The Effect of User Experience and Quality of Products on Customer

Loyalty of Guna Bhakti Credit Products in BJB Batam

Mardiana, Maryani Septiana

Applied Business Administration, PoliteknikNegeriBatam

Jl. Ahmad Yani, Batam Centre 29461, Indonesia

mardianaaa012@gmail.com

Keywords: User Experience, Product Quality, Customer Loyalty.

Abstract: This research to examine the Effect of User Experience and Product Quality on Customer Loyalty for Guna

Bhakti Credit Products at BJB Batam. Respondents from this research were customers of the BJB Batam who

have used credit products for devotion at least 2 times. The population in this research were customers of

credit products for the service of BJB with a total sample of 80 respondents. The sampling technique here

uses purposive sampling method. In this research, data were collected through questionnaires given directly

to respondents as well as through structured interviews to respondents by submitting several questions directly

that had been prepared. The data analysis method used is a descriptive statistical analysis using multiple linear

regression. The results of this research are two independent variables, namely user experience, and product

qualitypartially and simultaneously affect customer loyalty.

1 INTRODUCTION

1.1 Background

user experience is a person’s perception and response

to the experience of using a product, system, or

service. The user experience felt by customers is an

impact of the quality of the products provided by the

bank. Where product quality is the overall features

and characteristics of the product or service that affect

its ability to satisfy stated or implied needs.

Product quality will emerge when customers have

gained experience from the products that have been

used. If the product is of good quality for users, it will

provide a good experience for users. With the user

experience of each customer, as well as the quality of

the products that support and provide good value to

customers, it will create an attitude of loyalty to the

use of the BJB products that have been offered.

The attitude of customer loyalty to always use the

products offered by BJB will appear if customers

experience a different service after using the product.

The services provided are that BJB officers provide

convenience in the credit application process, serve

responsively, and so on. With this service, it will

create a loyal attitude of customers to use BJB

products. Because customers feel the best quality

service provided by BJB.

Currently, BJB offers credit products that have

been widely used by people who are interested in

these products. The credit product is in the form of

guna bhakti credit, which this credit can help the

community in meeting user needs. Guna bhakti credit

is a credit facility provided by BJB for debtors whose

salaries are payroll or non-payroll and agencies that

already have cooperation with BJB

(https://www.bankbjb.co.id/ina). Guna bhakti loans

are addressed to prospective debtors who have jobs as

government employees, BUMN, BUMD, TNI /

POLRI. Based on the background description, the

title in this study is "The Influence of User Experience

and Product Quality on Customer Loyalty in Guna

Bhakti Credit Products at BJB Batam".

2 REVIEW OF LITERATURE

2.1 Theoretical Review

2.1.1 Service

According to Kotler (2002) services are actions or

activities that can be offered by one party to another,

Mardiana, . and Septiana, M.

The Effect of User Experience and Quality of Products on Customer Loyalty of Guna Bhakti Credit Products in BJB Batam.

DOI: 10.5220/0010357101250132

In Proceedings of the 2nd International Conference on Applied Economics and Social Science (ICAESS 2020) - Shaping a Better Future Through Sustainable Technology, pages 125-132

ISBN: 978-989-758-517-3

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

125

which is essentially intangible and does not result in

any ownership. Its products can be attributed or not

associated with a physical product. eight fundamental

aspects differentiate between services and physical

goods, which are as follows:(1) The service products

consumed cannot be owned by consumers. (2) A

Service product is a performance product that is

intangibles or intangible. (3) In the service production

process, consumers have a greater role to participate

in the processing compared to physical goods. (4)

People involved in the service process play a role in

the formation of services. (5) In terms of

operationalizing inputs and outputs, service products

are more varied. (6) Certain service products are

difficult to evaluate by consumers. (7) Service cannot

be saved. (8) Time factors in the service process and

service consumption are relatively more considered.

2.1.2 User Experience

User Experience or commonly called UX is the

perception and response of a person who is based on

the use or anticipation of the use of the product,

System, or service (Wiryawan, 2011). The user

experience also explains how users experience

enjoyment and satisfaction after using products,

viewing, or holding products.

