Using Convolutional Neural Networks and Raw Data to Model

Intraday Trading Market Behaviour

Vitaliy Milke

a

, Cristina Luca

b

, George Wilson and Arooj Fatima

c

School of Computing and Information Science, Anglia Ruskin University, East Road, Cambridge, U.K.

Keywords: Convolutional Neural Networks, Intraday Trading, Raw Financial Market Data, Machine Learning, Deep

Learning, Supervised Learning.

Abstract: This paper presents the use of Convolutional Neural Network (CNN) for finding patterns within intraday

trading by being trained with raw Tick and other financial data. The network is specifically used to predict

the probability of future movement at the intraday level of trading. The method of raw data pre-processing is

evaluated and is critical to avoid errors that reduce the final accuracy of the model; for intraday trading, this

includes a focus on the irregular Tick event rather than an arbitrary equal measure of interval time, such as a

minute or a day. Training involves the use of a moving image window of 200 Ticks, where each increment of

time is from 1 to 10 Ticks. For normalization (atypical for financial data) Tick intervals are capped at 20

milliseconds, Volumes are capped at 10 million, and Prices scaled over local extremes for each 200-Tick chart

interval. The neural network was trained using the publicly accessible cloud computing GPU processors of

Google Colaboratory. An original methodology for selecting the training data was used which reduced the

number of calculations by including only patterns close to the active movements of interest.

1 INTRODUCTION

Stock and currency markets are known to exhibit

increased volatility influenced by negative political

events and unexpected government decisions. It is

challenging to predict such events and the high levels

of volatility have a high associated risk (Weissman,

2005) for Algorithmic Trading Systems (ATS) which

use long-term historical trends based on the analysis

of time-series that average and thereby veil the

behaviour patterns of securities market participants.

The volatility of market prices during short-term

periods, such as a day (intraday trading) depends on

the over-arching macro-economic or political trend at

the previously known time of publication of the

macro-economic statistics. During most of a 24-hour

intraday trading session, volatility is then influenced

by the behaviour of the market participants. Just as

predictive techniques can be applied to the long term

behaviour of the markets, so can such techniques be

applied to intraday trading behaviour.

a

https://orcid.org/0000-0001-7283-2867

b

https://orcid.org/0000-0002-4706-324X

c

https://orcid.org/0000-0001-6129-9032

In recent years, powerful open-source new

technologies of Machine Learning (ML) have been

introduced, including Deep Learning (DL) which

utilises the functionality of neural networks whose

architecture includes hidden layers. One of the areas

where ML/DL techniques are already applied is

Financial Market trading and in particular the

development of ATS with a ML/DL learning basis

(Chen at al., 2016), (Zhang, Zohren and

Roberts

,

2019).

This paper presents some research undertaken on

intraday trading using Convolutional Neural

Networks (CNN) using the Tick’s database with the

aim to predict the probability of financial market

behaviour for short periods of up to 60 minutes into

the future. Integral data, such as five, fifteen-minute

or longer-term data, as well as Recurrent Neural

Networks (RNN), are often used for market following

strategies. This paper focuses on the strategy of

finding market pivot points where patterns of

behaviour of market participants that are visible on

tick data are essential.

224

Milke, V., Luca, C., Wilson, G. and Fatima, A.

Using Convolutional Neural Networks and Raw Data to Model Intraday Trading Market Behaviour.

DOI: 10.5220/0008992402240231

In Proceedings of the 12th International Conference on Agents and Artificial Intelligence (ICAART 2020) - Volume 2, pages 224-231

ISBN: 978-989-758-395-7; ISSN: 2184-433X

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

The remainder of this paper is structured as

follows: Section 2 reviews existing works related to

our research. In Section 3 the proposed approach is

presented along with a description of the data used

and the normalization techniques applied. Section 4

discusses the preliminary results obtained and the

validation of the proposed approach. In section 5 the

benefits of the selected neural network and future

work are discussed. Finally, the conclusions are

drawn in Section 6.

