The Need for an Enterprise Risk Management Framework for

Big Data Science Projects

Jeffrey Saltz and Sucheta Lahiri

Syracuse University, Syracuse, NY, U.S.A.

Keywords: Risk Management Framework (RMF), Big Data, Data Science, Enterprise Risk Management (ERM).

Abstract: This position paper explores the need for, and benefits of, a Big Data Science Enterprise Risk Management

Framework (RMF). The paper highlights the need for an RMF for Big Data Science projects, as well as the

gaps and deficiencies of current risk management frameworks in addressing Big Data Science project risks.

Furthermore, via a systematic literature review, the paper notes a dearth of research which looks at risk

management frameworks for Big Data Science projects. The paper also reviews other emerging technology

domains, and notes the creation of enhanced risk management frameworks to address the new risks introduced

due to that emerging technology. Finally, this paper charts a possible path forward to define a risk management

framework for Big Data Science projects.

1 INTRODUCTION

Despite an increase in the use of Big Data Science by

government, industry and educational institutions,

there is currently no universally accepted definition

that describes the key characteristics of Big Data (Al-

Mekhlal & Khwaja, 2019). For example, the three V’s

(Volume, Variety and Velocity) is a common

framework used to describe Big Data analytics (Chen,

Chiang & Storey; 2012). However, additional

dimensions have been added to that framework, such

as Veracity, Variability (Gandomi & Haider, 2015).

A yet broader definition of Big Data Science has been

used by Saltz and Stanton (2017), who focus on the

collection, processing, analysis, visualization,

preservation and management of vast amount of

information. Furthermore, some use the term Big

Data Analytics, rather than Big Data Science.

Independent of the specific term used, this field

leverages data to develop functional ideas to facilitate

performance measurement, create sustained value,

and competitive advantage (Fosso, Akter, Edwards,

Chopin, & Gnanzou, 2015).

Risk Management is a different field that is also

critically important for a wide range of organizations.

One view of Enterprise Risk Management is

described by Lam (2017, pp.6), who notes that it is

“an integrated and continuous process for managing

enterprise-wide risks—including strategic, financial,

operational, compliance, and reputational risks”.

Thus, an Enterprise Risk Management Framework

(RMF) enables organizations to understand and

mitigate potential project risks as well as enabling the

alignment of the interests of the stakeholders to a

common goal (Lam, 2017).

In short, enterprise risk management enables

organizations to manage project risk via the

identification and management of risk elements that

are contained within the organization’s project

portfolio (e.g., Lam, 2003, Liebenberg and Hoyt,

2003, Nocco and Stulz, 2006, Beasley et al., 2008,

Hoyt and Liebenberg, 2009). Furthermore, to

properly address project risks, organizations need to

have an enterprise risk management framework, as

this will help model, measure, analyze, and respond

to the project risks. This is done by treating the

potential risks as a portfolio of risks to be managed

collectively (Gordon, Loeb, and Tseng, 2009).

To help evaluate the need for a new RMF for Big

Data Science projects, this paper explores the

following questions:

Q1: Do Big Data Science projects introduce new

risks into an organization?

Q2: Can current RMFs handle these risks?

Q3: Is there research that exists, with respect to

integrating Big Data Science risks within

enterprise risk management?

268

Saltz, J. and Lahiri, S.

The Need for an Enterprise Risk Management Framework for Big Data Science Projects.

DOI: 10.5220/0009874502680274

In Proceedings of the 9th International Conference on Data Science, Technology and Applications (DATA 2020), pages 268-274

ISBN: 978-989-758-440-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 BIG DATA SCIENCE AND

ENTERPRISE RISK

2.1 Big Data Science Risks

Independent of what specific Big Data Science

definition is used, organizations should be aware of

the risks that can occur when using Big Data Science.

