Tax Crime Prediction with Machine Learning: A Case Study in the

Municipality of S

˜

ao Paulo

Andr

´

e Ippolito and Augusto Cezar Garcia Lozano

Tax Intelligence Office, Under-secretariat of Municipal Revenue, Secretariat of Finance,

S

˜

ao Paulo City Hall, 190 Libero Badar

´

o Street, S

˜

ao Paulo, Brazil

Keywords:

Data, Government, Decision-making, Machine Learning, Fiscal, Audit, Tax, Crime, Random Forests,

Ensemble, Compliance, Revenue.

Abstract:

With the advent of Big Data, several industries utilize data for analytical and competitive purposes. The

government sector is following this trend, aiming to accelerate the decision-making process and improve the

efficiency of operations. The predictive capabilities of Machine Learning strengthen the decision-making

process. The main motivation of this work is to use Machine Learning to aid decision-making in fiscal audit

plans related to service taxes of the municipality of S

˜

ao Paulo. In this work, we applied Machine Learning to

predict crimes against the service tax system of S

˜

ao Paulo. In our methods, we structured a process comprised

of the following steps: feature selection; data extraction from our databases; data partitioning; model training

and testing; model evaluation; model validation. Our results demonstrated that Random Forests prevailed over

other learning algorithms in terms of tax crime prediction performance. Our results also showed Random

Forests’ capability to generalize to new data. We believe that the supremacy of Random Forests is due to the

synergy of its ensemble of trees, which contributed to improve tax crime prediction performance. With better

predictions, our audit plans became more assertive. Consequently, this rises taxpayers’ compliance with tax

laws and increases tax revenue.

1 INTRODUCTION

With the large volume of data currently available,

companies of various types of industries are utiliz-

ing data for competitive reasons (Provost and Fawcett,

2013). Computers now have more processing power

and current algorithms can perform deeper analysis

than before. This scenario has enabled the automa-

tion of data analysis, which in turn improves decision-

making. Decision-making based on data, or data-

driven decision-making, is the process of making de-

cisions based on data analysis rather than intuition. In

the corporate world, the practice of decision-making

based on data has strong correlation with productivity

growth, financial return and rise of market value.

The government area is progressively exploring

data to benefit from data analysis and data-driven

decision-making (Matheus et al., 2018). Govern-

ments collect data from a myriad of areas, such as

traffic, energy and social security. Some of the goals

related to the analysis of this data are faster and more

precise decision-making, resulting in increased effi-

ciency and effectiveness of operations.

One kind of data analysis that empowers decision-

making is predictive analytics. Historical data stored

in corporate databases allow risk prediction and trade

opportunities discovery by means of predicitive an-

alytics. The results of these analysis guide deci-

sions. Machine Learning operationalizes the core

techniques and algorithms of predictive analytics

(Mitchell, 1997).

The main motivation of this case study is the

use of Machine Learning to help decision-making in

government taxes audit plans. Most of these plans

aim to increase taxpayers’ compliance and, therefore,

can leverage government taxes revenue. Compliance

means conforming to a rule, such as a policy or a law

(Lin, 2016). Compliance has applicability to several

areas. Some examples are compliance in healthcare,

sales or taxes. Research on tax compliance leads to

the conclusion that an individual pays taxes due to

fear of the economic consequences of detection and

punishment (Alm, 2019). Machine Learning can pre-

dict taxpayers’ actions that do not comply with tax

laws, such as crimes against the tax system.

We ground the work of this case study on data

452

Ippolito, A. and Lozano, A.

Tax Crime Prediction with Machine Learning: A Case Study in the Municipality of São Paulo.

DOI: 10.5220/0009564704520459

In Proceedings of the 22nd International Conference on Enter prise Information Systems (ICEIS 2020) - Volume 1, pages 452-459

ISBN: 978-989-758-423-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

from fiscal audits of the municipality of S

˜

ao Paulo,

related to service taxes. The city of S

˜

ao Paulo has an

outstanding role in the Brazilian economic scenario.

With regard to the Brazilian Gross Domestic Product

(GDP), in the year of 2016, S

˜

ao Paulo had a contribu-

tion of 33.71% (S

˜

ao Paulo State Government, 2019).

In 2019, S

˜

ao Paulo’s revenue from municipal taxes

represented 20% of the revenue collected from all the

Brazilian municipalities (S

˜

ao Paulo Commercial As-

sociation, 2019). The predominant participation of

S

˜

ao Paulo’s tax revenue in the total income of the

municipality corroborates its importance (S

˜

ao Paulo

City Hall, 2019). In 2018, it amounted to 56.72%

of the total revenue, turning out to be the main re-

source that comprised the total income. Among all

municipal taxes, service taxes were the most relevant,

corresponding to 49.97% of the revenue, followed by

property taxes, which contributed with 33.45%.

