A Simple Scenario-based Qualitative Model for Assessing Start-up

Risks

Y. Ayse B. Nordal

Undervisningsbygg Oslo, KF 0605, Oslo, Norway

Keywords: Start-up, Risk Model, Scenarios, Likelihood Barometer, ISO 31000:2018.

Abstract: ISO 31000:2018 Risk Management Guidelines and COSO:2017 Enterprise Risk Management framework

have two important and common characteristics. Firstly, they connect risks with business objectives. Secondly,

they define risks as potential events that represent both positive and negative deviations from the expected.

When a start-up company assesses its risks, the readily available source often consists of a blog-post on

enterpreneurship that defines for instance 5, 10 or 15 potential events, which may represent negative

consequences for its growth and development. Only some of these sources offer a classification of the risks

so that the given start-up can see whether these risks are spread on different areas/dimensions or if they are

accumulated in a few areas. To date, there are no easily available models which visualize the focus areas that

the start-up ought to give priority to and treat with actions.This paper aims to contribute to solve the above-

mentioned challenges by introducing a scenario-based model, which takes into account risks as well as

opportunities in accordance with ISO 31000:2018. The model defines 4 complex risk dimensions/focus areas,

each of them consisting of 10 elements and 60 potential scenarios. The scenarios are ranked in accordance

with the degree of contribution to a start-up’s risks and opportunities. The results of the scenario analysis are

summarized through the use of a likelihood barometer. The barometer visualises whether the start-up’s risks

and opportunities are concentrated on one risk dimension, or whether these are spread on several dimensions.

Thereafter, a traditional risk matrix is used to evaluate and rank the risks and opportunities which represent

the highest negative and positive contributions to the start-up’s failure or success.

1 INTRODUCTION

Start-ups tend to experience specific challenges when

they assess their risks and opportunities, especially at

the beginning of their venture:

1. They have limited benefits from the use of a

traditional risk matrix. This is due to a lack of

information, which would enable them to set up a

reliable likelihood scale for potential events. They

have neither statistical data nor experience data to

create a probability distribution of the potential

events, or to attach frequencies or probabilities to a

potential event.

As Leveson states “One problem in assessing

likelihood is that little real information is available

about the future, especially at the beginning of the

development process, when decisions about where to

focus efforts are made.” (Leveson, 2019). “(…)

Methods like market research, decision trees/ what- if

analysis will help to tackle this uncertainty to some

extent” (Nordal, 2015). However, a meaningful

likelihood scale, which could have been used in a risk

matrix, is not easily accessible.

2. Start-ups have limited resources and their

priority is to know where to set proactive controls to

hinder the likelihood of potential negative events and

to promote the positive ones. This necessitates a

creative process, which may build on a scenario

analysis since: “In complex settings, scenarios can be

used to identify a wide range of risks, rather than

existing or obvious risks. Therefore, a problem‐based

scenario may not start with a single issue (...) but aim

to identify all the relevant problems. The act of

scenario building opens up possibilities in a creative

manner, both with what might happen and what can

be done to prevent or promote those outcomes based

on whether they are viewed as harmful or beneficial”

(Jones, 2010).

The most harmful and most beneficial scenarios

will be given priority in action-settings.

3. Start-ups have limited resources to implement

sophisticated risk assessment processes. Organizing

98

Nordal, Y.

A Simple Scenario-based Qualitative Model for Assessing Start-up Risks.

DOI: 10.5220/0009389500980105

In Proceedings of the 2nd International Conference on Finance, Economics, Management and IT Business (FEMIB 2020), pages 98-105

ISBN: 978-989-758-422-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

workshops for identifying risks, using computerized

solutions to analyze them, keeping risk registers and

formal reports may not be achievable for start-ups, at

least at the very beginning. On the other hand, start-

ups have a unique quality: “Having articulated their

business intent and emphasized the customer

connection, leaders give their people freedom within

a framework —the liberty to operate within well-

delineated boundaries—as well as opportunities to

influence key decisions, such as which strategies to

pursue or products to develop” (Gulati, 2019).

The risk management process of a start-up should

be customized and scaled to this reality. A likelihood

barometer may be a suitable tool in this regard. This,

as it allows for a creative process of evaluating the

scenarios and developing strategies to handle them.

