Enabling Monetization of Depreciating Data on Blockchains

Christian Dahdah, Coline Van Leeuwen, Ziad Kheil, J

´

er

ˆ

ome Lacan

a

, Jonathan Detchart

b

and Thibault Gateau

c

Institut Sup

´

erieur de l’A

´

eronautique et de l’Espace (ISAE-SUPAERO), Universit

´

e de Toulouse, France

{al-cheikh-christian.el-dahdah, coline.van-leeuwen, ziad.kheil}@student.isae-supaero.fr,

Keywords:

Depreciative Data, Fair Exchange, Public Ledger, Ethereum, Solidity, Space Debris.

Abstract:

In this paper, we introduce a protocol to securely exchange data on chain while varying its price according

to their freshness, maturity and lifetime. The exchange protocol, implemented as a smart contract, is best

applied to crowdsourcing systems for fast depreciating digital goods, in which information is publicly shared

after a given delay. The smart contract acts as a trusted intermediary to make sure that the funds of a client

are delivered to the provider if and only if the data were really transferred. It also ensures that the data will be

freely shared on the blockchain when the data has sufficiently depreciated. We demonstrate our work with an

available prototype for specific space tracking data exchange.

4

1 INTRODUCTION

The interest of blockchains is demonstrated for many

contexts. Cryptocurrencies are indeed the main appli-

cations but the intrinsic properties of blockchains let

alone traceability, immutability and decentralization

open new opportunities in many contexts such as sup-

ply chains or marketplaces. Smart contracts, which

allow blockchains to perform transparent computa-

tions, led to the development of Distributed applica-

tions (Dapps) resulting in powerful services through

complementary onchain and offchain procedures.

Crowdsourcing is one of many domains that can

take great advantage of distributed ledgers. The un-

derlying principle is to allow users to share data with

others. Traditionally, crowdsourcing platforms are

managed in a centralized way, prompting several po-

tential concerns about security, trust and privacy. The

decentralized structure of blockchains allows to seam-

lessly handle such issues, therefore, they are natural

candidates to deploy crowdsourcing platforms (Ko-

gias et al., 2019; Ma et al., 2020).

Although each crowdsourcing system presents its

own specificities, their common issue is that the data

is often shared freely. However, this hinders commer-

cial entities to participate in aforesaid platforms. In

a

https://orcid.org/0000-0002-3121-4824

b

https://orcid.org/0000-0002-4237-5981

c

https://orcid.org/0000-0002-8719-5044

this paper, we propose an incentive mechanism allow-

ing users to sell digital goods on blockchain based

crowdsourcing systems, all the while respecting the

golden idea of sharing by publishing them for free af-

ter a given time.

The proposed mechanism relies on publishing en-

crypted data on the blockchain, and selling the de-

cryption key to clients interested by an immediate ac-

cess to the information.

But in order to stay in the spirit of crowdsourcing

data, the provider pledges to publicly release the de-

cryption key, free of charge, after sufficient time has

passed.

Thus the mechanism is best suited for data with

fast depreciation rates, with an interest to publish in-

formation publicly after a certain time in order to

build a reputation and establish trust. To illustrate

this, the protocol can be used to sell encrypted forex

trade signals to clients. When these signals decay the

key is publicly shared, and the information is avail-

able to everyone, and can be evaluated to establish

reputation thus attracting future audience. In our im-

plementation

1

we applied this to space debris posi-

tions which also lose precision over time. In this

particular case, Trusat (ConsenSys-Space, 2020), a

crowdsourcing project, aiming to store space debris

and satellite observations to promote space safety can

benefit from this Dapp.

1

https://github.com/ChristianDahdah/Monetization-of-

Depreciating-Data-Through-Smart-Contracts

500

Dahdah, C., Van Leeuwen, C., Kheil, Z., Lacan, J., Detchart, J. and Gateau, T.

Enabling Monetization of Depreciating Data on Blockchains.

DOI: 10.5220/0010252105000507

In Proceedings of the 7th International Conference on Information Systems Security and Privacy (ICISSP 2021), pages 500-507

ISBN: 978-989-758-491-6

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Note that, since we are dealing with depreciating

data, the price integrated in the contract is also subject

to decline. Unrushed clients can therefore wait until

the price suits their need. The protocol implemented

in a smart contract acts as a judge by solving poten-

tial disputes between sellers and buyers. The Claim-

and-refund procedures guarantee a private and fair ex-

change.

