Analysis of Corporate Bankruptcy and Financial Statement Fraud

Prediction using Altman Models and Beneish Models

Cut Annisa Selanda, and Afriyanti Hasanah

Applied Business Administration, Politeknik Negeri Batam, Jl. Ahmad Yani, Batam, Indonesia

Keywords: Altman Models Model, Beneish Models Model, Bankruptcy, Financial Statement Fraud

Abstract: The purpose of this study was to analyze the prediction of financial statement fraud and bankruptcy of

companies using the Altman Models model and the Beneish Models model. This research is a descriptive

analysis research with a quantitative approach using secondary data from the company’s financial statements.

The population in this study are property and real estate companies listed on the Indonesia Stock Exchange

(BEI) in the period 2014-2018 with a sample of 24 companies. The result showed that there is a

relationship between financial statement fraud and company bankruptcy conditions where there are financial

statements that are predicted to go bankrupt before manipulated, there are financial statements that are

manipulated before bankrupt, and there are financial statements that are simultaneously predicted to go

bankrupt and manipulated. Based on the analysis, the researcher argued that stakeholders would be better

protected when the Altman Models model and Beneish Models model are used simultaneously. Further

research is recommended to use another bankruptcy prediction tool and financial statement fraud prediction

tool.

1 INTRODUCTION

Each company has a financial report that serves to

provide information for making decisions, making

calculations, measurements, and evaluating all

aspects of the company's economy in a

comprehensive manner (Syakur, 2015). Financial

statements must be presented in a relevant, accurate,

detailed, and free from all forms of fraud. Many of

the practices that occur, high expectations in

achieving the income of a company are often

followed by ambition to manipulate financial

statements (Christy, Sugito, & Abdul, 2015). The

material misstatement of financial statements was

deliberately done to trick investors and creditors

(ACFE, 2016). Earnings management is a form of

financial statement fraud by reporting fictitious

transactions that will produce the desired profit value.

Cases of manipulation of financial statements

occur abroad and domestically. In 2001 it was

revealed that the management of one of the largest

companies in the United States, the Enron companies,

overestimated profits in the company's financial

statements until its debts were discovered and finally

declared bankrupt in December 2001 (Deil, 2014).

In 2002, the company World com which was also a

large company in the United States went bankrupt

after the company's financial game was revealed

(Pertiwi, 2015). The case of financial manipulation

in Indonesia was carried out by the SNF companies.

In 2018, SNP Finance was declared bankrupt after

committing fraud by reporting a fictitious financial

report by the Financial Services Authority (OJK).

Based on the cases above, financial statement fraud

needs to be detected as an effort to protect those who

need information (Gumiwang, 2018).

Fraud detection was carried out by Beneish

Models by formulating 8 analysis ratios to identify

the occurrence of fraudulent financial statements or

being involved in earnings manipulation (Beneish,

1999). The ratio can predict that 76% of the sample

companies studied by Beneish Models are classified

as manipulating financial statements. The method

found by Beneish Models is known as the Beneish

Models model. An analysis of the causes of the

financial statement fraud needs to be done. One of the

causes of fraud in bankruptcy (Albrecht, Albrecht,

Albrecht, & Zimbelman, 2012). Companies in a

vulnerable situation will try to increase profits to get

financial statements that will attract investors to

invest. Bankruptcy prediction was carried out by

Altman Models using 5 financial ratios and came to

154

Selanda, C. and Hasanah, A.

Analysis of Corporate Bankruptcy and Financial Statement Fraud Prediction using Altman Models and Beneish Models.

DOI: 10.5220/0010354501540164

In Proceedings of the 2nd International Conference on Applied Economics and Social Science (ICAESS 2020) - Shaping a Better Future Through Sustainable Technology, pages 154-164

ISBN: 978-989-758-517-3

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

be known as the Altman Models model. Z-Score's

research results were able to predict bankruptcy with

an accuracy rate of 95% (Altman E. I., 1968).

There is the highest possibility that companies

facing financial difficulties will manipulate their

income to show a healthy company condition

(Maccarthy, 2017). This is in line with other research

statement that poor financial conditions have a strong

motivation to commit fraud (Abbas, 2017). Another

study by shows that companies are in a state of

financial difficulties and also detected as a

manipulator (Mavangere, 2015). This research is a

development of research that applies the Beneish

Models and Altman Models models simultaneously in

detecting bankruptcy and corporate fraud by using a

sample of companies that have been proven to have

committed fraud and bankruptcy (Maccarthy, 2017)

(Abbas, 2017) (Mavangere, 2015). The sample of this

study is the property and real estate subsector

companies listed on the Indonesia Stock Exchange

(IDX). The purpose of this study is to test first, that

the company is in a bankrupt or bankrupt zone before

it is classified as a manipulator. Second, the company

is classified as a manipulator before it is predicted to

be in a zone prone to bankruptcy or bankruptcy.

Third, companies classified as manipulators are also

predicted to be in a bankrupt or bankrupt zone.

The difference in research conducted with

previous research is, most of the previous studies

used a sample of companies that have been declared

cheating so that the conclusions obtained are limited

to cases that have been proven to be cheating, while

the sample of companies in this study is companies

that are still listed on the IDX.

2 THEORETICAL FRAMEWORK

AND HYPOTEHESIS

DEVELOPMENT

2.1 Theoretical Framework

2.1.1 Agency Theory

Agency theory underlies a set of shareholder

contracts with management in managing the control

and use of resources in the company (Jensen &

Meckling, 1976). Information about the company's

performance and operations are more widely owned

by management, giving rise to opportunities to

commit fraud such as manipulation of numbers in the

financial statements which will eventually develop

into something that is materially misleading and will

harm the company.

2.1.2 Fraud Triangle Theory

The Fraud Triangle theory explains that cheating is

caused by 3 factors including the first, pressure which

covers almost everything including economic

demands, lifestyle, and so on. Second, the

opportunity (opportunity) that usually occurs due to

a lack of internal control supervision and abuse of

authority. Third, rationalization is a set of ethical

values in a person's attitude and character (Cressey,

1953).

2.1.3 Maximizes Social Welfare Theory

Bankruptcy theory states that social welfare is

maximized when companies experience economic

difficulties. This is because creditors are more

interested in the availability of assets and the extent

to which these assets can satisfy their claims rather

than the prospect of saving the company.