2 MATERIALS AND METHODS

2.1 Materials

Risk management guidelines by the International

Organization for Standardization (ISO, 2018) has a

novel contribution to the definition of risks. Same as

in the 2009 issue, it defines risk as the effect of

uncertainty on objectives. However, in note 1 to said

definition a new element was introduced, as follows:

“An effect is a deviation from the expected. It can be

positive, negative or both, and can address, create or

result in opportunities and threats” (ISO, 2018).

This paper introduces a likelihood barometer that

employs said risk definition. The barometer includes

4 major start-up risk dimensions. Each of these

consists of 10 elements. Each element can materialize

as 6 different scenarios which affect the uncertainty

in positive or negative direction.

2.2 Methods

2.2.1 The Creation of a Likelihood

Barometer

The paper follows the classical tradition that a risk

may be expressed as:

R= L * C (1)

where L is likelihood and C is consequence (impact).

It is assumed that a start-up is exposed to 4 major risk

dimensions. These are:

(D1): Market access

(D2): Product characteristics

(D3): Line & support functions

(D4): Contracts and commitments

Further, it is assumed that every risk dimension

consists of 10 elements each. Every element may be

described by 6 scenarios which can have:

HN: High negative effect (3)

MN: Moderate negative effect (2)

LN: Low negative effect (1)

LP: Low positive effect (-1)

MP: Moderate positive effect (-2)

HP: High positive effect (-3)

