Taking Inventory Changes into Account While Negotiating in Supply

Chain Management

Celal Ozan Berk Yavuz

1 a

, C¸ a

˘

gıl S

¨

usl

¨

u

1

and Reyhan Aydo

˘

gan

1,2 b

1

Department of Computer Science,

¨

Ozye

˘

gin University, Istanbul, Turkey

2

Interactive Intelligence Group, Delft University of Technology, The Netherlands

Keywords:

Agent-based Negotiation, Bidding Strategy, Supply Chain Management.

Abstract:

In a supply chain environment, supply chain entities need to make joint decisions on the transaction of goods

under the issues quantity, delivery time and unit price in order to procure/sell goods at right quantities and time

while minimizing the transaction costs. This paper presents our negotiating agent designed for Supply Chain

Management League (SCML) in the International Automated Negotiation Agents Competition (ANAC). Ba-

sically, the proposed approach relies on determining reservation value by taking the changes in the inventory

stock into account. We have tested the performance of our bidding strategy in the competition simulation

environment and compared it with the performance of the winner strategies in ANAC SCML 2019. Our

experimental results showed that the proposed strategy outperformed the winner strategies in overall.

1 INTRODUCTION

A supply chain is a network in which suppliers, manu-

facturers, distributors, wholesalers and retailers inter-

act with each other by procuring and processing inter-

mediate products or distributing goods in order to pro-

vide final products to end customers (Mbang, 2011).

The main goals of supply chain are increasing effi-

ciency by prognosticating demand, decreasing overall

cost, strengthening communication between entities,

dealing with the dynamic nature of the environment

and so forth. To achieve those goals, supply chain

entities must be in cooperation in order to operate ef-

fectively (Lin and Lin, 2004). One of the main as-

pects of cooperation requires joint decision making in

transactions, where sellers and buyers mutually deter-

mine the unit cost and amount of the goods to be sold

as well as their delivery time. By and large, there is

a conflict of interests among those stakeholders. For

instance, a buyer prefers to buy a product at a low cost

while a seller would like to sell the product at a high

cost. In such cases, they need to negotiate to resolve

their conflicts and come up with an agreement. Nego-

tiations for supply chain management has a number

of challenges due to the fact that supply chain enti-

ties form a complex ecosystem. First, stakeholders

a

https://orcid.org/0000-0002-7946-198X

b

https://orcid.org/0000-0002-5260-9999

are uncertain about supply and demand because of the

stochastic nature of market. They do not know what

is acceptable or unacceptable for other side. Learning

other side’s interests and preferences over their inter-

action can help them make well-targeted offers, which

are most likely to be accepted by their opponent (Hin-

driks et al., 2009; Aydo

˘

gan and Yolum, 2012). Sec-

ond, the supply chain has a dynamic structure where

new entities may join or leave the environment. In

such a dynamic and open environment, they need to

choose whom to negotiate to minimize the risks aris-

ing from contract violations. Furthermore, there are

multiple concurrent negotiations between sellers and

buyers and they are not independent at all. It is impor-

tant to establish a coordination among multiple ongo-

ing negotiations in order to procure and sell goods at

right quantities.

In the last decades, researchers work on develop-

ing agent-based negotiation technologies to automate

this process (Ito et al., 2007; Fujita, 2014; Sanchez-

Anguix et al., 2014; Fatima et al., 2014; de Jonge

et al., 2019; Mell et al., 2018). To address the afore-

mentioned issues, the International Automated Ne-

gotiating Agents Competition (ANAC), introduced a

new league called Supply Chain Management League

(SCML) in which the participants are asked to de-

velop a factory manager agent for a supply chain sim-

ulation environment to maximize the agent’s profits.

In the environment, the factory manager agents need

94

Yavuz, C., Süslü, Ç. and Aydo

˘

gan, R.

Taking Inventory Changes into Account While Negotiating in Supply Chain Management.

DOI: 10.5220/0008976900940103

In Proceedings of the 12th International Conference on Agents and Artificial Intelligence (ICAART 2020) - Volume 1, pages 94-103

ISBN: 978-989-758-395-7; ISSN: 2184-433X

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

to decide on what agents to negotiate, build a dy-

namic endogenous utility function for negotiations,

which remains robust by adjusting itself as the sup-

ply chain environment state changes, deal with the

concurrent negotiations, determine bidding and ac-

ceptance strategies, decide on reservation value, man-

age a production schedule to decide the level of pro-

duction with respect to simulation steps and so on. In

this paper, we present our factory manager agent de-

veloped for the SCML. The novel aspects of our agent

are reservation value adjustment strategy based on the

average inventory change, and procuring all types of

products, apart from the products which can be pro-

cessed in factory, so as to maximize the negotiation

opportunities. We have tested our agent by running

simulations with the top performing factory manager

agents developed by participants in SCML 2019 and

found that in overall, our agent outperformed the ex-

isting agents under the performance metrics average

profit, number of simulation runs in which the agents

went bankrupt, and have more profit than its oppo-

nent.

The rest of the paper is organised as follows: sec-

tion 2 briefly describes the supply chain environment,

section 3 introduces the strategy of the factory agent,

section 4 explains the experiment setup and interprets

the results, section 5 expresses the existing studies in

the literature, and section 6 presents conclusion.

2 NEGOTIATION COMPETITION

FOR SCM

The International Automated Negotiating Agents

Competition (ANAC) has been organized since 2010

to facilitate agent-based negotiation research and in-

troduces new research challenges every year (Jonker

et al., 2017). In 2019, the challenge of design-

ing negotiating agents for supply chain management

has been introduced by the organizers under Supply

Chain Management League (SCML) in cooperation

with NEC-AIST.

In the given environment, there are a variety of

agents such as factories, miners, and consumers. The

main aim is develop a factory manager agent maxi-

mizing its profit. The factory manager agents need

some raw materials and intermediate products pro-

vided by miners and other factories respectively in

order to produce their products which will be sold

to the consumers and other factory manager agents.

