Investigation of Day-ahead Price Forecasting Models in the Finnish

Electricity Market

Daniel Zaroni

1

, Arthur Piazzi

2

, Tam

´

as Tettamanti

2

and

´

Ad

´

am Sleisz

1

1

Department of Electric Power Engineering, Budapest University of Technology and Economics, Budapest, Hungary

2

Department of Control for Transportation and Vehicle Systems, Budapest University of Technology and Economics,

Budapest, Hungary

Keywords:

Electricity Price Forecasting, Day-ahead Market, Neural Networks.

Abstract:

The electricity market is a rather complex market and the prices depend on several different factors. The price

dynamics are bound to get even more volatile, with a stronger integration between European electricity markets

and the increasing share of renewable energy sources. Therefore, the development of accurate electricity price

forecasting methods has increasing importance in the field. This paper investigates the performance of several

deep learning models for the Finnish electricity market. The investigation comprehends different architectures

types, data aggregation schemes as well as pre-training method. In this manner, this work does not only

presents new forecasting methods but also gives valuable comparison between approaches.

1 INTRODUCTION

Electricity is a fundamental commodity and price for-

mation is an extremely complex process. The dy-

namics of electricity trading have quite unique fea-

tures: the balance between production and consump-

tion must be constant at all times and, at the same

time, both the load and generation are influenced by

external factors (e.g. time of the day, time of the year,

weather conditions) and, finally, all those changes in-

fluence and are influenced by neighboring markets,

especially in the European Electricity market. Where

the increasing number of player participating in the

market increases the complexity of price formation.

Another strongly influencing factor is the increasing

penetration of renewable energy sources into the grid.

The rising of renewables leads to a stronger depen-

dency on weather conditions and, in consequence, the

prices become even more volatile and harder to pre-

dict (Weron, 2007).

In this scenario, high and sudden peak prices can

occur and can lead to a change in the behavior of

different market agents. Due to the aforementioned

unpredictability of generation and consumption, the

imbalance increases and the grid can become unsta-

ble. In order to address this issue, electricity price

forecasting (EPF) has become an important asset in

the energy sector. By studying and developing robust

models with high accuracy, it is possible to reduce this

uncertainty and the problems that come with it.

Additionally, it can be seen already an increasing

level of integration between different regions. The

so-called market integration also has its influence on

the price dynamics and, even though some researchers

studied the level of integration between regional mar-

kets(Bunn and Gianfreda, 2010; Zachmann, 2008),

there are only a few papers that analyze the influ-

ence of neighboring markets on the predictive accu-

racy of forecasting models (Ziel et al., 2015; Lago

et al., 2018; Panapakidis and Dagoumas, 2016).

The contributions of this paper are threefold:

• Proposing new forecasting models for Day-Ahead

Electricity Prices.

• Analyzing the influence of neighboring markets in

price forecast.

• Investigating different data aggregation schemes.

The remainder of this paper is divided as follows: lit-

erature review, methodology, results, conclusion and

recommendation for further research.

2 BACKGROUND

In this section, Electricity Price Forecasting tech-

niques are briefly discussed and the importance of

considering market integration is explained.

Zaroni, D., Piazzi, A., Tettamanti, T. and Sleisz, Á.

Investigation of Day-ahead Price Forecasting Models in the Finnish Electricity Market.

DOI: 10.5220/0009140908290835

In Proceedings of the 12th International Conference on Agents and Artificial Intelligence (ICAART 2020) - Volume 2, pages 829-835

ISBN: 978-989-758-395-7; ISSN: 2184-433X

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

829

2.1 Electricity Price Forecasting

The EPF literature varies when it comes to estab-

lishing the existing methods, however, a widely ac-

cepted definition was proposed by Weron (Weron,

2014), which divides EPF techniques into five areas:

(i) game theory models, (ii) fundamental methods,

(iii) reduced-form models, (iv) statistical models, and

(v) machine learning methods.

Statistical approaches and machine learning meth-

ods have shown to yield the best results for short-

term forecasting, hence, they are the most widely used

techniques for this purpose. Moreover, hybrid models

can be derived from the combination of different ap-

proaches and, therefore, they are not fully inserted in

only one area, but can generate robust models as well.

Finally, for non-linear modeling, e.g. price dynamics

in a short-term electricity market, statistical models

do not perform so well when compared to artificial

intelligence techniques (Ventosa et al., 2005).

