Internal and External Factor Analysis in Bottleneck Detection in Shop

Sales: The Case of Grocery Shops in Lithuania

Detlef Hartleb

1,2

, Andreas Ahrens

1

, Ojaras Purvinis

3

, Jelena Za

ˇ

s

ˇ

cerinska

1,4

and Diana Micevi

ˇ

cien

˙

e

5

1

Hochschule Wismar, University of Technology, Business and Design, Wismar, Germany

2

ETSIST, Universidad Polit

´

ecnica de Madrid, Madrid, Spain

3

Kaunas University of Technology, Kaunas, Lithuania

4

Centre for Education and Innovation Research, Riga, Latvia

5

Panev

˙

e

ˇ

zys University of Applied Sciences, Kaunas, Lithuania

Keywords:

Buyers’ Burstiness, Cashiers’ Bottleneck, Payment Process, Buyers’ Waiting Time in the Queue to the Cash

Register, Payment Processing Time at the Cash Register.

Abstract:

The optimization of supermarket processes as well as the increase in productivity and profitability of shop sales

requires extensive knowledge of bottlenecks within the sales processes as bottlenecks limit the capacity of shop

sales. Bottlenecks refer to bursty processes in analogy to the occurrence of bit-errors in data transmission

systems. The aim of the paper is to analyse external and internal factors in shop sales underpinning the

examination of external and internal factors in shop sales based on the collected data of two supermarkets in

Lithuania. In this context, concentrated arrival of customers is identified as an external factor. By internal

factors, the buyers’ waiting time in the queue to the cash register as well as the payment processing time at the

cash register are meant. In this work the internal factors of the payment process are modelled by gap processes

where the obtained parameters such as the buyers’ concentration and the buyers’ probability allow a good

comparison of the payment related processes. This work aims at achieving customer quality improvement

through prevention of queuing. The obtained results show that the waiting time in the queue to the cash

register is quite bursty whereas the payment processing time at the cash register is quite regularly distributed.

Therefore, the conclusion can be drawn that at the cash register short periods of high activities are followed

by longer periods of inactivity.

1 INTRODUCTION

The optimization of supermarket processes as well

as the increase in productivity and profitability of

shop sales requires extensive knowledge of bottle-

necks within the sales processes. By bottlenecks, cus-

tomers that arrive at a rate that exceeds the processing

system rate are meant (Ahrens et al., 2019c). Bottle-

necks can appear due to external and internal factors.

A concentrated arrival of customers is defined as the

external factor. Buyers’ waiting time in the queue to

the cash register and the payment processing time at

the cash register are determined as the internal fac-

tors. Within the present work, by customers shop vis-

itors and buyers are meant. A shop visitor is someone

who visits the shop, but does not buy anything in this

shop, and a buyer is defined as one who has purchased

something in the shop.

Customer satisfaction is one of the key factors

strongly influencing the success or failure of a busi-

ness. It is important to track the customer satisfaction

in order to make the customers more loyal (Micevi-

ciene et al., 2018). Despite the efforts of scientists and

researchers to investigate the customer characteristics

(e.g. satisfaction, customer buying characteristic, re-

purchase behavior) (Mittal and Kamakura, 2001; Ku-

mar et al., 2016), this work is aiming to achieving

customer quality improvement through prevention of

queuing as waiting lines or queues are still a com-

mon phenomenon in life, and long waiting times at

the cash register are still an indicator of customer dis-

satisfaction.

When analyzing the customer flow through the

shop, it should be pointed out that bottlenecks can

emerge in any single process within the shop (e. g. at

the butcher station, at the bakery station or at the cash

register). Bottlenecks appear when the capacity of a

shop’s single process is less or equal than designed

Hartleb, D., Ahrens, A., Purvinis, O., Zaš

ˇ

cerinska, J. and Micevi

ˇ

cien

˙

e, D.

Internal and External Factor Analysis in Bottleneck Detection in Shop Sales: The Case of Grocery Shops in Lithuania.

