Modeling the Cabin Capacity Allocation Problem in the Cruise Industry:

An Italian Case Study

Giusy Macrina

1 a

, Francesca Guerriero

1 b

and Luigi Di Puglia Pugliese

2 c

1

Dipartimento di Ingegneria Meccanica, Energetica e Gestionale, Universit

´

a della Calabria, 87036, Rende, Italy

2

Istituto di Calcolo e Reti ad Alte Prestazioni, Consiglio Nazionale delle Ricerche, 87036, Rende, Italy

Keywords:

Revenue Management, Cruise Sector, Allocation Problem.

Abstract:

In this paper we present several optimization models for cruise cabin capacity allocation. In particular, we

address the problem of managing the booking requests for a set of cabins with different type and price in

a cruise ship. We formulate three models, considering several features of the problem such as: the limited

number of bookable places on the ship, different planning and operation horizon, the possibility to postpone

a departure or to apply special offers. Then, we present an Italian case study and we analyze the impact of

different strategies on the revenues achievable by the company.

1 INTRODUCTION

Since 1980, the cruise industry has grown rapidly

worldwide, with an impressive annual rate of 8.4%.

Between 2009 and 2019, the number of cruise passen-

gers increased from 17.8 millions in 2009 to 30 mil-

lions in 2019. In 2017 the cruise sector contributed

114 billion euros to the global economy, counting

28.5 millions of passengers (www.cruising.org). The

cruise sector is expected to grow more, in fact, the

occupancy rate of cabins is very high compared to

other tourism sectors, such as the hotels. It is impor-

tant to note that this parameter plays a crucial role.

In fact, if in other sectors, such as the hotels or the

airlines, having an occupancy rate equals to 70% in-

dicates a success, in a cruise ship this rate must be

around 95% or more. Thus, a cruise company al-

ways tries to complete the booking for a ship, apply-

ing discounts or promotions, avoiding empty cabins

during the trips. The main reason is that the rev-

enues of a cruise are not only related to the tickets,

but also to several services offered on-board, such as

excursions, photo books and other entertainment ac-

tivities. Hence, choosing a strategy for maximizing

the overall revenues is a very challenging task. This

makes the cruise sector an interesting and profitable

area for applying revenue management techniques.

a

https://orcid.org/0000-0001-6762-3622

b

https://orcid.org/0000-0002-3887-1317

c

https://orcid.org/0000-0002-6895-1457

Revenue management methods are useful tools for

helping companies in finding profitable policies to al-

locate their limited resources to different customer

segments, in a given planning horizon (Klein et al.,

2020). Originating in the airline industry in the 1970s,

these techniques have been extended to many indus-

tries, we cite for example restaurants (Saito et al.,

2019), (Guerriero et al., 2014), railway (Meissner

and Strauss, 2010), car rental (Guerriero and Olivito,

2014), (Oliveira et al., 2017). However, the scien-

tific production related to the application of revenue

management techniques in the cruise industry is not

very extensive (Sturm D., 2018). Only few contri-

butions, addressing real-case applications of revenue

management methods in this sector, have been pub-

lished. The paper of (Ladany and Arbel, 1992) repre-

sents one of the first work addressing pricing strate-

gies for passenger cabins on cruise-liners. (Biehn,

2006) emphasized that the cruise ships are not float-

ing hotels, and explained why common hotel rev-

enue management methods cannot be applied to the

cruise sector. He focused on several critical factors

such as: pricing, multiple capacity limitations, book-

ing periods, the huge number of cabin categories and

the trips extensions (i.e., additional services offered

to customers for extending the base itinerary). (Mad-

dah et al., 2010) proposed a dynamic model to han-

dle multi-dimensional cabin category and lifeboat ca-

pacity constraints, and to consider the uncertainty of

demand by assuming that customers arrive according

to a discrete-time stochastic process. (Li et al., 2014)

Macrina, G., Guerriero, F. and Pugliese, L.

Modeling the Cabin Capacity Allocation Problem in the Cruise Industry: An Italian Case Study.

DOI: 10.5220/0010299402330240

In Proceedings of the 10th International Conference on Operations Research and Enterprise Systems (ICORES 2021), pages 233-240

ISBN: 978-989-758-485-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

233

modeled a problem which considers pricing and room

assignment as well as the potential on-board expenses

of customers. (Sturm and Fischer, 2019) extended the

work of (Li et al., 2014) taking into account addi-

tional issues, such as the interdependence of booking

request components, i.e., inseparable group arrivals,

and exploiting the possibility to use connected cab-

ins. (Li, 2014) considered the risk of cancellation

and focused on the possibility to accept overbook-

ing requests. Hence, he applied a real options ap-

proach to formulate a risk decision model for cruise

line dynamic overbooking. (Ayvaz-Cavdaroglu et al.,

2019) developed a pricing approach focusing on the

customer habits and three main features of cruise in-

dustry: the long booking period, the restriction on the

price variations from week to week, and the effect of

promotion expense decisions on the total revenues of

the company.

