Effect of Investment, Trade Openness and Labor Force on

Economic Growth

Adi Irawan Setiyanto

1

, Resti Ayu Ningsih

2

1

Management Bussiness, Batam Polytechnic, Ahmad Yani Street, Batam Center, Batam

Keywords: Economic Growth, Foreign Investment, Domestic Investment, Export, Import, Labor Force, Trade

Openness.

Abstract: Indonesia's economic growth is predicted to decline in 2019. This study uses independent variables namely

PMA, PMD, Net Exports and Labor and with the dependent variable of economic growth. The sample used

in this study uses 33 provinces in Indonesia. This study aims to determine the effect of investment both

foreign and domestic investment, labor, net exports on economic growth. The method used is multiple linear

regression analysis and simple. The results of this study indicate that the variable PMA, PMDN and labor

or labor force have no significant effect on economic growth, while the variable net exports or trade

openness has a significant effect on economic growth.

1 INTRODUCTION

Economic growth is a process characterized by a

long-term average income growth of the population

(Boediyono, 2001). Sukirno (2010) also discusses the

economic growth that exists in the process of

development of goods and services produced by the

community so that people's prosperity increases. Can

also be made to develop the economy in a country

characterized by an increase in the production of

goods or services in a region within a certain period.

Estimates of the world economy will decline in

2019. The World Bank officially released on 9

January 2019, the global economic growth rate in

2018 will reach 3%. The World Bank also predicts

that global economic growth will decline in 2019 to

2.9%. The weakening of the global economy occurred

due to the weakening of world trade and

manufacturing activities.

As a developing country, Indonesia is also one

of the countries that has lost the global economy.

The Central Statistics Agency (BPS) outlined data

on Indonesia's economic growth in 2018 of 5.2%.

The World Bank cites the name of Indonesia

specifically, reduce the global economy causing

Indonesia's economic growth to decline from 5.2%

in 2018 to 5.1% in 2019. The Main Economist for

the World Bank Indonesia said in overcoming this

Indonesia must increase the value of exports and

investation. Investment is one of the important things

for economic growth. Investment can be used as a

tool to restore the economy, create jobs, and reduce

poverty. Ghosh (2013) also said that investment is

needed to increase economic growth. Foreign

investment (PMA) is needed as a support for

development that cannot be fully financed by

domestic investment (PMDN), especially those that

produce raw materials, finished goods and semi-

finished goods, and capital goods to create business

and employment opportunities (Sukirno, 2010).

Indonesia's economic growth is not only seen in

terms of investment value but also in terms of foreign

trade, namely export and import activities or trade

openness. David Ricardo in Sukirno (2010) said that

in increasing economic growth, a country needs

international trade activities. One of the positive

factors influencing economic growth is the growth of

the labor force (Tadaro & Stephen, 2003). According

to the Global CEO of the World Bank in maintaining

economic growth to remain stable and increasing,

each country must invest in human resources. The

investment in question is by preparing competent

human resources to be able to compete in the global

era, the lower the unemployment rate, the higher the

economic growth. If the number of people who work

is high, the income of the community will increase

and will affect people's purchasing power. Increased

purchasing power will cause the wheels of demand

to increase and economic growth will be maintained

52

Setiyanto, A. and Ningsih, R.

Effect of Investment, Trade Openness and Labor Force on Economic Growth.

DOI: 10.5220/0010355100520062

In Proceedings of the 2nd International Conference on Applied Economics and Social Science (ICAESS 2020) - Shaping a Better Future Through Sustainable Technology, pages 52-62

ISBN: 978-989-758-517-3

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 THEORETICAL BASIS

2.1 Theories of Economic Growth

Smith (1776) argues that there are two main factors

that influence economic growth in a country, namely

output growth (GDP) and Population Growth. Output

growth has three main elements, namely available

natural resources, population, and availability of

capital goods. Smith argues that the most basic means

of production activities in a community is the natural

resource itself while the amount of natural resources

is the maximum limit that can be used in the process

of economic growth. Two other elements of

production, namely the population and available

capital stock. These two elements determine the

amount of community output.

2.2 Economic Growth

Economic growth is characterized by developments

in the economic process that will have an impact on

the number of goods and services produced by the

community increases. According to Rahardja (2004)

a country's economy is considered to experience

growth when the number of goods and services

produced increases.

Economic growth is measured using the growth

rate of Gross Domestic Product (GDP). GDP is the

total income and total national expenditure on the

output of goods and services for a certain period.

GDP itself describes the economic performance, so

if a country's GDP is high, the better the economic

activity in the country.

2.3 Gross Regional Domestic Product

(GRDP)

Economic growth is an increase in the average

income of the community in the long run (Sukirno,

2010). According to BPS the GRDP is defined as the

sum of all the values of final goods and services

produced by all economic sectors in a region.

According to Bank Indonesia (BI), GRDP at

Current Price (ADHB) shows the total number of

goods and services calculated using current year

prices. ADHB GRDP is used to determine the ability

of a region's economic resources. GRDP at Constant

Price (ADHK) shows the total value of goods and

services calculated based on prices that apply to a

certain year as a base year. ADHK GRDP is used to

determine the real economic growth of a region from

year to year.

2.4 Investment

Investment is an investor's activity in buying capital

goods and equipment used in production activities

with the aim of increasing the production capacity of

goods and services available in economic activities

(Sukirno, 2010). Investors make investments to make

profits in the future. Mankiw (2006) says that the

investment itself consists of goods that are purchased

for future use.

2.5 Foreign Investment (FI)

Direct investment or foreign investment (FI) is a

foreign investor who invests capital in Indonesia with

the aim of either building, buying or acquiring a

company. PMA has many advantages that are long-

term, have an impact on technological growth, and

open new jobs.

2.6 Dometic Investor (DI)

DI is a domestic investor who invests capital in

Indonesia using capital obtained in Indonesia. W.W.

