An Analysis of Financial Literacy Level on Participants in the

Polibatam Capital Market School Cooperation between Indonesia

Stock Exchange and PT Phillip Sekuritas Indonesia Batam Branch

Sonny Gunawan, and Muhammad Ramadhan Slamet

Department of Business Management, Politeknik Negeri Batam, Jl.Ahmad Yani, Batam, Indonesia

Keywords: Financial literacy, Capital Market Schools, Capital Markets.

Abstract: The purpose of this study is to determine the level of financial literacy of participants in the Polibatam capital

market school. This study's financial literacy aspects include aspects of personal basic financial knowledge,

loans and credit, savings and deposits, insurance, and investment. This research is a descriptive study of the

quantitative method. This study’s sample consists of 30 participants of Polibatam capital market school

between January to March 2020. This study's results indicated that the financial literacy level of Polibatam

capital market school participants between January to March 2020 as a whole is 84.8%. According to Chen

and Volpe, if the percentage is interpreted into the financial literacy level criteria, then 84.8% is in the high

category (> 80%).

1 INTRODUCTION

Every individual or student needs financial literacy,

which is a basic need. Financial problems can not

only be caused by income, but also from mistakes in

financial management, such as economic difficulties.

Therefore, every individual and student must have

financial literacy to minimize financial problems.

Financial literacy is a set of processes to increase

the confidence, knowledge, and skills of the wider

community to manage finances well. Indonesian

people have not used financial institutions properly,

even though financial literacy is a fundamental need

in managing finances. The low level of financial

literacy in Indonesian society has an impact on the use

of financial services. (Otoritas Jasa Keuangan, 2014).

In connection with that, Indonesia Stock

Exchange cooperates with several universities to

improve financial literacy in Indonesia. One of them

is Politeknik Negeri Batam. The college has

established a collaboration between Indonesia Stock

Exchange and PT Philip Sekuritas Batam Branch to

hold an investment gallery. One of the agenda, the

implementation of the Capital Market School or

commonly abbreviated as SPM.

Measurement of the level of financial literacy is

an essential thing for SPM participants. It aims to

determine the financial literacy profile of each

participant so that the SPM organizers can find out

potential investors in utilizing financial products and

services. Also, this measurement is useful for SPM

organizers to evaluate the material presented to adjust

the average level of participants' financial literacy.

2 LITERATURE REVIEW

2.1 Financial Literacy

Financial literacy is an essential requirement that is

needed for someone to avoid financial problems.

Financial problems can not only be caused by income,

but also from mistakes in financial management and

lack of knowledge in managing finances. Achieving

and improving the welfare of financial literacy

signifies individuals' ability to use the resources they

have (Dwiastanti & Hidayat, 2016). The level of

financial literacy by OJK is divided into four, namely:

1. Well literate is a skill in using service and

financial products and having knowledge and

confidence in financial institutions, including

features, benefits and risks, rights, and obligations

related to financial service products.

2. Sufficient literate is the ability to have confidence

and knowledge of financial institutions.

Gunawan, S. and Slamet, M.

An Analysis of Financial Literacy Level on Participants in the Polibatam Capital Market School Cooperation Between Indonesia Stock Exchange and PT Phillip Sekuritas Indonesia Batam

Branch.

DOI: 10.5220/0010353402050211

In Proceedings of the 2nd International Conference on Applied Economics and Social Science (ICAESS 2020) - Shaping a Better Future Through Sustainable Technology, pages 205-211

ISBN: 978-989-758-517-3

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

205

3. Less literate is an ability that only knows financial

institutions and products.

4. Not literate is having no skills in using financial

products and services and knowledge, and

confidence in financial institutions.

Financial literacy, in general, can be divided into

two, namely basic financial literacy and advanced

financial literacy (Lusardi, 2011).

1. Basic financial literacy

Basic financial literacy is centred on a

fundamental question: does someone have the

necessary level of financial knowledge needed to

make financial decisions.

