Fools Rush In: Competitive Effects of Reaction Time in Automated

Trading

Henry Hanifan and John Cartlidge

a

Department of Computer Science, University of Bristol, Merchant Venturers Building, Woodland Road, Bristol, U.K.

Keywords:

Agent Based Modelling, Auctions, Automated Trading, Financial Markets, Simulation, Trading Agents.

Abstract:

We explore the competitive effects of reaction time of automated trading strategies in simulated financial mar-

kets containing a single exchange with public limit order book and continuous double auction matching. A

large body of research conducted over several decades has been devoted to trading agent design and sim-

ulation, but the majority of this work focuses on pricing strategy and does not consider the time taken for

these strategies to compute. In real-world financial markets, speed is known to heavily influence the design

of automated trading algorithms, with the generally accepted wisdom that faster is better. Here, we introduce

increasingly realistic models of trading speed and profile the computation times of a suite of eminent trading

algorithms from the literature. Results demonstrate that: (a) trading performance is impacted by speed, but

faster is not always better; (b) the Adaptive-Aggressive (AA) algorithm, until recently considered the most

dominant trading strategy in the literature, is outperformed by the simplistic Shaver (SHVR) strategy—shave

one tick off the current best bid or ask—when relative computation times are accurately simulated.

1 INTRODUCTION

As trading in financial markets has become in-

creasingly automated, the importance of speed is

paramount. Competition between automated trading

systems (ATS) looking to capitalise on fleeting op-

portunities ahead of rivals has resulted in a prolif-

eration of high frequency trading (HFT) algorithms

capable of executing many thousands of trades each

second (Duffin and Cartlidge, 2018). The effects of

ever-faster ATS (the so called race to zero) can be ob-

served in the dynamics of modern financial markets:

individual stocks now frequently exhibit ten percent

price swings in less than one tenth of a second (John-

son et al., 2013); flash crashes can cause whole mar-

kets to lose a trillion dollars in five minutes (Baxter

and Cartlidge, 2013); and when market-leading ATS’s

malfunction, the owners can be pushed to bankruptcy

in under an hour (Baxter and Cartlidge, 2013).

Yet, the literature on automated financial trading

agents is largely bereft of considerations of compu-

tational speed, with the majority of work focusing

on pricing strategies. One reason for this is largely

historical, with trading agent experiments tending to

follow Vernon Smith’s seminal design that helped

a

https://orcid.org/0000-0002-3143-6355

birth the field of experimental economics (Smith,

1962). Using human participants, Smith (1962) set

up a simple marketplace where traders took turns

to quote prices and execute trades in an open out-

cry style marketplace. To enable strict comparisons

with earlier work, later studies that introduced new

automated trading algorithms (e.g., ZIC (Gode and

Sunder, 1993); ZIP (Cliff, 1997); GD (Gjerstad and

Dickhaut, 1997); and AA (Vytelingum, 2006)) tended

to follow Smith’s original design. Although subse-

quent works have gradually introduced a series of

adaptations, such as the use of an order book (Das

et al., 2001), real-time experiments that include hu-

man and agent participants (Das et al., 2001; De

Luca and Cliff, 2011; De Luca et al., 2011; Cartlidge

and Cliff, 2012), and more realistic market dynam-

ics such as continuous replenishment of assignments

(De Luca et al., 2011; Cartlidge and Cliff, 2012) and

continuously varying equilibria (Cliff, 2019; Snashall

and Cliff, 2020), the time taken for agents to com-

pute their strategy has remained significantly under-

studied.

Several works have demonstrated that altering the

design of trading agent experiments can raise doubt

over how well previously established results trans-

late to real world markets. This had led several au-

thors to call for more experimental realism (e.g., De

82

Hanifan, H. and Cartlidge, J.

Fools Rush In: Competitive Effects of Reaction Time in Automated Trading.

DOI: 10.5220/0008973700820093

In Proceedings of the 12th International Conference on Agents and Artificial Intelligence (ICAART 2020) - Volume 1, pages 82-93

ISBN: 978-989-758-395-7; ISSN: 2184-433X

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Luca et al. (2011); Cartlidge and Cliff (2012, 2018);

Cliff (2019); Snashall and Cliff (2020)). Here, we

address that challenge by introducing minimal mod-

els of computation time (‘thinking’ time, or ‘reac-

tion’ time, of traders) into the standard experimen-

tal framework. Using an adaptation of the Bristol

Stock Exchange (for open source download, see BSE

(2012); for platform description, see Cliff (2018)), we

explore the competitive effects of computation speed

on a suite of reference trading algorithms available on

the platform: GVWY, SHVR, ZIC, ZIP, and AA.

Perhaps unsurprisingly, results demonstrate that

the relative speeds of trading strategies does affect

profitability. However, depending on the particular

strategies competing in the market, being faster is

not necessarily better. Further, we show that when

relative reaction times are accurately modelled, AA

– long considered the dominant trading agent strat-

egy in the literature – is beaten in static symmetric

markets by the simple non-adaptive trading strategy

SHVR. Given other recent evidence that AA’s domi-

nance is sensitive to the mixture of competing strate-

gies in the market (Vach, 2015; Cliff, 2019; Snashall

and Cliff, 2020), and the complexity of the market

dynamics (Cliff, 2019; Snashall and Cliff, 2020) this

result adds further support that AA is non-dominant

when markets are more realistically modelled.

The rest of the paper is organised as follows. In

Section 2 we review related work and introduce key

economic concepts and technical details of the trad-

ing agents used in these experiments. In Section 3 we

introduce three methods for modelling trader speed:

(i) fixed ordering, (ii) tournament ranking, and (iii)

speed proportional selection. Section 4 presents re-

sults from a series of experiments with homogeneous

markets (containing one trader type) and heteroge-

neous pair-wise balanced markets (containing two

trader types). In Section 5 we discuss the implications

of results and describe avenues for future work. Fi-

nally, Section 6 presents the conclusion that reaction

speeds matter, and therefore the research community

will benefit from future focus in this area.

2 BACKGROUND

2.1 Trading Agent Experiments

In the 1960s, Vernon Smith conducted a series of trad-

ing experiments with small groups of untrained hu-

man participants (i.e., students) to investigate compet-

itive market behaviours (Smith, 1962). He was able

to demonstrate that these simple simulations of finan-

cial markets produced surprisingly efficient equilibra-

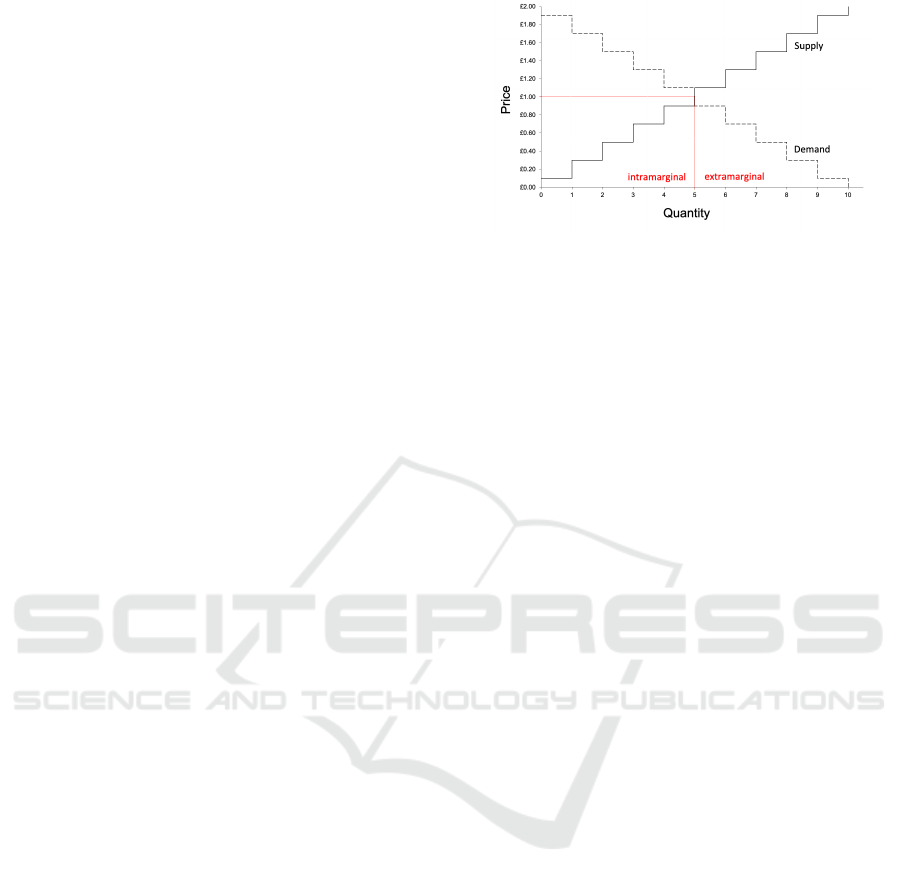

Figure 1: Symmetric supply and demand schedules, show-

ing a market with n = 10 buyers (demand) and n = 10 sellers

(supply). Limit prices for buyers (maximum price to buy)

