A Cooperative Market-based Decision Guidance Approach for

Resilient Power Systems

Alexander Brodsky, Eric Osterweil and Roberto Levy

Computer Science Department, George Mason University, Fairfax, VA, 22030, U.S.A.

Keywords: Resilience, Optimization, Power Systems, Cooperative Markets, Privacy, Security.

Abstract: National and local economies are strongly dependent on stable power systems. While the problem of power

system resilience in the face of natural disasters and terrorist attacks has been extensively studied from the

systems engineering perspective, a major unsolved problem remains in the need for preventive solutions

against the collapse of power systems. These solutions must ensure the most economically efficient operation

of power systems, within the bounds of any remaining power capacity. Transferring power usage rights from

the lowest-loss to the highest-loss entities would result in significant reduction of the combined loss. The

existing power systems do not take this fact into account. To address this need, we envision a paradigm shift

toward three-step system for (1) a cooperation power market where power usage rights can be transferred

among participating entities, (2) decision guidance to recommend market asks and bids to each entity, and (3)

optimization that, given the market clearance, will recommend precise operational controls for each entity’s

microgrid. The key challenge to address is the design of this three-step market system that will guarantee

important properties including Pareto-optimality, individual rationality, and fairness, as well as privacy,

security, pseudo-anonymity and non-repudiation.

1 INTRODUCTION

National and local economies are strongly dependent

on power systems, which involve power generation,

transmission, distribution and, increasingly,

distributed renewable power sources such as

photovoltaic arrays and wind turbines, local micro-

turbine generation, and power storage. The power

systems are getting increasingly complex, due to the

shift toward distributed and multidirectional flow of

power and largely unpredictable supply of power

from renewable sources, which are not dispatchable

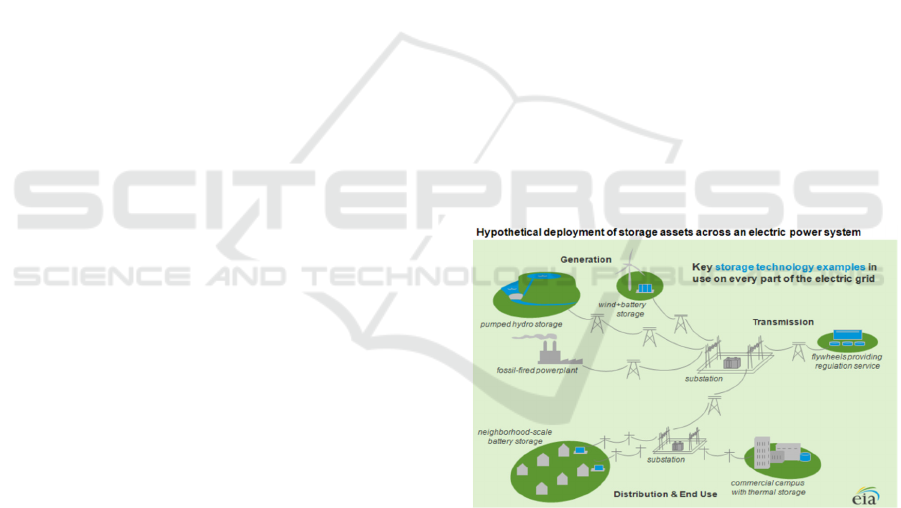

(Moslehi & Kumar 2010). Figure 1 depicts a

prototypical electric power system with renewable

sources and power storage (US Energy Information

Administration.)

Power systems are highly vulnerable to natural

disasters and terrorism, resulting in huge economic

losses, such as the 2003 northeast blackout estimated

at $6 billion (Rose et al. 2007) (Lassila et al. 2005).

Sectors that are highly affected include non-durable

and durable manufacturing, construction, food

processing, wholesale trade and business services to

name a few (Rose et al. 2007).

Figure 1: Distributed power system with storage

technologies (Source: U.S. Energy Information

Administration).

While outages may occur due to natural causes,

such as hurricanes, blizzards, wildfires or technical

failures, preparedness for major disasters due to

terrorism is paramount. Unlike natural disasters or

technical failures, which occur randomly, terrorist

attacks, especially conducted by more sophisticated

state-supported players, can be optimized to cause

maximum damage with the payoff of high economic

impact and instilling fear (Rose et al. 2007). It is

256

Brodsky, A., Osterweil, E. and Levy, R.

A Cooperative Market-based Decision Guidance Approach for Resilient Power Systems.

