What Reviews in Local Online Labour Markets Reveal

about the Performance of Multi-service Providers

Joschka Kersting and Michaela Geierhos

Semantic Information Processing Group, Paderborn University, Warburger Str. 100, Paderborn, Germany

Keywords:

Customer Reviews, Sentiment Analysis, Online Labour Markets.

Abstract:

This paper deals with online customer reviews of local multi-service providers. While many studies investigate

product reviews and online labour markets with service providers delivering intangible products “over the

wire”, we focus on websites where providers offer multiple distinct services that can be booked, paid and

reviewed online but are performed locally offline. This type of service providers has so far been neglected

in the literature. This paper analyses reviews and applies sentiment analysis. It aims to gain new insights

into local multi-service providers’ performance. There is a broad literature range presented with regard to the

topics addressed. The results show, among other things, that providers with good ratings continue to perform

well over time. We find that many positive reviews seem to encourage sales. On average, quantitative star

ratings and qualitative ratings in the form of review texts match. Further results are also achieved in this study.

1 INTRODUCTION

This paper deals with the analysis of online cus-

tomer reviews. Namely, the subject of interest are re-

views from the English-speaking, American version

of Amazon in the category of Home & Business Ser-

vices

1

(AHS). Here, customers can buy and rate ser-

vices that are fulfilled by service providers. Examples

are “TV Wall Mounting”, “Desk Assembly”, “House

Cleaning” and outdoor services such as “Tree Trim-

ming” (Amazon, 2017).

User-generated, for anyone accessible reviews in-

herit an important role in e-commerce (Kokkodis and

Ipeirotis, 2016). They are part of online feedback

mechanisms (Dellarocas, 2003) that can be described

as word-of-mouth networks. These refer to the in-

formative communication between consumers about

opinions and experiences with goods or services and

their providers (Hu et al., 2006; Esch, 2017).

Providers without reviews are less likely booked

than those with many positive reviews (Lin et al.,

2016). Furthermore, studies show that positive re-

views, especially positive average ratings (Anderson

and Magruder, 2012; Luca, 2016; Chevalier and May-

zlin, 2006) and a high number of reviews are posi-

tively associated with sales (Duan et al., 2008). Other

1

The category Home & Business Services can be found

at https://www.amazon.com/Amazon-Home-Services/b?

ie=UTF8&node=10192820011/.

research partly supports or challenges these findings

or takes another point of view when it comes to

customer reviews and sales (Chevalier and Mayzlin,

2006; Hu et al., 2006; Godes and Mayzlin, 2004).

Generally, scholars show that customer reviews on av-

erage are either very positive or negative (Hu et al.,

2006), while being generally important to purchase

decisions (Park et al., 2007).

Apart from the named uniform products and ser-

vices, there are so-called “online labour markets”

(OLM(s)), where providers offer tailor-made solu-

tions to their customers. Such solutions include the

production of designs, software and so forth (Lin

et al., 2016; Kokkodis and Ipeirotis, 2016). OLMs

deliver experience goods. For consumers, it is not

possible to foresee work quality and satisfaction, be-

cause reviews cover past transactions only (Kokkodis

and Ipeirotis, 2016). The sold goods are tailor-made

for the customers while being produced after closing

a contract, not prior to that (Lin et al., 2016). Most

providers in OLMs use multi-tasking even though this

is in general said to be harmful to success in business

(Goes et al., 2018).

While scholars investigated OLMs such as Up-

work (Horton and Golden, 2015; Kokkodis and

Ipeirotis, 2016; Lin et al., 2016; Agrawal et al.,

2015; Lehdonvirta et al., 2014; Berinsky et al., 2012),

OLMs with multi-service categories such as AHS are

yet not researched. The difference is that the first

Kersting, J. and Geierhos, M.

What Reviews in Local Online Labour Markets Reveal about the Performance of Multi-service Providers.

DOI: 10.5220/0008787702630272

In Proceedings of the 9th International Conference on Pattern Recognition Applications and Methods (ICPRAM 2020), pages 263-272

ISBN: 978-989-758-397-1; ISSN: 2184-4313

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

263

mainly deliver intangible products that often are used

as input for business processes and include a bidding

process (Lin et al., 2016) while the second offers man-

ual services, often done at a person’s house or apart-

ment (Amazon, 2017) without bidding. Here, the

appropriate term is multi-service categories, as there

are categories where many different services belong.

For example, “TV wall mounting” means that hun-

dreds of different TVs may be installed in utterly dif-

ferent apartments according to the customer’s needs

(more dimensions are possible like different room/

wall types, attachments). Users review providers ac-

cording to their corresponding services. The reviews

cannot be found at a specific article such as a smart-

phone but at providers with their different possible

services. Apart from the general inspection of such

cases, there are further open questions.

It is unclear which services a particular provider

executes while one can assume providers perform dif-

ferently well in varying areas. It’s critical for con-

sumers to know in which areas a provider excels.

Apart from difficulties, there are numerous questions

to be answered. Firstly, as reviews correspond to past

transactions only, do providers with positive reviews

in a certain time span continue to perform well and

receive positive reviews in the next time span? To

answer this question, I compare the best rated cate-

gories of providers with the other categories over time

[Q1]. Secondly, do many reviews and many positive

reviews enhance a provider’s sales? Here, to develop

an answer, it is investigated how the average rating

of the most rated category per provider compares to

the average rating of the other categories per provider

over time spans [Q2]. Thirdly, do positive and nega-

tive About Me texts

2

promote or hinder the compari-

son of the best rated categories? Here, average quan-

titative ratings of providers with positive and nega-

tive About Me texts are confronted [Q3]. Fourthly,

do quantitative and qualitative ratings match together?

That is, do quantitatively well rated providers re-

ceive reviews with on average good sentiments [Q4]?