On the risk element in question. A negative effect will

involve risks and a positive effect will involve

opportunities. These dimensions and elements are

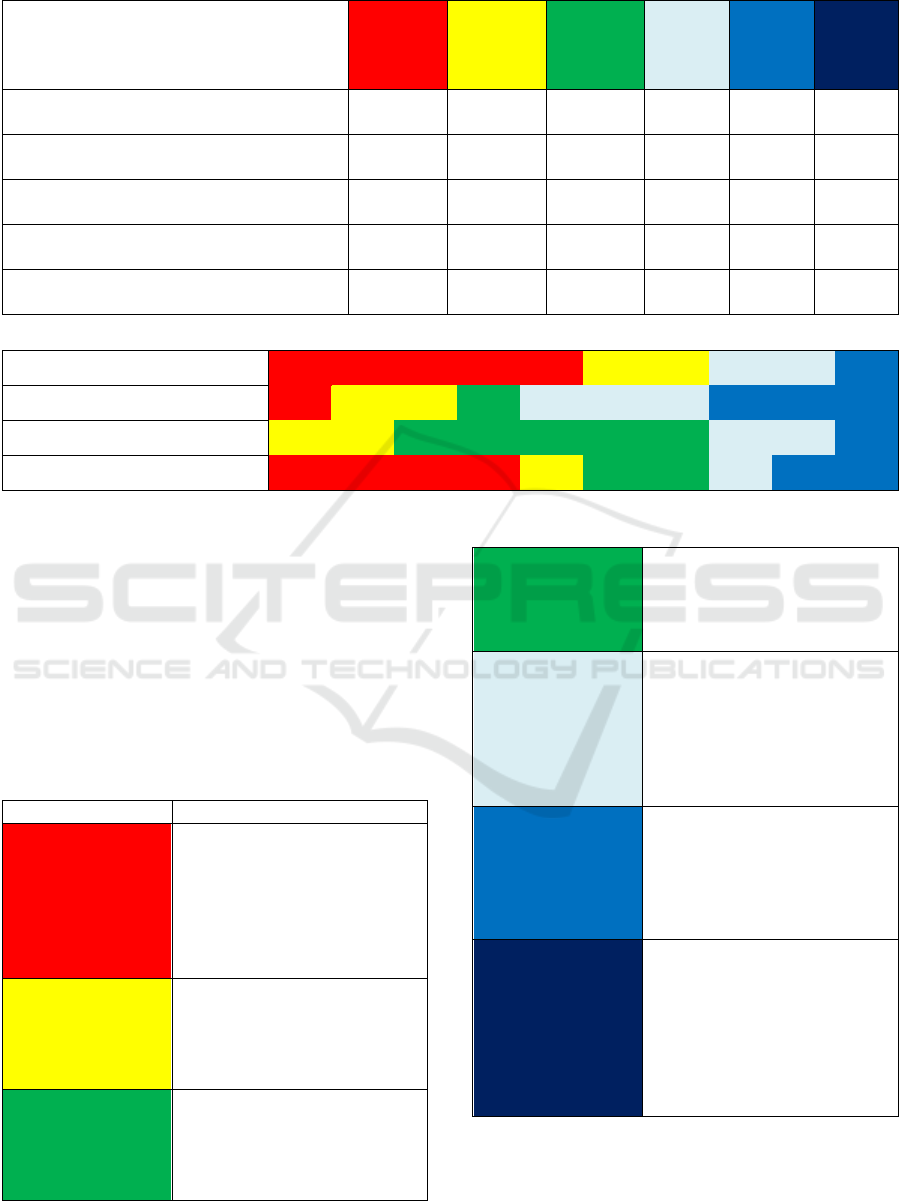

presented in Table 1.

As seen in Table 1 “compliance with ethical and

legal standards” is one of the ten elements in the risk

dimension “product characteristics”. This element

can contribute to risks or to opportunities, depending

on the prevailing scenario which represents the start-

up’s reality.

Table 2 describes such possible scenarios and how

they are expected to affect risks and opportunities.

In the first scenario, the start-up delivers a

product/service, which may be in breach of existing

laws and regulations or is questioned based on the

ethical standards of society. An example may be a

computer game, which has discriminatory content or

a toy with toxic materials. This scenario will create

high risk in the product dimension.

The second scenario does not represent a legal or

ethical violation, but lack of knowledge or lack of

assurance of compliance. It is assumed that such lack

of assurance may create moderate risk

In the third scenario, some interest groups are

critical to the product. A product, which uses fur or

leather, may be a relevant example.

In the fourth scenario, the product complies with

laws and regulations and with the general ethical

standards of the society. This may mean a slight

opportunity, but not a competitive advantage. The

product or service delivers in accordance with the

expectations of the society.

In the fifth scenario, several interest groups in the

society support the use of the product from an ethical

point of view. The use of raw materials stemming

from the underdeveloped countries, an environmental

focus or universal design can be possible reasons for

such support.

The sixth scenario describes the greatest

opportunity. Here, the product has the support of

many

interest groups as well as the media and

A Simple Scenario-based Qualitative Model for Assessing Start-up Risks

99

Table 1: Risk Dimensions and Elements.

MARKET ACCESS PRODUCT

CHARACTERISTICS

LINE & SUPPORT

FUNCTIONS

CONTRACTS

&COMMITMENTS

Dependency on a single

product

Compliance with ethical and

legal standards

Organization structure Flexibility and terms of the

office space solution

Access to complementary

product market

Compliance with

environmental targets

Dependence on specialized

work force

Flexibility and terms of the

leasing agreements

Existence of substitutes on

the market

Degree of innovation

embedded in the product

Entrepreneurial experience Financial strength

Access to several customer

income segments

Universal design Knowledge about industry

standards

Liquidity

Possibility to offer

maintenance services to own

product

Product security Understanding the context Environmental commitments

Possibility to sell again

(repeat sales)

Access to raw materials Supplier and sub-contractor

operations

Legal commitments, product

warranties and other

liabilities

Patents and protection rights Price and terms Competition on human

resources

Support and grant schemes

The product is relevant only

for the luxury product

market

Production process features

and complexity

Outsourced activities Quality commitments to

customers

Access to international

markets

Technical requirements and

constraints

Cost structure The control system

Availability of multiple

market channels

Market readiness Payment schemes Commitments re.

certifications

Table 2: Choosing the Representative Scenario in Each Element.

HN

(3)

MN

(2)

LN

(1)

LP

(-1)

MP

(-2)

HP

(-3)

The product's

compliance with

ethical

standards or

laws &

regulations may

be questioned

due to specific

reasons.

The product’s

compliance with

all relevant laws

and regulations

is not evaluated.

Some groups in

the society may

be critical to the

use of the

product for

ethical reasons.

The product

complies with

all laws and

general ethical

standards.

Several interest

groups support the

use of the product

from an ethical point

of view.

Regulators, media

and many interest

groups support

the use of the

product from a

legal and ethical

point of view.

regulators.

The likelihood barometer model requires that the

given start-up identifies its representative scenarios

and the scenarios’ effect on risks and opportunities

for all elements, in each risk dimension.

Table 3 provided below illustrates the

identification of representative scenarios for all

elements.

