The SMEs Innovation in Europe

Alberto Costantiello, Lucio Laureti and Angelo Leogrande

*

Department of Economics, Lum-University, S.S. 100 Km. 18 70010, Casamassima, Ba, Italy

Keywords: Innovation, Innovation and Invention, Management of Technological Innovation and R&D, Political

Economy.

Abstract: In this article we investigate the determinants of SMEs Innovation in Europe. We use data from the European

Innovation Scoreboard of the European Commission in the period 2000-2019 for 36 countries. Data are

analyzed through Panel Data with Fixed Effects, Random Effects, Dynamic Panel at 1 Stage and WLS. Results

show that the presence of Innovators is positively associated with “Enterprise births”, “Government

Procurement of Advanced Technology Products”, “Firm Investments”, “Intellectual Assets”, “Sales Impacts”,

“Share High and Medium High-Tech Manufacturing” and negatively associated to “FDI Net Inflows” and

“Population Density”.

1 INTRODUCTION

In this article we investigate the determinants of

innovation in European SMEs. Specifically, we use

data from the European Innovation Scoreboard of the

European Commission for 36 countries

1

in the period

2000-2019. The role of innovation has an essential

force to drive economic growth has been recognized

especially in “Schumpeterian Economics”, in the

Solow’s growth model and in the “Endogenous

Growth Theory”.

Schumpeterian Economics. In the context of the

Schumpeterian economics the presence of innovation

is an essential force to drive the economic growth.

Schumpeterian economics is based on fourth main

drivers that are “Innovation and technological

change”, “Institutions”, and “Entrepreneurs”

(Schumpeter, 1934). The main element in the theory

of Schumpeter is the role of the entrepreneurship.

Entrepreneurs can promote innovation and

technological change. But in Schumpeterian

economics it is also relevant the role of institutions,

in fact institutions can promote the formation of the

human capital either to create the conditions for the

*

www.angeloleogrande.com

1

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia,

Denmark, Estonia, Finland, France, Germany, Greece,

Hungary, Iceland, Ireland, Israel, Italy, Latvia, Lithuania,

development of an entrepreneurial class able to

generate economic value. A Schumpeterian related

concept that has had a successful course in the history

of the economic ideas is the concept of “creative-

destruction” i.e. the idea that every innovation has a

destructive power. The destructive power of

innovation consists in the fact that it creates the

conditions to make old products and services obsolete

and by this way can induce many firms in failure. The

creative-destruction is not only an interesting

theoretical idea but it is also a true threat for many

corporations and economic organizations that should

defends themselves either by increasing the

investment in Research and Development either by

introducing a deeper strategical orientation in

managerial choices.

Solow’s Growth Theory. The role of innovation and

Research and Development also is relevant in the

Solow’s Growth theory (Solow, 1956). In the theory

of Solow, in the long run the investment in Research

and Development is essential to promote

technological change that is the main force able to

promote the increasing in labour productivity. The

investment in Research and Development, the

increase in the level of knowledge and professional

Luxembourg, Malta, Montenegro, Netherlands, Norway,

Poland, Portogallo, Romania, Serbia, Slovakia, Slovenia,

Spain, Sweden, Switzerland, Turkey, Ukraine, UK.

Costantiello, A., Laureti, L. and Leogrande, A.

The SMEs Innovation in Europe.

DOI: 10.5220/0010472600230032

In Proceedings of the 3rd International Conference on Finance, Economics, Management and IT Business (FEMIB 2021), pages 23-32

ISBN: 978-989-758-507-4

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

23

skills of human capital, and a deeper orientation to

innovation and technological change in economic

organizations are the main drivers that can promote

economic growth in the long run. The role of

innovation in the Solow’s growth theory is considered

strategically, and as a macroeconomic variable, and

relates to the idea of knowledge and research and

development in a context oriented to economic

growth.

Endogenous Growth Theory. The role of

innovation and Research and Development is also

recognized in the Endogenous Growth Theory

(Romer, 1994). The endogenous growth theory can

explain the increasing in GDP in the short even if

inputs are fixed. Innovation and Research and

Development create the conditions to promote

economic growth through the reorganization of the

production function or firms and corporations. But in

Endogenous Growht Theory innovation cannot be

considered as an exogenous determinant of the

economic growth, there are not external incentives

that can promote the ability of firms to innovate

through their investment in Research and

Development. At the contrary, the investment in

Research and Development as a tool to promote

innovation is endogenous i.e. firms recognize the

potential profits of innovation, for the fact that new

products and services open new markets and give

access to a greater number of customers, and then

they invest in it. In a certain sense Endogenous

Growht Theory indicates the inner determinants of a

market structure that can promote the private

investment in innovation without the intervention of

government or policy makers. Firms and

corporations, no matter if they are SMEs or large

companies, have endogenous motivations to invest in

innovation that are in their ability to increase

productivity, sales, competitiveness and to acquire

new markets and new customers. The investment in

innovation and Research and Development can create

the premise of an economic growth even in the

presence of fixed inputs through the reorganization of

the factors of productivity.