A classic example of a risk that could arise when

using Big Data Science predictive analytics was seen

by Target, a large retailer in the United States. Target

used predictive analytics to understand future

consumer needs, including predicting if one of their

consumers was pregnant (Someh et al. 2016;

Erevelles, Fukawa & Swayne, 2016). With the

capabilities of Big Data to perform predictive

analysis, Target predicted a female shopper’s

pregnancy, and sent marketing material to her family

residence, weeks before she told her family about the

pregnancy.

However, the risks of using Big Data Science

extend beyond possible misuses of predictive

analytics. Data inconsistency is another risk that must

be considered when using Big Data Science,

especially since data inconsistencies are often

exacerbated due to the velocity of the data, as old data

may become obsolete or not be consistent in meaning

with newly generated data (Kim & Cho, 2018; Tse,

Chow, Ly, Tong, & Tam, 2018).

There are also regulatory risks associated with the

protection of data. This is particularly important

where regulatory requisites, such as General Data

Protection Regulation (GDPR) and US Privacy Act,

have introduced specific regulatory risks associated

with data privacy. Hence, a different concern that

organizations need to address is how to do Big Data

Science without impeding on the data privacy of

consumers. For example, using Big Data analytics,

one can analyze a person’s political preference,

spending habits, and other private information via the

content or posts published on the internet (Zhang,

2018).

2.2 The Need for a Big Data Science

Informed RMF

It is therefore important for organizations to address

these risks (e.g., Ethical, Reputational, Operational)

pre-emptively. In other words, as Big Data Science is

increasingly used, it is creating new risks for the

organizations to understand and manage.

To manage these risks, there needs to be a

framework that encompasses and manages all Big

Data Science risks encountered by an organization.

Using a conceptual framework for data governance

combined with an existing risk management standard

is one approach for Big Data Science risk

management. However, as discussed in the next

section, existing frameworks are generic in nature and

unequipped in managing the risk of Big Data Science

on an enterprise level.

3 EXISTING RMF PITFALLS

FOR BIG DATA SCIENCE

Standards such as NIST, the Committee of Sponsoring

Organizations (COSO) Enterprise Risk Management

Framework, and ISO 31000:2009. Risk management:

Principles and guidelines are all focussed on risk

management activities, assessment process and

deployment. Each of these standards are explored to

determine if they could properly handle Big Data

Science specific risks.

3.1 COSO RMF

In 2004, the first comprehensive guidance on

enterprise risk management was published by

Committee of Sponsoring Organizations – COSO

(Committee of Sponsoring Organizations of the

Treadway Commission [COSO], 2004). Revisions

were done in 2013 and then again in 2017 (Committee

of Sponsoring Organizations of the Treadway

Commission [COSO], 2016). The COSO-ERM

Integrated Framework has been popular for

incorporating enterprise risk (Fox, 2018).

