SMARTINSUR: A Platform for Digitizing Business Transactions in

the Insurance Industry

Andreas Lux

1

and Michael Muth

2

1

Department of Computer Science, Trier University of Applied Sciences, Schneidershof, Trier, Germany

2

Smart InsurTech AG, Klosterstr. 71, 10179 Berlin, Germany

Keywords: Micro Service Platform, Business Transaction (GeVo), BiPRO Standard, Process Mining Service.

Abstract: For the digitization of business processes in insurance, the concept of a platform is presented that is based on

the design principles of modern software architectures (domain-driven design, micro services). This raises the

question of whether the complex application scenario can be realized with this software development

approach and whether the advantages of agile development come into play. The complex interplay of the

different roles involved in the processes, namely insurance companies, sales organizations and brokers, is

illustrated using the example of a document service. The advantages resulting from the digitization of the

example process, such as labor and cost savings, but also quality improvement and increased customer

satisfaction are worked out. In the near future, process events will be recorded via the integration of a process

mining service that can be of great help for further process optimization.

1 INTRODUCTION

Like all sectors of the economy, the insurance

industry is forced to face the digital transformation in

order to remain competitive. The implementation of

digital business models is essential for insurance

companies, sales organizations and broker pools in

order to operate successfully in a rapidly changing

and flexible environment in the near future.

Smart InsurTech AG (SmIT) has set itself the goal

of digitally supporting this transformation process by

providing a cloud-based B2B platform (Parker et al.,

2017), (Ingeno, 2018), (Fowler, 2002). The

SmartInsur platform represents the current techno-

logical approach to digitally support time-consuming

and labor-intensive business processes in the

insurance industry and to outsource individual

functionalities from the old monolithic systems,

which were used by the former individual companies

from which SmIT emerged.

The focus of this paper is the question whether the

complex application scenario can be realized with the

help of modern software technologies such as

DevOps (Kim et al., 2016), micro services (Newman,

2015), (Richardson, 2018), containerization (Liebel,

2019) and whether the advantages of agile

development (Beck and Fowler, 2000), (Beck and

Andres, 2004), (Martin, 2008) prove their worth. In

addition, the benefit that results from this new kind of

system approach is described. This benefit is

illustrated using the implementation of a business

transaction service (GeVo service).

2 PROCESSES IN THE

INSURANCE INDUSTRY

Processes in the insurance industry are characterized

by great diversity and complexity, connecting a wide

variety of business partners in different roles.

In order to better describe these processes and

make them more usable for digitization, various

players have already come together in 2006 to form

BiPRO e.V. (German branch institute for process

optimization in the insurance sector). Within this

association, both insurance and brokerage companies

and service providers work on information

technology standards in order to standardize cross-

company processes in the insurance industry and to

describe them in the form of norms (BiPRO, 2015).

The current BiPRO release 2 is divided into the

business areas of search, transmission, inventory,

tariff/offer/application (in German: TAA) and risk

data. There are also general standards for

796

Lux, A. and Muth, M.

SMARTINSUR: A Platform for Digitizing Business Transactions in the Insurance Industry.

DOI: 10.5220/0009512607960800

In Proceedings of the 22nd International Conference on Enterprise Information Systems (ICEIS 2020) - Volume 2, pages 796-800

ISBN: 978-989-758-423-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

authentication and other so-called specific services,

e.g. for external navigation in insurance portals. The

GeVo service (acronym for German word

“GeschäftsVorfall”, in English “business case”)

described in the following chapter is based on the

BiPRO 430 standard.

3 GeVo SERVICE AS

APPLICATION SCENARIO

The so-called GeVo service, hereinafter also referred

to as “Smart GeVo”, is currently being implemented

as the first application scenario of the SmartInsur

platform.

The starting point of the service is as follows: The

insurance company (IC) has sovereignty over the

contracts. Only the information that is marked as

consistent information by the IC is actually part of the

insurance contract of the customer. This information

with the specified conditions is manually entered into

the systems of insurance sales organizations and

brokers, in this paper called broker management

software (BMS). Corresponding documents attached

to the insurance information are also stored there.

Since the manual entry of the delivered quantity

of documents is very difficult to handle and errors

always occur, the data quality in the BMS system is

not sufficient to be able to fully automate valid

follow-up processes on the sales organisation/broker

side. This means that only a small part of processes

such as commission settlement and the delivery of

information to the policy holder can be done in a

semi-automatic way.

Smart GeVo aims to automate the transfer of the

information provided by the insurance company with

the appropriate classification and analysis into the

BMS systems.