To this end, Section 2 presents our protocol en-

abling the monetization of depreciating data. Algo-

rithms for fair data exchange and for Dispute and

Refund are described. An implementation in an

Ethereum smart contract is described in Section 3.

One of the main objectives is the minimization of the

gas spent which could lead to significant contract fees.

This implementation is benchmarked in Section 4.

2 PROTOCOL DESCRIPTION

2.1 Protocol Overview

The global context of this paper is a crowdsourc-

ing system implemented over a blockchain where the

users share some data freely. Thanks to the trans-

parency provided by the blockchain, we assume that

the system implements a reputation mechanism al-

lowing to evaluate the behavior and the quality of the

data shared by users (Dennis and Owen, 2015).

The main contribution of this paper is a complete

protocol allowing the transfer of depreciating data to

different clients through a smart contract. In the case

of honest provider and clients, each client pays the

amount corresponding to the indicated price at the

time she acquired the data.

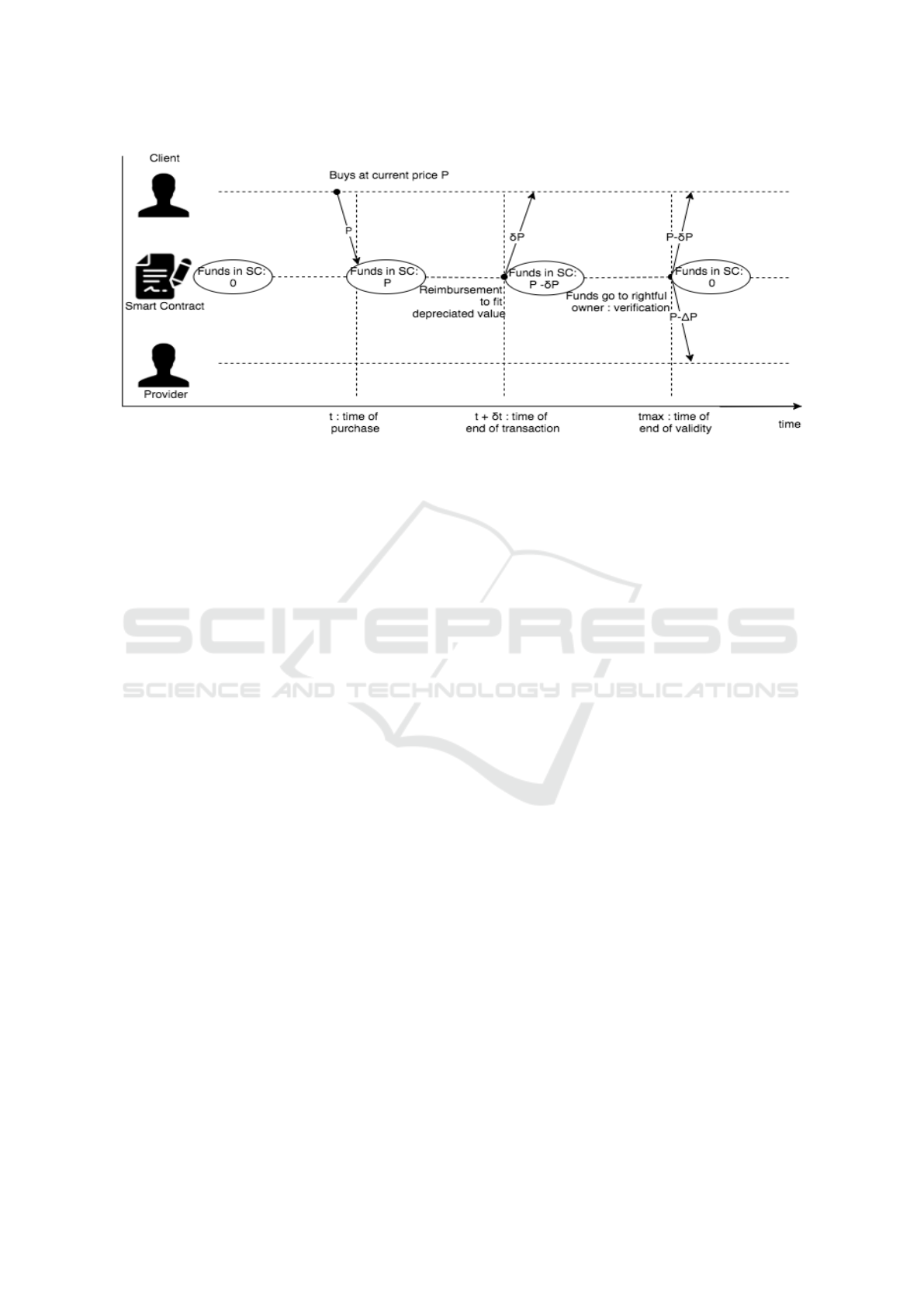

The global process is summarized in Fig. 1 and

detailed in the next paragraphs. Globally, when a

provider wants to share data, she first encrypts it and

stores it in the smart contract. The provider also an-

nounces the type of data, the price and the way it

depreciates in function of time. The Smart Contract

makes it mandatory to reveal the decryption key of

the data before a given deadline in order to allow the

provider to retrieve his earnings. This condition is es-

sential to be able to evaluate the correctness of the

provided key and the quality of the sold data.

If a client wants to access this data, she trans-

fers the funds corresponding to the current cost of the

data, and through the protocol, receives a decryption

key. During the procedure, the smart contract does

not learn the value of the key but is able to verify the

fairness of the exchange once the key is revealed.

Since this procedure requires several exchanges,

the contract takes into account any significant time

delay in transactions and reimburses clients to fit the

depreciated value of the data and not the current price

at the time of purchase.

After the revelation of the key by the provider,

a certain delay is given to the client to potentially

launch a dispute procedure in case of fraud. The Dapp

verifies the exchanges and can reimburse the client.

On the other hand, if no dispute was initiated,

the smart contract allows the provider to retrieve his

funds.

Note that our system does not verify the quality of

the transferred data or that the exchanged key allows

the decryption of the message but it can be extended