and sellers (minimum price to sell) are evenly distributed

over the interval [£0.10,£1.90], giving theoretical equilib-

rium price P

0

= £1.00 ± 0.10 and expected quantity trans-

acted Q

0

= n/2 = 5. Intra-marginal traders, to the left of

Q

0

, expect to transact. Extra-marginal traders do not.

tion behaviours, with trade prices quickly tending to

the theoretical equilibrium value predicted by the un-

derlying market supply and demand. Intriguingly,

three decades later, Gode and Sunder (1993) were

able to reproduce similar results, but this time using

‘zero intelligence’ (ZI) algorithmic traders that gen-

erate random quote prices. Despite their simplicity,

markets of ZIC traders (the letter C indicating traders

are constrained to not make a loss) were shown to

exhibit equilibration behaviours similar to that of hu-

mans, suggesting that intelligence is not necessary for

competitive markets to behave efficiently: the market

mechanism (the rules of the continuous double auc-

tion) performs much of the work.

However, Gode and Sunder’s (1993) result was

later shown to only hold when market demand and

supply are symmetric (i.e., when the magnitude of the

gradient—the price elasticity—of supply and demand

schedules are similar, such as the example shown in

Figure 1). For asymmetric markets, such as when the

supply curve is horizontal, ‘zero’ intelligence is not

enough to provide human-like levels of market effi-

ciency (Cliff, 1997). To account for this, Cliff intro-

duced a new minimally-intelligent trading algorithm,

which he named Zero Intelligence Plus (ZIP). ZIP

maintains an internal profit margin, µ, which is in-

creased or decreased by traversing a decision tree that

considers the most recent quote price, the direction

of the quote (buy or sell) and whether it resulted in a

trade. Margin, µ, is then adjusted with magnitude pro-

portional to a learning rate parameter, similar to that

used in Widrow-Hoff or in back-propagation learn-

ing. Cliff (1997) successfully demonstrated that mar-

kets containing only ZIP traders will exhibit human-

like behaviours in all of Smith’s original experimental

market configurations, both symmetric and asymmet-

Fools Rush In: Competitive Effects of Reaction Time in Automated Trading

83

ric.

Other intelligent trading agents have been devel-

oped to maximise profits in experimental markets that

follow Smith’s framework. Most notably, these in-

clude: GD, named after its inventors, Gjerstad and

Dickhaut (1997); and Adaptive-Aggressive (AA), de-

veloped by Vytelingum (2006). GD selects a quote

price by maximising a ‘belief’ function of the likely

profit for each possible quote, formed using histori-

cal quotes and transaction prices in the market. Over

time, the original GD algorithm has been successively

refined: first by Das et al. (2001) and Tesauro and

Das (2001) (named Modified GD, or MGD) to en-

able trading using an order book (see example in

Figure 2), and to reduce belief function volatility;

and then by Tesauro and Bredin (2002), who used

dynamic programming to optimise cumulative long-

term discounted profitability rather than immediate

profit (GD eXtended, or GDX). In contrast, AA in-

corporates a combination of short-term and long-term

learning to update an internal profit margin, µ. In the

short-term, µ is updated using rules similar to ZIP.

Over the long-term, AA calculates a moving average

of historical transaction prices to estimate the market

equilibrium value, P

0

, and current price volatility cal-

culated as root mean square deviation of transaction

prices around the estimate P

0

. If the AA trader es-

timates that it is extra-marginal (and will therefore

find it difficult to trade profitably: see Figure 1) it

trades more aggressively (by reducing µ), if it is intra-

marginal (and will therefore find it easier to profit) it

trades more passively (by increasing µ).

For a summary of trading strategies, see Table 1.

2.2 The Battle for Trading Dominance

For the last two decades, a research theme has

emerged: to develop the best trading agent that can

successfully beat human participants and other trad-

ing agents in Smith-style experiments (see Snashall

and Cliff (2020) for a detailed historical account).

It was first demonstrated that trading agents, specif-

ically ZIP and MGD, outperform humans when di-

rectly competing in human-agent markets (Das et al.,

2001): “. . . the successful demonstration of machine

superiority in the CDA and other common auctions

could have a much more direct and powerful finan-

cial impact—one that might be measured in billions

of dollars annually”. This announcement quickly

generated global media coverage and significant in-

dustry interest. Shortly afterwards, Tesauro and

Bredin (2002) suggested that GDX “may offer the

best performance of any published CDA bidding strat-

egy”. Subsequently, after it’s introduction in 2006

Volume Price Price Volume

1 0.97 0.99 2

2 0.96 1.01 1

1 0.94 1.03 3

1 0.90 1.04 1

Bids

Asks

Figure 2: A Limit Order Book (LOB), presenting the cur-

rent market state. Bids (orders to buy) are presented on

the left hand side, ordered by price descending. Asks (or-

ders to sell) are presented on the right hand side, ordered

by price ascending. Volume indicates the quantity avail-

able at each price. The top line presents the Best Bid

(BB = 0.97) and Best Ask (BA = 0.99) prices in the mar-

ket, and the difference between these prices is called the

spread = BA − BB = 0.02. The midprice of the book is

(BB + BA)/2 = 0.98; the microprice is volume weighted

midprice, calculated as: (2/3)0.97 + (1/3)0.99 = 0.977.

Orders can be submitted at any price, subject to a mini-

mum resolution, or tick size (tick = 0.01). Aggressive or-

ders that cross the spread (i.e., an ask with price p

a

≤ 0.97,

or a bid with price p

b

≥ 0.99) will immediately execute at

the price presented in the LOB (i.e., the ask will transact at

price BB = 0.97; the bid will transact at price BA = 0.99).

Passive orders that do not cross the spread will rest in the

LOB, with position determined by price.

(Vytelingum, 2006), AA was shown to dominate ZIP

and GDX (Vytelingum et al., 2008) and also humans

(De Luca and Cliff, 2011): “we therefore claim that

AA may offer the best performance of any published

strategy”. And so, for several years, AA held the

undisputed algo-trading crown.

However, more recently, doubt about the domi-

nance of AA has emerged. In particular, for markets

containing AA, GDX, and ZIP strategies, the mix-

ture (i.e., the proportion) of strategies in the market

has been shown to affect AA performance. In par-

ticular, AA only dominates when there is a signifi-

cant proportion of other AA agents in the market; in

other cases, it is regularly beaten by GDX and ZIP

(Vach, 2015). This finding was supported by Cliff

(2019), through exhaustive testing of markets contain-

ing mixtures of MAA (a slightly modified version of

AA which utilises microprice of the orderbook; re-

fer to Figure 2), ZIC, ZIP, and SHVR (a simple non-

adaptive strategy that quotes prices one tick inside the

current best price on the order book). Further, Cliff

(2019) found that introducing more realistic mar-

ket dynamics—continuous replenishment of assign-

ments, rather than periodic replenishments at regu-

lar intervals; and also a continuously moving equilib-

rium, P

0

, which was set to follow real world historical

trade price data—MAA did not dominate, and when

considering profitability, MAA was significantly out-

performed by ZIP and SHVR. A related study by

Snashall and Cliff (2020) also showed that GDX

dominates MAA, ZIP, ZIC, and ASAD (Assignment-

Adaptive, developed by Stotter et al. (2013)) in these

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

84

Table 1: Summary of trading agent strategies when acting as a buyer. When selling, prices are moved in the opposite direction.

