The Factor of Determinants Influencing Firm Value with

Opportunity to Grow as Moderating Variable: A Case Study at

Manufacture Companies Listed in the Indonesia Stock Exchange in

the Period of 2012-2015

Maggee Senata

1

, Khaira Amalia Fachruddin

1

and Amlys Syahputra Silalahi

1

1

Faculty of Economics and Business, Universitas Sumatera Utara, Medan-Indonesia

Keywords: Opportunity to Grow, Firm Value, Manufacture Companies, Indonesia Stock Exchange

Abstract: The objective of the research was to find out and to analyze the influence of Financial Ratio, Firm Size,

Financial Function, ad Institutional Ownership on Firm Value and the Opportunity to Grow in moderating

the influence of all independent variables on Firm Value in the manufacture companies listed in the

Indonesia Stock Exchange in the period of 2012-2015. The research used panel data analysis to test the

hypothesis and interaction test to test moderating variable. The result of the research showed that Financial

Ratio and Firm Size had the influence on Firm Value. Opportunity to Grow could not moderate the

influence of Financial Ratio, Firm Size, and Institutional Ownership on Firm Value.

1 INTRODUCTION

Basically the company's goals can be grouped into

two, namely short-term goals and long-term goals.

The company's short- term goals are related to

maximizing profits while the company's long-term

goals are related to maximizing the welfare of the

owner. So that the company's ability to empower its

resources will have a major impact on achieving

company goals.

A manufacturing company is a branch of

industry that applies machinery, equipment, labor,

and certain media in the process of processing raw

materials into finished goods. Manufacturing

companies in Indonesia themselves are one of the

largest industries owned by Indonesia given the

richness of natural resources owned. Referring to the

report of the United Nations Industrial Development

Organization (UNIDO), Indonesia is ranked in the

top 10 manufacturing countries in the world after

China, the United States, Japan, South Korea, India,

Italy, France and Brazil. One of the largest

manufacturing sub-sectors in Indonesia is the food

and beverage industry, considering that Indonesia's

population reaches approximately 250 million

people. But at the ASEAN level, competitiveness

reflects the performance of manufacturing

companies, Indonesia is still inferior to several other

countries, such as Singapore, Malaysia and

Thailand. This is due to the lack of financial support

that makes it difficult for entrepreneurs to compete

with competitors.

In addition, some time ago, Indonesia was

threatened by the deindustrialization phenomenon,

which can be seen from the decreasing contribution

of manufacturing companies to gross domestic

product. The growth of the manufacturing industry

has declined and is below national economic growth.

For example, in the period 2013 to 2015, the

contribution of the manufacturing industry to GDP

was 21.03 percent, 21.01 percent and 20.84 percent

respectively. While in terms of growth rates grew

by 4.37 percent, 4.61 percent, and 4.25 percent or

below national economic growth respectively 5.78

percent, 5.02 percent and 4.79 percent. Even so,

various estimates of Indonesia's manufacturing

performance that fluctuated even declined when

compared to the last ten years due to various aspects

that are still being discussed until now.

The following is a phenomenon table of 10

companies to see the factors that can influence the

value of manufacturing companies listed on the

Senata, M., Fachruddin, K. and Silalahi, A.

The Factor of Determinants Influencing Firm Value with Opportunity to Grow as Moderating Variable: A Case Study at Manufacture Companies Listed in the Indonesia Stock Exchange in the

Period of 2012-2015.

DOI: 10.5220/0009510112891293

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1289-1293

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1289

Indonesia Stock Exchange (IDX) in the period 2012

to 2015.

