Stocks Prices Prediction with Long Short-term Memory

Zinnet Duygu Akşehir

1a

, Erdal Kılıç

1b

, Sedat Akleylek

1c

, Mesut Döngül

2d

and Burak Coşkun

2e

1

Department of Computer Engineering, Faculty of Engineering, Ondokuz Mayıs University, Samsun, Turkey

2

Rönesans Holding, Ankara, Turkey

Keywords: Prediction, Stocks Prices, Long Short-term Memory.

Abstract: It is a difficult problem to predict the one-day next closing price of stocks since there are many factors

affecting stock prices. In this study, by using data from November 29, 2010 to November 27, 2019 and stocks

for the closing price of the next day are predicted. The long short-term memory method, a type of recurrent

neural networks, is preferred to develop the prediction model. The set of input variables created for the

proposed model consists of stock price data, 29 technicals and four basic indicators. After the set of input

variables is created, the one-day next closing prices of AKBNK and GARAN stocks are developed the model

to predict. The model's prediction performance is evaluated with Root Mean Square Error(RMSE) metric.

This value is calculated as 0.482 and 0.242 for GARAN and AKBNK stocks respectively. According to the

results, the predictions realized with the set of input variables produced are sufficiently successful.

1 INTRODUCTION

While the predictability of stock returns is of great

importance for investors, it has become the most

researched and curious subject by researchers.

Determining stock prices is a very difficult problem.

This situation can be associated with high uncertainty

and mobility in prices. Moreover, many variables

such as political events, general economic situation,

movements in other stock exchanges and investors'

expectations affect price movements.

When the stock market and stock index

forecasting studies are surveyed, it is seen that

artificial intelligence and data mining techniques are

at the forefront. It is observed that artificial neural

network (ANN) methods are used more frequently

than other methods. In addition to these methods,

studies have shown that deep learning methods are

also used. Studies are usually in the direction of

estimating the value of the stock market index.

For example, Akel and Bayramoğlu using data

from 4 January 1999 to 28 February 2001 date,

a

https://orcid.org/0000-0002-6834-6847

b

https://orcid.org/0000-0003-1585-0991

c

https://orcid.org/0000-0001-7005-6489

d

https://orcid.org/0000-0002-2479-6475

e

https://orcid.org/0000-0001-7175-1109

estimated the IMKB 100 ındex by the ANN method.

Input variables of the network; USD / TL exchange

rate, ISE trading volume, central bank exchange

reserves, central bank one-month deposit interest rate,

and gold exchange are determined (Akel and

Bayramoğlu, 2008).

Karaatlı et al. used regression and artificial neural

network models to estimate the IMKB100 index

value. They used data from January 1960 to

December 2002 date and determined as the period of

analysis and the data were dealt with monthly. In the

study, input variables for forecasting models were

treasury bill rate, gold price, inflation rate, industrial

production index, savings deposit interest rate,

exchange rate, and time variables. When the models

were compared, the regression model has seen to be

more successful than the artificial neural network

model (Karaatlı et al., 2005).

Using data from 2 July 2001 to 13 July 2006 date,

Kutlu and Badur, who using different input variables

in their models, tried to estimate the IMKB 100 index

with the artificial neural networks approach. In the

study, the previous day's index, US dollar, overnight

Ak¸sehir, Z., Kılıç, E., Akleylek, S., Döngül, M. and Co¸skun, B.

Stocks Prices Prediction with Long Short-term Memory.

DOI: 10.5220/0009351602210226

In Proceedings of the 5th International Conference on Internet of Things, Big Data and Security (IoTBDS 2020), pages 221-226

ISBN: 978-989-758-426-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

221

interest rate values, and the previous day's stock

market index values of France, Germany, UK,

S&P500, Brazil, and Japan were used as input

variables. Three different models were created using

these variables.

The first model, which was composed of the

previous day's index value, US dollar, and overnight

interest rate variables, produced more successful

results (Kutlu and Badur, 2009).

