Analysis of Free Time Intervals between Buyers at Cash Register using

Generating Functions

Detlef Hartleb

1,2

, Andreas Ahrens

1

, Ojaras Purvinis

3

and Jelena Zaˇsˇcerinska

1,4

1

Hochschule Wismar, University of Technology, Business and Design, Wismar, Germany

2

ETSIST, Universidad Polit´ecnica de Madrid, Madrid, Spain

3

Kaunas University of Technology, Kaunas, Lithuania

4

Centre for Education and Innovation Research, Riga, Latvia

Keywords:

Bottleneck, Buyers’ Burstiness, Cashiers’ Bottleneck, Cash Register, Buyers’ Waiting Time Gaps, Generating

Functions.

Abstract:

The optimization of bursty business processes requires stochastic models with measurable parameters. Often

simplifications worked out in the analysis of such models lead to inaccuracies when events occur in a bursty

manner. In this work, a novel approach based on generating functions is introduced for modelling the bursty

appearance of buyers via gap processes when paying at the cash register. The obtained approach is verified by

analysing the payment process at the cash register by taking the free time intervals (gaps) between buyers as

well as the payment processing time at the cash register into account. As both payment-related processes can

be described by gap processes, the use of generating functions allows close-form solutions when analysing the

payment process at the cash register. As an example the payment process is analysed in two supermarket of

different sizes in Lithuania. The obtained results show that the free time intervals at the cash register are quite

bursty independent of the size of the shop whereas the payment processing intervals at the cash register are

quite regularly distributed.

1 INTRODUCTION

In order to model bursty business systems accurately

when optimizing the performance of such systems

using e. g. the well-known queuing theory, stochas-

tic processes with measurable parameters have to be

found. Such optimizations based on gap-processes

have been studied successfully when analyzing bit-

errors in telecommunication systems (e.g. wireless

systems) (Wilhelm, 1976; Wilhelm, 2018) as well

as packet arrivals in Ethernet-based data networks

(Kessler et al., 2003) or when analyzing the internet

traffic (Kresch and Kulkarni, 2011; Zukerman et al.,

2003), where data packets arrive in bursts as well.

However the concept of gap processes has never been

applied to model the payment process as carried out

in this work.

Bursts correspond to an enhanced activity level

over a short period of time followed by long periods

of inactivity and often leads to bottlenecks. In busi-

ness systems, bottlenecks limit the flow of customers,

services or products, etc. It happens when single busi-

ness processes within the business system operate at

their capacity limit or beyond. Given the diversity of

systems in which burstiness emerges, the modelling

of burstiness plays an important role as bottlenecks

are still an indicator for customers dissatisfaction.

Burstiness in shop sales, as studied in this work,

can be addressed when the components have a mea-

surable activity pattern (such as to buy or not to buy).

Fig. 1 illustrates the customer behaviour in shop sales.

When analyzing the buying process chain, the cus-

tomer arrival at the shop, the selection of goods, the

payment process as well as the customer or buyer de-

parture is meant. In this work a customer is a person

who visits the shop but does not buy anything.

This work is aiming to achieving customer quality

improvement through prevention of queuing by ana-

lyzing the payment process at the cash register (Mice-

viciene et al., 2018; Mittal and Kamakura, 2001; Ku-

mar et al., 2016). The payment process itself can be

divided into the process of buyers’ waiting to the cash

register described by free time intervals between buy-

ers as well as the payment processing time (also re-

ferred as buyers’ service time). Fig. 2 highlights the

two parametersinfluencingthe paymentprocess at the

42

Hartleb, D., Ahrens, A., Purvinis, O. and Zaš

ˇ

cerinska, J.

Analysis of Free Time Intervals between Buyers at Cash Register using Generating Functions.

DOI: 10.5220/0010172700420049

In Proceedings of the 10th International Conference on Pervasive and Parallel Computing, Communication and Sensors (PECCS 2020), pages 42-49

ISBN: 978-989-758-477-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

not to buy

customer arrival

buyer departure

cash register

customer

in the shop

(to buy/not to buy)

shop entrance

to buy

customer flow

through

the shop

customer departure

Figure 1: Customer behaviour in shop sales.

cash register. As the payment processing time is usu-

ally determined by technological limits (scanning of

the purchased goods, the paying process itself) and

the experience of the sales staff, only the free time

intervals between buyers to the cash register as an in-

dicator of bottlenecks throughout the whole process

of buying are studied in this work.

The free time intervals between buyers to the cash

register, as indicated in Fig. 3, as well as the payment

processing time intervals are described and modelled

by gaps. The gaps are characterized by the gap distri-

bution function u(k), defined as the probability that a

gap Y between two buyers is greater than or at least

equal to a given number of non-buying customers k,

i. e.

u(k) = P(Y ≥ k) . (1)

Alternatively, the gap-density function v(k) = P(Y =

k) can be used as well, denoting the probability, that

a gap Y of length k appears.

By describing the process of buyers’ waiting to the

cash register and the process of payment individually

by gaps, the payment process can be modelled by two

independent gap-processes with different parameters

as highlighted in Fig. 4. As the payment processing

times are quite regularly distributed, the focus in this

work is put on the free-time intervals between buyers

buyers‘ service

time

free time intervals

(gaps)

between buyers

cash register

capacity utilization

Figure 2: Parameters influencing cash register capacity uti-

lization.

