Data Lakes for Insurance Industry: Exploring Challenges and

Opportunities for Customer Behaviour Analytics, Risk Assessment, and

Industry Adoption

Bálint Molnár

1 a

, Galena Pisoni

2 b

and Ádám Tarcsi

1 c

1

Eötvös Loránd University, ELTE,IK Pázmány Péter 1/C, 1117, Budapest, Hungary

2

University of Nice Sophia Antipolis, Nice, France

Keywords:

Data Warehouse, Data Lake, Enterprise Architecture, Data Science, Insurance.

Abstract:

The proliferation of the big data movement has led to volumes of data. The data explosion has surpassed

enterprises’ ability to consume the various data types that may exist. This paper discusses the opportunities

and challenges associated with implementing data lakes, a potential strategy for leveraging data as a strategic

asset for enterprise decision-making. The paper analyzes an information ecosystem of an Insurance Company

environment. There are two types of data sources, information systems based on a transactional databases

for recording claims, as the basis of financial administration and systems policies. There exists neither Data

Warehouse solutions nor any other data collection solutions dedicated to utilizing by Data Science methods and

tools. The emerging technologies provide opportunities for synergy between the traditional Data Warehouse

and the most recent Data Lake approaches. Therefore, it seems feasible and reasonable to integrate these

two architecture approaches to support data analytics on several aspects of insurance, financial activities, risk

analysis, prediction and forecasting.

1 INTRODUCTION

The rise of Fintech, changing consumer behavior,

and advanced technologies are disrupting equally all

the financial services industry, among which also it’s

most prominent member, insurance. The insurance

industry is preparing for the process of digital trans-

formation and how it conducts business and big data

capabilities lie at the centre of it. The insurance in-

dustry has been using data to calculate risks for years,

still, with new technology now available to collect and

analyze large volumes of data for patterns and bet-

ter risk prediction and calculation, the value of under-

standing how to store and analyze it has grown expo-

nentially (Liu et al., 2018).

Insurers are at their early stage of discovering the

potential of big data, and multiple technology compa-

nies are investigate how to make value of such tech-

nology.

Equally important is to note that the majority of

insurance companies are left with systems, processes,

a

https://orcid.org/0000-0001-5015-8883

b

https://orcid.org/0000-0002-3266-1773

c

https://orcid.org/0000-0002-8159-2962

and practices that would be still recognizable by those

that were in the industry in the 1980es. Changes

brought by digitalization even more pressure the in-

surance industry (Traum, 2015; Pisoni, 2020).

Due to the big volume of data generated by insur-

ers, it is especially important to enable the best use of

them, and in this paper, we discuss opportunities and

challenges in implementing data lakes for insurance

companies and a potential strategy for leveraging data

as a strategic asset for enterprise decision making, es-

pecially in the domain of customer behavior analytics

and risk assessments. We present potential data lake

reference architecture, it’s respective data warehouse,

and a mapping between the different components of

the Data Lake to Zachman architecture. Also, we

identify potential future challenges companies will

face due to the use of big data, and we draw what in

our view will be the new business logic of insurance

companies in the digital era. The organization of the

paper as follows: Section 2 an overview and analysis

of architectures and applications of Data Warehouse

and Data Lake, Section 3 investigates huge data col-

lection and opportunities and limits for data analytics

in the domain of customer behavior analytics, Section

4 analyzes how Data Lake and Data Warehouse can

Molnár, B., Pisoni, G. and Tarcsi, Á.

Data Lakes for Insurance Industry: Exploring Challenges and Opportunities for Customer Behaviour Analytics, Risk Assessment, and Industry Adoption.

DOI: 10.5220/0009972301270134

In Proceedings of the 17th International Joint Conference on e-Business and Telecommunications (ICETE 2020) - Volume 3: ICE-B, pages 127-134