Within the GeVo service, documents from three

different input sources are processed and – were

appropriate - are enriched with relevant additional

information.

The workflow of the GeVo service was developed

in a two-day workshop using the Event Storming

method (Brandolini, 2019), (Avanscoperta S.r.l.,

2019), see figure 1. In collaboration between domain

experts and software developers, a common visual

model of the application domain was developed. The

complete GeVo process was modelled from start to

end on a high level of abstraction divided into

individual contexts and visualized in a so-called

context map (Evans, 2003).

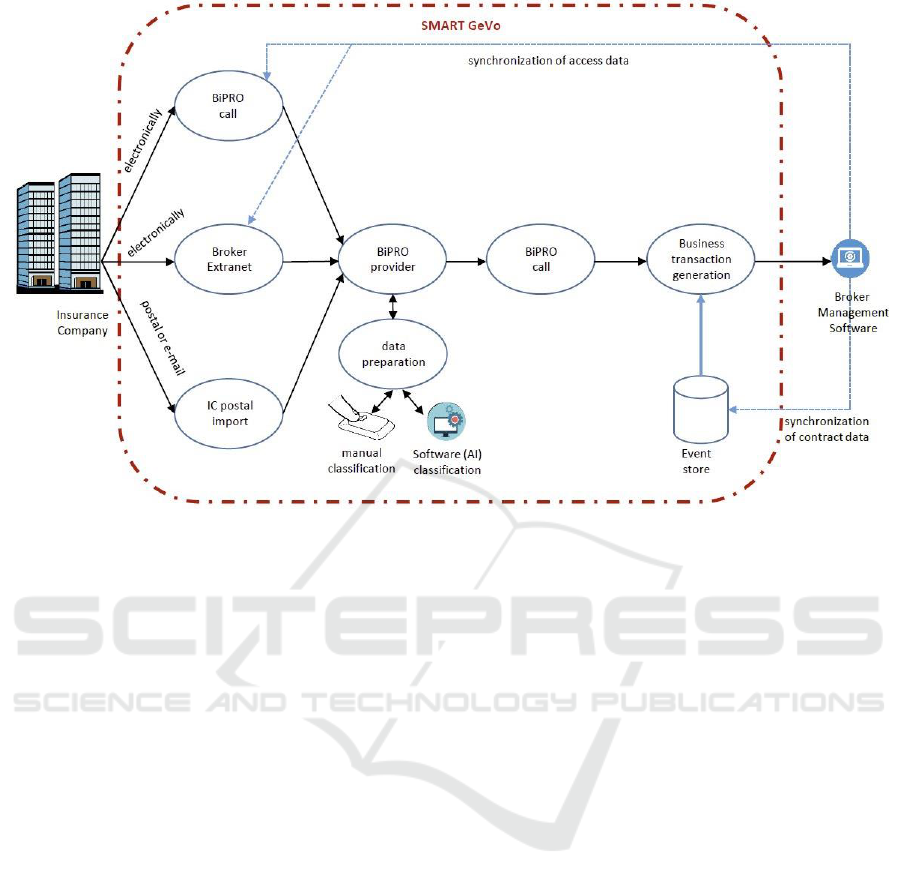

The GeVo-Service provides a solution that can

receive documents from the following sources of an

insurance company (see figure 2):

▪ BiPRO call: The platform permanently picks

up all BiPRO 430 deliveries from insurance

companies and makes them available for the

BMS systems connected to the platform.

▪ Broker Extranet: The IC extranets for sales

organizations and brokers are continuously

searched for documents. To generate a BiPRO

delivery (shipment) from relevant documents

residing in the extranet, meta data are required.

These meta data are generated by the BiPRO

provider context. The BiPRO provider context

communicates with a data preparation context

which reads and analyses the documents using

special scan software with AI technology

(1blick GmbH, 2019). The complex document

structures are analysed and evaluated, so that

they can be assigned optimally to the BMS

systems for further processing.

Figure 1: First Vision of GeVo Service created by Event Storming Method.

SMARTINSUR: A Platform for Digitizing Business Transactions in the Insurance Industry

797

Figure 2: Overall View of Smart GeVo Application Scenario.

▪ Manual document feed: Documents delivered

by letter or e-mail can be handed over, for

example, via an app to the BiPRO provider

context. As with documents from the IC

extranets, corresponding meta data are then

extracted using the above mentioned scan

engine which hopefully delivers relevant

information like e.g. insurance company, the

insurance category, contract number, customer

name, document subject etc.

