Practical Analysis of Traceability Problem in Monero’s Blockchain

Michal Kedziora

a

and Wojciech Wojtysiak

Faculty of Computer Science and Management,

Wroclaw University of Science and Technology, Wroclaw, Poland

michal-kedziora.com/#contact

Keywords:

Blockchain, Cryptocurrency, Traceability, Monero.

Abstract:

This paper presents an analysis of the cryptocurrency security based on the traceability problem in the Monero

Blockchain. Researchers found a weakness in Monero transactions in the beginning of the network existence,

where the real input could be deduced by the elimination. We decided to do further research on the newest

data available after several Monero updates where introduced and implemented to evaluate, if this weakness is

still available in the recent transactions. The analysis of the existing sizes of ”Ring Signature” in transactions

in subsequent versions of the Monero network has proven that the minimum required size for a given version

is most often used, which can in some rare situation potentially lead to the creation of a user profile, and

identifying transaction.

1 INTRODUCTION

Cryptocurrencies are becoming an increasingly pop-

ular method of electronic exchange of funds. They

are based on a peer-to-peer system that, using cryp-

tographic techniques. The basis of their operation is

cryptographic evidence, which allows a transaction

between two parties, without the participation of a

trusted third party(Nakamoto, 2008). This approach

prevents the cancellation of transactions and allows

you to reduce the commission, which increases the

safety of sellers, and deposit mechanisms can be in-

troduced to protect buyers. Due to the many disad-

vantages and limitations of Bitcoin(Kedziora et al.,

2019), such as the lack of appropriate technologies

to ensure the privacy of cryptocurrencie, Monero has

been proposed(Van Saberhagen, 2013)(Wijaya et al.,

2016), which provides higher transaction security

standards and meets two main features:

• Untraceability - For each transaction, the connec-

tion between the sender and the recipient can not

be tracked.

• Unlinkability - You can not combine two transac-

tions sent to the same recipient.

The first property in Bitcoin currency is not kept,

because all transactions are publicly available in

Blockchain blocks, and thus a connection between

the parties to the transaction can be determined. The

a

https://orcid.org/0000-0002-7764-1303

lack of the use of masking algorithms, thanks to

the in-depth analysis of Blockchain can also lead to

the connection of network users and their transac-

tions, and hence the disclosure of many confiden-

tial information from publicly available data(Li et al.,

2017)(Mell, 2018)(Maurer, 2016)(Biryukov and Pus-

togarov, 2015). In Monero, the above restrictions

have been offset by the use of several mechanisms.

The sender’s identity is protected by the addition of

additional false source addresses, and thanks to a one-

off public key for each ”output”, a unique address is

created, and the real one is unavailable to the public in

Blockchain. In spite of this, for transactions dated be-

fore the introduction of many network improvements

in 2017, research has shown that a significant portion

of them can be traced(Noether, 2014)(Noether and

Noether, 2014).

The aim of the paper is to analyse in practice

the mechanisms implemented in the Monero sys-

tem to ensure the security and anonymity of transac-

tions is confirmed, and there is no possibility to con-

duct analysis on transaction data sets exported from

Blockchain for current time intervals to examine the

possibility of merging transactions with their real in-

puts.

1.1 Monero’s Blockchain

Monero is one of the most valuable privacy-oriented

cryptocurrencies. It was presented in November

Kedziora, M. and Wojtysiak, W.

Practical Analysis of Traceability Problem in Monero’s Blockchain.

DOI: 10.5220/0009325802610268

In Proceedings of the 15th International Conference on Evaluation of Novel Approaches to Software Engineering (ENASE 2020), pages 261-268

ISBN: 978-989-758-421-3

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

261

2013 in a document describing the ’CryptoNote v

2.0’ technology by Nicolas van Saberhagen, and the

first implementation is dated September 12, 2014.

The Monero network is updated usually every six

months(Noether et al., 2014). Since the first imple-

mentation, 8 major updates have been created, each

time introducing a series of changes that increase the

level of security and comfort of using cryptocurren-

cies(Alonso, 2018).

The ring signature technology in Monero is used

to protect the privacy of the sending transaction. It is

a kind of electronic signature in which a group of po-

tential transaction participants is combined to create

a unique transaction authorization(Courtois, 2016).

