Pricing Competition in a Duopoly with Self-adapting Strategies

Youri Kaminsky, Tobias Maltenberger, Mats P

¨

orschke, Jan Westphal and Rainer Schlosser

Hasso Plattner Institute, University of Potsdam, Potsdam, Germany

Keywords:

Dynamic Pricing, Duopoly Competition, Price Anticipation, Self-adaptive Strategies, Cartel Formation.

Abstract:

Online markets are characterized by highly dynamic price adjustments and steady competition. Many mar-

ket participants adjust their prices in real-time to changing market situations caused by competitors’ pricing

strategies. In this paper, we examine price optimization within a duopoly under an infinite time horizon with

mutually unknown strategies. The challenge is to derive knowledge about the opponent’s pricing strategy au-

tomatically and to respond effectively. Strategy exploration procedures used to build a data foundation on a

competitor’s strategy are crucial in unknown environments and therefore need to be selected and configured

with caution. We show how our models explore and exploit a competitor’s price reaction probabilities. More-

over, we verify the quality of our learning approach against optimal strategies exploiting full information. In

addition to that, we analyze the mutual interplay of two self-learning strategies. We observe a clear winning

party over time as well as that they can also form a cartel when motivated accordingly.

1 INTRODUCTION

Online markets are becoming increasingly dynamic

and competitive. Market participants can observe

their competitors’ prices and adjust their prices with

high frequencies. Hence, to maximize their profits,

merchants need to automatically adjust prices to re-

spond to steadily changing market situations.

Given that online markets allow market partici-

pants to observe their competitors’ prices in real-time,

dynamic pricing strategies, which take into account

the competitors’ strategies by learning historical price

reactions and gradually adjusting the own strategy ac-

cordingly, are getting implemented more frequently.

However, efficiently determining optimal price re-

actions to maximize long-term profits in competitive

markets is anything but trivial, especially for wide

price ranges and large numbers of goods. In on-

line markets, both perishable goods (e.g., food prod-

ucts (Tong et al., 2020), event tickets (Sweeting,

2012), and seasonal pieces of clothing (Huang et al.,

2014)) and durable goods (e.g., electronic devices

(He and Chen, 2018) and licenses for software (Ha-

jji et al., 2012)) are subject to automated price adjust-

ment strategies. Oftentimes, these strategies follow a

periodically recurring pattern over time (e.g., Edge-

worth cycles) (Noel, 2007) (Noel, 2012). In the case

of a duopoly, where two market participants are com-

peting against each other, Edgeworth cycles entail that

both market participants undercut each other until one

market participant’s lower bound is reached (e.g., the

profit yields zero), and the market participant raises

the price to secure future profits.

In this paper, we present a model for optimizing

pricing strategies under duopoly competition in which

sales probabilities are allowed to be an arbitrary func-

tion of competitor prices. We consider durable goods

under an infinite time horizon. Our goal is to derive

price response strategies that optimize the expected

long-term future profits under uncertain environments

by learning from the observed actions of the competi-

tor and adapting to them effectively.

Our contributions are as follows. We derive mech-

anisms to find effective self-tuning responses against

(i) fixed but unknown competitor strategies including

deterministic as well as randomized (mixed) strate-

gies. Based on these mechanisms, we analyze the in-

teraction of (ii) two self-adapting strategies over time.

Furthermore, we study (iii) how self-tuning strategies

can be adapted to naturally form a cartel in which

market participants settle on a fixed price and there-

after stop competing with price adjustments.

The remainder of this paper is structured as fol-

lows. In Section 2, we delve into related work regard-

ing dynamic pricing models in general, and duopoly

models in particular. Thereafter, Section 3 describes

our infinite time horizon duopoly consisting of two

competing market participants. In Section 4, we

outline the theoretical framework on which our ap-

proach to determining optimized pricing strategies

60

Kaminsky, Y., Maltenberger, T., Pörschke, M., Westphal, J. and Schlosser, R.

Pricing Competition in a Duopoly with Self-adapting Strategies.

DOI: 10.5220/0010232900600071

In Proceedings of the 10th Inter national Conference on Operations Research and Enterprise Systems (ICORES 2021), pages 60-71

ISBN: 978-989-758-485-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

rests upon. Thereafter, in Section 4, we propose our

concepts to tackle scenarios in which the competitor’s

strategies are unknown. For the case of an unknown

competitor’s strategy, it also provides an in-depth de-

scription of our self-adapting strategy for optimized

price reactions. In Section 5, we evaluate our pro-

posed pricing strategies for selected market setups.

Section 6 summarizes our contributions.

2 RELATED WORK

Given that efficiently determining optimized prices

for the sale of goods is one of the key challenges

of revenue management, both comprehensive books

(Phillips, 2005) (Talluri and Van Ryzin, 2006) (Gal-

lego and Topaloglu, 2019) and conceptual papers

(McGill and van Ryzin, 1999) (Bitran and Caldentey,

2003) cover the broad field of dynamic pricing. In ad-

dition, (den Boer, 2015) and (Chen and Chen, 2015)

provide an extensive overview over dynamic pricing

developments in recent years.

Most existing models consider so-called myopic

customers who arrive and decide. Instead, (Levin

et al., 2009), (Liu and Zhang, 2013), and (Schlosser,

2019b) analyze dynamic pricing models with cus-

tomers who strategically time their purchase by an-

ticipating future prices in advance.

(Adida and Perakis, 2010), (Tsai and Hung, 2009),

and (Do Chung et al., 2011) study dynamic pricing

models under competition with limited demand infor-

mation by employing robust optimization techniques

and learning approaches. Especially in the area of de-

mand learning, however, the vast majority of tech-

niques is not flexible enough to be widely adopted

in practice. In the area of data-driven approaches to

dynamic pricing, (Schlosser and Boissier, 2018) ana-

lyzes stochastic dynamic pricing models in competi-

tive markets with multiple offer dimensions, such as

price, quality, and rating.

(Gallego and Wang, 2014) considers a continuous

time multi-product oligopoly for differentiated per-

ishable goods by harnessing optimality conditions to

solve the multi-dimensional dynamic pricing prob-

lem. In a more general oligopoly model for the sale

of perishable goods, (Gallego and Hu, 2014) analyzes

structural characteristics of equilibrium strategies.

(Mart

´

ınez-de Alb

´

eniz and Talluri, 2011) studies

duopoly pricing models for identical products. Since

the sale of perishable goods is typically subject to in-

complete market information, (Schlosser and Richly,

2018) looks at dynamic pricing strategies in a finite

horizon duopoly with partial information.

(Schlosser and Boissier, 2017) analyze optimal

repricing strategies in a stochastic infinite time hori-

zon duopoly. (Schlosser, 2019a) extends this work

by including endogenous reference price effects and

price anticipations. The authors consider both known

and unknown competitor strategies. However, they

use an entirely different demand setup and price ex-

ploration mechanism to anticipate competitor prices.

Moreover, they do not study cartel formation.

3 MODEL DESCRIPTION

We consider a scenario, where two competing mar-

ket participants A and B want to sell goods on on-

line marketplaces. Those marketplaces allow frequent

price adjustments based on data that were collected

on competitors’ pricing strategies. Nowadays, com-

puting power enables those competing market partic-

ipants to perform market analyses for thousands of

product frequently to support almost real-time price

anticipation strategies. For this work, we have sev-

eral assumptions that abstract away from a real price

competition but allow space for exploration.

The product supply of each market participant is

considered to be unlimited. Hence, we assume that

both market participants have the ability to reorder an

arbitrary amount of a product at any time.

All of our models focus on discrete prices only

(i.e., both competing market participants are only al-

lowed to price their product at one of the predefined

prices prices =

{

p

1

,... , p

n

}

). None of our models

makes distributional assumptions on the set of poten-

tial prices. Thus p

1

,. .. , p

n

may follow any poten-

tial distribution including non-uniform ones. While

the assumption of a discrete price model allows for

simplification of the model computation, real-world

scenarios can still be mapped to our setting. In most

markets, the products’ smallest difference in price is

a cent. Thus, most competitions can be easily sim-

ulated by our models. Moreover, the coherent costs

c, c ≥ 0 (e.g., for delivery) are predefined, as they do

not change over time. In most cases, these coherent

costs do not play a huge factor for computing optimal

strategies, so we chose to set c = 0 for our experi-

ments. As a consequence, in our experiments, a sale’s

net profit equals the offer price.