Fifthly, exists an association of the number of offered

services by a provider with customer satisfaction and

therefore reviews? As an example, it can be seen that

a provider with just one service may satisfy his cus-

tomers more on average than a provider with ten dif-

ferent services. Thus, this paper investigates how the

average star ratings of providers with few rated cate-

gories compare to those with many [Q5].

The structure of this paper is as follows: The

second Section deals with related literature. The

third Section presents technical details and informa-

2

A text on AHS where a provider describes himself, his

company and offered services.

tion about the method. Section number four analyses

the data and Section five concludes.

2 SYSTEMATIC LITERATURE

OVERVIEW

2.1 Dimensions Used in the Literature

In the following, a systematic overview of the related

literature will be given. Here, research gaps will be

identified. For systematization, we aimed at finding

dimensions that are covered by previous studies. The

following table will present studies and dimensions

accordingly.

Time spans represent the first dimension, i.e.

whether scholars have separated their data according

to different periods and surveyed changes. The sec-

ond dimension, category specific, refers to the ques-

tion whether researchers investigated (and compared)

categories (of products, services) within their data.

Average rating asks whether one or more average rat-

ings were calculated.

The fourth dimension asks for sentiment analysis

scores. The next dimension asks for a comparison of

qualitative contents, i.e. text, and quantitative el-

ements, i.e. grades. This can be performed by cal-

culating quantitative scores from texts and bringing

them together with the quantitative scores. Dimen-

sion number six, the number of services, refers to

the question whether the studies take into considera-

tion that one provider may offer several things such

as different services at once. Quality is a dimension

that assures whether the paper deals with quality as a

subject or whether the main subject is related to qual-

ity in terms of customer reviews. The last dimension

asks whether prices were an object of consideration.

2.2 Presentation of Related Studies

The first presented paper (Kokkodis and Ipeirotis,

2016) investigates category specific reputation in an

OLM (Upwork) with intangible products. The paper

focusses on the design of reputation systems rather

than on the gathered data and observations based on

them. It neither considers a sentiment analysis, nor

a comparison of qualitative and quantitative elements

of reviews. The study touches some of the dimen-

sions from Table 1, which this paper uses, but there

are great differences in the realisation and questions

answered. At any rate, this study is the only one that

takes the number of offered services into considera-

tion.

ICPRAM 2020 - 9th International Conference on Pattern Recognition Applications and Methods

264

Table 1: Research Areas Touched by Selected Literature.

Time Category Average Sentiment Qual. & Quant. Number Quality Prices

Studies Spans Specific Rating Analysis Comparison Services

Kokkodis & Ipeirotis, 2016 x x x x x

Lin et al., 2016 x (x)

Horton & Golden, 2015 x x x (x) x (x)

Berinsky et al., 2012 x x x

Chevalier & Mayzlin, 2006 x x (x) (x) x

Ghose & Ipeirotis, 2006 x x x x x x

Hu & Liu. 2004 x

Our Study x x x x x x (x)

x = matches completely, (x) = matches partially, empty field = matches not

The second considered study (Lin et al., 2016)

deals with the effectiveness of reputation in OLMs. It

uses transaction data from a large OLM such as Up-

work (the used market place’s name is deliberately not

mentioned). As can be seen in Table 1, the study does

not consider several dimensions that are used in this

paper. The scholars do not use time spans in their

investigation, but average ratings. There is neither

a sentiment analysis, nor comparison of quantitative

and qualitative ratings, nor a usage of prices. The au-

thors see it as the theoretical core of their paper that

reputation is a measure for quality, therefore the di-

mension of quality is included (Lin et al., 2016).

Study number three (Horton and Golden, 2015)

deals with reputation inflation. That is, the study uses

transaction data from the OLM Upwork (and an affil-

iate) to investigate the phenomenon of increasing av-

erage ratings for providers. Here, the authors suggest

that negative feedback is more expensive than positive

feedback and that this cost can lead to a state where

only positive feedback is given.

When it comes to the dimensions from Table 1,

there are several points fully or partially matched. The

paper uses time spans for the observations. Besides

that, it considers different categories, as well as av-

erage ratings. The study constructs some kind of a

sentiment score based on the appearance of certain

terms in reviews. The approach does not consider

a weighting of terms, e.g. giving domain-specific

words a stronger impact than others (Horton and

Golden, 2015). However, the featured paper brings

together quantitative and qualitative ratings, i.e. sen-

timent scores. Here, they mainly use this feature to

connect public and private feedback rather than check

whether quantitative and qualitative scores on aver-

age fit together or fit to other information. To put

it short, even this dimension is used differently than

in the present paper. Neither the number of services

per provider nor the prices of services are used. As

in other studies, ratings are regarded as a measure of

quality here (Horton and Golden, 2015).

The authors of the fourth presented study (Berin-

sky et al., 2012) perform an evaluation of OLMs. The

study investigates the general applicability of OLMs

to research experiments. Therefore, it is an interest-

ing study for a basic understanding of OLMs. Again,

here a market is used that provides intangible prod-

ucts over large distances. The study tackles very few

dimensions used in this paper, but does entirely dif-

ferent work and answers entirely different questions.

Study number five (Chevalier and Mayzlin, 2006)

investigates effects of customer reviews on sales. The

data consist of review and sales data of books gath-

ered from Amazon and another major book seller

from the USA. Including the dimensions from Table

1, the featured study uses time spans in their data, but

no categories. The conducted experiments use aver-

age ratings, but not sentiment analysis. The study uses

the number of reviews per book as a variable. Nat-

urally, there was no number of services considered.

The scholars make not only different points, but also

have an entirely different subject of investigation.