One of the main actions that potentially help to in-

crease S

˜

ao Paulo’s contribution to tax revenue is the

implementation of tax audit plans that are oriented

to tax compliance. We have practical results in the

Brazilian municipality of S

˜

ao Paulo, which demon-

strate that audits originated by tax compliance ac-

tions, aiming to orientate taxpayers on how to comply

with tax laws, incremented our service taxes revenue

in 15%. The main cause of this increment is the rise

in risk perception, since taxpayers realize they are un-

der surveillance. Sometimes only sending messages

to taxpayers telling them that they will be object of

scrutiny can increase compliance (Alm, 2019).

We believe that Machine Learning can help our

compliance-oriented audit plans to be more assertive,

due to the predictive power of its techniques and algo-

rithms. Thus, Machine Learning application in audit

plans can reverberate, leading to higher amounts of

tax revenue. Predictions of tax crimes can permit our

local government to plan fiscal audits precisely, be-

fore crimes are committed, forcing taxpayers to com-

ply with tax laws and regulations.

Some governments apply Machine Learning in

crime prediction. Police in Venice (Bernasconi, 2018)

and in Chicago (Fingas, 2017) utilize Machine Learn-

ing to predict crimes like robberies, shootings and

murders. The Internal Revenue Service (IRS) of the

United States of America (Olavsrud, 2019) applies

Machine Learning to detect identity theft and pre-

refund fraud in the tax system. In comparison, our

work aims to predict different types of crimes that are

specific to the service tax system of the municipal-

ity of S

˜

ao Paulo, such as denial to provide documents

to fiscal authorities. Other governments use Machine

Learning to tax fraud prediction. The Government of

Chile (Gonz

´

alez and Vel

´

asquez, 2012) and of Spain

(L

´

opez et al., 2019) have case studies based on Neural

Networks. In our work, we apply and compare more

Machine Learning algorithms, like Random Forests,

Logistic Regression and Ensemble Learning.

In this work, we apply Machine Learning tech-

niques and algorithms with the goal of predicting ser-

vice tax crimes against the tax system of the munic-

ipality of S

˜

ao Paulo. As input, we use data from

our fiscal audits. In general terms, our methods en-

compass the following steps: feature selection; data

extraction from our fiscal audits database; data par-

titioning; model training and testing; model evalua-

tion; model validation. The results of our case study

highlight Random Forests’ tax crime prediction per-

formance and also its capability of adapting to new

data. We are not aware of any work with the goal to

predict crimes against S

˜

ao Paulo’s service tax system,

based on Random Forests.

This paper is organized as follows: Section 2

reviews the related works, Section 3 provides the-

oretical background on fiscal authorities, tax audits,

crimes against the tax system and Machine Learning,

Section 4 explains our methods, Section 5 presents

and discusses the results of our case study, Section 6

concludes the paper and suggests future work.

2 RELATED WORKS

Some related works about the use of Machine Learn-

ing in crime prediction and tax fraud detection de-

serve highlight. One example is the use of Machine

Learning by the Italian Police with the goal of predict-

ing crimes (Bernasconi, 2018). In this case, Machine

Learning extracts patterns from data about time and

localization of previous crimes. It triggers alerts, out-

putting where and when a crime has high probability

to occur. This conduced to more precise prediction of

crimes, redounding in the arrest of a man at a hotel

bar in Venice just before he was about to commit a

robbery.

Other case study that applied Machine Learning

to predict crimes comes from the Chicago Police (Fin-

gas, 2017). The solution analyses crime statistics, so-

cial and economic data, climate and localization reg-

istries and data from shot sensors. Whenever Machine

Learning predicts a crime with high probability, the

solution sends an alert to the police officers’ smart-

phones. Chicago Police reports reduction in the num-

ber of shootings and murders after the use of Machine

Learning.

Some governments have applied Machine Learn-

ing for tax fraud prediction. One example is the

IRS of the United States of America, which imple-

Tax Crime Prediction with Machine Learning: A Case Study in the Municipality of São Paulo

453

mented the Return Review Program (RRP) system.

