Huff Model for Shopping Centre Assessment using Aggregated

Mobile Phone Data

Irina Arhipova

1a

, Gundars Berzins

1

, Aldis Erglis

1

, Evija Ansonska

1

,

Juris Binde

2

and Andris Kovalcuks

3

1

Faculty of Business, Management and Economics, University of Latvia, Aspazijas Boulevard 5, Riga, LV-1050, Latvia

2

Latvian Mobile Telephone, Ropazu Street 6, Riga, LV-1039, Latvia

3

Ltd. “KA”, Stabu Street 15-88, Riga, LV-1010, Latvia

juris.binde@lmt.lv, andris.kovalcuks@56n.digital

Keywords: Market Share, Gravity Model, Attractiveness.

Abstract: There are several models of gravity, one of which is Huff model. It calculates customer gravity probabilities

for existing locations of trade objects. In this study, aggregated mobile data-based approach using Huff model

to determine the market share of trading objects is developed. The mobile activity data is used to give a more

precise understanding of available number of potential customers in a certain territory of Latvia. By using the

mobile phone base station unique number of users per day in 2016 within an area of each shopping centre, it

is possible to determine the unique user share and ratio between shopping centres. The use of mobile data, as

well as other statistics and real estate appraisal data, provides the opportunity to create universal criteria for

location and shopping centre standardization to compare prices for similar real estates in a specific region.

The research results have shown that the mobile activity data could be applied in gravity-based Huff model

for estimation of retail attractiveness and market share.

1 INTRODUCTION

Market analysts have used four theoretical

approaches to analyze the potential and location of a

retail area: analogy models, regression models,

central location theory and retail gravity theory

(Aboolian, et al, 2007). Analog models use existing

data and growth models from similar retailers or

leasable areas. Regression models determine

potential sales based on such factors such as

population, income and number of households in the

region (De Beule, et al, 2014).

Central location theory states that customers are

willing to travel longer distances to shopping centres

with a relatively wide selection of goods. Gravity

models determine that customer groups are redirected

to specific locations due to such factors as the

distance to a shopping centre, the distance between

shopping centres, customers of a retail area, the size

of a shopping centre, location of competitors, etc.

(Friske & Choi, 2013).

a

https://orcid.org/0000-0003-1036-2024

There are several models of gravity (Anderson,

2011), one of them is Huff model, which calculates

customer gravity probabilities to existing locations of

trade objects. From these probabilities, sales potential

can be estimated for each location using income,

population or other factors.

Huff model depends on distance calculation using

the traditional Euclidean distance or travel time in the

street network. Other factors, such as sales volume,

product variety, and retail space, should be

considered when determining the attractiveness of a

trade area. Huff model is used to:

Display probability-based locations for trade

objects,

Model economic impact of new competitive store

locations;

Predict high and low potential trade areas

resulting from the development of a new trade

object (Fernández & Hendrix, 2013).

Huff's gravity model predicts that as the size of a

shopping centre increases, the probability that the

customer will prefer the location of the shopping

Arhipova, I., Berzins, G., Erglis, A., Ansonska, E., Binde, J. and Kovalcuks, A.

Huff Model for Shopping Centre Assessment using Aggregated Mobile Phone Data.

DOI: 10.5220/0009361400910097

In Proceedings of the 2nd International Conference on Finance, Economics, Management and IT Business (FEMIB 2020), pages 91-97

ISBN: 978-989-758-422-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

91

centre increases. Similarly, as distance increases, the

probability that customers will visit a retail facility

decreases (1):

∑

(1)

where:

P

ij

is the probability that the customer will go from

the location i to the shopping centre location j;

S

j

is the size of the shopping centre in location j;

T

ij

is the travel time (or distance) from the

customer location i to the shopping centre location

j;

is a parameter that needs to be empirically

evaluated to reflect the impact of different types

of shopping travel time.