- x - - x - - x - - - x x - - - - x -

2 2 3 40

Figure 3: Modelling free-time intervals between buyers to

the cash register (a buyer (represented by ”x”) within a se-

quence of non-buying customers (represented by ”-”)).

to the cash register.

Often the performance has been studied under

the assumption that the gaps are exponentially dis-

tributed. However, under bursty conditions such ex-

ponential gap distribution functions (Weisstein, 1999)

become inaccurate (Feldmann, 2000; Kessler et al.,

2003; Ahrens et al., 2019b). Thus, for modelling

bursty behaviour, the gap distribution function should

be different from the exponential one. Against this

background, in this work a novel approach for mod-

elling bursty as well as non-bursty business processes

by using generating functions, which will be used to

describe the payment process, is presented.

The concept of generating functions is well-

developed in the research community (Chattamvelli

and Shanmugam, 2019). Generating functions have

been identified as an extremely beneficial tool when

analyzing discrete sequences of infinite length (Zhang

et al., 2016; Li, 1992). Instead of analyzing a se-

quence of infinite length, a single function can be

derived, representing the sequence of infinite length.

For example, the gap-distribution sequence u(k) =

(1,1,1,1, ...) can be represented by the power series

U(t) =

∞

∑

k=0

u(k)t

k

= 1+t + t

2

+ . .. . (2)

This power series converges for |t| < 1 to

U(t) =

∞

∑

k=0

u(k)t

k

=

1

1− t

. (3)

The function U(t), defined in (3), provides an alter-

native description for the gap distribution function

u(k) = (1,1, 1,1,.. .) of infinite length. The elements

of the sequence u(k) are the coefficients of the in-

finite polynomial defined by (2). Such closed form

solutions are known for exponential gap distribution

functions. However,it is ratherdifficultto find closed-

form solutions for gap distribution function that are

different from the exponential one (Wilhelm, 1976;

Wilhelm, 2018).

The novelty of this paperis givenby the use of gen-

erating functions applied to the system model, namely

free time intervals between buyers at the cash register,

for simulating bursty buyers’ behaviour. As an illus-

trative example the free time intervals between buyers

at the cash register are studied in two supermarkets

of different sizes in Lithuania.

Analysis of Free Time Intervals between Buyers at Cash Register using Generating Functions

43

time (in sec)

m

th

-buyer‘s

payment process

(m+1)

th

-buyer‘s

payment process

(m-1)

th

-buyer‘s

payment process

gap process I

(waiting time to cash register)

gap process II

(payment processing time)

Figure 4: Modelling the payment process by two independent gap processes.

The remaining part of this paper is organized as

follows: Section 2 introduces the theoretical basis for

modelling buyers’ behaviour. Section 3 briefly re-

views the basics of using generating functions fol-

lowed by approaches to model bursty as well as non-

bursty buyers’ behaviour. Section 4 is dedicated to the

use of generating functions for gap modelling to anal-

yse bursty as well as non-bursty buyers’ behaviour.

The associated results of an empirical study of differ-

ent grocery shops in Lithuania are discussed in Sec-

tion 5. Finally, some concluding remarksare provided

in Section 6.

2 BURSTY BUSINESS

PROCESSES

Bottlenecks in supermarkets, created by bursty cus-

tomers (i. e. buyers), can limit the capacity of the

whole shop since e. g. more buyers appear at the

cash register than can be served. Conventionally, bot-

tlenecks can be measured by indicators or parame-

ters such as the buyers’ probability and buyers’ con-

centration. These parameters can be obtained when

analysing the gaps between the buyers, i. e. the free

time intervals between the buyers to the cash register

as shown in Fig. 3. Here, stochastic processes with

measurable parameters are needed when analysing

the free time intervals between buyers.

Practically, when analysing the free time inter-

vals between buyers at the cash register as depicted

in Fig. 5, the gap distribution function u(k) can be de-

rived by introducing a suitable time interval t

A

and

discretising the free time intervals t

ℓ

. After mapping

them to the discrete parameter t

ℓ

/t

A

, the subsequent

rounding delivers the discrete gap parameter k

ℓ

.

t

1

t

2

t

3

time

Figure 5: Free time intervals at the cash register.

Alternatively, the gap density function v(k), de-

fined as the probability that a gap Y between two buy-

ers to the cash register is equal to a given number of

non-buying visitors k, is of high interest, too. Taking

the gap density functionv(k) = P(Y = k) into account,

(1) can be re-written as

u(k) = v(k) + v(k+ 1) + v(k + 2) + .. . . (4)

