The Transition from IAS 39 to IFRS 9 and Its Impact on Financial

Performance: Case of a Moroccan Public Financial Institution

Abdallah Bellagdid

1

, Abdelhak Sahibeddine

1

, Imane Britel

2

and Christophe Godowski

2

1

National School of Business and Management, University of Chouaib Doukkali, Morocco

2

The Institute of Business Administration, University of Limoges, France

Keywords: IFRS9, Financial Instruments, Financial Performance, Prudential Supervision.

Abstract: The following framework provides a thorough insight into the international accounting standards with a

particular focus on the one pertaining to the financial instruments IFRS 9 applied and monitored, for

instance, by afinancial public institution. It also sheds a light on the procedure that needs to be followed by

other entities upon the implementation of a new international accounting standard. The investigation

conducted, the methodology used as well as interviews established with the staff of consolidation and

calculations practiced has allowed for the elaboration a comparative study between real situation and

simulated situation (IFRS 9). Synthetic as well as visual, the study has led us to formulate a detailed and all-

encompassing vision on the impact of this transition on the financial performance of the financial group,

without omitting the risk aspect relative to this concept represented by prudential supervision.The value of

the present research lies to identify the various representations of this new international accounting standard,

to propose recommendations for a perfect control and realization of its strategic as well as operational

objectives.

1 INTRODUCTION

The international accounting standards, known as

IAS (International Accounting Standards) or IFRS

(International Financial Reporting Standards) were

born of a meticulous desire to create a single

European accounting standard. This new accounting

model aims to redefine certain concepts, notably

financial transparency, comparability of financial

statements and improved quality of information.

In its capacity as a public body, the organization

adopted international accounting standards in its

financial approach in 2008 and applied them to the

consolidated financial statements. The Accounting

and Consolidation Department of the financial group

monitors compliance with these standards.

However, as part of the project to modernize

international accounting standards in order to adapt

to the international economic and financial context,

the management responsible continually updates the

annual financial statements in line with the notices

issued by the IASB. The year 2018 was marked by

the advent of IFRS 9 on financial instruments.

The transition from IAS 39 to this new standard

is a challenge not only for this financial group, but

also for all financial institutions. This transition is

described as a far-reaching trajectory because of its

representations and repercussions on the accounting

logic (the new provisioning principle), as well as on

the consolidated financial statements for fiscal year

2018.

It is important to note that the application of

these standards and the monitoring of related

reforms is not limited to compliance with regulatory

requirements. It also focuses on a molar approach

that seeks to improve macroeconomic indicators

while strengthening the country's international

competitive position.

The present work sets out a certain number of

objectives, starting with a review of the transition to

the new standard, the quantification of its impact on

the financial performance of the financial group, and

finally proposing avenues for improvement and

making appropriate recommendations.

Our research therefore consists of linking two

poles: that of the application of international

accounting standards in the consolidated financial

statements and that of financial performance.

We assume that any reform within this

framework directly influences the performance and

Bellagdid, A., Sahibeddine, A., Britel, I. and Godowski, C.

The Transition from IAS 39 to IFRS 9 and Its Impact on Financial Performance: Case of a Moroccan Public Financial Institution.

DOI: 10.5220/0010448900890097

In Proceedings of the 3rd International Conference on Finance, Economics, Management and IT Business (FEMIB 2021), pages 89-97

ISBN: 978-989-758-507-4

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

89

financial health of the organization. This leads us to

set the following problem:

Does the adoption of the international accounting

standard IFRS 9 impact the financial

performance of a public entity - case of a public

financial institution -?

This questioning can be broken down into three sub-

questions:

First, the premeditation of the reforms of

international accounting standards: What

contribution does the mastery of normes make to

the financial performance of the financial group?

Secondly, to what extent can the financial group's

mastery of international accountingstandards

support its accounting activity?

Finally, to what extent can the international

accounting standard IFRS 9 influence

theprudential ratio of a public financial

institution?

Based on the above considerations, the

methodology that seems to us the most suitable is a

hybrid approach. It involves applying a qualitative

approach, through the elaboration of an individual

interview guide. We will try to complete it with

quantitative data through the application of the

methods and tools of the quantitative approach.

Our plan for this research is twofold: The first

part consists in forging the theoretical construct of

our work. The second part constitutes the empirical

pole. We then present the impact of the transition

from IAS 39 to IFRS 9 on the Group's financial

performance, the state of completion of our work

and the areas for improvement in order to better

control future reforms.

