A Fuzzy Cognitive Map Approach to Investigate the Sustainability of

the Social Security System in Jordan

George Sammour

1a

, Ahmad Alghzawi

2

and Koen Vanhoof

2b

1

Business Technology Department, Princess Sumaya University for Technology, Amman, Jordan

2

Department of Business Informatics, Hasselt University, Hasselt, Belgium

Keywords: Fuzzy Cognitive Maps, Time Series Prediction, Economic Modelling, Social Security System.

Abstract: Fuzzy Cognitive Maps are emerging as an important new tool in economic modelling. The aim of this study

is to investigates the use of fuzzy cognitive maps with their learning algorithms, based on genetic algorithms,

for the purposes of prediction of economic sustainability. A Case study data are extracted from the Jordanian

Social Security system for the last 120 months; The Real-Code genetic algorithm and structure optimization

algorithm were chosen for their ability to select the most significant relationships between the concepts and

to predict future development of the Jordanian social security revenues and expenses. The study shows that

fuzzy cognitive maps models clearly predict the future of a complex financial system with incoming and

outgoing flows. Therefore, this research confirms the benefits of fuzzy cognitive maps applications as a tool

for scholarly researchers, economists and policy makers.

1 INTRODUCTION

The Social Security is a package of social insurances,

where each insurance defines and meets the citizens’

needs in accordance with a legislation outlining the

obligations and rights, and sets up a balance between

them. Accordingly, Social Security is a general

insurance symbiotic system aims to protect people

socially and economically where the law defines its

benefits and funding sources; the government,

through institutions or bodies established under this

system, achieves these benefits in case of any social

risk such as old-age, disability, death, work injuries,

and unemployment. Such benefits are financed by

contributions paid by insured persons and employers.

This system is interested in the achievement of social

competency considerations.

Social security systems all over the world face

financial problems. This phenomenon has a number

of reasons like underfinancing, unclear and too lavish

rules to benefit from them and insufficient control.

Pension systems more specifically also suffer from a

growing number of beneficiaries giving the increased

life expectancy in many countries due to better

medical conditions and improved life styles. As a

a

https://orcid.org/0000-0001-5080-8292

b

https://orcid.org/0000-0001-7084-4223

result, governments struggle with the development of

social security systems, more specifically pension

systems that are sustainable over a longer period.

The construct of an optimal pension system

should be based on data available. However, there

are limited research addressing the issue of

sustainable social security and pension systems. The

data available on any of these social security systems

are vast, relatively complicated and cover many

different variables like age, gender, family

composition, average of salary, years of contribution,

eventual reduction systems and so on. As a result,

scientific analysis of the sustainability of a social

security system, in particular a pension system needs

very specific data analysis methods.

Fuzzy Cognitive Maps (FCMs) have been

developed as a knowledge-based tool to model and

analyze complex systems using causal relations

(Kosko, 1986). From the structural perspective, an

FCM can be defined as a fuzzy digraph that describes

the underlying behavior of an intelligent system in

terms of concepts (objects, states, variables or

entities) and causal relations. Essentially, FCMs are a

kind of recurrent neural networks that support

backward connections that sometimes form cycles in

Sammour, G., Alghzawi, A. and Vanhoof, K.

A Fuzzy Cognitive Map Approach to Investigate the Sustainability of the Social Security System in Jordan.

DOI: 10.5220/0009128304810489

In Proceedings of the 22nd International Conference on Enterprise Information Systems (ICEIS 2020) - Volume 1, pages 481-489

ISBN: 978-989-758-423-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

481

the causal graph (Tsadiras, 2008). This implies that

concepts in the information network can be

understood as neural processing entities with

inference capabilities

The objectives of this research is to investigate

the sustainability of the Jordanian Social Security

(JSS) system, as a case study, using FCMs with time

series as a predictive method. This will be achieved

by predicting the revenues and expense using real

time series data extracted from the JSS system.

2 LITERATURE REVIEW AND

RESEARCH MOTIVATION

Among earlier studies on the field of retirement is the

study of Sala and Xavier (1996), the study considered

the theory of social security. The author argued that

programs of social security around the world connect

public pensions to retirement. For example,

individuals do not lose their pensions if they make a

million dollars a year in the stock market, but they do

face marginal tax rates of up to 100 % if they decide

to work. In that context, the study constructed a

positive theory that is compatible to resolve such

issues. Furthermore, the study concluded that when

the difference between the level of skill of the young

and that of the old is big enough, total output in an

economy where the old-aged do not work is higher.

Thomas and Soares (1999), analysed the welfare

implications of the social security system and

compared overall equilibrium measures of welfare to

the commonly used notion of actuarial fairness. The

study revealed that social security has a considerable

impact in the extent of the capital stock and the rate

of return to private saving.