Rostow believes that economic growth in a country

depends on the ability of the country. Resources that

can be used in obtaining capital are reducing the

amount of consumption, increasing the amount of

savings, establishing financial institutions, and so on

(Sukirno, 2010).

2.7 Export

Exports are activities of one country in receiving

goods from other countries' production. The deciding

factor in export activities is the ability of this

country to produce goods that are able to compete in

foreign trade (Sukirno, 2010). Exports will increase

compared to national income, but will increase

national income.

2.8 Imports

Imports are activities carried out by one country in

obtaining goods made in other countries.

Community income is the most important

determinant of imports. High community income will

have an impact on the import activities that they will

do (Sukirno, 2010).

2.9 Labor Force

According to Simanjuntak (2007) the labor force is

the number of people who work and look for work.

Effect of Investment, Trade Openness and Labor Force on Economic Growth

53

surging labor force in job seekers will make the

burden of development increase and will slow

down the economic process in a country. The

population itself has an important role for economic

development in terms of the demand and supply side,

viewed from the demand side of the population acting

as consumers and from the supply side as the owner

of factors of production or labor.

2.10 Hypothesis

2.10.1 Foreign Investment Influences

Economic Growthection

The results of research conducted by Chaudhry,

Mehmood, & Mehmood (2013) found that foreign

direct investment (FDI) had a significant positive

effect on economic growth. The more foreign direct

investment into domestic companies, the more jobs

will be available. This will reduce the number of

unemployed and help improve the community's

economy. This also helps in increasing economic

growth. Based on the neo-classical theory of

economic growth investment is a driving factor in

economic growth, so the hypothesis proposed is:

H1: Foreign investment significantly influences

economic growth in Indonesia.

2.10.2 Domestic Investment Has an Effect on

Economic Growth

Onafowora & Owoye (2019) found that domestic

investment has a significant positive effect on

economic growth. PMDN is an investment that

functions in building buildings and equipment used

in production activities. This will increase a country's

production capability and long-term economic

growth will also increase. According to the neo-

classical theory of economic growth investment

becomes an important factor in economic growth,

therefore the following hypotheses are proposed:

H2: Domestic investment has a significant effect on

economic growth in Indonesia.

2.10.3 Trade Openness Affects Economic

Growth

Ul Din, Regupathi, & Abu-Bakar (2017) and Doku,

Akuma & Afriyi (2017) found that trade openness

significantly positively affected economic growth.

Import activities are useful in helping a country to

obtain goods or services that cannot be produced by

the country itself. Unlike the activity of imports,

export activities help a country process its

production so that it does not only revolve in the

country but also revolves globally. It can be assumed

that if the demand for goods from abroad increases,

the amount of production will increase, this will

affect labor demand. Based on the explanation that

has been presented, the following hypothesis is

proposed:

H3: Trade openness has a significant effect on

economic growth in Indonesia.

2.10.4 Labor Influences Economic Growth

Doku, Akuma & Afriyi (2017) found that labor force

significantly positively affected economic growth.

According to the classical economic growth theory

labor force is one of the important factors that

influence economic growth. Labor has a relationship

with production costs and wages. Labor is related to

labor productivity, if the number of workers

increases, it will increase the productivity of labor.

This causes changes in the quantity and quality of

the workforce itself so as to encourage growth so

that the following hypothesis is proposed:

H4: Labor force significantly influences economic

growth in Indonesia.

2.10.5 Investment, Trade Openness, and

Labor Force Influence Economic

Growth

Ul Din, Regupathi, & Abu-Bakar (2017) and Doku,

Akuma & Afriyi (2017) found that investment, trade

options, and labor force had a significant positive

effect on economic growth. Investment, trade

opennes and labor force have a relationship between

one another. Investment increased due to investors

investing in Indonesia. This indicates that Indonesia

has its own charm in the eyes of investors.

The investment itself will directly carry out the

system of import and export of raw materials, both

raw and raw materials. Import activities are carried

out if the country cannot meet the demand for raw

materials. Export activities will occur if the country

has good quality goods and helps a country to process

the production of goods so that it does not revolve in

the country. Export activities will help in increasing a

country's foreign exchange. If the value of exports

increases, so will the amount of production of goods

which will affect the demand for labor.

The relationship between the three variables is

very strong on economic growth in a country.

According to the classical economic growth theory

ICAESS 2020 - The International Conference on Applied Economics and Social Science

54

explained by Adam Smith that investment, trade

openness and labor force are driving factors in a

country's economic growth. Based on the above

explanation, the hypothesis proposed is:

H5: investment, trade options, and labor force

together have a significant effect on economic growth

in Indonesia.

3 RESEARCH METHODS

3.1 Data Types and Sources

This study uses secondary data, where data is

obtained from collecting institutions (Kuncoro,

2007). The type of data in this study is ratio data.

Sources of data in this study are BPS official website

www.bps.go.id and BKPM official website

www.bkpm.go.id.

3.2 Location and Research Object

This research was conducted in Indonesia. The object

of this study is the provinces in Indonesia with a

population of 34 provinces. The research period is

from 2016-2018 with secondary data types obtained

from the official BPS and BKPM official websites.

3.3 Sampling Technique

The sampling technique used in this study is the

purposive sampling technique. Purposive sampling

is a technique for determining research samples with

certain considerations so that the data obtained are

more representative (Sugiyono, 2010). The criteria

used in sampling are provinces that have data of all

variables in the 2016-2018 period. Based on these

criteria, the sample used in this study was 33

provinces in Indonesia.

3.4 Data Collection Technique

This study uses data collection techniques using data

archives in the database using the official BPS

website, www.bps.go.id and the official BKPM

website, www.bkpm.go.id.

3.5 Data Processing Techniques

Data processing techniques that will be carried out

by the author in this study is to use a computerized

calculation technique using the SPSS 22 program.