Q is new quote price, L is limit price, T is tick size, BB is best bid on the LOB. Traders cannot make a loss, i.e., Q ≤ L.

Agent Name Method to Determine New Quote Price, Q

GVWY Giveaway Q = L. Always post quote at price equal to limit price.

SHVR Shaver Q = min(BB + T,L). Post quote one tick inside current best bid.

ZIC Zero Intelligence

Constrained

Q = q ∈ U [0.01,L]. Quote randomly from Uniform distribution bounded by system

minimum value (one tick, T = 0.01) and limit price, L.

ZIP Zero Intelligence

Plus

Q = L(1 − µ), where 0 ≤ µ < 1 is an internal profit margin. When a trade occurs, if

Q is greater than trade price, then decrease µ (i.e., raise price), otherwise increase µ.

If new best bid on LOB has price BB > Q, decrease µ (i.e., raise price).

AA Adaptive

Aggressive

Q = L(1 − µ), where 0 ≤ µ < 1 is an internal margin. Estimate market equilibrium,

P

0

, to determine whether L is intra-marginal (L ≥ P

0

) or extra-marginal (L < P

0

). If

extra-marginal, increase aggressiveness (decrease µ); else increase µ.

GDX GD eXtended

(not used in this

study)

Q selected by dynamic programming to maximise cumulative long-term discounted

profitability of a ‘belief’ function that calculates likely outcome of each price, q,

based on the success of previous quotes and transaction prices in the market.

more realistically complex markets (SHVR was not

tested in the latter study).

2.3 Latency and Reaction Speed

Throughout the previous works, the primary motiva-

tion has been focused on pricing strategies for trad-

ing efficiency (i.e., profit maximisation and market

equilibration behaviours). However, if we are to bet-

ter understand the behaviour of these algorithms in

more realistic environments, it is important to con-

sider latency, a key real-world factor that is missing

in most of these studies. In real-world financial mar-

kets, communication latency (the differential delays

in which traders can access trading information and

initiate trades with an exchange), and trading latency

(or reaction time: the time it takes for a human or

algorithmic trader to react to new information) are

major determinants of trading behaviours and mar-

ket dynamics (Duffin and Cartlidge, 2018; Snashall

and Cliff, 2020). In real markets, the proliferation

and profitability of high frequency trading (HFT) evi-

dences the efficacy of harnessing reduced latency, en-

abling traders to capitalise on fleeting opportunities

ahead of competitors.

Several studies have conducted human-agent and

agent-agent trading experiments using real-time asyn-

chronous trading platforms. For their seminal demon-

stration of agents outperforming human traders, Das

et al. (2001) used a hybrid platform consisting of

two of IBM’s proprietary systems: GEM, a dis-

tributed experimental economics platform; and Ma-

genta, an agent environment. Although real-time

asynchronous, trading agents were constrained to op-

erate on a sleep-wake cycle of ¯s seconds, with fast

agents having mean sleep time ¯s = 1, and slow agents

having mean sleep time ¯s = 5. A random jitter was in-

troduced for each sleep s such that: s ∈ [0.75 ¯s,1.25 ¯s].

Fast agents were set to wake on all new orders and

trades, slow traders were set to wake only on trades.

Therefore, although this real-time system enabled

asynchronous actions, algorithmic traders were artifi-

cially slowed to have reaction times comparable with

human traders.

Following Das et al. (2001), other real-time

human-agent experiments have invoked a similar

sleep-wake cycle. Using the Open Exchange (OpEx)

platform (download available: OpEx (2011)), De

Luca et al. (2011) demonstrated AA, GDX, and ZIP

outperform humans when agents have sleep-wake

cycle ¯s = 1; agent-agent experiments, demonstrat-

ing AA dominance, were performed using a discrete

event model (such that reaction times were ignored).

OpEx has also been used for further human-agent ex-

periments, for example, to demonstrate that: aggres-

sive (spread-jumping) agents that are faster (i.e., those

with lower ¯s values) can perform less well against hu-

mans (De Luca et al., 2011); faster trading agents can

reduce the efficiencies of human traders in the mar-

ket (Cartlidge et al., 2012); and agents with reaction

speeds much quicker than humans can lead to endoge-

nous fragmentation within a single market, such that

fast (slow) traders are more likely to execute with fast

(slow) traders (Cartlidge and Cliff (2012); a result that

has analogies with the robot phase transition demon-

strated in real-world markets (Johnson et al., 2013)).

Agent-only real-time asynchronous experiments

have also been conducted using the Exchange Portal

(ExPo) platform (download available: ExPo (2011)).

Stotter et al. (2013, 2014) used ExPo to introduce

a new Assignment-Adaptive (ASAD) trading agent.

They demonstrated that in ASAD:ZIP markets (with

sleep-wake cycle, ¯s = 4), signals produced by the

trading behaviour of ASAD are beneficially utilised

Fools Rush In: Competitive Effects of Reaction Time in Automated Trading

85

by ZIP traders, to the detriment of ASAD themselves.

Communications latency has been considered in

other works, e.g.: Duffin and Cartlidge (2018) model

latency arbitrage in fragmented markets; and Miles

and Cliff (2019) study the effects of latency in simu-

lated markets distributed globally in the cloud. Trad-

ing speed has also been incorporated into strategies,

e.g.,: Gjerstad (2003) used a pace parameter to con-

trol the arrival rate of GD (renamed Heuristic Belief

Learning, or HBL) traders, and to alter quote price

as a function of elapsed time; and McGroarty et al.

(2019) introduced an agent model of financial mar-

kets with agents that operate on different timescales to

simulate common strategies and behaviours, such as

market makers, fundamental traders, high frequency

momentum and mean-reversion traders, and noise

traders.

These works are representative of the literature

relevant to reaction time in trading algorithms. In

all, we see that computation times are either skewed

by enforced sleep, directly encoded, or drawn from

a probability distribution. As far as the authors are

aware, there is no attempt to systematically under-

stand the effects of reaction time using accurate com-

putation times of individual strategies. Here, we at-

tempt to address this gap.

3 METHODOLOGY

3.1 BSE: The Bristol Stock Exchange

The Bristol Stock Exchange (BSE) is a minimal,

discrete-time simulation of a centralised financial

market, containing a single exchange with Limit Or-

der Book (LOB), and reference implementations of

several leading trading strategies from the literature,

including five trading strategies that we consider in

this paper: GVWY, SHVR, ZIC, ZIP, and AA. For

a summary description of each trader, see Table 1.

For full details on BSE, refer to Cliff (2018). Python

source-code for BSE is available open-source on the

GitHub repository (BSE, 2012).

1

3.1.1 Random Order Selection (BSE Default)

Each time step, BSE ensures all traders act exactly

once by selecting traders at random, without replace-

ment. As such, there is no concept of relative reaction

times of traders. Over the course of a simulation ex-

periment, a fast trader will have the same number of

1

In this paper, we use BSE version 22/07/18, commit

hash: c0b6a1080b6f0804a373dbe430e34d062dc23ffb.

opportunities to act as a slow trader. Due to the ran-

domised sequence of actions, the slower trader will be

able to act first when presented with ‘lucky’ opportu-

nities as often as the fast trader. This is unrealistic.

In the following section, we introduce three simple

models of reaction time to the BSE framework.

3.2 Modelling Reaction Time

3.2.1 Fixed Order Selection

The simplest model of reaction time that we imple-

ment is the ordering model. Here, traders are selected

to update and act in a fixed order, alternating each

time step between buyers first and sellers first to en-

sure bias is not introduced. For each buyer b

i

∈ B and

seller s

i

∈ S (where |B| = |S| = n), we introduce two

orderings:

Order

A

= s

1

,b

1

,s

2

,b

2

,..., s

n

,b

n

(1)

Order

B

= b

1

,s

1

,b

2

,s

2

,..., b

n

,s

n

(2)

In the first time step, one of the orderings is selected

at random (e.g, Order

A

); in the second time step, the

ordering is switched (i.e., Order

B

); the third time step

returns to the first ordering (Order

A

); etc. In this way,

traders s

1

and b

1

are always selected to act first each

time step; s

n

and b

n

are always selected to act last.

