A Review Paper on the Application of Big Data by Banking

Institutions and Related Ethical Issues and Responses

Victor Chang

1a

, Lina Xiao

2

, Qianwen Xu

2

and Mitra Arami

3

1

School of Computing, Engineering and Digital Technologies, Teesside University, Middlesbrough, U.K.

2

IBSS, Xi’an Jiaotong-Liverpool University, Suzhou, China

3

PARDIS Ltd, London, U.K.

Keywords: Big Data, IoT, Banks, Ethical Issues of Big Data, Suggested Solutions.

Abstract: Nowadays, Big Data and the Internet of Things (IoT) are one of the most popular topics. This review paper

demonstrates an overview of the application of Big Data and IoT in banking institutions. In the beginning, a

brief definition of Big data and IoT is provided and the integration of technologies by banks is illustrated.

Then, this paper explains the potential sources where banks could generate Big Data. Next, the major works

that banking institutions use Big Data are listed. In the final two parts, some acute ethical concerns are raised

and appropriate solutions are suggested for the banking industry and other organizations.

1 INTRODUCTION

Due to the financial crisis and its impacts between

2007 and 2009, the public has realized the importance

of corporate to disclose financial and non-financial

data regularly and adequately. Central banks and

regulators should take responsibility to make

objective evaluations and implement strict

monitoring. This practice indicates for many parties

consisting of firms, central banks, regulators, and so

on, they have to deal with massive and complicated

data in a limited time. The era of Big Data enables a

sharp increase in different forms of data such as client

data, trade figures, health data, management data, etc.