The right signer, or ”one-time key”, associated with

the ”output” of the transaction, and the others - ac-

quired from past transactions recorded in Blockchain,

are equal and impossible to identify. Together, they

form a list of ”inputs” of transactions, of which only

one is appropriate. This allows masking the origin of

the transmitted cryptocurrency. To eliminate the pos-

sibility of double release, ”Key image” was used. It

is a cryptographic security key, which is part of ev-

ery transaction signed ”Ring Signature”. Each ”out-

put” transaction has only one ”Key image”, and their

list is stored in Blockchain, so that anyone who ex-

tracts the currency can verify that no resulting transac-

tions have been doubled. Monero users have a pair of

public keys as public address(Mercer, 2016). Adress

is based on Diffie-Hellman exchange created before

each transaction made by user. The one-time keys for

the output are:

K

0

= H

n

(rK

B

1

)G + k

B

2

G = (H

n

(rK

B

1

) + k

B

2

)G (1)

k

0

= H

n

(rK

B

1

) + k

B

2

(2)

where r is random number such that 1 < r < N, and

public key is K

0

= H

n

(rK

B

1

)G + k

B

2

. The rG value is

used to calculate a Diffie-Hellman like shared secret.

Then k

B

1

rG = rK

B

1

is calculated. A private key k

B

1

is called also the view key, as it allows to verify if an

output is valid and properly addressed(Alonso, 2018).

The operating principle looks as follows, if user

X wants to send Monero to user Y, with the size of

the ring six, one of the ”inputs” will be taken from

the X wallet and placed in the ring, and the rest of the

past transactions saved in Blockchain. Together they

form a group of six potential signers, and from out-

side it will not be possible to determine which ”input”

is the right one signed by ”One time key” from user

X, and thanks to the verification of ”Key image”, the

Monero network will be able to confirm that sent to Y,

they were not issued before. RingCT, is an algorithm

by which the value of each ”output” is encrypted and

saved in the transaction. Only the recipient can de-

code the value. Encryption is done by the sender us-

ing the private transaction key. This information is

provided in the ”ecdhInfo” section. The private trans-

action key is created by combining the private ”view

key” of the recipient and the public transaction key.

1.2 Related Work

As presented in the research paper ”An Empirical

Analysis of Tracebility in the Monero Blockchain”,

Authors: Malte M

¨

oser, Kyle Soska, Ethan Heilman,

Kevin Lee, Henry Heffan, Shashvat Srivastava, Kyle

Hogan, Jason Hennessey, Andrew Miller, Arvind

Narayanan and Nicolas Christin, the Monero soft-

ware allows you to configure users with many vari-

ables(Moser et al., 2018). At the beginning of the ex-

istence of Monero, it was not determined what is the

minimum number of additional ”outputs” required,

called ”mixins”. According to research, about 64% of

transactions did not have them at all, they are 0-mixin

transactions. The reason for this behavior could have

been lower fees for transactions due to its size. This

creates a problem not only for these operations, but

also for future ones that will use them, because the

”output” X, which is the only one in transaction A,

and for example one of two (X and Y) in transaction

B, makes it unambiguously we can determine that Y

is the correct ”output” for transaction B.

The above-mentioned research focused on several

periods related to network updates in terms of the

policy of adding ”mixins” to the transaction and an-

alyzed the data from Blockchain to block 1288774,

until April 15, 2017:

• before January 1, 2016: ”mixins” selected evenly,

all had to have the same value, older ones selected

more often than new ones,

• after January 1, 2016, version 0.9.0: the minimum

number of ”mixins” is two, and favoring newer

ones,

• after September 19, 2016, version 0.10.0: Intro-

duction of the ”CT Ring”, which was finally avail-

able from January 10, 2017,

• after December 13, 2016, version 0.10.1: match-

ing ”mixins”, min. 25% of the last 5 days.

To conduct the research, an iterative algorithm was

used, which in each operation on a set of transaction

data retrieved from Blockchain, selects all ”mixins”

which can not be the correct ”output” because they

were issued earlier(Kumar et al., 2017). The results

show that in the first version of Monero, for the trans-

action ”0-mixins”, about 89% of the relevant ”inputs”

ENASE 2020 - 15th International Conference on Evaluation of Novel Approaches to Software Engineering

