Management Support Systems Model for Incident Resolution in FinTech

based on Business Intelligence

Mar

´

ıa Del Carmen Z

´

u

˜

niga

1 a

, Walter Fuertes

1 b

, Hugo Vera Flores

2 c

and Theofilos Toulkeridis

1,3 d

1

Department of Computer Sciences, Universidad de las Fuerzas Armadas ESPE,

Av. General Rumi

˜

nahui S/N, P.O. Box 171 5 231 - B, Sangolqu

´

ı, Ecuador

2

BI-Solutions, Av. de los Shyris N36-120, Allure Park Building, 170505, Quito, Ecuador

3

Universidad de Especialidades Tur

´

ısticas UDET, Quito, Ecuador

Keywords:

Business Intelligence, Data Mining, Financial Services, Financial Incident Management, FinTech,

Management Support System.

Abstract:

Financial technology corporations (FinTech) specialize in the electronic processing of business transactions

and compensation of charges and payments. Such operations have a technological platform that connects

multiple financial institutions with companies of the public and private sector. In its constant concern for

the provision of efficient services, the company created a unit to guarantee the quality and availability of

24x7x365 of its services by granting their clients confidence regarding online-financial environments through

high-security timely security standards management of incidents. However, poor management of incident

resolution was detected as there are is a lack of tools to monitor transactional behavior or identify anomalies.

Consequently, resolution time has been delayed and, therefore, continuity and regular operation of services. In

this sense, economic losses are frequent, yet the real loss results in its confidence and reputation. In response to

this problematic issue, the current study proposes developing a support model of information management for

the appropriate and timely resolution of incidents by analyzing historical information, which allows to detect

of anomalies in transactional behavior and improve resolution time of events affecting financial services.

The used methodology is ad-hoc and consists of various phases, such as identifying the present situation.

Afterward, it builds the solution based on Ralph Kimball and Scrum methodologies and validates its result.

With the implementation of the work, the business intelligence model improves incident management by

providing indicators for the timely detection of anomalies in financial transactions.

1 INTRODUCTION

With the Internet’s initiation, many traditionally de-

veloped activities have changed and progressed over

time, moving from a manual environment to an elec-

tronic environment. A clear example of this devel-

opment is the financial transactions conducted daily

by millions of persons (Gai et al., 2018). Elec-

tronic transactions realize the extensive use of tech-

nology. However, it requires another element of great

importance for its usability, which is trust, being a

more challenging issue to build in online environ-

ments since transactions are impersonal. The funda-

a

https://orcid.org/0000-0002-2916-2375

b

https://orcid.org/0000-0001-9427-5766

c

https://orcid.org/0000-0002-5701-1013

d

https://orcid.org/0000-0003-1903-7914

mental factor is to promote trust by strengthening the

companies’ computer systems that provide electronic

processing services to feel safe using their digital me-

dia or channels. Financial Technology (FinTech), in

its constant concern for the effective and efficient pro-

vision of its different services, developed a project to

mitigate the business’s operation risks. Whatever the

operational reason, they have a direct effect on the

quality and consistency of financial transactions. In

this type of financial incident, on several occasions,

customers have detected anomalies in the services.

Moreover, since they lack tools to monitor the

quality of transactions, the company’s personnel use

on-demand queries to the database to understand and

resolve incidents. This causes poor handling in the

resolution of incidents due to the low visibility of

indicators that allow monitoring and understanding

transactional behavior on time. Even though FinTech

240

Zúñiga, M., Fuertes, W., Flores, H. and Toulkeridis, T.

Management Support Systems Model for Incident Resolution in FinTech based on Business Intelligence.

DOI: 10.5220/0010456402400247

In Proceedings of the 23rd International Conference on Enterprise Information Systems (ICEIS 2021) - Volume 1, pages 240-247

ISBN: 978-989-758-509-8

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

has qualified personnel for incident management, they

lack the appropriate tools to monitor service quality.

Our research hypothesis establishes that the informa-

tion management model’s implementation will pre-

dominantly optimize the resolution times of financial

incidents registered in the company.

Our primary research question was: Which infor-

mation management models have been used to solve

financial incident deficiencies? In response, a few

proposals are framed in the given research topic. Bed-

ford et al., (Bedford et al., 2005), conceptualize an

incident as: ”the unplanned interruption of an IT ser-

vice and the reduction in its quality. Also, the failure

of a configuration element that has not yet impacted

the service is an incident”. Bobyl et al., (Bobyl et al.,

2018), promotes the continuous development of con-

trols in order to monitor and evaluate the implemented

services. Latrace et al., (Latrache et al., 2015) dis-

cusses several crucial business processes based on in-

formation technology (IT) services because adverse

IT incidents can disrupt the business’s daily activities

and cause adverse effects, such as loss of customer

confidence, productivity, and finances. Serna et al.,

(Serna et al., 2016), argues that information systems

have become a fundamental tool to improve complex

decision-making processes’ efficiency and effective-

ness, particularly those in which quantitative vari-

ables and large volumes of data intervene. Farahmand

(Farahmand et al., 2003), states that an entity needs to

have an effective system capable of identifying, evalu-

ating, and monitoring. These studies demonstrate the

industry’s concern and the scientific community to re-

duce or even avoid entirely financial incidents.

