Total Cost of Ownership for Automated and Electric Drive Vehicles

Lambros Mitropoulos

1 a

, Konstantinos Kouretas

1 b

, Konstantinos Kepaptsoglou

1 c

and Eleni Vlahogianni

2 d

1

School of Rural and Surveying Engineering, National Technical University of Athens, Athens, Greece

2

School of Civil Engineering, National Technical University of Athens, Athens, Greece

Keywords: Electric Vehicle, Total Cost of Ownership, Automated Vehicle, Economic Evaluation.

Abstract: Advances in technology and alternative fuels change the on-road vehicle fleet mix, which traditionally

depends on internal combustion vehicles. These changes affect also the total cost of ownership (TCO) per

vehicle technology and their market penetration rates. The goal of this paper is to identify indicators for a

TCO based analysis for three vehicle technologies: A Hybrid Electric Vehicle (HEV), an Electric Vehicle

(EV) and an Automated Electric Vehicle (AEV). The study is conducted by using data for the French market,

for existing vehicle models; thus, the level three or “conditional driving automation” is used for the AEV. The

assessment shows that while the EV is the most economical vehicle when considering the TCO, the HEV is

more economical during the first two years. The high purchase cost of the AEV does not compensate during

the vehicle lifetime compared to the other two technologies, although it profits from lower maintenance and

time costs. The HEV approximates the AEV TCO at the end of its lifetime, however the higher expected

resale value of the HEV make it attractive for consumers that desire lower purchase cost and higher resale

value.

1 INTRODUCTION

The ever-increasing urbanization of cities worldwide

urges authorities into addressing challenges with

respect to the environment and the quality of life of

their inhabitants. The latest EU targets and policy

objectives for the 2020-2030 period include a

reduction of 40% of GHGs relative to 1990 levels and

a share of 35% of zero or low-emission new cars and

vans by 2030 (EC, 2018). The promotion of Electric

Vehicles (EVs) is one of the key policies of the

European Commission towards achieving the GHG

reduction target. This is stressed through EU planning

for a 100% zero-emissions fleet in cities by 2050, and

the goal that several EU countries have set to ban

internal combustion engine vehicles from urban areas

by 2032 (EAFO, 2018). For example, Norway plans

to ban gasoline and diesel engine vehicles from urban

areas by 2025; whereas other countries, including the

Israel, Holland, Iceland, Denmark, Switzerland and

Scotland plan to follow by 2032 (Burch and Gilchrist,

a

https://orcid.org/0000-0002-6185-1904

b

https://orcid.org/0000-0003-0645-9077

c

https://orcid.org/0000-0002-5505-6998

d

https://orcid.org/0000-0002-2423-5475

2018).

Automakers focus on introducing more EV

models, while they advance their technological

aspects and levels of automation. Automated

Vehicles (AV) have recently emerged in the market,

with growing potential. Although full automation is

not yet commercially available, extensive testing is

being carried out by technology and car

manufacturers. The autonomous/driverless vehicle

market was valued at $24.10 billion in 2019, while in

Europe reached $12.9 billion in 2019 (Research and

Markets, 2020a; 2020b). Over 5,800 autonomous

vehicle patents were filed globally between 2010 and

2017, from which Germany accounted for 51% of

them (Research and Markets, 2019).

Based on literature review findings, promotion of

new vehicle technologies depends greatly on

incentives. Incentive policies usually focus on the

vehicle and aim to reduce the direct cost of vehicles

for the user; however, research usually focuses on the

34

Mitropoulos, L., Kouretas, K., Kepaptsoglou, K. and Vlahogianni, E.

Total Cost of Ownership for Automated and Electric Drive Vehicles.

DOI: 10.5220/0010398800340043

In Proceedings of the 7th International Conference on Vehicle Technology and Intelligent Transport Systems (VEHITS 2021), pages 34-43

ISBN: 978-989-758-513-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

optimal allocation of charging infrastructure for EVs

(Bhatti et al.,2015; Gnann and Plotz,2015).

There is a limited number of tools used to model

and optimize incentive policies in EU and US; the

components selected in these tools are those, which

can often be influenced by policy makers. The Fleet

Purchase Cost and the Total Cost of Ownership

(TCO) models are useful tools for policy makers to

gain insights into the costs and benefits of the

transition to electric vehicles. The TCO model relies

on two components: the capital costs and operational

costs, as the cost of purchase and annual maintenance

are probably the most profound and understood costs

by customers.

A TCO that integrates costs for vehicle

technologies is developed in this study to compare the

performance of three different vehicle technologies

by providing absolute TCO values. Instead of

considering high level of automation for which no

real-life data exists, this study focuses on existing

vehicle technologies; thus, the level three or

“conditional driving automation” is considered in the

assessment. for the AEV.

On-road vehicle technology options examined in

this study include hybrid electric vehicle, electric

vehicle and automated electric vehicle. The Hybrid

Electric Vehicle (HEV) combines a

conventional internal combustion engine with

an electric propulsion system. The Electric Vehicle

(EV) refers to a vehicle that is powered entirely by

electric energy, stored in a large battery pack which

is charged from an external power source. The

Automated Electric Vehicle (AEV) is an advanced

version of an EV, for which selective driving tasks are

carried out by the vehicle itself rather than the driver.

Different types of sensors collect information on the

environment which lead to decisions by using a

computer, with algorithms, machine learning or/and

Artificial Intelligence (AI) systems.

2 ELECTRIC DRIVE TRENDS

AND SALES

Five years ago, EVs were considered an expensive

mobility solution that targeted only fleet operators or

elite social classes. Although several EU countries

adapted policies to increase the share of EVs in their

fleets, electric passenger vehicles accounted for just

1.2% of new cars sold in 2015, while the total EV

fleet represents only 0.15% of all passenger cars in

Europe (EEA, 2016). Although several policies and

incentives, have been developed and adopted, to

support the promotion of electric drive vehicles, the

adoption rate is still low.

