Resource Flow based Order Selection Method in Project Cost

Estimation Process

Nobuaki Ishii

1

, Yuichi Takano

2

and Masaaki Muraki

3

1

Faculty of Engineering, Kanagawa University, 3-27-1 Rokkakubashi, Kanagawa-ku, Yokohama, 221-8686, Japan

2

School of Network Information, Senshu University, 2-1-1, Higashimita, Tama-ku, Kawasaki, Kanagawa, Japan

3

Graduate School of Decision Science and Technology, Tokyo Institute of Technology, Tokyo, Japan

Keywords: Business Process Modeling, Competitive Bidding, Project Management, Resource Allocation.

Abstract: Since the project price is fixed in EPC (Engineering, Procurement, and Construction) projects, the

contractor should devote significant resources to the cost estimation process to realize the accurate cost

estimation and then accept profitable projects from clients in competitive bidding situations. However, it is

impossible for any contractor to devote sufficient resources to all the orders because of the resource

constraints. In this study, a multistage project cost estimation process model, consisting of pre-evaluation,

order selection, man-hour allocation, and a series of cost estimation steps, is developed. Then, this study

devises a resource flow based order selection method and man-hour allocation method to provide successful

results to clients and to maximize the contractor’s profits under the limited resources. Specifically, those

methods dynamically select orders to estimate cost at each order arrival and allocate the resources to the

selected orders, respectively. The effectiveness of our method is demonstrated through simulation

experiments using the developed model.

1 INTRODUCTION

EPC (Engineering, Procurement, and Construction)

projects (Pritchard and Scriven, 2011) correspond to

the execution process of industrial projects, such as

process plants, structures, and information systems.

Those projects start after the final investment

decision by the clients, and are complete when the

contractor delivers facilities based on the client’s

requirements for a limited period of time under a

lump sum turnkey basis. Since any EPC project

includes unique and non-repetitive activities, many

uncertainties exist in the project execution process.

Furthermore, since the project price is fixed before

the start of the project, the contractor often faces

eventual loss of profit in EPC projects. Thus, it is

necessary for any contractor to precisely estimate the

project cost in order to determine the bidding price.

Namely, the cost estimation process in an EPC

project is critical for any contractor who seeks to

increase profits and reduce the possibility of

realizing a loss, i.e., a deficit risk, due to cost

estimation error.

Cost estimation is also crucial for ensuring the

proper volume of accepted orders. Inaccurate cost

estimation could not only lead to deficit orders but

could also exhaust the contractor’s resources, which

are necessary to carry out long-term deficit projects,

as Ishii et al. (2014) stated. Moreover, a contractor’s

deficit order would have severely harmful effects on

the client’s business. For example, it would generate

an additional cost and/or delay to the project

delivery date, thus the client would miss a business

opportunity.

Since the quality and quantity of the data

available for cost estimation determine the accuracy

of the estimated cost, a significant amount of high-

quality data is required to improve accuracy. In

process plant engineering, for example,

the data and

methods required to attain the target accuracy of

project cost estimation have been studied

(AACE,

2011). In any cost estimation method, such as

parametric, analogy, and engineering (Kerzner,

2013), higher accuracy requires more data and,

accordingly, more engineering man-hours (MH) to

acquire and analyse the data for cost estimation.

Thus, experienced and skilled human resources

who can acquire data for cost estimation and create

project plans are required for accurate cost

estimation.

Those resources, however, are limited for

Ishii, N., Takano, Y. and Muraki, M.

Resource Flow based Order Selection Method in Project Cost Estimation Process.

DOI: 10.5220/0006481901550162

In Proceedings of the 7th International Conference on Simulation and Modeling Methodologies, Technologies and Applications (SIMULTECH 2017), pages 155-162

ISBN: 978-989-758-265-3

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

155

any contractor. Furthermore, once the orders are

successfully accepted, the corresponding project

execution will also need considerable human

resources. For these reasons, the contractor should

realize appropriate selection of orders and allocation

of MH for cost estimation of each selected order to

maximize the total expected profit under the

constraint of the total MH.

Based on the above observations, this paper

examines the cost estimation process of EPC

projects in dynamic order arrival situations. Namely,

activities of the project cost estimation process are

identified, and a model of the multistage project cost

estimation process that divides the cost estimation

process into four phases, i.e., pre-evaluation, order

selection, MH allocation, and a series of cost

estimate steps, is developed.

We next devised an order selection method based

on resource flows for dynamically selecting orders

to estimate cost at each order arrival through the pre-

evaluation and the order selection in the developed

model. In addition, we use MH allocation rules for

allocating the limited resources to the selected orders

in the MH allocation. The resource flow based order

selection method selects orders on the basis of the

flow rate of the contractor’s MH for estimating cost

and that of the expected profits from the orders. MH

allocation rules prioritize orders in the queue waiting

for allocating MH for estimating cost, and then it

allocates MH to the orders based on the priority. We

finally analyse the effectiveness of our developed

methods through numerical examples by using the

discrete-event simulation model of the multistage

project cost estimation process.