2 RELATED WORK

Traditional statistical methods of data analysis are

well described (Halls-Moore, 2019), (Baralis et al.,

2017), (Bekiros, 2015), (Zhong and Enke, 2017) and

include technologies/methodologies such as Online

Analytical Processing (Chaudhuri and Dayal, 1997)

but are mainly focused on testing pre-formulated

hypotheses. Many researchers have used Recurrent

Neural Networks (RNN) (Hagan at al., 2016), (Dixon,

2018), (Lee and Soo, 2017) to provide predictions for

financial time-series (Chen at al., 2018), (Wang at al.,

2016) but they are not so good at filtering out noise

from very large amounts of input data. Furthermore,

in the selection of the period of interest, fixed time

interval units (weeks, days, hours, minutes) are often

used within which critical information can be lost due

to the smoothing effect of integrating the transaction

data within each fixed equal unit time interval over

the set of intervals covering that period. Such critical

information (dependent on the behaviour of the

financial market participants) might be time intervals

between transactions, large share/contract (volume)

individual transactions, and pivot point indicators. In

contrast to RNN, Convolution Neural Networks

(CNN) process input data in a reduced-resolution

form allowing all data to contribute to the training

process and finding patterns in the data that otherwise

would not be revealed (Samarasinghe, 2016).

A CNN is a type of artificial neural network that

has successfully been applied to analyzing two-

dimensional visual imagery. The work of a CNN (as

applied to an image) is usually interpreted as a

transition from specific image features to more

abstract details via a series of stages culminating in a

set of high-level concepts. At the same time the

network self-tunes its weights and generates the

necessary hierarchy of abstract attributes, filtering

unimportant details and highlighting the essential

properties. The same principle of creating the

abstracts may be employed for analyzing financial

market data. Several approaches have used technical

indicators in market transaction data to identify

patterns (Chen and Liao, 2018), (Dymova,

Sevastjanov and Kaczmarek, 2016), (Chen and Chen,

2016). In (Sezer and Ozbayoglu, 2018), the authors

utilised 15 images of time series charts from stock

market and exchange traded funds and 15 technical

indicators to train a CNN over a 15-day period.

However, technical indicators are based on integral

(averaged) parameters and significant market

information can be lost (Gocken at al., 2016). The

approach of representing financial time-series in the

form of two-dimensional images for further analysis

using standard CNN for image recognition has also

gained popularity (Chen at al., 2016). For the analysis

of medium-term movements, a combination of a long

short-term memory neural network and CNN has

been used (Zhang, Zohren and

Roberts, 2019). All the

above papers examine medium-term movements of

financial markets that are longer than one day. On the

other hand, CNN has also been used to predict

outcomes specifically for high-frequency financial

market data (Doering, Fairbank and Markose, 2017),

although it remains to be seen if this technique

performs better than other machine learning methods.

The purpose of the current research is to present

an intraday trading method that uses a CNN, with raw

tick data with variable interval transactions that

preserve critical information in order to predict the

probabilities of the directions and depths of the next

price movement. As opposed to other research, this

paper does not aim to predict a specific price level in

the future, but only determines the probabilities of

directions and depths of movement, which is

sufficient to open a long or short position in a

financial instrument. Closing a position is carried out

by standard methods of money and risk management.

Thus, this model is a classification algorithm, not a

regression. Also, this paper differs from previous

work by using a CNN to analyse the intraday

movements of the financial market without use of

high-frequency trading (HFT) order books so

allowing utilization of publicly available GPU

machine resources. In addition, this paper presents a

unique method of nonlinear normalisation of prices,

intervals and volumes to improve the quality of

probability prediction. The authors also propose a

method for reducing the number of calculations by

pre-processing the data and considering only patterns

ready for significant movement.

Using Convolutional Neural Networks and Raw Data to Model Intraday Trading Market Behaviour

