Technical Due Diligence as a Methodology for Assessing Risks in

Start-up Ecosystems

Iván Sanz-Prieto

1a

, Luis de-la-Fuente-Valentín

1b

and Sergio Rios-Aguilar

2c

1

Universidad Internacional de La Rioja, UNIR, Madrid, Spain

2

Dept. of

Organization Engineering, Business Administration and Statistics, Universidad Politécnica de Madrid (UPM),

Madrid, Spain

Keywords: Technical Due Diligence, Risk, Start-ups, Software, Business Model.

Abstract: The dynamics of transformations that the world is experiencing at global dimensions due to the intensity of

technological changes demand sophisticated management tools to assess risks in the business and industrial

sectors, aimed at ensuring investment security. The objective of this article is to analyse and propose the

technical Due Diligence as a methodology to assess risks in Start-up ecosystems. The method used was mixed;

a quantitative approach, and the qualitative approach, supported by a literature review with bibliographic

arches. The sample was composed of thirty (30) experts, to whom a survey was applied, and to (10) of them,

an interview that was subjected to a process of triangulation of the information, which was supported by

documentary arches. The results showed the need to identify technological risks (product, service and

process); commercial risks regarding the scalability of the business; and financial, legal, fiscal and

environmental risks as part of a comprehensive and integral procedure.

1 INTRODUCTION

In the Due Diligence process, it has been used as part

of a set of good practices when developing

assessment procedures on the behaviour of marketing

activities in the markets, where entrepreneurs,

investors, suppliers, customers and competitors are

involved and who are about to sign purchase and sale

contracts, here these operations are evaluated in terms

of legality, requirements, financial management and

physical conditions of the property before executing

the transactions, which are subject to regulatory

compliance.

For example, many organizations engaged in

foreign trade must be reviewed with the rigorousness

of the case with a detailed analysis, to rule out the

existence of sanctions and penalties by any of the

international bodies with the capacity to catalog

fraudulent operations, which constitutes a significant

risk, which must be weighed at the time of making a

decision by the investor; the objective is to limit the

risks at all costs to protect it from unforeseen costs.

a

https://orcid.org/0000-0002-5643-4946

b

https://orcid.org/0000-0001-9727-315X

c

https://orcid.org/0000-0003-0225-6598

For its part, the technical Due Diligence in

Kiziniewiez's speech quoted by (Kutera and Anysz,

2016) "comprises three detailed analyses of the

property: legal, technical, financial". It is usually

associated with the valuation of a property (land,

infrastructure, buildings, machinery, equipment,

systems, products, services or processes), but also

emphasizes patents, trademarks, intellectual property,

reservation of title, among others, it is an essential

methodology for making business and industrial

decisions, which involves the detection of risks in the

present and future before a possible transaction or

commercial operation involving large capitals.

Now, this technical due diligence methodology

plays a relevant role in the Start-ups ecosystems,

business model that from the industry and

globalization 4.0 as phenomena in full effervescence

"focused on artificial intelligence, nanotechnologies,

the internet of things, digital skills, creativity (...)"

(Arévalo and Fuenmayor, 2020), are built from the

acceleration in the technological and digital

revolution for transformation, which can reuse

technologies, this is precisely what entrepreneurs take

Sanz-Prieto, I., de-la-Fuente-Valentín, L. and Rios-Aguilar, S.

Technical Due Diligence as a Methodology for Assessing Risks in Start-up Ecosystems.

DOI: 10.5220/0010521704210428

In Proceedings of the 23rd International Conference on Enterprise Information Systems (ICEIS 2021) - Volume 2, pages 421-428

ISBN: 978-989-758-509-8

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

421

advantage of, they take the current trends, study them

rigorously, measure the impact it will have, the

evolution, projection and the way the product or

service is adapted to the changes to come, Here

investors capture these initiatives to obtain great

economic benefits, for this, they must make sure of

the business opportunities, physical characteristics,

property, code, systems, the risks that surround it and

other aspects to avoid defects that lead to financial

losses.

