Time-series Modeling for Consumer Price Index Forecasting using

Comparison Analysis of AutoRegressive Integrated Moving Average

and Artificial Neural Network

Intan Yuniar Purbasari

1

, Fetty Tri Anggraeny

1

and Nindy Apsari Ardiningrum

2

1

Department of Informatics, Faculty of Computer Science, Universitas Pembangunan Nasional “Veteran” Jawa Timur,

Raya Rungkut Madya, Surabaya, Indonesia

2

Alumni of Department of Informatics, Faculty of Computer Science, Universitas Pembangunan Nasional “Veteran” Jawa

Timur

Keywords: ARIMA, ANN, Consumer Price Index, Time Series Data

Abstract: The Consumer Price Index (CPI) is an index number that measures the average price of goods consumed by

households and is one factor that influences inflation in a country. The CPI forecast is calculated in monthly

periods each year to anticipate the possibility of a spike in the inflation rate. Forecasting the CPI makes use

of past values, commonly known as time-series data (TSD). One method to assist the forecasting process on

TSD is the Autoregressive Integrated Moving Average (ARIMA). However, ARIMA is less accurate for

nonlinear data problems. Another method that can also be used for forecasting with linear data problems is

the Artificial Neural Network (ANN). This study compared the two forecasting methods between ARIMA

and ANN by predicting the Indonesian CPI value from January - December 2018. The TSD used is in data

on the Indonesian CPI value between January 2009 and December 2017. This study indicates that the ANN

method is better than ARIMA because it produces a smaller MSE of 59.23. However, ARIMA is also good

because the two methods' forecast results are in the range of the CPI value.

1 INTRODUCTION

In economic terms, inflation is a term that

significantly affects the economy of a country,

which is a process of increasing prices for both

goods and services continuously during a specific

period measured using a price index (Nopirin, 1987).

One of the most frequently used price indexes to

measure inflation is the Consumer Price Index

(CPI). CPI compares prices in a month against the

previous month, which is based on the base year for

calculating the CPI. The effect on inflation is that

the higher the resulting index value, the greater the

possibility of inflation. In one condition, inflation

can be considered beneficial, but it can also be

regarded as detrimental. But in general, inflation can

lead to economic instability, failure to carry out

development, and lower levels of living and welfare.

Monthly CPI values may be predicted for the

next several periods using statistical analysis. CPI

forecasting can be made with one of the forecasting

methods that use time-series data, including

AutoRegressive Integrated Moving Average

(ARIMA), AutoRegressive Fractionally Integrated

Moving Average (ARFIMA), Winter,

Autoregressive Conditional Heteroskedasticity

(ARCH), and other algorithms (Wigati, Rais, &

Utami, 2016). However, in general, economic data

forecasting such as CPI, mostly uses the ARIMA

method (Pimpi, 2013) (Deswina & Desmita, 2015),

(Wigati, Rais, & Utami, 2015), (Mohamed, 2020).

This is because the ARIMA method is sufficient for

short-term forecasting, whereas if used for long-term

forecasting, the resulting value will tend to be

constant (Djawoto, 2010). In (Hiteshi Tandon, 2020)

a model has been developed to forecast future

COVID-19 cases in India using ARIMA based time-

series analysis. ARIMA is also successful in

predicting stock price which is a short term

prediction (Adebiyi, Adewumi, & Ayo, 2014).

According to (Janah, Sulandari, & Wiyono, 2014),

the ARIMA model is a time series modeling for

linear data, but in reality, not all phenomena that use

time series have a linear relationship. Instead, some

are nonlinear. Therefore, we also need a method that

Purbasari, I., Anggraeny, F. and Ardiningrum, N.

Time-series Modeling for Consumer Price Index Forecasting using Comparison Analysis of AutoRegressive Integrated Moving Average and Artificial Neural Network.