225

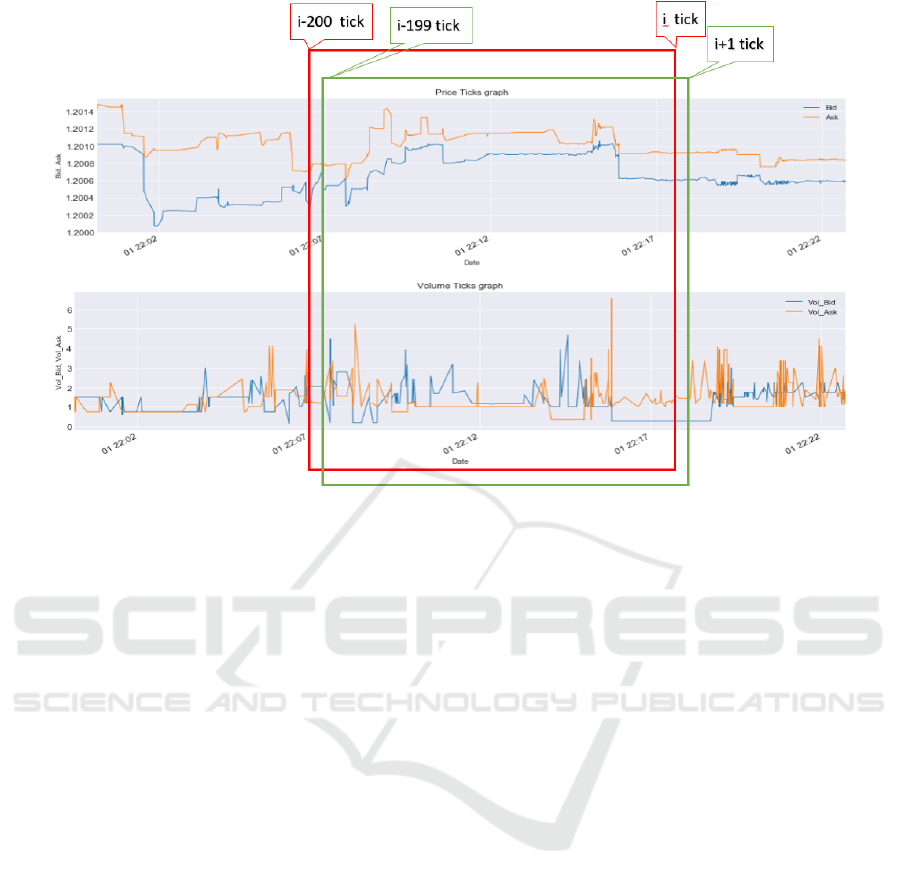

Figure 1: Two hundred tick charts (pictures) for finding patterns.

3 PROPOSED APPROACH

The present study hypothesises that the CNN will

accurately model short-term patterns of intraday

trading because of training with non-linear time

interval data and appropriate data pre-processing. The

majority of the CNN experimental data analyses in

this work was undertaken using the Google

Colaboratory (Google Inc, 2019) utilising the Keras

library (Chollet, 2015) based on the TensorFlow

backend (Abadi, 2015).

3.1 Data Used

Data for this work was downloaded from the

EUR/ESD Forex historical trading data resources

(Dukastcopy Swiss Banking Group, 2019). The data

consists of the date and time of transactions providing

irregular time intervals between bid and offer price

(Ticks) with an accuracy of milliseconds, the prices

of supply and demand (Ask and Bid), as well as the

Volume data (millions of Lots, where Lots are the

number of trading units in one transaction). Most of

the experiments used a period of twelve months from

January to December 2018 inclusive; this dataset

consists of more than 25 million rows. 80% of the

dataset was used for training and 20% was reserved

for validation using an iterative approach. For the

initial testing of ideas/models a dataset of six months

from January to June 2019 inclusive was used; this

dataset consists of more than 16.6 million rows. Each

epoch used by the CNN-DL algorithm utilises

training data and then checks the model with the

validation dataset. Due to the very large amount of

data the model is trained iteratively using data from

approximately two-week intervals.

3.2 Generation of a Three-dimensional

Tensor

Given that a CNN has been proven successful in the

analysis of images and is able to find local patterns in

a picture, the analysis of short-term trading can be

compared with the analysis of images of the type

presented in Figure 1. The CNN takes a 200 Tick

moving image window of Tick prices and volumes

versus time, progressing left-to-right (increasing

time) in Tick increments. As each new tick appears a

new chart is generated for the last 200 Ticks (about 5

minutes for this data). As a result, the two-

dimensional arrays of prices and volumes are

transformed into a three-dimensional tensor. Once the

nonlinear data is normalized it is submitted as source

data to the CNN, which is used for training and

subsequent pattern recognition. The third dimension

of 200 ticks for each chart was chosen as the practical

maximum possible of GPU memory for the tensor

training on the open-source Google Colaboratory.