Electric, hybrid plug-in and hybrid vehicle sales

in EU market recorded a high in July 2020, by

accounting for 18% of the total European passenger

vehicles, to reach 230,700 units in one month. The

increased sales are also attributed to the additional

vehicle models and segment options (e.g., city car,

sedan, executive, etc.) being occupied by electric

vehicles, including the Peugeot 209, Mini Electric,

MG ZS, Porsche Taycan and Skoda Citigo, resulting

in July 2020 in 38 different electric vehicle models in

Europe, as compared to 28 in 2019. (Compared to

around 11 BEV models in Australia and 18 total

model variants in US) (Gaton, 2020). Norway is the

segment leader, with a market share in hybrids and

electric vehicles of 18% and 31%, respectively, in

2018 (ICCT, 2019) followed by Finland and Sweden.

By comparison, Germany had one of the lowest

shares out of all European countries recorded.

More than 3 million hybrids vehicles have been

sold in Europe between 2000 and July 2020. The top-

selling hybrid markets in EU in 2015 were France,

followed by the UK, Italy, Germany, Spain,

Netherlands, and Norway (ACEA, 2016). Nearly

60 % of all new vehicles manufactured by Toyota

which are sold in the EU are hybrid electric; other

automakers that follow are Ford, Mercedes-Benz,

Peugeot and Audi (ICCT, 2019). It took Toyota 15

years to reach the milestone of 1 million hybrid sales

(2000-2015) and only five more years to reach 3

million sales in July 2020. Top-selling Toyota

hybrids are the Auris Hybrid, the Yaris Hybrid, the

Prius and the RAV4 Hybrid. The top-selling Lexus

models include the Lexus RX 400h/RX 450h , and

the Lexus CT 200h (Toyota, 2018).

A total of 165,915 hybrid cars have been

registered in France between 2007 and 2014,

(AVERE, 2014) including diesel-powered hybrids.

Among EU Member States, France had the second

largest hybrid market share in 2014, with 2.3% of new

car sales. Although, hybrid vehicle shares of new

vehicles increased in France in 2018 (3.7%), other

countries such as the Spain, the Netherlands and

Denmark surpassed it. Despite private vehicle sales

decreased in France by 31.9% in 2020 compared to

2019, hybrid vehicle sales increased for the same

period by 136.8% (i.e., 38,334 versus 90,785 sales)

(Alvarez, 2021).

3 AUTOMATED VEHICLES

Autonomy is pursued both by car manufacturers and

ride-sharing companies, offering mobility services

(e.g., Uber, Waymo), and, offering advanced versions

Total Cost of Ownership for Automated and Electric Drive Vehicles

35

of already available models (e.g., Tesla, Nissan,

Volkswagen).

From basic driving assistance systems to full

autonomy, there are several steps in-between.

Although several definitions have been proposed, six

levels of autonomy (level 0 – 5) are commonly

accepted today and are being used in industry

standards. A simplified way of describing each Level

is (Wevolver, 2020):

- Level 0 (L0): No automation

- Level 1 (L1): Advanced Driver Assistance

Systems (ADAS) - Adaptive cruise control that

automatically accelerates and decelerates based

on other vehicles on the road.

- Level 2 (L2): Partial driving automation - Both

steering and acceleration are simultaneously

handled by the autonomous system; the driver still

monitors the environment and supervises the

support functions.

- Level 3 (L3): Conditional driving automation -

The system can drive without the need for a

human to monitor and respond; however, the

system might ask a human to intervene.

- Level 4 (L4): High driving automation - These

systems have high automation and can fully drive

themselves under certain conditions.

- Level 5 (L5): Full automation, the vehicle can

drive wherever, whenever.

The most advanced commercially available AVs

are classified between Levels 2 and 3 (Tesla

AutoPilot, Nissan ProPilot, Audi etc.). As of 2020,

there are no commercially available vehicles

classified in Levels 4-5 are (Wevolver, 2020). Freight

transport and ride-sharing companies seem to more

actively pursue full automation for their fleet. For

example, the Waymo company already offers

driverless taxi cars within a specified Operational

Design Domain (ODD) in Phoenix (Waymo One) and

has expanded its services and research in freight

trucks (Waymo Via). Shuttle services are also a

promising field. NAVYA provides autonomous

shuttles for passengers and tow-tractors for logistics,

implemented with promise in private industrial sites

or other specific ODDs.

In spite of their rapid development, the legislative

framework around the world does not fully cover

autonomous vehicles. The Vienna Convention on

Road Traffic since 1968 describes that every driver of

a vehicle shall in all circumstances have his vehicle

under control so as to be able to exercise due and

proper care and to be at all times in a position to

perform all manoeuvres required of him (UNECE,

1968). New Amendments that were put into force

since 2016 allow automated driving technologies to

transfer driving tasks to the vehicle, provided that

these technologies are in conformity with the United

Nations vehicle regulations or can be overridden or

switched off by the driver (UNECE, 2014). Further

regulation amendments are being considered in

countries where AV technology is more advanced and

there is a growing market interest, such as Germany

and the US.

3.1 AV Components and Performance

The specific components that differentiate an AV

from a conventional electric or hybrid vehicle are:

(Wevolver, 2020; Gawron, 2018; Stephens et al.,

2016):

- AI platform/Computer (Sensor processing, AI

computations, path planning, vehicle control).

- Cameras (Detection and classification of static

(signs, lanes, boundaries, etc.) and dynamic

objects (pedestrians, cyclists, collision-free space,

hazards, etc.))