Therefore, this study proposes a tool with the nec-

essary elements to achieve the transactional behav-

ior of financial services, intending to improve inci-

dent management through BI instruments. The de-

velopment of a BI solution was proposed within this

working framework, consisting of analyzing customer

needs, developing and configuring visual reports, cre-

ating data warehouses, information cubes, indicators,

metrics, dimensions, and control boards. These BI

solutions are subject to constant changes which the

company experiences, so it remains below develop-

ment. Agile methodologies offer adequate support for

BI project management. However, they need to be

supported by their BI methodologies for their design

and development.

Furthermore, while a traditional methodology al-

lows modeling the processes that cover BI sys-

tems’ needs, agile methodologies include managing

projects quickly and flexibly. In this way, it is possible

to apply these two methodologies in the same project.

The most popular agile methodology best adapted

to BI project management is Scrum (Schwaber and

Sutherland, 2013). Scrum, in conjunction with Ralph

Kimball’s dimensional modeling method (Kimball

and Ross, 2011), was used for the development of the

solution. Therefore, this research’s main contribution

is to favor the country’s financial sector by develop-

ing a tailored system that allows visualizing the status

of transactions over time. Hereby, the user can iden-

tify variations, which demonstrate the service qual-

ity’s degradation and allows FinTech to act on time to

detect anomalies and resolution of interruptions.

The remainder of the article is organized as fol-

lows: Section 2 describes the theoretical framework

necessary to obtain a suitable foundation for imple-

menting the solution. Section 3 explains the solution

design. Section 4 presents the evaluation of the re-

sults. Finally, section 5 contains the conclusions and

lines of future work.

2 BACKGROUND

2.1 Business Intelligence (BI)

According to (Ayoubi and Aljawarneh, 2018), BI

is an interactive process that explores and analyzes

structured information about an area and discovers

trends or patterns to derive ideas and draw conclu-

sions. M

´

endez del R

´

ıo defines BI as a set of tools and

applications to aid decision-making, enabling interac-

tive access, analysis, and multiplication of mission-

critical corporate information. These applications

provide valuable knowledge about operational infor-

mation by identifying business problems and opportu-

nities. Users can access large amounts of information

in order to establish and analyze relationships and un-

derstand trends that will ultimately support business

decisions (D’Arconte, 2018). Based on the definitions

mentioned earlier, BI is a set of processes that facil-

itate data integration from various systems, whether

internal or external, to facilitate the analysis and inter-

pretation of information through visualization tools to

support decision-making and knowledge generation.

Within this context, information sources are

those where an organization’s operational data are

recorded. Depending on their origin, they can be in-

ternal or external sources, such as Operational or

transactional systems, including custom-developed

applications such as ERP, CRM, and SCM; Depart-

mental information systems, which includes fore-

casts, budgets, spreadsheets, among others; External

information sources, in some cases purchased from

third parties. They are essential to enrich the informa-

tion about customers.

Management Support Systems Model for Incident Resolution in FinTech based on Business Intelligence

241

Additionally, the Extract, Transform and Load

(ETL) process is responsible for the recovery of data

from information sources to strengthen the data ware-

house. The ETL process is divided into five sub-

processes (Hahn, 2019): Extraction, which phys-

ically retrieves the data from different information

sources. The raw data are available at this time.

Cleanup, which recovers the raw data and checks

its quality, removes duplicates, and, where possi-

ble, fixes erroneous values and fills in empty values.

In other words, the data are transformed whenever

possible in order to reduce loading errors. Hereby,

clean and quality data are available. Transformation,

which retrieves clean, high-quality data and struc-

tures, summarizes it in the different analysis mod-

els. The result of this process is obtaining clean,

consistent, summarized, and useful data. Integra-

tion, which validates that the data loaded into the data

warehouse is consistent with the definitions and for-

mats. It also integrates them into the several models of

the different business areas which have been defined

through them—finally, Actualization, which allows

adding the new data to the data warehouse.

2.2 Financial Technology (FinTech)

FinTech has become a common term in the financial

industry that describes novel technologies adopted by

financial service companies (Gai et al., 2018). We se-

lected FinTech as it specializes in the electronic trans-

fer of funds and information through its products and

services for the financial sector. One of its products

is the collection and payment service. Due to the va-

riety and complexity of configurations, it is the ser-

vice that inspired the current study, with the certainty

that it will form the basis for future developments in

other FinTech services. The interbank collection and

payment network allows a financial institution to con-

nect to collection companies through the technolog-

ical platform, supporting its clients to proceed with

their financial contributions. The collection may be

realized online and back office.

We consider that the service indicators allow

knowing the transactionality of financial institutions

and their percentage of participation in the interbank

network. Below are the service indicators for the col-

lection and payment network: a) Status, which al-

lows knowing the status of transactions (i.e., success-

ful or rejected). b) Response, which allows know-

ing the reasons why a transaction presents a specific

status (e.g., successful, invalid password, funds not

available, the client does not exist, destination not

available, external decline, etcetera.); and, c) Chan-

nel, which refers to the client’s channel to conduct

their contribution: virtual channel, window.

