Analysis of the Company's Financial Performance before and after

the Company Conducts an Initial Public Offering

Humera Asad Ullah Khan

1

Management,Bahaudin Mudhary University, Jl. Raya lenteng 10, Sumenep, Indonesia

Keywords: Current Ratio; Quick Ratio; Debt Ratio; Debt Equity Ratio; Return On Investment; Return On Equity

Abstract: This research was conducted on the basis of knowing the company's financial performance before and after

the company conducted an IPO. IPO is an alternative source of corporate funding to develop its business so

that company performance can increase. The benefits of the company doing an IPO are obtaining new

sources of funding available in large quantities, improving the company's image and increasing company

value. The focus of the problem in this study is whether there are significant differences in financial

performance before and after the company conducted an IPO in 2018. The results of this study indicate that

the current ratio (0,7461), quick ratio (0,7901), debt equity ratio (0,8851) has increased level after

companies do IPO. Debt ratio (0,6157) return on investment (0,7209) and return on equity (0,15323) has

decreased after companies do IPO, This can be seen from the results of statistical tests which show that the

value of t is greater than t table, which means that H0 is rejected. There is no difference in the debt ratio

before and after the company has conducted an IPO. This can be seen from the results of statistical tests

which show that the value of t is greater than t table, which means that H0 is accepted.

1 INTRODUCTION

Judging from the number of companies that have

gone public in Indonesia, this indicates that

Indonesia has experienced a significant

development. This is certainly a sign that people are

starting to implement an open economy and are

ready to compete. One of the intermediaries that is

often used is the capital market as an official stock

trading venue (Chughtai, Asma Rafique; Azeem,

Aamir; Amara; Ali, 2000). The main reason for a

go-public company is to offer its shares which are

driven by the company's capital needs, where the

capital is used to meet the company's operational

costs. But the most important reason why a company

offers its shares to the public is, the desire of the

company to grow the company. This is of course

accompanied by a large capital requirement as well

(Sha, 2017).

The activity of a company to sell its shares to the

public through the capital market is usually called a

public offering. When a company sells its shares for

the first time it is called an Initial Public Offering

(IPO) or by another name Go Public(Husaini, 2012).

Companies that are going to go public are required

to fulfill a number of mandatory requirements for

information disclosure of the period before and after

the Initial Public Offering (IPO). Corporations may

raise capital in the primary market by way of initial

public offerings (IPO). The IPO are a type of public

offering in which shares of stock in a company

usually are sold to institutional investors that in turn

sell to the general public, on a securities exchange,

for the first time (Seng, Yang, & Yang, 2017). The

main IPO methods are book-building, auction

method, and public offer. IPO literature and assert

that many factors are related to the uncertainty of

IPO pricing. the level of underpricing is determined

by various firm specific attributes (Gumanti, Lestari,

& Abdul Mannan, 2017). These implicit and explicit

attributes that could reflect the firm future prospect

amongst others include ownership structure, industry

membership, length in operation, size of the firm,

issue size, reputation, the quality of management, etc

(Abdulla, Dang, & Khurshed, 2016).

An IPO can be viewed as an information-

releasing event that changes the information

structure of a company, especially with regards to its

relationship with lenders. One of the most important

motives for firms to go public is to gain access to

external financial markets. As a result, research has

examined the impact of a firm’s listing

Ullah Khan, H.

Analysis of the Company’s Financial Performance before and after the Company Conducts an Initial Public Offering.

DOI: 10.5220/0010305800003051

In Proceedings of the International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies (CESIT 2020), pages 179-184

ISBN: 978-989-758-501-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

179

decision on its financial policies post-IPO. For

example, it is well-documented that immediately

after going public firms rely less on debt financing

because they can raise capital in the equity markets

However, little attention has been devoted to the

question of how a firm’s debt maturity evolves after

the IPO. This is a significant omission because debt

maturity is also an important capital structure

decision jointly determined with leverage (Djaddang

& Ghozali, 2017). It is important for the

shareholders of an IPO firm to know whether there

will be a change in the debt maturity structure post-

IPO for there are costs and benefits of switching

between debts of different maturities. For instance,

while short-term debt typically has lower interest

rates, is relatively easier to negotiate, and requires

less collateral than longterm debt, it exposes the firm

to the refinancing and liquidity risks (Abdulla et al.,

2016).