Diler attempted to predict the direction of the

IMKB 100 index the next day with the Ann method

in his study. Input variables of the model determine

as 10-day simple moving average, 5 and 10-day

weighted moving average, 10-day momentum, a

stochastic indicator (K%), relative strength index

(RSI), MACD (12 and 26-day exponential averages).

The success rate of the model calculated as 60.81%

(Diler, 2003).

Altay and Satman tried to estimate the IMKB 30

index with ANN and regression methods. They

tackled the data they used in the model on a daily and

monthly basis. When the models compared, it

appeared that the regression model is more successful

for both cases. It also stated that the ANN model

generally correctly predicted the direction of the

IMKB 30 index (Altay and Satman, 2005).

Sui et al. attempted to predict the direction of the

Shanghai stock market with support vector machines

(SVM). In the forecast model, they tried to estimate

the stock market direction of the day based on the

previous day's price. Alexander filter, relative

strength index, money flow index, Bollinger bands,

Chaikin oscillator, moving average

convergence/divergence, stochastic K%,

accumulation/distribution oscillator, and Williams’ R

technical indicators used as input variables in the

study. The prediction study with these technical

indicators achieved a 54.25% success rate (Sui et al.,

2007).

Inthachot et al. attempted to estimate the Thai

stock exchange index with ANN and SVM methods.

He used ten technical indicators for this forecast

model. When the performance of the two models

evaluated, it is seen that the model created by the

ANN method was more successful (Inthachot et al.,

2015).

Gündüz et al. attempted to estimate the daily

movement directions of three shares in Borsa Istanbul

with convolutional neural networks. In the model

they created, data between January 2011 and

December 2015 used. Two different sets of input

variables used for the model created. There are daily

opening, closing, highest and lowest values of stocks

in the first input variable set. In the second input

variable set, there are technical indicators calculated

from gold and dollar price data. When the second

dataset is added to the model created with the first

dataset, it was seen to improve the classification

performance of the model (Gündüz et al., 2017).

Parmar et al. attempted to predict the future value

of stocks of a company with regression and long short

term memory (LSTM) methods. The input variables

of the models consist of the open, close, low, high and

volume values of the stock. The input variables of the

models consist of approximately nine lakh records

consisting of the open, close, high, low, and volume

values of the stock. When the models compared, the

model created with the LSTM method was found to

be more successful than regression-based model

(Parmar et al., 2018).

Hossain et al. proposed a novel hybrid model

based on deep learning for stock forecasting. The

dataset used in the model consists of 66 years of

S&P500 index values (date, open, close and volume).

The proposed hybrid network has achieved 0.00098

MSE for this dataset (Hossain et al., 2018).

Pang et al. attempted to predict the Shanghai A-

Share Composite index and price of the Sinopec stock

via LSTM with embedded layer (ELSTM). This layer

used to reduce the data dimension. The created model

has achieved 0.017 MSE for Shanghai A-Share

Composite index while achieved 0.0019 MSE for

Sinopec stock (Pang et al., 2018).

Given the domestic and international stock market

index studies examined above, we found that stock

price data generally was chosen as the input dataset.

We have created a slightly different set of data from

these studies. This dataset we created; consists of

stock price data (including the opening price, the

highest price, the lowest price, the closing price and

the volume), 29 technical indicators calculated from

these price data, and 5 basic indicators. In this study,

we tried to estimate the closing price of two stocks

within the IMKB100 by using the LSTM method with

this data set we created.

The rest of this study is organized as follows: In

Section II, information about the dataset used in the

developed model is given. The LSTM method used in

the application is detailed in Section III. We describe

our experimental results in Section IV. The last

section consists of the conclusion and future works.

2 PREPARATION OF DATASET

This section provides information about how the

dataset created for the prediction model.

IoTBDS 2020 - 5th International Conference on Internet of Things, Big Data and Security

222

2.1 Feature Selection

Determining the attributes to be used in the prediction

model is one of the most important parts of the study.