Consumer agents specify what products they want to

buy on a bulletin board. Factory manager agents can

see those requests and initiate a negotiation with con-

sumer agents in a bilateral fashion on the unit price

of their product, delivery time, grace period, quantity,

and negotiated penalty. Note that grace period and

negotiation penalty are optional. Furthermore, In or-

der to produce their products, factory manager agents

may also need to negotiate with miners and other fac-

tories to supply their needs.

Here, the main challenge is to design a factory

agent, which decides with whom to negotiate and

when to negotiate in a supply chain environment so as

to maximize its profits. There are a number of chal-

lenges for designing such an agent. First, agents need

to make their decisions across multiple concurrent ne-

gotiations. Second, they are not given a predefined

utility function as in other negotiation environment

such as Genius (Lin et al., 2014). An endogenous

utility function, which dynamically estimates utilities

of given offers based on environment states, should be

defined by agent designers.

In the competition, the NEGMAS framework

(Mohammad et al., 2019) is used to simulate the

aforementioned negotiation environment. In the fol-

lowing part, we provide the details of this environ-

ment.

2.1 Environment Settings

In SCML environment, there is a publicly available

bulletin board where agents post call for proposals

(CFP) specifying what materials/products they want

to buy and their constraints on the negotiation is-

sues such as the limits for price and so on. In addi-

tion to call for proposals, the bulletin board also con-

tains some public information such as the list of the

bankrupted agents, breaches.

Based on the CFPs, other agents may initiate ne-

gotiation request. If the publisher of the underlying

CFP accepts the request, negotiation starts. Each CFP

is represented as a tuple as follows:

CFP = (p, j,q,d,c,g) (1)

where p denotes the product type to be bought, j

denotes the price interval (e.g.[0, 4]), q denotes the

quantity interval, d denotes the delivery time interval,

c denotes the negotiated penalty interval in case of

contract violation, and g denotes the grace period in-

terval, which states the time of signing contract.

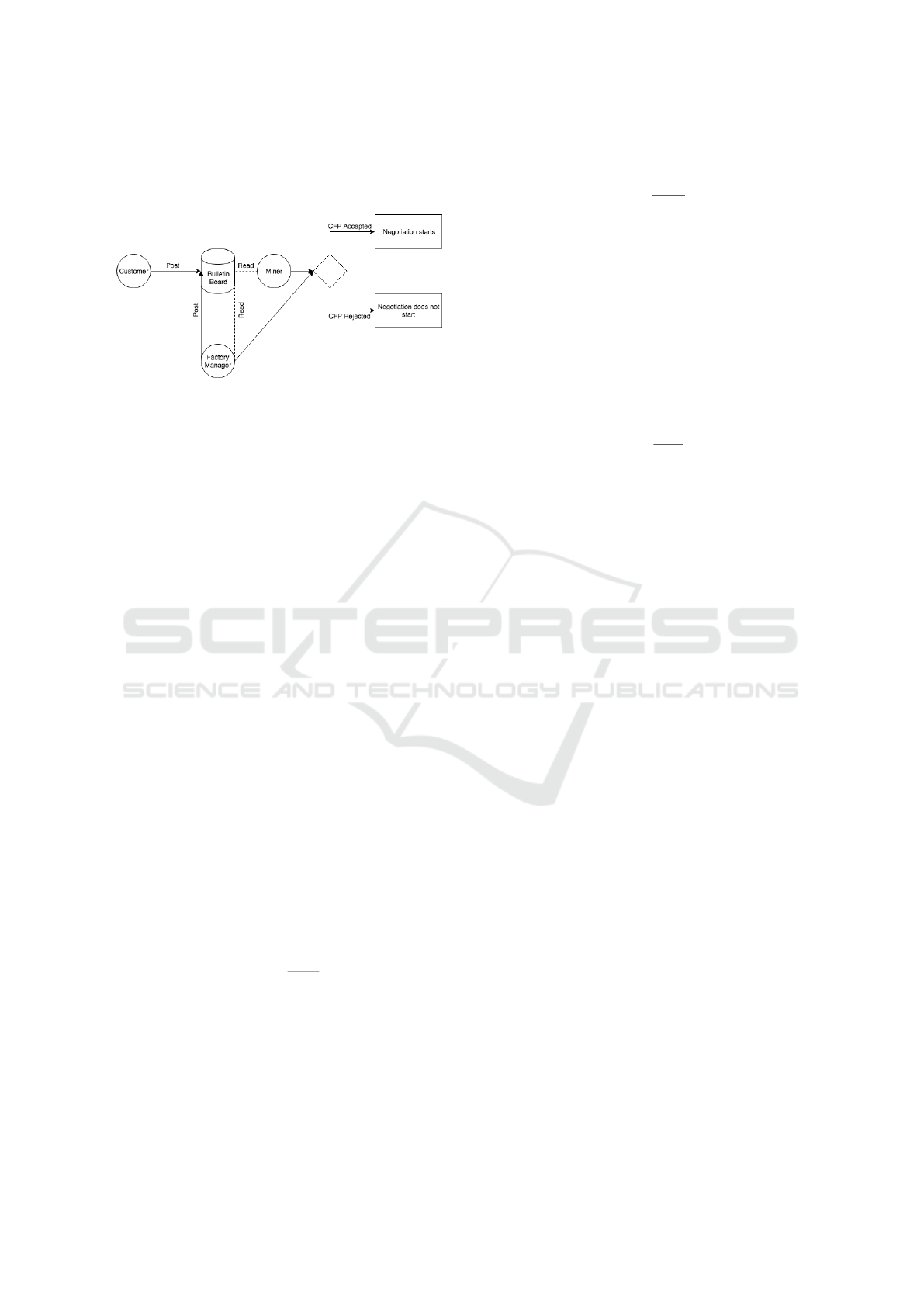

Figure 1 depicts how the agents interact with the

bulletin board. As seen below, customer agents only

post CFPs to the bulletin board and factory man-

ager agents may request for negotiation, if a customer

agent accepts a negotiation request, a negotiation be-

tween these agents begin. Similar to customer agents,

factory manager agents post CFPs but they can also

read miners’ and factory manager agents’ CFPs and

Taking Inventory Changes into Account While Negotiating in Supply Chain Management

95

request for negotiations for those they are interested

in. Miners on the other hand, only read CFPs and re-

quest negotiations for them.