As most of the products on big online market-

places are present for a long period of time and do

not need to be sold until a specific date, we consider

the time horizon under which we perform our pric-

ing analyses to be infinite. However, we can use a

discounting factor δ, 0 < δ < 1 to express the desire

to gain profits early. Moreover, we decided to use a

discrete time model with some adjusting screws, that

Pricing Competition in a Duopoly with Self-adapting Strategies

61

t t+1t+h

Phase1 Phase2

participantA

participantB

i

th

price (i+1)

th

price

i

th

price

Figure 1: Discrete time model used across all models.

allow for very different scenarios.

We only allow price adjustments at specific pre-

defined times, as most marketplaces do not allow for

continuous price adaptions. While market participant

A might react to the current market situation at t and

t + 1, market participant B might react at t + h and

t +1+h, h ∈ (0, 1). A visualization of this time model

can be found in Figure 1. The hyper-parameter h

allows for simulation of various different scenarios.

While h = 0.5 results in a fair duopoly competition,

h 6= 0.5 results in a biased scenario. Here, one can

think of one competitor being able to have access to

more computing power and thus, on average, reacting

faster to price adjustments by the other party.

Furthermore, we divide the presented opponent

strategies into deterministic and stochastic strategies.

Deterministic strategies are characterized by only al-

lowing for a single price reaction to a given price.

Meanwhile, stochastic strategies have a larger pool

of reactions for a single price from which they can

choose one. In our case, stochastic strategies select

the reaction randomly, although not necessarily uni-

formly distributed. This allows for interesting obser-

vations, as the optimized strategy against an unpre-

dictable opponent can be counter intuitive. In general,

a market participant’s strategy can be characterized by

a probability distribution of how to respond to a cer-

tain competitor price. In this context, the probability

that B reacts to A’s price p

A

∈ prices (under a delay

h) with the price p

B

∈ prices is denoted by

P

react

(p

A

, p

B

) : (prices, prices) → [0, 1]. (1)

Further, as we do not represent different product con-

ditions (e.g., used or new) or seller ratings in our mod-

els, customers can only base their buying decision on

the two competitors’ prices at time t. As demand

learning is not in focus, we assume that the customer’s

behavior is known or has already been estimated. In

our models, one customer arrives at each time inter-

val [t,t + 1] and chooses to buy a product based on

the current price level. After deciding to buy, the cus-

tomer purchases from the competitor with the lower

price or randomly chooses a competitor if the offer

prices are equal. The probability that a customer buys

a product of market participant A is described as

P

buy

A

(p

A

, p

B

) : (prices, prices) → [0, 1]. (2)

where p

A

denotes the offer price of participant A and

p

B

denotes the offer price of participant B, respec-

tively. Note that the sales probability of participant A

can be summarized as a function which depends on

(i) the current competitor price p

B

and (ii) the price

p

A

chosen by participant A for one period. However,

it may also include (iii) the competitor’s price reac-

tion p

0

B

and (iv) the reaction delay h of participant B.

Hence, based on (1), (2) can be expressed via condi-

tional probabilities P

buy

A

(p

A

, p

B

| h, p

0

B

).

Resulting from that, the expected total future

profit G of market participant A given both player’s

strategies can be computed by evaluating

E (G) =

∞

∑

t=0

δ

t

· P

buy

A

(p

A

t

, p

B

t

) · p

A

t

.

The objective is to maximize this expected profit.

4 SOLUTION PROPOSITION

In Section 4.1, we describe our basic optimization

model to solve the problem defined in Section 3 for

known inputs. Based on this model, in Section 4.2,

we address the case when the competitor’s strategy is

unknown. In Section 4.3, we study the case when both

participants use adaptive learning strategies. Finally,

in Section 4.4, we analyze how cartels form.

4.1 Basic Optimization Model

Taking participant A’s perspective based on assumed

buying probabilities (2) for one period (with reaction

time h) as well as assumed price reaction probabilities

(1), the value function V (p

B

) of the duopoly problem

can be solved using dynamic programming methods

(e.g., value iteration) with T steps using initial values

for V

T

(p

B

) via t = 0,1, .. ., T − 1, p

B

∈ prices,

V

t

(p

B

) = max

p

A

∈prices

n

∑

p

0

B

∈prices

P

react

p

A

, p

0

B

·

P

buy

A

p

A

, p

B

| h, p

0

B

· p

A

+ δ ·V

t+1

p

0

B

o

.

(3)

The associated price reaction policy (i.e., how to re-

spond to participant B’s price p

B

) is determined by

the arg max of (3) derived at the last step of the re-

cursion in t = 0. Note that the number of recursion

steps T and the starting values V

T

(p

B

) can be chosen

such that the approximation satisfies a given accuracy

(based on the discount factor and the maximum at-

tainable reward). In addition to that, when solving

(3) repeatedly with slight changes (e.g., with updated

price reaction probabilities), suitable starting values

of previous solutions can be used.

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

62

i

th

adaption (i+1)

th

adaption

i*T

a

(i+1)*T

a

(i-1)

th

strategy i

th

strategy (i+1)

th

strategy

strategy

participantA

participantB

Figure 2: Participant A competing against an unknown pric-

ing strategy by adjusting their own strategy over time.

4.2 Dealing with Unknown Strategies

We assume that market participant A does not know

market participant B’s strategy and that participant B’s

strategy is fixed and does not change over time.

The objective of A is to approximate B’s strategy

based on the reactions to proposed prices while still

being competitive on the market. Therefore, A con-

tinuously adjusts their strategy after a fixed number

of time steps T

a

to have a competitive strategy while

gathering more data about the reactions of the oppo-

nent B. This process is visualized in Figure 2. The re-

actions are recorded in a two dimensional data struc-

ture tr as follows. tr [p

A

, p

B

] is the total number of

times B reacted with price p

B

to A’s price p

A

. Fur-

thermore, we define #tr (p

A

) as the total number of

times A has seen a reaction to price p

A

as

#tr (p

A

) =

∑

p

B

∈prices

tr [p

A

, p

B

].

After T

a

time steps, participant A computes the best

anticipation strategy via (3) using the estimated prob-

ability distribution over B’s recorded price reactions

so far with P

react

(p

A

, p

B

) from (1). If there are no

reactions recorded for p

A

, we assume a uniform dis-

tribution over all available prices. Therefore,

p

A

, p

B

7→

1

|prices|

, if #tr (p

A

) = 0

tr [p

A

, p

B

]

#tr (p

A

)

, otherwise.

Participant A acts according to the computed strategy

for the next T

a

time steps, until they do the next strat-

egy computation also taking the newly collected data

into consideration. The size of T

a

should be as small

as possible to update the participant’s strategy often

and is only limited by the available computation time

and the available computational resources.

Over time, participant A gets to know B’s strat-

egy, as the observed distribution over the price re-

actions will become closer to the expected distribu-

tion. In the optimal case, this model will deliver the

same price anticipation strategy as the competitor’s

price response probabilities would be exactly known.

However, if A receives an unprofitable reaction for

a specific price, it is likely that the model will not

propose this price in the future again. A’s strategy

might get stuck and will not change in the future. In

order to counteract this behavior, we need to moti-

vate the model to explore. We call exploring the act

of proposing prices that have not seen enough reac-

tions, even though these prices would not be part of

the optimal anticipation strategy that could be build

based on the recorded price reactions. The partici-

pant is able to gather new reactions and extend their

data foundation significantly. Below, we propose two

procedures to explore participant B’s pricing strategy.

Note that both mechanisms differ from the one used

in (Schlosser, 2019a), where artificially added obser-

vations of high price reactions of the competitor are

used to organize the price exploration in an incentive-

driven framework based on an optimistic initiation.

