A Smart Treasury Fit for the 4th Industrial Revolution

Johan von Solms and Josef Langerman

Department of Computer Science, University of Johannesburg, Kingsway, Johannesburg, South Africa

Keywords: Innovation, Smart Treasury, 4th Industrial Revolution, Evolution of Treasury, Digital Technology,

Digitalisation of Treasury.

Abstract: This paper looks at the importance of Treasury management, within a typical commercial bank and evaluates

how digital technology can support this key function in the future. Since the 2008 financial crisis, the role and

responsibility of Treasury has grown significantly in terms of scope and strategic importance. There are an

ever-increasing number of requirements from Regulators, Senior Management and Shareholders, that

Treasury must deliver on - as the guardian of the bank’s balance sheet. To meet these growing demands and

challenges Treasury needs to consider ways to streamline its operational activities, in order to become more

strategically focussed. Leveraging digital technologies associated with the 4th Industrial Revolution can play

an important part in the transition towards an intelligent Treasury of the future. However, it is imperative to

have a proper and well-defined digital roadmap that can steer the evolution of the Treasury function. This

paper’s aim is to research and outline an approach that can guide the establishment of a next generation smart

Treasury. It considers a couple of management issues common to most bank Treasuries and then demonstrates

how these activities can be converted to smart processes through digitalisation.

1 INTRODUCTION

The Treasury department forms the nerve centre of

most banks. It plays a crucial role, as the guardian of

the balance sheet and manager of the scarce financial

resources including capital and liquidity. Since the

financial crisis, the role and responsibility of Treasury

has grown significantly in terms of scope and

strategic importance. However, it is under increasing

pressure on various fronts and therefore require

change and transformation. On the one side, the

regulatory requirements are becoming more onerous

- calling for greater granularity and precision; higher

frequency of reporting; forward looking analytical

capabilities and others. On the other side, the

CEO/CFO increasingly looks to the Treasurer for

strategic decision-making and holistic attestation that

the balance sheet is efficiently optimised.

For many Treasuries there are a number of

obstacles in the way of achieving this broader

mandate, including the complexity of the bank’s

business model; fragmentation of upstream systems;

legacy technology not tailored for evolving Treasury

needs; and the magnitude of data that must be

processed and analysed. Comprehensive

digitalisation of Treasury can help address some of

these challenges and can deliver a range of

commercial benefits, for example reduce operating

costs; enhance Net Interest Income; improve risk

management and optimise capital and liquidity

buffers (BCG 2019).

This paper explores the creation of a Smart

Digital Treasury Model (SDTM). The purpose of the

SDTM will be to guide the creation and development

of a digital Treasury that optimally leverage existing

technologies and incorporates new innovations

associated with the 4th Industrial Revolution.

Relevant innovations refer to Artificial Intelligence,

Machine Learning, Big Data analytics, Blockchain

and Cloud Competing, to name but a few. The SDTM

will also allow for measuring the digital maturity of

an existing Treasury function, as a starting point in

the transition to a smarter operating environment.

This paper is structured as follows. Section 2 will

review the literature around the digitalisation of

Treasury and the challenges in the way. Section 3

covers a short overview of the evolution of Treasury

and the need for leveraging digital innovations, in

order to support its growing role and responsibility.

Section 4 looks at how a Smart Digital Treasury can

be established, within the existing bank technology

infrastructure. Section 5 identifies and describes three

digital case studies, common to most Treasuries, to

demonstrate the benefit and advantages of

122

von Solms, J. and Langerman, J.

A Smart Treasury Fit for the 4th Industrial Revolution.

DOI: 10.5220/0009470501220128

In Proceedings of the 2nd International Conference on Finance, Economics, Management and IT Business (FEMIB 2020), pages 122-128

ISBN: 978-989-758-422-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

implementing digital innovations. It then shows how

the intelligent outputs can be used to help steer the

balance sheet more optimally.