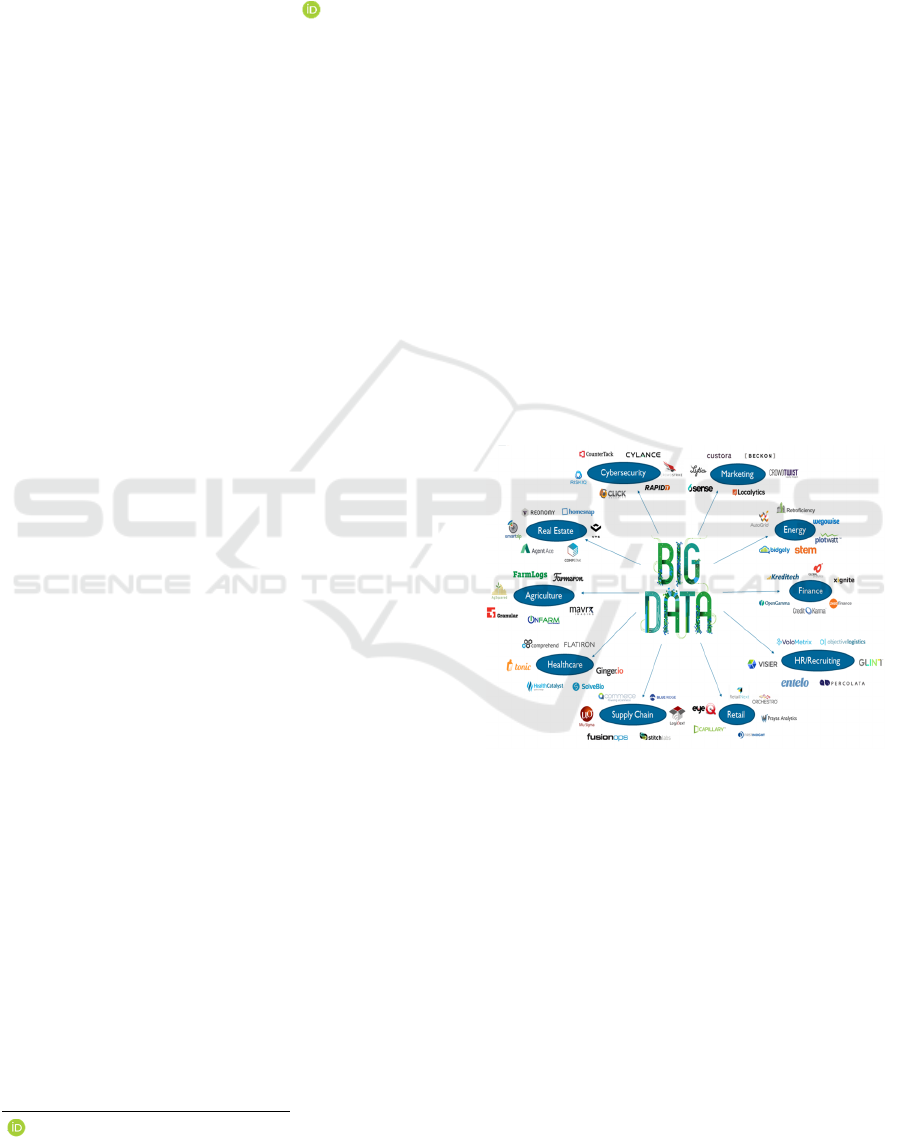

From the picture below, Big Data has been widely

used in all walks of life, such as marketing, HR,

healthcare, supply chain, agriculture, finance, and so

on (Invested Development, 2015; Marr, 2015;

Stackowiak et al., 2015). Therefore, it is essential for

businesses to know how to develop Big Data to

improve their business operations, processes,

communications and opportunities.

a

https://orcid.org/0000-0002-8012-5852

Figure 1: The era of Big Data employed.

It is a universal truth that Big Data is deemed as a

competitive advantage and organizations could

benefit a lot from these advanced technologies. For

example, for the meteorological department and

agricultural sector, Big Data can be utilized for

disaster prediction. For firms, they may make use of

Big Data to understand consumer behavior and

increase their sales revenue. For banking institutions,

they harness the ability of Big Data to avoid risk and

better serve their customers. It is worth noting that

Big Data itself is neutral with no harm. However, the

negative impacts of Big Data may come from the

Chang, V., Xiao, L., Xu, Q. and Arami, M.

A Review Paper on the Application of Big Data by Banking Institutions and Related Ethical Issues and Responses.

DOI: 10.5220/0009427701150121

In Proceedings of the 2nd International Conference on Finance, Economics, Management and IT Business (FEMIB 2020), pages 115-121

ISBN: 978-989-758-422-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

115

intentions, methods and people who use it. Overall,

this paper discusses the role of Big Data and IoT in

banking industries and highlights some ethical issues

later. Several responses from different perspectives

are also put forward within the context to address

those concerns.

2 BIG DATA AND IOT

In recent years, firms, governments and other sectors

have been deployed Big Data partly due to the

inherent limitation of traditional analytical tools. That

is, traditional data processing methods are inadequate

to process pretty large and complex data sets. Grable

and Lyons (2018) stated that “when analyzed

computationally, Big Data can provide more precise

insights into hidden patterns, trends, and associations,

especially in the context of human decision making”

(p.17). In the early 2000s, Doug Laney (2001) defined

Big Data, including three concepts: volume, variety,

velocity. Based on his original work, other concepts

have been complemented: veracity and value (Grable

and Lyons, 2018). Bholat (2015) claimed that even in

the banks, data are generated of high volume, high

velocity and diverse in form.

Generally, IoT is considered as the ‘third

industrial revolution’. The term was explained as “a

conceptual framework, which involves embedding

connectivity and intelligence across a wide range of

devices over the cloud” (Dutta and Ghosh, 2018, p.

1). Saxena and Ali Said Mansour Al-Tamimi (2017)

