Role of E-Commerce and Own Capital in Income through Loan

Capital as Intervenning Variables:

Empirical Study in Sumenep Regency

Istiyanatul Mahbubah

Universitas Bahaudin Mudhary Madura

Keywords: E-Commerce, Equity, Equity Loans, Revenue.

Abstract: Micro, Small and Medium Enterprises (SMEs) are the most important part in the economy. Many government

efforts to assist the Development SMEs by providing a forum for businesses in the form of credit loan capital

is expected to encourage businesses to increase revenue. The purpose of this study was to determine the

influence of their E-Commerce, own capital and loan capital directly and the indirect effect between equity

and income through the business premises against the loan capital. This research was conducted in SMEs in

Sumenep. Research carried out by conducting a survey with a questionnaire. The data used in this study are

primary data, while the analysis method used is the analysis of lane or path analysis to determine the effect,

directly and Sobel test to determine the effect indirectly. The analysis showed the capital itself has a positive

influence on capital loans and E-Commerce has a positive influence on the loan capital. E-Commerce and

loan capital has a positive effect on income.

1 INTRODUCTION

The development of the increasingly complex world

of technology encourages each individual or group to

apply in all activities. The current era of globalization

is also known as the New Economy Era (New

EconomyEra), the Digital Economy Era. The New

Economic Era was marked by the application of

Information Technology in carrying out its economic

activities. The application of Information Technology

is now needed in the current era of globalization. The

application of Information Technology required is the

development of a web-based business application

model for Small and Medium Enterprises to increase

competitive advantage and to increase sales.

The growth of MSMEs in Sumenep district has

increased from year to year, this is evidenced by the

turnover rate received by some MSMEs, but there are

some MSMEs that have not increased, if we look

more deeply why these players have a significant

increase in turnover because of wider service

coverage.

Currently in the world of commerce there is no

reach of space and time, people are required to trade

by providing services and goods quickly, in addition

to the development of information technology can

now improve performance quickly, precisely and

accurately, advances in information technology

encourage companies carry out new sales and

marketing practices until the provision of services and

goods can be done quickly. The internet is one part of

advances in information technology. Consumers

around the world can access the internet anywhere.

The lifestyle of consumers who are now becoming

more instantaneous.

One of the opportunities that must be exploited by

micro, small and medium enterprises is the use of

advances in information technology that can be

carried out by Micro, Small and Medium Enterprises

in providing fast, precise and accurate services is by

using Electronic Commerce or E-Commerce.

According to previous research conducted by

(Helmalia & Afrinawati, 2018) concluded that E-

commerce has an effect on increasing the income of

MSMEs. Another opportunity that MSMEs get is the

existence of government policies that have made

efforts to enable small and medium-sized businesses

to broaden their horizons about opportunities and

challenges through online systems or commonly

known as e-commerce. The drafting of government

regulations which are e-commerce regulations is

mandated by Law 7/2014 on trade.

262

Mahbubah, I.

Role of E-Commerce and Own Capital in Income through Loan Capital as Intervenning Variables: Empirical Study in Sumenep Regency.

DOI: 10.5220/0010307400003051

In Proceedings of the International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies (CESIT 2020), pages 262-268

ISBN: 978-989-758-501-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Capital is an important thing in a business to be

built, in a business it is not only needed for own

capital but also assisted by loan capital. The existence

of loan capital will affect the increase in income and

business productivity (Meisthya Pratiwi, 2013)

According to previous research conducted by

Riawan & Wawan Kusnawan (2018), increased

income is also influenced by capital, based on

observations and interviews that it turns out that many

MSME players find problems regarding the lack of

capital they have so that business development is

hampered.

The lack of capital in Sumenep district makes it

difficult for small businesses to develop due to the

lack of capital they have, and the need for additional

funds from third parties, either in the form of

additional from the government or in the form of loan

funds from banks.

The purpose of this study was to determine the

effect of Ecommerce and Own Capital on Increasing

Income of Micro, Small and Medium Enterprises in

Sumenep Regency through the Intervening variable

of Loan Capital. Given that E-commerce has recently

been favored by both large and small producers and

retailers in general, this is because promotion through

online media is easier to reach consumers in terms of

introducing or selling their products. E-commerce

makes it easier for consumers and producers to make

transactions.