Other studies have developed gravity models

using Geographic Information System (GIS)

technologies for the train station catchment area

determining (Lin, et al, 2016), healthcare services

spatial access analysis and planning (Luo, 2014),

evaluation of new university site locations (Bruno &

Improta, 2008) and others.

To prove that the new technical solutions and in

this particular case mobile data availability allow

developing applications of mobile data in multiple

fields, the cooperation with the largest mobile

operator in Latvia from 2016 to 2018 implemented a

cooperation project for updatable Latvian regional

business index development (Arhipova, et al, 2019).

This research has generated substantial

knowledge and data to work on multiple business user

cases in real estate, retail related and utility business

sectors where the mobile telecommunication data can

be used as a tool to optimize business decisions and

test assumptions for long-term strategic investment

decisions. Researchers at the University of Latvia, in

collaboration with leading real estate experts, have

developed a user case for shopping centers

attractiveness evaluation.

According to the latest data, shopping center stock

in Riga, the capital city of Latvia, significantly

changed during 2018 and 2019. During the last two

years, the expansion of several existing shopping

centers and new projects was finished. IKEA opened

its first shopping center near Riga with the total area

of 34 500 m

2

. A year later, in 2019, one shopping

center was opened – Akropole Riga (adding more

than 60 000 m

2

of new leasable retail space) and Alfa

expansion (adding 18 300 m

2

and providing a total

gross leasable area of 66 000 m

2

) was commissioned.

There is also Origo expansion that could be finished

in 2020, thus increasing the leasable retail stock by

additional 16 500 m

2

(CBRE Baltics, 2018).

Riga as capital of Latvia had 649 000 m

2

of total

leasable space in shopping centers by the end of 2018.

The vacancy rate of shopping centers in Riga was

around 4%. Economic growth, salary grows by 6 to 7

percent in recent years, and subsequentially

consumption increase activity on the retail market in

2018. At the same year two large shopping center sale

transactions took place in Riga. The 24 300 m

2

Galleria Riga shopping center was purchased by the

East Capital Baltic Property Fund and the 18 000 m

2

Dole shopping center by the Premier Estates Ltd.

Details of the transactions have not been disclosed

(Realia Group, 2019).

The challenge of existing models is source data

reliability that largely depends on the quality of

statistics gathered or obtained from statistics variety

of statistical sources. The study explores the use of

alternative data sources for shopping centres

attractiveness statistics based on mobile-data

obtained from mobile network providers.

The purpose of the study is developing and testing

a new aggregated mobile data-based approach to

estimate the market share for selected shopping

centers based on the Huff model. The new mobile

data-based modes will provide a more reliable source

for customer number probability estimates than

existing models.

2 HUFF MODEL

DEVELOPMENT, USING

MOBILE PHONE DATA

STATISTICS

Huff’s gravity model could be used with different

metrics to calculate gravity-based probabilities of

customers to each location using income, population

or other variables. It is very important that accurate

data about economic or social activity available for

specific territories. However, statistical data of people

living in a certain territory is not accurate and at same

time does not represent real number of people

available in this territory.