Assurance. For a specific number of time steps T

i

the participant randomly proposes prices that have not

received enough reactions. By doing so, the partici-

pant gains more confidence in the next strategy eval-

uation. We will only apply this procedure in the first

T

i

time steps to build a profound first strategy, but it is

also reasonable to apply this procedure at a later point

in time (e.g., when the strategy has not changed for a

long time). In the former case, there is no recorded

data and if T

i

≤ |prices| A proposes a different price

each time step. If T

i

> |prices| then A will start over

and proposes every price at least once before propos-

ing it a second time. Which price is proposed ex-

actly will be decided randomly to account for |prices|

mod T

i

6≡ 0. During exploration, the model only cares

about gaining new information about participant B’s

strategy and neither takes competitiveness nor profits

into account. Afterwards, participant A continuously

adjusts its procedure as described before.

Incentive. The price anticipation (1) is modified in

order to motivate the model to include prices in its

strategy that have not seen enough reactions by par-

ticipant B yet. The way to motivate depends on the

customer’s buying behavior. We search for the com-

bination of prices p

A

∗, p

B

∗ that gives participant A

the highest possible profit in the next iteration. There-

fore, we utilize the part of the value function (3) for

calculating the immediate profit as follows:

p

A

∗, p

B

∗ = argmax

p

A

,p

B

∈prices

P

buy

A

(p

A

, p

B

) · p

A

.

It is desirable for the algorithm to propose a price that

receives the reaction p

B

∗ because participant A can

react with p

A

∗ and will then gain the highest pos-

sible profit. The algorithm needs to decide whether

Pricing Competition in a Duopoly with Self-adapting Strategies

63

high immediate profit is worth risking long-term prof-

its. This way, participant A slowly adjusts its strat-

egy by taking new prices into consideration until

enough reactions for every available price were re-

ceived. P

react

(p

A

, p

B

) for λ ∈ R

+

is defined as

P

react

(p

A

, p

B

) =

tr [p

A

, p

B

] + λ

#tr (p

A

) + λ

, if p

B

= p

B

∗

tr [p

A

, p

B

]

#tr (p

A

) + λ

, otherwise.

With λ, it is to some extent possible to control how

many reactions for a price participant A would like to

receive before deeming this price as unprofitable. If

λ ≈ 0 and if A receives an unprofitable reaction for

a specific price, this price will not be proposed again

as we do not assume a desirable price reaction in the

future. However, if we choose λ to be larger (e.g.,

λ ≥ 1), there need to be multiple undesirable price

reactions before they outweigh the possible chance of

a high profit in the next iteration.

Both procedures have their own advantages and

disadvantages. The advantage of the Assurance ex-

ploration procedure is that participant A gains a sparse

but broad data foundation very quickly. After ini-

tial exploration, participant A is able to build their

first competitive strategy. Furthermore, if participant

B uses a deterministic strategy and T

i

≥ |prices|, the

evaluated strategy after exploration will not change in

later strategy adaptions as A has already seen every

possible reaction from B. In this case, A fully reveals

the strategy after T

i

time steps. A major downside of

this procedure is that participant A does not care about

profits for T

i

time steps. As we consider an infinite

event horizon, it is negligible if the competitor does

not work efficiently for a finite number of time steps.

If we instead consider a real world market situation,

the competitor might not be able to survive the explo-

ration phase. Therefore T

i

needs be chosen wisely and

in proportion to |prices|. It is not feasible to try out

most of the available prices if |pr ices| is large.

In this case, it might be better to use the Incen-

tive approach. The participant considers profits and

losses starting from the first proposed price and pro-

gressively explores prices that have not seen a reac-

tion because exploring is part of strategy evaluation.

On the other hand, it might take the Incentive proce-

dure several strategy adaptions before every price has

been proposed at least once and even more rounds of

strategy adaptions before the incentive weight λ has

been smoothed out completely.

It is worth noting that both procedures do not take

interpolation into account. For example, in real-world

scenarios where prices p

A

− 1 and p

A

+ 1 are unprof-

itable, it is very likely that price p

A

is also unprof-

(i-1)

th

simulation

i

th

adaption

i

th

simulation

i

th

adaption

t

(i+1)

th

simulation

i

th

strategy(i-1)

th

strategy

i

th

strategy

t+T

d

participantA

participantB

Figure 3: Two competing self-learning strategies over time.

itable. However, as both procedures have not seen a

reaction for p

A

, they are influenced to propose this

price. Therefore, both procedures have the problem

that they might propose prices unnecessarily. Addi-

tionally, both exploration procedures have one hyper-

parameter that each needs to be tuned. We will dis-

cuss choosing T

i

and λ further in Section 5.2.

4.3 Competing Self-adaptive Strategies

The last model that we present is an extension of the

one presented in Section 4.2. Instead of competing

with an unknown but fixed strategy, both parties can

adapt their pricing strategies over time to react to the

current market pricing situation and the other partici-

pant’s pricing strategy. Similar to the model presented

in Section 4.2, both participants need a data founda-

tion to base their strategy decision on. We, therefore,

collect the respective opponent’s price reactions over

time in the data structure tr. After a predefined num-

ber T

d

of price reactions, one market participant is

allowed to analyze their collected price reactions in

order to adapt their own pricing strategy. Another T

d

price reactions later, the other market participant re-

acts to the changed market situation.

A visualization of the procedure can be found in

Figure 3. The collection of the mentioned T

d

price

reactions is grouped together in the referenced data

collection lasting for T

d

time steps. A data collec-

tion block represents the real market competition. All

the tracked price reactions are passed into the strat-

egy adaption of the respective participant at time step

t. The computation of the newly adapted strategy is

the same as the one from Section 4.2. The partici-

pant’s (i − 1)

th

strategy is replaced with the i

th

strat-

egy, which will be used for the next two data collec-

tion blocks while participant B still uses their (i − 1)

th

strategy. The next data collection block starting at t

runs another T

d

time steps. At t + T

d

, participant B

updates their strategy which will be used within the

subsequent two data collection blocks.

The model presented in this section mainly dif-

fers from the one presented in Section 4.2 by the two

strategies changing the over time. Reaction data col-

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

64

lected at t = 0 will probably be outdated at some later

point t

i

which might result in inaccurate price reaction

strategies. The model needs to anticipate that. In or-

der to do so, we introduce a vanishing of values within

our tr data structure. After a pricing strategy adaption

was performed, the values are multiplied with a con-

stant factor α ∈ [0,1]. This allows to decide between

different intensities of keeping all of the collected, but

possibly outdated data. For example, with α = 1 all

recorded reactions will be kept and with α = 0 the

data structure will be reset. While α = 0 leads to bet-

ter anticipation strategies when just respecting the last

simulation run, α > 0 is expected to account for the

long-term trend and to be less prone to over-fitting the

own strategy on a single data collection run.

4.4 Incentivizing Cartel Formations

Additionally, we present a way to allow both market

participants to form a cartel in which they constantly

price their products equally. Note, instead of pre-

defining a cartel price in advance, we study the case

whether it is possible to modify our self-tuning price

anticipation/optimization framework such that two of

our independently applied learning strategies form a

cartel without direct communication.

In order to determine the best cartel price, we

reuse a modified version of the presented formula to

find the optimal incentive price as follows:

p∗ = argmax

p∈prices

P

buy

A

(p, p) · p.

Further, in our models, the adaption of the response

policy derived by (3) is organized as follows. We

manually overwrite the reaction of market participant

A to p∗ with p∗. Thus, market participant A signals

to market participant B its willingness to support a

cartel price. The rest of our approach to define price

reactions and to decide on prices, as described in Sec-

tion 4.2 and Section 4.3, remains unchanged.

5 EXPERIMENTAL EVALUATION

In this section, we study the performance of our dif-

ferent approaches from Sections 4.2, 4.3, and 4.4. To

do so, we consider numerical examples, where the

buying behavior and the competitor’s strategies to be

learned are defined in Section 5.1.

5.1 Setup

In Section 5.1.1, we define example approaches for

deterministic and stochastic strategies. Thereafter, in

Section 5.1.2, we analyze the customer behavior.