argued that it enables better monitoring and

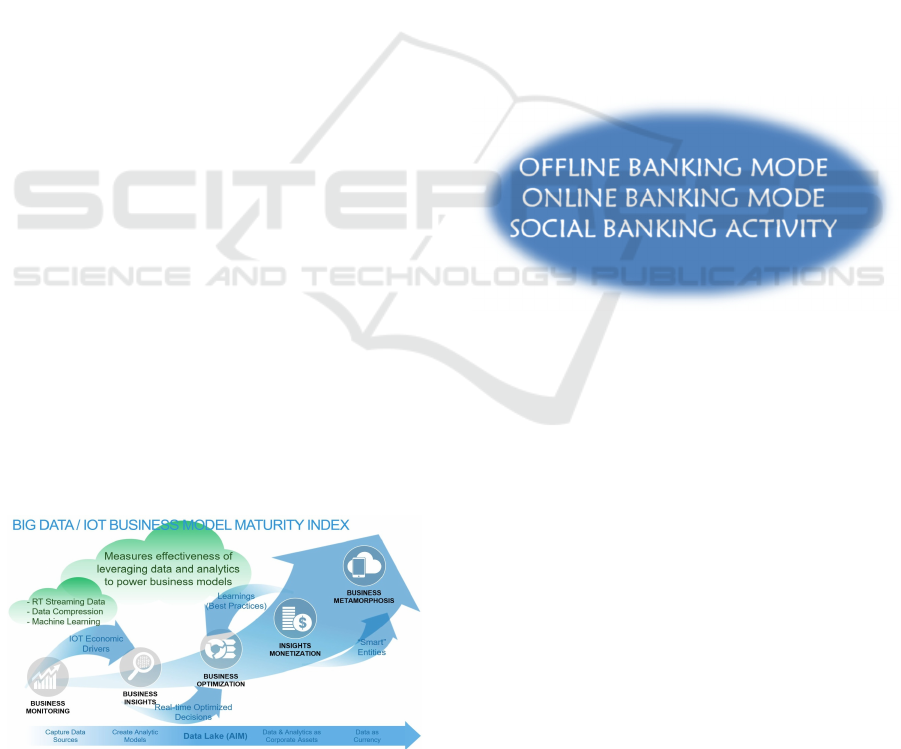

interaction. The following picture vividly depicts a

relationship between Big Data and IoT in terms of the

business model maturity index. Briefly, IoT produces

large volumes and complex, diversified data and Big

Data assistants IoT. Additionally, Big Data cannot do

without cloud computing. Therefore, IoT, Big Data

and cloud computing are the basis of each other.

Figure 2: Big Data/IoT Business Model Maturity Index.

According to Saxena and Al-Tamimi (2017), the

banking industry may combine Big Data and IoT

technologies altogether to establish a more robust

framework. IoT technologies have promoted the

innovation of financial service, improve interaction

with clients, help optimize the structure of

organizations and even assist in designing better

business models. Therefore, IoT could be tapped by

banks to improve their customer relationship

management. In case of theft or misplace of

customers’ plastic cards, IoT technologies come in

handy to find lost objects. Big Data can be generated

by IoT technologies in their own turn and data sharing

could be facilitated by IoT. Overall, banks’ efficiency

can be significantly improved and customer trust can

be built through the application of Big Data analytics

and IoT technologies.

3 POTENTIAL SOURCES OF BIG

DATA FOR BANKS

Figure 3: Three potential sources of Big Data for banks.

Big Data can be generated by banks in many ways.

As shown in the picture, offline and online channels

and social banking activities are the main sources of

Big Data for banks. Generally, offline banking mode

is the most common method to manage customer

relationships, such as customers visiting the bank

physically. Except for the offline channel, banks

could also transact with customers via online modes

such as internet banking, telephone banking, ATM,

WAP-banking and other means (Cheng et al., 2006).

Besides, customer relationships may be forged

through banking activities on social networking

media like Wechat or Weibo, as Ghazinoory et al.

(2016) said that “social banking” allows customers to

be more involved and their behavioral features can be

identified through insights from social data. For

instance, a Wechat Subscription called “ShanRong”,

the e-commerce platform of CCB, releases the news

of the latest and popular promotion for users. Data

analysts investigate user behavior characteristics

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

116

based on massive data and finally, three outcomes can

be achieved. Firstly, operators could make timely

optimization decisions by evaluating the

attractiveness of functions and marketing activities

introduced by ShanRong subscription to users.

Secondly, it can implement real-time monitoring,

active forewarning for online fraud, and timely

detection of inhuman ticket brushing and intrusion.

