A Comprehensive Evaluation of Economic Vitality and Markov's

Prediction: An Empirical Study of a Major City in China

Ziqian Xia

1

, Jinquan Ye

2

and Xie Guan

3

1

Jiluan Academy, Nanchang University, No.999 Xuefu Road, Nanchang, China

2

School of Management, Nanchang University, No.999 Xuefu Road, Nanchang, China

3

Jiangxi Vocational College of Mechanical & Electrical Technology, Nanchang, China

Keywords: Economic Vitality, Markov Forecasting, Comprehensive Evaluation.

Abstract: The region's economic vitality is an important part of its competitiveness. Based on previous studies, we use

the grounded theory to perform indexing and then uses the Entropy method and Topsis evaluation methods to

conduct a comprehensive evaluation of economic vitality for a major city in China. Finally, Markov

forecasting is deployed. The forecasting method studied the trend of the vitality. Economic vitality is of great

significance to regional economic division and regional policy formulation. Our thesis uses Chinese data to

construct a model of economic vitality, filling an empirical gap in economic vitality research.

1 INTRODUCTION

Since China joined the world trade organization, the

economy has grown exponentially. Although

economic development can be perceived by the

enhancing of life quality, the evaluation of regional

economic development is still necessary. For a long

time, GDP as the index dominate the economics

evaluation in China. However, the gross domestic

product index cannot fully represent the situation of

the economy especially the vitality of the economy.

So the Economic vitality(EV) index is constructed in

this paper, which is a comprehensive index includes

the dimensions of multiple industries and can provide

support for economic policy decisions.

2 LITERATURE REVIEW

Many scholars have made contributions to the

regional economic vitality, some of which define the

economic vitality index. For foreign scholars, Human

Capital Index(HCI) indicators (Kraay A, 2018) are

often used to represent the vitality of a region (Yang

et al, 2020; Barro & Lee, 2013), or to link economic

vitality with community development (Martyniuk et

al, 2016).For Chinese scholars, after many efforts of

defining the economic vitality, there is currently no

dominant indicator for EV and there is also a lack of

functional test of indicators. Here we summarize the

definition as follows:

Table 1: Summary of literature.

Metrics Authors

Production output; Fiscal surplus;

Number of enterprises; Disposable

income; Science and technology

spending; Health and pensions etc.

Lou et al, 2005

Fiscal revenue; Education and

manpower; Income; Employment;

Innovation ability etc.

Lu et al, 2007

Urbanization; Industrialization; GDP etc. Sun et al, 2007

Economic growth; Enterprise benefit;

Social security etc.

Jin et al, 2007

The degree of opening; Quality of life;

The innovation ability etc.

Hou et al, 2015

Human resources; Private economy;

Industrial structure etc.

He et al, 2019

Government intervention; Consumption;

Infrastructure construction; The

investment structure etc.

Lu et al, 2019

It can be seen that the current research on

economic vitality has some problems, such as the

inconsistency between the definition and the selection

criteria of indicators. As for the HCI index, it is too

difficult to obtain relevant data. Therefore the

education index is often used to replace all HCI

indicators, which can only reflect only one aspect of

the region vitality and the prediction based in that

Xia, Z., Ye, J. and Guan, X.

A Comprehensive Evaluation of Economic Vitality and Markov’s Prediction: An Empirical Study of a Major City in China.

DOI: 10.5220/0009469500490054

In Proceedings of the 2nd International Conference on Finance, Economics, Management and IT Business (FEMIB 2020), pages 49-54

ISBN: 978-989-758-422-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

49

indicator for the overall situation is not convincing.

Moreover, the economic vitality is limited to the

economic vitality of the community, which leads to

its narrow definition and is not an macroeconomic

indicator. The selection criteria of indicators are not

open and clear enough, which brings doubts on the

credibility and usefulness of indicators.

Based on the above problems, our research

refers to the development of a comprehensive

evaluation system of economic vitality from a macro

perspective, in which the data of evaluation indicators

are easy to obtain, and the effect of this index is

performed.

3 DEFINITION OF ECONOMIC

VITALITY

We will define metrics through the following criteria:

Data accessibility, Comprehensiveness, and Data

continuity. Economic activity will be measured by

following metrics:

Consumer price index(CPI)

International tourism arrivals(ITA)

Real estate investment (RI)

Industrial production(IP)

Imports and Exports(IE)

Transport(T)

The data come from the Shanghai bureau of

statistics.