DOI: 10.5220/0010309802560263

In Proceedings of the 10th International Conference on Operations Research and Enterpr ise Systems (ICORES 2021), pages 256-263

ISBN: 978-989-758-485-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

therefore critical to solve the problem of resiliency

and response to low-probability but extremely high-

impact scenarios (Wang et al. 2016).

While the existing power systems are far from

resilient, the problem of resiliency has been

extensively studied and is well-understood from the

system engineering perspective (e.g., see Wang et al.

2016, Guikema et al. 2006, Liu & Singh 2011, Wang

et al. 2015, Mohagheghi & Yang 2011) including (1)

hardening and resilience investment, such as

vegetation management, undergrounding and

elevating substations; (2) corrective actions and

emergency response, such as emergency load

shedding, special protection systems and islanding

schemes, and (3) damage assessment and system and

load restoration, such as distributed generation,

microgrids, distribution automation, mobile

transformers and decentralized restoration strategies.

A major unsolved problem remains, however, in

the need for mitigation solutions that incrementally

protect against the collapse of power systems as their

capacities become degraded. These mitigation

solutions must ensure most efficient operation of

power systems, in terms of their economic impact,

within the bounds of any remaining power capacity,

whether it is 80%, 50%, or 20% in large distribution

areas. The key difficulty in this problem is lack of

expressiveness into account for the economic impact

on diverse affected businesses and communities,

some of which may sustain huge economic losses,

while others would only be marginally affected.

Estimates of losses per kilowatt-hour (KWH)

from electricity disruptions range from $1.5 to

$7.5/KWH and, according to a more recent estimate,

at $50/KWH for some sectors (Rose et al. 2007). This

means, for example, that a business in these high-loss

sectors consuming 40 MW of power and losing half

of its power supply will be losing $1M per hour, while

a business at the lower end of the spectrum will be

losing “only” $0.03M per hour, with the combined

loss of $1.03M per hour.

It is easy to reduce this combined loss to “only”

$0.06M from $1.03M, by transferring 20 MW power

capacity from low-loss to high-loss business, and

compensating the low-loss business. This is over 94%

savings over the combined loss, but the power control

systems do not currently have the ability to take this

fact into account. Similarly, in the case of $1.5/kWh

vs. $7.5/kWh losses, we can save ⅔ of the combined

loss; in the case of $1.5/kWh vs. $4.5/kWh, we can

save ½ of the combined loss; and in the case of

$1.5/kWh vs. $3.0/kWh, we can save ⅓ of the

combined loss.

Optimally reducing the combined economic loss

through secure cooperation markets for power is

exactly the focus of this position paper. This is a

challenging problem, given the complexity of power

systems and diverse economic impacts to

participating (business, public or community)

entities. We believe, however, that this problem is

solvable, as discussed in the next sections.

2 PROPOSED SOLUTION

Power systems control, for every entity having a

microgrid (MG), is actuated for every time interval,

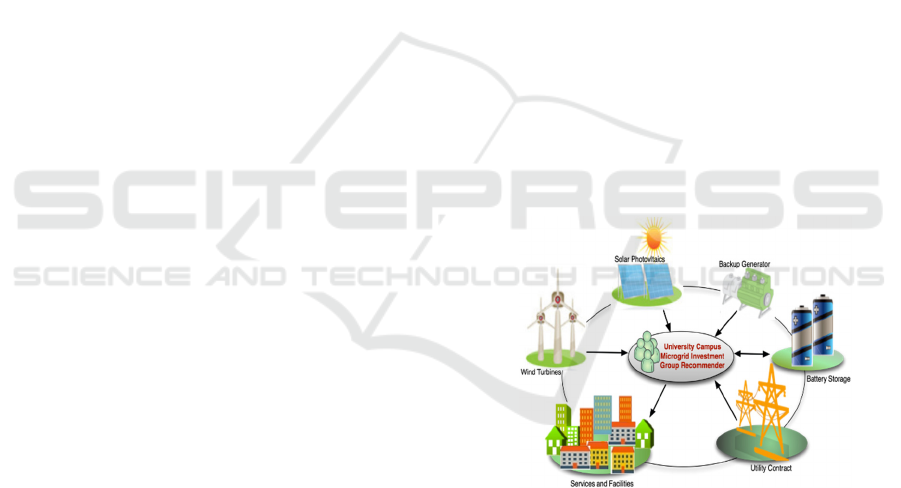

typically of 15, 30 or 60 minutes. Figure 2 depicts

prototypical microgrid components. The control deals

with how each power system resource/component is

operated, including: whether or not each power load

(e.g., for HVAC, lighting, data center) is activated

and at what level; whether each local generator is

activated and at what level of output; whether a power

storage device (e.g., high-capacity lithium battery) is

activated in charge or discharge mode and at what

level of power; and, the amount of power the entity

pulls from the grid (subject to contractual agreement

with a utility company), or possibly contributes to the

grid, when the power flow is reversed.