by a reputation system (such as the one developed in

the Trusat project). With this kind of system, it is not

in the best interest of the seller to sell wrong key or

data because of the potential reputation repercussions.

2.2 Security Model and Objectives

We consider that the blockchain functionalities

ensure user authentication and correct executions of

smart contracts. We also consider the following hy-

potheses on the cryptographic building blocks: [H1]

the hash function returns a perfectly random value

(random oracle model) and is collision-resistant;

[H2] the random generator is assumed to be perfect

and [H3] the pseudo-random generator function PRG

used to generate the stream added to the data is

unpredictable. The security objectives are:

Provider Fairness. An honest provider receives the

client’s funds corresponding to the date of purchase.

Client Fairness. An honest client receives the key

that will be publicly shared at the end of the process or

a part of the insurance funds provided by the provider

if the latter is not honest.

Note that the second objective does not protect

against a provider that shares a key different from the

one she used to encrypt the data. This case is managed

by a reputation system which will detect the fraud at

the end of the process and thus will degrade the rating

of the provider.

The potential attackers are [A1] the provider that

wants to get the client’s funds without revealing the

data, [A2] a client that wants the data without paying

the funds, [A3] a third party who observes the block-

chain and wants to recover data without paying.

2.3 Description

Suppose a provider P wants to sell some informa-

tion I deemed depreciative. Let |I | be the length of

Enabling Monetization of Depreciating Data on Blockchains

501

Figure 1: Protocol overview.

I . Transparency and reliability are required keystones

for such a transaction.

In view of such objectives, a protocol to safely ex-

change encrypted data and their keys, over a certain

validity period, is presented in Alg.1 and is detailed

in the next paragraphs. The management of the funds

during the process is illustrated in Fig. 2.

2.3.1 Store Encrypted Data on the Blockchain

To encrypt the data, P creates a random seed S and

generates K with |K | = |I |, in order to use stream

cipher encryption: I

0

= K ⊕ I . I

0

is then uploaded

to the contract. With this method, any user having

K is able to recover I from I

0

. To save on gas stor-

age cost, the provider can use any PRG to generate

K = PRG(S) and exchange S, since this does not fun-

damentally change the mechanism of exchange, the

following protocol is used to transfer S which gener-

ally has a length smaller that |K |.