2 LITERATUREREVIEW

The analysis of the impact of the transition from IAS

39 to IFRS 9 on financial performance requires first

of all an assessment of the environment in which this

accounting reform will be adopted, while highlighting

the main contributions of the new IFRS 9 to the

accounting sphere, and then an exploration of

previous work that has dealt with this issue.

2.1 From IAS 39 to IFRS 9

The entry into force of IAS 39 in 2001 was highly

unproven since it used the fair value method, which

was a real obstacle for financial institutions in terms

of asset recognition. This state of affairs has led

users of international accounting standards and

experts in the field to reconsider their positions on

IAS 39 because:

- Insolvency in terms of management of financial

instruments;

- The lack of transparency preserved by this

standard;

- The use of Fair Value as a valuation option;

- Non-anticipation of market events in terms of

asset impairment.

This non-exhaustive list of criticisms was the

trigger point for the draft IFRS 9 standard. In July

2014, the IASB (International Accounting Standards

Board) published the final version of the IFRS9

standard entitled "Financial Instruments" to replace

IAS39 "Financial Instruments: Recognition and

Measurement".

The new standard, which came into force on

January 1, 2018, is complex to apply and has

brought several new accounting and financial

innovations, including a new classification and

measurement of financial instruments, the

introduction of the provisioning principle of

expected credit losses (ECL) and the reform of

hedge accounting.

2.2 Impact of IFRS 9 on Financial

Performance: State of Play

The application of IFRS 9 has aroused the interest of

scientific researchers because it has brought about

enormous changes, especially for financial

institutions. However, it should be noted that the

number of scientific research studies dealing with

this accounting reform remains too small, in contrast

to the many agencies and auditing firms that have

conducted studies to measure the real impact of the

application of the said standard.

In order to complete this transitional phase, Bank

Al Maghreb had granted a 2-month grace period to

institutions for the quarterly financial publication of

consolidated accounts. This affirms the great

vigilance that must be adopted by institutions for a

non defaulting application of the standard.

In addition, we conducted an international

Benchmarking exercise involving a group of

consolidating entities that have anticipated the

application of IFRS 9 in 2017. The objective was to

estimate the impact of the application of IFRS 9 on

shareholders' equity and consequently on the

statement of financial position. We have selected a

sample of international financial institutions with a

sizeable portfolio. It is important to note that no

Moroccan group has anticipated the implementation

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

90

of the new IFRS 9 standard or quantified its impact

on the financial statements.