This article focuses its efforts on analyzing and

proposing the technical Due Diligence as a

methodology to assess risks in Start-up ecosystems,

since these business initiatives are loaded with

exponential digital technologies represented in a set

of technical specifications that require to be detailed

with the rigorousness of the case by a

multidisciplinary and interdisciplinary team of

experts in various areas to know the operation of the

product, services or processes that will be offered in

the market by investors, hence the importance of the

methodology within the transaction process to

materialize a purchase-sale contract, this tool

provides good management practices that provide

reliability and impartiality.

This paper is structured as follows. Section 2

describes the existing literature on Technical Due

Diligences and Start-ups. Section 3 is oriented to

explain the research method used to obtain the results.

Section 4 shows the results and the proposed

methodology (TDD). Last, section 5 explains the

conclusions reached after carrying out the research.

2 TECHNICAL DUE DILIGENCE

AND START-UPS

The Technical Due Diligence, methodology oriented

to a verification or audit on a property or asset,

whether tangible or intangible, the conditions in

which they are (state in physical terms and operation),

the market price after determining the depreciation if

any, in short, all the attributes that characterize it.

Technical Due Diligence is a "process of analyzing

the technical aspects of a product or service. It usually

takes place before fundraising rounds and mergers

and acquisitions. These complex transactions require

strict due diligence investigation (...)" (Gilmanov,

2019).

From another point of view, this methodology is

used when a process of buying and selling any real

estate is underway, where it is essential for the

investor to know, unravel and manage in advance the

different technical risks that could influence the

commercial operation (Aguirre and Baeza, 2019).

The purpose of this method is basically to know

from a technical point of view the entire life cycle

through which the property has gone through (design,

maintenance and operation), to ensure the investor

that the possible risks that are being generated are

detected in time, which for the purposes of this article

is based on the Start-ups ecosystems, loaded with

technological platforms (servers) and systems

(software), from here will focus on this type of assets

with tangible and intangible qualities, which require

specifications, source code, patent, originality in the

production of software and many other features,

which will provide sufficient guarantees to make a

decision on the business.

The Technical Due Diligence must contain the

following aspects: identify in sufficient detail the

tangible or intangible asset, general description and

where it is located within the company, location

(equipment, machinery, platform, server, software or

system); check the physical conditions of the asset

(state of preservation, useful life); verify the conditions

of updating (applies to intangible assets); reports on

maintenance, rehabilitation and/or updating that have

been practiced during the useful life; verify the

necessary technical documentation (compliance with

regulations): patents, licenses, source codes, permits,

rights, approvals, homologations, accessibility,

insurance, backup, etc. determine the value, bearing in

mind the quantification of costs for repairs or

improvements, if any; identify and assess the potential

risks that could arise from technical defects, in order to

reduce them as much as possible in the event of a

possible investment.

The objective of this methodology is to have a

technical inspection report executed by a team of

specialized professionals, who have the task of

performing a detailed diagnosis and prognosis on the

current conditions of a given asset, product, service

or process promoted by Start-ups ecosystems,

identifying existing weaknesses, leading to a proposal

for readjustment, repair or improvements to obtain

the real value in the market. Next, the phases or stages

of the usual Technical Due Diligence process were

analyzed from the perspective of (Gilmanov, 2019):

1. Kick-off Call: the starting point for a technical

process, usually resulting from a preliminary

contact between the interested parties, with the

purpose of specifying the scheduling (work

schedule / roadmap) of the time to materialize

each of the activities, tasks, requirements and

steps to be addressed by an independent team of

subject matter experts.

ICEIS 2021 - 23rd International Conference on Enterprise Information Systems

422

2. Documentation Review: before performing an

on-site verification of the asset, product, service

or process, the team of experts is given the task

of backing up all existing documentation

correctly (architecture, design, processes,

backup and recovery, monitoring, servers),

which will serve as input to develop the

respective analyses.

3. On-site Due Diligence / Remote Call: in this

opportunity, investors require a live meeting to

take place in the facilities where the property is

located, it is a sine qua non condition to know

primary sources, all the technical parts of the

asset, product, service or process, especially the

operation of each component that integrates it,

usually occurs in a session of 1-2 days.

