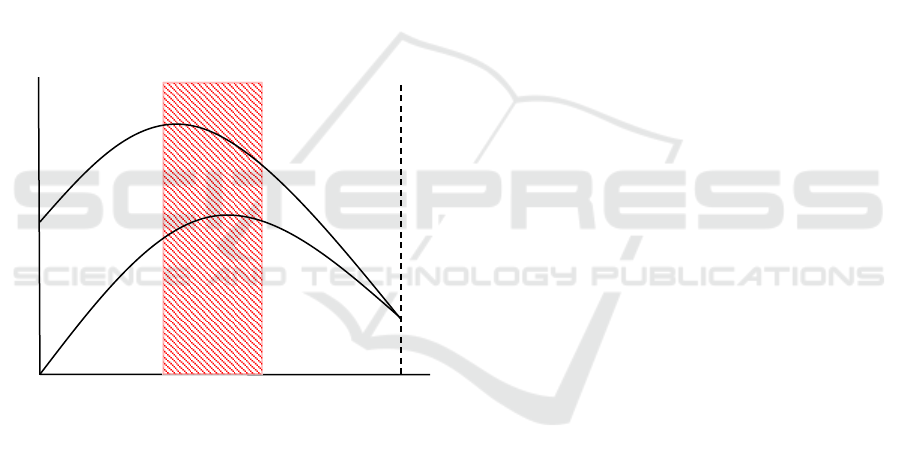

In Figure 1, the size of the fiscal “gap” Δq outlines

a certain band (indicated by shading), which is called

the AFC and has important properties. In the AFC,

there is fiscal antagonism: an increase in the tax

burden is “useful” to the budget and, consequently, to

the state, but extremely “harmful” to the producer, i.e.

the interests of one economic agent are achieved by

infringing on the interests of another agent. This

automatically follows from the fact that the

downward branch of the Laffer production curve and

the upward branch of the Laffer tax curve are

involved in the AFC. Thus, the AFC is a values zone

of the tax burden, in which the interests of the

producer and the state are in conflict (Balatsky,

2016).

Figure 1: Schematic representation of the area of fiscal

contradictions.

The introduction of the AFC into consideration

brings in a new understanding of the effectiveness of

fiscal policy: the wider the width of this zone, the

greater the antagonism between the stimulating and

fiscal functions of the country's tax system and the

less chances to eliminate this antagonism.

In later years, the AFC has been subject to

rethinking and various interpretations. So, in 2010

professor I. Maiburov interpreted the AFC as a kind

of tax trap (Maiburov et al., 2010).

In particular, a fiscal policy in which the tax

burden is higher than the Laffer point of the 2nd kind

(q>q**) is classified as a major tax trap, and a policy

in which the tax burden is within the AFC

(q*<q<q**), is treated as an additional tax trap.

The concept of the AFC is of limited scope; it is

mainly used in the analytical practice of economists

from Kazakhstan, Russia, Ukraine and Georgia. This

state of affairs is largely due to criticism of the

concept of the Laffer curve, which underlies the

concept of the AFC.

In 2017, as per the European Commission, the

powerful duty rate for computerized business was

around 8.5%, while for business in general - 20-23%.

At the state level, this translates into a huge drop in

tax revenues, accounting for 12 to 15% of digital

business volumes, respectively (Volovik, 2017).

In the event that we make an interpretation of this

pattern into information on the volume of Web trade,

for instance, the examination

"DigitalEconomyCompass 2020", utilizing the

supposition that there are no distinctions in the level

of the taxation rate, incidentally, the potential duty

incomes in the EU could add up to 40-50 billion

dollars each year, in Ukraine - up to 0.24-0.3 billion,

in Kazakhstan - up to 3.36-4.2 billion dollars each

year (DigitalEconomyCompass, 2020). What's more,

in the event that the portion of "uncontrolled" internet

business develops, these volumes of lost duty

incomes will likewise develop. Furthermore, that is

simply web retail. What other duty potential is

covered up by the remainder of the computerized

economy?

The EU is creating instruments to improve charge

proficiency while guaranteeing decency and uniform

monetary standards for both customary and advanced

organizations. Among the potential ways to deal with

taking care of this issue are thought of:

introduction of charges on the turnover of an

advanced organization,

taxation of pay from the arrangement of

computerized administrations,

taxation of computerized deals.