DOI: 10.5220/0009983800530060

In Proceedings of the 10th International Conference on Pervasive and Parallel Computing, Communication and Sensors (PECCS 2020), pages 53-60

ISBN: 978-989-758-477-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

53

i. e. any single process, whose utilization is 100 %

or more, within the buying process chain. By buying

process chain, the customer arrival at the shop, the se-

lection of goods, the payment process which includes

both waiting in the queue to the cash register and the

payment processing at the cash register as well as the

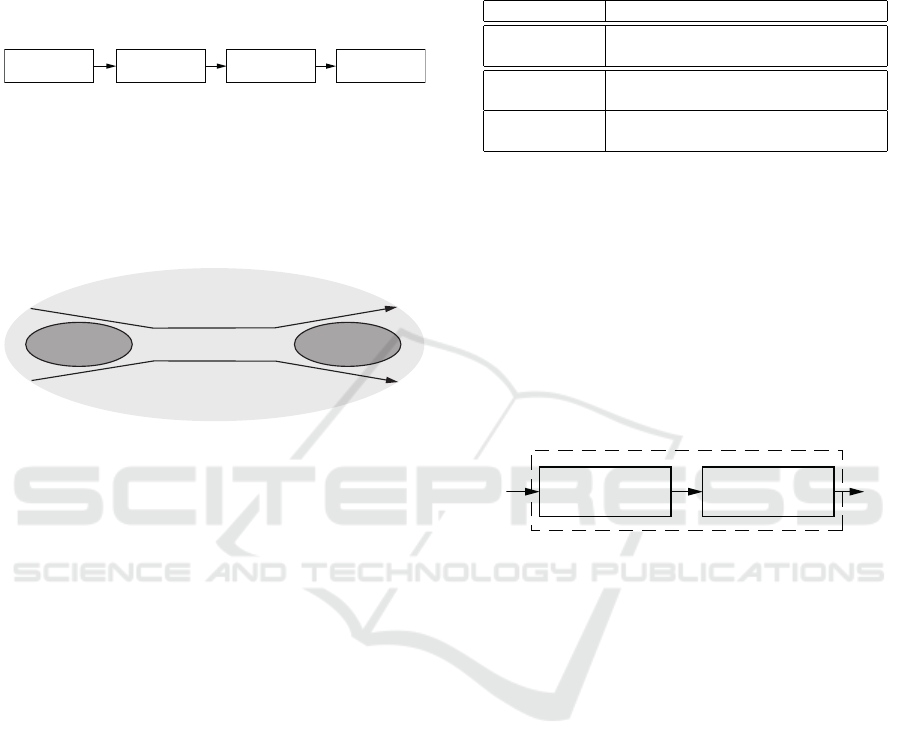

customer departure is meant (see also Fig. 1).

Phase 1:

customer arrival

Phase 2:

selection of goods

Phase 3:

payment process

Phase 4:

departure

Figure 1: Phases of the buying process chain.

Therefore, any bottleneck will halt the continuous

flow of customers throughout the shop. Fig. 2 demon-

strates a bottleneck in shop sales created by internal

and/or external factors whereas in this work the focus

is put on studying and modelling internal factors only.

Phase 1+2: Shop

Visitor/Customers

Phase 3: Bottleneck

at the cash register

Phase 4: Shop

Buyers

Figure 2: Bottleneck in shop sales when analysing the pay-

ment process according to Fig. 1.

As bottlenecks refer to bursty processes in anal-

ogy to the occurrence of bit-errors in data transmis-

sion systems or the arrival of TCP packets in com-

munication networks (Kessler et al., 2003), the aim

of the paper is to analyse external and internal fac-

tors in shop sales underpinning the examination of

factors in shop sales based on the collected data of

two supermarkets in Lithuania. Factors introducing

burstiness as a means of bottlenecks in the shopping

process are given in Tab. 1. The literature reveals

three different approaches to factor analysis, namely,

PEST (Political, Economic, Social and Technolog-

ical) (Sammut-Bonnici and Galea, 2015), SWOT

(Strengths, Weaknesses, Opportunities and Threats)

(G

¨

urel, 2017) as well as external and internal factors

(Ahrens and Za

ˇ

s

ˇ

cerinska, 2014). Analysis of these

three approaches allows concluding that external and

internal factors are also part of PEST and SWOT.

Consequently, the approach of external and internal

factors is applied in the present work, whereas fac-

tor is defined as a reason of change of a phenomenon.

It should be noted that external factors refer to exter-

nal situations such as the concentrated arrival of cus-

tomers at the shop. In turn, internal factors are con-

ventionally regulated by a shop itself. It is worth not-

ing that bottlenecks within the process chain of sell-

ing and buying are limiting the capacity of shop sales.

