Development of Taxation Application for Start-up based on Cloud

Computing following MSMEs Tax Regulation

Supardianto

1

, Ridi Ferdiana

2

and Selo Sulistyo

2

1

Department of Informatics, Politeknik Negeri Batam, Jl. Ahmad Yani, Batam, Indonesia

2

Department of Electrical Engineering and Information technology, Universitas Gajah Mada, Yogyakarta, Indonesia

Keywords: Information technology, financial governance, taxation, waterfall, user centred design.

Abstract: The level of participation of taxpayers, especially Start-ups in Indonesia, is still a relatively low, cause of the

lack of understanding of taxation and administration. The purpose of designing the application is to be able

to make sound financial governance such as recording transactions, calculating gross circulation every month

and year, and helping in taxation and administration, such as calculating the Final Income Tax according to

Government Regulation No. 23 of 2018 and making a report as supporting documents for the Annual Agency

Tax Return report. Tax applications for start-ups are developing in cloud computing. This application

development stage refers to the Waterfall development model through the requirements, analysis, design,

implementation, testing, and maintenance. The requirements stage reinforces by applying the User-Centred

Design method. Black-box testing on application functionality shows that the application is running well, and

the output produced in this application successfully displays the Final Income Tax attachment output that can

use for Annual Agency Tax Return reporting. This research can help MSMEs / Start-ups to manage Final

Income taxation and administration.

1 INTRODUCTION

Indonesia is one of the developing countries and

needs funds to finance the country’s development.

The country’s most significant source of income

comes from taxes. Taxation is a dynamic fiscal policy

instrument. Its application must always follow the

economy's dynamics, both domestic and international

(Rosdiana, 2015). According to Law No. 16 of 2009

concerning Income Tax article 1 paragraph 1, tax is a

mandatory contribution to the state-owned by

individuals or entities that are coercive based on the

Act, with no direct compensation and used for the

state's needs for the greatest prosperity of the people.

The level of taxpayer participation, especially

MSMEs or Start-ups in Indonesia, is still relatively

low; at least two things cause it, according to the

Directorate General of Taxes, first the MSME

turnover rate is very high, second the lack of financial

literacy. Financial literacy is related to tax

administration. Tax revenue in developing countries,

especially in Indonesia, is still not optimal; the

reduced tax administration influences it (Rudiati et

al., 2013).

Having good financial governance can be a tax

administration solution for MSMEs or Start-ups. An

example of good financial governance is that MSMEs

or Start-ups can record transactions so that later they

can produce useful financial reports. Quality financial

reports can present accurate, honest, relevant,

reliable, comparable, and understandable

information. Quality financial statements are relevant

because they will use as a basis for decision making

(Roychowdhury et al., 2019). The use of technology

for every financial governance activity in the Start-up

will also be a factor in the Start-up's success and

progress. The utilization of accounting software can

be a solution for start-ups who do not have an

accountant.

Applications Widely used by MSMEs are

currently limited to recording transactions and have

not helped start-ups about taxation, especially in the

Final Income Tax for MSMEs (Supardianto et al.,

2019). The technology that is the solution is still

limited to single-tenancy-based applications and

cannot yet become the primary solution because it

still requires users to invest in infrastructure; while

Start-up is in the development phase, it is essential to

save additional costs. With the use of cloud

212

Supardianto, ., Ferdiana, R. and Sulistyo, S.

Development of Taxation Application for Start-up based on Cloud Computing following MSMEs Tax Regulation.

DOI: 10.5220/0010354602120222

In Proceedings of the 2nd International Conference on Applied Economics and Social Science (ICAESS 2020) - Shaping a Better Future Through Sustainable Technology, pages 212-222

ISBN: 978-989-758-517-3

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

computing by utilizing software-as-a-service, every

user can access it through the internet without

installing software.

2 LITERATURE REVIEW

2.1 Taxation for Start-ups in Indonesia

Every individual, MSME, or Start-up who earns

income from goods trading business or service

management, must be taxed. Every MSME has

obligations related to income tax.

The relevant government regulation on Income

Tax and MSME is the issuance of Government

Regulation No. 23 of 2018, which came into effect on

July 1, 2018, replacing Government Regulation No

46 of 2013 for income from businesses received or

obtained by taxpayers who have a particular gross

circulation. Taxpayers whose business activities have

a turnover below Rp. 4.8 Billion in one tax year will

be subject to the Final Income Tax of 0.5% of the total

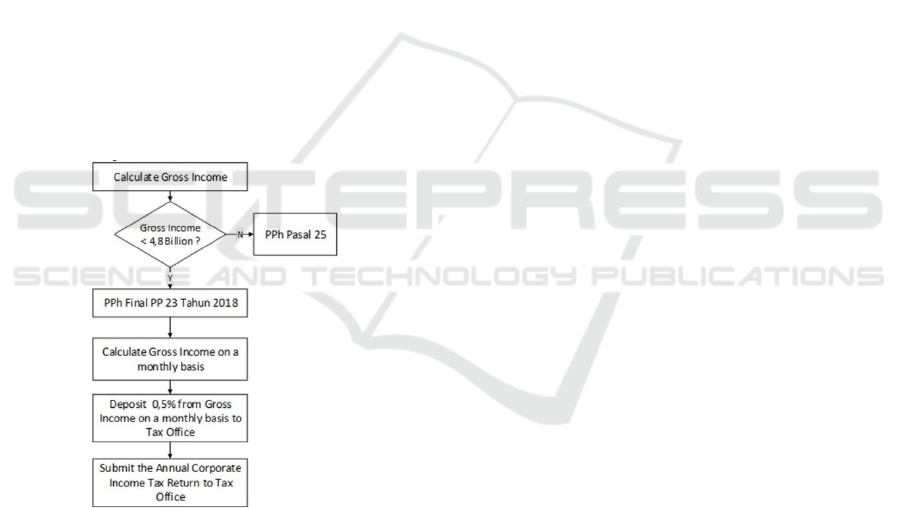

turnover. The flowchart for the Final Income Tax can

be seen in Figure 1.