4. Follow-up: this research stage starts with a

number of questions related to the conditions,

functioning and technical operation of the

property: originality, patents, licenses,

programming codes, etc., which must be clarified

in different sessions and interactions between the

parties involved in the process per se.

5. Report: the team of independent experts

proceeds to set out in a final document all the

advantages and disadvantages that were

obtained from the technical verifications of the

property under verification, with the objective

that investors have enough data in a report at a

rigorous level of detail to make a decision with

reliable and trustworthy information.

With these steps is that a technical investigation is

achieved, which starts with an initial contact between

the interested parties and the independent team of

professionals that is hired, at this stage the general

guidelines of the study are addressed, in addition to

the particularities that the investor demands about the

current state of the property that is being subjected to

technical verification, all doubts are dispelled in a

preliminary time about any factor that the experts

consider relevant.

Start-ups, as a new concept that emerges from the

recurrent advances achieved by the computer and

technological era, which has been able to mutate in a

dizzying way from one invention to another, but this

has multiplied in the first two decades of this century,

to an unimaginable level of evolution, where all those

areas and sectors that act in the markets were adapting

according to the possibilities, acquiring advanced

equipment to manage organizational processes, began

a culture of innovation from the trends of the so-

called technological revolution, elements that

improve productivity and competitiveness.

Harvard professor and Silicon Valley American

entrepreneur Steve Blank defined start-ups as a

"temporary organization that aims to pursue a

repeatable and scalable business model" (Blank,

2010). This type of entrepreneurship as a business

model can adopt a transitional condition for the

development of a product or service that has the

quality of remaining in operation in the market as

many times as necessary, and whose characteristic is

to achieve profitability and constant benefit, making

it capable of progressing over time by generating

added economic and social value, an idea that can be

replicated in other niches by making tropicalizations

and adjustments on the culture of a locality until it is

strengthened as a solid company.

They are temporary organizations as they are

focused on a necessary stage of transaction,

peremptory period to accommodate within the

segment where it operates, while achieving the

objectives of the business model, performing for this

the execution of a number of processes and actions so

that it can evolve to another level (scaling), which

avoids stagnation or stagnation on these products and

services that will be repeatable and may also have a

level of unmatched acceptance to the influence of

digital technologies, being profitable for the market

that has been arranged.

In this regard argues (Reis, 2012), that it is an

organization of people with different expertise in

different areas that merge to exploit creativity and

explore the intentionality of developing a new

product or service in an environment of maximum

risk, volatility and uncertainty, as exogenous

variables that entrepreneurs must manage

information about the market segment to manage

these natural distorting agents.

The concept of Start-ups is built as a venture in an

ecosystem based on technological advances and

knowledge management as two components that

provide the foundations for a new business to emerge,

it is an articulated symbiosis that combines know-

how with new digital technologies to develop

exponentially competitive initiatives from the

transformation of intellectual and digital capital,

creating useful products and services for consumers.

However, this approach necessarily involves

knowing and managing information about the

variables and dimensions that act within the complex

environment (market volatility), since this model

requires fusion activities between the knowledge of

the different visions of the team, creativity combined

with technologies to obtain originality in the idea as

Technical Due Diligence as a Methodology for Assessing Risks in Start-up Ecosystems

423

an innovative and often renovating venture, since it is

also possible to reinvent a product, service or area of

a large company that seeks greater competitiveness

and profitability.

This new business trend has been able to update

and modernize the components of the different

schools of entrepreneurship, the Chicago (Frank

Knight, 1885-1972 / Theory of the entrepreneur's

profit, risk assumption), Schumpeterian (Joseph

Schumpeter 1883-1950 / Innovation and creative

destruction) and Austrian (Israel Kirzner 1930-

present / Theory of opportunity and profit)

(Somarriba, 2015), who had already mentioned

creative destruction, knowledge, risk and uncertainty,

then, the contributions have been significant, the

millennium authors have undoubtedly incorporated

digital technologies as differentiating, comparative

and competitive advantages to accelerate the

successful operation of this model.