The choice to make a company go public is

accompanied by both benefits and consequences.

The benefits obtained are that there is a large amount

of new funding sources available, increasing the

company's image which also affects the company's

value. As for the consequences borne by the

eminten, the company is obliged to become a

transparent and professional company and must

comply with all applicable capital market

regulations by regularly reporting the company's

annual report (Rimbani, 2013).

2 LITERATURE

Whether or not the company's performance can be

assessed from its financial performance, financial

performance has a very important role. This means

that if the financial performance is good, it will

attract other investors to invest. Financial

performance interprets the achievement of the

company's success for the activities that have been

carried out. Company Performance Can be done by

analyzing company performance through financial

statement analysis using financial ratios (Erna

Alliffah, 2018).

Financial Ratio is defined as the activity of

comparing the numbers written in financial

statements by sharing one number with another . In

analyzing financial ratios, it can be used as a

reference for company development, which is seen

from if the financial condition has decreased, the

company must evaluate and improve its performance

in the future. This means that if the company is

good, then the company is able to settle its debts and

can improve efficiency in processing assets that

increase company profits.. The financial ratios used

in this research are Current Ratio, Quick Ratio, Debt

Ratio, Debt Equity Ratio, Return On Investment,

Return On Equity (Lili Sari et al., 2013).

2.1 Current Ratio

Current Ratio can be determined by comparing

current assets with current debt . Current Ratio (CR)

is a ratio that measures the ability of a company's

current assets to meet short-term liabilities with

current assets owned. If the Quick Ratio is used, the

number 100% is considered to have shown good

short-term financial conditions (Erna Alliffah,

2018). Quick Ratio (QR), namely the ability of

current assets to pay current liabilities. This ratio

provides a better indicator of the company's liquidity

compared to the current ratio, due to the omission of

elements of inventory and prepayments as well as

substandard assets from the ratio calculation. Quick

Ratio is a ratio that shows the company's ability to

meet its liabilities or current liabilities with current

assets regardless of company value (Kurniawan,

Arifati, & Andini, 2016). The current ratio is a

liquidity ratio that measures a company's ability to

pay short-term obligations or those due within one

year. It tells investors and analysts how a company

can maximize the current assets on its balance sheet

to satisfy its current debt and other payables

(Someshwari & Mahadevappa, 2013). The current

ratio compares all of a company’s current assets to

its current liabilities. These are usually defined as

assets that are cash or will be turned into cash in a

year or less, and liabilities that will be paid in a year

or less (Chughtai, Asma Rafique; Azeem, Aamir;

Amara; Ali, 2000).

2.2 Debt Ratio

Debt ratio measure how much company assets

financed by creditors . This debt ratio can be used to

test how far the company uses the money it borrows.

The use of the amount of the company's debt

depends on the success of revenue and the

availability of assets that can be used as debt

collateral and how much risk is assumed by

management (Tumandung, Murni, & Baramuli,

2017). The results of the DR calculation, creditors

prefer a low debt ratio because the lower the debt

ratio the greater the protection against creditors'

losses in the event of liquidation.. It is different with

shareholders who want more leverage to increase

their expected profit. Companies with debt ratios

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

180

above the industry average are a danger sign because

it will be difficult for companies to borrow

additional funds without having to raise equity first

(Asmirantho & Yuliawati, 2015). an increase in the

leverage ratio should result in lower agency costs

outside equity and improve firm’s performance, all

other things being equal. From the analysis above,

there is an inverse relationship between leverage

(DR) and firm performance (Anarfo, 2015).

profitable firms are capable to raise their debt ratio

morethan those less profitable companies. The

financial

leverage theory demonstrates that the problem is

dichotomous because earnings as well as risk

increase with increasing debt

ratio. While earnings are something positive risk

is regarded as a negative consequence. Or we want

to maximise profit and minimise risk. M & M’s

propositions depend on perfect capital markets, but

borrowing is costly and inconvenient for many

individuals. The most serious capital market

imperfections are often those created by the

government like taxes (Svendsen, 2003).