As a result of the researches, stock price values, basic

and technical indicators were used to determine the

closing next day price of two stocks within the IMKB

100. The stock price data includes the open, close,

high, low, and volume values of these stocks. Also in

the input dataset, there are 29 technical indicators

calculated from these price data of the stock. In

addition to these attributes, there are also 5 basic

indicators: S&P 500, USD / TL parity, brent oil,

MSCI Turkey ETF, and BIST100 closing values. The

size of this dataset created as a matrix is 2265x39.

Technical analysis indicators use price and

transaction data to determine trends and analyze

formations. And with the help of some mathematical

calculations, he tries to express price movements by

a numerical value. Technical analysis indicators are

examined in 4 sub-headings: momentum, volume,

trend, and volatility indicators (Çetinyokuş, 2002). In

this study, the technical indicators to be used in the

model were determined as follows: 4 volume

(Chaikin Money Flow, On Balance Volume, etc.), 7

volatility (Average True Range, Bollinger Band,

Kelter Channel Central, etc.), 6 momentum (Relative

Strength Index, Stochastic Oscillator, Money Flow

Index, etc.), and 12 trend (Mass Index, Aroon

Indicator, Commodity Channel Index, Exponential

Moving Average, etc.) indicators.

2.2 Creation of the Dataset

The stock price data used in the study obtain from

Borsa Istanbul. The values of basic indicators obtain

from the stooq.com website.

3 METHODOLOGY

A Recurrent Neural Network (RNN) is a type of

neural network whose inputs are sequences of data

ranges from text, image to time series. RNN

architectures provide successful results in time-based

problems due to their ability to connect with the past

and interpret. But in the case of establishing a

connection with the distant past, it's hard to keep that

much information in its memory and use it (Elman,

1990). As a solution to this memory problem of RNN

and the 'vanishing gradient problem,' Hochreiter and

Schmidhuber proposed the Long Short Term Memory

(LSTM) units in 1997 (

Hochreiter and Schmidhuber,

1997). LSTM is a variant of RNNs and can learn long-

term dependencies. In this way, it produces new

outputs based on what it has learned in the past.