To get a good User Experience, then a product

must have suitability between the product features to

the needs of the user. This will determine whether the

product is valuable or worth it later if it is easy to find

and easy to use the first time, it can make the user's

feeling happy when using it. Products must be easy to

use to complete or do things that users want. In user

experience there are 4 elements according to Frank

Guo (2012) consisting of: (a) Value (Valuable),

Features that exist on the product according to user

needs. Even though a product is easy to use, if it does

not fit the needs of users, it does not have valuable

value. (b) Ease of access (adoptability), if a product is

valuable and has value but is not easy to obtain, the

product cannot be said to have a good user

experience. The product is easy to process so users

can easily borrow from the product. (c) Usability

(Usability), users can easily make the desired loan

through the product. For example, when a user wants

to lend a loan for Bhakti, the user is only required to

submit collateral in the form of an Employee Decree

(Certificate). (d) Desirability related to emotional

attractiveness. Users feel a pleasant experience when

using the product. If the product meets four elements;

the product has a good user experience

2.1.3 Product Quality

According to Kotler and Amstrong (2015), product

quality is the ability of a product in demonstrating its

function, it includes the overall durability, reliability,

accuracy, ease of operation and repair of the product

also other product attributes in evaluating the

satisfaction of a particular product, service, or

company, consumers generally refer to various

factors or dimensions. Here are eight dimensions of

product quality revealed by Tjiptono (2000) in

Mahmudi (2015), among others: (a) Performance is

related to the functional aspects of an item and is the

main characteristic that the customer considered in

buying the item. (b) Features, are a useful aspect of

forming to add basic functions, with regards to

product options and images. (c) Conformance to

specification (conformity to specifications), this is

related to the level of conformity to specifications that

have been predetermined based on customer desires.

(d) Durability (durability), which reflects economic

life in the form of a measure of durability or the

lifetime of the goods. (e) Perceived quality

(impression of quality) consumers do not always have

complete information about product attributes.

However, consumers usually have information about

the product indirectly.

A product can be said to have good quality if the

product is covered by these dimensions. With the

existence of these dimensions in a product, it is

expected that the product has more value than

competing products.

2.1.4 Customer Loyalty

According to Tjiptono (2011) in Paendong, et al

(2017) loyalty is a repurchase behavior solely

regarding the purchase of the same specific brand

repeatedly because it is indeed the only brand

available, the cheapest brand and so on. Meanwhile,

according to Jill Griffin (2015) in Nugraha and

Rusmin (2019), customer loyalty is a buying behavior

as a nonrandom purchase that is expressed from time

to time by several decision-making units.

Griffin (2005) in Lestari and Yulianto (2018) put

forward several indicators of loyalty as follows: (1)

Transaction habits, how often customers make

transactions. (2) Repurchase, the customer's

willingness to make transactions by utilizing various

other services provided by the operator. (3)

Recommendations, verbal communication about the

customer's experience to others in the hope that the

person is willing to follow it. (4) Commitment, the

customer's ability to continue to utilize the services

ICAESS 2020 - The International Conference on Applied Economics and Social Science

