A Composite Indicators Approach to Assisting Decisions in Ship

LCA/LCC

Yiannis Smirlis

1a

and Marc Bonazountas

2

1

School of Economics, Business and International Studies, University of Piraeus, Greece

2

EPSILON Malta, Ltd, Tower Business Center, Swatar, Malta

Keywords: Ship, Life Cycle Assessment, Key Performance Indicators-KPIs, Composite Indicators.

Abstract: During of the life cycle of ship, multiple decisions concerning design, operation and demolition must be made.

The Life Cycle Assessment/Cost (LCA/LCC) framework applied in ships, mandates that such decisions need

to encounter dominant economic and environmental aspects about the ship. In this paper we consider these

decisions in the context of Multi-Criteria Decision Analysis and present a methodology to construct composite

indicators to assist decision making. For the criteria introduced we propose the use of key performance

indicators (KPIs) that quantify economic and environmental dimensions. For the construction, aggregation

and weighting of the KPIs we present linear programming models that estimate the weights endogenously

from the data. The models developed can discriminate the optimum designs, thus assisting decision making.

1 INTRODUCTION

A ship Life Cycle Assessment (LCA) is a framework

to evaluating different economic and environmental

aspects and impacts, from its design and building

from raw materials, through operation, maintenance,

end-of-life treatment, recycling and final disposal to

its end of lifetime. It is a tool to better understand

costs, risks, opportunities, trade-offs and nature of

environmental impacts. LCA can assist in identifying

opportunities to improve the environmental

performance of a ship at various points in its life

cycle, in informing decision and policy makers in the

maritime industry and in selecting relevant indicators

of economic and environmental performance.

The basic theory of LCA (Curran, 1996) is

transferred to the field of maritime and shipping from

the products and services design throughout their

lifespan. For the products, the requirements and the

implementing guidelines for LCA is covered by the

international standards ISO 14040 and 14044 (ISO

2006). Especially the economic impact of LCA, has

been addressed by the concept of Life Cycle Cost

(LCC) (Aurich et. al., 2007; Dhillon, 2013). LCC

aims to identify factors that affect cost, to quantify

them and to evaluate the cost effectiveness of

a

https://orcid.org/0000-0002-6608-3326

alternative strategies to incur over a specified period

of time. LCA/LCC were applied to energy systems,

electromobility, buildings and built environment,

food and agriculture, biofuels and biomaterials,

chemicals, wastewater treatment, solid waste

management, etc. (Hauschild et. al, 2018).

Ships, seen as complex systems, integrated in

economic, technical and transportation activities,

need to be studied in line with the concept of

LCA/LCC (Marius, 2014; Angelfoss, 1998). Ships’

life cycle is decomposed in three phases: the design

and ship building (phase I), the operation &

maintenance (phase II), and the end-of-life,

demolition and disposal (phase III). During the ships’

life, designers, shipowners, executives, and others,

are confronted with different decision situations that

are complex and involve a large number of options

and alternatives. For example, in the ship

design/construction phase, shipbuilders -- based on a

primitive ship construction (ship reference) that

fulfils all the technical, cruising, safety and

environmental regulations -- have a large number of

options to consider and evaluate as type of fuel and

engines, materials for the structure and

superstructure, type of generators. Every single

combination, if applied to the final ship structure, has

economic and environmental consequences.

Smirlis, Y. and Bonazountas, M.

A Composite Indicators Approach to Assisting Decisions in Ship LCA/LCC.

DOI: 10.5220/0008895401430150

In Proceedings of the 9th International Conference on Operations Research and Enterprise Systems (ICORES 2020), pages 143-150

ISBN: 978-989-758-396-4; ISSN: 2184-4372

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

143

During the operation phase of a ship, the

LCA/LCC approach may give useful answers to

questions such as which technical adjustments are

cost /environmental effective so to reduce operating

expenses? which are the most beneficial options for

ship lay-up or hire out for offshore storage facility?

which is the most environmental friendly and cost

efficient solution among alternatives such as to burn

diesel fuel inside ECA or to install scrubbing

technology or even after a costly damage? which

alternative decisions (in terms of costs) are the most

valuable: repair the vessel? to sell the ship in the

second-hand market or to sell ship for scrap?. Finally,

in the end-of-life period, the decision whether to

dismantle a ship or continue the activity by

restructuring it in a retrofit procedure or convert it to

another type of maritime mission, requires both

technical condition assessment and economic

evaluation since a decision may end up in adverse

economic results, with a negative impact on the

environment.