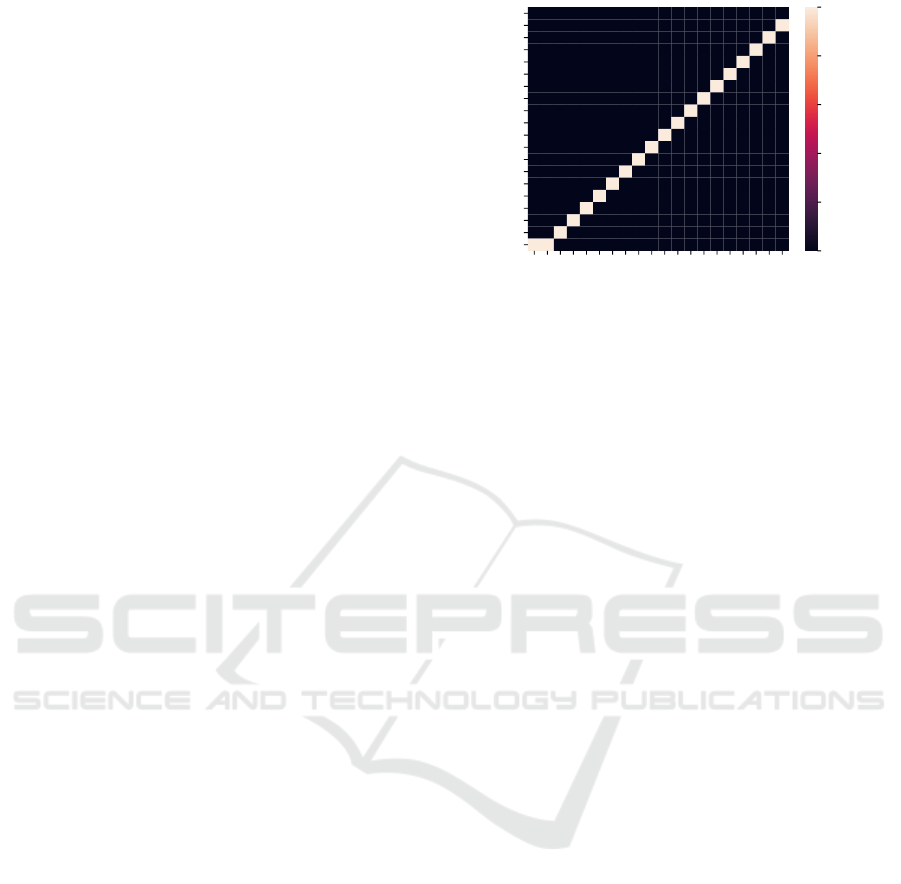

2 4 6 8 10 12 14 16 18 20

Competitor Price

2018161412108642

Price Reaction

0.0

0.2

0.4

0.6

0.8

1.0

Figure 4: Visualization of price response probabilities for

Underbid as an example for a deterministic strategy.

5.1.1 Test Strategies of the Competitor

We introduce two different groups of pricing strate-

gies with a single representative each that will be re-

ferred to in the subsequent evaluation.

Deterministic. We test strategies that always react

with the same price for a proposed price. Their be-

havior can be formally described as

∀p

A

∈ prices : ∃! p

B

: P

react

(p

A

, p

B

) = 1.

Among those included strategies, the simplest and

widely used is a strategy we call Underbid. The other

participant’s price is underbid by one unit (e.g., ∆) but

respects the minimum available price. This strategy

can be expressed by the response function

F : prices → prices, p 7→ max(min (prices), p − ∆).

An exemplary visualization of strategy F can be

found in Figure 4. We used twenty possible prices,

prices

20

=

{

∆,2∆, .. ., 20

}

, ∆ = 1. Each cell shows

the probability that the competitor reacts with p

B

to a

current price p

A

. In other words, each cell shows the

result of P

react

(p

A

, p

B

). Resulting from that, a column

contains a distribution over all price reactions p

B

to a

given price p

A

. As Underbid is a deterministic strat-

egy, in each column a single p

B

makes up 100% of

the occurrences. This can be clearly seen in Figure 4.

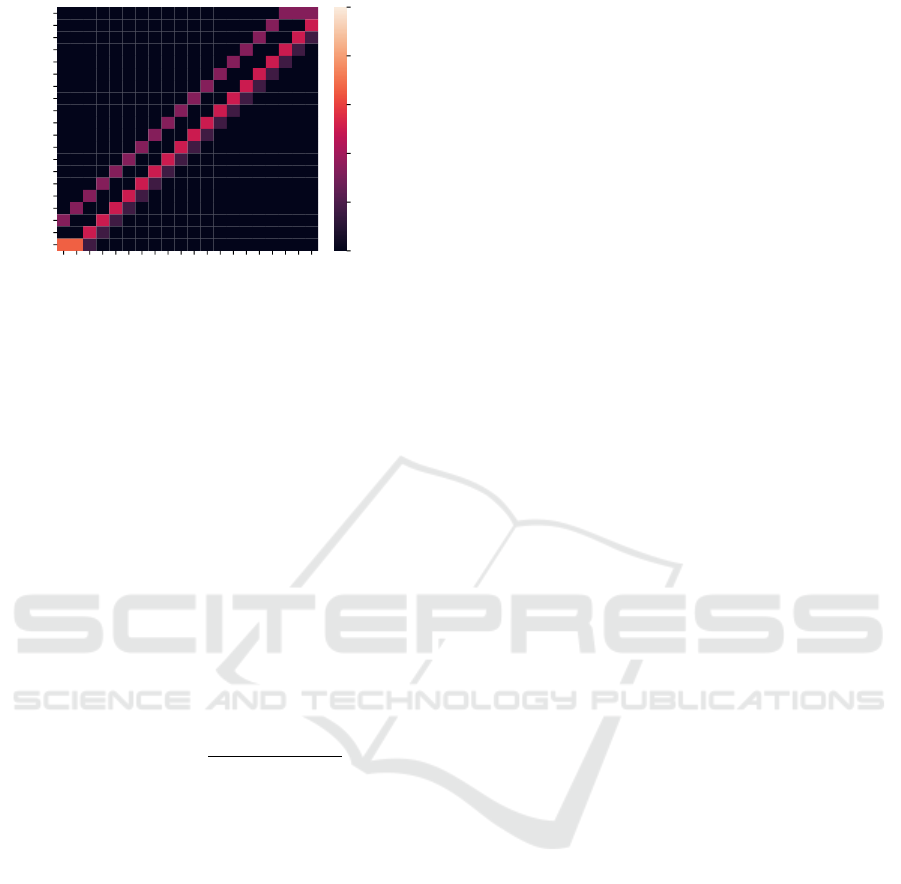

Stochastic. The second group of strategies we want

to consider contains stochastic strategies only. Those

are characterized by their non-deterministic behavior.

A given price p

A

might result in different price reac-

tions p

B

. One can compare this behavior with playing

multiple pricing strategies at the same time. Figure 5

shows a stochastic strategy which, using the indicator

Pricing Competition in a Duopoly with Self-adapting Strategies

65

2 4 6 8 10 12 14 16 18 20

Competitor Price

2018161412108642

Price Reaction

0.0

0.2

0.4

0.6

0.8

1.0

Figure 5: Visualization of an exemplary stochastic strategy.

function 1

{·}

, can be described as

P

react

(p

A

, p

B

) =

1

/2, ·1

{

p

B

=max(p

A

−1, min(prices))

}

+

1

/6, ·1

{

p

B

=max(p

A

−2, min(prices))

}

+

1

/3, ·1

{

p

B

=min(p

A

+2, max(prices))

}

.

5.1.2 Customer Buying Behavior

The subsequent evaluation will use a fixed customer

buying strategy. Nonetheless, all models are capable

of handling arbitrary customer buying behavior. We

decided to pick a realistic buying behavior in order

to make this evaluation as practical as possible. We

define the probability that a customer buys a product

given the current prices p

A

and p

B

as follows:

buy : (pr ices, prices) → (0,1] :

(p

A

, p

B

) 7→ 1 −

min(p

A

, p

B

)

max(prices) + 1

.

The customer is more likely to buy a product if the

minimal price on the market is lower. If both prices

are very high, it is less likely that the customer buys

a product. As mentioned earlier, we assume that the

customer always chooses the lower price. If both pro-

posed prices are the same, the customer randomly

chooses one market participant’s product. Therefore,

the probability that the customer decides participant

A’s product offer is defined via

dec

A

: (prices, prices) → [0,1] :

(p

A

, p

B

) 7→

1, if p

A

< p

B

1

/2, if p

A

= p

B

0, otherwise.