Figure 1: Flowchart Final Income Tax.

Start-ups only need to pay 0,5% Final Income Tax

on the Gross Income every month, and Start-ups must

deposit the 0,5% Final Income Tax on that particular

month at the latest on the 15th of the following month

to the state treasury account. Start-ups must submit

the Annual Corporate Income Tax Return at the latest

on the 4th month of the following fiscal year to the

tax office (Supardianto et al., 2019).

The Ministry of Cooperatives and Small and

Medium Enterprises noted the number of MSMEs in

Indonesia numbered 59 million business operators.

Based on data from Statistics Indonesia, the

contribution of MSMEs to the national gross

domestic product (GDP) reached 57 percent or 1,537

trillion rupiahs. However, seen from the MSME

participation value of the tax revenue report in the

Annual Tax Reporting for the 2019 tax year, only 1.3

million actors out of the total MSMEs. At least two

things cause the low level of participation of MSMEs

taxpayers; according to the Directorate General of

Taxes, the MSME turnover rate is very high, second

the lack of financial literacy. In contrast to large

companies, Start-up / MSMEs generally do not have

specialized divisions that handle their tax obligations

because they are still at the development stage and

have not considered the tax.

2.2 Page Setup

The need for technology-based administration is that

there is still much work, such as manual recording

and calculation. Manual recording and calculation is

not a problem if there are only a few transactions, but

they are undoubtedly prone to errors if there are many

transactions and repeated. Companies that deal with

the import of goods, with the number of goods that

enter, the calculation of import tax on these goods is

carried out one by one so that it is inefficient because

it takes a long time so that it often experiences

difficulties (Anggraeni et al., 2017).

This manual management and calculation also

occur for the PPh 21 tax type for recitation in several

small companies. Processing like this is still not

considered optimal, so it needs the role of an

information system to be able to handle it [6,7]. For

some work types, an employee or employee's income

tax deduction is still carried out by the company. So

that there are still many employees who do not clearly

understand how to calculate PPh 21 on the income

they get from their work (Sari et al., 2015).

The role of technology can convey information so

that many people can find out about information

quickly. Lack of taxation information is the cause of

the low level of taxpayer participation. Land and

Building Tax is a tax taken by a region that must be

paid by taxpayers in that area. However, the low level

of participation causes the low income received from

these taxes (Sidharta & Mirna Wati, 2015). Land and

building tax are a source of income that helps increase

local revenue. So that the administration cannot be

carried out manually because it is vulnerable to

manipulation (Azhar et al., 2016). One of the most

widely used technology uses today is the use of cloud

computing.

Development of Taxation Application for Start-up based on Cloud Computing following MSMEs Tax Regulation

213

2.3 Cloud Computing

The use of technology in tax administration intends to

increase the number of taxpayers and increase tax

revenue. The use of this technology makes it possible

to automate and gather information better (Cotton &

Dark, 2017). Cloud computing technology can be

used as the best alternative to creating systems that

can realize these problems.

Cloud computing can change the outlook on

infrastructure investment in terms of computing

technology. Previously investment in computing

technology was seen as an asset, but cloud computing

could see as an investment in computing as a service

provider (De Paula & De Figueiredo Carneiro, 2016).

Cloud computing technology is a blend of technology

and business, where cloud computing has become a

promising commercial computing model. The aim is

to reduce the complexity of infrastructure

management from users.

Cloud computing is a computing technology

where resources are dynamic and scalable and can be

used to share virtually and access via the internet (Wu

et al., 2010). Cloud computing is a computing method

where the role of the internet is the main thing. Cloud

can interpret as a shared resource, where applications

and information are provided to users on demand. In

general, the use of cloud computing technology is

using online applications. The user does not install the

application because the application is already

available on the internet. Service on Cloud

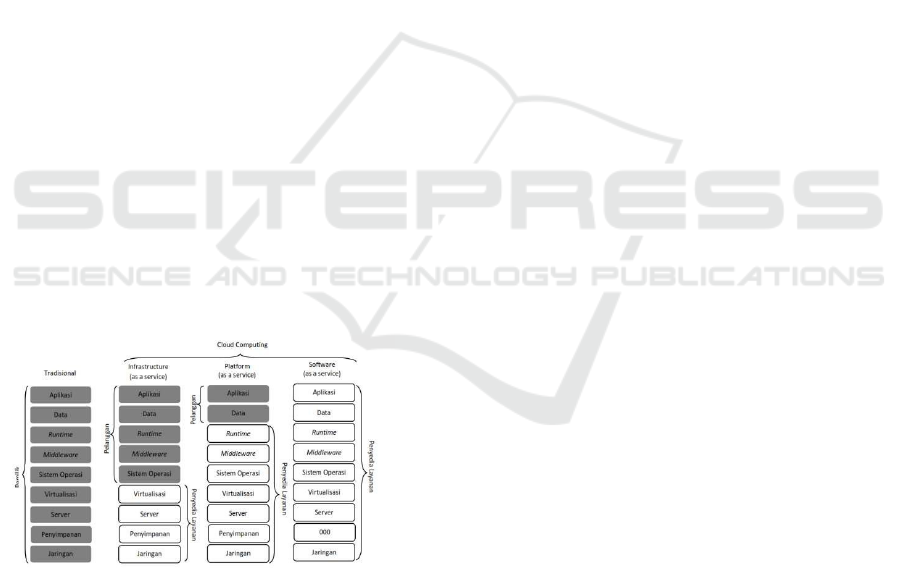

Computing can be seen in Figure 2.

Figure 2: Service on Cloud Computing.

Cloud computing has three services offered, i.e.

Software as a Service (SaaS), Platform as a Service

(PaaS), and Infrastructure as a Service (IaaS) (Zhang

et al., 2010). SaaS is a service that provides

applications, so users do not need to install and access

through the internet; users also do not need to think

about how data is stored, and manage applications.