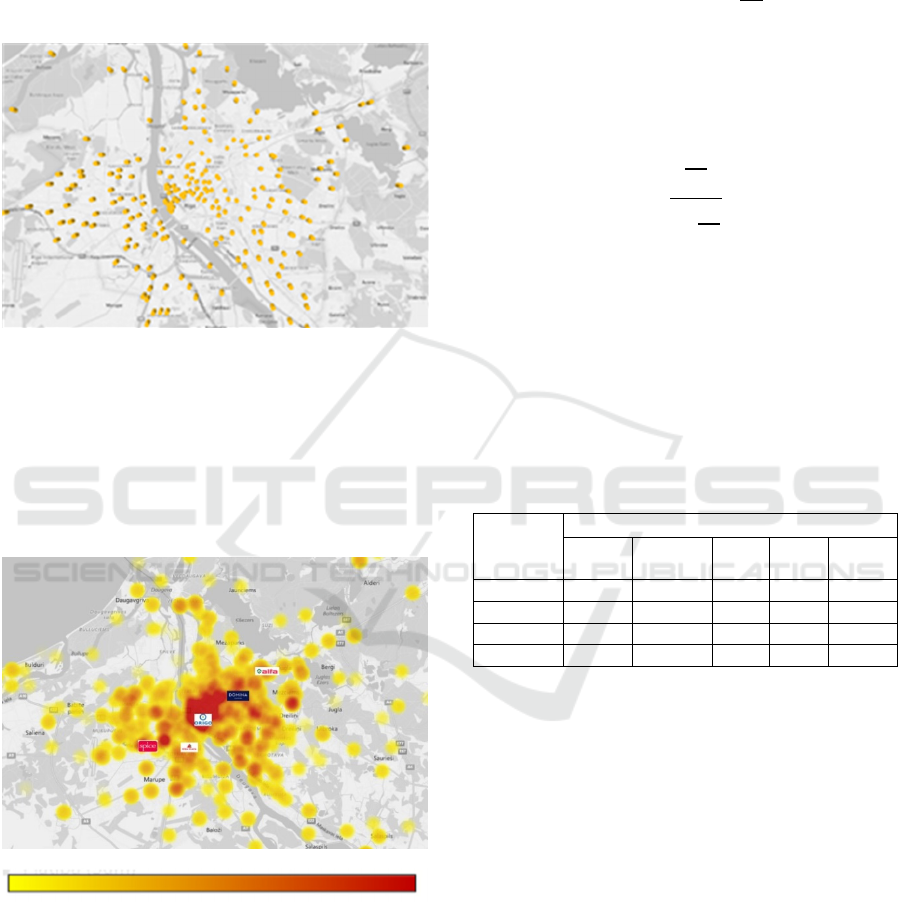

Therefore, for this research a mobile activity data

is used which gives a more precise understanding of

available number of potential customers in a certain

territory. Mobile activity data used from 297 mobile

base stations placed in capital of Latvia - Riga city

territory is used (Fig. 1).

Base stations are used as a geographic reference

instead of dividing territory in quadrants. Daily

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

92

average unique mobile users are calculated for each

mobile base station for year 2016. Unique mobile

users represent unique devices (mobile users)

connected to mobile station in 15 minutes interval. To

avoid overlapping of potential and existing customers

all unique mobile users in 1 km radius from shopping

centre were excluded from further calculations.

Figure 1: Mobile phone base stations in Riga.