2.3 Methodologies for the Design and

Development of the Solution

Companies need to innovate their way of responding

to changes’ demands based on constant technological

developments. Within this context, agile methodolo-

gies appear as a set of working ways oriented towards

a dynamic execution that seeks to promote adaptation

to change and obtain positive results (Schwaber and

Sutherland, 2013). Agile methodologies are based on

people and their interactions. They allow adapting the

way of working to the project’s conditions to manage

them flexibly, safely, and efficiently, reduce costs, and

increase productivity (Alliance, 2016).

Within this working framework, the development

of a BI solution was proposed to analyze the clients’

needs, developing and configuring visual reports by

creating data warehouses, information cubes, screens,

indicators, metrics, and dimensions. Agile method-

ologies offer support for BI project management.

However, they need to be supported by their BI

methodologies for their design and development.

Furthermore, while a traditional methodology al-

lows modeling the processes that cover BI sys-

tems’ needs, agile methodologies encompass meth-

ods for managing projects quickly and flexibly, so

it is possible to apply these two methodologies in

the same draft. The most popular agile methodol-

ogy best adapted to BI project management is Scrum

(Schwaber and Sutherland, 2013). Scrum allows

partial and regular deliveries of the final product,

prioritized by the benefit they bring to the project

client. Scrum is designed for projects in complex

environments, where it is required to obtain results

quickly, while the requirements are changing, innova-

tion, competitiveness, flexibility, and productivity are

fundamental (Malik et al., 2019).

In conjunction with Scrum, Ralph Kimball’s di-

mensional modeling method (Kimball and Ross,

2011)(Macas et al., 2017) was used to develop the

solution. This method, also calls the Dimensional

Life Cycle of the Business, includes the definition of

the technical architecture, the physical design of the

database and ETL, and the definition and develop-

ment of the application. The final phase of deploy-

ment allows the application to be available to users

for evaluation and production. This cycle is based on

four basic principles (Nugra et al., 2016), are focus on

the business, building an adequate information infras-

tructure. At this point, all the necessary elements are

provided in order to deliver value to business users.

Kimball proposes a method that facilitates simplify-

ICEIS 2021 - 23rd International Conference on Enterprise Information Systems

242

ing the complexity of the development of Data Ware-

house solutions (Kimball and Ross, 2011).

3 RESEARCH DESIGN

3.1 Definition of Roles, Analysis of Data

Sources and Definition of Indicators

and Metrics

For the development of the solution, three resources

were included: Operations Coordinator, Scrum Spe-

cialist, and BI Developer. The Product Owner col-

lected user stories and acceptance criteria for each one

of them, which became the input to define and write

the Product Backlog elements.

Product Backlog collects the requirements to form

the product. Instead, the Product Owner is responsi-

ble for compiling this list. Based on the business’s

needs, in the Sprint Planning, it was established that

the system is developed in three Sprints, being the

user stories with high priority to those which are con-

templated in the first instance.

In the Sprint Backlog, the requirements to be de-

veloped for the system were specified. In the first

Sprint, the initial information gathering tasks were

planned, considered essential for proper development.

This required the active participation of the Product

Owner and the commitment to manage the access and

delivery of relevant data to develop the UP Collec-

tions and Payments data mart. Table 1 demonstrates

the pending list for each Sprint.

Table 1: List of pending of each Sprint.

Sprint Activities

1 Data source identification and analysis

1 Definition of management indicators

1 Physical design of DSA data model

1 Physical design of DWH data model

1 DSA and DWH database creation

1 Report model generation (prototype)

2 Design and development of ETLs

2 Create attributes, metrics and cubes

2 Dashboards development for monitoring

3 Channel dashboard development

3 Dev. of transaction response dashboards

3 Creation and setup of the autoload job

3 Incremental bucket loads

3 User testing and tuning

3 Go into production

In this phase of development, we identified the data

source analysis, which will constitute the data ware-

house construction input. The Financial Services

Company has a transactional system developed under

Oracle database, Oracle Developer, and Oracle Appli-

cation.

The Key Performance Indicators (KPIs) are met-

rics that help identify a specific action or strategy’s

performance regarding the definition of indicators and

metrics. It is possible to identify performance based

on the objectives set previously (Midor et al., 2020).

For FinTech, the objectives set for monitoring the

quality of services are established by the total num-

ber of transactions and the transaction status. There-

fore, the indicators that they request to analyze for

the Collections and Payments Service are Total trans-

actions by Merchant, transactions by Financial insti-

tution, transactions by Status, transactions by collec-

tion channels, transactions per Transaction response,

transactions by type of transaction.

3.2 Physical Model of the Data Staging

Area and Data Warehouse

The first step was to design the intermediate layer

between the source system and the Data Warehouse

(DWH), called Data Staging Area.

Data Staging Area (DSA): The DSA is the central

layer that served as storage between the source sys-

tem and the DWH. It allows managing the data with

the origin’s structure to facilitate the DWH’s denor-

malized model’s integration and transformation. The

created structures contain identical fields from the cat-

alogs and transactional table of the data source.