Consequently, in the context of (1) and (2) in (3), the

resulting buying probability is described by

P

buy

A

p

A

, p

B

| h, p

0

B

= h · buy(p

A

, p

B

) · dec

A

(p

A

, p

B

)

+(1 − h) · buy(p

A

, p

0

B

) · dec

A

(p

A

, p

0

B

).

5.2 Results for Unknown Strategies

In the evaluation of the model for the unknown op-

ponent’s strategy, we compare how long the different

exploration procedures Assurance and Incentive take

to approximate the real opponent’s strategy and what

their profits are along the way. The quality of differ-

ent learning strategies can be verified by comparing

them to the optimal strategy, which can be obtained

by solving (3) for the opponent’s strategy.

We evaluate the two exploration procedures (As-

surance and Incentive) in the setting described in Sec-

tion 5.1, where the underlying opponent’s strategy is

either Underbid or Stochastic. We use the discount

factor δ = 0.99 and intervals with h = 0.5. We de-

duced T = 100 to be sufficient for the strategy an-

ticipation. We choose the number of time steps after

which A adjusts their strategy as T

a

= 1. This, in re-

turn, implies that the strategy is reevaluated after ev-

ery new price reaction from B.

In the following, we compare the Assurance pro-

cedure under different numbers of time steps for ex-

ploration T

i

and the Incentive procedure under differ-

ent incentive weights λ respectively. For this purpose,

we choose T

i

and λ as follows:

T

i

∈

{

0,10, 20,40, 100

}

,λ ∈

{

0.001,0.5, 1,2, 5

}

.

We use T

i

= 0 and λ = 0.001 to get a good baseline for

each approach. In order to get a profound impression

of the calculated strategy at a specific time step t, we

run the simulation S = 1000 times for T

S

= 100 time

steps. The average of A’s expected profits in these

simulations is divided by the simulation length T

S

and

will be denoted E

t

. Therefore, E

t

is A’s expected

profit with the strategy used at time step t. We de-

note O to be the expected profit that is achieved when

the optimal strategy is used. O is constant as the op-

timal strategy does not change over time. If E

t

≈ O,

we know that A either found the optimal strategy or

another strategy that produces very similar profits. If

this keeps up for a greater number of time steps, A

successfully identified B’s strategy. An example is vi-

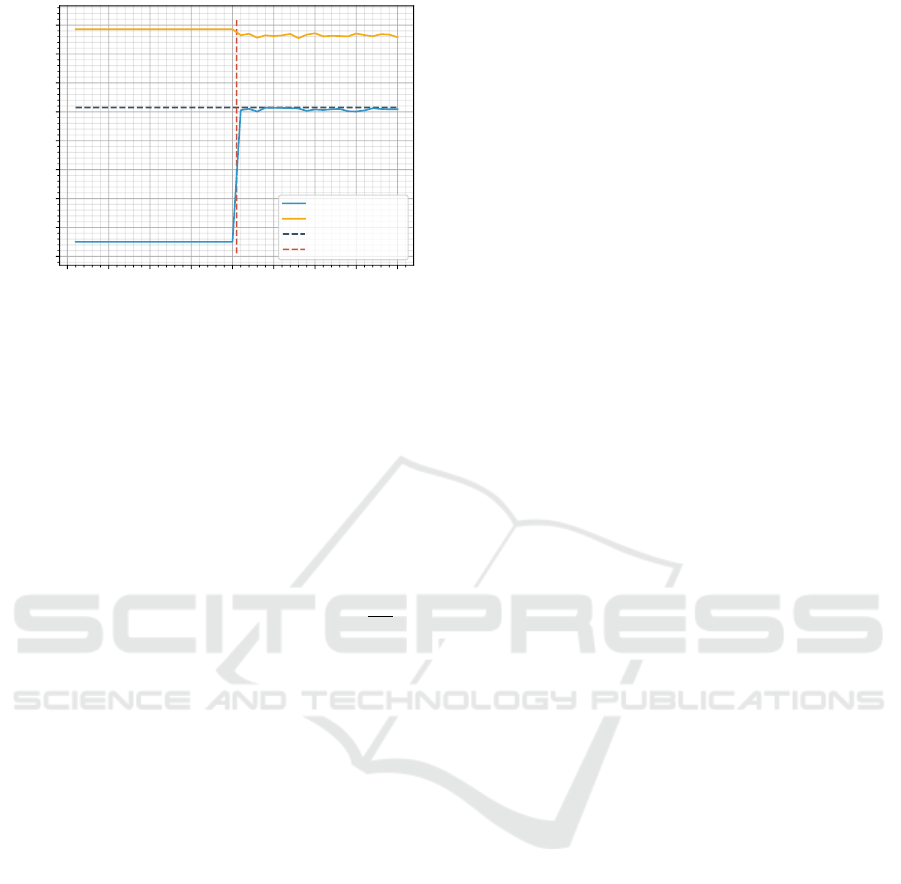

sualized in Figure 6. The figure depicts the develop-

ment of expected profits E

t

over time when utilizing

the Assurance procedure. We used prices = prices

20

with Underbid as B’s underlying strategy and T

i

= 20

time steps for initial exploration.

As discussed in Section 4.2, A will be able to find

the optimal strategy because B’s strategy is determin-

istic and T

i

≥ |prices|. This can be seen clearly in

Figure 6. During exploration with Assurance, A’s ex-

pected profits are mediocre but after exploration, the

expected profits are equal to the optimal profits. In

order to compare the two procedures over a longer

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

66

0 5 10 15 20 25 30 35 40

Time

0.75

1.00

1.25

1.50

1.75

2.00

2.25

2.50

2.75

Profit per Time Step

A’s Profit

B’s Profit

A’s Optimal Profit

Exploration

Figure 6: Profit per time step against Underbid on 20 prices

with with Assurance exploration and T

i

= 20.