2.3 Debt Equity Ratio

Debt Equity Ratio Adding debt to the balance sheet

if the cost of debt is lower than equity is expected to

increase profitability and increase share prices,

thereby increasing shareholder welfare and

increasing company growth (Raharjo & Muid,

2013). The conservative vertical financial rule

stipulates that the amount of foreign capital cannot

exceed own capital by a ratio not exceeding 1: 1. For

creditors, the greater the DER value, the greater the

risk of failure that may occur in the company. For

companies, the lower the DER value, the higher the

funding that comes from the owner and the greater

the safety limit for the borrower in case of loss or

depreciation of assets (Agustine, 2013).

2.4 Return on Investment

Return on Investmentis the net earning power ratio.

Return on Investment is the ability of capital

invested in all assets to generate net profit. ROI is a

measure of the company's overall ability to generate

profits with the total number of assets available in

the company. This increase in profit has a positive

effect on the company's financial performance in

achieving the goal of maximizing company value

which will be responded positively by investors so

that the demand for company shares can increase

and can increase the company's stock price

(Priatinah, 2012).

2.5 Return on Equity

Return on equityThe higher the income the company

gets, the better the position of the owner of the

company. Return on Equity (ROE) is a ratio that

shows how much capital contributes to creating net

income. ROE (Return On Equity) compares net

income after tax with the equity that has been

invested by the company's shareholders (Rusli &

Dasar, 2014). Return on equity (ROE) or also often

called by Return On Common Equity, in bahasa

Indonesia is often translated as Rentability of Own

Share (Rentability of Own Capital). Investor to buy

the shares will be attracted to this profitability ratio,

or part of total profitability that can be allocated to

shareholders. As known, shareholders has residual

claim on obtained profits. Profit obtained by the

company firstly will be used to pay any interest of

debts, then preference share, and then (if any) will

be given to common shareholders. Return on equity

(ROE) is the profitability ratio to measure the

company ability to generate profit based on share

capital owned by the company (Rosikah et al, 2018).

3 REASEARCH METHODS &

RESULT

This research uses an event study research type

(event study). Based on the research objectives,

namely to describe the company's financial

performance before and after carrying out an IPO on

the IDX in 2018 seen from the current ratio, quick

ratio, debt ratio, debt equity ratio, return on

investment and return on equity. Researchers use

secondary data in the form of company financial

statements in the form of balance sheets, company

profile income statements and other data. Samples

taken based on purposive sampling technique

obtained 55 companies that conducted Initial Public

Offering (IPO) in 2018.

Descriptive statistical analysis technique aims to

provide a description of the research subject based

on the variable data obtained and the group of

subjects studied. Descriptive statistics in presenting

data through tables, graphs, pie charts, pictograms,

calculation of mode, median, mean, calculation of

data distribution through the calculation of the

average and standard deviation and calculation of

percentages. At this stage, the researcher will

Analysis of the Company’s Financial Performance before and after the Company Conducts an Initial Public Offering

181

conduct a descriptive statistical analysis by testing

the value of the current ratio, quick ratio, debt ratio,

debt equity ratio, return on investment, and return on

equity before and after the company conducts an

IPO (Initial Public Offering).

Normality Test The normality test is used to

determine the data used in the study to follow or

approach the normal distribution. If the data are not

normally distributed, then non-parametric statistical

tests are used. The criteria for testing the normality

test are as follows: The number of significance

(sig)> 0.05, then the data is normally distributed.

