Storage Fees in a Container Yard with Multiple Customer Types

Yahel Giat

a

Department of Industrial Engineering, Jerusalem College of Technology, HaVaad HaLeumi 21, Jerusalem, Israel

Keywords:

Container Yard, Marine Shipment, Pricing, Poisson Arrivals, TEU.

Abstract:

We consider a small container storage yard that is located in the outskirts of a marine shipping port. Customers

are classified according to the number of storage space they need. The yard has a limited number of storage

spots, and serves customers only if there is sufficient space to fulfill their needs. We define the yard’s state

space and derive its steady-state probability matrix for Markovian arrivals and service times. We consider the

profit function of two services that the yard offers its customers. In the first, storage fees are independent of

the storage duration and in the second they are proportional to it. We show when these pricing schemes are

equivalent and demonstrate numerically how profits depend on customer arrivals rates and yard size.

1 INTRODUCTION

In the shipping industry, container yards may have to

store containers for some time before they are trans-

ported to their next destination. We consider a small

container yard located near a marine port that pro-

vides two service schemes. In the first, the yard

owner manages the entire container-shipping process

and therefore the client is unmindful and not respon-

sible for the storage time in the yard, whereas in the

second scheme, it is the customer that orders the entry

and exit of the container from the yard. Accordingly,

in the first service scheme, customer fees are indepen-

dent of the storage duration (“one-time fee”). In con-

trast, under the second scheme, storage fees are pro-

portional to the storage duration (“proportional fee”).

Customers’ arrivals to the yard is assumed to fol-

low a Poisson process. In the simplest setting, each

customer requires storage for a single container, if

such is available. If there is no vacant spot then the

customer is rejected and receives service elsewhere

(i.e., no backlogging). The general setting extends to

multiple customer types. Here, the arrivals of type-k

customers follow a Poisson process with rate λ

k

and

they require k units of storage space for a time that is

exponentially distributed with mean µ

k

.

Since the two services are offered to customers,

the yard owner is interested to determine whether one

service is more profitable than the other. In other

words, given a proportional and one-time fees, which

a

https://orcid.org/0000-0001-7296-8852

service provides a greater profit to the owner? Alter-

natively, we wish to find whether it is possible to set

specific fees for each service such that their pricing

schemes are equivalent. Furthermore, when the yard

owner has the ability to change the yard’s size (for ex-

ample, through leasing to and from neighboring lots),

then the question rises what is the optimal lot size?

To address these questions we describe the state

space of the yard and the probability of the yard to be

in each state. We then show that if for each customer

type the proportional fee is set to be equal to the one-

time fee multiplied by the expected service time, then

the two pricing schemes are equivalent.

We use a numerical illustration to show proper-

ties of the profit function, in particular to demon-

strate optimal yard size and the effects of customer ar-

rivals rate on the profit function. While the motivation

of this paper are container yard operations, we note

that the model can be applied to many other settings.

For example, parking lots serve vehicles of varying

sizes (e.g., mini cars; passenger cars; vans; minibuses;

buses). Another notable example is the telecommu-

nication industry, when customers with larger band-

width demands require more servers than those with

smaller bandwidth needs (Moscholios et al., 2016).

Managers of such systems may benefit from applying

our model to their particular settings.

Giat, Y.

Storage Fees in a Container Yard with Multiple Customer Types.

DOI: 10.5220/0010239001770184

In Proceedings of the 10th International Conference on Operations Research and Enterprise Systems (ICORES 2021), pages 177-184

ISBN: 978-989-758-485-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

177

2 LITERATURE REVIEW

Queueing systems in which a customer may require

more than one server arise naturally in many cases.

The queueing system that is most related to our model

are the M/M/m queues. The notation M/M/m de-

scribes a queuing systems with Markovian arrival

times, Markovian service time with m servers. Green

(1980) and Green (1981) studies an M/M/m version

assuming that the servers assigned to the same cus-

tomer do not end service simultaneously, that is, these

servers become available independently. They derive

analytic expressions for the distribution of the wait-

ing time in the queue and the distribution of the num-

ber of busy servers. A similar model is developed

in Federgruen and Green (1984) assuming that each

server has a general service time distribution. They

use an approximation for the queue-length distribu-

tion. In contrast to these papers, in Fletcher et al.

(1986) the servers become available simultaneously.

Hassin et al. (2015) consider an M/M/K/K system

with a fixed budget for servers. The system owner’s

problem is choosing the price, and selecting the num-

ber and quality of the servers, in order to maximize

profits, subject to a budget constraint. In their model,

however, there is only one customer type. In contrast,

our model is similar to Kaufman (1981) and allows

for multiple customer types where each type differs

in the number of servers that it requires.