To safely exchange information on the blockchain,

the Diffie-Hellman (DH) protocol is used with each

client, thus P generates public and private DH keys

(P

priv

,P

pub

).

P contacts the smart-contract to sell his product:

she chooses a certain initial price, a function ∆ detail-

ing the value decrease of his data, a duration of va-

lidity for his data, and the minimum quantity of data

she pledges to upload. Furthermore, P can deliber-

ately choose to offer a stake in Ether as an insurance

fund of his trustworthiness. These variables are stored

in the contract, meanwhile his DH keys are emitted

as events to cut on gas cost. The contract assigns an

identification Id to this offer.

2.3.2 Exchange Protocol

The steps of the decryption key exchange are the fol-

lowing:

1. At a given time t

i

0

, a client C

i

interested in buying

this depreciating data must generate (offchain) his

DH keys : (C

i

priv

,C

i

pub

), and send the funds C

i

f unds

in ether to the contract depending on the current

price ∆(t

i

0

) (computed from the initial price by the

price decrease function ∆). The funds sent are

blocked on the contract and can be withdrawn by

the client if step 4 is not accomplished. His public

key is emitted through a specific event.

2. With P

pub

and C

i

pub

, P and C

i

generate a shared

secret key K

i

3

of length |S |. Offchain P gener-

ates a random binary sequence K

i

2

of length |S|

then, through the contract, emits S ⊕ K

i

2

⊕ K

i

3

as

an event on the contract.

3. Then, C

i

computes the hash: h

i

= H(S ⊕ K

i

2

⊕

K

i

3

⊕ K

i

3

) = H(S ⊕ K

i

2

) and sends it to the con-

tract.

4. P can then check that C

i

has S ⊕ K

i

2

by verifying

that h

i

= H(S ⊕ K

i

2

). If it is wrong, P stops the

selling process. Else P sends K

i

2

to C

i

through the

contract , which stores the new current price value

∆(t

i

1

).

5. Finally C

i

now has K

i

2

and can compute S ,

then K and eventually I . Moreover, the smart-

contract computes and reimburses the price dif-

ference ∆(t

i

0

) − ∆(t

i

1

) between the initiation of the

exchange (step 1) and its end (step 4), to ensure C

i

has access to the data at the current depreciation

value.

These 5 steps lead to a client having access to the

encryption key S, meanwhile eavesdroppers can not

conclude anything. Note that another client also can-

not circumnavigate the logic behind this, by using the

same K

i

2

as the first client for example, because steps

2 to 5 need to be done independently for each client,

thus the provider generates a different key K

i

2

for each

client.

2.3.3 Finalization

If the provider does not reveal S, she will not be able

to withdraw his/her earnings and insurance funds, and

the clients will be refunded. If the provider does re-

veal the key, she must wait an additional time. During

this time window, any client can choose to set a dis-

pute (see next paragraph).

Finally after the fixed time window, the provider

can withdraw his remaining unclaimed funds and the

remaining funds from the insurance deposit. Note that

this operation can only be done once, and only after

the time window has passed. No client can set a dis-

pute after the provider withdraws his/her money.

ICISSP 2021 - 7th International Conference on Information Systems Security and Privacy

502

Figure 2: Funds transactions over contract validity.

2.3.4 Dispute and Refund

If client C

i

deems that the seed received does not cor-

respond to S publicly published by the provider, he

calls the contract to raise a dispute (see Alg. 2) by

simply specifying the Id bought. The contract checks

whether S was released by the provider or not. Then,

the contract must check if a full-on fraud has hap-

pened on S by checking if H(S ⊕K

i

2

) = h

i

. The funds

paid by the client, and the insurance deposited by the

provider (divided by the total number of clients), can

be retrieved by the party who is right.

2.4 Security Analysis

The analysis presented in this Section is a summary

of the main arguments demonstrating the security of

our proposal.