We can consider this as traders s

1

and b

1

as acting

much quicker (having a smaller computation time, or

reaction time) than traders s

n

and b

n

.

3.2.2 Tournament Ranking Selection

The second model of reaction time assigns a speed

ranking to each trader. Each time step, we perform

the routine presented in Algorithm 1. We begin by

creating a pool containing all traders, and then se-

lect two traders at random from the pool and compare

rank. The trader with the lowest rank is selected to act

and then removed from the pool. This simulates two

traders racing to act on new market information. We

repeat these steps until all traders have acted and the

pool is empty. Similar to the previous random order

(Section 3.1.1) and fixed order (Section 3.2.1) models,

this process ensures that all traders act exactly once

each time step.

3.2.3 Speed Proportional Selection

The final model of reaction time is the most realistic.

Every trader is initially assigned a reaction time. Each

time step, traders are selected to act in proportion to

their relative speeds, such that trader A, with a reac-

tion time of R

A

= 1 would act twice as often as trader

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

86

Algorithm 1: Tournament Ranking.

Result: All traders have acted exactly once

input : P is the set of all traders, size 2n

while (size(P) > 1) do

Randomly select trader A from P;

Randomly select trader B from P;

if (rank(B) > rank(A)) then

Trader A to act;

Remove A from set P;

else

Trader B to act;

Remove B from set P;

end

end

Select remaining trader in P to act;

B with a reaction time of R

B

= 2. To achieve this, each

time step we select traders from a biased pool contain-

ing multiple references to each trader, such that the

number of references is inversely proportional to each

trader’s relative reaction time. For example, if R

A

= 1

and R

B

= 2, we generate a biased pool, P = {A,A,B},

containing two references to trader A and one refer-

ence to trader B. Each time step, traders are randomly

selected to act, without replacement, until the pool is

empty. We use notation R

A

B

= 1/2 to indicate A’s re-

action time is half B’s reaction time; similarly R

B

A

= 2

indicates B’s reaction time is twice as long as A.

This model provides two advantages over the pre-

vious models. First, it enables faster agents to act

multiple times before a slower agent can act (for

R

B

A

= 2, each time step A acts twice, while B acts only

once). Second, it allows slower traders to occasion-

ally get ‘lucky’ by being selected first. Therefore, of

the simple models presented here, this process most

accurately simulates the real world.

3.3 Experimental Configuration

For all experiments, markets contained an equal

number of n buyers and n sellers, with assignment

limit prices distributed evenly across the interval

[£0.10, £1.90], as shown in Figure 1. Market sessions

lasted 330 time steps, with assignments replenished

periodically every 30 time steps. Each simulation

configuration was repeated 100 times. Error bars on

graphs indicate 95% confidence intervals. Statistical

significance is calculated using Student’s t-test. This

simple, static, symmetric market is deliberately cho-

sen to enable comparisons with the literature. Reac-

tion time, using the procedures defined in Section 3.2,

is the only independent variable that we manipulate,

with the BSE default setting (all traders have equal re-

action times) directly equivalent to previous studies.

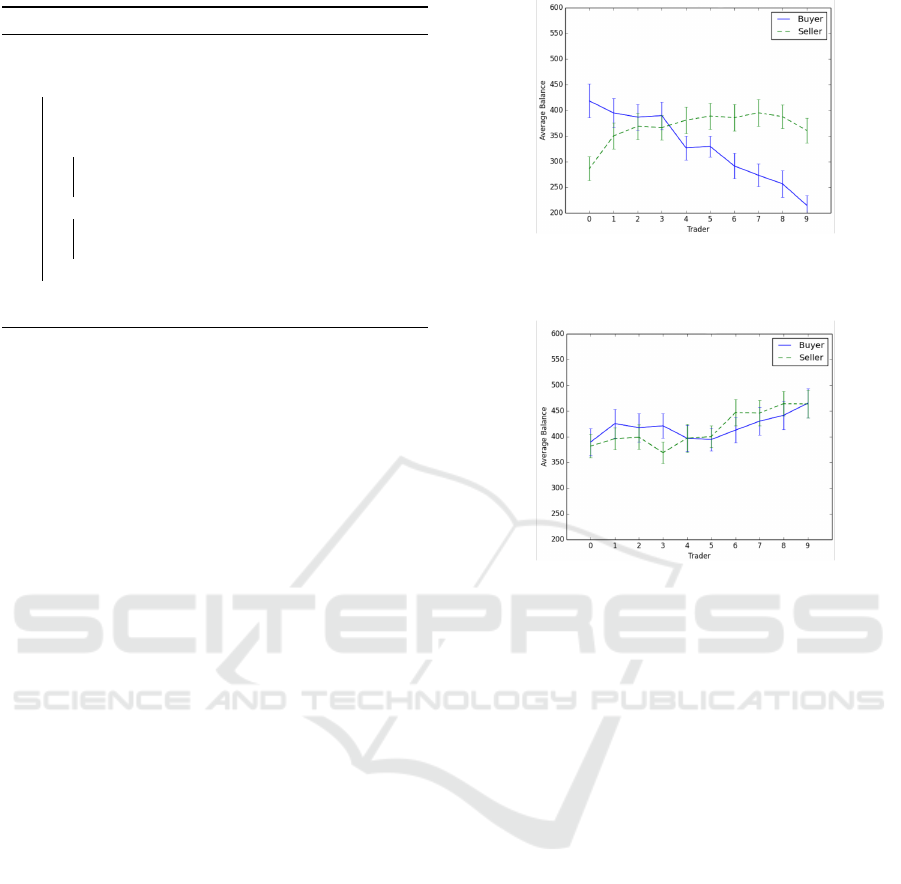

Figure 3: Fixed order selection for homogeneous ZIP mar-

kets. Buyers (solid blue line) perform better when selected

earlier, while sellers (dashed green line) perform worse.

Figure 4: Fixed order selection for homogeneous AA mar-

kets. All traders tend to perform better when selected later.

4 RESULTS

We present results of experiments originally per-

formed for an MSc project. For further details, see

Hanifan (2019).

4.1 Fixed Order Results

We ran a series of experiments using homogenous

trading populations with fixed order selection. Re-

sults demonstrate that the order in which traders act

had no effect on traders’ performance (measured by

profit generated) for GVWY, SHVR, and ZIC markets

(results not shown). This result is perhaps predictable,

as these simple trading agents cannot identify and op-

timally capitalise on profit making opportunities, un-

less they do so accidentally. However, a difference

can be observed in results for homogeneous ZIP mar-

kets and homogeneous AA markets. In ZIP markets

(Figure 3), there is a significant difference in perfor-

mance between traders selected first (trader 0) and

traders selected last (trader 9). However, perhaps sur-

prisingly, while it is advantageous to be selected ear-

lier when a buyer, it is better to be selected later when

a seller. In AA markets (Figure 4), the ordering has

less impact, but there is a general trend that being

Fools Rush In: Competitive Effects of Reaction Time in Automated Trading

87

(a) AA Profits

Figure 10: The distribution of the ask and bid quote price s wit h t h e homoge -

neous AA BSErank experiment.

These results show that within this market the sellers are generally o↵ering

quote prices with larger profit margins than the buyers, since the pr i ces they

o↵er are further away from the market equilibrium (see Fig 10) and both buyers

and sellers have identical customer orders that are centered around the market

equilibrium. This trend of the sellers operating with a large profit margin but

the buyers operating with a small profit helps to explain why the slower seller

against outperform t he ir faster counterparts, whereas t he faster buyers outpe r -

formed their slower counterparts.

In general within this market the quote prices from the buyers are coming in

higher compared to t h e equilibrium than th e quote prices from the sellers are

coming in low. Due to this it is better for a supplier to act towards the end of

the timestep as by this point more buyers have been able to update their bids

on the LOB, providing more bids to generate profit o↵. This is the opposite for

the buyers as the o↵ers on the LOB are generally providing smaller profits since

the prices are so high, in the rare case however that the supplier o↵ers a very

low bid it is a benefit f or the buyer to act faster in order to secure this trade.

8.3.3 Balanced Tes ts : Trader A vs Trader B

The next experiment I carried out was still within the BSErank system, but

instead of being homogeneous tests, were balanced tests between two traders.