2 RELATED WORK

A variety of studies have been conducted on project

cost estimation from the viewpoints of cost

estimation accuracy, MH allocation for cost

estimation, order selection, and so on. For example,

AACE (2011), Humphreys (2004), and Towler and

Sinnott (2008) demonstrated the relationship of cost

estimation accuracy and the methods and data used

for cost estimation in the field of process plant

engineering projects. Furthermore, they suggested

that cost estimation accuracy is positively correlated

with the volume of MH for cost estimation.

However, only a few of studies have examined

management issues on the project cost estimation

process that uses the methods and data for cost

estimation.

Regarding MH allocation in the cost estimation

process, Ishii et al. (2016a) developed an algorithm

that determines the bidding prices under the limited

MH for cost estimation. Their algorithm allocates

MH to maximize expected profits based on the cost

estimation accuracy determined by allocated MH. In

addition, Takano et al. (2014) developed a stochastic

dynamic programming model for establishing an

optimal sequential bidding strategy in a competitive

bidding situation. Their model determines the

optimal markup in consideration of the effect of

inaccurate cost estimates. Takano et al. (2016) also

developed a bid markup decision and resource

allocation model that determines the optimum bid

markup and resource allocation simultaneously.

Furthermore, Takano et al. (2017) developed a

multi-period resource allocation method for

estimating project costs in a sequential competitive

bidding situation. Their method allocates resources

for cost estimation by solving a mixed integer

programming problem that is formulated by making

a piecewise liner approximation of the expected

profit functions. Those studies, however, assume the

order arrivals in advance, and thus they cannot deal

with dynamic order arrival situations.

Regarding the order selection in the cost

estimation process, Shafahi and Haghani (2014)

proposed an optimization model that combines

project selection decisions and markup selection

decisions in consideration of eminence and previous

works as the non-monetary evaluation criterion used

by owners for evaluating bids. In addition, Ishii et al.

(2016b) developed the threshold function method

(TFM) for deciding bid or no-bid on newly arrived

orders based on the threshold function of MH

utilization with respect to the expected profit of

orders. In TFM, the threshold function is determined

through simulation experiments under a set of

averaged conditions for estimating cost. They show

that TFM increases the expected profits from orders

compared to the case of no order selection by

simulation experiments. In TFM, however, the

contractor needs to build a simulation model of the

cost estimation process and certain computational

loads to obtain the threshold function. In addition, a

long-term

and stable cost estimation conditions, such

as order arrivals, expected profits from orders, and so

on, are assumed in advance to determine the threshold

function through simulation runs.

Thus, TFM could

not deliver good performance in practical situations

where the cost estimation conditions are unstable and

change dynamically.

Based on the above literature review, we found

that most of the studies have paid little attention to

SIMULTECH 2017 - 7th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

156

the project cost estimation process in practical

situations. More specifically, in practice, the

contractor needs to select orders to bid and allocate

MH for cost estimation dynamically to each selected

order which has different characteristics. In light of

these facts, this paper develops a method for

selecting orders and determining MH allocation in

consideration of the contractor’s available MH and

the orders’ profitability under the dynamic order

arrival conditions as is the case in practical

situations.

3 A MULTISTAGE MODEL OF

PROJECT COST ESTIMATION

PROCESS

3.1 Project Cost Estimation Activities

The project cost estimation process can be

recognized as a series of activities that starts with the

arrival of bid invitations from the client and closes

by the date of bidding (Ishii et al., 2016b). A variety

of orders arrive, and the contractor selects orders to

estimate the project costs through the cost estimation

process. Then, the contractor determines the

accuracy of cost estimation by allocating MH to the

cost estimation activities of selected orders in

consideration of the MH availability, expected

profits, competitive bidding situations, and so on.

When the available MH is not sufficient to estimate

cost accurately, the contactor must allocate fewer

MH, thereby reducing expected profit due to

inaccurate cost estimation, or no-bid on the order.

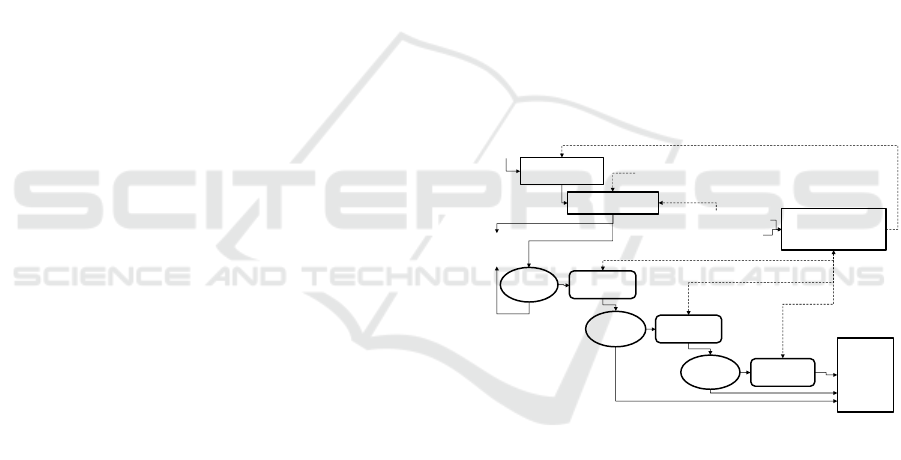

3.2 Overview of the Model

Based on the above observations, we propose a

multistage model of the project cost estimation

process which consists of pre-evaluation, order

selection, MH allocation for cost estimation, and a

series of cost estimation steps, as shown in Figure 1,

by referencing the model developed by Ishii et al.