The Perspective of the Fourth Industrial

Revolution. The fourth industrial revolution is based

on innovation and research and development

especially in the context of informatics and its

applications to other field of knowledge such as for

example medicine, finance, business management

and transportation. The Fourth Industrial Revolution

has been produced through the usage of algorithms in

the context of Artificial Intelligence, Machine

Learning and Big Data. The impact of the Fourth

Industrial Revolution has changed the same idea of

innovation in SMEs. In effect there a substantial

identity between the application of the Artificial

Intelligence-AI, Machine Learning-ML and Big

Data-BD in SMEs and the ability of SMEs to

innovate. But the Fourth Industrial Revolution has

also created a mix of fears and expectations in respect

to the ability of algorithm to improve productivity

without reducing employment. The old threats of a

zero sum game between technological innovation and

employment has been revitalized in the context of the

Fourth Industrial Revolution and some author

(Harari, 2017) has also hypothesized the creation of a

new useless class i.e. a class of workers without any

possibility to contribute to the improvement of the

economic system. Algorithms have a great ability to

promote innovation and productivity and in the future

they could certainly improve the level of output for

worker. But there are many jobs that could be

destroyed, in the sense of creative destruction, due to

the introduction of AI, ML and BD especially in

service sectors. Many professions such as doctors,

engineers, accountants could be replaced, especially

for routine task, from algorithms. But in the long run

also creative jobs in the entertainment and media

sectors could be replaced by algorithms. Finally also

scientific jobs, such as researchers and knowledge

based workers could be replaced by algorithms due to

the fact that AI has potentially an infinite ability to

acquire knowledge and produce while humans are

limited in their ability to elaborate information.

Product Innovation and Process Innovation. But

even if it is possible to distinguish tech-pessimists from

tech-optimists it is also necessary to consider that the

“Compensation Effect” seems to work especially in the

case of product innovation (Costantiello & Leogrande,

2020). In effect while on one side process innovation

is positively associated to rising unemployment, on the

other side product innovation is positively associate to

the reduction of unemployment. The difference

between product innovation and process innovation is

relevant since it can suggest to policy makers the

ability to design new political economies that

incentivize specifically product innovations in respect

to process innovation boosting the investment in

Research and Development. A relevant question is also

associate to the finance-innovation nexus (Laureti, et

al., 2020 ) i.e. the ability of SMEs to finance

innovation. The efficiency of the finance-innovation

nexus is an essential tool to boost productivity and

economic growth.

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

24

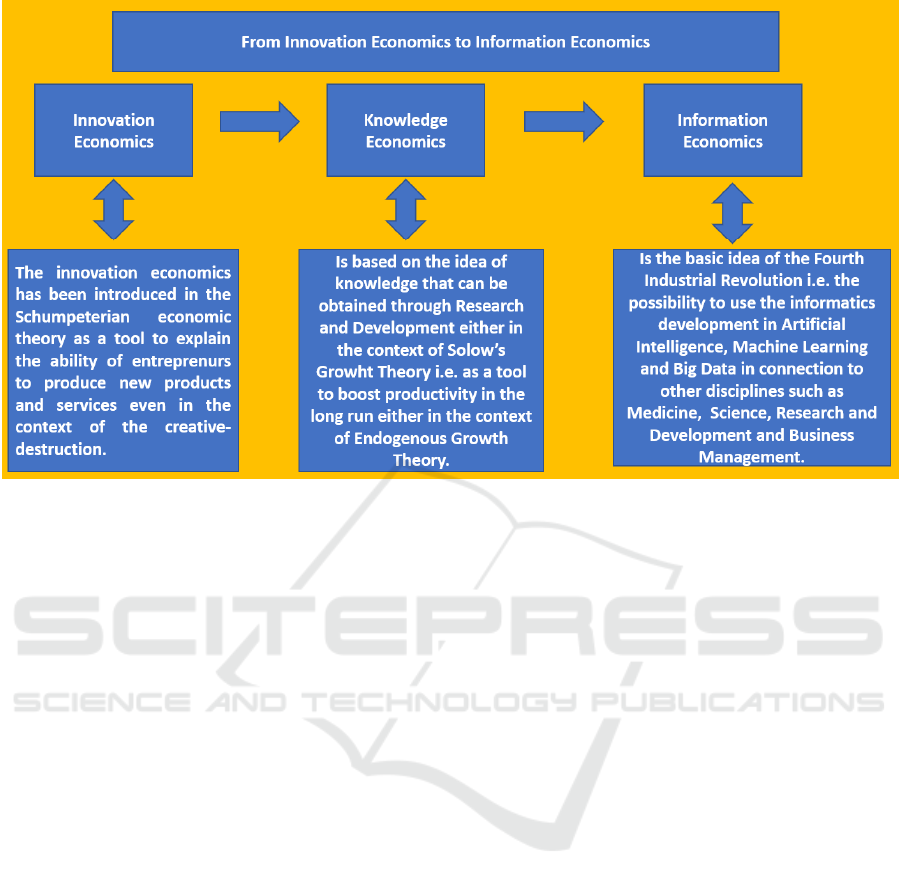

Figure 1: The passage from the Innovation Economics to Information Economics.

The article continues as follows: the second

paragraph contains a brief literature review on the

ability of SMEs to innovate; the third paragraph

presents the econometric model and the discuss the

results; the fourth paragraph concludes.

2 LITERATURE REVIEW

(Albassami, et al., 2019) affords the question of the

ability of SMEs to perform knowledge management.

The authors analyze SMEs in Pakistan. SMEs in

Pakistan show a sustained growth. The results show

the role of organization innovation and knowledge

management in creating the premise for SMEs

growth. (Hillemane, 2012) consider the fact that

SMEs, for their organizational structure, have more

abilities in implementing technological innovation.

But, the fact that SMEs operate in an industrialized or

underdeveloped country has a role in shaping the

ability of small firms to innovate. The authors

focalize their study on India. SMEs in India can boost

either process either product innovation. SMEs can

innovate with internal efforts or with external

supports. SMEs that innovate with external support

perform better in product and process innovation.

(Nada, et al., 2012) afford the question of the

innovation management in Turkish SMEs. The

authors investigate the practices of innovation

management in 25 SMEs countries. Specifically, the

authors perform two different goals: on one hand they

try to investigate the methodologies that Turkish

SMEs apply in performing innovation management

and on the other hand they give suggestion to perform

an efficient political economics of innovation. The

results show that Turkish SMEs have low efficiency

in implementing innovation, due to lack of

organizational and strategical planning. (Love &

Roper, 2015) analyze the relationship between

innovation, exportations, and growth in SMEs. The

authors find the presence of a positive relationship

among in innovation, exportations, and growth in

SMEs. The greater the orientation of SMEs toward

innovation, the greater the probability to export

successfully. Specifically, the results show that SMEs

that export growth faster and innovate better than

non-exporting-SMEs.