The procedure carried out in this study is the

researcher summarizes the data to be tested into

Microsoft Excel. Calculate the rate of economic

growth and the value of trade openness in Microsoft

Excel. After the data is processed and ready to be

tested, the researchers enter the data into the data

processing application for data testing.

3.6 Data Analysis Technique

The data analysis technique of this study uses

statistical analysis techniques that are simple and

multiple linear regression using the SPSS 22

program. This simple linear regression analysis is

used to determine the effect of the independent

variable with the dependent variable, while multiple

regression is used to determine the effect of the

independent variables together on the dependent

variable.

3.7 Descriptive Statistics

Descriptive statistics are statistics that describe the

characteristics of a data to be examined. Descriptive

statistics also have frequency, dispersion, center

tendency measurements, and shape measurements. A

frequency that indicates the number of times a

phenomenon occurs. Measurement of central

tendency is used to measure the central value of a

data distribution in the form of: mean, median, mode

(Hartono, 2014). no problem related to the

heterokedastity test. Conversely, if the significance

value is less than 0.05 then there are problems related

to heterokedastity (Ghozali, 2016).

3.8 Regression Model

Data analysis was used to answer the hypotheses

raised in this study. This study uses simple regression

analysis and multiple regression. Simple regression is

an approach method used for modeling the effect

between dependent variables and independent

variables. The independent variable explains the

dependent variable. In Suyono (2018) the structure

of the recession equation model is:

Y = α + βx (1)

Information:

Y : Dependent variable

α : Constants

βx : Variable Coefficient x

Whereas multiple regression is a model used to test

one or more independent variables together. In

Effect of Investment, Trade Openness and Labor Force on Economic Growth

55

general, the structure of the model is described as

follows:

Y = α + β

1

+ β

2

+ ............+β

n

+ ε

(2)

The structure of the multiple regression equation

model in this study can be described as follows:

PE = α + β

1

FDI+ β

2

DI+ β

3

TO+ β

4

LF+ ε

(3)

Information:

α : Constants

PE : GRDP value in the provinces in Indonesia

FDI : Realization of foreign investment in the

provinces in Indonesia

DI : The value of domestic investment

realization in the provinces in Indonesia

TO : Ratio of total exports and imports

divided by GRDP in provinces which are in

Indonesia

LF : Number of workers in the provinces in

Indonesia

3.9 Hypothesis test

3.9.1 T-Statistics Test

The t-statistic test in this study is used to test whether

there is a relationship between each independent

variable on the dependent variable partially. At a

confidence level of 5% or 0.05, the statistical t-test

criteria is if sig <0.05 then H0 is accepted, and

vice versa if sig> 0.05 then H0 is rejected or H1 is

accepted. H0 in this t test is the independent

variable significantly influencing the dependent

variable and H1 that is the independent variable does

not significantly influence the dependent variable

(Santoso, 2009).

3.9.2 F-Statistics Test

The F-Statistics test is used to see whether the

dependent variable simultaneously has a significant

effect on the independent variables in the model.

The criteria to determine the results of the F test

are, first is to compare the calculated F value and the

F table if the calculated F value> F table and sig <0.05

then H0 is accepted and rejected H1, conversely if F

counts <F table or sig> 0 , 05 then H0 is rejected and

H1 is accepted. H0 in the F test is an independent

variable that simultaneously influences the dependent

variable and H1 which is an independent variable

simultaneously does not affect the dependent variable

(Santoso, 2009).

4 RESEARCH RESULTS AND

DISCUSSION

4.1 Results of Processing Data

Collected

The sample used in this study was 33 provinces in

Indonesia. Samples were taken by province which has

variable data used in this study in the 2016-2018 time

span. Province which does not have the required

variable data is West Sulawesi Province. West

Sulawesi does not have export and import data for

2016 and 2017 so that West Sulawesi Province cannot

be sampled in this study.

Table 1: Data characteristics.

Description Frequency Percentage

Number of

P

r

ovinces

34 100%

Province without

data

1 3%

Num

b

e

r

of

Sam

p

les use

d

33 97%

4.2 Descriptive Statistics

Descriptive statistics are statistics that describe the

characteristics of the data to be examined.

Descriptive statistics also have frequency, dispersion,

measurement of central tendencies, and measurement

of shapes. A frequency that indicates the number of

times a phenomenon occurs. Measurement of central

tendency is used to measure the central value of data

distribution in the form of: average, median, mode

(Hartono, 2014). The purpose of this analysis is to

determine the state of the variables used during the

study period. The results of the descriptive statistical

analysis can be seen as follows:

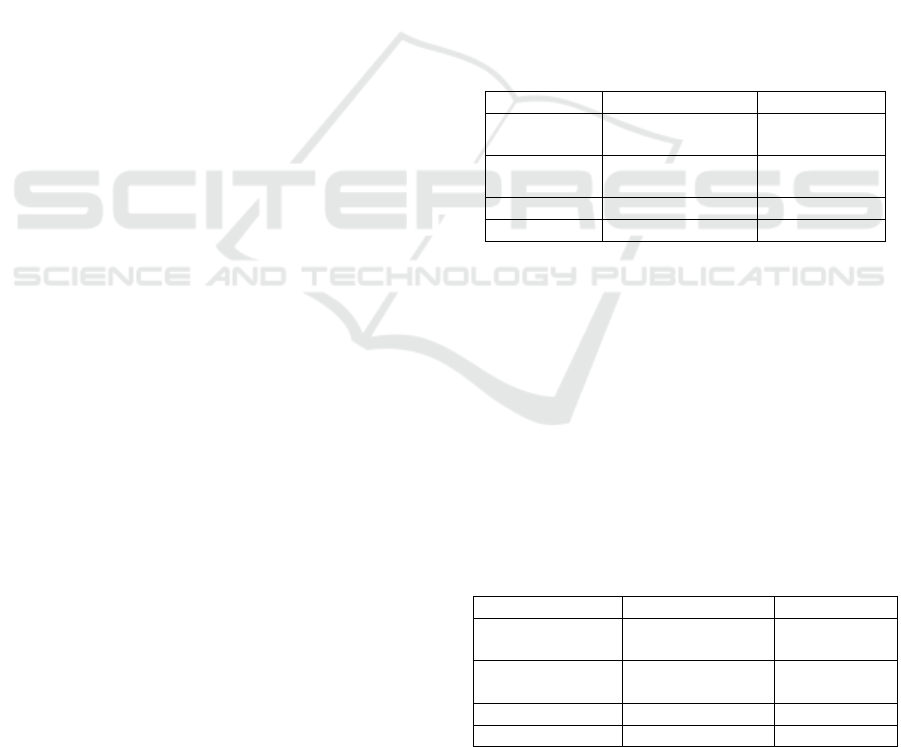

Table 2: Descriptive statistics.