In this paper we allege that a significant number

of problems that arise during the life cycle of a ship

with the context of LCA/LCC, can be formulated and

considered under the scope of decision-making

theory. Accordingly, a decision-maker is called to

evaluate alternatives on the basis of two or more

criteria so to discriminate the superior in terms of

economy and environmental impact. For the criteria,

we particularly consider established economic and

environmental key performance indicators (KPIs)

that measure the performance of each alternative

decision in specific aspects (ship building cost,

operational expenses, maintenance and repair costs,

energy efficiency, NOx/Sox emissions etc.). Then,

based on mathematical programming methods, we

propose to aggregate the KPIs in composite indicators

that express more abstract concepts, understandable

by the users thus assisting the decision-making

process.

This paper is organized as follows. Section 2

presents the relation of KPIs used as criteria in the

decision-making LCA processes. Section 3 presents

the construction of composite indicators so to exploit

KPIs and assist decision making by identifying the

optimized alternative decisions. Section 4 presents an

illustrative example for evaluating alternative ship

designs. Conclusions appear at the end of this paper.

2 KPIs AND COMPOSITE

INDICATORS IN SHIP LIFE

CYCLE ASSESSMENT

Key performance indicators (KPIs) within the

LCA/LCC framework are quantifiable performance

measurements used for specific economic, technical,

operational and environmental dimensions of a ship.

Common KPIs, potentially used in ship LCA/LCC

are the: (1) Building Cost, Capital Expenditure

(CAPEX), (2) Operational Expenditure (OPEX), (3)

Maintenance and Repair costs (MRC), (4) Average

Annual Cost (AAC), (5) Required Freight Rate

(RFR), (6) Net Present Value (NPV), (7) Average

Annual Benefits (AAB), (8) Earnings Before

Interests, Taxes, Depreciation and Amortization

(EBITDA), (9) Return on Investment Capital (ROIC),

and (10) Energy Efficiency Design Index (EEDI).

KPIs like the above, are provided in different units,

dollars, number of years etc., may have any scale of

measurement, ratio, ordinal etc. and may have

positive contribution/utility (e.g., NPV, EBITDA,

EEDI) or negative (OPEX, MRC, AAC, NOx/Sox

emissions). Such KPIs have been used in past

research studies to estimate the ships’ performance.

For instance, the work of Gratsos & Zachariadis

(2009) examines the importance of the Average

Annual Cost (AAC) as an indicator to evaluating

different ship designs that technically appear as

optimized. Furthermore, the Energy Efficiency of

Operation (EEO) (Lu et al., 2015) is defined and

utilized to predict the operational ship performance.

According to the LCA/LCC, KPIs are used for

measuring costs, revenues, energy efficiency, etc., not

only for a specific period but for the entire lifecycle

of the ship. For example, during the ship design (first

phase of LCA), different ship models and

configurations are evaluated in terms of operating –

maintenance costs, total revenues gained during the

operation phase, price at the time of demolition,

potential use of recycled materials etc. In this context,

the decision-making problem is to identify those

alternative designs that have the total optimum

performance (minimum costs, maximum revenues,

minimum environmental impact). This goal cannot be

achieved by only exploiting KPIs, because they are of

low-level and measure only partial dimensions.

Furthermore, KPIs may usually conflict one another.

For example, a ship built with low budget, at the

operation stage may have higher maintenance and

repair costs.

ICORES 2020 - 9th International Conference on Operations Research and Enterprise Systems

144

In this study we propose as more beneficial for the

assessment of different alternative decisions the use

of composite indicators derived from the aggregation

of properly selected KPIs. Composite indicators, in

general, are commonly used for benchmarking of

entities, summarizing in a single measurement,

complex social, economic, environmental etc.

concepts by involving several thematically related

sub-indicators. According to our approach, composite

indicators’ that measure abstract concepts such as

“economic benefits”, “environmental impact” etc.,

meaningful to a decision-maker, may derive from the

aggregation of the values of individual sub-indicators

(KPIs).