In the theoretical example provided above the

start-up is given two important and relevant signals:

The market access dimension represents more

risks than opportunities and should be

given priority when the start-up defines its

policies and plans its actions

5 prevailing scenarios create high risks and

deserve attention when proactive controls are

going to be defined

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

100

Table 3: Representative Scenarios for All Elements in a Dimension.

HN

(3)

MN

(2)

LN

(1)

LP

(-1)

MP

(-2)

HP

(-3)

1. Dependency on a single product X

2. Access to complementary product

market

X

3. Existence of substitutes on the market

X

4. Access to several customer income

segments

X

5. Possibility to offer maintenance

services to own product

X

6. Possibility to sell again (repeat sells) X

7. Patents and protection of rights X

8. The product is relevant only for the

luxury product market

X

9. Access to international markets X

10. Availability of multiple market

channels

X

Sum 5 2 0 2 1 0

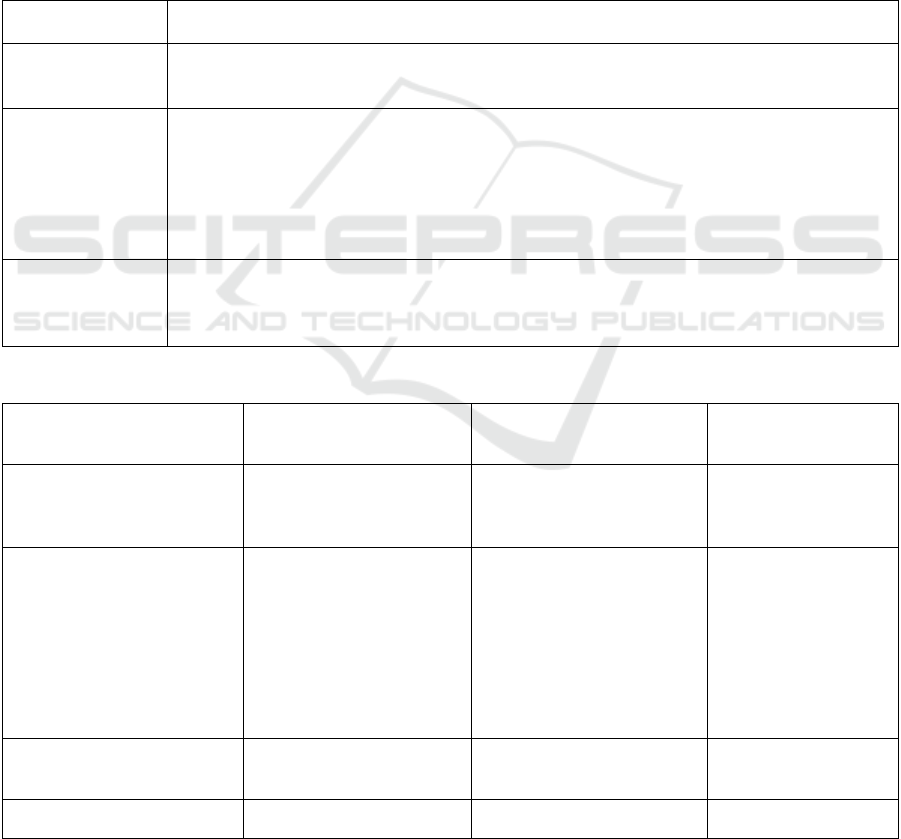

The last step in the creation of the likelihood

barometer is to set up the complete picture for all

dimensions which are defined in Table 1. The total

likelihood picture for the given start-up is defined in

Table 4.

The start-up’s likelihood barometer visualizes the

information, which is found in Figure 1.

The likelihood barometer in the example provided

above indicates the following:

The dimension “Product Characteristics” is

the start-up’s strength. The prevailing scenarios

indicate opportunities, which may be utilized and

optimized. Thus, the start-up should focus on

strengthening existing opportunities in this

dimension

The scenarios attached to “Line and support

functions” represent “Low risk”. If these risks

are treated correctly, they may contribute to the

success of the start-up

The start-up should treat the “Market access”

and “Contracts and commitments” dimensions

proactively, introducing control actions to hinder

that these scenarios are actualized or reduce their

duration

2.2.2 Setting up Impact Criteria

Likelihood is only one aspect of risk. This paper and

its underlying model express risk as a product of

likelihood and consequences (impact). Thus, in the

next step the paper seeks solutions to the following

issues:

a. Setting up criteria for impact (consequences)

b. Extracting information from the multi-

dimensional likelihood barometer for further use

in a risk matrix

This paper’s underlying model employs impact

criteria used by many prior studies (Curtis P & Carey

M, 2012). The easiest approach with 3 impact types

and 3 impact levels are defined. The following impact

types are assumed to be relevant and significant for a

start-up:

A Simple Scenario-based Qualitative Model for Assessing Start-up Risks

101

Table 4: The total likelihood profile.