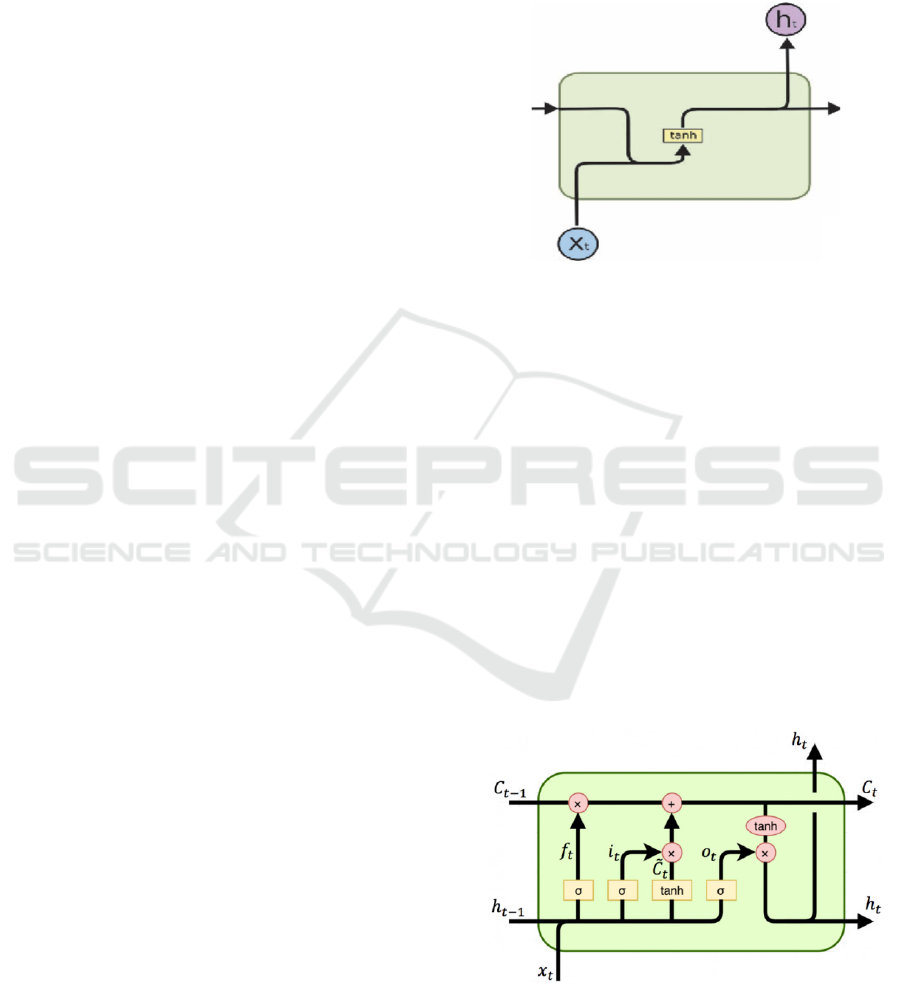

While traditional RNNs have a single tangent

layer (see Fig. 1), the LSTM has four different layers:

input gate, output gate, forget gate, and the memory

cell.

Figure 1: The traditional RNN unit.

The LSTM transaction equations are given as fallow

(Hochreiter and Schmidhuber, 1997):

=

.

ℎ

,

+

(1)

=

(

.

ℎ

,

+

)

(2)

=(

.

ℎ

,

+

) (3)

Č

=tanh

(

.

ℎ

,

+

)

(4)

=

⊙

+

⊙Č

(5)

ℎ

=

⊙tanh

(

)

(6)

From the above equations, for an input vector () the LSTM

unit at time step :

is an input gate,

is a forget gate,

is an output gate,

is a memory cell, ℎ

is hidden state,

is weight matris, is bias vector, and activation

function. The default conections among these units are

presented Figure 2.

Figure 2: LSTM unit.

Stocks Prices Prediction with Long Short-term Memory

223

4 EXPERIMENTAL RESULTS

With the LSTM model we created within the scope of

the study, we evaluated closing price of AKBNK and

GARAN stocks of the next day. In this study, we

determined the analysis period from November 29,

2010 - November 27, 2019, and we handled the data

daily.

We used the AKBNK and GARAN stocks price

data (open, high, low, and close), 29 technicals, and 5

basic indicators as the input variable of the model we

developed.

The details of the model we developed are as

follows:

For the training set, we take the first 75% of

the data, and for testing, we chose the rest of

the data.

Input data segmentation is made by 9 width

sliding window. That is, each input variable

having 9 days of observation.

Our model consists of five LSTM layers and

one dense layer. The output sizes of the

LSTM layers are 256, 128, 64, 32, and 16,

respectively.

We added a dropout layer between the

LSTM layers to prevent the model from

over-fitting.

The activation function of the LSTM layers

is 'hard sigmoid' while the activation

function of the dense layer is 'hyperbolic

tangent'.

We've set the number of epochs to 150, the

batch size is 32.

We also benefited from the Root Mean Square

Error (RMSE) metric indicated with (7) when

evaluating the performance of the model.

=

∑

(

−

)

(7)

In the above equation, shows the number of

data, is predicted value, and is actual value.

According to this metric, the RMSE value's close to

zero shows that the created prediction model is

successful.