DOI: 10.5220/0010369200003051

In Proceedings of the International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies (CESIT 2020), pages 599-604

ISBN: 978-989-758-501-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

599

can solve nonlinear problems. One such approach is

the Artificial Neural Network (ANN) (Fitriani,

Ispriyanti, & Prahutama, 2015), which is a system

utilized by modeling the workings of the human

brain neural network to complete calculation forms

(Susilokarti, Arif, Susanto, & Sutiarso, 2015).

Similar approach was also proposed by (Domingos

S. de O. Santos Júnior, 2019) which evaluated the

use of hybrid systems of ARIMA combined with

Multilayer Perceptron and Support Vector Machine,

while (Ümit Çavuş Büyükşahin, 2019) used

ARIMA-ANN hybrid method improved by

Empirical Mode Decomposition.

This study compared two forecasting methods,

ARIMA and ANN, to predict the Indonesian CPI

with time-series data for January 2009 - August

2018 and assessed the accuracy of forecasting based

on the MSE criteria and the calculation of the CPI

value range.

2 MATERIALS AND METHOD

2.1 Dataset

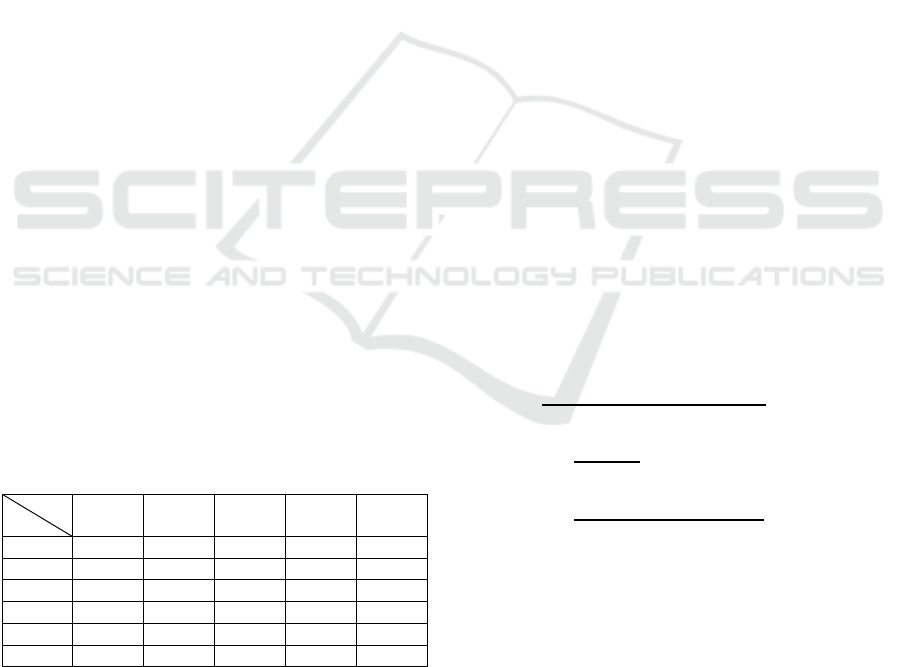

Dataset used is a secondary data on the Indonesian

Consumer Price Index (CPI), which is quantitative

starting from January 2009 - December 2018 (120

data) and was officially published by the Central

Statistics Agency (BPS) online on its website

(www.bps.go.id). The proportion of training data is

108 data (taken from January 2009 - December

2017), while testing was 12 (from January 2018 -

December 2018). Table 1 lists a part of the CPI as

the dataset as an example. Before proceeding to each

method, data needs to be normalized within the

range 0 to 1 using MinMax normalization.

Table 1: Indonesian CPI 2009-2018.

Year

Month

2009 2010 2011 2012 2013

Jan 113.78 118.01 126.29 130.9 136.88

Feb 114.02 118.36 126.46 130.96 137.91

Ma

r

114.27 118.19 126.05 131.05 138.78

A

pr

113.92 118.37 125.66 131.32 138.64

Ma

y

113.97 118.71 125.81 131.41 138.6

Jun 114.1 119.86 126.5 132.23 140.03

2.2 Research Method

The data used is the CPI for January - December

2018. To get the value of the three months, the time-

series data, as sampled in Table 1, were processed in

two stages: ARIMA and ANN. We perform

forecasting with these two methods and also

calculate their MSE values. We also checked to see

whether the value is in the CPI value range or not.