In 1968, the International Organization for Stan-

dardization (ISO) introduced the ISO 668 standard,

detailing classification, dimensions and ratings for

freight containers (ISO, 2020). While standard ISO

shipping containers have an assortment of size the

vast majority come in one of two lengths twenty feet

(6.06m) and forty feet (12.2m). For example, as of

2012, 84 percent of the global feet containers were

either twenty or forty feel long (Notteboom et al.,

2020). The twenty foot container is typically used

as the unit measure, also called Twenty Equivalent

Unit Container (TEU). Accordingly, the forty feet

container is sometimes called a two TEU container or

a Forty Equivalent Unit Container (FEU). The TEU

measure is used mainly in the marine shipping indus-

try, with ship sizes measured according to their TEU

capacity.

Pricing schemes for container storage service has

been explored in various settings. Yu et al. (2011)

focuses on the pricing of incoming containers. Our

model is more related to Woo et al. (2016) who an-

alyzes pricing storage of outgoing containers. Their

pricing structure is nonlinear where there is a limited

free storage time that is followed by a per day stor-

age fee. Our study emphasizes a single aspect of the

container freight shipping cycle, whereas other stud-

ies focus on other steps in the process. For exam-

ple, Zhang et al. (2014) optimize the repositioning of

empty containers, Chan et al. (2019) attempt to fore-

cast ports’ container throughput, and Dong and Song

(2012) consider the optimal leasing of the containers

themselves.

Container storage is similar to autonomous vehi-

cle storage and retrieval systems. These systems share

two critical features with the container storage prob-

lem. First, they park vehicles with varying sizes and

therefore may demand a different number of storage

units. Second, vehicles can be easily moved around

so that vacant storage units can be located adjacently

to accommodate large vehicles that require multiple

units. See Marchet et al. (2012) for an analysis of

such a system. Similarly, our model can be applied

to the management of recharging docks in electric ve-

hicle charging stations (Dreyfuss and Giat, 2017). In

this setting recharging docks are the system’s servers

and vehicles with larger batteries may require more

recharging docks than smaller batteries.

3 A CONTAINER YARD

We begin with description of a simple yard model in

which there are only two types of customers. In Sec-

tion 3.2 we show that these results can be extended to

any number of customer types.

3.1 Two Customer Types

A yard owner provides short-term container storage.

The yard has S storage spots and customers arrive

with a single container that is either a TEU or FEU.

TEU’s require a single storage spot and FEU’s re-

quire two spots. It is relatively easy to move con-

tainers around (“remarshalling”), and therefore any

two available spots can be made to store an FEU. We

assume no backlogging and therefore if there is no

room to store a container, then the customer stores

their container elsewhere.

Customers’ arrivals and storage times are indepen-

dent of each other. We assume that the arrivals of the

FEU’s and TEU’s follow a Poisson process with rates

λ

F

and λ

T

, respectively. Storage times of containers

in the yard are exponential with means µ

F

and µ

T

for

the FEU’s and the TEU’s, respectively.

The yard’s current state is the number of FEU’s

and TEU’s that are currently stored in it. Let (i, j) de-

note the state in which there are i FEU’s and j TEU’s

stored in the yard and let K denote the state space of

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

178

6

-

0

1

2

S−1

2

S−3

2

S−5

2

0 1 3 S−4 S−2 S

q

q

Number of FEU’s

Number of TEU’s

(a) S is an odd number.

6

-

0

1

2

S

2

S

2

−1

S

2

−2

0 2 4 S −4 S−2 S

q

q

Number of FEU’s

Number of TEU’s

(b) S is an even number.