(Mañez, et al., 2013) afford the question of the

relationship between process innovation and total

factor productivity in SMEs. The authors consider

question if the most productive SMEs are those that

perform process innovation in a sample of Spanish

SMEs. Results show that most productive SMEs

introduce process innovation, even if the extra-

productivity gain induced by process innovation last

in the short run.

(Thomä & Zimmermann, 2020) analyze the

ability of SMEs in implementing innovation even in

the case of low investments in Research and

Development. The authors have analyzed different

clusters of German SMEs based on their use of in-

house Research and Development, their use of

The SMEs Innovation in Europe

25

external knowledge, and the implementation of

interactive learning. The results show that even SMEs

firm that have lower investment in Research and

Development, i.e., firms that invest less in

technological innovation, can improve their

performance through internal and external interactive

learning. Since learning is associated positively with

the increase in productivity than it results that the

increase in learning mode can improve the ability of

SMEs to produce knowledge.

(Lesáková, et al., 2017) afford the question of the

ability of SMEs to innovate and to eliminate

innovation barriers. The authors focus their research

on Slovak SMEs. Slovak SMEs are divided in three

groups: innovation leaders, modest innovators, and

non-innovators. Results shows that the presence of

financial resources is main factor to boost innovation

in SMEs. SMEs, in the sample analyzed, have

identified three main barriers to innovation:

bureaucracy, corruption and the lack of public

policies oriented to innovation. The authors suggest

to policy makers to implement political economies to

improve innovation in SMEs based on the sequent

elements: financial resources, high quality human

resources, cooperation, networking, and the creation

of deeper and more profitable relationship between

institutions and SMEs.

(Nikolić, et al., 2015) analyze the presence of

barriers to innovation in Serbian SMEs. The authors

find that the main barriers to innovation are indicated

as follows: lack of human capital open to innovation

processes and products, the absence of a conscience

of the role of innovation in boosting firms’

performance, the lack of inadequate government

strategy in supporting innovativeness, the

insufficiency of capital, the presence of a market that

has quantitative and qualitative limitations. Such

social, institutional, financial, and organizational

elements limit the ability of Serbian SMEs to promote

innovation.

(Didonet & Diaz-Villavicencio, 2020) consider

the role of market organization in shaping the ability

of SMEs to innovate. The authors collect data from a

sample of 169 Ecuadorian SMEs. The results show

that SMEs that have a deeper market orientation have

also greater probabilities to boost organizational

innovation. SMEs’ organizational structure is also

relevant to improve learning. SMEs that are interested

in augmenting the degree of innovation should

implement an organizational structure that should be

able to promote market orientation, creativity among

the human capital and to promote technological

improvements. Market orientation is the main force

that can boost innovation in SMEs.

(Van de Vrande, et al., 2009) afford the question

of the usage of the practice of open innovation in

SMEs. The authors collect a database of 605 Dutch

SMEs. Results shows that SMEs engage in open

innovation persistently. Medium enterprises apply

open innovation deeply in respect to small

enterprises. SMEs perform open innovation to

improve their market standing, to increase market

share and to promote customer care, customer loyalty

and customer retention. (Subrahmanya & Mathirajan,

2010) analyze the drivers of technological innovation

in India SMEs. The authors also promote a

comparison between the growth rates of innovative

SMEs in respect to non-innovative SMEs in the sense

of investment, employment, and sales. Results shows

that innovation is relevant in improving SMEs

growth.

(Radziwon & Bogers, 2019) afford the question of

the tension between the necessity to participate in

open innovation processes and the budget constraint

connected to the management of internal sources

dedicated in promoting firm’s growth. SMEs need to

operate in a multi-stakeholder environment to

maximize the benefits of open innovation. Authors

consider the role of regional ecosystem in shaping the

collaboration between SMEs and the external

environment. The results show the presence of an

interdependence among SMEs necessity to innovate,

multi-stakeholder analysis and environmental

ecosystems.

(Nowacki & Staniewski, 2012) analyze the role of

innovation in SMEs. Authors consider the essential

role of innovation in shaping the competitiveness of

SMEs in respect to large companies. Results of the

analysis, based on a questioner of over than 600

Polish managers of SMES, show that a large amount

of CEOs are aware of the great potential of

innovation. But managers lack the ability to

implement innovation in productive processes of in

products and services. Authors find that neither the

level of education of the manager neither the number

of employees of the firm area able to predict the

degree of innovation in SMEs. The lack of financial

resources is a barrier to boost innovation in SMEs.

(Agostini & Nosella, 2017) consider the positive

relationship between SMEs and innovation measured

based on patents and intellectual propriety rights.

Specifically, the authors analyze how internal and

external knowledge impact of patents. The two

variables of patent propensity and patent portfolio

size are analyzed. Results show that: internal

knowledge improve SMEs’ patent propensity while

external knowledge impact patent portfolio size.

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

26

(Anwar, 2018) consider the role of Business

Model Innovation in creating the conditions to

compete for SMEs. BMI is an essential tool for SMEs

specially to survive in highly competitive markets.

The authors analyze the role of Business Model

Innovation in SMEs. The dataset used is based on 303

Pakistani SMEs. The results show the presence of a

positive relationship between the adoption of BMI

and SMEs performance.

(Subrahmanya, 2015) investigates 197

engineering SMEs in Bangalore city in India to verify

the following two questions:

• The distinction between innovation and non-

innovative SMEs;

• The economic and organizational

determinants able to explain the differences

between SMEs that perform high sales and

SMEs that are characterized by low sales.