ISBN: 978-989-758-447-3

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

127

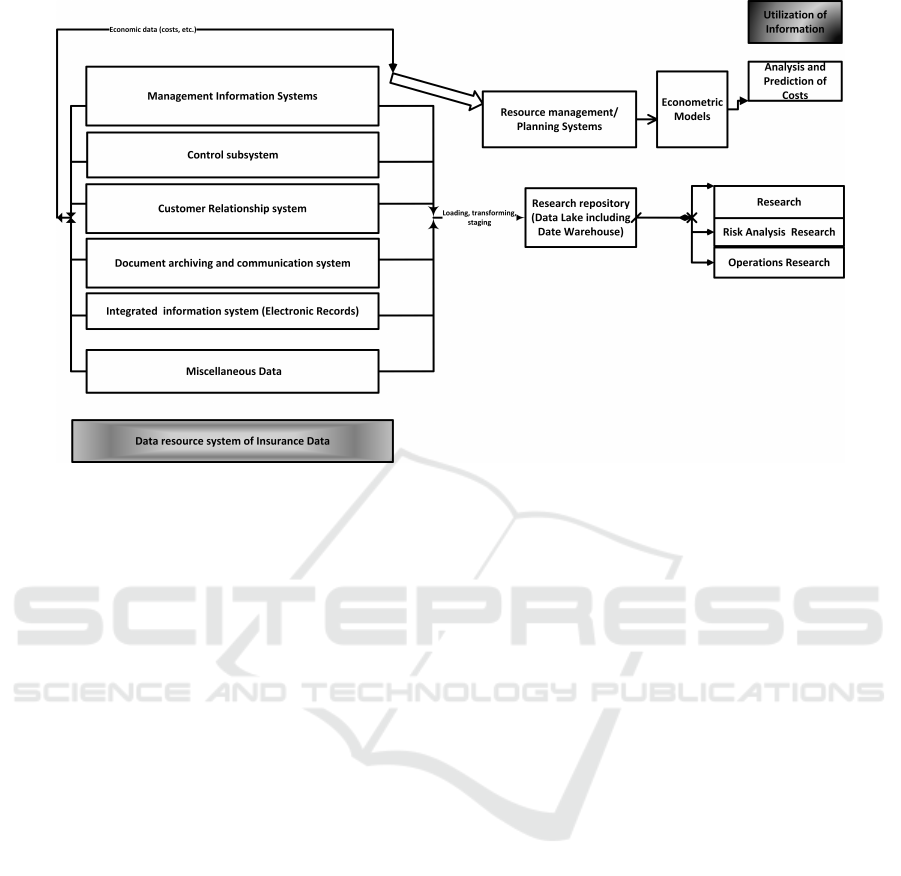

Figure 1: Sources of data and usage, inspired by (LaPlante and Sharma, 2014; Boobier, 2016; Duggal et al., 2015).

help risk calculation, Section 5 examines the industry

response and potential new logic for insurers of the

future, and then the article concludes with a summary.

2 POTENTIAL APPLICATION

DOMAINS

Potential domains for the use of the big data and data

lakes in the insurance process include:

• Pricing and underwriting, estimating the price of

an insurance policy is based on complex risk as-

sessment process, big data can give the ability

to more accurately price each customer by com-

paring individual behaviour compared to a large

pool of data, a process that allows the insurance

companies to correlate behaviour to risk (Boobier,

2016). This is most visible in the car insurance,

where insurers can compare the behaviour of sin-

gle driver to the behaviours of a large sample of

other drivers, especially given the big number of

past claims they have data for customers.

• Settling claims, a typical claim process starts with

an insurer asking to assess the loss or the damage

of the insured person or company, and this process

can be long and painful for both of the parties.

Different solutions have been devised already in

this respect: automated claims setting, especially

based on the domain of car insurance, where the

company has a large amount of data, and already

from past data can fully automatize claim report

and their response to them. Insurance compa-

nies can execute and automate decisions related

to big data, such as whether the insurance com-

pany should pay the claim or not risks, which can

be later only approved by staff member instead

of doing the process manually, which can also, in

turn, save personnel time and effort (Minelli et al.,

2013).

• Monitoring of houses, the insurance companies

use and distribute IoT devices to monitor a range

of activities at home. By comparing the real-time

data collected from the delivers about the house

risk, the insurance companies can intervene be-

fore a claim occurs, by recommending the poli-

cyholder to adjust the high-risk behavior, such as

forgetting to lock the door or to set alarms. Hav-

ing integrated data in this scenario is a key, be-

cause it allows insurance companies to see which

policy-holders have good practices or which will

almost close to certainly submit a claim, and like

in future the company can reward good behavior

of customers (Pal and Purushothaman, 2016).

