Mobile Banking: Overview of Most Common Theoretical

Foundations of Technology Adoption

Chama Jaride and Ahmed Taqi

Faculty of Juridical Economic and Social Sciences Tetouan, Abdelmalek Essaâdi University, Morocco

Keywords: Mobile banking, M-banking, Technology adoption, Customer relationship management.

Abstract: In a connected economy, financial services must be dynamic, customer-centric, available and compatible

with consumers' lifestyles. As an innovative technology, Mobile Banking (M-banking) represents a good

example of new technology allowing customers to produce financial transactions via mobile devices. The

paper aims at determining different theoretical foundations adopted by several researchers who try to

explain the perceptions and behaviours of customers with regard to mobile banking as well as the factors

that could predict the use of mobile banking services by banking customers. This study provides an

overview by analyzing the current state of art in knowledge of mobile banking and its theoretical

foundations. The results suggest the predominance of technology adoption models such as TAM, UTAUT

and UTAUT2.

1 INTRODUCTION

The advent of technology has transformed the

banking sector. Today, banks are investing heavily

in mobility, which has become an essential strategic

axis for the development of the sector. It's a change

in the way that banking services are used, in the

bank / customer relationship, and simply in the way

of money management. This phenomenon is so

important that IT professionals have described it as

one of the most important developments in the field

of business and mobile commerce (Oliveira and al,

2014).

Some authors show that M-banking strengthens

relationships and emphasizes its benefits for

customer relationship management. Thus, banks

seems not only willing to integrate the channels of

mobile banking services into their logistics structure

to provide better service to their customers, but also

to improve the effectiveness and efficiency of these

channels (Sharma and Sharma, 2019).

It has been noticed that user attitudes towards

accepting a new information system has an impact

on its success (Al-Somali and al, 2009). The

problem is that financial institutions still do not have

an exact and precise idea of the behaviors of

consumers to accept, use and be loyal through the

use of mobile banking services (Shareef and al,

2018). Banks do not have enough information on

why customers use mobile banking services and why

they will continue to use them in the long term

(Albashrawi and Motiwalla, 2020). This clearly

explains that mobile banking remains a relevant and

interesting research topic around the world,

especially in terms of the adoption of this innovative

channel and its feasibility to gain customer

satisfaction and loyalty.

The following section includes a presentation of

mobile banking benefits for both costumers and

banking institutions. Then a literature review is

presented in the next section before addressing the

theoretical foundations of technology acceptance

and a comparative analysis of main theoretical

models of technology adoption. Then a discussion

section is presented before formulating some

conclusions.

2 MOBILE BANKING BENEFITS

M-banking is a new technology that is increasingly

present in banking establishments given to its many

advantages in terms of reducing operating costs and

improving customer relationship management. This

service also presents many benefits to banking

customers in terms of access and mobility. Mobile

banking has become the self-service delivery

channel that enables banks to deliver information

and offer services to their customers with more

convenience (Lin, 2013).

From the beginning, Mobile banking services

allowed customers to perform account balance

inquiries, surveys of transaction history, fund

transfers and bill payments via mobile devices.

Indeed, when it was launched, mobile banking only

provided general banking transactions. In the present

times, mobile banking application offer more

complex services such as credit request or financial

investments.

(Lin, 2013) explains that mobile banking is a set

of mobile commerce applications that allow

customers to perform both conventional transactions

(e.g fund transfers), but also more advanced

operations (e.g trading and portfolio management).

(Oliveira and al, 2014) confirms that M-banking

includes three components which are mobile

accounting (e.g check book requests, blocking lost

cards, transferring money or insurance policies

subscription ), mobile brokerage (sale and purchase

of financial instruments), and mobile financial

information services (e.g balance requests, statement

requests, exchange rate information).

Mobile banking services thus meet customers

needs and also business needs. Indeed, it is clearly

demonstrated that, as a self-service technology, it is

an important factor in reducing staff costs. By

replacing physical retail banking with intensive

labor to automated processes, banks improve their

productivity, efficiency and profitability (Asad and

al, 2016).