The sixth study (Ghose and Ipeirotis, 2006) and

deals with the design of ranking systems, especially

the impact of subjectivity in reviews on sales and re-

views quality. The authors use product data and re-

view for conducting a study that does not tackle the

research questions proposed by this paper. The con-

sidered objects are different. This comes from the fact

that products such as audio players and DVD films

were used. Apart from that, the authors neither use

the polarity in the sentiment analysis, nor compare

the sentiment with the seller’s About Me texts, nor

compare the sentiment with the quantitative average

rating.

The seventh and last study that is being examined

was written by (Hu and Liu, 2004). Even though

the authors have a different focus, this study should

be considered here because it focusses on sentiment

analysis and reviews. To put it short, it can be said

that the sentiment analysis is the only dimension used

from Table 1. The authors perform a totally different

study which aims at using natural language process-

What Reviews in Local Online Labour Markets Reveal about the Performance of Multi-service Providers

265

ing and data mining techniques to face the high num-

ber of customer reviews. The authors of the study fo-

cussed on their mining and summary techniques and

not on other findings that could be made from re-

views.

2.3 Categorisation of this Study

As indicated in the last row of Table 1, the present pa-

per matches almost all categories except for one and

another one partially. That is, this study uses differ-

ent time spans for the data. This paper further pays

respect to the fact that there are different service cate-

gories offered and views them one at a time. Average

ratings for quantitative and qualitative elements of re-

views play an important role in the data set and anal-

ysis of this paper. A comparison of quantitative and

qualitative elements are important, too. Thus, a sen-

timent analysis is performed as well. The number of

services per provider, a dimension that is poorly cov-

ered in the related literature, is also taken into consid-

eration in this paper. Quality is not a directly observed

dimension here. As other authors have stated, good

reviews are an indicator of quality (Lin et al., 2016;

Horton and Golden, 2015).

However, all five of the research questions from

Section 1 are unique so far. Scholars have neither an-

swered, nor asked the same questions as this paper

does. Especially, none of the researchers has taken

into consideration a local OLM with multi-service

providers. This encourages a practical software im-

plementation in order to answer the research ques-

tions.

3 METHOD

For acquiring data, a sophisticated application that

collects unstructured data from the dynamic webpage

of AHS and saves them in a structured manner to

a database needed to be written. This is called a

crawler (Abhyankar et al., 2014). For further tasks

such as processing natural language, other libraries

were used. The acquired data were saved to four

database-tables: “categories”, “reviews”, “sellers

3

”

and “sell analysis.” The analysis table (sell analysis)

is filled in with per provider every category where he

has received reviews. Further information like the av-

erage sentiment score are added, too. Data fields are,

among other things, the IDs of sellers and articles.

Both serve to connect the tables with each other.

3

Even though the sellers on AHS are providers, Ama-

zon refers to them as sellers. Both words are used synony-

mously.

Having investigated existing solutions for senti-

ment analysis, several of such algorithms were imple-

mented in order to choose the most appropriate one.

We have further investigated a systematic overview of

such algorithms and consequently chose an adequate

one. Among others, a self-developed algorithm us-

ing SentiWordNet (Esuli and Sebastiani, 2007) was

tested. The self-developed method assigns polarity

values to each word. Then, an overall score for the

whole document is calculated (Esuli and Sebastiani,

2007). The sentiment scores lie between 0 and 1.0.

The higher value determines whether a review is pos-

itive or negative, i.e. a value of > 50%. Further, rules

are used such as adverbs that modify the following ad-

jectives (Singh et al., 2013). The self-developed algo-

rithm was chosen due to its adequate performance on

multi-service provider reviews. The other methods,

however, performed poor, e.g. by assigning a nega-

tive sentiment score to a review that clearly was very

positive both in language and quantitative star rating.

The line graphs in the analysis Section 4 are con-

stituted by taking the first-best, second-best etc. and

first-most rated, second-most rated categoriy per ev-

ery provider. Then, consequently, the quantitative star

ratings were averaged along all first-best, second-best

categories etc. Here, relative time intervals were used

in order to draw a course of lines over the time. The

same procedure was used for sentiment scores. Fur-

ther remarks on the method of graph creation can be

found along with answering Q1 in Section 4.2.

4 ANALYSIS

This Section provides the analyses of this paper. It

starts with a descriptive analysis and continues with

the research questions. However, the method is ex-

plained along with Q1.

4.1 Descriptive Statistics

Having collected the data, all in all, 348

4

categories

are eligible for the investigation. Of 559 qualified

categories at first

5

, 211 with no reviews were de-

ducted. Data collection took place between August

and September 2017.

The categories contain 32, 965 customer reviews

and 4, 631 sellers. The first review was posted in July

2014, the last collected in September 2017. The dis-

tribution of the reviews over the years is as follows:

4

All numbers in this Section were taken at the end of the

period considered in this paper.

5

Categories for which Amazon did not display all re-

views were excluded.

ICPRAM 2020 - 9th International Conference on Pattern Recognition Applications and Methods

266

In 2014, there were only 20 reviews, while 3, 931

reviews were posted in 2015, 11, 709 in 2016 and

17, 305 in 2017 (up to the end of September). That

is, AHS experienced a high user growth.

A category has on average 94.73 reviews and a

provider has 7.11 reviews on average. Providers sell

on average in 3.52 categories, while categories have

on average 13.31 providers having received reviews.

Categories have up to 1, 338 reviews. Providers serve

up to 78 categories.

When it comes to the star ratings on AHS, it can

be said that they are overwhelmingly positive, hav-

ing on average 4.76 stars. This is interesting as it is

consistent with a study finding that quantitative rat-

ings are on average positive (Chevalier and Mayzlin,

2006). In general, the distribution of star ratings is un-

equal. The absolute majority of reviews is rated with

five stars: 29, 305. Four stars were given to 1, 813 re-

views, three to 665, two to 411 and one star was given

to 771 reviews in total.

