Discounted Markov Decision Processes with Fuzzy Rewards Induced by

Non-fuzzy Systems

Karla Carrero-Vera

1

, Hugo Cruz-Su

´

arez

1

and Ra

´

ul Montes-de-Oca

2

1

Benem

´

erita Universidad Aut

´

onoma de Puebla, Av. San Claudio y R

´

ıo Verde,

Col. San Manuel, CU, Puebla, Pue. 72570, Mexico

2

Departamento de Matem

´

aticas, Universidad Aut

´

onoma Metropolitana-Iztapalapa, Av. San Rafael Atlixco 186,

Keywords:

Markov Decision Processes, Dynamic Programming, Optimal Policy, Fuzzy Sets, Triangular Fuzzy Numbers.

Abstract:

This paper concerns discounted Markov decision processes with a fuzzy reward function triangular in shape.

Starting with a usual and non-fuzzy Markov control model (Hern

´

andez-Lerma, 1989) with compact action

sets and reward R, a control model is induced only substituting R in the usual model for a suitable triangular

fuzzy function

˜

R which models, in a fuzzy sense, the fact that the reward R is “approximately” received. This

way, for this induced model a discounted optimal control problem is considered, taking into account both a

finite and an infinite horizons, and fuzzy objective functions. In order to obtain the optimal solution, the partial

order on the α-cuts of fuzzy numbers is used, and the optimal solution for fuzzy Markov decision processes

is found from the optimal solution of the corresponding usual Markov decision processes. In the end of the

paper, several examples are given to illustrate the theory developed: a model of inventory system, and two

others more in an economic and financial context.

1 INTRODUCTION

In various applied areas, such as engineering, opera-

tions research, economics, finance, and artificial in-

telligence, among others, the data required to propose

a mathematical model present ambiguity, vagueness

or approximate characteristics of the problem of in-

terest (see, for instance, (Fakoor et al., 2016), (Efendi

et al., 2018)). Under this context, it is possible to find

in the literature the approach of fuzzy numbers to in-

corporate this kind of characteristics or assertions to

mathematical models. The basic theory on the sub-

ject of fuzzy numbers was proposed by L. Zadeh in

his seminal article written in 1965, which is entitled:

“Fuzzy Sets” (Zadeh, 1965). Subsequently, various

research articles and texts referring to the fuzzy the-

ory can be found in the literature on the subject, more-

over, it is possible to locate extensions of the theory in

other fields of mathematical sciences, such as control

theory, see (Driankov et al., 2013).

In this manuscript, the authors provide a Markov

decision process (MDP, in plural MDPs) with a finite

state space, compact action sets and fuzzy character-

istics in its payoff or reward function. The idea is the

following: a crisp Markov control model (MCM) is

considered, that is, an MCM of the type that has been

analyzed in (Hern

´

andez-Lerma, 1989), with reward R

as a basis, and a new MCM is induced changing only

R for a reward function with fuzzy values. Specifi-

cally, the authors assume that the fuzzy reward func-

tion is triangular. This way, the fuzzy control prob-

lem consists of determining a control policy that max-

imizes the expected total discounted fuzzy reward,

where the maximization is made with respect to the

partial order on the α-cuts of fuzzy numbers.

It is important to mention that triangular fuzzy

numbers have been extensively studied and applied in

fuzzy control (Pedrycz, 1994). Furthermore, the tri-

angular fuzzy numbers could be used to approximate

an arbitrary fuzzy number (see (Ban, 2009) and (Zeng

and Li, 2007)).

The methodology that is followed in this article

to guarantee the existence of optimal policies in the

fuzzy problem consists in applying the existence of

optimal policies and the validity of dynamic program-

ming for the crisp control problem, as well as certain

properties of the fuzzy triangular numbers.

To illustrate the theory developed several exam-

ples are given: a model of inventory system, and two

more in an economic and financial context.

In a short summary, the main contribution of the

Carrero-Vera, K., Cruz-Suárez, H. and Montes-de-Oca, R.

Discounted Markov Decision Processes with Fuzzy Rewards Induced by Non-fuzzy Systems.

DOI: 10.5220/0010231400490059

In Proceedings of the 10th International Conference on Operations Research and Enterprise Systems (ICORES 2021), pages 49-59

ISBN: 978-989-758-485-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

49

article is to present an extension of the standard dis-

counted MDPs to discounted MDPs with fuzzy re-

wards. In a general way, a fuzzy reward considered

models the fact that a non-fuzzy reward is “approxi-

mately” received (in a fuzzy sense), and it is obtained

that the optimal control of the fuzzy MDP coincides

with the optimal control of the non-fuzzy one and the

optimal value function for the fuzzy MDP is “approx-

imately” (in a fuzzy sense) the optimal value function

of the non-fuzzy MDP (see Theorem 4.6 and Remark

4.7, below).

Research works related to the topic developed

here are the following: (Kurano et al., 2003) and

(Semmouri et al., 2020). In (Kurano et al., 2003)

a fuzzy control problem with finite state and action

spaces is examined. Under this same context, (Sem-

mouri et al., 2020) presents the problem of maximiz-

ing the total expected discounted reward through the

use of ranking functions.

The paper is organized as follows. Section 2

presents the basic results about fuzzy numbers (arith-

metic, metric, order, among others) as well as the

notation used in subsequent sections. The following

section presents a sketch of definitions and results re-

garding the control problem under the criterion of ex-

pected total discounted reward for both, finite and in-

finite horizons. Section 4 presents the main results

of the paper. In this section the theory on the fuzzy

control problem is studied under the criterion of a to-

tal expected discounted reward. Finally, in Sections

5 and 6 examples to illustrate the theory developed

are given. One of them refers to an inventory con-

trol system considered in a fuzzy environment; this

example is taken into account with a finite planning

horizon. The other two examples refer to finance and

economics issues addressed in (Webb, 2007) for the

crisp versions, and then the respective fuzzy versions

are given in this document. Both examples contem-

plate an infinite horizon.

2 BASIC THEORY OF FUZZY

NUMBERS

In this section definitions and results about the fuzzy

theory are presented. The fuzzy set theory was pro-

posed by Zadeh in 1965 (Zadeh, 1965), an interesting

feature of using a fuzzy approach is that it allows the

use of linguistic variables such as: low, very, high,

advisable, highly risky, etc. The following definition

describes the concept of a fuzzy number.

Definition 2.1. Let Θ be a non-empty set. Then a

fuzzy set A on Θ is defined in terms of the member-

ship function µ, which assigns to each element of Θ

a real value from the interval [0,1]. Consequently a

fuzzy set A can be expressed as a set of ordered pairs:

{(x,µ(x)) : x ∈ Θ}.

The value µ(x) in the previous definition repre-

sents the degree to which the element x verifies the

characteristic property of a set A ⊂ Θ. Then, using

the membership function, a fuzzy number can be de-

fined as follows.

Definition 2.2. A fuzzy number A is a fuzzy set de-

fined on the real numbers R characterized by means

of a membership function µ, µ : R −→ [0,1],

µ(x) =

0, x ≤ a

l(x), a < x ≤ b

1, b < x ≤ c

r(x), c < x ≤ d

0, d < x,

(1)

where a,b,c, and d are real numbers, l is a non-

decreasing function and r is a non-increasing func-

tion. The functions l and r are called the left and right

side of fuzzy number A, respectively.