(2016b). In the model, we assume that the cost is

estimated through the cost estimation steps: E1, E2,

and E3 estimate. Each step needs MH and a period

of time for cost estimation, and the accuracy of the

estimated cost increases through the cost estimation

activities in each step.

The cost estimate manuals, such as AACE

classification matrix (AACE, 2011), the classes of

estimates by Kerzner (2013), and so on, can be used

for reference of the cost estimation accuracy and for

the required MH in each step. For example, AACE

classifies cost estimation into five classes and

indicates the methods, data, and the accuracy of cost

estimation in each class. Two of the classes in

AACE are in the order of magnitude type estimation

for a project feasibility study. Thus, the developed

model divides the cost estimate activities into three

steps in reference to the AACE system. Namely, we

assume that the project cost is estimated through a

series of three cost estimation steps, and the

accuracy of the estimated cost is improved in

accordance with the steps.

In the model, the pre-evaluation and the order

selection determine whether to select and bid the

newly arrived order or not. Specifically, the pre-

evaluation evaluates the resource flow of the process

if the newly arrived orders are selected as explained

in section 4.1. The order selection determines

whether to select orders for estimating costs or not

from the viewpoint of changes of the resource flow,

the volume of orders to be accepted, the expected

profits, MH availability for cost estimation, and so

on.

Figure 1: A model of multistage project cost estimation

process.

The selected order is first filed in the queue for

the E1 estimate and waits to be assigned the MH for

cost estimation by the mechanism of MH allocation

for cost estimation. If any MH is not assigned to the

order until the bidding date, the contractor does not

bid for it due to the lack of MH. If the MH is

assigned to the order, its project cost is estimated

with the accuracy of the E1 estimate. This order is

then filed in the queue of the E2 estimate and waits

for MH assignment for the E2 estimate. If the MH is

not further assigned to the order until the bidding

date, the contractor determines the bidding price

based on the accuracy of the E1 estimate. By

contrast, if the MH is assigned to the order waiting

Queue

for

E1

Estimation

E1

Queue

for

E2

Estimation

E2

Queue

for

E3

Estimation

E3

MH allocation

for cost

estimation

MH for cost estimation

Bid

price

decision

&

Bid

Order selection

Decline

bid

invitation

Results of cost estimation

Newly

arrived

orders

Goal: Attain total volume of accepted

orders, Maximize expected profits

Orders for bid

No-bid orders due

to lack of MH

Total volume of MH

MH allocation rule

Pre-

evaluation

Evaluation

results

Expected profits & MH for cost estimation

within the cost estimation process

Resource Flow based Order Selection Method in Project Cost Estimation Process

157

in the queue of the E2 estimate, its project cost is

estimated with the accuracy of the E2 estimate, and

filed in the queue of the E3 estimate. The same

decision is made for the orders in the queue of the

E3 estimate.

The project cost estimation problem, addressed

in this paper, is a kind of dynamic scheduling

problem that determines the processes dynamically

for each order arriving at a system. In our problem,

however, orders and the volume of resources for cost

estimation are determined dynamically under the

conditions of resource availability and due date of

the order in order to maximize the total expected

profits from orders. On the contrary, in the standard

scheduling problems (Jacobs et al. 2011), orders and

the volume of resources are predetermined, and the

orders are scheduled so as to minimize the makespan

and/or reduce tardy jobs. From this perspective, we

believe that the project cost estimation problem in

this study can be recognized as a novel dynamic

scheduling problem.

4 METHODS OF ORDER

SELECTION AND MAN-HOUR

ALLOCATION

This section shows the two methods, i.e. order

selection and MH allocation for cost estimation, that

are used in the project cost estimation process shown

in Figure 1.

These two methods are developed based on the

following assumptions:

Assumptions:

1) Orders for cost estimation arrive randomly;

2) Expected profit, required MH and periods for

cost estimation of each estimate step are

predetermined;

3) Probability of a successful bid of each order,

i.e. accepted order, is predetermined.

4.1 Resource Flow based Order

Selection Method

For the order selection through the pre-evaluation

and the order selection shown in Figure 1, we

develop a resource flow based order selection

method (RFSM) that decides estimating cost or

declining bid invitation on arrived orders according

to the changes of MHR and EPR by the arrived

orders. MHR and EPR are the flow rate of MH for

cost estimation and the total expected profits from

orders, respectively, within the cost estimation

process. Those are determined as Eqs. (1) and (2).

For explaining the basis of RFSM, in this section,

we assume that the project costs of at least step E2

are estimated in all the selected orders.