4 COMPREHENSIVE

EVALUATION

4.1 Entropy Method

a. First, we establish the decision-making matrix of

the indicators. In the matrix, each row is matched with

a time node and the column refers to the indicators.

Then we using the concept of entropy information to

determine the weight of the indicators:

11 12 1

21 22 2

12

s

s

tt ts

x

xx

x

xx

X=

x

xx

(1)

where

ij

x

represents the value of the

j

indicator

of the time node

i

.

After normalized:

1

ij

ij

t

ij

i

x

r

x

(2)

b. So we can find the information entropy of the

indicators:

1

ln

ln

t

ij ij

i

j

rr

e

t

(3)

c. Calculating weight vectors:

1

1

(1 )

j

j

s

j

j

e

w

e

(4)

4.2 Topsis Evaluation

After the entropy method is deployed, Topsis

evaluation method is used to calculate the overall

performance score of the various indicators of each

time node, and it finally returns a column with Topsis

value between 0 to 1.

Here we note that the information utility value of

an indicator depends on the difference coefficient of

the indicator, its value directly affects the size of the

weight, the greater the information utility, the

greater the importance to the evaluation,and the

greater the weight.

a. Calculate the normal matrix:

2

1

ij

ij

n

ij

j

a

a

a

(5)

b. Recalculate the normalized matrix after

weighting:

ij ij j

Va

(6)

c. Then find the ideal optimal solution and the

ideal worst solution to the index. Here we define that

if the indicator is considered beneficial to economic

vitality then the optimal solution will be the

maximum value of all the observation concerning the

weight for this indicator. And vice the unhelpful

indicator takes the minimum value. The worst

solution and the optimal solution value is opposite to

each other, and obviously, here only the CPI is a non-

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

50

beneficial indicator which we always expect to be at

a appropriate interval.

i. Calculates the ideal optimal solution of the

Euclid distance.

2

1

()

n

iijj

j

SVV

(7)

j. Calculating the ideal worst solution of the Euclid

distance of the standardized matrix.

2

1

()

n

iijj

j

SVV

(8)

k. Finally get performance ratings for each time

nodes.

i

i

ii

S

E

SS

(9)

4.3 Inspection of the Result Data

After we get the economic vitality, we need to further

analyze the general trend of Shanghai's economic

vitality.

We will use the ' Moving horizon estimation' to fit

the general trend of economic vitality in Shanghai.

The process is as follows. We assume that the

prediction of a value in the future depends on the

average of the 'n' number in front of it. The predicted

value of target, the mathematical expression is:

1

0

1

ˆ

k

ttn

n

yy

k

(10)

In fact, this also has the effect of smoothing the

original time series data to find the changing trend of

the data.