When taking into consideration the data from the

analysis table, there are findings to be made. The data

consist of the combinations of every provider and ev-

ery category he has received reviews in. That is, for

example, a provider with reviews in ten different cat-

egories would appear in ten data rows. Such com-

binations are from now on called provider-category

combinations.

There are 16, 306 provider-category combinations

in total. Further, there are 11, 307 combinations with

one review, 2, 718 with two reviews and 2, 551 with

three or more reviews. Thus, there are many providers

having served and received reviews in several cate-

gories only once. There are 2.02 reviews on average

per combination.

For research question five, it is interesting to know

how many providers serve in one, two etc. cate-

gories. While the average lies at 3.52 categories per

provider, taking all provider-category combinations

even with less than three reviews into consideration,

2, 262 providers have just one category, 814 have two

and 407 have three categories. The number drops fur-

ther, e.g. there are only 43 providers with ten cate-

gories. The number quickly becomes single-digit.

Regarding the time at which reviews were given,

between the first and last review of the provider-

category combinations are on average 242 days, i.e.

8 months

6

. While there is a combination which re-

ceived all three reviews on the same day, the maxi-

mal distance between the first and last review is 1, 019

days, i.e. 2 years and 10 months.

When it comes to the sentiment scores, there are

different interesting information to be found: On av-

6

To simplify the calculation, the months have 30 days.

erage, the About Me texts and reviews are ca. two

thirds positive. That is, About Me texts are about

69.6% positive and 30.4% negative. Similar values

can be found concerning the average sentiment scores

or reviews. They are 22.2% negative and 77.8% pos-

itive.

The next Sections answer the research questions.

4.2 Q1: Performance of the Best Rated

Categories over Time

This Section develops answers to Q1. For dealing

with the research questions of this paper, the acquired

and aggregated data were further processed. Then,

line diagrams were developed. The first research

question asks for a comparison of the best rated cat-

egories of providers with the other categories over

time. Thus, there is a comparison of the best with

the next three best categories per every provider.

The best and most rated categories of this Section

are those who overall, at the end of the period con-

sidered, have the best and most ratings overall (aver-

age/total number of all ratings regardless of the time

point).

The data of this paper, as Figure 1 demonstrates,

are separated into ten relative time intervals which

represent ten percent each (x-axis). Further, this paper

uses average star ratings (y-axis). That is, the diagram

provides an overview of the best rated categories in

the form of their average ratings over time.

Every review was assigned to a relative time point.

Thus, these show at which time the review was given

relative to the other reviews of a provider in the

corresponding category. An example is a provider

who received three reviews in the category “Row-

ing Machine Assembly” on the following dates: 10th

Febuary 2017, 21st Feburary 2017 and 30th February

2017. Here, one time interval (a tenth) is two days

long. The first date would mark the beginning of the

time (zero in the diagram), the second date is close to

the middle (60), while the third review marks the last

possible time point (100). As the second review falls

into the interval between two time points (50 and 60),

it is categorized as the latter, i.e. 60.

In the end, all best, second-best etc. categories’

ratings are averaged for every time point. This way of

building the diagram is used for all other figures in the

following Sections of this Section. Of course, it was

adapted according to the current necessities. When

there were two best rated categories with the same star

rating, one was randomly chosen, as a combination

of those delivered an unsatisfying picture. All above

remarks apply to the most rated categories, too.

What Reviews in Local Online Labour Markets Reveal about the Performance of Multi-service Providers

267

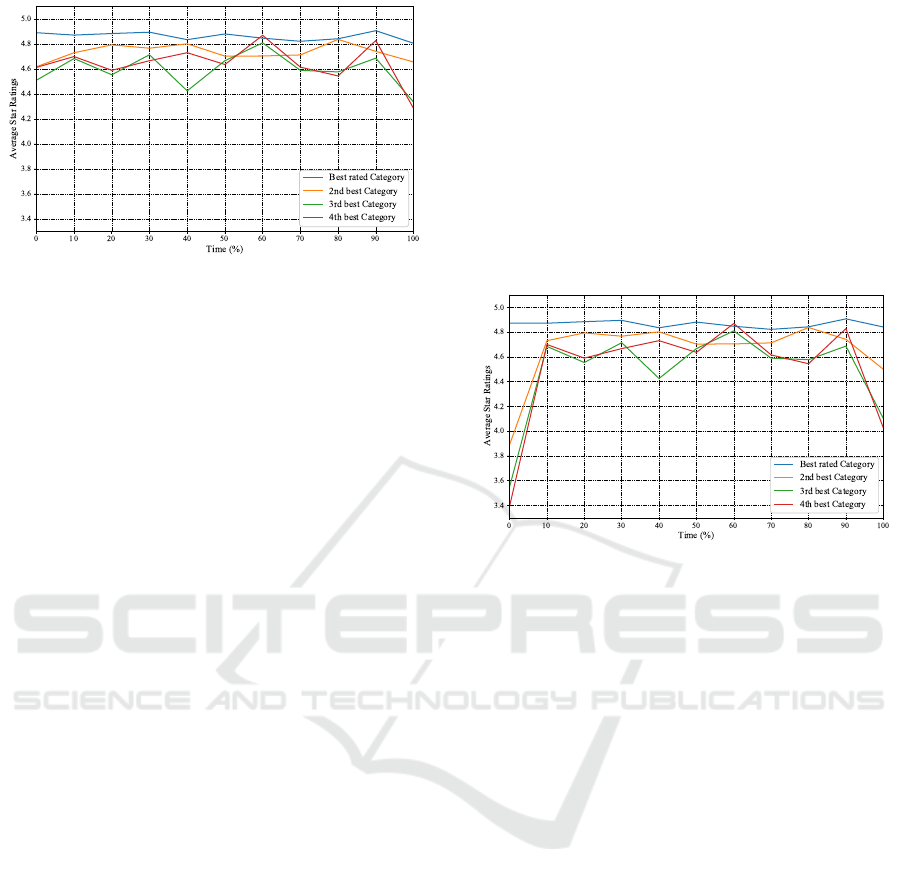

Figure 1: Average Star Ratings over Time for the Best Rated

Provider-Category Combinations with at Least Three Re-

views.