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

226

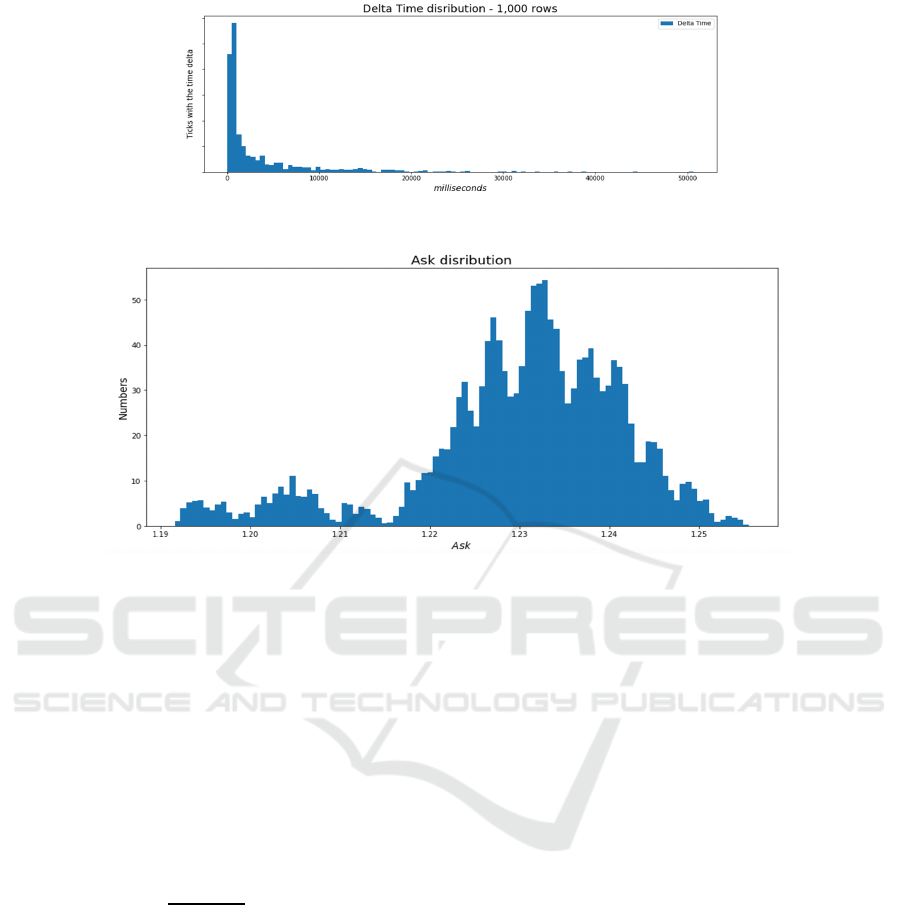

Figure 2: Distribution of 1,000 first intervals between Ticks.

Figure 3: Ask Price distribution over a 4-month period.

3.3 Normalisation of Input Data

The raw data contains transaction information where

the interval between transaction times, volumes and

price ranges vary enormously. It is desirable that the

matrices of input parameters, the output response

vector and the matrix of calculated coefficients

(weights) should take values from the interval [0,1] as

such data normalization will increase the accuracy of

the CNN training.

The typical linear mathematical normalization for

each parameter is calculated by the formula:

x

(1)

In the current paper, instead of absolute minimum and

maximum values, boundaries are chosen where the

value of the variable has a high probability.

3.3.1 Tick Intervals

The raw data includes transaction times and,

therefore, by differencing successive times, time

array data can be converted to Tick intervals (a

measure of the intensity of trading). Figure 2 shows

that for the first 1,000 Ticks since January 1

st

2018,

the vast majority of Tick intervals are less than 20

seconds. The same conclusion was confirmed for

other periods. Accurate counting of all Ticks with

time intervals of more than 20 seconds gives a figure

of 7,374 out of more than 8.5 million or about

0.086%. Any linear scaling over such a skewed

distribution (maximum Tick interval for this data is

100,000 milliseconds) would be unrepresentative and

lose information, and so for purposes of

normalization any Tick value greater than 20 seconds

is capped at that value, thus when scaled to [0,1]

retains the detail of the trading activity for 98.7% of

the trading session time. This approach does not lose

important information since long intervals are

primarily associated either with stops of exchange

trades or with weekends (low activity).

3.3.2 Volume

A similar method of normalization (as described

above for Tick intervals) is applicable for Volumes,

which also have a substantial unevenness. A

statistical distribution of the Lot size versus Volume

for any 1,000 Ticks (data rows) and more show a

skewed distribution similar to Tick intervals and the

vast majority of high trading unit Volumes do not

exceed 10 million. Thus, all Volumes over 10 million

equate to 10 million and the data scaled accordingly

to ensure a better fit between the data and the

interpolation.