Although there are more complex architectures

for modeling this type of problem, feed-forward net-

works can be used to predict the prices (Catal

˜

ao et al.,

2007). Another approach is to combine different tech-

niques, i.e. hybrid models, and compare them to sim-

pler architectures, as it was done by (Rodriguez and

Anders, 2004) and (Shafie-Khah et al., 2011).

Finally, when building a time-dependent model,

such as the electricity price behavior throughout the

days, Recurrent Neural Networks (RNN) might be a

good asset to better represent the rapidly changing

price dynamics. Ugurlu et al. (Ugurlu et al., 2018)

modeled the Turkish day-ahead market using the two

most prominent RNN architectures: LSTM and GRU.

A single European market is still far from being

implemented, however, increasing levels of integra-

tion can be seen across different regional markets. De

Menezes et al. (de Menezes and Houllier, 2016), for

example, shared evidence showing that spot prices of

Belgium and France have strong similar dynamics.

The European Union is trying to implement a

larger level of integration across Europe, therefore,

neighboring countries might play a role in the price

dynamics of a bidding area, which could influence the

robustness of a forecasting model that takes this novel

factor into consideration (Jamasb and Pollitt, 2005).

Even though the literature evaluating the level of in-

tegration of different regional markets has been done

several times, studies analyzing the effects of market

integration into the prediction accuracy of forecasting

models are rather insufficient yet.

Panapakidis et al. (Panapakidis and Dagoumas,

2016) built a neural network-based model to predict

Italian day-ahead prices considering external price

forecasts as exogenous inputs. The authors tested sole

applications of ANNs, but also hybrid models, where

the ANN was combined with clustering algorithms.

Ziel et al. (Ziel et al., 2015) used day-ahead prices

of the Energy Exchange Austria (EXAA) to predict

the prices of other European markets on the same

day. The clearing prices of EXAA are released before

other European markets, so it was possible to model

the price dynamics of other markets while considering

EXAA prices of the same day as one of the inputs. It

was shown statistical improvements in the forecasting

for some markets that included this information on the

model.

Jesus Lago et al. (Lago et al., 2018) considered

the Belgium electricity market to forecast the prices

while using various French electricity features. They

investigated the market integration influence using a

feed-forward neural network and proposed two differ-

ent methods to incorporate the integration of the mar-

kets. The first method is a deep neural network that

takes into account features from connected markets,

aiming to reduce the prediction error in a local mar-

ket. A second model was presented, predicting prices

from two markets simultaneously, which showed sta-

tistical improvements in the model accuracy.

3 METHODOLOGY

In this section, the individual components and con-

cepts which support this work are explained.

3.1 Data Set and Input Definitions

The Nordic electricity market, also known as Nord

Pool, is a power market dedicated to the electrical

products. It was established in 1992, and by the

time of its conception, included some Nordic coun-

tries such as Norway, Sweden, Denmark and Finland

(Souhir et al., 2019). Today it trades in 15 European

countries. Nord Pool’s website

1

makes data avail-

able for each country and region (for countries with

more than one bidding area) participating in the mar-

ket. Finland was chosen as the study subject among

the participants of the Nordic market.

Three years of data were considered for this study,

ranging from 01/01/2016 to 31/12/2018. Moreover,

an hourly resolution was used, since the day-ahead

prices are commercialized in this resolution. Finally,

based on the literature (Lago et al., 2018), two days

of past price data was used.

1

https://www.nordpoolgroup.com

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

830

Among the available data, the following list enumer-

ates the variables and the motivation behind the selec-

tion of that specific information for this study.

• Electricity Prices (

¯

X

Price

): Electricity price is the

target variable of the study, therefore, historic

price values were naturally considered as inputs

for the models.

• Generation (

¯

X

Generation

) and Consumption

(

¯

X

Consumption

) Day-ahead forecasts: Through the

bidding process, supply and demand actively

influence the prices. For this reason, values of

generation and consumption were considered.

• Electricity Prices from the United Kingdom

¯

P

UK

:

Even though Nord Pool also runs the UK market,

this is an external market. The reason for using

UK prices is to analyze the changes in the accu-

racy of our forecasting model when considering

input information from external markets.