/

ii

iUE

M

HR MH D

∈

=

(1)

/

ii

iUE

E

PR EP D

∈

=

(2)

where i is order under estimating cost in the

process. MH

i

, EP

i

, and D

i

are the volume of cost

estimation MH, the expected profit, and period for

cost estimation of order i, respectively. In addition,

UE is a set of orders within the cost estimation

process.

Now, assume that P

E3

(MHR

E3

, EPR

E3

) indicates

the coordinate point where costs of all the orders are

estimated to E3, P

E2

(MHR

E2

, EPR

E2

)indicates the

coordinate point where costs of all the orders are

estimated to E2, and MHR

CP

is the maximum flow

rate of MH available in the cost estimation process.

Then, the rate of maximum expected profits

EPR

max

is calculated based on the magnitude

relationship between MHR

E3

and MHR

CP

as Eqs. (3)

or (4).

1) If MHR

E3

≦ MHR

CP

:

EPRmax =EPRE3 (3)

2) If MHR

CP

< MHR

E3

:

23

3223

23

23

max

EE

EEEE

CP

EE

EE

MHRMHR

EPRMHREPRMHR

MHR

MHRMHR

EPREPR

EPR

−

⋅−⋅

+⋅

−

−

=

(4)

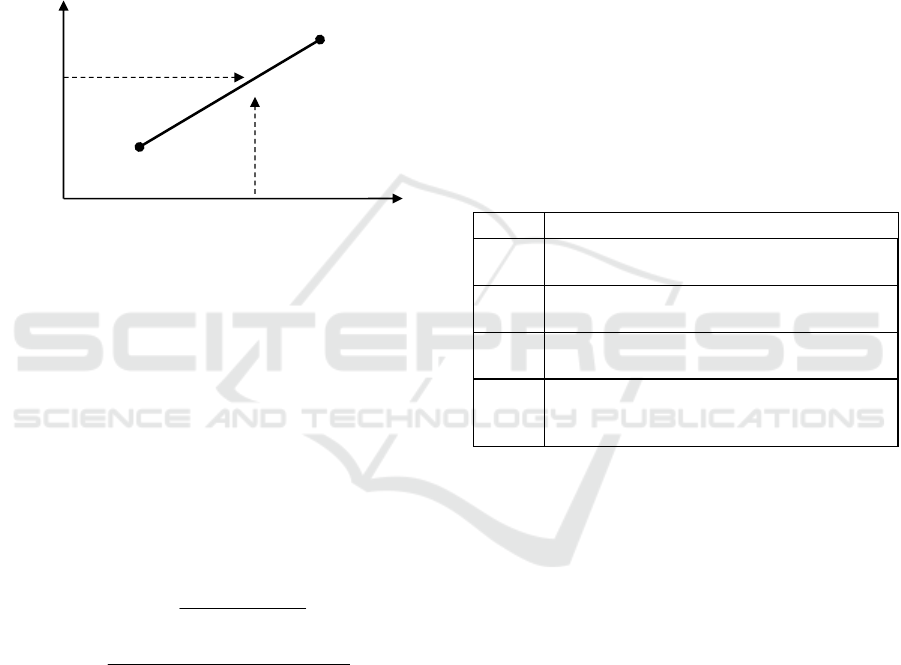

Eq. (4) assumes that there is linearity between

P

E3

and P

E2

, then EPR

max

exists where MHRcp

intersects the line connecting the points of P

E3

and

P

E2

as shown in Figure 2.

Next, if the new order nwd has arrived for cost

estimation, P’

E3

(MHR’

E3

, EPR’

E3

) and P’

E2

(MHR’

E2

,

EPR’

E2

), which indicate the coordinate points

including nwd, are calculated in Eqs. (5) to (8).

nwd

EEE

MHRMHRRMHR

33

'

3

+⋅=

(5)

nwd

EEE

EPREPRREPR

33

'

3

+⋅=

(6)

nwd

EEE

MHRMHRRMHR

22

'

2

+⋅=

(7)

nwd

EEE

EPREPRREPR

22

'

2

+⋅=

(8)

SIMULTECH 2017 - 7th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

158

where MHR

nwd

and EPR

nwd

indicate MHR and

EPR of a newly selected order for cost estimation,

respectively, in steps E2 and E3. In addition, R is a

coefficient to discount the flow rate by the next

order arrival if the newly arrived order is not

selected. It is calculated by Eq. (9) by the average

cost estimation period of orders within the cost

estimation process ED and the number of orders

within the process NE, where R=0 if NE=0.

NEEDNEEDEDR /11/)/( −=−=

(9)

Figure 2: Relations between MHR and EPR.

Then RFSM evaluates EPR’

max

indicating the

flow rate of maximum expected profits if nwd is

selected by Eqs. (10) or (11). Eq. (11) calculates the

value where MHRcp intersects the line connecting

the points of P’

E3

and P’

E2

based on the assumption

that there is linearity between P’

E3

and P’

E2

as is the

case of Eq. (4).