2.2 Hypothesis Development

2.2.1 The Company Is Predicted to Go

Bankrupt before Manipulated

The Fraud Triangle theory which states that one of

the causes of fraud is when under pressure and

opportunity (Cressey, 1953). Abuse of authority by

management is done to produce financial reports that

are always good so investors remain interested in

investing their capital (Jensen & Meckling, 1976).

This hypothesis can be supported if there are

companies that are in the gray zone or are bankrupt

from the results of the Altman Models interpretation,

before being classified as a manipulator of the results

of the M-Score interpretation.

2.2.2 The Company Is Predicted to Be

Classified as a Manipulator before It

Is in the Bankruptcy Zone

The Fraud Triangle theory which states that one of

the causes of fraud is the opportunity (Cressey, 1953).

The opportunity is owned by management as a party

that is more flexible about the company's financial

statements (Jensen & Meckling, 1976). The desire

and ambition to achieve a company is often followed

by fraud (Christy, Sugito, & Abdul, 2015).

Companies always want to have financial reports that

look good when the fraud can lead to bankruptcy in

the future. This hypothesis can be supported if there

Analysis of Corporate Bankruptcy and Financial Statement Fraud Prediction using Altman Models and Beneish Models

155

are companies classified as manipulators from the M-

Score interpretation results before they are predicted

to be in the gray zone or bankrupt from the Altman

Models interpretation results.

2.2.3 Companies That Are Classified as

Manipulators Simultaneously Are Also

Predicted to Be in the Bankruptcy

Zone

The Fraud Triangle theory which states that one of

the causes of fraud is when the opportunity arises

when management wants to commit fraud and there

is the pressure when the company is in bad

condition so that the company is categorized in

bankruptcy and also classified as a manipulator

(Cressey, 1953).

This hypothesis can be supported if there are

companies that are classified as manipulators and are

also in a bankrupt zone.

3 RESEARCH METHODS

3.1 Data Types and Sources

The type of data in this study are secondary data in

the form of financial statements of the property and

real estate sub-sector companies for the period 2014-

2018. Data sources were obtained through the IDX's

official website, www.idx.co.id. As well as the

individual company sample pages.

3.2 Variable Operational Definitions

and Measurements

3.2.1 Bankruptcy

In 1995, Altman Models modified the model so that

it could be used in all types of companies in

developing countries (Altman, Peck, & Hartzell,

1995). The elimination of Sales / Total Assets

variables is done because this ratio is very varied in

companies with different asset sizes. The modified

Altman Models equation is:

Z-Score = 6.56Z1 +3.26Z2 + 6.72Z3 + 1.05Z4

Source: (Altman E. I., 1968)

The definition of ratio used as a measurement is:

1. Z1 Ratio (Net Working Capital to Total Assets)

𝑍1

𝑁𝑒𝑡 𝑊𝑜𝑟𝑘𝑖𝑛𝑔 𝐶𝑎𝑝𝑖𝑡𝑎𝑙

𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

The Z1 ratio measures the company's ability to

generate networking capital from total assets. If the

company is in financial difficulty, working capital

will decrease faster than total assets, so the ratio will

decrease.

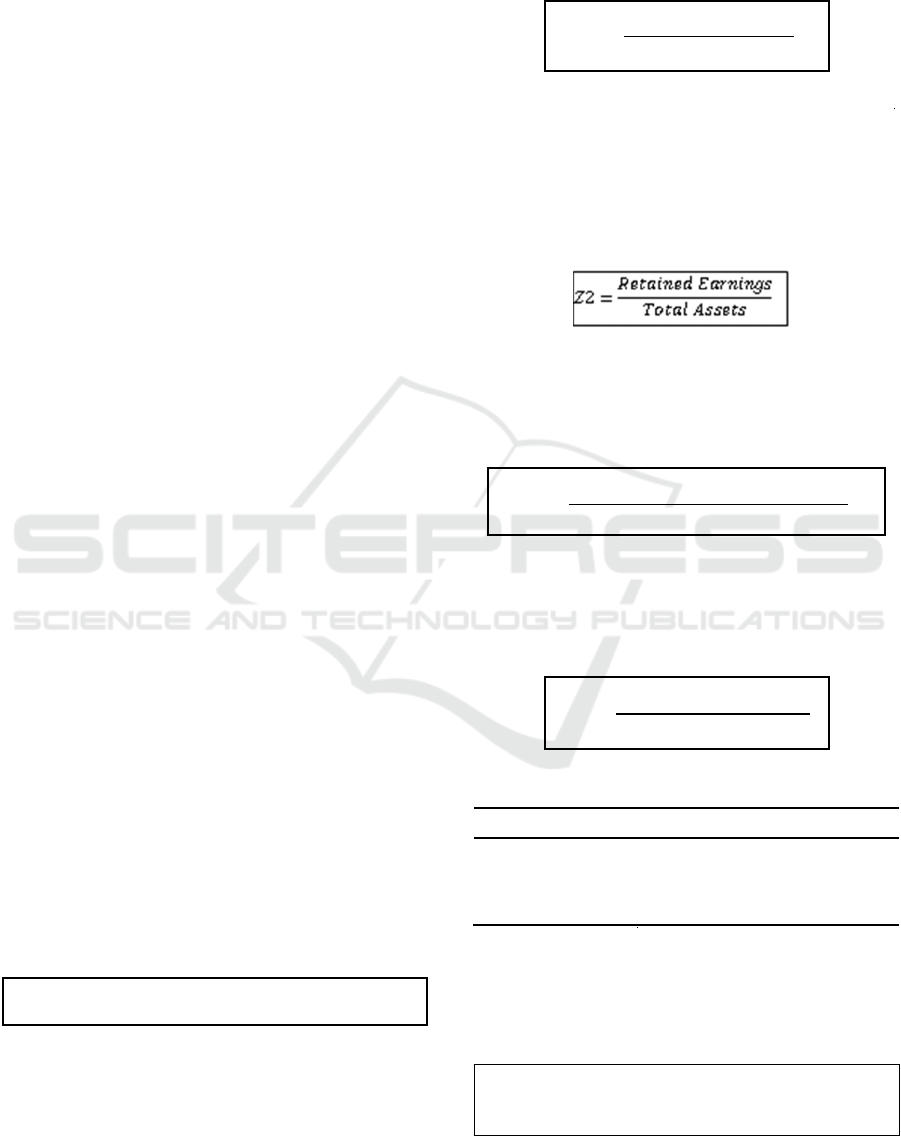

2. Z2 Ratio (Retained Earnings to Total Assets)

The Z2 ratio measures the company's ability to

generate retained earnings from total company assets.