3.2 Architectures

Neural network-based models present themselves as

a benchmark in several forecasting tasks. In the elec-

tricity market, this trend is no different. Consider-

ing all possible architectures types, sizes, input defini-

tions schemes and other variations, there is almost an

infinite number of possible models. In this work, ar-

chitecture wise, the investigation is limited into three

types. The first being the standard Feedforward Neu-

ral Network (FNN) (Singhal and Swarup, 2011).

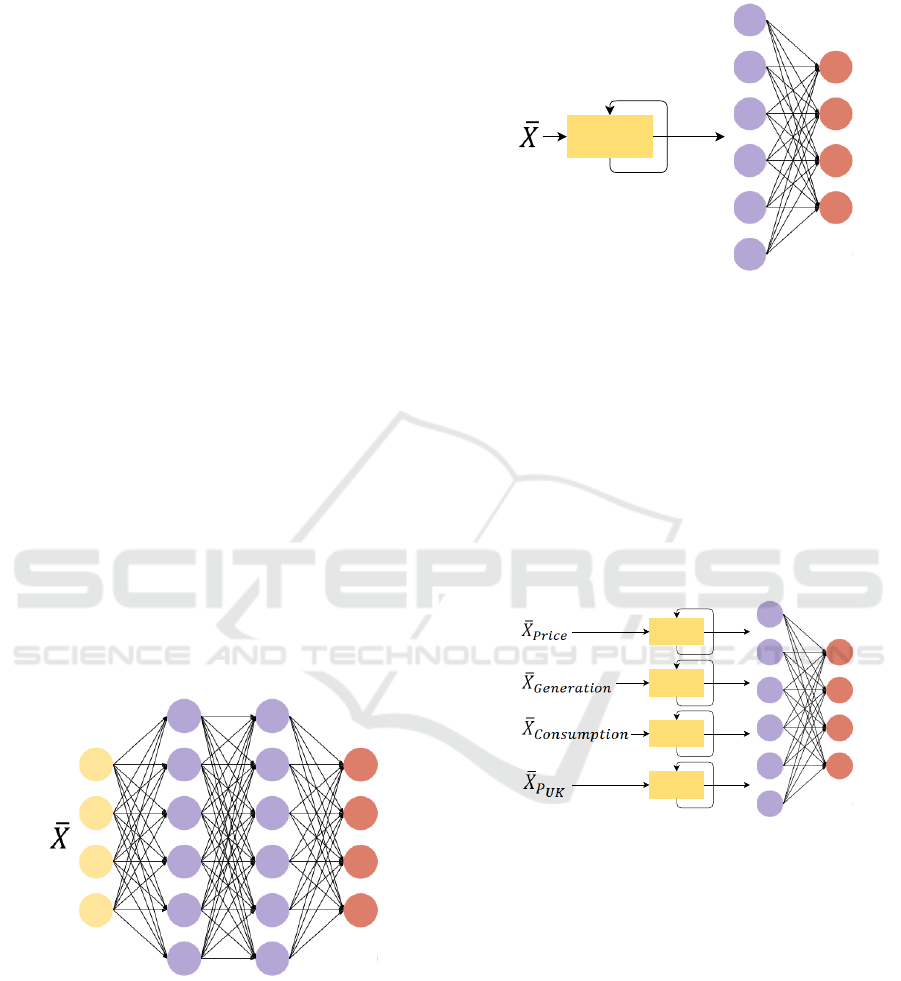

Figure 1: Example of a FNN architecture.

Secondly, Long Short-Term Memory (LSTM) a type

of recurrent network, originally designed to explicitly

capture temporal dependencies, was also investigated.

Since this type of network is especially suitable for

time series, it is a natural candidate for the task, as

done by (Kong et al., 2017) and (Peng et al., 2018).

The traditional LSTM architecture aggregates the

data in the input level, requiring all inputs to refer to

the same time period, as shown in Fig. 2.

LSTM

Figure 2: LSTM with input level concatenation scheme.

It is worth mentioning that the prognoses for gener-

ation and consumption for the following day of the

day-ahead market are available before the bid dead-

line. Therefore, they could be used for the forecast-

ing model, while the prices cannot. To support inputs

with different sequence lengths and time stamps con-

catenation in the hidden layer level was proposed as

shown in Fig. 3. Which consist of the utilization of

independent LSTM layers for each data type, the out-

put of these layers are then stacked to create the input

for the next hidden layer.

LSTM

LSTM

LSTM

LSTM

Figure 3: LSTM with hidden layer level concatenation

scheme.

