Factors Influencing Reuse Intention of e-Payment in Thailand:

A Case Study of PromptPay

Kobthong Ladkoom

1

and Bundit Thanasopon

2

1

King Mongkut’s Institute of Technology Ladkrabang, Bangkok, Thailand

2

Information Technology Faculty, King Mongkut’s Institute of Technology Ladkrabang, Thailand

Keywords: e-Payment, Reuse Intention, Concern for Information Privacy (CFIP), TAM, PLS-SEM, Trust, Attitude,

Satisfaction, Confirmation, Perceived Usefulness, Privacy Risk, Risk Acceptability, Consumer’s Liability.

Abstract: Thai e-commerce is growing rapidly in the past few years. The driving factors for the rapid growth arise from

increased Internet and mobile phone use as well as improved e-payment and logistics. Thai government has

come up with a national e-payment initiative called “PromptPay” with an aim to reduce the use of cash and

catalyze the adoption of e-payment in Thailand. However, the use of e-payment in Thailand is still lagged

behind other countires. The objective of this research is therefore to identify factors influencing reuse

intension of e-payment in Thailand and their antecedents. For our preliminary study, we survey PromptPay

100 users in Bangkok and analyze the data using PLS-SEM technique. The results suggest that satisfaction

and attitude positively impact reuse intention of PromptPay. In addition, perceived usefulness is found to be

a driver of user satisfaction and positive attitude towards PromptPay, while positive confirmation affects

satisfaction. However, trust is unexpectedly found to be insignificant to reuse intention of PromptPay. Our

proposed conceptual model offers an alternative model studying e-payment adoption in other context, while

our findings could help Thai government in planning their strategy for improving the diffusion rate of

PromptPay in Thailand.

1 INTRODUCTION

Nowadays, e-commerce tends to play an increasingly

important role in our life. In order to be able to offer

convenience and fast service deliver to consumers,

service providers increasingly turn to electronic

payment (e-payment). According to the statistics

from Let’s Talk Payments, it is reported that during

2011 to 2015, e-payment generated and income of

over 296 billion USD (Gogoingkron, 2017).

In Thailand, the government has been trying to

encourage Thai people to adopt a national e-payment

system called “PromptPay” since 2015 which plays

an important role in the government’s strategy to use

technology to drive the economy. (Malabuppha T,

2017). PromptPay is a system that links Thai ID

number or mobile number to account is linked to the

owner’s bank account. A person with a PromptPay

account transfer money to or receive money from

another person with a PromptPay account with a very

small fee.

In the present, e-payment have become very

popular in Thailand which can be seen from the

e-payment usage statistics from 2016 to 2018 which

has went up 3.5%. The number of e-payment

registration is approximately 46.5 million accounts

and around 1.1 billion transactions in 2018 (Bank of

Thailand Statistics, 2018).

However, according to BIS

statistics, (2017),

while the amount of e-payment transactions in

Thailand has increased from 49 times/person/year by

the end of 2016 to 63 times/person/year in 2017, it is

still quite low when compared to other countries. It is

found that, for example, Singaporian uses e-payment

782 times/person/year 500 times/person/year for

Korean and 411 times/person/year for British. This

low usage rate may be due to the fact that

infrastructure supporting e-payment services tends to

be available only in big cities, making most Thai

people unable to reach the service. In addition, many

Thai people still have concerns about risks and

computer security when using e-payment as they

concern about their personal information such as

citizen ID, telephone numbers, e-wallet ID, bank

account or email address.

Ladkoom, K. and Thanasopon, B.

Factors Influencing Reuse Intention of e-Payment in Thailand: A Case Study of PromptPay.

DOI: 10.5220/0009410407430750

In Proceedings of the 22nd International Conference on Enterpr ise Information Systems (ICEIS 2020) - Volume 1, pages 743-750

ISBN: 978-989-758-423-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

743

Because of those reasons, the researchers

recognize the importance of studying factors that

impact the Thai customers’ intention to use

e-payment repeatedly. Therefore, our research

objectives are to study factors that impact and

influence intention to reuse of e-payment in Thailand

and develop a conceptual framework of e-payment

reuse intention in Thailand. In this article, we start

with a literature review on technology reuse intention.

As a result, we identify six factors which are trust,

satisfaction, attitude, confirmation, perceived

usefulness and concerns for information privacy

(CFIP) and consequently create a conceptual model

for e-payment reuse intention. To verify the proposed

model, we collect data using questionnaire. The data

are analyzed and reported. Finally, we discuss on the

results of research are offer both academic and

practical implications.

2 LITERATURE REVIEW AND

RESEARCH HYPOTHESIS

2.1 Reuse Intention

Reuse intention can be defined as an intention to buy

products or services continually after consumers had

bought the products or services once. Besides, reuse

intention is associated with personal decision to

repeatedly purchase products and services from the

same business by considering their current situations

(Hellier et al., 2003). According to Bhattacherjee

(2001), the decision to reuse an information system

(of IS continuance usage) is the same as the decision

to repurchase products and services of the consumers

because reuse decision is influenced by the first time

that a user uses the information system.