Contribution and Organization of the Work. In

this work we present three mathematical formula-

tions, of incremental complexity, for the cabin capac-

ity allocation problem in the cruise industry. The first

model is a basic problem, in which booking requests

are accepted until a maximum capacity is reached,

then, they are rejected. In the second and third models

we consider the possibility to offer customers a post-

poned departure time at the same price, in case all the

cabins of the requested type are all booked for the se-

lected data. The main difference between these last

two models is that in the second one, we suppose that

all the customers accept the postponement, while in

the third one we consider also the possibility of rejec-

tion. This specific feature (i.e., postponement of the

departure date) has not been considered in the scien-

tific contributions published on the same topic so far.

It is worth observing that the proposed models can be

used to evaluate booking limits and thus the obtained

solutions can support the decision maker in accepting

or denying arriving booking requests, when booking

limit revenue management policies are implemented.

The behaviour of the proposed models are evalu-

ated empirically on realistic data related to the Italian

cruise line: Costa Crociere. In particular, we investi-

gate how different price strategies may influence the

achievable revenues. The rest of the paper is orga-

nized as follows: in Section 2 we describe the pro-

posed models. In Section 3 we describe the real case

study and we discuss on the results obtained by testing

the proposed models, on realistic data and considering

different pricing schemes. In Section 4 we summarize

the conclusions of our work.

2 MATHEMATICAL

PROGRAMMING MODELS

In this section we present the proposed models, aimed

at allocating the cruise cabin capacity, in such a way

to maximize the revenue. In particular, we present

three mathematical formulations, we describe the ob-

jective functions and constraints of each model and

we highlight their most important features and limits.

2.1 First Mathematical Model

Let k = 1. . .

¯

K indicate the cabins type available for

the booking. In each time period t = 1 . . . T of the

booking horizon, a customer may book a cabin of type

k. Let

¯

t = 1 . . .

¯

T be the operational horizon, i.e. the

period of time where the ships embark the passengers.

It is worth noting that the boarding/landing operations

are not scheduled each day of the operation horizon,

hence, let Ω ⊆

¯

T be the subset of days in which a ship

embarks the passengers (i.e., boarding/landing opera-

tions are allowed). In other words, we may introduce

a binary vector H of size

¯

T which refers to the ports

where the ships stop and passengers may get on/off.

The generic element h

¯

t

belonging to the vector H is

equal to one if during the day

¯

t the boarding/landings

operations are allowed, zero otherwise. Hence, we

may set Ω = {

¯

t : h

¯

t

= 1}.

The booking horizon is defined such that the last

possible day of booking is the day before the starting

of the operational horizon, i.e., the day before the start

date of the cruise.

On the other hand, each cabin can be reserved up

to F days before departure. Thus, a customer, who

wants to depart at time

¯

t, can book a cabin at any in-

stant of time t belonging the set L(

¯

t) = {t|

¯

t − F ≤ t ≤

¯

t − 1}.

Each cruise trip has a duration of α days. Let p

¯

t

kt

be the price at time t for booking a cabin of type k for

the departure time

¯

t, while d

¯

t

kt

be the requests received

at time t for booking a cabin of type k for the departure

time

¯

t. A ship has a limited number of cabins of type

k, indicated as C

k

.

Let x

¯

t

kt

be an integer decision variable that rep-

resents the number of accepted booking requests for

cabins of type k arrived at time t, for the period

¯

t,

∀

¯

t ∈ Ω;k ∈

¯

K, t ∈ L(

¯

t).

Using the notation introduced above, the first for-

mulation takes the following form.

Max

¯

K

∑

k=1

∑

¯

t∈Ω

∑

t∈L(

¯

t)

p

¯

t

kt

x

¯

t

kt

(1)

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

234

x

¯

t

kt

≤ d

¯

t

kt

¯

t ∈ Ω, k = 1...

¯

K, t ∈ L(

¯

t)

¯

t+α−1

∑

τ=

¯

t−α+1

t−1

∑

s=1

x

τ

ks

+

¯

t+α−1

∑

τ=

¯

t−α+1

x

τ

kt

≤ C

k

¯

t ∈ Ω, k = 1...

¯

K, t ∈ L(

¯

t)

x

¯

t

kt

≥ 0, integer

¯

t ∈ Ω, k = 1...