126

provided by operators in the future and are reluctant

to stop as a customer

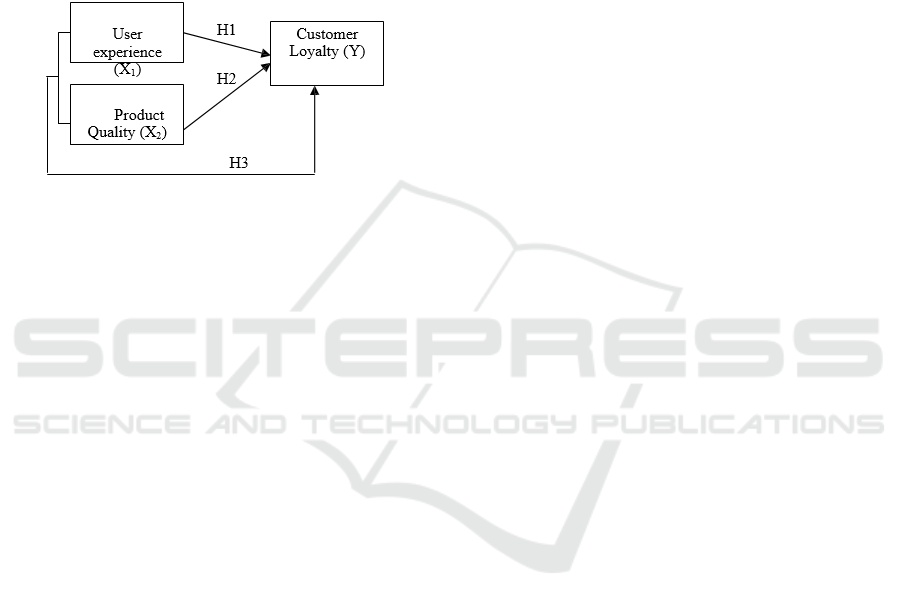

2.2 Conceptual Framework

Sugiyono (2014) defines that framework thinking

will theoretically link a research variable between the

dependent variables and the dependent variables. The

thought frameworks in this study are as follows:

2.3 Hypothesis

Hypotheses are suspected or provisional answers to

the research results that researchers will do.

Hypotheses in this study include:

H1 = Allegedly user experience affects the loyalty of

Guna bhakti credit customers at BJB Batam.

H2 = Allegedly the quality of the product affects the

loyalty of Guna Bhakti credit customers at BJB

Batam

H3 = Alleged User Experience and product quality

simultaneously affect the loyalty of Guna Bhakti

credit customers at BJB Batam.

3 METHOD OF RESEARCH

3.1 Research Design

In this study using quantitative descriptive methods

through case studies by taking population samples at

BJB Batam. Data collection was carried out using a

questionnaire survey on credit customers to measure

respondents' perceptions based on customer

experience and product quality when interacting with

Guna Bhakti credit products at BJB Batam.

3.2 Population and Sample

The population in this study were customers who

used the Guna Bhakti credit BJB Batam at least 2

(two) times, totaling 350 (three hundred and fifty)

customers. In this study, the sampling technique used

the Slovin and Husein formula with a sample size of

80 respondents.

3.3 Data Collection Technique

Data collection techniques used in this study are:

1. Questionnaire

The questionnaire is a technique implemented by

providing a question or written statement to the

respondent to be answered (Sugiyono, 2011). Every

question or statement in the questionnaire will be

measured using a Likert scale. In this case, the scale

used is:

1. For SS answers, agree strongly, given a score=4

2. For S answer, agree given a score = 3

3. For TS answers, Disagree, given a score = 2

4. For STS answers, Strongly Disagree given a

score=1

2. Interview

Collecting data sourced from parties related to the

issues raised in the study by conducting a question

and answer directly. In this study, the parts related to

both the company and with users especially those

who have used Guna Bhakti Credit Products? BJB

Batam at least 2 times. In this study, the interview

technique used is structured interviews where the

interviewer submits several questions that have been

prepared.

3.4 Method of Data Analysis

The methods of analysis used in this study are:

1. Descriptive Analysis

Descriptive statistical analysis is used to support the

analysis and provide a general description of the

research variables. In this descriptive analysis, it will

be investigated how the perception given by

respondents through a questionnaire on each

statement item, measured using a Likert scale. The

results will be displayed in the form of a frequency

distribution table of research variable items

consisting of the frequency of respondents' answers.

2. Multiple Linear Regression Analysis

This multiple linear regression analysis is used to

determine the effect of the linear relationship. In this

study, researchers used Multiple Linear Regression

analysis techniques to test the truth of the hypothesis,

namely whether there is an influence of user

experience and product quality on customer loyalty

for Guna Bhakti credit products at BJB Batam.

The Effect of User Experience and Quality of Products on Customer Loyalty of Guna Bhakti Credit Products in BJB Batam

127

3. Hypothesis Testing

Regression coefficient testing is intended to test the

significance of the influence of independent variables

(X), namely user experience and product quality.

Both jointly (F test) and individually (t-test) onb the

dependent variable (Y), namely customer loyalty of

Guna Bhakti credit product BJB Batam. Thus, it will

be known together whether the independent variables

affect the dependent variable in this study.

4 RESULT AND DISCUSSION

4.1 Research Result Descriptive

Statistics

4.1.1 Characteristics of Respondents

Respondents in this study were customers to Guna

Bhakti credits, which used the product at least twice,

amounting to 80 respondents. The characteristics of

respondents including gender, age, job status,

education, and long-time use of the product.

