Saudi Stock Market Sentiment Analysis using Twitter Data

Amal Alazba

1,2

, Nora Alturayeif

1,3

, Nouf Alturaief

1,3

and Zainab Alhathloul

1

1

Department of Information and Computer Science, KFUPM, Dhahran, Saudi Arabia

2

Department of Information Systems, King Saud University, Riyadh, Saudi Arabia

3

Department of Computer Science, Imam Abdulrahman Bin Faisal University, Dammam, Saudi Arabia

Keywords:

Machine Learning, Sentiment Analysis, Supervised Learning, NLP.

Abstract:

Sentiment analysis in the finance domain is widely applied by investors and researchers, but most of the work

is conducted for English text. In this work, we present a framework to analyze and visualize the sentiments of

Arabic tweets related to the Saudi stock market using machine learning methods. For the purpose of training

and prediction, Twitter API was used for collecting off-line data, and Apache Kafka was used for real-time

streaming tweets. Experiments were conducted using five machine learning classifiers with different feature

extraction methods, including word embedding (word2vec) and the traditional BoW methods. The highest

accuracy for the sentiment classification of Arabic tweets was 79.08%. This result was achieved with the

SVM classifier combined with the TF-IDF feature extraction method. At the end, the predicted sentiments of

the tweets using the outperforming classifier were visualized by several techniques. We developed a website

to visualize the off-line and streaming tweets in various ways: by sentiments, by stock sectors, and by frequent

terms.

1 INTRODUCTION

Generally, stock market behavior has a random pat-

tern that cannot be predicted very accurately. How-

ever, with the advent of machine learning, the user-

generated content can be analyzed and used to predict

stock returns (Ranco et al., 2015; Karabulut, 2013).

Recent research has shown a significant relationship

between the stock returns and the user-generated con-

tent (Ranco et al., 2015; Pagolu et al., 2016; Oliveira

et al., 2017). Different data sources were used to col-

lect the users’ content, such as Twitter (Ranco et al.,

2015), Facebook (Karabulut, 2013) and LiveJournal

(Gilbert and Karahalios, 2010). Also, different analy-

sis techniques have been applied on users’ data, such

as mood analysis (Nofer and Hinz, 2015) and senti-

ment analysis (Ranco et al., 2015; Pagolu et al., 2016;

Oliveira et al., 2017). However, a significant corre-

lation between the stock returns and user-generated

content were mostly found in twitter data by utilizing

sentiment analysis (Ranco et al., 2015).

Although there are many studies that have investi-

gated the use of Twitter as a major source for public-

opinion analysis, none of them analyzed the sentiment

of Arabic stock market tweets. In this work, we con-

tribute to the field of sentiment analysis of Twitter

Arabic data. Sentiment analysis is concerned with

classifying an opinion of text into positive, negative

or neutral. We used the sentiment analysis to classify

tweets about Saudi stock market into positive or neg-

ative. The stock market is changing frequently, there-

fore, it is very important to analyze real-time tweets.

We used Apache Kafka for real-time sentiment analy-

sis of Saudi stock market tweets. Then, the predicted

sentiment of the collected and the real-time tweets

were visualized into a website.

The proposed work can be used by individuals

who are interested to invest in the Saudi stock mar-

ket. The website provides insights about to what ex-

tent people are satisfied with the Saudi stock market

in different sectors. To reproduce our results and for

future work, the code and data used in the experiments

can be accessed through GitHub

1

.

The rest of the paper is organized as follows. In

section 2, we briefly review the related research about

user-generated content and the stock market. The

methodology is discussed in details in section 3, start-

ing by the data collection, followed by the data anal-

ysis, data streaming and data visualization. In sec-

tion 4, we show the evaluation results of the sentiment

analysis. Section 5 presents the website that was de-

veloped to visualize the results of this work. Finally,

in section 6 we will wrap up with a conclusion and a

discussion on future work that can be extended from

this paper.

1

https://github.com/Noufst/Saudi-Stock-Market-

Sentiment-Analysis

36

Alazba, A., Alturayeif, N., Alturaief, N. and Alhathloul, Z.

Saudi Stock Market Sentiment Analysis using Twitter Data.

DOI: 10.5220/0010026100360047

In Proceedings of the 12th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2020) - Volume 1: KDIR, pages 36-47

ISBN: 978-989-758-474-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 RELATED WORK

In this section, we briefly review the research which

investigates the correlation between the Twitter data

and financial markets. Most of the research used sen-

timent analysis (Ranco et al., 2015; Pagolu et al.,

2016; Oliveira et al., 2017), whereas analyzing the

user’s mood has not been largely explored (Nofer and

Hinz, 2015). This might be because sentiment anal-

ysis has shown to be significantly affecting the stock

market while the users’ mood has shown no signifi-

cant correlation with the stock market. Also, the ma-

jority of the research was conducted on English tweets

(Ranco et al., 2015; Pagolu et al., 2016; Oliveira et al.,

2017). One study has used Germany tweets (Nofer

and Hinz, 2015); however, the tweets were translated

into English before the analysis.

Ranco et al. investigated the relations between

30 stocks of the DJIA index and Twitter data (Ranco

et al., 2015). They collected over 1.5 million En-

glish tweets using the Twitter Streaming API. Three

financial experts have labelled 100,000 tweets using

three sentiment labels: negative, neutral or positive.

They used SVM model to classify 1.5 million tweets

to compare the data of the stock price returns with

tweets polarity. The results have shown a significant

relationship between the abnormal stock returns with

sentiments of tweets.

A more focused analysis of one company was ex-

plored by Pagolu et al. (Pagolu et al., 2016). The

aim of this study was to find if there is a correla-

tion between the public opinions of the company with

stock prices of that company. 2.5 million tweets about

Microsoft were collected using Twitter API, however,

only 3,216 tweets were annotated by a human. A ma-

chine learning model was built using the Random For-

est algorithm with an accuracy of 70.2%. They com-

pared the sentiments of the tweets with stock price

data of Microsoft, and a strong correlation between

them were found.