2.3 ARIMA Method

ARIMA is a combined model of two models:

AutoRegressive (AR), notated by 𝑝, and Moving

Average (MA), notated by 𝑞. Thus, ARIMA's

notation is ARIMA (p, d, q), where 𝑑 is the

differencing process level (Box, Jenkins, Reinsel, &

Ljung, 2016).

The general form of the ARIMA model is in

Equation 1:

𝑌

𝑏

𝑏

𝑌

⋯𝑏

𝑌

𝑎

𝑒

⋯

𝑎

𝑒

𝑒

(1)

where 𝑌

is data in time 𝑡 (𝑡1,2,…,𝑛, 𝑏

is a

constant, 𝑌

, 𝑌

is data in time 𝑡𝑖 𝑖

1,2, … 𝑝, 𝑒

is the error in time 𝑡, 𝑒

, 𝑒

is the

error in time 𝑡𝑗 𝑗 1,2,…,𝑞, 𝑏

, 𝑏

is the 𝑖

th

AR parameter, and 𝑎

, 𝑎

is the 𝑞

th

MA parameter.

Because ARIMA requires that the data be

stationary, it is necessary to test the stationarity,

moving value to zero. In order to find out whether

the data meets these requirements, we calculate the

AutoCorrelation Function (ACF) and Partial

AutoCorrelation Function (PACF) values from the

raw data (120 data), and a correlogram is made to

make it easier to see the resulting graphical shape

directly. ACF is used to determine patterns related to

time in a time series, whereas PACF is the set of a

lag. Equation 2 and equation 3 are the formulas to

calculate ACF, while equation 4 is the PACF

formula.

𝑟

∑

̅

̅

∑

̅

(2)

𝑥̅

∑

(3)

𝑟

∑

,

∑

,

(4)

where 𝑟

is the ACF value on lag 𝑘; 𝑥

is the data

value at time 𝑡; 𝑥̅ is the average of all data, and 𝑟

is the PACF value on lag 𝑘.

From the ACF correlogram diagram, if the data

formed forms a linear pattern, then the data is not

stationary. However, if the pattern drops

exponentially or waves close to zero, then the data is

stationary. Suppose the graph has not yet produced a

stationary form. In that case, the data must be carried

out by a “differencing” process, which is subtracting

the value from a period with the previous period’s

value. The differencing process is defined in

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

600

equation (5) for first order differencing and equation

(6) for second order differencing.

𝑋

𝑋

𝑋

(5)

𝑋

𝑋

𝑋

𝑋

𝑋

(6)

If the data has been through the differencing

process, then the value of d will increase by how

many times the data goes through the differencing

process. Thus, the notation ARIMA (0,0,0) changes

to ARIMA (0,1,0).

2.4 ANN Method

Artificial Neural Network (ANN) is a network

modeled after human neural networks. ANN is often

used in dynamic time sequence systems that are

nonlinear on a large scale consisting of many

processing elements connected in parallel. ANN

consists of several connected units of input and

output, and each connection has a weight that can

change to get the desired forecasting result. There

are three layers in ANN: the input layer, hidden

layer, and output layer.

Two phases in ANN are the training and testing

phase. The steps taken are to define the input pattern

and its targets, initializes the initial weights with

random numbers, specify the number of iterations

and the desired error. This step is repeated as long as

the iteration is not past the maximum epoch limit.

For the training phase, there are 2 (two) sub-

processes: feed-forward and backpropagation.