In many cases some retired people have to get

back to the Labour field, that depends on many

reasons among which the work on the informal work,

which does not provide the pension according to the

conditions of work (ILO, 2014). In support of this

issue, the International Labour Organization (ILO)

(2014) published a report “Social protection for older

persons: Key policy trends and statistics”. The report,

included 178 (including Jordan) countries, revealed

that in many countries with high percent of informal

employment, only minority of people can access

pensions, and many older people can count only on

family support. The report also concluded that, nearly

half (48 %) of all people over pensionable age do not

obtain a pension. Many of those who obtains a

pension, the level of income is not adequate. Thus, the

majority of the world's older people have no income

security, have no right to retire and have to work as

long as they are able to and often badly paid and in

insecure conditions.

In the context of Jordan, Alhawarin (2014) studied

the issue of getting back to the Labour field. The

author collected data from about 5000 households

containing about 6000 individuals. The study

revealed that nearly 85% of male retirees had retired

early, and about 45% of them got back to the labour

market and took jobs, which were characterized, to

some extent by informality. Economically active

early retired persons; however, seem to suffer from

high unemployment rates, particularly those who

retire from the private sector. The results of analysis

showed that individuals retired from the Jordanian

armed forces were more probably to retire early and

to get back to labor market. Whereas the household

wealth appears to affect the probability of early

retirement, family size has a positive effect.

Mohammed and Najim (2014) conducted a study

aimed at identifying the influence of the services

provided by the Public Institutions for JSS at the level

of satisfaction on the work of the institution in the city

of Amman. The study found that the level of services

of public institutions and the level of satisfaction for

Social Security. The outcomes also found a

statistically significant effect of the services on the

level of satisfaction with the work of the institution.

In their study, Enoff and McKinnon (2011) aimed to

promote sharing of knowledge and good practice on

contribution collection and the compulsion of

compliance. The data proposes that seven core factors

unite often to form the basis of success in contribution

collection and consent. Additionally the improvement

of benefit adequacy and public standing of programs

and the financial health, such success may support

both national and international efforts to expand

social protection coverage.

Early retirement is an important factor that affects

the sustainability of social security systems. Fenge

and Pestieau (2005) investigated theoretical and

empirical evidence, which explains why early

retirement became such a burden for systems of social

security and suggested pension system reforms,

which will reverse the trend. The study used evidence

from the European Union (compared with other

industrialized countries including Canada and the

United States). The study showed that the effective

retirement age is impacted by social security

regulations (as a change in eligibility age) and

discussed ways of measuring those embedded

stimulus. Furthermore, pushing older workers to

retire does not free jobs for young unemployed

individuals. Finally, the study concluded that the gap

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

482

between productivity and salaries is a stimulus for

employers to release themselves from older workers

and claim that governments must not support this

behavior by recompensing the elderly workers for the

difference between salaries and severance payments

in early retirement programs.

In their study, Imrohoroğlu and Kitao (2012),

aimed to assess the efficacy of proposed Social

Security reforms and its influence on sustainability of

the US pension system. It was revealed that Social

Security reform to raise retirement ages could have a

large impact on the sustainability of the US pension

system through changes in life-cycle savings and

labor supply. In particular, labor force participation of

older workers and their benefit take-up behavior react

strongly to certain reforms. The study revealed that an

increase in the earliest retirement age would not have

any significant effect on the budget of the Social

Security system since the benefits will be

permanently raised by forcing individuals to postpone

retirement. The study suggested that policies that

encourage the participation and work effort of older

workers as well as individuals' own saving for

retirement could help enhance the sustainability of the

system.

A study conducted on Middle East and North

African (MENA) countries addressed the question of

removing deficits about equity, efficiency, and

financial sustainability and how the prospects are for

more profound reforms in the future. The study

revealed that the countries of MENA have hardly

conducted any noteworthy pension reforms in the

past and claim that this reluctance is because of

political considerations of the ruling regimes and to

the fact that most countries of MENA until now were

able to finance the deficits of their pension schemes

(Loewe, 2014). It was concluded, “The prospects of

reforms that go beyond simple changes in

contribution rates or pension formulas remain

bleak.”

Based on the above discussions, it is important

to note that most of the research conducted to

investigate the sustainability of social security

systems are based on questionnaires and statistically

analyze the collected data. Few researches used real

time series data to address the concern specifically

FCMs. The main advantage in the analysis of the use

of FCM’s is they incorporate learning algorithms,

which time series do not.

In recent years, the use of FCMs in time series

forecasting has been noticeable due to the

transparency of FCM-based models. For example,

the approaches proposed in Pedrycz (2010), Pedrycz

et al. (2016), Lu et al. (2014), and Froelich and

Pedrycz (2017) rely on fuzzy information granules to

forecast the time series with high accuracy. The

values of the learning part of the time series are

clustered, where the number of clusters is a user-

defined parameter, using the fuzzy 𝑐-means

algorithm (Bezdek et al., 1984). At each time

iteration, the value of the time series fits to each

cluster with some membership degree with

presumption that every cluster (i.e., concept) plays

the role of a fuzzy set. On the other hand, other

algorithms proposed a low-level approach where

neurons represent attributes instead of comprising

information granules (Froelich and Salmeron, 2014;

Poczęta and Yastrebov, 2015; Papageorgiou, et al.,

2015; Salmeron and Froelich, 2016). Nevertheless,

these methods suffer from the same drawback that is;

there is no guarantee that the produced weight set

encompasses a realistic interpretation for the system.