2 LITERATURE REVIEW

Researching the contemporary role of banks’

Treasury functions and understanding how it can be

transformed across the banking sector, is crucial for

future development. (Roszkowska and Prorokowski

2017) found that the top three primary challenges to

successful Treasury strategies were - delivering an

integrated view of Treasury and overall balance sheet

management; income volatility from interest rate

changes; and fragmented IT processes.

Since the financial crisis most banks have been

focussed on a diverse range of issues, namely -

reinforcing their balance sheets to meet the new

prudential requirements; improving their online

customer front-ends; fending off the challenges

coming from digital competitors; and combatting the

pressure on falling margins.

One area that to a large extend has been

overlooked for technology investment and

digitalisation is Treasury. A survey by the Boston

Consulting Group of 44 banks revealed that most

Treasury functions have relatively low levels of

digital maturity. The analysis shows that only 11% of

bank Treasuries made widespread use of advanced

technologies and use cases, while about 70% have yet

to embrace digitalisation in any meaningful way

(BCG 2019).

A PWC Global Treasury benchmark survey found

that the biggest roadblock for implementing digital

technologies in Treasury were inter-alia - lack of

digital use cases / business case studies; no mid-term

strategy; and lack of people skills (PWC 2019). Other

reasons for the slow uptake are driven by inter-alia -

high IT costs; fragmented data and IT systems; legacy

systems not tailored to meet growing Treasury

demands; but also, the fact Treasury continue to be a

large user of spreadsheet-based applications.

A 2018 survey by the Association for Financial

Professionals found that the vast majority of finance

professionals (97 percent) reported that spreadsheets

are currently being used at their companies to manage

risk. Despite spreadsheet use dominance, few

respondents (28 percent) view them as an efficient

risk management tool (AFP 2018).

Spreadsheets are a flexible tool which provides

ease of use, but it is not ideally suited to support the

future challenges Treasury will face. Given the

changing role of Treasury over the last couple of

years, from primarily preforming a cash management

function to now driving holistic balance sheet

management, it needs to leverage technology and

especially digital smart technology more effectively

going forward.

In order to become a digital Treasury of the

future, it is therefore important to research and outline

the key features, benefits and strategic imperatives to

make this transition (Lipton A, Shrier D, Pentland A

2016). It is also critical for achieving a successful

outcome, to have a proper and well-defined approach

to guide the transition of the Treasury function from

the current state to a more automated future state,

where emphasis is placed on strategic activity rather

than operational processing (Polak, Masquelier,

Michalski 2018).

The next section looks at the changes that took

place in bank Treasuries over the last couple of years.

It is important to understand the drivers underlying

these changes and the increasing demands it puts on

a Treasury, before considering adoption of new

digital technology.

3 EVOLUTION OF TREASURY

The history of a bank Treasury has its roots in the

latter part of the previous century, with the

introduction of Treasury specific management

systems and software. Over the turn of the century

many Treasury functions turned from a regional focus

to a more global focus as banks consolidated and

expanded internationally. However, since the 2008

financial crisis, Treasury’s role and responsibility has

changed significantly. The evolution can be divided

into distinct stages, driven by the developments in

regulations, new technology, monetary policy and

competitor activity.

3.1 Pre-financial Crisis (Prior to 2008)

- Cheap Funding and Liquidity

Prior to the financial crisis, a bank’s treasury activity

was often part of the Money Market Funding desk,

which resided in the Markets or Trading divisions.

The main responsibility was the raising of funding

through the issuance of money market paper and

short-term instruments, as well as the management of

the daily cashflow requirements of the bank. The

management focus was short term in nature and the

Treasury area was often a profit centre.

Monetary policy was relatively loose and

regulations self-regulating, creating a market

A Smart Treasury Fit for the 4th Industrial Revolution

123

environment where funding was easy to obtain and

relatively cheap. One of the major consequences of

the cheap funding were that Cost of Funds was not

accurately reflected in new asset origination, resulting

in an increase in credit supply and low loan margins -

with limited leeway to absorb future funding shocks

(Ramskogler 2014). Therefore, when the crisis hit,

banks struggled to continue financing their bulky

balance sheets on a profitable basis.