Furthermore, it is also found that attitude and

perceived behavioral control, which, related to

“perceived value” and “perceived service quality”,

are the factors that influence the intention to

repurchase airline tickets of passengers in economy

class by using the theory of planned behavior (Jun and

Cheol, 2019).

In conclusion, the current study defines reuse

intention as the intention to purchase products and

services continually which occur when customers are

satisfied and have a positive attitude after they had

bought and use the products and services for the first

time. To put in the context of this study, we argue that

reuse intention of “PromptPay” is similar to

consumers’ repurchase intention. Specifically,

consumer satisfaction and positive attitude towards

PromptPay are the results of a positive first-time in

turn encourages continuous use of the system.

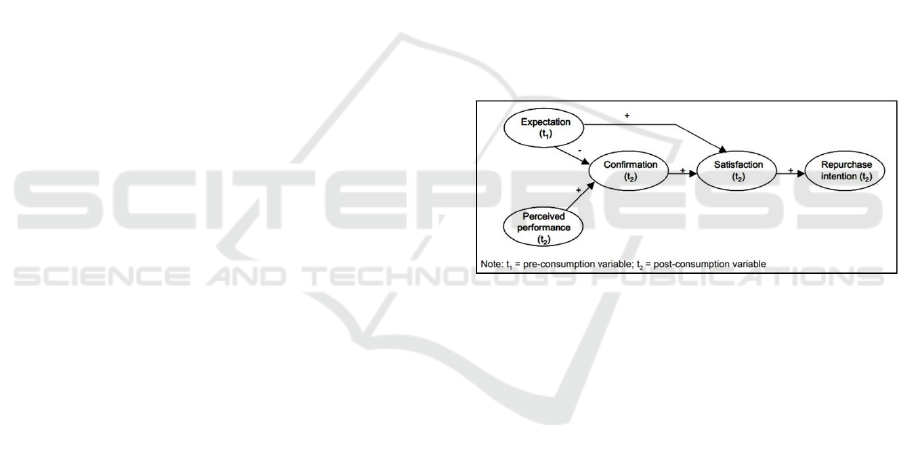

2.2 Expectation Confirmation Theory

Expectation Confirmation Theory (ECT) is a theory

that explains consumers’ repurchase intention. From

Figure 1, it can be seen that customers’ satisfaction is

decided by two factors, namely expectation and

confirmation. Prior to purchasing products or

services, customers usually have a certain level of

expectation on the performance levels. After

purchasing, they will evaluate the performance of the

purchased products or services and finally compare

what they get with their expectations. When what

customers receive is beyond their expectations, it

enhances the customers’ positive satisfaction. On the

contrary, if what they get is lower than their

expectations, their satisfaction will be negative

accordingly. Higher levels of satisfaction positively

affect repurchase intention, as shown in Figure 1

(Bhattacherjee et. al, 2001).

Figure 1: Expectation-Confirmation Theory (ECT).

Even though this theory is developed in consumer

product context, we argue that confirmation and

satisfaction also make a significant contribution to

PromptPay reuse intention. The reasons are explain in

the next section.