Figure 2: An Example of Microgrid Components.

We propose a three-step system for (1) a

cooperation power market where power usage rights

can be transferred among participating entities, (2)

decision guidance to recommend market asks and

bids to each entity, and (3) optimization that, given

the market clearance, will recommend precise

operational controls for each entity’s microgrid. The

main research challenge is the design of this three-

step market system that guarantees important

properties including Pareto-optimality, individual

rationality, fairness, as well as privacy, security,

pseudo-anonymity and non-repudiation.

A Cooperative Market-based Decision Guidance Approach for Resilient Power Systems

257

2.1 Three Step Cooperation Market

System

We envision the cooperation market be realized by

the three main steps:

● Cooperation market of power futures (or

options): This market runs before the beginning of

every time interval. Traded in this market are rights

to increase, or commitment to curtail, power

consumption upper bounds in time intervals 1,...,n for

each participating entity. The market clearance results

in (1) precise amounts of power in these

rights/commitments for each participating entity over

time intervals 1,...,n and (2) the amount of money

each entity receives from or gives to the market in lieu

of these rights/commitments. Of course, market

clearance must result in equilibrium of supply and

demand, for both power and money.

Before market runs, each participating entity submits

a combined (parametric) bid-ask, which we formulate

in the terminology of bids: agreeing to pay at most the

value v(𝑘𝑤

, …., 𝑘𝑤

) for the right to increase power

upper bounds by 𝑘𝑤

, …., 𝑘𝑤

) in time intervals

1,...,n. Note that, in this terminology, agreeing to pay

a negative amount, say -$1000, means receiving

$1000; and the right of power increase by a negative

amount, say -50 KW, means the commitment to

curtail power consumption upper bound by 50KW. A

bid-ask by a participating entity is a value function

v : [𝑚𝑖𝑛𝐾𝑊

, 𝑚𝑎𝑥𝐾𝑊

] x … x [𝑚𝑖𝑛𝐾𝑊

, 𝑚𝑎𝑥𝐾𝑊

] → R

(1)

where 𝑚𝑖𝑛𝐾𝑊

,..., 𝑚𝑖𝑛𝐾𝑊

are negative lower

bounds, 𝑚𝑎𝑥𝐾𝑊

, …, 𝑚𝑎𝑥𝐾𝑊

are positive upper

bounds, and the value v(𝑘𝑤

, …., 𝑘𝑤

) represents the

(maximum) amount of money the entity is ready to

pay for increasing the power consumption bounds by

(𝑘𝑤

, …., 𝑘𝑤

) in time intervals 1,...,n, relatively to

the current power upper bounds ( 𝑈𝐵

,..., 𝑈𝐵

)

allocated to the entity. Note again that 𝑘𝑤

< 0 means

that the entity will decrease the power upper bound

by 𝑘𝑤

in time interval i. And that v(𝑘𝑤

…., 𝑘𝑤

)

< 0 means that -v(𝑘𝑤

, …., 𝑘𝑤

) is the (minimum)

amount of money the entity is ready to receive for

(𝑘𝑤

,…., 𝑘𝑤

).

Given all bid-asks submitted in a market round,

market clearance results in precise

rights/commitments for power increase/curtailment

as well as payments made or received by participating

entities, as explained earlier.

● A decision guidance solution that, given a

description of all existing resources for an entity

(power loads and their equivalent values, local

generation, power storage, renewable sources, as well

as current power bounds), recommends the entity a

precise bid-ask to the market.

● A decision guidance solution that, given

market clearance, as well as the description of all

existing resources for an entity, performs value

optimization and recommends to the entity the precise

optimal operational parameters for each interval

1,...,n. The operational parameters include which

power loads are activated at what level (in KW) and

which are shed; which local generation resources are

activated at what level; which storage devices are

being used in charge or discharge mode and at what

level; etc.

2.2 Critical Properties of the Market

System

A major design challenge of the market system is to

assure some critical properties dealing with

optimality and fairness, which is easier to understand

in the framework of cooperative games. Consider a

cooperative game in which players who form a

coalition are entities that participate in the market.

Each entity (player) decides on bids/asks; then, the

market clears; finally, the entity decides on optimal

operation for n time intervals.