• Monitoring of health, big data can be used to un-

derstand patient risks and prevent health issues

before they arise. One way may be through draw-

ing insights from big data to better make predic-

tions and recommendations to customers for dif-

ferent insurance policies and their coverage, by

connecting medical records and multiple sources

or information regarding attitudes towards health

like wearable of phone data. One example would

ICE-B 2020 - 17th International Conference on e-Business

128

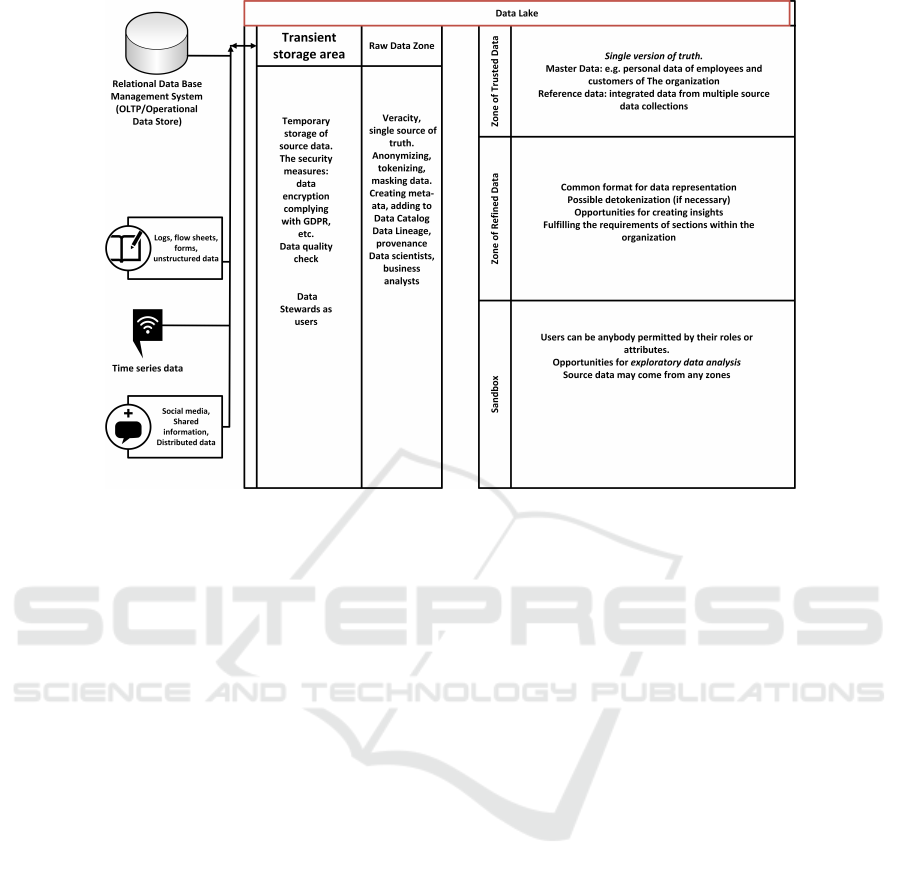

Figure 2: Data Lake Reference Architecture.

be a diabetic patient who needs insulin and if such

intake is traced, the insurer would also be alerted

such an irregular use (Spender et al., 2019).

• Improve customer experience, insurance compa-

nies have started to investigate the use of chat-

bots to allow for a more rapid response to cus-

tomer queries and automatizing the response pro-

cess. To implement the process, an AI algorithm

needs to be trained on a big data and huge amount

of data from the past on insurance policies, claims

and other areas of business of the company, and as

a result provide near to instance response to cus-

tomer questions. The chatbots can be used also

by new employees and even the staff can use and

query the chatbots, which can be also voice-based,

and like this to gain the information needed to

serve the customer in front of them(Koetter et al.,

2018; Riikkinen et al., 2018).

Other use can be for business process management

aims (Rodrıguez et al., 2012), as well as for improved

security of services (Ristov et al., 2012).

3 DATA LAKES AND DATA

WAREHOUSE

ARCHITECTURES

Generally, organizations are full of data that are stored

in existing databases, produced by various informa-

tion systems, data streams are coming from mobile

applications, social media, web information systems,

and other devices that are linked to the internet (Inter-

net of Things, IoT). The collected data can be consid-

ered as heterogeneous in both structure and content,

i.e. there are structured, semi-structured, and unstruc-

tured data items, some of them are accompanied by

meta-data. There is an essential difference regarding

data capture in traditional Business Information Sys-

tems and Information Systems for Financial Indus-

tries especially Insurance. In the Financial Industry,

especially the Insurance environment, the initial data

gathering is typically manual, and even the structured

data contains plenty of textual information. The in-

put data are created typically by human agents who

can make errors in data either intentionally or unin-

tentionally. Examples of error-prone data entry are

as follows: name, address, identifiers (social security

numbers). Thereby, the method of data entry leads

to imprecise data that makes difficult any data mining

exercises, e.g. association relationships that may have

been found prove to be erroneous. While inputting

data into Information System of Insurance Policies,

Customers Data, frequently use either templates or

copy-paste commands to fill in various forms as e.g.

claims in forms to comply with policies, standards,

and other regulations. The problem with that prac-

tice is that it conceals the subtle differences among the

electronic customers’ records that would be precious

for data analytics and knowledge discovery. Informa-

tion that is produced by automated systems along with

Data Lakes for Insurance Industry: Exploring Challenges and Opportunities for Customer Behaviour Analytics, Risk Assessment, and

Industry Adoption

129

Table 1: Comparison of Data Warehouses vs Data Lakes.

- Data Warehouse Data Lake

Data Structured, processed Raw: Structured / semi-structured / unstructured

Processing Schema-on-write Schema-on-read

Storage Requires large storage (architecturally complex) Requires larger data storages (architecturally less

complex). It can be cheaper despite the large amount of

data stored.