Data Warehouse (DWH): Its function is more

complicated than a data warehouse. It is composed of

Dimensions: Dimensional modeling allowing to con-

textualize the facts by adding different analysis per-

spectives. A dimension contains a series of attributes

or characteristics through which we can group and fil-

ter the data. Tables of Facts: Facts are composed of

the details of the process; this means that they con-

tain numerical data and measurements (metrics) of the

business being analyzed. The technique used to per-

form the dimensional modeling of the current study

is the star model. It is composed of a central fact ta-

ble called DW HEC TRANSACCIONES COBROS,

which is connected through relationships to the di-

mension tables.

3.2.1 Sprint 1: Prototype Design and

Implementation

We developed a prototype that allows users to vali-

date the solution’s usability. The technique used was

Management Support Systems Model for Incident Resolution in FinTech based on Business Intelligence

243

”visual design,” which consists of the design of the

GUI. For this purpose, we created an information

cube whose data source was an Excel file with fic-

titious data. We used the visualization tool available

at FinTech.

3.2.2 Sprint 2: ETL Design and Development

The ETL process starts with the DSA tables’ trunca-

tion, followed by the transactional system’s data ex-

traction. They are placed in the DSA in order to per-

form the transformation and cleaning process. Then,

they are stored in the data warehouse. In order to per-

form such a step, we used SQL Server Integration Ser-

vices (SISS). A SISS package is a work unit in which

the elements which participate in the ETL process are

created. These elements may be of two types:

• Control Flows: They are the program flow control

structures. They indicate the sequence with which

the ETL elements need to be executed.;

• Data Flow: Also known as the stored procedure

(SP), which allows defining the start of the load.

The first step in the ETL process is to create a project

in Microsoft Visual Studio called pqt ETL. As the

next step, we need to create the data connections to

the source, DSA, and DWH. Then, we proceeded with

creating the SQL task to truncate all the tables in the

DSA to clean them to receive the information from

the source. To comply with such intention, we drag

the ”Execute SQL Task” object and type the trunca-

tion SQL statement.

The elements for the extraction of data from the

source tables to the DSA are created one by one using

the ”Data Flow Task” object. In this object, we need

to configure both the data source and the destination.

Once the data extraction is realized, the next step is

the cleaning, integrity validation, consolidation, and

uploading of the data to the DWH.

3.2.3 Creation of Attributes, Metrics, and Smart

Cubes

This task starts with the attributes creation of the di-

mensions, the relationship between them, and the def-

inition of business indicators, where the relationship

of the logical layer and its equivalents in the physi-

cal layer is established, i.e., tables and fields of the

database.

• Creation of Attributes: Attributes in Microstrat-

egy are associated with an ID and a description

for their Creation;

• Creation of Facts: Facts are values by which the

business will be analyzed. For the present study,

the facts are the number of transactions, trans-

action amount, commission, number of approved

transactions, and rejected transactions. The facts

will be used to create the metrics, which will be

the elements and attributes for creating the Smart

Cube. In the menu

¨

Scheme objects

¨

ın the Facts

folder, the metrics are created. The indicators are

then created in the ”Public objects” menu. In this

step, we need to specify the mathematical opera-

tion that will be applied to the event.

• Creation of Smart Cubes: In Microstrategy, a di-

mensional cube (dataset) allows OLAP Services

functions in reports and documents, reducing ac-

cess to the data warehouse.