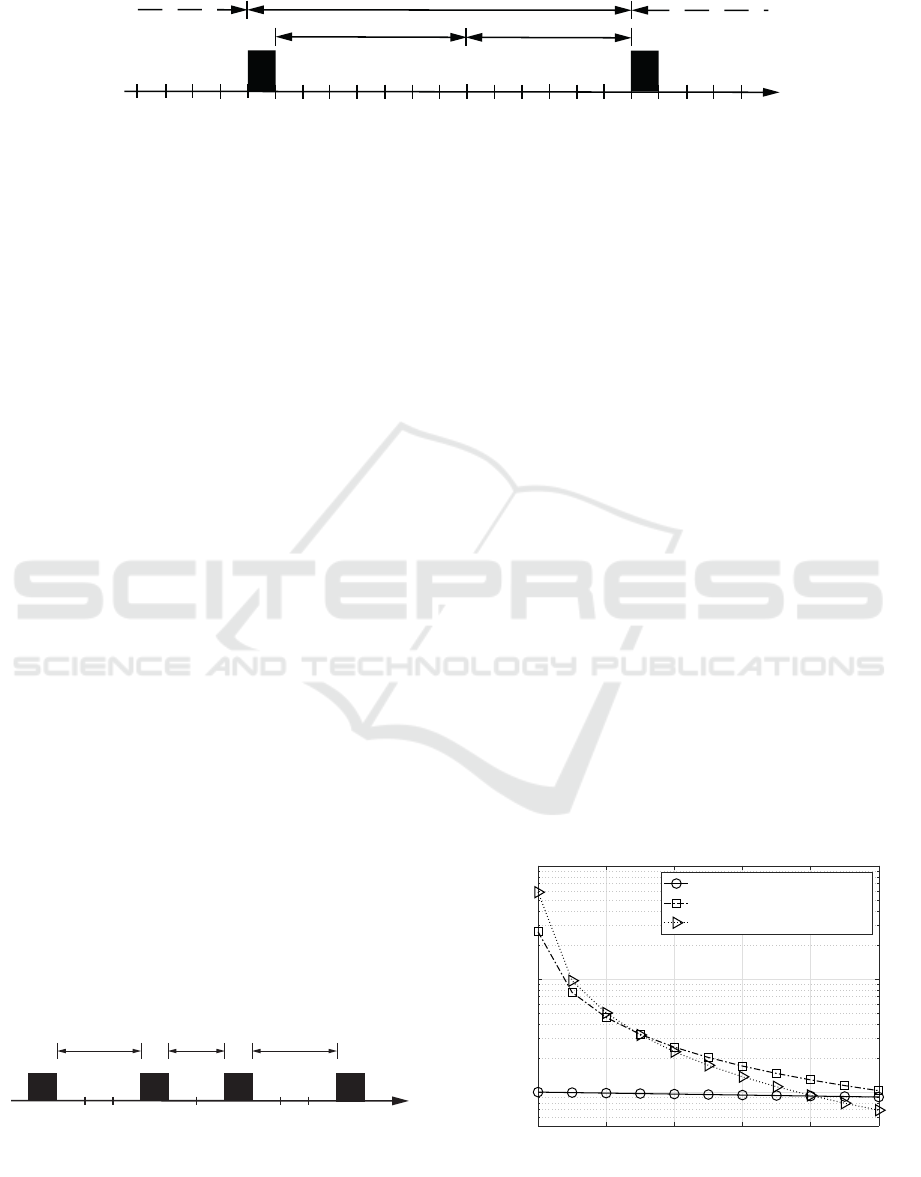

Fig. 6 shows different gap density functions v(k)

when analysing the free time intervals (gaps) between

buyers to the cash register at buyer probability of

p

e

= 10

−2

. With an increasing level of burstiness

as demonstrated in Fig. 6, the probability that after

a buyer in the distance k = 0 another buyer appears,

i. e. v(0), increases. In this situation, the buyers ap-

pear more and more concentrated.

Intuitively, the buyers’ behaviour can be described

by a probability of purchase or buyer probability p

e

(as a percentage of the visitors in the shop who buy

something). However, the buyer probability does

not give any indication of how concentrated the buy-

ers are. In this case the model has to be extended

by at least a second parameter as shown by Wil-

helm (Wilhelm, 1976; Wilhelm, 2018) and Ahrens

(Ahrens et al., 2019a) by introducing buyer concen-

tration (1− α).

A process will appear bursty if the probability of

short gaps is higher and lower for longer gaps if com-

pared with a process with no burstiness (Fig. 6). This

results in many short intervals (gaps) of high activity

(probability) separated by longer intervals (gaps) of

0 2 4 6 8 10

10

-2

10

-1

10

0

no burstiness

medium-level of burstiness

high-level of burstiness

v(k) →

k →

Figure 6: Gap density functions v(k) for different levels of

burstiness at buyer probability of p

e

= 10

−2

.

PECCS 2020 - 10th International Conference on Pervasive and Parallel Computing, Communication and Sensors

44

inactivity.

As shown in (Wilhelm, 1976) and (Ahrens, 2000;

Ahrens et al., 2019a) a good gap distribution function

for bursty as well as non-bursty buyers’ behaviour is

given by

u(k) = [(k + 1)

α

− k

α

] · e

−β·k

. (5)

depending on the buyer probability p

e

and the buyer

concentration (1− α). The parameter β defined in (5)

has to fulfil the following equation

p

e

≈ β

α

(6)

as shown by (Wilhelm, 1976; Wilhelm, 2018). Prac-

tically, relevant buyer concentration is in the range of

0.0 < (1− α) ≤ 0.5, whereas the buyer concentration

of (1− α) = 0 describes the situation with non-bursty

buyers (also refers to memoryless buyer scenario),

where the buyer probability is sufficient to describe

the buying process.