After all these model parameters were set, we

went through to the training stage of the model. After

the training of the model was completed, we

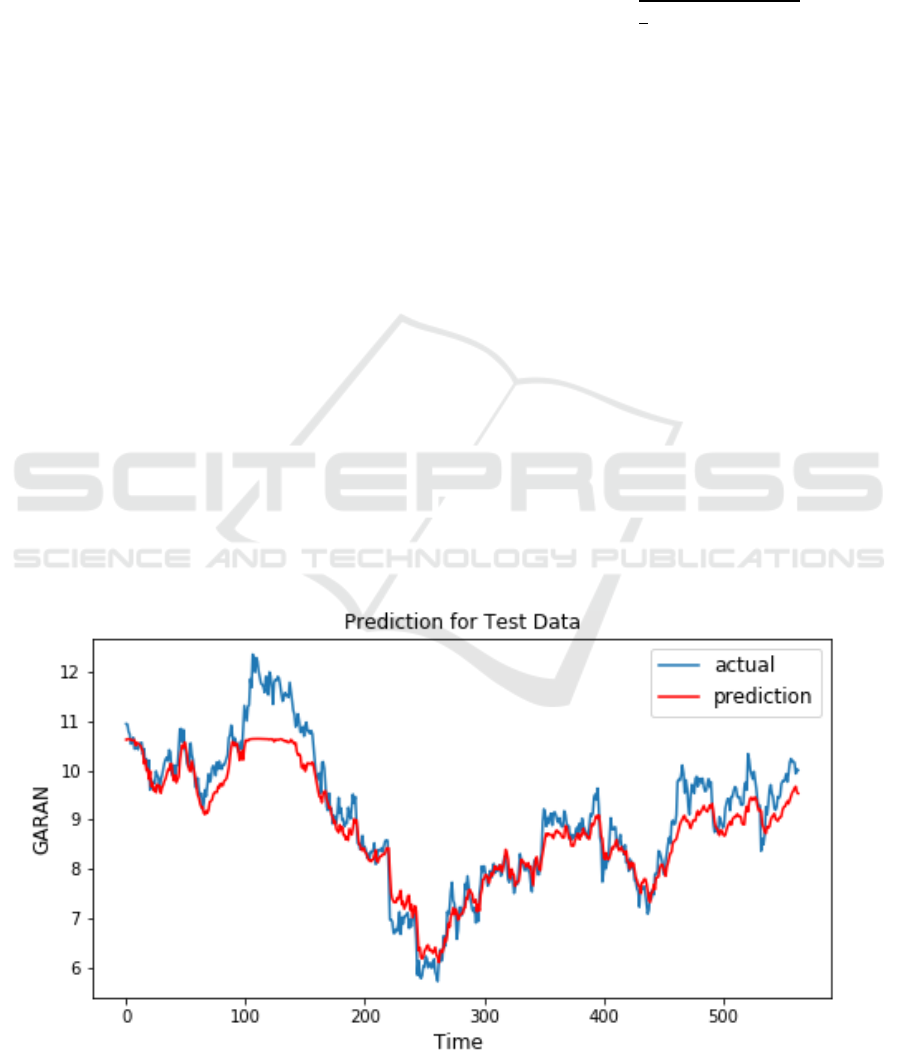

performed the prediction on the test data. The graphs

of the actual closing prices of GARAN and AKBNK

stocks and the values predict during the test is given

in Figure 3 and Figure 4 respectively.

Graphics shown in blue in Figure 3 and Figure 4

shows the actual closing price, while the graph in red

indicates the predicted values.

When the figures are examined, the two curves

generally overlap. However, successful forecasts

could not be produced in cases where the stock price

dipped or peaked.

Also, the RMSE values of the model created for

GARAN and AKBNK stocks calculated as 0.282 and

0.482 respectively. These values indicates that the

created prediction model is successful.

Figure 3: GARAN stock prediction and actual closing price during the test.

IoTBDS 2020 - 5th International Conference on Internet of Things, Big Data and Security

224

Figure 4: AKBNK stock prediction and actual closing price during the test.

5 CONCLUSIONS AND FUTURE

WORK

When we examined the results, we found that the

LSTM model, created with the selected basic and

technical indicators, realized successful predictions.

Also, we found that the price direction correctly

predicted even though the price value could not be

predicted correctly when the stock price reached the

bottom and peak.