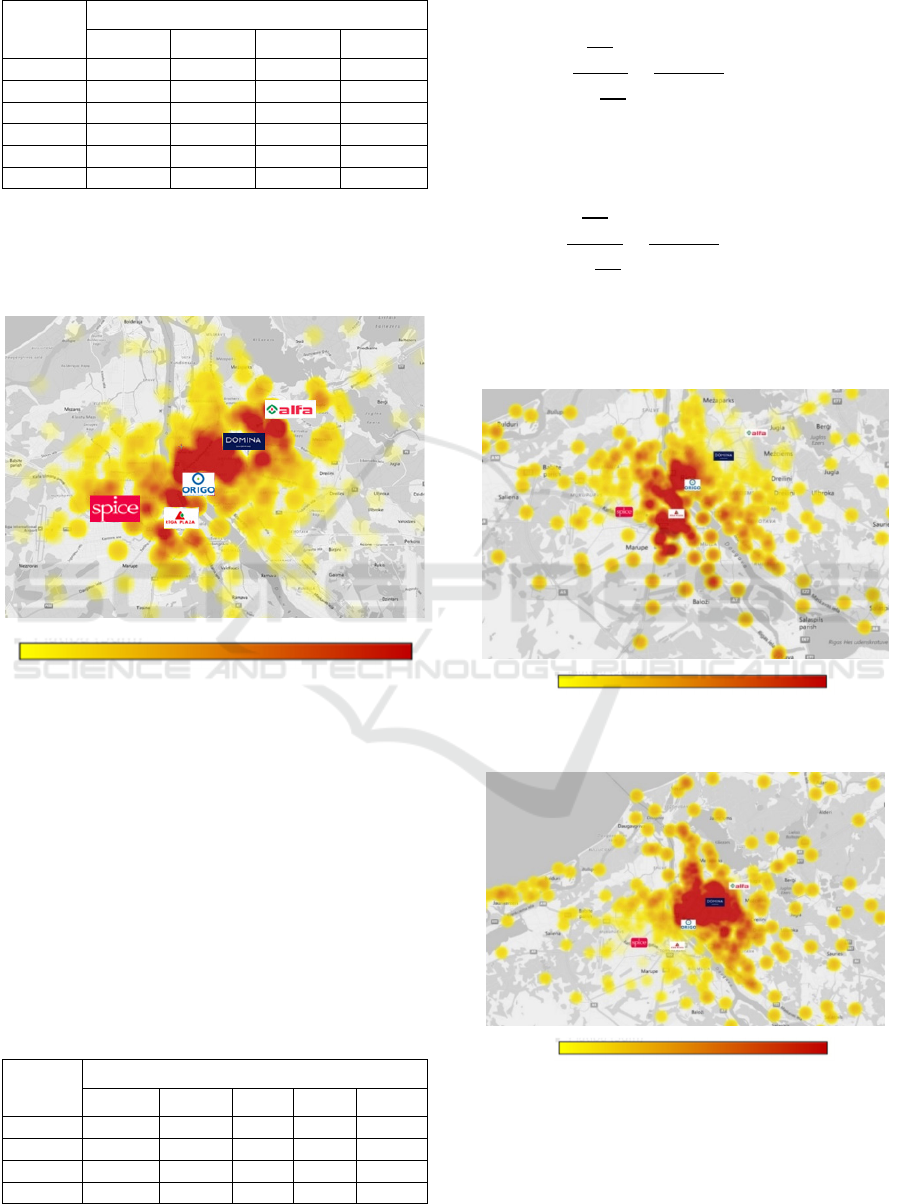

Huff's gravity model assumes that attractiveness

is based on the size and distance to shopping centres,

therefore the following two datasets were selected for

the analysis (Fig. 2):

Locations and size of 5 shopping centres

(j = 1,..,5)

Mobile network base stations (i = 1, .., 297).

The lowest mobile phone activity

The highest mobile phone activity

Figure 2: Shopping centres and mobile phone base stations.

To evaluate the probabilities of a customer

preference of shopping centre location, there are 3

steps:

Determine the distance from 5 shopping centres to

mobile phone base stations;

Determine the attractiveness of 5 shopping

centres, which are directly proportional to the

leasable area S

j

(m

2

) and inversely proportional to

the square of the distance T

ij

2

(2):

(2)

where j=1,…5; i=1,…,297.

Calculate the probabilities when customers from

each mobile phone base station’s area i are most

likely to go to each shopping centre j (3):

∑

(3)

where j=1,…,5; i=1,…297.

The Euclidean distance was used to determine the

distance (km) from 5 shopping centres to the mobile

network 297 base stations in Riga city area. For

example, the distance from # 100102 base station to

Riga Plaza shopping centre equals 4.49 km, but to

Origo shopping centre equals 2.02 km (Tab. 1).

Table 1: Example of the distances (km) from shopping

centres to base stations.

Base

station

#

Shopping centre

Riga

Plaza

Domina Alfa Spice Origo

100102 4.49 1.67 4.64 7.09 2.02

100103 4.20 1.70 4.74 7.01 1.75

100105 3.93 2.37 5.35 6.39 1.48

100409 0.97 6.44 9.34 4.35 3.32

2.1 Shopping Centre Attractiveness

Determination

Mobile phone base stations within a 1 km radius of

the shopping centre are excluded from further

analysis, because the actual mobile phone users are

already connected to the base stations as customers

with the probability tends to 1.