The pr ev i ous two experiments have shown that time can a↵ect the performance

of a trader, namely if the trader is a ZIP buyer. Since we now know th at time

can be a factor, we want to an aly s e how this factor e↵ects di↵erent markets

and whether it impacts di↵erent markets in the same way. For example, so

far the GVWY trader ’ s p e rf or man ce hasn’t been e↵ected, but within markets

containing di↵erent strategies, the speed it reacts to transactions could make a

28

(b) AA Quote Prices

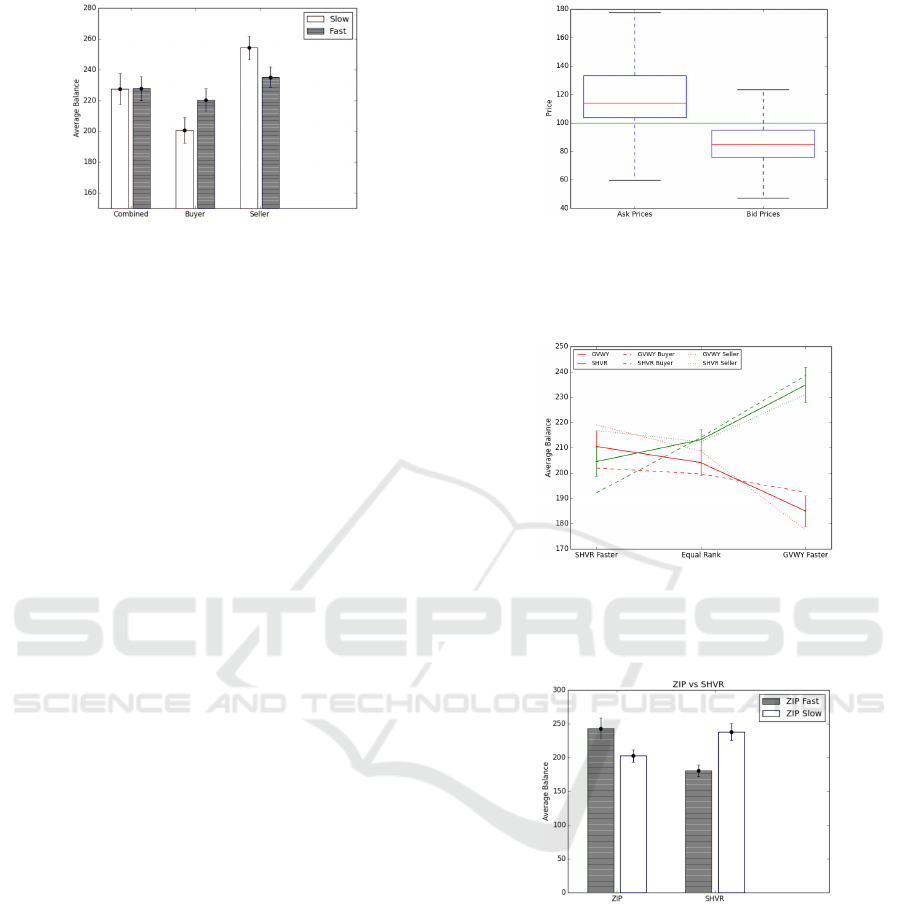

Figure 5: Tournament ranking selection for homogeneous AA markets: (a) fast (grey) buyers outperform slow (white) buyers,

while slow (white) sellers outperform fast (grey) sellers; (b) distribution of quote prices, showing asks (left box-plot) tend to

be posted farther from equilibrium (green line) than bids (right box-plot).

selected later improves performance. In particular,

traders selected last generate significantly more profit

than traders selected first. This could be because AA

traders that act later each time step have additional

information available to produce a better estimation

of P

0

, and therefore are likely to post a more prof-

itable quote. However, this simple ordered model is

very contrived and so we only present these results as

evidence that selection ordering impacts profitability

of the adaptive traders, AA and ZIP. We investigate

further using more realistic models in the following

sections.

4.2 Tournament Ranking Results

4.2.1 Homogeneous Markets

We performed tournament ranking selection in homo-

geneous markets. When pitted against only traders of

the same type, GVWY and ZIP perform better when

faster, but the difference is not significant. For other

traders there is no difference between fast and slow

traders. However, for AA (see Figure 5), we see

that fast buyers significantly outperform slow buyers,

while slow sellers significantly outperform fast sell-

ers. Overall, sellers generate significantly more profit

than buyers, which is a result of prices tending to ap-

proach equilibrium from above. We see that asks (i.e.,

sell quotes) tend to be farther from equilibrium than

bids (i.e., buy quotes), suggesting that sellers are re-

taining higher profit margins than buyers. Therefore,

as there are fewer opportunities for buyers to get a

good deal, being faster is beneficial. Conversely, for

sellers, it is better to be slower, and wait for more at-

tractive bids to arrive each time step before acting.

4.2.2 Heterogeneous: Balanced Tests

In many balanced tests there was no significant dif-

ferences in outcomes between trader strategies when

Figure 6: Balanced test SHVR:GVWY, using tournament

ranking selection. As GVWY (red) increases relative speed

(left to right), SHVR (green) increasingly outperforms

GVWY. Both traders benefit from being ranked slowest.

Figure 7: Balanced test ZIP:SHVR, using tournament rank-

ing selection. ZIP significantly outperforms SHVR when

ZIP is faster (grey bars), but is significantly outperformed

by SHVR when ZIP is slower (white bars).

varying speed using the ranking model (not shown).

However, results for SHVR are interesting. For

GVWY:SHVR (see Figure 6), it can be seen that it

benefits SHVR to be slower than GVWY. GVWY

is an honest strategy (always quoting at the current

limit price) with no consideration of the order book.

Therefore, SHVR benefit from na

¨

ıve GVWY traders

posting earlier each time step. For ZIP:SHVR (see

Figure 7), we see that faster ZIP outperform slower

SHVR, while faster SHVR outperform slower ZIP.