Agile-aware Fixed structure Tailored

Purpose of Data Fixed (BI, reporting) Not Yet Determined (Machine Learning, Data analytics)

Target audience Business Professionals Data Scientist

auto-fill and edit check options as e.g. speech to text,

OCR (optical character recognition) that computerize

customers’ data may introduce systematic and ran-

dom inaccuracies that differ from clerks to clerks, a

software tool to software tool. These errors are diffi-

cult to quantify and forestall.

To ensure that there will be a centralized loca-

tion that would serve as the single source of truth, the

data with different types and structures from various

sources should be collected and loaded into a Data

Lake. The most recent technologies can yield oppor-

tunities for the application of data analytics and mod-

els of Data Science. The results of running data ana-

lytic algorithms could be actionable knowledge in the

clinical research environment.

Generally, it is assumed that the data coming from

source systems are in good quality however, the mar-

ket and administrative forces have not enforced a sat-

isfyingly high level on standards of data quality. The

typical life history of data can be seen in Figure 1.

On the left part of the diagram, the various major

source systems of financial data can be found. The

data are represented as customers’ electronic personal

records, geo-codes for geographical information, and

other loosely coupled data related to management,

and business administration.

Our paper showcases architecture for a moderate

size insurance enterprise environment so that the Vs

(volume, velocity, variety, veracity, variability, value)

of the Big Data are as follows: A population of a

million customers may generate electronic customer

records in the order of terabytes yearly. Primarily, the

variability of structured, semi-structured, and unstruc-

tured data increases the complexity thereby the diffi-

culty of ensuring the single point of truth within the

data collection.

Data Lake as a Big Data analytics system allows

the continuous collection of structured and unstruc-

tured data of an organization in the form of data rep-

resentation without changing the original data, with-

out data cleaning and transformation of data models

- i.e. without loss of information, so the informa-

tion can be analyzed with the greatest degree of free-

dom. Data Lake solutions focus primarily on inte-

gration and efficient data storage processes, besides

providing advanced data management, data analyt-

ics, machine learning, and self-service Business In-

telligence (BI) and data visualization services as well.