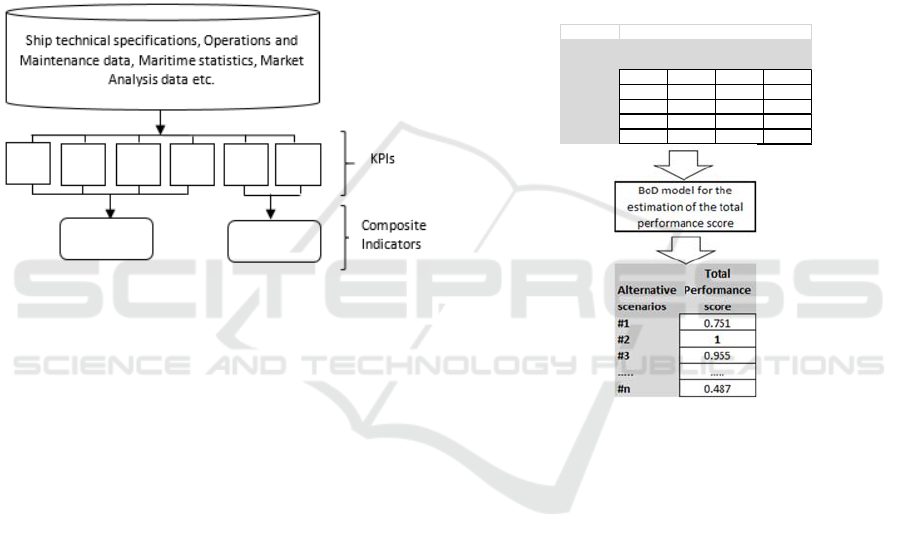

Figure 1: The hierarchy of data processing, from raw data

to KPIs and composite indicators.

Figure 1 presents the place of the composite

indicators in the hierarchy of data processing,

deriving from KPIs regarded as sub-indicators which

in turn are estimated from data sources (ship technical

specifications, Operations and Maintenance data,

Maritime statistics, Market Analysis data etc.).

3 DERIVATION OF THE

COMPOSITE INDICATORS

In the derivation process of composite indicators, the

aggregation and the weighting are the most important

steps and for them, a number of alternative

methodologies (Nardo et al. 2005, OECD 2008) have

been proposed to substitute the common approach of

using additive or multiplicative average formulas in

conjunction with constant, predetermined values for

the weights: Principal components/Factor analysis,

Benefit of the doubt approach, Unobserved

components model, Budget allocation process,

Analytic hierarchy process, Conjoint analysis etc.

Among them, the Benefit of the doubt (BoD)

modelling (Melyn and Moesen, 1991; Cherchye,

2007) uses linear programming and an additive

weighted-based form to estimate the scores of the

composite indicator. Advantage of the method is that

it arranges so the weights of the sub-indicators to

derive directly from that data, endogenously, as result

of an optimization process. BoD is inspired by the

multiplier formulation of Data Envelopment Analysis

(DEA) (Charnes et. al, 1978) as it estimates different

weights for each unit (alternative design) under

assessment, choosing the most favourable values so

to let them reach the highest possible score. BoD

modelling can discriminate alternative decisions to

superior and non-superior. Figure 2 depicts the

estimation process.

Figure 2: The estimation of the superiority index from the

decision matrix.

BoD linear programming models are applied to

the decision matrix composed of alternative decision

scenarios and the KPIs (criteria) to obtain a total

performance score. Alternative decisions with score

equal to 1 are regarded as superior. The mathematical

background of this method is briefly described in the

following sub-sections.