time period, we set A’s cumulative profit in propor-

tion to the cumulative profit under the optimal strat-

egy. A’s cumulative profit will be denoted CE

t

and the

cumulative profit under the optimal strategy will be

denoted CO

t

. Consequently, we have CE

t

=

∑

t

i=1

E

i

and CO

t

=

∑

t

i=1

O = t · O. If CE

t

= CO

t

, A found the

optimal strategy or another one that achieves equal

profits. Furthermore, in order for the cumulative prof-

its to be approximately equal, the strategy needs to

be used for several time steps to account for inferior

strategies applied in the past. We will call

CE

t

CO

t

the

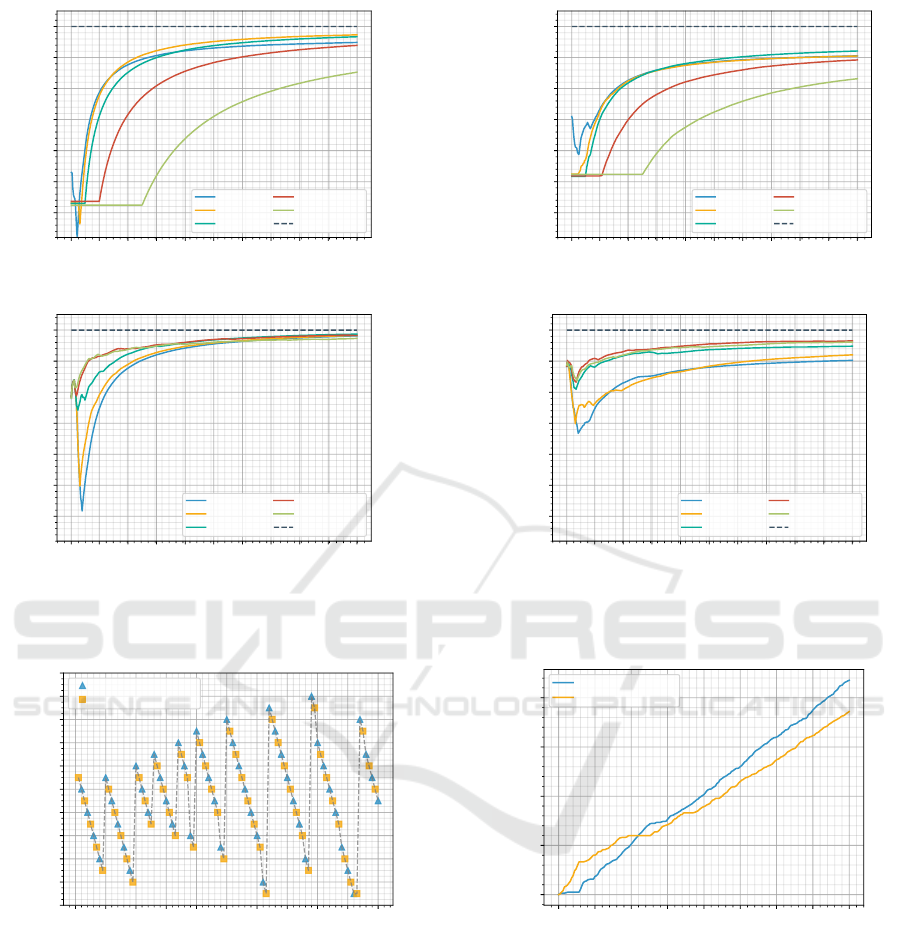

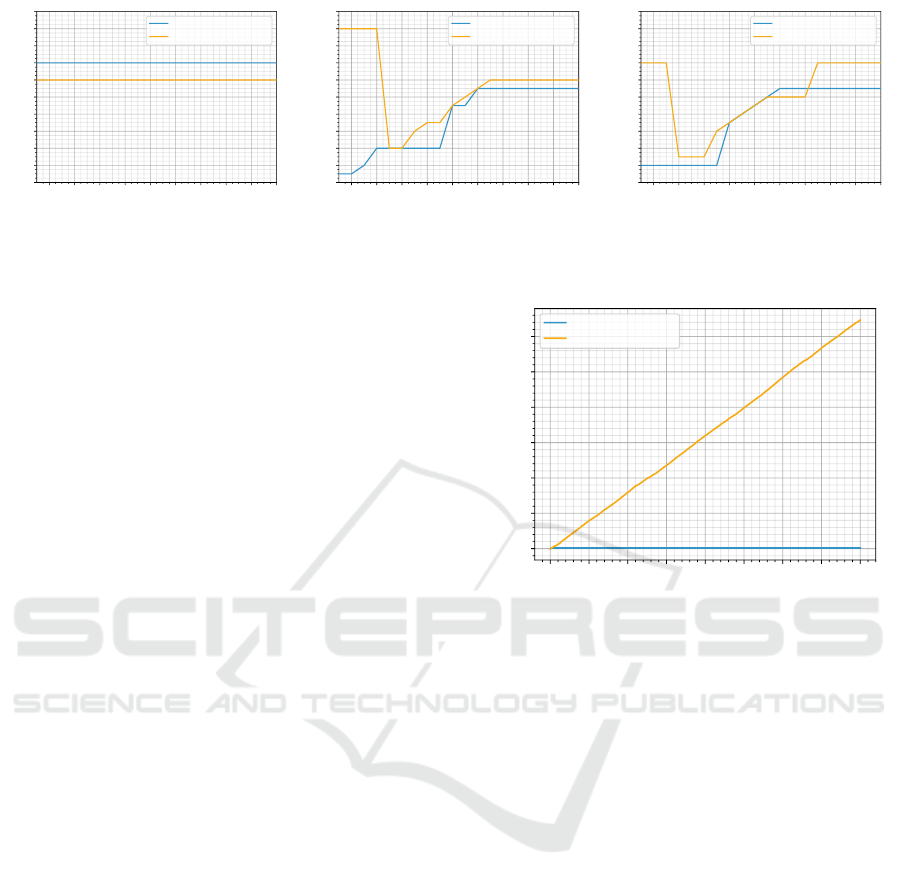

profit ratio. Figure 7 depicts the profit ratio of the As-

surance and Incentive procedure with their respective

configurations for 400 time steps.

Assurance and Underbid Strategy (Figure 7a).

The figure shows that it takes a long time for larger T

i

to account for losses during exploration as we know

that A would find the optimal strategy after T

i

= 20

time steps. T

i

= 10 seems to have found the optimal

strategy after initial losses as well. This can be seen

because the plot is approached by T

i

= 20. These two

configurations as well as T

i

= 40 and T

i

= 100 will

approach the optimal profit ratio of 1 on the infinite

event horizon. With T

i

= 0 the model was not able to

find the optimal strategy which explains why its plot

is being overtaken by that of T

i

= 20.

Assurance and Stochastic Strategy (Figure 7b).

The figure shows that for a stochastic strategy more

exploration is needed. The configuration T

i

= 0 and

T

i

= 10 converge to the same point, which means that

the additional exploration did not contain any bene-

ficial information. T

i

= 20 results in a higher profit

ratio but similar to the deterministic scenario, it takes

very long for larger T

i

to account for missed profits

during the exploration phase.

Incentive and Underbid Strategy (Figure 7c). In

the figure we can see that every configuration after

some initial profits experiences a drop in profit ra-

tio. The reason for that is because the model tries

out less profitable prices after gaining enough infor-

mation about profitable prices.

This is visualized in Figure 8 for λ = 1. The model

continuously tries out higher prices. For a lower λ

proposing these prices happens very fast. That is the

reason why the drop for lower λ is greater compared

to larger λ. Model configurations with larger λ take

longer to gain confidence for the profitable prices be-

fore trying out less profitable prices. This also means

that larger λ take longer to accept that the opponent

strategy is deterministic. It is therefore not surprising

that the order of profit ratio at t = 400 is the ascending

order of λ. Every configuration is able to find the op-

timal strategy. However, we see that the larger λ the

longer it takes for the model to be certain.

Incentive and Stochastic (Figure 7d). The plots in

this figure have a similar shape compared to the same

procedure with Underbid as the underlying opponent

strategy. The drop is less significant which should be

due to the Stochastic being a more forgiving strategy

compared to Underbid. λ = 0.001 seems to not have

received enough opponent reactions which can be

seen as the plot is stagnating for larger t. Moreover,

larger λ perform equally well.

Comparing the results, we decide that the Incentive

procedure should be preferred over the Assurance

procedure for exploration. The Incentive procedure

produces higher profit ratio compared to Assurance

procedure. This is because the later needs exploration

for T

i

≥ |prices| time steps in order to produce a good

strategy which can be clearly seen in the scenario of

the Stochastic strategy. However, if T

i

is too large it

takes very long to compensate the exploration phase.

For the Incentive procedure λ ≈ 1 seems to be ideal.

Moreover, configurations with large λ take too long to

be confident about the opponent’s strategy while con-

figurations with small λ are considerably less likely to

propose a price multiple times.

5.3 Results for Self-adaptive Strategies

The evaluation of the interaction between two self

adapting strategies will be divided into three major

parts. The first of those runs the competition with two

identically configured models and observes how the

competition affects each of these. The second part

focuses on the parameter α and its effect on model’s

performance. The final part examines whether both

Pricing Competition in a Duopoly with Self-adapting Strategies

67

1 40 80 120 160 200 240 280 320 360 400

Time

0.4

0.5

0.6

0.7

0.8

0.9

1.0

Profit Ratio

T

i

= 0

T

i

= 10

T

i

= 20

T

i

= 40

T

i

= 100

Optimal Profit

(a) Assurance exploration against Underbid

1 40 80 120 160 200 240 280 320 360 400

Time

0.4

0.5

0.6

0.7

0.8

0.9

1.0

Profit Ratio

T

i

= 0

T

i

= 10

T

i

= 20

T

i

= 40

T

i

= 100

Optimal Profit

(b) Assurance exploration against Stochastic

1 40 80 120 160 200 240 280 320 360 400

Time

0.4

0.5

0.6

0.7

0.8

0.9

1.0

Profit Ratio

λ = 0.001

λ = 0.5

λ = 1.0

λ = 2.0

λ = 5.0

Optimal Profit

(c) Incentive exploration against Underbid

1 40 80 120 160 200 240 280 320 360 400

Time

0.4

0.5

0.6

0.7

0.8

0.9

1.0

Profit Ratio

λ = 0.001

λ = 0.5

λ = 1.0

λ = 2.0

λ = 5.0

Optimal Profit

(d) Incentive exploration against Stochastic

Figure 7: Profit ratios for Assurance and Incentive exploration against Underbid and Stochastic over 400 time steps.