Using Convolutional Neural Networks and Raw Data to Model Intraday Trading Market Behaviour

227

3.3.3 Prices

Figure 3 shows the statistical distribution of Ask price

over four months, varying slightly from 1.19 to 1.26.

The Bid price distribution is similar. One approach is

to normalize the data before splitting it into training

and test data using forecasted maximum and

minimum prices; this approach is not used here due

to uncertainties in such forecasts. Given that the detail

of price changes during any 200 Tick chart is

important to retain but is less significant relative to

the changes over four months, the normalization of

prices was based on the local maximum and

minimum prices of each Tick chart as generated

rather than the global extremes of the period of

interest.

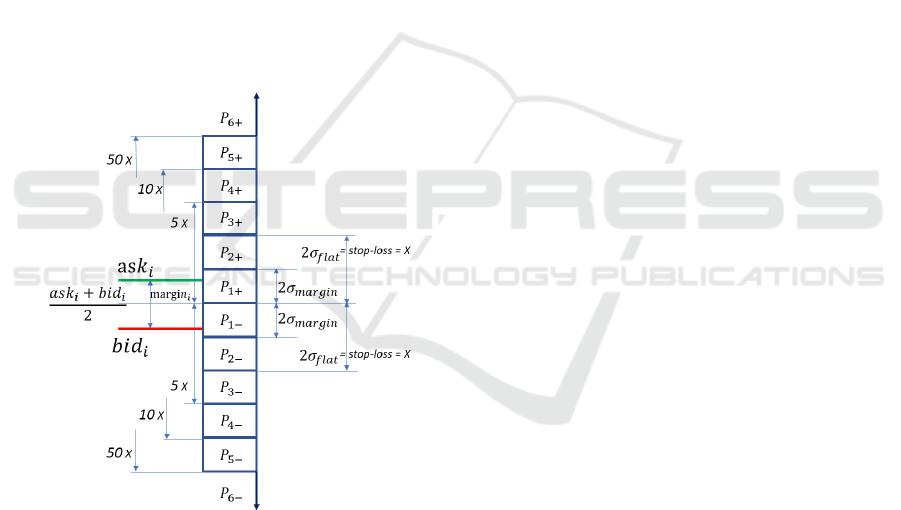

3.4 Probabilities

The interval (depth) of a possible short-term price

movement in both directions was divided into 12

irregular intervals (Figure 4).

Figure 4: Probabilities vector.

The division is done based on the statistical

distribution of intraday margin (the difference

between ask and bid prices), as well as based on the

stochastic distribution of flat fluctuations, which are

the most likely cause of stop losses. Each interval has

the probability of price movement from the current

tick, which has ask

i

and bid

i

prices. The price

movements may go up or down, which correspond to

P

+

and P

-

probabilities.