In the diagram in Figure 1, it can be seen that

the best rated categories (blue line) have a consid-

erably better start than the other categories. The

second-, third- and fourth-best rated categories, how-

ever, mostly improve their ratings in the following pe-

riods. The second-best rated categories in form of the

orange line reach star ratings close to the blue line and

stay there, even touching the blue line at point 80. At

the end, the second-best categories get poorer ratings

again.

The third- and fourth-best rated categories raise

and fall several times, especially at the end. For some

reason, the ratings of the third-best categories (green)

go from close to 4.5 stars at the beginning, to 4.8 stars

after the middle, to less than 4.4 stars at the end. The

fourth-best categories reach at some time points bet-

ter average ratings than the third-best. Of course, the

fourth-best rated categories consist of an average that

combines every provider’s fourth-best rated category.

Though, as indicated in Section 4.1, most providers

do not have that many categories (3.52 on average).

When there is a provider with four or more categories

where the third-best rated has a rating of 4.4 stars

and the fourth 4.2 stars while the next provider has

3.8 stars for his third-best rated category and there is

no fourth category at all, the average rating of all the

fourth-best rated categories is higher (4.2) than that of

the third (4.1).

To conclude, the best rated category of every

provider continues to perform well over time, while

being stable, but performs slightly poorer than at the

start. The distance between the best rated category

and the rest is in general rather decreased than in-

creased. These findings suggest that a provider has

one or two best categories where he performs steadily

well. While he here generally performs well, he has

more unsteady ratings in the next best rated categories

(third and fourth best). In general, the current Figure

1 shows that a provider seems to continue perform-

ing well over time spans in categories where he has

received positive reviews before. One possible expla-

nation for this is that a provider has several areas in

which he excels, not only one.

Figure 1 was plotted for provider-category com-

binations with at least three reviews. It was assumed

that these exclude such combinations that are less rep-

resentative due to them having received a rating just

once or twice. In order to provide a completer picture

and possibly suggest further findings, there is an addi-

tional diagram for all combinations, even those with

less than three reviews. It can be found in figure 2.

Figure 2: Average Star Ratings over Time for the Best Rated

Provider-Category Combinations.

Figure 2 shows comparable line courses to Figure 1.

A considerable contrast between the two Figures 1

and 2 is that the second-, third- and fourth-best cat-

egories, here as orange green and red lines, are more

volatile. The beginning shows that they start much

lower and increase their ratings to time point ten. In

fact, they start partly as low as 3.4 stars on average,

which is slightly over a neutral rating of circa 3.0

stars.

Figure 1 here answers Q1 equally as Figure 2

does, but further demonstrates that the number of

ratings per provider-category combination can reveal

important findings as well, because Figure 2 has got

4, 663 reviews in the best rated category at time point

zero, where 1 has over 500 reviews. The next research

question deals with the most rated instead of the best

rated categories.

4.3 Q2: Performance of the Most Rated

Categories over Time

Q2 asks for an investigation of the most rated cate-

gories and their ratings over time. This is performed

as it is not known whether many reviews and many

positive reviews improve a provider’s sales. Figure 3

provides an overview of the data for this question.

Interestingly, all four lines in Figure 3 are close to

each other. Furthermore, they seem to rotate around

ICPRAM 2020 - 9th International Conference on Pattern Recognition Applications and Methods

268

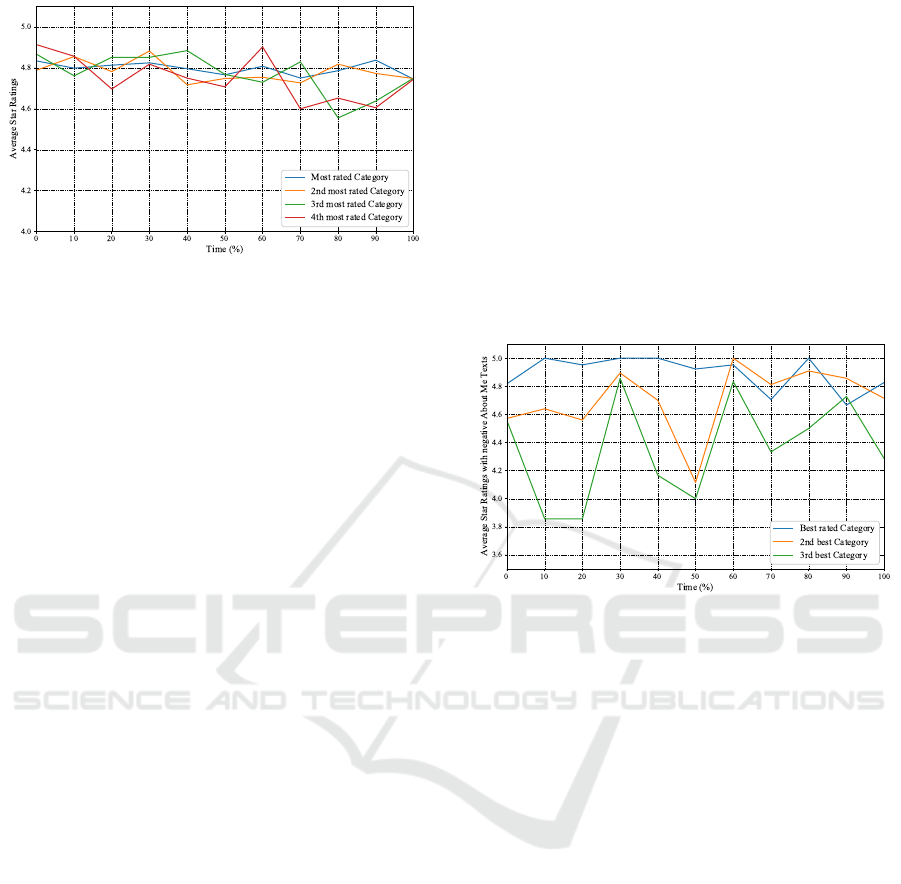

Figure 3: Average Star Ratings over Time for the Most

Rated Provider-Category Combinations with at Least Three

Reviews.

each other, as their average star ratings are volatile.