0 5 10 15 20 25 30 35 40 45 50

Time

0

2

4

6

8

10

12

14

16

18

20

Price

Participant A’s Prices

Participant B’s Prices

Figure 8: Market simulation of the Incentive procedure with

λ = 1 competing against Underbid on 20 prices.

strategies can form a cartel. For all of these tests, we

use an interval split h = 0.5, a discount factor δ = 0.99

and an evaluation time horizon T = 50. Strategy up-

dates are performed frequently with T

d

= 10 in order

to shorten the initial exploration phase. We simulate

each configuration for 2000 time points to account for

long term effects. Additionally, the models use the In-

centive technique, presented in Section 4.2, to explore

prices the competitor has not reacted to.

0 250 500 750 1000 1250 1500 1750 2000

Time

0

1000

2000

3000

4000

Profit

Participant A’s Profit

Participant B’s Profit

Figure 9: Profit progression of two competing, self-

adapting price strategies.

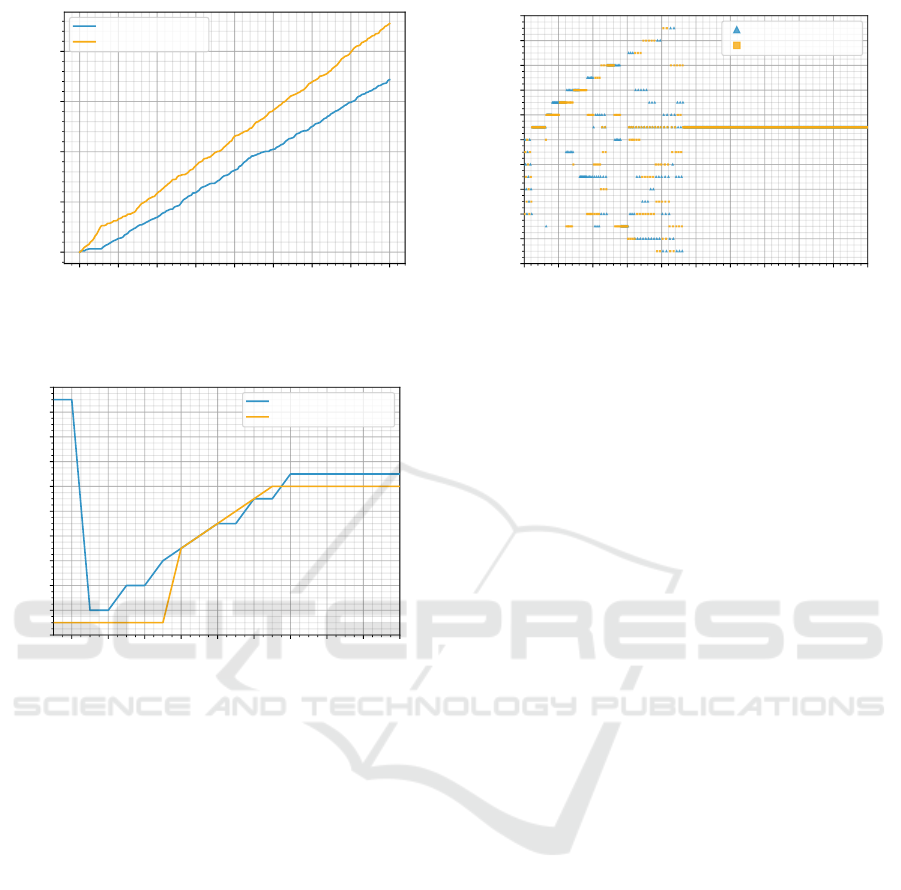

Identical Start Conditions. In this scenario, we let

two identically configured models compete. Both

models differentiate between new and old reactions,

α 6= 1. We identified α = 0.8 as suitable to account

for focusing on newer reactions while keeping track

of old ones, too. Figure 9 shows the progress of the

profits of both strategies. In the beginning, market

participant B is ahead due to the fact that the strategy

of market participant B has one period of additional

data during the strategy reevaluation. Therefore, it

can finish its exploration phase earlier. However, the

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

68

2 4 6 8 10 12 14 16 18 20

Competitor Price

0

2

4

6

8

10

12

14

16

18

20

Reaction

Participant A’s Strategy

Participant B’s Strategy

(a) Both strategies at t = 100

2 4 6 8 10 12 14 16 18 20

Competitor Price

0

2

4

6

8

10

12

14

16

18

20

Reaction

Participant A’s Strategy

Participant B’s Strategy

(b) Both strategies at t = 400

2 4 6 8 10 12 14 16 18 20

Competitor Price

0

2

4

6

8

10

12

14

16

18

20

Reaction

Participant A’s Strategy

Participant B’s Strategy

(c) Both strategies at t = 1000

Figure 10: Progression of both strategies at different time points t.

earlier update has its disadvantages, too. Market par-

ticipant B notices first that they have to restore a low

price level at some point to gain higher profits in the

future. However, in this scenario market participant

A can exploit this behavior by choosing a low price,

so participant B has to increase the price level. There-

fore, market participant A never has to increase the

price level itself, but can force market participant B

to do so once the price level drops too low. Accord-

ingly, market participant A wins out at some point and

never looses the profit lead again. We see that market

participant B is not able to stop the downward trend

once it started. When competing for an extended pe-

riod of time, both strategies enter a loop of chosen

prices, which both models profit from. While mar-

ket participant B looses the competition, its strategy

is still optimal from its point of view. The alternative

of matching a low price of market participant A is not

lucrative, as there is no guarantee that market partici-

pant A will restore the price level and market partici-

pant B looses profit in the long run. When looking at

the strategy evolution, we see that both models start

with similar strategies to explore the respective com-

petitor’s strategy. Figure 10a shows that market par-

ticipant B is ahead during the exploration phase. Both

strategies evaluate the competitor reactions from most

profitable to least profitable. As we can see, partici-

pant B is already using price 12, while participant A

is still evaluating the more profitable price of 14.

Figure 10b shows the learning progress of both

strategies at t = 400. Market participant B has learned

that it has to restore the price level at some point,

while market participant A exploits B’s strategy by

matching lower prices in order to force B to raise the

price level afterwards. After 1000 time periods, both

strategies do not change any more. The final strate-

gies are presented in Figure 10c. We can see that both

strategies underbid each other in the mid price ranges.

However, they differ in their behavior once the price

drops too low and also in their price reaction on too

high market prices. Moreover, market participant A

0 250 500 750 1000 1250 1500 1750 2000

Time

0

1000

2000

3000

4000

5000

6000

Profit

Participant A’s Profit

Participant B’s Profit

Figure 11: Profit progression of two competing, self-

adapting price strategies with α

A

= 0 and α

B

= 1.

already deems prices below 7 as too low, while mar-

ket participant B only deems below 3 as too low.

α

α

α Deviations. While the previous section focused

on α = 0.8, this section investigates the impact of se-

lected α values on the models’ performances. Fig-

ure 11 shows the competition of two extreme α val-

ues (i.e., α

A

= 0 and α

B

= 1). We see that participant

B wins the competition very decidedly. α = 0 is ob-

served to be the worst possible setting as the incentive

based learning has to start over and over again. This

is due to the fact that the model loses every recorded

price reaction after each strategy evaluation. There-

fore, previously played prices appear to be new to the

unsuspecting model. In the short term, this strategy

can work out because it focuses on high profit prices

first and the model with α = 1 wants to learn about

all prices instead. However, this effect is mitigated as

participant B updates its strategy earlier.

Therefore, we present a more competitive setting

where participant A uses α = 1 and participant B uses

α = 0.5. An α value of 0.5 allows a model to focus on

newer reactions, yet not loosing information on older

ones. Figure 12 shows the profits of both competing

strategies over time. We can see that participant B’s

Pricing Competition in a Duopoly with Self-adapting Strategies

69

0 250 500 750 1000 1250 1500 1750 2000

Time

0

1000

2000

3000

4000

Profit

Participant A’s Profit

Participant B’s Profit

Figure 12: Profit progression of two competing, self-

adapting price strategies with α

A

= 1 and α

B

= 0.5.