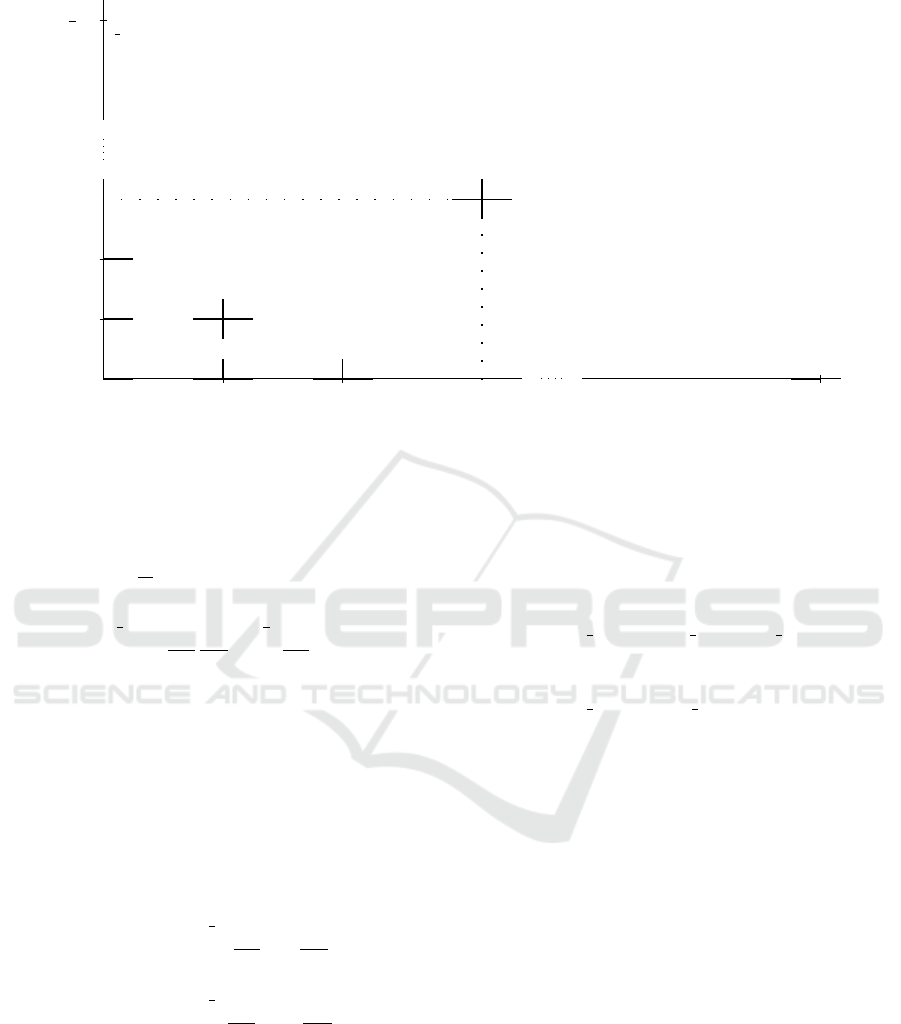

Figure 1: State space of the yard.

the yard. Since there are S storage spots,

K = {(i, j)|0 ≤ i ≤ b

S

2

c,0 ≤ j ≤ S − 2i},

where bxc represents the floor function.

In Figure 1b we depict the state space when S is

odd and in Figure 1a when S is even. When S is even

the number of states in the yard is (

S+2

2

)

2

, whereas if

S is odd then the number states is

S+1

2

·

S+3

2

.

The transition rates between states depend on the

number of FEU’s and TEU’s in the system. Consider

the state (i, j). If i < bS/2c then the transition rate to

state (i + 1, j) is the arrivals rate of FEU’s, λ

F

and if

j < S the transition rate to state (i, j+1) is the arrivals

rate of TEU’s λ

T

. If i > 0 then the transition rate to

state (i − 1, j) is iµ

F

and if j > 0 then the transition

rate to state (i, j − 1) is jµ

T

. The system’s transition

rates diagram is depicted in Figure 2.

Let

I

(i, j)

=

1 if {(i, j) ∈ K }

0 otherwise

.

For each state (i, j) ∈ K , using the transition rates de-

scribed above, the state’s balance equation is given by

π

i, j

λ

F

I

{(i+1, j)∈K }

+ λ

T

I

{(i, j+1)∈K }

+ iµ

F

I

{(i−1, j)∈K }

+ jµ

T

I

{(i, j−1)∈K }

= π

i+1, j

(i + 1)µ

F

I

{(i+1, j)∈K }

+ π

i, j+1

( j + 1)µ

T

I

{(i, j+1)∈K }

+ π

i−1, j

λ

F

I

{(i−1, j)∈K }

+ π

i, j−1

λ

T

I

{(i, j−1)∈K }

, (1)

and the normalizing condition is

∑

(i, j)∈K

π

i, j

= 1. (2)

To compute statistical properties of the system (e.g.,

probability for rejection, expected number of FEU’s

and TEU’s) we must first compute the system’s steady

state probabilities. These are given in the following

proposition.

Proposition 1. Let a

F

:=

λ

F

µ

F

and let a

T

:=

λ

T

µ

T

. Let

~

π denote the system’s steady state probability matrix

such that π

i, j

is the probability for the system to be in

state (i, j) ∈ K in steady state. Then

π

0,0

=

S

2

∑

i=0

S−2i

∑

j=0

a

F

i

i!

a

T

j

j!