The experience of the Republic of Belarus, which

is a leader among the CIS countries in the

development of the field of information and

communication technologies, is of interest for

research and practical application. In Belarus, income

from electronic interactive games is taxed. In 2019,

the Tax Code of the Republic of Belarus fixes such

categories as “electronic wallet”, “electronic money”,

“provision of services in electronic form”

(Pekarskaya, 2018).

The portrayed inclinations are not a removed

endless future - partially, this is now a reality.

According to the Association of Internet Trade

Companies, in 2019 in Kazakhstan online trade

turnover exceeded 700 billion tenge, which is 1.8

0 q* q** 1 q

Y

T

Economic Growth for Sustainable Development: The COVID-19 Pandemic and Tax Instruments

133

times more than in 2018 - 269 billion tenge, which is

already about 7% of the retail turnover. trade.

According to forecasts, by 2023, the online retail

market, the turnover of global e-commerce is

expected to reach 2.7 trillion dollars. In this regard,

taxation and control of the digital economy are

already the challenges of today for tax and customs

authorities.

In e-commerce itself, the demand for

marketplaces is growing. Vivid examples are the

electronic platforms Alibaba and Amazon, which

occupy about half of the online markets in China and

the United States. Another e-commerce trend is

purchases primarily through smartphones. The share

of buyers who place orders using smartphones

worldwide is 54%. In Kazakhstan, this indicator

approached 65%.

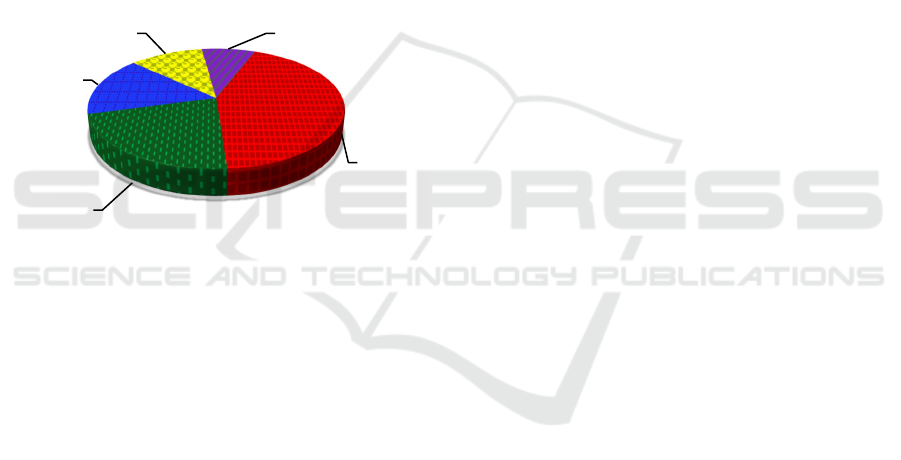

Figure 2 shows the major players in this sector.

Figure 2: E-commerce market - fashion (clothing and

footwear).

The largest online stores in Kazakhstan generate

more than $200 million in revenue. There are also

industry leaders on the domestic Internet. One of

them, with a turnover of $120 million, was the

segment of the sale of air and railway tickets.

AirAstana is still the largest player here (71%). The

second place is taken by Kazakhstan Temir Zholy

(KTZh) with a share of 13%, the third is Aviata (6%),

the fourth is Chocotravel (4%). Another major

segment of the e-commerce industry is fashion

(apparel and footwear). The turnover here is $136

million (Kuzhukeeva, 2016).

2 METHODS AND TYPES OF

TAXATION

Consumer protection and competition law does not

consider the digital economy sector as special, for

which there are separate requirements or exceptions.

And thus, there are currently no special taxes for

digital businesses in Kazakhstan. Legal digital

businesses work according to the current tax laws.

The State Revenue Committee of the Ministry of

Finance of the Republic of Kazakhstan in the taxation

direction of the digital economy has taken a

noticeable step: it introduced tax administration of

foreign suppliers of electronic and Internet services

since 2017. Now they are tax-registered and pay VAT

in the Republic of Kazakhstan.