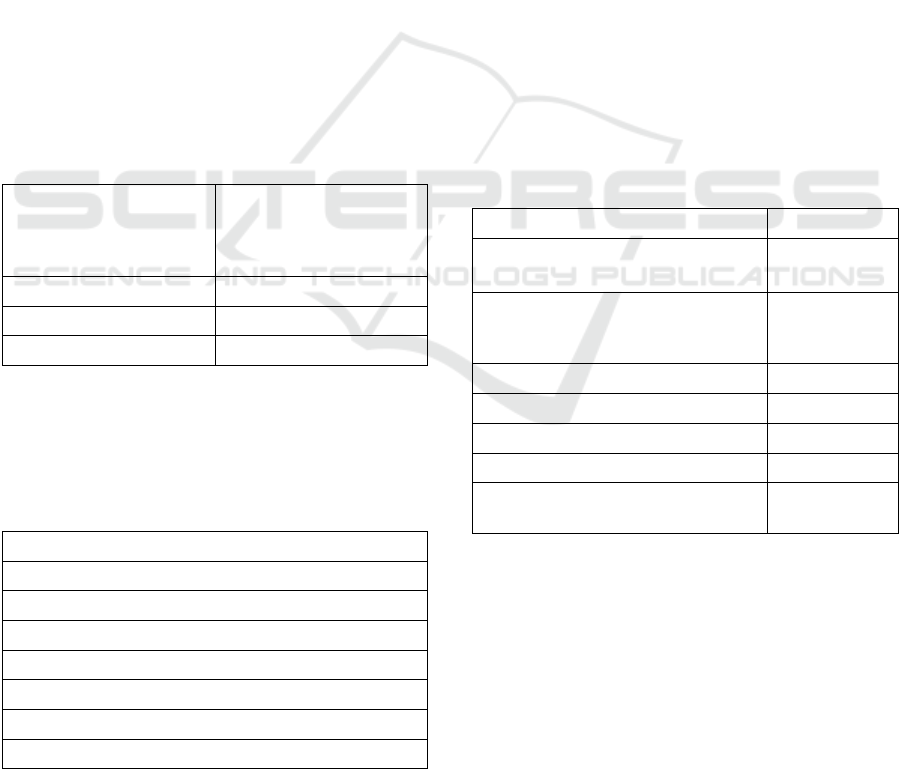

There are five components of COSO ERM –

Governance & Culture, Strategy & Objective-Setting,

Performance, Review & Revision, Information,

Communication & Reporting. As shown in Figure 1,

the COSO enterprise risk management framework

also has 20 principles, ranging from exercising board

risk oversight to reporting on risk performance

(Prewett & Terry, 2018).

Figure 1: 2017 Enterprise Risk Management Framework

Principles and Components (Prewett & Terry, 2018).

While, these principles encourage organizations

to identify and manage risks, they are all at a high

The Need for an Enterprise Risk Management Framework for Big Data Science Projects

269

level, and do not offer a framework on how to actually

identify the risks. In other words, COSO-ERM is a

general set of guidelines which are focussed on the

processes deployed in a firm. It is an integrated

approach that describes how to implement risk

management guidelines via the setting and meeting

program goals and reviews. However, Big Data

Science may introduce new risks that the organization

would not identify, and hence, would not manage via

the COSO-ERM framework. In short, COSO ERM by

itself is not sufficient to manage Big Data Science

risks.

3.2 ISO 31000

The ISO 31000 standard was developed in 2009 by

the ISO Technical Management Based Working

Group on risk management (International

Organization for Standardization, 2009; Choo & Goh;

2015). In conjunction with the earlier standards of

AS/NZS 4360:2004, ISO 31000 incudes new

definitions of risk management, including eleven risk

management principles (Olechowski, Oehmen,

Seering, & Ben-Daya, 2016), which are:

1. Risk management creates value

2. Risk management is an integral part of

organizational processes

3. Risk management is part of decision making

4. Risk management explicitly addresses

uncertainty

5. Risk management is systematic, structured

and timely

6. Risk management is based on the best

available information

7. Risk management is tailored

8. Risk management takes human and cultural

factors into account

9. Risk management is transparent and inclusive

10. Risk management is dynamic, iterative and

responsive to change

11. Risk management facilitates continual

improvement

As can be seen via these principles, the framework

focuses on risk assessment via risk identification,

analysis and evaluation. It provides a conceptual

approach that creates exhaustive ERM practices in an

organization (Gjerdrum & Salen, 2010). The

backbone of the risk management process is the

ability to create and deploy risk assessments that

eventually lead to risk treatments.

Similar to COSO, the standard is not without

limitations in that the scope of ISO 31000 is high

level and does not help to identify new risks to an

organization. Furthermore, the framework’s

definition of risk is the “uncertainty effect on defined

goals” (Kamarulzaman, Bakar & Abas, 2019). In

other words, goals and objectives must be defined

pre-emptively before risk can be known. However,

this objective is challenging, as the goals and

objectives within a Big Data Science project keep on

changing, due to new data and insights generated

during the project.