−1

π

i, j

=

a

F

i

i!

a

T

j

j!

π

0,0

(3)

Proof: We need to show that

~

π is the unique solution

to the system (1 - 2). Consider the following system

of equations:

iµ

F

π

i, j

= λ

F

π

i−1, j

(i, j),(i − 1, j) ∈ K

jµ

T

π

i, j

= λ

T

π

i, j−1

(i, j),(i, j − 1) ∈ K

(i + 1)µ

F

π

i+1, j

= λ

F

π

i, j

(i + 1, j),(i, j) ∈ K

( j + 1)µ

T

π

i, j+1

= λ

T

π

i, j

(i, j + 1),(i, j) ∈ K

∑

(i, j)∈K

π

i, j

= 1. (4)

It can be easily verified that

~

π is a solution to the sys-

tem (4). Summing the first four equations in (4) gives

(1) and therefore

~

π satisfies (1 - 2). Uniqueness fol-

lows from the fact that (1 - 2) is an ergodic Markov

chain and therefore has a unique steady state proba-

bility.

Many mathematical softwares compute the Pois-

son distribution (Poisson(λ, k))very efficiently and

therefore for computational purposes, it may be con-

venient to use the following relationship:

(λ)

k

k!

=

Poisson(λ,k)e

λ

in (12). When computational consid-

erations are critical and only lowerbound probabilities

are needed then the following lemma may be useful.

Storage Fees in a Container Yard with Multiple Customer Types

179

6

-

0 1 2 j S

0

1

2

i

b

S

2

c

Number of FEU’s

Number of TEU’s

r -

λ

T

6

λ

F

r -

λ

T

6

λ

F

µ

T

r -

λ

T

6

λ

F

2µ

T

r

Sµ

T

r

?

b

S

2

cµ

T

r

-

λ

T

6

λ

F

?

µ

F

r -

λ

T

6

λ

F

?

2µ

F

r -

λ

T

6

λ

F

?

µ

F

µ

T

r -

λ

T

6

λ

F

?

iµ

F

jµ

T

Figure 2: The yard’s states’ transition rates.

Lemma 1. e

−(a

T

+a

F

)

is a lower bound of π

0,0

.

Proof: Since

N

∑

i=0

λ

k

k!

< e

λ

for any finite N, we have that

π

0,0

−1

=

S

2

∑

i=0

S−2i

∑

j=0

a

F

i

i!

a

T

j

j!

<

S

2

∑

i=0

a

F

i

i!

e

a

T

< e

a

F

e

a

T

. Thus, π

0,0

> e

−(a

T

+a

F

)

.

The accuracy of the lower bound in Lemma 1

increases with S whereas the computational time to

compute π

(0,0)

is O(S

2

). Thus, when S is very large,

it is convenient to use the lower bound in lieu of the

direct formula without any appreciable loss of accu-

racy.

Let L

F

and L

T

denote the average number of

FEU’s and TEU’s in the yard, respectively.

L

F

= π

0,0

S

2

∑

i=0

i

a

F

i

i!

S−2i

∑

j=0

a

T

j

j!

,

L

T

= π

0,0

S

2

∑

i=0

a

F

i

i!

S−2i

∑

j=0

j

a

T

j

j!

. (5)

Let r

F

and r

T

denote the probability of an FEU and a

TEU to be rejected, respectively. For the TEU’s this

happens when there is not a single empty slot and is

the sum of the probabilities of the states (0,S),(1,S −

2),...,(S/2 − 1,2),(S/2,0). Thus, r

T

=

S/2

∑

i=0

π

i,S−2i

.

For the FEU’s, r

F

equals r

T

plus the probabilities of

the states (0,S − 1),(1,S − 3), ..., (S/2 − 2, 3), (S/2 −

1,1). Thus, r

F

= r

T

+

S/2−1

∑

i=0

π

i,S−2i−1

. Therefore, the

probabilities for the FEU’s and TEU’s to be accepted

are:

1−r

F

=

S

2

∑

i=0

S−2i

∑

j=0

π

i, j

−

S

2

∑

i=0

π

i,S−2i

−

S

2

−1

∑

i=0

π

i,S−2i−1

,

1−r

T

=

S

2

∑

i=0

S−2i

∑

j=0

π

i, j

−

S

2

∑

i=0

π

i,S−2i

. (6)

The following relationship between occupancy and

rejection holds for both container types:

L

T

= a

T

(1 − r

T

)

L

F

= a

F

(1 − r

F

). (7)

3.2 The General Model

In many (if not most) situations customers arrive with

more than just one container. Therefore, we extend

the model to a yard that accepts multiple customer

types. We let K denote the number of customer types

where customer-type k,k = 1, ..., K requires k storage

units. The customer’s use of the k slots is simultane-

ous, i.e., starts and ends at the same time. Let λ

k

de-

note the arrival rate of customer-type k and let µ

k

de-

note the expected storage time required by customer-

type k. Similarly to the two customer types model,

we assume that arrivals follow a Poisson process, and

that storage times are exponentially distributed and

that these times are independent.