These innovative business initiatives, to a

significant extent are derived from training and

education processes in organizations specialized in

many areas (science, technology, management

sciences, among others) of knowledge, through the

support of research centers and agencies attached to

universities and other agencies, which are engaged in

collaborative scientific work on a range of topics in

different sciences and disciplines, taking into account

the digital technology trends to ensure solid projects

that provide consistent knowledge to design new

products and/or services, which represent utility and

innovation (Peris, 2014).

A conceptual approach to Start-ups, is situated as

an emerging business proposal with a temporary

space, which is able to combine the technical and

scientific knowledge of a multidisciplinary team,

which exceeds the comfort zone of an entrepreneur or

businessman, taking advantage of the benefits offered

by current trends in digital technologies to develop an

innovative business idea in an increasingly volatile

and risky environment, projecting opportunities,

profitability and growth.

Start-ups, are contributing significantly to the

markets and global economic systems are dynamic,

the behavior of the creation of new business ideas

take boom in the global context, which has allowed to

determine that the actions linked to entrepreneurship

have become key initiatives for the supply and

demand of innovative goods and services to acquire

other dimensions much more competitive, there

companies classified as startups have a dizzying level

of growth, which places them as an important engine

for economic development. (Arenal, Armuña, Ramos

and Feijóo, 2016).

3 METHOD

The quantitative approach of deductive logic and

based on the positivist paradigm, provided the data as

a quality to verify and check the validity of the article,

as referred (Martinez, 2002), privileges the

objectivity of knowledge through quantification, this

was achieved by applying a survey to (30) expert

subjects on the subject. These experts were selected

based on their experience in start-up environments,

investment funds and large international consulting

firms, which gives the interviews an added value due

to their practical orientation.

While the interpretative paradigm was the

complementary model used for the treatment of

information, which in the discourse of (Sandín, 2003)

rejects the idea that social science methods should be

identical to the natural sciences, requiring

overcoming rigidity and unilateralism [4]. Thus, the

multiple realities of technical Due Diligence were

understood and interpreted from an intersubjective

perspective through an interview with (10)

specialists. Hence, it is based on the qualitative

approach, as stated by (Yuni and Urbano, 2005) it is

not a mechanical procedure with formal stages, but

requires the assumption of decisions, assessments and

conceptual and procedural alternatives, contrasted

with the systematic review of the literature.

From the interview, fundamental categories and

subcategories emerged to nurture the technical Due

Diligence methodology within the Start-up

ecosystems, managed with a triangulation process.

All this derived in the results that allowed to build the

contribution and contribution with new knowledge

about the usefulness of this verification mechanism,

good practices, reliable and impartial.