2 4 6 8 10 12 14 16 18 20

Competitor Price

0

2

4

6

8

10

12

14

16

18

20

Reaction

Participant A’s Strategy

Participant B’s Strategy

Figure 13: Strategy comparison at t = 1000 with α

A

= 1

and α

B

= 0.5.

strategy using α = 0.5 is more effective.

As we saw earlier, participant B is at a structural

disadvantage. Nonetheless, B is able to win over par-

ticipant A due to the superior α value. In contrast to

the first experiment, participant B is able to force A to

restore the price level, as we can see in Figure 13. Par-

ticipant A is not able to remove misleading reactions

from the early exploration. Thus, market participant A

is not able to compete with market participant B who

adapts its strategy accordingly.

5.4 Results for Cartel Formations

The following focuses on a cartel formation using two

self-learning strategies. While the previous experi-

ments showed that the two models do not form a car-

tel on their own, the introduction of an artificial price

reaction as discussed in Section 4.3 helps with that.

Figure 14 shows the product prices p

A

and p

B

of both

market participants over time.

We observe that both strategies explore the pos-

sible prices at first, as we see a lot of different prices

0 50 100 150 200 250 300 350 400 450 500

Time

0

2

4

6

8

10

12

14

16

18

20

Price

Participant A’s Prices

Participant B’s Prices

Figure 14: Price history with market participant A’s artifi-

cial cartel price reaction.

played. Both participants choose the cartel price some

time, but they do not form a cartel instantly. Given

that participant A will always react to a price p

B

=

p

B

∗ = 11 with p

A

= p

A

∗ = 11, we see that partici-

pant B at some point t ≈ 250 decides to consistently

react to p

A

∗ with p

B

∗ in order to form a cartel. Af-

ter the formation phase, both parties continue to stick

with the cartel price. As expected, the earned profits

of both participants are high and both strategies out-

perform their competing counterparts.

6 CONCLUSION

In recent times, market participants try to adapt their

prices more frequently to gain a competitive edge.

Online markets offer optimal conditions to employ

dynamic pricing strategies, as it is easy to observe

competitor’s prices and to change the own price. We

analyze optimized pricing strategies for different sce-

narios. In all of these, we compete in a duopoly and

operate under an infinite time horizon. Additionally,

we allow for an arbitrary functional dependency be-

tween the sale probability and the current market sit-

uation consisting of two competitors’ prices.

Firstly, we show how to explore the competitor’s

strategy efficiently while losing a minimum profit.

We try out two different ways of estimating the com-

petitor strategy. On the one hand, we simply cycle

through prices to gain more information about spe-

cific prices. On the other hand, we use an incentive

approach for motivating the model to try out prices

that have not been proposed before. We find that the

incentive approach should be preferred over the other

as profits are considered during exploration.

Secondly, we let our self-learning strategies inter-

act with each other. Both of the strategies estimate the

respective competitor’s strategy and adapt their price

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

70

responses in fixed intervals. We observe that equal

strategies evolve over an extended period of time,

but stop evolving at some point. Afterwards, neither

strategy is changed again. When comparing differ-

ent strategies, we observe that diminished knowledge

of past price reactions outperforms settings without

any as well as those with unlimited backward reaction

tracking. Moreover, we slightly modify one strategy

such that it prefers playing a cartel price. We show

that both strategies stop competing once they discover

the cartel price. Although customers suffer from the

high price, it is the most beneficial scenario for both

market participants due to high profits.

REFERENCES

Adida, E. and Perakis, G. (2010). Dynamic pricing and

inventory control: Uncertainty and competition. Op-

erations Research, 58:289–302.

Bitran, G. and Caldentey, R. (2003). An overview of pricing

models for revenue management. Manufacturing and

Service Operations Management, 5:203–229.

Chen, M. and Chen, Z.-L. (2015). Recent developments in

dynamic pricing research: Multiple products, compe-

tition, and limited demand information. Production

and Operations Management, 24:704–731.

den Boer, A. V. (2015). Dynamic pricing and learning: His-

torical origins, current research, and new directions.

Surveys in Operations Research and Management Sci-

ence, 20:1–18.

Do Chung, B., Li, J., Yao, T., Kwon, C., and Friesz, T. L.

(2011). Demand learning and dynamic pricing under

competition in a state-space framework. IEEE Trans-

actions on Engineering Management, 59:240–249.

Gallego, G. and Hu, M. (2014). Dynamic pricing of perish-

able assets under competition. Management Science,

60:1241–1259.

Gallego, G. and Topaloglu, H. (2019). Revenue Manage-

ment and Pricing Analytics. Springer.

Gallego, G. and Wang, R. (2014). Multiproduct price opti-

mization and competition under the nested logit model

with product-differentiated price sensitivities. Opera-

tions Research, 62:450–461.

Hajji, A., Pellerin, R., L

´

eger, P.-M., Gharbi, A., and Babin,

G. (2012). Dynamic pricing models for erp systems

under network externality. International Journal of

Production Economics, 135:708.

He, Q.-C. and Chen, Y.-J. (2018). Dynamic pricing of

electronic products with consumer reviews. Omega,

80:123–134.

Huang, Y.-S., Hsu, C.-S., and Ho, J.-W. (2014). Dynamic

pricing for fashion goods with partial backlogging. In-

ternational Journal of Production Research, 52:4299–

4314.

Levin, Y., McGill, J., and Nediak, M. (2009). Dy-

namic pricing in the presence of strategic consumers

and oligopolistic competition. Management Science,

55:32–46.

Liu, Q. and Zhang, D. (2013). Dynamic pricing compe-

tition with strategic customers under vertical product

differentiation. Management Science, 59:84–101.

Mart

´

ınez-de Alb

´

eniz, V. and Talluri, K. (2011). Dynamic

price competition with fixed capacities. Management

Science, 57:1078–1093.

McGill, J. and van Ryzin, G. (1999). Revenue management:

Research overview and prospects. Transportation Sci-

ence, 33:233–256.

Noel, M. (2007). Edgeworth price cycles, cost-based pric-

ing, and sticky pricing in retail gasoline markets. The

Review of Economics and Statistics, 89:324–334.

Noel, M. (2012). Edgeworth price cycles and intertempo-

ral price discrimination. Energy Economics - ENERG

ECON, 34.

Phillips, R. L. (2005). Pricing and Revenue Optimization.

Stanford University Press.

Schlosser, R. (2019a). Dynamic pricing under competition

with data-driven price anticipations and endogenous

reference price effects. Journal of Revenue and Pric-

ing Management, 16:451–464.

Schlosser, R. (2019b). Stochastic dynamic pricing

with strategic customers and reference price effects.

ICORES 2019, pages 179–188.

Schlosser, R. and Boissier, M. (2017). Optimal price re-

action strategies in the presence of active and passive

competitors. ICORES 2017, pages 47–56.

Schlosser, R. and Boissier, M. (2018). Dynamic pricing

under competition on online marketplaces: A data-

driven approach. International Conference on Knowl-

edge Discovery and Data Mining, pages 705–714.

Schlosser, R. and Richly, K. (2018). Dynamic pricing

strategies in a finite horizon duopoly with partial in-

formation. ICORES 2018, pages 21–30.

Sweeting, A. (2012). Dynamic pricing behavior in perish-

able goods markets: Evidence from secondary mar-

kets for major league baseball tickets. Journal of Po-

litical Economy, 120:1133–1172.

Talluri, K. T. and Van Ryzin, G. J. (2006). The Theory and

Practice of Revenue Management. Springer.

Tong, T., Dai, H., Xiao, Q., and Yan, N. (2020). Will dy-

namic pricing outperform? theoretical analysis and

empirical evidence from o2o on-demand food service

market. International Journal of Production Eco-

nomics, 219:375–385.

Tsai, W.-H. and Hung, S.-J. (2009). Dynamic pricing and

revenue management process in internet retailing un-

der uncertainty: An integrated real options approach.

Omega, 37:471–481.

Pricing Competition in a Duopoly with Self-adapting Strategies

71