This optimal operation results in some value for

each participating entity, which is the total benefit of

running power loads (i.e., avoiding negative

economic impact) minus the total costs of operation,

plus (resp. minus) the money received from (resp.

given to) the market. If the entity does not participate

in the market, it can extract the value by optimizing

its resources within the available bounds of power

consumption. Let (𝑣

,..., 𝑣

) be the resulting values

for entities for the case when they do not cooperate

(i.e., do not participate in the market); and (𝑣

,..., 𝑣

)

be the resulting values for the entities if they do

cooperate, i.e., these are the values assigned to

players (entities) of the cooperative game (the market

system). A key research challenge is to design the

market system that will satisfy a number of important

properties of cooperative games, including the

following:

● Pareto-optimality (also called efficiency): it is

impossible to improve the resulting value 𝑣

of one

entity without sacrificing the value 𝑣

of at least one

other entity (i j). It is not difficult to show that this

property is equivalent to having operational

parameters of all entities that maximize the combined

benefit

∑

𝑣

. This is as though there were a

centralized authority that would jointly optimize all

entities and enforce the resulting operational

decisions across the board. This may be impractical,

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

258

particularly because business and communal entities

have very diverse power system and economic impact

characteristics, and, furthermore, may not want to

share this detailed (and sometimes confidential)

information with others or the centralized authority.

A major challenge that we need to overcome in the

envisioned market-based solution is the design of the

market system in which participating entities only

share their bid-asks yet the resulting operation of

power systems is equivalent to the result of joint

operational optimization (without actually doing it).

● Individual Rationality: 𝑣

𝑣

for every

entity i = 1,...,k. In other words, every entity can only

improve its value by participating in the game

(market), because otherwise it would not.

● Fairness: This property deals with how the

cooperation benefit

𝛥=

∑

𝑣

-

∑

𝑣

=

∑

𝑣

𝑣

=

∑

𝛥

(2)

is distributed among the players (entities). Note

that, for each entity i, its cooperation benefit 𝛥

= (𝑣

-

𝑣

) must be non-negative to satisfy the individual

rationality property. An important question that needs

to be answered is how to define the most appropriate

definition of fairness in the context of power system

resilience and disaster response aimed at minimizing

losses. We believe that some proposed notions of

fairness, such as symmetry in cooperative games, may

not be appropriate, as we explain further in the

Technical Approach section. Intuitively, we would

like to have the notion of fairness by which low-loss

entities are compensated, possibly with some

premium, for their loss and agreement to further

curtail power consumption, to maximize loss

reduction of high-loss entities. This is as opposed to

the situation when low-loss entities would use a

disaster as an opportunity to make very high profits

(as opposed to cutting losses) due to them having a

valuable resource of power rights during a huge

shortage of power supply.

Privacy, security, confidentiality, pseudo-

anonymity, and non-repudiation: Transparency into

how the fair-market-price is computed and set will

build confidence in the fairness of the ecosystem, but

the underlying bid-asks expose some aspects of

market participants’ financial interests and

disposition. The privacy and security of this data

must be enforced by the implementing architecture.

The necessary properties of such an architecture will

be a model which will publish (to a subset of semi-

trusted audit/regulatory entities) and verify the

existence of any and all bid-asks that have been made,

pseudo-anonymity that will protect the privacy of the

identity of market participants associated with ask

and bid information, and provide non-repudiation (so

that once pseudo-anonymous bids and asks are

published and used to calculate the fair-market-value

of power, the submitting market participant cannot

disavow their existence).

3 TECHNICAL APPROACH

3.1 Design of Three-step Market

System

As described in the prior section, we need to perform

three tasks: (1) guiding entities on how to generate

their bid-asks; (2) market clearance given bid-asks

from all participating entities; and, (3) after the

market clears, optimization of operational controls of

power system for each entity. We discuss directions

for the solution, starting with market clearance.

3.1.1 Market Clearance

Assume that the bid-asks submitted to the market are

value functions 𝑣

,..., 𝑣

, where

𝑣

( 𝑘𝑤

,..., 𝑘𝑤

) represents the (maximum)

amount of money the entity i is ready to pay for

increasing the power consumption bounds by

(𝑘𝑤

,...,𝑘𝑤

) in time intervals 1,...,n, relatively to

the power upper bounds (𝑈𝐵

,...,𝑈𝐵

) currently

allocated to entity i. The first step is to determine

optimal flows of power

( 𝑘𝑤

,..., 𝑘𝑤

) for each entity i = 1,...,k by

maximizing the combined value of all entities

𝑣

𝑘𝑤

,...,𝑘𝑤

(3)

subject to:

● the (negative) lower bounds and (positive)

upper bounds on power transfer for every entity i =

1,...,k and every time interval j = 1,...,n, and

● power equilibrium (balancing) constraints, for

each time interval j =1,...,n.