4 RESULTS

4.1 Technical Due Diligence:

Methodology for Assessing Risks in

Start-ups

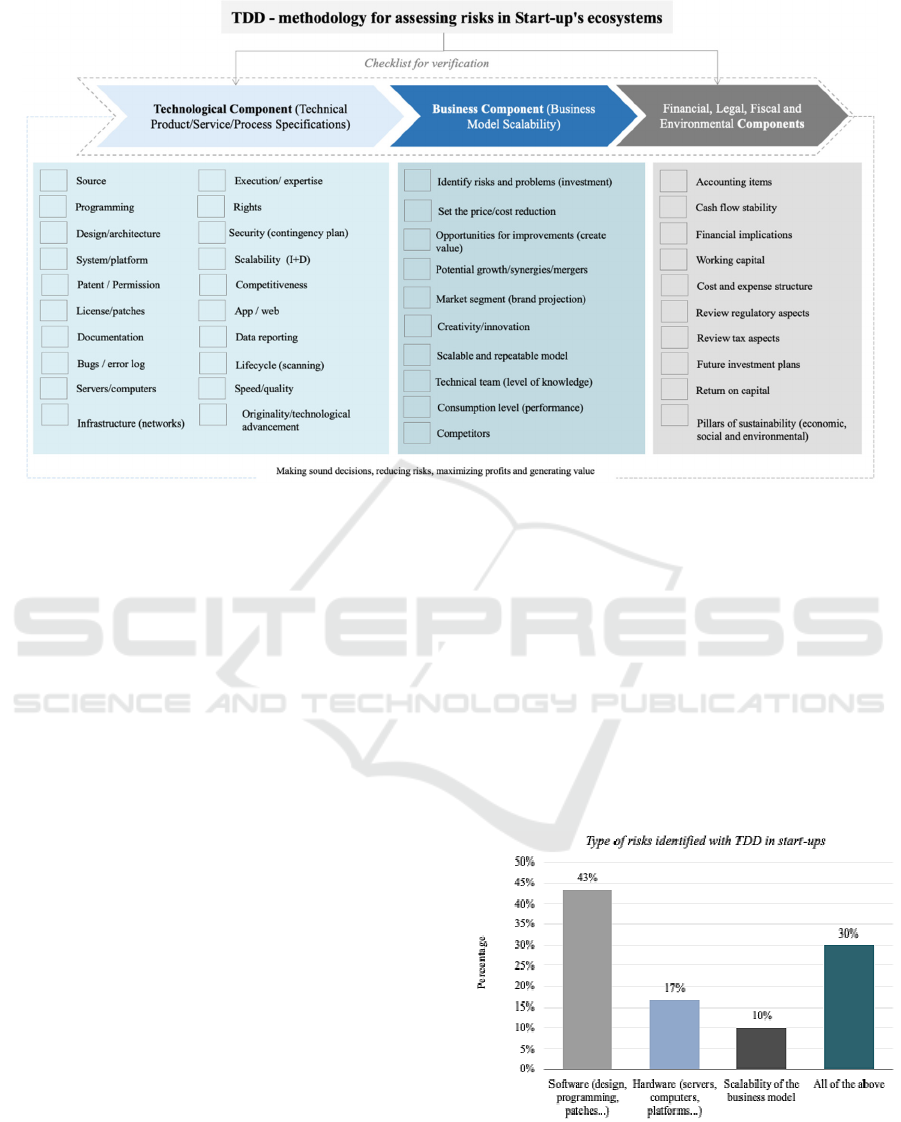

As part of the contribution of this article, Figure 1

proposes a methodology aligned with the needs

identified from the results obtained from the surveys

and interviews on the Technical Due Diligence to

assess the risks in the Start-up ecosystems, which

involves a checklist comprising three major

components, the first related to technology, covering

all the technical specifications of the product, service

or process; the second is the commercial, whose north

ICEIS 2021 - 23rd International Conference on Enterprise Information Systems

424

Figure 1: Technical Due Diligence Methodology applied to Start-up ecosystem.

is to delve into the scalability of the business model

and finally, the financial, legal, fiscal and

environmental component, which is limited to a full

and comprehensive examination, providing

reliability, security, data and useful information for

investors, which are in line with the approaches of

(Gilmanov, 2019).

In the technological component, a detailed

investigation of the entire life cycle of the start-up is

developed, from the origin, the operation, the

generation of errors as a factor present in this type of

platforms based on computerized and intangible

computer codes, the idea is to identify every detail

however small, which is susceptible to risks and

incompatibilities with the environment where the

product has been developed, as stated by (Aguirre and

Baeza, 2019).

This consistent and coherent proposal aims to

offer a global procedural vision of the need to make

the right decisions when investing in start-up

ecosystems in order to minimize risks, uncertainties

and incompatibilities, with a view to maximizing

profits and generating value.

So far, the few existing works have been oriented

to Technical Due Diligences within the office,

residential and industrial buildings sector (Kutera and

Anysz, 2016), which describes in a sequential way the

process to be carried out to study the feasibility of a

real estate purchase.