Thus, a proper description of bottlenecks will help to

increase the productivity of shop sales.

Table 1: External and internal factors that influence bottle-

necks in shops.

Classification Description

external concentrated arrival of customers or

visitors at the shop

internal waiting time in the queue to

the cash register

internal payment processing time at

the cash register

In this work only the internal factors such as the

waiting time in the queue to the cash register and pay-

ment processing time at the cash register (further re-

ferred as buyers’ service time) are studied and mod-

elled as highlighted in Fig. 3. It should be pointed out

that, while the payment processing time is usually de-

termined by technological limits (scanning of the pur-

chased goods, the paying process itself) and the expe-

rience of the sales staff, bottlenecks can be identified

by analyzing the free time intervals between buyers at

the cash register.

waiting in the queue

to the cash register

payment

processing time

Phase 3: payment process

Figure 3: Elements of payment process (Phase 3).

Apart from that, the payment processing time

gives a good insight into the buyers’ behaviour, find-

ing out if the buyers consistently buy few articles or

many articles.

It should be pointed out that, in this work, the ex-

amination of the buyers’ waiting time in the queue

to the cash register is equivalent to the analysis of

cashier free time intervals between two buyers. Here,

it is expected that a high level of burstiness indicates

that long free time intervals at the cash register are

followed by many short free time intervals.

The question of the utilization of cash registers

plays a central role when optimizing the productivity

and profitability of shop sales. For example, buyers

may appear in a very concentrated (bursty) manner at

the checkout, which may result in short breaks (short

free times at the cash register) between the individual

payment processes followed by longer breaks (Fig. 4).

On the other hand, it is important to know whether the

buyers’ service time differs under the assumption of

bursty cashier free time intervals.

In this paper, gap-based models known from data

transmission systems are used for bottleneck identi-

fication in grocery shops in Lithuania. The obtained

PECCS 2020 - 10th International Conference on Pervasive and Parallel Computing, Communication and Sensors

54

time (in s)

buyers

service

free time

of

cash register

free time

of

cash register

buyers

service

Figure 4: Interplay of buyer free time intervals and buyer

service times at cash register.

parameters such as the buyers’ concentration and the

buyers’ probability allow a good analysis of the flow

of shop customers. The validation of the obtained re-

sults will be carried out using the data of two super-

markets of different sizes in Lithuania.

The novelty of this paper is given by the analy-

sis of internal factors in bottleneck detection through

a comparison of different approaches for measuring

burstiness in real shop processes. Internal factors are

investigated through the waiting time in the queue to

the cash register as well as the payment processing

time at the cash register. It is worth noting that this pa-

per is dedicated to the payment process by jointly de-

scribing and modelling the waiting in the queue to the

cash register as well as the payment processing time

at the cash register by gap processes. Describing each

process by gaps individually, the payment process can

be modelled by two independent gap-processes with

different parameters. Exemplary, gap parameters for

modelling and simulation are found by analyzing the

payment process of two supermarkets in Lithuania.

The remaining part of this paper is organized as

follows: Section 2 introduces the theoretical basis for

internal factors in bottleneck detection. The distribu-

tion of buyers within bursty environments for bottle-

neck analysis is given in Section 3 followed by ap-

proaches for measuring burstiness in bursty business

processes in Section 4. The associated results of an

empirical study of different grocery shops in Lithua-

nia are discussed in Section 5. Finally, some conclud-

ing remarks are provided in Section 6.

2 BURSTY BUSINESS

PROCESSES

In general, any process including the process of buy-

ing in which binary decisions are made can be de-

scribed by gaps as illustrated in Fig. 5 (Ahrens et al.,

2019b).

- x - - x - - x - - - x x - - - - x -

2 2 3 40

Figure 5: Modelling of the buying process by gaps (a buyer

(represented by ”x”) within a sequence of non-buying visi-

tors (represented by ”-”)).

When neglecting the payment processing times

(also referred as buyers’ service times), gap processes

appear when describing the free time intervals be-

tween buyers at the cash register as highlighted in

Fig. 5. The process of buying can be defined by buyer

probability p

e

as well as buyer concentration (1 − α)

(Wilhelm, 1976; Ahrens, 2000). A customer becomes

with the probability p

e

a buyer and remains with the

probability (1 − p

e

) a visitor. On the other hand, the

payment processing time at the cash register can be

modelled by gaps as well. Therefore the payment

process can be modelled by two independent gap pro-

cesses, namely the description of the waiting time in

the queue to the cash register and the payment pro-

cessing time at the cash register.