Thirdly, formulate personalized online marketing

activities and push individual notifications through

the precise clustering of customers. Thus, these social

banking activities are again a potent source of Big

Data, in the sense that banks are appraised of the

needs and requirements as well as feedback and

grievances regarding various issues.

4 MAJOR AREAS BANKING

INSTITUTIONS UTILIZE BIG

DATA

Banks utilize Big Data mainly to intensify their risk

management frameworks to become more transparent

and auditable (Srivastava and Gopalkrishnan, 2015).

According to The Economist (2012), high-

performance hardware and software are used by

financial services to investigate complicated patterns

of fraud within unstructured data. Nunan and

Domenico (2013) argued that the application of Big

Data "has enabled the cost-effective provision of

financial services in areas that would previously have

been regarded as too risky to be sustainable". For

instance, before a statement is issued, credit card

issuers usually apply Big Data analytics to detect a

cardholder's fraudulent behavior. Moreover,

Srivastava and Gopalkrishnan (2015) demonstrated

that data analysis is useful to identify and assess

finance crime management solution rules by

detecting the correlation between financial crimes

and transactions' attributes in advance. The

followings are specific ways.

Figure 4: Ways to manage risk by utilizing Big Data.

In addition, by using Big Data, banks are able to

improve their marketing strategies. The data helps

them to profile and categorize their customers and

then to learn what the customer’s need and predict

their behavior. In this way, it becomes easier for

banks to identify their potential customers or provide

better service for their existing customers (Hassani,

Huang & Silva, 2018).

5 SOME ETHICAL ISSUES

ARISING FROM BIG DATA

Due to the immense commercial and social value that

Big Data may bring, today, people consider Big Data

as a competitive advantage for financial institutions

and other sectors. However, a range of ethical

concerns may arise as a matter of time when using

and dealing with Big Data technologies. More

specifically, as Bratu (2018) said that Big Data

analytics covers a series of processes, including data

acquisition, storage, distribution, evaluation, and

information implementation. Hence, the concerns

relate not only to the gathering, retention of data and

its security, but also with its analysis and

interpretation by data scientists, and with the

commercial trade of personal data. This paper is

going to investigate, depict, and assess several ethical

concerns, and then relevant suggestions may be

proposed later.

5.1 Privacy and Consent

Bratu (2018) argued that breaching and invading

privacy and information suppliers’ approval are the

most commonplace ethical topics at a challenging

level. The right to privacy attracts much attention and

debate from the public regarding the usage of Big

Data. Privacy is quite vital to be protected as a human

right because it is tremendously beneficial to

individuals and society as a whole (Nersessian, 2018).

When one’s data is to be harvested and stored,

notification should be explicitly conveyed and the

informed consent should be obtained. Fuller (2017)

found that in practice, most service providers offer

information, generally in a written text form, to users

to obtain their consent. Then, a form needs signing,

or a box needs to be ticked by users to confirm that

they understand and accept all the terms represented

to them.

In practice, however, Wilbanks (2014) pointed

out that this is a process intentionally limiting the

liabilities of the parties who obtain users’ information

rather than sincerely notify the data subjects.

Consequently, the ability of users whose data are

gathered tends to be imperceptibly minimized. To

conclude, there are three main practical difficulties in

managing privacy and acquire informed consent

(Solove, 2013). Firstly, for those who are not aware

A Review Paper on the Application of Big Data by Banking Institutions and Related Ethical Issues and Responses

117

of the importance of privacy, they tend to ignore

relevant policies. Secondly, some people

acknowledge the significance and read the terms but

do not understand them. Thirdly, although some

people understand the privacy policies literally, they

may make unwise choices due to insufficient

background knowledge.

5.2 Security Problem

Since the banking industry has gradually achieved the

network, banks have always been the coveted objects

by hackers as they are capital-intensive areas.

Landwehr (2014) emphasized that customers’ data

should be kept complete and be protected from

accidental or intentional threats. Accordingly, he

proposed strategies to handle such threats through

prevention, detection, reply and recovery. There is no

doubt that it is data handlers’ responsibility to prevent

the data from exposure, misuse, or cyber-attack.