262

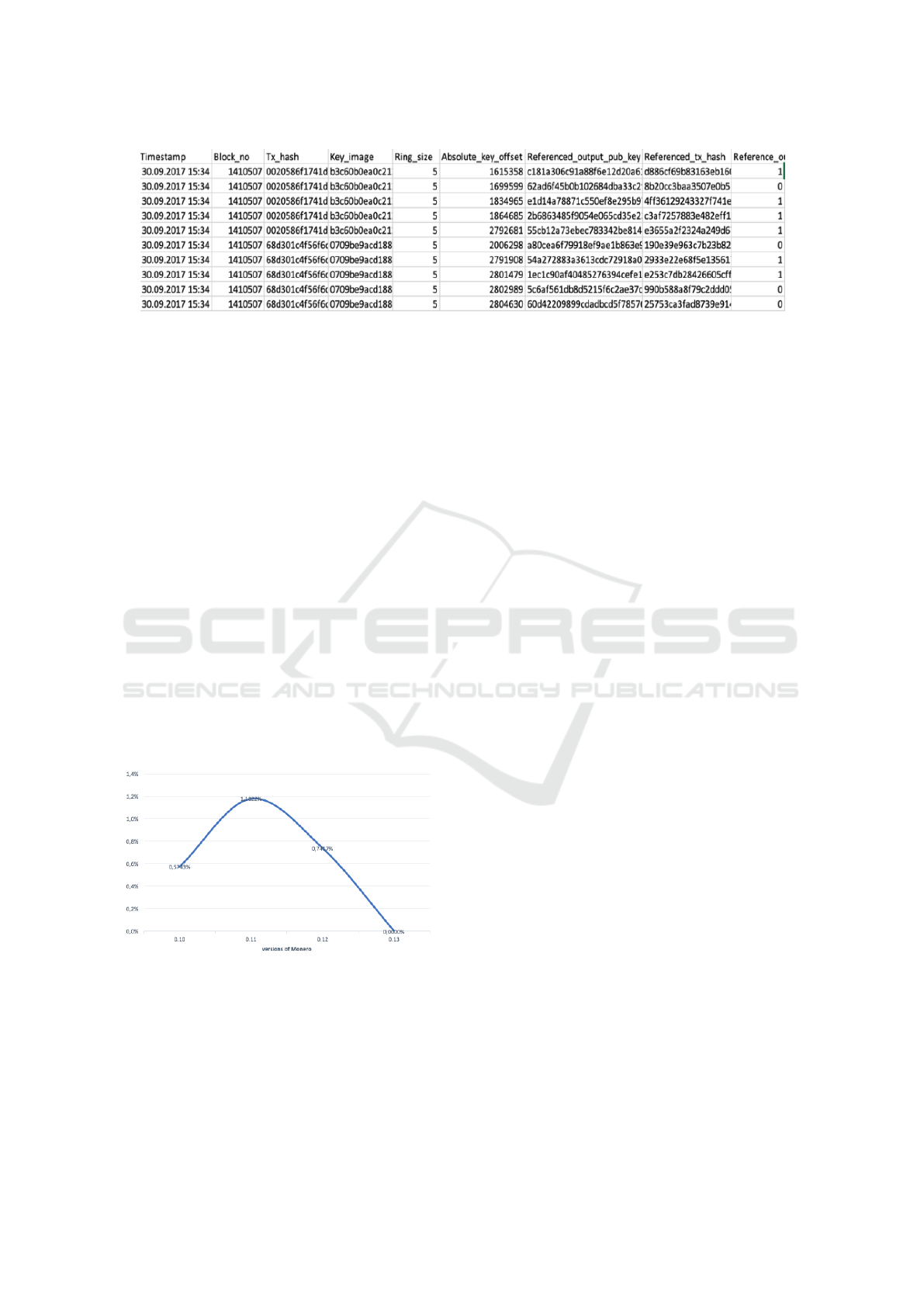

Figure 1: An Exemplary Structure of the Exported Transaction History from Monero Blockchain.

could have been identified, for all 2 053 328 trans-

actions, about 77%. In version 0.9.0, where the mini-

mum number was two, for ”2-mixins”, about 64%, for

all, 3 156 248, about 62%. Between version 0.10.1

and April 15 2017, about 42% for ”2-mixins” and

about 40% for 1 046 028 transactions. It can also be

concluded that in addition to the first version, ”2- mix-

ins” was the most commonly used, i.e. the smallest

value required, and the least often between seven and

nine. After September 16, 2017, the Monero version

0.11.0.0, the next network update took place on April

6, 2018. Version 0.12.0.0 introduced some interesting

upgrades. The minimum ring signature size has been

increased from five to seven, the Proof-of-Work algo-

rithm has also been changed to prevent DoS attacks

by ASICs and added sorting. On October 18, 2018,

version 0.13.0.0 was released. Updated PoW algo-

rithm to CNv2. ’Bulletproofs’ was enabled to reduce

the size of the transaction and the size of the ring sig-

nature was set to eleven globally, the maximum trans-

action size was set to half the size of the block(Wijaya

et al., 2018).