Successfully trained model in the previous stage will

be tested by providing input; then, the network will

produce output as expected by applying the steps to

the backpropagation algorithm above but only in the

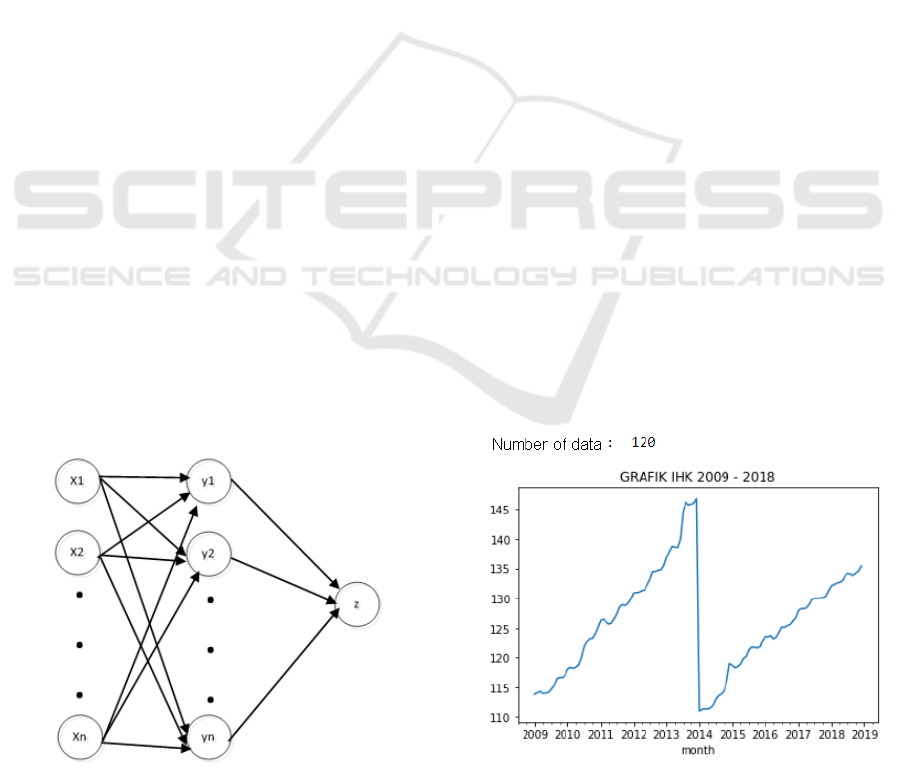

feed-forward section. Figure 1 is the general form of

a traditional ANN, where 𝑥

,𝑥

,…,𝑥

are nodes in

the input layer, 𝑦

,𝑦

,…,𝑦

are nodes in hidden

layers, and 𝑧 is the output layer.

Figure 1: A traditional ANN architecture.

3 RESULTS AND DISCUSSIONS

All methods in this research are implemented in

Python.

3.1 ARIMA Forecasting

3.1.1 Data Identification

The data identification stage is carried out to identify

whether the data to be used met the ARIMA method

requirements' assumptions or not, which is

stationary. If the resulting data is non-stationary, it is

necessary to carry out the differencing stages first.

Based on the plot in Figure 2(a), the time series data

for the CPI value are still non-stationary, with a

trend that tends to be linear starting in 2009. In

2014, the plot showed that the CPI value decreased

drastically with a massive difference in values and

returned to a linear pattern until 2018. Therefore,

data must be processed with the differencing step to

produce stationary data. Figure 2(b) plots the data

after a differencing process of level one.

Because it has passed one differencing level, the

ARIMA model (p, d, q) is now ARIMA (p, 1, q).

Meanwhile, the p and q values can be determined

through the correlation test between the time series

by utilizing the ACF and PACF.

After getting the temporary model ARIMA (p, 1,

q), the next step is to calculate the ACF and PACF

from the data and then plot them. The data used to

calculate ACF and PACF is stationary data, which

come from the first level of differencing. Thus, the

number of data calculated is 108 data, because the

12 initial data in the 2009 period did not have the

results of differencing calculations.

(a)

Time-series Modeling for Consumer Price Index Forecasting using Comparison Analysis of AutoRegressive Integrated Moving Average and

Artificial Neural Network

601

(b)

Figure 2: Plot of CPI Data (a) before and (b) after

differencing step.