Oliveira et al. have analyzed the tweets to fore-

cast the stock market behavior (Oliveira et al., 2017).

They collected roughly 31 million tweets using Twit-

ter REST API. The collected tweets contain hashtags

of all stocks traded in US markets. A lexicon-based

model was used to extract the sentiment of the tweets.

Many machine learning algorithms such as Neural

Network, SVM and Random Forest were used to pre-

dict the stock market. The results have shown that the

stock market behavior can be predicted using senti-

ment analysis of twitter data.

Some studies have investigated the effect of users’

mood in the stock market. Nofer and Hinz conducted

an empirical study to explore the correlation between

the people’s mood and the stock market (Nofer and

Hinz, 2015). They collected around 100 million Ger-

man tweets using Twitter API and included only pos-

itive and negative tweets using a dictionary of key-

words. They translated German tweets into English

in order to use the ASTS tool. The DAX intraday

returns of 30 major German companies were used in

the analysis. The result has shown no significant rela-

tionship between the stock market and Twitter users’

mood.

In this study, we aim to analyze Arabic tweets re-

lated to the Saudi stock market. The sentiments can be

further analysed to examine the correlation between

tweets and the Saudi stock index.

3 METHODOLOGY

This section describes the framework that we present

to analyze the sentiment of Arabic tweets for the

Saudi Stock market. In general, there are three ap-

proaches that one can handle this problem: super-

vised learning, lexicons or using a hybrid of both. In

the current work, we adopt supervised learning to ex-

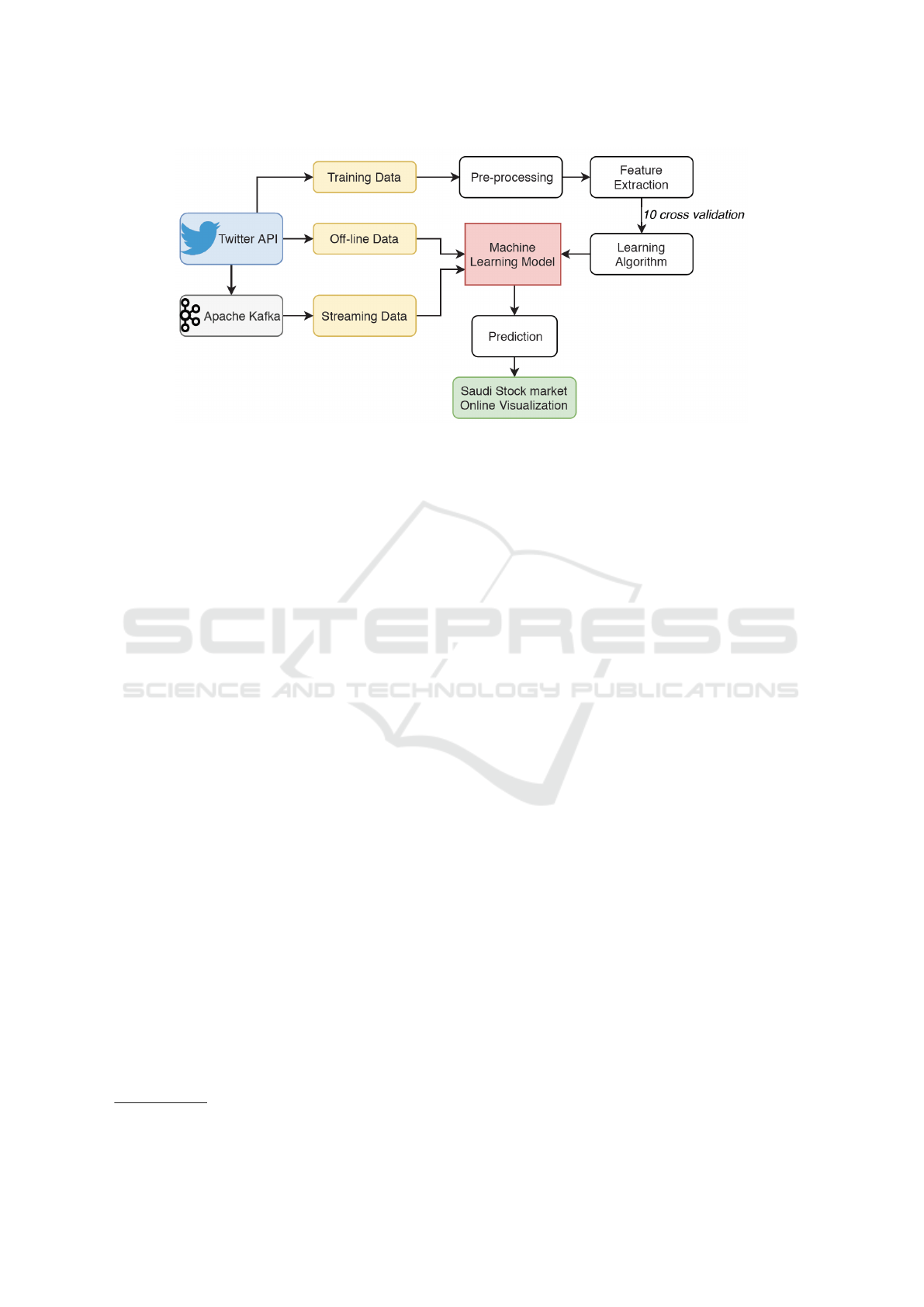

tract the sentiment of tweets. Figure 1 illustrates the

framework of the sentiment analysis process, starting

from collecting the data until the visualisation of the

results.

3.1 Data Collection

As one of the most popular social media platforms in

Saudi Arabia, Twitter has been selected for this study

as the data source for the sentiment analysis. In or-

der to collect the tweets related to the Saudi stock

market, the Twitter search API

2

was queried with a

specific keywords such as "A` rJ¥m", "¤d",

"¨FA", etc. However, Twitter’s standard search API

only searches against a sampling of recent tweets pub-

lished in the past 7 days. Thus, to collect tweets in one

year period, the IDs of users who publish tweets re-

lated to Saudi stock market were extracted. Then, we

extracted the timelines of these users and filter them

based on the keywords and date. The irrelevant tweets

(e.g. advertisement tweets) were eliminated.