In the manuscript the following class of fuzzy

numbers are considered.

Definition 2.3. A fuzzy number A is called a triangu-

lar fuzzy number if its membership function has the

following form:

µ(x) =

0, x < a

x − a

β − a

, a ≤ x ≤ β

γ − x

γ − β

, β ≤ x ≤ γ

0, x > γ,

(2)

i.e. making l(x) =

x − a

β − a

and r(x) =

γ − x

γ − β

in (1),

where a, γ and β are real numbers such that a < β < γ.

In the subsequent sections, a triangular fuzzy number

is denoted by µ = (a,β,γ).

The next example shows a triangular fuzzy num-

ber.

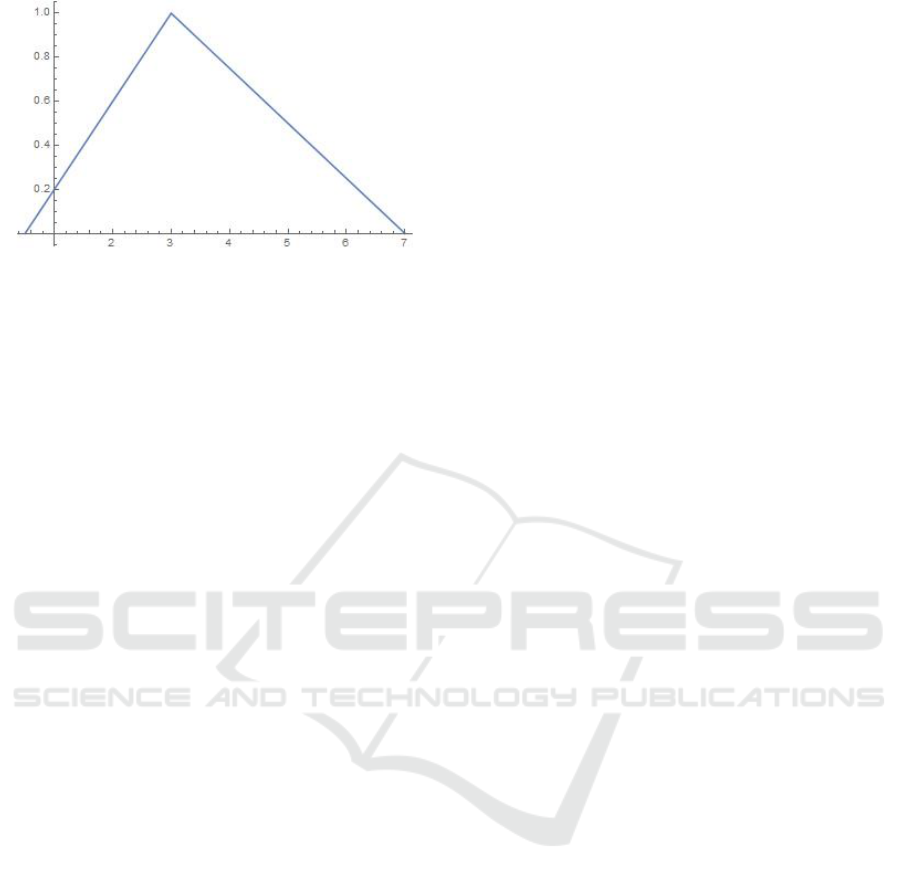

Example 2.4. Figure 1 illustrates a graphical rep-

resentation of the triangular fuzzy number A =

(1/2,3,7).

Definition 2.5. Let A be a fuzzy number with a mem-

bership function µ and let α be a real number of the

interval [0,1]. Then the α-cut of A, denoted by µ

α

, is

defined to be the set {x ∈ Θ : µ(x) ≥ α}.

Remark 2.6. a) Equivalently to Definition 2.2, a

fuzzy number is a fuzzy set with a normal mem-

bership function, i.e. there exists x ∈ Θ such that

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

50

Figure 1: A triangular fuzzy number.

µ(x) = 1 (Klir and Yuan, 1996). Let F(R) denote

the set of all fuzzy numbers.

b) According to Definition 2.2 and Definition 2.5,

for a fuzzy number A, its α-cut set, µ

α

=

[A

−

(α),A

+

(α)] is a closed interval, where

A

−

(α) = inf{x : µ

A

(x) ≥ α} and A

+

(α) = sup{x :

µ

A

(x) ≥ α}. Consequently, for each α ∈ [0,1],

(a,β,γ)

α

= [(β − a)α + a,γ − (γ − β)α] for trian-

gular fuzzy numbers.

Definition 2.7. Let ? denote any of the four basic

arithmetic operations and let A and B be fuzzy num-

bers. Then, a fuzzy set is defined on R, A ? B, by the

expression

µ

A?B

(u) = sup

u=x?y

min{µ

A

(x),µ

B

(y)}, (3)

for all u ∈ R.

A direct consequence of the previous definition is

the following result.

Lemma 2.8. If A = (a

l

,a

m

,a

u

) and B = (b

l

,b

m

,b

u

)

are two triangular fuzzy numbers, then the basic op-

erators for triangular fuzzy numbers are as it follows,

a) A ⊕ B = (a

l

+ b

l

,a

m

+ b

m

,a

u

+ b

u

);

b) A B = (a

l

− b

u

,a

m

− b

m

,a

u

− b

l

);

c) A ⊗ B = (min{a

l

b

l

,a

l

b

u

,a

u

b

l

,a

u

b

u

},a

m

b

m

,

max{a

l

b

l

,a

l

b

u

,a

u

b

l

,a

u

b

u

});

d) A B = (min{a

l

/b

l

,a

l

/b

u

,a

u

/b

l

,a

u

/b

u

}),

a

m

/b

m

,max{a

l

/b

l

,a

l

/b

u

,a

u

/b

l

,a

u

/b

u

}).

e) λA = (λa

l

,λa

m

,λa

u

), for each λ ≥ 0.

Let D denote the set of all closed bounded inter-

vals A = [a

l

,a

u

] on the real line R. For A,B ∈ D,

A = [a

l

,a

u

], B = [b

l

,b

u

] define

d(A,B) = max(

|

a

l

− b

l

|

,

|

a

u

− b

u

|

). (4)

It is possible to check that d defines a metric on D

and (D,d) is a complete metric space.

Furthermore, for A,B ∈ D define: A . B if and

only if a

l

≤ b

l

and a

u

≤ b

u

, where A = [a

l

,a

u

] and

B = [b

l

,b

u

]. Note that “.” is a partial order in D.

Now, define

ˆ

d : F(R) × F(R) −→ R by

ρ(µ,ν) = sup

α∈[0,1]

d(µ

α

,ν

α

), (5)

with µ,ν ∈ F(R). It is straightforward to see that ρ is

a metric in F(R) (Kurano et al., 2003).

Furthermore, for µ,ν ∈ F(R) define

µ 4 ν i f and only i f µ

α

. ν

α

(6)

with α ∈ [0,1].

Remark 2.9. Observe that “4” corresponds to a

partial order of F(R). A partial order is a reflexive,

transitive and antisymmetric binary relation (Alipran-

tis and Border, 2006). In this case, (F(R),4) is a par-

tially ordered set or poset. Moreover, if ˜x satisfies that

x 4 ˜x for each x ∈ F(R), then ˜x is an upper bound for

F(R). If the set of upper bounds of F(R) has a least

element, then this element is called the supremum of

F(R) (Topkis, 1998).