In attack [A1] (see Section 2.2), the funds are

transferred to the provider only if she wins the dis-

pute and refund procedure. This is equivalent to the

provider finding values of S , S

0

and K

0

i

2

such that

H(S

0

⊕K

i

2

) = h

i

= H(S ⊕ K

i

2

), which is implies find-

ing a collision in the hash function. This is not pos-

sible from hypothesis [H1]. For attack [A2] to occur,

the first possibility is that the client recovers directly

I by guessing S . However, this is impossible accord-

ing to hypotheses [H2] and [H3]. The second possi-

bility is to deduce H(S ) from H(S ⊕ K

i

2

) by guessing

K

i

2

, which is impossible considering hypothesis [H2].

There are no over possibilities to recover I without

paying the funds. Attack [A3] can succeed only if

the user guesses S which is impossible in view of hy-

potheses [H2] and [H3].

2.5 Related Work

Our work is connected to several existing projects

in the domains of security, cryptography and block-

chains. More specifically, it is related to some well-

known problems.

The first one is the time commitment (Boneh and

Naor, 2000): a user presents a commitment of a hid-

den data and promises to reveal it before a given

time. Solutions were already proposed on Bitcoin

(Andrychowicz et al., 2014) and Ethereum (Li and

Palanisamy, 2018). In our context, the encrypted data

is stored on the blockchain, and thus the smart con-

tract is able to check whether the seed is revealed and

whether this seed allows the data decryption. Note

that this justifies our choice to store data on-chain,

enabling the implementation of reputation systems

through data validation in a Dapp.

The second problem is the fair exchange of digi-

tal goods. A third party is mandatory (Pagnia and

G

¨

artner, 1999) and blockchains can assume this role

(Bentov and Kumaresan, 2014). An efficient solution,

called Zero Knowledge Contingent Payment protocol,

has been proposed (BitcoinWiki, 2016), but a prac-

tical and secure solution was not proposed for data

exchanges until 2017 (Campanelli et al., 2017). The

ingenuity of this solution lies in the fact that the seller

and the buyer make offchain exchanges using zero-

knowledge (ZK) proofs. One should notice that some

smart contracts avoid quite complex ZK computations

and are able to manage disputes (Dziembowski et al.,

2018). These proposals can not be used directly in

our context because we need to manage time related

aspects relative to the data depreciation (depreciation

function, time of interest of the client, time delay in

reception of the decryption key).

Enabling Monetization of Depreciating Data on Blockchains

503

Algorithm 1: Exchange protocol.

1 while CurrentTime < TimeLimit do

2 Do in parallel

3 Provider uploads data ;

4 end

5 Do in parallel

6 Clients buy data at the current price

∆(t

i

0

) ;

7 for i ← 1 to |Clients| do

8 DH exchange and computation of

the secret key K

i

3

;

9 Provider generates random key

K

i

2

offchain;

10 Provider emits S ⊕ K

i

2

⊕ K

i

3

through the contract;

11 Client i stores h

i

= H(S ⊕ K

i

2

) on

the contract;

12 if h

i

is validated by the provider

then

13 Provider stores K

i

2

on the

contract;

14 Smart Contract reimburses the

client by the price difference

(∆(t

i

0

) − ∆(t

i

1

)) to ensure the

data is bought at the current

depreciated rate ;

15 end

16 end

17 end

18 Wait;

19 if TimeLimit almost reached then

20 Provider reveals S ;

21 end

22 end

23 if CurrentTime > TimeLimit + DisputeTime

then

24 Provider withdraws the remaining funds

that hasn’t been claimed by clients ;

25 end

The last point considered in the design of our pro-

tocol is the (possible) depreciative value of some data.

Indeed, according to the type of data, their value can

decrease more or less quickly. If we follow the ex-

ample of Trusat data (ConsenSys-Space, 2020), the

computation of the localization of a space debris - po-

sition and speed vector at a given date - lose accuracy

over time, which may render old observations quickly

obsolete depending on usage (e.g. in collision avoid-

ance, accuracy is critical). This concept of perish-

able or depreciating data was recently studied in the

context of Internet of Things (Jiao et al., 2018) and in

Algorithm 2: Dispute and refund protocol.