This optimization results in power flow values

(𝑘𝑤

∗

,...,𝑘𝑤

∗

) for each entity i, as well as the

associated entity value 𝑣

∗

= 𝑣

( 𝑘𝑤

∗

𝑑,..., 𝑘𝑤

∗

).

This gives the market clearance for power flows. We

also need to determine the payment made or received

by each entity i = 1,...,k. To do that, consider the

optimal combined value V’ of all entities achieved by

cooperation: V’ =

∑

𝑣

∗

Also consider the

combined value V of all entities without cooperation:

V=

∑

𝑣

, where 𝑣

is the result of stand-alone value

A Cooperative Market-based Decision Guidance Approach for Resilient Power Systems

259

maximization for entity i, subject to its power usage

upper bounds. The difference 𝛥= V’ - V is the

cooperation benefit, i.e., increase in the combined

value due to cooperation. Depending on the fairness

criteria to be used, the cooperation benefit 𝛥 will be

distributed among the entities: 𝛥= 𝛥

+.... +𝛥

. Thus

the new value 𝑣

of each entity i must be the old value

(without cooperation) 𝑣

plus the cooperation benefit

𝛥

: 𝑣

= 𝑣

+ 𝛥

. But the value for entity i from the

combined value optimization is 𝑣

∗

. Therefore, the

payments paid or received by each entity i must be

done to cover the difference between𝑣

and 𝑣

∗

, so

that the cooperation benefit for entity i will be exactly

𝛥

, in accordance with the fairness criteria. This

completes the payment part of the market clearance.

While these are general ideas, we envision a careful

design and formalization of the three-step

cooperation market, developing its clearance

algorithm and mathematically proving that it satisfies

the desirable properties of Pareto-optimality,

individual rationality, and fairness.

3.1.2 Guiding Entity’s Decision on Bid-ask

to Market

We envision the development of a composite model

for power microgrid and its components, which will

express the value function V for the entity’s

microgrid. The value V(𝑘𝑤

, …., 𝑘𝑤

, 𝑈𝐵

,..., 𝑈𝐵

,

x), where x is a vector of all microgrid operational

controls over time intervals 1,...,n, is the total value

achieved by microgrid operation, which is the benefit

of running all activated load (e.g., preventing loss)

minus all costs. The model will also include the

Boolean function C(𝑘𝑤

, …., 𝑘𝑤

, 𝑈𝐵

,..., 𝑈𝐵

, x)

which expresses microgrid operational feasibility

constraint in terms of 𝑘𝑤

,…., 𝑘𝑤

, x.

Recall that operational control involve which

loads are activated at what level, which local

generators are activated at what level, which batteries

are activated in charge and discharge mode and at

what level etc. Given this information, we need to

compute bid-ask to the market, which is a function

v: [𝑚𝑖𝑛𝐾𝑊

, 𝑚𝑎𝑥𝐾𝑊

] x … x [𝑚𝑖𝑛𝐾𝑊

, 𝑚𝑎𝑥𝐾𝑊

] → R

where the value v(𝑘𝑤

,…., 𝑘𝑤

) represents the

(maximum) amount of money the entity is ready to

pay for increasing the power consumption bounds by

(𝑘𝑤

, …., 𝑘𝑤

) in time intervals 1,...,n, relatively to

the current power upper bounds ( 𝑈𝐵

,..., 𝑈𝐵

)

allocated to the entity.

We need to generate (a representation of) function

v under the assumption that, given (𝑘𝑤

, …., 𝑘𝑤

)

added to the existing power upper bounds, the

microgrid will be optimally operated. In other words,

v(𝑘𝑤

, …., 𝑘𝑤

) = 𝑚𝑎𝑥

V(𝑘𝑤

, …., 𝑘𝑤

, 𝑈𝐵

,..., 𝑈𝐵

, x)

(4)

subject to

(1) upper bound constraints for total power

consumption for every time interval,

(2) power balance constraints for every time

interval and

(3) microgrid operational constraints C(𝑘𝑤

, ….,

𝑘𝑤

, 𝑈𝐵

,..., 𝑈𝐵

, x).

The challenge in computing a representation of

this function is that it may not have a closed analytical

form, which is needed if we want to use efficient

mathematical programming algorithms (e.g., branch

and bound for mixed integer linear programming) in

market clearance optimization. Thus, we may need to

resort to its approximation. Computing this

approximation efficiently yet accurately is a research

challenge that needs to be addressed.