This is the result that we may intuitively expect, if

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

88

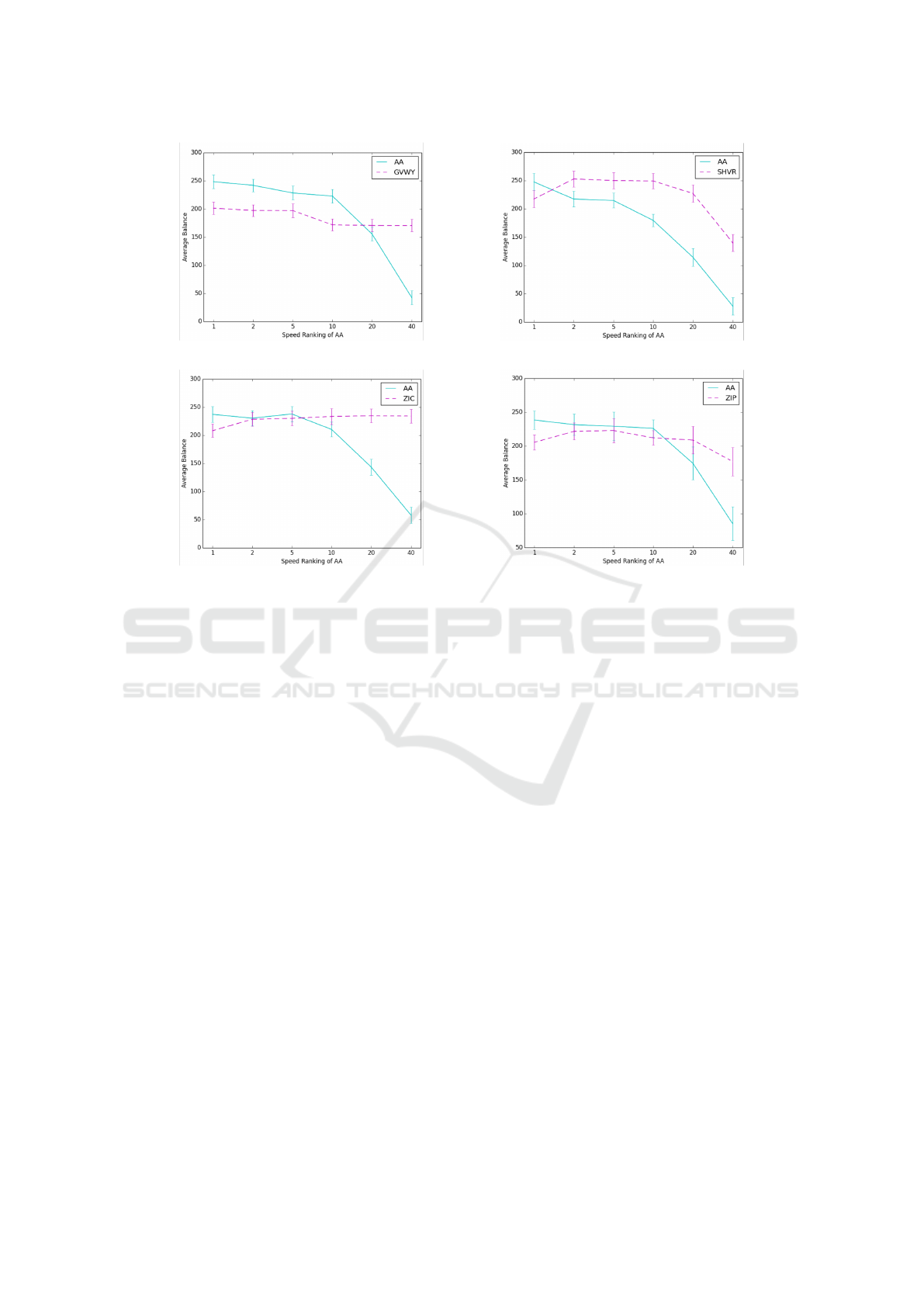

(a) AA:GVWY (b) AA:SHVR

(c) AA:ZIC (d) AA:ZIP

Figure 8: Sensitivity analysis of AA using speed proportional selection in heterogeneous markets. Reaction time of AA

relative to the competing trader type is varied from R

AA

∗

= 1 to R

AA

∗

= 40 (x-axis). Each test, AA (light blue) outperforms the

competitor (purple dash) when compute times are equal (R

AA

∗

= 1). As R

AA

∗

increases, AA performance falls, until an inversion

point is reached where AA no longer outperforms the competitor. For SHVR, inversion occurs between 1 < R

AA

SHV R

< 2.

we consider that faster is always better.

These results indicate that the benefits of speed de-

pend on the competing strategies in the market. For

the parasitic SHVR, which requires a ‘sensible’ order

book to trade sensibly, it is better to be fast when intel-

ligent traders are quoting in the market. Conversely,

when competitors are trading honestly, it is benefi-

cial to be slower. However, while the ranking model

enables traders to directly compete for opportunities

on speed alone, it does not allow faster traders to act

more often than slower traders, which is unrealistic.

We remove this constraint in the following model.

4.3 Speed Proportional Results

4.3.1 AA: Reaction Speed Sensitivity Analysis

Figure 8 presents results of speed sensitivity analysis

of AA performance in heterogeneous balanced-group

tests against each of the other four trading strategies:

(a) GVWY, (b) SHVR, (c) ZIC, (d) ZIP. The reac-

tion time of AA relative to the competing trader type

is varied from R

AA

∗

= 1 to R

AA

∗

= 40. Graphs show

the effect of increasing R

AA

∗

(x-axis). In each case,

we see that when R

AA

∗

= 1 (i.e., equal reaction times),

AA (light blue line) outperforms the competing trader

(purple dashed line). This is the BSE default setting,

and the result conforms to previous findings that AA

dominates in symmetric markets with balanced num-

bers of traders (De Luca and Cliff, 2011).

However, as relative AA reaction time R

AA

∗

is in-

creased, we see that AA performance gradually falls,

until a point is reached where AA is beaten by the

competing trader group. This inversion point varies

between trader groups, but occurs very quickly for

SHVR, between R

AA

SHV R

= 1 and R

AA

SHV R

= 2, suggest-

ing that AA’s dominance over SHVR is sensitive to

small variations in relative trader speeds.

4.3.2 Profiling Reaction Times of Traders

Here, we attempt to accurately profile the reaction

times of each trading agent. In BSE, the computa-

tion time of an agent is composed of two methods:

getOrder, which is called each time a trader is se-

lected to submit a new order into the market, thus re-

quiring the calculation of a new quote price, Q; and

respond, which is called after each market event, and

is used by traders to update internal parameters based

Fools Rush In: Competitive Effects of Reaction Time in Automated Trading

89

Table 2: Profiled reaction times of trading agents.

Trader Time (µs) Stateful Reactive R

∗

SHV R

GVWY 4.2 N N 0.61

SHVR 6.9 N Y 1.00

ZIC 7.1 N N 1.03

ZIP 8.4 Y Y 1.22

AA 9.5 Y Y 1.38

on the event data (e.g., a new trade, or a new best bid

or ask on the LOB).

Of the trading agents considered in this work,

three are stateless: GVWY, SHVR, and ZIC. These

traders have no internal parameters to update and

therefore take no action when their respond method

is called. Only ZIP and AA have an internal state.

These traders use their respond method to update in-

ternal variables in order to calculate a new profit mar-

gin, µ. When getOrder is called, ZIP and AA use

their current profit margin, µ, to calculate a new quote

price, Q = µL. In comparison, GVWY and ZIC gen-

erate a quote price without reference to market data;

SHVR uses the current best bid and ask in the LOB to

generate a new quote price.

Table 2 shows the profiled reaction times of each

trading agent, observed across 52 million method

calls under varying market conditions including pop-

ulation size, mix of traders in the market, assignment

replenishment schedules, etc. (see Hanifan (2019)

for details). Unsurprisingly, we see that the traders

with the longest computation times, ZIP and AA, are

those with an internal state that requires continuous

updating. The relative reaction times between the

fastest and slowest traders is roughly a factor of two:

R

AA

GWVY

= 2.26. The relative reaction times between

AA and ZIP is R

AA

ZIP

= 1.13. This result is consistent

with the average relative times R

AA

ZIP

= 1.19 presented

by Snashall and Cliff (2020), and we take this as con-

firmatory evidence that our profiling is accurate. The

final column of Table 2, headed R

∗

SHV R

, presents reac-

tion time of each trader relative to SHVR. Generating

a quote price relative to the current LOB, SHVR is the

only stateless (and therefore fast) trader that reacts to

market information; although it does so in a simplistic

non-adaptive fashion (unlike the slower AA and ZIP).

4.3.3 Results using Profiled Reaction Times

We used profiled computation times (Table 2) for pro-

portional selection in heterogeneous balanced-group

tests for pairwise comparisons between all trader

types. The majority of results showed no signif-

icant difference, suggesting the relative differences

in reaction speeds between the trader agents are not

large enough to have an impact. However, results

for ZIP:SHVR and AA:SHVR were particularly in-

teresting (see Figure 9). For ZIP:SHVR (Figure 9(a)),

under BSE’s default randomised selection process

(white bars), ZIP outperforms SHVR. However, when

selecting traders proportional to their true relative

speeds (grey bars) SHVR outperforms ZIP (although

the difference is not significant). A similar, but more

pronounced trend emerges between AA:SHVR (Fig-

ure 9(b)). Here, AA significantly outperforms SHVR

under the default randomised selection (white), and

significantly underperforms SHVR under speed pro-

portional selection (grey).