A Data Lake offers services for Business Users us-

ing BI tools but the typical target audience is the

data scientists. Data Lake is effective for an organi-

zation where a significant part of the organizational

data is structured (and interpreted, stored in several,

not yet reconciled sources), complemented by a large

amount of unstructured data. The most important is

that goal of the data processing is to utilize corpo-

rate data assets, exploring further new contexts, typi-

cally non-repetitive research questions. Our proposed

Data Lake architecture consists of a Data Warehouse

as well, to support or the information requirements

of the organization (see Table 1). Within a hybrid

Data Lake that contains a robust Data Warehouse as

well, the life cycle of data commences with transfor-

mation, cleansing and integration. The objective to

build up a Data Lake is to separate the daily opera-

tion, transactional data from the non-production data

collection. Historically, the Data Warehouse technol-

ogy has been employed for that purpose. During the

data staging phase, the data are cleansed and filtered

for the target data structure within the Data Ware-

house, i.e. the fact table and dimensions. The phase

of data staging includes data migration, data integra-

tion, translation of codes used for data representation,

transformation between data base management sys-

tems. The Data Warehouse served as a basis for data

analysis traditionally. The ETL (Extract, Transform,

Load) procedure is applied for feeding data into the

Data Warehouse. During that step the general data

cleansing and transformation happens, e.g. amputa-

tion of trailing and leading white spaces, superfluous

zeros, standardization of identifiers/identifying num-

bers, inflicting constraints on data fields, converting

English units into metric units. While the before men-

tioned data-transformation is carried out relationships

among entities may be dropped or harmed. Similar

way, the data integration from multiple source sys-

tems, can lead to errors that are transmitted into the

Data Warehouse

To overcome the data quality limitations of Data

Warehouse, the idea of the Data Lake is conceptu-

alized. Touted idea of Data Lake is that it deposits

data in their original form, i.e. the Transientand/or

Raw Data (see Figure 2 and Figure 3, (LaPlante

and Sharma, 2014)) contains the data after an in-

ICE-B 2020 - 17th International Conference on e-Business

130

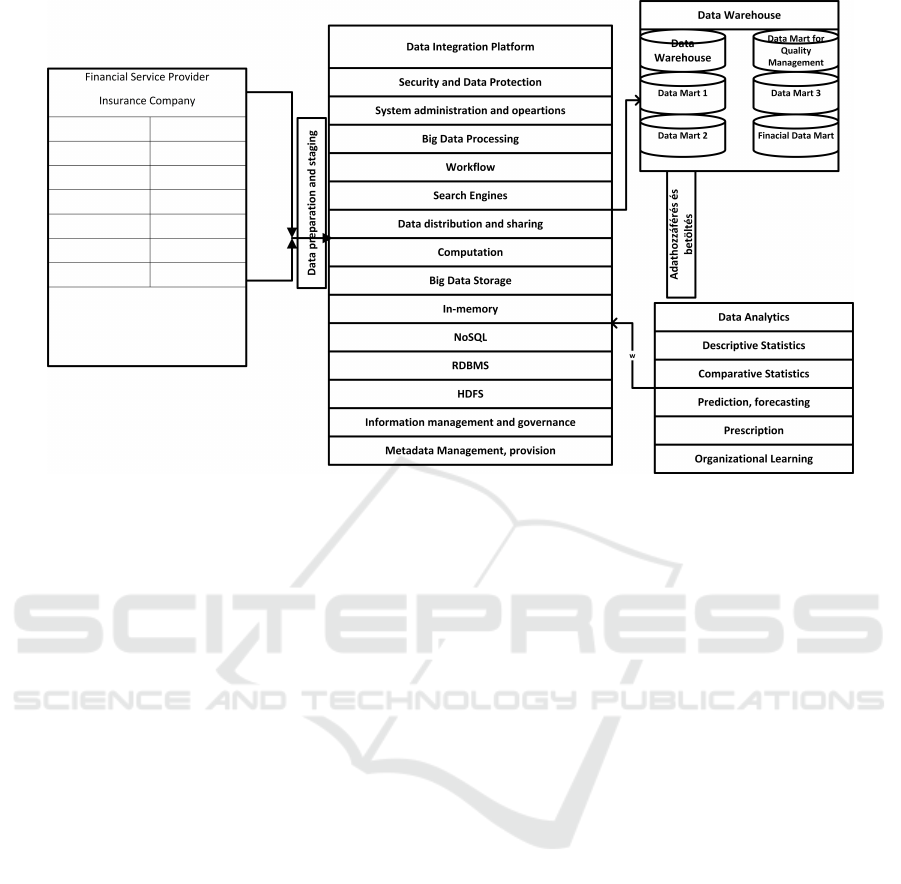

Figure 3: Fintech Data Lake Data Warehouse.

gestion phase so that the Data lake collects struc-

tured data from RDBMS (Relational Database Man-

agement Systems), semi-structured data (XML, bi-

nary XML, JSON, BSON etc.), and unstructured data

along with meta-data that are represented typically

in semi-structured format. The ingestion phase may

mean loading, batch processing, data stream process-

ing of source data while the necessary quality checks

are carried out utilizing the MapReduce capability

(Duggal et al., 2015). The essential property of the

raw data zone is that it is considered as “a single

source of truth” as it keeps the data in their original

form, however the masquerading, and tokenizing of

the data may happen in that zone. Data scientists,

business/data analysts can return to that zone when

they look for associations and relationships that may

have lost during data conversion, transformation, en-

coding, and encrypting.

The Trusted Zone executes the procedures for data

alteration as quality assurance, compliance with stan-

dards, data cleansing, and data validation. In that

zone, several data transformations happen to corre-

spond to prescribed local and global policies whereby

the data can be considered as a “single version of the

truth”. This zone may contain master data and the

fact data that are governed through the data catalog

that is filled in by meta-data automatically or semi-

automatically. The data in the Refined Zone undergo

several further changes that aim at the usability of

data in algorithms of Data Science. These transfor-

mations include formatting, potential detokenization,

data quality control to fulfill of requirements of algo-

rithms so that models of the subject area (e.g. health-

care) and data analytics can be created. Thereby,

knowledge discovery exercises can be carried out and

understanding of data collections may be achieved.

The access rights of users within each zone should

be strictly maintained in the form of Role-Based Ac-

cess Control, and for the temporary deviations from

the baseline can be solved by Attribute-Based Ac-

cess Rights. For researchers, managers, and other

subject area experts who would like to pursue ex-

ploratory data analytics (Myatt, 2007), the Sandbox

provides opportunities to set up models, discover as-

sociations and relationships among attributes without

involving members of IT department and other extra

costs. The researcher can bring data into the Sand-

box from any other zones within a controlled environ-

ment. It is even allowed to export interesting results

back to the raw data zone for re-use. The claimed

advantage of the Data Lake is that the data extracted

from the source systems are transformed before the

actual use data for analysis. This approach permits

more adaptability to requirements than the controlled,

structured environment of Data Warehouses. (see Ta-

ble 2, (Zachman, 1987)).

4 INSURANCE DATA AND

CUSTOMER

The Financial Sector, especially, the Fintech com-

panies are consumer-centric enterprises. The Insur-

Data Lakes for Insurance Industry: Exploring Challenges and Opportunities for Customer Behaviour Analytics, Risk Assessment, and

Industry Adoption

131

Table 2: A mapping schematically between Zachman architecture and component of Data Lakes.