¯

K, t ∈ L(

¯

t)

(2)

(3)

(4)

The objective function (1) maximizes the total

revenue. Constraints (2) guarantee that the number

of accepted booking requests does not exceed the de-

mand. Ships capacity constraints are modeled by

equations (3), finally; constraints (4) define the vari-

ables domain.

It is worth noting that this model can be easily de-

composed in

¯

K smaller sub-problems, simpler to be

solved. In fact, since the requests arrive for single

type of cabins and they are not related each others, the

total number of cabins of each type k may be consid-

ered as a single ship. Hence, for modelling the sub-

problem, we may modify the quantities defined for

the previous model as follows: let d

¯

t

t

the booking re-

quests of cabins received at time t for the time depar-

ture

¯

t, and p

¯

t

t

be the price for booking a cabin at time

t for the time departure

¯

t. C is the maximum capacity

of the ship. Let x

¯

t

t

be an integer decision variable that

represents the number of accepted booking requests

for cabins arrived at time t, starting from the period

¯

t,

∀

¯

t ∈ Ω;k ∈

¯

K, t ∈ L(

¯

t). We named this requests regu-

lar” requests. A sub-problem for a ship composed of

cabins of type k, which maintains the same objective

and constraints of the previous one, can be modelled

as follows:

Max

∑

¯

t∈Ω

∑

t∈L(

¯

t)

p

¯

t

t

x

¯

t

t

(5)

x

¯

t

t

≤ d

¯

t

t

¯

t ∈ Ω, t ∈ L (

¯

t)

¯

t+α−1

∑

τ=

¯

t−α+1

t−1

∑

s=1

x

τ

s

+

¯

t+α−1

∑

τ=

¯

t−α+1

x

τ

t

≤ C

¯

t ∈ Ω, t ∈ L (

¯

t)

x

¯

t

t

≥ 0, integer

¯

t ∈ Ω, t ∈ L (

¯

t)

(6)

(7)

(8)

2.2 Second Mathematical Model

The model proposed in Section 2.1 is a basic version

in which the booking requests for cabins of type k are

accepted until the maximum number of available cab-

ins in the ship, for the departure time

¯

t, is reached.

The other requests are rejected. However, adopting

this strategy could be not profitable, since the pos-

sibility to offer alternative travel options to the cus-

tomer is not taken into account. Sometime, some cus-

tomers could be interested in booking a cruise, but

their requests cannot be accepted due to the unavail-

ability of cabins at departure time

¯

t. Hence, an inter-

esting strategy is to propose to customers who try to

book a cabin of type k for the departure time

¯

t, another

cabin of the same type k but in another departure time

indicated as α, in the same port, maintaining the same

price proposed at time t. In fact, since α is the dura-

tion of the trip, the same tour of a cruise ship starts

each α days, in the same port.

To model this possibility, we need to introduce

a new set of variables y

¯

t

kt

,

¯

t ∈ Ω, k = 1. . .

¯

K, t =

1. . . L(

¯

t), that represent the number of accepted re-

quests of cabins of type k for the departure time

(

¯

t − α) that will be scheduled at departure time

¯

t. We

referred to this type of requests as promo” requests.

The related problem can be represented mathemati-

cally as follows.

Max

¯

K

∑

k=1

∑

¯

t∈Ω

∑

t∈L(

¯

t)

p

¯

t

kt

(x

¯

t

kt

+ y

¯

t+α

kt

)

(9)

x

¯

t

kt

≤ d

¯

t

kt

¯

t ∈ Ω, k = 1...

¯

K, t ∈ L(

¯

t)

¯

t+α−1

∑

τ=

¯

t−α+1

t−1

∑

s=1

(x

τ

ks

+ y

τ

ks

) +

¯

t+α−1

∑

τ=

¯

t−α+1

(x

τ

kt

+ y

τ

kt

) ≤ C

k

¯

t ∈ Ω, k = 1...

¯

K, t ∈ L(

¯

t)

y

¯

t

kt

≤ d

¯

t−α

kt

− x

¯

t−α

kt

¯

t ∈ Ω, k = 1...

¯

K, t ∈ L(

¯

t)

x

¯

t

kt

≥ 0, integer

¯

t ∈ Ω, k = 1...

¯

K, t ∈ L(

¯

t)

y

¯

t

kt

≥ 0, integer

¯

t ∈ Ω, k = 1...