3.1.3 Optimization of Microgrid

Operational Controls

Market clears with instantiated power usage right

increases (𝑘𝑤

∗

, …., 𝑘𝑤

∗

) for an entity’s microgrid

for time intervals 1,...,n. Microgrid optimization is

maximization of the operational value V(𝑘𝑤

∗

, ….,

𝑘𝑤

∗

, 𝑈𝐵

,..., 𝑈𝐵

, x) for x subject to operational

constraints C(𝑘𝑤

∗

, …., 𝑘𝑤

∗

, 𝑈𝐵

,..., 𝑈𝐵

, x), when

all power usage right increases are fixed as per market

clearance. The challenge here is being able to

mathematically model microgrid operational value

and constraints for diverse set of resources used in the

microgrid. Also, since this optimization needs to be

done before the start of every time interval, efficiency

of an optimization algorithm is critical. We discuss

these challenges in more detail in the next section.

3.2 Power System Modeling, Decision

Guidance, and Optimization

All three steps in the three-step market system require

decision optimization. Finding bid-ask to be

submitted to the market and finding operational

control of the microgrid require modeling and

optimization of the underlying power system, as

described earlier. The model of the power system is

quite involved, because it must capture, in addition to

general computation of benefits, costs and balancing

constraints, the precise models of power network

components. They may include various types of

utility contracts; diesel generators; power storage

including batteries, spinning wheels, and hydro-

storage; schedulable loads such as ice generation for

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

260

cooling, boiling water and charging electric cars in a

parking garage; solar panels and wind turbines. These

models are quite involved and diverse.

To be able to scale the development of diverse

microgrid model instances, we would like to create a

reusable extensible repository of component models,

so that specific microgrid models can be easily

composed based on model components, similar to how

it is done in simulation-based systems (Lambert et al.

2006). At the same time, we would like to get

efficiency of the best mathematical programming

algorithms, such as for Mixed Integer Linear

Programming (MILP), which significantly outperform

simulation-based optimization algorithms. To bridge

the gap, we envision to leverage some research ideas

from our prior work, the work on microgrid component

models (Altaleb & Brodsky 2013, Levy et al. 2016b,

Levy et al. 2016a, Ngan et al. 2014), as well Unity

Decision Guidance Management System (Unity

DGMS) (Nachawati et al. 2017, Brodsky & Luo 2015).

It allows modular simulation-like modeling,

automatically generates mathematical programming

models, and solves them using the best available

mathematical programming algorithms. We plan to use

mixed integer linear programming solvers as well as

gradient-based non-linear programming solvers on

power system optimization.

To support the three-step market system we

envision the development of a Decision Guidance

solution based on Unity DGMS. The decision

guidance solution will be based on formal modular,

extensible analytic performance model which

expresses metrics of interest and feasibility

constraints as a function of investment and operation

decision variables. Metrics of interest include benefit,

cost and overall value of power system operation over

a number of time intervals. Feasibility constraints

include capacity limitation of physical resources,

power flow equation, contractual terms, and power

demand. Decision variables include all power system

operational controls over the planning time intervals

such as (1) power flows in the network as a whole, (2)

specific controls for each physical network

component such as power generators, transmission

lines, distribution, power storage, and renewable

sources of energy, and (3) financial instruments such

as contracts with power providers.

3.3 Market Privacy, Security,

Confidentiality,

Pseudo-anonymity, and

Non-repudiation

Entities involved in the energy marketplace will need

to expect that the market value of energy will be

computed fairly. The fair-market-value must be

computed by evaluating what each participating

consumer is willing to spend, how much energy is

needed, and (under appropriate circumstances) how

much power a customer may be willing to provide to

the power grid (and at what price). The ability to

audit how this price is computed and set will build

confidence in the fairness of the ecosystem.

Nevertheless, these data elements expose some

aspects of entities’ financial interests and disposition,

and the privacy and security of these data must be

enforced by the implementing architecture. To

ideally accomplish this, the information used will

need to be publishable to a set of entities (who may

not necessarily be market participants, but may be

regulatory), so that the market’s fairness can be

inspected and regulated. However, because exposure

of this level of consumer-interest in pricing would be

considered private information, it may result in

gaming of the system, and many market participants

may not want it to be publicly discoverable and

attributable, a pseudo-anonymous approach that

provides non-repudiation is critical. Such a viable

architecture will need to provide the necessary

transparency that allows inspection into how the fair-

market-value of energy was arrived at by a

community of auditing/regulatory entities, while also

protecting the security and privacy of consumers so

that their private data and interests maintain a

sufficient level of privacy protection, and must offer

non-repudiation facilities so that entities can be held

accountable after committing to asks/ bids.