Unfortunately, no generating function for the gap

distribution function u(k), defined in (5), can be de-

rived (Wilhelm, 1976; Wilhelm, 2018), except for

(1− α) = 0.

3 GENERATING FUNCTIONS

Generating functionscan be used for describing an in-

finite sequence of numbers by treating them as the co-

efficients of a power series (Zhang et al., 2016). The

concept of generating functions is well-established in

the research community and used in this work for

modelling the free time intervals (gaps) between buy-

ers at the cash register.

Bursty as well as non-burstyfree time intervals be-

tween buyers to the cash register is described by the

gap distribution function u(k) defined in (1). The gen-

erating function associated to (1) is the power series

U(t) =

∞

∑

k=0

u(k)t

k

. (7)

In the following sections, close-form solutions are de-

rived for both non-bursty as well as bursty free time

intervals between buyers at the cash register.

3.1 Non-bursty Buyers Behaviour to the

Cash Register

For situations with independent events, i. e. buyers

to the cash register, the gap distribution function u(k)

can be defined by the buyers probability p

e

solely as

shown in (Ahrens et al., 2019b) and results in

u(k) = (1 − p

e

)

k

. (8)

Consequently, the generating function is obtained as

U(t) =

∞

∑

k=0

u(k)t

k

=

∞

∑

k=0

(1− p

e

)

k

t

k

. (9)

The generating function is a geometric series with the

quotient q = (1− p

e

)t and leads for |q| < 1 to

U(t) =

∞

∑

k=0

q

k

=

1

1− q

=

1

1− (1− p

e

) · t

. (10)

With the approximation 1 − p

e

≈ e

−p

e

for small p

e

,

the generating function can be re-formulated as

U(t) =

1

1− e

−p

e

·t

. (11)

Given the generating function U(t) defined in (11)

the corresponding elements of the sequence u(k) can

be calculated based on Taylor’s theorem by the k-th

derivative of the generating functionU(t) at the posi-

tion t = 0. The elements of the sequence u(k) result

in

u(k) =

U

k

(0)

k!

(12)

Differentiating the generating function U(t), defined

in (11), the elementsof the series u(k) can be obtained

as

u(0) = 1

u(1) = e

−p

e

≈ (1− p

e

)

u(2) = e

−p

e

· e

−p

e

≈ (1− p

e

)

2

.

.

. =

.

.

.

and confirm (8). The validation of the generating

function can be carried out when analysing the aver-

age gap length (free time intervals) between two buy-

ers to the cash register. Having completely indepen-

dent buyers, the average gap length between two buy-

ers can be expressed by the buyer probability p

e

as

1

p

e

− 1 =

∞

∑

k=0

k· v(k) . (13)

With

∞

∑

k=0

k· v(k) =

∞

∑

k=0

u(k) − 1 (14)

we get

1

p

e

=

∞

∑

k=0

u(k) =

∞

∑

k=0

u(k) · 1

k

. (15)

This equation can be re-written as

1

p

e

=

∞

∑

k=0

u(k) · 1

k

= U(1) (16)

Analysis of Free Time Intervals between Buyers at Cash Register using Generating Functions

45

and is confirmed by U(1) as U(1) results with (11) in

U(1) =

1

1− e

−p

e

≈

1

p

e

. (17)

Therefore, the generating function should be suit-

able for describingnon-bursty buyers behaviour to the

cash register.

3.2 Bursty Buyers Behaviour

For bursty free time intervals between buyers to the

cash register, the following gap distribution function

is identified to be useful

u(k) = [(k + 1)

α

− k

α

] · e

−β·k

, (18)

with the parameter (1 − α) describing the buyer con-

centration and p

e

= β

α

defined as buyer probabil-

ity (Wilhelm, 2018; Ahrens et al., 2019a). Unfor-

tunately, there is no known closed-form solutions

for the corresponding generating function (Wilhelm,

1976). Therefore an approximation for u(k) defined

in (18) has to be applied (Wilhelm, 1976; Wilhelm,

2018). Taking the series expansion of the expression

(k+ ∆k)

α

= k

α

(1+

α

k

∆k + ...) (19)

into account, the expression (18) simplifies with ∆k =

1 to

u(k) ≈

∞

∑

k=0

αk

α−1

e

−β·k

. (20)

Using the integral instead of the sum, the generating

function U(t) results in

U(t) = cα

∞

Z

k=0

k

α−1

e

−β·k

t

k

dk (21)

and can be re-defined as

U(t) = cα

∞

Z

0

k

α−1

e

(ln(t)−β)k

dk . (22)

The parameter c has to be determined in order to fulfil

the condition u(0) = 1. Using the integral

∞

Z

0

k

δ−1

e

−ωk

dk =

Γ(δ)

ω

δ

. (23)

the following solution with ω = β − ln(t) and δ = α

can be obtained

U(t) = cα Γ(α) ·

1

(β− ln(t))

α

, (24)

with the parameter Γ(·) describing the Gamma func-

tion. With

β− ln(t) = (1− (1− [β − ln(t)])) (25)

the expression β − ln(t) can be represented for |β −

ln(t)| ≪ 1 as

β− ln(t) ≈ 1− e

−(β−ln(t))