2.3 Factors Affecting the Use of

e-Payment

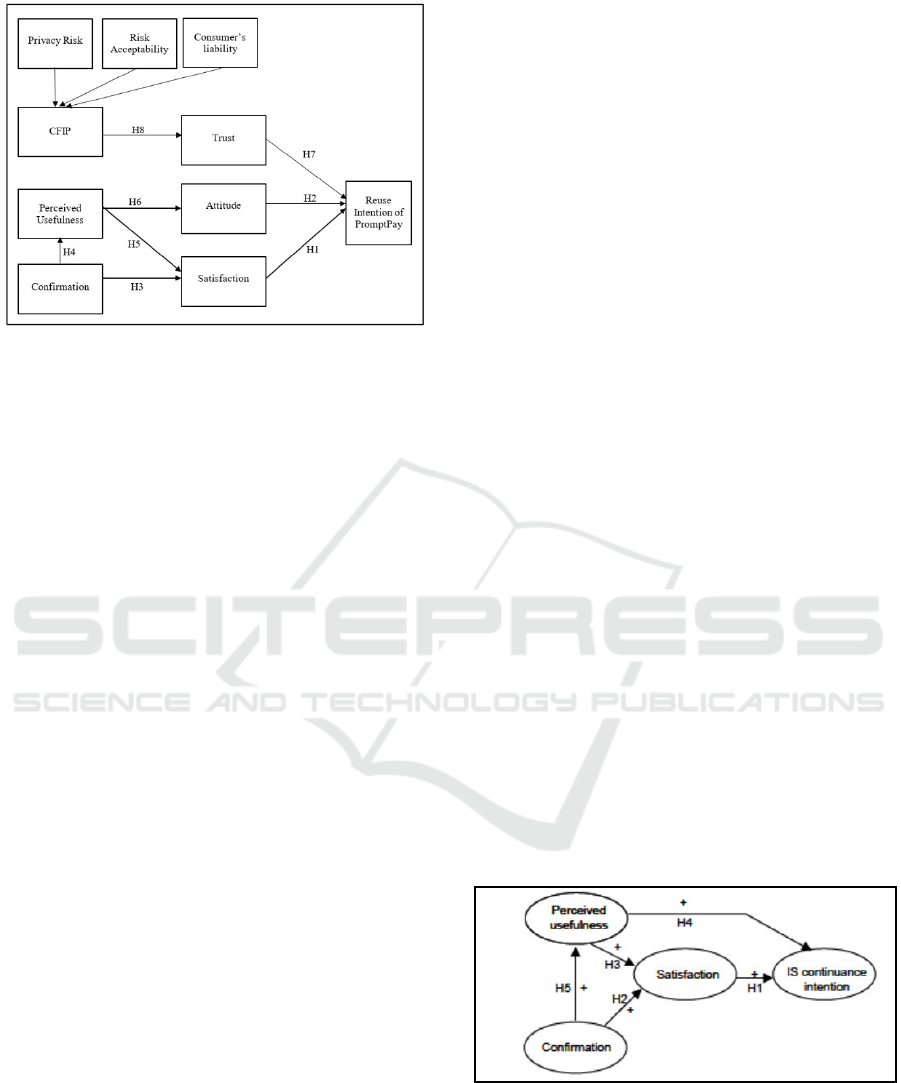

We reviewed the literature and developed a

conceptual model consisting of six factors, namely,

trust, attitude, satisfaction, confirmation, perceived

usefulness and CFIP (Figure 2).

2.3.1 Satisfaction

Prior works have provided several definitions of

satisfaction. For example, Oliver and Richard (1980)

proposes that satisfaction is the result of a comparison

between expectations and perceptions of the

performance

of purchased goods or services from

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

744

Figure 2: Conceptual framework.

actual use. Gustafsson et al., (2015), satisfaction is the

difference between one’s expectation and the actual

outcomes that one perceives. Therefore, if a customer

receives a product or service that meet his/her

expectation, his/her satisfaction will be increased.

A high level of satisfaction often leads to word of

mouth and repurchase intension.

In summary, satisfaction refers to the feeling of

satisfaction of what customers receive and what they

expect when using e-payment. Customers’ satis-

faction will occur after using it. According to

(Gustafsson et al., 2015), the expectancy

confirmation Theory (ECT), indicates that

satisfaction is a result of experiences’ evaluation after

purchasing products and services whether the same as

their expectation or not. If the result is similar to their

expectations, it will make customers feel satisfied

which leads to repurchase intentions of the customers.

On the other hand, if customers’ evaluation is lower

than their expectations, it will make them feel

unsatisfied and do not use it again. From the research

of Nguyen and Tran (2018), they have studied

repurchase intention and factors that motivate people

to adopt mobile ride hailing apps in Vietnam. They

collected 427 questionnaires from Grab and Uber

users, and it was found that perceived service quality

and satisfaction of system quality motivates

customers to reuse the services.

Therefore, satisfaction is an important factor that

motivates customers return to use e-payment again.

H1: Satisfaction Positively Impacts Reuse

Intention of e-Payment.

2.3.2 Attitude

Attitude towards e-payment use is influenced by

perceived ease of use and perceived usefulness of the

e-payment system (Gustafsson, 2015). It is one of the

most important concepts in social psychology and

communication. From the literature review, there are

several definitions of attitude.

Schiffman and Kanuk (1994) defined that attitude

means propensity to express satisfaction towards a

thing or expression of inner feeling reflecting that

people have propensity of being satisfied or

unsatisfied with something, such as brands, shops or

e-payment systems.

To put it simply, attitude is thought, feeling or

satisfaction towards a certain thing, person or

satisfaction of purchasing products and services

which lead to related actions or unrelated actions.

Therefore, whenever consumers trust an e-payment

system that it is easy to use and beneficial, it creates

positive attitude, good satisfaction towards

e-payment, which is a significant contributor to reuse

intention. Norazah et al., (2011) perceived usefulness,

ease of use, entertainment and attitude as key

antecedents of intention to reuse 3G mobile service.

The result indicates that attitude and perceived

usefulness are related to the decision to reuse 3G of

customers. Thus, attitude is another essential factor of

intention to reuse e-payment.

H2: Attitude Positively Affects Reuse Intention

e-Payment.

2.3.3 Confirmation

Confirmation is a part of expectation-confirmation

Theory of continued IT usage (ECT-IT). The model

is developed from ECT which is used to explain

repurchase intention in consumer produces context

(Bhattacherjee et al., 2001). ECT is a model of

expectation and confirmation theories which are

developed to explain continuance usage intention of

information systems Figure 3.

Figure 3: Expectation-Confirmation Model of Continued IT

usage (ECM-IT) (Bhattacherjee et al., 2001).