Aspects /

Perspectives

what how where who when why model view

Contextual Fact, business

data / for analysis

Business Service Business

Intelligence,

Workflow

Business entity,

function

Chain of Business

Process,

Workflow

Business goal Scope

Conceptual Underlying

Conceptual data

model / Data

Lake structured,

semi- and

unstructured data

Business

Intelligence with

added value

originated

Workflow Actor, Role Business Process

Model

Business

Objective

Enterprise Model

Logical Class hierarchy,

Logical Data

Model structured,

semi-structured

and unstructured

data

Service

Component

Business

Intelligence,Data

Analytics

Hierarchy of Data

Analytics Service

Component

User role, service

component

BPEL, BPMN,

Orchestration

Business Rule System Model

Physical Object hierarchy,

Data model

(Object Data

Store)

Service

Component

Hierarchy of

Service

Component

Component,

Object

Choreography Rule Design Technical Model.

Detail Data in

SQL/NoSQL,

other file

structures

Service

Component

Business

Intelligence,Data

Analytics

Hierarchy of Data

Analytics Service

Component

Component,

Object

Choreography,

Security

architecture

Rule specification Components

Functioning

Enterprise

Data Function Network Organization Schedule Strategy

ance Industry that tries to follow the mainstream tech-

nology and not to lag put emphasis on data analyt-

ics and the application of Big Data related technolo-

gies. Traditionally the Financial Industry generally

and the Insurance Industry especially are interested

in the consumer groups that can be defined by age,

gender, on-line activities, social and economic status,

geographical distribution. In the Financial Industry,

the enterprises customize the services and products to

encounter the requirements of every customer frag-

ment. Naturally, consumers are not treated equally,

and those who have bigger affordances are tradition-

ally being treated better. The identification and spe-

cial treatment of these affluent consumer groups are

important and the use of data lakes and data ware-

houses can significantly improve the process of de-

tection of different target groups. Another of the ben-

efits of exploitation of the Big Data technologies in

the Financial Industry is to offer fraud detection ap-

proaches. The Insurance Industry gravitates towards

on-line services on a large scale so there is a high

chance to be the victim of a fraud. The Data Sci-

ence assists the companies in the Financial Industry

to understand their consumers behaviour, even the

patterns of on-line actions. The key to fraud detec-

tion is in making use of more contextual data. Not

just data about the immediate transaction and session,

data about user is needed from his/her patterns of ac-

tivities, biometric data about the person involved in

the transaction, and background data on the user in-

volved. Again, the advantage of use of data lakes is in

the fast response with adequate information from the

pool of data. In the Financial Industry, banking, pay-

ments, and insurance the concept of personal touch in

services acquires importance and it becomes the most

significant tool for marketing. The rivalry among the

competing companies enforces the the enterprises to

adopt such personalized type of services. In the In-

surance Industry, the personal recommendation may

include how to save money by combination of insur-

ance policies, which combined insurance policy with

investment has benefits for the consumer, etc. Once

more, such data can be easily generated from the data

lake of the company.