3.2.4 Development of Dashboards for SP

Monitoring and Transaction Status

In this phase, we performed the reports and dash-

board development containing the attributes and in-

dicators implemented in the previous section. Also,

detailed reports were generated that will be used in

order to analyze the transactional behavior of UP’s

collection and payment network. The deliverable’s

objective was to provide dashboards for the Service

Quality Sub-Process to identify the trend of rejec-

tion of transactions and unusual increases that may

affect UP services. Hereby, a dashboard was pro-

vided for the Operations Coordinator to view details

such as graphs of total transactions, approved and re-

jected transactions, annual, monthly, daily amounts,

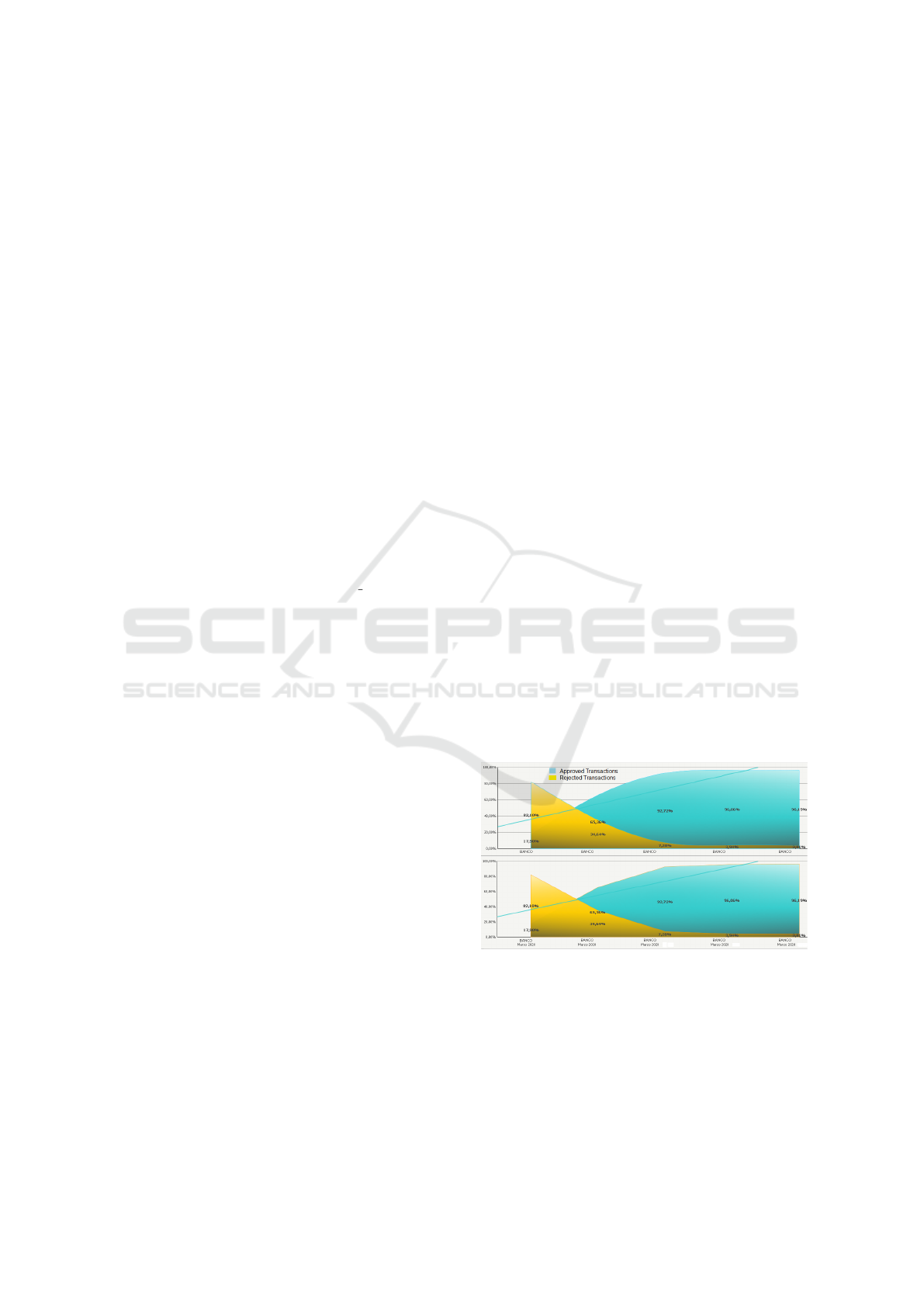

and market share percentages. Next, in Fig. 1 and 2,

the developed dashboards are presented:

Figure 1: Dashboards Sprint 2.

3.3 Sprint 3: Sprint Goal Development

The results obtained with this Sprint’s execution

were: (1) Development of two dashboards that al-

low to identify the channels with the highest collec-

tion of the different types of transaction and visualize

the responses, which generate the transaction’s rejec-

ICEIS 2021 - 23rd International Conference on Enterprise Information Systems

244

Figure 2: Dashboards Sprint 2.

tion. This analysis will allow the quality area to no-

tify the Account Executive of the news presented for

resolution. (2) Creation and configuration of the au-

tomatic loading Jobs of both the DWH and Micros-

trategy cube, i.e., put into production. (3) Conduction

of the final tests and completion with the movement

towards production.

3.3.1 Channel Dashboard Development and

Transaction Response

In this deliverable, we developed the dashboard to

identify the channels with the highest collection, clas-

sified by type of transaction (i.e., consultation, pay-

ments, and reversals). Likewise, the transaction re-

sponse dashboard was developed, displaying the inci-

dence of error response codes issued by the collect-

ing institution. It should be noted that before the im-

plementation of this study, there were no reports on

collection by channel and details of response codes.

The tool provides clear and concise information on

the channels with the highest collection, recurrence,

and error codes, elements which allow the Company

to pursue the correct decisions to mitigate errors in

the transaction responses and emphasize the use of

digital channels. Figure 3 illustrates the dashboards

developed:

Figure 3: Dashboards Sprint 3.

3.4 Creation of Load of Jobs

In this phase, the package was published in the Sys-

tem Integration of SLQ Server (Server, 2020), and we

created the daily extraction job below the following

criteria: Daily ETL execution: This was necessary to

extract the information based on the accounting date

of the previous day. Also, we performed the config-

uration of notifications of success or failure for the

ETL and smart cube in Microstrategy. Incremental

Bucket Loads: It consists of performing the incremen-

tal loads of the historical data of the transactional ta-

ble of the data source. User Testing: In order to en-

sure that the solution is quality-driven, certification

tests were conducted with the Product Owner to gain

user acceptance. Transfer to Production: This activ-

ity consisted of publishing the developed dashboards

in the production environment and granting permis-

sions to the users created for this purpose. User train-

ing: With the launch of the product, the user training

for the correct practice of the product was finally per-

formed, with relative success.