However, establishing a robust system is equally vital

because not every disaster may be foreseeable. These

systems can assist in detecting attacks and responding

to them timely and appropriately. Besides, other

suitable new safeguards should be in place if

necessary.

Nevertheless, Fuller (2017) mentioned that

whatever means are taken, hacked computers and

leakage of confidential data have frequently been

happening, which indicates that breaches of security

will always be a tricky problem. Recently, HSBC was

exposed that hackers attacked its customer accounts

between 4 October and 14 October in 2018 (Davis,

2018). Consequently, around 1% of American

customer personal information was leaked out.

Besides, in May 2016, managers and employees of

Agricultural and Commercial Bank and China CITIC

Bank illegally sold customers’ personal credit reports,

involving 2.57 million personal information items.

5.3 Commercial Usage of Customer

Data

Big Data may possess commercial usefulness in

various ways. For example, Fuller (2017) claimed

that a website or a store card could intelligently record

information about a user’s previous purchase. With

the footprint left by consumers, firms may carry out

precision marketing, target promoting and persuade

consumers to purchase further. Likewise, banks also

make commercial use of Big Data to recommend

appropriate wealth management products to specific

customer groups. On the one hand, many people

acknowledge that the commercial usage of data helps

them to access the products they might want and like

in a more convenient way. However, on the other

hand, as people’s data generate a huge financial gain,

there is a tendency for firms to sell personal data for

profit, even illegally. It is necessary and urgent to

have some effective regulations around us in case

personal data is used for evil and illegal purposes.

Nevertheless, Kitchin (2014) pointed out that

currently, few particular laws and codes have been

formulated to regulate data brokers and their power

has not been limited to a reasonable level yet. Thus,

regard to this field, effective and timely actions

should be taken, such as imposing relevant ethical or

legal restrictions upon data brokers before this

problem is more acute and severe.

5.4 Unfairness

Big Data has been widely used by financial

institutions such as banks, trust companies in

assessing people's suitability for loans. As O'Neil

(2016) investigated that this may aggravate the

existing social inequalities. For instance, for an

individual who has a poor credit record and lives in a

poor neighborhood, it is probable for institutions to

judge that person as an inappropriate candidate for a

loan application or charge him or her higher

premiums of insurance. This practice may deprive the

opportunities of the poor and reinforces their existing

poverty. Therefore, it is unreasonable and inequitable

for banks to use Big Data to categorize and sort

people as this may further deepen social unfairness to

a new level.

It is worth investigating the Big Data’s role in

accessing financial services in China. Compared with

developed countries, China's financial services

penetration rate is lower (Kshetri, 2016). Kshetri

(2016) also highlighted that, especially for low-

income families and small and midsize enterprises

(SMEs), the low penetration problem is more acute

and severe than for high-income households and large

firms. Klein and Cukier (2009) claimed that SMEs in

China contribute to 70% of GDP, but only 20% of

financial resources are available to them. What is

more, around 89% of Chinese SMEs face barriers in

meeting banks’ requirements when applying for loans

(Jing, 2014). Two main reasons are explainable for

this situation. Firstly, borrowing loans to poor people

and micro-enterprises will bring traditional banks

higher transaction costs and inconvenience of

processes, so banks are usually reluctant to serve

these borrowers. Secondly, information opacity is

another reason to interpret why the weak and small

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

118

businesses have difficulty in reaching financial

services and other favorable policies.

Kshetri (2014) claimed that information opacity is

partly since Chinese credit rating agencies could not

provide adequate and complete information on SMEs'

creditworthiness. This practice may perhaps be

because certified audited financial statements are not

compulsory for those micro firms. However, it has

become crucial for banks to minimize their lending

risks based on reliable and transparent credit

information. Kunt and Maksimovic (2004) found that

as foreign banks grasp less credit information of

Chinese people and SMEs than banks in China, they

are more cautious even reject those "opaque"

borrowers' loan service applications. Big Data may

help increase chances for Chinese low-income

families and micro-enterprises to obtain financial

services via evaluation and analysis of potential

borrowers’ creditworthiness and reduction of

transaction costs. Nevertheless, the unfairness cannot

be eliminated in a short time.