- RADAR (Detection of motion in a wide range of

light and weather conditions)

- SONAR (for close proximity)

- LIDAR (High-precision detection in all light

conditions)

- GNSS/ IMU / INS (Rough positioning and motion

compensation for some sensors)

- DSRC/ C-V2X (Dedicated Short-Range

Communication, Cellular V2X, for

communication between vehicles and other

vehicles or devices directly without network

access through an interface called PC5).

Although these sensors and systems may also

exist in conventional vehicles, the computational

requirements for AVs can be up to 100 times higher

than the most advanced vehicles in production today

(NVIDIA, 2019).

Several approaches have been used to quantify the

effects of AV utilization in travel behaviour, travelled

distance, travel patterns, etc related to conventional

vehicles. It is often suggested that high automation

will enable higher speeds and fuel consumption

(Fleming and Singer, 2019). At the same time,

smoother driving patterns by avoiding unnecessary

braking/ acceleration and optimum trajectories would

have the opposite effect. Stephens et al., (2016)

estimated a 2-8% increase in fuel consumption due to

higher speeds and a 7-16% decrease due to eco-

driving, resulting (combined with other factors) to an

overall 5-22% fuel reduction (average 14%). Another

study (Taiebat et al., 2019) estimated that time cost is

reduced by 38% and fuel economy is reduced by

20%. While combined effects are hard to be

quantified, efforts have been also made to estimate

the overall impact of AVs to the environment. The

energy consumption is found to be reduced by 2-4%

(Wadud et al., 2016).

Kockelman and Lee (2019), estimated that an AV

requires 4-15% more processing power (because of

VEHITS 2021 - 7th International Conference on Vehicle Technology and Intelligent Transport Systems

36

sensors and computers) compared to the equivalent

basic electric vehicle version. Sensors and computers

place a significant burden on AV power consumption.

A medium subsystem for a connected-AV could

demand an additional 240 W of power, place 22.4 kg

of weight and need 1.25 MJ/GB (over a 4G network)

for communications (Gawron, 2018). A larger system

could reach up to 327 W and 55.4 kg of weight.

Powertrain types vary among AVs.

Other effects which are difficult to quantify

include costs incurred by traffic violations (expected

to be lower for AVs), time for parking, changes in

residence location and daily travel behavior.

Additionally, several industries are directly or

indirectly affected, such as land development, digital

media, medical, construction, legal etc. (Clements

and Kockelman, 2017).

4 METHODOLOGY

4.1 Model and Indicators

The Total Cost of Ownership (TCO) model accepts

input by suitable cost indicators and data. The TCO

can be used for cost-benefit analysis and evaluation

of transportation policies, for vehicle taxation

programs, and for evaluating vehicle performance

and trade-offs by developing different scenarios. The

six indicators that compose the TCO in this study, are:

1) vehicle purchase cost including depreciation and

subsidies 2) fuel cost, 3) maintenance and repair cost,

4) vehicle resale value, 5) insurance and taxes, and 6)

time cost. The estimated TCO per vehicle technology

represents costs over the vehicle lifetime. The TCO

per vehicle is estimated for the base year 2019 for

France; and all conversions are based on the country’s

inflation rate. Indirect costs related to emissions,

safety or congestion are not included in this study.

The present worth of costs that occur in future

years is estimated with the Present Value of an

ordinary Annuity (PVA), which is the value of

expected future payments that have been discounted

to a single equivalent value today. The PVA is

calculated by Eq.1.

(1)

R is the amount of recurring cost, n is time expressed

as number of years, i is the real discount rate derived

from Eq.2.

(2)

The nominal interest rate is assumed to be 6.0% and

the inflation rate is assumed to be 1.1%, resulting to a

real discount rate of 4.9%.

4.2 Vehicles and Characteristics

4.2.1 Vehicle Assumptions

This study uses specific vehicle characteristics to

estimate the cost indicators of the three vehicle

technologies. The analysis for costs provides insights

for the total impact in monetary terms of any fleet

scenario containing these three vehicle technologies:

HEV, EV and AEV. The most popular HEV and EV

models are selected (i.e., the vehicle with the highest

annual sales for this technology). The C segment is

selected for all vehicle types (small family).

Identifying specific vehicle models was necessary for

extracting impacts based on specific vehicle

characteristics. The car models used are the Toyota

Corolla 1.8 (HEV) and the Nissan Leaf 40kW (EV).

A lot of debate focuses on the ownership status of

AVs, as these may also be used satisfactory in

Mobility as a Service (MaaS) and on-demand services

(Yap et al., 2016). These transport concepts should be

also supported by full automation (Level 5). For the

AEV there are no commercially available L4, L5

vehicles for private use. Tesla’s AutoPilot and

Nissan’s ProPilot fare at Level 2. Just lately (2020)

Tesla and Nissan claimed to reach Level 3 with their

latest upgrades to Self-Driving Mode (Tesla) and

ProPilot 2.0. In this study the AV is considered to

operate at Level 3 (L3) and as a personally owned

vehicle, so as to be able to utilize existing

information, and assess vehicles in the short-term.

Since L3 could be seen as a more limited version of

L4-L5 capabilities, we select lower bound estimations

for the vehicle’s performance, as these were found in

literature. For contingency reasons, the AEV is built

on the EV model characteristics.

Due to more balanced driving (eco-driving)

automation lowers fuel costs by 10% (Stephens et al.,

2016). However, increased system power demands

are required for internal operations. A conservative

estimation (-5%) is assumed for combined effects of

increased system power demands and reduced

consumption because of eco-driving, based on

common ground in literature (Gawron, 2018; Pierre

Michel, 2016; Stephens et al., 2016; Kockelman, and

Lee, 2019). The vehicle characteristics are shown in

Table 1.