3.3 NIST RMF

The U.S. National Institute of Standards and

Technology (NIST) developed a framework to

address cyber risk. There are three parts of NIST

framework - Core, Profile and Implementation Tiers

(Hiller & Russell, 2017). For example, the Core

detects and responds to attacks/vulnerabilities and

protects assets.

In short, the NIST Risk Management Framework

was created to manage and mitigate the risks that get

generated in information systems within an

organization (Kohnke, Sigler, & Shoemaker, 2016),

such as cyber-attacks, and no other risk elements are

addressed.

3.4 Analytics Governance Framework

The Analytics Governance Framework (AGF)

focuses on improving big data project management

and minimizing project management risk (Yamada &

Peran; 2017). While some might view AGF as a Big

Data Science specific approach to manage Big Data

Science risk, its focus is only on project execution

risk.

For example, it proposes a list of guiding

principles that streamline the responsibilities of

project managers, analytics specialists, and data

management specialists. As such, the goal of AGF is

to produce successful projects by prioritizing projects

in the pipeline, with clear guidelines for data

management practitioners on a top-down enterprise

level. This will minimize misunderstandings between

stakeholders and practitioners, keep timelines in

place, and manage expectations.

This framework could possibly be leveraged to

help create a foundation for a Big Data Science ERM

(since it aligns the objectives and interests of both the

clients and the practitioners along with the managers).

However, by itself, AGF is not a risk management

framework but rather, a project management

framework. Hence, there is a need of adding another

framework (or layer) to help manage Big Data

Science that will help create context, as well as

analyze, evaluate, and manage risk.

DATA 2020 - 9th International Conference on Data Science, Technology and Applications

270

4 RMFS FOR OTHER

EMERGING TECHNOLOGIES

The need of having a new risk management

framework for an emerging technology is not unique

to Big Data Science. Below we discuss three other

examples: cloud computing, industry 4.0 and supply

chain management that also required a new risk

management framework.

4.1 Cloud Computing

Cloud computing is a model for allowing ubiquitous,

convenient, and on-demand network access to a

number of configured computing resources that can

be rapidly provisioned and released with minimal

management effort or service provider interaction

(Mell & Grance, 2011). Internet and different data

avenues are used to host software and hardware as a

Service via cloud computing (Armbrust, 2010).

Big data and cloud computing are associated with

each other. Big data facilitates the use of computing

applications to perform queries and retrieve desired

outcomes in a timely and seamless manner.

Furthermore, cloud computing can use Hadoop, a big

data storage service, to facilitate the foundational

engine for data processing (Hashem et al., 2015).

Cloud-based technologies have clearly defined

benefits – such as providing a centralized location for

storing high volume data on remote servers (Hao &

Yang, 2019). As cloud services are shared, dynamic

and scalable, these services have faced concerns

around data security and cyber-attacks (Durowoju,

Chan & Wang, 2011; Grobauer, Walloschek &

Stocker; 2011). Some of the cloud computing

challenges that require a top down approach on an

enterprise level include data vulnerabilities, the threat

to employee privacy, sharing cloud links, cloud file

synchronization, and the security issues related to

enterprise directory integration.

However, in exploring how to understand and

minimize these risks, it has been shown that it is

difficult to manage these cloud computing risks with

an existing RMF; and there is a need for having an

adaptive risk management framework specifically for

cloud computing (Medhioub and Kim, 2017).

Hence, it has been suggested that an integrated risk

management framework is required to address cloud

computing issues and align the interest of the

management and stakeholders (Medhioub and Kim,

2017).

4.2 Industry 4.0

The concept of Industry 4.0 was coined in 2011 at the

Hanover Fair. It is an umbrella term that encompasses

concepts of the Internet of People (IoP), Internet of

things (IoT), Internet of Services, Internet of Energy

and Cyber Physical System (Hermann, Pentek, &

Otto, 2015; Lom, Pribyl, & Svitek, 2016). Apart from

operational risks generated with machines, methods,

materials, and human resources, Industry 4.0

introduces new and unknown risks with machine,

robots and data vulnerability (Tupa, Simota &

Steiner, 2017).