2. Advanced financial literacy

More knowledge is needed compared to

fundamental knowledge in making savings and

investment decisions. This statement states that

someone who knows advanced finance will

understand risk and income: how bonds, stocks,

and mutual funds work, and basic asset pricing.

2.2 Aspects of Financial Literacy

According to Nababan & Sadalia (2012) explanation

in financial literacy, there are several aspects, which

include:

1. Basic Personal Finance, namely about the basic

knowledge possessed by individuals in

understanding the financial system such as

inflation, interest rates, asset liquidity, credit, and

so forth.

2. Cash Management (money management), i.e.,

one's ability to manage finances appropriately and

adequately. If an individual manages his finances

well, he has the right level of financial literacy.

3. Credit and Debt Management, namely the process

of activities that are interconnected between one

another in a structured manner in the process of

collecting and presenting information about a

bank's credit. In contrast, debt management is a

debt payment system that involves third parties in

assisting debt lending.

4. Saving (Savings), which is the portion of a

person's income that is not used for consumption,

but instead is allocated to be savings. Study

someone how they can set aside a portion of their

income source for savings and manage it.

2.3 Capital Market School

According to the Indonesia Stock Exchange (2017),

the Capital Market School (SPM) is an educational

program that is regularly held by the Indonesia Stock

Exchange (IDX). The purpose of this educational

program is to help all levels of society better

understand the procedures for becoming an investor

in the capital market. SPM is divided into two levels:

1. SPM level 1 which is intended for people who

have never been a stock investor. Participants

will get material on investments, especially

stock investments and how to invest shares in

the Indonesian capital market and a general

description of the capital market.

2. SPM level 2, namely an Investment Workshop

intended for people who have become stock

investors in the Indonesian capital market.

Participants must bring proof of SID by carrying

an access card or trading transaction

confirmation of shares when they take SPM

level 2. SPM level 2 can also be followed by

SPM level 1 participant on the same day. The

participants will learn about fundamental

analysis and technical analysis as a basis for

choosing stocks to be invested.

2.4 Capital Market

Article 1 number 13 of Law No.8 of 1995 states,

"Capital Market is a market that has activities to

conduct public offerings and trade in securities

involving public companies and institutions and

professions related to securities." Meanwhile, the

Stock Exchange is an institution that provides

facilities and systems and organizes to bring together

securities sellers and buyers of other parties with the

intention of trading securities among market

participants.

2.5 Capital Market Function

According to Tandelilin (2001), a capital market is a

meeting place for sellers and buyers of securities that

risk profit and loss. In essence, the capital market has

two market functions, namely:

1. Intermediary institutions have an essential role in

supporting the economy; therefore, the capital

market can involve parties who have excess funds

with those who need funds.

2. Encouraging the creation of efficient fund

allocations; this is due to the existence of a capital

market. The party with excess funds (investor)

can choose investment alternatives that provide

optimal returns.

According to Sunariyah (2006), the function of

the capital market in a country is as follows:

1. As a place to interact between sellers and buyers

to determine the price of shares or securities

traded.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

206

2. Provide opportunities for investors to determine

the expected return.

3. Provide an opportunity for investors to resell their

shares or other securities.

4. Provide opportunities for all people to be able to

participate in the development of a country's

economy.

5. Reducing information and transaction costs for

securities.

2.6 Capital Market School Instruments

Tandelilin (2001) explains that capital market

instruments are all securities that are traded generally

in the capital market. According to Law No. 8 of 1995

concerning the capital market, securities represent all

commercial debt securities, receipts of debt, bonds,

shares, credit securities, every right, option, warrants,

or derivatives of securities or all instruments

designated as securities.

In general, securities traded through the capital

market include bonds, shares, mutual funds, and

derivative instruments. The following is an

explanation of the following instruments as follows:

1. Shares are proof of ownership of a person on the

assets of a company. One of the most popular

types of instruments in the capital market is stocks.