Respondents by sex consisted of 36 women and 44

men. Respondents by age showed that most of the

customers of the BJB Batam were aged 41-50 years

old, as many as 37 people. While a small proportion

of customers come from the age group> 51 years,

which is as many as 2 people. This shows that most

respondents are in the productive age category.

Respondents based on employment status showed

that most customers had employment status as PNS

as many as 42 people, while a small proportion had

BUMD employment status of as many as 6 people.

This is because one of the requirements for credit

loans at BJB Batam is to work as a civil servant and

have a decree that can be pledged to the Bank.

respondents based on education showed that most

customers had S1 education, namely as many as 55

people, while a small proportion had S2 education.

This is because Bachelor / S1 education is a

requirement of PNS acceptance. So that most users of

Guna Bhakti Credit products have Bachelor / S1

education and already have jobs as PNS. Respondents

based on the length of the product have shown that

the majority of customers who use the product for 5-

10 years, as many as 51 people, while for customers

who use the product for 11-15 years, as many as 29

people. This is because the majority of BJB customers

who use Guna Bhakti Credit twice as many times are

customers who have used products 5-10 years have

felt the benefits provided by these products so that

customers make repeated loans at BJB.

4.1.2 Respondents Responses

The results of the responses of respondents in each

questionnaire on each research variable will be

analyzed and sought the average value of

respondents'answers so that it can be seen by

respondents' perceptions as a whole on the variable

user experience, product quality, and customer

loyalty

.

1. Respondents’ Responses to User Experience

Variables

The results of respondents' responses to the

questionnaire used to measure user experience

variables and the results of the average value of

respondents' answers showed that respondents'

ratings of user experience were quite good, with an

average value of 3.21. The results of the respondents

'statement showed that the highest respondents'

ratings were given regarding Guna Bhakti credit

products that had a good function / use and by my

needs which got a rating of 3.35. good and by the

needs of customers., while getting the lowest rating

contained in the statement in lending Guna Bhakti

credit my data is kept confidential, so it makes me feel

safe with an assessment of 3.13. This can be

interpreted that the customer considers the product to

have provided a fairly good experience.

2. Respondents' Responses to Product Quality

Variables

The results of respondents' responses to the

questionnaire used to measure product quality

variables and the results of the average value of

respondents' answers showed that respondents'

ratings of product quality were quite good, with an

average value of 3.25. The results of the respondent's

statement show that the highest respondent's rating is

contained in the statement I chose to do credit at BJB

Batam because the interest given was low compared

to other banks that received the highest rating of 3.35

and included very good. This shows that customers

assess products with very good quality are products

that have low interest compared to others. While the

lowest valuation is in the statement, I feel that the

Guna Bhakti credit can be used for more than 5 years

to get a pretty good rating with a value of 3.15. This

shows that product quality is a factor that influences

customers in deciding the use of the product.

3. Respondents' Responses to Customer Loyalty

Variables

The results of respondents 'responses to the

questionnaire used to measure customer loyalty

ICAESS 2020 - The International Conference on Applied Economics and Social Science

128

variables and the results of the average value of

respondents' answers showed that customer loyalty is

quite good, with an average value of 3.22. The results

of the respondent's statement indicate that the highest

rating contained in the statement I intend to provide

personal information about the performance of credit

products/services for BJB service to my closest

relatives who get the highest rating of 3.35 and is very

good. This shows that the customers feel comfortable

with credit products for BJB service so that the

customer intends to provide personal information

related to the performance of credit products/services

for BJB Service. While the lowest rating is on the

statement, I intend to add credit nominal or top up the

credit platform on the BJB, with a value of 3.05 and

is quite good. This shows that customers have

different needs. So that not all customers will top up

the platfo2rm or increase the nominal credit.

Multiple Linear Regression Analysis. To test the

hypothesis proposed in this study using multiple

linear regression, it is to know the influence of two or

more free variables to its variables. In this study free

variables include user experience and quality of

products. The dependent variable is customer loyalty.