The main objective of the RRP is to detect fraud, iden-

tifying fraudulent returns at a lower false detection

rate (McKenney, 2017). RRP aims to detect iden-

tity theft and pre-refund fraud in the tax system and it

applies predictive techniques and models (Olavsrud,

2019). Reports from the IRS state that an RRP pilot

of 2014 was able to improve fraud detection by 59.4%

(McKenney, 2017).

There are other case studies in the government

area related to tax fraud prediction. One example

is originated from the Tax Administration of Chile

(Gonz

´

alez and Vel

´

asquez, 2012), which applied De-

cision Trees, Neural Networks and Bayesian Net-

works to detect taxpayers who use false invoices. In

their case study, Neural Networks prevailed over the

other algorithms, correctly detecting 92% of the fraud

cases.

Another example of tax fraud prediction based on

Machine Learning comes from the Spanish Institute

of Fiscal Studies (L

´

opez et al., 2019). Their study ap-

plied Neural Networks to data from the Spanish Rev-

enue Office, with the goal of identifying taxpayers

who evade tax. Their model yielded 84% of correct

predictions.

Our work differentiates from these case studies.

Firstly, comparing to the police cases and IRS, the

type of crimes we aim to predict are peculiar and more

specific to the service taxes scenario, also embracing

more crimes, like denial to provide invoices to fiscal

authorities. Secondly, in comparison to the Tax Ad-

ministration of Chile and the Spanish Institute of Fis-

cal Studies, we applied and evaluated more Machine

Learning algorithms, such as Random Forests, Lo-

gistic Regression and Ensemble Learning. Besides,

these governments’ tax systems are distinct from S

˜

ao

Paulo’s tax system. This implies that the laws taxpay-

ers have to comply with, when executing services in

the city of S

˜

ao Paulo, are also different and, conse-

quently, the types of taxpayers’ behaviors and crimes

are distinct too. Our results showed the supremacy of

Random Forests, with regard to tax crime prediction

performance. To our knowledge, there are not works

that aimed to predict crimes against S

˜

ao Paulo’s ser-

vice tax system, using Random Forests.

3 THEORETICAL BACKGROUND

In the following subsections, we define fiscal authori-

ties, tax audits and crimes against the tax system, ac-

cording to Brazilian’s laws and regulations, also ex-

emplifying some of these crimes. In the sequence,

we explain the main concepts and foundations of Ma-

chine Leaning, describing the main features of the al-

gorithms that we applied in this case study.

3.1 Fiscal Authorities

Fiscal authorities play an essential role in engender-

ing tax revenue. According to Brazilian tax laws, fis-

cal authorities are the individuals authorized to col-

lect taxes for the municipality, having the exclusive

competency to constitute the tax credit. In order to

constitute this credit, fiscal authorities have to opera-

tionalize tax audits.

3.2 Tax Audits

A tax audit is an inspection process that mainly

comprises verifying the inception of the tax obli-

gation, calculating the amount of tax that is due,

identifying the taxpayer and proposing, if applicable,

the tax penalty. Fiscal authorities have the functional

responsibility for charging taxes and fines. Their

activities, under their jurisdiction, have precedence

over other administrative sectors.

3.3 Crimes against the Tax System

According to Brazilian tax laws, crimes against the

tax system are crimes that aim to suppress or reduce

taxes. These crimes are committed when taxpayers

omit information, make false declarations, defraud

fiscal documents, create false or inexact documents,

and deny providing documents or invoices to fiscal

authorities.

3.4 Machine Learning

In Machine Learning, algorithms learn from experi-

ence with respect to a task and performance measure,

if its performance measure at the task improves with

experience (Mitchell, 1997). Machine Learning algo-

rithms learn from data, acquiring experience by ad-

justing its parameters based on data features (a.k.a.

attributes), characteristics and patterns, in order to ob-

tain its best performance measure.

One of the usual tasks in Machine Learning is

classification. Algorithms specialized in this task

have to specify which category some input data be-

long to (Goodfellow et al., 2019). Classification can

be supervised or unsupervised. In the former, data

has labels previously categorizing elements into the

classes we are seeking. In the latter, there are no la-

bels for categories and it is necessary to apply spe-

cific algorithms that learn the categories from data,

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

454

forming groups based on similarities of data elements

(a.k.a. instances).

Perfomance measures for classification are based

on the following values, which we describe using the

context of our case study:

• True Positives (TP): number of criminals correctly

classified;

• False Positives (FP): number of taxpayers that are

not criminals but are incorrectly classified as such;

• False Negatives (FN): number of criminals not

classified as such;

• True Negatives (TN): number of not criminals

correctly classified.