The first finding to be made is that the most rated cat-

egories all have high average ratings.

This finding can especially be seen when compar-

ing the lines in Figure 3 to the two Figures 1 and 2

from the previous Section. Even though the previous

Section deals with the best rated categories, the most

rated ones achieve in part better star ratings or at least

comparable values.

That is, taking the data of this paper in consideration,

Figure 3 demonstrates that most reviews, especially

the most rated categories per provider, are strongly

positive. At any rate, the picture in Figure 3 does not

show a clear picture like other diagrams. The most

rated categories, here in blue, do not outperform the

others. Other categories such as the third-most rated

even outperforms the most rated for several time in-

tervals in a row, here between time points 20 and 40.

All in all, the most rated categories have volatile rat-

ings that may fluctuate around 0.3 stars maximum.

The fluctuations seem to be stronger after half of the

time, i.e. after time point 50. Overall, the average

star ratings seem to decrease slightly over all time

points. Generally, it can be stated that the most rated

categories perform well over time spans. A possible

explanation is that many reviews and many positive

reviews enhance providers sales. Even scholars sug-

gest that providers with many good reviews often can

make more follow-up sales (Lin et al., 2016).

4.4 Q3: The Association of Best Rated

Categories with About Me Texts

Q3 deals with the average star ratings of the best

rated categories over time from the previous Section

4.2 in combination with the sentiment scores of the

providers’ About Me texts. That is, this Section aims

at finding out how providers’ best rated categories

perform when viewing only those with positive or

negative sentiment scores of the providers’ About Me

texts.

Figure 4 shows the best rated categories over time

with at least three reviews and negative About Me

texts. Again, the best rated categories seem rather

stable compared to the others. At any rate, the val-

ues here are much more volatile.

In this Section, the fourth-best rated categories

were excluded due to too few values. The most rated

categories showed comparable values to the best rated

regarding the current topic and thus were excluded. If

the sentiment Score of the About Me text is 0.5 posi-

tive or higher, it will be categorised as a positive text,

otherwise as negative.

Figure 4: Average Star Ratings over Time for the Best Rated

Provider-Category Combinations with at Least Three Re-

views and Negative About Me Texts.

The values vary from about 3.8 stars on average to

5.0 stars. The best rated categories show with their

blue line many high rated reviews reaching as high as

5.0 stars on average. The data set of the best rated

categories was split into those with negative About

Me texts and with positive texts, which can be found

in Figure 5. Interestingly, the values here are still

volatile, but not as much as in Figure 4. This fig-

ure does not differ too much in its appearance from

Figure 1 in Section 4.2. Figure 5 has e.g. over 400

values at time point zero, while Figure 4 has slightly

over 100.

When it comes to the best rated categories and

the About Me texts’ sentiment scores, the following

general observation can be drawn: Those provider-

category combinations whose provider has an About

Me text with a negative sentiment have highly volatile

average ratings. This high volatility partially comes

from a low number of reviews. Even though all rat-

ings are positive, some of them are comparatively low

positive even reaching close to the neutral area of

about 3.8 stars on average.

What Reviews in Local Online Labour Markets Reveal about the Performance of Multi-service Providers

269

Figure 5: Average Star Ratings over Time for the Best Rated

Provider-Category Combinations with at Least Three Re-

views and Positive About Me Texts.

4.5 Q4: Quantitative Average Ratings

and Average Sentiment Scores in

Comparison

Q4 deals with a comparison of quantitative and qual-

itative ratings. In the introduction in Section 1, it

was questioned whether average star ratings match

the sentiment of the corresponding textual reviews. A

possible scenario is a review that has five stars but

where the reviews only addresses weaknesses of the

provider’s performance in the text. However, this Sec-

tion will answer the question of whether quantitative

and qualitative ratings match.

Figure 6 presents a diagram with two y-axis.

While the left y-axis presents the average star ratings

of the best rated categories, the right y-axis presents

the average sentiment score of the corresponding re-

views. Only the positive sentiment scores are shown.

Figure 6: Average Star Ratings and Positive Sentiment

Scores over Time for the Best Rated Provider-Category

Combinations with at Least Three Reviews.

The lines in the upper part are known from Figure

1 (Q1). Underneath, there are the corresponding sen-

timent scores for which the y-axis is on the right with

its measurement units.

It is the aim of this Section to generally clear

whether well rated categories have review texts with

positive sentiments. However, in general, one can see

in Figure 6 that all well rated categories have compar-

atively good sentiment scores. With sentiment scores

way over 70% and as high as 80%

7

, the best rated

categories have very positively written review texts.

When taking a closer look at the lines’ courses in

Figure 6, it is visible that the courses in the lower part

are not the exact same but close to those in the up-

per part. For example, the blue lines are quite stable

and do not show volatile values, though the lower blue

line is fluctuating more than the upper one. At any

rate, the sentiment lines are comparably high like the

star lines in the upper half and therefore, Q4 can be

answered positively. That is, quantitatively well rated

providers receive reviews with good sentiments on av-

erage. This can possibly be explained by the idea that

customers who rate very positively also write good

comments just supporting the star rating.