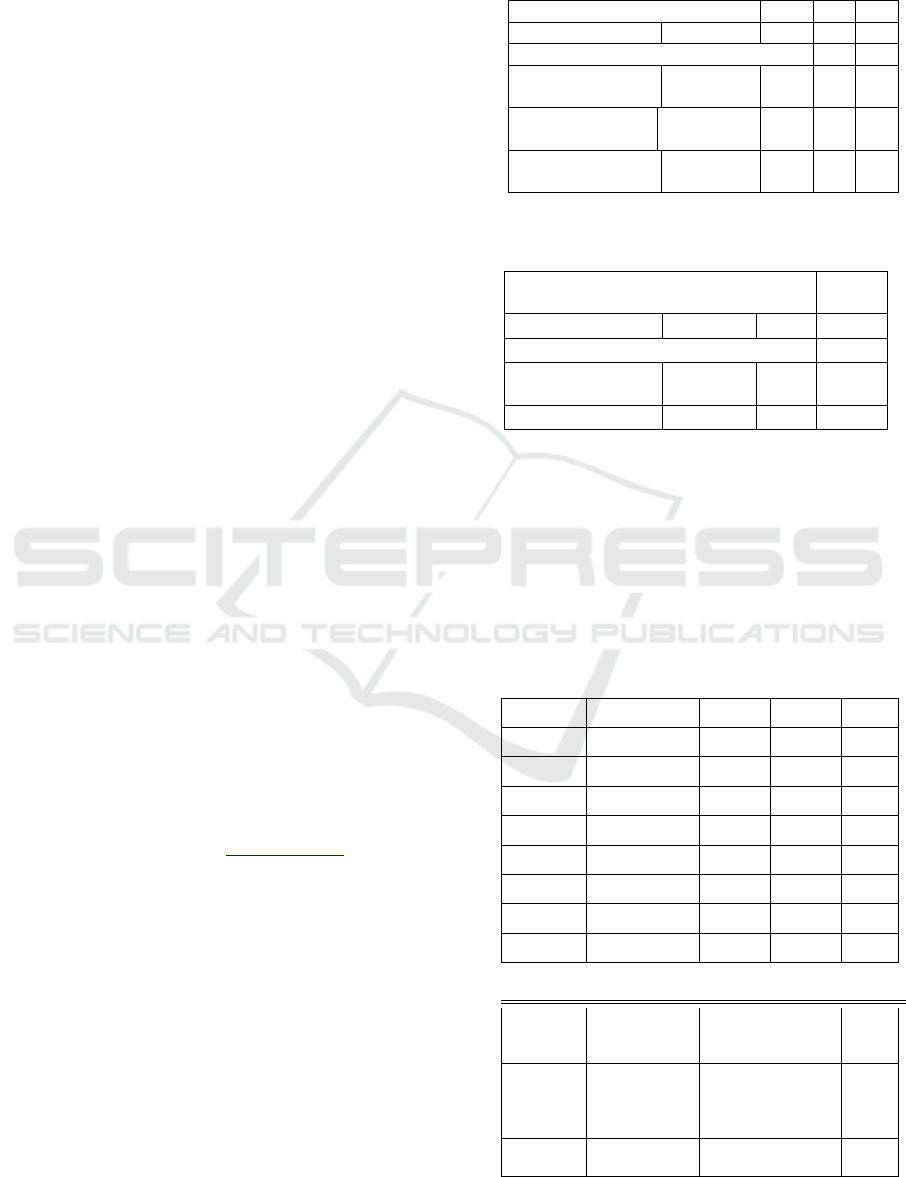

Table 1: The phenomenon of the influence of Debt

Policy, Profitability, Liquidity, Dividend Policy,

Firm Size, Inventory Activities, and Institutional

Ownership

Variable

Year

2012 2013 2014 2015

Firm Value 8,61 8,24 8,84 8,92

Debt Policy 0,72 0,73 0,75 0,78

Profitability 33,88 31,65 29,81 24,85

Liquidity 173,4

4

174,2

8

158,1

2

145,85

Dividend

Policy

39,49 39,74 30,48 52,41

Firm Size 24,07 24,17 24,34 30,53

Inventor

y

Activities

12,95 12,7 12,66 12,79

Institutional

Ownership

58,56 60,08 60,55 62.97

Opportunity

to Grow

14,31 11,85 14,65 23,41

2 THEORICAL FRAMEWORK

Company value can be measured by the value of

stock prices on the market, based on the formation

of the company's stock price in the market, which is

a reflection of public evaluations of the company's

performance in real terms. The process of forming

stock prices in the market will depend on the

conditions of the level of market efficiency, both

information and decision (Harmono, 2009).