The attractiveness from all 297 base stations in

Riga territory and the total attractiveness are

calculated for 5 shopping centres. The overall

attractiveness from the base station area is calculated

as the sum of the attractiveness of all 5 shopping

centres. For example, the total attractiveness from

# 100102 base station equals 27064.4, but from

# 100409 base station equals 58549.9 (Tab. 2).

Huff Model for Shopping Centre Assessment using Aggregated Mobile Phone Data

93

Table 2: Example of shopping centre attractiveness.

Shopping

centre

Base station #

100102 100103 100105 100409

Riga Plaza 2484.1 2830.3 3235.4 52947.5

Domina 16766.7 16112.6 8340.8 1129.3

Alfa 2227.3 2138.5 1676.2 550.4

Spice 814.5 834.5 1004.8 2162.5

Origo 4771.9 6292.9 8818.1 1760.3

Total

27064.4 28208.8 23075.3 58549.9

The overall attractiveness of shopping centres is

identified on the map from the mobile phone base

stations within 30 km surrounding area of Riga in

Figure 3.

The lowest attractiveness The highest attractiveness

Figure 3: Shopping centres attractiveness.

It can be concluded, that the Origo shopping

centre is the most attractive compared to other

shopping centres.

2.2 Shopping Centre Market Share

Probability Estimation

Using formula (3) the probabilities when customers

from each mobile phone base station area i are most

likely to go to the shopping centre j is calculated

(Tab. 3).

Table 3: Example of shopping centre market share

probability estimation.

Base

station

#

Shopping centre

Riga Plaza Domina Alfa Spice Origo

100102 9.2% 62.0% 8.2% 3.0% 17.6%

100103 10.0% 57.1% 7.6% 3.0% 22.3%

100105 14.0% 36.1% 7.3% 4.4% 38.2%

100409 90.4% 1.9% 0.9% 3.7% 3.0%

For example, probability that customers will go to

Riga Plaza from # 100102 base station equals (4):

∑

2484.1

27064.4

9.2%

(4)

In its turn, probability that customers will go to

Riga Plaza from # 100103 base station equals (5):

∑

2830.3

28208.8

10.0%

(5)