3. Z3 Ratio (Earnings Before Interest and Tax

to Total Assets)

𝑍3

𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝐵𝑒

𝑓

𝑜𝑟𝑒 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑎𝑛𝑑 𝑇𝑎𝑥

𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

Z3 ratio measures the effectiveness of the company

in earning profits before paying interest and taxes.

4. Ratio Z4 (Book Value of Equity to Book

Value of Debts)

𝑍4

𝐵𝑜𝑜𝑘 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝐸𝑞𝑢𝑖𝑡𝑦

𝐵𝑜𝑜𝑘 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝐷𝑒𝑏𝑡𝑠

Table 1: The Altman Models Model Parameter Index

No. Z-Score Classification

1 <1.10 The company is bankrupt

2 1.10<Z<2.60 The company is in grey zone

3 >2.60 The company in good condition

Source: (Altman E. I., 1968)

3.2.2 Fraudulent Financial Statements

Fraudulent is measured using the Beneish Models

model with the formula:

M-Score = -4.84 + 0.92 DSRI + 0.528GMI +

0.404AQI + 0.892 SGI + 0.115DEPI

+ -

ICAESS 2020 - The International Conference on Applied Economics and Social Science

156

0.172 SGAI + 4.679TATA + -0.327 LVGI

The definition of ratio used as a measurement is:

1. Day Sales in Receivable Index (DSRI)

The DSRI ratio is used to compare accounts

receivable against sales generated by the company

one year (t) and the previous year (t-1).

DSRI=

/

/

An increase in the amount of trade receivables owned

indicates.

2. Gross Margin Index (GMI)

The GMI ratio is used to compare the company's

gross profit for one year (t) and the previous year (t-

1).

GMI=

/

/

Z4 ratio shows the capability of a company to fulfill

the obligations of the capital market value. Generally,

companies that run aground will accumulate more

debt than their capital.

Altman Models ratio calculation is intended to

determine the category of a company classified as

healthy, prone to bankruptcy, or bankrupt if it gets a

value according to the parameter index according to

the Z-Score. The parameter index determined by

Altman Models is as follows:

The decrease in the company's gross profit means

the company's prospects have decreased and indicated

fraud.

3. Assets Quality Index (AQI)

Increasing the amount of deferred expenses is an

indication of fraud because the company is trying to

delay costs.

𝐴𝑄𝐼

1

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠

𝐹𝑖𝑥𝑒𝑑 𝐴𝑠𝑠𝑒𝑡𝑠

𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

1

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠

𝐹𝑖𝑥𝑒𝑑 𝐴𝑠𝑠𝑒𝑡𝑠

𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

AQI ratio compares non-current assets other than

fixed assets with the total assets of the company in

one year (t) and the previous year (t-1).

4. Sales Growth Index (SGI)

The SGI ratio compares sales in one year (t) and the

previous year (t-1).

𝑆𝐺𝐼

𝑆𝑎𝑙𝑒𝑠

𝑆𝑎𝑙𝑒𝑠

A decrease in this ratio indicates a decrease in sales.

This indicates fraud.

If LVGI> 1, then this shows the potential

condition of the company for the occurrence of

earnings overstatement to meet the needs of paying

the high debt.

5. Depreciation Index (DEPI)

The DEPI ratio compares depreciation expense to

fixed assets before depreciation in one year (t) and the

previous year (t -1).

𝐷𝐸𝑃𝐼

𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛

𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛

𝐹𝑖𝑥𝑒𝑑 𝐴𝑠𝑠𝑒𝑡𝑠

𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛

𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛

𝐹𝑖𝑥𝑒𝑑 𝐴𝑠𝑠𝑒𝑡𝑠

𝐭𝐨𝐫

Beneish Models ratio calculations each have a

parameter index to determine whether the company

is classified as a manipulator and a non-manipulator.

The parameter index determined by Beneish Models

is as follows:

6. Index (SGAI)

The SGAI ratio measures sales, general expenses, and

administration to sales in one year (t) and the previous

year (t -1).

𝑆𝐺𝐴𝐼

𝑆𝐺𝐴𝐼

𝑆𝑎𝑙𝑒𝑠

𝑆𝐺𝐴𝐼

𝑆𝑎𝑙𝑒𝑠

A decrease in the company's operating expenses when

there is an increase in sales indicates an overstatement

of earnings.

7. Total Accrual to Total Assets (TATA)

A decrease in the company's operating expenses when

there is an increase in sales indicates an overstatement

of earnings.

Analysis of Corporate Bankruptcy and Financial Statement Fraud Prediction using Altman Models and Beneish Models

157

𝑇𝐴𝑇𝐴

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑃𝑟𝑜𝑓𝑖𝑡

𝐶𝑎𝑠ℎ𝑓𝑙𝑜𝑤 𝑓𝑟𝑜𝑚 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐴𝑐𝑡𝑖𝑣𝑖𝑡𝑖𝑒𝑠

𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

8. Leverage Index (LVGI)

Index of debt level is a ratio that compares the

amount of debt to total assets in a year (t) and the

previous year (t -1).

𝐿𝑉𝐺𝐼

𝑇𝑜𝑡𝑎𝑙 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

𝑇𝑜𝑡𝑎𝑙 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

Table 2: The Beneish Models Parameter Index

No Index Non-

Mani

p

ulator

Manipulator

1 DSRI <1.030 >1.460

2 GMI <1.041 >1.190

3 AQI <1.040 >1.250

4 SGI <1.134 >1.610

5 DEPI <1.001 >1.077

6 SGAI <1.001 >1.041

7 TATA <0.018 >0.031

8 LVGI <1.037 >1.111

Total <2.22 >2.22

Source: (Beneish, 1999)

3.3 Location and Research Object

The study was conducted on the property and real

estate subsector companies listed on the Indonesia

Stock Exchange (IDX) for the period 2014-2018.