N Min Max Mean

Std. Dev

Y 99

-4,56 9,938 5,25 1,79

X1 99 7.962

5.573.518 913.687 1.239.012

X2 99 8.772

49.097.423 8.114.119 11.559.764

X3 99 -24.713 55.927 7.265 15.319

X4 99 273.423 20.779.888 3.652.533 5.108.125

Source: The data is processed using the spss software

Based on the descriptive statistical test results in

table 2, N shows the amount of data that is 99 data

obtained secondary and then processed. Minimum

shows the lowest value of each variable data. On the

Y variable, namely economic growth, the minimum

ICAESS 2020 - The International Conference on Applied Economics and Social Science

56

value of -4,561, this figure is the economic growth

of NTB Province in 2018. On variable X1, foreign

investment shows a value of USD 7,962 which is the

value of foreign investment in Maluku Province in

2018, while in the investment variable X2 shows the

minimum value of IDR 8,772 is the value of domestic

investment in North Maluku in 2016. In X3

variable the trade openness variable shows the

minimum value of -24,713 is the value of Banten

trade openness. Province in 2018 and in variable X4

the labor force variable showed a value of 273,423

people, namely the number of workers in 2016 in

North Kalimantan Province.

Maximum shows the highest value of each

variable data. In variable Y, the maximum economic

growth value is 9,938, which is the economic growth

rate of Central Sulawesi Province in 2016. In variable

X1, foreign investment shows a maximum value of

USD 5,573,518, which is the value of foreign

investment in West Java in 2018, while on the

domestic investment variable, X2 shows the

maximum value of Rp.49,097,423 is the value of

DKI Jakarta's domestic investment in 2018. On the

X3 variable namely the trade openness variable

shows a maximum value of 55,927.61 is the value

owned by South Kalimantan in 2018 and in variable

X4 workforce variable shows the value of 20,779.

888 people are values owned by West Java in 2018.

Means showing the average value of each data

variable. In the Y variable, namely economic growth,

the average value is 5.254. On the X1 variable,

foreign investment showed an average value of USD

913,687, while on the X2 domestic investment

variable showed an average value of Rp8,114,119. In

the X3 variable, the trade openness variable shows an

average value of 7,265.01 and on the X4 variable, the

labor force variable shows a value of 3,652,533

people.

Standard deviations indicate the heterogeneity

contained in the tested data or the average amount of

variability of the data examined. In the Y variable,

namely economic growth, the standard deviation is

1.799. On variable X1, foreign investment shows a

standard deviation of USD 1,239,012, while on the

domestic investment variable X2 shows a standard

deviation of Rp11,559,764. In the X3 variable the

trade openness variable shows the standard deviation

of 15,319.07 and in the X4 variable the labor force

variable shows the value of 5,108,125 people.

4.3 Classical Assumption Testing

Results

The results of testing the classic assumptions of the

regression model are usually referred to as good

models if they meet the test requirements, the results

of the tests that have been carried out consist of:

heteroscedasticity test and multicollinearity test.

4.3.1 Heterokedasticity Test

Heteroscedasticity occurs if the model has a residual

value that does not have a constant variant. The step

in measuring heterokedastity is the Glejser test. If

the significance value is more than 0.05, there are no

problems associated with the heterokedastity test.

Conversely, if the significance value is less than 0.05

then there are problems associated with

heterokedastity (Ghozali, 2016). The test results can

be seen as follows:

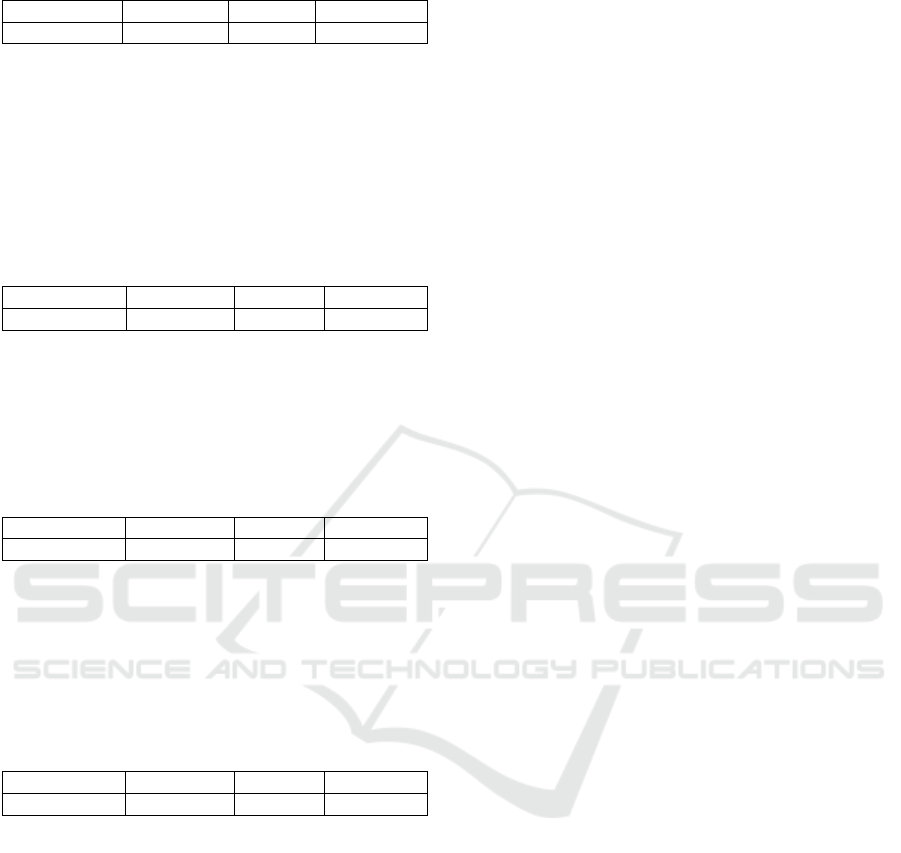

Table 3: Heterokedasticity Test.