Figure 1: Agent Interactions with the bulletin board.

During the negotiation, they exchange offers

based on a variant of Rubinstein’s alternating offer

protocol (Aydo

˘

gan et al., 2017). Different from the

alternating offer protocol, both agents propose an ini-

tial offer and one of them is arbitrarily chosen as the

opening offer (Mohammed et al., 2019). Afterwards,

the agent receiving the offer can accept the offer, re-

ject the offer by making a counter offer, or end the

negotiation without an agreement. This process is re-

peated until the negotiation deadline is reached or an

agreement is achieved. If an agreement is reached, the

agreed offer becomes contract to be signed at the end

of the grace period which as a default value of 1 step,

if not negotiated. Note that agents can also refuse to

sign the contract without incurring any penalty.

In order for a contract to be successfully exe-

cuted, the seller party must transfer the products to the

buyer’s inventory and the buyer must pay the price for

the products. In case of failure to execute the contract,

either a breach report is imposed on the perpetrator

or penalty cost should be paid. The breach informa-

tion consisting of the breach type and breach level,

a metric for the severity of the breach, is reported to

the bulletin board. The breach types along with the

breach level calculations are described below.

• Insufficient Funds: Reported for the buyer party

failing to pay the cost of buying the products. The

level of the insufficient funds breach is calculated

in the following way:

s =

a − b

a

(2)

where,

a : Cost of the contract for the buyer

b : Buyer’s balance

• Insufficient Products: Reported for the seller

party failing to transfer products to the buyer’s

inventory. The level of the insufficient products

breach is calculated in the following way:

s =

f −h

h

(3)

where,

f : Amount of products to be transferred to the

buyer’s inventory.

h : Amount of products in seller’s inventory.

• Insufficient Funds for the Penalty: Reported

for the seller party when after getting an insuffi-

cient products breach, it fails to pay the negotiated

penalty in case of breach. The level of the insuffi-

cient funds for penalty breach is calculated in the

following way:

s =

z − b

b

(4)

where,

z : Amount of negotiated penalty to be paid by

the buyer.

• Refusal to Execute: May be reported for either

party which dishonors the contract by a refusal to

execute. The breach level of refusal to execute is

always 1.

In case of insufficient funds breach, the agents are

given an opportunity to renegotiate, if both parties ac-

cept the renegotiate the breach may be avoided; oth-

erwise, the opportunity is lost. If insufficient prod-

ucts breach is occurred, the perpetrator is required to

pay the global penalty, which is 2% of the money the

buyer would supposed to pay to the seller.

In the simulation environment, the production

graph states the kinds of available products in the sim-

ulation environment, and manufacturing processes

showing how products are processed to generate other

products. The production graph is generated ran-

domly at the beginning of the simulation and dis-

closed to all agents.

Each product in the production graph is classi-

fied as raw materials, intermediate products and final

products. A product is said to be a raw material if it

is not an output of any manufacturing process, an in-

termediate product if it can be both an input and out-

put of manufacturing processes, a final product if it

is not an an input to any manufacturing processes but

merely an output of manufacturing processes. While

the types of products and manufacturing processes

available in the simulation is a public information, the

agents cannot access other agents’ inventory and pro-

duction profile (e.g. the quantity and the type of prod-

uct).

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

96

2.2 Simulation Entities

The simulation environment consists of miners, fac-

tory managers and consumers forming a supply chain

in which miners supply raw materials and sell those

to factory managers, which process the raw materials

to produce intermediate and final products. Consumer

agents drive demand for the final products and acquire

them from the factory managers.

2.2.1 Miner Agents

Miner agents sell raw materials for the factory man-

agers through negotiations. During a negotiation,

they aim to maximize the quantity of raw materials

supplied with a high unit price in a short amount

of delivery time in order to maximize the supply

chain throughput. The miners can request negotia-

tions based on the CFPs posted by factory managers.

2.2.2 Factory Manager Agents

Factory manager agents process raw materials or in-

termediate products to produce another intermediate

products or final materials. They have warehouses

in which the products are stored and factories where

there are production lines which run specific manu-

facturing processes. The factory manager agents have

random private manufacturing process profile (i.e., in-

put/output products, cost of processing, processing

time).

The factory manager agents can post CFP to buy

intermediate products or raw materials. They can ne-

gotiate with buyers by responding to the CFP posted

by buyers on the bulletin board. For each negotiation

threads, they introduce a utility function in order to

maximize their final score, which is calculated as fol-

lows:

(B

n

− B

0

)

B

0

(5)

where B

n

and B

0

denote the final balance and initial

balance respectively.

2.2.3 Consumer Agents

Consumer agents has a consumption schedule and

they purchase final products from the factory man-

ager agents by posting buy CFPs to the bulletin board.

For each negotiation thread, the utility function is de-

termined by taking into account the deviation in the

consumption schedule and unit price.

3 PROPOSED FACTORY AGENT

STRATEGY

We present a new factory manager agent, namely

Adaptive Reservation Value Agent (ARV Agent),

which evaluates the offers with respect to inventory

changes and negotiate accordingly. This agent con-

sists of the following decision modules:

• Deciding which Negotiations to Enter: Our

agent checks all CFPs irrespective of the required

materials for its manufacturing process, and its

final products and requests/accepts negotiations

with the non-bankrupted agents. The main mo-

tivation for negotiating materials apart from the

ones the agent can process in its factory is that our

agent can enter additional negotiations and resell

those to maximize profit.