1) If MHR

E3

< MHR

CP

:

EPR’max =ERP’E3 (10)

2) If MHR’

E2

< MHR

CP

< MHR’

E3

:

2

'

3

'

3

'

2

'

2

'

3

'

2

'

3

'

2

'

3

'

max

EE

EEEE

CP

EE

EE

MHRMHR

EPRMHREPRMHR

MHR

MHRMHR

EPREPR

EPR

−

⋅−⋅

+⋅

−

−

=

(11)

Finally, the order nwd is selected for cost

estimation in the case of R×EPR

max

< EPR’

max

or

MHR’

E3

<MHR

CP

.

The former condition means that the flow rate of

expected profit EPR’

max

gained by selecting nwd for

cost estimation is higher than the flow rate of

expected profit R×EPR

max

gained by cutting nwd.

The later condition means that the flow rate of MH

for cost estimation including nwd, i.e., MHR’

E3

,

is

less than the maximum flow rate available in the

process.

4.2 Man-Hour Allocation Method

For the allocation of MH for cost estimation under

dynamic order arrival situations, we use a

dispatching method, as is the case of the dynamic

scheduling problem in production systems (Jacobs et

al., 2011) because the project cost estimation is

similar to the production.

Specifically, when MH is released from the cost

estimation of an order, this method selects an order

based on the MH allocation rules, which prioritize

orders in the queue of each estimate step. The

selected order is subsequently assigned the required

MH for its cost estimation step. If the required MH

is more than the MH available, the selected order

waits in the queue until the required MH is released.

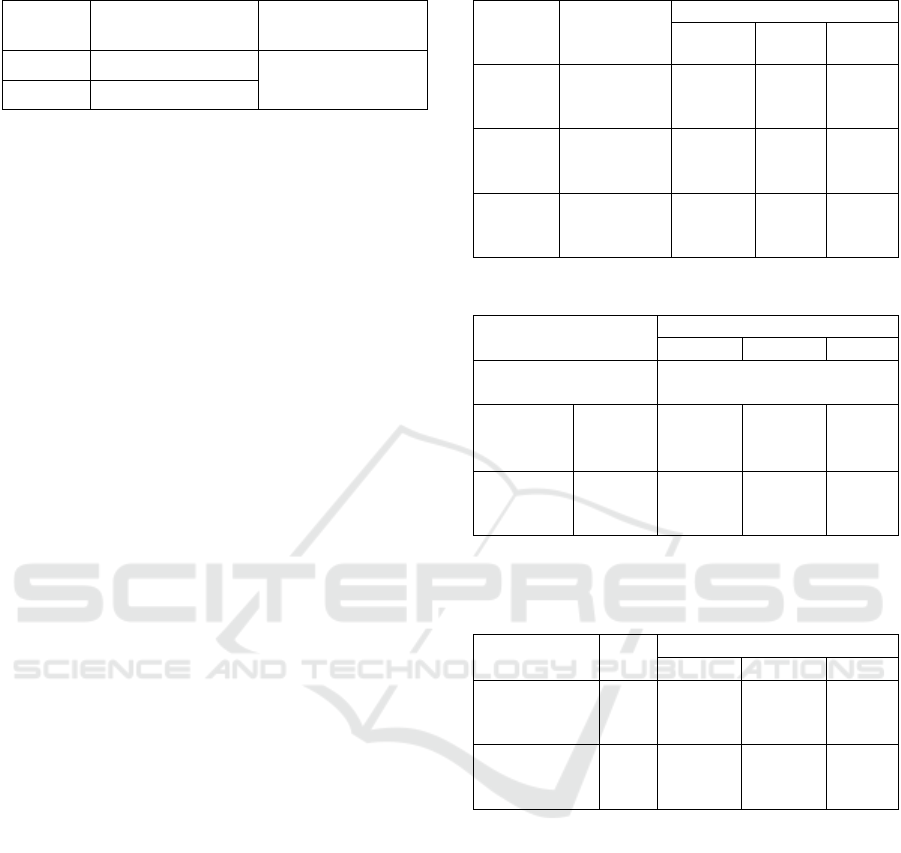

Table 1 shows potential rules that could be

applicable for dynamic MH allocation in the project

cost estimation problem.

Table 1: Potential MH allocation rules.

Rule Description

FIFO

First-In First-Out: Order is selected on a first-in

first-out basis.

SDUF

Shortest DUe date First: Order remaining with

the shortest estimation period is selected.

SET

Shortest Estimation Time: Order having the

shortest estimation period is selected.

HEPF

Highest Expected Profit per MH First: Order

having the highest expected profit per MH for

cost estimation is selected.

5 NUMERICAL EXAMPLES

This section evaluates the performance of the

developed methods for managing the project cost

estimation process effectively by simulation

experiments. We use a general-purpose simulation

system AweSim! (Pritsker and O’Reilly, 1998) for

building a simulation model of the multistage project

cost estimation process.

5.1 Design of Simulation Experiments

In our simulation experiments, the performance of

the two order selection methods, i.e., the developed

method in this paper RFSM, and the existing method

TFM (Ishii et al., 2016b), are compared as two basic

cases shown in Table 2. Namely, 100 simulation

runs of a 120 period simulation length are performed

by each method, and the average expected profits

per 12 periods are compared.