Total Cost of Ownership for Automated and Electric Drive Vehicles

37

Table 1: Characteristics per vehicle technology.

units

HEV

EV

AEV

Weight

kgs

1,348

1,610

1,635

b

Fuel

efficiency

a

l/100km

4.9

270

c

297

c

Battery

energy

kWh

0.75

40

40

Max output

kW

90

110

110

Consumption

Wh/km

-

171

154

a

Based on the WLTP (World harmonized light-duty vehicles

test procedure)

b

Estimated based on additional sensors’ weight for “medium”

size equipment (Gawron, 2018).

c

Electric range in kilometers, achieved using the WLTP test

procedure. Figures obtained after the battery was fully charged.

Due to data availability, in this analysis the TCO

model is applied in France for year 2019. The average

annual distance travelled of 11,900 kilometres is used

for all vehicle models and the average vehicle

ownership period is considered to be 9.0 years (i.e.,

107,100 kilometres over lifetime) (AIC, 2020). We

do not assume any change in total travel for the AV

at L3 automation. All costs are estimated for privately

owned vehicles.

4.2.2 Purchase and Depreciation Cost

For the vehicle purchase cost, the official price

released by the official automaker of each model is

used, including the VAT (value added tax) of 20% in

France.

The addition of semi-autonomy options on

existing vehicle models varies and may increase the

original vehicle purchase price between €1,000

(Nissan ProPilot) and €7,500 (Tesla). Both systems

rank at L2 autonomy, with Tesla recently claiming to

be closer to L3. (Nissan, 2020; Tesla 2020).

Automakers follow different pricing policies

regarding AV technologies. For example, Tesla

vehicles are equipped with the necessary hardware for

self-driving and autonomous drive; thus, unlocking

semi-autonomy options is a matter of a software

upgrade. The AV’s purchase price is increased by

€5,000 in comparison to the EV (the most economical

version of Nissan Leaf version at L2 ProPilot is priced

at € 38,400, and Tesla’s L3 self-driving option

requires an additional € 7,500).

A subsidy of $7,000 is applied to the EV and AV,

whereas the HEV is not subjected to any type of

subsidy.

Vehicles are undervalued over time, and there is a

greater loss of their value during the first years of their

life time. The depreciation or resale value is

considered at the end of the ownership period (9

years). The HEV and the EV retain approximately

20% and 5%, respectively, of their initial value after

9 years (Lebeau et al., 2013). Depreciation for the

AVE is assumed to follow the EV pattern, applied

over its purchase price.

4.2.3 Operation Cost

The frequency of fuelling/charging per vehicle over

their lifetime is estimated by dividing the lifetime

kilometres travelled by the vehicle efficiency. The

new released WLTP 2019 (World harmonized Light-

duty vehicles Test Procedure) measurements per

vehicle are considered in this study. The fuel cost is

estimated by considering gasoline and electricity

prices for France in year 2019 (EC, 2020). The

average gasoline price is 1.50 €/litre and the

electricity price is 0.190 €/kWh.

The annual insurance cost is estimated for a 30-

year-old driver who has a driving license for 12 years

and lives in the region of Paris (Danielis et al. 2018;

Hagman et al. 2016). The HEV annual insurance is

€643. The average difference was 14% higher for EV

(with a high of 37%) compared to petrol and diesel

vehicles due to costs to repair or replace specific

vehicle parts (Fleet Europe, 2019). As the number of

EVs increases in Europe, their insurance cost

approximates conventional vehicles’ insurance cost.

The annual insurance cost for the EV in France is

estimated to be €730.

Autonomy features are considered by insurance

companies as a positive addition because many car

crashes are attributed to human errors. The large-

scale presence of Advanced Driver Assistance

Systems (ADAS), (which do not constitute full

automation), such as forward collision warning

(FCW), automatic emergency braking (AEB), lane

departure warning (LDW) and lane keeping

assistance (LKA), could prevent about 40% of all

passenger-vehicle crashes, 37% of injuries and 29%

of deaths (Benson et al., 2018). Previous studies

assumed that safer driving would lower insurance

rates by 50%. This is regarded as conservative, as

today's Tesla Autopilot is reported to have already

decreased accident rates by 40% (NHTSA, 2017).

The authors acknowledge, how-ever, that this

estimate is highly uncertain, given the profound

changes ahead for the insurance industry, which are

beyond the scope of this research.

In the last quarter of 2019 (pre-COVID19 era)

Tesla claimed 1 accident per 3.1 million miles driven

with autopilot (Level 2). When all systems were

disengaged, 1 accident per 1.6 million miles ocured.

This is significantly better than NHTSA’s equivalent

data showing 1 accident per 479k miles (Tesla, 2020).

Βased on accident rates, Stephens et al., (2016)

VEHITS 2021 - 7th International Conference on Vehicle Technology and Intelligent Transport Systems

38

assumed a 10%-40% reduction in insurance

premiums for partial automation and 40-80% for full

automation. However, when road crashes occur, the

cost of repair may be significantly higher. For

example, a typical windshield in US may cost $250-

$400 (Nissan Rogue, 2018), while for an ADAS

equipped vehicle may reach up to $1,200-$1,650

(Benson et al., 2018).

For the AEV, a conservative lower-bound

reduction of 10% is assumed (Stephens et al., 2016)

over the estimated EV insurance cost. Incurring costs

due to accidents are not considered.

Registration and tax costs include all

governmental taxes and fees payable at time of

purchase, as well as annual fees to keep the vehicle

licensed and registered. The annual vehicle taxes in

France depend on the taxable horsepower and CO

2

emissions of each vehicle and on the geographical

area. All vehicle drivers are exempt from regional

taxes so the cost of registration will be significantly

lower. The final annual estimated amount is €187.