3.2 Post Financial Crisis (2008 to 2015)

– Strengthening the Balance Sheet

Subsequent to the global financial crisis a range of

new regulations were introduced, calling for higher

capital buffers, larger liquid asset portfolios, more

granular and frequent reporting, stress testing etc.

(Sironi 2018). In order to meet these increasing

prudential demands and ensure the regulations were

implemented, Treasury functions was centralised into

a Group Treasury function. Treasury also became a

utility function, meaning the objective was neither to

make a profit or a loss.

A new Treasury structure evolved, with clearly

defined disciplines. Based on the author’s experience

these tend to comprise of - Funding & Liquidity

Management; Capital Management; Asset &

Liability Management; Funding Execution; and

Portfolio Management.

Many of these disciplines were expanded to

ensure the balance sheet was further reinforced, for

example Funds Transfer Pricing was established to

ensure marginal forward-looking Cost of Funds were

accurately transmitted to new product origination;

off-balance sheet liquidity exposures were identified

and included as contingent stress outflows in the

liquidity buffer; and increased emphasis was placed

on funding strategy and execution, in order to raise

longer term stable sources of capital and funding.

Monetary policy became tighter with many global

economies implementing quantitative easing, to

inject liquidity into the markets and introduced asset

repurchase programmes for bad loans, to relief the

pressure on bank balance sheets.

3.3 Post New Regulations - Custodian

of the Holistic Balance Sheet

The majority of the new regulations came into effect

by the middle of the 2010’s. This meant the role of

Treasury started to shift more towards becoming a

guardian of the balance sheet, with responsibility for

the holistic management of all assets and liabilities.

One reason was that senior management needed to

ensure the balance sheet was sustainable and

profitable going forward, in light of all the prudential

constraints that was imposed on scarce balance sheet

resources like capital and liquidity.

Treasury became the owner of the central Profit

and Loss (P&L) account as well as all the banking

book risks (including all impacts from leverage,

capital, liquidity, Interest Rate Risk hedging,

wholesale funding issuance etc). This central balance

sheet ownership gave Treasury an important seat at

the table on strategic decision-making and guiding

future business activity.

The challenge for most Treasuries was that the

development of their technology infrastructure,

processes and tools did not keep track with the change

in the management responsibilities. A proportionally

large amount of time is still spent on operational

activities (often Excel based) and data analysis, with

limited capacity for strategic activity. The biggest

obstacles Treasury face on this front include

fragmented data systems, visibility gaps across the

full banking book and out dated modelling tools

(BCG 2019).

Given the changing Treasury landscape and the

increasing importance of the strategic Treasury

mandate, it is therefore essential to better harness the

capabilities digital technology and innovations can

offer. In order to achieve this a well-defined roadmap

is required within Treasury.

4 SMART DIGITAL TREASURY

MODEL (SDTM)

The Smart Digital Treasury Model (SDTM) was

developed to guide the creation and development of a

digital Treasury that optimally deploy existing

technologies and incorporates new digital innovations

associated with the 4th Industrial Revolution. Relevant

digital technology refers to Artificial Intelligence,

Machine Learning, and Big Data analytics etc (Von

Solms 2020). Most bank Treasuries already operate in

an existing technology environment, it is therefore

important to first understand the present infrastructure

and constraints before considering the adoption of

digital technologies.

4.1 Existing Treasury Technology

Environment

A Treasury function normally comprises of a wide

range of relative diverse activities, which differ

greatly in terms of output and system requirements.