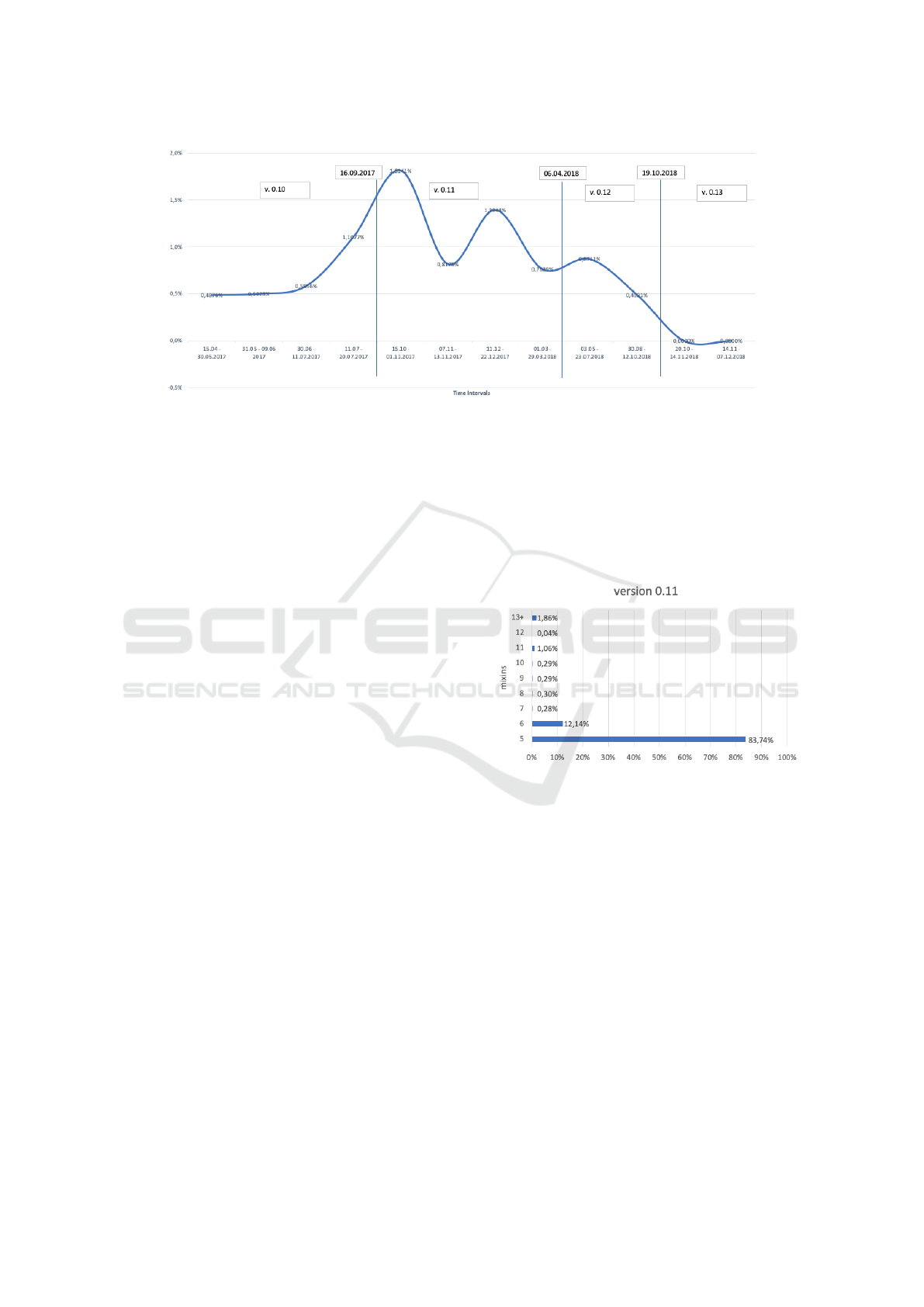

Figure 2: Percentage of Traceable ”inputs” According to

the Monero Network Version.

The use of three main technologies in Monero pro-

viding privacy: addresses ”stealth”, ”Ring Signature”

and ”RingCT”, resulted in an increase in the size of

the transaction and Blockchain itself. This limited

the possibility of increasing the minimum amount of

mixins, because the ”Range proof” algorithm signif-

icantly increased the transaction size and its fee. In

response to this from the beginning of 2018, the ”Bul-

letproofs” technology was started, which was finally

implemented in version 0.13.0.0 on October 18, 2018.