The author finds that SMEs that innovate

successfully have adequate resources and capabilities

and that younger SMEs have higher sales growth in

respect to older SMEs.

(Bigliardi, 2013) consider the role of innovation

in creating competitive advantage in SMEs with

particular attention to their financial performance and

firm size. Authors find that the increasing in

innovation promote a better financial performance.

But innovation is also relevant to meet customers’

need and to increase competitiveness.

(Chereau, 2015) investigate the strategical role of

innovation in SMEs. The authors find that different

organization strategies are associated to different

degree of innovation i.e. to gain high innovational

performance in SMEs must to develop and implement

specific strategies based on innovation. If SMEs are

interested in promoting technological change

persistently, they must strengthen the strategic-

innovation nexus.

(Clark, 2010) analyzes the innovation processes in

95 New Zealand SME. The author shows that

innovative SMEs are able to growth faster in respect

to non-innovative SMEs and that are also well

established i.e. they have a consolidated market share.

(Classen, et al., 2014) considers the role of

innovation in either family and non-family firms. The

authors analyze product innovation, process

innovation, innovation outcomes and labor

productivity. Data are collected from 2.087 German

SMEs, the authors find that there are significant

disparities between family and non-family SMEs in

the sense of innovational processes. Specifically,

family SMEs overperform in respect to non-family

SMEs in the sense of process innovation. But family

SMEs underperform in a confrontation with non-

family SMEs in the sense of labor productivity.

(Clauss, et al., 2020) analyze the relationship

between Business Model Innovation-BMI and

Business Model Reconfiguration-BMR. The authors

sustain that not all the BMR generate a BMI.

Considering a study over 213 corporations the results

show that firm can have a better performance in BMI

in respect to BMR. In the case of BMI SMEs can

maximize three relevant metrics in corporate

performance i.e., value creation, value proposition

and value capture.

(Olander, et al., 2011) consider the relationship

between human capital and innovation in SMEs.

Since innovation is a product of the knowledge of

employees then it is economically relevant for the

SMEs to minimize the risk of leaking and leaving. To

reduce the risk of loss in human capital, the authors

promote the adoption of a system of Human Resource

Management-HRM that is more oriented to

knowledge recognition and protection. The authors

show that the development of a HRM-knowledge

oriented can benefit the innovational capability of

SMEs. HRM-related knowledge should be applied in

different areas that are: recruitment, education,

training, retaining employees, capturing and diffusion

knowledge in-house and monitoring.

(Doh & Kim, 2014) analyze the relationship

between innovation in SMEs and government support

policies in South Korea. The authors consider the

ability of SMEs to innovate as based on technological

innovation that are patent, trademarks, and new design

registrations. Results show the presence of a positive

relationship between the investment of government in

support of innovation and the number of design

registration at a regional level attributable to SMEs.

There is also a positive relationship between patent

acquisition and new design registration of SMEs.

Policy makers that are interested in boosting innovate-

ion in SMEs should either promote a financial support

for innovative firms and create the condition for a

deeper networking between SMEs and universities.

(Rammer, et al., 2009) investigate the relationship

among R&D, innovation management practices and

innovation success in SMEs. The authors consider

that investing in R&D for SMEs ca be considered a

risky activity due to the presence of high fixed costs,

high minimum investments, and financial constraints.

SMEs prefer to reduce direct investment in R&D and

to promote innovation management to increase

productivity and competitiveness. But the authors

find that to have success in innovation it is essential

for SMEs to invest either in internal R&D either in

external R&D. Successful SMEs in the sense of

The SMEs Innovation in Europe

27

innovation also can cooperate and create extended

networks among external institutions and

organizations able to produce knowledge and

innovation. SMEs that do not invest in R&D con

obtain similar results through the improving the

quality of their human resources and with the

implementation of team working.

(Baumann & Kritikos, 2016) analyze the

relationship between R&D, innovation, and

productivity in Micro, Small and Medium

Enterprises-MSMEs. The authors focus on micro

firms i.e. economic organizations with less than 10

employees. Data are collected from the German KfW

SME panel. The results show the presence of a

negative relationship between R&D intensity and the

firm size. The greater the R&D intensity the grater the

degree of innovation. Particularly R&D intensity

tends to have a strict connection in respect to product

innovations rather than to process innovations.

(Vasilescu, 2014) analyze the role of finance in

relation with the ability of SMEs to innovate. There are

many barriers that can reduce the financial capability

of SMEs to create new products, services and

processes such as limited market power, lack of

management skills, absence of adequate accounting

records, insufficient assets, transaction costs, lack of

collateral. The authors suggest that to remove the

financial obstacles that can reduce the ability of SMEs

to innovate it is necessary to intervene at a political

level to create more opportunity to give credit to firms.

(Henttonen & Lehtimäki, 2017) afford the

question of how high-tech SMEs engage in open

innovation. The authors use data from 13 technology

intensive SMEs in forestry sector in Finland. The

results show that in SMEs the open innovation is used

for commercialization rather than for Research and

Development. The creation of large cooperation with

external firms and the outsourcing have partially

compensated the internal weaknesses of SMEs.

3 THE MODEL

We estimate the sequent model using data from

European Innovation Scoreboard for 36 countries in

the period 2000-2019:

The estimated the value of Innovators that is

constituted of three parts: “SMEs with product or

process innovations”, “SMEs with marketing or

organizational innovations” and “SMEs innovating in-

house”. We found that the variable “Innovators” is:

• Positively associated to “Enterprise births”: the

increasing in “Innovators” has a positive effect

on the birth of enterprise with more that 10

employees. This positive relationship can be

explained with a condition of context in the

sense that if an industrial or entrepreneurial

environment is positively oriented to

innovation, then it tends to be mode productive

and successful. If SMEs are successful than it

can be created an imitative process that can

induce the formation of more SMEs. In effect

firms tend to be more numerous in successful

sectors and this phenomenon also create the

economic specialization of areas and regions.