• Deciding Unit Cost of the Product to be

Bought: Unit cost of a product is the cost incurred

by obtaining/producing a unit of product. Note

that for the rest of the paper we refer “selling ne-

gotiation” when our agent is negotiating in order

to sell the other party its products. Similarly, we

refer “buying negotiation” when our agent is ne-

gotiating in order to buy products/materials from

the other party. The unit cost of product p is used

in utility value calculations during selling negoti-

ations as follows:

V

p

=

c

price

η

p

= β

p

= 0

κ

p

(β

p

6= 0) ∧ (η

p

= 0)

((V

i

+φ

i

)∗η

p

)+(κ

p

∗β

p

)

η

p

+β

p

(β

p

6= 0) ∧ (η

p

6= 0)

(6)

where V

p

denotes the unit cost of product p while

V

i

denotes the unit cost of input product, which is

needed to produce p.

When the factory manager has not produced

(η

p

= 0) or bought (β

p

= 0) any product p since

the beginning of the simulation, the unit cost of p

is equal to the catalog price of p (c

price

).

When the factory manager produced some prod-

uct p (η

p

6= 0) but not bought any product p

(β

p

= 0) since the beginning of the simulation, the

unit cost of p is equal to average cost of buying the

product p through former negotiations (κ

p

).

When some p is produced in factory (η

p

6= 0) and

obtained through negotiations (β

p

6= 0), the unit

cost of p is equal to the weighted average of the

total production cost of p ((V

i

+ φ

i

) ∗ η

p

) where

i is the input product to produce p and φ

i

is the

processing cost of the input product and total cost

Taking Inventory Changes into Account While Negotiating in Supply Chain Management

97

of buying product p through former negotiations

(κ

p

∗ β

p

).

• Determining the Utility Function for Evaluat-

ing the Given Offers: Different utility functions

are defined with respect to the agent’s role in the

negotiation. When our agent is selling a product,

the utility of an offer o is calculated as follows:

U

s

(o) = max(((o[s

p

] −V

p

) ∗ o[q

o

]),0) (7)

where o[s

p

] denotes the unit price of the product

specified in the offer and o[q

o

] denotes the quan-

tity of the product in the offer. The utility of the

offer o is equal to the difference between the total

price specified in the offer and the total cost of the

underlying product calculated by our agent. The

utilities of the offers are normalized during nego-

tiations.

When our agent is buying product p, the utility

of the offer during the negotiation is calculated as

follows:

U

B

(o) =

(

k ∗ o[q

o

] c

price

= o[s

p

]

(c

price

− o[s

p

]) ∗ o[q

o

] otherwise

(8)

where o[s

p

] denotes the unit price of the product

as stated in the offer, c

price

catalog price of the

underlying product and o[q

o

] denotes the quantity

of the product as stated in the offer. Here, k is a

coefficient equals to 0.01 in order to assign a non

zero utility for the offers equal to the catalog price

of the underlying product. The motivation behind

this is the fact that no storing cost of products in-

curred by the agent and there is no inventory stor-

age capacity, hence it is not undesirable to buy

products equal to catalog price.

• Preparing CFP: At each simulation step, our

agent posts CFPs on the bulletin board to buy

products. Thus, other factory managers or miners

interested in our agent’s CFP can request negotia-

tion. The CFPs are constructed as follows:

Algorithm 1.

1 α ← 16

2 θ ← 10

3 c ← 10.5

4 for p in products do

5 for s in range(θ) do

6 q ← (1,s + α)

7 d ← min(c

step

+ s,max steps)

8 j ← (0.5,cprices[p])

9 post(CFP(p, j,q,d,c))

10 end

11 end

In this procedure q and j denote the lower and

upper boundaries for the quantity of the product

(e.g., (1, 3) shows the negotiable quantities are be-

tween 1 and 3.) and for the price of the product

respectively. d is the delivery time of the prod-

uct, c

step

is the current time step of the simulation,

max steps is the length of the simulation in terms

of simulation steps, p is the product to be bought

and c is the penalty incurred per product in case of

insufficient products breach is committed by the

seller.

• Determining Reservation Value for Negotia-

tion Strategy:

During negotiations, the reservation value is the

minimum acceptable utility for an offer. For

selling negotiations, the reservation value of a

particular product is updated based on the average

inventory change of the product per simulation

step. At the end of simulation step, when our

agent acts as a seller, the reservation value of the

product is updated as denoted in Algorithm 2.

Algorithm 2: Reservation value when our agent acts as

the seller during negotiations.

1 δ ← 0.01

2 for p in products do

3 ∆ ← avg supplies[p] − avg demands[p]

4 if ∆ 6= 0 then

5 if ∆ < 0 and |amount[p]/∆|> r

step

then

6 r[p] ← min(r[p] −δ ∗ ∆,0)

7 end

8 else

9 r[p] ← max(r[p]+ δ ∗ ∆, 1)

10 end

11 end

12 end

where for a product p, ∆ denotes the difference

between the average inflow and outflow of prod-

uct p per step, which is equal to the average in-

ventory change. In line 5, it is checked if the

amount of product p in inventory is in decrease

and is expected to be depleted before the end

of the simulation (i.e when |amount[p]/∆|> r

step

where amount[p] is the amount of product p in in-

ventory and r

step

is the remaining simulation steps

left to the end of the simulation). The reserva-

tion value of product p (r[p]) for selling negotia-

tions is decreased by δ ∗ ∆ if the condition in line

5 is satisfied; otherwise it is increased (Line 9).

The motivation behind decreasing the reservation

value is to allow agents to concede more in order

to increase the number of successful selling ne-

gotiations (i.e. minimizing the scrap products at

the end of the negotiation). If there are no prod-

ucts expected to remain at the end of the negotia-

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

98

tion, the reservation value is increased. Hence, the

agent can maximize the utility by making more

profit, at a reasonable risk of more negotiation

failures.