Some authors criticize the employment of LSTM for

fast-changing system, pointing out the internal states

of the network can linger and therefore slow down

the output of the model (Lu and Salem, 2017). A

common approach to tackle this problem is the em-

ployment of Convolution Neural Networks (CNN),

for time series as done by (Bai et al., 2018) and (Zahid

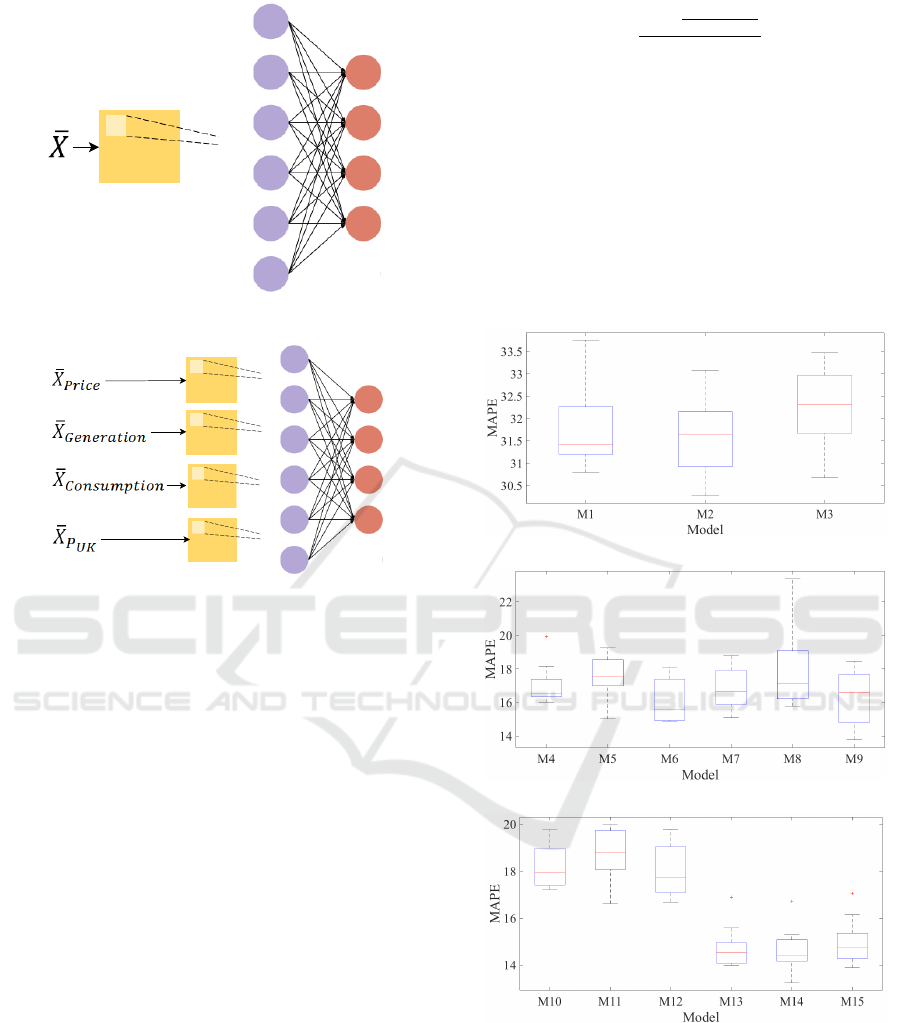

et al., 2019). Traditional CNN suffers from the same

rigidity of the LSTM, therefore, the same concatena-

tion schemes were implemented, as presented in Fig.

4 and Fig. 5. In this work, one-dimensional CNN was

adopted.

Two more variations were investigated. The first

being the inclusion of UK prices in the forecasting

Investigation of Day-ahead Price Forecasting Models in the Finnish Electricity Market

831

...

Figure 4: CNN with input level concatenation scheme.

...

...

...

...

Figure 5: CNN with hidden layer level concatenation

scheme.

model. Lastly, a pre-training process was also ex-

plored. It consists of firstly training the models with

system data, hoping that the overall behavior of the

system and of a specific country share similar pat-

terns. The system price is an unconstrained market

clearing reference price for the Nordic region cal-

culated without any congestion restrictions. System

generation and consumption is the summation of all

individual regions. After that, the model is fine-tuned

with the original data from Finland.