The proof of the following result can be consulted

in (Puri et al., 1993).

Lemma 2.10. The metric space (F(R),ρ) is com-

plete.

Definition 2.11. A sequence {l

n

} of fuzzy numbers is

said to be convergent to the fuzzy number l, written as

lim

n−→∞

l

n

= l, if for every ε > 0 there exists a positive

integer N such that ρ(l

n

,l) < ε for n > N.

The following result is an extension of Lemma 2.8

and its proof is straightforward.

Lemma 2.12. For triangular fuzzy numbers the fol-

lowing statements hold:

a) If {(a

n

l

,a

n

m

,a

n

u

) : 1 ≤ n ≤ N} where N is a positive

integer, then

N

M

n=1

(a

n

l

,a

n

m

,a

n

u

) = (

N

∑

n=1

a

n

l

,

N

∑

n=1

a

n

m

,

N

∑

n=1

a

n

u

).

b) If u

n

= {(a

n

l

,a

n

m

,a

n

u

) : 1 ≤ n} and

∑

∞

n=1

a

n

i

<

∞, i ∈ {l,m,u}, then S

n

:=

L

n

m=1

X

m

,n ≥

1, converges to the triangular fuzzy number

(

∑

∞

n=1

a

n

l

,

∑

∞

n=1

a

n

m

,

∑

∞

n=1

a

n

u

).

The next remark provides the Zadeh’s extension

principle which provides a general method for fuzzi-

fication of non-fuzzy mathematical concepts.

Remark 2.13 (Zadeh’s Extension Principle). Let L be

a function such that L : X −→ Z and let A be a fuzzy

subset of Θ with a membership function µ. Zadeh’s

extension of L is the function

ˆ

L which, applied to A

Discounted Markov Decision Processes with Fuzzy Rewards Induced by Non-fuzzy Systems

51

gives the fuzzy subset

ˆ

L(A) of Z with the membership

function given by

ˆµ(z) =

sup

x∈L

−1

(z)

µ(x), L

−1

({z}) 6= ∅

0, L

−1

({z}) = ∅.

(7)

Observe that, if A is a fuzzy subset of Θ, with the mem-

bership function µ, and if L is bijective, then the mem-

bership function of

ˆ

L(A) is given as follows

ˆµ(z) = sup

{x:L(x)=z}

µ(x)

= sup

{x∈L

−1

(z)}

µ(x)

= µ(L

−1

(z)).

Now, a fuzzy random variable will be defined. In this

case, the definition proposed in (Puri et al., 1993) will

be adopted.

Definition 2.14. Let (Ω, F ) be a measurable space

and (R, B(R)) be the measurable space of the real

numbers. A fuzzy random variable is a function

˜

X :

Ω −→ F(R) such that for all (α,B) ∈ [0,1] × B (R),

{ω ∈ Ω :

˜

X

α

∩ B 6= ∅} ∈ F . Equivalently,

˜

X must be

viewed as a generalized interval with a membership

function µ and α-cut: X(ω)

α

= [X

−

(ω),X

+

(ω)].

Definition 2.15. Let (Ω,F ,P) be a probability space

and let

˜

X be a discrete fuzzy random variable with

the range { ˜s

1

, ˜s

2

,..., ˜s

l

} ⊆ F(R). The mathematical

expectation of

˜

X is a fuzzy number, E(

˜

X), such that

E(

˜

X) =

l

M

i=1

˜s

i

P(

˜

X = ˜s

i

). (8)

A proof of the following result should be consulted in

(Puri et al., 1993).

Lemma 2.16. Let

˜

X and

˜

Y be discrete fuzzy random

variables with finite range. Then

a) E[

˜

X] ∈ F(R).

b) E[

˜

X +

˜

Y ] = E[

˜

X] + E[

˜

Y ].

c) E[λ

˜

X] = λE[

˜

X], λ ≥ 0.

3 DISCOUNTED MARKOV

DECISION PROCESSES WITH

FUZZY REWARD FUNCTIONS

In this section the theory on Markov decision pro-

cesses necessary for this article is introduced. This

kind of processes are used to model dynamic systems

in a discrete time. Firstly the optimal control prob-

lem with a crisp reward is presented, later the reward

function is changed by a fuzzy reward function and

the new optimal control problem is given.

3.1 Markov Decision Models

Detailed literature on the theory of Markov deci-

sion processes can be consulted in the references:

(Hern

´

andez-Lerma, 1989) and (Puterman, 1994).

A Markov decision model is characterized by the

following five-tuple:

M := (X,A,{A(x) : x ∈ X}, Q, R), (9)

where

a) X is a finite set, which is called the state space.

b) A is a Borel space, A is denominated the control

or action space.

c) {A(x) : x ∈ X} is a family of nonempty subsets

A(x) of A, whose elements are the feasible ac-

tions.

c) Q is the transition law, which is a stochastic ker-

nel on X given K := {(x,a) : x ∈ X ,a ∈ A(x)}, K is

denominated the set of feasible state-actions pairs.

d) R : K −→ R is the one-step reward function.

Now, given a Markov control Model M, the concept

of policy will be introduced. A policy is a sequence

π = {π

t

: t = 0,1,...} of stochastic kernels π

t

on the

control set A given the history H

t

of the process up to

time t, where H

t

:= K × H

t−1

,t = 1, 2,... and H

0

=

X. The set of all policies will be denoted by Π. A

deterministic Markov policy is a sequence π = { f

t

}

such that f

t

∈ F, for t = 0,1,..., where F denotes the

set of functions f : X −→ A such that f (x) ∈ A(x),

for all x ∈ X. A Markov policy π = { f

t

} is said to be

stationary if f

t

is independent of t, i.e., f

t

= f ∈ F, for

all t = 0, 1, .... In this case, π is denoted by f and F is

denominated the set of stationary policies.

Let (Ω,F ) be the measurable space consisting

of the canonical sample space Ω = H

∞

:= (X ×

A)

∞

and F be the corresponding product σ-algebra.

The elements of Ω are sequences of the form ω =

(x

0

,a

0

,x

1

,a

1

,...) with x

t

∈ X and a

t

∈ A for all t =

0,1,.... The projections x

t

and a

t

from Ω to the sets

X and A are called state and action variables, respec-

tively.

Let π = {π

t

} be an arbitrary policy and µ be an

arbitrary probability measure on X called the initial

distribution. Then, by the theorem of C. Ionescu-

Tulcea (Hern

´

andez-Lerma, 1989), there is a unique

probability measure P

π

µ

on (Ω,F ) which is supported

on H

∞

, i.e., P

π

µ

(H

∞

) = 1. The stochastic process

(Ω,F , P

π

µ

,x

t

) is called a discrete-time Markov control

process or a Markov decision process.

The expectation operator with respect to P

π

µ

is de-

noted by E

π

µ

. If µ is concentrated at the initial state

x ∈ X, then P

π

µ

and E

π

µ

are written as P

π

x

and E

π

x

, re-

spectively.