Some usual performance measures are accuracy

(ACC), recall (R), precision (P), F-measure (F) and

specificity (S) (Hossin and Sulaiman, 2015). Given a

dataset of N taxpayers, these measures are calculated

according to the following formulas:

ACC =

T P + T N

N

(1)

R =

T P

T P + FN

(2)

P =

T P

T P + FP

(3)

F =

2 x R x P

R + P

(4)

S =

T N

T N + FP

(5)

In our study, we applied supervised classification,

using the following algorithms: Neural Networks,

Naive Bayes, Decision Trees, Ensemble Learning,

Random Forests and Logistic Regression.

3.4.1 Neural Networks

Neural Networks (Hardesty, 2017) are models repre-

sented by interconnected nodes that form a net. These

networks usually solve classification problems. The

neural network receives data values and features. It

calculates weights for these features, with the objec-

tive of minimizing the error between the predicted

classification and the actual classification. These

weights are initially set to random values. In the

sequence, an iterative process begins to adjust these

weights, in order to minimize the error between the

predicted classification and its true labels.

3.4.2 Naive Bayes

Naive Bayes (Zhang, 2019) is a probabilistic algo-

rithm used for classification. It assumes independence

among data features. This means that the presence of

a particular feature is not probabilistically related to

other features used in a model. It is mainly based on

conditional probabilities and its application to classi-

fication enables to calculate the probability of classifi-

cation in one of the classes of the data, given the value

of features.

3.4.3 Decision Trees

Decision Trees (Poole and Mackworth, 2017) are

structure-based models for classification. They are

represented as hierarchies that form trees, in which

nodes represent data features. Arcs coming from a

node represent possible values of a feature. Moving

down to the lowest level of the tree’s hierarchy, leaves

are reached, representing possible classifications of

data elements. The starting node of a decision tree

corresponds to the data feature that partitions data ele-

ments into the most homogeneous groups as possible.

This homogeneity is measured by means of entropy

(Mitchell, 1997) such that the less entropy a group has

the more homogeneous are its data elements. The fol-

lowing node of the tree is the remaining data feature

that best partitions the data in homogeneous groups.

The process of selecting the features that represent the

tree’s nodes continues in this manner until all the fea-

tures are represented in the tree.

3.4.4 Ensemble Learning

Ensemble Learning (Rokach, 2010) combines the re-

sults of multiple learning algorithms, aiming to yield

better performance than can result from the isolated

application of any of its constituent algorithms. For

combination of multiple classifiers, the most com-

monly applied methods are simple fusion methods

(Kuncheva, 2002). These methods combine the out-

put of a committee of classifiers. If this output is given

by probabilities, the final classification is measured

calculating the maximum, average or median proba-

bility of all classifiers, for example. If the classifiers’

output is discrete, e.g. binary classification, the com-

mittee classification results from a majority vote, in

which the most frequent class label among the classi-

fiers is the final classification. Usually, for better re-

sults, it is beneficial that the committee is composed

of heterogeneous classifiers.

Tax Crime Prediction with Machine Learning: A Case Study in the Municipality of São Paulo

455

3.4.5 Random Forests

Random Forests (Breiman, 2001) are based on the

construction of various decision trees. These trees are

combined, such that a random forest is an ensemble

of decision trees. In practice, a training set of data

elements is drawn randomly for each tree. In addi-

tion, a subset of the input data features is sampled at

random. Each tree is grown with these sets without

pruning. To minimize the error in classification, trees

of the ensemble must be the least similar as possible,

to augment the synergy among the trees. Each tree

predictor of a forest outputs a class and majority vote

determines the Random Forests’ prediction. Its basic

premise is that an ensemble of decision trees will out-

perform any of the individual trees solely considered.

3.4.6 Logistic Regression

Logistic Regression (Russell and Norvig, 2010) is a

classification algorithm based on Statistics and in its

basic form classifies data elements in two classes (bi-

nary classification). It uses a logistic function, which

is based on the natural logarithm. The logistic func-

tion outputs numbers between 0 and 1 that are inter-

preted as the probability of a data element belonging

to a class. Logistic Regression fits weights to data

features, minimizing the error between the predicted

class and the true class.

4 MATERIAL AND METHODS

This case study aimed at applying Machine Learn-

ing to fiscal data, with the goal to predict crimes

against the service tax system. We used historic

data from our fiscal audits plan of action and from

our face-to-face fiscal audits. We applied some of

the main Machine Learning models and algorithms,

which were compared with respect to performance

measures.

Our objective was to obtain a predictive model

that is able to assertively foresee which business

taxpayers will commit crimes against the tax system.