Initially the ISO 31000 standard was proposed to

address these risks (Niesen, Houy, Fettke, and P.

Loos, 2016). However, later research noted that to

manage these risks, a new risk management model

was needed that integrated BPM (Business Process

Management) and PPM (Process Performance

Management) with other, more traditional, risk

management elements (Tupa, Simota and Steiner;

2017).

4.3 Supply Chain

Supply chain risk is defined by potential incidents

associated with inbound supply (i.e., from supplier

failures) or the supply market, in which its outcomes

result in the inability of a purchasing organization to

meet customer demand (Zsidisin, Melnyk, and

Ragatz, 2005).

It has been noted that it is imperative to have a

supply chain risk management framework that can

collect, analyze and monitor supply chain real time

data (Fan, Heilig & Voβ; 2015). The need for a supply

chain risk management framework has arisen in order

to manage or mitigate risks related to utilized

resources, network systems and performance criteria

(Lassar, Haar, Montalvo, and Hulser; 2010). This

need was initially identified due to significant

financial losses at companies such as General Motors

(1996) and Boeing (1997). More recently, COVID-19

and the related supply shock has also demonstrated

this supply chain risk (Baldwin & Tomiura, 2020).

To help address these risks, a Supply Chain

Management Framework, which is integrated into a

Knowledge Management Framework that hosts all

the known risk elements on the knowledge base, has

been proposed (Solomon, Ketikidis & Choudhary,

2012).

The Need for an Enterprise Risk Management Framework for Big Data Science Projects

271

5 BIG DATA SCIENCE RMF

RESEARCH – A SYSTEMATIC

LITERATURE REVIEW

To explore the existing research on Big Data Science

and risk management frameworks, a Systematic

Literature Review (SLR) was performed. An SLR

was used since it provides an understanding of the

relevant literature and more generally, provides a

good idea of what is known about a particular topic

or discipline (Boell & Cecez-Kecmanovic; 2014).

5.1 Methodology

As shown in Table 1, six repositories were searched

for literature on Risk Management Frameworks

relating to Big Data Science – ACM Digital Library,

Science Direct, IEEE Explore, Scopus, Web of

Science, and Google Scholar. As the domain of Big

Data Science is an emerging domain, we restricted the

search to articles published in last five years i.e., from

2015 (through February 2020). In addition, only

articles published in English were considered.

Table 1: Search Summary.

Repository searched

ACM digital library,

Google Scholar, science

direct, scopus, web of

science, IEEE xplore

Publication period 2015 to 2020

Language English

Search applied Full text

As shown in Table 2, the search consisted of two

separate terms, the first was related to risk

management framework, and the second term related

to big data science.

Table 2: Keyword combinations used for literature search.

"risk management process" + "big data"

"risk management framework" + "data science"

"risk management process" + "big data"

"risk management framework” + "data analytics"

"risk management framework” +”data mining”

“risk management framework” + “business analysis”

“risk management framework” + “artificial intelligence”

"risk management framework" +” text mining”

After the documents were retrieved, a content

analysis was performed that focused on ensuring that

the article focused on risk management frameworks

for Big Data Science project risks, and was performed

as follows using the following two step process. First,

the title, abstract and conclusion were reviewed to

determine if the paper had the appropriate focus. For

papers where it was not clear if they should be

included or excluded, they were then briefly reviewed

in full. Finally, the articles that past this analysis were

reviewed in depth and categorized into key themes.

5.2 Findings

There was a total of 334 articles identified by the

previously defined search criteria. After the content

analysis, 46 articles remained relevant.

As shown in Table 3, the literature search did not

identify any article that provided a risk management

framework for Big Data Science projects. In fact, the

articles were broadly classified into several other

categories (risk management standards, RMFs in

different sectors, Big Data execution challenges).