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

52

The transition law of a Markov control process

(see 9) is often specified by a difference equation of

the form

x

t+1

= F(x

t

,a

t

,ξ

t

), (10)

t = 0, 1,2,..., with x

0

= x ∈ X known, where {ξ

t

} is

a sequence of independent and identically distributed

(i.i.d.) random variables with values in a finite space

S and a common distribution ∆, independent of the

initial state x

0

. In this case, the transition law Q is

given by

Q(B|x,a) = E[I

B

(F(x,a,ξ))],

B ⊆ X, (x,a) ∈ K, E is the expectation with respect to

distribution ∆, ξ is a generic element of the sequence

{ξ

t

} and I

B

(·) denotes the indicator function of the set

B.

Definition 3.1. Let (X ,A,{A(x) : x ∈ X },Q,R) be a

Markov model, then the expected total discounted re-

ward is defined as follows:

v(π,x) := E

π

x

"

∞

∑

t=0

β

t

R(x

t

,a

t

)

#

, (11)

π ∈ Π and x ∈ X, where β ∈ (0,1) is a given discount

factor. Furthermore, the T -stage expected total dis-

counted reward, for each x ∈ X and π ∈ Π, is defined

as follows:

v

T

(π,x) := E

π

x

"

T −1

∑

t=0

β

t

R(x

t

,a

t

)

#

, (12)

where T is a positive integer.

Definition 3.2. The optimal value function is defined

as

V (x) := sup

π∈Π

V (π,x), (13)

x ∈ X. Then the optimal control problem is to find a

policy π

∗

∈ Π such that

v(π

∗

,x) = V (x),

x ∈ X, in which case, π

∗

is said to be the optimal pol-

icy. Similar definitions can be stated analogously for

v

T

. In this case, V

T

denotes the optimal value func-

tion.

Assumption 3.3. a) For each x ∈ X , A(x) is a com-

pact set on B(A), where B(A) is the Borel σ-

algebra of space A.

b) The reward function R is a non negative and

bounded function.

c) For every x,y ∈ X, the mappings a 7→ R(x,a) and

a 7→ Q(y|x, a) are continuous in a ∈ A(x).

The proof of the following theorem can be con-

sulted in (Hern

´

andez-Lerma, 1989).

Theorem 3.4 (Dynamic Programming). Under As-

sumption 3.3 the following statements hold:

a) Define W

T

(x) = 0 and for each n = T − 1, ..., 1, 0,

consider

W

n

(x) = max

a∈A(x)

{R(x,a) + βE[W

n+1

(F(x,a,ξ))]}.

(14)

x ∈ X. Then for each n = 0, 1, ..., T −1 there exists

f

n

∈ F such that

W

n

(x) = R(x, f

n

(x)) + βE[W

n+1

(F(x, f

n

(x),ξ))],

x ∈ X. In this case, π

∗

= { f

0

,..., f

T −1

} is a Marko-

vian optimal policy and v

T

(π

∗

,x) = W

0

(x), x ∈ X .

b) The optimal value function V , satisfies the follow-

ing dynamic programming equation:

V (x) = max

a∈A(x)

{R(x,a)+βE[V (F(x,a,ξ))]}, (15)

x ∈ X.

c) There exists a policy f

∗

∈ F such that the control

f

∗

(x) ∈ A(x) attains the maximum in (15), i.e. for

all x ∈ X,

V (x) = R(x, f

∗

(x)) + βE[V (F(x, f

∗

(x),ξ))].

(16)

d) Define the value iteration functions as follows:

V

n

(x) = min

a∈A(x)

{

c(x,a) + βE[V

n−1

(F(x, f

∗

(x),ξ))]

}

,

(17)

for all x ∈ X and n = 1,2,. . ., with V

0

(·) = 0. Then

the value iteration functions converge point-wise

to the optimal value function V , i.e.

lim

n→∞

V

n

(x) = V (x),

x ∈ X.

3.2 Objective Functions

Consider a Markov decision model M = (X,A,{A(x) :

x ∈ X },Q,

˜

R), where the first four components are the

same as in the model given in (9). The fifth compo-

nent corresponds to a fuzzy reward function on K.

The evolution of a stochastic fuzzy system is as

follows: if the system is in the state x

t

= x ∈ X at time

t and the control a

t

= a ∈ A(x) is applied, then two

things happen:

a) a fuzzy reward

˜

R(x,a) is obtained.

b) the system jumps to the next state x

t+1

according

to the transition law Q, i.e.

Q(B|x,a) = Prob(x

t+1

∈ B|x

t

= x,a

t

= a),

with B ⊆ X.

Discounted Markov Decision Processes with Fuzzy Rewards Induced by Non-fuzzy Systems

53

For each policy π ∈ Π and state x ∈ X , let

˜v

T

(π,x) :=

T −1

M

t=0

β

t

˜

E

π

x

˜

R(x

t

,a

t

)

, (18)

where T is a positive integer and

˜

E

π

x

is the expectation

with respect to

˜

P

π

x

and its expectation of a fuzzy ran-

dom variable is defined by (8). The expression given

in (18) is called the T -stage fuzzy reward. Further-

more, the following objective function will be consid-

ered:

˜v(π,x) :=

∞

M

t=0

β

t

˜

E

π

x

˜

R(x

t

,a

t

)

. (19)

In this way, the control problem of interest is the max-

imization of the finite/infinite horizon expected total

discounted fuzzy reward (see (18) and (19), respec-

tively). In the next section it will be proved that (18)

converges to the objective function (19) with respect

to the metric ρ (see (5)). The following assumption is

considered for the reward function of fuzzy model M.

Assumption 3.5. Let B,C and D be real numbers,

such that 0 < B < C < D. It will be assumed that the

fuzzy reward is a triangular fuzzy number (see Defini-

tion 2.3), specifically

˜

R(x,a) = (BR(x,a),CR(x,a),DR(x,a)) (20)

for each (x, a) ∈ K, where R : K −→ R is the reward

function of the model introduced in Section 3.1.

Remark 3.6. Observe that, under Assumption 3.5

and Lemma 2.12, the T -stage fuzzy reward (18) is a

triangular fuzzy number.

4 OPTIMAL CONTROL

PROBLEM WITH FUZZY

REWARDS

In this section results will be presented which refer

to the convergence of the T -stage fuzzy reward (18)

to the infinite horizon expected total discounted fuzzy

reward (19). Later, the existence of optimal policies

and validity of dynamic programming will be verified.

Lemma 4.1. For each π ∈ Π and x ∈ X,

lim

T −→∞

ρ( ˜v

T

, ˜v) = 0,

where ρ is the Hausdorff metric (see (5)).

Proof. Let π ∈ Π and x ∈ X fixed. To simplify the

notation in this proof v = v(π, x) and v

T

= v

T

(π,x)

will be denoted. Then, according to (18) and (20) the

α-cut of the fuzzy reward function, is given by

∆

T

: = (Bv

T

,Cv

T

,Dv

T

)

α

= [B(1 − α)v

T

+ αCv

t

,D(1 − α)v

T

+ αCv

T

].

Analogously, the α-cut of (19) is given by

∆ : = (Bv,Cv, Dv)

α

= [B(1 − α)v + αCv, D(1 − α)v + αCv].

Hence, by (5), it is obtained that

ρ(∆

T

,∆) = sup

α∈[0,1]

d(∆

T

α

,∆

α

).

Now, due to the identity max(c,b) = (c + b +

|

b − c

|

)/2 with b,c ∈ R, it yields that

d(∆

T

α

,∆

α

) = (1 − α)D(v − v

T

) + αC(v − v

T

).

Then,

ρ(∆

T

,∆) = sup

α∈[0,1]

(v − v

T

)(D − α(D −C))

= (v − v

T

)D.