3.1 Optimization Models for the

Aggregation and the Weighting of

KPIs

Assume that in a typical assessment in the ship design

/building phase I, n alternative designs have to be

assessed in terms of m KPIs so to derive scores of a

composite indicator. The decision matrix of the

problem is composed of a set of n alternative designs

12

{ , ,..., }

n

Aaa a

and of m individual KPIs

Alternat ive

scenarios KPI_1 KPI_2 ….. KPI_m

#1 0.25 125

0

….. 55.3

#2 0.48 175

0

….. 48.18

#3 1.32 195

0

….. 23.45

….. ….. ….. ….. …..

#n 0.99 980 ….. 60.15

KPIs

A Composite Indicators Approach to Assisting Decisions in Ship LCA/LCC

145

12

, ,...,

m

XX X

,

12

( , ,..., )

iii in

Xxx x

1, ..,im

. The values

, 1,.., , 1,..,

ij

x

imjn

denote the performance score of the alternatives

j

a

on the KPIs

i

X

.For any alternative

j

a

, the

contribution of a the i-th KPI to the total value of the

composite indicator, is expressed by the factor

iij

wx

, with the weight

i

w

to be unknown, under

estimation. In such a setting, the value of the

composite indicator for an alternative

j

derive by the

additive linear form

1

m

j

iij

i

Iwx

. The value

j

I

expresses the total performance of the alternative

j

a

on all the involved KPIs. Consequently if for two

alternatives

12

,

jj

holds

12

j

j

II

, the conclusion is

that alternative

1

j

, is superior (has better

performance) than alternative

2

j

. It is important to

note that this additive form function designates a

compensatory approach (OECD 2008, Bandura 2011)

according to which, any possible disadvantage (low

value) of a particular alternative design in a specific

KPI can be counterbalanced by the advantage (high

value) in other KPIs.

For the estimation of the values of the weights

i

w

, the BoD model (1) is proposed.

00

1

I

m

jiij

i

M

ax w x

1

1, 1, ..,

m

jiij

i

Iwxjn

,1,..,

i

wi m

(1)

Model (1) is solved

n times, once for each alternative

design

0

j

and estimates the optimal values

*

, 1,...,

i

wi m

of the weights so to maximize its

total performance score. Let this score be

0

*

j

I

. The

constraints

1

1, 1, ..,

m

iij

i

wx j n

ensure a

comparative assessment and set maximum attainable

score

0

*

j

I

equal to 1. The factor ε in the constraint

,1,..,

i

wi m

, seen as a parameter, is assigned

small values (approximately ε =10

-6

) and prevents the

weights to accept zero values. Model (1) is able to

discriminate alternative designs to superior and non-

superior. Superior are those that, in the comparative

process, achieved to reach the upper bound score 1 by

selecting the proper optimal values

*

i

w

(superior

alternatives={

*

:1

j

jI

}) and non-superior are

those that did not succeeded to do so ( non-Superior

alternatives ={

*

:1

j

jI

}).

About the meaning of the weights

i

w

and the

values that can be assigned to them, it is necessary to

point out that they must not be considered as

importance coefficients that reflect the contribution

of a KPI to the value

*

j

I

but rather as the “trade-off”

factors expressing the marginal rate of substitution

between two alternatives (Decancq and Lugo 2013).

In sub-section 3.4 the issue of restricting them

according to the users’ opinion will be discussed.

Despite the flexibility of Model (1) to choose the

weight values directly from the data, there are certain

drawbacks: it provides unrealistic weight values, it

privileges the alternatives with high performance to

only few sub-indicators, it is not capable to

discriminate those that achieve the highest score 1

and due to different set of weights, lacks a common

cross-alternative comparison (Zhou et al. 2007). The

latter can be resolved by a model variation that uses

common set of weight values. The issue of common

weights in BoD has been transferred again from the

similar DEA context (see Kao (2010), Bernini et al.

(2013), Koronakos et al (2019)). The modified

extension of model (1) with common weights is

formulated as follows.

For an alternative

j, let

j

d

be the difference

between the sum

1

m

iij

i

wx

and the 1 (the deviation

factor from the absolute attainable score 1), i.e.