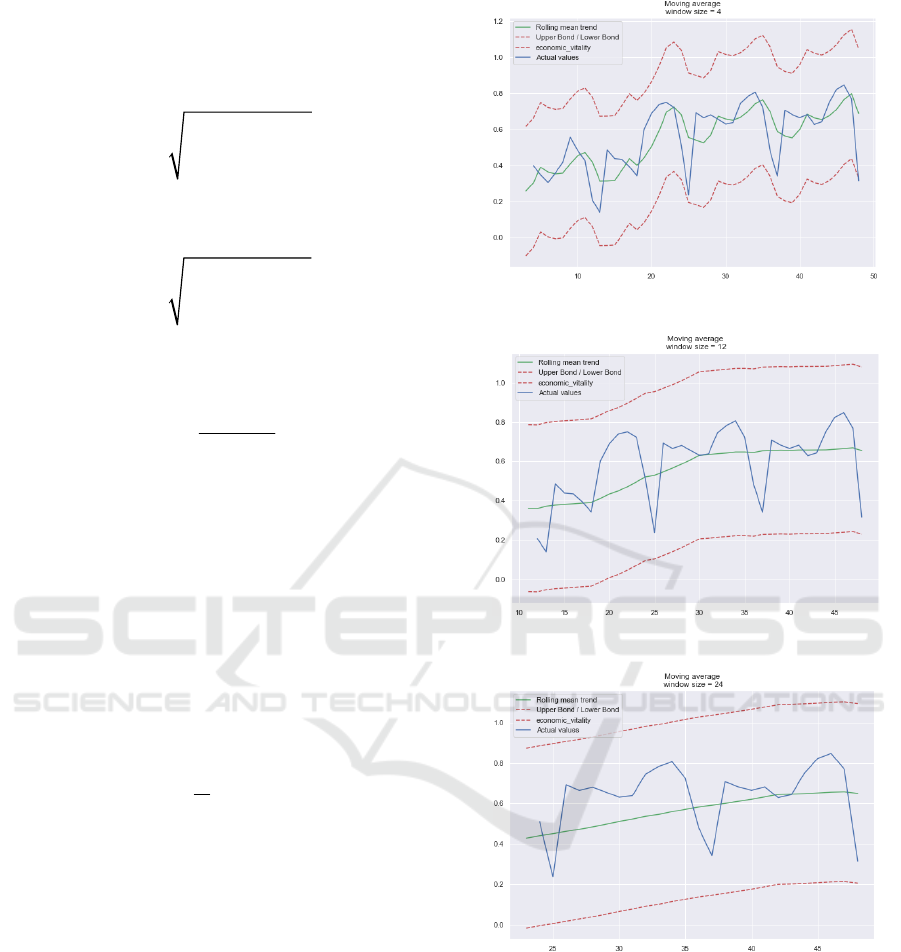

We made a smooth data graph with sliding

window values of 4(month), 12(month) and

24(month). The results are shown in the following

figure.

From the graph, we can see that all of the data in

these three images are within the confidence interval.

Moreover, these smoothing results indicate that the

economic vitality of Shanghai is rising steadily,

which is the most obvious among the smoothing

results with a sliding window value of 24 months.

This is consistent with the actual situation and reflects

the rationality and accuracy of the index.

Figure 1: Moving average size=4.

Figure 2: Moving average size=12.

Figure 3: Moving average size=24.

5 MARKOV PREDICTION

5.1 Markov Prediction Model

By defining economic vitality index, we use Topsis

and entropy method to get the weight of each

economic vitality index. After determining the index

weight, the specific value of the economic vitality of

each month in Shanghai is obtained. By observing the

A Comprehensive Evaluation of Economic Vitality and Markov’s Prediction: An Empirical Study of a Major City in China

51

time series diagram, it is concluded that the economic

vitality growth rate of Shanghai defined by various

indicators has periodic fluctuation in time. Based on

this property, 'Markov' model can be used to analyze

and predict the growth rate of Shanghai's economic

vitality in the coming months. And compared with the

actual results, the difference between the actual

results and the predicted results was analyzed.

Summarize the reasons and make further assumptions.

5.2 Model Calculation

a. Establishment of decision matrix:

11 12 1

21 22 2

12

f

f

ee ef

hh h

hh h

H

hh h

(11)

b. The value NEY

i

is the monthly economic vitality

c. Calculate the monthly growth rate of economic

activity:

1

1

ii

i

i

NEY NEY

gr

NEY

(12)

d. In our study, we found that the quarter digit,

median digit and three-quarters digit of the economic

vitality growth rate of Shanghai were about -0.15,

0,0.15 respectively.

We define the probability matrix of state transition.

Firstly, C

1

can be defined as grade a, C

2

as grade b ,

C

3

as grade c and C

4

as grade d. As shown in the

following table.

Table 2: Transition Table.

Rank A B C D

Economic

vitality

growth rate

rating

(-∞,-0.15) [-0.15,0) [0,0.15) [0.15,+ ∞)

Then, according to the definition of conditional

probability, The state transition probability P(C

i

C

j

) from state C

i

to C

j

is the conditional probability

P(C

j

| C

i

), as:

()(|)

ij i j j i

STP P C C =P C C

(13)

So we get the transition probability matrix:

11 12 1

21 22 2

12

f

f

ff ff

STP STP STP

STP STP STP

STP

STP STP STP

(14)

It is obvious that:

1

01

1

ij

f

ij

j

STP

STP

(15)

e. Markov prediction method is used to predict the

probability of state occurrence in the process of time

development. The state probability is represented by

the symbol

j

(

k

), and

k

is the transfer times:

1

() 1

f

j

j

k

(16)

Then according to markov process's no aftereffect

and Bayes conditional probability formula, we can

get:

1

() ( 1)

f

jiji

i

kSTPk

(17)

We have the row vector

12

() [ () () ()]

f

kkk k

(18)

and we use that to get the vector iteration formula:

() ( 1) (0)( )

k

kkSTP STP

(19)

5.3 Prediction Result

The predicted results are shown in the following

Table 3: The results of the Markov.