3.1.2 Model Parameter Estimation

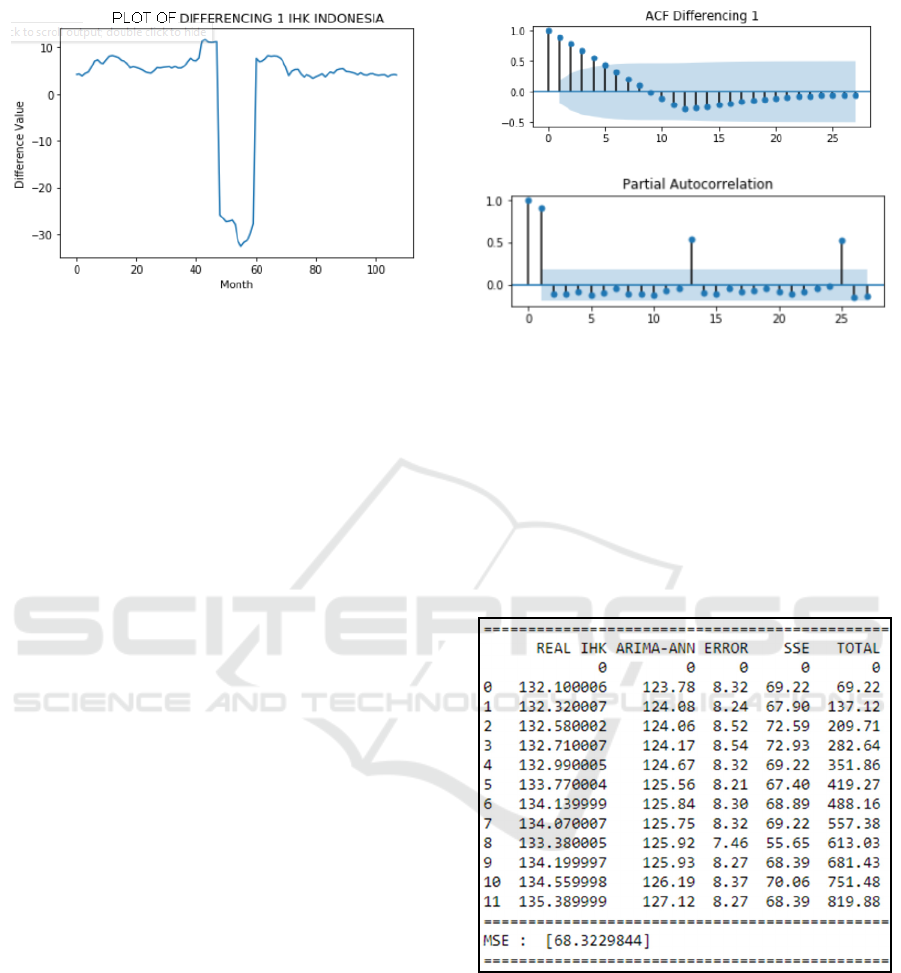

The data used to calculate ACF and PACF are

stationary (from the first level of differencing).

Thus, the number of data to be calculated is only 108

data because the 12 initial data in the 2009 period

did not have the results of differencing calculations.

In ACF and PACF, there is a lag term used to

determine how many ACF and PACF values will be

calculated. On this 108 CPI data, the number of lags

is n / 4 = 108/4 = 27 lag. Because ACF and PACF

are only used to support transient parameter

estimates and determine p and q models, the

calculations use Python's already available

functions. The ACF and PACF calculations results

are in Figure 3(a) and 3(b), respectively.

In Figure 3(a), the ACF value in lag 1 is outside

the blue line, which indicates that the series still

influence or correlate. The ACF value is used to

estimate the value of the MA or q parameter. Thus,

based on the displayed graph, it can be estimated

that the Indonesian CPI time series model used is a

moving average model. Also, because the graph is

disconnected at lag 1, the provisional model

estimates show that the MA parameter is 1.