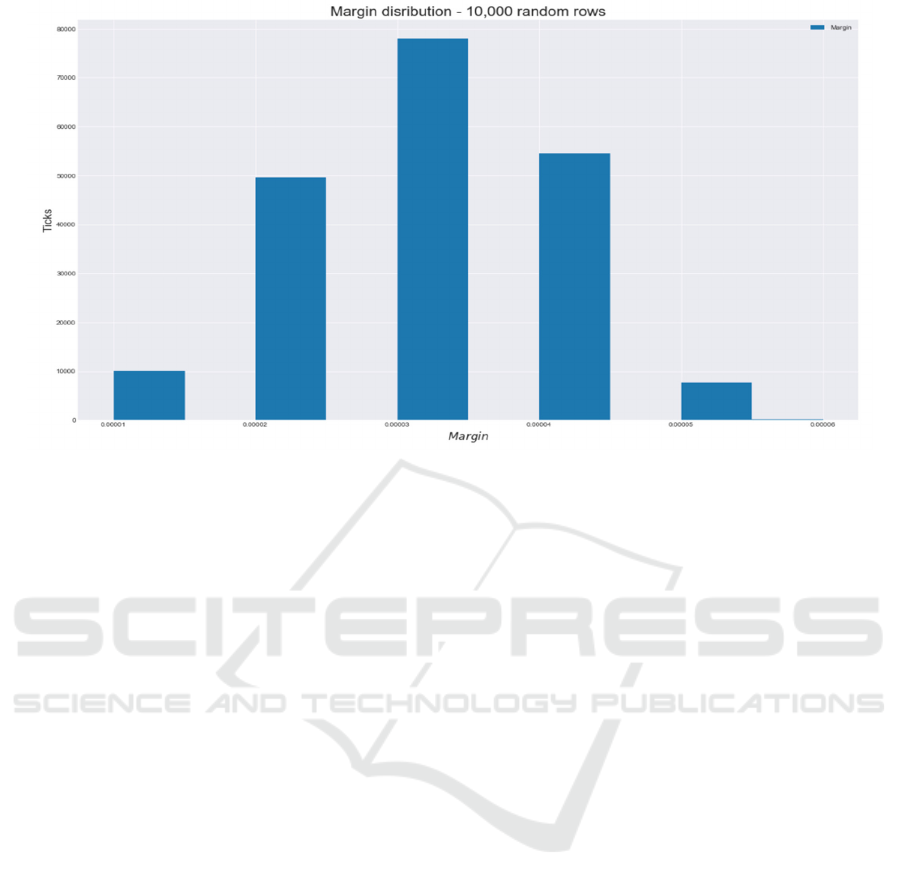

Data analysis done by the authors shows that the

margin and the flat movements have similar statistical

distribution close to Normal (Gaussian) distribution

(Figure 5). Therefore, the splitting of the probability

vector can be associated with two standard deviations

of these distributions. It is possible to equal the border

between the P

1+

and P

2+

interval to two standard

deviations of the margin distributions. Similarly, the

border between P

2+

and P

3+

is equal to two standard

deviations of the flat movement (fluctuations)

distributions. The flat fluctuations are the most likely

cause of stop losses. For intraday trading, it is very

important to reduce the number of stop-losses (Alves,

Caarls and Lima, 2018). The stop loss level was also

tied to two standard deviations of flat movements as

can be seen in Figure 4. Thereby, a reduction in losses

in real trading is achieved. Splitting of the other parts

of the probability vector is implemented as the stop-

loss level multiplied by 5, 10 and 50. The multipliers

have been chosen to ensure a similar probability of

achieving these price levels. Most of the time

financial markets are flat but demonstrate an

oscillatory (retreating) movement with a small

amplitude. For this reason, stop loss often occurs

during intraday trading. This feature of financial

markets is often overlooked when neural networks

solve the regression task of predicting future prices.

The probability categorization task described in this

paper has advantages over the indicated regression

task since only recoilless movements were taken into

account when forming the probability vector.

Rollbacks were considered movements in which

returns from the beginning did not exceed half of the

movement passed.

The authors performed experiments with other

measures of flat movement, including the Golden

Ratio. However, this half-reverse movement forms

the clearest distributions over the above 12 intervals.

The data collection for supervised learning was

done on a complete 1.5 year dataset. The supervisory

signals (outputs vector) were formed based on the

recoilless movement for the next 8,000 ticks

(approximately one hour) but taking into account that

any open position should be sold before the end of the

trading day.

3.5 Reduction of Calculations

To be able to use publicly available GPU processor

resources for a reasonable time the number of

calculations needs to be reduced. To do this an

additional variable L was introduced equal to the

number of ticks before the significant movement of

the financial market began. If during the L-ticks after

the considered time the price does not go beyond the

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

228

opposite stop loss, then the current tick is considered

uninteresting, and the algorithm goes to the next tick.

As mentioned above, the size of the stop loss was

calculated from the standard deviation of the flat

fluctuation distribution. Consequently, a significant

size of the useless flat fluctuation was excluded from

the training dataset for the neural network. Through

an iterative experiment, the most relevant value L =

14 was chosen which retained the most significant

number of long recoilless movements in the training

dataset. For the 1.5 year dataset containing 42 million

lines this simple improvement reduced the dataset

size by 73%. The authors understand that entering an

additional dropout parameter can also remove some

interesting movement data, especially those that start

slowly. However, for intraday trading, it is not so

essential to catch all the movements. It is more

important to recognize the movements with the

highest probability of continuation and not to take a

stop loss.

The decrease made in calculations can be

especially useful in the authors' further work on

Reinforcement Learning agents, where the number of

iterations for training the neural network can increase

by orders of magnitude.

4 RESULTS

A supervised learning method was used for training a

one-dimensional eight layer CNN where non-uniform

intervals between adjacent Ticks are presented to the

network in the form of a separate column feature.