In contrast to the ”Range proofs” algorithm, where the

number of operations increases linearly to the number

of ”outputs” and bits within reach, the ”Bulletproofs”

grows only logarithmically. This allows two types of

applications: ”single output” and ”multiple output”.

Thanks to the implementation of this technology, the

transaction fee decreased, and the size of the sample

transaction was reduced by approximately 80%. The

average transaction fee in January 2018 was even 13.5

$. During the year, it decreased due to the decline in

cryptocurrency prices and a smaller number of trade-

oriented transactions to the level of 0.5 $ - 1.0 $. After

the introduction of the ”Bulletproofs” technology, the

fee fell from the level of 0.6 $ to 0.02 $, which is

a very large improvement of the transaction and the

cryptocurrency itself. This allowed to set the min-

imum number of ”mixins” to eleven, which makes

it impossible to track transactions based on ”inputs”.

This will be presented later in the paper.

2 MONERO BLOCKCHAIN

ANALYSIS

Conducting the experiment required three main steps.

The first was to install the Monero wallet and syn-

chronize with the network to download the local

Blockchain node. The next step was to use the trans-

action export tool to export the transaction history for

different periods from the local Blockchain database.

Finally, it was necessary to use a cloud computing in

order to implement the iterative algorithm and gen-

erate results. The wallet has been synchronized in

the Linux system, because the tools used to export

data from Blockchain are dedicated to this system.

In the background, the ”Daemon” Monero worked,

which was supposed to synchronize with the network

and scan whether our system is intended for transac-

Practical Analysis of Traceability Problem in Monero’s Blockchain

263

tions and enable sending them. Blockchain Monero is

stored locally in the LMDB database in the data.mdb

file. The LMDB database is a transactional database

in the form of a key - value, offering very high ef-

ficiency both in terms of speed and space. It is rec-

ommended to use SSDs for synchronizing the local

node, because the data structure even for fast HDDs

is very difficult, and thus synchronization can take up

to several days.

The transaction export tool which was available

on the GitHub platform by Martin Matak was used to

export the history of the transaction from Blockchain.

It allows you to export to a csv file, transaction details

stored in Blockchain. After compilation and show-

ing the path to our Monero together with the local

Blockchain node, we can run the program for one of

the selected parameters. For the experiment, the op-

tion to export all ”key images” with associated pub-

lic keys ”outputs” was used, starting with the spec-

ified block. The generated csv file consists of nine

columns: timestamp, block number, transaction hash

address, key image, ring size, key offset, key public

associated with ”key image”, address of hash trans-

action associated with public the ”output” key, which

is also one of the ”stealth” addresses of this transac-

tion. On the xmrchain.net portal you can verify the

received export. For each block number, it is possi-

ble to display transaction details and the associated

”Key image” together with the ”Ring Signature” par-

ticipants. You can read information about the block

number, confirmation number, transaction size, fee,

exact date and ”stealth” addresses.

Figure 3: Percentage of the Use of a given Number of ”mix-

ins” in Transactions, 15/04 - 3/05/2017.

The first step is to export test data from Blockchain

to be able to load it into a cluster. In order to im-

plement the algorithm on a large number of data, the

Google platform was used. It is a cloud service that

offers many interesting solutions, including Google

App Engine, Google Cloud Storage, Google Cloud

SQL, Google Cloud Compute, Google Big Query. For

the purpose of the research, Google Cloud Storage

was used to store selected exports and instances of

Google Cloud Compute virtual machines as comput-

ing power. Three machine instances were used for the

calculations, the main one with four processors and

15 GB of virtual memory, and two with one processor

and 3.75 GB of virtual memory. Then, the data had to

be sent to the server, the project was built locally and

a calculation command sent to the virtual machines.

After correctly performed iterations, we get a percent-

age result of the possible ”merged” transactions in a

given set of data.

Figure 4: The Most Popular Sizes of ”Ring Signature” De-

pending on the Version of the Monero Network.

Transaction histories stored in Blockchain occupy a

lot of space, and their export and the iterative algo-

rithm executed on them requires significant comput-

ing resources and fast SSDs, therefore the test data

has been divided into relevant parts related to changes

in the Monero network. The initial interval is April

15, 2017, until May 30, 2017, the first not covered by

research in the previously presented research work, to

verify the impact of subsequent network updates on

the ability to track transactions based on the elimina-

tion of their ”inputs” in historical operations.