¯

K, t ∈ L(

¯

t)

(10)

(11)

(12)

(13)

(14)

The objective function (9) maximizes the total

revenue, obtained by accepting the regular and the

promo requests. Constraints (10) are the same as

the conditions (2). Equations (11) model the capac-

ity constraints, taking into account both the regular

requests and the promo ones. Constraints (12) guar-

antee that the number of accepted promo requests for

the departure time

¯

t and the cabin type k, does not

exceed the demand, considering also the regular re-

quests. Constraints (13) and (14) define the domain

of variables.

As for the model (1)– (4) presented in Section 2.1,

we can decompose this model in

¯

K sub-problems, one

for each type of cabin k. With this purpose, we mod-

ify the parameters and the variables by removing the

index related to the type of cabin k, maintaining the

same objective function and constraints. Hence, for

each type of cabin, we model and solve the follow-

ing optimization problem, which is easier to be solved

than the mathematical formulation (9) – (14).

Max

∑

¯

t∈Ω

∑

t∈L(

¯

t)

p

¯

t

t

(x

¯

t

t

+ y

¯

t+α

t

) (15)

x

¯

t

t

≤ d

¯

t

t

¯

t ∈ Ω, t ∈ L(

¯

t) (16)

¯

t+α−1

∑

τ=

¯

t−α+1

t−1

∑

s=1

(x

τ

s

+ y

τ

s

)+

Modeling the Cabin Capacity Allocation Problem in the Cruise Industry: An Italian Case Study

235

¯

t+α−1

∑

τ=

¯

t−α+1

(x

τ

t

+ y

¯

t

t

) ≤ C

¯

t ∈ Ω, t ∈ L (

¯

t)

y

¯

t

t

≤ d

¯

t−α

t

− x

¯

t−α

t

¯

t ∈ Ω, t ∈ L (

¯

t)

x

¯

t

t

≥ 0, integer

¯

t ∈ Ω, t ∈ L (

¯

t)

y

¯

t

t

≥ 0, integer

¯

t ∈ Ω, t ∈ L (

¯

t)

(17)

(18)

(19)

(20)

2.3 Third Mathematical Model

The main limit of the model proposed in Section 2.2

is that it assumes a customer will accept to book a

cabin even if the departure will be postponed of α

days. Actually, a customer could not accept the de-

parture postponement, hence, taking into account the

possibility of rejection is a critical issue. To model

this possibility, we introduce the customer’s probabil-

ity of acceptance. Let a

¯

t

kt

be a binary parameter that

will be equal to one if the probability of acceptance

is larger than P, zero otherwise for each k = 1, . . .

¯

K,

t = 1. . . L(

¯

t),

¯

t ∈ Ω.

Hence, we formulate the problem as follows:

Max

¯

K

∑

k=1

∑

¯

t∈Ω

∑

t∈L(

¯

t)

p

¯

t

kt

(x

¯

t

kt

+ a

¯

t

kt

y

¯

t+α

kt

) (21)

x

¯

t

kt

≤ d

¯

t

kt

¯

t ∈ Ω, k = 1...

¯

K, t ∈ L(

¯

t)

¯

t+α−1

∑

τ=

¯

t−α+1

t−1

∑

s=1

(x

τ

ks

+ a

τ

ks

y

τ

ks

)+

¯

t+α−1

∑

τ=

¯

t−α+1

(x

τ

kt

+ a

τ

kt

y

τ

kt

) ≤ C

k

¯

t ∈ Ω, k = 1, ...,

¯

K, t ∈ L(

¯

t)

a

¯

t

kt

y

¯

t

kt

≤ d

¯

t−α

kt

− x

¯

t−α

kt

¯

t ∈ Ω, k = 1, ...,

¯

K, t ∈ L(

¯

t)

x

¯

t

kt

≥ 0, integer

¯

t ∈ Ω, k = 1, ...,

¯

K, t ∈ L(

¯

t)

y

¯

t

kt

≥ 0, integer

¯

t ∈ Ω, k = 1, ...,

¯

K, t ∈ L(

¯

t)

(22)

(23)

(24)

(25)

(26)

The objective function (21) maximizes the rev-

enue, while constraints (22) – (26) are similar to (10)

– (14). This model, as the previous ones, can be de-

composed in easier sub-problems. However, the main

limit of this model is that the demand is considered

an aggregate data. Hence, it supposes that all the cus-

tomers behave similarly.

3 COMPUTATIONAL RESULTS

In this section we describe our computational study

and analyze the obtained results. In particular, we

firstly describe the case study features. Then, we dis-

cuss on the experimental results obtained by applying

the different models presented in Section 2, by high-

lighting the impact of the use of these models in terms

of achievable revenue.