5.5 Data Cleaning, Analysis and

Presentation of Results

Except for the ethical concerns discussed above,

another issue also captures people’s attention that is

the data clean, analysis and presentation of the

outcomes by data analysts. As Fuller (2017) argued

that data expert s’ one role is to be taleteller. That is,

before presenting persuasive final results, data

scientists need to carry on a series of data processing,

including data cleaning. In people’s minds, Big Data

is objective and just “is”, but the data processing may

embed various biases and human factors’

interference. First, each data does not exist without

ground. It could be obtained in different ways such as

data acquisition, data sharing even cyber-attack

illegally. Biases may be introduced in these ways at

the same time. Second, data cleaning is usually

implemented before detailed analysis conducted.

Data experts have discourse power to determine the

approach to handle the missing data, such as imputing

missing variables, transforming variables and

removing outliers. However, data cleaning and

analysis processes are rarely documented. The

experts’ choices on the approaches may influence the

analysis, interpretation and presentation in the next

steps. The influence is long-term and it is not limited

to the one-step but the whole progress (Borgman,

2015). Third, the specific tools adopted in the data

analysis process may incorporate preconceptions.

The algorithms employed to carry out the analysis of

the data are given specific values and are embodied in

specific scientific methods (Kitchin, 2016). Fourth,

aside from the tools and algorithms used to analyze

the data, biases may also result from data scientists

themselves. In order to take responsibility for the

interpretation result and try to minimize the biases,

the analysts have to identify the influence of their

analyzing experience and opinions in their

interpretation (Boyd and Crawford, 2012). Last but

not least, apart from the biases resulting from the

analysis and interpretation, the presentation of final

results from analysis deserves attention as well. In the

presentation, analysts commonly use tables, graphs,

charts, diagrams, etc. to realize data visualization.

However, some conscious or unconscious biases may

result from these visualizations, which might

encourage readers to see and understand results in

particular ways. According to Gitelman and Jackson

(2013), using different visualization methods in the

presentation may produce different effects.

Additionally, in that the decision-makers will make

decisions on the presentation of the analysis results,

the presenters need to present them properly.

6 PROPOSED SOLUTIONS

The ethical issues discussed above are somewhat

complicated and overlapping. Each of them should be

treated seriously by taking appropriate actions.

Broadly, solutions are proposed from three

perspectives: technical, legal and ethical.

6.1 Technical Solutions

Regard to some ethical issues raised before, like

security problems, technological development and

innovation may assist in addressing. That is,

continuously update high-performance hardware and

software systems that store and process Big Data. For

instance, in terms of frequent cyber-attacks of banks,

as advised by Fuller (2017), the security holes can

partly be handled through continuous oversight and

strengthening infrastructure construction and

development. Overall, integration of experienced

data handlers and a robust framework can mitigate the

security problems to a great extent. As data science is

an advanced domain with rapid changes, so relevant

techniques to improve security will change and

develop correspondingly. Similarly, for those who

deliberately damage security will transform means

and find new coping ways as well. Ultimately, at

least, notifications of the risks from technical

limitations, failures and security breaches should be

clearly conveyed to people who may be influenced.

A Review Paper on the Application of Big Data by Banking Institutions and Related Ethical Issues and Responses

119

Besides, acquiring interested parties’ consent to those

risks is necessary.

6.2 Legal Solutions

Many legal and regulatory methods are formulated to

deal with plenty of matters. Nevertheless, there are

still some challenges that should not be

underestimated. Among them, the most three acute

issues are explained below. Firstly, as Big Data, its

analysis and its commodification change so rapidly

and frequently, it is urgent to develop corresponding

legislations in time (Fuller, 2017). If legislations lag

behind current practices, not only these legal and

regulatory means would be old-fashioned, but also

bad people will make unbridled attacks and individual

rights and interests cannot be guaranteed promptly.