The reservation value for buying negotiations for

product p is determined as follows:

r

p,t+1

=

(

r

p,t

+ γ Failure

r

p,t

− θ Otherwise

(9)

where r

b,t+1

, and r

b,t

denote the updated and for-

mer reservation value respectively. In case a ne-

gotiation fails, the reservation value is increased

by γ = 0.01; otherwise, decreased by θ = 0.001.

The adaptive structure of the reservation value

prevents the agent to act too greedy or generous

during the negotiations.

• Making an Offer (Offering Strategy): Our

agent adopts a time-based concession strategy

(Faratin et al., 1998) to make its offers during the

negotiation. According to the time based conces-

sion strategy, the agent monotonically concedes

over time. The target utility of the current offer is

calculated as follows:

t

u

= 1 + (r − 1) ∗ t

z

(10)

where,

t

u

: Target utility

r : Reservation value

t : Normalized timeline. It takes a value between

0 and 1, where 0 represents the beginning time

and 1 denotes the timeline reaching the dead-

line.

z : Concession coefficient, z=10 for our agent

When our agent makes an offer, it first calculates

the target utility. Among all possible offers, the

offer with the smallest absolute value difference

between the utility of the offer and target utility,

is offered.

• Deciding whether or not to Accept Opponent’s

Offer: During the negotiation, our agent adopts

AC

next

acceptance strategy (Baarslag et al., 2014).

If the utility value of the given offer is greater than

or equal to utility of its next offer, opponent’s offer

is accepted; otherwise, it is rejected.

• Scheduling Production: At each simulation step,

all idle production lines are scheduled to pro-

duce output products when there are enough input

products in the inventory. When there are less in-

put products than the number of idle production

lines, all input products in the inventory is used

for production.

4 EVALUATION

In the experiment, we have evaluated the performance

of our agent based on the score (see Equation 5)

gained at the end of simulations. The performance

of our agent is compared with the performance of

the SCML league winner agents in ANAC namely

SAHA, F2J, IFFM, and the greedy factory manager

agent provided by the ANAC organizers. In the simu-

lation environments, there are multiple factory agents.

In the current set up, we can specify agents strate-

gies to be compared for only two factory agents and

the rest of the factory agents by default are played

by the greedy factory agents whose score is not taken

into account. In our evaluation, we use the same sim-

ulation parameters with the ANAC setup except the

number of simulation. We set the number of simula-

tion steps as 150 in order to analyse more interactions

while it is a random number between 50 and 100 in

the competition.

4.1 Simulation Parameters

The simulation parameters determine the initial setup

of the supply chain environment. The values of the

simulation parameters in the experiments are speci-

fied below:

• Type of raw materials : 1

• Number of intermediate products : uniform(1,4)

• Number of final products : 1

• Number of miners : 5

• Number of consumers : 5

• Starting balance : 1000

• Production line count : 10

• Production cost : uniform(1,4)

• Amount of manufacturing process inputs : 1

• Amount of manufacturing process outputs : 1

• Time required for manufacturing process : 1 step

4.2 World Parameters

The world parameters determine the rules for negotia-

tions, simulation length and several other rules for the

simulation. The parameters for the simulation in our

experiments is shown below:

• Number of simulation steps : 150

• Simulation time limit : 7200 Secs

• Negotiation time limit : 120 Secs

• Negotiation rounds limit : 20

Taking Inventory Changes into Account While Negotiating in Supply Chain Management

99

• Negotiation time limit for each round : 10 Secs

• Negotiation speed multiplier : 21

• Immediate negotiations : No

• Default grace period for contract signing : 1

• Transportation delay : 0

• Negotiable penalties : Yes

• Allow breach renegotiations : Yes

• Global breach penalty : 0.02

• Base insurance premium : 0.1

4.3 Experiment Results

As we mentioned before, we have tested the perfor-

mance of our agent by running simulations with the

agent provided by the organizing committee namely,

greedy factory manager agent (GFM), and top per-

forming agents in the competition specifically, SAHA

agent, IFFM agent, and F2J agent.

To evaluate the performance of our agent, we have

compared the mean scores of each agent, the number

of times they outperformed their opponents, and the

number of times each agent bankrupted at the end of

the negotiation. For each agent pairs, we ran 10 dif-

ferent simulations (e.g. different product costs, cata-

logue costs, and number of intermediate products etc.)

and calculate the mean score for each agent. Fur-

thermore, we applied statistical significance test on

the score data to check whether the medians of data

are significantly different. It is worth noting that we

applied the Smirnov-Kolmogorov test to see whether

the data follows a normal distribution - which is a re-

quirement for t test. Since our data is not distributed

normally, we adopt a non-parametric statistical signif-

icance test namely Wilcoxon signed-rank test with a

significance level of 0.01.