Consequently, the non-uniformity of intervals

between Ticks was explicitly entered into the neural

network along with data on prices and volumes.

Validation compares the existing correct values of the

next short-term price movement that the CNN did not

see during training with the probability of the

predicted direction and the interval (depth) of this

movement.

Due to the very large amount of input data the

CNN training was carried out iteratively,

approximately one million Ticks each on Google

Colaboratory. This approach emulates training in real

trading. The Keras ModelCheckpoint callback

function was used to memorize training results for

each epoch with the subsequent choice being the

epoch with the best accuracy. For this research, the

authors ran experiments for data batch size

parameters ranging from 10 to 100, and the number

of epochs in the range 5 to 30. The best results for the

current time were achieved when using a data batch

size parameter equal to 20 with the number of epochs

equal to 12. For the mentioned sets of global

parameters, the CNN training on 12 month Tick data

took 15 hours of continuous time divided into

iterations. Preliminary results show a sufficiently

high accuracy which must still be comprehensively

verified in cross-validation calculations, taking into

account the restrictions used for time-series.

Calculations utilizing the public GPU processing

resources can take a substantial amount of time due

to the size of the data and the limited time of

uninterrupted use of these resources. Once

comprehensive validations are completed these

results will be published.

5 CONCLUSIONS

In this work, the authors used CNN to predict the

probability of direction and interval of future

movement of intraday transactions of the financial

market using non-standard methods of preliminary

processing of raw data. Fundamental to the approach

is normalization of the non-linear data and the

translation of 2D data into a 3D tensor through

creation of successive 200 Tick charts. As a result, the

dimension of the input data increases dramatically

with the associated impact on resources. The authors

propose an original method for selecting the training

data which reduces the number of calculations by

including only patterns close to the active movement.

The approach uses raw Tick data to train the neural

network to predict the probability of direction and

interval of future movement. The training process

itself is dependent on the capabilities of the Google

Colaboratory platform and the model must be re-

trained continuously.

One observation is that the loss of information on

extra-large volume Lots is more sensitive than on

large time intervals between Ticks. However, in

transactions with extra-large Lots there are often

substantial price changes and possible delays with the

execution of market orders, lowering the quality of

the prediction. In further research the authors may

create a separate parallel path to the main neural

network for analyzing massive volumes. It may be

worthwhile to use machine learning methods that are

faster than neural networks, such as decision trees and

their variations.

The current results show that CNNs can be used

as a useful additional tool for modelling intraday

trading. An aspirational goal for future work by the

authors is to create an agent with Reinforcement

Learning which will use all the original approaches

described in the current paper to normalize raw data

Using Convolutional Neural Networks and Raw Data to Model Intraday Trading Market Behaviour

229

Figure 5: Margin distribution.

and reduce the number of calculations for the

possibility of using publicly available GPU cloud

processor resources. A major difficulty is, of course,

that the financial markets are constantly changing, so

that one trained neural network is likely to become

less accurate when predicting events ever further into

the future from the period of time over which the net

was trained. For this reason it is necessary to

periodically re-train the neural network; for example,

once a week during the weekend when financial

markets are closed. Future work by the current

authors will also explore the use of a hybridized

approach using a combination of CNN-RNN in

conjunction with reinforcement learning.

REFERENCES

Abadi, M., Agarwal, A., Barham, P., Brevdo, E., Chen, Z.,

Citro, C., Corrado, G., Davis, A., Dean, J., Devin, M.,

Ghemawat, S., Goodfellow, I., Harp, A., Irving, G.,

Isard, M., Jia, Y., Jozefowicz, R., Kaiser, L., Kudlur,

M., Levenberg, J., Mane, D., Monga, R., Moore, S.,

Murray, D., Olah, C., Schuster, M., Shlens, J., Steiner,

B., Sutskever, I., Talwar, K., Tucker, P., Vanhoucke,

V., Vasudevan, V., Viegas, F., Vinyals, O., Warden, P.,

Wattenberg, M., Wicke Machine Learning on

Heterogeneous Distributed Systems. [online] Available

through: <https://www.tensorflow.org> [Accessed 17

October 2019]., M., Yu, Y. and Zheng, X., 2015.

TensorFlow: Large-Scale

Alves, S.A., Caarls, W. and Lima, P.M., 2018. Weightless

Neural Network for High Frequency Trading. In 2018

International Joint Conference on Neural Networks

(IJCNN). IEEE

Baralis, E., Cagliero, L., Cerquitelli, T., Garza, P. and

Pulvirenti, F., 2017. Discovering profitable stocks for

intraday trading. Information Sciences 405.