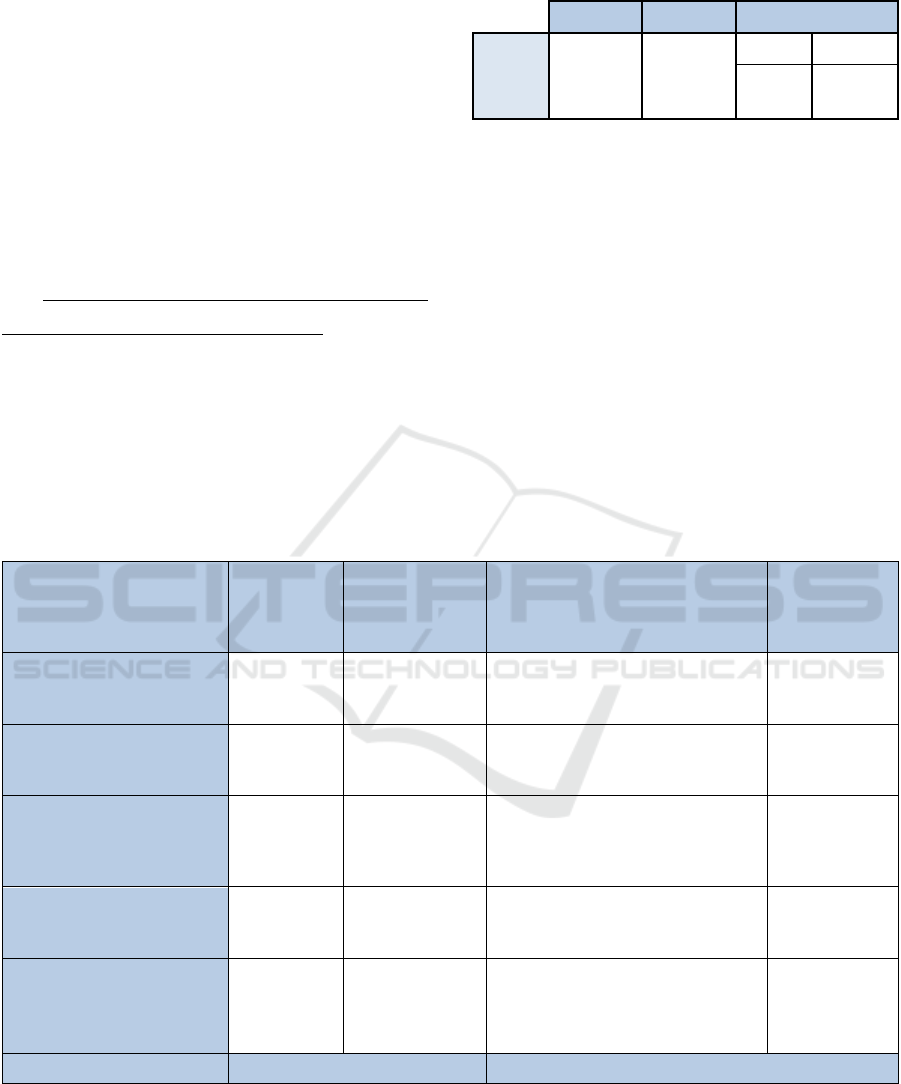

Table 1 : International benchmarking.

Group Impact on the balance sheet structure

PNB

Paribas

A €2.5 billion net tax decrease in

Shareholders' Equity; accompanied by a

€3.3 billionchangein the overall amount of

impairment.

Société

Générale

The decrease in the value of consolidated

shareholders' equity of 1 milliard €.

ENGIE

The Group values the loss on consolidated

consolidated equity at €235 million;

compared to aloss of €224 million recorded

in K. own share.

BPCE

Changes in the JV (net of tax) charged to

equity for an amount of €(198) million.

Gains and losses due to the reclassification

of certain assets are transferred to reserves

for an amount of €3 million.