PaaS is intended for developers or developers to

develop an application on a platform that can be

customized. IaaS aims to bring virtual hardware

technology to users, so users do not need to place their

hardware at the office physically, but can be accessed

or remotely via the internet network.

SaaS service is a model that makes it easy for

clients to use and rent applications from providers

without installing them on their PCs (Rani & Student,

2014). SaaS allows clients to access applications

through cloud infrastructure through interfaces from

thin/thick clients such as Mozilla Firefox, Internet

Explorer, Google Chrome. SaaS is a service where

the actual development of software and applications

occurs on a platform provided by the PaaS layer. SaaS

deals with end-users because end-users can access

and use applications created by cloud providers (E &

R, 2013; Katyal & Mishra, 2013).

SaaS technology has several advantages, i.e.,

users do not directly manage or control cloud

infrastructure, including networks, servers, operating

systems, storage media, or even individual

application capabilities, with the possibility of

exceptions from limited circuits of users with specific

application configurations. This model can provide

very beneficial benefits for both users and providers

of cloud computing services (Youseff et al., 2008).

SaaS services have several advantages, among others

(Kulkarni et al., 2012; Mather et al., 2009; Thakral &

Singh, 2014):

Reducing application software license fees

The SaaS model allows applications to be run by

many clients at the same time.

The application provider is responsible for the

control and restrictions on the use of the

application

SaaS users do not need to buy infrastructure

because they already use infrastructure from the

cloud service provider.

Applications with the SaaS model can configure

by the API but do not fully adjust.

3 RESEARCH METHOD

3.1 Research Tools and Material

The tools used to support this research are as follows:

Microsoft Visio 2016 as software for designing

UML system modelling.

PHP and HTML as a programming language used

to develop web-based systems.

MySQL as a DBMS that is used to manage

databases.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

214

The materials used in this study are as follows:

Government Regulation regarding taxation for

MSMEs regarding Final Income Tax.

Information regarding the Agency's Annual SPT

Report.

The final income tax calculation is following the

applicable Income Tax.

Knowledge of the design and development of

cloud-based applications with software-as-a-

service services.

3.2 How to Research

It is developing an application system that aims to

design and develop cloud-based taxation applications

that can be used for MSMEs and Start-ups to calculate

the Final Income Tax according to the applicable

Income Tax for MSMEs and provide attachments or

documents needed at the time of the Annual Agency

Tax Return.

3.3 Application System Development

The taxation application system for start-up uses

cloud computing technology with software-as-a-

service. The application will place on the cloud side

for users to then access through a browser on an

internet network.

The application was used to calculate the Final

Income Tax, like making monthly transaction reports

and making reports to support the Agency's Annual

Tax Return report. This application develops using

cloud computing technology with software-as-a-

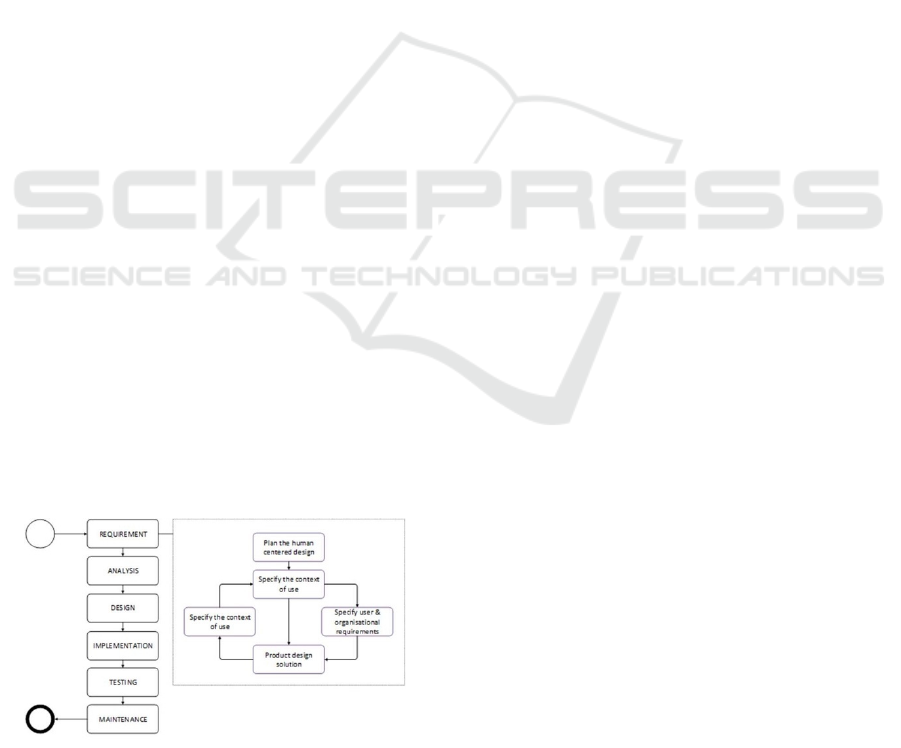

service. The system development method used is

SDLC using the Waterfall model consisting of

planning, analysis, design, implementation, testing,

and system maintenance. At the requirement stage,

the User-centred Design method uses to get a better

picture of the user needs to perform at the requirement

stage. The flow diagram of the application system

development can be seen in Figure 3.

Figure 3: Service on Cloud Computing.

3.3.1 Requirement Phase

The process of gathering needs is to find out what

users need so that software can understand what is

needed by the user. The user needs at this stage are

carried out on the UCD method. The following

description is at the UCD stage:

Plan the human-centred design

At this phase, the researcher conducts a

fundamental analysis of theory, a method that

aims to explore this research's needs. In the

fundamental analysis of the theory, books and

journals reinforce the theories used by

researchers.

Specify the context of use

This stage is to understand who the application

users are designed, identify stakeholders, or be

directly or indirectly involved in the system or

application development process. Application

users are pioneering Start-up or MSMEs

businesses in Indonesia.