For this purpose, our basis to calibrate our model

was the historic fiscal data and the Machine Learning

algorithms that we applied to the data.

To apply our proposed methods, we used the

open source tool KNIME (Berthold et al., 2009).

This tool enabled us to explore data, apply Machine

Learning algorithms, compare their performance

measures and select the best-performing one. We

operationalized these tasks with the use of workflows

that KNIME’s functionalities permit to build.

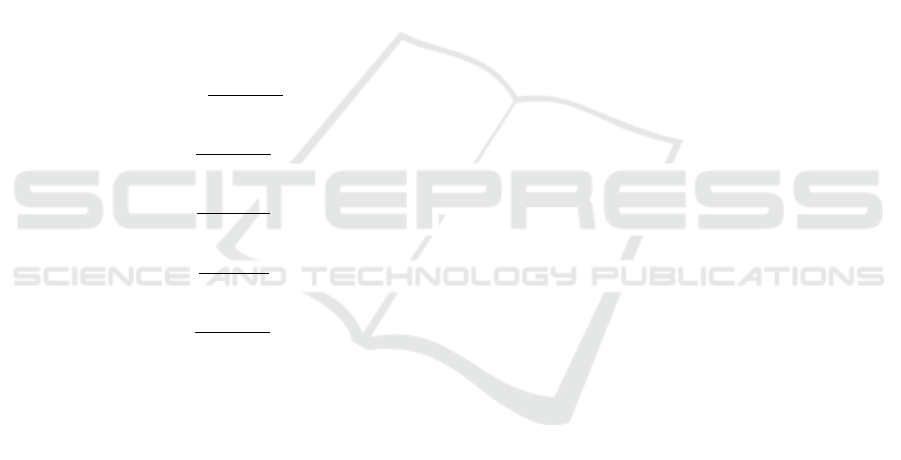

As illustrated in Figure 1, the process of our methods

comprises the following steps:

1) Feature selection

2) Data extraction from our fiscal audits database

3) Data partitioning

4) Model training and testing

5) Model evaluation

6) Model validation

Figure 1: The process of our methods is composed of six

steps: we select features; extract data from our database

based on these features; partition data into train and test sub-

sets; train and test the model applying different algorithms;

evaluate and validate the model.

4.1 Feature Selection

In step 1, based on our data exploration findings and

expertise, we selected the attributes that composed

our model. We selected three features:

• anual tax value declared in invoices in which the

taxpayer declared himself as a firm of profession-

als specialized in a unique service, such as a com-

pany of lawyers or a company of architects;

• anual tax value declared in invoices in which the

taxpayer declared himself as a small business that

is permitted to use simplified procedures to com-

ply with tax service obligations;

• a binary field containing the information whether

or not the taxpayer committed a crime against the

tax system in previous tax audits (class label).

In Table 1, we give an example of an instance of our

dataset with such attributes.

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

456

Table 1: Example of an instance of our dataset.

tax payer ID anual tax value as a specialized company anual tax value as a small business crime

999999999 150,000 90,000 1

4.2 Data Extraction

In step 2, we selected data based on our feature selec-

tion. We collected data from face-to-face fiscal audits

and plans of action of 2016, 2017 and 2018, which

are stored in our relational database.

Originally, a fiscal audit is modelled in our

database as an entity, with fields containing data re-

lated to the identification of the taxpayer, the date

of the beginning and end of the fiscal audit, the au-

dit goals and whether or not the taxpayer comitted a

crime. In our database, a plan of action is also an en-

tity, with fields that identify the taxpayer and the esti-

mated tax fine he would be submitted to, based on the

service income he declares in his invoices and also the

declaration of his specific economic conditions (e.g.

simple business), which implies in different tax obli-

gations to comply with.

We extracted data applying Structured Query

Language (SQL) scripts. In the sequence, we con-

verted the resulting dataset to a spreadsheet format.

There were no missing values and we did not need to

transform data types, since the algorithms applied in

the case study are all adequate to binary and numeri-

cal data.

4.3 Data Partitioning

In step 3, we separated our dataset into two sub-

sets: one subset for calibration of our model (train-

ing and test data), comprised of data from 2016 and

2017; other subset to validate our model, comprised

of data from 2018. The first subset has 151 cases

(instances), comprised of 91 crime cases (60%) and

60 cases that are not crimes (40%). Tax values for

this subset ranged from 6,030.27 reals (Brazilian cur-

rency) to 1,718,637.72 reals, having an average value

of 200,589.25 reals. The validation subset has 66

cases, 36 of them are crimes (55%), while 30 are not

crimes (45%). In this subset, tax values range from

50,799.00 reals to 5,936,188.34 reals, having an aver-

age value of 250,035.40 reals.