4.2.4 Maintenance Cost

The EV’s maintenance requirements are lower

compared to the HEV. Based on the mechanical

components of vehicles it is assumed that the

maintenance cost for an EV is 30% less than the costs

for an Internal Combustion Engine Vehicle (ICEV)

(Prevedouros and Mitropoulos, 2018; DeLuchi and

Lipman, 2001; Bakker, 2010). Two studies in the US

(Duvall, 2002) and the EU (Propfe et al., 2013),

concluded that maintenance costs for EVs (excluding

the battery replacement cost) would be 30% and 50%,

respectively, lower compared to an ICEV. This study,

uses the results from these two studies and isolates the

battery replacement cost from maintenance. Thus, the

EV maintenance cost is estimated to be €0.033 per

kilometre. The HEV embraces all the components of

an ICEV but due to its regenerative braking there is

less brake wear. It is estimated that its maintenance

cost is €0.053 per kilometre (Duvall, 2002).

For AVs it is expected that during their early

introduction period the maintenance cost will be

higher compared to internal combustion vehicles, due

to new skills and expertise that will be required

(similarly to EVs). In addition, to mainstream vehicle

components, the vehicle sensors require monitoring

and calibration. Sensor calibration will likely be

required during a routine inspection, or/and when

sensors are damaged in the event of an accident or

during uncommon weather phenomena. Maintenance

of AI and advanced IoT sensors and technologies

such as computer vision, and machine learning, will

be dictated by experts in these fields, rather than

mechanic repair shops; a change that will likely

increase their overall maintenance cost.

On contrary, lower acceleration and deceleration

for AVs will likely reduce wear and tear, and reduce

maintenance costs (Bosch et al., 2018; Wadud, 2017).

The predictive maintenance techniques that will be

used in AVs will inform users in advance, which will

minimize regular vehicle checks, and likely reduce

the impact of a total damaged vehicle component that

leads to higher cost replacement.

Opposed to Wadud (2017), it is believed that

maintenance cost will play a significant role to the

TCO of AVs, and policy of each company to tackle

these costs will contribute towards increasing their

market share (e.g., similar to battery replacement

cost).

For the AEV in this study, it is expected that the

built-in sensors need periodic maintenance, hence the

maintenance cost of EV is adjusted to exclude labour

costs for a car mechanic and include labour costs for

an electrical engineer. This adjustment results to an

overall increase of 21% or €0.0398 per kilometre

(based on hourly wages in France) (Salary explorer,

2020).

Nissan guarantees the Leaf’s battery for a total

period of 8 years or 160,000 kms. Lexus is the first

company to feature a 10 year or 624,371 miles

(1,000,000 kms) battery pack warranty for the model

UX300e (InsideEvs, 2020). Accordingly, no battery

replacement is considered for the 9 years of

ownership.

The cost of tires is the same for all three vehicles

as their tire type would be similar. Tires are expected

to be changed every 40,000 kms and an additional

15% of tires’ cost is added for replacing the tires at

the car dealership. Tire type (205/55 R16) and prices

per vehicle were found online (Norauto, 2020).

4.2.5 Time Cost

Studies on automated impacts studies integrate into

their assessment the travel time savings, as waste of

time is considered as a driving cost (Wadud, 2017).

Level 3 autonomy does not provide any time saving

as drivers can safely turn their attention away from

the driving tasks but they must still be prepared to

intervene within a limited time. However, this study

integrates the time a driver wastes to fuel/charge a

vehicle during its lifetime (Mitropoulos and

Prevedouros 2015). Time loss reflects the loss of

productivity and it is estimated for all vehicle

technologies. The number of stops for

fuelling/charging is calculated by considering the

lifetime distance travelled, the vehicle fuel efficiency,

Total Cost of Ownership for Automated and Electric Drive Vehicles

39

the fuel tank capacity (HEV) and the battery pack size

(EV and AEV).

For the HEV it is assumed that each driver

requires on average six minutes to complete the

fuelling procedure (i.e., to enter the fuel station, wait,

fuel, pay and leave the fuel station) (Mitropoulos and

Prevedouros 2015). In the EV/AEV case, the fuel

tank is replaced by the battery pack; thus for an EV

user it is assumed that 40 minutes charging are

required by using a 50 kWh DC quick charger at

home or work (Nissan, 2020) to charge a depleted

battery in order to complete a trip, and this event will

occur for 2% of the annual total charging cycles

(Mitropoulos and Prevedouros 2015). For the rest of

the charging cycles, it is assumed that no time is

wasted by users for charging batteries (i.e., charging

occurs overnight or at stops/destinations with

charging stations).

5 RESULTS AND DISCUSSION

The TCO for the three vehicle technologies are

presented in Table 2 and show which vehicle is more

attractive for consumers. The most attractive vehicle

for a lifetime of nine years is found to be the EV,

while the HEV ranks second among the three vehicle

technologies. Similarly, when accounting only for the

purchase and fuel costs, the EV cost is 10% and 15%

lower compared to the HEV and the AEV,

respectively. However, when considering only the

purchase cost, the EV cost is 5% higher compared to

the HEV and 16% lower compared to the AEV.

Table 2: Total cost of ownership per technology.

HEV

EV

AEV

Purchase

25,550

33,900

38,900

Subsidy

-

-7,000

-7,000

Depreciation

-4,988

-1,763

-2,023

Fuel

7,600

2,910

2,512

Insurance

5,587

6,343

5,708

Registration

1,625

1,625

1,625

Maintenance

& tires

6,210

4,192

4,848

Time

293

127

116

Total

41,877

40,335

44,867

Cost (€)/km

0.391

0.337

0.419

Research findings, state that obstacles to the

adoption of plug-in vehicles among other factors is

the higher purchase price compared to similar

conventional gasoline vehicles (Carley et al., 2013).

Therefore, the main goal of policy makers should be

to decrease the purchase cost for vehicles that plug-in

or use automated systems. Time cost composes a

small share of the TCO, and its lowest value (€116) is

attributed to the AEV. The EV/AEV are assumed to

stop for charging in 2% of their total charging cycles.