Specify user and organizational requirements

At this stage, an interview activity is carried out,

which is useful for knowing the application’s

functionality to be designed. From the results of

interviews conducted at Yogyakarta KPP

Pratama, three things must be done by taxpayers

who use Final Income Tax, i.e., calculating

transactions or incoming money, depositing taxes

every month, and reporting the Annual Tax

Return every year.

Based on a survey of several Start-ups, there are

still Start-ups that do not record transactions and do

not do tax processing because the tax knowledge is

still lacking so that it has difficulty in making the

attachments needed at the time of the Annual Tax

Report.

Product Design Solution

From the results of these interviews and surveys,

conclusions can be drawn from the user's needs.

The above results' solution is to create features

that can overcome the needs of these users in the

application that will be designed by creating

functional and non-functional requirements and

making user interface designs built.

Evaluate Design Against User Requirements

This stage is the process after design. Researchers

conducted usability testing.

3.3.2 Analysis Phase

System analysis is carried out by observing,

surveying, and studying literature on tax problems,

calculation, and reporting of tax returns both in theory

and application. After conducting a literature study,

Development of Taxation Application for Start-up based on Cloud Computing following MSMEs Tax Regulation

215

survey, and direct observation of the existing process,

it can be formulated that the problem that occurs is

that there is no transaction recording at the new Start-

up, which makes it difficult to calculate the Final

Income Tax for the Start-up, and causes the Start-up’s

participation to carry out tax reporting is still low.

With the development of a taxation application

for Start-up with cloud computing technology can

provide convenience and solutions for existing Start-

ups in calculating Final Income Tax and provide

supporting reports as part of the Annual Agency Tax

Return.

3.3.3 Design Phase

The process of designing a cloud-based taxation

application, among others, by making UML diagrams

consisting of use case diagrams, activity diagrams,

making database schemes, and designing the interface

design that will develop.

3.3.4 Implementation Phase

Stages of implementation include making a database,

making applications based on system designs

prepared previously. Data analysis results show that

the creation of taxation applications for cloud

computing-based start-ups requires a database as user

data storage.

This application program's coding is done using

IDE Visual Studio Code software with the PHP

programming language and using Zilla and Putty File

software to place applications in the cloud.

3.3.5 Testing Phase

Stages of application system testing are done by

functional testing of each module section of the

program, whether it is running following the system

design functions. Testing using black-box testing

focuses on logic, functionality, and to minimize errors

and ensure the resulting output is as expected.

3.3.6 Maintenance Phase

Maintenance stage serves to support the operational

application system that has been implemented so that

it can accommodate any changes that occur.

4 RESULT AND DISCUSSION

4.1 System Overview

The system description of the tax application for

cloud-based start-ups that will design is shown in the

Figure4.

Figure 4: System overview.

Note:

1. Start-ups who use the application only need to

record transactions that occur through invoice

recording. The results of the recording will then

be sent and stored in the database server.

2. The application will retrieve invoice data from

Start-up that has been stored for later calculation,

and the user can generate results in the form of

reports that can be used by tax-related start-ups.

3. The administrator’s role is to add the Final Income

Tax taxation rules if the new Final Income Tax is

published or change the tariff if there is a change

in the tariff and provide information to the user.

4. The application can display users who have

registered.

There are four main processes contained in the

taxation application for this cloud-based start-up, i.e.:

The process of recording transactions.

The first step taken by the application user is to

record the transactions that occur in his business.

This transaction recording process requires the

user to provide a number for each transaction that

occurs. This number intends to make each

transaction have an identity.

The process of calculating the final Income Tax is

following the applicable MSMEs Taxation.

After the transaction is made and saved, the

application will calculate the Final Income Tax

following the applicable MSME Taxation Tax

regulations.

The process of making a final income tax report

After the calculation has been done and the

application calculates per month, the application

displays these calculations according to each

user's tax year.

Each user can generate attachments to the Final

Income Tax report every month for one tax year

by selecting the desired tax year.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

216

The Process of Managing Taxation Regulations

and Providing Information

Administrators can add and change taxation rules

according to MSMEs’ taxation conditions that

apply. The user will use the tax rules for each of

his tax periods.

4.2 System Requirements Analysis

4.2.1 Functional Requirements Analysis

Functional requirements analysis identifies the

processes that will be carried out by the system. The

functional requirements of taxation applications for

cloud-based start-ups are as follows:

1. Administrator

Provide information to users.

View registered users.

Add new legislation related to taxation Final

Income Tax.

2. User

Record transactions in the form of e-invoice

transactions.

Displays recorded e-invoices that have been

recorded.

Displays details of each recorded e-invoice.

Displays information on the amount of

monthly Final Income Tax.

Displays information on the amount of final

income tax annually.

Make changes to the tax rules used.

Displays information in the form of gross

circulation graphs of recorded e-invoices.

4.2.2 Non-functional Requirement Analysis

Analysis of non-functional requirements identifies

the behaviour properties owned by the system. The

needs of non-functional tax applications for start-ups

as an online taxation service for a start-up are as

follows:

Availability

Availability is a system to be able to provide

services to users. The system can run for 24 hours

without stopping, except for system maintenance

or system updates.

Availability ensures that users can get

information at any time, and access the

application at any time.

Ergonomic

Ergonomic is the interaction between users of the

system or application. The application built must

be able to be used efficiently or user friendly. That

is because application users are general users who

are not all accustomed to computers.

Portability

Applications can access on any platform or

operating system that can run web-based

applications. It is intended that users can access

applications through any device.

Security

The browser used by the user must be able to

receive an SSL certificate from the system to

ensure data security. Access to the system is

limited via the internet, and offline access trials

cannot be served.