Secondly, although relevant legislation already exists

in some circumstances, in reality, they are not feasible

or/and maybe routinely overlooked. In such cases,

laws must be adapted to make sure they are

meaningful, believed and enforceable. Thirdly,

making applicable and global legislation is crucial.

Actually, each country enacts laws and regulations

based on its conditions and differentiation may exist

among different nations. However, there is no border

restricting data, so it is necessary to coordinate and

cooperate between countries to produce some agreed

international standards. These significant

undertakings may consume much cost, time and

effort, but they are undoubtedly crucial and deserve

these valuable resources.

6.3 Ethical Solutions

The financial crisis reflected the absence of

professional ethics and low moral standards. After

that, banking supervisors and politicians have been

aware that the corporate governance system and

financial institutions’ ethical culture play a vital role

in the occurrence and development of the crisis. That

is, poor performance in corporate governance and

unethical behavior of management and employees are

partly responsible for the financial crisis.

Consequently, the global financial stability and social

welfare will be influenced negatively. For instance,

Enron’s managers colluded with Arthur Andersen to

manipulate accounts, which indicated the deficit of

professional ethics. The incident caused both Enron

and Andersen to suffer from a terrible loss of

reputation (Markham, 2015). Thus, for financial

institutions, including the banking industry, ethical

status is rather significant. In order to improve the

overall level of financial practitioners’ ethics, first

and foremost, board characteristics count. Baselga-

Pascual et al. (2018) demonstrated that within an

organization, the board of directors (BOD) is

considered as the most vital internal governance

mechanism because formulating and monitoring the

ethical culture of the whole organization is BOD’s

responsibility. Baselga-Pascual et al. (2018)

investigated a positive relationship between ethical

reputation and board characteristics. More generally,

the larger board size, more diversified gender, and

CEO duality may contribute to more effective

monitoring and oversight. However, if board

members are too busy to have regular meetings, poor

monitoring and a low ethical reputation may be

formed. Therefore, it is crucial for financial

institutions to make a balance in the structure of

BOD. Additionally, BOD themselves are required to

conduct ethically and establish appropriate and

feasible ethics codes for employees. Last but not

least, regular evaluation of the company’s ethical

atmosphere and strict monitoring of employees'

behavior ought to be in place.

Besides, data scientists and employees have been

advised to undertake an oath of practicing specific

ethical codes, showing they fully understand those

standards and are willing to take responsibility and

accept the oversight from others. However, in order

to ensure the effectiveness, two requirements should

be satisfied. One thing is that all data scientists must

comply with the oath and everyone is equal before the

regulations. The other is that severe punishment

measures like penalties would be acted on any data

analysts who breach of it.

7 CONCLUSION

To sum up, in this review paper, we give a brief

introduction to Big Data and IoT. Then we focus on

the usage of Big Data and IoT in banking institutions

through analyzing the potential sources where banks

could acquire Big Data and the major areas that banks

adopt data. From these two parts, we find that the

banking industry frequently generates Big Data in

three ways. They are offline channels, online channel

and social banking activities. Generally, the banking

industry makes use of Big Data to reinforce risk

management frameworks to reduce financial risks. In

addition, Big Data can also be utilized to develop

more accurate marketing strategies, reduce

transaction and to operate costs and provide better

service to consumers. Next, we list some ethical

issues related to the application of Big Data such as

privacy and consent, security problems, commercial

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

120

usage, unfairness and data cleaning, presentation

process. Finally, several responses are provided from

technical, legal and ethical aspects. On the whole, Big

Data is a strategic resource if it is used legally and

adequately by organizations. We expect Big Data

could benefit people and the whole society to the

greatest extent.

FUNDING

We are grateful to VC Research to support this

research, with grant number VCR 0000026.

REFERENCES

Baselga-Pascual, L., Trujillo-Ponce, A., Vähämaa, E., &

Vähämaa, S. (2018). Ethical Reputation of Financial

Institutions: Do Board Characteristics Matter?. Journal

of Business Ethics, 148(3), 489–510. DOI:

10.1007/s10551-015-2949-x.

Bholat, D. (2015). Big data and central banks. Bank of

England Quarterly Bulletin, 55(1), 86–93.