3.4 Sampling Technique

The sample selection is done by using a non-

probability purposive sampling technique with the

first criteria, property, and real estate subsector

companies listed on the Indonesia Stock Exchange

(BEI) in a row during the 2014-2018 period. Second,

Publish financial statements 5 years in a row during

the period 2014-2018.

3.5 Data Collection Technique

Data collection techniques used in this study are

archival data techniques in the database, namely

secondary data collection in the form of financial

statements.

3.6 Data Processing Techniques

The research data processing technique is first,

determining the variables of the financial statements.

Second, the data input process is entered into the

table. Third, the calculation of the variables ratios of

the Altman Models model and the Beneish Models

Model. Data processing using Microsoft Excel

programs.

4 RESULT AND DISCUSSION

4.1 Altman Models Ratio Calculation

Result

Table 3: Altman Models Ratio Calculation Result

No Company Z-Score

2014 2015 2016 2017 2018

1 APLN 2.77 2.31 1.8 2.32 1.72

2 ASRI 1.63 1.49 1.57 2.05 2.35

3 BEST 7.2 5.34 5.55 5.76 6.62

4 BIPP 3.12 5.08 3.09 3.09 3.95

5 BKSL 2.98 2.48 3.2 3.55 3.2

6 COWL 1.26 1.1 1.37 0.62 -0.05

8 DART 7.64 -1.42 -2.33 -1.33 -2.18

9 DILD -1.64 -0.58 -1.86 -1.72 -0.52

10 EMDE -2.14 -2.41 -1.12 -1.24 -1.14

11 FMII -3.05 2.5 -0.69 -2.78 -2.8

12 GPRA -1.72 -2.24 -2.04 -1.87 -1.89

13 GWSA -1.04 -0.67 -1.69 -2.76 -1.52

14 KIJA -1.58 -1.84 -1.2 -2.44 -1.08

15 LPCK -0.98 -0.6 -1.9 -0.6 -0.65

16 LPKR -1.39 -1 -1.61 -1.4 -1.83

17 MDLN -0.74 -0.69 -2.24 -2.04 -1.87

18 MTLA -0.78 -2.17 -2.15 -1.25 -2.68

19 MTSM -2.93 -2.82 -0.39 -2.16 -2.55

20 NIRO -1.87 -1.45 -1.18 -1.64 -2.31

21 MORE -2.38 -20.3 -2.44 -2.22 -1.88

22 PWON -1.39 -0.22 -0.25 -1 -1.95

23 SMDM -1.52 -1.89 -1.53 -2.3 -2.24

24 SMRA -1.33 -0.91 0.75 -1.56 -2.19

Source: Data processed with Microsoft Excel.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

158

4.2 Beneish Models M-Score Ratio

Calculation Result

Table 4: Beneish Models M-Score Ratio Calculation Result

No Company Z-Score

2014 2015 2016 2017 2018

1 APLN -2.15 -2.07 -1.78 -1.58 -1.86

2 ASRI -1.65 -1.82 -1.53 -1.87 -1.48

3 BEST -1.67 -1.28 7.27 -2.39 -2.99

4 BIPP -1.08 -2.29 -1.89 -1.83 -2.47

5 BKSL -1.57 -2.02 -0.81 -1.48 -1.86

6 COWL -1.87 -2.06 -1.79 -1.33 -2.24

8 DART -1.84 -1.78 -1.77 -1.93 -1.73

9 DILD

0,3361

11 ‐1.42 ‐2.33 ‐1.33 ‐2.18

10 EMDE

‐1.64 ‐0.58 ‐1.86 ‐1.72 ‐0.52

11 FMII

‐2.14 ‐2.41 ‐1.12 ‐1.24 ‐1.14

12 GPRA

‐3.05 02.05 ‐0.69 ‐2.78 ‐2.8

13 GWSA

‐1.72 ‐2.24 ‐2.04 ‐1.87 ‐1.89

14 KIJA

‐1.04 ‐0.67 ‐1.69 ‐2.76 ‐1.52

15 LPCK

‐1.58 ‐1.84 ‐1.2 ‐2.44 ‐1.08

16 LPKR

‐0.98 ‐0.6 ‐1.9 ‐0.6 ‐0.65

17 MDLN

‐1.39 ‐1 ‐1.61 ‐1.4 ‐1.83

18 MTLA

‐0.74 ‐0.69 ‐2.24 ‐2.04

0,10208

3

19 MTSM

‐0.78 ‐2.17 ‐2.15 ‐1.25 ‐2.68

20 NIRO

‐2.93 ‐2.82 ‐0.39 ‐2.16 ‐2.55

21 MORE

‐1.87 ‐1.45 ‐1.18 ‐1.64 ‐2.31

22 PWON

‐2.38 ‐2.03 ‐2.44 ‐2.22 ‐1.88

23 SMDM

‐1.39 ‐0.22 ‐0.25 ‐1 ‐1.95

24 SMRA

‐1.52 ‐1.89 ‐1.53 ‐2.3 ‐2.24

Source: Data processed with Microsoft Excel

4.3 Descriptive Statistic

Table 5: Descriptive Statistic

Variable N Min Max Mean

Std.

Deviation

Z-Score 120 -0,05 31,88 5,6976 4,85823

M-Score 120 -3,05 7,64 -1,4711 1,44233

Source: Data proses by SPSS Statistics 20.

Based on the above table, it can be seen that the

amount of data used in this study is 120 data each

from the results of the M-Score and Altman Models

5 years in a row with a sample of 24 real estate and

property sector companies listed on the IDX. The

table shows that the known Altman Models as a

bankruptcy prediction tool has an average value of

5.6976, a standard deviation value of 4.85823, a

minimum value of -0.05 obtained by Cowell

Development Company (COWL) in 2018, and a

maximum value of 31.88 obtained by Indonesia

Prima Property Company (OMRE) in 2016. M-Score

as a cheating prediction tool has an average value of

-1.44711, a standard deviation value of 1.44233, a

minimum value of - 3.05 obtained by Fortune Mate

Indonesia Company (FMII) in 2014, and a maximum

value of 7.64 obtained by Duta Realty Company

(DART) in 2014.

4.4 Normality Test

Table 6: Normality Test

Shapiro Statistic D f Sig.