One of ways to evaluate whether profits are used

to make decisions or not is to compare the earnings

and performance of shares of a company that goes

public. If the company is profitable, the retained

earnings account will rise so that the book value of

equity will also increase. This increase in equity

book value indicates an increase in the book value of

the company. The ability of earnings information

and book value in explaining the stock price is

getting bigger. Statistically, about 62% of the

information explains the company's stock price. This

means that the information that drives this stock

price is dominated by the company's book value and

profit value. When the publication of profits occurs,

there is also a reaction in the price and volume of

stock trading. This shows that earnings information

is very relevant in decision making on the stock

exchange (Sulistiawan, et al., 2011).

Oportunity to grow is the opportunity of the

company to grow in the business world it manages.

Growth or the opportunity to grow a company can

affect company performance because large

companies tend to obtain economies of scale that

can indirectly affect company performance

(Wardhani & Joseph, 2010).

Solvability Ratio or Leverage Ratio is a ratio

used to determine the company's ability to pay

obligations if the company is liquidated. The higher

the ratio, the more creditor money the company uses

to generate profits. The higher the company's debt

ratio, the greater the influence of corporate finance

(Sumarson, 2013). In determining debt policy,

companies must consider the right amount. The

establishment of a debt policy by the Company will

certainly have an impact on how investors see the

existence of the company. Indirectly, investors will

look at the value of the company based on the debt

policy that has been taken.

Profitability ratio is a ratio to assess a company's

ability to seek profits. This ratio also provides a

measure of management effectiveness of a company.

This is indicated by profits generated from sales and

investment income (Brigham & Houston, 2010).

High profitability is a positive signal for investors

because it influences the prospects for better

corporate growth in the future. Indirectly investors

will capture the positive signal as a perception where

the value of the company with high profitability has

a high corporate value.

Liquidity is a financial ratio that measures the

ability of a company to fulfill short-term obligations

with its current assets. The liquidity dimension

reflects a review of management performance in

terms of the extent to which management is able to

manage working capital funded by current debt and

balances. With the better liquidity of a company it

will also have a positive impact on the value of the

company in the eyes of investors (Harmono, 2009).

Dividend policy is the percentage of profits paid

to shareholders in the form of cash dividends,

safeguarding the stability of dividends from time to

time, distribution of stock dividends, and repurchase

of shares (Van Horne & Wachowicz, 2014).

Companies that distribute dividends will provide a

signal to investors regarding the condition of the

company. So that the dividend policy taken by the

company will also have an impact on the value of

the company.

Company size can be classified as one of the

elements of the work environment that will also

influence the perception of management later. The

choice of an accounting method can be used as a

tool to influence company value (Hery, 2012).

Companies with large sizes tend to be easier to gain

access to the capital market, so they tend to get more

business opportunities. So that it can be concluded

that the increasing size of a company will be able to

encourage the better value of the company.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1290

Activity ratio is a ratio used to measure the

effectiveness of a company in using its assets. Or it

can also be said that this ratio is used to measure the

level of efficiency (effectiveness) of the utilization

of company resources (Brigham & Houston, 2010).

A manufacturing company is a company sector that

produces raw goods into finished goods, so

inventory management is very much needed related

to the increase in company earnings. The higher

level of company activity shows that the higher the

effectiveness of the company in managing

transaction activities in the company.

Institutional investors who invest in company

shares will get a large incentive to influence and

monitor management actions that have an impact on

reduced earnings management actions. Institutional

ownership by some researchers is believed to affect

the company's performance and the company's goal

of maximizing company value. The company is a

collection of contracts (agreements) with various

parties involved, such as employees, shareholders,

government, creditors, and so on (Hery, 2013). In

addition to helping manage, company ownership

also has an impact on the decisions that will be

made. Proper decision making will have an impact

on the better performance obtained.