Even though the model is able to achieve good

prediction rates. Consequently, this implies that the

modelled system cannot be interpreted, although the

FCM reasoning is still transparent.

In this paper, we investigate this complex issue

using a real case study data extracted from the

Jordanian Social Security System (JSS). More

precisely, the contribution of this research is twofold.

On the one hand, a FCM-based system is developed

to forecast the social security revenues and expenses

in Jordan. This will allow experts to forecast the

revenues in next years and understand the underlying

behaviour behind such predictions. On the other hand,

to investigate the trade-off between interpretability

and accuracy of FCMs, as we include expert

knowledge to the system. To achieve this first, an

initial FCM will be developed without any

restrictions, and second, a FCM model will be

developed using knowledge coming from experts.

3 FUZZY COGNITIVE MAPS

Cognitive mapping has become a convenient

knowledge-based tool for modelling and simulation

(Kosko, 1986). FCMs can be thought of as recurrent

neural networks with learning capabilities, consisting

of concepts and weighted relations among them.

Concepts denote entities or variables, which are

equivalent to neurons in neural network models.

While weights associated to connections denote the

causality among such nodes or concepts. Each link

takes values in the range [−1, 1], denoting the

causality degree between two concepts because of

the quantification of a fuzzy linguistic variable,

which is often assigned by experts during the

A Fuzzy Cognitive Map Approach to Investigate the Sustainability of the Social Security System in Jordan

483

modeling phase (Nápoles, et al., 2016). The

activation value of neurons is also fuzzy in nature and

regularly takes values in the range [0, 1]. The higher

the activation value of a neuron, the stronger its

influence over the investigated system, offering

decision-makers an overall picture of the systems

behaviour.

Mathematically FCMs are used to demonstrate

and to model the knowledge on the examining system

in terms of concepts. It can be defined by using a 4-

tuple (𝐶, 𝑊, 𝐴, 𝑓) where 𝐶 = {𝐶1, 𝐶2, … , 𝐶𝑀}

denotes a set of 𝑀 neural processing entities, 𝑊: (𝐶𝑖,

𝐶𝑗) → 𝑤𝑖𝑗 is a function that associates a causal weight

𝑤𝑖𝑗 ∈ [−1,1] to each pair of neurons (𝐶𝑖, 𝐶𝑙).

Similarly, 𝐴: (𝐶𝑖) → 𝐴𝑖 is a function that associates

the activation degree 𝐴𝑖 ∈ ℝ to the 𝐶𝑖 neuron at each

iteration-step moment 𝑡 (𝑡 = 1,2, … , 𝑇). Finally, a

transformation function 𝑓: ℝ → [0,1] is used to keep

the neurons’ activation value in the allowed interval.

Equation (1) portrays the inference mechanism

attached to an FCM-based system, using the (0)

vector as the initial activation. This neural procedure

is repeated until either a fixed-point attractor is

discovered or a maximal number of iterations is

reached.

𝑨

𝒊

𝒕𝟏

𝒇𝒘

𝒋𝒊

𝑨

𝒋

𝒕

𝑴

𝒋

𝟏

𝒘

𝒊𝒊𝑨

𝒊

𝒕

,𝒊𝒋

(1)

The three most widely used threshold functions

are the bivalent function, the trivalent function, and

the sigmoid variants. Bivalent or trivalent are discrete

FCMs, which cannot properly represent the degree of

an increase or a decrease of a concept. Nevertheless,

since discrete FCM are deterministic models they can

always converge to a fixed-point attractor or limit

cycle. Thus, the number of distinct states is finite.

Continuous FCM (e.g. sigmoid FCM) on the other

hand are able to simulate numerical changes of the

activation value of concepts. They are consequently

recommended for both qualitative and quantitative

scenarios, as their prediction capability is much

higher than discrete FCM (Nápoles, et. al, 2016). The

increase of the numerical precision of predictions

however may also lead to fully chaotic behavior

offering no guarantee of convergence. Furthermore,

as reported by Bueno and Salmeron (2009), the

results revealed that the sigmoid function

outperformed other functions using the same decision

model. Consequently, the threshold function is a

crucial issue for the system behaviour and

performance. Therefore, in this research we will focus

on Sigmoid FCMs.

FCMs can be constructed either using the

knowledge coming from domain experts or using a

learning method. In the next sub-section, an

evolutionary procedure to derive the network

structure in a supervised fashion is described.

3.1 Fuzzy Cognitive Maps Learning

The literature indicates that, when forecasting using

time series, the use of the appropriate regression is of

the highest importance. Likewise, the use of the right

concepts in the FCM will influence the forecasting

accuracy of the models (Salmeron and Froelich,

2016). This signifies that the weight matrix

constructed in the FCM will be of the highest

importance when obtaining forecasting accuracy. The

learning process of the FCM itself or the opinion of

experts will be the most important factor in this

regard, resulting in an optimal weight matrix. The

reason is that FCMs derive their strength from their

simplicity. Thus, an expert opinion has to be present

to predict accurately.