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

124

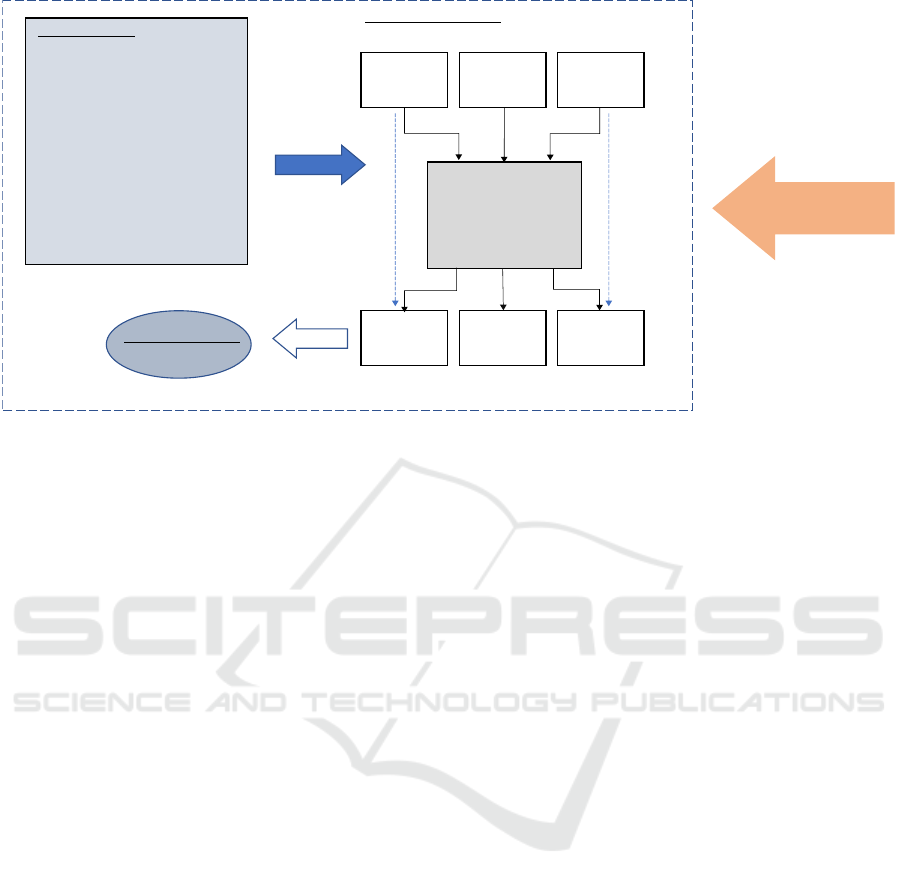

Figure 1: Overview of typical Treasury data flows and dependencies.

Therefore, a typical Treasury is very dependent on

upstream IT and data systems (e.g. Product and

Pricing, Accounting, Risk Management etc.) for data

inputs to run its different Treasury Management

Systems (see Figure 1).

These legacy bank systems often operate in silos

and are very fragmented, making it difficult for

Treasury to construct a holistic view of say the

balance sheet. In the absence of integrated data and

IT systems the historical bridge solution was often

that Treasury had to build tactical data feeds between

upstream systems and its own Treasury Management

Systems (TMS). These data pipes are often ‘dumb’ in

nature, since it contains limited amounts of intelligent

information and data insights, to drive management

decisions and support strategic management commit-

tees like the Asset and Liability Committee (ALCO).

Many banks have realised these inherent

limitations and have initiated strategic long-term

technology infrastructure and data projects to

improve this environment, for example establishing a

central data depository, often called the ‘Golden

Source’. The objective is to provide an integrated and

standardised data platform to feed Treasury

Management Systems (TMS) and analytical tools in

a more automated and consistent manner.

While banks continue to run these long-term and

large-scale technology projects to establish a Golden

Data source platform, it is often difficult for a

Treasurer to identify where digital technology

solutions, can or should fit into this complex picture

(Figure 1).

It is therefore imperative to have a well-defined

approach and digital plan that can guide effective

implementation of Treasury digitalisation, while the

longer-term strategic infrastructure projects continue

to be delivered.

4.2 Digital Adoption Roadmap for a

Treasury

The Smart Digital Treasury Model (SDTM) provides

a coherent roadmap that can guide the establishment

of a next generation smart Treasury function and

support the successful adoption of digital technology

and innovations, within an existing Treasury

environment. The following is the key steps in the

process: -

1. Diagnostic – identify and evaluate all the key

activities within the Treasury function. This will

differ based on a bank’s business model and the

set-up of Treasury within the organisation.

2. Gap analysis – assess the current digital

maturity and define the optimal future digital

state. Then evaluate the improvements required

to close the identified gaps.