While the significance number (sig) <0.05, the data

is not normally distributed.

T test (Paired Sample T-Test) T test or paired

two-sample test is a parametric statistical test used to

test whether there are differences between two

related samples. Data came from two different

measurements or observation periods taken from

paired subjects. This study aims to determine

whether there are differences in the company's

financial performance before and after carrying out

an IPO (Initial Public Offering) in 2018.

Descriptive Statistical Analysis Current Ratio

(CR) before conducting an IPO, seen from the

standard deviation value, was 0.7107, whereas when

IPO had been conducted, it was 0.7461, this shows

the increase in the company's current assets so that

the company is better able to pay its short-term debt.

Descriptive Statistical Analysis Quick Ratio

(QR) before conducting an IPO seen from the

standard deviation value is 0.7296, while when it has

conducted an IPO of 0.7901 this shows that the

company's Quick Ratio Level after carrying out an

IPO is better than before the company conducted an

IPO, which shows an indication that the company is

able to pay its short-term debt which is fulfilled with

more liquid current assets.

Descriptive Statistical Analysis Debt Ratio (DR)

before conducting an IPO seen from the standard

deviation value was 0.6925, while when having an

IPO it was 0.6157, this shows that the Debt Ratio

Level has decreased when it has conducted an IPO.

Reduced risk for creditors if all debts are related to

all assets owned by the company.

Descriptive statistical analysis of the Debt Equity

Ratio (DER) before conducting an IPO can be seen

from the standard deviation value is 0.8056, while

when IPO has been carried out is 0.8851, this shows

that the Debt Equity Ratio level has increased. Based

on this explanation, the conclusion is that the

increased risk for the owners of the company's

capital can be seen from the amount of debt on their

own capital guaranteed by the company. The higher

the Debt Equity Ratio, the greater the financial risk

that is borne by the company.

Descriptive Statistical Analysis of Return On

Investement (ROI) before carrying out an IPO is

seen from the standard deviation value is 0.17312,

while when having an IPO it is 0.17209 this shows

that the rate of return on investment has decreased

because the proportion of the decline in company

profits is lower than the decrease in assets. company

owned.

Descriptive statistical analysis of Return On

Equity (ROE) before carrying out an IPO is seen

from the standard deviation value is 0.16362, while

when it has conducted an IPO of 0.15323 this shows

that the rate of return on equity (ROE) has decreased

so that it indicates a decrease in net income

associated with owner's equity. The higher the value

of Return On Equity, the greater the profit of being

the owner of the capital (Table 1).

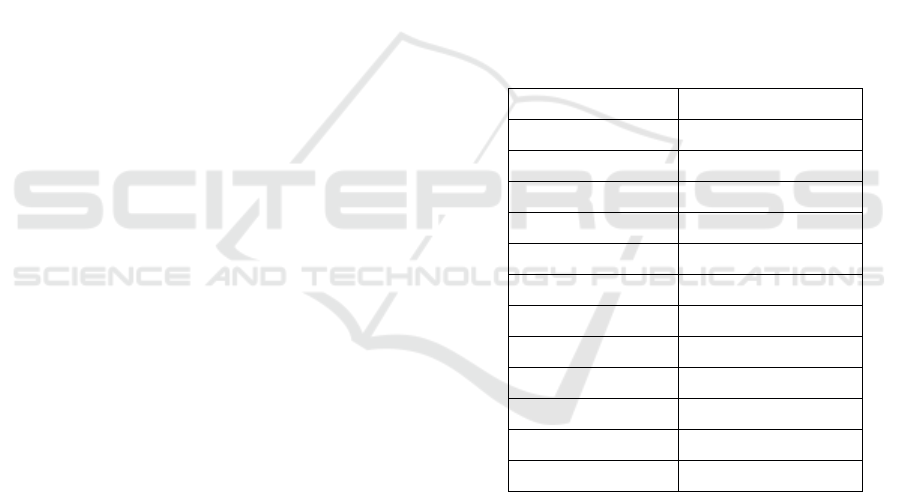

Table 1: Classical Assumption Test Results, Normality

Test Results.