2 LITERATUR REVIEW

2.1 Business Process Reengineering

According to Peppard (1995, p.20), it is stated that

Business Process Reengineering is a development

philosophy which leads to achieving steps in

developing company performance by redesigning

existing processes throughout the organization. The

same thing is stated by Brown (1999, p.336), that

Business Process Reengineering is a radical business

redesign which tries to achieve improvement in

business processes by questioning business

assumptions or rules related to organizational

structures and procedures.

Based on the above definitions, it can be

concluded that Business Process Reengineering is a

way of thinking about development by planning and

redesigning business processes related to

organizational structures and procedures to achieve

certain goals.

2.2 E-Commerce

Electronic Commerce (E-Commerce) or better

known as Online Shopping is the implementation of

commerce in the form of sales, purchase, ordering,

payment, or promotion of a product, goods and / or

services made by utilizing computers and digital

electronic communication facilities or data

telecommunications. In addition, this form of

commerce can also be done globally, namely by using

the internet network (Kuswiratmo, 2016: 163).

E-commerce is useful in reducing administrative

costs and business process cycle times, and

improving relationships with both business partners

and customers. (Suhartini, dwi, et al, 2018)

Several definitions have been given for e-

commerce (electronic commerce). Martin et al, define

e-commerce as the use of IT to carry out business

activities between two or more organizations, or

between an organization and one or more end-

customers, through one or more computer networks

(Jogianto, 2005: 286).

2.3 Capital

Capital is the main thing in running a business,

including trading. Capital is all forms of wealth used

in the production process or to produce output.

Capital is wealth that can generate profits in the

future.

The capital used can be sourced from your own

capital, but if it turns out that your own capital is not

sufficient, you can add loan capital. So, in general, the

types of capital that can be obtained to meet their

capital needs consist of own capital and loan capital.

(Suyadi Prawirosentono, 2001: 118)

The definition of capital in this study is the cost

used to produce or buy merchandise and day-to-day

operations, either from own capital or from other

sources. Capital in this study is measured by the

average monthly capital in rupiah units.

Capital According to the Source:

a. Own Capital / Net Worth / Internal Resources.

This source comes from the owners of the

company or comes from within the company,

for example the sale of shares, member savings

in the form of a cooperative business, this

wealth itself has a characteristic, namely being

permanently tied to the company.

b. Foreign capital / foreign assets / external

sources.

This source comes from outside the company,

namely in the form of long-term or short-term

loans. Short-term loans, namely loans with a

Role of E-Commerce and Own Capital in Income through Loan Capital as Intervenning Variables: Empirical Study in Sumenep Regency

263

maximum maturity of one year, while loans

with a maturity of more than one year, are

called long-term loans. The characteristic of

this foreign wealth is that it is not permanently

bound, or only temporarily bound, which at any

time will be returned to the lender (Buchari

Alma, 2012: 249).

2.4 Income

Income is the maximum value that can be consumed

by a person in a period by expecting the same

condition at the end of the period as in the original

state. This definition does not emphasize the

quantitative total expenditure on consumption of a

period, in essence, income is the receipt or

remuneration of the factors of production, revenue is

the producer 's receipt in the form of money obtained

from the sale of goods produced.

According to Keynes, income is changes in the

number of production factors used and changes in the

ability of each unit of production factors to generate

income (Rosyidi, 2003: 46). Income is the result of

selling production factors that are owned to the

production sector. In macroeconomics, income is the

value of goods and services produced in a single year

period in a country.

2.5 Micro Small and Medium

Enterprises

In law number 20 of 2008 concerning micro, small

and medium enterprises (MSMEs), the definition of

MSMEs is as follows:

a. Micro enterprises are productive businesses

owned by individuals and / or individual

business entities that meet the criteria of micro

enterprises as regulated in this Law.

b. Small Business is a productive economic

business that stands alone, which is carried out

by an individual or a business entity that is not

a subsidiary or branch of a company that is

owned, controlled, or is a part, either directly or

indirectly, of a Medium or Large Business that

meets the criteria of a Business. Small as

referred to in this Law.

c. Medium Business is a productive economic

business that stands alone, which is carried out

by an individual or business entity that is not a

subsidiary or branch of a company that is

owned, controlled, or is part of, either directly

or indirectly, with a Small or Large Business

with a total net worth or annual sales as

regulated in this Law.