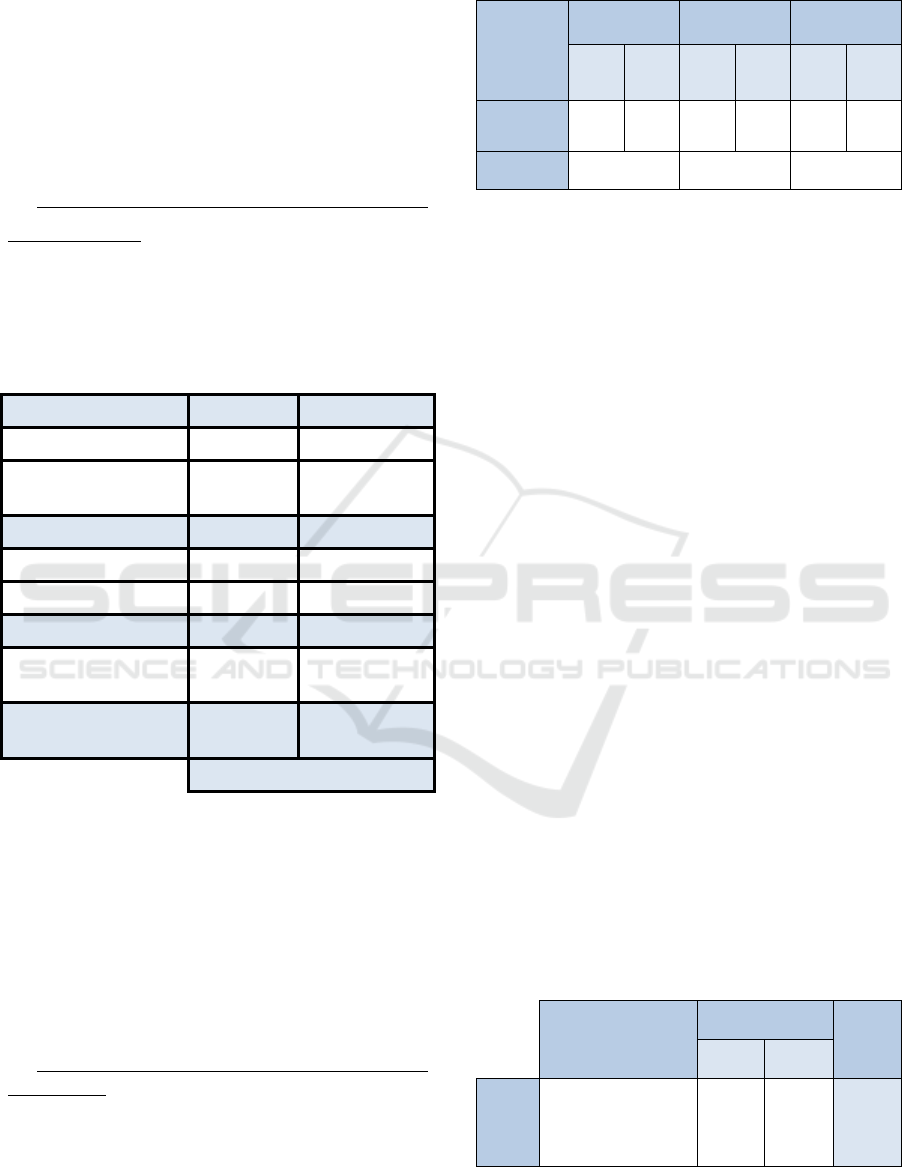

In the same context, the U.S. rating agency Fitch

Ratings published on Monday, August 6, 2018 the

results of its study analyzing the first-time adoption

of IFRS9 on the capital of Moroccan banks. The

published financial statements of banks, in the first

quarter of 2018, confirmed the increase in bond

provisions, accompanied by the reduction of equity

capital to 13.8% for BCP, 10.5% for BMCE Bank

and 9.1% for Attijariwafa Bank - all national banks

of systemic importance - and 3.2% for Credit du

Maroc.

Figure 1 : Impact of IFRS 9 on equity.

As for the report published by CFG Research,

the introduction of new provisioning rules to cover

impairment of financial assets impacted, in 2018, the

provisions on receivables of the 6 listed banks by

MAD 16.7 billion, an increase of 32% compared to

the provisions under IAS 39. In addition, this

accounting adjustment had a direct impact on the

equity of listed banks of nearly MAD 12 billion, of

which 92% stems from the three leaders (67% of

outstanding loans in Morocco) Attijariwafa bank,

BCP and BMCE Bank Of Africa.

On the other hand, M.S.I.N., the broker of the

stock exchange company, has accentuated its analysis

on listed banks. According to his calculations, the

latter have lost 12 billion DH of capital since the

adoption of IFRS 9. Their shareholders' equity has

thus fallen from MAD 137.6 billion to MAD 125.6

billion, a drop of 8.8%, with an immediate impact on

their ability to absorb shocks accompanied by a risk

of increased financing costs.

3 METHODOLOGY OF THE

STUDY

This section begins with a presentation of the

epistemological and methodological position

advocated for measuring the impact of the adoption

of IFRS 9 on the financial performance of a

government organization. It then goes on to explain

the nature and survey tools used to reconcile the said

standard.

3.1 Sample

The study was carried out within a public financial

institution with a scope of 145 subsidiaries in all

business lines and industries. The Group's

diversified structure makes the analysis of the

impact of the transition and changeover to IFRS 9

within this institution very interesting and will

provide relevant answers to the questions raised.

3.2 Nature of the Investigation

In order to provide an answer to our research

question, that of the impact of the application of

IFRS 9 on the financial performance of this

institution, it is crucial to establish a hypothesis that

constitutes the starting point of our research. We

therefore assume that the change in accounting

regulations, in particular the transition from IAS39

to IFRS9, has a direct impact on the performance

and financial health of the organization.

This hypothesis must be analyzed and tested to

measure its degree of conformity and validity. In this

respect, our research is part of the positivist current

(Verifiability, Confirmability and Rebuttability), in

The Transition from IAS 39 to IFRS 9 and Its Impact on Financial Performance: Case of a Moroccan Public Financial Institution

91

order to identify the causes and consequences of the

events produced. Through this epistemological

paradigm, we seek to study the refutability or

acceptance of our hypothesis, which is the basis of

our research.

In terms of methodological considerations, we

have opted for a hybrid approach. On the one hand,

the quantitative component in order to trace and

explain the staging of links and causes and effects

with respect to our research theme, to evaluate the

implementation of this new standard and to measure

its impact. On the other hand, there is a qualitative

component through the development of an interview

guide, since both approaches are based on a logic of

concordance as well as opposition.

In addition, our research is part of a hypothetico-

deductive approach that leads us to avenues of

reflection and analysis applicable to the different

aspects studied. This approach also allows us to

construct the theoretical prerequisites concerning

international accounting standards that will serve as

a basis for the verification of hypotheses.

3.3 Conduct of the Investigation

We have chosen a conceptual model, a logic of

reflection, to respond to the problem we have set. It

is a question of starting with the interview guide in

order to obtain a preconfirmation of the hypothesis,

an instrument of access to reality.