3 LITERATURE REVIEW

Mobile banking has seen exponential use around the

world and, as a result, spectacular growth in the

literature. Examining and explaining the adoption of

mobile banking services is at the center of research

of several academics and practitioners around the

world.

Much research has been used and sometimes

even combined several theoretical models of

technology acceptance. This is the case of the study

carried out in 2020 by (Le and al ,2020) among 370

customers that have never used or are currently

using mobile banking in Vietnam. This work, based

on the theoretical model of UTAUT in its first and

second version and TAM, has shown that some

factors have been assessed to be more important

than others in affecting intention to use mobile

banking services. First, the authors cite social

influence which means that an individual, who

perceives and uses mobile banking services, is

strongly influenced by people and environment

around him. Secondly, they address the

compatibility that corresponds to the user's external

environment that will help him overcome the

obstacles associated to the use of new information

technology. Then come other factors such as

performance expectancy, perceived ease of use,

perceived trust, perceived cost, and behavioral

intention. When these factors come together, this

leads to a high level of use of mobile banking

services through regular use.

(Alalwan and al, 2017) developed a conceptual

model adapted from the UTAUT2 model, but this

time not by combining it with another model but by

integrating an external variable which is trust. The

objective of this Jordanian study carried out on a

sample of 343 users was to study the most important

factors that predict the actual adoption of M-Baking

sevices. Several explanatory variables have been

mentioned in this work such as performance

expectancy, hedonic motivation and trust.

In the work of (Masrek and al, 2014), the authors

has also studied the relationship between

technological trust and satisfaction in mobile

banking. Masrek and al used a quantitative research

methodology via a survey involving 312 M-banking

consumers in Malaysia. The results of the study

confirmed the importance of technological trust in

predicting satisfaction in mobile banking services.

(Albashrawi and Motiwalla, 2020) explained in

the United states during 2020 the acceptance of

mobile banking using the UTAUT model by

integrating another model witch is the information

Systems Success of Delone and Mclean (ISSM). The

approach adopted by the authors combined subjective

measures that capture perceptions of system use (e.g

by asking users) with objective metrics that capture

actual system usage (by analyzing users' bank files in

terms of frequency and duration of use), in order to

avoid the potential biases generated by

overestimating or underestimating of system user.

The results of the study highlighted, among other

things, that bank practitioners should focus on

improving the quality of M-banking service without

forgetting social influence, because both of these

factors have proven to be essential for consumers of

mobile banking in USA.

The study by (Lin, 2013) was carried out among

300 Taiwanese bank customers to assess the

importance of the quality of mobile banking factors

between two groups of customers, a first group with

little experience in mobile banking and a second

group with high experience in mobile banking.

According to the author, the quality of mobile

service is increasingly recognized as a critical factor

for a successful implementation of mobile banking.

The results of the study confirm that customers with

low and high experience generally consider the

quality of mobile service in terms of speed,

reliability, convenience and personalization as

essential elements for a high quality of M-banking

witch can increase customers' trust in their bank.

(Oliveira and al, 2014) combined three models of

information systems, namely Unified Theory of

Acceptance and Use of Technology (UTAUT), Task

Technology Fit (TTF), and Initial Trust Model

(ITM), to better understand the adoption of mobile

banking services in Portugal among 194 customers.

The study found that the most important concepts

behind the adoption of M-banking are behavioral

intention of customers to adopt a new technology,

facilitating conditions, performance expectancy and

trust. According to Oliveira and al, customers are

more willing to trust in a new service such as mobile

banking if company’s reputation is good and also if

a risk insurance service is implemented.

The conceptual model developed by (Baabdullah

and al) in 2018 used the information Systems

Success of Delone and Mclean (ISSM) by

combining it with the UTAUT2 model in order to

verify the way the use of M-banking could

contribute to satisfaction and loyalty of customers in

Saudi Arabia.