Criteria for Micro, Small and Medium Enterprises

The criteria for Micro, Small and Medium Enterprises

according to Law Number 20 of 2008 in article 6

chapter IV are as follows:

a. Micro Business Criteria are as follows:

1) Have a net worth of at most Rp. 50,000,000.00

(fifty million rupiah) excluding land and

buildings for business; or

2) Have annual sales proceeds of not more than Rp.

300,000,000.00 (three hundred million rupiah).

b. Small Business Criteria are as follows:

Has a net worth of more than Rp. 50,000,000.00

(fifty million rupiah) up to Rp. 500,000,000.00 (five

hundred million rupiah) excluding land and

buildings for business premises; or have annual

sales of more than Rp. 300,000,000.00 (three

hundred million rupiah) up to a maximum of Rp.

2,500,000,000.00 (two billion five hundred million

rupiah).

c. Medium Business Criteria are as follows:

1) Have a net worth of more than Rp.

500,000,000.00 (five hundred million rupiah)

up to a maximum of Rp. 10,000,000,000.00

(ten billion rupiah) not including land and

buildings for business premises.

2) Have annual sales of more than Rp.

2,500,000,000.00 (two billion five hundred

million rupiah) up to a maximum of Rp.

50,000,000,000.00 (fifty billion rupiah).

3 RESEARCH METHODOLOGY

3.1 Types and Design of Research

This research researchers use a quantitative approach.

Quantitative method is a research method which can

be interpreted as a research method based on the

philosophy of positivism, used to research on certain

populations or samples, data collection using research

instruments, quantitative data analysis in order to test

predetermined hypotheses.

3.2 Population and Sample

Population and sample in this research are all research

subjects, if the researcher wants to examine all the

elements in the research area, the research is called

population research. The study or research is called a

population study. (Arikunto S, 2006), in this case the

research subjects were SMEs engaged in food in

Sumenep district with a total of 30 respondents.

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

264

3.3 Data Analysis Techniques

This study uses data analysis techniques using the

Smart PLS version 3 tool which runs on computer

media. According to Abdillah (2018) PLS (Partial

Least Square) as a prediction model does not assume

a certain distribution to estimate parameters and

predict quality relationships, therefore parametric

techniques to test significant parameters are not

needed and the evaluation model for prediction is

nonparametric. PLS model evaluation is done by

evaluating the outer model and inner model.

3.4 Structural Model (Inner Model)

The structural model in this study is evaluated using

R ^ 2 for the dependent construct, the path coefficient

or t-values for each path to be tested for significance

between constructs in the structural model. The value

of R ^ 2 is used to measure the degree of variation in

changes in the independent variable on the dependent

variable. The higher the R ^ 2 value, the better the

prediction model of the proposed research model.

However, R ^ 2 is not an absolute parameter in

measuring the accuracy of the prediction model

because the theoretical basis of the relationship is the

most important parameter to explain the causality

relationship.

3.5 Hypothesis Testing (Path Analysis)

The path analysis model aims to determine the effect

of the independent variable on the dependent

variable, either directly or indirectly. Supriyanto and

Maharani (2013: 74-75) explain the steps in path

analysis, namely as follows:

1. Designing models based on concepts and

theories

2. An examination of the underlying assumptions.

The assumptions underlying Path are:

a. The relationship between variables is linear

and adaptive

b. Only recursion models can be considered, that

is, only one-way causal systems. Meanwhile,

the model containing reciprocal causal cannot

be done with path analysis.

c. Endogenous variables at least in interval

measure

d. Observed variables are measured without

error (measurement instruments are valid and

reliable)

The analyzed model is correctly identified based on

the relevant theories and concepts, if the path analysis

has been carried out based on the sample.