A total of 5209 Arabic language tweets over the

period of January 1st, 2019 to December 13th, 2019

related to the Saudi stock market were extracted from

twitter API (after excluding redundant and irrelevant

tweets, e.g. advertisement tweets). Each tweet record

contains: (1) tweet identifier, (2) date/time of cre-

ation, and (3) text. The tweets used in this study are

based on data obtained from public timelines.

2

https://dev.twitter.com/

Saudi Stock Market Sentiment Analysis using Twitter Data

37

Figure 1: Framework of the proposed twitter sentiment analysis system.

3.2 Data Pre-processing

The pre-processing of the tweets’ text involves a set of

operations that are already shown to be efficient with

a high accuracy result (Duwairi and El-Orfali, 2014).

Four stages were employed:

1. Cleaning: Tweets contain many emoticons and

unnecessary data, thus, cleaning step is applied to

better define the feature space. RegEx matching

and preprocessor

3

packages in Python were uti-

lized to remove URLs, hashtags, emoticons, user

mentions and extra whitespace.

2. Normalization: In order to transform the tweets to

a more unified sequence, the following steps were

applied:

• Prolonged word showing intense emotions like

"EAtm" is replaced with "EAtm".

• Punctuation and diacritics (short vowels) such

as "Å Ä ¿" are removed.

• Tatweel "þþ" is removed. For example, us-

ing Tatweel in the word "ws"” may look

like"wþþþs".

• The letters that appear in different forms are

Unified. For example, unify ", , , " to be

"".

3. Stop Words Removal: Stop Words are a group of

words that do not express any emotion, such as

preposition. Thus, stop words are removed, for

the model to focus on the expressive words, and

to enhance the quality of the classifier.

4. Tokenization: The process of tokenization splits

sentences (tweets) into words, which makes the

3

https://pypi.org/project/tweet-preprocessor/

texts easier for additional processing; e.g. pro-

ducing the “words vectors”.

3.3 Sentiment Analysis Model

The design of the sentiment analysis model involves

two sub-tasks: feature extraction and model train-

ing. For this study, three types of word representa-

tion techniques were used for the learning features,

and five different machine learning classifiers were

selected as the prediction model.

3.3.1 Feature Representation

Machine learning methods require lots of feature en-

gineering work for proper textual representations.

Most Arabic sentiment analysis applications still rely

on costly hand-crafted features and lexicon-based fea-

tures to achieve the preferred accuracy (Abu Farha

and Magdy, 2019). Many of the state-of-art NLP

architectures adopted word embedding techniques,

which have many advantages compared to Bag-of-

Words (BoW) representation. For example, words

that share similar contexts in the text are placed within

close proximity to one another in the vector space.

In addition, word embeddings have lower dimensions

than the BoW (Mikolov et al., 2013a).

In this work, we utilized neural word embeddings

created by Altowayan and Tao (Altowayan and Tao,

2016) as an alternative for such hand-engineered fea-

tures. They utilized the well-known and widely used

word2vec model (Mikolov et al., 2013b) with Contin-

uous Bag of Words (CBOW) model architecture to em-

bed Arabic words in a continuous vector space. Their

embeddings were built using a corpus contains around

190 million words from 3 sources: Quran, Arabic

KDIR 2020 - 12th International Conference on Knowledge Discovery and Information Retrieval

38

news, and consumer reviews to enrich the corpus with

different dialectal vocabulary.

Despite that BoW introduced limitations such as

sparse representation and large feature dimension

(Mikolov et al., 2013a), we used BoW for build-

ing a baseline model. Two approaches of BoW

were implemented: counting word occurrence and

Term Frequency-Inverse Document Frequency (TF-

IDF). Both methods were applied using the fea-

ture_extraction.text module available in the open

source Python library: scikit-learn.

3.3.2 Models Training

In this work, we used a supervised machine learning

approach to train a sentiment classifier. For the pur-

pose of training, 427 tweets were labeled manually

by two experts in Tadawul All Share Index (TASI).

The tweets were labeled with two sentiments: posi-

tive (211 tweets) and negative (216 tweets). Positive

tweets were given the label "1", and negative tweets

were given the label "0". The meaning and examples

of each label are illustrated in Table 1. Nevertheless,

it should be noted that the ground-truth data labels

should be considered informed but not 100% accu-

rate, as human decisions can involve errors.

Five different learning algorithms were employed

for the development of the tweets sentiment clas-

sifier: (1) Random Forest, (2) Stochastic Gradient

Descent (SGD), (3) Linear SVM, (4) Logistic Re-

gression and (5) Decision Tree. All learning algo-

rithms were implemented using scikit-learn libraries.

The algorithms were trained to classify new obser-

vations based on the set of labeled data (tweets),

each described by 3 different feature representations

(word2vec, count occurrence and TF-IDF), which are

demonstrated in Section 3.3.1. Lastly, in order to

evaluate the classifiers’ performance in more general

cases, 10-fold cross validation was used from scikit-

learn’s model_selection module.

3.4 Data Streaming

In the stock market, it is crucial to have a real-

time sentiment analysis of users’ opinion. Therefore,

Apache Kafka

4

was utilized to predict the sentiment

of the tweets in real-time. Apache Kafka is a dis-

tributed service that uses topic-subscribe messaging

which can be used as a real-time streaming platform.

In this paper, we created a topic named stock_market

to collect streaming tweets on Saudi stock market.