3.1 The Italian Case Study

In this section, we present the main features of

the realistic case study used in the computational

phase. We have considered the Italian cruise line:

Costa Crociere. Thus the cabin capacities, the

cabin types and the the tariff segments are de-

rived from the web-site of the considered cruise line

(https://www.costacruises.com/), whereas the cabin

rates are obtained from the data published by the on-

line travel agency Logitravel (www.logitravel.it).

Some of the available data have been slightly

modified in order to fit with the models assumptions.

In particular, we consider only three categories of cab-

ins, i.e., low that includes the intern cabins, medium

that contains both ocean and balcony, and high that

refers to the suite. Thus, capacities and prices have

been appropriately defined (see Tables 1–3).

We have chosen the itinerary Marseille -

Barcelone - Palma de Maiorca - Cagliari - Civitavec-

chia (Rome)” depicted in Figure 1. It is worth observ-

ing, that not all the cities are embarkation ports. In

fact, it is possible to start the cruise only from Savona,

Cagliari and Rome.

Figure 1: Cruise itinerary.

The ship which performs this trip, named Costa

Diadema” (see Figure 2), is one of the largest in the

fleet of Costa Crociere. In fact, it can host 4947 pas-

sengers and 1253 crew members, and also has an out-

side promenade extending over 500 m. There are sev-

eral on-board activities in Costa Diadema: 4D cine-

mas, lively bars, gourmet restaurants and the spa area.

Figure 2: Costa Diadema (www.costacruises.com).

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

236

Costa Diadema has 1862 cabins of three types: In-

side (i.e., the most economic), Balcony and Ocean

view, Suite and Samsara. We will refer to these

classes as: low, medium and high, respectively. Ta-

ble 1 summarizes the capacities, i.e., the number of

available places, of each type of cabin.

Table 1: Capacity of the cabins classified by type.

Type Low Medium High

Capacity 701 1086 75

The cruise starts its journey in June and repeats its

tour until the end of September. It is 7-days long and

it visits the same port each week in the same day. The

first city, visited on Monday, is Savona, then Marseille

in Tuesday and so on. We have considered data refer-

ring to 2018, thus the first possible departure was on

June the 2

nd

. For our study, we have considered two

weeks of service, thus 14 days when it is possible to

embark on the cruise and 21 days of service.

Prices. The cabins rates vary depending on the de-

parture date and the type of cabins, Table 2 reports the

prices related to the period 02/06 – 30/06 of the year

2018.

Table 2: Prices of the cabins for the year 2018

(www.logitravel.it).

Type 02/06 09/06 16/06 23/06 30/06

Intern e669 e669 e669 e749 e749

Ocean e839 e869 e869 e919 e929

Balcony e949 e949 e949 e998 e1,018

Suite e1,194 e1,194 e1,194 e1,243 e1,263

In our experimental study, we assume that the

price is influenced by the time of booking, the depar-

ture date and the availability of the cabins in the ship.

Hence, for representing the variation of price, we fol-

low the idea considered by (Joshi, 2004). At first, we

evaluated a maximum and a minimum price for each

cabin type, denoted as p

max

and p

min

, respectively and

summarized in Table 3.

Table 3: Maximum and minimum prices for each type of

cabin.

Type Low Medium High

p

min

e669 e839 e1,194

p

max

e749 e1,018 e1,263

Then, the first strategy we consider for incentiviz-

ing customers to buy, is related to the time remaining

before the departure. Hence, we apply the lowest fare

if the requests arrive very early, i.e., when the ship

is almost empty. On the contrary, the fares will be

increased if the booking requests arrive close to the

departure time, i.e., when only few cabins are avail-

able and the customers are willing to pay the most

extensive price for booking a cabin. To calculate the

corresponding fare p

ask

(i.e., the price offered to the

customers), we use the next linear equation (27) pro-

posed by (Joshi, 2004):

p

a

ask

= p

max

−t

r

j (27)

where t

r

is the remaining time that is the time left for

the cruise to start and j is a normalizing constant de-

fined in such way that p

a

ask

will be p

min

, when t

r

is

equal to the maximum number of days before the de-

parture in which the booking is possible.

The second strategy is related to the number of

available cabins. Hence, we calculate the price as fol-

lows:

p

b

ask

= p

max

− c

r

k (28)

where c

r

is the number of remaining cabins and k is a

normalizing constant such that p

b

ask

will be p

min

, when

c

r

is equal to the maximum number of available cab-

ins.

The last strategy is a hybrid approach, which takes

into account both time of booking and the available

cabins. The p

c

ask

is calculated as follows:

p

c

ask

= p

max

− (t

r

j) − (c

r

k) (29)

where j and k are normalizing constants such that p

c

ask

is p

max

, when t

r

is equal to the booking period and c

r

is close to zero.