4.4 Model Training and Testing

In step 4, we trained and tested our model, using a

10-fold cross validation method, applying Machine

Learning algorithms to our training and test subset of

data. We applied six algorithms: Neural Networks,

Naive Bayes, Decision Trees, Logistic Regression,

Random Forests and Ensemble Learning. The last one

is an ensemble of the other five algorithms, such that

the resulting prediction corresponds to the prediction

with highest probability among the classifiers of the

ensemble.

4.5 Model Evaluation

In step 5, we evaluated the results obtained by each

algorithm applied to the model, comparing them in

terms of their performance measures: recall, preci-

sion, F-measure, accuracy and specificity.

4.6 Model Validation

In step 6, in order to validate our model, we applied

the best-evaluated algorithm to our validation subset

of data. In this step, we also calculated the perfor-

mance measures of the algorithm.

5 RESULTS AND DISCUSSION

After applying our methodology to the dataset com-

prising the fiscal data of 2016 and 2017, the algo-

rithms achieved the performance measures listed in

Table 2. We verified that Random Forests yielded the

highest scores in the majority of the performance met-

rics utilized (precision, accuracy and specificity), con-

sidering the algorithms used in the case study. The

resulting model corresponds to an ensemble of 100

decision trees.

We validated the model adjusted by Random

Forests against fiscal data of 2018. The resulting per-

formance metrics are listed in Table 3.

We believe that Random Forests results are due to

its power to ensemble multiple decision trees, which

enables the algorithm to adjust a model that best cap-

tures the synergy of a multitude of trees. Besides,

when the adjusted model was applied to unseen fiscal

data of 2018 (validation step), the results indicated the

model’s capability to generalize to new data.

Tax Crime Prediction with Machine Learning: A Case Study in the Municipality of São Paulo

457

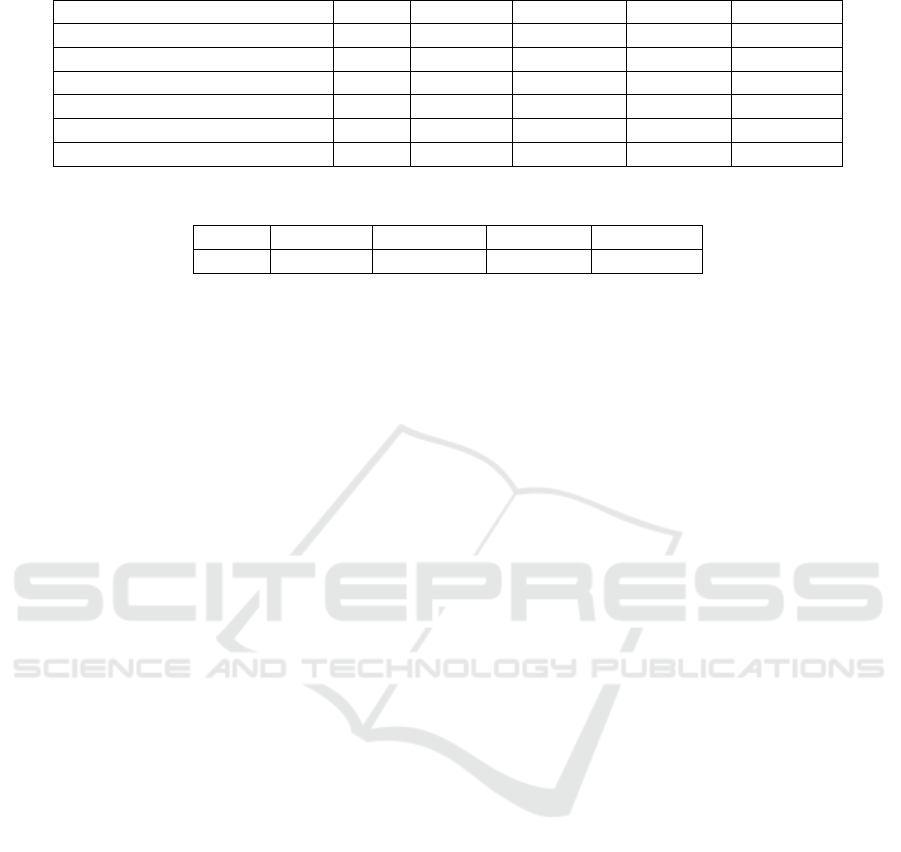

Table 2: Performance measures of the algorithms in the evaluation step.