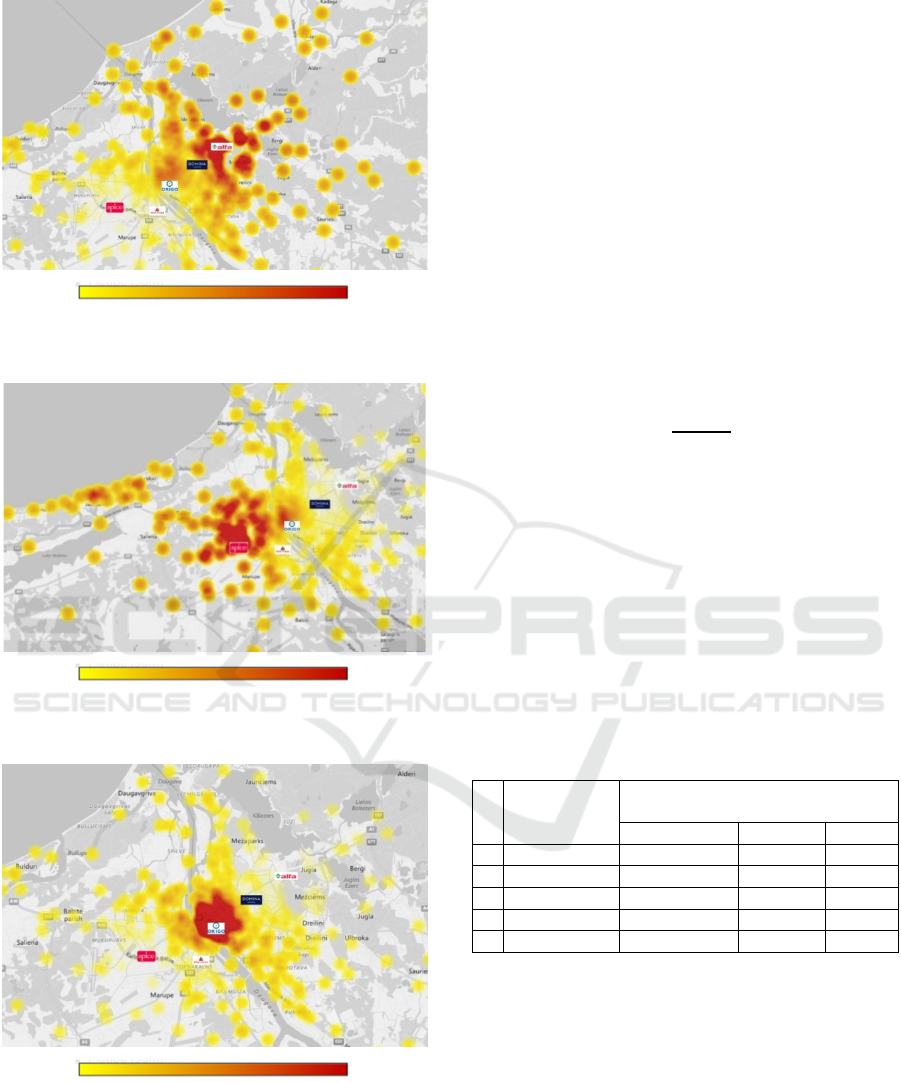

As a customer approaches a shopping centre, it

gains a higher market share, resulting in higher red

values (Fig. 4a - 4e).

0%

100%

Figure 4a: Riga Plaza shopping centre market share

probability estimation.

0%

100%

Figure 4b: Domina shopping centre market share

probability estimation.

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

94

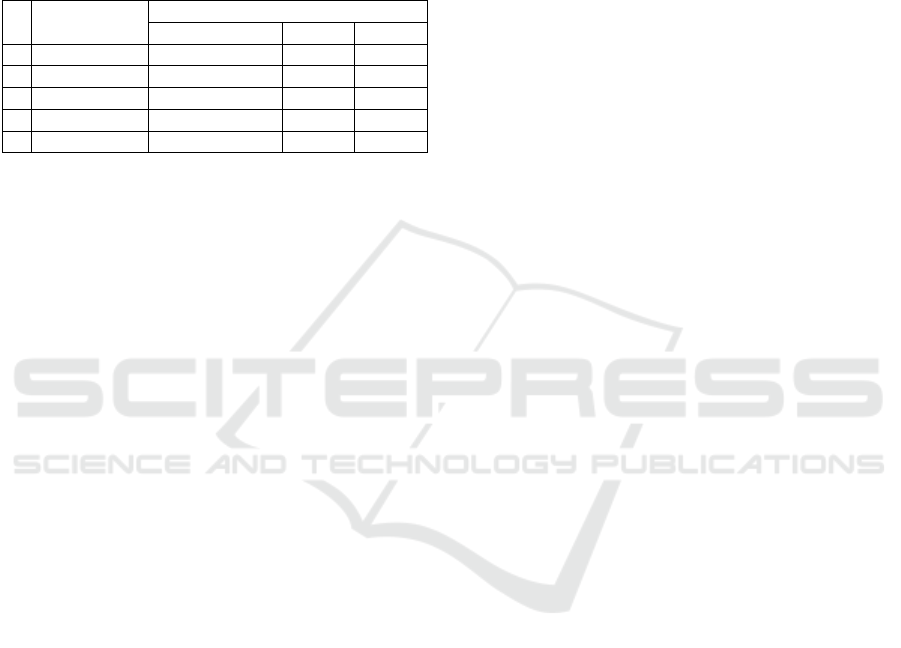

0% 100%

Figure 4c: Alfa shopping centre market share probability

estimation.