M-Score .940 21 .214

Z-Score .945 21 .276

Source: Data processed with SPSS Statistics 20

Based on the results of the normality test above,

it is known that the value of degree of freedom is 21

if the value of degree of freedom <50 then the

normality decision is taken using Shapiro. The

Shapiro output shows significant value for the

Altman Models of 0.214 and a significant value for

the M- Score of 0.276, because the significant values

of the two models> 0.05, it can be concluded that the

calculated Altman Models and M-Score data are

distributed normally.

4.5 Descriptive Analysis

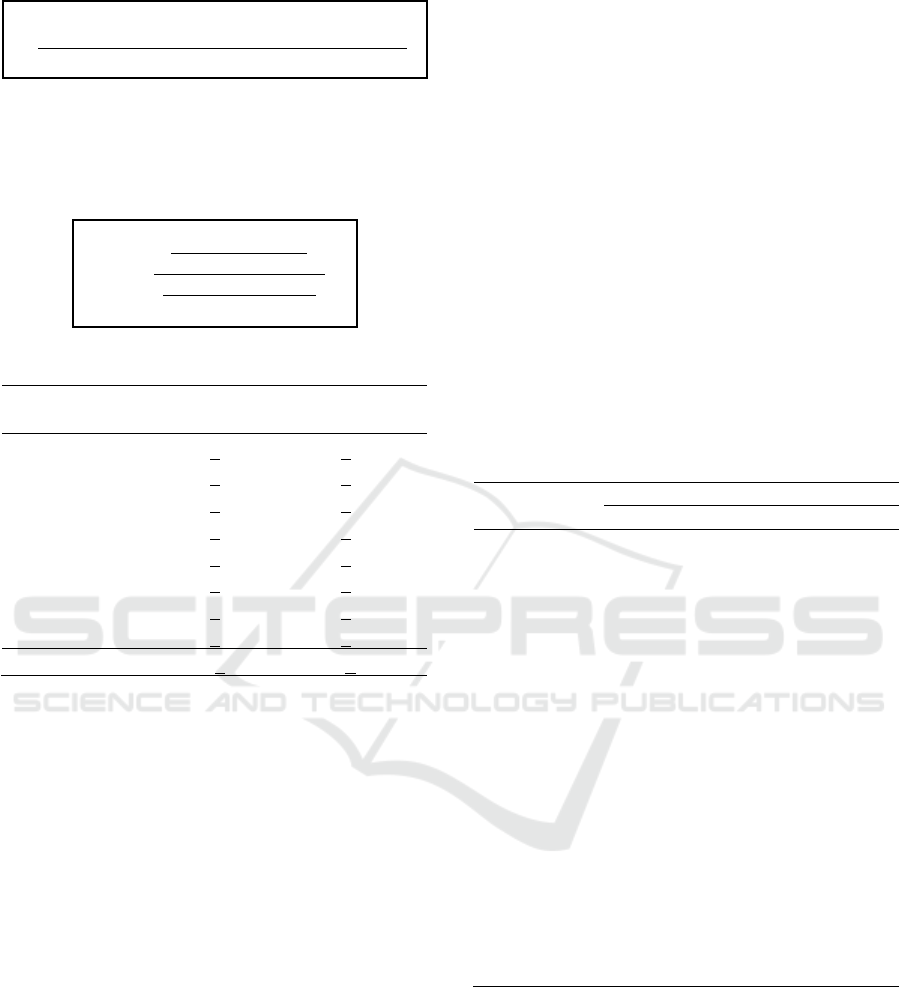

A summary of the company's conditions each year

from 2014 to 2018 using the Altman Models model is

as follows:

Figure 1: Company Conditions Using the Altman Models

Model

Overall based on the Altman Models results, the

property, and real estate sub-sector companies are in

a healthy condition. A summary of the company's

conditions each year from 2014 to 2018 using the

Beneish Models M-Score model is as follows:

Figure 2: Company Conditions Using the Beneish Models

Model

Analysis of Corporate Bankruptcy and Financial Statement Fraud Prediction using Altman Models and Beneish Models

159

Overall based on the M-Score results, the property

and real estate sub-sector companies in 2014-2018

were classified as manipulators.

The two tables above show that the majority of

companies are in good health, but on the other hand,

most companies are detected as manipulators every

year. This shows that an analysis of the company's

financial condition and the detection of simultaneous

financial statement fraud is needed.

4.6.1 The Company Is Predicted to Go

Bankrupt before Manipulated

Based on the results of table 3 and table 4 calculations

using the Altman Models model and Beneish Models

model, there are companies that are predicted to be

in the bankruptcy zone before being classified as a

manipulator. This states that the first hypothesis (H1)

is supported. The company is as follows:

1. Fortune Mate Indonesia (FMII) Company

In 2014, the Altman Models of 2.25 indicated that

the Fortune Mate Indonesia companies was in a

bankrupt condition and the M-score of -5.05 showed

that the company was not classified as a

manipulator. 1 year to 2 years after the company is

predicted to be bankrupt, namely in 2016 and 2017,

the Altman Models of 7.74 and 13.44 shows that

companies leaving the gray zone are in good health

but the M- Score is 2.50 and -0.69 shows that the

company is classified as a manipulator. In 2014 the

overall M- Score results did not indicate that the

company was classified as a manipulator, but the

SGAI ratio value indicated the potential for fraud.

4.6 Data Analysis of Hypotheses

The company's 2014 financial report found that sales

decreased by 14% while operations increased by

7%. Beneish Models stated that the value of the

SGAI ratio ≥1,040 indicates the potential for fraud. In

2015 and 2016 the company left the gray zone but

the M-Score results stated that the company was

classified as a manipulator. This shows that the

company is indicated to be healthy because based on

the financial statements, the company experienced

an increase in sales of up to 437% in 2015 and 68%

in 2016. Beneish Models said an increase in sales

with an SGI ratio of 61,610 indicates the potential for

fraud. In 2015 and 2016 there was also an increase in

the composition of the accruals of assets owned by

the company. Beneish Models state an increase in

accrual transactions in revenue recognition with a

TATA ratio of ≥0.031 indicates the potential for

fraud. In 2016 the value of the AQI ratio increased

by 0.95 from the previous year, Beneish Models

stated that an increase in the amount of non-current

assets with an AQI ratio value ≥1,250 indicates the

potential for fraud.