As seen from the model, ECM-ITfocuses on three

factors. The first is satisfaction. The model proposes

that satisfaction has a positive effect on continuance

usage of IT products or services. Secondly, perceived

Factors Influencing Reuse Intention of e-Payment in Thailand: A Case Study of PromptPay

745

usefulness is a factor that motivates customers’

satisfaction because it can tell the benefits that

customers will receive from the experiences of using

IT products and services which affect on customers’

satisfaction as well as expectation-confirmation

theory. Lastly, confirmation is proposed to have a

positive impact on perceived usefulness can be

divided into three types of situations (1) positive

disconfirmation - what customers get is better than

their expectations. (2) confirmation - what customers

get is similar to their expectations. (3) negative

disconfirmation - what customers get is lower than

their expectations. Based on the ECM-IT model, we

propose the following two hypotheses:

H3: Confirmation or Positive Disconfirmation-

Positively Influences Satisfaction.

H4: Confirmation or Positive Disconfirmation

Positively Affects Perceive Usefulness.

2.3.4 Perceived Usefulness

Bhattacherjee et al., (2001) propose the ECT-IT

model and collected the data of 1,000 online banking

users. The results points out that perceived usefulness

and satisfaction influence reuse intention of

information system. Therefore, we propose that

perceived usefulness motivates customers’ reuse

intention of PromptPay because when customers

perceived the usefulness of Promptpay such as

cheaper fee, saving time and, convenience, it will

improve customer satisfaction of the service.

H5: Perceived Usefulness has a Positive Effect on

Satisfaction.

In addition, the literature on technology

acceptance model (TAM) has suggested perceived

usefulness as an antecedent to attitude toward using a

technology (Davis, 1989). Based on TAM, for

customers to have a positive attitude toward

PromptPay, they need to be able to perceived the

benefits or usefulness of the system. A positive

attitude then lead them to continuously decide to

reuse PromptPay.

H6: Perceived Usefulness has a Positive Effect on

Attitude.

2.3.5 Trust

Trust is a very important factor for online transactions

when compared to face-to-face transaction because it

often involves high levels of uncertainty and risk

factors. One of the major risks is information privacy

which is particularly important to e-payment

transaction. Credit card numbers or bank account

information leaks could lead to a negative impact on

trustworthiness of the website which in turn damage

consumer reuse intention. Generally, trust comes

from actual use and reuse of the e-payment system.

When customers build trust with the website, they

will make other transactions. If customers do not trust

the website, untrustworthiness will be and important

obstacle to online transactions (Gefen et al., 2003).

From the research of Pavlou, (2003), it was found

that trust is the willingness to risk for getting services

as it showed that trust involves with benevolent,

honest, competence and predictability. So, when trust

has been built, good customer relationships,

transaction costs reduction and fast service delivery

could be achieved. Consistently, studied factors

influencing reuse intention of online transactions by

collecting 400 responses using an online

questionnaire posted on a popular social media site.

They analyzed the collected data found a two-way

relationship between satisfaction and trust. The two

factors also positively influence reuse intention.

Consequently, we argue that trust is very

important to reuse intention of e-payment due to the

high information privacy risks involved. The system

will be accepted and successful when consumers trust

in the system. The more consumers trust, the more

chance they use again. In addition, when trust has

been built consumers will receive the benefits of

using e-payment because it saves the costs and time.

Therefore, we hypothesize the effect of trust as

follows:

H7: Trust Positively Influences e-Payment Reuse

Intention of PromptPay.

2.3.6 Concern for Information Privacy

(CFIP)

According to Zhou (2011), concern for information

privacy reflects users’ attitudes toward personal

information privacy. For online payment, some

consumers concern about revealing their personal

information such as identification number, telephone

number and bank account. In this article, we have

identified three dimensions of concern about

information privacy in the context of e-payment.

The first dimension is privacy risk. According to

Hang et al. (2005), there are six types of perceived

risk including financial risk, performance risk,

privacy risk, psychological risk, social risk and time

risk. For online payment or online transactions in

general, privacy risk has often been identified as one

of the most important inhibitors to adoption. Privacy

risk can be defined as the potential loss of control over

one's personal information.

Iris et al,. (2005) and Tao Zhou (2010) have the

same opinion that perceived risk has a negative

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

746

relationship with reuse intention of e-payment,

especially privacy risk. The risk of personal

information that might be revealed on the Internet can

cause users to perceive high risk and feel insecure,

causing them not be willing to use e-payment.

The second dimension is risk acceptability. Risk

acceptance informs decision to take a particular risk.

According to Eid (2016), rink acceptability in

e-payment is categorized into two types. First,

accepting the risk before using the system or

accepting risk during the online payment processes.

Second, the risk acceptance level, but it still needs to

be controlled, followed, detected and reviewed in

order to make sure that if they use e-payment, they

have to accept the risk.