4.6 Q5: Indications of the Number of

Offered Services per Provider

This Section answers Q5. It is not known whether

a provider’s number of offered services is associated

with customer satisfaction and therefore reviews. It

would be an interesting finding whether providers

with few categories (specialization), for example,

have very good ratings while those with several cat-

egories have less good ratings. However, to answer

this research question, it is further worth taking a look

at indications of the number of reviews per provider-

category combination.

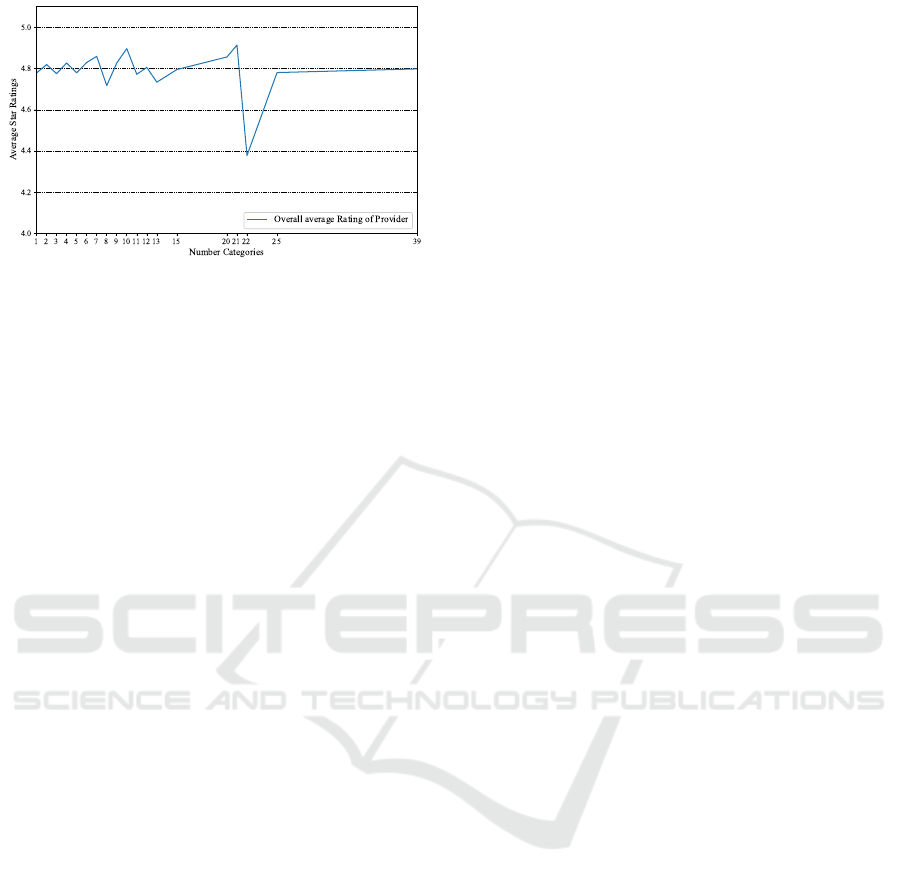

Figure 7 shows the average star ratings (y-axis)

of providers who offer services in one, two etc. cate-

gories (x-axis) and who have received at least three re-

views there. The axis labels in this figure show gaps,

as there were e.g no providers having 26 − 38 cate-

gories, but one with 39 categories. Providers have on

average 3.52 categories only.

As can be seen in Figure 7, the average star ratings

of providers with different numbers of categories are

volatile. No clear trend is discernible. At any rate,

they are generally as high as 4.8 stars, a highly pos-

itive value. It is not observable that a provider with

less categories has better ratings. This can possibly

be explained by the fact that there seems to be no as-

sociation between the number of offered services and

customer satisfaction.

7

However, such values are very high as many positive

words have, according to SentiWordNet, even a certain neg-

ative score percentage.

ICPRAM 2020 - 9th International Conference on Pattern Recognition Applications and Methods

270

Figure 7: Average Star Ratings and Number of Categories

per Provider with at Least Three Reviews.

5 CONCLUSION

This Section draws a conclusion about the present pa-

per.

All aims of this paper have been reached as the

five research questions were answered. Additionally,

in order to ensure adequate results, different means of

looking at the data like excluding categories with less

than three reviews have been used. Further, several

other ideas have been tested before deciding how and

which data to use in this paper.

Amazon did not display all reviews of several cat-

egories with many ratings. Therefore, some cate-

gories were excluded from the investigation, which I

regard as a limitation. Furthermore, the total number

of reviews available on AHS, a few ten thousands of

reviews, is generally quite low so far. After all, the

presented foundations and related literature are satis-

fying in their scope and findings. As research so far

has neglected local multi-service providers, this pa-

per closes an important research gap whose findings

can help develop a completer picture in areas such

as customer review research, OLMs and online ser-

vice providers. It is a surprising finding that even

non-local service providers with multiple service cat-

egories have been studied little so far. It is further no-

ticeable that local multi-service providers with good

ratings perform, though the nature of their services

is intangible and hardly comparable, almost equally

well over time [Q1] (even though their ratings drop

slightly). This can be caused by the fact that Amazon

selects sellers eligible for selling on AHS and they

may exclude poorly performers after some time.

Apart from the best rated categories, the most

rated perform almost equally well over time [Q2].

A possible explanation is that many reviews and

many positive reviews stimulate sales. Another is

that many positive reviews encourage customers to

float with the crowd and give rather positive reviews.