Assume that Z(t) = [Z

1

(t), Z

2

(t), …, Z

N

(t)] is the

desired system response for the (𝑡−1) activation

vector, A(t) = [A

1

(t), A

2

(t), …, A

N

(t)] is the FCM

output for the (𝑡−1) initial vector, while 𝑇 is the

number of the learning records. Equation (2) displays

an error function used in the context of time series

forecasting, where 𝑊 represents the candidate

weight matrix, N is the number of neurons, while 𝑡

indexes the iteration steps (i.e., the learning records).

In short, this learning scheme attempt minimizing the

dissimilarity between the expected outputs and the

predicted ones.

𝐸𝑊

1

𝑇1

𝑛

𝑍

𝑡

𝑋

𝑡

(2)

In this supervised learning model, a continuous

search method (i.e., Particle Swarm Optimization,

Genetic Algorithms) generates the weights matrices

to be evaluated by the algorithm. Equation (3) shows

the structure of the weight set.

𝑊

𝑊

,

,…,𝑊

,

,𝑊

,

,…,𝑊

,

,…,𝑊

,

(3)

In this research, we adopt the Real-Coded

Genetic Algorithm (RCGA) as standard continuous

optimizer. The RCGA is an evolutionary search

method that codifies genes directly as real numbers

and can be used to optimize parametrical problems

for continuous variables (Herrera et. al, 1998).

Therefore, each chromosome involves a vector of

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

484

floating point numbers that involves a candidate

solution. The size of the chromosomes is identical to

the length of the vector, which is the solution to the

optimization problem. In this way, each gene

represents a variable of the problem, i.e. a weight

component. Genetic operators only have to observe

the fact that the values of the genes remain within the

interval established by the variables they represent.

Each chromosome in the population is evaluated

based on a fitness function according to the error

function. Because Genetic Algorithms are frequently

expressed like maximization-type problems, the

previous error function is expressed in terms of a

fitness function, which is formalizes as follows:

𝐹𝑊

1

𝑎∗𝐸𝑊1

(4)

Where 𝛼 > 0 is a user-specified parameter, 𝑊 is

the candidate weight set computed by the RCGA

optimizer, while (𝑊) is the error function. During the

optimization, parents are selected and new

population of chromosomes are generated with some

probability. In this research, we use the well-known

roulette wheel method as standard selection operator.

4 SUSTAINABILITY OF SOCIAL

SECURITY SYSTEM IN

JORDAN

The aim of this research is focused on predicting the

revenue and expense values and understanding the

underlying interrelation between concepts; the latter

is the main motivation to use cognitive mapping

models. To achieve that, we introduce a case study

case of forecasting social security revenues and

expenses in Jordan. The dataset used for analysis are

extracted from the JSS system, related to revenues

and expense in Jordan for the period of 120 months

(from 2006 until 2015). Each data set contains a set

of variable that contribute to the overall value (i.e.

revenues or expenses). The data set variables (map

concepts) for both revenues and expenses are listed in

Table 1.

Table 1: Revenues and Expenses Datasets.