4.2 Technical Due Diligence: Analysis

of Qualitative Research

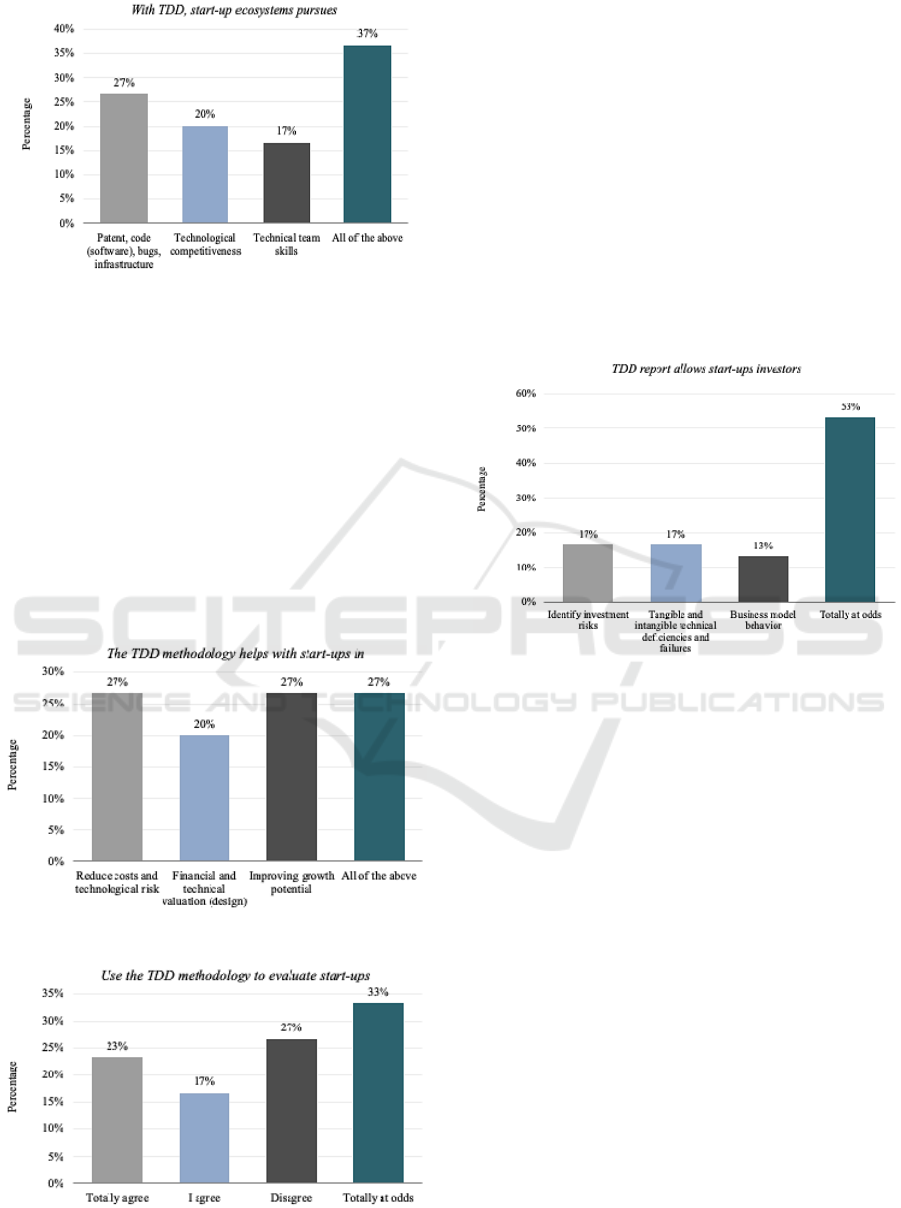

Below are the most significant graphs on this

methodology in the Start-up ecosystems to assess the

risks, and that emerged from the surveys and

interviews applied, results that provide credibility,

validity and certification of this management tool to

study the technical specifications in this type of users

and customers in various market segments, where

differentiation is a competitive constant to seize

opportunities in segments of the markets.

Figure 2: Risk identified.

Technical Due Diligence as a Methodology for Assessing Risks in Start-up Ecosystems

425

Figure 3: Approach to TDD methodology.