The introduction of digital technologies by tax

and customs authorities is aimed at increasing the

efficiency of the implementation of control and

supervisory functions. The transformation of cash

register equipment monitoring is also successful.

With the help of the widespread introduction of

online cash registers, today the State Revenue

Committee (SRC) of the Ministry of Finance of the

Republic of Kazakhstan has at its disposal data across

the country on all deals separated by merchandise.

This gives new freedoms to burden organization and

control. In fact, the State Revenue Committee (SRC)

of the Ministry of Finance of the Republic of

Kazakhstan has moved from particular control to

consistent checking. What's more, this is as of now a

change in outlook in the control capacity of the

assessment specialists. The customary way to deal

with charge control, which was utilized until the mid

2000s, included checking every citizen once at

regular intervals. The cutting edge approach is now

founded on the investigation of large information. It

includes the danger division of citizens, a huge

decrease in the portion of on location examinations,

while taking a stab at complete inclusion of all

citizens by controller, while two citizens out of 1000

fall straightforwardly under charge audits (both

cameral and on-site). Consequently, the portion of

yearly investigated citizens has diminished multiple

times. Obviously, the decrease in charge reviews is

now the aftereffect of checking and rehearsing

infringement of assessment enactment along with

citizens by submitting remedial government forms.

Simultaneously, charge observing isn't an

advancement of the Kazakh charge specialists: since

the start of the 2000s, applicable instruments have

been effectively presented in evolved nations, the

Netherlands and the UK were among the first on this

way (Pugachev, 2016).

The development of electronic channels of

interaction with taxpayers is one of the key and

successfully implemented areas in the work of the

State Revenue Committee of the Ministry of Finance

of the Republic of Kazakhstan. Currently,

Kazakhstan has a large number of electronic tax

services, including: “Personal account of the

Lamoda

with a

share of

43%

OTTO

Kazakhsta

n 22%

Wildberries

16%

AliExpres

s 11%

KupiVip

8%

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

134

taxpayer” on the website salyq.kz, “Electronic

government” on the website egov.kz, “API services

of the Ministry of Finance of the Republic of

Kazakhstan”, “Mobile application of the portal of the

SRC – eSalyq” is published on the AppStore and

PlayMarket (Official Internet resource of the State

Revenue Committee of the Ministry of Finance of the

Republic of Kazakhstan, 2020).

Among the areas implemented by the State

Revenue Committee of the Ministry of Finance of the

Republic of Kazakhstan, it is necessary to separately

emphasize the development of a mechanism for

tracing the movement of goods from the customs

border of the EAEU to the phase of their execution,

just as the advancement of the foundation of naming

of products pointed toward forestalling the avoidance

of obligations and contributing, in equal, to

expanding the assortment of expenses and extract

charges. The improvement of electronic announcing

appears to be encouraging - customs freedom of

products by means of the Web, when electronic

archives are sent straightforwardly from the

declarant's workplace directly to the customs

inspector via remote channels.

Mukhambetov et al. (2020) in their study

examined the analysis of financial indicators used to

assess the sustainability of companies.