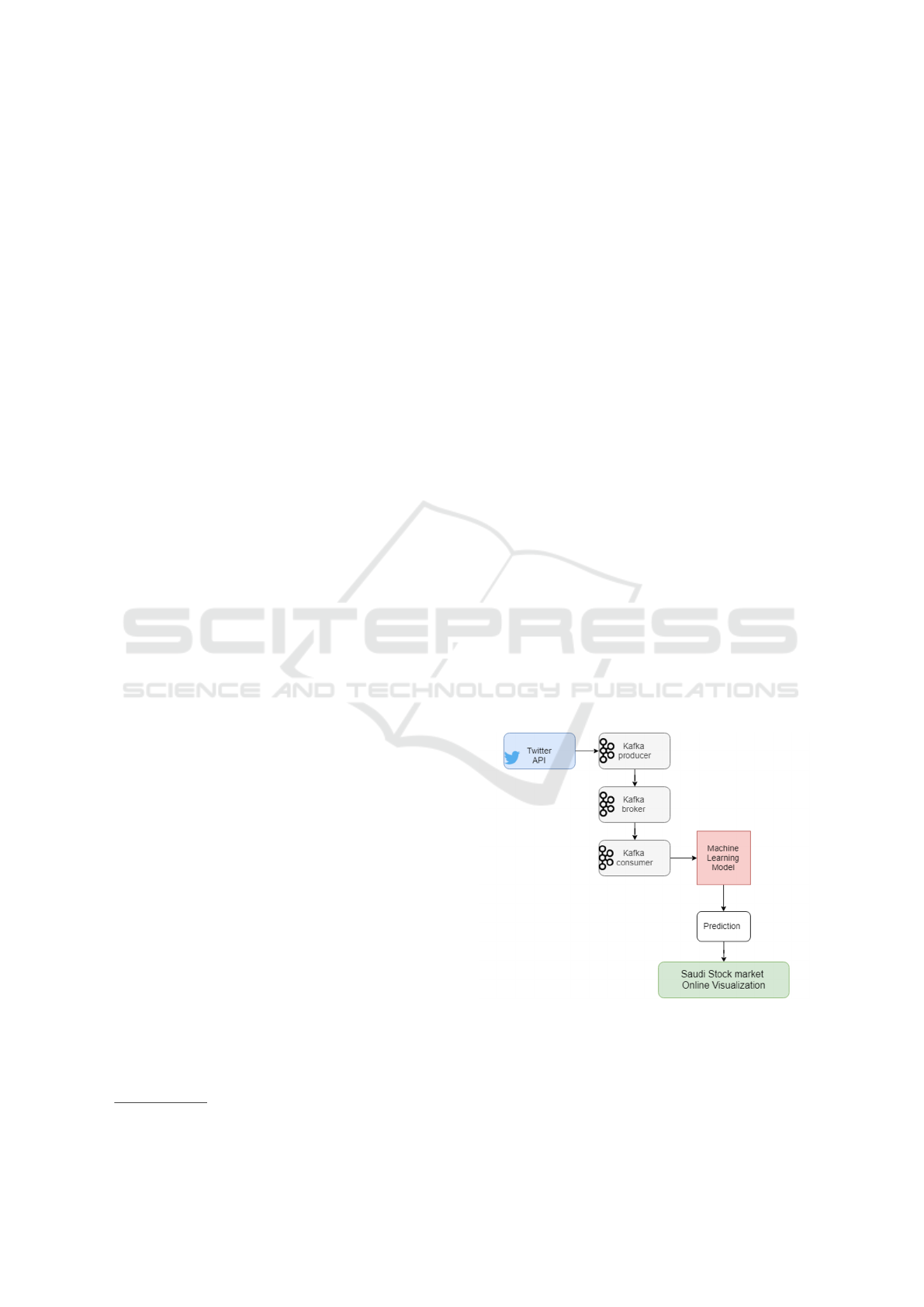

The architecture of Kafka that is integrated with the

4

https://kafka.apache.org

trained model is presented in Figure 2. The architec-

ture consists of six components:

• Kafka Producer: This component is one of the

main modules in Kafka. It publishes the stream-

ing tweets to the stock_market topic that was cre-

ated previously.

• Kafka Broker: Kafka consists of a cluster of

servers; each server is called a broker. The server

stores a key, value (the tweet text and time cre-

ated), and a timestamp of each tweet and saves the

tweets in the stock_market topic in the server. The

data that is stored in the broker are immutable, any

new tweet will be appended to the log.

• Kafka Consumer: The consumer can subscribe to

one or more topics. In this research, the consumer

subscribes to the stock_market topic. Now, the

consumer can consume the data in the server to

be analyzed and visualized in the next two steps.

• Machine learning model: The previously trained

model described is Section 3.3, will be loaded in

order to be used to classify real-time streaming

tweets.

• Sentiment analysis/prediction: Each tweet stored

in the stock_market topic and consumed by the

consumer will be fed to the classifier. The clas-

sifier will return the sentiment of a tweet; whether

it is a positive or a negative tweet.

• Visualization: Finally, the results will be visual-

ized by a website. The visualization outcome is

described in Section 3.5.

Figure 2: Kafka architecture.

Saudi Stock Market Sentiment Analysis using Twitter Data

39

Table 1: Labels of tweets used in annotation and an example of each label.

Label Example Tweet English Translation

Positive: if there is a clear

indicator of bull market

even if it is not strong

Aq wbF± ws ¨ ¨§C

..ºAW`A A¤ rS ¢

¾®yl Xbh§ d d± w§ T§d

r «r Xq §wtl

.l ¢l¤ T§ Ayq ArKl

My opinion of the market next week is

that it’s green and full of tender..

By the start of Sunday, it may go

down a little, for intimidation only.

Then, we will notice a move for the

leading companies, and God knows best.

Negative: if there is a clear

indicator of bear market

even if it is not strong

CA ¨Am¤ ¨nf ylt

wt¯ F± wF ,rWys

ws ,¾Ay¶Ah zf rb ¢y

¤znA bK

Technical and financial analysis are out

of control. Do not expect a motivational

news for the stock market, it’s oversold.

3.5 Data Visualization

For the data to be meaningful and useful for public

users, a website is developed to visualize the senti-

ments of Saudi stock market data. In the website, the

sentiment of the previously collected tweets, as well

as the real-time tweets, are visualized. The tools that

have been used in both the server and client sides are

described next.