If EV/AEVs are used exclusively for short trips, and

as their battery efficiency is enhanced, then time cost

for charging EVs and AEVs will be minimal.

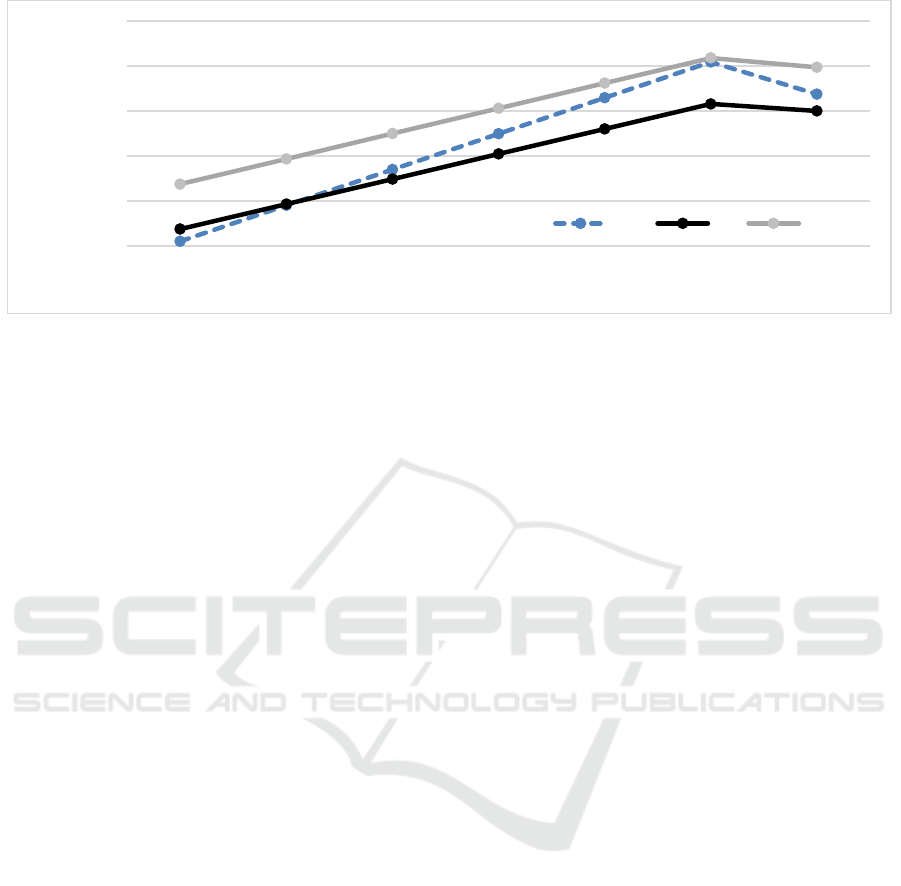

Figures 1 shows the TCO per mile per vehicle

technology as it accumulated per distance travelled

over their life cycle. The EV may be adopted as the

most economical vehicle bases on the overall TCO,

however, the HEV is the most economical vehicle for

the first 20,000 kilometres. It is important to note that

the HEV starts with an initial low purchase cost and

becomes competitive to the AEV, after 100,000

kilometres, while the EV maintains the first place to

the end of their lifetime.

The final vehicle ranking appears to be affected

by the depreciation cost (Figure 1) as it assumed that

the vehicle is sold at 107,100 kms. In this case the

HEV has higher salvage value because of less

technological advances on the vehicle that pose a high

uncertainty to it, including the battery pack and built-

in sensors. Although, depreciation cost for hybrid

vehicles can be estimated based on experience, for

EV and AEV is highly uncertain, as there is no

available data for the latter one. Therefore, HEVs

become more attractive for consumers that value

significantly the purchase cost, desire higher salvage

value, drive longer distances and may feel anxious

about electricity infrastructure aspects.

The nine years of ownership appear to be an

adequate period of time for vehicle costs to spread

over their lifespan and present cost changes. The high

initial purchase cost for the AEV is compensated after

roughly 8 years of ownership when considering the

HEV TCO, which might be a long period of time for

a significant share of consumers when purchasing a

new vehicle (the average of passenger cars in EU is

10.7 years). Therefore, to maintain electric vehicle

competitive, the automobile manufacturers must

provide battery warranty for the vehicle lifetime (i.e.,

nine years in this case). In the case that battery

replacement cost is included, the TCO of the EV and

the AEV increases significantly (i.e., roughly

€6,200), and the HEV is ranked clearly as the best

vehicle in terms of TCO. To compensate for this

additional battery cost, the ownership of the vehicle

should be increased to 130,000 kilometres or 11 years

and assume that by that time all vehicles have lost

completely their original worth.

Wadud, (2017) estimated costs for fully

automated vehicles and various vehicle sectors,

income groups and user types. He concluded that

VEHITS 2021 - 7th International Conference on Vehicle Technology and Intelligent Transport Systems

40

Figure 1: Vehicle travelled distance and total cost of ownership.

high-income households would benefit more by AVs.

Also, more benefits are expected for specific

transport uses, such as for taxis. This study shows that

for lower levels of automation there is a necessity to

form additional policies to support their adaption

when purchasing the vehicle, otherwise this vehicle

technology will fail to increase its market share.

Automation’s positive impacts include safety and

time, and since level three automation does not

provide considerable time savings to drivers, the

safety impacts need to be quantified and integrated

into the purchase cost or/and insurance costs.

Otherwise, they risk to have minimum penetration

into the automobile market.

If these aspects will not be considered, then Level

3 automation will likely serve as a transition

technology between electric and fully automated

(Level 4 and 5) vehicles. However, in this case the

interested consumers will belong to higher income

levels or will be technology geeks with great

willingness to overpay additional vehicle features.