The ARIMA pattern (p, 1, q) now becomes

ARIMA (p, 1,1). If the ACF value is used to indicate

the MA parameter, the PACF value indicates the AR

or p parameter. Based on Figure 3(b), because the

blue line also breaks lag one, it can be estimated at

this time, the time series model also contains an

autoregressive pattern. The p parameter has now

also changed its value to 1. Identification for the

estimated parameter ARIMA (p, d, q) is now known;

all the parameters are ARIMA (1,1,1). Furthermore,

the ARIMA model (1,1,1) will be used to formulate

forecasting the value of Indonesia's CPI.

(a)

(b)

Figure 3: ACF (a) and PACF (b) calculations.

3.1.3 ARIMA Forecasting Result

From the estimated ARIMA parameters (p, d, q),

forecasting the CPI value in 2018 will use ARIMA

(1,1,1). The coefficients for AR and MA are

1.309 𝑥 𝑒

and

4.760 𝑥 𝑒

, respectively. The

overall results for the 12 months in 2018 using

ARIMA (1,1,1) are in Figure 4. The Minimum

Square Error (MSE) is also computed.

Figure 4: ARIMA Forecasting and its MSE.

The forecast value generated by ARIMA has a

reasonably large error. However, the ARIMA

forecast value can still be useful if the next stage's

testing is in the CPI value range.

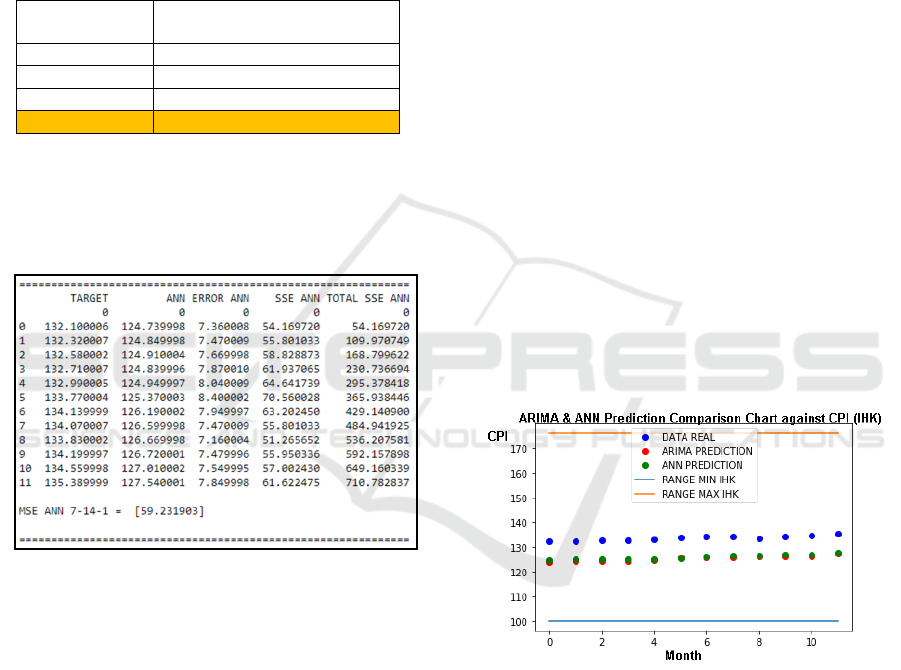

3.2 ANN Forecasting

The training and testing data to be used as input on

ANN need to be normalized first to get values from

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

602

0 to 1. Normalized training and testing data have

seven columns (including the last column as

CLASS), so the initial ANN architecture is 7-x-1.

The x value is determined by experimenting on

different values such as 8, 9, 10, and 14, and the best

value (which has the lowest MSE of 59.23) is 14.

Therefore, the ANN architecture 7-14-1 is used in

the forecasting phase. Table 1 lists the MSE

comparison of four ANN architectures.

Table 2: MSE Comparison of four ANN architectures.