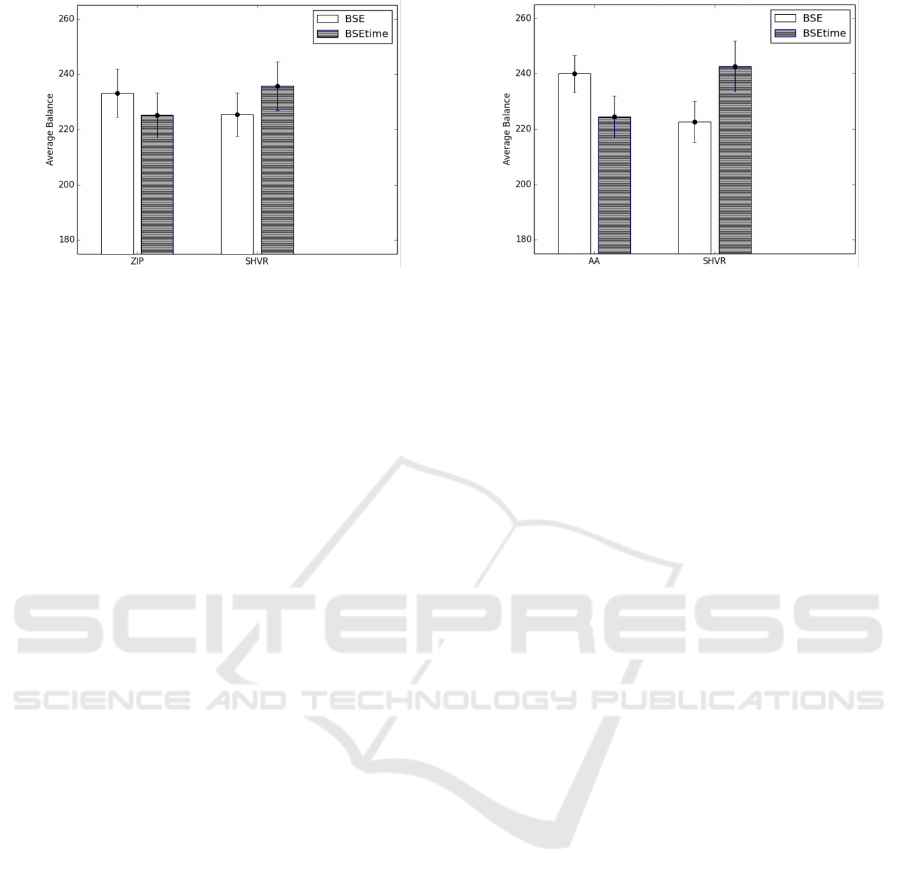

5 DISCUSSION

The result presented in Figure 9, demonstrating

SHVR is more profitable than AA (significantly, p <

0.05) and ZIP (not significant, p > 0.05) is a novel

result. By accurately accounting for the relative re-

action times of the two algorithms, we have demon-

strated that, in balanced tests, SHVR—the simple

non-adaptive order book strategy—is able to gener-

ate more profit than AA in a Smith-style static sym-

metric marketplace, of the kind that AA was specif-

ically designed to succeed in (Vytelingum, 2006),

and in which several studies have previously demon-

strated AA as being the dominant known strategy

(Vytelingum et al., 2008; De Luca and Cliff, 2011).

More recently, the dominance of AA has been

questioned in several works. Using the discrete-event

simulation mode of OpEx, Vach (2015) used Smith-

style markets (similar to those used here) to com-

pare efficiencies of traders in markets containing AA,

GDX, and ZIP, as the proportion of each trader type

in the market was varied. He showed that for large

regions of the mixture space, GDX was the dominant

strategy in these 3-way markets. Later, using BSE,

Cliff (2019) demonstrated that in Smith-style markets

containing equal proportions of MAA (AA modified

to use microprice), SHVR, ZIC, and ZIP, profits per

trader have no significant difference; while in more

complex markets with continuously varying equilib-

ria, SHVR and ZIP significantly outperform MAA on

profits. A follow-up study (Snashall and Cliff, 2020)

demonstrated that GDX dominates in complex mar-

kets containing MAA, ASAD, GDX, and ZIP; and

on average scores greater efficiency than AA in the

simpler Smith-style markets. These works show that

AA’s previously perceived dominance is sensitive to

the mixture of competing strategies in the market, and

the complexity of market dynamics. Here, we were

able to demonstrate that even in Smith-style markets

with two balanced groups of traders (the exact mar-

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

90

(a) ZIP:SHVR (b) AA:SHVR

Figure 9: Comparison of results between random selection (white) and speed proportional selection (grey), for heterogeneous

markets using profiled thinking times (see Table 2): (a) SHVR outperforms ZIP under speed proportional selection (not

significant); (b) SHVR significantly outperforms AA under speed proportional selection.

kets that AA was previously shown to dominate), AA

is less profitable than the simple SHVR strategy when

we account for reaction speed.

We believe that this finding is significant, not only

because it contributes to the recent body of evidence

suggesting that AA is non-dominant, but also because

it demonstrates that the performance of adaptive trad-

ing algorithms (AA and ZIP) are sensitive to reaction

time; and once reaction time is considered, SHVR

may be relatively superior. In more complex markets

designed to emulate real-world financial dynamics,

SHVR has previously been shown to outperform AA

and to perform similarly to ZIP (Cliff, 2019). Here,

we extend this result to show that SHVR can also

outperform in simple markets, once we account for

speed. In this study, we have not considered the GDX

trading strategy and we reserve this for future work.

However, we note that Snashall and Cliff (2020) have

recently profiled the reaction time of GDX and shown

it to be an order of magnitude slower than AA. We

therefore believe that, given the evidence we have pre-

sented here, if we factor in speed using proportional

selection, GDX would likely perform less well than

SHVR (and also AA and ZIP), as each competing

trader strategy would be able to act ten times for every

GDX trader’s action.

All evidence is starting to suggest that SHVR, al-

though extremely simple, could be a profitable trading

strategy to employ. However, we should perhaps not

be too surprised. SHVR is the only agent described in

this paper that directly uses the current order book to

determine quote price (by simply shaving one tick off

the current best bid or ask). While AA, GDX, and ZIP

are able to trade in markets containing an order book,

metrics such as the current spread, volumes, buy/sell

imbalances, etc., are not considered. This is valuable

information that is routinely used by HFT strategies

in the real markets. We therefore suggest that more

emphasis is placed on utilising order book metrics for

trading algorithms. We note that the MAA (modified

AA) strategy introduced by Cliff (2019) considers the

order book microprice to perform calculations for up-

dating profit margin. This is a useful start, however

we believe that this approach should be taken further,

such that strategies should separate into two processes

the long-term function of determining a desired price

(e.g., by updating profit margin), and the short-term

function of working to achieve that price (e.g., by

shaving the bid). One could easily imagine a sim-

ple combination of ZIP and SHVR that could perform

this strategy. We aim to investigate the incorporation

of order book metrics into trading agent strategies in

future work.

In real-world markets, order book information and

reaction speed is so strategically useful that, in or-

der to stop a trader’s trading intention from being

used adversely by predatory competitors, some trad-

ing venues, described as dark pools, do not reveal

quotes (see, e.g., Cartlidge et al. (2019), for a sum-

mary of dark pools and methods for implementing

cryptographically secure dark pool mechanisms us-

ing multi-party computation (MPC)). Further, as the

majority of predatory HFT strategies rely on being

quick(est) to act, there is also some movement in real

markets towards introducing artificial delays (speed

bumps), non-continuous trading, and re-ordering poli-

cies (see, e.g., Mavroudis and Melton (2019) for a

study on the effects of a temporal fairness policy on

the Refinitiv Matching foreign exchange).

In real markets, communications latencies can be

orders of magnitude larger than the reaction times of

automated execution algorithms. However, these la-

tencies can be (relatively easily) minimised by pay-

ing for (costly) services such as exchange hosting

(enabling traders to co-locate equipment within the

same data centre as the exchange matching engines

Fools Rush In: Competitive Effects of Reaction Time in Automated Trading

91

and market data systems for the lowest latency ac-

cess) and direct market access feeds. Therefore, for

all automated trading systems (ATS) making use of

these low-latency services (including the majority of

HFT), communications latency becomes a level play-

ing field. In these circumstances, reaction time is the

principle speed differentiator.

6 CONCLUSIONS

We have introduced methods for simulating the reac-

tion time of trading agents in financial market experi-

ments, using the open-source Bristol Stock Exchange

(BSE) platform. Historically, trading agent experi-

ments have not considered the time it takes for agent

strategies to compute: each time step, agents are se-

lected to act in random order, and agents are unre-

stricted in the (real-world) time taken to compute an

action. This is unrealistic, particularly given the un-

questionable emphasis placed on trading speed in the

real financial markets.