3. Categorise improvements – group together

similar improvements with common features

e.g.

Streamline a process – integrating,

standardising and automating certain

processes.

Client Insight - understand client behaviour

better.

Optimise prudential buffers – reduce overly

conservative risk mitigants.

Treasury Activities

• Cash Management

• Intraday-Liquidity

• Client Behavioural Modelling

• Collateral Optimisation

• Liquidity Buffer Investment

Management

• Funding strategy decision

• Capital Supply and Demand

• Leverage management

• IRRBB hedging

• Internal price clearing / Curve

setting

• Forecasting / Stress Testing

• Liquidity measurement and

monitoring (LCR & NSFR)

• Wholesale funding Money Market

and Debt Market

• Data reconciliation

•….

GOLDEN

SOURCE

Upstream Business & Fin ance S y stems

Product

System (e.g.

Deposits)

Accounting /

General

Ledger

System

Risk

Management

System

Funds

Transfer

Pricing

(Inhouse)

Interest Rate

Risk Hedging

(Vendor)

Liquidity Risk

Management

(Excel)

Treasury Management Systems (TMS)

‘Dumb’ Data flows

‘Dumb’ Data flows

Technology Infrastructure

Output

Management Decisions

e.g. ALCO deck

Digital Technology /

Digital Innovation

Systems

A Smart Treasury Fit for the 4th Industrial Revolution

125

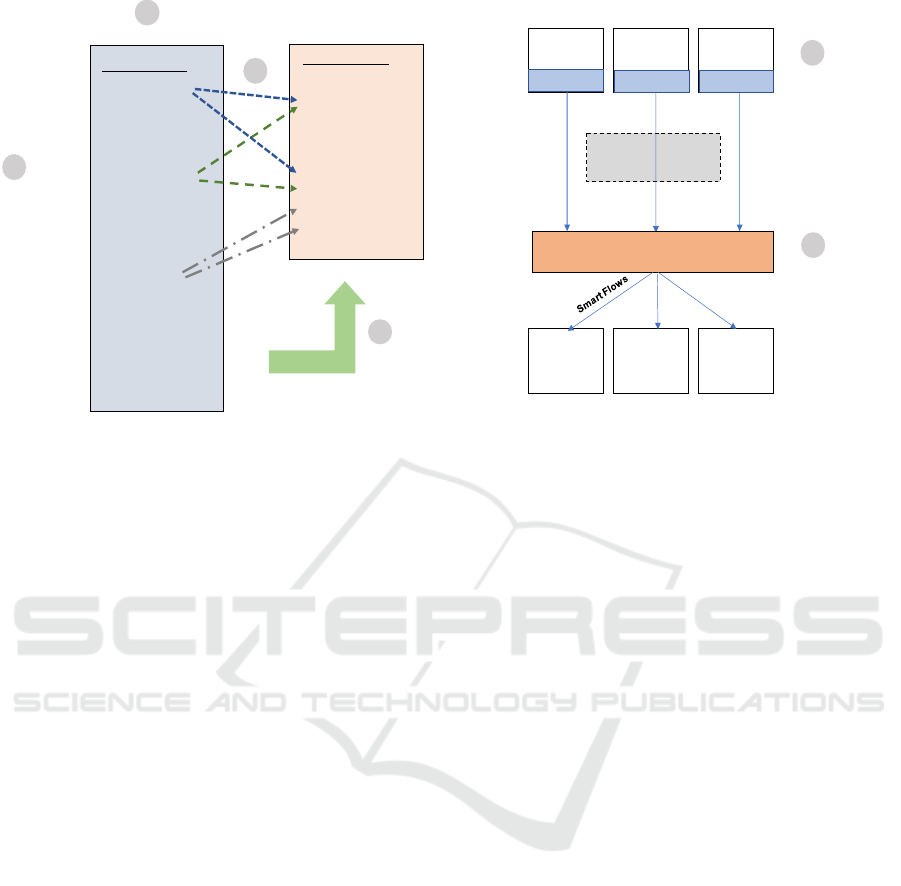

Figure 2: Roadmap towards a Smart Digital Treasury.