But if SMEs fail in their ability to innovate and

growth, then also the imitative behavior of other

entrepreneurs could be limited, and the birth of

new enterprise could stagnate.

• Negatively associated to FDI net inflows: the

presence of FDI inflows reduce the ability of

SMEs to innovate. This can be since innovation

can be better explained in the context of

endogenous growth theory i.e. firms invest in

R&D to promote their competitiveness and

productivity. In the case of FDI inflows SMEs

are less incentives to promote inner growth of

innovation, R&D, and knowledge. But it is also

necessary to consider that generally FDI inflows

tend to be used in highly profitable sector with a

shortermist ability to generate revenues i.e. they

have in a certain sense some “speculative

attitude” while the investment in R&D for

SMEs is risky and can be monetized only in a

long run perspective. Probably if policy maker

could create some incentive to give a longer run

perspective to FDI inflows then the negative

relationship between FDI inflows and

“Innovators” could turn positive.

• Negatively associated to “Population Density”:

“Population Density” is defined as the number

of inhabitants in squared kilometers. The

𝑰𝒏𝒏𝒐𝒗𝒂𝒕𝒐𝒓𝒔

𝒊𝒕

=𝒂

𝟏

+𝒃

𝟏

𝑬𝒏𝒕𝒆𝒓𝒑𝒓𝒊𝒔𝒆𝑩𝒊𝒓𝒕𝒉

𝒊𝒕

+𝒃

𝟐

𝑭𝑫𝑰𝑵𝒆𝒕𝑰𝒏𝒇𝒍𝒐𝒘𝒔

𝒊𝒕

+𝒃

𝟑

𝑷𝒐𝒑𝒖𝒍𝒂𝒕𝒊𝒐𝒏𝑫𝒆𝒏𝒔𝒊𝒕𝒚

𝒊𝒕

+𝒃

𝟒

𝑮𝒐𝒗𝒆𝒓𝒏𝒎𝒆𝒏𝒕𝑷𝒓𝒐𝒄𝒖𝒓𝒆𝒎𝒆𝒏𝒕𝑶𝒇𝑨𝒅𝒗𝒂𝒏𝒄𝒆𝒅𝑻𝒆𝒄𝒉𝒏𝒐𝒍𝒐𝒈𝒚𝑷𝒓𝒐𝒅𝒖𝒄𝒕𝒔

𝒊𝒕

+𝒃

𝟓

𝑺𝒉𝒂𝒓𝒆𝑯𝒊𝒈𝒉𝑨𝒏𝒅𝑴𝒆𝒅𝒊𝒖𝒎𝑯𝒊𝒈𝒉𝑻𝒆𝒄𝒉𝑴𝒂𝒏𝒖𝒇𝒂𝒄𝒕𝒖𝒓𝒊𝒏𝒈

𝒊𝒕

+𝒃

𝟔

𝑭𝒊𝒓𝒎𝑰𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕𝒔

𝒊𝒕

+𝒃

𝟕

𝑰𝒏𝒕𝒆𝒍𝒍𝒆𝒄𝒕𝒖𝒂𝒍𝑨𝒔𝒔𝒆𝒕𝒔

𝒊𝒕

+𝒃

𝟖

𝑺𝒂𝒍𝒆𝒔𝑰𝒎𝒑𝒂𝒄𝒕𝒔

𝒊𝒕

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

28

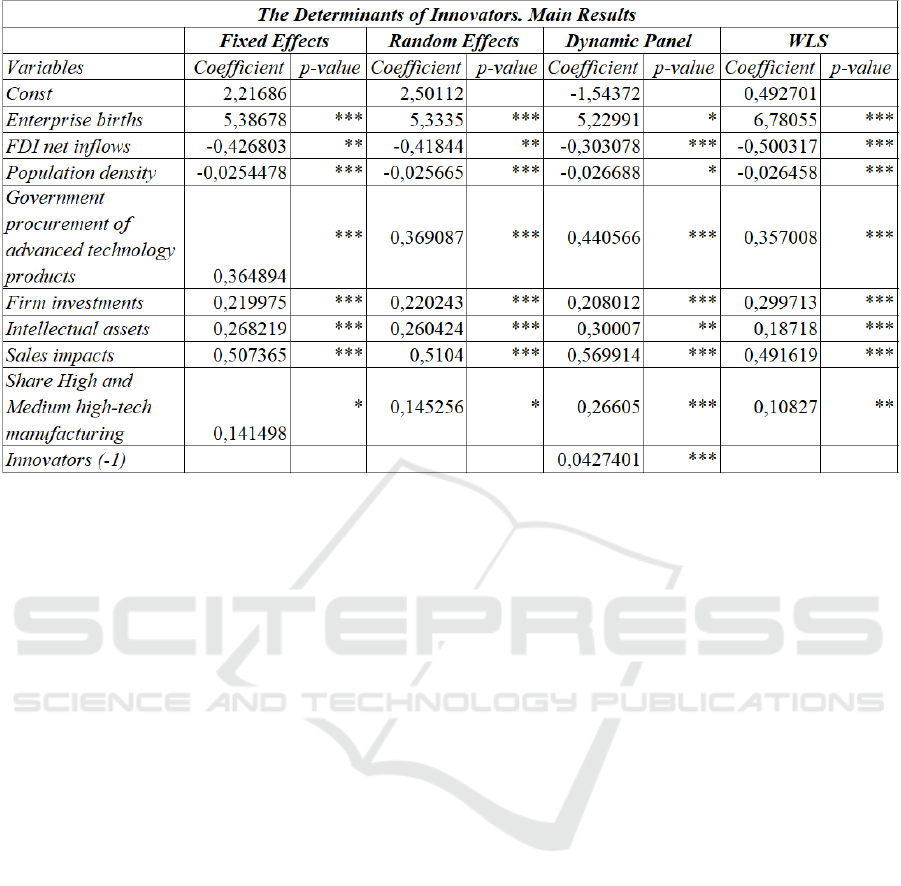

Figure 2: The determinants of Innovation in European SMEs. Main econometric results.

negative relationship between “Innovators” and

“Population Density” means that generally

innovative SMEs are not located in city centers or

highly urbanized areas. The negative association

can also be considered on a strictly economic

point of view: in effect locating a SME in a city

center can be very costly and can also reduce the

possibility to acquire high skilled human capital.