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

180

A yard’s state is denoted by the vector

(i

1

,...,i

k

,...,i

K

) where i

k

denotes the number of

customers with demand for k storage units that

are currently in the system. Here, too, we use

K to denote the state space of the yard. A state

(i

1

,...,i

K

) ∈ K if and only if i

k

≥ 0 for all k and

0 ≤

∑

K

k=1

k · i

k

≤ S. Therefore, it is convenient to

define the state space, K , can be defined iteratively

as follows: (i

1

,...,i

k

,...,i

K

) ∈ K if and only if

0 ≤ i

K

≤ N

k

(S) ≡

S

K

0 ≤ i

K−1

≤ N

K−1

(S) ≡

S − Ki

K

K − 1

.

.

.

≤ i

k

≤ N

k

(S) ≡

S −

K

∑

j=k+1

j · i

j

k

(8)

.

.

.

0 ≤ i

1

≤ N

1

(S) ≡ S−Ki

K

−(K−1)i

K−1

−···−2i

2

In the above, N

k

(S) is the maximal number of cus-

tomers of type k that the yard can accommodate given

that the yard is serving i

1

,...i

k−1

customers of types

1,...,k − 1, respectively.

Let π

i

1

,...,i

K

denote the steady state probability of

state (i

1

,...,i

K

) ∈ K . For each state (i

1

,...,i

k

) ∈ K ,

the state’s balance equation is given by

π

i

1

,...,i

K

K

∑

k=1

λ

l

I

(i

1

,...,i

k

+1,...,i

K

)

+

K

∑

k=1

i

l

µ

l

I

(i

1

,...,i

k

−1,...,i

K

))

=

K

∑

k=1

(i

k

+ 1)µ

i

k

+1

π

i

1

,...,i

k

+1,...,i

K

I

(i

1

,...,i

k

+1,...,i

K

)

+

K

∑

k=1

λ

k

π

i

1

,...,i

k

−1,...,i

K

I

(i

1

,...,i

k

−1,...,i

K

)

, (9)

and the normalizing condition is

∑

(i

1

,...,i

K

)∈K

π

i

1

,...,i

K

= 1. (10)

In (9), I

(i

1

,...,i

k

)

is one if (i

1

,...,i

k

) ∈ K and zero oth-

erwise.

We show that the results of Section 3.1 extend to

any number of customer types.

Proposition 2. Let a

k

:=

λ

k

µ

k

. The unique solution to

(9-10) is

π

i

1

,...,i

k

=

K

∏

k=1

a

i

k

k

i

k

!

π

0,...,0

(i

1

,...,i

k

),∈ K (11)

π

0,...,0

=

∑

(i

1

,...,i

k

),∈K

K

∏

k=1

a

i

k

k

i

k

!

!

−1

Proof: The proof is similar to the proof of Proposition

1 and is described here briefly. Consider the following

system of equations:

∀(i

1

,...,i

K

) ∈ K

π

i

1

,...,i

k

−1,...,i

K

λ

k

I

i

1

,...,i

k

−1,...,i

K

= i

k

µ

k

π

i

1

,...,i

k

,...,i

K

I

i

1

,...,i

k

−1,...,i

K

k = 1,...,K. (12)

~

π is a solution to this system and therefore solve (9),

too.

Next, we need to show that the relationship (7)

holds here, too. Let r

k

is the probability that a type-k

customer is rejected and L

k

is the expected number of

type-k customers in the yard.

Proposition 3. a

k

(1 − r

k

) = L

k

for each k = 1,...,K.

Proof: By definition,

L

k

=

N

K

(S)

∑

i

K

=0

···

N

k

(S)

∑

i

k

=0

···

N

1

(S)

∑

i

1

=0

i

k

· π

i

1

,...,i

K

= π

0,...,0

N

K

(S)

∑

i

K

=0

···

N

k

(S)

∑

i

k

=0

···

N

1

(S)

∑

i

1

=0

i

k

K

∏

j=1

a

i

j

j

i

j

!