Va

r

ia

b

le T Si

g

.

Foreign

investme

,802 ,424

Domestic

Investment

-,212 ,823

Trade

1,620 ,109

Labor Force -958 ,340

Source: The data is processed using the spss software

4.3.2 Multicolieniertas Test

Multicolieniertas test is the existence of a

definite liner relationship between the free changes.

To find out if there is a problem with data related to

multicollinearity test can be seen from the value of

VIF (Value Infaltion Factor). If the VIF value is less

than 10 then the variable has no problems related to

the multicollinearity test with other independent

variables (Priyatno, 2009). The multicollinearity test

results are as follows:

Table 4: Multicolieniertas test.

Variable Tolerance VIF

Foreign

investment

,408 2,451

Domestic

Investment

,269 3,174

Trade O

p

enness ,865 1,156

La

b

o

r

Force ,365

2,743

source: the data is processed using the spss software

Effect of Investment, Trade Openness and Labor Force on Economic Growth

57

4.4 Hypothesis Testing Results

4.4.1 Simple Linear Regression Analysis

Simple linear regression analysis is used to determine

the direction of the relationship between the

independent variable and the dependent variable. The

results of simple linear regression calculations

performed by the author are:

Table 5: Simple linear regression test.

source: the data is processed using the spss software

Based on table 4.6 above, simple linear regression

test equations can be written as follows:

Y = a + bX (4)

Variable foreign investment on economic growth:

Y = 5,120 + 1,467X (5)

Then it can be concluded that the regression

coefficient of foreign investment of 1.467 means

that if foreign investment increases by 1% there will

be an increase in economic growth of 1.467%.

Domestic investment variable on economic

growth:

Y = 5,274 + 2,423X (6)

It can be concluded that the domestic investment

regression coefficient of -2.423 means that if

domestic investment increases 1% there will be a

decrease in economic growth of 2.423%.

Variable trade openness on economic growth:

Y = 5,564 + 2,890X (7)

It can be concluded that the trade openness

regression coefficient of -2.890 means that if trade

openness increases by 1% there will be a decrease in

economic growth of 2.890%.

Labor force variables on economic growth:

Y = 5,217 + 9,965X (8)

Then it can be concluded that the labor force

regression coefficient of 9.965 means that if the labor

force increases by 1% there will be an increase in

economic growth of 9.965%.

4.4.2 Multiple Linear Regression Analysis

Multiple linear regression analysis is used to

determine the direction of the relationship between the

independent variable with the fully dependent

variable. The results of multiple linear regression

calculations performed by the author are:

Table 6: Multple linear regression test.

Va

r

ia

b

le B T Sig.

Foreign

investment

2,632 1,173 ,244

Domestic

Investment

-4,137 -1,398 ,166

Trade

Openness

-2,891 -2,319 ,023

La

b

o

r

Force 1,764 ,306 ,760

Source: The data is processed using the spss software

PE = α + β

1

FDI+ β

2

DI+ β

3

TO+ β

4

LF+ ε (8)

Variable foreign investment, domestic investment,

trade openness and labor force on economic growth

PE = 5,495 + 2,632FDI+ 4,137DI+ 2,891TO+

1,764LF+ ε (9)

4.5 Data Analysis

Based on statistical tests conducted by the author on

5 hypotheses, it is known that:

The variable of foreign investment as H1 has a value

of sig> 0.025 so that it has no significant effect on the

variable of economic growth in Indonesia and the

hypothesis is declared unsupported.

Table 7: The foreign investment hypothesis.

H

y

p

othesis T-Calculate Si

g

. Result

H1 1

,

000

,

320

Unsu

p

p

o

r

te

d

source: the data is processed using the spss

software

The domestic investment variable as H2 has a

value of sig> 0.025 so that H2 has no influence and

is not significant to the variable of economic growth

in Indonesia and the hypothesis is declared

unsupported.

Va

r

ia

b

le B T Sig.

Foreign

investment

1,467 1,000 ,320

Domestic

Investment

-2,423 -,153 ,878

Trade

Openness

-2,890 -2,500 ,014

La

b

o

r

Force

9,965

,279

,781

ICAESS 2020 - The International Conference on Applied Economics and Social Science

58

Table 8: The domestic investment hypothesis.

Hypothesis T-Calculate Sig. Result

H2

-,153

,878

Unsu

p

p

o

r

te

d

source: the data is processed using the

spss software

The trade openness variable as H3 has a

significant negative effect because it has a value of

sig <0.025 so it has a significant effect on economic

growth variables in Indonesia and the hypothesis is

declared supported.

Table 9: The trade openness hypothesis.

Hypothesis T-Calculate Sig. Result

H3 -2,500 ,014 Supported

source: the data is processed using the spss software

The labor force variable as H4 has an

insignificant influence on the variable of economic

growth in Indonesia because it has a sig value>

0.025 and the hypothesis is declared unsupported.

Table 10:

The labor force hypothesis.