Several models were trained based on a combina-

tion of the components and concepts explained above.

Table 1 summarizes all 15 models tested for this pa-

per.

4 NUMERICAL RESULTS

In this section, the numerical results obtained by

the aforementioned models are presented. The

performance of the systems is shows in terms of the

Mean Absolute Percentage Error (MAPE). MAPE

was calculated according equation (1), where Pred

i

are the prediction values over the test dataset, Act

i

are

the actual values and N is the size of the test set.

MAPE =

∑

N

i=1

|Pred

i

−Act

i

|

Act

i

N

× 100 (1)

Since the training process of deep learning models is

inheritably stochastic, the outcome of a single train-

ing is not reliable. More robust and meaningful re-

sults can be obtained with 10-Fold Cross-Validation

(Kohavi et al., 1995). Altogether, 150 trainings were

performed to evaluate the 15 proposed models. Due

to the high number of models involved in this investi-

gation, the MAPE values will be presented separately

in 3 graphs, grouped by the basic architecture type.

Fig. 6 shows the dispersion of results in a box-plot

manner.

(a)

(b)

(c)

Figure 6: Box-plot of the Mean Absolute Percentage Er-

ror: (a) FNN-based models, (b) LSTM-based models and

(c) CNN-based models.

The results confirm the intuition that FNN-based

models, Fig. 6a, perform the worst since they pose

a simpler architecture. Also, as it was expected, feed-

ing extra information for models with simpler archi-

tectures such as FNN did not lead to improvements,

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

832

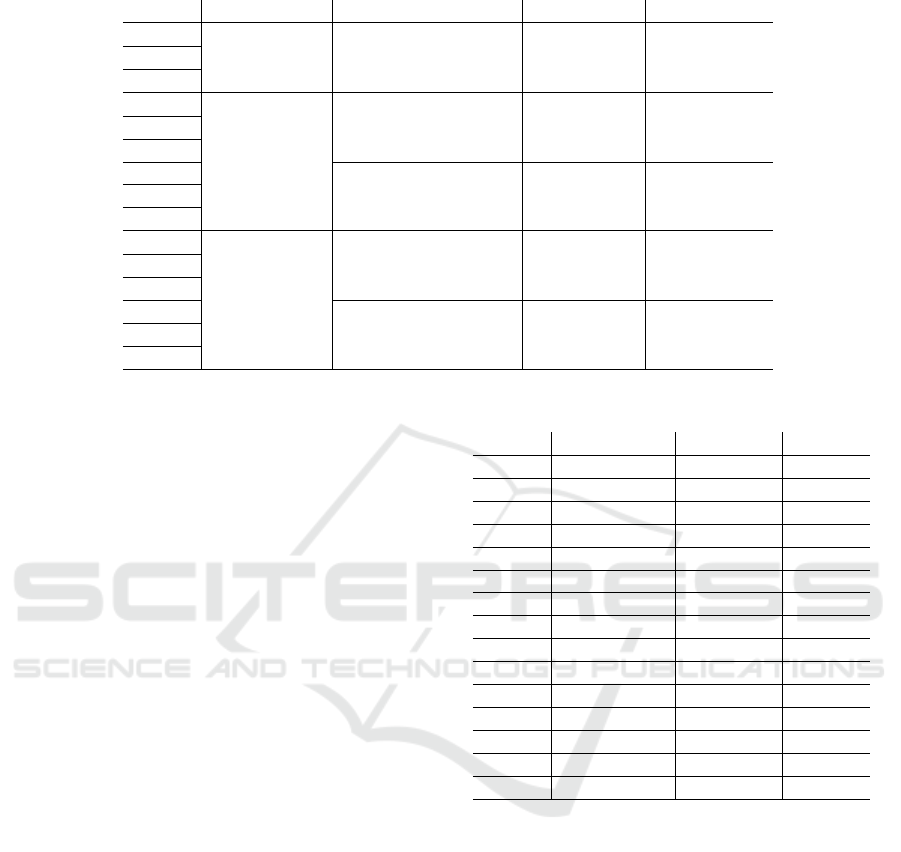

Table 1: Models Summary.