Next, data samples were exported for selected

months of 2017, and for March 2018, one month be-

fore the update to version 0.12.0.0, where the mini-

mum size of the ring was set to seven. After the up-

date, selected weeks from April 2018. From May 3,

2018 to July 23, 2018, and from August 30, 2018

to October 12, 2018, before the update 0.13.0.0 of

October 19, 2018 introducing technology reducing

the transaction size, and thus its payment: ”Bul-

letproofs”, and increasing the required ring size to

eleven. The last ranges are data from October 20,

2018 to December 7, 2018, that is transactions were

carried out on the latest version of the network. In or-

der to verify the obtained results, a trial simulation

was also carried out for data from the period from

June 23, 2015 to July 13, 2015.

ENASE 2020 - 15th International Conference on Evaluation of Novel Approaches to Software Engineering

264

Table 1: The Obtained Results of the Iterative Algorithm for Selected Time Intervals.

Time interval Key images Inputs %

23.06 - 13.07.2015 204 103 156 950 76,8974%

15.04 - 30.05.2017 437 229 2132 0,4876%

30.05 - 09.06 2017 135 852 683 0,5028%

30.06 - 11.07.2017 117 650 689 0,5856%

11.07 - 20.07.2017 86 758 961 1,1077%

15.10 - 01.11.2017 146 026 2649 1,8141%

07.11 - 13.11.2017 106 172 868 0,8175%

11.12 - 22.12.2017 197 022 2748 1,3948%

01.03 - 29.03.2018 228 186 1743 0,7639%

03.05 - 23.07.2018 821 380 7155 0,8711%

30.08 - 12.10.2018 425 962 2096 0,4921%

20.10 - 14.11.2018 472 666 0 0,0000%

14.11 - 07.12.2018 279 707 0 0,0000%

2.1 Experiment Results

After completing the iterative algorithm on virtual

machines, the following results were obtained: In the

Table 1, in order to verify the results obtained, data

from 2015 was presented. For this data sample, the

number of transactions ”0-mixins” was as much as

71.8%, which is the main reason that as much as

76.9% ”inputs” it could be combined with the right

transaction.

Figure 5: Percentage of the Use of a given Number of ”mix-

ins” in Transactions, 03/05 - 14/05/2018.

The data show the time intervals for which the algo-

rithm was performed. The number of all ”Key im-

ages” for transactions from a given period of time.

The number of possible ”inputs” and their percent-

age. Current data from April 15, 2017, which focused

on research shows that with subsequent updates and

changes to the network and the increasing number of

transactions with new settings, the ability to combine

the relevant ”inputs” has decreased to an acceptable

and safe level for transactions, which was presented

in the Figure 4.

The chart shows that for transactions from April

15, 2017 to July 20, 2017, you could combine from

0.49% to 1.11% ”inputs”. This is the time when

the minimum ”Rign Signature” size was three, and

normal transactions were allowed and the encrypted

RingCT value. Due to a significant reduction in the

share of ”inputs” in the 0-mixin transaction from

the beginning of Monero existence, a maximum of

only 1.11% of transactions may be at risk. Transac-

tions from October 15, 2017 to March 29, 2018 were

made on the Monero version 0.11 network, which in-

creased the size of ”Ring Signature” to five and in-

troduced the ”RingCT” transaction requirement. This

solution requires that all ”inputs” also come from

”RingCT”. This could affect the fluctuation from

1.11% to 1.81%, which is the highest value observed

during the tests. Then the percentage falls and os-

cillates between 0.82% and 1.39%, at the end of the

period it reaches 0.76%. Version 0.12 introduced

the sorting ”inputs” and set the minimum number

of ”mixins” to seven. A downward trend is ob-

served from 0.87% to 0.49%. Along with Octo-

ber 19, 2018 and the current version of 0.13 of the

Monero network, the ”Bulletproofs” technology was

implemented, reducing the volume of transactions,

which allowed to determine the number of ”mixins”

at eleven, without the increase of transaction fees. As

results from the conducted research, it is impossible

to combine potential ”inputs” with current transac-

tions performed after updating the network to version

0.13. The results obtained prove that from October

19, 2018, the problem of potentially traceable ”in-

puts” of the transaction has been eliminated and trans-

actions in Monero’s cryptoval question can be con-

sidered anonymous and secure. The chart in Figure 2

presents a summary of results according to the year of

collected data. Both in the range from 2017 and 2018,

Practical Analysis of Traceability Problem in Monero’s Blockchain

265

Figure 6: Percentage of Traced ’inputs’ in the Time Periods.

the possibility of combining ”inputs” with the transac-

tion is less than 1%. For the data collected from 2018,

the result is only 0.49%, compared to 0.87% from the

previous year. It is mainly influenced by the Monero

network upgrade from October 19, 2018, solving the

problem under investigation.