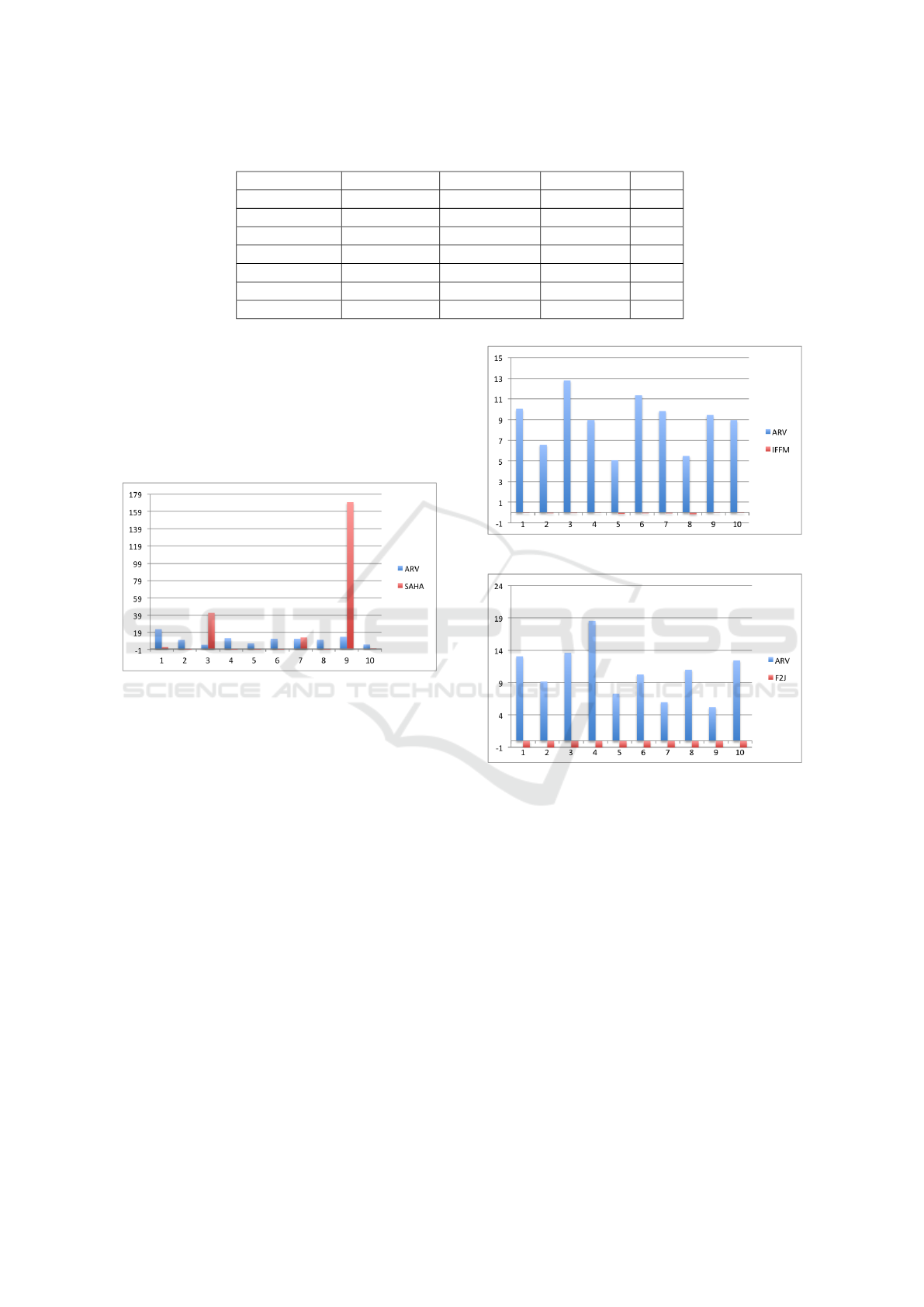

Table 1 shows the average scores of each agent

with their standard deviations, and the number of

times they won and bankrupted for each agent pair

out of 10 simulations. It can be obviously observed

that SAHA agent outperforms IFFM and F2J signifi-

cantly according to the average score although its per-

formance varies a lot (high standard deviation). It also

outperformed our agent in pairwise comparison but

the performance difference is not as much as others.

As far as the number of wins are concerned, our agent

outperformed SAHA agent (7 versus 3). When we

analyzed the results in a detailed way, we observed

that SAHA performed better with respect to the aver-

age score because when it beats our agent, the score

difference is tremendous compared to ours. That is

why it has a higher average score although we won

more negotiations. It earns a lot due to its strate-

gic pricing approach aiming at exploiting consumers

while we stick on the catalogue price and aim to earn

from the demand.

In pairwise comparison, our agent outperformed

all other agents except SAHA agent according to av-

erage scores. It is seen that we are the winner when

we negotiate with them (10 wins out of 10 runs). In

the following sections, we elaborately presents the re-

sults of 10 negotiations in which our agent negotiate

with each agent separately.

4.3.1 Greedy Factory Manager Agent

Our agent against greedy factory manager agent

(GFM) achieved a mean score around 13.5 meaning

that our agent’s funds at the end of simulation was on

average 13.5 times higher than the initial, while the

greedy factory manager agent has an average score of

-1, which is the possible lowest score in the simula-

tion. Figure 2 shows the score of each agent per each

simulation runs. As seen from the bar chart, our agent

outperformed the opponent in all simulation runs. It

is not a surprising outcome since that agent is not very

sophisticated agent.

Figure 2: Scores of ARV and GFM for 10 negotiations.

When we apply the statistical tests, p value is

0.00512 and w value is 0. Because the p value is less

than the significance level 0.01 and w score is less

than the critical w score 5, the null hypothesis is re-

jected. That means the medians of the distributions

differ significantly under the significance level 0.01.

4.3.2 SAHA Agent

The average score of our agent against SAHA agent

was 10.94 while the SAHA agent got the average

score of 22.24. Figure 3 depicts the score of each

agent per simulation runs. We can observe that our

agent outperformed the SAHA agent 7 times out of

10 runs. We have found out that the cases SAHA

agent outperformed our agent when the SAHA agent

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

100

Table 1: Performance Comparison of Each Agent Pairs.

Agents Avg Score St dev Bankrupts Wins

SAHA/IFFM 183.37 / 0 296.43 / 0.12 0/0 5/5

SAHA vs F2J 32.94 / -0.02 95.36 / 0.07 0/0 4/6

F2J/IFFM 0.76 / -0.06 0.19 / 0.88 0/0 3/7

ARV/GFM 13.5/-1 2.27/0 0/10 10/0

ARV/SAHA 10.94/22.24 5.26/53.49 0/5 7/3

ARV/IFFM 8.85/-0.06 2.48/0.04 0/0 10/0

ARV/F2J 10.65/-1 4.01/0 0/10 10/0

could run the manufacturing process for producing fi-

nal products to sell to the consumers. SAHA agent

exploited consumers to sell many products at a high

price while our agent charged consumers at the cat-

alog price of products at most even when the selling

negotiation success rate was high, SAHA agent per-

formed better in this scenario.