Year.Month Rank Probability

2020.2

A

0.428571

B 0

C 0

D 0.571429

2020.3

A

0.183673

B 0.28514

C 0.171429

D 0.359184

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

52

Table 3: The results of the Markov. (cont.)

Year.Month Rank Probability

2020.4

A

0.153153

B 0.386359

C 0.225048

D 0.23544

2020.5

A

0.16573

B 0.394502

C 0.226987

D 0.212781

N month

(steady state)

A

0.172996

B 0.387838

C 0.22255

D 0.216617

5.4 Prediction Result Analysis

Through the analysis of the above table, it can be seen

that February 2020 presents A polarized form, and the

probability of economic vitality growth rate grade A

is' 0.428571 ', while the probability of economic

vitality growth rate grade D is' 0.571429 '.This shows

that according to the historical data of the last four

years, January 2020 is in the trough of cyclical

fluctuations in the growth rate of economic vitality.

Therefore, based on the historical data, it is

predicted that the possibility of a continuous decline

in the economic vitality growth rate in '2020.2' is'

0.408571 '. This is because of the particularity of the

Chinese year cycle, and there is such a long holiday

as the Spring Festival in China. In Holiday people

will reduce a variety of normal economic activities;

The date of the Spring Festival is determined by the

lunar calendar, which usually falls in January or

February. So this form of polarization makes sense,

and it fits the reality.

6 INSIGHTS ADVICE TO THE

GOVERNMENT

Markov forecast allows us to have a comprehensive

grasp of the future economic situation, so that the

government can adjust economic policies in time. For

the current Markov results, Shanghai, as China's

economic center city, has maintained a stable growth

of economic vitality. In some months, such as the

months of Chinese Spring Festival, we can clearly see

that the economic vitality reaches a local maximum.

But in the long run, it is more and more difficult

to maintain high economic vitality with the increase

of economic volume. At present, China's economic

growth is slowing down. As a prior indicator of

economic development, economic vitality can

effectively show the current and future economic

level of a region.

This paper suggests that the government can use

the following methods to maintain economic vitality:

Carrying out industrial reform, using welfare fiscal

policies, improving the level of international opening-

up, speeding up the regional integration development

strategy and forming regional growth poles.

7 FUTURE WORK

Due to the current situation of COVID-19

pneumonia, China's economy and even the world

economy have been disrupted by the sudden

epidemic. In the context of blocking cities, reducing

international exchanges and suppressing

agglomeration, the economy has suffered huge losses.

The next work can assess the economic loss of the

epidemic through the economic vitality determined in

this paper, and provide theoretical support for the

economic recovery.

REFERENCES

Kraay, A. (2018). Methodology for a World Bank human

capital index. The World Bank.

Yang, Z., & Pan, Y. (2020). Are cities losing their vitality?

Exploring human capital in Chinese cities. Habitat

International, 96, 102104.

Barro, R. J., & Lee, J. W. (2013). A new data set of

educational attainment in the world, 1950–2010.

Journal of development economics, 104, 184-198.

Martyniuk-Peczek, J., Parteka, T., & Peczek, G. (2016).

Territorial Aspects of Entrepreneurial Activity in Polish

Suburban Zones. Procedia engineering, 161, 1639-

1646.

Lou haimiao, & sun qiubi. (2005). Evaluation of economic

vitality of Chinese provinces based on factor analysis.

Journal of fuzhou university (philosophy and social

sciences) (03), 33-36.

Lu xiaoli, & guo wanshan. (2007). Comprehensive

evaluation index system of urban economic vitality.

Statistics and decision-making, 2007 (11), 77-78.

Sun faping, ma hongbo, & wang lanying. Research on

strengthening economic vitality of qinghai. Qinghai

ethnic studies (3), 92-98.

Jin yan-jie. Evaluation of urban economic vitality in China.

Geography science (1), 11-18.

Hou rongtao. Construction of economic vitality evaluation

system and empirical analysis of futian district [J].

Economist (6) : 148-150.

A Comprehensive Evaluation of Economic Vitality and Markov’s Prediction: An Empirical Study of a Major City in China

53

He Ruqun. (2019). The pearl river, west river economic belt

urban economic dynamism evaluation research.

(Doctoral dissertation, guangxi normal university).

Lu jin, & wang xiaofei. (2019). Fixed asset investment,

aging and economic vitality - a study based on the

provincial perspective. Journal of population (5).

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

54