Demands. To calculate the demand, we consider a

linear demand function (Cohen et al., 2015) denoted

by:

Q(p) = A − Bp (30)

We use the price elasticity of demand to calcu-

late the parameters A and B. The demand curve is

high elastic for luxury goods and we can state that

the higher the price the higher the elasticity. We use

a linear regression and calculate the curve demand

through Microsoft Excel. The equations are depicted

in Tab 4, where y represents Q(p) and x is p.

Table 4: Demands equations for each type of cabin.

Type elasticity equation

low 7 y=-0.2857x+221.43

medium 15 y=-0.7778x+ 765.22

high 20 y=-0.3347x+420

3.2 Results

We now describe the results obtained by solving the

three mathematical models proposed in Section 2. We

Modeling the Cabin Capacity Allocation Problem in the Cruise Industry: An Italian Case Study

237

use the Excel solver to find the solutions and we anal-

yse the results discussing the obtained revenues as

well as the occupancy of the cabins, considering the

21 days of service.

First Mathematical Model. We firstly analyse the

results obtained for the basic mathematical model rep-

resented by equations (1) – (4). We use the decom-

posed formulation (5)– (8), hence, we solve three sub-

problems, one for each type of cabin. We consider

four scenarios, by varying the prices p: 1) p = fixed

price, 2) p = p

a

ask

, 3) p = p

b

ask

and 4) p = p

c

ask

.

The first scenario is the most improbable, how-

ever, we want to analyse the case in which the price is

fixed, equal for each day of the time horizon.

Looking at results in Table 5, which summarizes

the revenues for each type of cabin as well as the total

revenue for the 21 days of service, it is evident that

the medium” cabins are the most profitable.

Table 5: Cruise revenue solving the first mathematical

model with fixed price.

type low medium high total

revenue (e) 892,386.00 1,880,706.00 20,980.00 2,976,072.00

This result, considering this setting, is obvious be-

cause of the higher number of available medium cab-

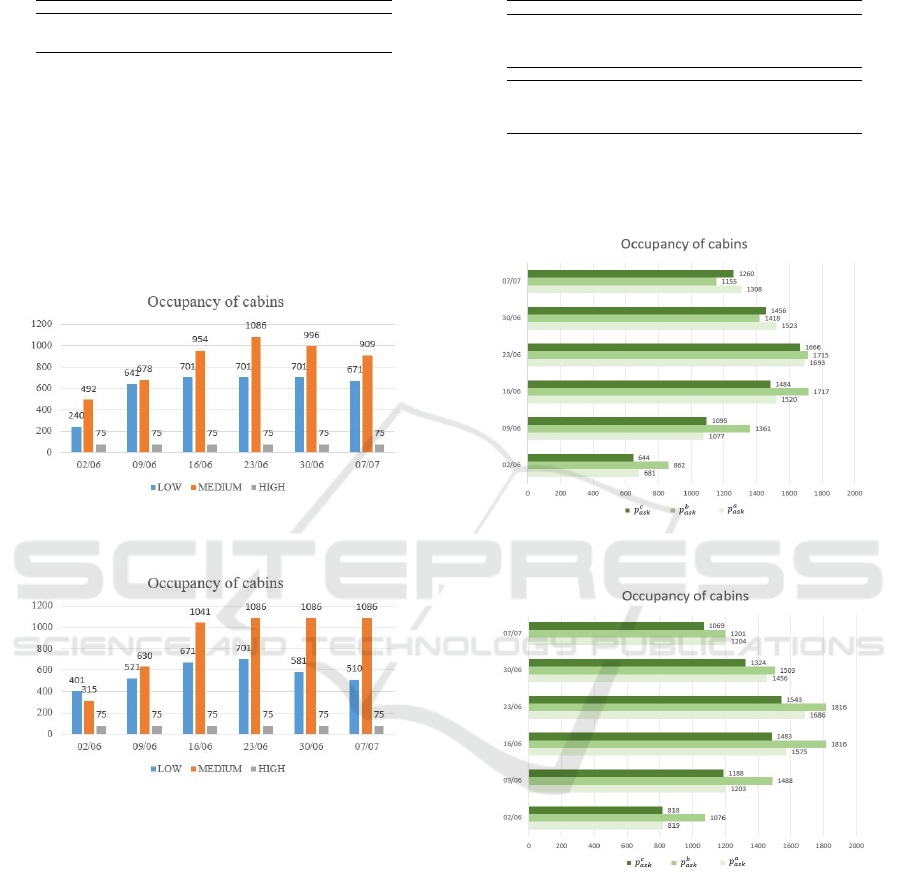

ins. Looking at Figure 3 we can observe that overall,

the highest numbers of reservations is concentrated in

the central departure dates.