Figure 2 shows, with 43%, that the type of risk

surrounding Start-ups is directly related to software

development in this entrepreneurial initiative, where

programming, language, design, patches, codes, bugs

and patents (copyright) are essential for optimal

operation to offer a quality product and service, in

addition, with 17%, the hardware as a component

(infrastructure) sine qua non that provides security,

stability and technical support to ensure efficiency in

the operations and transactions that may originate in

this ecosystem, with a view to achieving

technological competitiveness and scalability of the

model in the market.

Figure 4: TDD helps with.

Figure 5: TDD to evaluate.

Likewise, in figure 4, 27% and 20%, respectively,

show that this methodology helps emerging business

models such as start-ups to reduce costs and

technological risks to improve growth potential,

while valuing the financial and technical structure,

the latter based on the tangible and intangible

components on which the model was built. The

massification of this verification mechanism should

be promoted, due to the moderate use it is having in

the markets, beyond the circumstances, urgencies and

conditions of negotiation by investors who mobilize

capital in purchase and sale contracts, where it is key

to know in depth the functioning of these ecosystems

that generate value from exponential digital

technologies.

Figure 6: TDD allows stat-ups investors.

Figure 6 shows that the report derived from the

application of the TDD methodology, with 17% and

13% respectively, allows investors to identify the

risks in these Start-ups susceptible to evaluation and

technical verification, detecting with the rigorousness

of the case, the possible deficiencies and tangible and

intangible technical failures as part of the behavior of

this business model; which also cover with 17% and

10%, the operational, technical, environmental,

human, commercial, technological, financial, fiscal

and legal aspects.

The TDD in the world of emerging businesses

such as Start-ups, are increasingly taking place in

different markets, not only as innovative ventures, but

also as a type of organization that offer services to

large corporations to modernize and expand areas in

them, in order to adapt to global trends that drive the

smart industry and globalization 4.0, demonstrating

potential, software implementation capacity,

hardware, identifying technological risks, becoming

scalability models for investors (see Table 1).

ICEIS 2021 - 23rd International Conference on Enterprise Information Systems

426

Table 1: Categories and subcategories that emerged from the interviews.

Categories for TDD methodology

in Start-ups

Subcategories

Potential and ability to execute

Ownership, patent, expertise, code quality, technical equipment, similar

competitors, infrastructure, maintenance, bugs

Technological risk, technical

specifications

Reducing risk for unknown assets, knowing every detail of the product and

service

Visibility and financial quality

Approximate value of an intangible business, return on capital investment, cost

reduction

Global zones of operation

Legal, commercial, tax, environmental, financial, technological, operational,

strategic, human and financial team.

Scalability of the emerging business

model

Current global trends (digitization as an opportunity to create value), consumer

preferences

5 CONCLUSIONS

The emergence of ventures built with the

development of technologies are part of the global

trends in this millennium, where the digitization of

data and information, are booming in consumer

preferences, which has stimulated the emergence of

business models such as Start-ups, attractive

initiatives that have attracted the attention of investors

and entrepreneurs, who to boost capital seek to seize

opportunities, consumer trends, and in these

ecosystems have excellent opportunities.

For investors, adopting the TDD methodology is

an important need that offers guarantees within a

buying and selling process that is interested in a Start-

up, in order to situate the fulfillment of a set of

minimum conditions required to make decisions,

knowing the technological components where it has

been developed, analyzing the current state of the

architecture and infrastructure of the product, service

or process, the ownership of the code, which has

maintainable, scalable and susceptible to changes for

updates to suit the innovations that are emerging, the

level of security, hosting of the application, software

or system, all this is essential to ensure favorable

results of the investment.

Another component is linked to the commercial

behavior it has had or the estimates it will have to

generate value in the market segment (history, level

and preferences of consumption, profile of users /

customers), if that model shares characteristics of

scalability, repetition that provides the potential for

growth with mergers and synergies strategies, as well

as, the team of specialized collaborators, human

capital, genuine expression of creative knowledge

that has the responsibility to perform the code

development and other core aspects in the life cycle,

since Start-ups are intellectual business initiatives and

products, hence the relevance of intellectual property.