Borgman, C. L. (2015). Big data, little data, no data:

Scholarship in the networked world. MIT press.

Boyd, D. and Crawford, K. (2012). Critical Questions for

Big Data. Information, Communication and Society 15:

662–75.

Bratu, S., (2018). The Ethics of Algorithmic Sociality, Big

Data Analytics, and Data-Driven Research

Patterns.Review of Contemporary Philosophy, 17, 100–

106. DOI: 10.22381/RCP1720187.

Cheng, T. C. E. , Lam, D. Y. C. , & Yeung, A. C. L. . (2006).

Adoption of internet banking: an empirical study in

hong kong. Decision Support Systems, 42(3), 1558-

1572.

Davis, J. (2018) HSBC Bank Discloses Security Incident.

News Report, Security today. Available on: https://

securitytoday.com/articles/2018/11/08/hsbc-bank-

discloses-security-incident.aspx (assessed on 27 March

2020).

Dutta, N. S. and Ghosh, M., (2018). IoT Driving Social

Innovation. Telecom Business Review, 11(1), 1–5.

Fuller, M. (2017). Big Data, Ethics and Religion: New

Questions from a New Science. Religions, 8(5), 1–11.

DOI: 10.3390/rel8050088.

Gitelman, L., & Jackson, V. (2013). Introduction. In “Raw

Data” is an Oxymoron. Edited by Lisa Gitelman.

Cambridge: MIT Press, 1–14.

Grable, J. E. and Lyons, A. C. (2018). An Introduction to

Big Data. Journal of Financial Service Professionals,

72(5), 17–20.

Hassani, H., Huang, X., & Silva, E., 2018. Digitalisation

and big data mining in banking. Big Data and Cognitive

Computing, 2(3), 18

Invested Development, 2015. ‘Big Data and the Internet of

Things’, Available at: http://investeddevelopment.com/

2015/05/big-data-and-the-internet-of-things-weekly-

review-54-58/ (Accessed: 28 November 2018).

Jing, M. (2014). Alibaba, leaders team up for SME

financing. China Daily. Available on: http://

www.chinadaily.com.cn/business/2014-

07/23/content_17901230.htm (assessed on 31 March

2020).

Kitchin, & Rob. (2016). Thinking critically about and

researching algorithms. Information, Communication

& Society, 1-16.

Kshetri, N. (2016). Big data’s role in expanding access to

financial services in China. International Journal of

Information Management, 36, pp. 297–308. DOI:

10.1016/j.ijinfomgt.2015.11.014.

Laney, D. (2001). 3D data management: Controlling data

volume, velocity and variety. META group research

note, 6(70), 1.

Markham, J. W. (2015). A financial history of modern US

corporate scandals: From Enron to reform. Routledge.

Marr, B. (2015). Big Data: Using SMART big data,

analytics and metrics to make better decisions and

improve performance. John Wiley & Sons.

Nersessian, D. (2018). The law and ethics of big data

analytics: A new role for international human rights in

the search for global standards. Business Horizons,

61(6), 845–854. DOI: 10.1016/j.bushor.2018.07.006.

Nunan, D. and Di Domenico, M. (2013). Market research

and the ethics of big data. International Journal of

Market Research, 55(4), 2–13.

Saxena, S. and Ali Said Mansour Al-Tamimi, T. (2017).

Big data and Internet of Things (IoT) technologies in

Omani banks: a case study. Foresight, 19(4), p. 409.

Solove, Daniel J. (2013). Privacy management and the

consent dilemma. Harvard Law Review 126: 1880–903.

Srivastava, U. and Gopalkrishnan, S. (2015). Impact of Big

Data Analytics on Banking Sector: Learning for Indian

Banks. Procedia Computer Science, 50, 643–652. DOI:

10.1016/j.procs.2015.04.098.

Stackowiak, R., Licht, A., Mantha, V., & Nagode, L.

(2015). Big Data and the Internet of Things: enterprise

information architecture for a new age. Apress.

A Review Paper on the Application of Big Data by Banking Institutions and Related Ethical Issues and Responses

121