1

1

m

j

iij

i

dwx

. By its definition,

j

d

is a positive

number

0

j

d

, while the sum

1

n

j

j

d

denotes the

total deviation of all the alternatives from the absolute

score 1. The basic idea behind the common

assessment is to let alternatives cooperate in order to

get as close as possible to the absolute score 1. This

approach can be characterized as fair and democratic

since all the alternatives, collectively and equally,

participate to the generation of the optimal set of

common weights that yield the composite index. In

terms of linear programming, this is translated as a

goal to minimize the total deviation expressed by the

ICORES 2020 - 9th International Conference on Operations Research and Enterprise Systems

146

sum

1

n

j

j

d

. Model (2) achieves to do so.

1

n

j

j

M

in d

1

1, 1, ..,

m

iij j

i

wx d j n

,1,..,

0, 1,..,

i

j

wi m

djn

(2)

In model (2), the objective function minimizes the

sum of the deviations (distance of

L

1

norm) of all

alternatives between the performance that they can

achieve using the common multipliers and their ideal

rating. Compared to model (1), model (2) requires

less computational effort as it is solved only once and

it produces lower scores from model (1), thus

providing higher discrimination.

3.2 Controlling the Number of

Superior Alternatives

About the parameter ε, it is important to notice that

higher values than ε =10-6 reduce the number of

superior alternatives and thus affect the

discriminating power of the method (Cook et al.

1996). Large enough values may result to infeasibility

of model (1). The greatest unique value of ε, say ε*

that makes model (1) feasible, ensures that only one

superior, the best, alternative is obtained from the

process (Toloo & Tavana 2016). Such a value ε* can

be estimated by model (1) when its objective function

is replaced by

ε

M

ax

and the rest of the constraints

remain unchanged.

3.3 Normalization

Models (1)-(2) are capable to incorporate data from

KPIs that are expressed in different measurement

units (dollars, years of ship operation, etc.). However,

normalization of the data in KPIs is needed before

applying the aggregation step. The main reason is to

convert the data so all KPIs to have a positive

contribution or utility – higher values are more

desirable (for example Operational Expenditure -

OPEX). Another reason is that models (1)-(2) are

sensitive to outliers and to highly skewed data. The

normalization can be achieved with different

methodologies for example min-max, z-score etc.

3.4 Implementation of

Decision-Makers’ Preferences

Models (1)-(2) give freedom to the alternative designs

to assign such weight values so to appear as superior

as possible. This means that any design can appear as

excellent performer by overestimating those KPIs

that has advantage over the rest. However, this

situation may give results that contradict to prior

common views and overestimate KPIs that are

insignificant to the decision-maker. Fortunately, BoD

models are able to incorporate prior information by

imposing additional weight restrictions that express

the common value judgments of the decision maker.

The most important are those of type “pie-share”,

initially proposed by Wong and Beasley (1990) and

classified by Cherchye et al. (2007), that affect the

contribution of each KPI to the total indicator score.

For example the constraint

1

iij

m

iij

i

wx

ab

wx

,

imposes that the proportion /share of the i-th KPI will

vary between the constants

,ab

. In the same manner,

ordinal constraints of the “share” type can be adopted

to prioritize the contribution of a KPI over others.

This type of restrictions overcome the difficulty on

the interpretation of the weights and shift the focus to

KPI shares which are completely independent of

measurement units and easily understandable by the

decision makers.

4 ILLUSTRATIVE EXAMPLE

Assume that in the design /building phase of a new

40,000 DWT (Handymax) bulk carrier ship, the basic

technical specifications have been decided so to

consist the basic ship reference. Based on that, 18

alternative designs are considered as feasible for

implementation. These derive as distinct

combinations of different types of superstructure

materials (steel of various strength), of engines (2-4

strokes DE, Gas turbine etc) and equipment

(scrubber, ballast water treatment system, etc). The

problem under consideration is, which set of the

alternative designs achieve the best performance in

terms of economy and environmental impact,

considering the whole life of the ship, from its first

day of operation to its last. The proposed approach of

this paper is to define two composite indicators, say

ECO for economy and ENV for the environment,

estimate their values for all the alternative designs

A Composite Indicators Approach to Assisting Decisions in Ship LCA/LCC

147

and by comparing them, identify the most optimised

designs, the ones candidate for implementation.