• Server-Side Tools:

– Flask: Flask

5

is a framework written in python

that facilitates the design and development of

web applications. The main advantage of using

this framework is its extensibility.

– Python: in particular, python is used in the

server side for real-time twitter data streaming.

It runs the Kafka consumer that is written in

python. It sends the results in a JSON format to

the client to be read using JavaScript.

• Client-Side Tools:

– Interfaces: HTML (Hypertext Mark-up Lan-

guage) and CSS (Cascading Style Sheets) are

used to build the website. HTML and CSS are

the base of web scripting languages for devel-

oping web applications. HTML and CSS aren’t

the same; they are like the bones and skin for

any website. HTML is responsible for con-

structing and structuring the actual content of

the website, including the written text or fig-

ures, whereas, CSS is used to design or deco-

rate the website, such as the colors, the layout

and the visual effects.

– Data Processing: JavaScript

6

and jQuery

7

are

used to load, modify, transform, and control

5

https://palletsprojects.com/p/flask

6

https://www.javascript.com

7

https://jquery.com

the data. JavaScript is a dynamic scripting lan-

guage that makes websites more interactive. It

enables changing the content, layouts or posi-

tion of the website dynamically. jQuery is an

open-source library written in JavaScript. It

contains a set of functions that facilitate the use

of a JavaScript.

– Charts Visualization: to visualize the data in an

attractive and readable way, two JavaScript li-

braries were used: Chart.js

8

and D3.js

9

. Both

a powerful data visualization using different

types of charts such as (bar chart, pie chart, line

chart, etc.). Chart.js provides simple graphs

representation while D3.js can be used for com-

plex data visualizations that need a high level of

interactivity.

4 MODEL PERFORMANCE AND

EVALUATION

To examine the effectiveness of the proposed model

and for the purpose of methods comparison, the per-

formance is reported using F1-score and MAcc (mean

accuracy of the 10-folds cross validation). The de-

tailed performance of all the five classifiers on each

of the three feature representations are reported in Ta-

ble 2.

Several important conclusions can be drawn from

the results presented in Table 2. First, word em-

bedding perform poorly on all classifiers compar-

ing to the other two feature representations. This

shows that traditional BoW approach may work better

than Word Embedding in small datasets. In addition,

since our context is very domain specific, we couldn’t

find some corresponding vectors from the pre-trained

8

https://https://www.chartjs.org

9

https://d3js.org

KDIR 2020 - 12th International Conference on Knowledge Discovery and Information Retrieval

40

Table 2: F1-score and accuracy percentage for each classifier and feature representation.

Classifier Metric

Feature Representation

Count Occurance

TF-IDF

Word Embedding

Random Forest

Mean accuracy 75.38 77.06 62.06

F1-score 75.75 74.63 62.00

SGD

Mean accuracy 72.36 75.42 65.29

F1-score 72.32 74.44 63.88

Linear SVM

Mean accuracy 75.94 82.15 69.85

F1-score 75.98 79.08 68.42

Logistic Regression

Mean accuracy 73.97 78.07 64.49

F1-score 75.00 74.34 63.11

Decision Tree

Mean accuracy 71.83 75.23 54.48

F1-score 74.07 71.92 53.29

word embedding model created by Altowayan and

Tao (Altowayan and Tao, 2016). They have gener-

ated the embedding using a corpus from Quran, Ara-

bic news and consumer reviews with different Arabic

dialect vocabulary that does not include all Saudi di-

alect vocabulary. This suggests that such a simple use

of the word embedding may not give us an advantage

to Arabic sentiment analysis. This should encour-

age research in the application of word embedding for

Arabic to adapt more future-promising techniques.

As can be seen from Table 2, TF-IDF representa-

tion performed best among the three different repre-

sentations. Furthermore, SVM outperformed all other

learning algorithms with each feature representation.

SVM has F1-score of 79.08 and mean accuracy rate

of 82.15 using the TF-IDF representation.

5 SAUDI STOCK MARKET

ONLINE VISUALIZATION

The goal of this paper is a visualization that presents

the sentiment of the Saudi stock market trends. Using

the best classifier obtained with the process explained

in Section 3, we classified the off-line tweets and the

streaming tweets into one of two categories (positive

or negative). The sentiment of the resulted tweets are

visualized using several different visualization tech-

niques. Each technique is designed to highlight dif-

ferent aspect.

Figure 3 shows the total number of positive and

negative tweets about the Saudi stock market per day.

The user can select a specific month and see the peo-

ple opinion about the Saudi stock market or about

Aramco shares specifically. Also, the user can se-

lect to view the total number of positive and nega-

tive tweets over the year by selecting "all" using the

slider. In Figure 3, the peak of the tweets was on 17

Nov 2019 (the day where Aramco opened the sub-

scription of the shares). The graph shows that most

of the tweets on 17 Nov are positive, which gives an

indicator that people are optimistic and interested in

trading in Aramco.

Figure 3: The total number of positive and negative tweets

in November 2019.