Bekiros, S., 2015. Heuristic learning in intraday trading

under uncertainty. Journal of Empirical Finance, 30.

Chaudhuri, S. and Dayal, U., 1997. An overview of data

warehousing and OLAP technology. ACM Sigmod

record, 26(1).

Chen, C. and Liao, C., 2018. Short term intraday trading of

futures market analysis. In 33rd Youth Academic

Annual Conference of Chinese Association of

Automation (YAC). IEEE.

Chen, J.F., Chen, W.L., Huang, C.P., Huang, S.H. and

Chen, A.P., 2016. Financial time-series data analysis

using deep convolutional neural networks. In 7th

International Conference on Cloud Computing and Big

Data (CCBD). IEEE

Chen, T.L. and Chen, F.Y., 2016. An intelligent pattern

recognition model for supporting investment decisions

in stock market. Information Sciences, 346.

ELSEVIER.

Chen, W., Yeo, C.K., Lau, C.T. and Lee, B.S., 2018.

Leveraging social media news to predict stock index

movement using RNN-boost. Data & Knowledge

Engineering, 118. ELSEVIER.

Chollet, F., 2015. Keras [Online]. Available through:

<https://keras.io> [Accessed 17 October 2019].

Dixon, M., 2018. Sequence classification of the limit order

book using recurrent neural networks. Journal of

Computational Science, 24. ELSEVIER.

Doering, J., Fairbank, M. and Markose, S., 2017.

Convolutional neural networks applied to high-

frequency market microstructure forecasting. In 9th

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

230

Computer Science and Electronic Engineering

Conference. IEEE.

Dukastcopy Swiss Banking Group, 2019. Historical Data

Feed, [online] Available through:

<https://www.dukascopy.com/swiss/english/marketwa

tch/historical/> [Accessed 17 October 2019].

Dymova, L., Sevastjanov, P. and Kaczmarek, K., 2016. A

Forex trading expert system based on a new approach

to the rule-base evidential reasoning. Expert Systems

with Applications, 51. ELSEVIER.

Goçken, M., Ozçalıcı, M., Boru, A. and Dosdoğru, A.T.,

2016. Integrating metaheuristics and artificial neural

networks for improved stock price prediction. Expert

Systems with Applications, 44. ELSEVIER.

Google Inc, 2019. Google Colaboratory, [online] Available

through: <https://colab.research.google.com/notebooks

/welcome.ipynb> [Accessed 17 October 2019].

Hagan, M., Demuth, H., Beale, M. and De Jesus, O., 2016.

Neural Network Design, Martin Hagan. Lexington, KY,

2nd. Ed.

Halls-Moore, M., 2019. Advanced Algorithmic Trading, [e-

book]. Available through:

<https://www.quantstart.com/advanced-algorithmic-

trading-ebook> [Accessed 17 October 2019].

Lee, C.Y. and Soo, V.W., 2017. Predict Stock Price with

Financial News Based on Recurrent Convolutional

Neural Networks. In Conference on Technologies and

Applications of Artificial Intelligence (TAAI). IEEE.

Samarasinghe, S., 2016. Neural networks for applied

sciences and engineering: from fundamentals to

complex pattern recognition. Auerbach publications.

Sezer, O.B. and Ozbayoglu, A.M., 2018. Algorithmic

financial trading with deep convolutional neural

networks: Time series to image conversion

approach. Applied Soft Computing, 70. ELSEVIER.

Wang, J., Wang, J., Fang, W. and Niu, H., 2016. Financial

time series prediction using elman recurrent random

neural networks. Computational intelligence and

neuroscience.

Weissman, R., 2005. Mechanical trading systems: Pairing

trader psychology with technical analysis. John Wiley

& Sons.

Zhang, Z., Zohren, S. and Roberts, S., 2019. DeepLOB:

Deep convolutional neural networks for limit order

books. IEEE Transactions on Signal Processing,

67(11), pp.3001-3012

Zhong, X. and Enke, D., 2017. Forecasting daily stock

market return using dimensionality reduction. Expert

Systems with Applications, 67, pp.126-139.

Using Convolutional Neural Networks and Raw Data to Model Intraday Trading Market Behaviour

231