Analyzing the obtained results according to the

Monero network version, please note that version

0.10 introduced the possibility of using the ”RingCT”

transaction, which requires that the size of ”RingSig-

nature” be greater than 1. As shown in the re-

search paper ”A Traceability Analysis of Monero’s

Blockchain,” Amrit Kumar, Clement Fischer, Shruti

Tople, and Prateek Saxena, already after about a

month from the introduction of this version, almost

90% of transactions took place using this technology.

This has the main impact on the decrease in traceable

”inputs” to the level of 0.57%. Subsequent versions

of the network introduced the obligation to use the

”RingCT” technology, and increased the size of the

”Ring Signature” to levels five and seven. Percentage

of traceable inputs depending on Monero version can

be see in Figure 1.

The research shows that implementing version

0.11 did not eliminate the completely analyzed prob-

lem, there was still the possibility of connection be-

tween 1.18% in version 0.11 and 0.74% of ”inputs”

in version 0.12. The results for version 0.13 were

breakthrough, in which for the collected data, it is not

possible to combine the ”inputs” with the transaction

2.2 Ring Signature Size Analysis

By exporting transaction details from Blockchain

Monero for selected time periods, subsequent ver-

sions of the network, it was possible to analyze the

number of ”mixins” used by users in transactions.

Network updates introduced restrictions on the min-

imum number of ”mixins”, which is visible in the re-

sults obtained. The Figure 2 shows that 77.45% of

transactions took place with the size of ”Ring Signa-

ture” set to three. Then ”Ring Signature” size five and

four were used. It is worth noting that six transactions

had a ring size value of more than a thousand, and one

transaction for four thousand five hundred one.

Figure 7: Percentage of the Use of the given Number of

”mixins” in Transactions, 15/10 - 01/11/2017.

For the data from version 0.11, similarly to the previ-

ous results, the minimum required value for this ver-

sion was used, that is five, 84.74% of all transactions.

The largest size of the ring was one hundred, used in

two transactions.

The results from May 3, 2018 to May 14, 2018

show that 78.21% of the transactions were set to

”mixins” at level seven. The highest set value was

nine hundred and ninety-nine in one transaction.

After the introduction of the ”Bulletproofs” tech-

nology, the ”Ring Signature” size was standardized

for transactions up to eleven. The results obtained

confirm that all transactions from November 14, 2018

to November 22, 2018, have a fixed value and no

anomalies occur. On the Figure 3, in order to compare

the distribution of occurrence of ”mixins” in transac-

tions with current data, situations from the time in-

ENASE 2020 - 15th International Conference on Evaluation of Novel Approaches to Software Engineering

266

Figure 8: Percentage of Traceable ”inputs” Acc. Years.

terval from June 23 to July 13, 2015 were presented,

in which there were no restrictions as to the mini-

mum number. It follows that almost 72% of transac-

tions took place without the participation of ”mixins”,

which in principle makes it possible to trace them.

This state of affairs was dictated by the desire to re-

duce transaction fees. It was unacceptable because

the transactions in Monero should be anonymous in

principle. As can be seen in the Figure 5, the largest

percentage of transactions is with the minimum num-

ber of ”mixins” for a given version of the Monero

network. It can be deduced from this that users used

standard settings and were afraid of higher fees, as the

increase in the number of ”mixins” increases the size

of the transaction and increases the fee.

Figure 9: Percentage of the Use of a given Number of ”mix-

ins” in Transactions, November 14 - November 22, 2018.

Version 0.13 introduced the unification of the number

of ”mixins” for transactions up to eleven. The con-

ducted research confirmed this implementation (see

Figure 6). There are currently no transactions with

different sizes of ”Ring Signature”. Thanks to this,

individual transactions with a very large number of

”mixins” are not observed, as in older versions, e.g.

four thousand five hundred one in version 0.10, which

cause a high load for the block and require a lot of

time to be confirmed by the network. There are also

no transactions with a minimum number of ”mixins”,

which resulted in lower security and traceability.