We note that one article within the big data

execution challenges category did highlight legal risk,

and the potential risks related to the quality of the

analysis (Waterman & Bruening; 2014).

Table 3: Resultant documents with assigned categories.

Categories # of articles

Risk management standards

(ISO, NIST, COSO)

13

RMF in different sectors (e.g.,

Banking, Supply Chain Management,

Cloud Computing, Industry 4.0)

19

Big Data Execution Challenges 7

Big Data Ethics 2

Big Data as a solution 2

What is Big Data/Data Analytics/AI? 3

RMF for specifically for Big Data

Science Projects

0

Hence, this SLR supports the notion that there is

minimal currently research on exploring a Big Data

Science appropriate RMF.

6 CONCLUSIONS

While organizations are continuing to increase their

use Big Data Science, there has been less attention

focused on the risks associated with the use of Big

Data Science.

DATA 2020 - 9th International Conference on Data Science, Technology and Applications

272

Specifically, this paper notes that there are new

risks that a Big Data Science project introduces into

an organization (which addresses RQ1), that the

current RMFs do not handle these risks (which

addresses RQ2) and that there is currently minimal

research with respect to evaluating Big Data Science

risks within enterprise risk management (addressing

RQ3). Hence, this paper demonstrates the need for a

Big Data Science RMF that can address the unique

Big Data Science project risks.

In short, using an existing enterprise framework

for Big Data Science projects is not sufficient, in that

these frameworks will not capture all the risks of Big

Data project. These risks include model risk (e.g.,

model bias), reputation risk (e.g., in appropriate use

of data insights) and data risk (e.g., inconsistencies in

the data). These new risks need to be incorporated

within an enterprise level risk management

framework. Hence, the lack of a well-defined RMF

for this domain suggests that organizations have

unknown and/or unmanaged risks, and that a new

RMF for Big Data Science projects is required to

accurately capture and manage these new project

risks.

One potential next step, towards the creation of an

effective Big Data Science RMF, is to survey

organizations to identify best practices, identify

organizations that have extended standards such as

COSO, ISO-31000 or NIST. The survey could also

help to gain an understanding of internally deployed

RMFs for Big Data Science efforts. With this

information, one could consolidate the existing

organization specific models and frameworks used, to

see if there were components that could be leveraged

to create an enterprise level risk management

framework for Big Data Science projects.

REFERENCES

Abraham, R., Schneider, J., & vom Brocke, J. (2019). Data

governance: A conceptual framework, structured

review, and research agenda. International Journal of

Information Management, 49, 424-438.

Al-Mekhlal, M., & Khwaja, A. A. (2019, August). A

Synthesis of Big Data Definition and Characteristics. In

2019 IEEE International Conference on Computational

Science and Engineering (CSE) and IEEE International

Conference on Embedded and Ubiquitous Computing

(EUC) (pp. 314-322). IEEE.

Armbrust, M., Fox, A., Griffith, R., Joseph, A. D., Katz, R.,

Konwinski, A.,. & Zaharia, M. (2010). A view of cloud

computing. Communications of the ACM, 53(4), 50-58.

Ardagna, C. A., Ceravolo, P., & Damiani, E. (2016,

December). Big data analytics as-a-service: Issues and

challenges. In 2016 IEEE international conference on

big data (big data) (pp. 3638-3644).

Asadi Someh, I., Breidbach, C. F., Davern, M., & Shanks,

G. (2016). Ethical implications of big data analytics.

Research-in-Progress Papers, 24.

Baldwin, R., & Tomiura, E. (2020). 5 Thinking ahead about

the trade impact of COVID-19. Economics in the Time

of COVID-19, 59.

Boell, S. K., & Cecez-Kecmanovic, D. (2014). A

hermeneutic approach for conducting literature reviews

and literature searches. Communications of the

Association for Information Systems, 34(1), 12.

Chen, H., Chiang, R. H., & Storey, V. C. (2012). Business

intelligence and analytics: From big data to big impact.