(21)

Therefore, when T goes to infinity in (21), it con-

cludes that

lim

T −→∞

ρ( ˜v

T

, ˜v) = lim

T −→∞

(v − v

T

)D

= 0.

The second equality is a consequence of the domi-

nated convergence theorem (see (11) and (12)).

Definition 4.2. The optimal control fuzzy problem

consists in determining a policy π

∗

∈ Π such that

˜v(π,x) 4 ˜v(π

∗

,x),

for all π ∈ Π and x ∈ X . In consequence,

˜v(π

∗

,x) = sup

π∈Π

˜v(π,x),

for all x ∈ X (see Remark 2.9). In this case, the opti-

mal fuzzy value function is defined as follows:

˜

V (x) = ˜v(π

∗

,x),

x ∈ X and π

∗

is called the optimal policy of the fuzzy

optimal control problem. Similar definitions can be

stated for ˜v

T

, the T -stage fuzzy reward, in this case

the optimal fuzzy value is denoted by

˜

V

T

.

A direct consequence of a previous definition and

Theorem 3.4 is the next result.

Theorem 4.3. Under Assumptions 3.3 and 3.5 the fol-

lowing statements hold.

a) The optimal policy π

∗

of the crisp finite optimal

control problem (see (12)) is the optimal policy for

˜v

T

, i.e. ˜v

T

(π

∗

,x) = sup

π∈Π

˜v

T

(π,x) for all π ∈ Π

and x ∈ X.

b) The optimal fuzzy value function is given by

˜

V

T

(x) = (BV

T

(x),CV

T

(x),DV

T

(x)), (22)

x ∈ X, where

˜

V

T

(x) = sup

π∈Π

˜v

T

(π,x), x ∈ X.

Theorem 4.4. Under Assumptions 3.3 and 3.5 the fol-

lowing statements hold:

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

54

a) The optimal policy of the fuzzy control problem

is the same as the optimal policy of the optimal

control problem.

b) The optimal fuzzy value function is given by

˜

V (x) = (BV (x),CV (x),DV (x)), x ∈ X . (23)

Proof. a) Let π ∈ Π and x ∈ X be fixed. First, ob-

serve that (19) is equivalent to

˜v(π,x) := (Bv(π, x),Cv(π, x), Dv(π, x)),

as a consequence of Assumption 3.5. Then, the

α-cut of ˜v(π,x) is given by

˜v(π,x)

α

= [Bv(π,x) + α(C − B)v(π,x),Dv(π,x)+

α(D −C)v(π,x)].

Now, by Theorem 3.4, there exists f

∗

∈ F such

that

Bv(π,x) + α(C − B)v(π,x) ≤ Bv( f

∗

(x),x)+

α(C − B)v( f

∗

(x),x),

Bv(π,x) + α(D −C)v(π,x) ≤ Dv( f

∗

(x),x)+

α(D −C)v( f

∗

(x),x)

and since x ∈ X and π ∈ Π are arbitrary, the result

follows, due to Definition 4.2.

b) By Theorem 4.4 a), it follows that

˜

V (x) = (Bv( f

∗

(x),x),Cv( f

∗

(x),x),Dv( f

∗

(x),x)),

for each x ∈ X, thus applying Theorem 3.4, it is

concluded that

˜

V (x) = (BV (x),CV (x),DV (x)), x ∈ X .

It is important to observe that Assumption 3.5 could

be changed for the following one:

Assumption 4.5. Let B and D be real numbers, such

that 0 < B < R(x,a) < D for all x ∈ X and a ∈ A(x). It

will be assumed that the fuzzy reward is a triangular

fuzzy number of the type:

˜

R(x,a) = (B,R(x,a),D) (24)

for each (x, a) ∈ K, where R : K −→ R is the reward

function of the model introduced in Section 3.1.

Note that it is possible to prove with similar ideas to

the ones given in the proof of Theorem 3.5 the follow-

ing result:

Theorem 4.6. Under Assumptions 3.3 and 4.5 the fol-

lowing statements hold:

a) The optimal policy of the fuzzy control problem

is the same as the optimal policy of the non-fuzzy

optimal control problem.

b) The optimal fuzzy value function is given by

˜

V (x) = (

B

1 − β

,V (x),

D

1 − β

), (25)

x ∈ X.

Remark 4.7. Using Theorem 4.6, the main interpre-

tation of the fuzzy extension presented here is ob-

tained: the original non- fuzzy reward R is substi-

tuted by the fuzzy reward

˜

R(·,·) = (B,R(·,·), D) which

modelled the fact that “approximately” R, measured

in a fuzzy sense is gotten, and it is deduced that the

optimal control of the fuzzy MDP coincides with the

optimal control of the non-fuzzy one and the optimal

value function for the fuzzy MDP is “approximately”

(in a fuzzy sense) the optimal value function of the

non-fuzzy MDP.

5 A FUZZY INVENTORY

CONTROL SYSTEM

In this section, first a classical example of inventory

control system (Puterman, 1994) will be presented,

later a triangular fuzzy inventory control system will

be introduced. The optimal solution of the fuzzy

inventory is obtained by an application of Theorem

4.3 and the solution of the crisp inventory system.

The following example is addressed in (Puterman,

1994), below there is a summary of the points of

interest to introduce its fuzzy version. Consider

the following situation, in a warehouse where every

certain period of time the manager carries out an

inventory to determine the quantity of product stored.

Based on such information, a decision is made

whether or not to order a certain amount of additional

product from a supplier. The manager’s goal is

to maximize the profit obtained. The demand for

the product is assumed to be random with known

probability distribution. The following assumptions

will be treated to propose the mathematical model.

Inventory Assumptions.

a) The decision to additional order is made at the

beginning of the period and is delivered immedi-

ately.

b) Product demands are received throughout the pe-

riod of time but are fulfilled in the last instant of

the time of the period.

c) There are no unfilled orders.

c) Revenues and the distribution of demand do not

vary with the period.

Discounted Markov Decision Processes with Fuzzy Rewards Induced by Non-fuzzy Systems

55

d) The product is only sold in whole units.

e) The warehouse has a capacity for M units, where

M is a positive integer.

Then, under previous assumption, the state space is

given by X := {0,1,2,..., M}, the action space and ad-

missible action set are given by A := {0, 1, 2, ...} and

A(x) := {0, 1,2,...,M − x}), x ∈ X, respectively.

Now, consider the following variables: let x

t

de-

note the inventory at time t = 0,1,..., the evolution

of the system is modeled by the following dynamic

system Lindley kind:

x

t+1

= (x

t

+ a

t

− D

t+1

)

+

, (26)

with x

0

= x ∈ X known, where

a) a

t

denotes the control or decision applied in the

instant t and it represents the quantity ordered by

the inventory manager (or decision maker).

b) The sequence

{

D

t

}

is conformed by indepen-

dent and identically distributed non-negative ran-

dom variables with common distribution p

j

:=

P(D = j), j = 0,1,..., where D

t

denotes the de-

mand within the period of time t.