Investors who own shares will receive dividends

and take advantage of fluctuations/increases in

share prices by reselling the shares to obtain

profits that are commonly called capital gains.

2. A bond is a certificate that contains a contractual

agreement between the company and the investor.

It states that the investor has lent some money to

the company (the issuer) as the bondholder. Each

company that issues bonds should pay interest

regularly by a predetermined period and the

principal at maturity.

3. A mutual fund is a certificate stating that someone

entrusts a certain amount of money to a securities

company to be managed by a professional

investment manager, to be used as capital to invest

in the capital market or the money market.

4. Derivative instruments are derivatives of other

securities. These instruments cause the value of

derivative instruments is highly dependent on the

price of other securities. In general, types of

derivative instruments include proof of rights

(right issue), options, warrants, and futures.

3 RESEARCH METHOD

3.1 Research Object

This research object is Polibatam Capital Market

School Cooperation Between Indonesia Stock

Exchange and PT Phillip Sekuritas Indonesia Batam

Branch.

3.2 Sample Research

This research uses a sample convenience method.

Here are the sample criteria of this research, ie.

1. Participants of Polibatam Capital Market School

(SPM) cooperation between Indonesia Stock

Exchange and PT Phillip Sekuritas Indonesia

Batam Branch.

2. Participated in the Capital Market School (SPM)

period from January to March 2020.

According to Roscoe Sugiyono in Mamik (2015),

determining the minimum number of samples in this

study follows the provisions of 30 respondents.

3.3 Data Collection Method

In this study, the method of data collection is a

questionnaire. This questionnaire is a collection of

questions about investments, general financial

knowledge, loans, insurance, savings, and

investment. The questions adopted from the question

are in the research of Chen and Volpe in the year

1998. One correct question will get a score of 1 if the

wrong answer will get a score of 0. Here is the

formula (1).

=

x 100% (1)

The calculation result will be compared with the

criteria of financial literacy, according to Chen and

Volpe.

Table 1: Financial literacy level.

FinancialLiteracyLevel TheCorrectNumberof

Questions

Low <60%

Middle 60‐80%

High >80%

An Analysis of Financial Literacy Level on Participants in the Polibatam Capital Market School Cooperation Between Indonesia Stock

Exchange and PT Phillip Sekuritas Indonesia Batam Branch

207

3.4 Data Analysis Method

The data analysis method used is descriptive. This

method outlines and describes the data that has been

collected without making a general conclusion

(Sugiyono, 2014). In this study, it will be described

and spelled out related to the condition of financial

literacy of the capital market school participants in

Politeknik Negeri Batam.

4 RESULTS AND DISCUSSION

4.1 Results of Collected Data

Processing

This study aims to determine the condition of the

description of the participants' financial literacy level

in the Polibatam capital market school between

January to March 2020. By filling out the

questionnaire that has been distributed, it will

describe the financial literacy level of the Polibatam

capital market school participants with the

convenience sampling technique. The questionnaires

distributed by researchers to participants in the

Polibatam capital market school in 2020 were 102

participants who attended the capital market school in

the January-March period. However, 35

questionnaires were received back. Only 30

questionnaires met the criteria for further data

processing, while five questionnaires were deemed

inappropriate because they did not meet the criteria

set. The results of processing the collected data can

be seen in Table 2 below:

Table 2: Questionnaire data collected.

Total

Numberofquestionnairesdistributed 102

Numberofquestionnairesreceivedback 35

Numberofquestionnairesthatcannotbe

processed

5

Numberofquestionnairesthatcanbe

processed

30

Questionnaire distribution data based on

participants who attended the capital market school in

January-March 2020 can be seen in table 3 below:

Table 3: Questionnaire Distribution Data for January –

March.