(13)

where, recall, N

k

(S) is a shorthand notation for:

N

k

(S) ≡

S −

K

∑

j=k+1

j · i

j

k

,

and, in particular,

N

1

(S) ≡ S − Ki

K

− (K − 1)i

K−1

··· − 2i

2

. (14)

The expression 1 − r

k

denotes the probability that a

customer type k is accepted to the yard and is the sum

of the probabilities of all the states with up to and in-

cluding S − k spots in use. Thus, 1 − r

k

is given by

N

K

(S−k)

∑

i

K

=0

···

N

k

(S−k)

∑

i

k

=0

···

N

1

(S−k)

∑

i

1

=0

π

0,...,0

K

∏

j=1

a

i

j

j

i

j

!

. (15)

In the above, we can rewrite the upper limit of the

variables i

x

, x > k as N

x

(S) instead of N

x

(S − k) since

it does not add any more probabilities to the summa-

tion. Thus,

Storage Fees in a Container Yard with Multiple Customer Types

181

a

k

(1 − r

k

) = π

0,...,0

a

k

N

K

(S)

∑

i

K

=0

···

N

k+1

(S)

∑

i

k+1

=0

N

k

(S−k)

∑

i

k

=0

N

k−1

(S−k)

∑

i

k−1

=0

···

N

1

(S−k)

∑

i

1

=0

K

∏

j=1

a

i

j

j

i

j

!

= π

0,...,0

N

K

(S)

∑

i

K

=0

a

i

K

K

i

K

!

···

N

k+1

(S)

∑

i

k

=0

a

i

k+1

k+1

i

k+1

!

N

k

(S−k)

∑

i

k

=0

a

i

k

+1

k

i

k

!

N

k−1

(S−k)

∑

i

k−1

=0

a

i

k+1

k+1

i

k+1

!

N

k−1

(S−k)

∑

i

k−1

=0

···

N

1

(S−k)

∑

i

1

=0

a

i

1

1

i

1

!

By definition, N

k

(S − k) = N

k

(S) − 1 and therefore

a

k

(1 − r

k

) = π

0,...,0

N

K

(S)

∑

i

K

=0

a

i

K

K

i

K

!

···

N

k+1

(S)

∑

i

k

=0

a

i

k+1

k+1

i

k+1

!

N

k

(S)−1

∑

i

k

=0

a

i

k

+1

k

(i

k

+ 1)!

(i

k

+ 1)

ˆ

N

k−1

(S)

∑

i

1

=0

a

i

k−1

k−1

i

k−1

!

···

ˆ

N

1

(S)

∑

i

1

=0

a

i

1

1

i

1

!

where for x < k

ˆ

N

x

(S) ≡

S − k(i

k

+ 1) −

K

∑

j=x+1, j6=k

j · i

j

x

,

Shifting the i

k

variable by one we obtain

a

k

(1 − r

k

) = π

0,...,0

N

K

(S)

∑

i

K

=0

a

i

K

K

i

K

!

···

N

k+1

(S)

∑

i

k

=0

a

i

k+1

k+1

i

k+1

!

N

k

(S)

∑

i

k

=1

a

i

k

k

(i

k

)!

i

k

N

k−1

(S)

∑

i

1

=0

a

i

k−1

k−1

i

k−1

!

···

N

1

(S)

∑

i

1

=0

a

i

1

1

i

1

!

(16)

Changing the bottom limit of the variable i

k

variable

to zero does not change the value of (16). Thus,

a

k

(1−r

k

) = L

k

given in (13), which establishes the re-

lationship between the proportional and the one-time

pricing schemes.

3.3 Pricing Schemes

The yard provides two different service schemes, each

with it own pricing fee.

• One-time fee: The yard owners are functioning as

shipping brokers and use the yard for temporary

storage of their customers’ containers. In this case

the customers are charged a one-time storage fee,

since the customer has no control on how long the

container happens to be stored in the yard. There-

fore, the revenue to the yard from handling a con-

tainer is independent of the actual storage time.

We let p

O

F

and p

O

T

denote the storage fee per FEU

and TEU, respectively.

• Proportional fee: The yard owners provide stor-

age services to their customers who decide when

to bring it in and when to take it out. Now, it is

more reasonable to charge storage costs that are

proportional to the storage duration. For this rev-

enue scheme p

P

F

and p

P

T

denote the storage fee per

time unit per FEU and TEU, respectively.

As for the yard’s costs, these comprise two compo-

nents. The first is the cost of holding S storage sites.