For this problem, a number of KPIs may be

selected to describe both the economic and

environmental dimensions. In this example, we

further assume that a decision maker selects as the

most appropriate for the ship economy three KPIs,

namely the CAPEX, OPEX to represent costs and

AAB for the revenues. CAPEX measures, in thousand

$, the funds that a ship owner uses to purchase a

vessel from a shipyard, OPEX accounts in thousand $

per year, the ongoing costs that a ship owner pays to

run the ship over a specific period, e.g. typical year of

operation, while AAB represents the revenues and is

the average annual benefits form the ship, measured

in thousand $ per year. The details (formulas, data

parameters) for the estimation of these KPIs are not

mentioned here due to the limited size of the paper.

Accordingly, the environmental savings are described

by EEDI (Energy Efficiency Design Index) and the

NOx and Sox emissions calculated from the technical

specifications of each alternative design.

The values of the above mentioned KPIs appear

in Table 1. In this table, the first design, indicated as

REF, corresponds to the basic ship reference that

participates in the assessment equally with the rest of

the alternative designs.

Table 1: The basic data set.

Desgin CAPEX OPEX AAB EEDI NOx SOx

REF 6582 1.454 5.836 6.8 13.81 3.45

d1 5377.1 1.447 3.494 7.7 12.3 2.26

d2 5751.8 1.507 3.613 3.6 11.46 1.25

d3 5924.2 1.362 5.284 4.5 11.99 2.92

d4 6914.8 1.61 3.856 4.2 11.14 1.96

d5 5432.2 1.328 5.397 4 12.09 3.74

d6 5754.8 1.567 4.728 3.9 14.37 1.98

d7 5650.4 1.6 6.023 3.1 11.01 1.5

d8 5524.8 1.362 3.863 2.9 12.9 2.21

d9 6718.6 1.61 3.8 4 12.09 3.74

d10 7180.9 1.328 3.893 4.4 11.39 1.81

d11 5944.9 1.424 3.875 5.6 14.44 3.75

d12 7056.5 1.575 4.388 4 12.09 3.74

d13 5360.7 1.338 5.879 3.2 11.35 4.98

d14 5412.5 1.297 4.691 6.8 13.99 2.48

d15 6247.4 1.547 3.474 7.7 11.66 3.76

d16 6526.3 1.61 5.157 4 12.09 3.74

d17 5337.8 1.328 4.058 3.4 12.51 2.6

d18 6260.3 1.435 5.165 7.9 11.03 4.43

From inspecting the data in Table 1, we may

notice that a number of alternatives (e.g. d2) have

adequate performance on economy and poor in the

environmental KPIs while for others (e.g. d14) is

vice-versa.

In order to estimate the values of the composite

indicators ECO, ENV, models (1), (2) are applied to

the data set. Before that, a normalization process (see

Section 3.3) eliminates the differences in the scales of

measurement and reverses to positive the values for

the indicators with negative utility such as CAPEX,

OPEX, NOx, SOx. In such an arrangement the two

composite indicators ECO, ENV appear both with

positive utility (the higher the values, the better is the

design). Moreover, for the estimation of the economy

indicator ECO, we considered as most important the

AAB sub-indicator, giving emphasis to the revenues.

Accordingly, for the ENV indicator, the most

important sub-indicator is considered EEDI. This

initial information is implemented to the modelling as

ordinal weight restrictions of type “share” (see

Section 3.2). The values resulted from the model

application for the composite indicators ECO and

ENV, appear in the last four columns of Table 1.

The values of composite indicators ECO, ENV

derived from models (1)-(2) appear in Table 2.

Table 2: The values of the two composite indicators ECO,

ENV obtained by Models (1), (2).