4 FINDING AND DISCUSSION

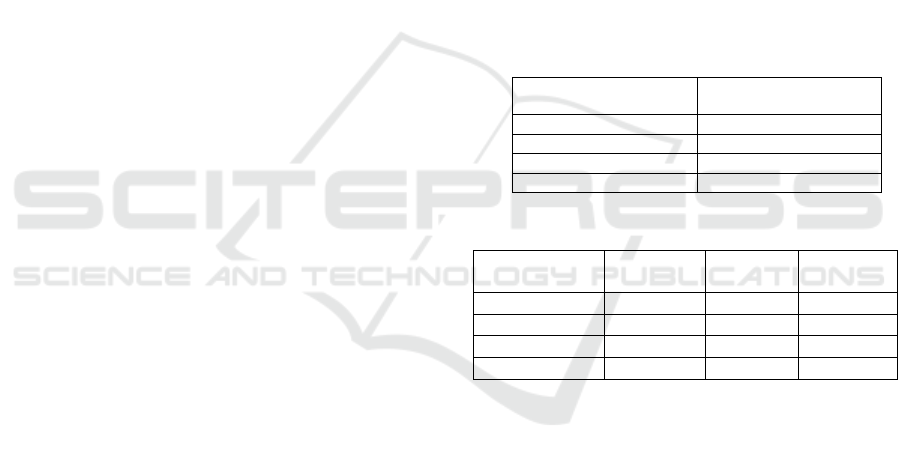

Based on the data presented in table 1 above, it is

known that the AVE value of all variables is > 0.5.

Thus it can be stated that each variable has good

discriminant validity.

4.1 Reliability Test

Composite Reliability is the part used to test the

reliability value of indicators on a variable. A variable

can be declared to meet composite reliability if it has

a composite reliability value > 0.6. The reliability test

with composite reliability can be strengthened by

using the Cronbach alpha value. A variable can be

declared reliable or satisfies Cronbach alpha if it has

a Cronbach alpha value > 0.7. The following is the

composite reliability value of each variable used in

this study:

Table 1: Average Variance Extracted (AVE).

Avrage Variance

Extracted (AVE)

E-Commerce 0,775

Loan Capital 0,508

Own Capital 0,602

Income SMES 0,502

Table 2: Composite Reliability.

Cronbach's

Alpha

Composite

Reliability

Ket

E-Commerce 0,902 0,932 Reliabel

Loan Ca

p

ital 0,859 0,891 Reliabel

Own Ca

p

ital 0,869 0,900 Reliabel

Income SMES 0,858 0,889 Reliabel

Based on the data presented in table 2 above, it

can be seen that the composite reliability value of all

research variables is> 0.6 and the Cronbach alpha

value of each research variable is> 0.7. These results

indicate that each variable has met the composite

reliability and Cronbach alpha so it can be concluded

that all variables have a high level of reliability.

4.2 Structural Model (Inner Model)

The structural model is used to show how strong is

the effect or influence of the independent variable on

the dependent variable. Meanwhile, coefficient

determination (R-Square) is used to measure how

much the endogenous variable is influenced by other

variables.

Chin stated that the R2 result of 0.67 and above

for endogenous latent variables in the structural

Role of E-Commerce and Own Capital in Income through Loan Capital as Intervenning Variables: Empirical Study in Sumenep Regency

265

model indicates that the effect of exogenous variables

(which influence) on endogenous variables (which

are influenced) is in the good category. Meanwhile, if

the result is 0.33 - 0.67, it is in the medium category,

and if the result is 0.19 - 0.33 it is in the weak

category.

Based on data processing that has been done using

the SmartPLS 3.0 program, the R-Square value is

obtained as follows.

Table 3: Nilai R-Square.

R Square

R Square

Ad

j

uste

d

Modal Pin

j

aman 0,570 0,538

Pendapatan UMKM 0,627 0,584

Based on the data presentation in the table above,

it can be seen that the R-Square value for the Loan

Capital variable is 0.570, which means that Loan

Capital can be explained by E-Commerce and Capital

itself by 57%, while 43% is explained by other

variables outside the model. Then for the R-Square

value obtained by the UMKM Income variable of 0,

627, which means that the variables of E-Commerce,

Own Capital, and Loan Capital are able to explain

MSME Income by 62.7%, while 37.3% is explained

by other variables outside the model.