We assume a per unit cost c

s

. The second cost arises

when the yard if forced to reject containers due to

lack of available storage. In this case, they incur a

reputation cost s

F

and s

T

for each rejected FEU and

TEU, respectively. Accordingly, depending on rev-

enue scheme, the yard’s expected profit as a function

of the number of slots it leases, F(S), is given by

• One-time fee: F

O

(S) = (1 − r

F

)p

O

F

λ

F

+ (1 −

r

T

)p

O

T

λ

T

− r

F

s

F

λ

F

− r

T

s

T

λ

T

− c

s

S if S > 0 and

zero, otherwise.

• Proportional fee: F

P

(S) = L

F

p

O

F

+ L

T

p

O

T

−

r

F

s

F

λ

F

− r

T

s

T

λ

T

− c

s

S if S > 0 and zero, other-

wise.

While the two revenue schemes seem to be inherently

different, in reality they behave in a similar manner.

To obtain the one-time fee profit function from the

proportional fee profit function one needs to scale the

storage fees (p

F

, p

T

) by the departure rates (µ

F

,µ

T

)

as described in the following proposition.

Proposition 4. If p

O

F

=

p

P

F

µ

F

and p

O

T

=

p

P

T

µ

T

then the two

pricing schemes are equivalent.

Proof: Substituting p

O

F

and p

O

T

with

p

P

F

µ

F

and

p

P

T

µ

T

, re-

spectively, into the definition of F

O

(S) results in

F

O

(S) = a

F

(1 − r

F

)p

P

F

+ a

F

(1 − r

T

)p

P

T

λ

T

− r

F

s

F

λ

F

− r

T

s

T

λ

T

− c

s

S.

By Proposition 3, a

k

(1 − r

k

) = L

k

for each k resulting

in F

O

(S) = F

P

(S).

The importance of Proposition 4 is in that it im-

plies a very simple relationship between the two pric-

ing schemes. Consider a yard operator that charges a

proportional fee of p

F

and p

T

for FEU’s and TEU’s,

respectively. If the operator wants to expand services

to storage according to a one-time fee, the compara-

ble one-time storage charge should be set to p

F

/µ and

p

T

/µ for FEU’s and TEU’s, respectively.

4 NUMERICAL EXAMPLE AND

DISCUSSION

In this numerical example we illustrate the effect of

yard size and container arrival on the profits of a

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

182

small container yard. This follows the author’s ex-

perience with a small privately-owned container yard

outside a shipping port in Israel. We assume that

FEU-related prices are double the TEU-related prices

and set p

F

= 50, p

T

= 25,s

F

= 10,s

T

= 5 and set the

cost of each storage location to be c

S

= 20. We nor-

malize the departure rates µ

F

= µ

T

= 1 to make the

pricing schemes equivalent. Let λ := λ

T

+ 2λ

F

. We

will use λ to measure the total demand for storage

spots.