1 if K

i

2

is not revealed then

2 Refund client with C

i

f unds

(= ∆(t

i

1

));

3 else if S is revealed then

4 if H(S ⊕ K

i

2

) 6= h

i

then

5 Refund client with C

i

f unds

+

InsuranceFunds/#O f Clients;

6 else if ProvidedData < MinData then

7 Refund client with C

i

f unds

+

InsuranceFunds/#O f Clients;

8 end

9 else if CurrentTime > TimeLimit and S is

not revealed then

10 Refund client with

C

i

f unds

+ InsuranceFunds/#O fClients ;

11 end

blockchain-based vehicular networks (Xi et al.,

2019), but these contexts focus mainly on the deter-

mination of the best price of the data. However, our

proposal is a contribution to integrate the depreciating

aspect of the data in the data exchange protocol.

3 SMART CONTRACT

IMPLEMENTATION

The Solidity code of our implementation can be found

on Github: https://github.com/ChristianDahdah/

Monetization-of-Depreciating-Data-Through-

Smart-Contracts

3.1 Gas Price and Gas Limit

One of the main limitations that greatly impact the

contract’s logic is the gas usage. The use of for-loops

with an unknown number of iterations or searching in

a table should be avoided in functions that do require

gas. Consequently, when a provider P sets the seed S ,

the hashes of S ⊕ K

i

2

(i : 1 → number of clients) are

not automatically compared with the ones provided

by each client to settle disputes.

Moreover, selling a product requires the initialisa-

tion and storage of a lot of variables: deploy time,

product end time, provider’s address, initial price,

depreciation type, insurance deposit, S, clients’ ad-

dresses and their respective K

2

, hashes and funds.

This sets a significant gas price to sell data which

needs to be updated often. For this matter it was best

seen to group a set of information into one reference,

all encrypted with the same S . This would be conve-

ICISSP 2021 - 7th International Conference on Information Systems Security and Privacy

504

nient for both the provider and the client since it im-

plies exchanging less keys and calling less functions.

3.2 Block Validation Time and

Transaction Delay

The process of creating a new reference of products,

exchanging keys and uploading data, can take several

minutes or even hours on Ethereum. Therefore the

contract cannot be functional for products that have a

really fast depreciation rate, unless the client buys (or

subscribes to) the reference beforehand and gets the

keys. Afterwards the provider progressively uploads

the data as soon as it is available. In this setting the

client will be able to access critical information in real

time without any delay. At the end of the offer time,

if the provider did not upload at least the minimum

number N of information agreed upon, the client can

raise a dispute and claim his funds.

Furthermore, getting the absolute time in a smart

contract depends on the block it was mined in. This

could raise security problems and multiple exploita-

tion opportunities. For example a malicious node

could mine a block and alter the time it was mined,

making a dispute in favor of a client instead of a

provider. Fortunately block timestamps cannot be

tempered a lot. A block with an abnormal timestamp

is rejected by the network (Goldberg, 2018). On the

long run the timestamp could be offset by a few min-

utes which could be acceptable.

3.3 Smart Contract Versatility and

Organisation

For clarity and ease of use, the protocol mechanism

was distributed over three solidity files:

• “Depreciation Contract.sol” contains mainly all

the needed variables for the protocol inside the

structure “DataReference”.

• “Client Depreciation Contract.sol” inherits from

the previous contract, and implements all the

functions needed for the client.

• “Provider Depreciation Contract.sol” inherits

from “Client Depreciation Contract.sol” (con-

sequently from “Depreciation Contract.sol”)

and implements all the functions related to

the provider, such as creating a new reference,

withdrawing funds, setting keys, and viewing the

clients’ addresses.

To make use of the protocol, it is sufficient to only

deploy the “Provider Depreciation Contract.sol”

once and define the contract’s interface and address

in a fourth contract that contains the data types for our

application. In our case we simulated an exchange of

space tracking data. The fourth contract “TLE.sol”

helps to store Two Line Elements data (TLEs)(Kelso,

2019) which is equivalent to a representation of a

space object’s location and velocity vector at a given

time. The satellite’s name (or line 0) is not encrypted

and the Two-Line Orbital Element Set Format (lines

1-2) are encrypted and stored in 49 bytes for minimal

gas usage. For developing and testing purposes,

“TLE.sol” inherits but does not implement the

interface of “Provider Depreciation Contract.sol”.