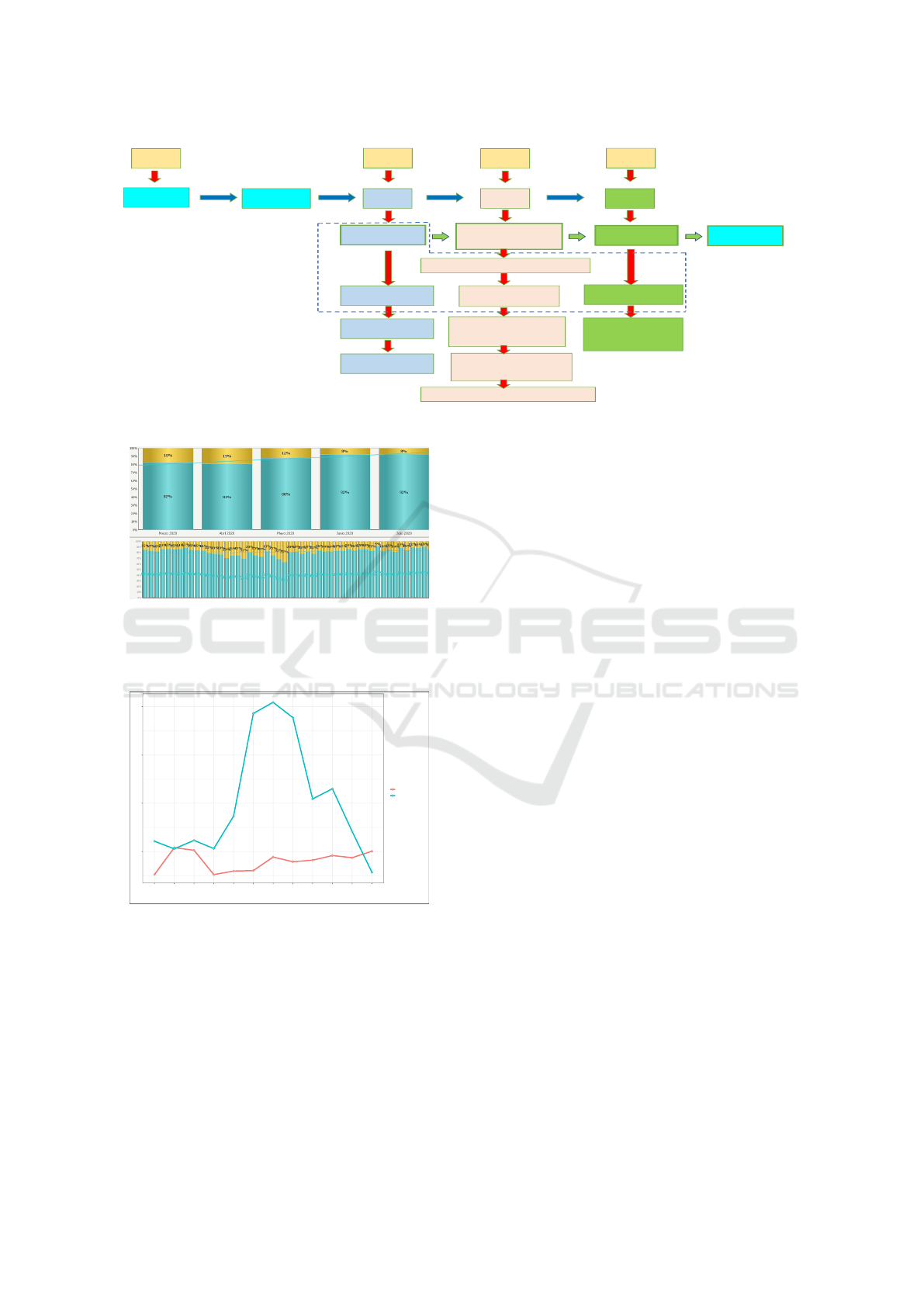

In summary, Figure 4 represents the complete de-

ployment cycle of model implementation. As previ-

ously explained, it starts with collecting user stories

and prioritization to obtain the product backlog. The

dimensional model’s development follows the inter-

action of one to three of the sprints to finally execute

the model’s implementation.

4 EVALUATION OF RESULTS

4.1 Comprehensive Daily Monitoring

The Comprehensive Monitoring dashboard allows

users to observe the percentage of the number of ap-

proved and rejected transactions, supporting FinTech

collaborators to identify unusual increases per day by

financial institutions and businesses to realize imme-

diate action. Fig. 5 indicates the daily comprehensive

monitoring dashboard.

4.2 Rejected Transactions

Figure 6 illustrates the rejected transactions according

to each month’s collections during the year 2019 until

May 2020. The rejections registered in 2019 tend not

to present more significant variability. Even though a

growing trend is visible as of July, reaching its peak

in December with 402,025 rejected transactions com-

pared to only about 209,631 in January of the same

year. This means that the actions given to the causes

Management Support Systems Model for Incident Resolution in FinTech based on Business Intelligence

245

USER

STORY

USER

STORY

USER

STORY

USER

STORY

Product

Backlog

SPRINT

BACKLOG

SPRINT

1

SPRINT

2

SPRINT

3

Dimensional

model design

Data source

analysis

Definition of

indicators

Design

DSA/DWH

Data source connection

Truncate DSA

tables

Creation attributes

and metrics

Extraction

transformation and

loading

Balance and certification DWH

Design and

development ETL

Visualization

Dashboard

development

Incremental

loads

configuration

Step to

production

Figure 4: A complete deployment cycle of model implementation.