Therefore, risk acceptability is a crucial factor

and influences concern for information privacy of

consumers both before and after deciding to use

e-payment. If the consumers cannot accept the risk,

they will always have concerns over the use of

e-payment which can lead to low levels of trust.

The third dimension is consumers’ liability.

when there are problems or mistakes while using

e-payment, they must be an institution that take

responsibility or a law that protect the consumer (Eid

et al., 2016) From the annual report of e-payment in

2016, it is found that the majority of consumers lack

the understanding and knowledge about any

responsible organization or institution case of

mistakes or fraudulent activities which causes

concerns and lack of trust to use e-payment.

To sum up, it can be concluded that concern for

information privacy (CFIP) refers to the concerns of

threats and insecure feeling about information

privacy and risks associated to making online

payment. CFIP has, three dimensions which are

privacy risk, acceptability and consumers’ liability. In

e-payment context, we argue that CFIP can have an

impact on these three dimensions are the important

factors that affect information privacy. If consumers

still concern about information privacy while using

e-payment, they will not trust the system. In contrast,

if consumers trust in the system, it will affect them to

have reuse intention of e-payment.

H8: Concern for Information Privacy (CFIP)

Negatively Impacts Trust.

3 RESEARCH METHODOLOGY

3.1 Data Collection

The data collection method of this study is survey.

We use paper-based questionnaire as our data

collection tool. The respondents in this research are

PromptPay users in Bangkok, Thailand. We had

collected 30 responses for the pilot test. After, the

pilot modifications have been made to the

questionnaire. We then be able to collect 115

responses. 12 responses of them were filtered out

since the respondents never use PromptPay and 3

incomplete responses

were also removed. The data

collection period was 4 months (from January – April

2019). We personally distributed the questionnaire in

banks, department stores, supermarkets and

restaurants.

The questionnaire was divided into 4 sections

including section 1: general information regarding

PromptPay use, section 2: questions for the factors,

section 3: demographic data, and section 4: an open-

ended question for suggestions.

3.2 Data Analysis

We test the proposed hypothesis using used partial

least square structural equation modeling or PLS-

SEM method. This method used covariation which

aims to estimate model parameters for explaining the

variance of latent variables. PLS-SEM has been used

increasingly in business management research such

as marketing, accounting, or IT. Moreover, PLS-SEM

can handle small sample sizes and exploratory

models, which is suitable for this research (Hair et al.,

2013). The software used for the analysis of this

research is Smart PLS 3.2.8.

4 RESULTS

Regarding the demographic data of the responses 52

persons were male, and 48 persons were female. 76

persons of them were single, and 24 persons of them

were married. The majority of the respondents are

between 21 and 30 years old (58%). Moreover, it is

also found that most respondents have at least

Bachelor’s degree (88%). The details are shown in

Table 1.

For the PLS-SEM analysis, we have created a

model of 7 latent variables, namely trust, satisfaction,

attitude, confirmation, concerns for information

privacy (CFIP), perceived usefulness and reuse

intention of PromptPay. The model also has a total of

31 observed variables.

We hypothesize CFIP as a formative construct

comprising of privacy risks, risk acceptability and

consumer’s liability. Therefore, the measurement

model evaluation is divided into 2 parts. (Hair et al.,

2012).

First, we evaluate reflective measurement

Factors Influencing Reuse Intention of e-Payment in Thailand: A Case Study of PromptPay

747

Table 1: Demographic data.

Descri

p

tion Unit Percent

Gender

- Male

- Female

52

48

52%

48%

Age

- Less than 20 years

- 21 - 30 years

- 31 - 40 years

- 41 - 50 years

- 51-60 years

3

58

29

8

2

3.0%

58.0%

29.0%

8.0%

2.0%

Educational background

- High school or below

- Undergraduate degree

- Bachelor degree

- Master Degree

- Doctoral

2

10

84

3

1

2.0%

10.0%

84.0%

3.0%

1.0%

model using Cronbach’s α, composite reliability

(CR), outer loadings and AVE. We found no internal

consistency reliability issues. For all constructs,

Cronbach’s

α are between 0.831-0.907 and CR are

between 0.887-0.935 which are more than the

acceptable level of 0.7. Regarding convergent

validity, outer loadings of all indicators are between

0.736-0.890. Moreover, the AVE values are between

0.657-0.818, well above the recommended value of

0.5. Therefore, it can be concluded that measurement

model is reliable. The data are displayed in Table 2.

The second part is the evaluation of the formative

measurement model of CFIP. We employ a two-stage

approach. For the first stage, a repeated indicator

approach was used. Next, the latent variable scores of

the first-order constructs are used as indicators for the

higher-order construct in the models tested in a

separate second stage Figure 4. To evaluate the

formative model, the researchers employ VIF to

check for multicollinearity and the t-values of the

formative indicators’ outer weight (Hair et al., 2012).

No multicollinearity issues were found and all outer

weights are significant.

Table 2: Outer Model : Reflective measurement model.