However, in the presence of well-studied impacts per

level of automation and integration into the purchase

cost (or as a form of subsidy), the AEV has the

potential to compete other vehicle technologies in the

short term and achieve a significant market

penetration.

6 CONCLUSIONS

This study estimates, in absolute values, the total cost

of ownership for private small family HEV, EV and

AEV in France. Six indicators were used to build the

TCO and provide insights about vehicles’

performance in economic terms over a lifetime of

nine years. The results showed that HEV and EV,

which are available in market for 20 and 10 years,

respectively, have lower purchase cost compared to

the AEV. The HEV is the most economical vehicle

for the first two years/20,000km, whereas, the EV

becomes more economical after the second year and

until the end of its lifetime. Thereafter, the EV

increases its lead and in year 8/100,000km achieves

its highest difference between the HEV and the AEV.

The rapidly changing field of AV technologies

and their uncertainties (e.g. insurance, maintenance,

depreciation) may lead to a range of cost estimates.

Level 3 AEV are more energy efficient (because of

smoother driving, offsetting the increased power

needs for the sensors and computers) and will likely

reduce road crashes. Still, AEV initial higher

purchase cost is making them less attractive to

consumers compared to the EV and HEV. The AEV

is found to have a higher TCO value than the EV

throughout its lifetime and approximates the HEV’

cost after 100,000 kms. It has to be noted, that this

estimate does not include incidental costs such as

crashes, which are expected to be significantly less

for AEV.

In the short-term, the HEV is an option for

consumers that value significantly the purchase cost,

desire higher salvage value and drive longer

distances. The EV is a better option for users that are

willing to pay an additional amount to purchase a

vehicle, desire more fuel-efficient vehicles, are not

interested to resale their vehicle, and commute shorter

distances. Level-3 AEV would attract high-income

users that are mainly interested in improved safety

features. Subsidies bridge the price gap between

vehicle technologies; however, impacts have to be

well-studied, quantified and integrated within the

lifetime of each vehicle to represent cost differences

to users with diverse travel behaviour.

25 000

30 000

35 000

40 000

45 000

50 000

0 20 000 40 000 60 000 80 000 100 000 107 100

Total Cost of Ownership (€)

Cumulative traveled distance (kms)

HEV EV AEV

Total Cost of Ownership for Automated and Electric Drive Vehicles

41

ACKNOWLEDGEMENTS

“This research is co-financed by Greece and the

European Union (European Social Fund- ESF)

through the Operational Programme «Human

Resources Development, Education and Lifelong

Learning 2014-2020» in the context of the project “A

Total Cost of Ownership Model for Automated and

Electric Vehicles (TCO4AEV)” (MIS 5049185).”

REFERENCES

ACEA, 2016. New passenger car registrations by

alternative fuel type in the European Union – Quarter

4 2015, European Automobile Manufacturers

Association. Retrieved from https://www.acea.be/

AIC, 2020. Average age of passenger cars in some

European countries, Automotive Information Centre.

Retrieved from https://www.aut.fi/

Alvarez, 2021. The best-sellinghynrid cars in France

(2020). L’auto journal. Retrieved from https://www.

autojournal.fr/economie/voitureshybrides-plus-vendue

s-france-2020-260958.html#item=1.

AVERE, 2014. Hybride: un marché en recul en 2014,

l'hybride essence tient le coup" (in French). France

Mobilité Électrique.

Bakker, D. 2010. Battery electric vehicles performance,

CO

2

emissions, lifecycle costs and advanced battery

technology development, Master thesis, Sustainable

Development, Energy and Resources Copernicus

Institute, University of Utrecht, Holland.

Benson, A. J., Tefft, B. C., Svancara, A. M., & Horrey, W.

J., 2018. Potential reductions in crashes, injuries, and

deaths from large-scale deployment of advanced driver

assistance systems. AAA Foundation for Traffic Safety.

Bhatti, S.F., M.K., Lim, H.Y. Mak, 2015. Alternative fuel

station location model with demand learning, Annals of

Operations Research, 230, 1, 105–127.

Bösch P.M, Becker, F., Beckerm H., Axhausen, K.W.,

(2018).Cost-based analysis of autonomous mobility

services, Transport Policy, 64, 76-91.

Burch, I., Gilchrist, J., 2018. Survey of global activity to

phase out internal combustion engine vehicles, Center

for Climate Protection.

Carley, S., Krause, R.M., Lane, B.W., Graham, J.D., 2013.

Intent to purchase a plug-in electric vehicle: a survey of

early impressions in large US cities, Transportation

Research Part D: Transport and Environment, 18, 39-45.

Clements, L., Kockelman, K., 2017. Economic effects of

automated vehicles, Transportation Research Record:

Journal of the Transportation Research Board, 2606

(1), 106-114.

Danielis R, Giansoldati M, Rotaris L., 2018. A probabilistic

total cost of ownership model to evaluate the current

and future prospects of electric cars uptake in Italy,

Energy Policy, 119, 268-281.

DeLuchi, M. A., Lipman, T. E., 2001. An analysis of the

retail and life cycle cost of battery-powered electric

vehicles, eScholarship University of California, Davis.

Retrieved from http://escholarship.org/

uc/item/50q9060k.

Duvall, M, 2002. Comparing the benefits and impacts of

hybrid vehicle options for compact sedan and sport

utility vehicles, EPRI.

EAFO project, 2018. The transition to a zero emission

vehicles fleet for cars in the EU by 2050.

EC, 2020. Emergy, Weekly oil bulletin. European

Commission Energy. Retrieved from https://ec.europa.

eu/energy/data-analysis/weekly-oil-bulletin_en?redir=1.

EC, 2018. Emission performance standards for new

passenger cars and for new light commercial vehicles.

European Commission. Retrieved from https://oeil.

secure.europarl.europa.eu/oeil/popups/ficheprocedure.

do?reference=2017/0293(COD)&l=en.