Figure 3: Occupancy of cabins, using the first mathematical

model and a fixed price.

Then, we analyse the results obtained by varying

the prices. Table 6 reports the parameters used in the

computational experiments

Table 6: Parameters setting.

Type Low Medium High

p

min

(e) 669 839 1,194

p

max

(e) 749 1,018 1,263

capacity 701 1086 75

j 2.150 3.210 3.500

k 0.002 0.020 0.320

We summarize the results in Table 7 which de-

picts the obtained revenues, for each price strategy

and each type of cabins. Overall, the total revenues

are less than that obtained with the fixed price, this

numbers confirm that making a sales forecast using

a fixed price leads to erroneous results, since using a

fixed price is an impracticable strategy. Looking at

Table 7 we may observe that the most profitable strat-

egy is obtained by using p

c

ask

. Hence, considering the

price as a function of both booking time and available

cabins is the most profitable approach.

Table 7: Cruise revenue solving the first model varying

price strategy.

type low medium high total

revenue p

a

ask

603,730.00 993,900.00 182,460.00 1,780,063.00

(e) p

b

ask

566,647.00 1,008,569.00 182,138.00 1,757,354.00

p

c

ask

600,678.00 1,071,410.00 130,649.00 1,802,737.00

Figure 4 depicts the comparison of the cabins oc-

cupancy, for each departure date, varying p

ask

. It is

evident that p

c

ask

is not only the price that allows to

reach higher values of revenues, but also higher value

of occupancy.

Figure 4: Occupancy of cabins, using the first mathematical

model and varying p

ask

.

Second and Third Mathematical Models. As for

the first mathematical model, we fix the price and

solve also the second mathematical model presented

in Section 2 (i.e., (9) – (14)), that considers the possi-

bility to postpone the departure time of one week. In

this setting, we suppose that all the customers accept

the postponement. We recall that the third mathemat-

ical model is an extension of the second one, in which

the probability of acceptance is considered. Hence,

we need to take into account the possibility that a

customer accepts or not this postponement. For our

computational study, we suppose that the probability

of acceptance is about 70%. Table 8 summarizes the

results for both the models considering a fixed price.

From Table 8, it is evident that both the models pro-

vide the same revenue and the most profitable type

cabins is once again the medium one.

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

238

Table 8: Cruise revenue solving the second and third math-

ematical models with fixed price.

type low medium high total

model

revenue II 610,370.00 1,297,326.00 179,100.00 2,086,796.00

(e) III 610,370.00 1,297,326.00 179,100.00 2,086,796.00

Figures 5 and 6 show the occupancy of cabins

for the solutions obtained using the second and third

models, respectively. Even if we obtain the same rev-

enues, looking at Figures 5 and 6 we may see some

differences in the configurations. In particular, focus-

ing on the first departure date, using the second model

the number of medium type cabins is higher than that

used by solving the third model. On the contrary, the

number of low cabins is lower.

Figure 5: Occupancy of cabins, using the second mathemat-

ical model and a fixed price.

Figure 6: Occupancy of cabins, using the third model and a

fixed price.

As for the first model, we analyse the results ob-

tained by varying the prices. Table 9 reports the re-

sults obtained for the second and third mathematical

model, respectively. Looking at Table 9 and focusing

on low type cabin, the third model finds more effec-

tive solutions. As a matter of fact, overall the revenues

are higher than those obtained with the second model.

The revenues achieved for the medium and high types

of cabins are similar, with the only exception of the

medium type when considering p

b

ask

, in that case, the

third model finds more profitable solutions than the

second one.

Figures 7 and 8 depict the overall occupancy of the

cabins for the second and third mathematical model,

respectively, by varying p

ask

. Comparing these fig-

Table 9: Cruise revenue solving the second and third math-

ematical models varying price strategy.

second

type low medium high total

revenue p

a

ask

579,735.00 943,484.00 183,237.00 1,706,456.00

(e) p

b

ask

546,678.00 998,892.00 182,220.00 1,727,790.00

p

c

ask

559,054.00 882,467.00 182,974.00 1,624,495.00

third

type low medium high total

revenue p

a

ask

603,854.00 943,484.00 182,460.00 1,729,798.00

(e) p

b

ask

603,727.00 1,166,082.00 182,163.00 1,951,972.00

p

c

ask

608,690.00 800,025.00 182,203.00 1,590,918.00

ures, it is easy to see that using p

b

ask

, the third model

finds more balanced solutions also in terms of occu-

pancy of the cabins.

Figure 7: Occupancy of cabins, using the second mathemat-

ical model and varying p

ask

.