If the data quality is sufficiently good, it will be

passed in a BiPRO-compliant style with the above-

mentioned meta data and the type of business

transaction (change of address, change of

contribution, damage report etc.) to the next context,

the business transaction generation service.

If the quality of the data and the corresponding

documents is not sufficient and if the meta data

cannot be extracted by the data preparation context, a

manual classification has to be done by the back-

office of the sales organizations and brokers, before

the information is passed to the business transaction

generation service.

The access of sales organizations and brokers to

fetch BiPRO documents or to read information from

the extranets is periodically synchronized by the BMS

systems or manually granted via an API. BiPRO calls

and documents from the extranet are regularly called

up in an automatic way after the broker's access data

have been stored; then the BiPRO documents are

imported or the shipments are processed as described

above.

In the business transaction generation context, the

data of the connected broker management software

are searched for the correct mapping of the business

transaction. A policy number mapping algorithm

correctly assigns the documents to the respective

sales organizations resp. broker of the connected

BMS systems.

In order to find the ID of the contract within the

BMS system, the important information (insurance

company, insurance division, contract number) must

be synchronized with the platform. This is done via

an event store (Vernon, 2013), (Richardson, 2019), to

which new signings of contracts and contract changes

are transferred to provide latest information to the

business transaction generation service.

If the transaction generation service now receives

information about a new event of this type, this

information is also used for the search within the

document assignment step. Based on the information

from the insurance company and the insurance

division, a search contract number is generated,

which is then used for the assignment. If the contract

has been clearly identified, the data (e.g. start of

contract, contract expiry, premiums etc.) and the

document are forwarded to the BMS for final storage

and further processing.

However, if an exact assignment can not be found,

the document with the associated data is made

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

798

available in an inbox of the BMS for manual

processing. All manual interventions by a user,

whether manual classification or manual processing

of the supplied data and the document, are saved and

analyzed with the assignment result in order to

continuously improve the performance of the service.

As part of the overall integration, it is now

possible to start follow-up processes such as e.g. the

creation of a resubmission in the connected broker

management software.

All communication between the different services

as well as key figures relating to the assignment and

quality of the data are stored for later analysis. The

evaluation is carried out using various tools such as

Graylog (Graylog, 2016) or Kibana (Kibana, 2015),

which provide important insights on the data for

further process improvement.

The main benefit of the overall scenario is that the

user receives all documents and business transactions

via the platform's GeVo service, regardless of the

sources from which this data originate. According to

the sales organizations and brokers of the connected

BMS systems, a large part of the documents is still

not delivered via BiPRO format. For this reason, the

GeVo service enables a much better data quality

according to BiPRO format and extensive automation

of the previously manual processing. Thus, the sales

organizations and brokers save expensive manual

back office activities at this point.

The GeVo service has already been tested by

selected beta testers and will be launched as first

application scenario of the SmartInsur platform by the

end of first quarter 2020.

4 FUTURE STEPS

The SmartInsur platform was designed and developed

according to the methodology of domain-driven

design (DDD), (Evans, 2003), (Vernon, 2013),

(Vernon, 2016). The focus is on the complex business

processes of an application domain and the close

cooperation between software developers and domain

experts. In addition to the definition of a uniform

language (ubiquitous language) and delimited

technical aspects (bounded contexts), DDD offers

strategic design patterns for implementing the

concepts in the form of a microservices architecture

(Richardson, 2018), (Newman, 2015).

Within this design concept, the integration of new

contexts with corresponding new functionality is

straightforward.

The next step in the enhancement of the platform

is the integration of a process mining service. In order

to be able to carry out an evaluation of the processes

and an analysis of the activities and supplied

document information regarding insurance

companies as well as sales organizations and broker

pools, all corresponding process data will be collected

in the process mining service and evaluated using

process mining techniques (van der Aalst, 2016),

(IEEE, 2019). By that, the complex application

scenario can be analyzed from three different per-

spectives, namely the insurance companies, the sales

organizations resp. brokers and the clients. Many

interesting questions can then be answered, e.g.

▪ What is the overall number of business

transactions per day/month/year?

▪ What is the number of business transactions per

sales organization or broker?

▪ What is the number of business transactions per

sales organization or broker per insurance

category? Answering this question will yield

hints for underused potentials.

▪ What is the average throughput time of a

business transaction?

▪ What is the number of manual activities per

business transaction?

▪ What is the overall number of fully automated

assignment of documents?

▪ What is the number of fully automated

assignment of documents per insurance

company? This performance indicator can be

used as a benchmark for classification.

▪ etc.

Another enhancement of the platform is the

support of other business cases by the provision of

public APIs. An example is the delivery of single

documents by the insurance company, where the

context BiPRO provider extracts relevant information

for further consumers according to BiPRO norm.