3 RESULTS AND DISCUSSION

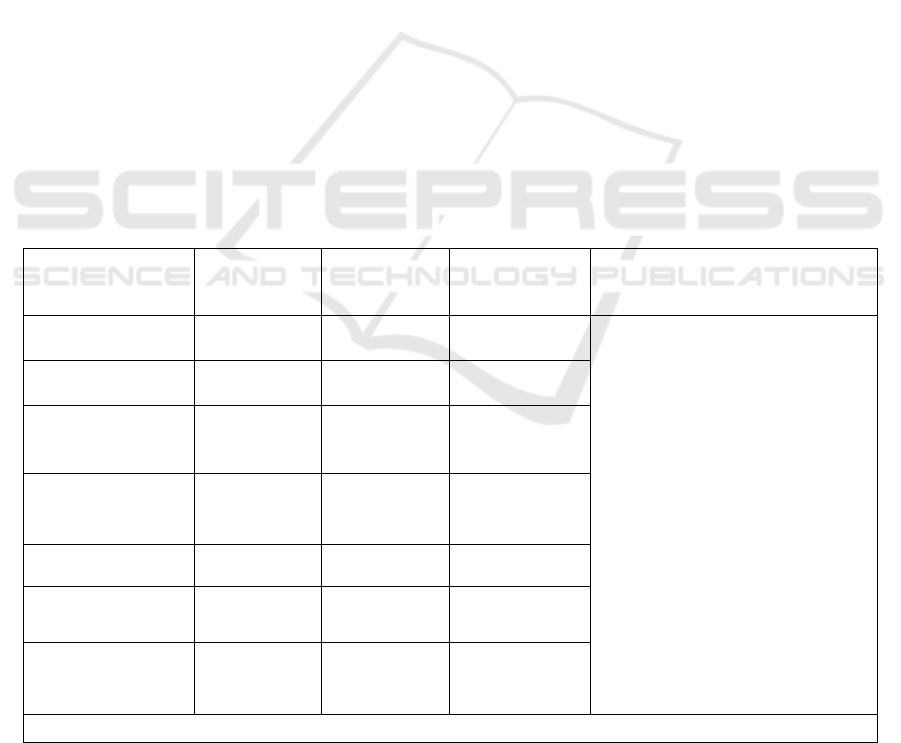

According to the Decree of the Government of the

Republic of Kazakhstan №721 dated October 30,

2020, the period of exemption for the obligation to

calculate (accrue) compulsory professional pension

contributions (CPPC), social security contributions

(SSC), contributions to compulsory social health

insurance (CSHIC and CSHI), with the exception of

those paid by an individual entrepreneur for himself,

was extended until January 1, 2021 (table 1).

The increase in profits in the field of e-commerce

made domestic lawmakers think about the

introduction of a new duty. The Majilis of the

Parliament of the Republic of Kazakhstan approved a

package of amendments to legislation on taxation and

improving the investment climate. Within its

framework, in particular, it provides the introduction

of taxation of foreign companies engaged in

electronic commerce and providing services via the

Internet to citizens of Kazakhstan - the so-called “tax

on Google”. Market experts are unanimous in the

opinion that the developed concept of “tax on

Google” is a response to modern trends in the

development of digital business models and is

consistent with international practice of taxation of

digital activities.

Table 1: Detailed table on tax and deduction rates for the period from April 1, 2020 to January 1, 2021.

Taxes and social

payments

Until April 1,

2020

From April 1

to September

30, 2020

From October 1,

2020 to January

1, 2021

Who is eligible for exemption?

Individual income

tax

10,0% 0,0% 10,0%

Individuals in private practice;

Subjects of micro, small,

medium-sized businesses, carrying

out activities according to the list of

types of activities approved by the

Government of the Republic of

Kazakhstan;

Subjects of large business

carrying out activities according to

the list of types of activities

approved by the Government of the

Republic of Kazakhstan.

Compulsory pension

contributions

10,0% 0,0% 10,0%

Compulsory

professional pension

contributions

5,0% 0,0% 0,0%

Compulsory social

health insurance

contributions

1,0% 0,0% 0,0%

Social tax 9,5% 0,0% 9,5%

Social security

contributions

3,5% 0,0% 0,0%

Compulsory social

health insurance

2,0% 0,0% 0,0%

Note - compiled by the authors based on data from PwC Kazakhstan

Economic Growth for Sustainable Development: The COVID-19 Pandemic and Tax Instruments

135

If the conditions of taxation in Kazakhstan are

met, foreign companies will be obliged to calculate

and independently pay VAT to the Kazakhstan

budget at a rate of 12% of taxable turnover. A

mechanism for fulfilling VAT obligations is also

being developed. Presumably, there will be special

conditions for the registration of such taxpayers.

By the way, in neighboring Russia, where the “tax

on Google” was introduced back in June 2016, the

rates are higher. For foreign organizations that

provide electronic services, the sale place of which is

Russia, there is a special procedure for taxing VAT.

In particular, since 2019, the VAT rate has been set at

16.67% of the remuneration for electronic services,

which includes VAT, and a simplified procedure for

declaring VAT and specifics of paperwork that allow

Russian buyers to accept input VAT as deduction.

4 CONCLUSIONS

Modern regulatory regulation of the digital economy

in Kazakhstan is based on the regulation of the

traditional, non-digital economy. In general, the state

of legal regulation of the digital economy is critically

assessed by experts. There is an obvious backlog of

legal regulation from the needs of practice (in

particular, against the background of the COVID-19

pandemic), and the time gap is increasing.