EEA, 2016. Fuel efficiency improvements of new cars in

Europe slowed in 2016, European Environmental

Agency.

Fleet Europe, 2019. New insurance policy launched for

EVs. Retrieved from https://www.fleeteurope.com.

Fleming, K., and Singer, M., 2019. Energy implications of

current travel and the adoption of automated vehicles,

National Renewable Energy Laboratory.

Gaton, 2020. Electric vehicle and hybrid sales hit record

share of 18 per cent in Europe, The Driven. Retrieved

from https://thedriven.io.

Gawron, J. H., Keoleian, G.A., De Kleine, R.D.,

Wallington, T. J., Kim, H.C., 2018. Life cycle

assessment of connected and automated vehicles:

Sensing and computing subsystem and vehicle level

effects, Environmental Science Technology, 52, 5,

3249–3256.

Gnann,T., Plotz,P., 2015. A review of combined models for

market diffusion of alternative fuel vehicles and their

refueling infrastructure, Renewable and Sustainable

Energy Reviews 47, 783–793.

Hagman J, Ritzén S, Stier J, Susilo Y., 2016. Total cost of

ownership and its potential implications for battery

electric vehicle diffusion, Research in Transportation

Business & Management, 18, 11-17.

ICCT, 2016.European vehicle market statistics-Pocketbook

2015/16, International Council on Clean

Transportation. Retrieved from https://theicct.org/

InsideEvs, 2020. How long do electric car batteries last.

Retrieved from https://insideevs.com/features/ 434296/

video-how-long-batteries-last/.

Kockelman, K.M., Lee, J., 2019. Energy implications of

self-driving vehicles, 98th Annual Meeting of the

Transportation Research Board. Transportation

Research Board, Washington D.C.

Lebeau, K., Lebeau, P., Macharis, C., van Mierlo, J., 2013.

How expensive are electric vehicles? A total cost of

ownership analysis, World Electric Vehicle Journal, 6,

996–1007.

Mitropoulos, L.K., Prevedouros, P.D., 2015 Life cycle

emissions and cost model for urban light duty vehicles,

VEHITS 2021 - 7th International Conference on Vehicle Technology and Intelligent Transport Systems

42

Transportation Research Part D: Transport and

Environment 41, 147–159.

NHTSA, 2017. Automatic vehicle control systems – Tesla

motors system. Investigation: PE 16-007. Office of

defects investigation. National Highway Traffic Safety

Administration.

Nissan, 2020. Official website. Retrieved from https://

www.nissanusa.com.

NVIDIA. 2019. Self-driving safety report. Retrieved from

https://www.nvidia.com/en-us/self-driving-cars/safety-

report/

Norauto, 2020. Retrieved from https://www.norauto.fr.

Pierre, M., Karbowski, D., Rousseau, A., 2016. Impact of

connectivity and automation on vehicle energy use,

SAE International.

Prevedouros, P., Mitropoulos, L., 2018. Impact of battery

performance on total cost of ownership for electric

drive vehicle. Proceedings of the 21st IEEE

International Conference on intelligent Transportation

Systems. November 4-7, 2018, Maui, Hawaii.

Propfe, B., Redelbach, M., Santini, D.J., Friedrich, H.,

2012. Cost analysis of plug-in hybrid Electric Vehicles

including maintenance & repair costs and resale values,

Proceedings of the EVS26 International Battery,

Hybrid and Fuel Cell Electric Vehicle Symposium, Los

Angeles, California, May 6-9, 2012.

Research and Markets. 2020a. Autonomous/driverless car

market - Growth, trends, and forecast (2020 - 2025).

Research and Markets, 2020b. Europe autonomous vehicle

(AV) market 2020-2030 by offering, automation level

(Level 1 - Level 5), vehicle type, power, ADAS feature,

ownership, and country: Trend outlook and growth

opportunity.

Research and Markets, 2019. Europe autonomous car

market research report: by vehicle autonomy, vehicle

type, application, regional insight - Industry trend,

competition analysis and forecast to 2030.

Salary Explorer, 2020. Average salaries in France 2020.

Retrieved from: http://www.salaryexplorer.com.

Stephens, T. S., Gonder, J., Chen, Y., Lin, Z., Liu, C.,

Gohlke, D., 2016. Estimated bounds and important

factors for fuel use and consumer costs of connected

and automated vehicles. NREL. National Renewable

Energy Laboratory.

Toyota, 2018. Toyota sells 1.52 million electrified vehicles

in 2017, three years ahead of 2020 target. Retrieved

from https://global.toyota/en/newsroom.

Taiebat, M., Stolper, S., Xu, M., 2019. Forecasting the

impact of connected and automated vehicles on Energy

use: A microeconomic study of induced travel and

energy rebound, Applied Energy Journal, 247, 297-308.

Tesla, 2020. Official website. Retrieved from https://

www.tesla.com/en_eu.

UNECE, 1968. Convention on road traffic, UNECE.

UNECE, 2014. Report of the sixty-eighth session of the

working party on road traffic safety, United Nations

Commission for Europe.

Wadud, 2017. Fully automated vehicles: A cost of

ownership analysis to inform early adoption.

Transportation Research Part A: Policy and Practice,

101, 163-176.

Wadud, Z., MacKenzie, D., Leiby, P., 2016. Help or

hindrance? The travel, energy and carbon impacts of

highly automated vehicles, Transportation Research

Part A Policy and Practice, 86, 1-18.

Wevolver, 2020. Autonomous vehicle technology report,

Wevolver.

Yap, M. D., Correia, G., van Arem, B., 2016. Preferences

for travellers for using automated vehicles as last mile

public transit of multimodal train trips, Transportation

Research Part A: Policy and Practice, 94, 1–16.

Total Cost of Ownership for Automated and Electric Drive Vehicles

43