The distribution of the gaps (e. g. describing free

time intervals between two buyers) can be described

by a gap distribution function u(k) defining the prob-

ability that a gap Y between two buyers is greater than

or at least equal to a given number k, i. e.

u(k) = P(Y ≥ k) . (1)

A bursty behaviour could emerge, if u(k) is dif-

ferent from the exponential distribution function

(Kessler et al., 2003; Weisstein, 1999). Next to gap-

distributions described by one parameter such as the

beforehand mentioned exponential, distribution func-

tions such as Weibull (Weisstein, 1999; Kessler et al.,

2003) or Wilhelm (Wilhelm, 1976), which depend on

two parameters, allow a greater precision when de-

scribing bursty business processes known from bit-

errors in telecommunications (Ahrens, 2000) as well

as the characteristic of transmission control protocol

(TCP) connection arrivals (Feldmann, 2000; Kessler

et al., 2003) or when analyzing the internet traffic

(Zukerman et al., 2003; Kresch and Kulkarni, 2011).

The distribution function u(k), published by Wil-

helm (Wilhelm, 1976), is defined by the parameters,

namely buyer probability p

e

and buyer concentration

(1 − α ), and results for bursty business processes (in-

cluding shop sales) in

u(k) = [(k + 1)

α

− k

α

] · e

−β·k

. (2)

with the parameter β defined by

p

e

≈ β

α

. (3)

For independent buyers, the buyers’ concentration re-

sults in (1 − α) = 0, whereas for practically relevant

bursty buyers’ processes, a buyer concentration in the

range of 0 < (1 − α) ≤ 0,5 can be expected. The

gap distribution function defined in (2) is of a high

level of practical relevance as the function was found

by analysing bit-errors in short-wave communication

channels (Wilhelm, 1976) and confirmed by analyz-

ing packet arrivals in TCP connections (Kessler et al.,

2003).

Internal and External Factor Analysis in Bottleneck Detection in Shop Sales: The Case of Grocery Shops in Lithuania

55

3 DISTRIBUTION OF BUYERS

WITHIN BURSTS

Bottlenecks as a capacity constraint can appear if

more buyers, who require service, than expected are

in the shop. Customers might have to wait because

their number exceeds the number of expected ones.

In this way the buyers appear in a bursty nature i. e.

a high number of buyers appears within a given time

interval and the flow of buyers throughout the shop

is limited (Ahrens et al., 2019a). When modelling

the payment process by gaps, a burst is based on the

buyer-visitor relationship and is defined as a pattern

which begins with a buyer and ends with a buyer,

when at least a visitors (who do not buy anything)

follow. The parameter a is also called the distance pa-

rameter (gap) between two buyers. If the gap after a

buyer is greater or equal compared to the distance pa-

rameter (gap) a, the burst is considered as terminated.

Fig. 6 highlights the burst definition with a = 3. The

burst ends, when the gap after a buyer is greater than

or equal to the distance parameter a (here in the ex-

ample a = 3), the proportion of these gaps is given by

the parameter u(a), i. e. the gap-distribution function

u(k).

Burstgap ≥ a gap ≥ a

Figure 6: Burst definition the distance parameter a = 3.

The number of bursts z

B

with the distance param-

eter a in a sample with z

f

-buyers results in

z

B

= z

f

· u(a) . (4)

From (4) the average number of buyers g within a

burst is calculated as

E{g} =

z

f

z

B

=

1

u(a)

. (5)

Tab. 2 shows the obtained parameters for different

values of a. The values obtained by simulations using

(2) show a good agreement with the theory using (4).

Assuming that the sample contains z

f

= 1000 buyers,

with the distance parameter a = 5 in total 957 bursts

for the memoryless buyer scenario (defined solely by

the buyers’ probability), but only 560 bursts for a sce-

nario with memory can be registered. This shows that

the number of buyers per burst increased when the

buyers’ concentration raised.

Fig. 7 illustrates the calculation of the buyers

within bursts. The Markov chain is started from state

B

i

i. e. it is assumed that the burst is already started

with a buyer. The Markov chain remains in state B

i

Table 2: Bursts z

B

at a buyers’ probability p

e

= 10

−2

for

different parameters of the buyers’ concentration (1 − α)

assuming z

f

= 1000 buyers.