Nevertheless, defining the interface is straightforward

and will drastically cut gas usage for deployment

(refer to section 4). Hence it is possible to include

multiple structures and data types inside one refe-

rence. In our case this could be useful to share TLEs

along with telescope images using IPFS (Benet,

2014).

4 BENCHMARKS AND RESULTS

All possible scenarios proved to be correctly func-

tional and gas usage was recorded on Ethereum-

Client Besu. The initial deployment of the smart con-

tract costs 3 675 449 gas. Note that deployment oc-

curs only once, meaning one common contract can

handle selling all future products from any provider

for any future application.

The only functions a client needs are detailed in

Fig. 3 with their gas costs. Keep in mind that a client

only needs to call each function once. This brings the

client to a grand total of 181 600 gas (roughly 1.02

USD at the time of writing). But keep in mind that

most probably clients will not need to raise a dispute.

On the other hand the provider has to call some

functions several times (indicated in fig-4) depending

on what she intends to sell and to how many clients.

The general case is described in Fig. 4. Furthermore,

the gas usage for uploading data varies depending on

its length.

Ideally P can sell information in bulk to multi-

ple clients. All in all, an example of selling 10 TLEs

(∼ 96 bytes each) to 50 clients, would cost P roughly

6 300 000 gas (40.19 USD at the time of writing)

which averages out to 126 000 gas per client (0.8

USD at the time of writing). The results seem to com-

pare favorably to other solutions (Dziembowski et al.,

2018) which needs to deploy a new contract for each

pair provider/client.

Finally, keep in mind that these tests were done

for the TLE crowdsourcing usecase. Gas costs can be

greatly optimized, a simple idea would be to imple-

Enabling Monetization of Depreciating Data on Blockchains

505

ment DH on Elliptic Curves (ECDH) to shorten the

keys.

200000

150000

50000

100000

Gas

0

Buy

Send

Hash

Raise

Dispute

Subtotal

28000

27600

126000

181600

Figure 3: Client Gas Usage on benchmarks.

Sell

Offer

Send

Send

Decoder

Release

Key

Add Data

(TLE)

Gas

100000

200000

300000

400000

500000

204000

28400

(per Client)

72000

(per Client)

103000

(avg per TLE)

45600

Figure 4: Provider Gas Usage on benchmarks.

5 LIMITATIONS

This protocol is based on the veracity/value of the

traded information, in other words a non-honest

provider could sell worthless information, a fraud that

the smart-contract cannot detect. To counteract this

we elucidated the importance of an on-blockchain

reputation system.

We should also note that on a permissioned block-

chain, gas cost is less of an issue, storage and compu-

tation are therefore less restrictive. This can eliminate

the need of a PRG since the whole Key can be stored

for the exchange of heavy sized data. Moreover, a

reputation system is less necessary due to the fact that

the providers would be more known and the informa-

tion’s value more trustworthy.

On the other hand, exchanging on the mainnet

promotes the reach of a greater range of actors, audi-

ence, and information, which is necessary for crowd-

sourcing purposes. This requires the implementation

of the full protocol (i.e. usage of PRGs to cut gas

costs) along with a reputation based system to ensure

the safety of both parties.

A reputation system could take the form of an au-

tomatic (such as in Trusat (ConsenSys-Space, 2020)),

on-chain verification (if the nature of the information

empowers this such as comparing numbers from one

provider to another), or user ratings indicating the

honesty of a provider. The penultimate idea justi-

fies the necessity of Xor operations, since complex

encryption/decryption methods cannot be used in a

smart contract and the decryption must be computed

on-chain.

Finally, the whole paper targets volatile and de-

preciating information because it binds the provider

to publicly reveal the Key before a fixed time and thus

reveal the published information. Outside this scope,

the protocol can be burdensome, and it may be best to

use other on-chain exchange protocols.

6 CONCLUSION

This paper introduces a full solution to monetize de-

preciating data in blockchain-based crowdsourcing

systems. The system ensures a fair exchange of digi-

tal goods while ensuring that the data will be released

freely before a given time. The algorithm described,

has been implemented on an Ethereum smart contract,

and benchmarked. An example was applied to a space

tracking data system and is available on Github

1

.

In future work, we plan to extend the concepts and

algorithms introduced here, for example to manage

larger data files. The formalization of the algorithm

and of the security proof will further be developed in

future publications.