Model Architecture Concatenation type Inputs Pre training

M1

ANN

P No

M2 Input level P, G, C No

M3 P, G, C, P

UK

No

M4

LSTM

P, G, C No

M5 Input level P, G, C, P

UK

No

M6 P, G, C, P

UK

Yes

M7 P, G, C No

M8 Hidden layer level P, G, C, P

UK

No

M9 P, G, C, P

UK

Yes

M10

CNN

P, G, C No

M11 Input level P, G, C, P

UK

No

M12 P, G, C, P

UK

Yes

M13 P, G, C No

M14 Hidden layer level P, G, C, P

UK

No

M15 P, G, C, P

UK

Yes

but actually worsened the accuracy of the M2 and

M3 when compared with M1. They present values of

MAPE above 30% and, therefore, can be considered

unsatisfactory.

Fig.6b shows the achieved results for the LSTM-

Based models. Even though model M9 obtained the

minimum value, M6 was the best model for this ar-

chitecture, presenting more consistent results.

Regarding the input concatenation (Input level:

[M4 M5 M6], Hidden layer level: [M7 M8 M9]),

it does not contributed for model accuracy, showing

similar results by the model counterparts (e.g. M4

⇔M7), however, a lesser dispersion can be identified

in models where the concatenation was realized in the

input level. The adoption of the pre-training process

was successful, enhancing the performance in both

cases (M5 ⇔ M6 and M8 ⇔ M9)

The results for the approaches based in convolu-

tional networks are found in Fig.??. The best per-

forming model in this group was the M14, achiev-

ing 14.61 % of average MAPE. In fact, M14 outper-

formed all methods investigated in this work. For

CNN models, the variation which contributed the

most was the concatenation type. Aggregation in the

hidden layer level enhanced substantially the outcome

of prediction for all cases. The influence of the pre-

training in this group was inconclusive. On the one

hand, it benefited model M12, on the other hand, it

slightly worsen model M15. Table 2 shows the nu-

merical results for a more concise evaluation.

Overall CNN-based methods outperformed the

other architectures tested. Although the best LSTM

and CNN models (M9 and M14, respectively) em-

ployed UK prices, it is not fair to assume that us-

ing external market prices will always represent im-

Table 2: Numerical results.

Model Median [%] Mean [%] Std [%]

M1 31.42 31.80 0.88

M2 31.63 31.60 0.91

M3 32.30 32.20 0.87

M4 16.56 17.06 1.19

M5 17.51 17.43 1.27

M6 15.61 16.09 1.27

M7 16.65 16.89 1.32

M8 17.13 17.83 2.32

M9 16.61 16.25 1.72

M10 17.93 18.23 0.91

M11 18.79 18.66 1.25

M12 17.73 18.03 1.08

M13 14.53 14.76 0.90

M14 14.42 14.61 0.96

M15 14.75 15.00 0.95

provements in accuracy, since a loss in performance

could been observed in other models using this in-

formation. Therefore, further investigation is highly

recommended.

5 CONCLUSION AND FUTURE

WORK

In this paper a plethora of different deep models was

investigated for electricity price forecasting of the

Finnish day-ahead market. Three different architec-

tures were explored, namely FNN, LSTM and CNN.

For the three architecture types, price information of

an external market was included as a way to examine

the influence of a market not directly connected to the

Investigation of Day-ahead Price Forecasting Models in the Finnish Electricity Market

833

one under analysis.

Additionally, for LSTM and CNN architectures

two different concatenation schemes and a pre-

training process was also implemented. Overall, 15

models were tested and the results indicated promis-

ing architecture schemes for price prediction, as well

as the importance of developing more complex archi-

tectures when dealing with such a volatile informa-

tion. The one-dimensional CNN showed the best re-

sults among all models and, therefore, it is the recom-

mended architecture for further research within this

task.

Suggestions for future work include:

• Testing and validating the results of the best per-

forming models with larger data sets and with

more inputs related to the price dynamic of the

Nordic market.

• Adding information of neighboring internal bid-

ding areas to assess the transmission bottlenecks

present around Finland.

• Considering external markets that are directly

connected to the examined country in order to

improve the predictive accuracy of the proposed

models.

ACKNOWLEDGEMENTS

The research was supported by the Hungarian Gov-

ernment and co-financed by the European Social

Fund through the project ”Talent management in

autonomous vehicle control technologies” (EFOP-

3.6.3-VEKOP-16-2017-00001).

REFERENCES

Bai, S., Kolter, J. Z., and Koltun, V. (2018). An em-

pirical evaluation of generic convolutional and recur-

rent networks for sequence modeling. arXiv preprint

arXiv:1803.01271.