It can be easier and more profitable to locate a

SMEs in less populated areas in connection with

Universities and in places in which there is a

higher level of well-being.

• Positively associated to Government

procurement of advanced technology products:

the countries in which Government invest more

in sustain technological investment have also

higher degree of innovative SMEs. This positive

relationship between government investment in

innovation and the presence of innovative SMEs

is the proof of the efficiency and efficacy of

political economics of innovation. Even if

innovation is in the interest of SMEs, since

through innovation SMEs can promote

productivity and competitiveness, it also

necessary the public intervention to improve the

ability of economic organization to invest in

risky assets such as that connected to Research

and Development especially related to product

innovation.

• Positively associated to Share of Employment in

High and Medium high-tech manufacturing: the

positive relationship between the presence of

innovative SMEs and the level of employment

in High and Medium High-Tech Manufacturing

can be better understood because effectively

innovative SMEs require high skilled human

resources with specifical competencies in

STEM discipline. High-tech innovative SMEs

tend to employ engineers, scientists, physicists,

and a workforce with postgraduate degrees such

as Master of Science or Ph.Ds.

• Positively associated to Firm investments: the

level of Firm Investment is based on three

different variables that are “R&D expenditure in

the business sector”, “Non-R&D innovation

expenditures”, “Enterprises providing training

to develop or upgrade ICT skills of their

personnel”. The positive relationship between

the presence of Innovative SMEs and Firm

Investments is the confirmation of the efficacy

of the private sector expenditure in Research

and Development and in the acquisition of ICT

skills. In particular either the enrichment of

human capital either the orientation towards

knowledge as an intangible asset are the main

drivers that can promote the persistence of a

positive association between Firm Investment

and the presence of Innovative SMEs.

• Positively associated to Intellectual assets: the

variable “Intellectual Assets” is based on three

different variables that are “PCT patent

applications”, “Trademark applications”,

The SMEs Innovation in Europe

29

“Design Applications”. Clearly, there are

positive relationship between the variable

“Intellectual Assets” and the presence of

innovative SMEs. In effects one of the main

outputs of innovative SMEs consist in the

creation of patents and intellectual assets. This

means that the greater the presence of

innovative SME the greater the ability of that

country to produce intellectual assets that are

valuable as patents, trademarks, and intellectual

property rights.

• Positively associated to “Sales impacts”: “Sales

Impact” is defined as the summation of three

variables that are “Medium and high-tech

product exports”, “Knowledge-intensive

services exports” and “Sales of new-to-market

and new-to-firm product innovation”. The

greater the ability of SMEs to innovate the

greater the ability of firms to exports medium

and high-tech products, knowledge intensive

services exports and to realize product

innovation. This means that innovation in SMEs

can boost either productivity either exportations.

If policy makers are interested in promoting

productivity and exportations, they should

incentivize innovation among SMEs.

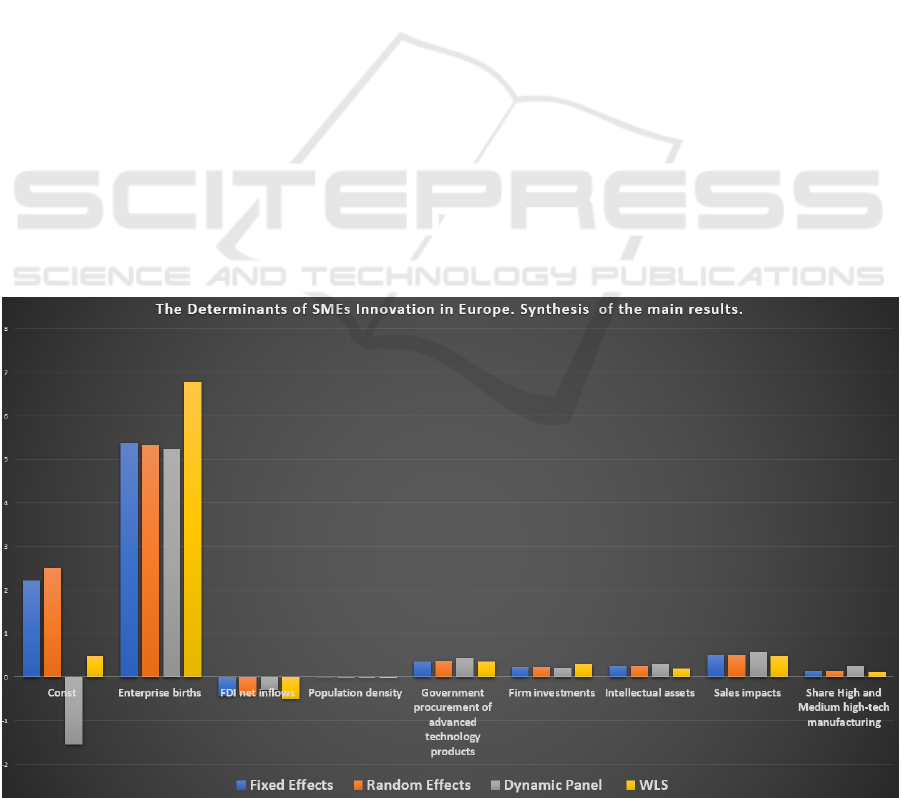

As we can see in the figure 2 the main relationship

in the model is between the variable “Enterprise

Birth” and “Innovators”. The greater the number of

new enterprises the greater the probability of an

increase in innovative SMEs. At a minor level also

the government intervention in the advancement of

technology and the sales impact are significantly and

positively associated to the presence of innovative

enterprises. This means that on one hand government

can have a significant role in boosting innovation in

SMEs and on the other hand innovative SMEs are

also able to boost sales. The econometric results show

a clear indication for policy makers: if governments

are interested in promoting the birth of new

enterprises, or the improvement of sales especially in

the sense of exportations, then they should invest

more in the ability of SMEs to innovate.