(1 − α) a Simulation Theory

0,0 10 901 895

0,1 10 662 660

0,2 10 473 474

0,0 5 957 951

0,1 5 752 736

0,2 5 560 560

A

B C D

Figure 7: Buyers’ distribution using Markov chain.

as long as the occurring buyers belong to the burst i,

i. e. the gap to the previous buyer is shorter than a.

When jumping to the next buyer, the burst can be fin-

ished when the gap k ≥ a. The Markov chain is then

in state B

i+1

i. e. in the next burst.

The number of buyers per burst can be calculated

by the weight distribution P(g) resulting in:

P(g = 1) = u(a)

P(g = 2) = u(a) · [1 − u(a)]

.

.

. =

.

.

.

P(g) = u(a) · [1 − u(a)]

g−1

.

The obtained results in Fig. 8 confirm that with the in-

creasing buyers’ concentration (1−α) more and more

buyers per burst appear.

4 MEASUREMENT OF

BURSTINESS

The optimization of underlying business processes

such as the cashier free time intervals at the cash reg-

ister as well as the payment processing time intervals

require the estimation of the level of burstiness in or-

der to find appropriate parameters for the simulation

when using the gap-distribution function u(k). With a

known gap density function v(k) = P(Y = k), denot-

ing the probability that a gap Y of length k appears, the

buyers’ concentration (1 − α) can be obtained, when

analysing the probability that after a buyer, in the dis-

tance of zero another buyer appears, i. e.

v(0) = u(0) − u(1) . (6)

With u(0) = 1 we get

v(0) = 1 − u(1) = 1 −

h

(2

α

− 1)e

−β

i

. (7)

PECCS 2020 - 10th International Conference on Pervasive and Parallel Computing, Communication and Sensors

56

1 2 3

SCALE

0

0.5

1

PDF

caseXXXXXXXXX

case1

case2

Figure 8: Buyers distribution P(g) within the bursts for dif-

ferent parameters of the (1 − α) at a buyer’s probability of

p

e

= 10

−2

and a distance parameter of a = 5.

The expression can be simplified for small values of

β as

e

−β

≈ 1 for β 1 (8)

and the parameter v(0) can be expressed as

v(0) ≈ 2 − 2

α

. (9)

From this equation, the buyers’ concentration (1 − α)

is estimated as

(1 − α) ≈ 1 − log

2

[2 − v(0)] (10)

for the proposed gap model when analyzing exem-

plary the free time intervals between buyers at the

cash register. Tab. 3 shows the obtained values when

using (10) and (2) for estimating buyers’ burstiness.

As shown in (Ahrens and Za

ˇ

s

ˇ

cerinska, 2017) the

probability v(0) can be obtained as

v(0) =

E{number of neighbouring buyers}

E{number of buyers}

. (11)

Therein, the parameter E{·} denotes the expectation

functional. The number of neighbouring buyers are

counted when after a buyer immediately the next

buyer appears, i. e. the distance k between two buyers

is k = 0 (also referred as neighbouring buyers).

Goh & Barabasi (Goh and Barab

´

asi, 2008) pro-

vided an alternative solution for estimating burstiness

in business processes independent of the selected pro-

cess by taking the mean value m

1

(average gap length

or average length of free time intervals between two

buyers at the cash register) as well as the standard de-

viation σ of the length of time intervals or gaps into

account and is defined as

B =

σ − m

1

σ + m

1

, (12)

with −1 ≤ B ≤ 1. Whereas regular (deterministic)

processes are described by negative parameters of B,

Table 3: Obtained values for the buyers’ concentration (1 −

α) at a buyer’s probability of p

e

= 10

−2

using (10).

Theory 0,0 0,1 0, 2

Estimation 0,0071 0, 104 0,202

Table 4: Comparison of the estimated level of burstiness at

a buyer’s probability of p

e

= 10

−2

.

(1 − α) 0, 0 0,1 0,2

B (Theory) 0,0025 0, 18 0,34

B (Praxis) 0,0018 0,17 0, 33

bursty business processes are described by positive

parameters of B.