Based on the results of the multiple linear regression

analysis test, the equation of the multiple linear

regression values can be obtained as follows:

Y = 3.311α + 0,219 X1 + 0,308 X2

Information:

Y = Customer Loyalty (Dependent Variable)

X1 = User Experience (Independent Variable)

X2 = Product Quality (Independent Variable)

From this equation, it can be described as follows:

a) α = constant number of the unstandardized

coefficient which in this study is 3,311. This

figure is a constant number which means

that if the value of the variable user

experience and product quality is equal to 0

(zero), then the amount of customer loyalty

is 3,311 or it can be interpreted as customer

loyalty for credit products to serve BJB has

good loyalty.

b) b) The value of the variable regression

coefficient user experience (b1) positive

value of 0.219 is that it can be interpreted

that every user experience increases by 1

unit, it will increase customer loyalty of

0.219 units assuming another independent

variable is fixed.

c) c) The variable regression coefficient of

product quality (b2) positive value, which is

0.308, can be interpreted that every product

quality improvement is 1 unit, it will

increase customer loyalty of 0.308 units

assuming another independent variable

value is fixed.

Hypothesis Testing

1. Significant Test Results t (Partial)

The T-Test is a test tool to see whether individual

independent variables affect the dependent variables.

To test T-Test, the hypothesis used is as follows:

H1 = Allegedly user experience influences the loyalty

of Guna Bhakti Credit customers at BJB Batam.

H2 = Allegedly the quality of the product affects the

loyalty of Guna Bhakti credit customers at BJB

Batam.

a) User experience variable

From the calculation result, the T value is 3,421 with

a significance value of 0.001 <0.05, while the T table

value is 1.991. This means that the value of T count

is greater than T table. Thus, it can be concluded that

the H1 proposed in this study is accepted, meaning

that there is an individual influence of the user

experience variable on customer loyalty Ghuna

Bhakti credit products at BJB Batam

b) Product quality variables

From the calculation results obtained t value of 4.408

with a significance value of 0.000 <0.05 while the t

table value of 1.991. This means that the calculated t

value is greater than the table t value. Thus, it can be

concluded that the H2 proposed in this study was

accepted, meaning that there was an individual effect

of product quality variables with customer loyalty for

Guna Bhakti credit products at BJB Batam.

2. Significant F Test Results (Simultaneous)

The F test is a testing tool to see whether the

independent variables jointly (simultaneously) affect

the dependent variable. The hypothesis is as follows:

H3 = Alleged User Experience and product quality

simultaneously affect customer loyalty Guna bhakti

credit at BJB Batam.

From the calculation results obtained F value of

30,930 with a significance level of 0,000. while the F

table value of 3.12 means that the calculated F value

is greater than the F table, besides that the

significance value also shows a number below 0.05.

So, it can be concluded that H3 is acceptable, which

The Effect of User Experience and Quality of Products on Customer Loyalty of Guna Bhakti Credit Products in BJB Batam

129

means that there is a simultaneous influence on the

variable user experience and product quality on

customer loyalty of Guna Bhakti credit products on

BJB Batam.

4.2 Discussion

4.2.1 Effect of User Experience Variable on

Customer

Loyalty of Guna Bhakti Credit Products BJB Batam

Based on the formulation of problems and hypothesis

testing results found that the user experience

calculated T 3,421, while the table T is 1,991, which

means that the table T Count > T (3,421 > 1,991) and

the significance of < 0.05 (0.001 < 0.05) so that H1 is

accepted which means there is an influence between

user experience variables (X1) partly on customer

loyalty credit

This research has supported the research

conducted by S. Paendong et al (2017) under the title

research Effect of Product Usage Experience, Product

Quality and Promotion of Customer Loyalty at Bank

Kawangkoan Bri Unit with the results of his research

that the product experience variable has a significant

effect on customer loyalty Bri Bank Kawangkoan

Unit. The results of hypothesis testing have been

proven that the experience of using the product has a

t count of 3.073 with a significant level of 0.003

<0.005 so it can be concluded that Ho is rejected, and

Ha is accepted, which means the experience of using

the product has a significant effect on customer

loyalty.

4.2.2 Effect of Product Quality Variable on

Customer Loyalty of Guna Bhakti

Credit Products BJB Batam

Based on the formulation of the problem and the

results of the hypothesis testing found that the value

of the calculated product quality T is 4,408, while the

table T value is 1,991, which means t count > T table

(4.408 > 1.991) and the significance of < 0.05 (0.000<

0.05) so that H2 is accepted which means there is an

influence between product quality variables (X2)

partially towards customer loyalty.