P

E3

(MHR

E3

, EPR

E3

)

P

E2

(MHR

E2

, EPR

E2

)

MHR

CP

EPR

max

X

[MH/Period]

[$/Period]

Flow rate of MH fo

r

cost estimation

Flow rate of total

expected profits

Resource Flow based Order Selection Method in Project Cost Estimation Process

159

Table 2: Basic simulation case.

Order selection

method

MH allocation rule

Case A RFSM

HEPF

Case B TFM

The total volume of MH for cost estimation is set

as 16,000 [MH/Period] in reference to a mid-size

process plant EPC contractor. Furthermore, as the

MH allocation rule, the HEPF rule is used

throughout all the simulation experiments, because it

is reported that the higher expected profit is gained

by HEPF rule (Ishii et al., 2016b))

Three order arrival scenarios— scenario S1,

scenario S2, and scenario S3— based on the order

arrival intervals defined by the triangular

distribution, as shown in Table 3, are determined. In

each scenario, orders of the three sizes, i.e., Small,

Medium, Large, arrive dynamically. The total

periods for cost estimation, periods for cost

estimation in each step, and the volume of MH for

cost estimation are set as shown in Table 4. In

addition, two scenarios of expected profit of

accepted orders, i.e. scenarios I and II, are set as

shown in Table 5. Furthermore, as the probability of

order acceptance, the arrived orders are sorted into

grade H: 70%, M: 40%, and L: 10%. Regarding the

rate of the grade, grade M is set as 40%, and grade H

changes from 0% to 60%, and thus it changes from

60% to 0% in grade L accordingly in each

simulation experiment. The expected profit of each

order is computed by multiplying the value in Table

5 by the probability of order acceptance. For

example, if the arrived order’s grade is M (40%) and

the expected profit of the accepted order is 20

[MM$], the expected profit is 8 [MM$].

Regarding the threshold function used for

selecting orders in TFM, the order with the expected

profit per MH 35.0 [$/MH] and the volume of MH

under estimating cost 6,000 [MH] are set, i.e., the

threshold function P(350, 6000), by using the

algorithm developed by Ishii et al. (2016b), under

cost estimation conditions as follows;

1) order arrival interval: S2,

2) the expected profit of orders: I,

3) the rate of probability of order acceptance in

each grade: H:30-M:40-L:30 [%].

Namely, the newly arrived order is selected for

estimating cost by the threshold function in TFM

when its expected profit per MH is higher than 35.0

[$/MH] and MH under estimating cost is less than

6,000 [MH].

Table 3: Order arrival interval [Orders/Period].

Scenario o

f

order

arrival

Parameters of

triangular

distribution

Order size

Small Medium Large

S1

Min.

Mode

Max.

1.05

1.50

1.95

2.70

3.00

3.90

3.15

4.50

5.85

S2

Min.

Mode

Max

0.84

1.20

1.56

1.68

2.40

3.12

2.52

3.60

4.68

S3

Min.

Mode

Max

0.70

1.00

1.30

1.40

2.00

2.60

2.10

3.00

3.90

Table 4: Cost estimation conditions.

Order size

Small Medium Large

Total periods available

for cost estimation

Triangular distribution

(Min.: 4.0, Mode: 7.5, Max.:9.0)

Periods for

cost

estimation

E1

E2

E3

1.0

1.5

2.0

1.0

1.5

2.0

1.0

1.5

2.0

MH for cost

estimation

[M MH]

E1

E2

E3

1.0

2.0

3.0

2.0

3.0

4.0

3.0

4.0

5.0

Table 5: Expected profit of accepted orders [MM$]

(Mode of triangle distribution. Min. & Max. are -/+ 10%

of the mode value.)