The results of this study conclude that customers

who see M-banking as a reliable communication

channel for acces to bank services, develop a feeling

of loyalty and satisfaction towards their banking

institutions.

The effects of mobile banking adoption on

customer relationship management, satisfaction and

customer interaction are also analyzed in the study

conducted by (Hamidi and Safareeyeh, 2018) in

Iran. The autors conclude that using mobile banking

technology allows more interaction and

communication with customers and that is clearly on

the advantage of customer relationship management.

4 THEORETICAL

FOUNDATIONS OF

TECHNOLOGY ADOPTION

The literature on the adoption of Information

Technology (IT) provides several theoretical

models. A considerable number of researchers have

formulated different models relevant to the field of

IT in order to further explain the acceptance of

technology from a user perspective. However, three

theoretical models stand out and come up most often

in research on the adoption of M-banking

technology. The Technology Acceptance Model

(TAM) established by (Davis and al, 1989), the

Unified Theory of Acceptance and Use of

Technology (UTAUT) established by (Venkatesh

and al, 2003) and the second version of the Unified

Theory of Acceptance and Use of Technology 2

(UTAUT 2) developed by (Venkatesh and al , 2012)

after.

These theoretical models of the adoption of

systems informations have been validated by a

variety of research fields including mobile banking

over the past decade (Albashrawi and Motiwalla,

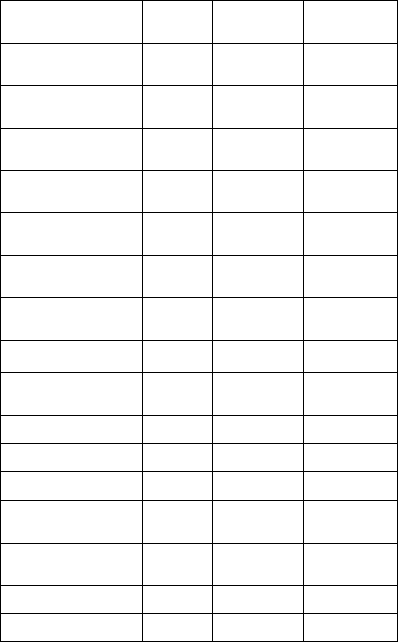

2020). The following table presents a comparative

analysis of the different variables that constitute

them.

Table 1: Comparative table of main theoretical models of

technology adoption

TAM UTAUT

UTAUT

2

External

Variables

X

Perceived

Usefulness

X

Perceived Ease

of Use

X

Attitude

Towards Usin

g

X

Behavioral

Intention

X X X

Performance

Expectanc

y

X X

Effort

Ex

p

ectanc

y

X X

Social Influence X X

Facilitating

Conditions

X X

Gender X X

Age X X

Experience X X

Voluntariness of

Use

X

Hedonic

Motivation

X

Price Value X

Habit X

4.1 Technology Acceptance Model

(Tam)

The Technology Acceptance Model (TAM) is the

most widely used technology adoption model cited

by many researchers, with over 117,000 citations on

Google Scholar

1

in 2020 of which nearly 20,000 are

Scopus indexed.

TAM was introduced first for information

systems by Davis and al in 1986 and then developed

in 1989. Following a longitudinal study with 107

users in order to identify the appropriate

functionalities and interfaces of systems information

to end users. The authors present three essential

theoretical constructs which are perceived

usefulness, ease of use, and behavioral intention.

Perceived usefulness and perceived ease of use

are two beliefs that create behavioral intention.

While behavioral intention is favorable to the use of

the technology and therefore affects the actual use.

These are for Davis and al the main determinants of

user attitudes towards the adoption of new

technologies.

The TAM model has been the measure of several

empirical studies. Many researchers have introduced

additional variables to the TAM or they have

combined it with other models to suggest new

conceptual models (Le, 2020), (Hassan and Wood,

2020), (Watat and Madina, 2019), (Gumussoy and

al, 2018), (Filali Halime, 2017) and (Mostafa,

2015).