Dataset Variables

Revenues

C1: Aging subscription

C2: Work related injuries

C3: Maternity insurance

C4: Years earlier service

C5: Optional Subscriptions

C6: Miscellaneous revenue

C7:Stamps

Expenses

C1: Pensions

C2: One time

C3: Work injuries

C4: Maternity insurance

Table 2 reports descriptive statistics about the

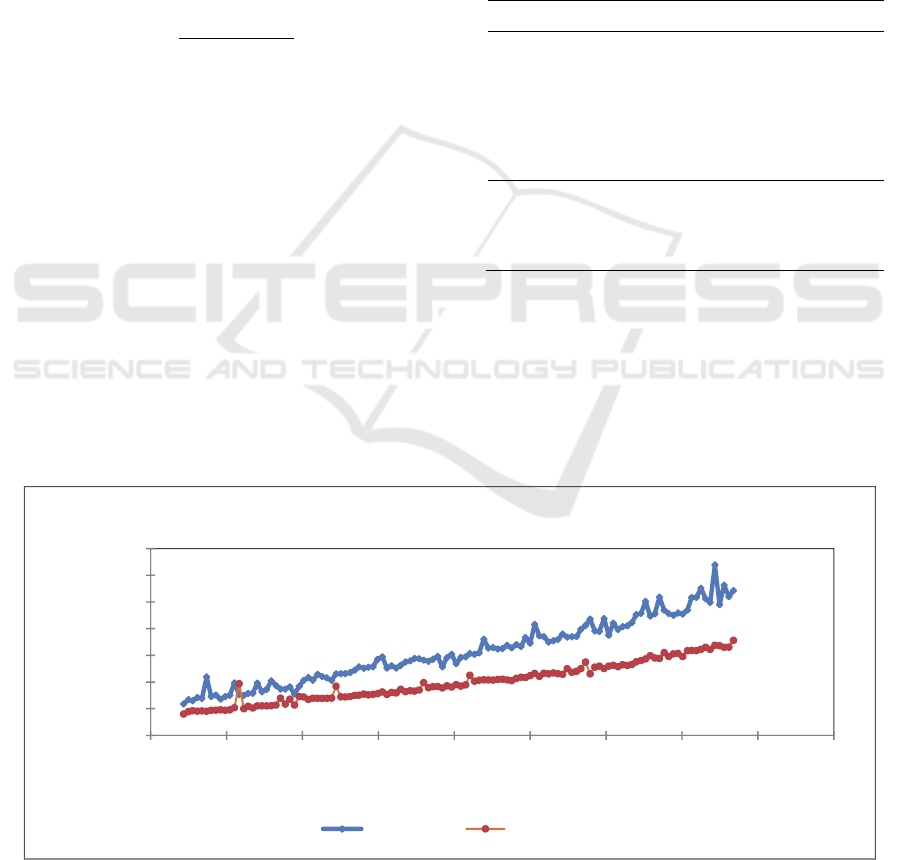

aggregated revenues and expenses and Figure 1

below depicts the trend of the aggregated revenues

and expenses. Over the past 120 months, the revenues

were higher than expenses, which implies that the JSS

is financially sustainable. Furthermore, the gap

between the trend lines of the revenues and expenses

has increased in recent months.

Figure 1: Observed revenues and expenses time series trend lines.

0

20000000

40000000

60000000

80000000

100000000

120000000

140000000

May‐05 Oct‐06 Feb‐08 Jul‐09 Nov‐10 Apr‐12 Aug‐13 Dec‐14 May‐16 Sep‐17

Jordanian Dinar (JOD)

month

RevenuesandExpensesTimeSeries

Revenues Expenses

A Fuzzy Cognitive Map Approach to Investigate the Sustainability of the Social Security System in Jordan

485

Table 2: Revenues and expenses descriptive statistics.

Variable Revenues Expenses

Observations 120 120

missing data 0 0

Minimum 23579730 16040461

Maximum 127734545 71242897

Mean 62829093 39864540

Std. deviation 23903670 14576539

In order to activate the neurons with values inside

the activation interval the data were normalized to the

[0,1] range using the min-max normalization method.

Furthermore, the datasets were randomly divided into

two disjoint subsets: the learning set (95%) and the

test set (5%). Aiming at evaluating the quality of the

FCM-base forecasting model, we adopt the Mean

squared Error (MSE).

Due to the stochastic nature of the heuristic

search methods, we perform 20 trials and average the

quality measures. Moreover, we use the following

parametric setting in all the simulations: 50

chromosomes as in the artificial population, 200

generations, the 𝛼 parameter is set to 10, the

crossover probability is set to 0.8, and the mutation

probability is set to 0.1, while the 𝐹𝑚𝑎𝑥 parameter is

set to 0.999. In addition, the models will be

experimented using two different configurations. In

the first one, genes can take values in the [-1, 1]

range, and this will be referred to as the unrestricted

model. Whereas, in the second configuration we

include expert knowledge related to the sign of

causal weights which be referred to as the restricted

model. For example, considering the revenues, the

longer an individual is subscribed with age (C1:

Aging subscription) the value of the optional

subscription (C5: Optional Subscriptions) will be

increased, which implies a positive casualty between

these two concepts. On the other hand, it is obvious

that the fewer the years an individual is subscribed

the lower

his optional subscription (i.e. there is a negative

casualty relation between C4: year’s early service

and C5: Optional subscription.

It is important to note that the goal is not to

increase performance but to preserve the coherence in

the causal cognitive network. Weights are freely

estimated in the [-1, 1] range which may actually

produce improved prediction rates due to the attached

freedom degree. However, there is no way to ensure

that weights produced by a heuristic search method

contains a causal meaning for the problem under

investigation. In the next sub-section, the results of

the FCM analysis for both configurations are

presented.

4.1 Analysis of the Results

Table 3 depicts the MSE error rates for the revenues

and expenses models. The average MSE of the test

set of the revenues model for the unrestricted model

are 0.0431, while for the restricted model, the

reported MSE is 0.1992. As for the expenses model,

the unrestricted model reported lower MSE measure

as well. As a result, one can note that promoting the

FCM interpretability leads to higher forecasting

errors. Thus, the question that arises here is that why

when attempting to promote the interpretability of

the FCMs leads to higher forecasting error, since in

principle, a neuron naturally produces a times series?

Table 3: Error rates of the revenues and expenses models

(restricted and unrestricted models).