ANN

Architecture

MSE

Denormalized Output

7

–

8 -1 77.35

7 – 9 – 1 70.26

7

–

10

–

1 65.07

7 – 14 – 1 59.23

3.3 ANN Forecasting Result

The ANN 7-14-1 is used to forecast the CPI value in

2018, and the result is in Figure 5.

Figure 5: ANN Forecasting and its MSE.

The forecast value generated by ANN has a

lower error than ARIMA, which is 59.23.

3.4 CPI Range

The CPI range is calculated based on the price of

goods in the current year used to predict (i.e., 2018)

and the price of goods in the base year. Due to the

large number of types of goods included in each

category, this study only used a sample of 6 prices of

most consumed goods from each category per year.

For the clothing category, the item prices used

are men's t-shirts, women's t-shirts, men's

underwear, women's panties, men's jeans, women's

jeans, sarongs, and Muslim prayer gown (mukena).

For the food category, the prices of goods used are

instant noodles, meatballs, fresh milk, cooking

spices, chicken meat, and cigarettes. For the housing

category, the prices of goods used are house contract

rates, builders' rates, iron blocks, plywood, sand, and

wall paint. As for the health category, the prices of

goods used are general practitioner rates, hospital

rates, drug prices, vitamins, men's haircuts and

women's haircuts. From the calculation, the

estimated CPI range for 2018 is between 100 - 176.

3.5 Comparison Analysis

Figure 6 compares ARIMA and ANN result in

predicting the CPI value for the year 2018. The

lower limit of the CPI range is marked with a

straight blue line that stretches across the value 100

and the upper limit of the CPI range is marked with

an orange straight line that stretches across the value

176. The actual CPI value data obtained from BPS

as a reference for comparison is marked with blue

circles for twelve data (representing each month),

while the ARIMA forecast data is marked with a red

circle. And the ANN forecast data is marked with a

green circle. Both ARIMA and ANN results lie

almost on the same line and are still in the blue-

orange lines' accepted range, representing the min

and max CPI range. Therefore, these two methods

are sufficient enough to forecast the CPI data model.

Figure 6: ARIMA and ANN Result Comparison

4 CONCLUSIONS

This research has resulted in several conclusions as

follows. Firstly, both methods (ARIMA and ANN)

can be used to predict the Indonesian CPI value from

January 2018 - December 2018. The ARIMA model

applied to this forecast is ARIMA (1,1,1) and

produces CPI values of 123.77, 124.08, 124.05,

124.16, 124.66, 125.55, 125.83, 125.75 125.91,

125.93, 126.19, and 127.12. Meanwhile, ANN

Time-series Modeling for Consumer Price Index Forecasting using Comparison Analysis of AutoRegressive Integrated Moving Average and

Artificial Neural Network

603

applies four forms of ANN architectures, which are

ANN 7-8-1, 7-9-1, 7-10-1, and 7-14-1. However, the

best form is 7-14-1 because it produced the smallest

MSE value of 59.23, with the resulting CPI forecast

values of 124.73, 124.84, 124.91, 124.83, 124.94,

125.37, 126.19, 126.59, 126.66, 126.72, 127.01, and

127.54.

Secondly, although both methods can be used for

forecasting, ANN provides better forecasting results

than ARIMA in forecasting research for the

Indonesian CPI value, with a difference of 9.09 in

MSE values, where ARIMA produced an MSE of

68.32 while ANN produced an MSE of 59.23.

However, although the resulting MSE is quite large,

all of the predicted values from these two methods

are still in the CPI range between 100 and 176. So it

can be said that the ARIMA and ANN forecast

results are at a reasonable level and can still be

calculated.

ACKNOWLEDGEMENTS

The authors would like to thank the Faculty of

Computer Science, Universitas Pembangunan

Nasional "Veteran" Jawa Timur, for its support to

publish this research.

REFERENCES

Adebiyi, A. A., Adewumi, A., & Ayo, C. (2014). Stock

price prediction using the ARIMA model. Proceedings

- UKSim-AMSS 16th International Conference on

Computer Modelling and Simulation, UKSim 2014.

doi:10.1109/UKSim.2014.67

Box, G. E., Jenkins, G. M., Reinsel, G. C., & Ljung, G. M.