The necessary properties of such an architecture

will be to create a model which allows market

participants to “bid” on energy (as previously

described), to be able to create an “ask” to provide

energy to the grid (as previously described). These

properties must also allow audit and regulatory

entities to verify the existence of any and all bids that

have been made by the set of market participants, the

existence of any and all asks that have been made by

the set of market participants, to protect the privacy

of sensitive information (such as the identity of

clients that can be associated with ask and bid

information), and non-repudiation (so that once bids

and asks are published and used to calculate the fair-

market-value of power, the submitting client cannot

A Cooperative Market-based Decision Guidance Approach for Resilient Power Systems

261

disavow their existence). In this architecture, it is

envisioned that there will be a set of semi-trusted

entities (such as the utility provider, possibly a set of

entities to compute the fair-market-value, or a

regulatory entity, etc.). This structure should ensure

that the marketplace and fair-market-value

computations are transparent enough that these semi-

trusted entities have only enough information to

verify bids and asks at admission time against the

pseudo-anonymous authors before publishing them.

The pseudo-anonymity architecture will be the

focus of additional research. With the data from bids

and asks being critical to computing and providing

transparency into the determination of a fair-market

value, the ability to disseminate these data to a semi-

trusted set of entities, for the data to be immutable,

and for it to be transparent will be explored in the

context of distributed ledgers. Initial considerations

will be given to blockchain technologies such as

private Ethereum, private bitcoin, and more recent

approaches such as those described by private

DLedger (Nakamoto n.d.; Zheng et al. 2017). Each

bid and ask will be separately represented in the

distributed ledger and will uniquely, and pseudo-

anonymously, indicate the specific market participant

who placed it. These investigations will underscore

the need for semi-public and immutable data to

bolster marketplace confidence, while still providing

privacy and non-repudiation.

To provide authentication and integrity

protections to the system’s semi-trusted providers, we

envision using their public DNS domain names (such

as example.com) and the DNS-based Authentication

of Named Entities (DANE) to build a reduced attack

surface security model (Osterweil et al. 2014). This

will allow protections to be managed by the power

utility, and will allow certificate’s to be issued to each

market participant. Each of these certificates will act

as a trust anchor for that entity and will correspond a

private key that will only be known to the market

participant whom the signing certificate was issued

to. These private keys will be used to create

attestations to revolving End Entity (EE) certificates,

which are created for every time interval of bids and

asks. These EE certificates will be used to create

digital signatures over each bid and ask, and that

signature will accompany its corresponding bid or ask

in the distributed ledger (with no other identifying

information). This will allow inspection of the data

in the ledger (by the subset of entities who are semi-

trusted), pseudo-anonymity of the market participants

(without the time interval-specific revolving EE

certificate, signatures do not identify the author’s

identity), and non-repudiation of each element (given

the EE certificate, each bid or ask can be verified and

attributed).

As an example, consider that a utility provider

issues subordinate signing certificates to k market

participants (𝑐

...𝑐

). At the beginning of each time

interval 𝑖, each client 𝑐

will create a new EE cert

(𝑐

). A bid 𝑏

and ask 𝑎

may be entered into a

distributed ledger with accompanying signatures

from that clients EE certificate from that epoch:

𝑏

,𝑠𝑖𝑔𝑛𝑎𝑡𝑢𝑟𝑒𝑏

Because 𝑐

is not publicly published, it is not

independently attributable. However, if a

compulsory audit is called for, each bid and ask can

be verified by having its corresponding EE certificate

disclosed, along with its pkcs7 signature chain to the

utility provider’s root certificate.

One key success criterion for the proposed

technology is scalability of optimization algorithms

for market clearance and microgrid operational

controls. This will be verified through a carefully

conducted experimental evaluation on a realistic

cooperation scenario to make an initial assessment on

the magnitude of economic losses that can be saved

during disaster response, as well as scalability of

optimization algorithms to deal with realistic size of

power systems in near real time.

Also, success criteria include the ability to

mathematically prove the desirable properties of

Pareto-optimality, individual rationality, and fairness

for the proposed three-step market system.

4 CONCLUSIONS

In a major shortage scenario, transferring power

usage rights from lowest-loss to highest-loss entities

has the potential of significantly reducing combined

loss and improving overall system resilience.

Unfortunately, the existing power systems do not take

this fact into account. With this drastic unutilized

reduction in combined losses, it is clear that power

systems need a paradigm shift, which we described in

this position paper. The market-based solution could

lead to a significant improvement of the resilience of

power cyber-physical systems.

REFERENCES

Altaleb, H. & Brodsky, A., 2013. A Primary Market for

Optimizing Power Peak-Load Demand Limits.