5 CONCLUSIONS

The SmartInsur platform as a technological basis

supports the necessary agility and flexibility of

business processes in the insurance environment and

guarantees seamless integration of all involved actors

(customers, sales organizations, brokers, insurance

companies). The monetary advantage for insurance

companies, sales organizations and brokers as users

of the platform results from the high degree of

automation of the business transactions and the

resulting optimized throughput times with savings on

expensive back office activities. A further advantage

for insurance companies and brokers results from the

SMARTINSUR: A Platform for Digitizing Business Transactions in the Insurance Industry

799

fact that the transaction costs can be allocated

according to the originators of the business

transactions and the corresponding efforts.

The future process mining service offers the

platform operator enormous potential in analyzing

and evaluating the process data of the business

transactions. These process data can be used, for

example, to provide new insurance companies and/or

brokers with best practice procedures or to make

existing platform customers aware of weaknesses in

their processes.

From a technological point of view, the

methodology of domain-driven design (DDD), the

implementation of the SmartInsur platform as a micro

services architecture and the agile development

process using Scrum (Sutherland, 2014) have shown

more than practicable for the complex application

scenario. We believe that the combination of these

methodologies was the only feasible way to realize a

first version of the completely new platform in the

short time period of less than a year. We also believe,

that this technological approach guarantees easy

extensibility and flexibility for the operation and

future enhancement of the SmartInsur platform.

ACKNOWLEDGEMENTS

We want to thank all the people that have contributed

directly or indirectly to the creation of this paper.

Special thanks go to Jürgen Brück (Smart InsurTech

AG) for fruitful discussions and very helpful

comments on drafts of this paper.

REFERENCES

1blick GmbH, 2019. https://www.1blick.de/produkte/-

scanengine (last access: 2020/01/27)

Avanscoperta S.r.l., 2019. https://www.eventstorming.com

(last access: 27.01.2020).

Beck, K., Fowler, M., 2000. Planning Extreme

Programming, Addison-Wesley.

Beck, K., Andres, C., 2004. Extreme Programming

Explained: Embrace Change, Addison-Wesley.

BiPRO (Brancheninstitut für Prozessoptimierung e.V.),

2015. https://bipro.net/wp-content/uploads/2019/05/-

poster_normen-services_201903_rgb_final-2.pdf (last

access: 2020/01/27).

Brandolini, A., 2019. Introducing Event Sourcing

(unfinished). Leanpub, Victoria, Canada.

Evans, E.J., 2003. Domain-Driven Design: Tackling

Complexity in the Heart of Software, Addison Wesley,

New York.

Fowler, M., 2002. Patterns of Enterprise Application

Architecture, Addison Wesley, New York.

Graylog, 2016. https://www.graylog.org (last access:

2020/01/27).

IEEE, 2019. International Conference on Process Mining,

ICPM 2019, Aachen, Germany, June 24-26, 2019.

ISBN 978-1-7281-0919-0.

Ingeno, J., 2018. Software Architect’s Handbook: Become

a successful software architect by implementing

effective architecture concepts. Packt Publishing.

Birmingham, UK.

Kibana. 2015. https://www.elastic.co/de/kibana (last

access: 2020/01/27).

Kim, G., et al., 2016. The DevOPS Handbook: How to

Create World-Class Agility, Reliability, and Security in

Technology Organizations, IT Revolution Press.

Portland.

Liebel, O., 2019. Scalable Container Infrastructures with

Docker, Kubernetes and OpenShift (English Edition),

Kindle Book.

Martin, R., 2008. Clean Code: A Handbook of Agile

Software Craftsmanship, Prentice Hall.

Newman, S., 2015. Building Microservices, O'Reilly

Media, Sebastopol, California.

Parker, G.G., van Alstyne, M.W., Choudary S.P., 2017.

Platform Revolution. Norton & Company.

Richardson, C., 2018. Microservice Patterns: With

Examples in Java, Manning, New York.

Richardson, C., 2019. https://microservices.io/patterns/-

data/event-sourcing.html (last access: 2020/01/27).

Sutherland, J., 2014. Scrum: The Art of Doing Twice the

Work in Half the Time, Random House LLC, New

York.

van der Aalst, W.M.P., 2016. Process Mining: Data

Science in Action, Springer, Heidelberg.

Vernon, V., 2013. Implementing Domain-Driven Design,

Addison Wesley, New York.

Vernon, V., 2016. Domain-Driven Design Distilled,

Addison Wesley, New York.

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

800