Observe that the difference equation given in (26) in-

duces a stochastic kernel defined on X given K :=

{

(x,a) : x ∈ X ,a ∈ A(x)

}

, as follows

Q(X

t+1

∈ (−∞, y])|X

t

= x,a

t

= a) = 1 − ∆(x + a − y),

where ∆ is the distribution of D with x ∈ X, y, a ∈

{0,1,...} and Q(X

t+1

∈ (−∞,y])|X

t

= x,a

t

= a) = 0,

if x ∈ X, a ∈ {0, 1, ...} and y < 0. Then it follows that

Q(X

t+1

= y|x,a) =

0 i f M ≥ y > x + a

p

x+a−y

i f M ≥ x + a ≥ y > 0

q

x+a

i f M ≥ x + a, y = 0

The step reward function is given by R(x,a) =

E[H(x + a − (x + a − D)

+

)], (x,a) ∈ K, where H :

{0,1,...} → {0,1,...} is the revenue function, which

is a known function and D is a generic element of

the sequence {D

t

}. Equivalently, R(x,a) = F(x + a),

(x,a) ∈ K, where

F(u) :=

u−1

∑

k=0

H(k)p

k

+ H(u)q

u

, (27)

with q

u

:=

∑

∞

k=u

p

k

. The objective in this section is

to maximize the total discounted reward with a finite

horizon, see (18).

In particular, suppose that the horizon is T = 50,

the state space X = {0,1,...,10}, the revenue function

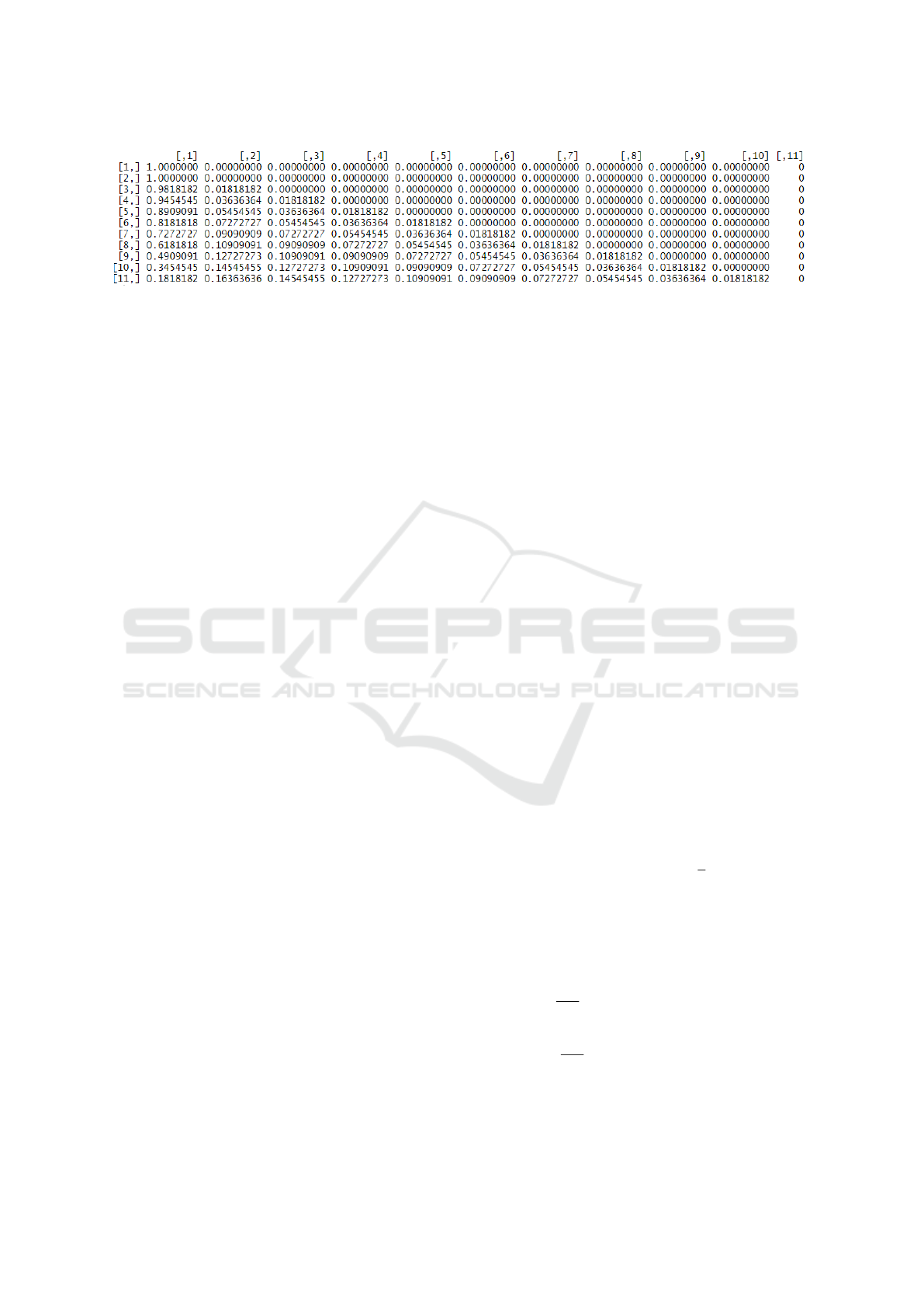

H(u) = 10u and the transition law is given in Figure

2. Then, in accordance with Theorem 4.3, which was

programmed in the statistical software R using the

next algorithm:

Algorithm: To calculate the optimal value and opti-

mal policy.

Input: MDP

Output: The optimal value vector.

An optimal policy

Initialize W

N

(x,A) = 0, W

∗

N

(x) = 0,

K

N

(x) = W

∗

N

(x).

t = N − 1

repeat

for x ∈ S do

f

x

= 0

a(x) = f

x

W (x,a(x)) = R(x,a(x))+

β

∑

Z

i=0

Q(y|x + a(x))W

t+1

(y, 0)

A(x) = 1,...,M − x

for a ∈ A(x) do

W

t

(x,a) = R(x, a)+

β

∑

Z

y=0

Q(y|x + a)W

t+1

(y, 0)

if W

t

(x,a) ≥ W (x,a(x)) do

W (x,a(x)) = W

t

(x,a)

f

x

= a

end for

W

t

(x) = W

t

(x, f

x

)

W

t

(x,0) = W

t

(x)

if W

t

(x) ≥ K

t+1

(x) do

K

t

(x) = W

t

(x)

W

∗

(x) = K

t

(x)