International Journal of Decision Support System

Technology, 5(2), pp.21–32. Available at:

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

262

http://dx.doi.org/10.4018/jdsst.2013040102.

Brodsky, A. & Luo, J., 2015. Decision Guidance

Analytics Language (DGAL) - Toward Reusable

Knowledge Base Centric Modeling. Proceedings of the

17th International Conference on Enterprise

Information Systems. Available at:

http://dx.doi.org/10.5220/0005349600670078.

Guikema, S.D., Davidson, R.A. & Liu, H., 2006. Statistical

Models of the Effects of Tree Trimming on Power

System Outages. IEEE Transactions on Power

Delivery, 21(3), pp.1549–1557. Available at:

http://dx.doi.org/10.1109/tpwrd.2005.860238.

Moslehi, K. & Kumar R., 2010, "A reliability perspective

of the smart grid." IEEE transactions on smart grid 1,

no. 1: 57-64.

Lambert T., Gilman P., Lilienthal P., 2006. Micropower

System Modeling with HOMER, Integration of

Alternative Sources of Energy, Farret, F, Godoy

Simões, John Wiley and Sons.

Lassila, J., Honkapuro, S. & Partanen, J., Economic

analysis of outage costs parameters and their

implications on investment decisions. IEEE Power

Engineering Society General Meeting, 2005. Available

at: http://dx.doi.org/10.1109/pes.2005.1489220.

Levy, R., Brodsky, A. & Luo, J., 2016a. Decision Guidance

Approach to Power Network Analysis and

Optimization. Proceedings of the 18th International

Conference on Enterprise Information Systems.

Available at:

http://dx.doi.org/10.5220/0005736401090117.

Levy, R., Brodsky, A. & Luo, J., 2016b. Decision guidance

framework to support operations and analysis of a

hybrid renewable energy system. Journal of

Management Analytics, 3(4), pp.285–304. Available at:

http://dx.doi.org/10.1080/23270012.2016.1229140.

Liu, Y. & Singh, C., 2011. A Methodology for Evaluation

of Hurricane Impact on Composite Power System

Reliability. IEEE Transactions on Power Systems,

26(1), pp.145–152. Available at:

http://dx.doi.org/10.1109/tpwrs.2010.2050219.

Mohagheghi, S. & Yang, F., 2011. Applications of

microgrids in distribution system service restoration.

ISGT 2011. Available at:

http://dx.doi.org/10.1109/isgt.2011.5759139.

Nachawati, M.O., Brodsky, A. & Luo, J., 2017. Unity

Decision Guidance Management System: Analytics

Engine and Reusable Model Repository. Proceedings

of the 19th International Conference on Enterprise

Information Systems. Available at:

http://dx.doi.org/10.5220/0006338703120323.

Nakamoto, N., Centralised Bitcoin: A Secure and High

Performance Electronic Cash System. SSRN Electronic

Journal. Available at:

http://dx.doi.org/10.2139/ssrn.3065723.

Ngan, C.-K. et al., 2014. Optimizing Power, Heating, and

Cooling Capacity on a Decision-Guided Energy

Investment Framework. Enterprise Information

Systems, pp.154–173. Available at:

http://dx.doi.org/10.1007/978-3-319-09492-2_10.

Osterweil, E., McPherson D & Zhang L, 2014. "The shape

and size of threats: Defining a networked system's

attack surface." In 2014 IEEE 22nd International

Conference on Network Protocols, pp. 636-641. IEEE.

Rose, A., Oladosu, G. & Liao, S.-Y., 2007. Business

interruption impacts of a terrorist attack on the electric

power system of Los Angeles: customer resilience to a

total blackout. Risk analysis: an official publication of

the Society for Risk Analysis

, 27(3), pp.513–531.

Wang, Y. et al., 2016. Research on Resilience of Power

Systems Under Natural Disasters—A Review. IEEE

Transactions on Power Systems, 31(2), pp.1604–1613.

Wang, Z. et al., 2015. Coordinated Energy Management of

Networked Microgrids in Distribution Systems. IEEE

Transactions on Smart Grid, 6(1), pp.45–53. Available

at: http://dx.doi.org/10.1109/tsg.2014.2329846.

Zheng, Z. et al., 2017. An Overview of Blockchain

Technology: Architecture, Consensus, and Future

Trends. 2017 IEEE International Congress on Big Data

(BigData Congress). Available at:

http://dx.doi.org/10.1109/bigdatacongress.2017.85.

A Cooperative Market-based Decision Guidance Approach for Resilient Power Systems

263