Likelihood profile -Totals

HN

(3)

MN

(2)

LN

(1)

LP

(-1)

MP

(-2)

HP

(-3)

Market Access 5 2 0 2 1 0

Product Characteristics 1 2 1 3 3 0

Line & Support functions 0 2 5 2 1 0

Contracts & Commitments 4 1 2 1 2 0

Totals 10 7 8 8 7 0

Market Access

Product Characteristics

Line & Support functions

Contracts & Commitments

Figure 1: The likelihood barometer.

Financial consequences

Media coverage

Talent attraction

Table 5 shows the impact (consequence) matrix for

the start-up example provided above. The

consequences presented in the figure is related to a

specific time period, for instance a year or a planning

period:

Table 5: The impact (consequence) criteria.

Consequence/Level Criteria

HN

(3)

Extra costs, more than

20 % of the budget

Negative comments in

the media, more than 20 news

articles

Staff turnover, more

than 15 %

MN

(2)

Extra costs, 10-20% of

the budget

Negative comments in

the media, 10-20 news articles

Staff turnover, 5-15 %

LN

(1)

Extra costs, less than 10

% of the budget

Negative comments in

the media, less than 10 news

articles

Staff turnover less than

5 %

LP

(-1)

Extra income, less than

10 % of the budget

Positive comments in

the media, less than 10 news

articles

Less than 20

applications to vacant positions

MP

(-2)

Extra income, 10-20 %

of the budget

Positive comments in

media, 10-20 news articles

20-50 applications to a

vacant position

HP

(-3)

Extra income, more

than 20 % of the budget

Positive comments in

the media, more than 20 news

articles

More than 50

applications to a vacant

position.

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

102

2.2.3 Visualizing the Results through a

Simple Risk Matrix

Three assumptions are made in order to transfer

information from a multi-dimensional likelihood

barometer into a two-dimensional risk matrix.

Table 6 gives an overview of these assumptions.

In the table, the concept “dimension” refers to the

four dimensions, which are described in Table1, i.e.:

“Market access”, “Product characteristics”, “Line

& support functions” and “Contracts &

commitments”. The concept “representative

elements” refers to the highest total number of

elements, which are described in each row of the

likelihood profile. This number reflects the

underlying scenarios, which are assumed to be

relevant in the given dimension.

3 RESULTS

Table 7 includes information from the likelihood

barometer in accordance with assumptions shown in

Table 6. We assume that the start- up has evaluated

the impact (consequence) - figures in accordance with

Table 5 and chose the values shown in column 3 of

Table 7. Based on these figures, the start-up’s risk

matrix is derived as follows:

Table 6: Assumptions about likelihood.

Assumptions Criteria

Assumption 1 The highest number in the likelihood profile decides the ranking of likelihood, i.e. whether risks

or opportunities are likely and whether the likelihood is low, medium or high

Assumption 2 If the likelihood profile has two or more equal numbers as either the highest number in the same

dimension, all indicating risks or opportunities, then the consequence figures will decide the final

ranking of the risks/opportunities.

If the consequence figures are also the same, then the results indicate a border case where

attached scenarios in both categories require attention.

Assumption 3 If the likelihood barometer has two or more equal numbers in opposite directions then the results

indicate a case, which is mentioned in ISO 31000, “a deviation from the expected, positive,

negative and both”.

Table 7: Likelihood, consequence (impact) and risk.

Dimension Likelihood value Consequence (Impact) level in

accordance with Table 5

Risk= L*C

Market Risks 3: Highest number is 5. 5

elements refer to category

HN.

2 6

Product

Characteristics

Category LP and category

MP have equal numbers. 3

elements refer to each.