= 1− e

−β

t (26)

and the generating functionU(t) results in

U(t) = cα Γ(α) ·

1

(1− e

−β

t)

α

(27)

In order to calculate the parameter c, the function

U(t) = u(0)t

0

+ u(1)t

1

+ u(2)t

2

+ · ·· , (28)

has to fulfil the condition

u(0) = 1 → U(0) = 1 , (29)

and therefore the parameter c has to be set

cαΓ(α) = 1 . (30)

Finally, the generating functionU(t) results in

U(t) =

1

(1− e

−β

t)

α

. (31)

Comparing (31) and (11), the equations match for

non-bursty (memoryless) free time intervals at the

cash register with (1 − α) = 0 (i. e. α = 1). In this

case the parameter β equals the buyer probability p

e

(Ahrens et al., 2019a).

The validation of the generating function can be

carried out when analysing the average gap length be-

tween two buyers using (15) with

U(1) =

1

p

e

. (32)

Taking (31) into account, the generating function

U(1) simplifies for small values of β with

1− e

−β

≈ 1− (1− β) = β (33)

to

U(1) =

1

(1− e

−β

)

α

=

1

β

α

=

1

p

e

. (34)

For bursty free time intervals between buyers to the

cash register, the parameter β must satisfy the follow-

ing condition

p

e

= β

α

(35)

as shown in (Wilhelm, 1976; Ahrens et al., 2019a).

The generating function defined in (31) includes the

description of non-bursty free time intervals between

buyers to the cash register for a buyer concentration

(1− α) = 0 or α = 1.

PECCS 2020 - 10th International Conference on Pervasive and Parallel Computing, Communication and Sensors

46

4 USE OF GENERATING

FUNCTION FOR GAP

MODELLING

The generating function, defined in (31), can now be

used to calculate the elements of the corresponding

gap distribution function u(k) in analogy to the gap

distribution function defined in (5). Given the gener-

ating function

U(t) =

∞

∑

k=0

u(k)t

k

(36)

the corresponding elements of the sequence u(k) can

be calculated based on Taylor’s theorem by the k-th

derivative of the generating function U(t) at t = 0.

The elements of the sequence u(k) result in

u(k) =

U

k

(0)

k!

(37)

Differentiating the generating function

U(t) =

1

(1− e

−β

t)

α

, (38)

the elements of the series u(k) can be obtained as

u(0) = 1

u(1) =

α

1!

e

−β

u(2) =

α· (1+ α)

2!

e

−2β

.

.

. =

.

.

.

For k = 1, 2,. .., the elements of the gap-distribution

function u(k) result in

u(k) =

α· (1+ α) · ... · (k− 1+ α)

k!

e

−kβ

. (39)

With

Γ(α+ k)

Γ(α)

= α· (1+ α) · ... · (k − 1+ α) (40)

and Γ(1 + k) = k!, the gap distribution function can

be formulated as

u(k) =

Γ(α+ k)

Γ(1+ k) · Γ(α)

e

−βk

. (41)

With (41) an alternative definition of the gap distri-

bution function u(k) for bursty as well as non-bursty

buyers’ behaviour at the cash register is provided.