5 RISK CALCULATION

Risk management is an important task in all indus-

tries. In the Financial Industry, Data Science provides

the opportunity to recognize the potential risks, as bad

payers or incorrect decisions of investments. The ap-

plication of data analytics methods cannot make the

potential risk avoidable, however, it offers the identifi-

cation of potential risks in a timely fashion. The tech-

niques of Data Science can assist enterprises in the

Financial Industry to adapt their company strategies

and business processes to minimize the risks. It has

recently become commercially viable to create risk

profiles for individual customers, defined by factors

such as age, gender, health, work activity, place of res-

idence, driving behavior, etc., and the willingness to

pay and make the categories corresponding individual

offers. One of the frontiers in applying the data lakes

will be exactly in this, and how to do it fast given that

the data is transformed during analytics. Developing

new, or more sophisticated, risk models can enable in-

surers to offer more competitive rates, or to offer in-

surance for previously uninsurable risks, due to infor-

mation gaps which today are filled in by the increased

ICE-B 2020 - 17th International Conference on e-Business

132

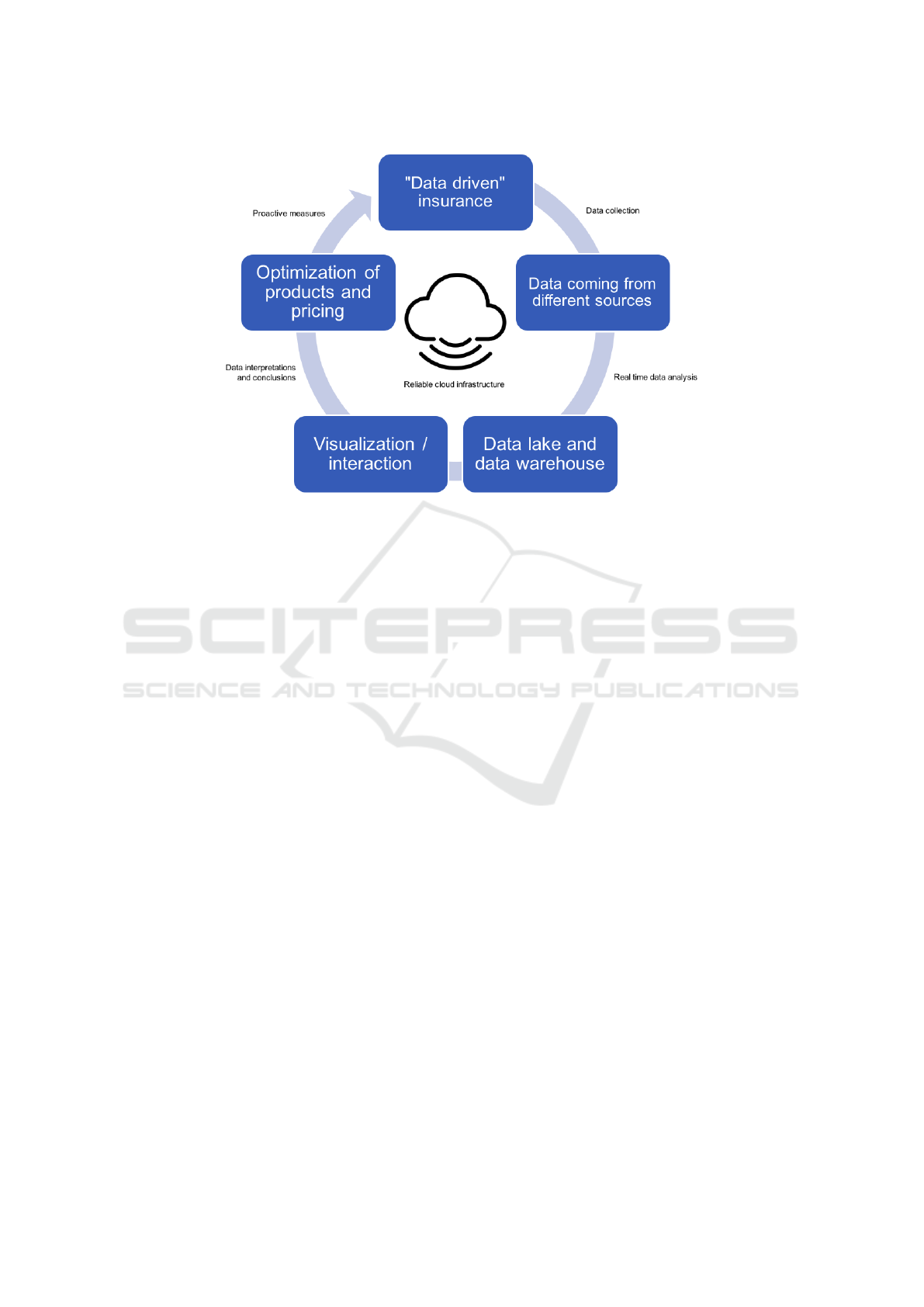

Figure 4: Business logic of insurance company in the digital era.

availability of data. Data lakes in this regard make

the work of a data analyst in a company much easier

and the use of new analytical methods would be faster

with the use of data lakes.

6 INSURANCE COMPANIES

Big data and new ways to elaborate data available

from multiple sources brought to raise the possibil-

ity for the insurance companies to offer usage-based

insurance(Thiesse and Köhler, 2008). For the mo-

ment it is only for niche customers, and as technol-

ogy advances are significant, it is expected to signif-

icantly increase market penetration. It might also in-

crease accessibility to insurance, and will allow to cat-

egories that previously did not insure to get coverage

through the monitored coverage programs. New busi-

ness models, based on a unique personal situation tied

to the consumer will rise. Potential examples of the

new scenario for which insurance companies neither

think nor have an offer yet, especially in the context

of usage-based insurance:

• Frequent air travelers, and people who travel of-

ten. Should travelers insure for all the flights or

only for the flights that are likely to be canceled

or delayed? Should this decision be made on in-

formation about weather, the company profile of

canceled flights, or other events that may impact

flight cancellations?

• Homeowners, and owners of personal posses-

sions. How to insure a house while on a rental

contract? What about Airbnb renting? In general

for personal possessions, should companies insure

only new possessions, or also old ones? Again,

should companies insure the rents for a longer du-

ration of time, or insure for single rents?

• Car insurance and drives that drive frequently or

infrequently. Should there be insurance coverage

for part-time driving, or based only on the num-

bers of km customers drive? Does the price that

now customers currently pay truly take into ac-

count the driving history of the person or is de-

termined based on the real risk of your car be-

ing stolen? If someone borrows the car for 2

days, should he have separate insurance, espe-

cially if the current insurance policy is based on

the owner’s behavioral profile? What about rides

in Blablacar?

In general, the benefits for insurers will be also in

reduced costs of underwriting and administration of

insurance policies, and using the data lakes approach

will have better integration with data from other in-

dustries, and significant improvement in the use and

making sense of such data.