Model (1) Model (2)

Design ECO ENV ECO ENV

REF 0.949 0.708 0.935 0.644

d1 0.796 0.766 0.806 0.797

d2 0.784 0.935 0.788 0.802

d3 0.934 0.858 0.941 0.747

d4 0.747 0.923 0.757 0.894

d5 0.969 0.875 0.970 0.695

d6 0.863 0.788 0.844 0.763

d7 1.000 1.000 0.923 1.000

d8 0.840 1.000 0.855 0.780

d9 0.749 0.875 0.756 0.695

d10 0.791 0.898 0.842 0.908

d11 0.813 0.708 0.827 0.609

d12 0.790 0.875 0.799 0.695

d13 1.000 0.970 1.000 0.687

d14 0.928 0.700 0.936 0.710

d15 0.747 0.802 0.758 0.713

d16 0.863 0.875 0.848 0.695

d17 0.873 0.902 0.885 0.752

d18 0.898 0.839 0.902 0.719

Based on the results presented in Table 2, a

number of remarks are possible. First, focusing on the

results of model (1), several designs appear as

superior (score equal to 1) in one of the two

dimensions. This is the case for designs d7 and d13

on economy (ECO indicator) and d7 and d8 on the

environment (ENV indicator). Only design d7 is the

best in both economics and environment and

presumably this design is suggested as the optimum

that achieves reduction of costs and the best

environmental protection. Scores obtained from

model (2) with common weights are lower that those

from model (1). Consequently, alternative d8 loses its

ICORES 2020 - 9th International Conference on Operations Research and Enterprise Systems

148

superiority classification and only d7 and d13 are

superior in ENV and ECO, respectively. Note that in

this model, no alternatives are optimum in both

composite indicators.

Figure 3: Graph of the values ENV, ECO composite

indicators derived from models (1)-(2).

Figure 3 presents the scores of designs in two axes

ENV and ECO, as obtained from model (1). Design

d7 located at the upper right corner with score 1 on

both ECO, ENV indicators is the best alternative.

Other alternatives that lie on the horizontal and

vertical boundaries (score 1) are superior in only one

dimension. Note that the basic reference design

(REF), being in an intermediate position, did not

achieved to reach superiority as other designs have

been proved better than this.

5 CONCLUSIONS

This study contributes to the ship LCA/LCC concept

by suggesting composite indicators to assist decision

making. Decision situations are formulated as multi-

criteria decision making/analysis problems in which,

key performance indicators-KPIs are considered as

economic and environmental criteria while the

different decisions to be made consists the

alternatives. The composite indicators use simple,

additive weighting sum to aggregate the KPIs so to

obtain scores for the alternative decisions. The

aggregation and the weighting of the KPIs is based to

linear programming models and the weights are

estimated endogenously from the data. The proposed

models are able to reveals the optimum performance

alternatives, those that minimize costs, maximize

revenues and minimize environmental impact.

The proposed methodology is simple to use and

implement without needing the user interaction. It is

flexible to accept initial information as user

preferences in order to access alternatives by a specific

priority on KPIs. Furthermore, the modelling presented

can be easily expanded to cover cases when the KPIs

are expressed in ordinal form or include uncertainty,

being expressed with intervals with constant bounds.

We hope you find the information in this template

useful in the preparation of your submission.

ACKNOWLEDGEMENTS

This study was co-funded by the European Maritime

and Fisheries Fund (EMFF) programme of the

European Union under Grant Agreement No 863565.

The EU support has been appreciated.

REFERENCES

Allen, R., Athanassopoulos A., Dyson R. G., Thanassoulis

E., 1997. Weights restrictions and value judgments in

Data Envelopment Analysis: Evolution, development

and future directions. Annals of Operations Research

73 0: 13-34 doi: 10.1023/A:1018968909638

Angelfoss, A. 1998. Life Cycle Evaluations of Ship

Transportation, Workshop April 15.-16., Ålesund

College, Report no. 10/B101/R-98/004/00, 1998.

Aurich, C., Schweitzer E., and Fuchs C. 2007. Life cycle

management of industrial product-service systems.

Advances in Life Cycle Engineering for Sustainable

Manufacturing Businesses. Springer London, 171-176.

Bandura, R., 2011. Composite indicators and rankings:

Inventory 2011. Technical report, Office of

Development Studies, United Nations Development

Programme (UNDP), New York.

Bernini, C., Guizzardi, A., Angelini, G., 2013. DEA-like

model and common weights approach for the

construction of a subjective community well-being

indicator. Social Indicators Research, 114(2), 405–424.