Month

Number of

Respondent

Percentage

January 2 7%

February 2 23%

March 21 70%

Total 30 100%

Based on table 3 above, the number of

respondents who have filled out the questionnaire in

January is 7% and the number of respondents in

February is 23%, and the number of respondents in

March is 70%. It can be said that most of the

respondents who filled out the most questionnaires

were capital market school participants in March

2020.

4.2 Characteristics of Respondents

Based on table 4 below, from the 30 respondents, the

number of respondents who are male was 6.7%, and

the number of female respondents was 93.3%,

meaning that most respondents are female. This is

because based on the data of respondents who register

for capital market schools, it tends to be mostly

women than men. It is because of the results of

research conducted by Krishna et al. (2010) in their

research found that women tend to understand

financial literacy better than men. The number of

respondents who have 0-20 years of age is 40%, and

the number of respondents who have 20-40 years of

age is 60%. The number of respondents who have an

income level of <10 million is 86.7%. The number of

respondents who have an income level between 10-

50 million is 10%, and 3.3% of respondents have an

income level between 50-100 million.

Table 4: Characteristics of respondents.

Characteristics Numberof

respondents

%

Gender:

1.Male 2 6.7%

2.Female 28 93.3%

Age:

1.0‐20 12 40%

2.20‐40 18 60%

IncomeLevel(Rp)

1.<100million 26 86.7%

2.10‐50million 3 10%

3.50–100million 1 3.3%

ICAESS 2020 - The International Conference on Applied Economics and Social Science

208

4.3 Overall Financial Literacy Level

The results of the study of the level of financial

literacy in the participants of the Polibatam capital

market school between January to March 2020 can be

seen in Table 5.

The way to obtain the results of calculating the

level of financial literacy is that all correct answer are

calculated divided by the number of questions then

multiplied by 100%. The lowest score is the

respondent who can only answer 17 questions

correctly from 25 questions given (68%). The highest

score is the respondent who can answer 24 questions

correctly from the 25 questions given (96%). The

average of respondents can answer the question

correctly at 84.8%, which shows that the level of

financial literacy of Polibatam capital market school

participants between January to March 2020 is high

(> 80%).

Table 5: Percentage of overall financial literacy level.

Descriptive

statistics

Percentageof

financialliteracy

level

Financial

literacylevel

Minimum 68% Middle

Maximum 96% High

Average 84.8% High

4.4 Financial Literacy Level

Table 6 below shows that 73.33% of respondents

have a high level of financial literacy that can answer

questions correctly above 80%. Only 26.67% of

respondents have a middle level that can answer

questions correctly between 60% -80%, and none of

the respondents answered the question correctly

below 60% (low).

Table 6: Financial literacy level.