H

y

p

othesis T-Calculate Si

g

. Result

H4

,

279

,

781 Unsu

p

p

o

r

te

source: the data is processed using the spss software

The variables of foreign investment, domestic

investment, trade openness and labor force as H5 do

not have an influence on economic growth variables

in Indonesia because they have a value of sig> 0.025

and the hypothesis is declared unsupported.

Table 11: Test F statistics.

H

y

p

othesis T-Calculate Si

g

. Result

H5

2

,

167

,

079

Unsu

p

p

o

r

te

source: the data is processed using the spss software

4.5.1 Effects of Foreign Investment on

Economic Growth

Based on the results of the statistical tests described

above, these results indicate that H1 is not supported,

so it can be concluded that there is no significant

effect between foreign investment on economic

growth in Indonesia. The results of this hypothesis

study are in line with previous research conducted by

Shevalova & Plaskon (2017). The study examined the

relationship of foreign investment to economic

growth in Ukraine, the study found that there was no

significant effect between foreign investment on

economic growth in Ukraine. The insignificance of

foreign investment with economic growth in

Indonesia can be seen in 2017. The realization of

investment in 2017 increased by USD 3.2 billion or

10% compared to last year and economic growth of

5.07% or an increase of 0.04%.

This shows that the increase that occurred in the

PMA did not have a significant influence on

economic growth. The use of foreign capital for

development is often not well targeted, investments

are not prioritized in creating employment for

workers maximally which will have an impact on

economic growth in. The following statistical test

results with neo-classical economic theory put

forward by Harrod (1948) and Domar (1957) which

states that investment is an important factor in

economic growth in a country, in Indonesia is not a

major factor.

4.5.2 Effect of Domestic Investment on

Economic Growth

Based on the results of the statistical tests described

above, these results indicate that H2 is not supported,

so it can be concluded that there is no significant

influence between domestic investment on economic

growth in Indonesia. The results of this hypothesis

study are in line with previous studies conducted by

Ali & Mna (2019). Ali & Mna's research (2019)

examined the relationship of domestic investment to

economic growth in three countries namely Tunisia,

Morocco and Algeria, the study found that there was

no influence between domestic investment on

economic growth in Morocco. Domestic investment

is not significant negative effect because investment

can reduce the amount of savings created in the

future if Indonesian people increase the level of

consumption, this will increase the amount of

availability of consumer goods and not reinvest

profits. This is also due to the uneven distribution of

investment value across all provinces in Indonesia

and this domestic investment does not touch the

layers of society, which means that domestic

investment is done more in the form of capital-

intensive, not much use of human labor.

It can also be seen that domestic investment with

economic growth in Indonesia can be seen in 2017.

Investment realization in 2017 increased by Rp 46

trillion or increased by 4% compared to last year and

economic growth of 5.07% only increased by 0.04%

compared to last year. This shows that the high

growth of domestic investment does not affect

economic growth.

The statistical test results are also not in line with

neo-classical economic theory put forward by Harrod

(1948) and Domar (1957) which states that

investment is an important factor in economic

Effect of Investment, Trade Openness and Labor Force on Economic Growth

59

growth in a country. Based on the results of the

statistical tests described above, these results indicate

that H1 is not supported, so it can be concluded that

there is no significant effect between foreign

investment on economic growth in Indonesia. The

results of this hypothesis study are in line with

previous research conducted by Shevalova &

Plaskon (2017).

4.5.3 Effect of Trade Openness on Economic

Change

Based on the results of the statistical tests described

above, these results indicate that H3 is supported, so

it can be concluded that there is a significant

negative effect between trade openness on economic

growth in Indonesia. The coefficient value for the

trade openness variable is -2,891 which indicates

that if export growth increases, economic growth

decreases by 2.891%. These results are in line with

research conducted by Asbiantari, Hutagaol &

Asmara (2016). This is because Indonesia needs

import activities to meet exports. Meanwhile, on the

import side it is not well managed resulting in a

deficit in the trade balance and this will make

Indonesia flood of imported goods without

producing products that can be re-exported. The

trade war between America and China has also

become one of the causes of the weakening of

exports. The trade war had an impact, which was a

slowdown in the global economy that caused prices

and demand for commodities that were the

mainstays of exports for Indonesia to slow down.

This can be seen in 2018 which experienced a deficit

in the trade balance of USD 8 billion, which

indicates that Indonesia is not good enough in

managing import activities in order to increase

export activities, but economic growth in 2018

experienced an increase of 5.17% or 0.1% .

4.5.4 Effect of Labor Force on Economic

Growth

Based on the results of the statistical tests described

above, these results indicate that H4 is not

supported, so it can be concluded that the labor force

has no significant effect on economic growth in

Indonesia. The results of this hypothesis study are in

line with previous studies conducted by Doku, Akuma

& Afriyi (2017) who found that labor influences

economic growth in African countries. This can be

seen from the development of the number of

workers from 2017. In 2017 the number of labor force

employed increased by 2.6 million workers with

economic growth increasing by 0.04%.

The increase in the number of workers does not

have a significant effect due to the lack of labor

productivity, causing a decrease in the number of

GRDP in 2017, amounting to Rp 5.6 trillion.

It can be concluded that only the number of

workers has increased but from the level of

productivity has not changed, even the opposite has

happened with the number of GRDP having

decreased. This shows that the increase in high

employment does not affect economic growth if it is

not accompanied by an increase in the amount of

productivity, although an increase does not have a

significant effect on economic growth

The statistical test results are also not in line with

the classical economic theory put forward by Smith

(1776) who said that the main factor in economic

growth is the amount of human resources available.

The theory will be in line if the increasing number of

workers is accompanied by an increase in labor

productivity.

4.5.5 Effects of Foreign Investment,

Domestic Investment, Trade Openness

and Labor Force on Economic Growth

Based on the results of the statistical tests described

above, these results indicate that H5 is not

supported, so it can be concluded that there is no

significant effect between foreign investment,

domestic investment, trade openness and labor force

on economic growth in Indonesia. The test results

found there are various directions. On the variable

foreign investment has a significant positive effect on

economic growth, while the variable on domestic

investment has no influence and has a negative

direction on economic growth. The trade openness

variable has a significant influence on economic

growth and has a negative direction, the labor force

variable has an insignificant effect and has a positive

direction on economic growth.