4.3 Design System

4.3.1 Use Case Diagram

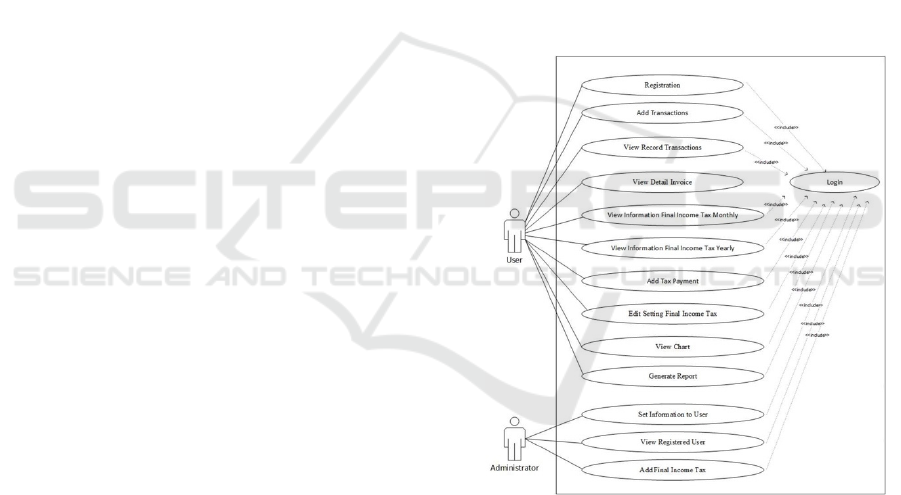

The tax application use-case diagram for cloud-based

start-ups can be seen in Figure 5.

Figure 5: Use-case diagram.

4.3.2 Design Table

The database used in the development of taxation

applications for cloud-based start-ups is a MySQL

database consisting of several tables as follows:

Table TB user

Table 1 contains user data (start-up / MSMEs)

that

register to be able to use the

application

Development of Taxation Application for Start-up based on Cloud Computing following MSMEs Tax Regulation

217

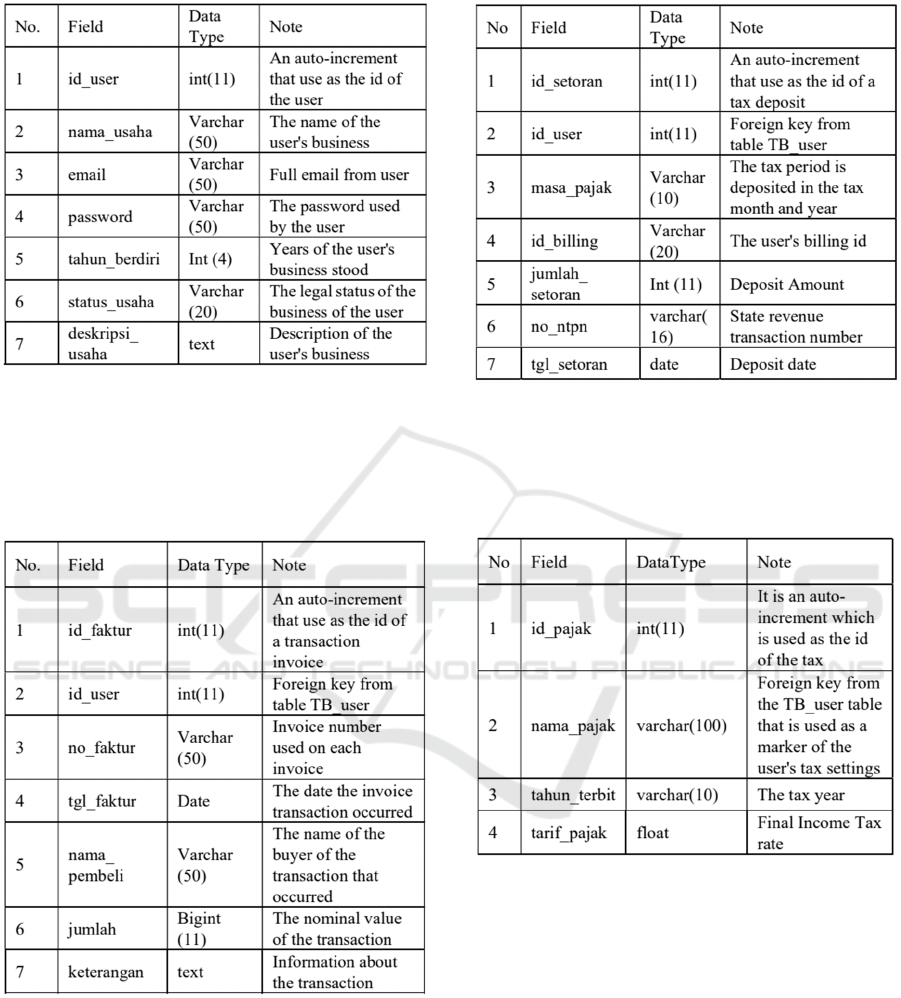

Table 1: Design table TB user.

Table TB_invoice

Table 2 contains invoice data recorded by the user

in the form of transaction activities of the ongoing

business.

Table 2: Design table TB invoice.

Table TB_deposit

Table 3 contains data from the tax payments that

users have made to be then recorded into the

application.

Table 3: Design table TB Deposit.

Table TB_tax

Table 4 contains data on the final Income Tax

legislation available. Data added by administrator.

Table 4: Design table TB tax.

Table TB_Setting_tax

Table 5 contains tax regulation data in the form of

the active tax year and the tax regulations that are

used.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

218

Table 5: Design table TB setting tax.

Table TB_info

Table 6 contains information that is entered by the

administrator who will appear to the user.

Table 6: Design table TB setting tax.