In 2017 and 2018 the results of the FMII company

Altman Models are still in good health and the M-

Score shows the company is not classified as a

manipulator. Each of the Beneish Models ratios if

examined shows that there is still a potential

indicated ratio of fraud. The ratio is the DSRI ratio

based on financial statements, the company has

difficulty in collecting cash from debtors, and sales

decreased by 9% in 2017. The AQI ratio shows the

potential for fraud because of an increase in the

amount of current assets that can provide benefits in

the future.

The LGVI ratio value in 2017 also shows that the

potential for fraud is due to an increase in the amount

of corporate debt by 120%. In 2018 the company is in

a healthy condition and only the LVGI ratio is

indicated to be a possible manipulator due to fraud

committed in the previous year. The financial

statements show an increase in the amount of debt up

to 221%. This shows that the analysis of each result

of the M-Score ratio value is needed to make a

decision.

2. Indonesia Prima Property (OMRE)

In 2014 the results of the Altman Models 1.51

showed that the Indonesian Prima Property

companies was gray or prone to bankruptcy and the

M-Score - 2.38 results showed that the company was

not classified as a manipulator. One year after the

company is predicted to be prone to bankruptcy,

namely in 2015 the Altman Models of 15.01 shows

the company coming out of the gray zone to be in a

healthy condition but the M-Score value of -2.03

indicates that the company is classified as a

manipulator. In 2014 the overall M-Score results did

not indicate that the company was classified as a

manipulator, but the SGAI ratio value indicated the

potential for fraud.

The company's financial statements show that

there was an increase in operating expenses on

decrease sales. Beneish Models states an increase in

operating expenses with a value of SGAI ratio ≥1,040

indicates the potential for fraud. In 2015 the

company came out of the gray zone but the M-Score

results stated that the company was classified as a

manipulator. This shows that in 2015 the company

was indicated to be healthy due to a decrease in asset

quality with an AQI ratio of ≥1,250.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

160

In 2016, 2017 and 2018, the company is in a

healthy condition and is not classified as a

manipulator, but if the M-Score ratio is analyzed one

by one, the value of the SGAI ratio 3 years in a row

will be potential for fraud. The financial report shows

that there was an increase in operating expenses by

1%, 0.82%, and 0.78% in sales which actually

continued to decrease. The value of the GMI ratio in

2017 also has the potential for fraud. A decrease in

profitability of the company's gross profit by 34% in

2017 caused the value of the GMI ratio ≥1,190 to

potential fraud. This shows that the analysis of each

result of the M-Score ratio value is needed to make a

decision.

The explanation above proves the existence of

companies that are in the gray zone or go bankrupt

before being classified as a manipulator. These results

are in accordance with the bankruptcy or the

condition of the company's financial difficulties can

lead to fraud (Albrecht, Albrecht, Albrecht, &

Zimbelman, 2012). This statement is in line with the

Fraud Triangle theory which states that one of the

causes of fraud is when under pressure and

opportunity (Cressey, 1953). Abuse of authority by

management is done to produce financial reports that

are always good so investors remain interested in

investing their capital (Jensen & Meckling, 1976).

This result is also in line with other research on

companies that have been declared cheating by using

the Altman Models model and Beneish Models

model, that prior to fraud, the company was in a

bankrupt situation (Kartikasari & Irianto, 2010)

(Maccarthy, 2017) (Abbas, 2017).

4.6.2 The Company Is Predicted to Be

Classified as a Manipulator before It

Is in the Bankruptcy Zone

Based on the results of the Altman Models and

Beneish Models Model calculations in table 3 and

table 4, there are companies that are predicted to be

classified as manipulators before being in the

bankruptcy zone. This states that the second

Hypotheses (H2) is supported. The company is as

follows:

1. APLN Company

Table 3 shows that in 2014 a Altman Models of

2.977 stated that the company was in good health

but an M-Score of -2.15 indicated the company was

classified as a manipulator from 2015 to 2018, after

being predicted to be classified as a manipulator, the

company's Altman Models value indicates a

bankrupt condition and is consistent with the

potential for fraud. The potential ratio variables for

fraud are as follows:

a. SGAI ratio value

In 2014 the sales increased by 7.5% but not in

accordance with the increase in operating expenses

and in 2018 it was known from the company's

financial statements, there was a 28% decrease in

sales resulting in an SGAI ratio ≥1,040 indicating a

potential for fraud due to the decrease prospects.

b. TATA ratio value

In 2014, 2015, 2016, and 2017, it is known that the

amount of cash generated from profits is low, namely

46%, 29%, 31%, and 36% of the operating profit

obtained. This causes the value of the TATA ratio

00.031 so that it is indicated the potential for fraud.

c. DSRI Ratio Value

In 2018 there was an increase in the amount of

receivables by 9.2% and a 28% decrease in sales

which led to a DSRI value of 41,460 which was

potential for fraud.

This explains that the fraud committed caused

bankruptcy and it will be difficult to stop committing

fraud because the company must continue to cover up

the fraud committed with other new frauds. Other

research states that this property issuer indeed carries

various bad records related to the condition of his

company.

2. BKSL Company

In 2014, the Altman Models was 2.98, which means

the company was in good health, but the M-Score

was - 1.57, indicating the company was classified as

a manipulator. A year after it was predicted to be

classified as a manipulator, the 2015 Altman Models

indicates that the company is prone to bankruptcy

and continues to have the potential for fraud. In2014

the company was in good health but there was a

decrease in profitability of the company's gross profit

by 45%, a decrease in the quality of fixed assets by

87%, and an increase in operating expenses by 29%

in sales which actually decreased by 26%. This causes

the value of the GMI ratio ≥1,190, the value of the

AQI ratio ≥1,250, and SGAI ≥1,040 which indicates

the potential for fraud.

In 2015, when the Altman Models showed that

the company was prone to bankruptcy, according to

information that the company had worsened due to

the decrease in gross profit because of the large

number of sales which fell after being caught in a

bribery case. In 2016, 2017, 2018, even though the

company left the bankrupt zone, the M-Score

Analysis of Corporate Bankruptcy and Financial Statement Fraud Prediction using Altman Models and Beneish Models

161

indicates the company was classified as a

manipulator. This shows that a company that looks

fine is not necessarily free from all forms of fraud.