Based on the data processing that has been done,

the results can be used to answer the hypothesis in this

study. Hypothesis testing in this study was carried out

by looking at the T-Statistics value and the P-Values

value. The research hypothesis can be stated as

accepted if the P-Values value <0.05. The following

are the results of hypothesis testing obtained in this

study through the inner model:

Table T-Statistic and P-Values

Based on the Beta Coefficient value and the T-

statistic value above, the test results for each

hypothesis are as follows:

Table 4: The Effect of E-Commerce on Borrowed Capital.

P Values Keteran

g

an

E-Commerce ->

Loan Capital 0.022

Signifikan

E-Commerce ->

Income SMES 0,000

Signifikan

Loan Capital ->

Income SMES 0.003

Signifikan

Own Capital ->

Loan Capital 0.027

Signifikan

Own Capital ->

Income SMES 0,033

Signifikan

The results of the hypothesis test show that the P-

Values value is 0.022, which means there is an effect

of E-Commerce on Borrowed Capital, with a T-

Statistics value of 2.296 indicating that E-Commerce

(X1) has an effect on Borrowed Capital (Y1), and it

is proven that H1 is accepted.

4.3 H2: The Effect of Own Capital on

Loaned Capital

The results of the path coefficient test based on the T-

Statistics value show that the effect of Own Capital

on MSME Income has a level of 2,950 with a P-

Values value of 0.003. Which means Own Capital

(X2) affects UMKM Income (Y2).

4.4 H3: The Effect of Loaned Capital

on UMKM Income

The results of the path coefficient test based on the T-

Statistics value show that the effect of Own Capital

on MSME Income has a level of 2,950 with a P-

Values value of 0.003. Which means that borrowed

capital (Y1) affects MSME income (Y2), so from

these results it can be concluded that H3 is accepted.

4.5 H4: The Effect of E-Commerce on

UMKM Income

From the results of the hypothesis test, it is known

that the P-Values that form the effect of E-Commerce

on MSME Revenue is 0,000 below the significance

value of 0.05 with a positive T-Statistics value, so that

E-Commerce (X1) has a significant effect on MSME

Income (Y2 ), it is proven that H4 is accepted.

4.6 H5: The Effect of Own Capital on

UMKM Income

The path coefficient test results based on the T-

Statistics value show a value of 2.285 with a P-Values

value of 0.033, so it can be concluded that Own

Capital (X2) affects MSME Income (Y2), and it is

proven that H5 is acceptable.