The statistical test results are not entirely in line

with classical economic theory put forward by Smith

(1776) and neo-classical economic theory put

forward by Harrod (1948) and Domar (1957) who say

that the main factors in economic growth are

investment, trade openness and the amount available

human resources. However, in Indonesia only

foreign investment, labor which has an influence but

not a significant influence whereas exports have a

significant effect but in a negative direction on

economic growth in 2016-2018.

Trade openness has the result of having a

significant negative effect on Indonesia's economic

growth. This indicates that if there is an increase in

ICAESS 2020 - The International Conference on Applied Economics and Social Science

60

trade openness, economic growth in Indonesia will

decline. This is because Indonesia needs import

activities to meet exports. Meanwhile, on the import

side it is not well managed resulting in a deficit in the

trade balance and this will make Indonesia flood of

imported goods without producing products that can

be re-exported.

Labor force in Indonesia has an insignificant effect

on Indonesia's economic growth. This is due to the

lack of labor productivity in producing GDP,

causing a decrease in the number of GRDP in 2017

amounting to Rp 5.6 trillion.

5 CLOSING

5.1 Conclusion

Based on the previous results and discussion, several

conclusions can be made, as follows:

Foreign investment has a significant effect on

Indonesia's economic growth. This is because the use

of foreign capital for development is often not well

targeted, investments that are not prioritized on

creating employment opportunities for the maximum

workforce that will have an impact on economic

growth in Indonesia.

Domestic investment has no significant effect and

has a negative direction on economic growth. This is

because investment can reduce the amount of savings

created in the future and not reinvest the profits.

This is also due to the uneven distribution of

investment value across all provinces in Indonesia

and domestic investment which does not touch the

layers of society, which means that domestic

investment is done more in the form of capital-

intensive, not much use of human labor.

5.2 Limitation

In this study, researchers found several limitations

including:

The sample of this study is limited to 33 provinces

in Indonesia and tested in 2016-2018 which will find

different results if carried out in other countries and

at different times.

5.3 Implications and Suggestions

5.3.1 Implications

This study aims to examine the effect of foreign

investment, domestic investment, trade openness and

labor force on economic growth in Indonesia. Based

on this research, foreign investment has an

insignificant influence on economic growth in

Indonesia, this indicates that Indonesia must be able

to manage investment properly so that the right target

and investment can drive Indonesia's economic

growth. Domestic investment has a negative and

insignificant effect on economic growth, this

indicates domestic investors should be able to control

the invested capital and profits so that the amount of

savings in the future does not decline.

Trade openness has a significant effect on

economic growth, this indicates that Indonesia must

increase the value of exports to avoid a deficit in the

trade balance by means of Indonesia must be able to

improve the quality of exported commodities so that

they can increase the value of exports. Labor force has

a significant and not significant effect on Indonesia's

economic growth, this indicates that Indonesia must

be able to employ workers according to their

expertise so that the increase in the number of

workers is in line with the increase in labor

productivity. this research is expected to be able to

add readers' insights and help the government in

determining the driving factors in economic growth

in Indonesia.

5.3.2 Suggestion

Suggestions for further research is to add the variable

amount of government expenditure as an

independent variable. This is consistent with the

economic growth equation:

Y = Consumption + Government+

Investment+ Export - Import

(10)

where Government means government expenditure.

Future studies can also use GDP based on expenditure

in order to describe the value of consumption.

REFERENCES

Ali, W., & Mna, A. (2019). The effect of FDI on

domestic investment and economic growth case of

three Maghreb countries: Tunisia, Algeria and

Morocco. International Journal of Law and

Management, Vol. 61 Issue: 1, pp.91-105.

Anggraini, R. (2019, February 7). Indonesia jadi Negara

Berpendapatan Tinggi, Ini Syaratnya. Retrieved from

Sindonews.com:

https://ekbis.sindonews.com/read/1376804/33/indonesi

a-jadi-negara-berpendapatan-tinggi-ini-syaratnya-

1549531350

Arifin, I., & Hadi, G. (2006). Membuka Cakrawala

Ekonomi. Jakarta: PT.Setia Purna.

Effect of Investment, Trade Openness and Labor Force on Economic Growth

61

Arifin, I., & W, G. H. (2009). Membuka Cakrawala

Ekonomi. Pusat Perbukuan Departemen Pendidikan

Nasional.

Asbiantari, D. R., Hutagaol, M. P., & Asmara, A. (2016).

Pengaruh Ekspor Terhadap Pertumbuhan Ekonomi

Indonesia. Jurnal Ekonomi dan Kebijakan

Pembangunan, Vol 5 No. 2 Hal 10-31.

Bado, B. (2016). Analisis Belanja Modal, Investasi dan

Tenga Kerja Terhadap Pertumbuhan Ekonomi

Sulawesi Selatan. Jurnal Ilmiah Econosains, Vol. 14

No. 2.

Bank Indonesia. 2018. Produk Domestik Regional Bruto.

Dipetik April 19, 2019, dari Bank indonesia:

www.bi.go.id

Boediyono. (2001). Seri Sinopsis Pengantar Ilmu Ekonomi

No. 5 Ekonomi Makro Edisi Keempat. Yogyakarta:

BPFE.

BPS. (2019, Februari 06). Ekonomi Indonesia 2018

Tumbuh 5,17 Persen. Dipetik Maret 17, 2019, dari

Badan Pusat Statistik:

https://www.bps.go.id/pressrelease/2019/02/06/1619/e

konomi-indonesia-2018-tumbuh-5-17-persen.html

Chaudhry, N. I., Mehmood, A., & Mehmood, M. S. (2013).