3 RESEARCH METHOD

The population of Manufacturing Companies that

are consecutively registered and distribute their

dividends on the Indonesia Stock Exchange during

the 2012-2015 period are 33 companies. The

sampling technique used is saturated sampling. The

number of research samples is 132 observations (33

companies × 4 years).

This research was conducted by accessing

several data sources from the official website of the

Indonesia Stock Exchange www.idx.co.id. The data

analysis model used in this study is panel data

regression analysis and moderating variable

regression model. The processing of data in this

study uses Eviews software version 7.

4 ANALYSIS

a. Model Selection

Then the model selection is done by using the

chow test and hausman test. In this research, FEM

was chosen so that the classical assumption test was

needed. The following are the results of the FEM

test.

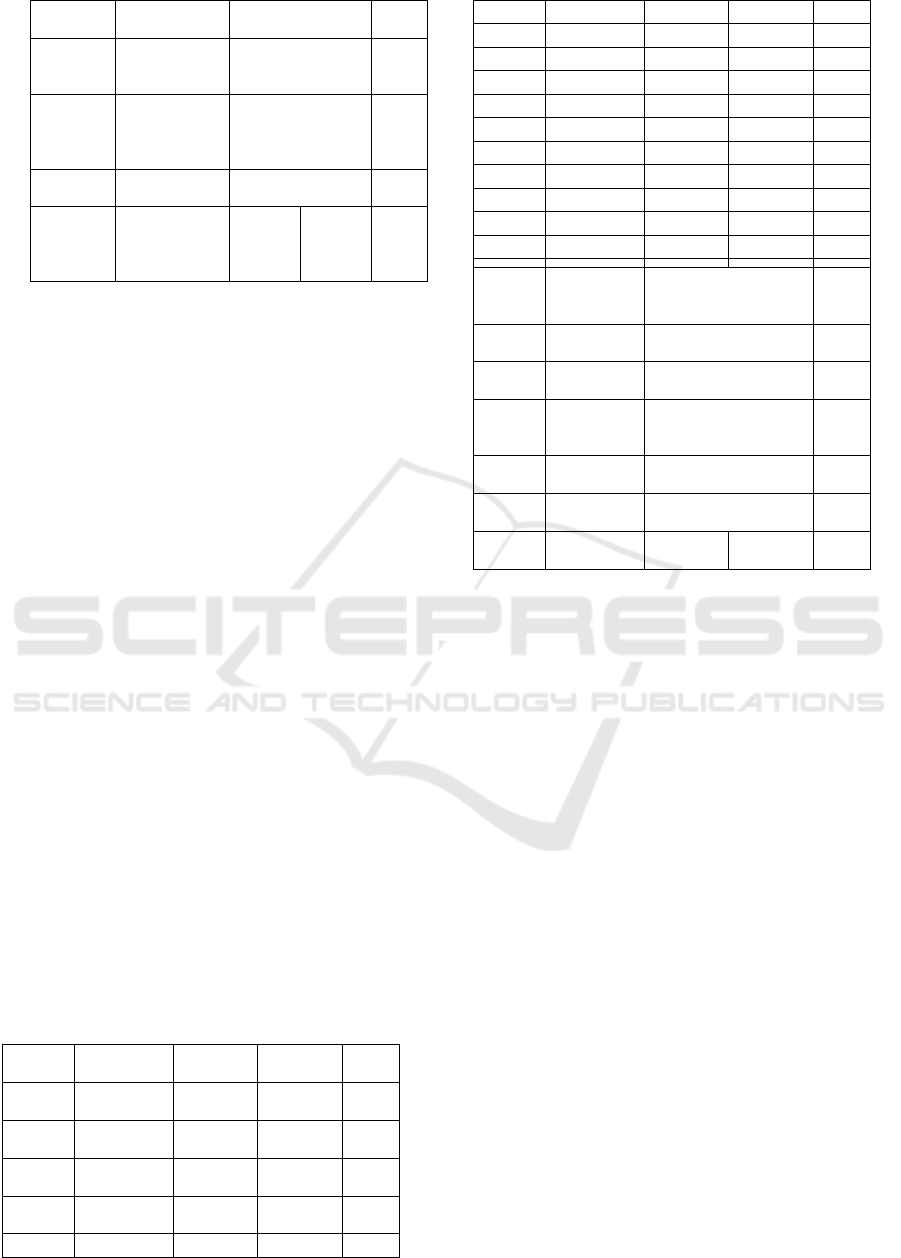

Table 2: Chow Test

Redundant Fixed Effects Tests

Pool: DPANEL

Test cross-section fixed effects

Effects Test Statistic d.f.

Prob.

Cross-section F 7.775160

(32,92

)

0.000

0

Cross-section Chi-

square 172.856932 32

0.000

0

Table 3: Hausmann Test

Table 4: Fixed Effect Model

Dependent Variable: Y?

Method: Pooled Least Squares

Date: 01/15/18 Time: 11:23

Sample: 2012 2015

Included observations: 4

Cross-sections included: 33

Total pool (balanced) observations: 132

Variable Coefficient Std. Error t-Statistic Prob.

X1? 0.459464 0.193487 2.374651 0.0196

X2? 0.289485 0.079529 3.640008 0.0005

X3? 0.724397 0.224056 3.233113 0.0017

X4? 0.119693 0.095468 1.253749 0.2131

X5? 0.856602 0.200654 4.269051 0.0000

X6? -0.034300 0.219173 -0.156497 0.8760

X7? -0.006089 1.476313 -0.004124 0.9967

C -7.849993 7.698099 -1.019731 0.3105

Cross-section fixed (dummy variables)