Figure 3: Scores of ARV and SAHA in 10 negotiations.

When we apply a statistical test, we see p =

0.44726 and w=20. Because the p value is greater

than the significance level 0.01, the null hypothesis is

failed to be rejected.

4.3.3 IFFM Agent

Our agent got an average score of 8.85 while the in-

surance fraud agent got an average of -0.06. Figure

4 depicts the score of each agent per simulation runs.

For all of the simulation runs, our agent got higher

score compared to the opponent.

Unlike SAHA agent, IFFM agent did not bankrupt

at all. The test statistic values of Wilcoxon signed-

ranks test is p = 0.00512 and w = 0 with a critical w

value 5. Since p value is less than the significance

level 0.01, the null hypothesis is rejected.

4.3.4 F2J Agent

Our agent got an average score of 10.65 while F2J

agent got -1 and bankrupted in all of the simulation.

Figure 5 shows the score of each agent per simulation

Figure 4: Scores of ARV and IFFM in 10 negotiations.

Figure 5: Scores of ARV and F2J in 10 negotiations.

runs. As seen from the chart, our agent beats in all

runs.

The test statistic scores for the final scores was

p=0.00512 and w=0 where the critical value of w is

5. Because p value is smaller than the significance

level 0.01 and w is smaller than the critical value, the

null hypothesis is rejected.

5 RELATED WORK

In the recent years, plenty of researches have been

conducted for concurrent bilateral negotiations in

supply chain management. To do so, researchers have

worked on various supply chain models which have

some similarities and differences with our study.

A negotiation-based multi-agentsystem for sup-

Taking Inventory Changes into Account While Negotiating in Supply Chain Management

101

ply chain managementForget et al. developed a sys-

tem that can coordinate agents in complex supply

chain management environments with multi-behavior

agents (Forget and CIRRELT., 2008). In their study,

agents can negotiate on quantity, price, and deliv-

ery time similar to the SCML. To simulate the sup-

ply chain environment, they developed an agent based

platform by emulating a lumber supply chain. In their

study, different types of negotiations namely collab-

orative one-to-one, collaborative one-to-many, adver-

sarial one-to-one, and adversarial one-to-many are an-

alyzed. In the collaborative negotiation case, the mu-

tual benefit of both parties is the concern while in

adversarial case (i.e. the individual utility case), the

agents try to maximize their own utility only. In our

case, all negotiations in the simulation are one-to-one

negotiations where agents have the discretion to act

adversarial or collaborative by defining utility func-

tions and negotiation strategies accordingly. We de-

signed utility functions for buying and selling negoti-

ations which remain robust because they are adjusted

based on the inventory changes and negotiation re-

sults (i.e success or failure of the negotiations).

Lin et al. developed a Multi-Agent system to im-

prove the order fulfillment process (OFP) in the Sup-

ply Chain System (Lin and Lin, 2004). An OFP is

the process of receiving the order, producing it, and

delivering the product to the customer. The OFPs are

assumed to be given in their study while in our study,

OFPs arise after the agents reach agreements through

negotiations and then sign contracts. They modelled

the order fulfillment process (OFP) as a distributed

constraint satisfaction problem (DCSP) in which the

constraints are distributed in all agents and to solve

DCSP. Their contribution was combining DCSP with

peer to peer negotiation approach in which the agents

negotiated on the constraints in order to find a solu-

tion for their inter-agent constraints. In other words,

peer to peer negotiation is the approach they used to

solve the DCSP which represents the OFP in supply

chain. In our study, peer to peer negotiations are used

to sell/buy goods while maximizing at the profits at

the end of the simulation. To test the performance of

their system, they used performance metrics such or-

der fulfillment rate and cycle time, which are the main

concerns of OFP. While in our study, we evaluated the

performance based on the final profits.

Chen et al. designed a negotiation based dynamic

multi-agent system for supply chain environments in

which the entities, represented as agents, can join

or leave the environment and there are multiple fi-

nal products where agents do negotiations for trans-

actions (Chen et al., 1999). The agents have con-

straints such as delivery time, quantity and price and

constraint resolution forms their acceptance strategy

during one-to-many negotiations, where the agent ne-

gotiates for buying goods from many suppliers in the

same thread and offer(s) of other party is accepted if

the constraints are satisfied. In our study on the other

hand there is one final product which are obtained by

processing input products, the factory managers don’t

have constraints but has the aim to maximize their

profit and therefore design their utility function dy-

namic to changes in market to make smart transac-

tions.

Fink developed a multi agent collaboration system

in supply chain management (Fink, 2004). In their

work, a set of potential contracts between both parties

are assumed to be given and during negotiations a me-

diator agent generates candidate contracts transparent

to both parties which can accept or reject the medi-

ator’s offer and the agreement is reached when both

parties accept the offer. The motivation behind this

study is to reach mutual agreements for both agents

while in our study the parties do bilateral negotiations

to exchange offers where the main concern is maxi-

mizing the individual benefit.

Williams et al. introduced a novel strategy that

enables agents to negotiate concurrently with multi-

ple unknown opponents (Williams et al., 2012). In

their work, they implement a coordinator entity which

records the observations of ongoing negotiations and

define a concurrent negotiation strategy based on the

opponents’ probabilistic actions. In our work, instead

of coordinating multiple negotiations, we update the

reservation values for the further negotiations based

on the negotiation results and inventory changes in

order to define a robust strategy in supply chain en-

vironment.

6 CONCLUSION

We developed a factory manager agent for Supply

Chain Management League in ANAC where suppli-

ers, factories and consumers interact with each other

through negotiations. The proposed agent adopts

adaptive adjustment of reservation value with respect

to changes in its inventory and negotiates accordingly.