4.4 Implementation System

4.4.1 Page Register

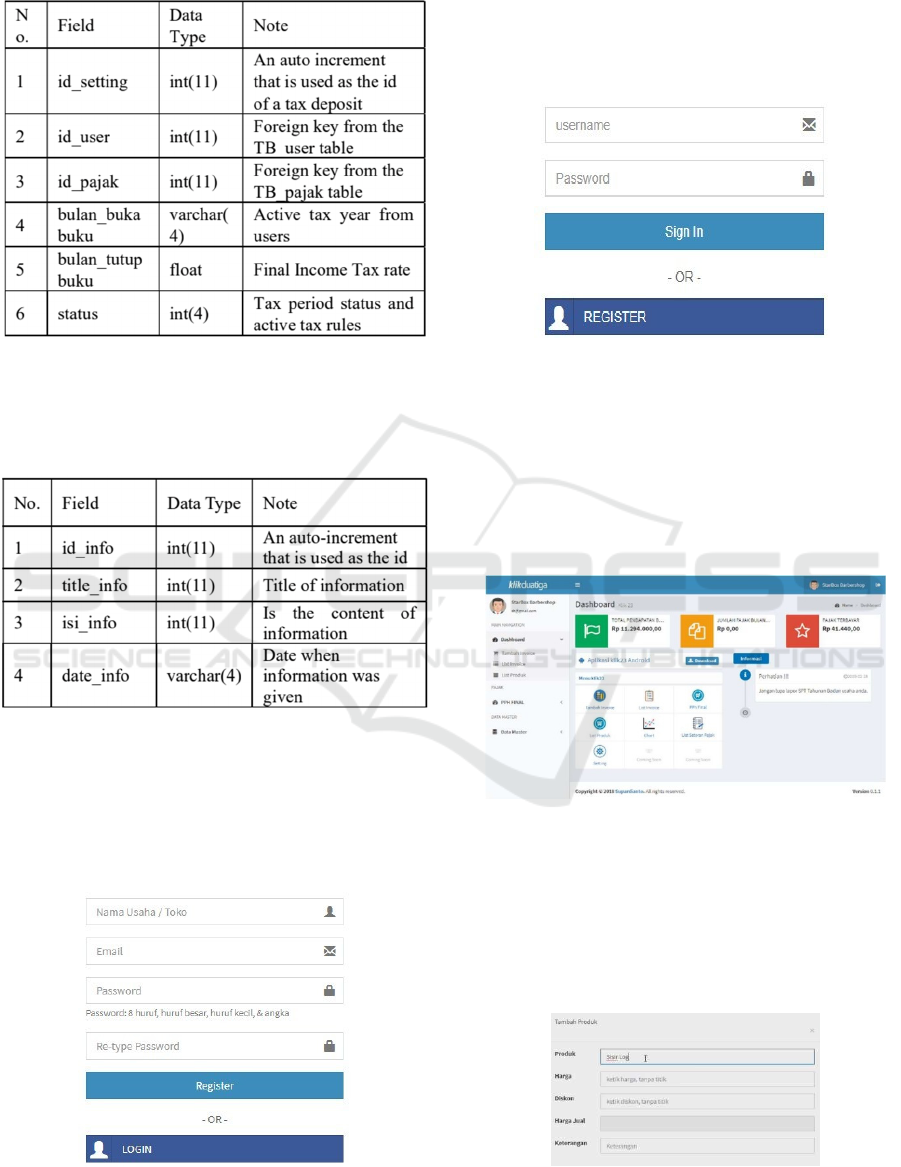

Figure 6 displays a registration form that allows users

to register to be able to use the application.

Figure 6: Page register.

4.4.2 Page Login

Figure 7 displays a login form that users can use to

enter the application. On the login page, the user will

be validated whether the user is registered or not.

Figure 7: Page login.

4.4.3 Page Dashboard

Figure 8, there will be information in the form of the

total number of invoices for one active tax year, the

total final income tax that has been paid, the

application menu list, and the list of invoices that

have records.

Figure 8: Page dashboard.

4.4.4 Page Add Product

Figure 9 displays an added product form. Used for

user who want to add product, and will use to in add

transactions. So, any kind of MSMEs can use this

application, because it does not depend on one type

of product.

Figure 9: Add product.

Development of Taxation Application for Start-up based on Cloud Computing following MSMEs Tax Regulation

219

4.4.5 Page Add Transactions

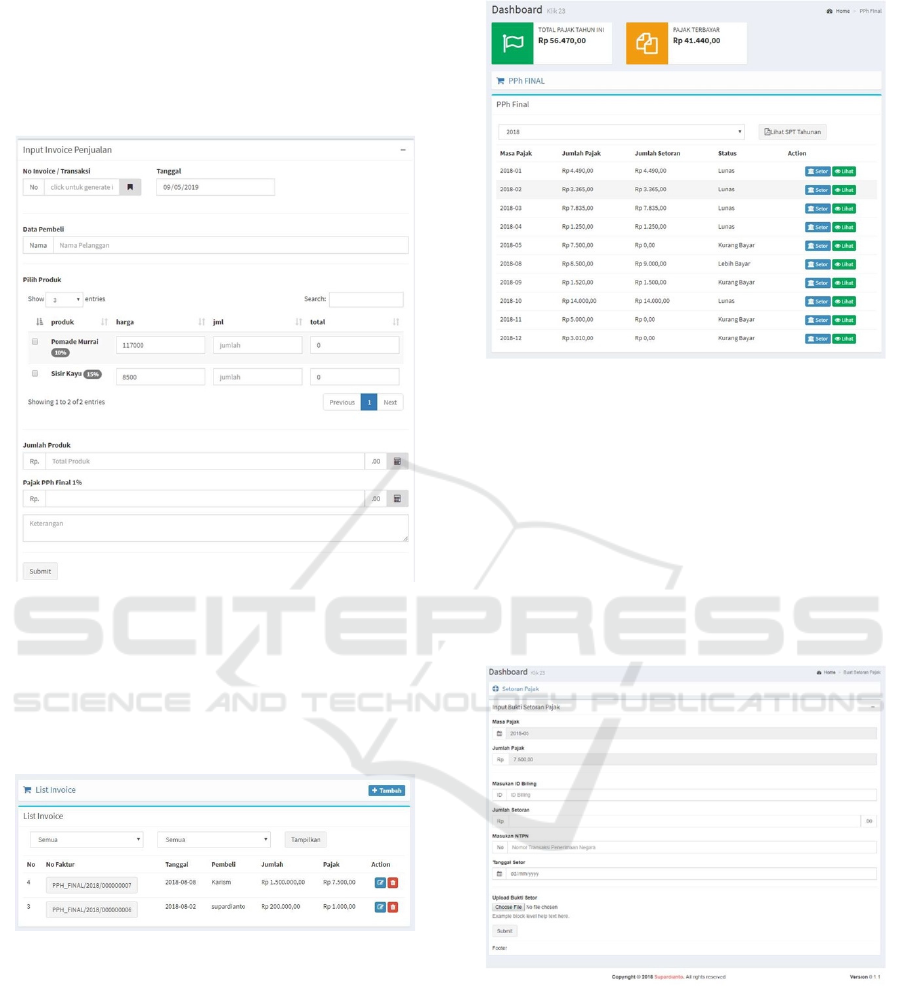

Figure 10 displays an added transaction form. Used

for users who want to record transactions and will be

saved as e-invoices.