R-squared 0.787456 Mean dependent var

-

1.15659

0

Adjusted R-

squ

are

d 0.697356 S.D. dependent var

1.03773

S.E. of

regr 0.570887

Akaike info

criterion

1.96179

Correlated Random Effects - Hausma

n

Test

Pool: DPANEL

Test cross-section random effects

Test Summary

Chi-Sq.

Statistic

Chi-Sq.

d.f. Prob.

Cross-section random35.794611 7 0.0000

The Factor of Determinants Influencing Firm Value with Opportunity to Grow as Moderating Variable: A Case Study at Manufacture

Companies Listed in the Indonesia Stock Exchange in the Period of 2012-2015

1291

essi

on

Sum squared

resi

d 29.98392 Schwarz criterion

2.83537

Log

like

liho

od -89.47860

Hannan-Quinn

criter.

2.31677

F-statistic 8.739794

Durbin-Watson

stat

2.05328

Prob(F-

stati

stic

) 0.000000

b. The Classical Assumption Test

The next normality test was carried out with

Jarque-Bera (J-B) with the probability value of

the Jarque-Bera statistic is 0,263327.

Multicollinearity test is done by a correlation

matrix with a correlation value between

independent variables no more than 0,9. Then

the autocorrelation test is carried out with

watson durbin with the value of the Durbin-

Watson statistic is 1,528159. Finally, the

autocorrelation test using the Breusch-Pagan

test with the Prob Obs * R-Squared value is

0,1551.

c. Panel Data Regression

Panel data regression equation is taken from the

FEM table to see the coefficient of

determination and the results of partial and

simultaneous hypothesis tests.

d. Moderating Variable Test

After t test and F test, the next step is testing the

moderating variable with the Moderated

Regression Analysis (MRA) test.

Table 5. MRA Test

Dependent Variable: Y

Method: Least Squares

Date: 01/21/18 Time: 18:01

Sample: 1 132

Included observations: 132

Varia

ble

Coefficie

nt

Std.

Error

t-

Statistic

Pro

b.