Machine Learning Algorithm Recall Precision F-measure Accuracy Specificity

Random Forests 0.516 0.870 0.648 0.662 0.883

Naive Bayes 0.890 0.609 0.723 0.589 0.133

Decision Trees 0.681 0.674 0.678 0.609 0.500

Logistic Regression 0.571 0.650 0.608 0.556 0.533

Ensemble Learning 0.670 0.642 0.656 0.576 0.433

Neural Networks 0.538 0.790 0.641 0.636 0.783

Table 3: Performance measures of Random Forests in the validation step.

Recall Precision F-measure Accuracy Specificity

0.889 0.640 0.744 0.667 0.400

6 CONCLUSIONS AND FUTURE

WORK

Contemporarily, as technology evolved, computers

can provide more processing power and algorithms

are capable of performing deeper analysis than be-

fore. This context enables data analysis automation,

which facilitates decision-making. Governments are

progressively benefiting from data analysis, seeking

to improve efficiency and effectiveness of its opera-

tions.

Predictive analytics is one branch of data analysis

that empowers decision-making. The core of tech-

niques and algorithms that permits predicitive analyt-

ics emanates from Machine Learning. This core can

support the decision-making process in government

taxes audit plans. Tax crimes prediction with Ma-

chine Learning allows local governments to precisely

plan fiscal audits before crimes against the tax sys-

tem happen, making taxpayers comply with tax laws

and regulations. Consequently, this naturally lever-

ages tax revenue of local governments.

This case study aimed to apply Machine Learn-

ing to predict service tax crimes against the tax sys-

tem of the municipality of S

˜

ao Paulo. We extracted

data from our fiscal audits of 2016, 2017 and 2018.

In our methodology, we implemented the following

steps: feature selection; data extraction from our fis-

cal audits database; data partitioning; model training

and testing; model evaluation; model validation. For

training, testing and evaluating our model, we used

fiscal data of 2016 and 2017 and utilized the follow-

ing algorithms: Neural Networks, Naive Bayes, Deci-

sion Trees, Logistic Regression, Random Forests and

Ensemble Learning.

Our results demonstrated that Random Forests ex-

celled the other algorithms with regard to tax crime

prediction performance metrics. Besides, we also val-

idated the model adjusted by Random Forests, apply-

ing it to previously unseen data (fiscal data of 2018).

We believe that the results achieved are justified by

the fact that Random Forests are an ensemble of deci-

sion trees. These combination of multiple trees helps

to strengthen the performance results, such that the

synergy of the various decision trees contributes to

make the predictions more precise. We are not aware

of any work with the objective of predicting crimes

against S

˜

ao Paulo’s service tax system, based on Ran-

dom Forests.

We also conclude that the use of Machine Learn-

ing contributes to the success of our fiscal audit plans.

The main reason for this contribution is the fact

that Machine Learning enables us to predict crimes

against the law system, adjusting models that can

more precisely make these predictions. These correct

predictions guide the decision of planning fiscal au-

dits more assertively.

In addition, in our work, a software tool that is

embedded in a computer implements the process of

crime prediction. Thus, we are able to enrich crime

prediction with fastness and automation. This en-

richment accelerates the decision process of our audit

plans, which in turn causes the rise of fiscal presence

and feeling of surveillance by taxpayers. Therefore,

this results in more compliance to tax laws, leading to

an increase in tax revenue.

Besides, we structured the process of our solution

in a workflow, which contributes with ease of mainte-

nance and evolution, regardless of the complexities of

code implementation.

As future work, we consider the application of

Machine Learning to predict tax fines values due to

tax laws violations. This can be achieved by ad-

justing, testing, evaluating and validating regression

models, for example, based on historical data of tax

fines values. Aside from this, other techniques and

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

458

algorithms can be added to the workflow of our solu-

tion, such as Principal Component Analysis (Johnson

and Wichern, 2008) and Deep Learning (Goodfellow

et al., 2019). A shortcoming of our work is the fact

that we did not consider the influence of time in tax

crime prediction. We can incorporate the effects of

time adding a variable that represents the date of the

tax law violation, to analyze if it improves the predic-

tion capability of the model.

REFERENCES

Alm, J. (2019). What motivates tax compliance. In Tulane

Economics Working Paper Series.

Bernasconi, F. (2018). Venezia, ecco il software che

predice tutti i reati. In Il Giornale. Avail-

able at: http://www.ilgiornale.it/news/cronache/

venezia-ecco-software-che-predice-tutti-i-reati-1603366.

html. Accessed in January, 2020.