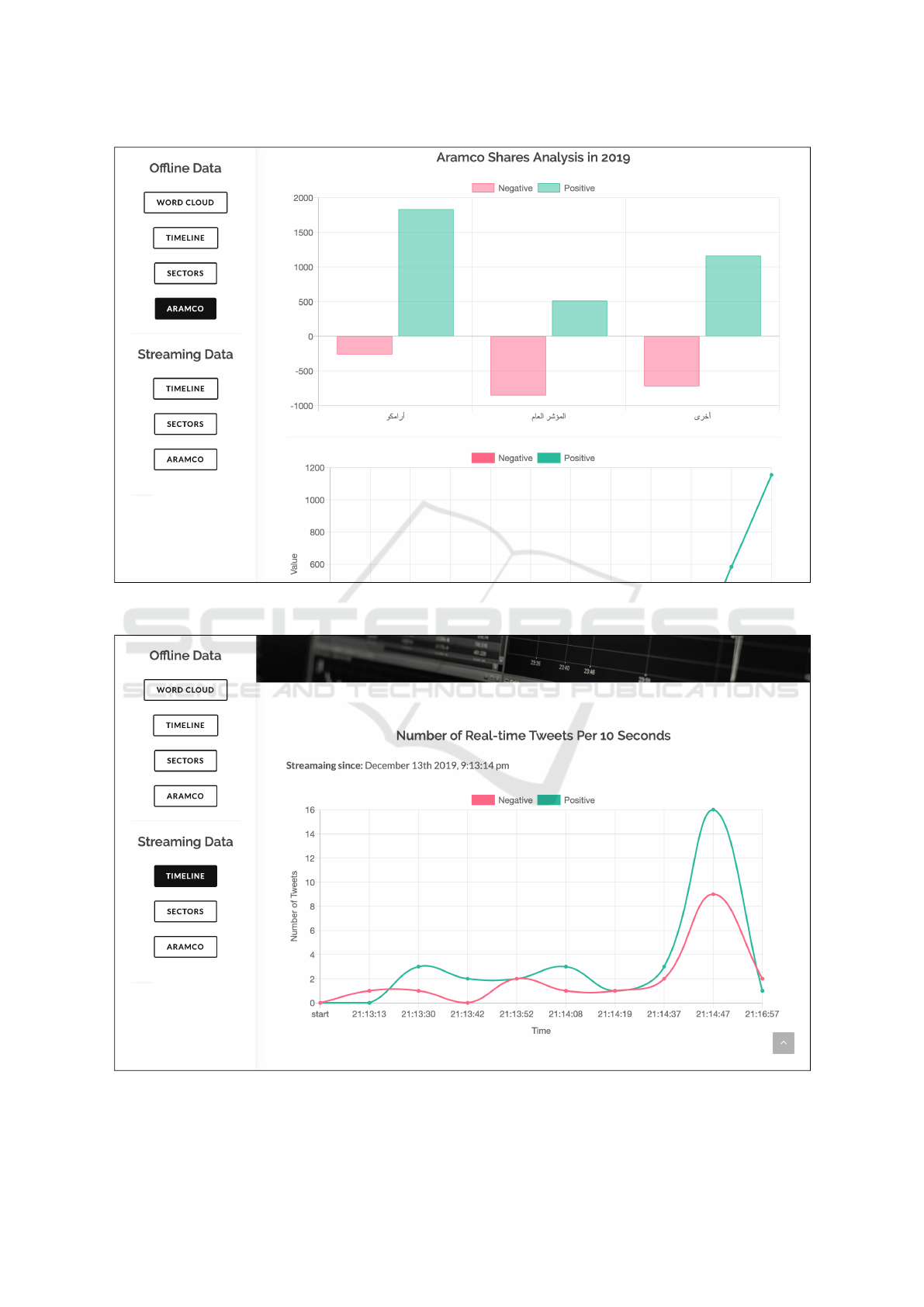

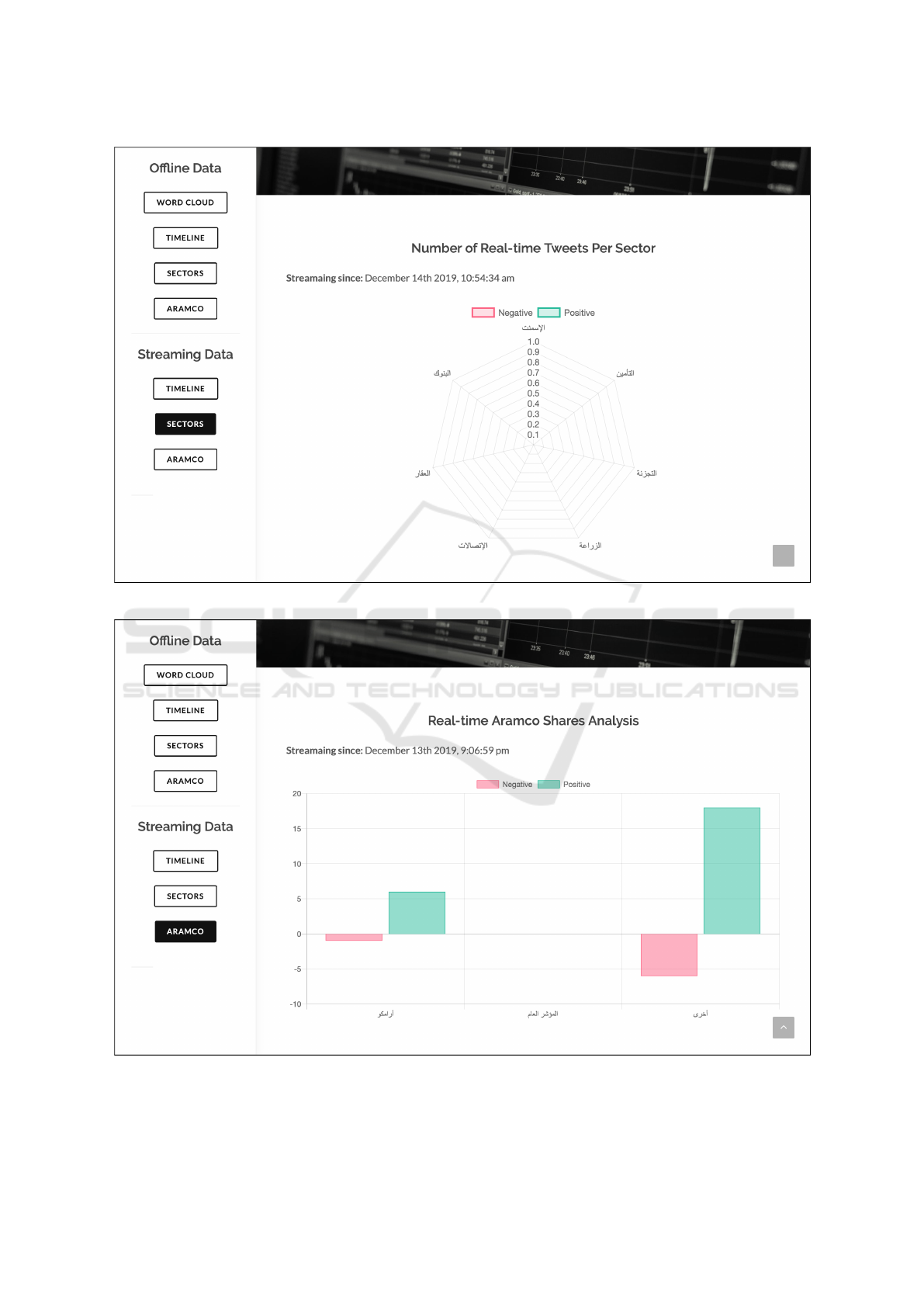

In Figure 4, the total number of positive and neg-

ative tweets for each sector is shown. This graph

can be very useful when an individual is interested

in investing in one of the following sectors: (Cement,

Banks, Real-Estate, Agriculture, Retail, Telecommu-

nications, and Insurance). The results show that peo-

ple in Saudi Arabia are mostly talking about Cement,

Banks, Real-Estate and Telecommunications sectors.

However, not all of the tweets are positively talking

about these sectors. As we can see in Figure 4, most

of the tweets are positive in Cement, Banks and Real-

Estate sectors, while the number of positive and neg-

ative tweets about the Telecommunications sector is

almost equal. The tweets about the insurance sector

stocks are mostly negative.

Moreover, we noticed a lot of tweets about the

Saudi Stock Market Sentiment Analysis using Twitter Data

41

Figure 4: The total number of positive and negative tweets

per sector.

Saudi stock market in general. Therefore, we visu-

alized the data into another graphs that show the to-

tal number of positive and negative tweets about the

Tadawul All Share Index (TASI), which is the ma-

jor stock market index on the Saudi Stock Exchange.

We compared the results of TASI with Aramco shares

and all the other sectors. Figure 5 shows the num-

ber of positive (the green bars) and negative (the red

bars) tweets for Aramco, TASI and other sectors. The

figure revealed that about 64% and 62% of TASI and

others sectors tweets are negative, respectively. How-

ever, about 88% of Aramco shares tweets are positive.

Figure 5: A comparison between Aramco, TASI and other

sectors in term of total number of positive and negative

tweets.

Figure 6 provides a visual representation of the

most frequently used terms in the positive and neg-

ative tweets, which were extracted using the text min-

ing steps listed in Section 3.2 with the predictions

from the proposed model. In order to show the Ara-

bic terms in proper a form, the word cloud was gen-

erated by installing the following packages in Python:

arabic_reshaper, bidi.algorithm and wordcloud. The

significance of a word (i.e. based on its frequency) is

associated with the font size of the word.

Figure 6: Word Cloud of the positive and negative tweets.

All the previous graphs show the result of

analysing the off-line data. Nevertheless, the same

graphs were implemented to visualize the streaming

data in real-time. Complete screenshots of the web-

site can be accessed in the Appendix.

6 CONCLUSIONS AND FUTURE

WORK

This paper addressed a sentiment analysis for tweets

expressed in Arabic language about the Saudi stock

market. We have collected 5209 tweets about the

Saudi stock market. We analyzed the sentiment of the

tweets using 427 labeled tweets, five machine learn-

ing classifiers, and three different feature extraction

methods. The SVM classifier with the TF-IDF train-