Dataset

Configuration (Model

type)

MSE

Revenues

Unrestricted Model 0.0431

Restricted Model 0.1992

Expenses

Unrestricted Model 0.026

Restricted Model 0.064

To answer this question, we must take note of the

convergence properties of the causal network. In

most FCM-based systems, ensuring convergence is

mandatory, otherwise making reliable decisions is

not possible (Nápoles et. al, 2016;

Homenda et. al,

2014). Nevertheless, in the time series context,

convergence is not desirable since it decreases the

network’s capability of computing both short and

long-term predictions. Consequently, producing

truly interpretable casual cognitive models may be

produced on the expense of performance. This is the

price we pay to produce truly interpretable causal

cognitive models. Nevertheless, whether such

forecasted values are acceptable for this real-world

problem is questionable.

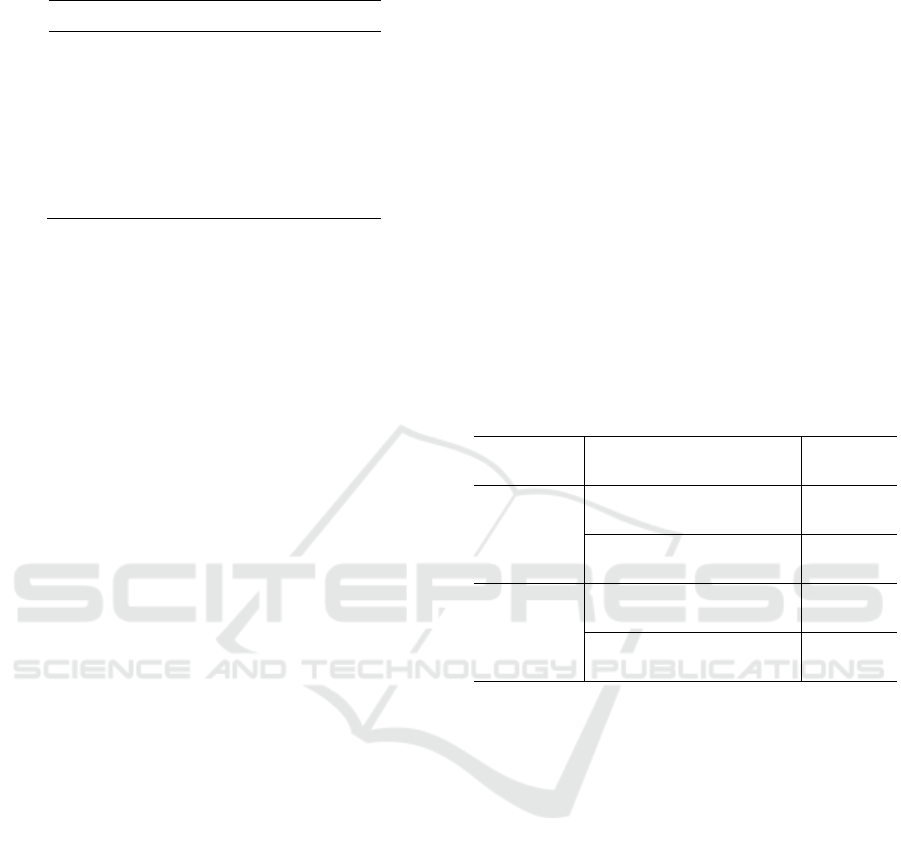

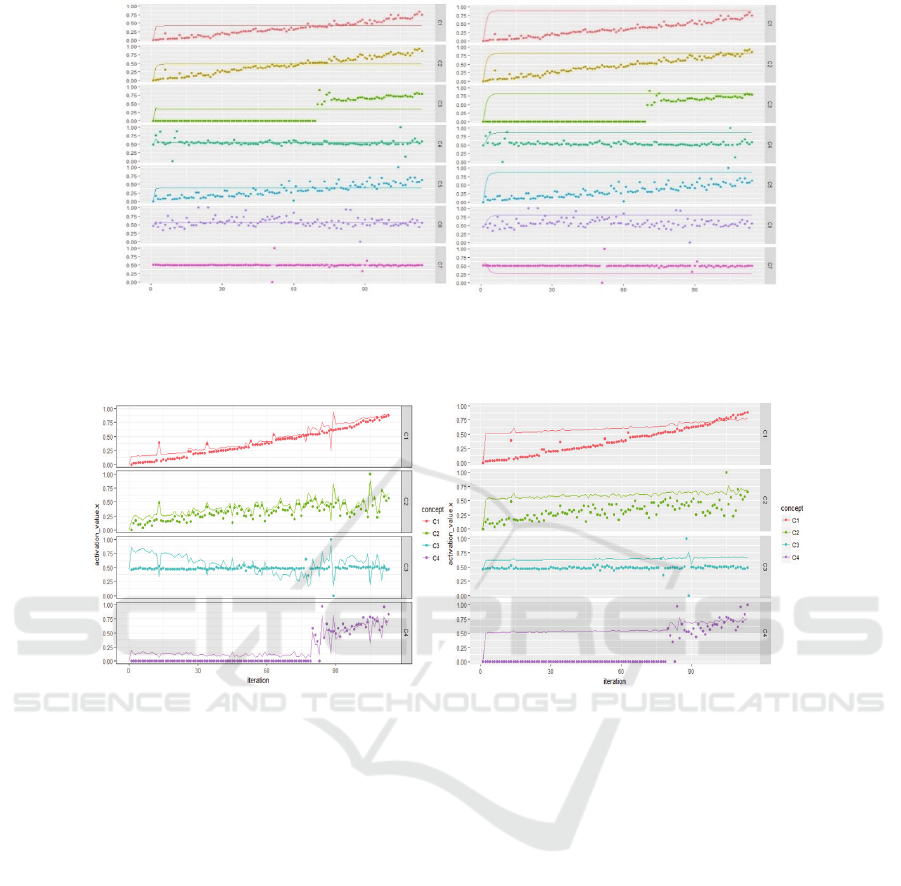

Figures 2 and 3 shows the actual and fitted values

for the unrestricted and restricted models of revenues

and expenses respectively. The horizontal axis

represents time steps, while the vertical axis shows

the activation values. The results depicted in the

figures confirms our hypothesis, the convergence

properties of the FCM-based system affect the

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

486

Figure 2: Actual versus forecasted revenues values using the using the current activation values to predict the next time series

point.

Figure 3: Actual versus forecasted expense values using the using the current activation values to predict the next time series

point.

quality of forecasted values for both revenues and

expenses. Forecasting error increases because of

decreasing the degree of freedom. This can be shown

in the forecasted values line trend for both models

(revenues and expenses) noticeably deviates from the

actual values.

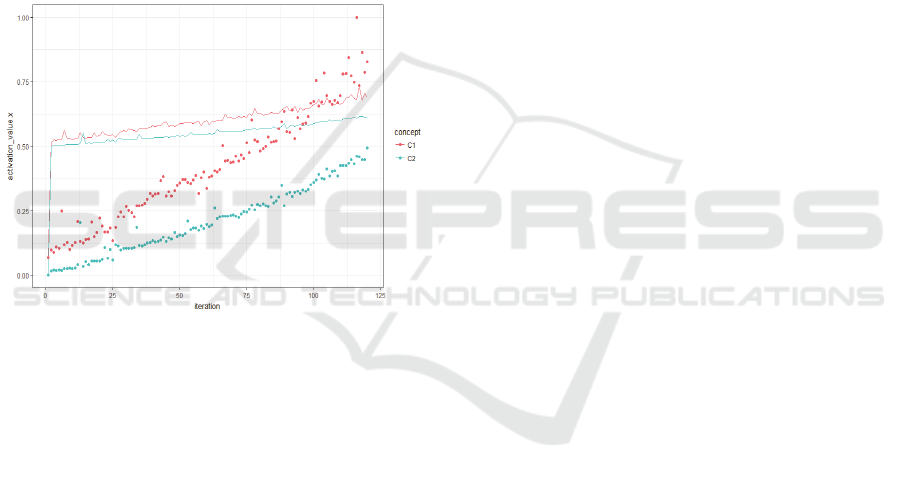

At the aggregated level of revenues and

expenses, Figure 4 shows the actual and forecasted

models (C1 represents revenues and C2 represents

expenses). The trend lines for the forecasted

revenues and expenses (straight line) follows the