Latent Variables Cronbach’s α CR AVE

Attitude 0.888 0.931 0.818

Confirmation 0.809 0.887 0.724

Perceived

Usefulness

0.869 0.905 0.657

Reuse Intention

of PromptPa

y

0.907 0.935 0.783

Satisfaction 0.846 0.906 0.764

Trust 0.831 0.887 0.664

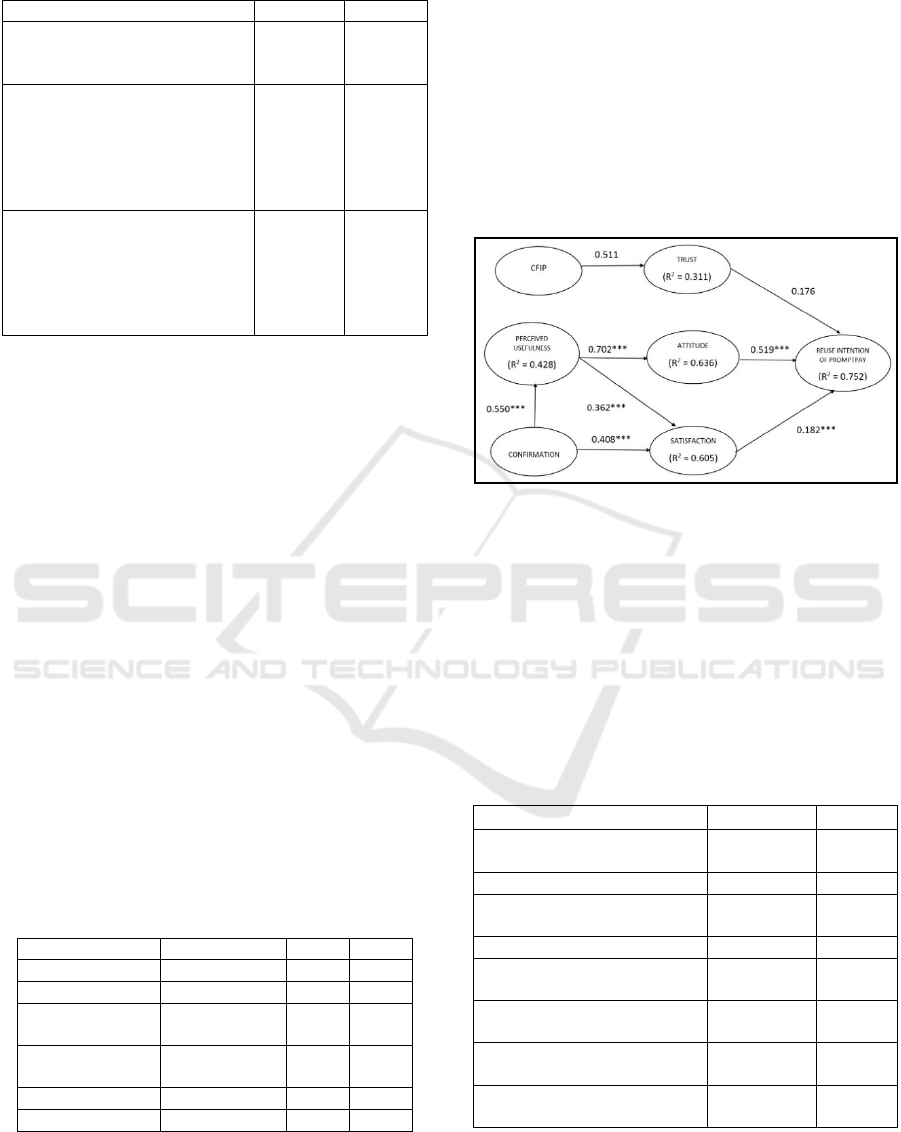

Next, we move on to structural model evaluation.

This process consists of three, procedures which are:

(1) collinearity assessment, (2) structural model: path

coefficients and (3) coefficient of determination. (R

2

).

For collinearity assessment the VIF values of all

predictor constructs are lower than 5.0 (Hair et al.,

2012).

Secondly, to obtain estimates of the structural

model relationships, we run the PLS-SEM algorithm

using SmartPLS software version 3.2.8 (Hair et al.,

2012) with a path weighting scheme, initial outer

weights of +1, maximum iterations of 300, and a stop

criterion of 10

7

. The results displayed in Figure 4.

Figure 4: Path Model of PLS-SEM.

The coefficient of determination assesses the

model’s predictive capabilities. It represents the

exogenous latent variables’ combined effects on the

endogenous latent variable (Hair et al., 2014). The

closer the R

2

value is to 1, the higher the levels of

predictive accuracy. The R

2

values of the endogenous

latent variables: reuse intention of PromptPay,

attitude and satisfaction, are 0.752, 0.636 and 0.605,

respectively.

Table 3: Path coefficients.