4 CONCLUSIONS

In the sequent article we have investigated the

determinants of the SMEs innovation in Europe. The

role of innovation and Research and Development

have been recognized as an essential driver for

economic prosperity and technological change in

Schumpeterian Economics, in Solow’s Growht

theory and in the Endogenous Growth Theory. The

Fourth Industrial Revolution with AI-ML and BD has

increased the ability of SMEs to innovate. But

innovation is not neutral in the sense of employment,

since it can produce more and better employment

such as in the case of product innovation, or at the

contrary can reduce the level of employment as in the

Figure 3: The determinant of SMEs Innovation in Europe. Synthesis of the main results.

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

30

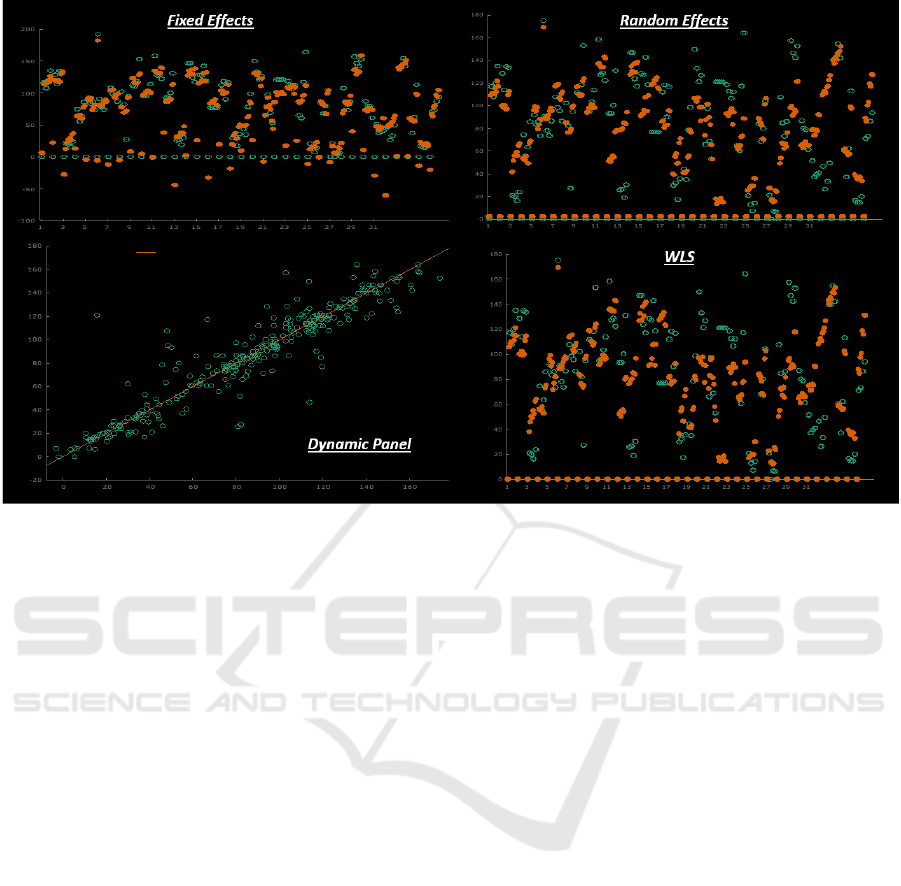

Figure 4: The predictive ability of the econometric models.

case of process innovation. The great risk with AI is

that it could operate as a process innovation (Ng,

2017). Innovative SMEs can have many positive

impacts valuable at a macroeconomic level and even

in the sense of political economy. To evaluate the

impact of innovative SMEs we use data from the

European Innovation Scoreboard of the European

Union for 36 countries in the period 2000-2019. As

showed in the econometric model discussed in the

third paragraph, the presence of Innovative SMEs is

positively associated to “Enterprise births”,

“Government Procurement of Advanced Technology

Products”, “Firm Investments”, “Intellectual Assets”,

“Sales Impacts”, “Share High and Medium High-

Tech Manufacturing”. But data also shows the

presence of a negative relationship between

Innovative SMEs “FDI Net Inflows” and “Population

Density”. Our analysis suggest that if policy makers

are interested in boosting firm natality, in augmenting

private investments, intellectual assets, in sustaining

the ability of firm to export, then they should

incentivize innovative SMEs.

REFERENCES

Agostini, L. & Nosella, A., 2017. A dual knowledge

perspective on the determinants of SME patenting:

results of an empirical investigation. Management

Decision, 55(6).

Albassami, A. M., Hameed, W. U., Naveed, R. T. &

Moshfegyan, M., 2019. Does knowledge management

expedite SMEs performance through organizational

innovation? An empirical evidence from small and

medium-sized enterprises. Pacific Business Review

International, 12(1), pp. 11-22.

Anwar, M., 2018. Business model innovation and SMEs

performance—Does competitive advantage mediate?.

International Journal of Innovation Management,

22(7).

Baumann, J. & Kritikos, A. S., 2016. The link between

R&D, innovation and productivity: Are micro firms

different?. Research Policy, 45(6), pp. 1263-1274.