Next, a reclassification model for all financial

instruments will be implemented and applied to the

Group's financial statements. We can therefore

observe and quantify the various changes in the

financial statements, consolidated balance sheet and

statement of comprehensive income.

At this stage, the establishment of a comparative

study between real and simulatedsituations becomes

possible, which will allow us to assess the impact on

financialperformance (the recommended KPIs) and

the prudential base (3 fundamental pillars of

equitycapital).

4 RESULTS OF THE EMPIRICAL

STUDY OF THE FINANCIAL

GROUP

This section begins by describing the approaches

followed and the lines of analysis undertaken, and

then presents the results of the various studies

envisaged.

4.1 Maintenance of the Accounting and

Consolidation Department

Following the interview guide developed and

implemented with the staff of the institution's

consolidation service, we collected a set of

responses that we analyzed carefully in order to

formulate a typical response (Appendix). The main

lines of investigation selected for this survey are as

follows:

Axis1: Understanding and assessing the

transition from IAS 39 to IFRS 9;

Axis2: Identification of the requirements in terms

of application of the new standard and

assessment of the impact of the change on

the financial governance of the financial

group;

Axis3: Formulation of observations on the

shortcomings raised in this standard,

while suggesting avenues for

improvement as well as prospects for the

development of this work.

After analyzing the responses to the interview

guide, we were first able to assess the criticality of

the transition to IFRS 9 and the various changes and

restatements applied. In addition to thatthe existence

of an effective impact on the Group's financial

performance has been confirmed, even if the Group

remains slightly influenced by the structural

soundness and composition of its securities

portfolio.

4.2 Financial Instrument

Reclassification Model

The first phase of the IFRS 9 project on the

classification of financial instruments is the main

component of the project, since it is by determining

the category to which a financial instrument can be

assigned that its measurement and recognition

method can be determined.

This phase represents the basis and starting point

of the transition process puted in place. It is the work

of art of a study about the specificities and rules

prescribed by IFRS 9. At this stage, the institution

must be vigilant in order to assure protection from

potential risks that may arise.

The recognition of provisions categories of

financial instruments under IFRS 9 like Bonds

included in the portfolio of available-for-sale assets

(AFS) and listed held-to-maturity assets (HTM)

which was not permitted to recognize as provision

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

92

under IAS 39. In addition, a new test was added in

order to recognize some instrument category, it is

the SPPI test.

4.3 Impact on Financial Performance

Before presenting the impact on the financial

performance of the financial group, we believe it is

useful to present a summary comparative study of

the actual and simulated situation of the group's

main financial statements in 2017 (consolidated

balance sheet and statement of comprehensive

income).

- Comparative study between the impact of IFRS 9

on the actual and simulated assetsituation

Because of the application of IFRS 9, we have

prepared a simulated consolidated balance sheet in

accordance with the rules prescribed in this standard,

and in application of the reconciliation table that we

have previously stated. The simulated assets and

liabilities of the establishment are as follows:

Table 2: Simulated and actual 2017 situation.

R (2017) S (2017) Statement of change

Property

situation

(MDh)

2 34 716

615

234 162

975

in % In Value

-

0,2359%

-

553 640%

The impact of the new standard has been greatly

weakened by the provisions and processes put in

place by the Group's consolidation management,

without omitting the Group's status as a public

institution with a solid and varied portfolio.

This change in the financial position is explained

by the new allocation of financial instruments due to

the application of the new expected loss principle

included in the provisions of IFRS 9. It should be

noted that the provisioning rate applied is 9.5%. For

simplification purposes, this rate is applicable for the

upward revision of the total amount of provisions

actually recognized and for the recognition of

provisions on financial instruments not provided for

in the actual fiscal year. We note the new values in

this table:

Table 3: Recognition of the provision according to the ECL principle.

CategoryofFinancialInst.

Actual

provision

2017

Actual value

of the EndTime

en MDH

Simulated provision

2017

Simulated

value of

theEnd Time

en MDH

Financial assetsat the JVR*

No provision

on this

category

8.822.275

A provision should berecognized on

adjusted variable income securitiesin

the AFS category.

45.329.676

Available-

forsalefinancialassets**

No

provisionhas

been made.

49.833.921

A provision must berecognized on

bonds included in the

fixedincomesecuritiesportfolio.

13.326.520

Loans and

receivables fromcredit

institutions

andsimilarinstitutions

6.194.000

DH

15.094.815

The new Mt according toIFRS 9 is:

(6 194 000 * 1,095) =6.782.430

DH

15.094.226

Loans and

receivables from

customers

1.557.252

MDH

42.410.959

The new provision willtherefore be :

(1 557 252 *1,095) = 1.705.191

MDH

42.263.019

HTM at

amortized

cost***

No

provision

has been

made.