6

-

200

400

600

800

60 120 180 2402

λ

Total arrival

Profit

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

S = 50

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

S = 100

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

S = 150

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

S = 200

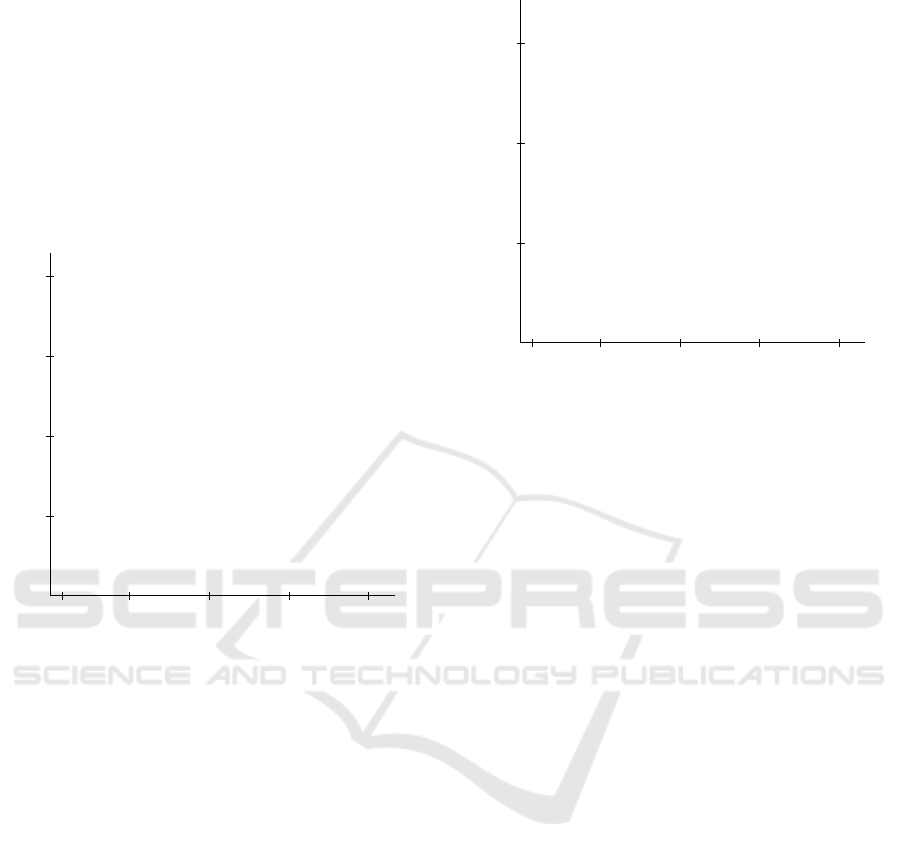

Figure 3: The profit as a function of the total arrival for

different yard sizes.

We first demonstrate how the profit function changes

with the total arrival λ where λ

T

= λ

F

(and there-

fore λ

T

= 1/3λ and λ

F

= 2/3λ). In Figure 3 we plot

the profit function for different yard sizes. The price

function is the fixed cost of the lease (c

s

S) plus an in-

come that is increasing and concave with the arrival

rate. Therefore, while bigger yards provide consider-

ably higher profits when the arrival rate is sufficiently

large, they require a higher threshold arrival rate to

provide be profitable in the first place.

In many cases the yard owner can expand or con-

tract the yard size by leasing space from or to neigh-

boring yards. In Figure 4 we plot the profit as a func-

tion of the yard size for different levels of arrival rates.

The profit function is a sum of an increasing concave

net income and a lease cost that is decreasing linearly

with the lot size. Therefore, for a fixed arrival rate

level, if the yard is very small then (assuming that

the storage price is greater than the unit lease cost)

increasing the lot size is profitable. However, for a

sufficiently large lot, the rejection rate is sufficiently

low that the decrease in container rejection due to an

6

-

200

400

600

50 100 150 2002

S

Yard size

Profit

..........

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

λ = 45

..........

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

λ = 90

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

λ = 135

..........

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

λ = 180

Figure 4: The profit as a function of the yard size for differ-

ent total arrival levels.

additional spot does not offset its lease cost and there-

fore profits will decrease if the yard size is increased.

In our example, when λ = 45 then the optimal lot size

is very small, S

∗

= 35, whereas in a lot with λ = 180

then the optimal size is S

∗

= 161. In this analysis of

the optimal yard size we do not take into account pos-

sible future growth in the customers’ arrivals rate. See

Giat (2018) for an analysis of such a situation.

5 CONCLUSION

This paper was motivated by a small storage yard

that temporarily stores containers for a short period

of time before they are transported to a neighboring

marine port. The vast majority of containers that are

stored in the yard are either the 20 feet TEU or its ex-

actly double counterpart, the forty feet TEU. We de-

scribe the two storage services that the yard provides

and show that if the proportional fee is equal to the

one-time fee multiplied by the expected duration then

the two schemes provide the same profits.

The numerical illustration shows the profit func-

tion’s properties. When viewed as function of the yard

size, it is a sum of a linearly increasing cost and an

increasing concave revenue and therefore there is an

optimal yard size. For the yard to be profitable, there

is a minimal necessary arrival rate. This threshold is

increasing with the yard size and therefore large yards

are initially at a disadvantage. However, if yard own-

ers are confident that there will be sufficiently many

customers, then they the larger yards will secure them

greater profits.

Storage Fees in a Container Yard with Multiple Customer Types

183

While the numerical analysis in this paper is lim-

ited to a two-type customer model, this paper also lays

the foundation to analyzing more complex settings

with multiple client types. Such an analysis can focus

on questions about whether it is beneficial to preemp-

tively reject smaller clients in order to secure space

for larger (and perhaps more profitable) customers.

REFERENCES

Chan, H., Xu, S., and Qi, X. (2019). A comparison of time

series methods for forecasting container throughput.

International Journal of Logistics Research and Ap-

plications, 22(3):294–303.

Dong, J. and Song, D. (2012). Lease term optimisation in

container shipping systems. International Journal of

Logistics Research and Applications, 15(2):87–107.

Dreyfuss, M. and Giat, Y. (2017). Optimizing spare battery

allocation in an electric vehicle battery swapping sys-

tem. In Proceedings of the 6th International Confer-

ence on Operations Research and Enterprise Systems,

pages 38–46. SCITEPRESS.

Federgruen, A. and Green, L. (1984). An m/g/c queue in

which the number of servers required is random. Jour-

nal of Applied Probability, 21(3):583–601.