Empirical relationship between foreign direct. China

Finance Review International, Vol. 3 Iss 1 pp. 26 41.

Doku, I., Akuma, J., & Afriyie, J. O. (2017). Effect of

Chinese foreign direct investment on economic growth

in Africa. Journal of Chinese Economic and Foreign

Trade Studies, Vol. 10 Issue: 2, pp.162-171.

Fauzia, M. (2019, Januari 9). Kompas.com. Dipetik

Agustus 8, 2019, dari Kompas.com:

https://ekonomi.kompas.com/read/2019/01/09/101500

026/bank-dunia--laju- pertumbuhan-ekonomi-global-

2019- melemah

Fauzia, M., & Jatmiko, B. P. (2019, 06 12). Kompas.com.

Dipetik 10 28, 2019, dari Kompas.com:

https://money.kompas.com/read/2019/06/12/09070032

6/ini-dampak-perang-dagang-as-china-ke-indonesia-

versi-bank-indonesia

Ghozali. (2016). Aplikasi Analisis Multiariate dengan

program SPSS Volume 2 Hal 64-67. Semarang:

BPFE Universitas Diponegoro.

Gosh, A. (2013). Does Life Insurance Activity Promote

Economic Development. Journal of Asia Business

Studies, 7(1), 31-43.

Hartono, J. (2014). Metode Penelitian Bisnis. Yogyakarta:

Universitas Gadjah Mada. Hasan, E., & Amar, S.

(2014). Pengaruh Investasi, Angkatan Kerja dan

Pengeluaran Pemerintah terhadap Pertumbuhan

Ekonomi di Provinsi Sumatera Barat. Jurnal Riset

Manajemen Bisnis dan Publik, Vol 1, No.1 .

Kuncoro, M. (2007). Metode Kuantitatif Teori Dan Aplikasi

Untuk Bisnis dan Ekonomi. Yogyakarta: UPP STIM

YKPN.

Leo. (2019, Januari 21). Ekonomi Batam Melambat Pada

2019; Prediksi. Diambil kembali dari Batampos.co.id:

https://batampos.co.id/2019/01/21/ekonomi-batam-

melambat-pada-2019-prediksi/, Mahfud. (2016).

Pengaruh Investasi dan Kualitas Tenaga Kerja

Terhadap Pertumbuhan Ekonomi Provinsi di Indoensia

Tahun 2009 Sampai Dengan 2015. Jurnal Ekonomi

Daerah .

Mankiw, N. G. (2006). Makroekonomi. Jakarta: Erlangga.

Nguyen, C. T., & Trinh, L. T. (2018). The impacts of

public investment on private investment and economic

growth: Evidence from Vietnam. Journal of Asian

Business and Economic Studies, Vol. 25 Issue: 1,

pp.15-3.

Onafowora, O., & Owoye, O. (2019). Public debt, foreign

direct investment and economic growth dynamics:

Empirical evidence from the Caribbean. International

Journal of Emerging Markets.

Pianda, D. (2018). Kinerja Guru. Sukabumi: CV Jejak.

Priyatno, D. (2009). Mandiri Belajar SPSS. Yogyakarta:

Mediakom.

Rahardja, P. (2004). Teori ekonomi makro: suatu

pengantar, Edisi Kedua. Jakarta: Lembaga Penerbit

FE, UI.

Santoso, S. (2009). Panduan Lengkap Menguasai Statistik

. Jakarta: PT Elex Media Komputindo.

Sari, A. C., & Kaluge, D. (2017). Analisi Faktor- Faktor

yang Mempengaruhi Pertumbuhan Ekonomi Asean

Member Countries Pada Tahun 2011-2016. Jibeka,

Vol. 11 Hal 24-29.

Shevalova, S., & Plaskon, s. (2017). Does the Ukrainian

Economy’s Absorptive Capacity. International Journal

of Emerging Markets, Vol. 13 Issue: 6, pp.1928-1947.

Simanjuntak, P. J. (2007). Sumber Daya Manusia dan

Tenaga Kerja. Jakarta: LPFF, Universitas Indonesia.

Smith, A. (1776). An Inquiry Into The Nature And

Causes Of The Wealth Of Nations. London: A. Strahan

and T. Cadell.

Sugiyono. (2010). Metode Penelitian Pendidikan

Pendekatan Kuantitatif, Kualitatif dan R&D. Bandung:

Alfa Beta.

Sukirno, S. (2010). Ekonomi Pembangunan: Proses,

Masalah, dan Dasar Kebijakan. Jakarta: Kencana.

Sulistiawati, R. (2012). Pengaruh Investasi terhadap

Pertumbuhan Ekonomi dan Penyerapan Tenaga Kerja

Serta Kesejahteraan Masyarakat di Provinsi di

Indonesia. Jurnal Ekonomi Bisnis dan

Kewirausahaan, Vol. 3, No. 1, 29-50.

Sumawinata, S. (2004). Politik Ekonomi Kerakyatan.

Jakarta: PT Gramedia Pustaka Utama. Suparmoko, M.,

& Ratnaningsih, M. 2012). Ekonomika Lingkungan

Edisi Kedua. Yogyakarta: BPFE.

Tadaro, M. P., & Stephen, C. S. (2003). Pembangunan

Ekonomi di Dunia Ketiga, edisi kedelapan. Jakarta:

Erlangga.

Ul Din, S. M., Reguphati, A., & Abu-Bakar, A. (2017).

Insurance Effect on Economic Growth-Among

Economices in Various Phases of Development.

International Business and Strategy, Vol. 27 Issue:4,

pp.501-519.

Widarjono, A. (2009). Ekonometrika pengantar dan

aplikasinya. Yogyakarta: Ekonisia.

Zhang, J., Alon, I., & Chen, Y. (2014). Does Chinese

investment affect Sub-Saharan African growth?

International Journal of Emerging Markets, Vol. 9

Issue: 2, pp.257-275.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

62