MIS quarterly, 1165-1188.

Choi, T. M., Chan, H. K., & Yue, X. (2016). Recent

development in big data analytics for business

operations and risk management. IEEE transactions on

cybernetics, 47(1), 81-92.

Choo, B. S. Y., & Goh, J. C. L. (2015). Pragmatic

adaptation of the ISO 31000: 2009 enterprise risk

management framework in a high-tech organization

using Six Sigma. International Journal of Accounting

& Information Management.

Duhigg, C. (2012). How companies learn your secrets. The

New York Times, 16(2), 1-16.

Durowoju, O. A., Chan, H. K., & Wang, X. (2011). The

impact of security and scalability of cloud service on

supply chain performance. Journal of Electronic

Commerce Research, 12(4), 243-256.

Erevelles, S., Fukawa, N., & Swayne, L. (2016). Big Data

consumer analytics and the transformation of

marketing. Journal of Business Research, 69(2), 897-

904.

Fan, Y., Heilig, L., & Voß, S. (2015, August). Supply chain

risk management in the era of big data. In International

conference of design, user experience, and usability

(pp. 283-294). Springer, Cham.

Fox, C. (2018). Understanding the new ISO and COSO

updates. Risk Management, 65(6), 4-7. Retrieved:

https://search.proquest.com/docview/2065314658

Gandomi, A., & Haider, M. (2015). Beyond the hype: Big

data concepts, methods, and analytics. International

journal of information management, 35(2), 137-144.

Gjerdrum, D. & Salen, W.L. (2010), “The new ERM gold

standard:ISO31000:2009”, Professional Safety, Vol.55

No.8, pp.43-44.

Gordon, L. A., Loeb, M. P., & Tseng, C. Y. (2009).

Enterprise risk management and firm performance: A

contingency perspective. Journal of accounting and

public policy, 28(4), 301-327.

Hashem, I. A. T., Yaqoob, I., Anuar, N. B., Mokhtar, S.,

Gani, A., & Khan, S. U. (2015). The rise of “big data”

on cloud computing: Review and open research issues.

Information systems, 47, 98-115.

Hermann, M., Pentek, T., & Otto, B. (2016, January).

Design principles for industrie 4.0 scenarios. In 2016

49th Hawaii international conference on system

sciences (HICSS) (pp. 3928-3937). IEEE.

The Need for an Enterprise Risk Management Framework for Big Data Science Projects

273

Hill, K. (2012). How Target figured out a teen girl was

pregnant before her father did. Forbes, Inc.

Hiller, J. S., & Russell, R. S. (2017). Privacy in crises: The

NIST privacy framework. Journal of Contingencies

and Crisis Management, 25(1), 31-38.

Kamarulzaman, M. S., Bakar, N. A. A., & Abas, H. (2019).

Risk Processing Framework for Big Data Security in

the Enterprise. Open International Journal of

Informatics (OIJI), 7(2), 170-178.

Kim, H. Y., & Cho, J. S. (2018). Data governance

framework for big data implementation with NPS Case

Analysis in Korea. Journal of Business and Retail

Management Research, 12(3).

Kohnke, A., Sigler, K., & Shoemaker, D. (2016). Strategic

Risk Management Using the NIST Risk Management

Framework. EDPACS, 53(5), 1-6.

Krasnow Waterman, K., & Bruening, P. J. (2014). Big Data

analytics: risks and responsibilities. International Data

Privacy Law, 4(2), 89-95.

Lam, J. (2017). Implementing enterprise risk management:

From methods to applications. John Wiley & Sons.

Lassar, W. M., Jerry, H., Montalvo, R., & Hulser, L. (2010).

Determinants of strategic risk management in emerging

markets supply chains: The case of Mexico. Journal of

Economics, Finance & Administrative Science, 15(28).