Charnes, A., Cooper, W. and Rhodes, E., 1978. Measuring

the efficiency of decision making units. European

Journal of Operational Research 2: 429-444.

Cherchye, L, Moesen, W., Rogge, N. and Van

Puyenbroeckan, T. 2007. Introduction to ‘Benefit of the

Doubt’ composite indicators, Social Indicators Research

82: 111–145 doi: 10.1007/s11205-006-9029-7

Cook, W. D., Kress, M., Seiford, L. M. 1996. Data

envelopment analysis in the presence of both

quantitative and qualitative factors. Journal of

Operational Research Society, 47, 945–953.

Curran, M. A., 1996. Environmental life-cycle assessment.

The International Journal of Life Cycle Assessment,

Volume 1, Issue 3, 1996.

Decancq, K., Lugo, M. A., 2013. Weights in

multidimensional indices of wellbeing: An overview.

Econometric Reviews, 32(1), 7–34.

Dhillon, B., 2013. Life cycle costing: techniques, models and

applications, Routledge ed. ISBN: 978-2881243028

A Composite Indicators Approach to Assisting Decisions in Ship LCA/LCC

149

Gratsos, G, Zachariadis, P., 2009. Life cycle cost of

maintaining the effectiveness of a ship’s structure and

environmental impact of ship design parameters.

Helenic Chamber of Shipping. Available at

http://nee.gr/downloads/60Life.cycle1.pdf

Hauschild, M., Rosenbaum, R., Olsen, S., 2018. Life Cycle

Assessment: Theory and Practice, Springer ed. ISBN

978-3-319-56474-6.

ISO, 2006. https://iso.org/standard/37456.html,

https://iso.org/standard/72357.html

Kao, C., 2010. Weight determination for consistently

ranking alternatives in multiple criteria decision

analysis. Applied Mathematical Modelling, 34(7),

1779–1787.

Koronakos, G., Smirlis, Y., Sotiros, D., Despotis, D., (2019).

Assessment of OECD Better Life Index by incorporating

public opinion, Socio-Economic Planning Sciences,

htps://doi.org/10.1016/j.seps.2019.03.005

Langdon Davis Management Consulting, 2006. Literature

review of life cycle costing (LCC) and life cycle

assessment (LCA), https://www.tmb.org.tr/arastirma_

yayinlar/LCC_Literature_Review_Report.pdf

Lu, R., Turan O., Boulougouris, E., Banks, C., Incecik, A.,

2015. A semi-empirical ship operational performance

prediction model for voyage optimization towards

energy efficient shipping. Ocean Engineering, Vol.

110, Part B. doi: 10.1016/j.oceaneng.2015.07.042.

Marius N., Haralambie, B., Catalin P. Applications of Life

Cycle Assessment (LCA) in shipping industry 14th

SGEM GeoConference on Energy and Clean

Technologies, Vol. 2, No. Conference Proc., June 19-

25, 2014, Vol. 2. (2014), pp. 289-296, ISBN 978-619-

7105-16-2, doi:10.5593/SGEM2014/B42/S19.038

Melyn, W., & Moesen, W., 1991. Towards a synthetic

indicator of macroeconomic performance: Unequal

weighting when limited information is available. Public

Economic Working Paper 17. Katholieke Universiteit

Leuven, Belgium.

Nardo, M., Saisana, M., Saltelli, A., Tarantola, S.,

Hoffman, A., Giovannini, E., 2005. Handbook on

constructing composite indicators. In OECD statistics

working papers 2005/03. doi:10.1787/533411815016.

OECD., 2008). Handbook on constructing composite

indicators: Methodology and user guide. Paris: OECD

Publishing

Toloo, M., Tavana M., 2017. A Novel Method for Selecting

a Single Efficient Unit in Data Envelopment Analysis

without Explicit Inputs/Outputs. Annals of Operations

Research 253(1):657-681 doi: 10.1007/s10479-016-

2375-1

Zhou, P., Ang, W., Poh, L., 2007. A mathematical

programming approach to constructing composite

indicators. Ecological Economics, 62(2), 291–297.

ICORES 2020 - 9th International Conference on Operations Research and Enterprise Systems

150