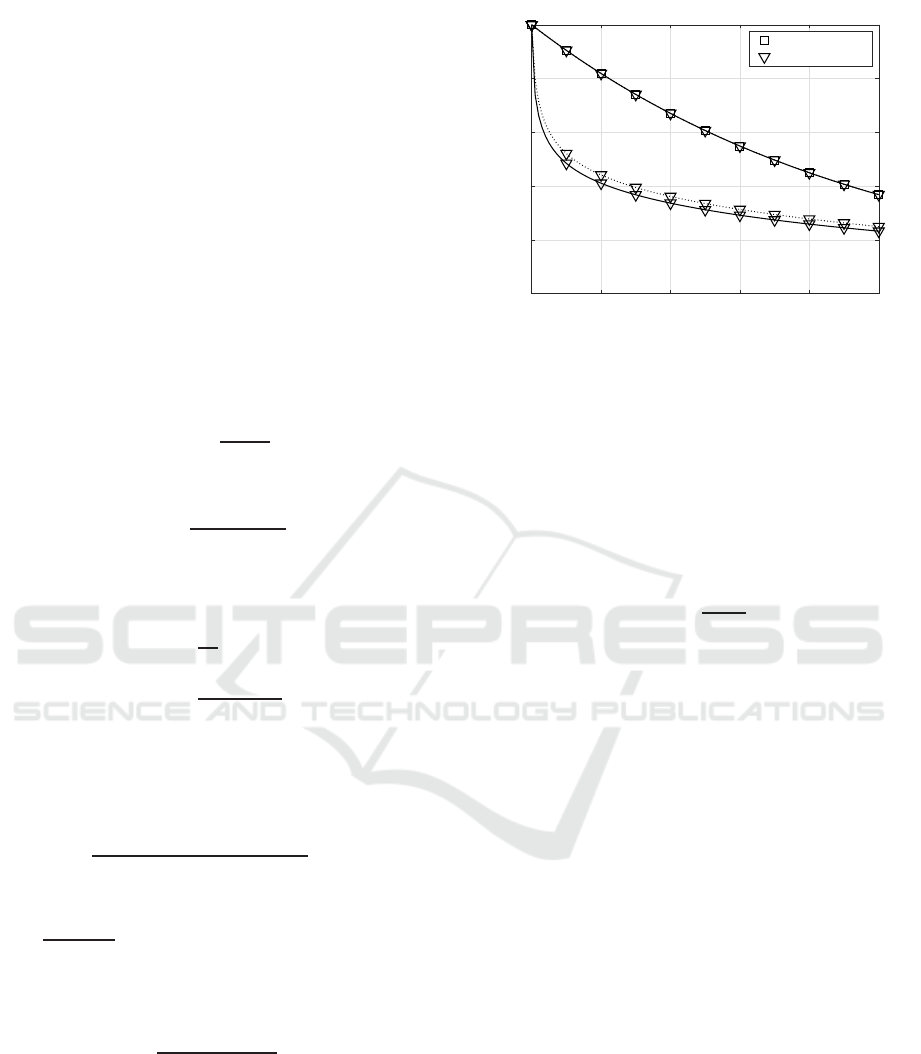

Fig. 7 shows the gap distribution functions defined in

(5) and (41). Both approaches show a close similar-

ity for different parameters of the buyer concentration

(1− α) at the buyer probability of p

e

= 10

−2

as (41)

was derived from (5).

0 20 40 60 80 100

0

0.2

0.4

0.6

0.8

1

u(k) →

k →

(1 − α) = 0.0

(1 − α) = 0.2

Figure 7: Comparison of the gap-distribution functions us-

ing (5) (dotted line) and (41) (solid line) for different pa-

rameters of (1− α) at the buyer probability of p

e

= 10

−2

.

The buyer concentration can be estimated when

analysing the probability that immediately after a

buyer in the distance k = 0 another buyer appears. In

this case the free time interval between buyers to the

cash register is zero. Taking (41) into account, the

buyer gap-density function v(k) = u(k)− u(k+ 1) re-

sults in

v(k) = u(k)

1−

k+ α

k+ 1

e

−β

. (42)

Analysing the free-time intervals with k = 0 the ex-

pression simplifies to

v(k) = u(0)· (1− α · e

−β

) . (43)

With u(0) = 1 and

e

−β

= 1− β ≈ 1 . (44)

for small values of β the probability v(0) = P(Y = 0)

equals the buyer concentration

v(0) = 1 − α . (45)

The probability v(0) is zero for non-bursty free time

intervals between buyers to the cash register and in-

creased to 50 % for bursty ones.

5 GROCERY SHOPS IN

LITHUANIA

In order to get practically relevant data regarding the

distribution of gaps, the free time intervals between

buyers to the cash register in two different shops (gro-

cery shop and supermarket) in Lithuania are studied.

The buyer probability as well as buyer concentration

derived from the obtained data allows identifying bot-

tlenecks during the payment process at the cash reg-

ister in shop sales.

Analysis of Free Time Intervals between Buyers at Cash Register using Generating Functions

47

The collected cash register data, obtained from a

single cash register of each shop, contain the opera-

tion time, the amount of goods purchased, their codes

and the prices paid by each buyer. The data collection

was carried out in June 2018 and September 2018.

Unfortunately, the cash registers do not record the

start time of the operation. Therefore, the service du-

ration time was not available from the database. To

cope with this problem the observed buyers’ service

durationswith differentquantities of goodswere anal-

ysed as shown in (Ahrens et al., 2019a). By analysing

the quantity of bought goods n

g

and the service dura-

tion t

s

the regression equation

t

s

= 1,9n

g

+ 22,8 (46)

was obtained. The equation yields that for one good

about 1,9 seconds and additionally about 22,8 sec-

onds for each buyer are required. The data were col-

lected in the grocery shop, and it is assumed that all

grocery shops as well as supermarkets have similar

performance as they are working with similar equip-

ment of cash registers and salespeople who are work-

ing at a similar intensity. Knowing the quantity of

goods and (46), the start and end times of each buyer

can be calculated. This allowed us to analyse the free

time intervals between two buyers’ service.