Analysing (12), a value B = −1 can be obtained

for any m

1

if σ = 0 and describes a completely reg-

ular (deterministic) process. In this case the density

function degenerates to a discrete line at m

1

, and the

whole process becomes deterministic. On the other

hand, B = 0 is considered as a neutral burstiness as

here σ = m

1

holds. Bursty business processes appear

for 0 ≤ B < 1, whereas the parameter B = 1 can be ob-

tained for m

1

= 0 for any σ. However, in the case of

non-negative random variables, the parameter m

1

= 0

appears just when all values are equal to zero. There-

fore B = 1 cannot be obtained practically.

Next to u(k) a gap density function v(k) defining

the probability that a gap Y between two buyers is

equal to a given number k, i. e.

v(k) = P(Y = k) (13)

can be defined. Taking v(k) into account, the gap dis-

tribution function u(k) results in

u(k) = v(k) + v(k + 1) + v(k + 2) + · ·· (14)

and the gap density function v(k) can be defined as

v(k) = u(k) − u(k + 1) . (15)

By taking v(k) into account, the mean value m

1

and

the variance σ

2

result in

m

1

=

∞

∑

k=0

k v(k) and σ

2

=

∞

∑

k=0

k

2

v(k) − m

2

1

. (16)

Analysing a buying process with independent buyers,

i. e. (1 − α) = 0, the parameter B results as shown in

(Ahrens et al., 2019a) in

B =

σ − m

σ + m

=

e

p

e

/2

− 1

e

p

e

/2

+ 1

. (17)

Tab. 4 shows the obtained parameters for the esti-

mated level of burstines described by the parameter

B when using (2). When using the gap-distribution

function v(k) defined in (15), the obtained parameter

B follows the buyers’ concentration (1 − α) in theory

as well as when analysing real visitor-buyer intercon-

nections.

Internal and External Factor Analysis in Bottleneck Detection in Shop Sales: The Case of Grocery Shops in Lithuania

57

5 GROCERY SHOPS IN

LITHUANIA

In order to analyse the level of burstiness, the duration

of the service times of the buyers at the cash register

as well as the free time intervals at the cash register of

two different shops (grocery shop and supermarket)

in Lithuania is studied in order to get appropriate pa-

rameters of the underlying gap distribution functions.

The collected cash register data, obtained from a sin-

gle cash register of each shop, contain the operation

time, the amount of goods purchased, their codes and

the prices paid by each buyer. The data collection was

carried out in June 2018 and September 2018.

Unfortunately, the cash registers do not record the

start time of the operation. Therefore, the service

duration time was not available from the database.

To cope with this problem we observed buyers’ ser-

vice durations with different quantities of goods (see

Tab. 5). It appeared, that the service duration t

s

de-

pends not only on the quantity of the goods, but also

on the type of goods, individual characteristics of the

buyer and other random factors, i. e. the dependence

is statistical. The correlation coefficient between n

g

and t

s

equals 0,72, and the regression equation is

given by

t

s

= 1,9n

g

+ 22,8 . (18)

The equation yields that for one good about 1,9 sec-

onds and additionally about 22,8 seconds for each

buyer are required. The data were collected in the

grocery shop, and it is assumed that all grocery shops

as well as supermarkets have similar performance as

they are working with similar equipment of cash reg-

isters and salespeople who are working at a similar

intensity. Knowing the quantity of goods and (18),

the start and end times of each buyer can be calcu-

lated. This allows us to analyse the free time intervals

between two buyers’ service.

In this work the payment process is jointly de-

scribed and modelled by independent gap processes

taking the waiting time in the queue to the cash regis-

ter as well as the payment processing time at the cash

register into account. By describing each process by

Table 5: Duration of the service at the cash register.

Amount of Goods Service Time

n

g

t

s

(ins)

3 44

1 18

10 30

1 11

18 61

1 37

gaps individually, the payment process can be mod-

elled by two independent gap processes with different

parameters as highlighted in Fig. 9.

5.1 Free Times of Cash Register

The histograms of the free time intervals at the cash

register for the grocery shop are given in Fig. 10 and

for the supermarket in Fig. 11. Comparing both fig-

ures it turns out that the free times of cash regis-

ter are more bursty in the supermarket. Here, either

short free time intervals or significantly longer free

times intervals are recognized. Tab. 6 highlights the

calculated buyers’ burstiness for the two investigated

shops, described the burstiness parameter B. The ob-

tained data confirm a higher level of burstiness in the

supermarket compared with the grocery shop when

analysing the free time intervals between two buyers.