Coefficients t-values

Attitude Reuse Intention

of PromptPa

y

0.519*** 4.948

CFIP Trust 0.511 6.172

Confirmation Perceived

usefulness

0.550*** 9.113

Confirmation Satisfaction 0.408*** 5.013

Perceived Usefulness

Attitude

0.702*** 10.212

Perceived Usefulness

Satisfaction

0.362*** 3.282

Satisfaction Reuse

Intention of PromptPa

y

0.182*** 1.923

Trust Reuse Intention of

PromptPay

0.176 1.360

From the path coefficients analysis, we can

summarize that H1, H2, H3, H4, H5, H6 are

supported, while. H7, H8 are rejected.

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

748

5 DISCUSSION

In this section, we compare and contrast our findings

with prior studies as well as discuss on possible

reasoning behind each relationship.

To our surprise we find that trust has no influence

on PromptPlay reuse intention. The study has

indicated that trust has an influence on reuse intention

of online transactions. A possible explanation could

be that the consumers have already had a high level

of trust in the PromptPay service sine it is a service

provided by the government. Therefore, they do not

really concern about trust when deciding to

continuously use PromptPay.

As expected, attitude has a positive effect on a

reuse intention of PromptPay. The finding conforms

with a research of Norazah et al. (2011) who find a

positive relationship between attitude and a decision

to repeatedly use 3G mobile services.

Satisfaction, has an effect on a reuse intention of

PromptPay. This is consistent with a research by

Nguyen and Tran (2018) which uncovers that

satisfaction positively affects repurchasing of

m-commerce ride hailing in Vietnam.

We also find that confirmation has an effect on

satisfaction. Similarly, Chin et al. (2015) point out

that satisfaction directly affects on reuse intention of

online transactions continuously. When customers

found a new channel to make an e-transaction. They

will be satisfied and will perceive the benefits of

e-transaction which creates a reuse intention because

it makes customers convenient, reduce the costs and

save their time when making an e-transaction. This

will be according to t-values p-values H3:

Confirmation or positive disconfirmation-positively

influences satisfaction. And H4: Confirmation or

positive disconfirmation positively affects perceived

usefulness.

Perceived usefulness has been found to have

positive effects on satisfaction and attitude. The

findings are consistent with TAM (Gefen et al., 2003)

and ECT-IT models (Bhattacherjee et al., 2001).

PromptPay allows consumers to make payment and

transfer money with less fee in no time when

compared to the traditional methods. These benefits

could make the consumers to be satisfied and have a

positive attitude.

Surprisingly, we found a positive relationship

between CFIP and trust. The direction of the

relationship is opposite to what we initially expected.

An explanation to this unanticipated finding is that,

even though consumers are concerned about

information privacy issues of PromptPay, they still

have high levels of trust in the system anyway since

it is run by the government.

6 CONCLUSION

This research aims to investigate the factors which

motivate customers to reuse PromptPay in Thailand.

From data of 100 PromptPay users in Bangkok, we

analyze the data using PLS-SEM and discover that

satisfaction and positive attitude are the main drivers

of reuse intention of e-payment.

Additionally, we suggest that in order to improve

user satisfaction and attitude towards an e-payment

system is useful to them. Moreover, it is also

important that the performance of the e-payment

system meets users’ initial expectation. If the

expectation is met, the users will perceive the system

as useful as well as be more satisfied. Unexpectedly,

trust is not found to be significant and the direction of

the relationship between CFIP and trust is in contrast

to our hypothesis.

In terms of implications, the proposed model

could also be a starting point for those who want to

study e-payment adoption in other contexts.

Moreover, the surprising finding of CFIP and trust

should be further investigated reuse. We argue that

the role of information privacy and trust in private and

public context of e-payment might be different. For

practical contributions, the findings provide

guidelines for the government agencies that is

responsible for encouraging PromptPay use among

Thai people.

REFERENCES

Bank of Thailand. “Annual Report payment 2018”. 2018.

Bhattacherjee, A et.al. “Understanding information systems

continuance: an expectation-confirmation model”. MIS

Quarterly 25. 2001, pp. 351–370.

BIS “Statistics on payment, clearing ans settlement systems

in the CPMI countries, Bank of Negara Malaysia”.

2017.

Chin Lung, Hsu and Judy Chuan Chuan Lind. “What drives

purchase intention for paid mobile apps? An

expectation confirmation model with perceived value”.

Electronic Commerce Research and Applications, vol.

14(1). 2015, pp. 46-57.

Davis, F. D. “Perceived usefulness, perceived ease of use,

and user acceptance of information technology.” MIS

Quarterly, 13, September 1989, pp. 3-16.

Ebrahim Nazaheri, Marie-Odile Richard, and Michel

Laroche. “Online consumer behaviour: Comparing

Factors Influencing Reuse Intention of e-Payment in Thailand: A Case Study of PromptPay

749

Canadian and Chinese website visitors”., vol. 64. 2011,

pp. 958 – 965.

Eid, M. I. “Determinants of e-commerce customer

satisfaction, trust, and loyalty in Saudi Arabia”. Journal

of Electronic Commerce Research, vol. 12(1). 2011, pp.