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

266

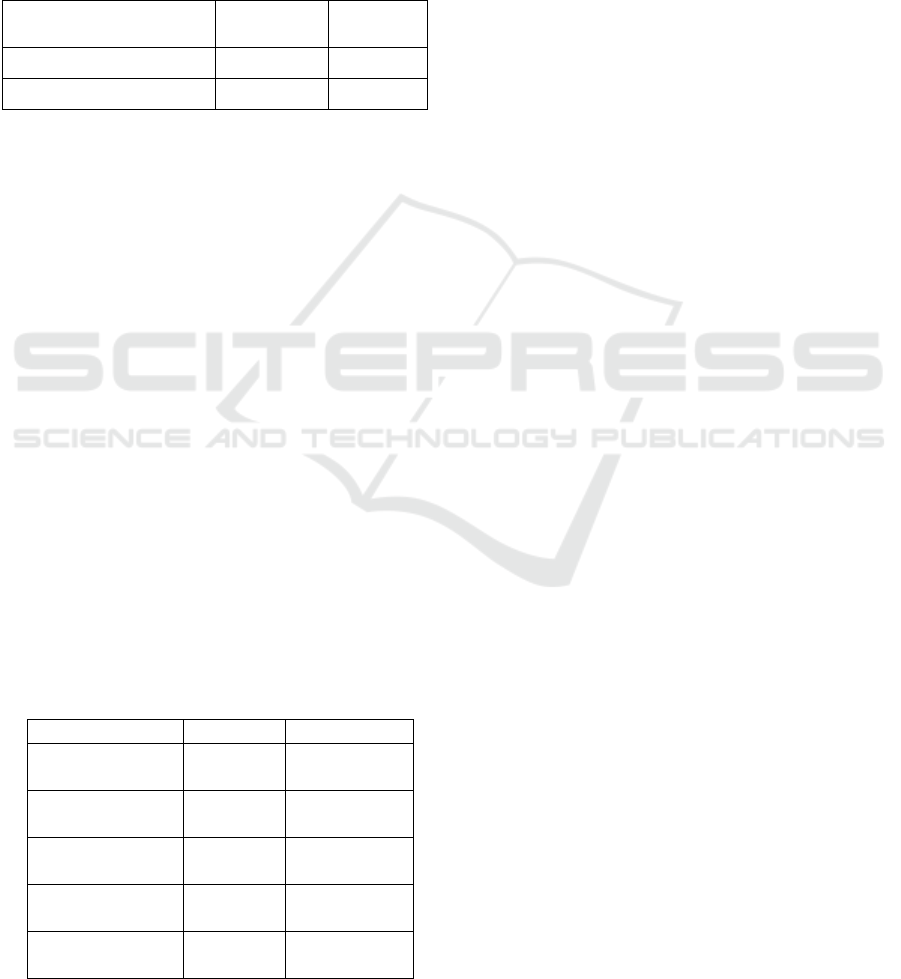

4.7 Indirect Hypothesis Testing

Figure 1: The Effect of E-Commerce on MSME Income

through Borrowed Capital as an Intervenning Variable.

Figure 2: The Effect of Own Capital on MSME Income

through Borrowed Capital as an Intervenning Variable.

4.8 H6: The Effect of E-Commerce on

MSME Income through Loaned

Capital as an Intervenning

Variable

From Table 4.8 above, it is obtained that the p-value

is below 5%, which means that the value is below the

significance value so that it can be concluded that E-

Commerce has an effect on MSME Income through

Loan Capital as an Intervenning Variable. So that H6

is accepted.