ing model achieved the highest accuracy (79.08%),

therefore it was chosen to be loaded in the website

to predict the sentiments of the off-line and real-

time streaming tweets. We utilized Apache Kafka to

stream real-time tweets. Then, we visualized the re-

sults using different types of charts in a website de-

veloped using Flask framework, Chart.js and D3 li-

braries. The preliminary evaluation results revealed

that TF-IDF feature representations performed better

than word embeddings and word occurrence. We be-

lieve that this work should encourage research in the

application of word embedding for Arabic to adapt

more future-promising techniques. Moreover, as ex-

emplified in the previous work, sentiment analysis in

Arabic language is a challenging task when compared

to other languages.

In this paper, we have trained only 427 tweets

for analyzing people’s sentiment about Saudi stock

market. In future, we aim to target larger training

KDIR 2020 - 12th International Conference on Knowledge Discovery and Information Retrieval

42

dataset, and to build a domain-specific lexicon with

enough data to evaluate the best method that can be

used to classify the tweets. In addition, another data

sources can be used beside Twitter, such as Stocktwits

10

which is a communication platform for people who

are interested in trading and stock market. The results

can be further analyzed with the Saudi stock market

index to find if a significant correlation exists between

them. Moreover, the proposed analysis can be utilized

by companies who are interested in finding a rela-

tionship between their short-term market performance

and people opinions. In addition, investors can utilize

our website to support the decision of which sector to

invest in.

REFERENCES

Abu Farha, I. and Magdy, W. (2019). Mazajak: An on-

line Arabic sentiment analyser. In Proceedings of the

Fourth Arabic Natural Language Processing Work-

shop, pages 192–198. Association for Computational

Linguistics.

Altowayan, A. A. and Tao, L. (2016). Word embeddings

for arabic sentiment analysis. In 2016 IEEE Inter-

national Conference on Big Data (Big Data), pages

3820–3825.

Duwairi, R. and El-Orfali, M. (2014). A study of the ef-

fects of preprocessing strategies on sentiment analy-

sis for Arabic text. Journal of Information Science,

40(4):501–513.

Gilbert, E. and Karahalios, K. (2010). Widespread worry

and the stock market. In Fourth International AAAI

Conference on Weblogs and Social Media.

Karabulut, Y. (2013). Can facebook predict stock market

activity? In AFA 2013 San Diego Meetings Paper.

Mikolov, T., Chen, K., Corrado, G., and Dean, J. (2013a).

Efficient estimation of word representations in vector

space. In 1st International Conference on Learning

Representations, ICLR 2013 - Workshop Track Pro-

ceedings.

Mikolov, T., Sutskever, I., Chen, K., Corrado, G., and Dean,

J. (2013b). Distributed representations ofwords and

phrases and their compositionality. In Advances in

Neural Information Processing Systems.