Bigliardi, B., 2013. The effect of innovation on financial

performance: A research study involving SMEs.

Innovation, 15(2), pp. 245-255.

Chereau, P., 2015. Strategic management of innovation in

manufacturing SMEs: Exploring the predictive validity

of strategy-innovation relationship. International

Journal of Innovation Management, 19(01).

Clark, D. N., 2010. Innovation management in SMEs:

active innovators in New Zealand. Journal of Small

Business & Entrepreneurship, 23(4), pp. 601-619..

Classen, N., Carree, M., Van Gils, A. & Peters, B., 2014.

Innovation in family and non-family SMEs: an

exploratory analysis. Small Business Economics, 42(3),

pp. 595-609.

Clauss, T., Bouncken, R. B., Laudien, S. & Kraus, S., 2020.

Business model reconfiguration and innovation in

SMEs: a mixed-method analysis from the electronics

industry. International Journal of Innovation

Management, 24(02).

Costantiello, A. & Leogrande, A., 2020. The innovation-

The SMEs Innovation in Europe

31

employment nexus in Europe. American Journal of

Humanities and Social Sciences Research (AJHSSR),

4(11), pp. 166-187.

Didonet, S. & Diaz-Villavicencio, G., 2020. Innovation

management in market-oriented SMEs: learning and

internal arrangements for innovation. International

Journal of Organizational Analysis.

Doh, S. & Kim, B., 2014. Government support for SME

innovations in the regional industries: The case of

government financial support program in South Korea.

Research Policy. Research Policy, 43(9), pp. 1557-

1569.

Harari, Y. N., 2017. Reboot for the AI revolution. Nature

News, 7676(324), p. 550.

Henttonen, K. & Lehtimäki, H., 2017. Open innovation in

SMEs: Collaboration modes and strategies for

commercialization in technology-intensive companies

in forestry industry. European Journal of Innovation

Management, 20(2), pp. 329-347.

Hillemane, B. S. M., 2012. Technological innovation in

Indian SMEs: need, status and policy imperatives.

Current opinion in creativity, innovation and

entrepreneurship, 2(1).

Laureti, L., Costantiello, A. & Leogrande, A., 2020 . The

Finance-Innovation Nexus in Europe. JISET -

International Journal of Innovative Science,

Engineering & Technology, 7(12).

Lesáková, Ľ., Gundová, P., Kráľ, P. & Ondrušová, A.,

2017. Innovation leaders, modest innovators and non-

innovative SMEs in Slovakia: Key factors and barriers

of innovation activity. Organizacija, 50(4), pp. 325-

338.

Love, J. H. & Roper, S., 2015. SME innovation, exporting

and growth: A review of existing evidence.

International small business journal, 33(1), pp. 28-48.

Mañez, J. A., Rochina-Barrachina, M. E., Sanchis, A. &

Sanchis, J. A., 2013. Do process innovations boost

SMEs productivity growth?. Empirical economics,

44(3), pp. 1373-1405.

Nada, N., Ghanem, M., Mesbah, S. & Turkyilmaz, A.,

2012. Innovation and Knowledge Management Practice

in Turkish SMEs'. Fatih University, Istanbul, Turkey,

Arab Academy for Science, Technology and Maritime

Transport, Alexandria, Egypt.

Ng, A., 2017. Artificial intelligence is the new electricity,

s.l.: Stanford MSx Future Forum.

Nikolić, M., Despotović, D. & Cvetanović, D., 2015.

Barriers to innovation in SMEs in the Republic of

Serbia. Ekonomika, 61(4), pp. 89-96.

Nowacki, R. & Staniewski, M. W., 2012. Innovation in the

management of SMEs in the service sector in Poland.

Amfiteatru Economic Journal, 14(6), pp. 755-773.

Olander, H., Hurmelinna-Laukkanen, P. & Heilmann, P.,

2011. Do SMEs benefit from HRM-related knowledge

protection in innovation management?. International

Journal of Innovation Management , 15(3), pp. 593-

616.

Radziwon, A. & Bogers, M., 2019. Open innovation in

SMEs: Exploring inter-organizational relationships in

an ecosystem.

Technological Forecasting and Social

Change, Volume 146, pp. 573-587.

Rammer, C., Czarnitzki, D. & Spielkamp, A., 2009.

Innovation success of non-R&D-performers:

substituting technology by management in SMEs.

Small Business Economics, 33(1), pp. 35-58.

Romer, P. M., 1994. The origins of endogenous growth.

Journal of Economic perspectives, 8(1), pp. 3-22.

Schumpeter, J. A., 1934. The theory of economic

development: an inquiry into profits, capital, credit,

interest, and the business cycle. New Brunswick:

Transaction Books.

Solow, R. M., 1956. A contribution to the theory of

economic growth. The quarterly journal of economics,

70(1), pp. 65-94.

Subrahmanya, M. B., 2015. Innovation and growth of

engineering SMEs in Bangalore: why do only some

innovate and only some grow faster?. Journal of

Engineering and Technology Management, Volume 36,

pp. 24-40.

Subrahmanya, M. H. & Mathirajan, M. K. K. N., 2010.

Importance of technological innovation for SME

growth: Evidence from India. WIDER Working Paper,

Volume 3.

Thomä, J. & Zimmermann, V., 2020. Interactive learning—

The key to innovation in non-R&D-intensive SMEs? A

cluster analysis approach. Journal of Small Business

Management, 58(4), pp. 747-776.

Van de Vrande, V., De Jong, J. P., Vanhaverbeke, W. & De

Rochemont, M., 2009. Open innovation in SMEs:

Trends, motives and management challenges.

Technovation, 6-7(29), pp. 423-437.

Vasilescu, L., 2014. Accessing Finance for Innovative EU

SMEs Key Drivers and Challenges. Economic Review:

Journal of Economics and Business, 12(2), pp. 35-47.

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

32