Scenario of

expected profit

Order size

Small Medium Large

I

E1

E2

E3

1

10

20

2

20

40

3

30

60

II

E1

E2

E3

1

15

20

2

30

40

3

45

60

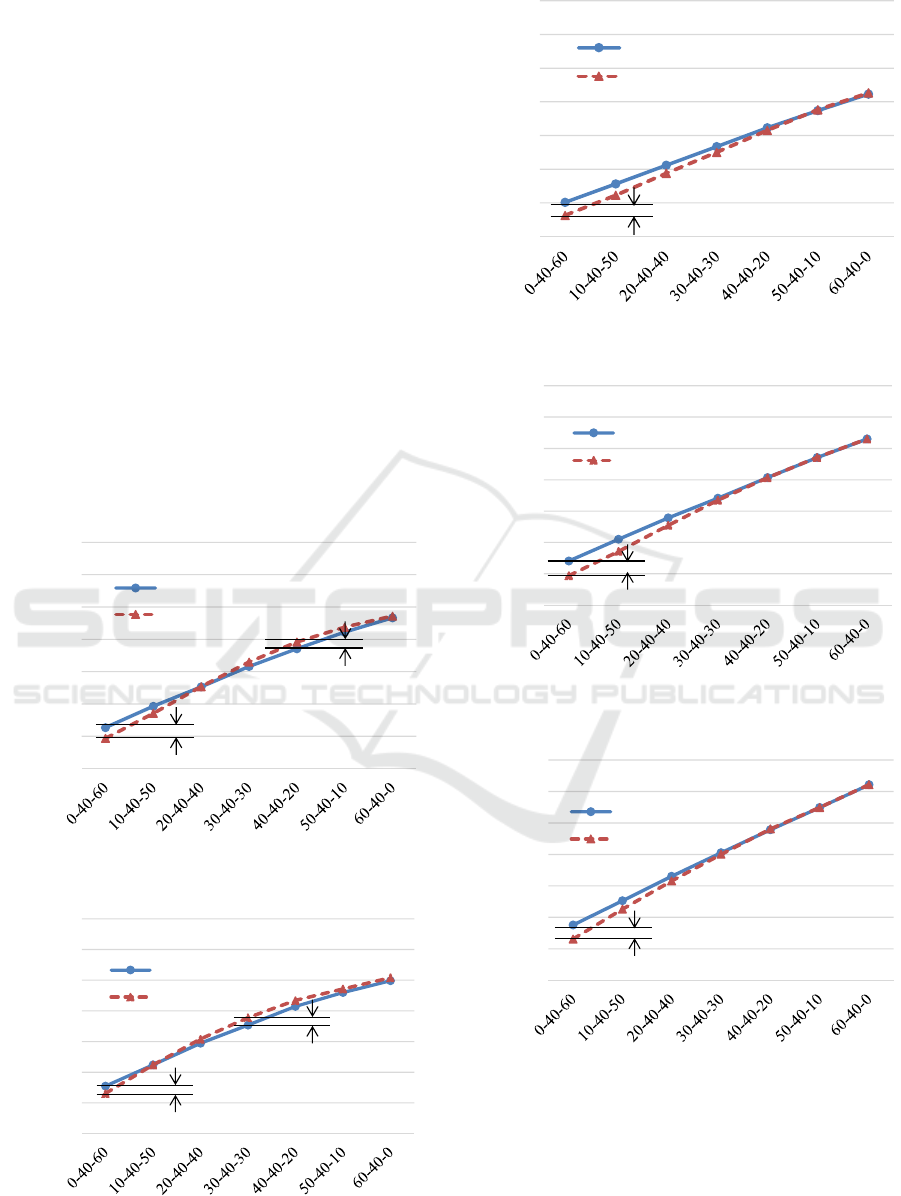

5.2 Results of Simulation Experiments

As shown in Figures 3 and 4, RFSM gains almost

the same or higher expected profit than that by the

existing TFM. Especially, RFSM performs well

when the rate of probability of order acceptance on

grade L is large. For example, in the case of 0-40-

60% in the rate of probability of order acceptance,

the expected profit by RFSM is increased 17.1%

compared to that by TFM as shown in Figure 3. On

the other hand, in the case of the expected profit by

TFM being better than RFSM, its difference is less

than 5.0% as shown in Figure 3 and 4. TFM uses the

fixed threshold function determined under the cost

estimation conditions shown in section 5.1

throughout the simulation experiments. We can say

SIMULTECH 2017 - 7th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

160

that TFM could not maintain the performance when

the cost estimation conditions change dynamically.

In addition, RFSM has almost the same or higher

expected profit than that of TFM at all the rate of

probability of order acceptance in the scenario S1.I

where orders arrive less than the scenario S2.I. as

shown in Figure 5. For example, in the case of 0-40-

60% in the rate of probability of order acceptance,

the expected profit by RFSM is increased 23.8%

compared to that by TFM.

It is also obvious that the expected profit gained

by RFSM is expanded compared to that of TFM

when the conditions of the expected profit in each

step are changed to the scenario II as shown in

Figures 6 and 7. For example, in the case of 0-40-

60% in the rate of probability of order acceptance,

the expected profit by RFSM in scenario S2.I is

increased 17.1% compared to that by TFM as shown

in Figure 3, however it is 24.0% in scenario S2.II as

shown in Figure 6. In these cases, TFM cuts too

many orders because of the higher ratio of low profit

orders compared to the cost estimation conditions

that determines the threshold function of TFM.

Figure 3: Expected profits in scenario S2.I.

Figure 4: Expected profits in scenario S3.I.

Figure 5: Expected profits in scenario S1.I.

Figure 6: Expected profits in scenario S2.II.

Figure 7: Expected profits in scenario S3.II.