35.114.321

A provision must berecorded on the

HTMside. The provision is:

4 264 321 * 9,5% = 405.111 DH

34.709.211

Total 151.276.291 MDH 150.722.653 MDH

* Increase in the value of Financial Assets at FVR following the reclassification of variable income securities from the

Available-for-sale category.

** Decrease in the value of variable income securities

*** Previously referred to as Held-to-maturity assets. This category includes Treasury bills andlisted HTMs

The Transition from IAS 39 to IFRS 9 and Its Impact on Financial Performance: Case of a Moroccan Public Financial Institution

93

We have recognized an impairment loss on

financial instruments due to the applicationof the

new ECL provisioning principle. The new amount

of provision (151.276.291 - 150.722.651) = 553.640

MDH,corresponds to the amount of the variation of

the patrimonialsituation. This provision will be

charged to the group's consolidated reserves and

willtherefore directly affect the integrated

shareholders' equity.

-Comparative study of the impact of IFRS 9 on the

income statement

This involves applying the progression rate,

obtained by calculating the average new cost of risk of

certain financial institutions, which in our case is 9.5%

Table 4: Simulatedstatement of comprehensive income.

Elements Real(2017) Simulated(2017)

Net bankingincome 6 805 078 6 805 078

Gross Operating

Income

790 044

790 044

- Cost of Risk - 95 562 - 104 640

Pre-taxincome (loss) 691 925 682 847

- Incometaxexpense - 754 683 - 747 995

Net income (loss) - 62 758 - 65 149

Non-

controllinginterests

- 149 284

- 149 284

Net income (Group

share)

86 526

84 135

(84 135 - 86 526) = -2 391

It appears from our simulation that the net

result, group share, varied negatively by 2,841%. It

should be noted that due to the regulations, the

group did not make any movement on the income

statement although the balance sheet structure and

the consolidated income statement of the group are

negatively impacted, except that this impact

remains sustained and manageable due to the

structure of the group and the solidity of its

securities portfolio

- Study of the impact of IFRS 9 on financial

performance

The evaluation of the institution's financial

performance is automatically linked to the

calculation of a number of KPIs that are considered

relevant and that unfailingly meet our needs in

terms of analysis.

Table 5: Economic Profitability Ratio.

Ratios

ROE ROE group ROI

R S R S R S

Result

0,28

56%

0,29

30%

0,55

51%

0,57

56%

6,61

42%

6,67

12%

Impact

-0,0074% + 0,0204% + 0,0570%

We note that the group is performing negatively

in terms of integrated ROE. The latter is explained by

the integrated net income which is (-62,758 MDH).

This negative result has been eased by the

implementation of the provisions of the new IFRS 9

standard; a ROE of -0.2930% recorded by a decrease

of -0.0074% compared to the actual situation.

Contrary to the integrated ROE, the Group's ROE

shows minimal positive results, due to the RNPG,

which is the result of a compensation between the

integrated net income and that relating to minority

interests (+86,526 MDH). The impact of IFRS 9

being positive in this case +0.0204%, since the

RNPG remains at the same level, while shareholders'

equity excluding minority interests and unrealized

gains or losses has decreased, following the volatility

of consolidated reserves (-17.33%).

In terms of ROCE, the ratio remains invariable.

However, the level of WCR will be impacted in the

coming years, as 37% of the total amount of

provisions will be allocated to the deferred tax item,

which will reduce it significantly. It should be noted

that the Group creates value, since the ROCE is higher

than the WACC in the actual and simulated situation.

Finally, the ROI shows a rate of (6.6142%) for the

actual situation, as it was positively influenced

+0.0570% in the simulated scenario following the

application of IFRS 9 (6.6712%). This still amounts to

a reduction in shareholders' equity in the face of the

stability of the net banking income achieved by the

group.

Table 6: Simulatedstatement of comprehensive income.

Calculated

Method

Result

Impact

IFRS 9

Real Simulated

Leverage

effect

Rf.Re

((Economic profitab-

Tx. Interest(1 - Tx. IS))

* Net indebtedness) / K.

own

12,9808% 13,3164% +0,3355%

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

94

Table 7: Numerical application of the Dupont model.