0% 100%

Figure 4d: Spice shopping centre market share probability

estimation.

0% 100%

Figure 4e: Origo shopping centre market share probability

estimation.

3 MARKET SHARE

ESTIMATION OF SHOPPING

CENTRE

To determine the number of potential customers C

j

for

a particular shopping centre j (average daily, monthly,

yearly), it is necessary to multiply the unique mobile

phone users N

i

(average daily, monthly, yearly) in

each base station area i with the probability P

ij

that

customers are likely to go to shopping centre j and

count them together (6):

(6)

Accordingly, the share of potential customers in

each shopping centre equals (7):

∑

(7)

It is possible to compare potential and actual share

of customers in each shopping centres. By using a

mobile phone base station unique number of users per

day in 2016 within a 1 km radius of each shopping

centre, it is possible to determine the unique user

share and ratio among shopping centres by selecting

Riga Plaza as 100%. Therefore, the market share of

potential customers within a radius of 1 km is the

highest for Origo – 58 %, and the lowest for Alfa –

only 7 %. (Tab. 4).

Table 4: Mobile phone unique users and potential

customers share within a 1 km radius of shopping centre.

#

Shopping

centre

Base station unique users and

potential customers

number per day share ratio

1 Riga Plaza 24 719 10 % 100 %

2 Domina 28 653 12 % 116 %

3 Alfa 17 583 7 % 71 %

4 Spice 31 042 13 % 126 %

5 Origo 143 800 58 % 582 %

By using Huff’s model, it is possible to determine

potential number of customers within a 10 km radius

of each shopping centre (5), the potential customers

share (6) and ratio between shopping centres by

selecting Riga Plaza as 100% (Tab. 5).

Comparing the obtained potential customer ratio

(Tab. 5) and actual ratio of customers in shopping

centres, it has concluded that the relationship between

shopping centres differed significantly from previous

results within a 1 km radius. This can be explained by

the fact that only 2 factors are used in the model: the

leasable area and the distance to the shopping centres

Huff Model for Shopping Centre Assessment using Aggregated Mobile Phone Data

95

from mobile phone base stations, without taking into

account other relevant factors, for example, the

presence of a train station in the case of Origo.

Therefore, it is necessary to add to the model other

factors or to multiply the number of potential

customers by a coefficient based on the ratios within

a 1 km radius.

Table 5: Potential customers within a 10 km radius of

shopping centre.

#

Shopping

centre

Potential customers

number per day share ratio

1 Riga Plaza 415 925 21 % 100%

2 Domina 524 305 27 % 126%

3 Alfa 322 640 17 % 78%

4 Spice 296 272 15 % 71%

5 Origo 392 442 20 % 94%

Valuation of shopping centres in illiquid markets,

such as the capitals of the Baltic States, is the subject

to subjective fluctuations in valuation due to the lack

of comparable deals and the absence of analogous or

similar objects in the largest and unique facilities in

the Baltic region. There is an objective difficulty in

comparing shopping centres across a broader

geography because the information about different

markets is aggregated in different, incomparable

formats and the data is affected by many local factors.

There is a lack of standardized reference points for

comparing locations and retails objects. Using mobile

data, as well as other statistics and real estate

appraisal data, provides the opportunity to create

universal criteria for location and shopping centre

standardization to compare prices for similar real

estate in a specific region.

Huff model-based approach for shopping center

assessment has been validated using real data,

including shopping centre total leasable area

(thsd.

m

2

), share of the customers (%), value per purchase

(EUR) and the turnover (EUR/m

2

). The research

results show that the model with two distance and

leasable area factors is not sufficient for the practical

purposes and should be expanded by the other factors

for model usability increasing, such as sales volume,

turnover, customer service level, etc.