Dynamic Forecasting – improve forward

looking analytical abilities.

Digitise Documents – scanning of paper-

based loan documentation.

Visualisation capability – ability to view

complex data in a simplified manner.

4. Mapping - map Treasury activities and required

improvements into the range of digital

technology available e.g. Smart workflow;

Machine Learning; Natural Language

Processing; Big Data; Blockchain; Cloud

computing etc.

5. Digital Use Cases - identify feasible Treasury

activities, which can be targeted for smart

transformation. Then size and prioritise which

of these challenges are most critical to resolve.

6. Smart Treasury Information - Consider how

the new insights / outputs, can be integrated into

a strategic tool e.g. a real-time dashboard to help

the Treasurer make a more informed decision.

Figures 2 and 3 provides an overview of how these

steps (numbers align with the overview above) can be

followed, to develop a Smart Digital Treasury. To

illustrate the concept further, three digital use cases

were identified namely -

modelling client behaviour,

intra-day liquidity management, and

securitisation of loans.

Section 5 will show how digital technology can be

embedded into the bank’s existing deposit / loan /

cash management systems, with the objective to make

the data flows ‘smarter’ and more useful for Treasury.

Figure 3: Transformed Smart Treasury.

These additional insights and smarter information

flows can then be used to drive more strategic

decision-making e.g. enhance the Funds Transfer

Pricing process used to steer the balance sheet (see

next section).

5 DIGITALISATION OF A

TREASURY FUNCTION

An important element to recognise is that digital

technology is not a panacea for all Treasury problems.

It can be expensive and ineffective if implemented

incorrectly or applied in areas where it has no natural

application. An important step is to identify feasible

cases studies, which will yield the most benefit with

the least amount of effort. Described below is a small

sample of common Treasury issues, to illustrate the

concept (shown in Figure 3). As the Treasury function

becomes digitally more mature and the benefits are

realised, the number of digital use cases can be

expanded.

5.1 Digital Use Cases

5.1.1 Customer Deposit Behaviour

One of the primary sources of bank funding are

Demand Deposits (e.g. Current Accounts) - on which

the bank pays a relatively low interest rate. These

depositors have the contractual right to withdraw their

funds within a day. However, in reality the money

remains with the bank for extended periods because it

Treasury Activities

• Cash Management

• Intraday-Liquidity

• Funding Strategy

• Collateral Optimisation

• Liquidity Buffer

Investment

Management

• Client Behavioural

Modelling

• Capital Supply and

Demand

• Leverage management

• IRRBB hedging

• Internal price clearing /

Curve setting

• Securitisation

• Forecasting / Stress

Tes ting

• Liquidity measurement

and monitoring (LCR &

NSFR)

• Wholesale funding

Money Market and

Debt Market

• Data reconciliation

•….

Digital Technology

• Artificial Intelligence

• Machine Learning

• Application

Programming Interface

• Cloud based

computing

• Blockchain

•Big Data

• Data Mining

• Robotic Process

Automation

• Image Recognition

•…..

Mapping

1

2

4

3

Improvements

Diagnostic

Gap

Analysis

Golden

Source

Deposit

Product

Cash

Payment

Loan

Pla tform

Smart Funds

Transfer

Pricing

Smart IRR

Hedging

Smart

Liquidity

Management

Treasury Management Systems

SMART DIGITAL TREASURY

Big Data

Machine Learning

Optical Image

Upstream Systems

Dynamic Flows

Smart Intraday Liquidity

Dynamic Flows

Smart Client Behaviour

Dynamic Flows

Smart Se curitisation

5

6

Busine ss

Cases

Smart

Information

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

126

is used as a working capital account by the customers.

It is therefore a cost-effective funding source for

banks and a big competitive advantage.

It is therefore crucial to better understand the

behaviour of these customers, in order to assign the

correct value proposition to the product. Over-valuing

the stability of funding may result in future liquidity

risk (money leaves when it is difficult / expensive to

replace), while undervaluing it may lead to the

customer switching the account to a competitor to

receive a higher interest rate. The problem is that the

behaviour of customers is often analysed and

projected, using statistical models that rely on static

historical data and do not incorporate forward looking

factors that can influence future client behaviour.