Fraud detection analysis must be carried out before

the possibility of bankruptcy in the following years.

3. DART Company

In 2014 the Altman Models was 3.89, indicating that

the company was in good health but the M-Score of

7.64 indicated that the company was classified as a

manipulator from 2015 to 2018 after being predicted

to be classified as a manipulator, the company's

Altman Models value indicates a bankrupt and prone

to bankruptcy potential, except in 2016. The potential

ratio variables for fraud are as follows:

a. DSRI ratio

In 2014, 2015 and 2016 from the company's financial

statements known to increase receivables by

1,541%, 24%, and 23%. Beneish Models states if the

value of accounts receivable that increases with a

DSRI value of ≥1,040 are potential for fraud.

b. DEPI Ratio

In 2014, 2016, 2017, and 2018 there was a decrease

in depreciation of assets which actually increased.

Beneish Models stated that the delay in disclosure of

depreciation with a DEPI value of 01,077 is potential

for fraud.

c. SGAI ratio

From 2014 to 2018 the value of the SGAI ratio

≥1,040, which indicates the potential for fraud. Sales

increased in 2014 but were not in line with the

number of operational increases, and sales decreased

in the following years but operational expenses that

actually increased caused the company to be detected

as the potential for fraud.

d. TATA Ratio

In 2014, 2015 and 2017, it is known that the amount

of cash generated on earnings is low and this explains

that the fraud committed caused bankruptcy. In 2015

the company was in a bankrupt condition after being

classified as a manipulator with a very high M-score.

In 2016 it was known that PT Indonesian Rating

Agency had downgraded Duta Realty Company

rating due to the weakening of financial conditions.

This is consistent with the detection using the Altman

Models model that in 2015 the company was in

bankruptcy condition and in 2016 the company

ranking was lowered.

The explanation above proves the existence of

companies that are predicted to be classified as

manipulators before being in the gray zone or going

bankrupt. The results of this hypothesis analysis are

in accordance with the statement other research

which explains that in general bankruptcy

experienced by large companies is due to the

manipulation of financial statements (Irianto, 2003).

This statement is in line with the Fraud Triangle

theory which states that one of the causes of fraud is

the opportunity (Cressey, 1953). The opportunity is

owned by management as a party that is more

flexible about the company's financial statements

(Jensen & Meckling, 1976). The statement of other

research the desire and ambition to achieve a

company is often followed by fraud (Christy, Sugito,

& Abdul, 2015). Companies always want to have

financial reports that look good when the fraud can

actually lead to bankruptcy in the future.

4.6.3 Companies That Are Classified as

Manipulators Simultaneously Are Also

Predicted to Be in the Bankruptcy

Zone

Based on the results of the calculation of table 3 and

table 4 using the Altman Models model and Beneish

Models model, there are companies that are classified

as manipulators simultaneously also in the

bankruptcy code. This states that the third hypotheses

(H3) is supported. The company is as follows:

1. ASRI Company

Table 3 shows that in a row from 2014 to 2018, the

Altman Models value stated that the company was in

a bankrupt condition and the M-Score was as large as

indicating the company was classified as a

manipulator. The potential ratio variables for fraud

are as follows:

a. DSRI ratio

In 2014, 2015, and 2016 there was an increase in

receivables by 77% in 2014, a decrease in sales by

2.5% in 2015, and an increase in receivables by 51%

in 2016 and a decrease in sales resulting in a DSRI

value ≥1,040 indicating potential for fraud.

b. DEPI Ratio

In 2018 there will be a depreciation decrease of

21%. Beneish Models stated that the delay in

disclosure of depreciation with a DEPI value of

01,077 is potential for fraud.

c. SGAI ratio

In 2014 and 2018 the value of the SGAI ratio

≥1,040 indicated the potential for fraud. There was

ICAESS 2020 - The International Conference on Applied Economics and Social Science

162

an increase in sales, but operating expenses decreased

so the company was suspected to be a manipulator

as stated by Beneish Models.

d. TATA Ratio

In 2015 it was known that operating profit rose 75%

but the amount of cash generated was not significant

and caused the value of the TATA ratio ≥0.031 so

that it was indicated as a potential for fraud.

This explains that there is a relationship between

fraud and bankruptcy. This must be watched out

because the value of the company that does not

improve and running its operations through fraud can

ultimately cause the company to go bankrupt.

2. Cowell Development (COWL) Company

Consequently from 2014 to 2017, the Altman Models

value states that the company is in a bankrupt

condition and M-Score is equal to indicate the

company is classified as a manipulator, whereas in

2018 the company is not classified as a manipulator

but is in a bankrupt condition. In 2014 from the value

of DSRI, the company is predicted to overestimate the

number of sales, the value of TATA shows the amount

of cash generated from earnings is not appropriate,

and the value of LVGI shows an increase in the

amount of debt by 206%. The SGI ratio is also

detected as the potential for fraud because sales rose

sharply by 70% so it is feared that the company has

the drive to continue to maintain and raise the sales

target. In 2017 based on the very high DSRI value,

namely an increase due to an increase in receivables

by 77%, indicating companies are having difficulty

collecting cash from the debtors. In 2018, the

company is not classified as a manipulator but is

already in the bankrupt zone, but the ratio still has

SGAI value that has the potential for fraud. Cowell

Development Company in 2018 is predicted to be in

bankrupt condition with the lowest Altman Models

value among all property and real estate sub-sector

companies because it is known that in 2018 the

company was declared to have suffered a very high

loss of 162 Billion Rupiah.

3. DILD Company

Respectively from 2014 to 2018, the Altman Models

value states that the company is in a bankrupt

condition, and an M-Score value of indicates the

company is classified as a manipulator. The potential

ratio variables for fraud are as follows:

a. DSRI ratio

In 2015 and 2018 there was an increase in sales but

accounts receivable increased by 51% in 2015 and

65% in 2016 which resulted in a DSRI value

≥1,040 indicating potential for fraudulent.

b. GMI ratio

In 2015 there was a decrease in the profitability of

gross profit where there was an increase in sales by

16% but not significantly to the increase in gross

profit. Beneish Models stated the value of the GMI

ratio ≥1,190 potential for fraud.

c. SGAI ratio

In 2014, 2015 and 2016 the value of the SGAI ratio

≥1,040 indicated the potential for fraud. There has

been an increase in sales for 3 years in a row, but it is

not in accordance with the increase in operating

expenses so the company is suspected to be a

manipulator as stated by Beneish Models (Beneish,

1999).

d. TATA Ratio

From 2015 to 2017 it was found that the company

experienced a deficit that showed an increase in

accrual transactions in revenue recognition. TATA

ratio value 00,031 so that it is indicated the potential

for fraud.