4 CONCLUSIONS

In this research, the new type of source data for

measuring customer retail potential and market share

analysis using mobile activity data has been

proposed. The results have shown that mobile activity

data could be used as alternative source data for the

gravity-based Huff model to estimate retail

attractiveness, market share, and potential customer.

Mobile activity data gives more precise and realistic

information about several potential customers in a

specific territory, therefore mobile activity data could

be used in the Huff model.

The finding also indicated the specific

requirements for conditions to obtain high-reliability

source data for the Huff model. Results indicate that

mobile base stations could be used as a reference to

customer location in urban territories with a large

number and density of mobile base stations. Mobile

station density should be evenly distributed across the

territory to avoid overfitting problems. The

granularity of available mobile activity data allows

the use of the Huff model for different periods not

losing accuracy.

The advantage of mobile data use for shopping

center market share estimates is the possibility to

constantly track market share fluctuations and

seasonal changes. The model provides reliable data

sources for potential customer estimates. The method

is relatively low cost compared with traditional

methods used.

There are several opportunities for future studies

of the gravity-based approach using mobile activity

data. It is possible to use more frequent information

on a weekly level that requires data from retail stores

on weekly basis such as turnover, gross profit,

number of purchases and putting it together with

mobile activity on weekly bases that could increase

prediction accuracy and explain the impact of

seasonal sales, special sales events, etc.

ACKNOWLEDGEMENTS

This work was supported by the University of Latvia

and KA Ltd. [grant number ZD2018/20712].

REFERENCES

Aboolian, R., Berman, O., Krass, D., 2007. Competitive

facility location and design problem. European Journal

of Operational Research, 182(1), pp.40–62.

Anderson, J., 2011. The Gravity Model. Annual Review of

Economics, 3(1), pp.133-160.

Arhipova, I., Berzins, G., Brekis, E., Opmanis, M., Binde,

J., Steinbuka, I., Kravcova, J., 2019. Pattern

Identification by Factor Analysis for Regions with

Similar Economic Activity Based on Mobile

Communication Data. Advances in Intelligent Systems

and Computing, 886, pp.561–569.

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

96

Bruno, G., Improta, G., 2008. Using gravity models for the

evaluation of new university site locations: A case

study. Computers & Operations Research, 35(2),

pp.436-444.

De Beule, M., Van den Poel, D., Van de Weghe, N., 2014.

An extended Huff-model for robustly benchmarking

and predicting retail network performance. Applied

Geography, 46, pp.80-89.

Fernández, J., Hendrix, E.M.T., 2013. Recent insights in

Huff-like competitive facility location and design.

European Journal of Operational Research, 227,

pp.581–584.

Friske, W., Choi, S., 2013. Another look at retail gravitation

theory: History, Analysis, and Future Considerations.

Academy of Business Disciplines Journal, 5(1), pp.88-

106.

Lin, T., Xia, J., Robinson, T. P., Olaru, D., Smith, B.,

Taplin, J., Cao, B., 2016. Enhanced Huff model for

estimating Park and Ride (PnR) catchment areas in

Perth, WA. Journal of Transport Geography, 54,

pp.336–348.

Luo, J., 2014. Integrating the Huff Model and Floating

Catchment Area Methods to Analyze Spatial Access to

Healthcare Services. Transactions in GIS, 18(3),

pp.436-438.

Real estate market report. Baltic States Capitals Vilnius,

Riga, Tallinn, 2019, Realia Group, https://www.ober-

haus.lt/wp-content/uploads/Ober-Haus-Market-

Report-Baltic-States-2019.pdf#page=62

The Baltics anticipating new stock increases in the capitals.

Baltics Retail, H2 2017/Q1 2018, CBRE Baltics,

www.cbre.com/researchgateway

Huff Model for Shopping Centre Assessment using Aggregated Mobile Phone Data

97