(2016). Time series analysis : forecasting and control

(5th edition). New Jersey: Wiley.

Deswina, A. P., & Desmita, E. (2015). Application of The

Box-Jenkins Method in Predicting the Consumer Price

Index in Pekanbaru City (Penerapan Metode Box-

Jenkins Dalam Meramalkan Indeks Harga Konsumen

Di Kota Pekanbaru). Jurnal Sains Matematika dan

Statistika, 1(1), 39-47.

Djawoto, D. (2010). Advanced Forecasting of Inflation

with Auto Regressive Integrated Moving Average

(ARIMA) Method (Peramalan Laju Inflasi Dengan

Metode Auto Regressive Integrated Moving Average

(ARIMA)). Jurnal Ekonomi dan Keuangan, 14(4),

524-538.

Domingos S. de O. Santos Júnior, J. F. (2019). An

intelligent hybridization of ARIMA with machine

learning models for time series forecasting.

Knowledge-Based Systems, 175, 72-86.

Fitriani, B. E., Ispriyanti, D., & Prahutama, A. (2015).

Forecasting Loads of Electricity Usage in Central Java

and the Special Region of Yogyakarta Using Hybrid

Autoregressive Integrated Moving Average - Neural

Network (Peramalan Beban Pemakaian Listrik Jawa

Tengah dan Daerah Istimewa Yogyakarta dengan

Menggu). Jurnal Gaussian, 745-754.

Hiteshi Tandon, P. R. (2020). Coronavirus (COVID-19):

ARIMA based time-series analysis to forecast near

future. Cornell University.

Janah, S. N., Sulandari, W., & Wiyono, S. B. (2014).

Application of The ARIMA Backpropagation Hybrid

Model for Price Forecasting of Indonesian Gabah

(Penerapan Model Hybrid Arima Backpropagation

Untuk Peramalan Harga Gabah Indonesia). Media

Statistka, 7(2), 63-69.

Mohamed, J. (2020). Time Series Modeling and

Forecasting of Somaliland Consumer Price Index: A

Comparison of ARIMA and Regression with ARIMA

Errors. American Journal of Theoretical and Applied

Statistics, 9(4), 143-153.

Nopirin. (1987). Monetary Economy (Ekonomi Moneter),

Book II . Yogyakarta: BPFE-UGM.

Pimpi, L. (2013). Implementation of ARIMA Method to

Forecast Indonesia Consumer Price Index (CPI) 2013

(Penerapan Metode ARIMA dalam Meramalkan

Indeks Harga Konsumen (IHK) Indonesia Tahun

2013). Paradigma, 17(2), 35-46.

Susilokarti, D., Arif, S. S., Susanto, S., & Sutiarso, L.

(2015). Comparative Study of Rainfall Prediction Fast

Fourier Transformation (FFT) Method, Autoregressive

Integrated Moving Average (ARIMA) and Artificial

Neural Network (ANN) (Studi Komparasi Prediksi

Curah Hujan Metode Fast Fourier Transformation

(FFT), Autore). agriTECH, 241-247.

Ümit Çavuş Büyükşahin, Ş. E. (2019). Improving

forecasting accuracy of time series data using a new

ARIMA-ANN hybrid method and empirical mode

decomposition. Neurocomputing, 361, 151-163.

doi:https://doi.org/10.1016/j.neucom.2019.05.099

Wigati, Y., Rais, R., & Utami, I. T. (2015). Time Series

Modeling with the ARIMA Process for Prediction of

Consumer Price Index (CPI) In Palu - Central

Sulawesi (Pemodelan Time Series Dengan Proses

Arima Untuk Prediksi Indeks Harga Konsumen (IHK)

Di Palu – Sulawesi Tengah). Jurnal Ilmiah

Matematika dan Terapan, 12(2), 149-159.

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

604