information Asymp. Sig

CR

(

Before

)

0.126

CR

(

After

)

0.157

QR (before) 0.165

QR

(

after

)

0.198

DR

(

before

)

0.276

DR (after) 0.045

DER

(

before

)

0.146

DER

(

after

)

0.065

ROI (before) 0.178

ROI

(

after

)

0.059

ROE

(

before

)

0.178

ROE (after) 0.089

Source:Processed data

Based on the table above, the asymp sig in all

variables is greater than the predetermined level of

significance value, namely 0.05, thus it can be

concluded that the data is normally distributed.

Hypothesis Test Results, T test (Paired T-TEST)

between the average (mean) Curent Ratio in the first

treatment (before) IPO is 1.2229, while the average

(Mean) of the second treatment (after) IPO is 2,

2249 shows that the probability value (pvalue) of the

current ratio in the sig column (2- tailed) is smaller

than the predetermined level of significance (α),

which is 0.05. It can be concluded that H0 is

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

182

rejected, meaning that with a 95% confidence

interval there is a difference in the current ratio

before and after the company conducts an IPO.

The results of the paired sample test between the

average (mean) quick ratio in the first treatment

(before IPO) were 1.2315, with the average (mean)

quick ratio in the second treatment (after IPO) was

2.2295, indicating that the probability value (p- the

value) of the quick ratio in the sig (2-tailed) column

is smaller than the predetermined level of

significance (α), which is 0.05. It can be concluded

that H0 is rejected, meaning that with a 95%

confidence interval there is a difference in the quick

ratio before and after the company has conducted an

IPO. This shows that there is a difference in the

quick ratio after the company has conducted an IPO.

The results of the paired sample test between the

average (mean) debt ratio in the first treatment

(before IPO) were 0.5674, with the average (mean)

debt ratio in the second treatment (after the IPO) was

0.354, indicating that the probability value (p- value)

of the debt ratio in the sig (2-tailed) column is

greater than the predetermined level of significance

(α), which is 0.05. It can be concluded that H0 is

accepted, meaning that with a 95% confidence

interval there is no difference in the debt ratio before

and after the company has conducted an IPO. This

shows that there is no difference in debt ratio after

the company has conducted an IPO.

The results of the paired sample test between the

average (mean) debt equity ratio in the first

treatment (before IPO) was 2.2282, with the average

(mean) debt equity ratio in the second treatment

(after the IPO) was 1.2320, indicating that the value

The probability (p-value) of the debt to equity ratio

in the sig (2-tailed) column is smaller than the

predetermined level of significance (α), namely

0.05. It can be concluded that H0 is rejected,

meaning that with a 95% confidence interval, there

is a difference in the debt to equity ratio before and

after the company conducted an IPO.

The results of the paired sample test between the

average (mean) return on investment in the first

treatment (before IPO) were 0.0760, with the mean

return on investment in the second treatment (after

IPO) of 0.0579, indicating that the probability value

( The p-value) of the return on investment in the sig

(2- tailed) column is smaller than the predetermined

level of significance (α), which is 0.05. It can be

concluded that H0 is rejected, meaning that with a

95% confidence interval there is a difference in

return on investment before and after the company

conducts an IPO.

The results of the paired sample test between the

average (mean) return on equity in the first treatment

(before the IPO) were 0.565, with the average

(mean) return on equity in the second treatment

(after the IPO) was 0.085, indicating that the

probability value ( p-value) of return on equity in the

sig (2-tailed) column is smaller than the

predetermined level of significance (α), which is

0.05. It can be concluded that H0 is rejected,

meaning that with a 95% confidence interval there is

a difference in return on equity before and after the

company conducts an IPO. It can be said that there is

a difference in return on equity after the company

has conducted an IPO.