In this way, the digitalization of the economy,

from one viewpoint, requires the advancement of

methodological and lawful help for tax assessment

from computerized business, and then again, the

utilization of computerized advances opens up

expansive possibilities for improving the devices of

control exercises of expense and customs

administrations.

This is proof of a specific rationalization: charges

in the computerized economy and advanced

innovations in tax assessment. It incorporates shared

turn of events, and complementarity, and reliance -

the famous "cat and mouse" of duty specialists and

citizens. The impact here is gotten by all members in

relations - citizens by upgrading the duty base in

unregulated businesses, the state - by decreasing the

unregulated and shadow areas by improving

assessment organization and expense control

advancements. Simultaneously, the potential for both

duty enhancement and expanding charge incomes to

financial plans stays huge, since the cycle is simply

starting.

Kazakhstan, on the way to the formation of

taxation of the digital economy, needs to understand

the experience of developed countries that have

already implemented certain instruments, as well as,

within the framework of integration processes in the

EAEU, to study the possibility of harmonizing tax

and customs and tariff regulation of the digital

economy of the Union countries.

REFERENCES

Balatsky, E.V. (2003). Analysis of the Tax Burden Impact

on Economic Growth through Production and

Institutional Functions. Problems of Forecasting, (2):

88-105.

Balatsky, E.V. (2016) Area of fiscal contradictions.

Encyclopaedia of the Theoretical Foundations of

Taxation, pages 111–114.

Business Information Center - Capital. Source:

https://kapital.kz

Challenges in Forecasting Tax Revenue. Special Series on

Fiscal Policies to Respond to COVID-19. www.imf.org

Decree of the Government of the Republic of Kazakhstan

dated December 12, 2017 No. 827 “On approval of the

State program “Digital Kazakhstan” (with amendments

and additions as of 01.10.2020)

Digital Economy Compass. Statista. [Electronic resource].

URL: http://staticstatista.com

Keshelava, A. V., Budanov, V. G., and Rumyantsev, V. Yu.

(2017). Introduction to the Digital Economy. On the

verge of the “digital future”. Book one. M.: VNII

Geosystems.

Kuzhukeeva, K.M. (2016). Overview of the e-commerce

market in Kazakhstan, (25): 269-273.

Maiburov, I.A., Ivanov, Yu.B., Pogorletsky, A.I.,

Sokolovskaya, A.M., Krisovatyi, A.I., and others, U.

(2010). Tax policy. Theory and practice: a textbook for

undergraduates studying in the specialties “Finance and

Credit”, “Accounting, Analysis and Audit”, “World

Economy” / Ed. I.A. Maiburov. Unity-Dana.

Mukhambetov, T., Yerdavletova, F., Kurbanova, K.,

Mukhametzhanova, Z., and Sadvakassova, K. (2020).

Analysis of financial indicators used to assess the

sustainability of companies. In E3S Web of

Conferences, 208: 03049.

Official information resource of the Prime Minister of the

Republic of Kazakhstan. (2019) Source:

https://primeminister.kz

Official Internet resource of the Committee for State

Revenues of the Ministry of Finance of the Republic of

Kazakhstan. SRC MF RK: [Electronic resource]. URL:

http://kgd.gov.kz/ru

Pekarskaya, A.Yu. (2018) Specific of taxation surveillance

in the context of digital economics development.

Belorusskiy ekonomicheskiy zhurnal – Belarusian

Economic Journal. 1 (82): 84–96.

Pugachev, A.A. (2016). Implementation of the control

function in the management of the tax potential of the

region. Social and Humanitarian Knowledge, 2(3):

187-194.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

136

Shcherbakov G.V. (2019). Laffer points, area of fiscal

contradictions and taxpayers’ acceptance power.

RUDN Journal of Economics, 27(1): 49—62.

Volovik, E. (2017). Taxation of the digital economy. What

problems does digitalization entail? Financial

newspaper, 48.

World Development Report. (2016). Digital dividends. The

World Bank: [Electronic resource]. URL:

https://openknowledge.worldbank.org

Economic Growth for Sustainable Development: The COVID-19 Pandemic and Tax Instruments

137