In 2016 it was known that Indonesia Securities

Rating downgraded Development Company in

accordance with the Altman Models prediction that

the company was right in bankruptcy since 2015. This

shows that the company continued to commit fraud to

run its operations even though the fraud did not make

the company look good- fine. This condition is very

dangerous to the company's value if there is no further

effort to analyze and improve the company's prospects

going forward.

The explanation above proves the existence of

companies classified as manipulators is also predicted

to be in the gray zone or go bankrupt. This result is

in line with other research that companies that are

predicted to go bankrupt are also detected to

manipulate financial statements (Mavangere, 2015).

This is in line with the theory of Fraud Triangle

which states that one of the causes of fraud is when

there is an opportunity when management wants to

commit fraud and pressure when the company is in

bad condition so that fraud continues (Cressey, 1953).

Although the accuracy of the ratio of the Altman

Models model and the ratio of the Beneish Models

model is not 100%, it is better to detect it in order to

avoid unwanted losses in the future.

Analysis of Corporate Bankruptcy and Financial Statement Fraud Prediction using Altman Models and Beneish Models

163

Property business observer explained that the

condition of the property subsector over the past 5

years was indeed not conducive because it was still in

a phase of stagnation, one of the factors stemming

from the wait and see actions of investors towards the

political year and tax reporting. The use of the

Altman Models model and the Beneish Models

model together is very helpful to find out the actual

financial condition of the company rather than just

using the Altman Models model which shows the

property and real estate companies are in a healthy

condition but it turns out to be potential for fraud. The

detection of the Beneish Models model still has the

possibility of inaccuracy in classifying the company.

The explanation above proves the existence of

companies classified as manipulators is also predicted

to be in the gray zone or go bankrupt. This result is

in line with other research that companies that are

predicted to go bankrupt are also detected to

manipulate financial statements (Mavangere, 2015).

Other research which states that one of the

causes of fraud is when there is an opportunity when

management wants to commit fraud and pressure

when the company is in bad condition so that fraud

continues (Cressey, 1953). Although the accuracy of

the ratio of the Altman Models model and the ratio

of the Beneish Models model is not 100%, it is better

to detect it in order to avoid unwanted losses in the

future.

5 CONCLUSION

The author can conclude the three supported

hypotheses that there are companies that are predicted

to be in the bankruptcy zone before being classified as

a manipulator. This shows that the condition of the

company's financial difficulties can cause companies

to commit financial statements. There are companies

that are predicted to be classified as manipulators in

the bankruptcy zone. This shows that fraud will also

cause the company to be in a vulnerable condition to

go bankrupt or bankrupt. There are companies that are

predicted to be classified as manipulators

simultaneously and also predicted to be in the

bankruptcy zone. This states that the company

continues to commit fraud to carry out its operations

even though the fraud does not make the company

look okay. This also shows that the company's

bankruptcy conditions are vulnerable to fraud.

Stakeholders will be better protected when the

Altman Models model and the Beneish Models model

are jointly used to see the company's condition.

REFERENCES

Abbas, A. (2017). Earnings Fraud and Financial. 117-134.

Asia Pasific Fraud Journal.

ACFE. (2016). Report to Nations on Occupational Fraud

and Abuse Global Study 2016.

Albrecht, W. S., Albrecht, C. O., Albrecht, C. C., &

Zimbelman, M. F. (2012). Fraud Examination 4th

Edition. Natorp Boulevard: South-Weastern, Chengage

Learning.

Z-Score, E. I. (1968). Financial Ratios, Dscriminant. 589-

609. Journal of Finance.

Z-Score, Peck, & Hartzell, J. (1995). Emerging Markets

Corporate Bonds: A Scoring System. Wiley and Sons.

Beneish, M. D. (1999). The Detection of Earning

Manipulation. Financial Analysis Journal.

Christy, I. M., Sugito, & Abdul, H. (2015). Penerapan

Formula Beneish M-Score dan Analisis DIiskriminan

Linier untuk Klasifikasi Perusahaan Manipulator dan

Non Manipulator. 287-293. Jurnal Gaussian.

Cressey, D. (1953). Other People's Money: a Study in The

Social Psychology of embezzlment.

Deil, S. A. (2014, April 3). Retrieved from Liputan6.com:

https://www.liputan6.com/bisnis/read/2031867/ enron-

skandal-besar-perusahaan-energi-yang- cekik-investor.

Gumiwang, R. (2018). Kasus SNP Finance: Upaya

Menutup Celah Curang Keuangan. Retrieved from

tirto.id: www.tirto.id.

Irianto, G. (2003). Skandal Korporasi dan Akuntan.

Jensen, & Meckling. (1976). The Theory of The Firm:

Manajerual Behaviour, Agency Cost, and Ownership

Srucrute. 305-360. Journal of Financial and Economics.

Kartikasari, R. N., & Irianto, G. (2010). Penerapan Model

Beneish (1999) dan Model Altman Models (2000)

dalan Pendeteksian Kecurangan Laporan keuangan.

Jurnal Akuntansi Multiparadigma.

Maccarthy, J. (2017). Using Altman Models Altman

Models and Beneish M-Score Models to Detect

Financial Fraud and Corporate Failure: A Case Study of

Enron Corporation. 159-166. International Journal of

Finance and Accounting 2017.

Mavangere, K. (2015). Predicting corporate bankruptcy and

earnings manipulation using the Altman Models

Altman Models and Beneish M score. International

Journal of Management Sciences and Business

Research.

Pertiwi, H. A. (2015, October 20). Perusahaan dengan

Skandal Terbesar di Dunia. Retrieved from

www.economy.okezone.com.

Syakur, A. S. (2015). INTERMEDIATE ACCOUNTING.

Jakarta: AV Publisher.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

164