When taking a look at the introduction, this behaviour

seems likely (reviews are either very positive or neg-

ative). However, providers with a negative sentiment

in their About Me texts are not only scarcer but have

highly volatile ratings compared to those with nega-

tive About Me texts [Q4]. Possibly, those provider

who control their self-description and are engaged

to provide a positive image are not only careful and

quality-conscious with their self-description, but also

with their work in general. Further, the qualitative

and quantitative ratings match [Q4] and thus, the re-

view texts match the star ratings. Interestingly, though

multi-tasking is harmful as stated in the introduction,

a higher number of offered services does not come

with a poorer provider performance [Q5]. That is in-

teresting as one might expect better ratings due to spe-

cialization in few categories.

What is more, is a self-developed sentiment analy-

sis method was chosen as it performs well on reviews

for multi-service providers. However, when dealing

with a comparison of sentiment scores and quantita-

tive star ratings, it arises a new question of an ade-

quate matching between both scales.

In general, the data, analyses and findings pre-

sented here not only are satisfying but can also be fur-

ther used for future research. Platform operators can

benefit from the findings in this paper. They can gain

an insight in how their platform compares to AHS and

local multi-service providers. For research, another

small part for the big picture is added.

ACKNOWLEDGEMENTS

This work was partially supported by the German

Research Foundation (DFG) within the Collaborative

Research Centre On-The-Fly Computing (SFB 901).

REFERENCES

Abhyankar, S., Demner-Fushman, D., Callaghan, F. M., and

McDonald, C. J. (2014). Combining structured and

unstructured data to identify a cohort of icu patients

who received dialysis. 21(5):801–807.

Agrawal, A., Horton, J., Lacetera, N., and Lyons, E. (2015).

Digitization and the contract labor market: A re-

search agenda. In Goldfarb, A., Greenstein, S. M.,

and Tucker, C. E., editors, Economic Analysis of the

Digital Economy, pages 219–250. The University of

Chicago Press, 1 edition.

Amazon (2017). Amazon.com: Home & business services.

https://www.amazon.com/Amazon-Home-Services/

b?ie=UTF8&node=10192820011. Accessed 2017-

10-03.

What Reviews in Local Online Labour Markets Reveal about the Performance of Multi-service Providers

271

Anderson, M. and Magruder, J. (2012). Learning from the

crowd: Regression discontinuity estimates of the ef-

fects of an online review database. 122(563):957–989.

Berinsky, A. J., Huber, G. A., and Lenz, G. S. (2012). Eval-

uating online labor markets for experimental research:

Amazon. com’s mechanical turk. 20(3):351–368.

Chevalier, J. A. and Mayzlin, D. (2006). The effect of word

of mouth on sales: Online book reviews. 43(3):345–

354.

Dellarocas, C. (2003). The digitization of word of mouth:

Promise and challenges of online feedback mecha-

nisms. 49(10):1407–1424.

Duan, W., Gu, B., and Whinston, A. B. (2008). Do online

reviews matter? – an empirical investigation of panel

data. 45(4):1007–1016.

Esch, F.-R. (2017). Gabler wirtschaftslexikon, stich-

wort: Word-of-mouth. http://wirtschaftslexikon.

gabler.de/Archiv/81078/word-of-mouth-v6.html. Ac-

cessed 2017-11-14.

Esuli, A. and Sebastiani, F. (2007). Sentiwordnet: A high-

coverage lexical resource for opinion mining. Techni-

cal report, Istituto di Scienza e Tecnologie dellInfor-

mazione Consiglio Nazionale delle Ricerche. Techni-

cal Report 2007-TR-02.

Ghose, A. and Ipeirotis, P. G. (2006). Designing ranking

systems for consumer reviews: The impact of review

subjectivity on product sales and review quality. In

Proceedings of the 16th WITS, pages 303–310. AIS.

Godes, D. and Mayzlin, D. (2004). Using online con-

versations to study word-of-mouth communication.

23(4):545–560.

Goes, P., Ilk, N., Lin, M., and Zhao, J. L. (2018). When

more is less: Field evidence on unintended conse-

quences of multitasking. 64(7):3033–3054.

Horton, J. and Golden, J. (2015). Reputation inflation: Ev-

idence from an online labor market. Technical report,

New York University. Working Paper.

Hu, M. and Liu, B. (2004). Mining and summariz-

ing customer reviews. In Proceedings of the 10th

ACM SIGKDD International Conference on Knowl-

edge Discovery and Data Mining, pages 168–177.

ACM.

Hu, N., Pavlou, P. A., and Zhang, J. (2006). Can online re-

views reveal a product’s true quality?: Empirical find-

ings and analytical modeling of online word-of-mouth

communication. In Proceedings of the 7th ACM

Conference on Electronic Commerce, pages 324–330,

New York, NY, USA. ACM, ACM.

Kokkodis, M. and Ipeirotis, P. G. (2016). Reputation trans-

ferability in online labor markets. 62(6):1687–1706.

Lehdonvirta, V., Barnard, H., Graham, M., and Hjorth, I.

(2014). Online labour markets-levelling the playing

field for international service markets? In Proceed-

ings of Crowdsourcing for Politics and Policy. ECPR.

Lin, M., Liu, Y., and Viswanathan, S. (2016). Effective-

ness of reputation in contracting for customized pro-

duction: Evidence from online labor markets. page

Articles in Advance.

Luca, M. (2016). Reviews, reputation, and revenue: The

case of yelp.com. Technical report, Harvard Business

School. Working Paper No. 12-016.

Park, D.-H., Lee, J., and Han, I. (2007). The effect of on-

line consumer reviews on consumer purchasing inten-

tion: The moderating role of involvement. 11(4):125–

148.

Singh, V., Piryani, R., Uddin, A., and Waila, P. (2013).

Sentiment analysis of movie reviews: A new feature-

based heuristic for aspect-level sentiment classifica-

tion. In Proceedings of the 2013 international Multi-

Conference on Automation, Computing, Communica-

tion, Control and Compressed Sensing, pages 712–

717. IEEE.

ICPRAM 2020 - 9th International Conference on Pattern Recognition Applications and Methods

272