In the case of the legal component, which goes

hand in hand with the others, it must include all the

legal documents, in order and updated, that support

the ownership of the start-up, in intellectual terms

(creative idea, copyright), the patent as a categorical

element that allows it to operate, and which will

naturally certify the ownership at all levels, avoiding

the risk of plagiarism, theft of source code, among

other aspects of security and reliability in increasingly

competitive markets.

As an innovative venture, the investor needs to

evaluate the financial history of the business model so

far and future projections (cost structure, expenses,

working capital, cash flow, profits, etc.), this will

show how feasible the final objective will be, which

is the reproduction of capital, profitability, return and

creation of economic value in the market, that is the

purpose of having the financial resources to boost

them, knowing the recovery period in which the

investment will be returned.

The TDD methodology is a very useful tool to

obtain data, figures and key information as a critical

success factor in the investments to be executed in an

emerging business model such as Start-up

ecosystems, providing security, reliability and a

broad overview of the conditions of risk, uncertainty,

opportunities and growth possibilities (scalability).

Applying the TDD methodology provides cost

savings due to the optimization of resources to carry

out the Due Diligence, and a significant time saving

of the whole process. On an experimental basis, this

methodology has been tested in several start-ups by

Technical Due Diligence as a Methodology for Assessing Risks in Start-up Ecosystems

427

analyzing the acquisition cost, progression and

present value over 2 years, which provides extra

information about the original deviation.

The projects on which the methodology has been

applied have been varied, mainly oriented to software

development and the data provided following the

methodology show that the calculations obtained are

closer to reality than the estimates that were made

following traditional methods (Due Diligence,

interviews, etc.).

REFERENCES

Aguirre M., Baeza, S. (2019). The importance of a

Technical Due Diligence in SOCIMIS.

Arenal, A., Armuña, C., Ramos, S., Feijóo C. (2018).

Ecosistemas emprendedores y startups, el nuevo

protagonismo de las pequeñas organizaciones. Revista

de economía industrial

Arevalo, D., Fuenmayor, N. (2020). Management in the

Context of Globalization and the Fourth Industrial

Revolution. Journal of Management and

Organizational Studies.

Audretsch, D., Belitski, M. (2021). Start-ups, Innovation

and Knowledge Spillovers.

Blank, S. (2010). What’s A Startup? First Principles.

Brett, J., Mitchell, T. (2019). Searching for trustworthiness:

culture, trust and negotiating new business

relationships.

Cebriá, L. (2008). La revisión legal (legal Due Diligence)

en el derecho mercantil. Editorial Comares, España.

Garidis, K., Rossmann, A. (2019). A framework for

cooperation behavior of start-ups.

Gibbons, C. (2019). A question of due diligence.

Gilmanov, A. (2019). Technical Due Diligence: make no

mistakes - follow these 9 key elements. TMS.

Keller, J., Plath, PB. (1999). Financing biotechnology

projects: Lender due diligence requirements and the

role of independent technical consultants. Applied

Biochemistry and Biotechnology.

Kutera, B., Anysz, H. (2016). The methodology of technical

Due Diligence report preparation for an office,

residential and industrial buildings. MATEC Web of

Conferences.

Lodge, T. Crabtree, A. (2019). Privacy Engineering for

Domestic IoT: Enabling Due Diligence.

Martínez, M. (2002). The new science. Its challenge, logic

and method. Mexico.

Peris, R. (2014). Start-ups tecnológicas: el reto del

crecimiento global. Universidad Pontificia Comillas.

Reis, E. (2012). El método lean start-up: cómo crear

empresas de éxito, utilizando innovación continua. (in

Spanish). Editorial Deusto.

Sandín, M. (2003). Qualitative research in education:

foundations and traditions. McGrawHill. Madrid.

Scott, P. (2002). Due Diligence List. San Jose: Writers Club

Press.

Somarriba, F. (2013). Actividad Emprendedora en el

Desarrollo Económico Local. (in Spanish).

Yuni, J., Urbano, C. (2005). Maps and tools to know the

school. Ethnographic research, action research.

Qualitative research methodologies. Editorial Brujas.

Argentina.

ICEIS 2021 - 23rd International Conference on Enterprise Information Systems

428