This is a good example of where a predictive

technology, like Artificial Intelligence, combined

with Big Data Analytics can play a key role to identify

patterns and trends in client behaviour. These

technologies can be implemented relatively easily by

limiting it to a couple of deposit products to start with.

Banks tends to have fairly good Product systems,

which would allow for easier adoption of these

technologies. If successful it can then be scaled to a

wider product set.

The benefit of digital adoption is that it will more

accurately reflect and value a bank’s deposit funding

franchise, but also guide future product design that is

more tailored to the need of a specific set of clients,

based on their unique behaviour.

5.1.2 Intraday Liquidity Risk Management

Intraday Liquidity Management (ILM) involves the

bank’s ability to meet its payment and settlement

commitments throughout the course of a business

day. Emphasis on ILM has significantly increased

since the global financial crisis.

The lack of good visibility of intraday flows often

have the result that banks are overly conservative and

hold more High-Quality Liquid Assets (HQLA) than

needed, in order to mitigate any unexpected funding

shortfalls. HQLA is a very expensive commodity to

deploy uncommercially.

The problem with ILM is that traditional liquidity

management techniques like - trend analysis; back

testing; limit setting; and end of day monitoring, do

not work well in this idiosyncratic and real-time

environment. It requires a forward-looking approach,

continuous calculation of the cumulative position,

forecasting using real time data points, and intelligent

monitoring of limits etc.

Leveraging machine learning can help to make ILM

a more efficient and effective management process.

Machine learning can be used to identify expected

payment occurrences vs unexpected flows and the

timing of these during the day. Visualization of theses

predicated cashflows can then help ascertain the

criticality of the payment and if it can be moved to

later in the day, when there is less stress on liquidity

(Accenture 2018).

5.1.3 Securitisation of Assets

One of the benefits of securitisation is that it allows

banks to pre-package heterogenous loans into

standardised capital market instruments, which is

more acceptable for counterparts. This provides the

option to quickly liquidate assets, i.e. sell illiquid term

assets in a contingent liquidity event or the ability to

deploy it as collateral for future funding needs.

Treasury plays a key part in working with the

different stakeholders across the business units (i.e.

mortgages, commercial loans, vehicle financing etc.)

to identify, scrub and package these underlying assets

into a Special Purpose Vehicle (SPV) for

securitisation.

However, there are two main hurdles that slows

down or even prevent the establishment of a new

securitisation transaction namely, the ongoing use of

paper-based documentation which needs to get

uploaded into systems, and business originators not

being aware of all the securitisation requirements

when originating new assets (i.e. what features would

make a new loan more liquidity friendly).

Digital technology like optical imaging and

Robotic Process Automation can play a big part in

addressing the problem and streamlining this process.

It is relatively easy to bolt these technologies onto the

underlying loan systems. Optical imaging can reduce

the time required to manually upload the necessary

documents and Robotic Process Automation can

speed up the process to collate loans with similar

characteristics into a common cohort for

securitisation.

This smart automation will significantly enhance

a bank’s ability to convert illiquid loans into liquid

instruments. This kind of asset is a more valuable

commodity, in that it can be used to raise secured

funding, which is a far cheaper option than unsecured

funding sources (e.g. term debt).

5.2 Using Smart Treasury Information

for Balance Sheet Steering

The three digital use cases described above illustrates

how smart digital technology can practically address

some of the challenges faced by Treasury i.e.

understand client behaviour better; improve the

predicative ability around payment instructions; and

A Smart Treasury Fit for the 4th Industrial Revolution

127

speed up the generation of new collateral. The real

strategic power lies in integrating these individual

outputs into a unified picture. One solution is to feed

these into an intelligent management dashboard.

Another is to use them in Funds Transfer Pricing,

which is responsible to charge out costs to the users

of funds and incentivise the generators of funding.