Lom, M., Pribyl, O., & Svitek, M. (2016, May). Industry

4.0 as a part of smart cities. In 2016 Smart Cities

Symposium Prague (SCSP) (pp. 1-6). IEEE.

Malik, V., & Singh, S. (2019). Cloud, Big Data & IoT: Risk

Management. In 2019 International Conference on

Machine Learning, Big Data, Cloud and Parallel

Computing (COMITCon) (pp. 258-262). IEEE.

Medhioub, M., Hamdi, M., & Kim, T. H. (2017, March).

Adaptive risk management framework for cloud

computing. In 2017 IEEE 31st International

Conference on Advanced Information Networking and

Applications (AINA) (pp. 1154-1161). IEEE.

Mell, P., & Grance, T. (2011). The NIST definition of cloud

computing.

Niesen, T., Houy, C., Fettke, P., & Loos, P. (2016, January).

Towards an integrative big data analysis framework for

data-driven risk management in industry 4.0. In 2016

49th Hawaii International Conference on System

Sciences (HICSS) (pp. 5065-5074). IEEE.

Olechowski, A., Oehmen, J., Seering, W., & Ben-Daya, M.

(2016). The professionalization of risk management:

What role can the ISO 31000 risk management

principles play?. International Journal of Project

Management, 34(8), 1568-1578.

Prewett, K., & Terry, A. (2018). COSO's Updated

Enterprise Risk Management Framework—A Quest

For Depth And Clarity. Journal of Corporate

Accounting & Finance, 29(3), 16-23.

Raschke, R. L., & Mann, A. (2017). Enterprise content risk

management: a conceptual framework for digital asset

risk management. Journal of Emerging Technologies in

Accounting, 14(1), 57-62.

Saltz, J. S., & Dewar, N. (2019). Data science ethical

considerations: a systematic literature review and

proposed project framework. Ethics and Information

Technology, 21(3), 197-208.

Saltz, J., & Stanton, J. (2017). An introduction to data

science. Thousand Oaks: SAGE Publications.

Solomon, A., Ketikidis, P., & Choudhary, A. (2012). A

knowledge based approach for handling supply chain

risk management. In Proceedings of the Fifth Balkan

Conference in Informatics (pp. 70-75). ACM.

Tse, D., Chow, C. K., Ly, T. P., Tong, C. Y., & Tam, K. W.

(2018, August). The challenges of big data governance

in healthcare. In 2018 17th IEEE International

Conference On Trust, Security And Privacy In

Computing And Communications/12th IEEE

International Conference On Big Data Science And

Engineering (TrustCom/BigDataSE) (pp. 1632-1636).

IEEE.

Tupa, J., Simota, J., & Steiner, F. (2017). Aspects of risk

management implementation for Industry 4.0. Procedia

Manufacturing, 11, 1223-1230.

Yamada, A., & Peran, M. (2017, December). Governance

framework for enterprise analytics and data. In 2017

IEEE International Conference on Big Data (Big Data)

(pp. 3623-3631). IEEE.

Walloschek, M., Grobauer, B., & Stöcker, E. (2011).

Understanding of Cloud Computing Vulnerabilities.

IEEE Computer and Reliability Society.

Wamba, S. F., Akter, S., Edwards, A., Chopin, G., &

Gnanzou, D. (2015). How ‘big data’can make big

impact: Findings from a systematic review and a

longitudinal case study. International Journal of

Production Economics, 165, 234-246.

Zhang, D. (2018, October). Big data security and privacy

protection. In 8th International Conference on

Management and Computer Science (ICMCS 2018).

Atlantis Press.

Zsidisin, G. A. (2003). Managerial perceptions of supply

risk. Journal of supply chain management, 39(4), 14-

26.

Zsidisin*, G. A., Melnyk, S. A., & Ragatz, G. L. (2005). An

institutional theory perspective of business continuity

planning for purchasing and supply management.

International journal of production research, 43(16),

3401-3420.

DATA 2020 - 9th International Conference on Data Science, Technology and Applications

274