Furthermore, since RFSM determines the order

selection based on the changes of the resource flow

rate, which reflects the conditions of the cost

estimation process, we can say that the resource flow

based method is effective for the selecting order,

50

100

150

200

250

300

350

400

Expected profit [MM$/Period]

RFSM

TFM

Rate of grade on order acceptance probability ( H-M-L) [%]

17.1%

4.3%

50

100

150

200

250

300

350

400

Expected profit [MM$/Period]

RFSM

TFM

Rate of grade on order acceptance probability ( H-M-L) [%]

5.0%

10.0%

50

100

150

200

250

300

350

400

Expected profit [MM$/Period]

RFSM

TFM

Rate of grade on order acceptance probability (H-M-L) [%]

23.8%

50

100

150

200

250

300

350

400

Expected profit [MM$/Period]

RFSM

TFM

Rate of grade on order acceptance probability ( H-M-L) [%]

24.0%

50

100

150

200

250

300

350

400

Expected profit [MM$/Period]

RFSM

TFM

Rate of grade on order acceptance probability ( H-M-L) [%]

19.2%

Resource Flow based Order Selection Method in Project Cost Estimation Process

161

especially when the conditions of cost estimation,

such as order arrival intervals, the expected profit of

accepted orders, and so on, change dynamically.

In addition, RFSM needs no complicated

mechanism to determine the order selection rules as

TFM requires. Thus, RFSM can work by lower

computational loads than that of TFM. We can say

that the RFSM is simple and sufficient to be

implemented as an order selection mechanism in the

project cost estimation process in practical situations.

6 CONCLUSIONS

This paper explores the project cost estimation

process of EPC projects in dynamic order arrival

situations, and then it develops a model of

multistage project cost estimation process. Based on

the process, we develop a resource flow based order

selection method. It selects orders for cost

estimation at each order arrival according to the

changes of the flow rate of the contractor’s man-

hours for estimating cost and that of the expected

profits from the orders to maximize the total

expected profits from orders. We analyse the

effectiveness of the developed method in terms of

the expected profit through numerical examples.

The following conclusions can be drawn from

the analysis of the numerical examples:

For increasing the total expected profits from

orders in EPC projects, the resource flow based

order selection method is effective as an order

selection mechanism in the cost estimation

process.

The performance of the resource flow based

order selection method is obvious, especially,

in the cases where the cost estimation

conditions change dynamically.

Several issues require further research. For

example, a generalized algorithm of resource flow

based order selection method that extends the

coordinate points of cost estimate more than three to

correspond to the number of cost estimation steps

should be developed. Regarding the expected profits

from orders, the interrelationship of the order

selection method and the MH allocation rule should

be explored. Management technologies for an

advanced model of the cost estimation process that

changes the total volume of MH associated with the

backlog of orders should also be explored.

ACKNOWLEDGEMENTS

This work was supported by JSPS KAKENHI Grant

Number 16K01252.

REFERENCES

AACE International, 2011. Cost estimate classification

system – As applied in Engineering, Procurement, and

Construction for the process industries. AACE

International Recommended Practice No. 18R-97.

Humphreys, K. K., 2004. Project and cost engineers’

handbook, CRC Press. Boca Raton.

Ishii, N., Takano, Y., Muraki, M., 2014. An order

acceptance strategy under limited engineering man-

hours for cost estimation in Engineering-Procurement-

Construction projects. International Journal of Project

Management, 32 (3), 519-528.

Ishii, N., Takano, Y., Muraki, M., 2016a. A revised

algorithm for competitive bidding price decision under

limited engineering Man-Hours in EPC projects,

Oukan, Journal of Transdisciplinary Federation of

Science and Technology, 10(1), pp. 47-56.

Ishii, N., Takano, Y., Muraki, M., 2016b. A Dynamic

Scheduling Problem in Cost Estimation Process of

EPC Projects, Proceedings of the 6th International

Conference on Simulation and Modeling Methodolo-

gies, Technologies and Applications, 187-194, Lisbon.

Jacobs, F. R., Berry, W. L., Whybark, C. D., Vollmann, T.

E., 2011. Manufacturing planning and control for

supply chain management, McGraw-Hill. New York.

Kerzner, H., 2013. Project management: a systems

approach to planning, scheduling, and controlling,

John Wiley & Sons, New Jersey.

Pritchard, N., Scriven, J., 2011. EPC contracts and major

projects, Sweet & Maxwell, London, 2

nd

edition.

Pritsker, A. A. B., O’Reilly, J. J., 1998. AWESIM: The

integrated simulation system. Proceedings of the 1998

Winter Simulation Conference, 249-255. Washington,

D.C.

Shafahi, A., Haghani, A., 2014. Modeling contractors'

project selection and markup decisions influenced by

eminence. International Journal of Project

Management, 32 (8), 1481–1493.

Takano, Y., Ishii N., Muraki, M., 2014. A sequential

competitive bidding strategy considering inaccurate

cost estimates. OMEGA, 42 (1), 132-140.

Takano, Y., Ishii, N., Muraki, M., 2016, Bid markup

decision and resource allocation for cost estimation in

competitive bidding, Optimization Online.

Takano, Y., Ishii, N., Muraki, M., 2017. Multi-Period

resource allocation for estimating project costs in

competitive bidding, Central European Journal of

Operations Research, 25 (2), 303-323.

Towler, G., R. Sinnott, R., 2008. Chemical engineering

design principles, practice and economics of plant and

process design, Elsevier. Amsterdam.

SIMULTECH 2017 - 7th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

162