According to (Boonsiritomachai and

Pitchayadejanant, 2017), the popularity of TAM

model is probably due to two aspects. First of all,

TAM was created to analyse the adoption of

technology in different cultural and technological

contexts with different levels of user expertise.

Secondly, TAM has been the subject of numerous

empirical studies in different fields of research,

which in conclusion support its overall explanatory

power. Indeed, its strong presence in the literature

has made it a measurement scale with high validity

for over thirty years.

However, some researchers have criticized the

TAM model and recommended that it be extended to

include other variables in order to strengthen it.

1

https://scholar.google.com/scholar?hl=fr&as_sdt=0%2C5

&q=technology+acceptance+model+tam&oq=TAM,

Accessed on 23/08/2020

4.2 Unified Theory of Acceptance and

Use of Technology (UTAUT)

The second theoretical model cited in many recent

studies is the Unified Theory of Acceptance and

Use of Technology (UTAUT) (Albashrawi and

Motiwalla, 2020), (Giovanis and al, 2019) (Nugraha

and al, 2018), and (Barati and Mohammadi, 2009).

This model is also widely used by several

researchers, with nearly 24,000 citations on Google

Scholar

2

, of which more than 2300 are Scopus

indexed.

This model has been proposed as an extension of

the popular TAM which aims to explain the

intention of users to adopt an information system. It

is considered as an influential theory in the context

of the adoption of new technologies.

Venkatesh and his co-authors proposed in 2003

this model through a study of 215 users. They claim

that four elements are the antecedents of behavioral

intention, namely performance expectancy, effort

expenctancy, social influence and facilitating

conditions.

Performance expectancy is the extent to which

people believe that using mobile banking services

will help them to achieve performance gains.

According to Venkatesh and al, this is the degree to

which the use of a technology will provide benefits

to consumers.

Effort expectancy is linked to the ease of access

to the M-banking service and the effort that will be

made in this regard.

Social influence is presented by Venkatesh and

al as the extent to which consumers perceive other

important people such family and friends believe

that they should use a particular technology.

Facilitating conditions represent the degree to

which people find it easy to connect and use mobile

banking services (e.g setting up an assistance

service).

According to the authors, performance

expectancy, effort expectancy and social influence

affect behavioral intention. While behavioral

intention combined with the facilitating conditions,

determines the use of technology. Age, gender,

experience and voluntariness of use are presented by

the authors as moderating variables into this model.

2

https://scholar.google.com/scholar?hl=fr&as_sdt=0%2C5

&q=unified+theory+of+acceptance+and+use+of+techn

ology+UTAUT&btnG=, Accessed on 23/08/2020.

4.3 Unified Theory of Acceptance and

Use of Technology 2 (UTAUT 2)

Venkatesh and al presented a second version of the

UTAUT model which is the UTAUT2 to study

technology adoption especially in the context of

Mobile Banking through a survey of 1512 mobile

internet consumers (Venkatesh et al., 2012) .

The authors have introduced to UTAUT three

constructs which are hedonic motivation which is

the pleasure felt from using technology, the value of

prize because consumers must pay the costs

associated with purchasing devices and subscribing

to the service, and habit, which is the extent to

which consumers tend to automatically adopt certain

behaviors.

The aim of the authors was to make the model

more suited to the context of the use of technologies

by the general public. This is successful given that

UTAUT 2 has been the subject of several studies

around the world (Merhi and al, 2019), (Baabdullah ,

2018), (Alalwan, 2017), and (Boonsiritomachai and

Pitchayadejanant, 2017).

5 DISCUSION

The existing literature is full of studies that have

discussed the adoption of mobile banking among

users, on the basis of the aforementioned theoretical

models. Indeed, many theoretical foundations have

supported the conceptualization of several research

models dealing with M-banking.