To simulate reaction time, three models were con-

sidered: (i) fixed ordering of agents; (ii) tourna-

ment selection using speed rankings; and (iii) propor-

tional selection of agents relative to speed. The latter

model—the most realistic—enabled fast traders to act

multiple times for each individual action taken by a

slower agent. We demonstrated, unsurprisingly, that

speed does affect trader performance, although being

faster is not always better: the outcome depends on

the competing trader strategies present in the market;

sometimes it can be beneficial to let the fools rush in.

Significantly, we were able to show that when sim-

ulating accurate reaction times of agent strategies, the

simplistic SHVR strategy is more profitable than AA.

Until relatively recently, AA had been considered the

dominant trading algorithm in the published litera-

ture, and this is the first time AA has been shown to be

outperformed by a simple non-adaptive strategy in a

static symmetric market containing two strategy types

with equal numbers.

This result confirms that speed matters, and if we

are to better understand real-world markets it is nec-

essary for reaction times to be considered more thor-

oughly. It also demonstrates that simple order book

strategies can outperform intelligent trading strategies

that make use of machine learning. This suggests that

there should be further investigation into methods for

incorporating order book information into adaptive

trading strategies.

ACKNOWLEDGEMENTS

John Cartlidge is sponsored by Refinitiv.

REFERENCES

Baxter, G. and Cartlidge, J. (2013). Flying by the seat of

their pants: What can high frequency trading learn

from aviation? In Proc. 3rd International Conference

on Application and Theory of Automation in Com-

mand and Control Systems, ATACCS, pages 56–65.

BSE (2012). BSE: The Bristol Stock Exchange.

GitHub public source-code repository available at:

https://github.com/davecliff/BristolStockExchange.

Cartlidge, J. and Cliff, D. (2012). Exploring the ‘robot

phase transition’ in experimental human-algorithmic

markets. In The future of computer trading

in financial markets, Driver Review DR25. Fore-

sight, Government Office for Science: London UK,

https://bit.ly/2llHjbh+.

Cartlidge, J. and Cliff, D. (2018). Modelling complex fi-

nancial markets using real-time human-agent trading

experiments. In Chen, S.-H. et al., editors, Complex

Systems Modeling and Simulation in Economics and

Finance, pages 35–69. Springer International, Cham.

Cartlidge, J., Smart, N. P., and Alaoui, Y. T. (2019). MPC

joins the dark side. In Proc. 14th ACM Asia Con-

ference on Computer and Communications Security,

AsiaCCS, pages 148–159.

Cartlidge, J., Szostek, C., De Luca, M., and Cliff, D. (2012).

Too fast too furious: Faster financial-market trading

agents can give less efficient markets. In Proc. 4th

International Conference on Agents and Artificial In-

telligence: Vol. 2, ICAART, pages 126–135.

Cliff, D. (1997). Minimal-intelligence agents for bargaining

behaviours in market-based environments. Technical

Report HPL-97-91, Hewlett-Packard Labs.

Cliff, D. (2018). An open-source limit-order-book exchange

for teaching and research. In 2018 IEEE Symposium

Series on Computational Intelligence, SSCI, pages

1853–1860.

Cliff, D. (2019). Exhaustive testing of trader-agents in real-

istically dynamic continuous double auction markets:

AA does not dominate. In Proc. 11th International

Conference on Agents and Artificial Intelligence: Vol.

2, ICAART, pages 224–236.

Das, R., Janson, J., Kephart, J., and Tesauro, G. (2001).

Agent-human interactions in the continuous double

auction. In Proc. 17th International Joint Conference

on Artificial Intelligence: Vol. 2, IJCAI, pages 1169–

1176.

De Luca, M. and Cliff, D. (2011). Human-agent auction

interactions: Adaptive aggressive agents dominate. In

Proc. 22nd International Joint Conference on Artifi-

cial Intelligence: Vol. 1, IJCAI, pages 178–185.

De Luca, M., Szostek, C., Cartlidge, J., and Cliff, D. (2011).

Studies of interactions between human traders and al-

gorithmic trading systems. In The future of computer

trading in financial markets, Driver Review DR13.

ICAART 2020 - 12th International Conference on Agents and Artificial Intelligence

92

Foresight, Government Office for Science: London

UK, https://bit.ly/2llv52c+.

Duffin, M. and Cartlidge, J. (2018). Agent-based model ex-

ploration of latency arbitrage in fragmented financial

markets. In 2018 IEEE Symposium Series on Compu-

tational Intelligence, SSCI, pages 2312–2320.

ExPo (2011). ExPo: The Echange Portal. Source-

Forge public source-code repository available at:

https://sourceforge.net/projects/exchangeportal/.

Gjerstad, S. (2003). The strategic impact of pace in dou-

ble auction bargaining. Working Paper, Department

of Economics, University of Arizona.

Gjerstad, S. and Dickhaut, J. (1997). Price formation in

double auctions. Games and Economic Behavior,

22(1):1–29.

Gode, D. K. and Sunder, S. (1993). Allocative efficiency

of markets with zero-intelligence traders: Market as a

partial substitute for individual rationality. Journal of

Political Economy, 101(1):119–137.

Hanifan, H. (2019). Investigating the impact speed has on

the performance of algorithmic traders within the BSE

simulation. Master’s thesis, Department of Computer

Science, University of Bristol, UK.

Johnson, N., Zhao, G., Hunsader, E., Qi, H., Johnson, N.,

Meng, J., and Tivnan, B. (2013). Abrupt rise of new

machine ecology beyond human response time. Sci-

entific Reports, 3(2627):1–7.

Mavroudis, V. and Melton, H. (2019). Libra: Fair order-

matching for elecronic financial exchanges. In Proc.

1st ACM Conference on Advances in Financial Tech-

nologies, AFT, pages 156–168.

McGroarty, F., Booth, A., Gerding, E., and Chinthalap-

ati, V. L. R. (2019). High frequency trading strate-

gies, market fragility and price spikes: an agent based

model perspective. Annals of Operations Research,

282(1):217–244.

Miles, B. and Cliff, D. (2019). A cloud-native globally

distributed financial exchange simulator for studying

real-world trading-latency issues at planetary scale. In

Proc. 31st European Modelling and Simulation Sym-

posium, EMSS, pages 294–303.

OpEx (2011). OpEx: The Open Exchange. Source-

Forge public source-code repository available at:

https://sourceforge.net/projects/open-exchange/.

Smith, V. (1962). An experimental study of competi-

tive market behavior. Journal of Political Economy,

70(2):111–137.

Snashall, D. and Cliff, D. (2020). Adaptive-aggressive

traders don’t dominate. In Agents and Artificial In-

telligence: 11th International Conference, ICAART

2019, Revised Selected Papers, LNAI. Springer Inter-

national.

Stotter, S., Cartlidge, J., and Cliff, D. (2013). Exploring

assignment-adaptive (ASAD) trading agents in finan-

cial market experiments. In Proc. 5th International

Conference on Agents and Artificial Intelligence: Vol.

1, ICAART, pages 77–88.

Stotter, S., Cartlidge, J., and Cliff, D. (2014). Behavioural

investigations of financial trading agents using ex-

change portal (ExPo). In Nguyen, N. T. et al., edi-

tors, Transactions on Computational Collective Intel-

ligence XVII, pages 22–45. Springer, Berlin.

Tesauro, G. and Bredin, J. L. (2002). Strategic sequential

bidding in auctions using dynamic programming. In

Proc. 1st Int. Joint Conf. on Autonomous Agents and

Multiagent Systems: Part 2, AAMAS, pages 591–598.

Tesauro, G. and Das, R. (2001). High-performance bidding

agents for the continuous double auction. In Proceed-

ings of the 3rd ACM Conference on Electronic Com-

merce, pages 206–209.

Vach, D. (2015). Comparison of double auction bidding

strategies for automated trading agents. Master’s the-

sis, Faculty of Social Sciences, Charles University in

Prague, CZ.

Vytelingum, P. (2006). The Structure and Behaviour of

the Continuous Double Auction. PhD thesis, School

of Electronics and Computer Science, University of

Southampton, UK.

Vytelingum, P., Cliff, D., and Jennings, N. (2008).

Strategic bidding in CDAs. Artificial Intelligence,

172(14):1700–1729.

Fools Rush In: Competitive Effects of Reaction Time in Automated Trading

93