Berthold, M. R., Cebron, N., Dill, F., Gabriel, T. R., K

¨

otter,

T., Meinl, T., Ohl, P., Thiel, K., and Wiswedel, B.

(2009). KNIME - the Konstanz Information Miner:

Version 2.0 and Beyond. SIGKDD Explor. Newsl.,

11(1).

Breiman, L. (2001). Random forests. In Machine Learning,

Volume 45, Issue 1. Springer.

Fingas, J. (2017). Chicago police see less violent

crime after using predictive code. In Engadget.

Available at: https://www.engadget.com/2017/08/06/

chicago-police-see-less-crime-after-predictive-code/.

Accessed in January, 2020.

Gonz

´

alez, P. C. and Vel

´

asquez, J. D. (2012). Characteri-

zation and detection of taxpayers with false invoices

using data mining techniques. In Expert Systems with

Applications. Elsevier.

Goodfellow, I., Bengio, Y., and Courville, A. (2019). Deep

Learning. MIT Press.

Hardesty, L. (2017). Explained: Neural networks. In

MIT News. Available at: http://news.mit.edu/2017/

explained-neural-networks-deep-learning-0414. Ac-

cessed in January, 2020.

Hossin, M. and Sulaiman, M. N. (2015). A review on eval-

uation metrics for data classification evaluations. In

International Journal of Data Mining and Knowledge

Management Process.

Johnson, R. A. and Wichern, D. W. (2008). Applied Multi-

variate Statistical Analysis. Pearson, 6

th

edition.

Kuncheva, L. I. (2002). A theoretical study on six classi-

fier fusion strategies. In IEEE Transactions on Pattern

Analysis and Machine Intelligence.

Lin, T. C. W. (2016). Compliance, technology, and modern

finance. In Brooklyn Journal of Corporate Financial

and Commercial Law, Vol. 11. Temple University Le-

gal Studies Research Paper.

L

´

opez, C. P., Rodr

´

ıguez, M. J. D., and Santos, S. L. (2019).

Tax fraud detection through neural networks: An ap-

plication using a sample of personal income taxpay-

ers. In Future Internet. MDPI.

Matheus, R., Janssen, M., and Maheshwari, D. (2018).

Data science empowering the public: Data-driven

dashboards for transparent and accountable decision-

making in smart cities. In Government Information

Quarterly. Elsevier.

McKenney, M. E. (2017). The return review program in-

creases fraud detection; however, full retirement of

the electronic fraud detection system will be delayed.

In Treasury Inspector General for Tax Administra-

tion. Available at: https://www.treasury.gov/tigta/

auditreports/2017reports/201720080fr.pdf. Accessed

in January, 2020.

Mitchell, T. M. (1997). Machine Learning. McGraw-Hill,

1

st

edition.

Olavsrud, T. (2019). IRS combats fraud with

advanced data analytics. In CIO. Avail-

able at: https://www.cio.com/article/3435364/

irs-combats-fraud-with-advanced-data-analytics.

html. Accessed in January, 2020.

Poole, D. and Mackworth, A. (2017). Artificial Intelligence:

Foundations of Computational Agents. Cambridge

University Press, 2

nd

edition.

Provost, F. and Fawcett, T. (2013). Data science and its rela-

tionship to big data and data-driven decision making.

In Big Data. MDPI.

Rokach, L. (2010). Ensemble-based classifiers. In Artificial

Intelligence Review.

Russell, S. J. and Norvig, P. (2010). Artificial Intelligence:

A Modern Approach. Pearson, 3

rd

edition.

S

˜

ao Paulo City Hall (2019). Relat

´

orio t

´

ecnico do balanc¸o

geral de 2018. Accounting Department.

S

˜

ao Paulo Commercial Association (2019). Impost

ˆ

ometro.

Available at: https://impostometro.com.br. Accessed

in January, 2020.

S

˜

ao Paulo State Government (2019). Conhec¸a S

˜

ao Paulo.

Sistema Estadual de An

´

alise de Dados (SEADE).

Available at: https://www.seade.gov.br/wp-content/

uploads/2019/01/Conheca SP 2019 jan29.pdf. Ac-

cessed in January, 2020.

Zhang, Z. (2019). Naive bayes explained. In Towards Data

Science. Available at: https://towardsdatascience.

com/naive-bayes-explained-9d2b96f4a9c0. Accessed

in January, 2020.

Tax Crime Prediction with Machine Learning: A Case Study in the Municipality of São Paulo

459