Figure 10: Page add transaction.

4.4.6 Page Invoice List

Figure 11 display a list of transactions that have

records. Users can search for transactions quickly on

this page.

Figure 11: Page invoice list.

4.4.7 Page Final Income Tax

Figure 12 contains information in the form of a total

Final Income Tax for one tax year and a list of the

Final Income Tax number in the monthly tax period.

On this page, the user can also generate an Annual

Agency Tax Return attachment.

Figure 12: Page final income tax.

4.4.8 Page Add Tax Payment

Figure 13 is a page used by users to record or record

proof of tax payments made through banks, post

offices, or third parties. It intends that users can easily

search when needed. Users need to know about the

billing id obtained on the director general's website,

as well as the state revenue transaction number

obtained after the user has successfully paid the Final

Income Tax.

Figure 13: Page add tax payment.

4.4.9 Page Chart Gross Income

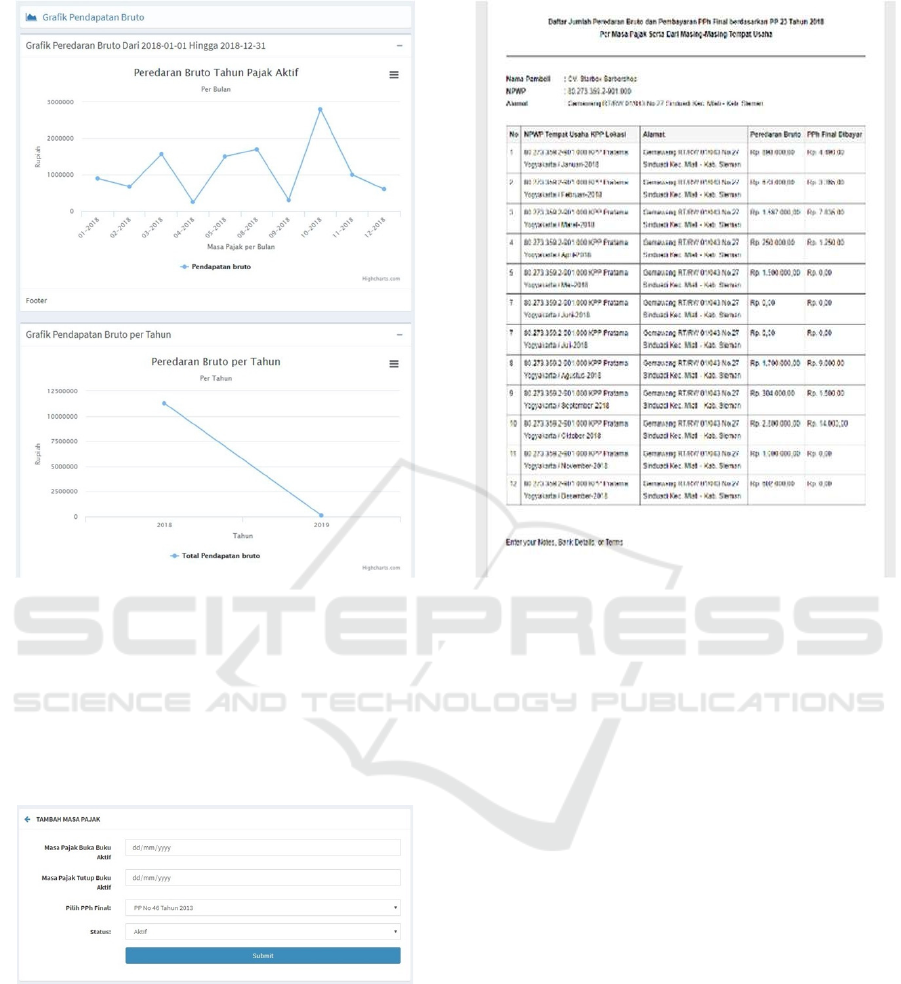

Figure 14 displays gross income information that has

records on the previous invoice and then grouped in

monthly periods during the active tax year. This page

can use as an evaluation material and see trends in the

user's business.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

220

Figure 14: Page chart gross income.

4.4.10 Page Tax Setting

Figure 15 is used to make settings for users of tax

rules that will use in the application. The user must

enter the tax period data that will be active according

to the tax year.

Figure 15: Page add tax setting.

4.4.11 Output Attachment for Annual

Corporate Tax Returns

Figure 16 is an interface implementation in the form

of an output attached to the Annual Corporate Tax

Return that can be used.

Figure 16: Output attachment.

4.5 Testing System

Functionality testing is done using the black-box

testing methods by observing the execution (output)

results through test data and checking the

functionality of the taxation application for cloud

computing-based start-ups. The results of

functionality testing conducted by the testers show

that the application has useful functionality

4.6 Discussion

This application development helps MSMEs to

record sales transactions. This application also helps

MSMEs to find out the total gross income of their

business for one month. This gross income is used to

get the amount of tax each month paid by MSMEs

when using Final Income Tax. This application also

helps users save proof of tax payments made to be

used if one day there is an inspection by the

Directorate General of Taxes.