end for

t = n − 1

until t = 0

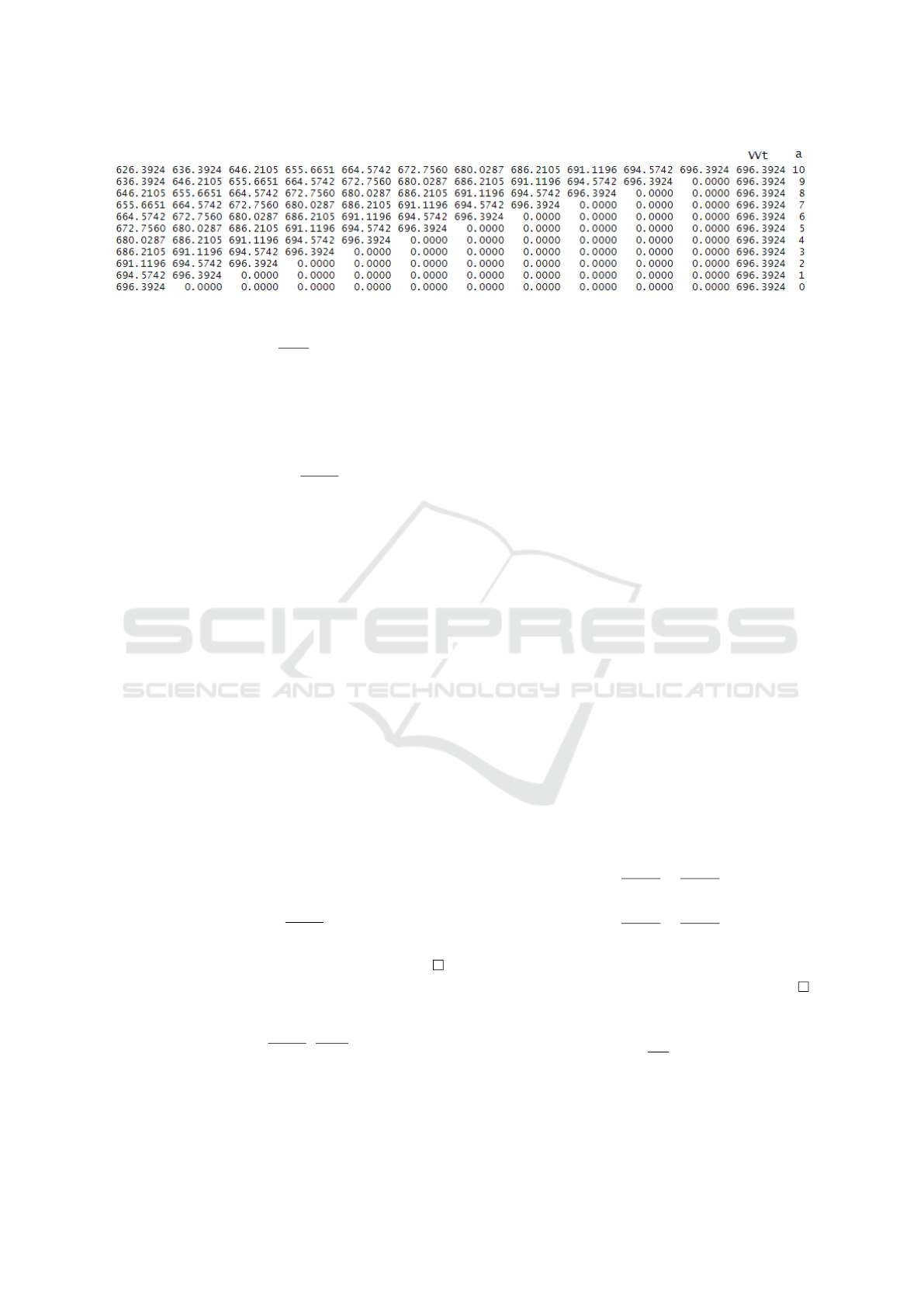

In consequence, the output of the program is obtained

as illustrated in Figure 3. In this matrix the last col-

umn represents the optimal policy and the penulti-

mate column the value function, for each state x ∈

{0,1,..., 10}. The other input of the matrix represents

the following:

G(x,a) := R(x, a) + αE[W

1

(F(x,a,D))],

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

56

Figure 2: Transition law.

(x,a) ∈ K.

In conclusion, the optimal value function is

V

T

(x) = 693.39 for each x ∈ X and the optimal pol-

icy is given by f (x) = M − x, x ∈ X with M = 10.

Now, considering that in operations research it is

often difficult for a manager to control inventory sys-

tems, due to the fact that data in each stage of ob-

servation is not always is certain, then a fuzziness

approach should be applied. In this way, take into

account the previous inventory system in a fuzzy en-

vironment, that is, the reward function given in As-

sumption 3.5 will be considered:

˜

R(x,a) = (BR(x,a),CR(x,a),DR(x,a)),

with 0 < B < C < D. Then, by Theorem 4.3, it follows

that the optimal policy of the fuzzy optimal control

problem is given by

˜

π

∗

= { f

0

,..., f

T −1

},

where f

t

(x) = M − x, x ∈ X and the op-

timal value function is given by

˜

V

T

(x) =

(BV

T

(x),CV

T

(x),DV

T

(x)), x ∈ X.

6 ECONOMIC/FINANCIAL

APPLICATIONS

In this section, two examples on applications in Eco-

nomics and Finance are presented. Firstly the crisp

model of both examples and the respective solution is

proposed. Later a fuzzy version of these problems is

introduced.

6.1 Example 1

Let X = {χ

0

,χ

1

}, 0 < χ

0

< χ

1

, A(χ) = [0,1], χ ∈ X.

The transition law is given by

Q({χ

0

}|χ

0

,a) = p, (28a)

Q({χ

1

}|χ

0

,a) = 1 − p, (28b)

Q({χ

1

}|χ

1

,a) = q, (28c)

Q({χ

0

}|χ

1

,a) = 1 − q, (28d)

for all a ∈ [0, 1], where 0 ≤ p ≤ 1 and 0 ≤ q ≤ 1. The

reward is given by a function R(χ,a), (χ, a) ∈ K that

met:

Assumption 6.1. (a) R depends only of a, that is

R(χ,a) = U (a), for all (χ,a) ∈ K, where U is non-

negative and continuous.

(b) There is a

∗

∈ [0,1] such that

max

a∈[0,1]

U(a) = U (a

∗

), (29)

for all χ ∈ X.

An interpretation of this example is given in the fol-

lowing remark.

Remark 6.2. The states χ

0

and χ

1

could represent

the behavior of a certain stock market, which is bad

(≡ χ

0

) and good (≡ χ

1

). It is assumed that , for each

a and t = 0, 1, · ··, the probability of going from χ

0

to

χ

0

is p (resp. the probability of going from χ

0

to χ

1

is

1− p); moreover, for each a and t = 0,1,···, the prob-

ability of going from χ

1

to χ

1

is q (resp. the probabil-

ity of going from χ

1

to χ

0

is 1 − q). Now, specifically,

suppose that in a dynamic portfolio choice problem,

two assets are available to an investor. One is risky-

free, and the risk-rate r > 0 is assumed known and

constant over time. The other asset is risky with

a stochastic return having mean µ and a variance

σ

2

. Following Example 1.24 in (Webb, 2007), the ex-

pected utility of the investor could be given for the

expression:

U(a) = aµ + (1 − a)r −

k

2

a

2

σ

2

, (30)

where a ∈ [0,1] is the fraction of its money that the

investor invests in the risky asset and the remainder

1 − a, he/she invests in the riskless asset. In (30),

k represents the value that the investor places on

the variance relative to the expectation. Observe

that if µ >

kσ

2

2

, then U defined in (30) is positive

in [0, 1] (in fact, in this case U(0) = r > 0 and

U(1) = µ −

kσ

2

2

> 0 ); moreover, it is possible to

prove (see (Webb, 2007)) that if 0 < µ − r < kσ

2

, then

max

a∈[0,1]

U(a) is attained for a

∗

∈ (0,1) given by

Discounted Markov Decision Processes with Fuzzy Rewards Induced by Non-fuzzy Systems

57

Figure 3: V

0

state-action matrix.

a

∗

=

µ − r

kσ

2

. (31)

Hence, taking R(χ,a) = U (a), χ ∈ X , and a ∈ [0,1],

where U is given by (30), and considering the last two

inequalities given in the previous paragraph, Assump-

tion 6.1 holds.