Bunn, D. W. and Gianfreda, A. (2010). Integration and

shock transmissions across european electricity for-

ward markets. Energy Economics, 32(2):278–291.

Catal

˜

ao, J. P. d. S., Mariano, S. J. P. S., Mendes, V.,

and Ferreira, L. (2007). Short-term electricity prices

forecasting in a competitive market: A neural net-

work approach. Electric Power Systems Research,

77(10):1297–1304.

de Menezes, L. M. and Houllier, M. A. (2016). Reassess-

ing the integration of european electricity markets: A

fractional cointegration analysis. Energy Economics,

53:132–150.

Jamasb, T. and Pollitt, M. (2005). Electricity market reform

in the european union: review of progress toward lib-

eralization & integration. The Energy Journal, pages

11–41.

Kohavi, R. et al. (1995). A study of cross-validation and

bootstrap for accuracy estimation and model selec-

tion. In Ijcai, volume 14, pages 1137–1145. Montreal,

Canada.

Kong, W., Dong, Z. Y., Jia, Y., Hill, D. J., Xu, Y., and

Zhang, Y. (2017). Short-term residential load fore-

casting based on lstm recurrent neural network. IEEE

Transactions on Smart Grid, 10(1):841–851.

Lago, J., De Ridder, F., Vrancx, P., and De Schutter, B.

(2018). Forecasting day-ahead electricity prices in eu-

rope: the importance of considering market integra-

tion. Applied Energy, 211:890–903.

Lu, Y. and Salem, F. M. (2017). Simplified gating in long

short-term memory (lstm) recurrent neural networks.

In 2017 IEEE 60th International Midwest Symposium

on Circuits and Systems (MWSCAS), pages 1601–

1604. IEEE.

Panapakidis, I. P. and Dagoumas, A. S. (2016). Day-ahead

electricity price forecasting via the application of arti-

ficial neural network based models. Applied Energy,

172:132–151.

Peng, L., Liu, S., Liu, R., and Wang, L. (2018). Effec-

tive long short-term memory with differential evolu-

tion algorithm for electricity price prediction. Energy,

162:1301–1314.

Rodriguez, C. P. and Anders, G. J. (2004). Energy price

forecasting in the ontario competitive power sys-

tem market. IEEE Transactions on power systems,

19(1):366–374.

Shafie-Khah, M., Moghaddam, M. P., and Sheikh-El-

Eslami, M. (2011). Price forecasting of day-ahead

electricity markets using a hybrid forecast method.

Energy Conversion and Management, 52(5):2165–

2169.

Singhal, D. and Swarup, K. (2011). Electricity price

forecasting using artificial neural networks. Interna-

tional Journal of Electrical Power & Energy Systems,

33(3):550–555.

Souhir, B. A., Heni, B., and Lotfi, B. (2019). Price risk

and hedging strategies in nord pool electricity mar-

ket evidence with sector indexes. Energy Economics,

80:635–655.

Ugurlu, U., Oksuz, I., and Tas, O. (2018). Electricity price

forecasting using recurrent neural networks. Energies,

11(5):1255.

Ventosa, M., Baıllo, A., Ramos, A., and Rivier, M. (2005).

Electricity market modeling trends. Energy policy,

33(7):897–913.

Weron, R. (2007). Modeling and forecasting electricity

loads and prices: A statistical approach, volume 403.

John Wiley & Sons.

Weron, R. (2014). Electricity price forecasting: A review

of the state-of-the-art with a look into the future. In-

ternational journal of forecasting, 30(4):1030–1081.

Zachmann, G. (2008). Electricity wholesale market prices

in europe: Convergence? Energy Economics,

30(4):1659–1671.

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

834

Zahid, M., Ahmed, F., Javaid, N., Abbasi, R. A., Kazmi, Z.,

Syeda, H., Javaid, A., Bilal, M., Akbar, M., and Ilahi,

M. (2019). Electricity price and load forecasting using

enhanced convolutional neural network and enhanced

support vector regression in smart grids. Electronics,

8(2):122.

Ziel, F., Steinert, R., and Husmann, S. (2015). Forecast-

ing day ahead electricity spot prices: The impact of

the exaa to other european electricity markets. Energy

Economics, 51:430–444.

Investigation of Day-ahead Price Forecasting Models in the Finnish Electricity Market

835