same trend in the actual values. Furthermore, the

revenues are higher than expenses with the gap

between them increases with time. Thus, the JSS is

financially sustainable.

5 CONCLUSIONS

In this paper, we proposed an FCM-based time

series-forecasting model to investigate the factors

affecting revenues and expenses of the social

security in Jordan. The proposed model uses a

RealCode Genetic Algorithm to learn the map

structure together with well-known methods for

FCM learning. As a first step, we allowed the

algorithm to indicate a relationship value between

the neurons to fluctuate between -1 and 1 without

constraints, which was referred to the unrestricted

model. However, the model occasionally computed a

positive relation where it should be a negative one

and vice versa, therefore producing a forecasting

model that does not have a coherent meaning for this

real-world problem.

(a) Unrestricted model (b) Restricted model

(a) Unrestricted model (b) Restricted model

A Fuzzy Cognitive Map Approach to Investigate the Sustainability of the Social Security System in Jordan

487

In order to produce meaningful weights, we

included domain knowledge related to the sign of

each causal relation. The numerical simulations have

shown that using the current value to forecast the

revenue values leads to higher error rates since the

model converges to an equilibrium attractor.

Furthermore, when using FCMs, it is key to

promote the network’s transparency, otherwise the

model will behave like a black box and as a result,

there is no reason to employ other (perhaps more

accurate) forecasting models. In the context of the

Jordanian Social Security financial sustainability, the

resulting models predicted that with time, the

revenues would still be higher than expenses. Future

research will be focused on increasing the

forecasting accuracy rates while retaining the

network capability.

Figure 4: Actual and forecasted revenues and expenses.

REFERENCES

Alhawarin, I., 2014. Patterns and Determinants of Early

Retirement: The Case of Jordanian Men. Jordan.

Journal of Economic Sciences, Vol. 1(1).

Bezdek, J. C., Ehrlich, R., Full, W., 1984. FCM: The fuzzy

c-means clustering algorithm. Computers &

Geosciences. 10, pp. 191-203.