Lemma 6.3. Suppose that Assumption 6.1 holds.

Then, for Example 2, V (χ) =

U(a

∗

)

1 − α

and f

∗

(χ) = a

∗

,

for all χ ∈ X.

Proof. Firstly, the value iteration functions will be

found: V

n

, for n = 1,2,....

By definition,

V

1

(χ

0

) = max

a∈[0,1]

U(a), (32)

this implies that V

1

(χ

0

) = U (a

∗

). In a similar way, it

is possible to obtain that V

1

(χ

1

) = U(a

∗

).

Now, for n = 2,

V

2

(χ

0

) = max

a∈[0,1]

{

U(a) + β[V

1

(χ

1

)(1 − p) +V

1

(χ

0

)p]

}

= U (a

∗

) + β[V

1

(χ

1

)(1 − p) +V

1

(χ

0

)p]

= U (a

∗

) + β[U(a

∗

)(1 − p) +U (a

∗

)p]

= U (a

∗

) + βU(a

∗

).

Analogously, V

2

(χ

1

) = U(a

∗

) + βU(a

∗

). Continuing

this way, it is obtained that

V

n

(χ

0

) =V

n

(χ

0

) =U(a

∗

)+βU(a

∗

)+.. .+β

n−1

U(a

∗

),

(33)

for all n = 1,2,....

By Theorem 3.4 d), V

n

(χ) → V (χ), n → ∞, χ ∈ X,

which implies that V (χ) =

U(a

∗

)

1 − β

, χ ∈ X. And, from

the Dynamic Programming Equation (see (15)), it fol-

lows that f

∗

(χ) = a

∗

, for all χ ∈ X.

Lemma 6.4. For the fuzzy version of Example 2, fol-

lowing Theorem 4.6, it results that

e

V (χ) =

0,

U(a

∗

)

1 − β

,

D

1 − β

,

χ ∈ X, with

˜

R(x,a) = (0,U(a),D), χ ∈ X , a ∈ A(χ),

where D > U(a

∗

) and f

∗

(χ) = a

∗

, for all χ ∈ X.

6.2 Example 2

Let X = {χ

0

,χ

1

}, 0 < χ

0

< χ

1

, A(χ) = [0,χ], χ ∈ X.

The transition law is given by

Q({χ

1

}|χ

0

,a) = 1, (34a)

Q({χ

0

}|χ

1

,a) = 1, (34b)

for all χ ∈ X and a ∈ [0,χ].

For this example, consider a person who will have

some kind of resource available to him/her at each pe-

riod of time; he/she will receive a profit depending on

the amount of resource consumed. Then, χ

0

and χ

1

are the amounts available to the person at each time

t. The reward R will be specified in Assumption 6.5

below.

Assumption 6.5. R is given by

R(χ,a) = U(a) = a

γ

, (35)

a ∈ [0,χ], χ ∈ X and 0 < γ < 1. Observe that U is

non-negative, concave and continuous (taking, as it is

common U(0) = 0), and that

max

a∈[0,χ]

U(a) = U (χ) = χ

γ

, (36)

for all χ ∈ X.

Lemma 6.6. Suppose that Assumption 6.5 holds.

Then, for Example 3,

V (χ

0

) =

χ

γ

0

1 − β

2

+

βχ

γ

1

1 − β

2

, (37a)

V (χ

1

) =

χ

γ

1

1 − β

2

+

βχ

γ

0

1 − β

2

, (37b)

and f

∗

(χ) = χ, for all χ ∈ X.

Proof. Similar to the proof of Lemma 6.3.

Lemma 6.7. For the fuzzy version of Ex-

ample 3, following Theorem 4.6, it results

that

e

V (χ) = (0,V(χ),

D

1−β

), χ ∈ X, with

˜

R(χ,a) = (0,U(a),D), χ ∈ X, a ∈ A(χ), where

D > max{χ

γ

1

,χ

γ

2

} and f

∗

(χ) = χ, for all χ ∈ X.

ICORES 2021 - 10th International Conference on Operations Research and Enterprise Systems

58

7 CONCLUSION

In this article, Markov decision processes were stud-

ied under the total expected discounted reward crite-

rion and considering for each of them a fuzzy reward

function, specifically of the triangular type. These

processes were induced from crisp processes taking

into account some of their properties to cause certain

properties in the fuzzy case, and the main interpreta-

tion of them is given in Theorem 4.6 and Remark 4.7.

The theory was illustrated by three interesting exam-

ples from applied areas, as operations research, eco-

nomics, and finance. Future work in the direction of

this paper consists in applying the methodology used

to other criteria of optimality such as the average case

or the risk-sensitive criterion. Moreover, it is possi-

ble to contemplate the extension to another class of

fuzzy payment function, for example, to trapezoidal

numbers.

REFERENCES

Aliprantis, C. D. and Border, K. (2006). Infinite dimen-

sional analysis. Springer.

Ban, A. I. (2009). Triangular and parametric approxima-

tions of fuzzy numbers inadvertences and corrections.

Fuzzy Sets and Systems, 160(21):3048–3058.

Driankov, D., Hellendoorn, H., and Reinfrank, M. (2013).

An introduction to fuzzy control. Springer Science &

Business Media.

Efendi, R., Arbaiy, N., and Deris, M. M. (2018). A new

procedure in stock market forecasting based on fuzzy

random auto-regression time series model. Informa-

tion Sciences, 441:113–132.

Fakoor, M., Kosari, A., and Jafarzadeh, M. (2016). Hu-

manoid robot path planning with fuzzy Markov deci-

sion processes. Journal of Applied Research and Tech-

nology, 14(5):300–310.

Hern

´

andez-Lerma, O. (1989). Adaptive Markov control

processes, volume 79. Springer Science & Business

Media.

Klir, G. J. and Yuan, B. (1996). Fuzzy sets and fuzzy

logic: theory and applications. Possibility Theory Ver-

sus Probab. Theory, 32(2):207–208.

Kurano, M., Yasuda, M., Nakagami, J.-i., and Yoshida, Y.

(2003). Markov decision processes with fuzzy re-

wards. Journal of Nonlinear and Convex Analysis,

4(1):105–116.

Pedrycz, W. (1994). Why triangular membership functions?

Fuzzy Sets and Systems, 64(1):21–30.

Puri, M. L., Ralescu, D. A., and Zadeh, L. (1993). Fuzzy

random variables. In Readings in Fuzzy Sets for Intel-

ligent Systems, pages 265–271. Elsevier.

Puterman, M. L. (1994). Markov decision processes: dis-

crete stochastic dynamic programming. John Wiley &

Sons.

Semmouri, A., Jourhmane, M., and Belhallaj, Z. (2020).

Discounted Markov decision processes with fuzzy

costs. Annals of Operations Research, pages 1–18.

Topkis, D. M. (1998). Supermodularity and complementar-

ity. Princeton university press.

Webb, J. N. (2007). Game theory: decisions, interaction

and Evolution. Springer Science & Business Media.

Zadeh, L. A. (1965). Fuzzy sets. Information and Control,

8(3):338–353.

Zeng, W. and Li, H. (2007). Weighted triangular approx-

imation of fuzzy numbers. International Journal of

Approximate Reasoning, 46(1):137–150.

Discounted Markov Decision Processes with Fuzzy Rewards Induced by Non-fuzzy Systems

59