Performance Indicator Calculation rule

Result

Impact

Real Simulated

Dupont

Profitability

Profit/

Equity

RNPG / CA

0,394%

0,49%

0,404%

0,492%

0,0102%

Active

Rotation

CA / K.

invested

25,15% 27,38%

Solvency

K. invested /

K. own

294,99% 300,03%

We note that all the calculated efficiencies

provide a positive leverage effect. The use of debt

within the group has led to an increase in the group's

return on equity. Indeed, the implementation of

IFRS 9 has a positive impact of +0.3355% on the

leverage effect. The existence of this effect depends

on the superiority of the economic profitability over

the interest rate applied to the financial group.

This indicator links asset management, the

achievement of a net margin and, lastly, debtcontrol.

We note through the calculation that the adoption of

IFRS 9 leads to an increase in allthe components of

the model +0.0102%. The company is in good

financial health and nothingwill prevent it from

achieving its objectives.

Table 8: Numerical application of the EVA model.

Result

Impact of

IFRS 9

Real Simulated

EVA 227 405,70 292 389,31

64 984

MDH

+28,58%

By numerical application, we notice that the group

creates value. The latter has evolved significantly in

the context of the simulated situation, with a

favourable evolution of +28.58%.Indeed, this growth

in the indicator refers to a profitability that will be

high and a growth ineconomic assets. This also

indicates that the economic profitability objectives

have been achieved.

As we have noted, the difference between the

two standards: IAS 39 and IFRS 9

impactthetreatment of financial instruments. As a

result, the implementation of IFRS 9 leads to

thesetting of several important indicators in the

balance sheet structure and the statement

ofcomprehensive income. This transition has a

positive impact on the Group's profitability,

andconsequently on its financial performance, with

the exception of consolidated ROE. Indeed, the

IASB's advancements on the subject of financial

instruments for fiscal year 2018 have asignificant

impact on equity, which is considered by entities and

SMEs as a measure ofunderperformance.

Study of the impact of IFRS 9 on the prudential base

Basel and international accounting standards are

often exhibited in a study frameworkwhere several

interactions are identified that can be synergistic or

even antagonistic.Moreover, it appeared to us from

our analysis of the Group's structure and our studies

on theapplicability of IFRS 9 that this could impact

one of the pillars of any financial institution, namely

the prudential base stipulated at the Basel III level.

Pilllar 1: Increasing Regulatory Funds and

Improving their Quality: We found that the group

complies with the minimum capital requirements.

However, adecrease in the equity ratios was

observed. This means that IFRS 9 has an effective

impact, but one that remains sustained and

manageable.

Pillar 2: Strengthening Risk Management

Mechanisms (LCR & NSFR): We can state from

the figures observed and our analysis of the current

context that, once again, the institution seems to be

asserting its subtlety and the solidity of its structure,

which in no way seems to be overwhelmed by the

advent of this new standard.

Pillar 3: Culminating Leverage Effect: Leverage

is defined as the ratio of total assets to shareholders'

equity. Banks used this ratio asa relevant indicator.

Table 9: Measuring impact on FP leverage impact.

Total assets

Share holders'

equity

Leverage effect

Impact

IFRS 9

R S R S R S

234 716

615

234 162

975

21 972

967

21 419

330

9,3615% 9,1472%

-0,2143%

The Transition from IAS 39 to IFRS 9 and Its Impact on Financial Performance: Case of a Moroccan Public Financial Institution

95

We note from our calculations that the institution

largely complies with the minimumset for equity

leverage, which is 3%. The impact of IFRS 9 on this

third pillar is not a causefor concern for the Group's

accounting and finance department

5 CONTRIBUTION AND

PERSPECTIVES OF THE

STUDY

The study we conducted on the impact of the

transition from IAS 39 to IFRS 9 is theresult of an

interview with the Group's consolidators, combined

with a brief analysis of thevarious extensions of this

transition, materialized by the calculation of various

KPIs, whilereferring to the history of the work

carried out in the same research framework.

It should be noted that the survey was established

in an estimation logic, by comparingthe existing

with the closest reality. Moreover, the focus of this

research is not limited solely tothe study and control

of the impact of the implementation of IFRS 9

within the financial group,but is also interested in

the preparation of a preventive process allowing a

better integration ofthe new accounting standards.

In the first quarter of 2018, the financial group

under review published its consolidatedfinancial

statements including the impact of the first-time

adoption of IFRS 9. The latter showthat the gross

impact of the evaluation of expected credit losses

amounted to 321 millions MAD. On the other hand,

the simulated study we conducted showed a

provision amount,according to the new principle, of

553 MDH. This difference has been absorbed on the

onehand, by the fact that the simulated study had as

the only variable the new IFRS 9.And on the other

hand, due to the doubling of its GNP which reached

1.6 MMDH in 2018 against 734.9 MMDH in 2017

for the first quarter, in addition to its RNPG which

amounted to 236 MMDH, up 109% over a year.