Z 4.829239

2.43795

1

1.98086

0

0.0

500

X1 -0.037538

1.14041

0

-

0.032916

0.9

738

X1Z 0.160674

0.37780

5

0.42528

3

0.6

714

X2 -0.226712

0.36507

3

-

0.621007

0.5

358

X2Z 0.143584 0.097112 1.478535 0.1420

X3 2.069656 1.376946 1.503077 0.1355

X3Z -0.461113 0.445551 -1.034927 0.3029

X4 -0.221010 0.338602 -0.652712 0.5152

X4Z 0.136022 0.107678 1.263232 0.2090

X5 -0.402812 0.280921 -1.433897 0.1543

X5Z 0.156614 0.098862 1.584166 0.1159

X6 -0.160621 0.335798 -0.478327 0.6333

X6Z 0.091757 0.111956 0.819579 0.4141

X7 2.281910 1.508490 1.512711 0.1331

X7Z -1.247377 0.546424 -2.282801 0.2243

C -9.999356 6.711227 -1.489945 0.1390

R-squared 0.311905 Mean dependent var

-

1.15659

0

Adjusted

R-squared 0.222927 S.D. dependent var

1.03773

0

S.E. o

f

regression 0.914777 Akaike info criterion

2.77293

9

Sum

squared

resid 97.07073 Schwarz criterion

3.12237

0

Log

likelihood -167.0140 Hannan-Quinn criter.

2.91493

2

F-statistic 3.505427 Durbin-Watson stat

1.55667

7

Prob(F-

statistic) 0.000060

5 RESULTS

The results of the simultaneous hypothesis testing

show: 1) Debt Policy has an effect on Company

Value; 2) profitability affects the value of the

company; 3) Liquidity in research affects the value

of the company; 4) Dividend policy in this study

does not affect Company Value; 5) Company Size

in this study has an effect on Company Value; 6)

Inventory Activities in this study do not affect

Company Value; 7) Institutional Ownership in this

study does not affect Company Value.

Growth Opportunities which are proxied by Price

Earning Ratio (PER) are not able to moderate each

influence of financial ratios, firm size, and

ownership structure on firm value.

6. CONCLUSIONS

This study shows that there are several independent

variables that do not affect the value of the company.

The moderating variable in this study which is

proxied to the Price earnings ratio (PER) is also not

able to moderate each influence of the independent

variable on the dependent variable. The PER proxy

is seen as a particular indicator by investors in

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1292

deciding to buy or otherwise sell company shares.

So that the proxy might result in bias as a signal that

gives an overview of the overall condition of the

company.

REFERENCES

Brigham, F. E. & Houston, J. F., (2010). Essential of

Financial Management (Dasar-Dasar Manajemen

Keuangan). Jakarta: Salemba Empat.

Harmono, (2009). Manajemen Keuangan Berbasis

Balanced Scorecard (Pendekatan Teori, Kasus, dan

Riset Bisnis). Jakarta: PT. Bumi Aksara.

Hery, (2012). Analisis Laporan Keuangan. Jakarta: PT.

Bumi Aksara.

Hery, (2013). Rahasia Pembagian Dividen & Tata Kelola

Perusahaan. Yogyakarta: Penerbit Gava Media.

Sulistiawan, D., Januarsi, Y. & Alvia, L., (2011). Creative

Accounting : Mengungkapkan Manajemen Laba dan

Skandal Akuntansi. Jakarta: Salemba Empat.

Sumarson, T., (2013). Sistem Pengendalian Manajemen

Konsep, Aplikasi, dan Pengukuran. Jakarta: Penerbit

Indeks.

Van Horne, J. C. & Wachowicz, J. M., (2014).

Fundamentals of Financial Management (Prinsip-

Prinsip Manajemen Keuangan). Jakarta: Salemba

Empat.

Wardhani, R. & Joseph, H., (2010). Karakteristik Pribadi

Komite Audit dan Praktik Manajemen Laba.

Simposium Nasional Akuntansi XIII Purwokerto.

The Factor of Determinants Influencing Firm Value with Opportunity to Grow as Moderating Variable: A Case Study at Manufacture

Companies Listed in the Indonesia Stock Exchange in the Period of 2012-2015

1293