The probability of free times’ durations up to 30

seconds, i. e. half a minute, are shown in Fig. 12

for the grocery shop and in Fig. 13 for the supermar-

ket. Whereas these durations are quite similarly dis-

tributed in the case of the grocery shop, the durations

tend to be slightly exponentially distributed in case of

the supermarket. The obtained data of the buyer prob-

ability and buyer concentration confirm a higher level

of burstiness in the supermarket compared with the

grocery shop.

5.2 Buyers’ Service Time

Next to the free time intervals, the service times of

the buyers at the cash register are analysed. The cor-

responding service times are depicted in Fig. 14 for

the grocery shop and in Fig. 15 for the supermarket.

Tab. 7 highlights the levels of burstiness obtained by

analyzing the buyers’ service times for the two inves-

tigated shops.

It comes out that negative burstiness factor B of

the time t spent at the cash register shows a rather

predominantly neutral (deterministic) behaviour than

a burst-like behaviour. The burstiness parameters are

very similar comparing the two shops assuming that

the parameter depends on the consumer behaviour,

performance of cash register and of salesperson. It

confirms our initial assumption that all shops show a

similar performance as they work with similar equip-

Table 6: Buyer’s Burstiness when analyzing the free-time

intervals.

Shop m

1

σ B

Grocery Shop 234,1 s 620,1 s 0,45

Supermarket 96,9 s 408,7 s 0,62

PECCS 2020 - 10th International Conference on Pervasive and Parallel Computing, Communication and Sensors

58

time (in sec)

payment buyer

m

payment buyer

(m+1)

payment buyer

(m-1)

gap process I

(waiting time at cash register)

gap process II

(payment processing time)

Figure 9: Modelling the payment process by two independent gap processes.

0 100 200 300 400 500 600

SCALE

0

0.1

0.2

PDF

Figure 10: Distribution of free times of cash register

(grouped) at grocery shop.

0 100 200 300 400 500 600

SCALE

0

0.2

0.6

PDF

Figure 11: Distribution of free times of cash register

(grouped) at the supermarket.

ment as well as staff who received a standardized

training.

6 CONCLUSION

The work carried out within the present research al-

lows establishing the inter-connections between bot-

tleneck and burstiness. The theoretical analysis fa-

cilitated the creation of the model of shop sales pro-

cess in 4 phases. In this work the waiting times in

the queue to the cash register as well as the payment

processing times at the cash register were studied and

jointly modelled. The obtained results show that the

payment processing times at the cash register are quite

regular. However, analysis of the free time intervals at

the cash register allow drawing the conclusion on its

bursty behaviour. The bursty behaviour of the cashier

free time intervals implies long breaks that alternate

with many short breaks. The obtained parameters for

Table 7: Burstiness analyzing the buyers’ service times.

Shop m

1

σ B

Grocery Shop 32,1 s 5,1 s −0,73

Supermarket 30,8 s 7, 1 s −0, 62

0 10 20 30

SCALE

0

0.05

0.1

PDF

Figure 12: Distribution of free time duration up to 30 sec-

onds (grocery shop).

0 10 20 30

SCALE

0

0.05

0.1

PDF

Figure 13: Distribution of free time duration up to 30 sec-

onds (supermarket).

bottleneck description within the defined internal fac-

tors were verified by the empirical data collected in

grocery shops in Lithuania. The analysis of the col-

lected data resulted in the conclusion that the level of

burstiness depends on such factors as the consumer

behaviour, the waiting times in the queue to the cash

register, the payment processing time at the cash reg-

ister and the performance of salesperson or cashier.

The investigation carried out in this work results

in differentiation between external and internal fac-

tors in shop sales. The theoretical analysis highlights

three factors that influence shop sales, namely exter-

nal factor such as a concentrated arrival of customers

or shop visitors to the shop and internal factors such

as waiting times in the queue to the cash register and

payment processing time at the cash register.

The empirical study carried out in grocery shops

in Lithuania allowed concluding that the burstiness

parameter depends on consumer behaviour, perfor-

mance of cash register and performance of salesper-

son or cashier. Further research will focus on widen-

ing the dataset for empirical studies.

Internal and External Factor Analysis in Bottleneck Detection in Shop Sales: The Case of Grocery Shops in Lithuania

59

0 20 40 60 80

SCALE

0

0.2

0.4

PDF

Figure 14: Buyers service time (grocery shop).

0 20 40 60 80

SCALE

0

0.2

0.4

PDF

Figure 15: Buyers service time (supermarket).