With the smarter insights generated in these case

studies, Treasury can for example - pay a higher rate

if the deposit funding is deemed to be long dated and

stable in nature; charge out the Intraday Liquidity

costs to the specific business units that controls their

client payments ineffectively; and provide a lower

funding cost to loan originators who write assets that

is securitisation friendly.

It is this kind of integration that can deliver true

efficiencies and can underpin proper strategic balance

sheet steering and help optimise the commercial

margin of the bank.

6 CONCLUSIONS

The role and responsibility of a bank’s Treasury

department has changed significantly over the last

couple of decades, but especially since the 2008

financial crisis. During this time, Treasury’s role and

responsibility has evolved significantly to become the

custodian of the balance sheet.

Comprehensive digitalisation of Treasury can

help support this expanding management mandate,

provide a competitive advantage, and deliver a range

of commercial advantages. The reasons are that

digital innovations provide a range of benefits that

can help stream-line operational intensive Treasury

activities. Leveraging these digital functionalities will

allow Treasury to focus more on strategic activities,

namely advising senior bank leaders and becoming

instrumental in helping them to protect and advance

the bank’s interest.

The problem is that Treasury tends to be a slow

adopter of digital technology and often do not have a

well-articulated digital strategy in place. The Smart

Digital Treasury Model (SDTM) was therefore

developed, with the objective to provide a bank

Treasury, a proper framework to transition towards

more intelligent management function (Von Solms

2020).

This paper has identified a number of digital use

cases to illustrate how implementation of digital

technology can take place for key Treasury activities.

Digital technologies can also bring challenges in

terms of new Risks and Threats and the sourcing of

relevant expertise and skills, but banks that invest in

these next generation technologies will be rewarded

by an improved ability to make the right Treasury

management decision at the right rime.

REFERENCES

Accenture Consulting 2019. Davies A, Wheaton M,

Stambaugh T, Wilson M, ‘Fluid Expectations Solid

Results – Improve performance and competitiveness

through Intra Day Liquidity Management’ Available

from the following link https://www.accenture.com/us-

en/insights/financial-services/intraday-liquidity-

management.

Association of Financial Professional (AFP) 2018. ‘Risk

Survey Report’. Available from the following link

http://www.fcibglobal.com/pdf/marsh/Marsh_2018-

afp-risk-survey.pdf.

Boston Consulting Group (BCG) 2019. Elgeti C, Schafer R,

Vogt P, Bromstrup I, Lai C, Granzer M, Strauch T.

‘Creating a Digital Treasury in Banking’. Available

from the following link https://www.bcg.com/en-

gb/publications/2019/creating-digital-treasury-

banking.aspx.

Lipton A, Shrier D, Pentland A. 2016. ‘Digital Banking

Manifesto: The end of Banks.’ Down Load link

https://www.finextra.com/finextra-downloads/feature

docs/mit_digital_manifesto.pdf.

Polak P, Masquelier F, Michalski G, 2018. ‘Towards

Treasury 4.0 / The evolving role of Corporate Treasury

management for 2020.’ Journal of Contemporary

Management Issues (University of Split, Croatia), Vol.

23, 2018, No.2, pp. 189-197.

PWC 2019. Di Paola S. ‘Global Treasury Benchmarking

Survey - Digital Treasury, it takes two to Tango’.

Available from the following link - https://www.

pwc.com/gx/en/services/audit-assurance/publications/

global-treasury-benchmarking-survey-2019.html

Ramskogler P 2014. ‘Tracing the origins of the financial

crisis’. OECD Journal: Financial Market Trends

Volume 2014/2.

Roszkowska P, Prorokowski L, 2017. ‘The changing role

of a bank’s treasury.’ Asia-Pacific Journal of Financial

Studies, 46: 797-823.

Sironi A 2018. ‘The evolution of banking regulation

since the financial crisis: a critical assessment’.

Paper can be downloaded from The Social Science

Research Network Electronic Paper Collection:

http://ssrn.com/abstract=3304672

Von Solms 2020. Author is developing the concept of the

Smart Digital Treasury Model further through a PhD

study and additional research papers.

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

128