This research has supported the research

conducted by Prabhata (2017) with the title Effect of

Service Quality and Quality of SME Credit Products

on Customer Loyalty of PT BPR Kerta Raharja

Bandung with the results of his research that the

product quality variable significant effect on

customer loyalty, which means the product quality

variable has a strong influence on customer loyalty at

PT. BPR Kerta Raharja.

Proven results of testing the hypothesis that has

been done that the product quality has a significance

value <0.05 (0.00 <0.05) this shows that the product

quality factor has a strong influence in relation to

customer loyalty at PT. BPR Kerta Raharja.

4.2.3 Effect of Variable User Experiencer,

and Product Quality Simultaneously

on the Customer Loyalty of Guna

Bhakti Credit Products BJB Batam

Based on the problem formulation and the results of

the hypothesis testing found that there is an influence

between user experience variables and the

simultaneous product quality to customer loyalty of

credit products to Bhakti BJB Batam. This is

reinforced by obtaining a Fcount of 30,930 and a

Ftable of 3.12 meaning Fcount> Ftable (30,930>3.12)

so that H3 in this study was accepted because Fcount>

Ftable is 30,930>3.12.

The value of regression calculations known from

the coefficient of determination obtained in 0445

means that the user experience relationship and

product quality to customer loyalty is 44.5% and the

rest is influenced by other variables not examined in

this study.

5 CONCLUSION &

RECOMMENDATION

5.1 Conclusion

Based on the results of research on the Influence of

User Experience and Product Quality on Customer

Loyalty of Guna Bhakti BJB Batam Credit Products,

the conclusions of this study are as follows: (1). User

Experience affects customer loyalty, the user

experience variable partially influences customer

loyalty of guna bhakti BJB Batam credit products.

This is evidenced by the t count of 3,421 with a

significance level of 0.001 <0.05, which means that

the better the user experience the customer gets, the

better customer loyalty to the product. This can be

seen from the functions and uses of credit products

according to user needs, thus making customers loyal

to the product. (2) Product quality affects customer

loyalty, the variable product quality partially affects

the customer loyalty of the credit product guna bhakti

BJB Batam. This is evidenced by the t count value of

4.408 with a significance level of 0.000 <0.05, which

means that the better the quality of the product

ICAESS 2020 - The International Conference on Applied Economics and Social Science

130

provided, the higher the customer loyalty will be.

This can be seen from the low-interest rates given by

credit products that make customers loyal. (3) User

experience and product quality jointly affect

customer loyalty. Guna Bhakti BJB Batam credit

products. This is evidenced by the F count value of

30,930 with a significance level of 0.000 <0.05,

which means that if the two variables are

simultaneously increased, customer loyalty will also

increase. This can be seen from the function and

usefulness of the product and the low interest given

by the Bank. So that it will increase customer loyalty

to the product.

5.2 Recommendation

Based on the conclusions above, it is suggested

several things as follows:

A. Practical Recommendation

(1). User Experience towards guna bhakti loan

customer loyalty to BJB Batam is good enough, so it

is expected that the guna bhakti BJB credit product

and bank officers can maintain and improve the

service and quality of the product. (2) The quality of

the product towards the customer loyalty of guna

bhakti credit to BJB Batam is quite good, so it is

hoped that the product of BJB guna bhakti credit and

bank officers can maintain and improve the service

and quality of the product. (3) BJB Batam must make

innovations by the times and technology in a

pandemic situation like this in product development

and promotion because in the Batam area various

types of new banks have started to emerge.

B. Theoretical Recommendation

The independent and intermediate variables in this

study are very important in influencing customer

loyalty so that it is hoped that the results of this study

can be used as a reference for further researchers to

develop other research by considering other variables

that can affect customer loyalty. As well as using

other research objects. This aims to obtain more

varied research results.

ACKNOWLEDGEMENTS

Acknowledgments are addressed to Batam State

Polytechnic.

REFERENCES

Azhari, I. M., Fanani, D., & Mawardi, M. K. (2015).

Pengaruh Customer Experience Terhadap Kepuasan

Pelanggan dan Loyalitas Pelanggan. Jurnal

Administrasi Bisnis, Vol 28.

Basith, a., kumadji, s., & hidayat, k. (2014). Pengaruh

Kualitas Produk Dan Kualitas Pelayanan Terhadap

Kepuasan Pelanggan dan Loyalitas Pelanggan (Survei

pada Pelanggan De’Pans Pancake and Waffle di Kota

Malang). Jurnal Administrasi Bisnis, Vol 11.