We have identified future studies as make

improvements for these situations where the stock

price is not closely predicted.

ACKNOWLEDGEMENTS

This work was supported by Rönesans Holding.

REFERENCES

Akel, V., Bayramoğlu, M. F., 2008. Kriz Dönemlerinde

Yapay Sinir Ağları ile Finansal Öngörüde bulunma:

İMKB 100 Endeksi Örneği. International Symposium

on International Capital Flows and Emerging Markets,

pp. 24-28.

Altay, E., Satman, M. H., 2005. Stock Market Forecasting:

Artificial Neural Network and Linear Regression

Comparison in An Emerging Market. Journal of

Financial Management and Analysis, 18(2), pp. 18-33.

Çetinyokuş, T., Gökçen, H., 2002. Borsada Göstergelerle

Teknik Analiz için Bir Karar Destek Sistemi. Gazi

Üniversitesi Mühendislik-Mimarlık Fakültesi Dergisi,

17(1).

Diler, A. İ., 2003. İMKB Ulusal-100 Endeksinin Yönünün

Yapay Sinir Ağları Hatayı Geriye Yayma Yöntemi ile

Tahmin Edilmesi. İMKB Dergisi, 7(25- 26), pp. 66-82.

Elman, J. L., 1990. Finding structure in time. Cognitive

science, 14(2), pp. 179-211.

Gunduz, H., Cataltepe, Z., Yaslan, Y., 2017. Stock Market

Direction Prediction Using Deep Neural Networks.

In 2017 25th Signal Processing and Communications

Applications Conference (SIU), pp. 1-4. IEEE.

Hochreiter, S., Schmidhuber, J., 1997. Long Short-Term

Memory. Neural computation, 9(8), pp. 1735-1780.

Hossain, M. A., Karim, R., Thulasiram, R., Bruce, N. D.,

Wang, Y., 2018. Hybrid Deep Learning Model for

Stock Price Prediction. In 2018 IEEE Symposium

Series on Computational Intelligence (SSCI), (pp.

1837-1844. IEEE.

Inthachot, M., Boonjing, V., Intakosum, S, 2015. Predicting

SET50 Index Trend Using Artificial Neural Network

and Support Vector Machine. In International

Conference on Industrial, Engineering and Other

Applications of Applied Intelligent Systems, pp. 404-

414. Springer.

Karaatlı, M., Güngör, İ., Demir, Y., Kalaycı, Ş., 2005. Hisse

Senedi Fiyat Hareketlerinin Yapay Sinir Ağları

Yöntemi ile Tahmin Edilmesi. Yönetim ve Ekonomi

Araştırmaları Dergisi, 3(3), pp. 38-48.

Kutlu, B., Badur, B., 2009. Yapay Sinir Ağları ile Borsa

Endeksi Tahmini. Yönetim, 20(63), pp. 25-40.

Pang, X., Zhou, Y., Wang, P., Lin, W., Chang, V., 2018.

Stock Market Prediction based on Deep Long Short

Term Memory Neural Network. In Proceedings of the

Stocks Prices Prediction with Long Short-term Memory

225

3rd International Conference on Complexity, Future

Information Systems and Risk (COMPLEXIS 2018), pp.

102-108.

Parmar, I., Agarwal, N., Saxena, S., Arora, R., Gupta, S.,

Dhiman, H., Chouhan, L., 2018. Stock Market

Prediction Using Machine Learning. In 2018 First

International Conference on Secure Cyber Computing

and Communication (ICSCCC), pp. 574-576. IEEE.

Sui, X., Hu, Q., Yu, D., Xie, Z., Qi, Z. A., 2007. Hybrid

Method for Forecasting Stock Market Trend Using

Soft-Thresholding De-noise Model and SVM. Springer

Verlag Berlin Heidelberg, pp. 387-394.

IoTBDS 2020 - 5th International Conference on Internet of Things, Big Data and Security

226