Figure 8: Occupancy of cabins, using the third mathemati-

cal model and varying p

ask

.

4 CONCLUSIONS

In this work we presented three optimization mod-

els for the cabin allocation problem in the cruise in-

dustry. We assess the performance of the proposed

models by considering realistic data, derived from an

Italian cruise line (i.e., Costa Crociere). In the com-

putational experiments we investigate the impact of

different pricing schemes on the total revenues the

Modeling the Cabin Capacity Allocation Problem in the Cruise Industry: An Italian Case Study

239

company can achieve. Some extensions to our work

are possible. It could be interesting to develop so-

phisticated revenue management strategies to support

cruises business, by optimizing the cabins allocation

and boosting revenues growth. In particular, it could

be interesting to define policies with upgrading, that

allow to sell superior-type cabins to a lower price if

some booking requests for cabins of a certain lower

type cannot be accepted, because of the capacity con-

straints. In this case, the main decision is to accept the

risk of selling a superior cabin at lower price, given

that unknown but, probably, more profitable demand

will arrive in the future. The development of buy-

up policies represents another important topic for fu-

ture investigation. It is important to note that, the

implementation of revenue management policies re-

quires the efficient solution of the cabin capacity allo-

cation problem, studied in this paper. Thus it could be

also interesting to deeply investigate the mathematical

structure of the models proposed and to exploit the re-

lated features to improve the solution approaches.

ACKNOWLEDGEMENTS

The authors are grateful to Dr. Roberto Tenuta, for his

assistance in the experiments and to the three anony-

mous reviewers for their insightful suggestions and

careful reading of the manuscript.

REFERENCES

Ayvaz-Cavdaroglu, N., Gauri, D., and Webster, S. (2019).

Empirical evidence of revenue management in the

cruise line industry. Journal of Travel Research,

58(1):104120.

Biehn, N. (2006). A cruise ship is not a floating ho-

tel. Journal of Revenue and Pricing Management,

5(2):135142.

Cohen, M., Perakis, G., and Pindyck, R. (2015). A simple

rule for pricing with limited knowledge of deman. ,

MIT Sloan, Research Paper No. 5145-15.

Guerriero, F., Miglionico, G., and Olivito, F. (2014). Strate-

gic and operational decisions in restaurant revenue

management. European Journal of Operational Re-

search, 237:1119–1132.

Guerriero, F. and Olivito, F. (2014). Revenue models and

policies for the car rental industry. Journal of Mathe-

matical Modelling and Algorithms in Operations Re-

search, 13:247282.

Joshi, K. (2004). Modeling alternate strategies for airline

revenue management. Graduate theses and disserta-

tions, University of South Florida.

Klein, R., Koch, S., Steinhardt, C., and Strauss, A. (2020).

A review of revenue management: Recent generaliza-

tions and advances in industry applications. European

Journal of Operational Research, 284(2):397 – 412.

Ladany, S. and Arbel, A. (1992). Optimal cruise-liner pas-

senger cabin pricing policy. European Journal of Op-

erational Research, 55(2):136147.

Li, B. (2014). A cruise line dynamic overbooking model

with multiple cabin types from the view of real op-

tions. Cornell Hospitality Quarterly, 55(2):197209.

Li, Y., Miao, Q., and Wang, B. (2014). Modeling a cruise

line revenue management problem. Journal of Rev-

enue and Pricing Management, 13(3):247260.

Maddah, B., L., M.-H., El-Taha, M., and Rida, H. (2010).

Dynamic cruise ship revenue management. European

Journal of Operational Research, 207(1):445455.

Meissner, J. and Strauss, A. (2010). Railway revenue man-

agement: overview and models. Working paper (avail-

able at http://www.meiss.com), Lancaster University

Management School.

Oliveira, B., Carravilla, M., and Oliveira, J. (2017). Fleet

and revenue management in car rental companies: A

literature review and an integrated conceptual frame-

work. Omega, 71:11 – 26.

Saito, T., Takahashi, A., Koide, N., and bIchifuji, Y. (2019).

Application of online booking data to hotel revenue

management. International Journal of Information

Management, 46:37 – 53.

Sturm, D. and Fischer, K. (2019). A cabin capacity alloca-

tion model for revenue management in the cruise in-

dustry. Journal of Revenue and Pricing Management,

18:441450.

Sturm D., F. K. (2018). Cruise line revenue management:

Overview and research opportunities. In Fink A.,

Fgenschuh A., G. M., editor, Operations Research

Proceedings 2016. Operations Research Proceedings

(GOR (Gesellschaft fr Operations Research e.V.)),

pages 441–447. Springer, Cham.

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

240