Bueno, S., Salmeron, J. L., 2009. Benchmarking main

activation functions in fuzzy cognitive maps. Expert

Systems with Applications. Vol. 36, pp. 5221-5229.

Enoff, L. and R. McKinnon, 2011. Social Security

Contribution Collection and Compliance: Improving

Governance to Extend Social Protection. International

Social Security Review Vol. 64 (4) pp. 99-119.

Froelich, W., Pedrycz, W., 2017. Fuzzy cognitive maps in

the modeling of granular time series. Knowledge-Based

Systems, Vol. 115, pp. 110-122.

Froelich, W., Salmeron, J. L., 2014. Evolutionary learning

of fuzzy grey cognitive maps for the forecasting of

multivariate, interval-valued time series. International

Journal of Approximate Reasoning. Vol. 55, pp. 1319-

1335.

Herrera, F., Lozano, M., Verdegay, J.L., 1998. Tackling

real-coded genetic algorithms: operators and tools for

behavioral analysis. Artificial Intelligence Review. Vol.

12, pp. 265-319.

Homenda, W., Jastrzebska, A., Pedrycz, W., 2014.

Modeling time series with fuzzy cognitive maps. In:

FUZZ-IEEE 2014, Beijing, China, pp. 2055-2062.

(ILO), S.P.D.o.I.L.O, 2014. Social protection for older

persons: Key policy trends and statistics.

Mohammed T. Mubaideen and Najim A. Najim (2014). The

Effect of Jordanian Social Security Corporation

Services on The Level of Satisfaction on Performance

At The Corporation In Amman / Jordan. Dirasat, Vol.

41 (2), pp. 155-169.

Imrohoroğlu, S. and S. Kitao, 2012. Social Security

Reforms: Benefit Claiming, Labor Force Participation,

and Long-Run Sustainability. American Economic

Journal: Macroeconomics, Vol. 4 (3): pp. 96-127.

Kosko, B., 1986. Fuzzy Cognitive Maps. International

Journal of Man-Machine Studies, Volume 24 (1), pp.

65-75.

Tsadiras, A.K., 2008. Comparing the inference capabilities

of binary, trivalent and sigmoid fuzzy cognitive maps.

Information Sciences, Vol. 178 (20), pp. 3880-3894.

Loewe, M., 2014. Pension Schemes and Pension Reforms

in the Middle East and North Africa, in Reforming

Pensions in Developing and Transition Countries,

Palgrave Macmillan UK: London. pp. 69-100.

Lu, W., Yanga, J., Liua, X., Pedrycz, W., 2014. The

modeling and prediction of time series based on

synergy of high-order fuzzy cognitive map and fuzzy c-

means clustering. Knowledge-Based Systems, Vol. 70,

pp. 242-255.

Nápoles, G., Papageorgiou, E.I, Bello, R, Vanhoof, K.,

2016. On the convergence of sigmoid Fuzzy Cognitive

Maps. Information Sciences. Vol. 349 (C), pp. 154-171.

Papageorgiou, E.I., Poczęta, K., Yastrebov, A., Laspidou,

C., 2015. Fuzzy cognitive maps and multi-step gradient

methods for prediction: applications to electricity

consumption and stock exchange returns.

Intelligent

Decision Technologies, Springer, pp. 501-511.

Pedrycz, W. (2010). The design of cognitive maps: A study

in synergy of granular computing and evolutionary

optimization. Expert Systems with Applications. Vol.

37, pp. 7288-7294.

Pedrycz, W., Jastrzebska, A., Homenda, W. (2016). Design

of fuzzy cognitive maps for modeling time series. IEEE

Transactions on Fuzzy Systems, Vol. 24, pp. 120-130.

Poczęta, K., Yastrebov, A., 2015. Monitoring and

prediction of time series based on fuzzy cognitive maps

with multi-step gradient methods. International

Conference on Automation (ICA 2015), Progress in

Automation, Robotics and Measuring Techniques,

Springer, pp. 197-206.

Robert Fenge and Pierre Pestieau, 2005. Social Security and

Early Retirement. MIT Press Books. The MIT Press,

1(1). ISBN: 9780262062497.

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

488

Sala-I-Martin, Xavier X., 1996. A positive theory of social

security. Journal of Economic Growth, Vol. 1 (2), pp.

277-304.

Salmeron, J.L., Froelich, W., 2016. Dynamic optimization

of fuzzy cognitive maps for time series forecasting.

Knowledge-Based Systems, Vol. 105, pp. 29-37.

Thomas F. Cooley and Jorge Soares, 1999. A Positive

Theory of Social Security Based on Reputation.

Journal of Political Economy, Vol. 107 (1), pp. 135-

160.

Tsadiras, A.K., 2008. Comparing the inference capabilities

of binary, trivalent and sigmoid fuzzy cognitive maps.

Information Sciences, Vol.178 (20), pp. 3880-3894.

A Fuzzy Cognitive Map Approach to Investigate the Sustainability of the Social Security System in Jordan

489