Nofer, M. and Hinz, O. (2015). Using twitter to predict the

stock market. Business & Information Systems Engi-

neering, 57(4):229–242.

Oliveira, N., Cortez, P., and Areal, N. (2017). The impact of

microblogging data for stock market prediction: Us-

ing twitter to predict returns, volatility, trading volume

and survey sentiment indices. Expert Systems with Ap-

plications, 73:125–144.

Pagolu, V. S., Reddy, K. N., Panda, G., and Majhi, B.

(2016). Sentiment analysis of twitter data for pre-

dicting stock market movements. In 2016 interna-

10

https://stocktwits.com

tional conference on signal processing, communica-

tion, power and embedded system (SCOPES), pages

1345–1350. IEEE.

Ranco, G., Aleksovski, D., Caldarelli, G., Gr

ˇ

car, M., and

Mozeti

ˇ

c, I. (2015). The effects of twitter sentiment on

stock price returns. PloS one, 10(9):e0138441.

APPENDIX

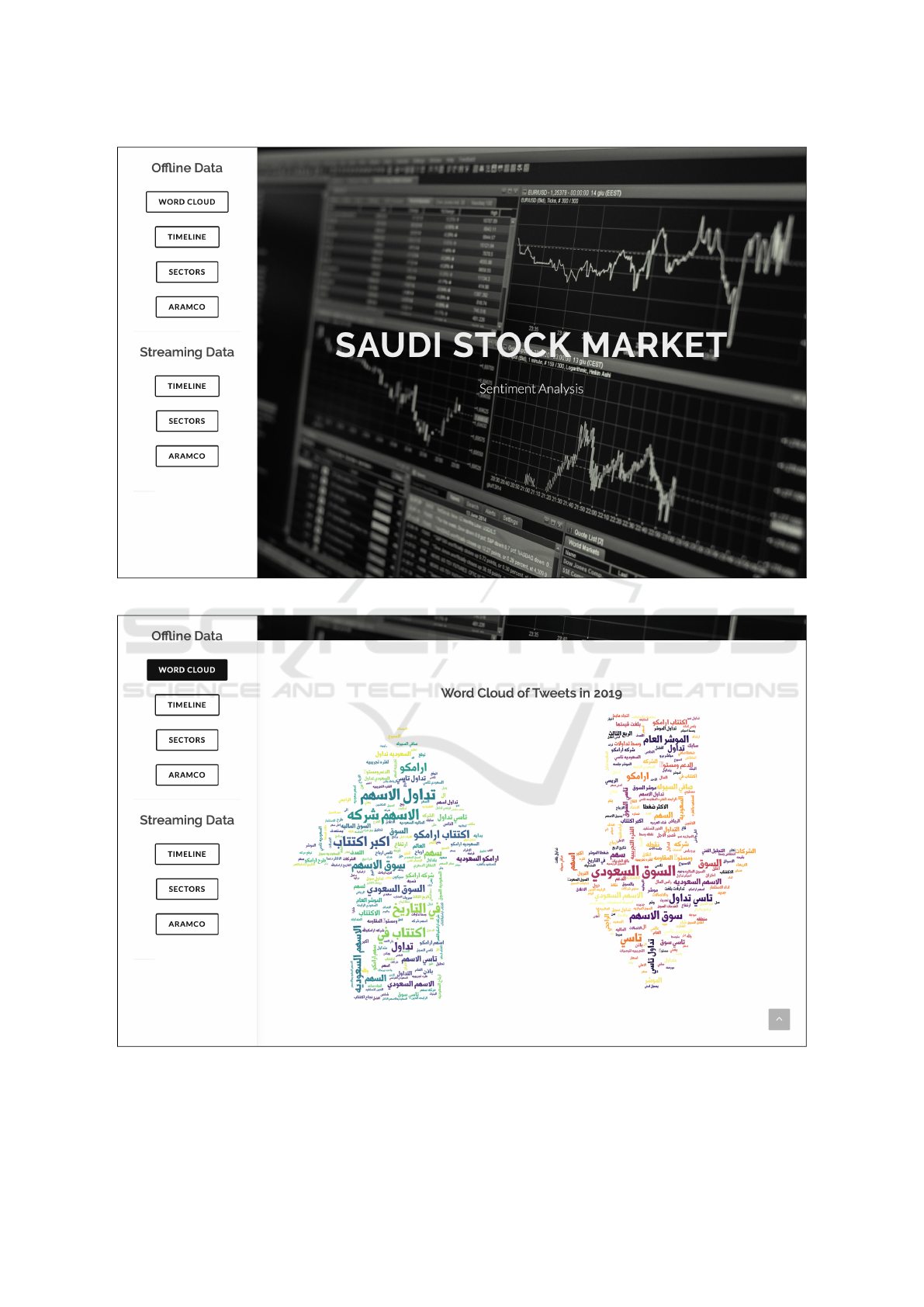

Screenshots of the interfaces of the Saudi Stock Mar-

ket Sentiment Analysis Website are presented next.

Saudi Stock Market Sentiment Analysis using Twitter Data

43

Figure 7: The home page of the website.

Figure 8: A webpage showing World Cloud of the off-line tweets.

KDIR 2020 - 12th International Conference on Knowledge Discovery and Information Retrieval

44

Figure 9: A webpage showing the number of tweets per day and their sentiments.

Figure 10: A webpage showing the number of tweets per sector and their sentiments.

Saudi Stock Market Sentiment Analysis using Twitter Data

45

Figure 11: A webpage showing comparisons of Aramco’s number of tweets and their sentiments against TASI and all the

other sectors.

Figure 12: A webpage showing the number of real-time tweets and their sentiments.

KDIR 2020 - 12th International Conference on Knowledge Discovery and Information Retrieval

46

Figure 13: A webpage showing the number of real-time tweets per sector and their sentiments.

Figure 14: A webpage showing a comparison of Aramco’s real-time tweets and their sentiments against TASI and all the other

sectors.

Saudi Stock Market Sentiment Analysis using Twitter Data

47