REFERENCES

Andrychowicz, M., Dziembowski, S., Malinowski, D., and

Mazurek, L. (2014). Secure multiparty computations

on bitcoin. In 2014 IEEE Symposium on Security and

Privacy, pages 443–458.

Benet, J. (2014). Ipfs-content addressed, versioned, p2p file

system. arXiv preprint arXiv:1407.3561.

Bentov, I. and Kumaresan, R. (2014). How to use bitcoin

to design fair protocols. In Garay, J. A. and Gennaro,

R., editors, Advances in Cryptology – CRYPTO 2014,

pages 421–439, Berlin, Heidelberg. Springer Berlin

Heidelberg.

BitcoinWiki (2016). Zero knowledge contingent pay-

ment. https://en.bitcoin.it/wiki/Zero Knowledge

Contingent Payment.

Boneh, D. and Naor, M. (2000). Timed commitments.

In Bellare, M., editor, Advances in Cryptology —

1

https://github.com/ChristianDahdah/Monetization-of-

Depreciating-Data-Through-Smart-Contracts

ICISSP 2021 - 7th International Conference on Information Systems Security and Privacy

506

CRYPTO 2000, pages 236–254. Springer Berlin Hei-

delberg.

Campanelli, M., Gennaro, R., Goldfeder, S., and Nizzardo,

L. (2017). Zero-knowledge contingent payments re-

visited: Attacks and payments for services. In Proc.

of the 2017 ACM SIGSAC Conference on Comp. and

Comm. Security, CCS ’17, page 229–243.

ConsenSys-Space (2020). Trusat white paper.

https://trusat-assets.s3.amazonaws.com/TruSat+

White+Paper v3.0.pdf.

Dennis, R. and Owen, G. (2015). Rep on the block: A next

generation reputation system based on the blockchain.

In 2015 10th International Conference for Internet

Technology and Secured Transactions (ICITST), pages

131–138.

Dziembowski, S., Eckey, L., and Faust, S. (2018). Fair-

swap: How to fairly exchange digital goods. In Pro-

ceedings of the 2018 ACM SIGSAC Conference on

Computer and Communications Security, CCS ’18,

page 967–984.

Goldberg, P. (2018). Smart contract best prac-

tices revisited: Block number vs. timestamp.

https://medium.com/@phillipgoldberg/smart-

contract-best-practices-revisited-block-number-

vs-timestamp-648905104323.

Jiao, Y., Wang, P., Feng, S., and Niyato, D. (2018). Profit

maximization mechanism and data management for

data analytics services. IEEE Internet of Things Jour-

nal, 5(3):2001–2014.

Kelso, T. (2019). Norad two-line element set format.

https://www.celestrak.com/NORAD/documentation/

tle-fmt.php.

Kogias, D. G., Leligou, H. C., Xevgenis, M., Polychronaki,

M., Katsadouros, E., Loukas, G., Heartfield, R., and

Patrikakis, C. Z. (2019). Toward a blockchain-enabled

crowdsourcing platform. IT Professional, 21(5):18–

25.

Li, C. and Palanisamy, B. (2018). Decentralized release

of self-emerging data using smart contracts. In 37th

IEEE Symposium on Reliable Distributed Systems,

SRDS 2018, Salvador, Brazil, October 2-5, 2018,

pages 213–220. IEEE Computer Society.

Ma, Y., Sun, Y., Lei, Y., Qin, N., and Lu, J. (2020). A

survey of blockchain technology on security, privacy,

and trust in crowdsourcing services. World Wide Web,

23:393–419.

Pagnia, H. and G

¨

artner, F. C. (1999). On the impossibility of

fair exchange without a trusted third party. Technical

report, Darmstadt University of Technology.

Xi, R., Liu, K., Liu, S., Chen, W., and Li, S. (2019). Perish-

able digital goods trading mechanism for blockchain-

based vehicular network. In 2019 IEEE Intl Conf

on Parallel Distributed Processing with Applications,

Big Data Cloud Computing, Sustainable Comput-

ing Communications, Social Computing Networking

(ISPA/BDCloud/SocialCom/SustainCom), pages 147–

154.

Enabling Monetization of Depreciating Data on Blockchains

507