REFERENCES

Ahrens, A. (2000). A new digital channel model suitable

for the simulation and evaluation of channel error ef-

fects. In Colloquium on Speech Coding Algorithms

for Radio Channels, London (UK).

Ahrens, A., Purvinis, O., Hartleb, D., Za

ˇ

s

ˇ

cerinska, J., and

Micevi

ˇ

ciene, D. (2019a). Analysis of a Business En-

vironment using Burstiness Parameter: The Case of a

Grocery Shop. In International Conference on Perva-

sive and Embedded Computing and Communication

Systems (PECCS), Vienna (Austria).

Ahrens, A., Purvinis, O., and Za

ˇ

s

ˇ

cerinska, J. (2019b).

Gap Distributions for Analysing Buyer Behaviour in

Agent-Based Simulation. In International Conference

on Sensor Networks (Sensornets), Prague (Czech Re-

public).

Ahrens, A., Purvinis, O., Za

ˇ

s

ˇ

cerinska, J., Micevi

ˇ

ciene, D.,

and Tautkus, A. (2019c). Burstiness Management for

Smart, Sustainable and Inclusive Growth: Emerging

Research and Opportunities. IGI Global.

Ahrens, A. and Za

ˇ

s

ˇ

cerinska, J. (2014). Factors that Influ-

ence Sample Size in Educational Research. In ATEE

Spring Conference ”Innovation and Challenges in Ed-

ucation”, pages 19–32, Klaipeda (Lithuania).

Ahrens, A. and Za

ˇ

s

ˇ

cerinska, J. (2017). Analysing Buyers

Burstiness in E-Business: Parameter Estimation and

Practical Applications. In International Conference

on e-Business (ICE-B), Madrid (Spain).

Feldmann, A. (2000). Characteristics of TCP Connection

Arrivals. In Park, K. and Willinger, W., editors, Self-

similar Network Traffic and Performance Evaluation,

chapter 15, pages 367–399. Wiley.

Goh, K.-I. and Barab

´

asi, A.-L. (2008). Burstiness and

Memory in Complex Systems. Exploring the Fron-

tiers of Physics (EPL), 81(4):48002.

G

¨

urel, E. (2017). Swot analysis: A theoretical review. Jour-

nal of International Social Research, 10:994–1006.

Kessler, T., Ahrens, A., Lange, C., and Melzer, H.-D.

(2003). Modelling of connection arrivals in Ethernet-

based data networks. In 4rd International Conference

on Information, Communications and Signal Process-

ing and 4th IEEE Pacific-Rim Conference on Multime-

dia (ICICS-PCM), page 3B6.6, Singapore (Republic

of Singapore).

Kresch, E. and Kulkarni, S. (2011). A poisson based bursty

model of internet traffic. In 2011 IEEE 11th Inter-

national Conference on Computer and Information

Technology, pages 255–260.

Kumar, A., Bezawada, R., Rishika, R., Janakiraman, R., and

Kannan, P. (2016). From Social to Sale: The Effects of

Firm-Generated Content in Social Media on Customer

Behavior . Journal of Marketing, 80(1):7–25.

Miceviciene, D., Purvinis, O., Glinskiene, R., and Tautkus,

A. (2018). Alternative Solution for Client Service

Management. Applied Research in Studies and Prac-

tice, 14(1):47–51.

Mittal, V. and Kamakura, W. (2001). Satisfaction, Repur-

chase Intent, and Repurchase Behavior: Investigat-

ing the Moderating Effect of Customer Characteris-

tics. Journal of Marketing Research, 38(1):131–142.

Sammut-Bonnici, T. and Galea, D. (2015). PEST Analysis,

pages 1–1. American Cancer Society.

Weisstein, E. W. (1999). The CRC Concise Encyclopedia of

Mathematics. CRC Press, Boca Raton and London.

Wilhelm, H. (1976). Daten

¨

ubertragung (in German).

Milit

¨

arverlag, Berlin.

Zukerman, M., Neame, T. D., and Addie, R. G. (2003). In-

ternet traffic modeling and future technology impli-

cations. In IEEE INFOCOM 2003. Twenty-second

Annual Joint Conference of the IEEE Computer and

Communications Societies, volume 1, pages 587–596

vol.1.

PECCS 2020 - 10th International Conference on Pervasive and Parallel Computing, Communication and Sensors

60