3 CONCLUSIONS

The presented work analyzes the security of Monero

Blockchain on the basis of the possibility of com-

bining the appropriate input transactions and exam-

ined how the share of a particular number of ”mixins”

in the transactions is distributed. The main assump-

tions of Monero cryptocurrencies were described and

the principle of operation of implemented technolo-

gies aimed at ensuring security and privacy of trans-

actions was presented. The results of available re-

search on the possibilities of combining ”inputs” of

transactions, based on the analysis of data recorded

in Blockchain, where presented. An analysis of the

share of a particular number of mixins in transactions

was also conducted. In order to verify the changes

introduced thanks to subsequent updates and check-

ing whether currently transactions in Monero are free

from the problem of combining ”inputs” based on the

analysis of transaction history, studies have been car-

ried out that between April 15, 2017 and October 12,

2018, it was tracked between 0.49% and 1.81% of

”inputs” in the transaction. It follows that the initial

problems caused by the large share of the ”0-mixins”

transaction were offset by subsequent updates and the

minimum size requirements of the ”Ring Signature”.

Summing up, after the latest network update, research

has shown that you can not combine ”inputs” with

transactions, i.e. the problem is resolved and Monero

transactions can be considered safe and impossible to

track down using this issue. The analysis of the exist-

ing sizes of ”Ring Signature” in transactions in sub-

sequent versions of the Monero network has proven

that the minimum required size for a given version is

most often used, and individual transactions with rare

values, can potentially lead to the creation of a user

profile, and this means identifying his transaction, e.g.

based on the time it was made. The conducted anal-

ysis showed that the latest update unified the size of

the ”Ring Signature”.

ACKNOWLEDGEMENTS

This work was partially supported by the European

Union’s Horizon 2020 research and innovation pro-

gramme under the Marie Sklodowska-Curie grant

agreement No. 691152 (RENOIR) and the Pol-

ish Ministry of Science and Higher Education fund

for supporting internationally co-financed projects in

2016-2019 (agreement no. 3628/H2020/2016/2).

Practical Analysis of Traceability Problem in Monero’s Blockchain

267

REFERENCES

Alonso, K. M. (2018). Monero-privacy in the blockchain.

Universitat Oberta de Catalunya.

Biryukov, A. and Pustogarov, I. (2015). Bitcoin over tor

isn’t a good idea. In 2015 IEEE Symposium on Secu-

rity and Privacy. IEEE.

Courtois, N. T. (2016). Stealth address, ring signatures,

monero. University College London, UK.

Kedziora, M., Kozlowski, P., Szczepanik, M., and Jozwiak,

P. (2019). Analysis of blockchain selfish mining at-

tacks. In International Conference on Information

Systems Architecture and Technology, pages 231–240.

Springer.

Kumar, A. et al. (2017). A traceability analysis of monero’s

blockchain. In European Symposium on Research in

Computer Security. , Cham.

Li, X. et al. (2017). A survey on the security of blockchain

systems. Future Generation Computer Systems.

Maurer, F. K. (2016). A survey on approaches to anonymity

in bitcoin and other cryptocurrencies. Informatik,

2016.

Mell, P. (2018). Managed blockchain based cryptocur-

rencies with consensus enforced rules and trans-

parency. In the IEEE International Conference

On Trust, Security And Privacy In Computing And

Communications/12th IEEE International Confer-

ence On Big Data Science And Engineering (Trust-

Com/BigDataSE). IEEE, volume 2018, page 17.

Mercer, R. (2016). Privacy on the blockchain: Unique ring

signatures. preprint, arXiv.

Moser, M. et al. (2018). An empirical analysis of traceabil-

ity in the monero blockchain. Proceedings on Privacy

Enhancing Technologies, 2018(3):143–163.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic

cash system. www.cryptovest.co.uk.

Noether, S. (2014). Review of CryptoNote white paper. HY-

PERLINK” cc/downloads/whitepaper review. pdf”.

Noether, S. and Noether, S. (2014). Monero is not that mys-

terious. Technical report, Monero Research Lab.

Noether, S., Noether, S., and Mackenzie, A. (2014). A note

on chain reactions in traceability in cryptonote 2.0.

Research Bulletin MRL-000, 1:1–8.

Van Saberhagen, N. (2013). Cryptonote v 2.0. Whitepaper.

Wijaya, D. A. et al. (2016). Anonymizing bitcoin trans-

action. In International Conference on Information

Security Practice and Experience. , Cham.

Wijaya, D. A. et al. (2018). Monero ring attack: Recre-

ating zero mixin transaction effect. In IEEE Inter-

national Conference On Trust, Security And Privacy

In Computing And Communications/12th IEEE Inter-

national Conference On Big Data Science And Engi-

neering (TrustCom/BigDataSE). IEEE, volume 2018,

page 17.

ENASE 2020 - 15th International Conference on Evaluation of Novel Approaches to Software Engineering

268