-1: 3 refers to category LP

-2: 3 refers to category MP

-1

-1

-1

-2

Line and Support Functions 1: Highest number 5 refers to

category LN

2 2

Contracts & Commitments 3: Highest number 3 9

A Simple Scenario-based Qualitative Model for Assessing Start-up Risks

103

-9 -6 -3 3 Market risks 6

Contracts &

Commitments

9

High

likelihood (3)

-6 -4

Product

Charact. -2 2 4 6

Medium

likelihood (2)

-3 -2

Product

Charact. -1 1

Line and

support func.

2 3

Low

likelihood (1)

HP impact MP impact LP impact LN impact MN impact HN impact

Figure 2: The Risk Matrix for the start-up.

The risk matrix indicates that the start-up should

introduce measures and controls to handle the

underlying scenarios attached to “Contracts &

commitments” and “Market risks”. Stimuli should be

introduced to motivate and accelerate the scenarios

attached to “Product Characteristics”.

4 DISCUSSION

The model presented in this paper can be viewed as a

first step in creating an elaborate risk assessment

model for start-ups. However, from a scientific point

of view, it suffers from the weaknesses associated

with the qualitative approach, among others:

a. The selected risk dimensions might not

represent the complete picture which is relevant

for the start-up

b. The scenario descriptions are subjective and

might not be realistic for all start-ups

c. The scenarios may be correlated

d. The scenarios may represent cause-and-effect

relations

e. Different risk elements in a certain risk

dimension might not necessarily have equal

weight

f. The arguments for the consequence (impact)

scale might not be realistic

5 CONCLUSION

Despite these weaknesses, the author thinks that the

model can help start-ups to approach their risks and

opportunities in a structured manner, without the

support of a software or a facilitator.

An EXCEL-model which is based on the above-

mentioned assumptions has been discussed with and

tested by a start-up called Bag’ In. The owner has

found the suggested risk elements and dimensions

realistic.

Several Norwegian start-ups are willing to test the

model. The following actions are planned:

Testing of the model by a statistically

significant sample of start-up companies in

Norway, in order to validate the relevance of risk

dimensions and elements.

Discussing the results with authorities which

fund growth companies and clusters

Discussing the results with banks

Developing the model further to differentiate

better between start- up and scale-up risks and

opportunities.

ACKNOWLEDGEMENTS

This paper and its underlying model have highly

benefited from the feedback of Regional Manager

Iselin Nordal with Qualisoft Norway, Head of Retail

at Avinor Elif Runa Nordal and Ole Martin Kjørstad

with the Central Bank of Norway. Kjørstad has

contributed to visualising of the model. The CEO of

Bag’In, a successful Norwegian start-up, Kåre

Sekkesæter has given invaluable feedback to the

suggested scenarios.

I agree with Mr. Sekkesæter on his words “You

can never succeed if you don’t dare to ask others for

help to develop your ideas.”

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

104

REFERENCES

Curtis, P & Carey, M (2012). Risk Assessment in Practice.

Research commissioned by COSO to Deloitte and

Touche LLP. Retrieved 4 August 2019, from

https://www2.deloitte.com/content/dam/Deloitte/globa

l/Documents/Governance-Risk-Compliance/dttl-grc-

riskassessmentinpractice.pdf

Gulati, R. (2019). The Soul of a Start-Up. Retrieved 4

August 2019, from https://hbr.org/2019/07/the-soul-of-

a-start-up

International Organization for Standardization (ISO)

(2018). Risk Management Guidelines. Geneva,

Switzerland

Jones, R. H. (2010). The use of scenarios in adaptation

planning: managing risks in simple to complex settings.

Melbourne: Victorian Centre for Climate Change

Adaptation Research

Leveson, N. (2019). Improving the Standard Risk Matrix:

Part 1. Retrieved 1 October 2019, from

http://sunnyday.mit.edu/Risk-Matrix.pdf

Nordal, Y., A., B. (2015, 29-31 May). Risk Management

Practices, Decision Making and Corporate

Governance. International May Conference on

Strategic Management - IMKSM2015, Bor, Serbia

PricewaterhouseCoopers LLP; Committee of Sponsoring

Organizations of the Treadway Commission (COSO).

(2017) Enterprise Risk Management: Integrating with

Strategy and Performance. New York: COSO

A Simple Scenario-based Qualitative Model for Assessing Start-up Risks

105