This application also helps users to provide

attachments to the agency’s annual tax return. The

attachment contains the gross income and the amount

of tax each month for one year. Based on this

application’s many conveniences, it is hoped that it

Development of Taxation Application for Start-up based on Cloud Computing following MSMEs Tax Regulation

221

can increase MSMEs’ participation in paying taxes

and reporting them.

5 CONCLUSIONS

Based on the results of the development and

evaluation of applications that have been carried out,

conclusions are as follows:

1. Taxation applications that have been built follow

the MSMEs tax laws that apply in Indonesia.

2. The application can manage transactions and

calculate the Final Income Tax, as well as make

an attachment that is used for the Annual

Corporate Tax Return.

3. The application can help MSMEs / Start-ups to

manage Final Income Tax taxation and

administration.

REFERENCES

Anggraeni, I., Wahana, A., & Sidharta, I. (2017).

APLIKASI PERHITUNGAN PAJAK IMPOR (Studi

Kasus Di Istana Grosir Group). Jurnal Computech &

Bisnis, 11(1), 59–68.

Azhar, F. I., Samaji, I., Si, M., & Setiawan, C. R. K. (2016).

APLIKASI PERHITUNGAN PAJAK BUMI DAN

BANGUNAN BERBASIS WEB (Studi Kasus: Dinas

Pendapatan Daerah Bekasi) WEB-BASED

APPLICATION FOR CALCULATION OF LAND AND

BUILDING TAX (Case Study: Dinas Pendapatan

Daerah Bekasi). E-Proceeding of Applied Science,

2(1), 358–366.

Cotton, M., & Dark, G. (2017). Use of Technology in Tax

Administrations 2: Core Information Technology

Systems in Tax Administrations. IMF Technical Notes

and Manuals.

De Paula, A. C. M., & De Figueiredo Carneiro, G. (2016).

Cloud computing adoption, cost-benefit relationship

and strategies for selecting providers: A systematic

review. ENASE 2016 - Proceedings of the 11th

International Conference on Evaluation of Novel

Software Approaches to Software Engineering, Enase,

27–39. https://doi.org/10.5220/0005872700270039

E, E., & R, G. (2013). Cyber Security and Reliability in a

Digital Cloud. US Dep. Def. Sci. Board Study, January.

Iwan Sidharta, & Mirna Wati. (2015). Perancangan Dan

Implementasi Sistem Informasi Urunan Desa (Urdes)

Berdasarkan Pada Pajak Bumi Dan Bangunan. Jurnal

Computech & Bisnis, 9(2), 95–107.

Katyal, M., & Mishra, A. (2013). A Comparative Study of

Load Balancing Algorithms in Cloud Computing

Environment. Int. J. Distrib. Cloud Computing, 1 no.2.

Kulkarni, G., Chavan, P., Bankar, H., Koli, K., & Waykule,

V. (2012). A new approach to software as service cloud.

2012 7th International Conference on

Telecommunication Systems, Services, and

Applications, 196–199.

https://doi.org/10.1109/TSSA.2012.6366050

Mather, T., Kumaraswamy, S., & Latif, S. (2009). Cloud

Security and Privacy (First Edit). O’Reilly Media, Inc.

https://doi.org/978-0596802769

Rosdiana, H. (2015). Rekonstruksi Supply Side Tax Policy.

Jurnal Ilmu Administrasi Dan Organisasi,

15(September 2008), 202–205.

Roychowdhury, S., Shroff, N., & Verdi, R. S. (2019). The

effects of financial reporting and disclosure on

corporate investment: A review. Journal of Accounting

and Economics, 68(2–3), 101246.

https://doi.org/10.1016/j.jacceco.2019.101246

Rudiati, S., Widada, B., & YS, W. L. (2013). Sistem

Informasi Penghitungan Pajak Reklame Di Dinas

Pendapatan, Pengelolaan Keuangan Dan Aset Daerah

Kabupaten Karanganyar Berbasis Multiuser. Jurnal

TIKomSiN, 1, 32–36.

Sari, D. M., Darmawiguna, I. G. M., & Arthana, I. K. R.

(2015). Sistem Informasi Perhitungan Pajak Pph 21

Berbasis Mobile. Kumpulan Artikel Mahasiswa

Pendidikan Teknik Informatika, 4.

Setiady, R. A., & Gusnandar, S. (2013). Aplikasi Berbasis

Web untuk Penggajian dan Pengupahan serta

Perhitungan PPh Pasal 21 pada PT XYZ. Jurnal

Teknologi Informasi, 1(6), 232–237.

Supardianto, Ferdiana, R., & Sulistyo, S. (2019). The Role

of Information Technology Usage on Startups Financial

Management and Taxation. Procedia Computer

Science, 161, 1308–1315.

https://doi.org/10.1016/j.procs.2019.11.246

T. Chou. (2010). Introduction to Cloud Computing. Cloud

Book.

Thakral, D., & Singh, M. (2014). Virtualization in Cloud

Computing. Journal of Information Technology &

Software Engineering, 04(02), 1262–1273.

https://doi.org/10.4172/2165-7866.1000136

Wu, J., Ping, L., Ge, X., Ya, W., & Fu, J. (2010). Cloud

storage as the infrastructure of Cloud Computing.

Proceedings - 2010 International Conference on

Intelligent Computing and Cognitive Informatics,

ICICCI 2010, 380–383.

https://doi.org/10.1109/ICICCI.2010.119

Youseff, L., Butrico, M., & Da Silva, D. (2008). Toward a

Unified Ontology of Cloud Computing. 2008 Grid

Computing Environments Workshop, 1–10.

https://doi.org/10.1109/GCE.2008.4738443

Zhang, Q., Cheng, L., & Boutaba, R. (2010). Cloud

Computing State of the art and research.pdf. Journal of

Internet Services and Applications, 7–18.

Zuana, K. R., & Sidharta, I. (2014). Sistem Informasi

Pemotongan PPH 21 Atas Gaji Karyawan PT.

Rajawali Tehnik. Jurnal Computech & Bisnis, 8(2),

112–121.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

222