78–93.

F. D. Davis. “Perceived usefulness, perceived ease of use,

and user acceptance of information technology.” MIS

Quarterly, 13, September 1989, pp. 3-16.

Gefen, D., Karahanna, E., and Strabub, D. w. “Trust and

TAM in online shopping: An integrated model”, MIS

Quarterly, 27(1). 2003, pp. 51-90.

Gogoingkron. “Focus e-Payment in Asia”. April 10, 2017.

[Online]. Retrieved; Sep 2017. From https://

thanawat.co/2017/04/10/e-payment-thailand/.

Gustafsson, A. et al., “The effects of customer satisfaction,

relationship commitment dimensions, and triggers on

customer retention.” Journal for Marketing. 69. 2015,

pp.210–218. satisfaction, relationship commitment

dimensions, and triggers on customer retention.”

Journal for Marketing. 69. 2015, pp. 210–218.

Hair Jr, J.F., Sarstedt, M., Ringle, C.M., Mena, J.A., 2012.

“An assessment of the use of partial least squares

structural equation modeling in marketing research”.

J.Acad. Market. Sci. 40, pp. 414–433.

Hair Jr, J. F., Hult, G. T.M., Rigle, C., & Sarstedt, M.

(2013). A primer on partial least squares structural

equation modelling (PLS-SEM). Sage Publications.

Hang Xu, Hock-Hai Teo, and Bernard C. Y. Tan.

“Predicting the Adoption of Location-Based Services:

The Role of Trust and Perceived Privacy Risk”.

Twenty-Sixth International Conference on Information

Systems. 2005.

Hellier, Phillip K., Geursen, Gus M., Carr, Rodney A. and

Rickard, John A. 2003, “Customer repurchase

intention: a general structural equation model,

European journal of marketin”. vol. 37, no. 11, pp.

1762-1800.

Heng Xu. “Measuring mobile users. Concerns for

information privacy”. Thirty Third International

Conference on Information Systems, Orlando. 2012.

Iris A. Junglas and Christiane Spitzmuller. “A Research

Model for Studying Privacy Concerns Pertaining to

Location_Based Services. Proceddings of the 38

th

Hawaii International Conference on System Sciences”.

2005.

Jun Hwan Kim and Cheol Lee Hyun. "Understanding the

Repurchase Intention of Premium Economy Passengers

Using an Extended Theory of Planned Behavior". Vol.

11. 2019, pp 1-19.

Kawarin Laeddeenun. “Technology Acceptance and online

Consumer behaviour affecting e-bookings’ purchase

decision in Bangkok”. Bangkok University. 2014.

Lim, H., Widdows, R. and Park, J. “M-loyalty: winning

strategies for mobile carriers”. Journal of Consumer

Marketing, vol. 23(4). 2006, pp. 208-218.

Malabuppha T. “e-Commerce Leaders Debate: Is Thailand

Ready to be a Cashless Society?”. January 27, 2017

[Online]. Retrieved; Sep2017.From

https://www.pricezagroup.com/2017/ecommerce-

leaders-debate-thailand-ready-cashless-society/.

Norazah M. and Norbayah M. "Exploring the relationship

between perceived usefulness, perceived ease of use,

perceived enjoyment, attitude and subscribers’

intention towards using 3G mobile services”. Journal of

Information Technology Management Volume XXII,

Number 1, 2011.

Nguyen and Tran. "Repurchase Intention: The Effect of

Service Quality, System Quality, Information Quality,

and Customer Satisfaction as Mediating Role: A PLS

Approach of M-Commerce Ride Hailing Service in

Vietnam". Marketing and Branding Research. Vol 5,

2018, pp 78-91.

Oliver and Richard L, “A cognitive model of the antecedents

and consequences of satisfaction decision”. Journal of

Marketing research. 17(4). 1980, pp. 460–469.

Pavlou, P.A. “Consumer acceptance of electronic

commerce: Integration trust and risk with the

Technology Acceptance Model”. International Journal

of Electronic Commerce, Vol. 7(3). 2003, pp. 101–134.

Sayhun Kim and Hyunsan Park. “Effect of various

characteristics of social commerce (s-commerce) on

consumers’ trust and trust performance”. International

Journal of Information Management, vol. 33. 2013, pp.

318–332.

Schiffman, L.G., and Kanuk, L.L. Consumer behaviour, 5

th

edition. New Jersey: Prentice – Hall. 1994.

Sharma, S., and Crossler, R. E. “Disclosing too much?

Situational factors affecting information disclosure in

social commerce”. 2014.

Tao Zhou. “The Impact of Privacy Concern on User

Adoption of Location-based Service”. Industrial

Management & Data Systems, vol. 111. Issue 2, 2010.

Zhou, T. “The impact of privacy concern on user adoption

of location-based service”. Industrial Management &

Data Systems, vol. 111(2), 2011, pp. 212–226.

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

750