This literature review allowed us to identify

most present theoretical foundations in previous

work, namely TAM, UTAUT and UTAUT 2 models

then to establish a comparative analysis of different

variables that constitute them with the aim of

highlighting the various points of convergence and

divergence between these models.

For this purpose, behavioral intention is the

common variable of the three theoretical models.

The authors of this literature review consider

behavioral intention as a cornerstone of M-banking

adoption.

Variables such as perceived usefulness and

perceived ease of use were introduced by TAM.

UTAUT and UTAUT 2 share several variables in

common such as, Effort Expectancy, Social

Influence, Facilitating Conditions and Performance

Expectancy. While other variables are specific to

each of the two models such as voluntariness of use

for UTAUT or hedonic motivation, price value and

habit for UTAUT2.

By eliminating the variable of voluntariness of

use and integrating new variables, the authors

attempt to adopt the second version of UTAUT to

the business environment of mobile banking from

consumers perspective.

This work also allowed us to observe that several

researchers do not use a single model to study

technological adoption, but attempt to combine two

or more theoretical models in their works. In

addition, many studies integrate new explanatory

variables into these models, in order to explore

better the adoption of M-banking technology by

customers.

6 CONCLUSION

In the current digital age, mobile banking has a

double benefit: it serve the interests of banks and

those of its customers. M-banking plays an

important role in helping banks to acquire new

customers and developing the relationship with

existing consumers. It allows to meet their

constantly changing requirements, satisfy them with

a distinct value and then create a competitive

advantage.

It is also one of the most effective tools that have

emerged to minimize costs and lighten the work load

for banking staff to allow them to focus their efforts

on other more complex and profit generating

activities.

Moreover, financial institutions develop and

promote this service because it offers the possibility

of placing different products to several customer

segments and thus allowing to maintain profitable

relationships (Tam and Oliveira, 2019).

The main motivation behind the above-

mentioned theoretical models of technology

adoption has been to go beyond the barriers that

hinder the adoption of M-banking in order to

increase the number of clients using this technology.

The importance of adopting and implementing

electronic banking services as a means of reducing

operational and transactional costs and increase

customer satisfaction and loyalty is validated, but

they are some prerequisite for this like provide

customers a support that is secure, complete, easy to

use and delivered under favorable conditions.

REFERENCES

Alalwan, A.A., Dwivedi, Y.K., Rana, N.P., 2017. “Factors

influencing adoption of mobile banking by Jordanian

bank customers: Extending UTAUT2 with trust,”

International Journal of Information Management 37,

99–110.

Albashrawi, M., Motiwalla, L., 2020. “An Integrative

Framework on Mobile Banking Success,” Information

Systems Management, 37, 16–32.

Al-Somali, S.A., Gholami, R., Clegg, B., 2009. “An

investigation into the acceptance of online banking in

Saudi Arabia,” Technovation 29, 130–141.

Asad, M.M., Mohajerani, N.S., Nourseresh, M., 2016.

“Prioritizing Factors Affecting Customer Satisfaction

in the Internet Banking System Based on Cause and

Effect Relationships,” Procedia Economics and

Finance, 1st International Conference on Applied

Economics and Business 36, 210–219.

Baabdullah, A.M., Alalwan, A.A., Rana, N.P., Kizgin, H.,

Patil P., 2018. “Consumer use of mobile banking (M-

Banking) in Saudi Arabia: Towards an integrated

model,” International Journal of Information

Management 44, 38–52.

Barati, S., Mohammadi, S., 2009. “ An Efficient Model to

Improve Customer Acceptance of Mobile Banking,”

Presented at the Proceedings of the World Congress

on Engineering and Computer Science, USA, p. 5.

Boonsiritomachai, W., Pitchayadejanant, K., 2017.

“Determinants affecting mobile banking adoption by

generation Y based on the Unified Theory of

Acceptance and Use of Technology Model modified

by the Technology Acceptance Model concept,”

Kasetsart Journal of Social Sciences.