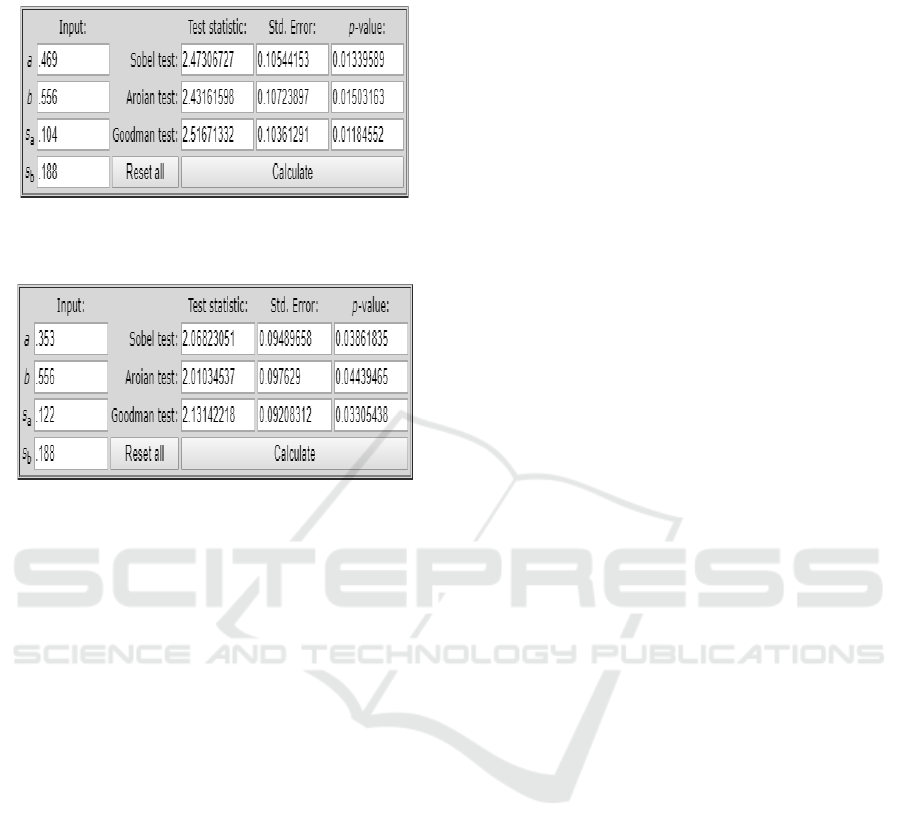

4.9 H7: The Influence of Own Capital

on MSME Income through Loaned

Capital as an Intervenning

Variable

From table 4.9 above, it can be seen that the p-value

is below the 5% significance value, this means that

capital itself has an indirect effect on MSME income

through borrowed capital as an intervening variable.

So from the description above it can be concluded that

H7 is acceptable.

5 CONCLUSION

Based on the research results, several conclusions can

be drawn to answer the problem formulation, namely:

1. E-Commerce has an effect on loan capital,

which means that with marketing through E-

Commerce, sales can increase so that it affects

the acquisition of loan capital from outside

parties.

2. Own capital affects the loan capital, the size of

the capital used in the business can determine

the size of the income of MSMEs so that it

affects the size of the loan capital to be

obtained.

3. Loan capital affects income, meaning that the

size of the loan capital obtained affects the size

of the income to be obtained.

4. E-Commerce has been empirically proven to

affect the income of MSMEs, which means that

using E-Commerce as a marketing medium can

increase sales so that income also increases.

5. Own capital is empirically proven to have an

effect on UMKM income, which means that the

size of capital can also affect the level of sales

so that it affects MSME income.

6. E-Commerce has been empirically proven to

have an effect on MSME income through

Loaned Capital as an Intervenning variable,

which means that income increases due to the

indirect effect of borrowed capital apart from

marketing through E-Commerce.

7. Own capital has been empirically proven to

have an effect on MSME Income through

Loaned Capital as an Intervenning Variable,

this means that with borrowed capital other

than Own Capital, sales can increase, so that it

will affect the amount of income to be received.

8. E-Commerce and Own Capital have an effect

on MSME Income through Loaned Capital as

an Intervenning variable, meaning that the

existence of electronic marketing will increase

sales so that it can increase income and the size

of own capital and loan capital from outside

can increase production which will have an

effect on increasing UMKM income.

Role of E-Commerce and Own Capital in Income through Loan Capital as Intervenning Variables: Empirical Study in Sumenep Regency

267

REFERENCES

Aribawa, Dwitya., 2016. E-Commerce Strategic Bussines

Environment Analysis in Indonesia. International

Journal of Economics and Financial Issues. ISSN:

2146-4138.

Alzahrani, Joman., 2018. The Impact of e-Commerce

adoption on bussiness strategy in saudy Arabian small

and medium enterprises (SMEs). Review of economics

and political Science Vol. 4 No.1

Gregory N. Mankiw., 2011. Principles of Economics

(Pengantar Ekonomi Mikro). Jakarta: Salemba Empat

Imam Ghozali, Structural Equation Modeling – Metode

Alternatif dengan Partial Least Squares (PLS)

(Semarang: Universitas Diponegoro, 2014), 39.

variabel intervenning. Jurnal Ekonomi Kuantitaif terapan.

Vol 9 No.2

Ramdansyah, Agus., 2017. Adoption Model Of E-

Commerce from SMEs Perspective in Developing

Country Evidence-Case Study for Indonesia. Europian

Research studies Journal. Vol XX Issue 4B,2017.

Robbins, Stephen dan Coulter, Mary., 2002. Manajemen,

Jakarta: Gramedia

Triandini,Evi, et al. (2013 Factors influencing E-Commerce

Adoption by SMES Indonesia: A Conceptual Model.

LontaNr Komputer Vol. 4 No.3

Turban, Efrain, et al., 2002. Ecommerce : A managerial

Perspective. Low price edition : 180-183.

Veiga, Marcelo Godke., 2019). The Financing of Small and

Medium Sized Enterprises: An analysis of the

Financing Gap in Brazil. Europen Bussiness

Organization Law Review 20;633-664

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

268