4 CONCLUSIONS

Judging from the results of hypothesis testing using

the t test, the t value of the current ratio, quick ratio,

Debt Equity Ratio, Return On Investment, Return

On Equity is greater than t table, meaning that there

is a significant difference before and after the

company conducts an IPO. So it can be concluded

that testing the hypothesis which states that there is a

significant difference in the current ratio before and

after the company has conducted an IPO can be

accepted.

Judging from the results of hypothesis testing

using the t test, the t value of the debt ratio was

smaller than the t table, meaning that there was no

significant difference before and after the company

conducted an IPO. So it can be concluded that the

testing of the hypothesis which states that there is a

significant difference in the debt ratio before and

after the company has conducted an IPO is rejected.

For the company, it should be able to increase

the liquidity ratio and profitability ratio in order to

increase the profit that will be generated by the

company, and the company should be able to reduce

its debt ratio so that the company can guarantee all

its long-term debt with all the assets owned by the

company. For companies that have not conducted

Initial Public Offering (IPO), it is hoped that this

research will become a reference for companies to

conduct Initial Public Offering (IPO) as an

alternative for companies in improving the

company's financial performance. For future

researchers, it is hoped that they can make a better

contribution, for example by adding a research

period or research variables to measure company

performance before and after conducting an Initial

Public Offering (IPO).

Analysis of the Company’s Financial Performance before and after the Company Conducts an Initial Public Offering

183

ACKNOWLEDGEMENTS

For Investor Who wants to invest, they should know

about the real price of share, and how invest safely.

Based on these research findings, it can suggest that

it is necessary for any companies to pay attention to

the increased financial ratios, as a reference and the

basis of consideration for investors in investing in

the company.

REFERENCES

Abdulla, Y., Dang, V. A., & Khurshed, A. (2016). Debt

maturity and initial public offerings. In Review of

Quantitative Finance and Accounting (Vol. 47).

https://doi.org/10.1007/s11156-015-0533-1

Agustine, R. (2013). Pengaruh ROE, EPS, dan DER

terhadap Harga Saham. Jurnal Administrasi Dan

Bisnis, 2(1).

Anarfo, E. B. (2015). Determinants of Capital Structure of

Banks: Evidence from Sub-Sahara Africa. Asian

Economic and Financial Review, 5(4), 624–640.

https://doi.org/10.18488/journal.aefr/2015.5.4/102.4.6

24.640

Asmirantho, E., & Yuliawati, E. (2015). Pengaruh Dividen

Per Share (Dps), Dividen Payout Ratio (Dpr), Price To

Book Value (Pbv), Debt To Equity Ratio (Der), Net

Profit Margin (Npm) Dan Return on Asset

(Roa)Terhadap Harga Saham Pada Perusahaan

Manufaktur Sub Sektor Makanan Dan Minuman

Dalam Kema. JIAFE (Jurnal Ilmiah Akuntansi

Fakultas Ekonomi), 1(2), 95–117.

https://doi.org/10.34204/jiafe.v1i2.525

Chughtai, Asma Rafique; Azeem, Aamir; Amara; Ali, S.

(2000). Impact of dividend and retained earnings on

stock prices in Bangladesh: An empirical

investigation. Savings and Development, 24(1), 5–31.

Djaddang, S., & Ghozali, I. (2017). The Role of Business

Risk and Non Debt Tax Shields on Capital Structure:

A study based on Cement Sector in Pakistan. IBT

Journal of Business Studies (JBS), 13(2), 13–14.

Erna Alliffah, S. A. I. F. (2018). Pengaruh Current Ratio,

Debt To Equity Ratio Dan Price Book Value Terhadap

Harga Saham Pada Sub Sektor Transportasi Yang

Terdaftar Di Bei Periode 2012-2016. Jurnal Ekonomi,

23(3), 403. https://doi.org/10.24912/je.v23i3.421

Gumanti, T. A., Lestari, A. R., & Abdul Mannan, S. S.