Davis, F.D., Bagozzi, R.P., Warshaw, P.R., 1989. “User

Acceptance of Computer Technology: A Comparison

of Two Theoretical Models,” Management Science 35,

982–1003.

Filali Halime, Z., 2017. “Etude de la resistance à

l’adoption et l’utilisation de la banque mobile Cas du

Maroc,” International Journal of Business &

Economic Strategy.

Giovanis, A., Assimakopoulos, C., Sarmaniotis C., 2019.

“Adoption of mobile self-service retail banking

technologies: The role of technology, social, channel

and personal factors,” International Journal of Retail &

Distribution Management 47, 894–914.

Gumussoy, C.A., Kaya, A., Ozlu, E., 2018. “Determinants

of Mobile Banking Use: An Extended TAM with

Perceived Risk, Mobility Access, Compatibility,

Perceived Self-efficacy and Subjective Norms,”

Industrial Engineering in the Industry 4.0, Era 225–

238.

Hamidi, H., Safareeyeh, M., 2018. “A model to analyze

the effect of mobile banking adoption on customer

interaction and satisfaction: A case study of m-

banking in Iran,” Telematics and Informatics 38, 166–

181.

Hassan, H.E., Wood, V.R., 2020. “Does country culture

influence consumers’ perceptions toward mobile

banking? A comparison between Egypt and the United

States,” Telematics and Informatics 46, 101312.

Le, H.B.H., Ngo, C.T., Trinh, T.T.H., Nguyen, T.T.P,

2020. “Factor Affecting Customers’ Decision to Use

Mobile Banking Service: A Case of Thanh Hoa

Province, Vietnam,” The Journal of Asian Finance,

Economics and Business 7, 205–212.

Lin, H.F., 2013. “Determining the relative importance of

mobile banking quality factors,” Computer Standards

& Interfaces 35, 195–204.

Merhi, M., Hone, K., Tarhini, A., 2019. “A cross-cultural

study of the intention to use mobile banking between

Lebanese and British consumers: Extending UTAUT2

with security, privacy and trust,” Technology in

Society 59, 101151.

Mostafa, R., 2015. “Investigating the Role of Trust in

Mobile Banking Acceptance,” Ideas in Marketing:

Finding the New and Polishing the Old, 834–842.

Nugraha, ES., Saputra, R.K., Nugraheni, D.M., 2018.

“Understand TTF by Considering the Trust Factor in

Adopting M-Banking,” Presented at the 2018 2nd

International Conference on Informatics and

Computational Sciences (ICICoS), IEEE, Semarang,

Indonesia, pp. 1–6.

Oliveira, T., Faria, M., Thomas M.A. , 2014. “Extending

the understanding of mobile banking adoption: When

UTAUT meets TTF and ITM,” International Journal

of Information Management, 34, 689–703.

Shareef, M.A., Baabdullah, A., Dutta, S., Kumar, V.,

Dwivedi, Y.K., 2018. “Consumer adoption of mobile

banking services: An empirical examination of factors

according to adoption stages,” Journal of Retailing and

Consumer Services, 43, 54–67.

Sharma, S.K., Sharma, M., 2019. “Examining the role of

trust and quality dimensions in the actual usage of

mobile banking services: An empirical investigation,”

International Journal of Information Management, 44,

65–75.

Tam, C., Oliveira, T., 2019. “Does culture influence m-

banking use and individual performance,” Information

& Management 56, 356–363.

Venkatesh, V., Thong, J.Y.L., Xu, X., 2012. “Consumer

Acceptance and Use of Information Technology:

Extending the Unified Theory of Acceptance and Use

of Technology,” MIS Quarterly 36, 157.

Watat, J.K., Madina, M., 2019. “Towards an Integrated

Theoretical Model for Assessing Mobile Banking

Acceptance Among Consumers in Low Income

African Economies,” Information Systems. Presented

at the European, Mediterranean, and Middle Eastern

Conference on Information Systems, Springer, Cham,

pp. 165–178.