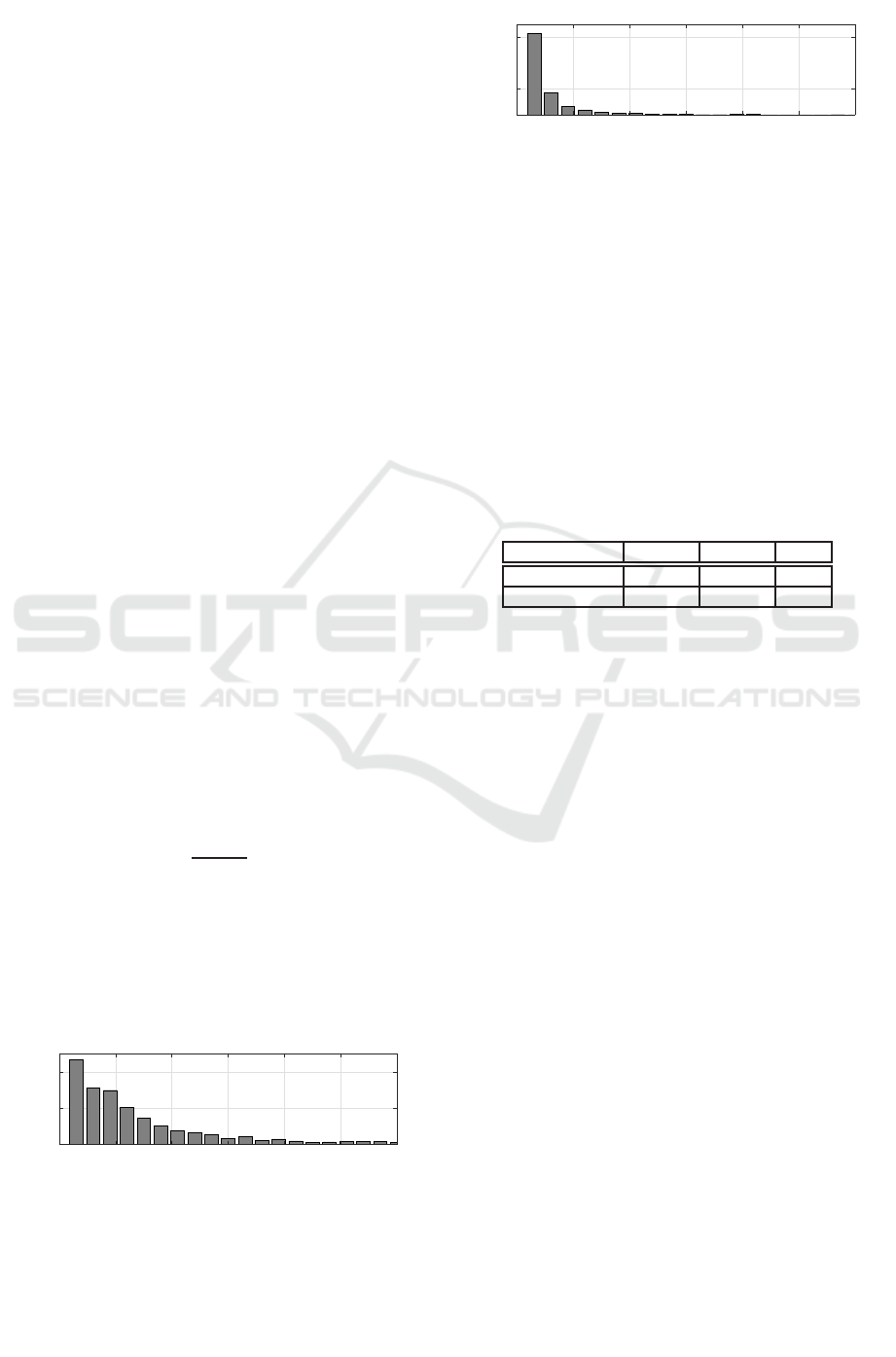

The histograms of the free time intervals at the

cash register for the grocery shop as well as the su-

permarket are given in Fig. 8 and Fig. 9. Comparing

both figures it turns out that the free times of the cash

register are more bursty in the supermarket. Here, ei-

ther short free time intervals or significantly longer

free time intervals are observed.

According to (Goh and Barab´asi, 2008), the level

of burstiness of free time intervals can be calculated

analytically and is defined as

B =

σ− m

1

σ+ m

1

, (47)

by taking the mean value m

1

(average gap length or

average length of free time intervals between two buy-

ers at the cash register) as well as the standard devi-

ation σ of the length of the free time intervals into

account. The burstiness parameter B ranges between

−1 ≤ B ≤ 1. Here, larger values of B indicate a

0 100 200 300 400 500 600

0

0.1

0.2

Probability →

t(ins) →

Figure 8: Distribution of free times of cash register

(grouped) at grocery shop.

0 100 200 300 400 500 600

0

0.2

0.6

Probability →

t(ins) →

Figure 9: Distribution of free times of cash register

(grouped) at the supermarket.

higher level of burstiness. As shown in (Ahrens et al.,

2019a), the parameter B equals the buyers’ concentra-

tion (1− α) in the range of 0 < B ≤ 1.

Tab. 1 shows the calculated level of burstiness, de-

fined by the parameter B, of free time intervals be-

tween buyers at the cash register for the two investi-

gated shops. The obtained data confirm a higher level

of burstiness in the supermarket compared with the

grocery shop when analysing the free time intervals

between buyers as shown in Fig. 8 and Fig. 9.

Table 1: Burstiness of free time intervals between buyers at

the cash register.

Shop m

1

σ B

Grocery Shop 234,1 s 620,1 s 0,45

Supermarket 96, 9 s 408,7 s 0,62

As the parameter B equals the buyers’ concentra-

tion (1−α), appropriate parameters of the underlying

gap process for modelling the free time intervals to

the cash register could be found. The results show a

slightly higher intensity, expressed by lower value m

1

and a higher buyer concentration, at the supermarket

compared with the grocery shop.

6 CONCLUSION

In this work the concept of generating functions was

applied to the field of business processes. By the theo-

retical investigations of the inter-connections between

buyers and corresponding gap-processes, a new ap-

proach based on generating functions was introduced.