Financial

LiteracyLevel

Numberof

Respondents

Percentage

Low 0 0%

Middle 8 26.7%

High 22 73.3%

Total 30 100%

4.5 Percentage of Respondents

Answered Each Question Correctly

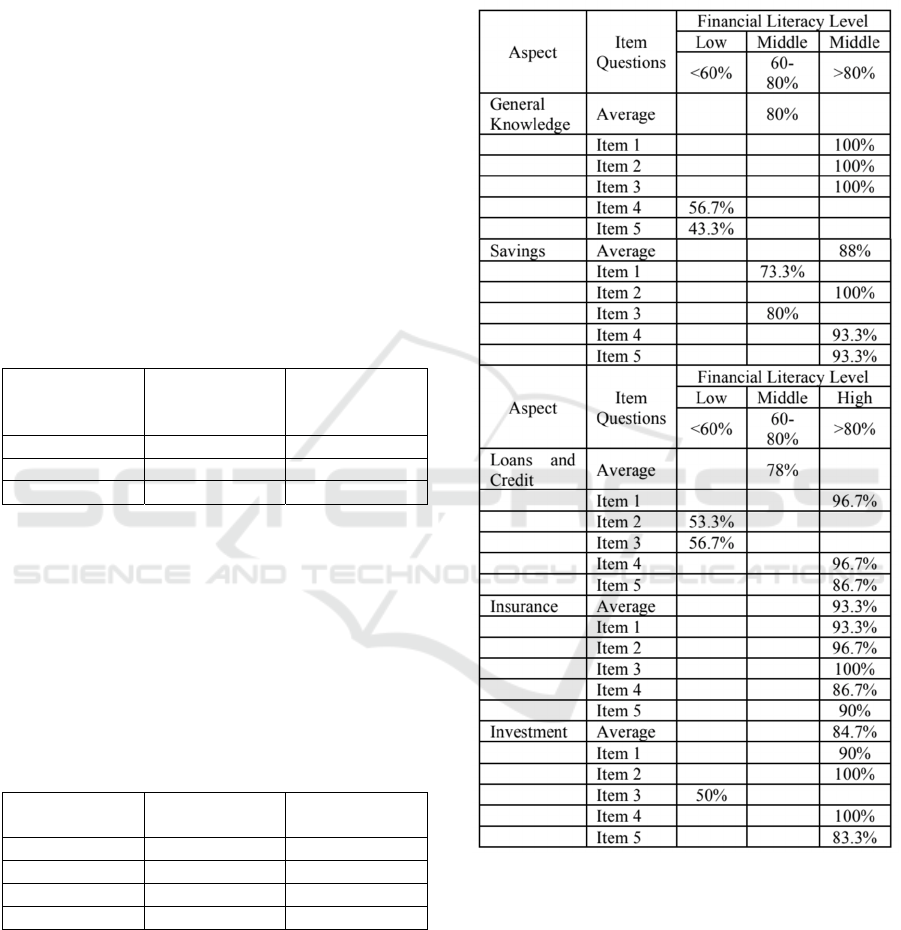

Table 7: Percentage of Respondents Answered Each

Question Correctly

Table 7 below shows the percentage of the

number of respondents who can answer each part of

the question correctly and the average percentage of

correct answers for each aspect of the question. In the

aspect of general knowledge of personal finance, it

can be seen in question item number 1,2,3 that the

correct answer of the respondent is 100%, while the

item questions number 4 and 5 are 56.67% and

43.33%. It can be seen that the average percentage of

correct answers in the aspect of general knowledge of

personal finance is 80% (intermediate category). It is

An Analysis of Financial Literacy Level on Participants in the Polibatam Capital Market School Cooperation Between Indonesia Stock

Exchange and PT Phillip Sekuritas Indonesia Batam Branch

209

known that the general knowledge aspect of personal

finance in question items number 4 and 5 falls into the

low literacy level category because the understanding

and knowledge of personal finance regarding

financial concepts is still too low.

In the aspect of savings and savings, it can be seen

in question item number 1 that the respondent's

correct answer is 73.33%, item questions number 2

and 3 are 100% and 80%, while question items

number 4 and 5 are 93.33%. It can be seen that the

average percentage of correct answers in terms of

correct savings and savings is 88% (high category).

In the aspect of loans and credit, it can be seen in

question item number 1 that the respondent's answer

is correct, namely 96.67%, item questions number 2

and 3 are 53.33% and 56.67%, while question items

number 4 and 5 are 96.67% and 86.67%. It can be

seen that the average percentage of correct answers in

the aspect of loans and credit correctly is 78% (middle

category). It is known that the loan and credit aspects

in question items 2 and 3 fall into the low literacy

level category, this is due to a lack of understanding

of loan concepts related to the use of credit,

determination of credit interest, and credit rating. This

is because few of the capital market school

participants use credit cards to support their daily

needs. They think that they don't really need credit

services.

In the insurance aspect, it can be seen in question

item number 1 that the respondent's correct answer is

93.33%, question items number 2 and 3 are 96.67%

and 100%, while question items number 4 and 5 are

86.67% and 90%. It can be seen that the average

percentage of correct answers in the aspect of

insurance correctly is 93.33% (high category).