There seem to be many avenues for extending

our research work, because of its novelty,its

originality, but above all because of its

representations and implications. A large-

scaleworkthat requires a continuous and perpetually

updated effort so that not only this financialgroup,

but also all institutions can accompany the mutations

and changes imposed by the special accounting

bodies.

6 GENERAL CONCLUSION

Several factors motivated us to choose this research

topic. First, the intellectual curiosity and the desire to

assimilate successfully part of the sphere of

international accounting standards, namely IFRS 9.

Then, our presentiment and conviction, that the

appropriation by this financial group of the transition

from IAS 39 to IFRS 9 would bring real added value.

The methodology of our research follows the

process of developing and implementingan

international accounting standard, from assimilation

to the evaluation of differences andimpact in order

to decide on the transition and deliver the

appropriate comments andinterpretations.

Our field survey fits well with the hybrid approach,

bringing together both qualitativeand quantitative tools.

It relies on the opinions expressed, as well

ascalculations to study the structural variability of the

main financial statements and then assess the impact on

the financial performance.

This work has enabled us to obtain a global and

detailed view of what otherestablishments and

consolidating entities could encounter following the

adoption of this newstandard, and its impact on the

structure of their financial statements and

consequently adeduction on financial performance..

In conclusion, this research has provided us with

an understanding of how the group is preparing for

the new accounting requirements and what the impact

might be on an establishment of this size.We should

note that international accounting standards in general

have now become a necessity for groups and

institutions to ensure good financial governance in

full compliance with regulatory requirements. We

hope that, through this work, we havecontributed to

the debate on the impact of the implementation of

IFRS 9, and that the actionscarried out in the field

have succeeded in providing answers to this problem.

REFERENCES

Abad, J. and J. Suarez. 2017. “Assessing the Cyclical

Implications of IFRS 9: A recursive model”, ESRB

Occasional Paper, 12

Barclays (2017), « European banks: IFRS9 – bigger than

Basel IV », pp 14.

Beatty, A and S. Liao. 2011. “Do Delays in Expected Loss

Recognition Affect Banks’ Willingness to Lend?”,

Journal of Accounting and Economics, 52.

Christophe Lejard (2018), La lutte contre la crise

financière par les normes comptables ? Le cas de

l’IFRS 9, Reporting, innovations et société (2018).

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

96

Deloitte. 2016. “Sixth Global IFRS Banking Survey: No

Time like the Present”.

European Banking Authority. 2017. “Report on Results from

the Second EBA Impact Assessment of IFRS 9”

EY (2018), « IFRS 9 Expectedcreditloss ce que révèle la

transition »

Gornjak, M. 2017. “Comparison of IAS 39 and IFRS 9: The

Analysis of Replacement”, International Journal of

Management, Knowledge and Learning, vol. 6, issue 1.

Grandguillot, F. (2017). Analyse financière : Activité et

performance de l’entreprise : Gualino.

Hicham MESK, Majda BRABIJE (2019): « Les Banques

Marocaines face à la nouvelle norme de

provisionnement des pertes attendues, IFRS 9: Etat

des lieux et enjeux », La revue marocaine de Contrôle

et de Gestion, Numéro 8.

Huian, M. 2012. “Accounting for Financial Assets and

Financial Liabilities According To IFRS 9, Economic

Sciences, 59 (1), 27-47IFRS 9: Financial Instruments.

KPMG (2015), «Réussir la transition IFRS 9: défis et

opportunités», Revue Banque, Numéro 783 Avril 205,

Page 78 – 80.

LOTFI Said, BENSAIDA Salma (2018) « Mesure des

impacts de la norme IFRS 9 sur le risque de crédit

bancaire », Revue du Contrôle, Comptabilité et Audit,

Numéro 5, Juin 2018

Novotny-Farkas, Z. 2016. “The Interaction of the IFRS 9

Expected Loss Approach with Supervisory Rules and

Implications for Financial Stability”, Accounting in

Europe

PricewaterhouseCoopers UK (2016), « IFRS 9: Impairment –

global banking industry benchmark », Mai.

The Transition from IAS 39 to IFRS 9 and Its Impact on Financial Performance: Case of a Moroccan Public Financial Institution

97