Figure 5: Daily Comprehensive Monitoring Dashboard.

which generated these rejections were not enough to

reduce this behavior.

209631

431718

410564

208573

237932

241739

353916

315463

328198

366324

348886

402025

485193

422187

492332

424456

692885

1544721

1636826

1510394

836153

920172

566228

227528

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Data collection

Rejected transactions

Year

Year−2019

Year−2020

Figure 6: Dashboard of rejected transactions.

Contrarily, in the year 2020, significant variability in

the data is visualized since it presents a significant

growth, from May (692,885) to July, which reaches

the highest value of about 1’636,826. This is due to

the pandemic confinement, as the use of online col-

lection services increased drastically. The analysis of

transactional behavior through the application dash-

boards allowed us to deduce the outstanding contribu-

tion to take actions and mitigate the causes that moti-

vated this increase.

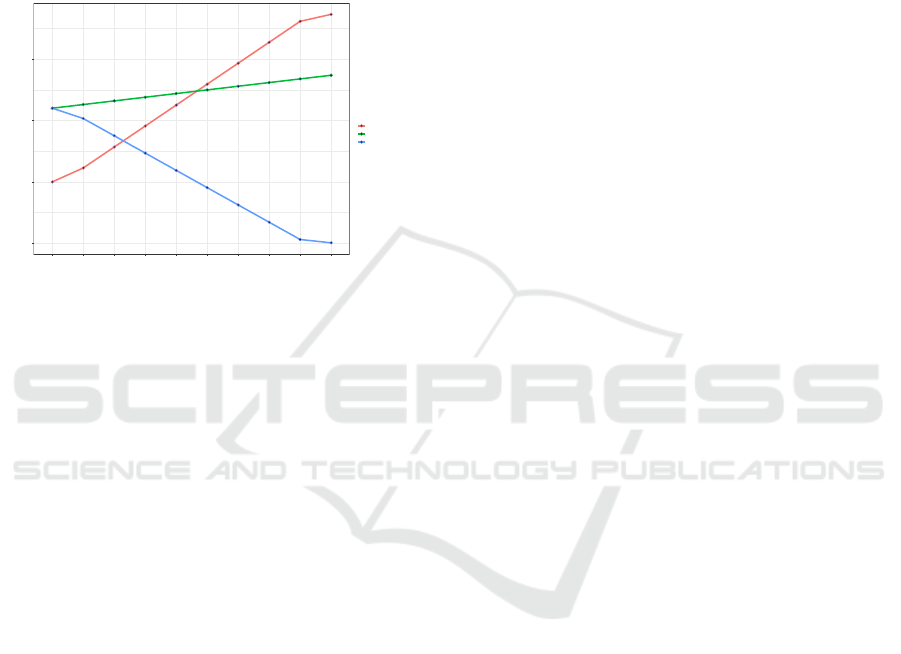

4.3 Return of Investment (ROI)

Considering that the present study was developed on

the existing infrastructure in FinTech, the ROI was fo-

cused on the development and implementation costs

of the software solution and the quantification of the

benefits in two years. For this purpose, in princi-

ple, the hourly rate that the collaborators involved in

the BI project invest monthly was established, whose

function was to analyze information to manage inci-

dents related to the Collections and Payments service

quality.

Specifically, the total monthly hours each team

member would use to generate the indicators and

analysis to manage the quality improvement of the

services were considered, such as Operations Leader,

Operations Coordinator, BI Coordinator, Coordina-

tor of Quality, summing up of about 1,143.75 USD.

This work’s implementation costs are included, such

as External Consulting for 8,000 USD and Devel-

opment for 6,000 USD. Besides, implementing a BI

project requires resources, both for the implementa-

tion phase and the solution’s maintenance (operation).

The BI coordinator’s proportional value is considered

the main item for the operation; this meant that the

costs related to maintenance amounted to a total of

about 600 USD.

In order to deliver a benefit value as close as pos-

sible to the national reality, the calculation was per-

formed considering macroeconomic figures such as

inflation and active interest rate. As of January 2020,

the central bank records an active interest rate of

9.14%, while inflation is recorded at 0.23%. There-

fore, a discount rate of 9.4% is estimated. With these

inputs, the discount rate was calculated at 9.4%. Fig-

ure 7 demonstrates the cost/benefit behavior for two

years and reveals the investment’s profitability. Ad-

ditionally, it indicates that during the first year, the

ICEIS 2021 - 23rd International Conference on Enterprise Information Systems

246

project’s costs are higher than the benefits, which

means that person-hours were lacked to be used ef-

ficiently. However, this behavior changes from the

breakeven point, where the costs are approximate

14,982 (USD), and the benefits are 15,946.4 (USD).