Generating functions were used for the analysis of

the free time intervals between buyers to the cash reg-

ister as a part of the payment process. The proposed

parameters, namely buyer probability and buyer con-

centration, allow identifying a burstiness level. In

turn, a burstiness level serves as an indicator of bot-

tlenecks. A high level of burstiness, expressed by the

buyer concentration, increases the possibilities of bot-

tleneck emergence.

For practical verification the payment process was

analysed in two shops of different sizes in Lithuania.

PECCS 2020 - 10th International Conference on Pervasive and Parallel Computing, Communication and Sensors

48

The obtained results show that in both shops free time

intervals at the cash register are quite bursty.

Practical implementation allows concluding that

the proposed solutions are applicable to the field of

business processes.

However the research has some limitations. In this

work only two grocery shops in Lithuania were in-

vestigated. Another limitation is that only one cash

register per shop was analysed.

Further work will concentrate on the joint mod-

elling of free time intervals between buyers as well as

the payment processing time at the cash register. For

this, it is important for service quality improvement

to analyse if the found burstiness of free time inter-

vals between buyers affects the buyers’ service time.

Future research will also focus on extending the

dataset for a practical study. It includes the compar-

ison of the implemented experimental analysis with

other existing approaches. Examination of the use of

the proposed approach for large shops with numer-

ous counters will be planned and executed in order

to demonstrate the use of the approach in real-life

projects.

REFERENCES

Ahrens, A. (2000). A new digital channel model suitable

for the simulation and evaluation of channel error ef-

fects. In Colloquium on Speech Coding Algorithms

for Radio Channels, London (UK).

Ahrens, A., Purvinis, O., Hartleb, D., Zaˇsˇcerinska, J., and

Miceviˇciene, D. (2019a). Analysis of a Business En-

vironment using Burstiness Parameter: The Case of a

Grocery Shop. In International Conference on Perva-

sive and Embedded Computing and Communication

Systems (PECCS), Vienna (Austria).

Ahrens, A., Purvinis, O., and Zaˇsˇcerinska, J. (2019b).

Gap Distributions for Analysing Buyer Behaviour in

Agent-Based Simulation. In International Conference

on Sensor Networks (Sensornets), Prague (Czech Re-

public).

Chattamvelli, R. and Shanmugam, R. (2019). Generating

Functions in Engineering and the Applied Sciences.

Morgan & Claypool.

Feldmann, A. (2000). Characteristics of TCP Connection

Arrivals. In Park, K. and Willinger, W., editors, Self-

similar Network Traffic and Performance Evaluation,

chapter 15, pages 367–399. Wiley.

Goh, K.-I. and Barab´asi, A.-L. (2008). Burstiness and

Memory in Complex Systems. Exploring the Fron-

tiers of Physics (EPL), 81(4):48002.

Kessler, T., Ahrens, A., C., L., and Melzer, H.-D. (2003).

Modelling of connection arrivals in Ethernet-based

data networks. In 4rd International Conference on

Information, Communications and Signal Processing

and 4th IEEE Pacific-Rim Conference on Multimedia

(ICICS-PCM), page 3B6.6, Singapore (Republic of

Singapore).

Kresch, E. and Kulkarni, S. (2011). A poisson based bursty

model of internet traffic. In 2011 IEEE 11th Inter-

national Conference on Computer and Information

Technology, pages 255–260.

Kumar, A., Bezawada, R., Rishika, R., Janakiraman, R., and

Kannan, P. (2016). From Social to Sale: The Effects of

Firm-Generated Content in Social Media on Customer

Behavior . Journal of Marketing, 80(1):7–25.

Li, S. (1992). Generating Function Approach for discrete

Queueing Analysis with decomposable Arrival and

service Markov Chains. In IEEE International Con-

ference on Computer Communications (INFOCOM).,

pages 2168–2177, Florence (Italy).

Miceviciene, D., Purvinis, O., Glinskiene, R., and Tautkus,

A. (2018). Alternative Solution for Client Service

Management. Applied Research in Studies and Prac-

tice, 14(1):47–51.

Mittal, V. and Kamakura, W. (2001). Satisfaction, Repur-

chase Intent, and Repurchase Behavior: Investigat-

ing the Moderating Effect of Customer Characteris-

tics. Journal of Marketing Research, 38(1):131–142.

Weisstein, E. W. (1999). The CRC Concise Encyclopedia of

Mathematics. CRC Press, Boca Raton and London.

Wilhelm, H. (1976). Daten¨ubertragung (in German).

Milit¨arverlag, Berlin.

Wilhelm, H. (2018). Calculation of Error Structures in

Binary Channels with Memory. Books on Demand,

Norderstedt.

Zhang, J., Shen, F., and Waguespack, Y. (2016). Incor-

porating Generating Functions to Computational Sci-

ence Education. In International Conference on Com-

putational Science and Computational Intelligence

(CSCI)., pages 315–320, Las Vegas (USA).

Zukerman, M., Neame, T. D., and Addie, R. G. (2003).

Internet traffic modeling and future technology im-

plications. In IEEE INFOCOM 2003. Twenty-

second Annual Joint Conference of the IEEE Com-

puter and Communications Societies (IEEE Cat.

No.03CH37428), volume 1, pages 587–596.

Analysis of Free Time Intervals between Buyers at Cash Register using Generating Functions

49