(2017). Underpricing and number of risk factors of

initial public offerings in Indonesia. Business: Theory

and Practice, 18(2016), 178–185.

https://doi.org/10.3846/btp.2017.019

Husaini, A. (2012). Pengaruh Variabel Return On Assets ,

Return On Equity, Net Profit Margin dan earning Per

Share Terhadap Harga Saham Perusahaan. Jurnal

Administrasi Bisnis, 6(1), 45–49.

Kurniawan, E. R., Arifati, R., & Andini, R. (2016).

Pengaruh Cash Position, Debt Equity Ratio, Return on

Asset, Current Ratio, Firm Size, Price Earning Ratio,

Dan Total Assets Turn Over Terhadap Deviden Payout

Ratio Pada Perusahaan Manufaktur Periode 2007-

2014. Journal Of Accounting, 2(2), 1–13.

Lili Sari, A., Santoso, B. H., Watung, R., Ilat, V., Meyer,

F. V., Corner, D. C., … Manado, R. (2013). Pengaruh

Npl, Roa, Dan Car Terhadap Pbv Pada Bank Bumn.

Jurnal Economia, 5(2), 1–15.

https://doi.org/10.35794/emba.v4i2.13108

Priatinah, D. (2012). Pengaruh Return On Investment

(ROI), Earning Per Share (EPS), Dan Dividen Per

Share (DPS) Terhadap Harga Saham Perusahaan

Pertambangan Yang Terdaftar Di Bursa Efek

Indonesia (BEI) Periode 2008-2010. Jurnal Nominal,

1.

Raharjo, D., & Muid, D. (2013). Analisis Pengaruh

Faktor-Faktor Fundamental Rasio Keuangan

Terhadap Perubahan Harga Saham. 2, 444–454.

Rimbani, R. P. (2013). ANALISIS PENGARUH ROE,

EPS, PBV, DER, DAN NPM TERHADAP HARGA

SAHAM PADA PERUSAHAAN REAL ESTATE

DAN PROPERTY DI BURSA EFEK INDONESIA

(BEI) PERIODE 2011 - 2013 Ryan Perkasa Rimbani

1. Akuntansi, 53(12), 182–228.

Rosikah et al. (2018). Effects of Return on Asset , Return

On Equity , Earning Per Share on Corporate Value.

The International Journal of Engineering and Science

(IJES, 7(3), 6–14. https://doi.org/10.9790/1813-

0703010614

Rusli, A., & Dasar, T. (2014). Pengaruh Rasio Keuangan

Terhadap Harga Saham Pada Perusahaan Bumn

Perbankan Yang Terdaftar Di Bursa Efek Indonesia.

Jurnal Akuntansi, 01(02), 10–17.

Seng, J.-L., Yang, P.-H., & Yang, H.-F. (2017). Initial

public offering and financial news. Journal of

Information and Telecommunication, 1(3), 259–272.

https://doi.org/10.1080/24751839.2017.1347762

Sha, T. L. (2017). Effects of Price Earnings Ratio ,

Earnings Per Share , Book to Market Ratio and Gross

Domestic Product on Stock Prices of Property and

Real Estate Companies in Indonesia Stock Exchange

Thio Lie SHA. International Journal of Economic

Perspectives, 11(1), 1743–1754.

Someshwari, T., & Mahadevappa, B. (2013). Profit

measurement under general price level accounting.

Journal of Commerce and Accounting Research, 2(2),

46–56.

Svendsen, S. (2003). The debt ratio and risk. International

Farm Management Congress. Retrieved from

http://ageconsearch.umn.edu/bitstream/24384/1/cp03s

v01.pdf

Tumandung, C., Murni, S., & Baramuli, D. (2017).

Analisis Pengaruh Kinerja Keuangan terhadap Harga

Saham pada Perusahaan Makanan dan Minuman yang

Terdaftar di Bei Periode 2011 – 2015. Jurnal Riset

Ekonomi, Manajemen, Bisnis Dan Akuntansi, 5(2),

1728–1737.

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

184