Therefore, the lower the investment costs, the greater

the benefit obtained for the project. We deduced that

person-hours are better used to analyze information

based on the implemented model with these results.

12000

12596.4

13192.8

13789.2

14385.6

14982

15578.4

16174.8

16771.2

17367.6

0

2273.8

5684.4

9095.1

12505.8

15916.4

19327.1

22737.8

26148.4

27285.3

12000

10322.6

7508.4

4694.1

1879.8

−934.4

−3748.7

−6563

−9377.2

−9917.7

Jan−19 Mar−19 Jun−19 Sep−19 Dec−19 Jan−20 Mar−20 Jun−20 Sep−20 Dec−20

Working Period

Cost (USD)

Label

Benefit

Costs

profitability

Figure 7: The behavior of cost/benefit and ROI.

5 CONCLUSIONS

The present study focused on implementing a BI sys-

tem with the necessary elements to achieve the trans-

actional behavior of financial services visible, in-

tending to improve incident management through BI

instruments. Hereby, management indicators were

identified, which allowed us to evaluate, understand,

and value transactional behaviors and trends through

a graphic representation. This resulted in a useful

tool that provides insights for employees who need to

manage anomaly detection and resolution. The sys-

tem’s implementation was able to be delivered in a

shorter time since the agile methodology for project

management Scrum was used combined with Kim-

bal’s dimensional modeling methodology, allowing

collaborators to hold a support tool for managing their

work. As future work, a new version’s deployment

is planned to take competitive advantages that these

platforms provide, such as data streaming and mas-

sive queries.

REFERENCES

Alliance, S. (2016). Learn about scrum. Saatavissa:

https://www. scrumalliance. org/why-scrum [Viitattu

9.7. 2016].

Ayoubi, E. and Aljawarneh, S. (2018). Challenges and op-

portunities of adopting business intelligence in smes:

collaborative model. In Proceedings of the First Inter-

national Conference on Data Science, E-learning and

Information Systems, pages 1–5.

Bedford, P., Millard, S., and Yang, J. (2005). Analysing the

impact of operational incidents in large-value payment

systems: A simulation approach. Liquidity, Risks and

Speed in Payment and Settlement Systems–A Simula-

tion Approach, pages 247–74.

Bobyl, V. V., Dron, M. A., and Taranenko, A. (2018). Op-

erational risks: Assessment and ways of mitigation.

D’Arconte, C. (2018). Business intelligence applied in

small size for profit companies. Procedia computer

science, 131:45–57.

Farahmand, F., Navathe, S. B., Enslow, P. H., and Sharp,

G. P. (2003). Managing vulnerabilities of information

systems to security incidents. In Proceedings of the

5th international conference on Electronic commerce,

pages 348–354.

Gai, K., Qiu, M., and Sun, X. (2018). A survey on fin-

tech. Journal of Network and Computer Applications,

103:262 – 273.

Hahn, S. M. L. (2019). Analysis of existing concepts of

optimization of etl-processes. In Computer Science

On-line Conference, pages 62–76. Springer.

Kimball, R. and Ross, M. (2011). The data warehouse

toolkit: the complete guide to dimensional modeling.

John Wiley & Sons.

Latrache, A., Nfaoui, E. H., and Boumhidi, J. (2015). Multi

agent based incident management system according to

itil. In 2015 Intelligent Systems and Computer Vision

(ISCV), pages 1–7.

Macas, M., Lagla, L., Fuertes, W., Guerrero, G., and Toulk-

eridis, T. (2017). Data mining model in the discovery

of trends and patterns of intruder attacks on the data

network as a public-sector innovation. In 2017 Fourth

International Conference on eDemocracy & eGovern-

ment (ICEDEG), pages 55–62. IEEE.

Malik, Z. H., Farzand, H., Ahmad, M., and Ashraf, A.

(2019). Tour de force: A software process model for

academics. In Intelligent Computing-Proceedings of

the Computing Conference, pages 885–901. Springer.

Midor, K., Sujov

´

a, E., Cierna, H., Zarebinska, D., and Ka-

niak, W. (2020). Key performance indicators (kpis)

as a tool to improve product quality. New Trends in

Production Engineering, 3(1):347–354.

Nugra, H., Abad, A., Fuertes, W., Galarraga, F., Aules,

H., Villacis, C., and Toulkeridis, T. (2016). A low-

cost iot application for the urban traffic of vehicles,

based on wireless sensors using gsm technology. In

2016 IEEE/ACM 20th International Symposium on

Distributed Simulation and Real Time Applications

(DS-RT), pages 161–169.

Schwaber, K. and Sutherland, J. (2013). The scrum guide:

The definitive guide to scrum: The rules of the

game.(2011). Available: scrum. org.

Serna, M. A. A., Arias, J., G

´

omez, J., Lopera, F., and Ar-

bel

´

aez, L. (2016). Information system for the quantifi-

cation of operational risk in financial institutions. In

2016 11th Iberian Conference on Information Systems

and Technologies (CISTI), pages 1–7.

Server, G. S. (2020). Sql server integration services.

Management Support Systems Model for Incident Resolution in FinTech based on Business Intelligence

247