In the investment aspect, it can be seen in question

item number 1 that the respondent's correct answer is

90%, question items number 2 and 4 are 100%, while

question items number 3 and 5 are 50% and 83.33%.

It can be seen that the average percentage of correct

answers in the aspect of investing correctly is 84.67%

(high category).

Table 7 shows the percentage of respondents'

answers to each question item correctly. In Table 4.8,

it can be seen that the lowest level of financial literacy

among participants in the 2020 Polibatam capital

market, namely in terms of loans and credit

amounting to 78% and the highest is from the aspect

of insurance amounting to 93.33%.

5 CONCLUSIONS

Based on the results, it can be seen that the overall

level of financial literacy of respondents as a whole is

84.8%, or it can be said that the financial literacy level

of capital market school participants is categorized as

high. This result shows that each capital market

school participant's knowledge of financial literacy is

good enough. Polibatam capital market school

participants understand proper financial management

and can take advantage of financial products and

services and implement them in their daily lives.

From the results of the data analysis and conclusions

above, there are some suggestions, including the

following:

1. For capital market school participants

Overall, the level of financial literacy possessed

by capital market school participants can be said

to be good. Participants are expected to enhance

their more complex financial literacy further and

can choose investment alternatives with high

investment risks and adequate investment

knowledge.

2. For Polibatam capital market school organizers

Polibatam capital market school organizers can

adjust the content or material to be delivered to

capital market school participants with the

average level of financial literacy of capital school

participants.

3. For further researchers

Further researchers will be able to pay more

attention to factors such as age, gender,

achievement index value, and the respondent's

demographic background and pay more attention

to other determinants that are thought to affect the

personal level. So, it is hoped that further

researchers pay more attention to these factors to

obtain better data.

REFERENCES

Indonesia stock exchange. 2017. Capital Market School

Information. Retrieved from the Capital Market School:

https://sekolahpasarmodal.idx.co.id/informasi

Indonesia stock exchange. 2018. Introduction to the Capital

Market. Retrieved from Law of the Republic of

Indonesia Number 8 of 1995 Concerning Capital

Markets: https://www.idx.co.id/investor/pengantar-

pasar-modal/

Chen, H., & Volpe, R.P.. 1998. An Analysis of Personal

Financial Literacy Among College Students. Financial

Services Review, 107-128.

Dwiastanti & Hidayat. 2016. Financial literacy of

housewives in shaping financial behavior in the city of

ICAESS 2020 - The International Conference on Applied Economics and Social Science

210

Malang. Malang: Journal of the national accounting

seminar.

Lusardi, A., &. M., & OS. 2011. Financial literacy around

the world and an overview. Journal of pension

economics & finance., 497-508.

Mamik. 2015. Qualitative Methodology. Jakarta: Zifatama.

Nababan, D., & Sadalia, I. (2012). Analisis personal

financial literacy dan financial behavior mahasiswa

strata I fakultas ekonomi. Personal Financial Literacy,

Financial Behavior,College Student, 6-7.OJK. 2014.

National Strategy on Financial Literacy. Jakarta:

Directorate of Literacy and Education.

OJK. 2019. OJK survey press release 2019. Retrieved from

the Financial Services Authority:

https://www.ojk.go.id/id/berita-dan-kasil/siaran-

pers/Pages/Siaran-Pers-Survei-OJK-2019-Indeks-

Literacy-and-Inclusion-Finance-Increased.aspx

Sugiyono. 2014. Qualitative Quantitative Research

Methods and R&D. Bandung: Alfabeta.

Sunariyah. 2006. Introduction to Capital Market

Knowledge, Fifth Edition. Yogyakarta: UPP STIM

YKP.

Tandelilin, E. (2001). Analisis Investasi dan Manajemen

Portofolio Edisi Pertama. Yogyakarta: BPFE.

An Analysis of Financial Literacy Level on Participants in the Polibatam Capital Market School Cooperation Between Indonesia Stock

Exchange and PT Phillip Sekuritas Indonesia Batam Branch

211