Ghozali, I. (2016). Aplikasi Analisis Multivariate Dengan

Program IBM SPSS 23. Semarang: Universitas

Diponegoro. Hassenzhal. (2014). User Experience

(UX): Towards an experiential perspective on product

quality.

Ismail, R. (2014). Pengaruh Kualitas Layanan, Kualitas

Produk Dan Kepuasan Nasabah Sebagai Prediktor

Dalam Meningkatkan Loyalitas. Jurnal Organisasi dan

Manajemen, Vol 10, 179-196.

Korn, H. A. (2013). Studi Mengenai Pengaruh Kualitas

Pelayanan dan Kualitas Produk Terhadap Kepuasan

Nasabah Untuk Meningkatkan Loyalitas (Studi pada

Nasabah Tabungan Bank CIMB Niaga Pemuda

Semarang). Sains Pemasaran Indonesia, Vol XII, 261-

282.

Kristanto, K., & Adiwijaya, M. (2018). Pengaruh Kualitas,

Harga, Dan Pengalaman Pelanggan Terhadap Loyalitas

Pelanggan Pada Rumah Makan Leko. AGORA Vol. 6,

No. 1, 1-10.

Lee, H. J., & Choi, J. (2018). A structural Model for Unity

of Experience: Connnecting User Experience,

Customer Experience and Brand Experience. Journal of

Usability Studies.

Lestari, Ani; Yulianto, Edy. (2018). Pengaruh Kualitas

Produk Terhadap Loyalitas

Pelanggan Dengan Kepuasan Pelanggan Sebagai Variabel

Mediasi (Survei Pada Pelanggan Citra Kendedes Cake

& Bakery Jl. S. Hatta B3 Kav. A, Kota Malang). Jurnal

Administrasi Bisnis, Vol 54.

Madeira, N. R., Germano, H., Macedo, P., & Correia, N.

(2018). Personalising the User Experience of a Mobile

Health Application towards Patient Engagement.

Nugraha, C., & Nuryadin, R. (2019). Loyalitas Pelanggan:

Dimensi Kualitas Layanan Jasa Pada Auto 2000. Jurnal

Ekonomi Perbankan, Vol. 1.

Paendong, S., Sepang, J. L., & Soegoto, A. S. (2017).

Pengaruh Pengalaman Penggunaan Produk, Kualitas

Produk Dan Promosi Terhadap Loyalitas Nasabah.

jurnal EMBA Vol. 5 No.3 September, 3498-3507.

Prabhata, I. (2017). Pengaruh Kualitas Pelayanan dan

Kualitas Produk Kredit Ukm Terhadap Loyalitas

Nasabah PT Bpr Kerta Raharja Bandung. Jurnal Ilmiah

Ilmu Administrasi, Vol 9.

Raharjo, S., & Japarianto, E. (2016). Pengaruh User

Experience terhadap Behavior Intention to Use Digital

Music Streaming Service dengan Attitude Toward

Behavior sebagai Media Intervening. Jurnal

Manajemen Pemasaran.

The Effect of User Experience and Quality of Products on Customer Loyalty of Guna Bhakti Credit Products in BJB Batam

131

Santoso, H. B., & Schrepp, M. (2019). The Impact of

Culture and Product on The Subjective importance of

user experience aspects. Journal Heliyon Vol. 5

Tabrani, Ahmad; Sumarna, Gian; Permatasari, Mitha;

(2019). Pengaruh Kualitas Layanan Terhadap Loyalitas

Nasabah (Tandamata) Pada Bank Bjb Cabang

Rangkasbitung. Jurnal Hukum Ekonomi Syariah, Vol

11.

Wijaya, R. C. (2018). User Experience Konsumen Dan

Pengemudi Taksi Pataga Terhadap Aplikasi Naxi: Studi

Kasus Pada Gamatechno Indonesia dan Ksu Pattaga.

Zulfitri. (2012). Pengaruh Kualitas Pelayanan Terhadap

Loyalitas Nasabah Bank Mega Syariah Cabang di

Jakarta. Jurnal Ilmu Ekonomi dan Sosial. Jilid 1, 1,

Nomor 2, 202-218. n.d.). Retrieved from

www.bankbjb.co.id.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

132