Moreover, it seeks more negotiation opportunities to

make some profits. To do so, it buys some products

which are not processed in its manufacturing lines and

sells them to customers with profit. We have evalu-

ated the performance of the proposed agent by com-

paring it with the top performing agents in ANAC

with respect to a number metrics. The experimental

results showed that our agent outperformed them.

In the current work, we have not designed strate-

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

102

gic pricing approaches; instead stick on the catalog

price of products and aimed to gain from demands.

As for future work, we are planning to incorporate

strategic pricing as SAHA agent did. Furthermore, it

would be interesting to predict consumer’s demand in

advance based on the past interactions. In the current

set up, there is only one production line in which one

input material is processed to produce a single prod-

uct. It would be more challenging if the factory agent

had production lines producing different products and

decided on which products it should invest more.

REFERENCES

Aydo

˘

gan, R., Festen, D., Hindriks, K. V., and Jonker,

C. M. (2017). Alternating offers protocols for mul-

tilateral negotiation. In Modern Approaches to Agent-

based Complex Automated Negotiation, pages 153–

167. Springer.

Aydo

˘

gan, R. and Yolum, P. (2012). Learning opponent’s

preferences for effective negotiation: an approach

based on concept learning. Autonomous Agents and

Multi-Agent Systems, 24(1):104–140.

Baarslag, T., Hindriks, K., and Jonker, C. (2014). Effective

acceptance conditions in real-time automated negoti-

ation. Decision Support Systems, 60:68–77.

Chen, Y., Peng, Y., Finin, T., Labrou, Y., Cost, R., Chu,

B., Yao, J., and Sun, R. (1999). A negotiation-

based multi-agent system for supply chain manage-

ment. Proc. Agents’99 Workshop Agent- Based

Decision-Support for Managing Internet-Enabled

Supply Chain, pages 15–23.

de Jonge, D., Baarslag, T., Aydo

˘

gan, R., Jonker, C., Fujita,

K., and Ito, T. (2019). The challenge of negotiation

in the game of diplomacy. In Agreement Technolo-

gies, pages 100–114, Cham. Springer International

Publishing.

Faratin, P., Sierra, C., and Jennings, N. R. (1998). Ne-

gotiation decision functions for autonomous agents.

Robotics and Autonomous Systems, 24(3):159 – 182.

Multi-Agent Rationality.

Fatima, S., Kraus, S., and Wooldridge, M. (2014). Princi-

ples of automated negotiation. Cambridge University

Press.

Fink, A. (2004). Supply chain coordination by means of au-

tomated negotiations. 37th Hawaii International Con-

ference on System Sciences, pages 243–265.

Forget, P. and CIRRELT. (2008). Collaboration Agent-

based Negotiation in Supply Chain Planning Using

Multi-behaviour Agents. CIRRELT (Collection). CIR-

RELT.

Fujita, K. (2014). Automated strategy adaptation for multi-

times bilateral closed negotiations. In Proceedings

of the 2014 international conference on Autonomous

agents and multi-agent systems, pages 1509–1510. In-

ternational Foundation for Autonomous Agents and

Multiagent Systems.

Hindriks, K., Jonker, C., and Tykhonov, D. (2009). The

benefits of opponent models in negotiation. In 2009

IEEE/WIC/ACM International Conference on Web In-

telligence and Intelligent Agent Technology, pages

439–444.

Ito, T., Hattori, H., and Klein, M. (2007). Multi-issue nego-

tiation protocol for agents: Exploring nonlinear utility

spaces. In IJCAI, volume 7, pages 1347–1352.

Jonker, C. M., Aydo

˘

gan, R., Baarslag, T., Fujita, K., Ito, T.,

and Hindriks, K. V. (2017). Automated negotiating

agents competition (ANAC). In AAAI, pages 5070–

5072.

Lin, F. and Lin, Y. (2004). Integrating multi-agent negoti-

ation to resolve constraints in fulfilling supply chain

orders. Electronic Commerce Research and Applica-

tions, 5:313–322.

Lin, R., Kraus, S., Baarslag, T., Tykhonov, D., Hindriks,

K., and Jonker, C. M. (2014). Genius: An in-

tegrated environment for supporting the design of

generic automated negotiators. Computational Intelli-

gence, 30(1):48–70.

Mbang, A. (2011). A new introduction to supply chains

and supply chain management: Definitions and the-

ories perspective. International Business Research,

5:194–207.

Mell, J., Gratch, J., Baarslag, T., Aydo

˘

gan, R., and Jonker,

C. M. (2018). Results of the first annual human-agent

league of the automated negotiating agents competi-

tion. In Proceedings of the 18th International Con-

ference on Intelligent Virtual Agents, pages 23–28.

ACM.

Mohammad, Y., Areyan Viqueira, E., Ayerza, N. A., Green-

wald, A., Nakadai, S., and Morinaga, S. (2019). Sup-

ply chain management world - A benchmark environ-

ment for situated negotiations. In PRIMA 2019: Prin-

ciples and Practice of Multi-Agent Systems - 22nd In-

ternational Conference, Turin, Italy, October 28-31,

2019, Proceedings, pages 153–169.

Mohammed, Y., Greenwald, A., Fujita, K., Morinaga, S.,

and Nakadai, S. (2019). SCM World:Automated Ne-

gotiating Agents Competition.

Sanchez-Anguix, V., Aydogan, R., Julian, V., and Jonker, C.

(2014). Unanimously acceptable agreements for ne-

gotiation teams in unpredictable domains. Electronic

Commerce Research and Applications, 13(4):243–

265.

Williams, C. R., Robu, V., Gerding, E., and Jennings, N. R.

(2012). Negotiating concurrently with unknown oppo-

nents in complex, real-time domains. In ECAI, pages

834–839.

Taking Inventory Changes into Account While Negotiating in Supply Chain Management

103