An important obstacle and limitation for the adop-

tion of such approaches by insurance companies are

to avoid risk prediction that is ’too thin’ and leaves

the company with big financial exposure to a potential

unlikely event. The lower the cost of the coverage for

high-risk events, the poorer the insurer will be. Fu-

ture works will need to investigate how to build new

risk models that will support usage-based insurance

offerings.

Data Lakes for Insurance Industry: Exploring Challenges and Opportunities for Customer Behaviour Analytics, Risk Assessment, and

Industry Adoption

133

In Figure 4 we present the basic structure of the

"data-driven" insurers. The data collected will be an-

alyzed in real-time in the data lake, visualizations will

be presented to insurers, and the insurer can decide

on optimization in offering and product or pricing.

This information can be presented further in knowl-

edge graphs (Tejero et al., 2020) and can be used for

the generation of reports with new insights, the execu-

tion of advanced data analysis task between business.

7 CONCLUSIONS

In this paper we presented our first attempt to tell

the ongoing problems in the insurance industry, what

would be potential advantages and challenges for use

of data lakes in the insurance industry, reflected how

they will influence customer behavior analytics, and

risk assessment, and lastly we discuss industry adop-

tion and challenges that may arise. Besides, we

present the basic structure of the digital insurance

ecosystem, with data lakes and data warehouses be-

ing at the center of it.

Big data and new ways of integrating data in the

digital transformation, such an integrated approach

will foresee the development of new open business

intelligence models, to better detect similar cases

among data and stress similarity and explore more the

use potential re-use of the same effort for different

businesses.

The future of insurance will be data-driven and

there will be the need to manage risk even if data

makes it easier to estimate it. The pace of change

however if big and modern data structures like data

lakes and data warehouses will give rise to new busi-

ness models for their functioning, that will change the

way they work as of today.

ACKNOWLEDGEMENTS

The project was supported by no. ED_18-1-2019-

0030 (Application-specific highly reliable IT solu-

tions) program of the National Research, Develop-

ment and Innovation Fund of Hungary, financed un-

der the Thematic Excellence Programme funding

scheme.

REFERENCES

Boobier, T. (2016). Analytics for insurance: The real busi-

ness of Big Data. John Wiley & Sons.

Duggal, R., Khatri, S. K., and Shukla, B. (2015). Improv-

ing patient matching: single patient view for clinical

decision support using big data analytics. In 2015

4th International Conference on Reliability, Infocom

Technologies and Optimization (ICRITO)(Trends and

Future Directions), pages 1–6. IEEE.

Koetter, F., Blohm, M., Kochanowski, M., Goetzer, J.,

Graziotin, D., and Wagner, S. (2018). Motiva-

tions, classification and model trial of conversational

agents for insurance companies. arXiv preprint

arXiv:1812.07339.

LaPlante, A. and Sharma, B. (2014). Architecting Data

Lakes. O’Reilly Media Sebastopol.

Liu, Y., Peng, J., and Yu, Z. (2018). Big data platform archi-

tecture under the background of financial technology:

In the insurance industry as an example. In Proceed-

ings of the 2018 International Conference on Big Data

Engineering and Technology, pages 31–35.

Minelli, M., Chambers, M., and Dhiraj, A. (2013). Big data,

big analytics: emerging business intelligence and an-

alytic trends for today’s businesses, volume 578. John

Wiley & Sons.

Myatt, G. J. (2007). Making sense of data: a practical guide

to exploratory data analysis and data mining. John

Wiley & Sons.

Pal, A. and Purushothaman, B. (2016). IoT technical chal-

lenges and solutions. Artech House.

Pisoni, G. (2020). Going digital: case study of an italian

insurance company. Journal of Business Strategy.

Riikkinen, M., Saarijärvi, H., Sarlin, P., and Lähteenmäki, I.

(2018). Using artificial intelligence to create value in

insurance. International Journal of Bank Marketing.

Ristov, S., Gusev, M., and Kostoska, M. (2012). Cloud com-

puting security in business information systems. arXiv

preprint arXiv:1204.1140.

Rodrıguez, C. et al. (2012). Eventifier: Extracting process

execution logs from operational databases. Proceed-

ings of the demonstration track of BPM, 940:17–22.

Spender, A. et al. (2019). Wearables and the internet of

things: Considerations for the life and health insur-

ance industry. British Actuarial Journal, 24.

Tejero, A., Rodriguez-Doncel, V., and Pau, I. (2020).

Knowledge graphs for innovation ecosystems. arXiv

preprint arXiv:2001.08615.

Thiesse, F. and Köhler, M. (2008). An analysis of usage-

based pricing policies for smart products. Electronic

Markets, 18(3):232–241.

Traum, A. B. (2015). Sharing risk in the sharing economy:

Insurance regulation in the age of uber. Cardozo Pub.

L. Pol’y & Ethics J., 14:511.

Zachman, J. A. (1987). A framework for information sys-

tems architecture. IBM systems journal, 26(3):276–

292.

ICE-B 2020 - 17th International Conference on e-Business

134