The Multiagent Model for Predicting the Behaviour and

Short-term Forecasting of Retail Prices of Petroleum Products

Leonid Galchynsky and Andriy Svydenko

Department of Management and Marketing, National Technical University of Ukraine,

“Ihor Sikorsky Kyiv Polytechnic Institute”, 37 Peremohy Av., Kyiv, Ukraine

Keywords: Multi-agent Models, Oligopolistic Market, Neuron Net, Retail Prices, Petroleum Products, Short–term

Forecasting.

Abstract: In this study, we develop a multi-agent system model for the purpose of predicting the behaviour of

petroleum product prices using short-term forecasting. Having analysed the issue, we found that the ability

of multi-agent models to describe the behaviour of individual market agents along with with the

oligopolistic nature of the market makes it possible to describe a long-term cooperation of agents. But

the accuracy of short-term price predictions for the multi-agent model is insufficient. According to our

hypothesis, this is caused primarily due to the nature of the agent’s heuristic algorithm as well as taking the

price indices as the sole input. The accuracy of the price forecast for the multi-agent model in the short term

is somewhat inferior to co-integration models and forecasting models based on neural networks that use

historical price data of petroleum products. In this paper we have studied a hybrid model containing a

certain set of agents, their price reaction is based on the neural network training process for each agent.

With this approach it is possible to consider not just the price data from the past, but also such factors as

potential threats and market destabilisation. Result comparison between the price obtained through our

short-term forecast model and real data shows the former’s advantage over pure multi-agent models, co-

integration models and over models forecasting based on neural networks.

1 INTRODUCTION

Assessment of the current situation and forecasting

price changes remains being a relevant theme in

market research. Previous studies made in recent

years regarding the petroleum product market in

different countries clearly show a significant margin

of error transience of price. High dependence on the

fuel market of the world oil market impact on retail

prices, and their volatility in recent years has a clear

upward trend. This all led to the existing situation, in

which forecasted retail prices show significant

deviations from the actual data.

Factor analysis has shown that the main sources

of market balance disturbances tend to be of external

nature, especially when it comes to prices of oil its

derivatives around the world and exchange rates.

However, based on the interpretation of Engle-

Granger, it has been proved that the price is fixed

depending on each particular combination of input

factors. This in turn permits using error correction

models to forecast retail prices. At the same time, it

is typical of the petroleum product market to

experience price hikes – sudden changes in retail

price of petroleum products due to shifts in external

factors.

Such price hikes are unpredictable, thus resulting

in destabilization of the petroleum product, which

then leads to negative consequences for the economy

and sometimes may even trigger social unrest. The

co-integration theory is not designated for such

cases; all the while it is effective in predicting the

trends of gasoline prices at times when the impact of

external factors is relatively small. The situation is

even more complicated by the oligopolistic nature of

the retail market. These two circumstances:

fluctuations in wholesale prices and the oligopolistic

nature of the market price give birth to an anomaly

known as price asymmetry. Thus creating the

necessity to not merely predict prices for a given

period, but to somehow anticipate fuel price hikes,

in an effort to control the situation. In this paper we

glance at the system of predicting and forecasting

prices of petroleum products, based on the factors

related to the data monitoring information system

632

Galchynsky, L. and Svydenko, A.

The Multiagent Model for Predicting the Behaviour and Short-term Forecasting of Retail Prices of Petroleum Products.

DOI: 10.5220/0006361706320637

In Proceedings of the 19th International Conference on Enterprise Information Systems (ICEIS 2017) - Volume 1, pages 632-637

ISBN: 978-989-758-247-9

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

that could potentially be a threat, destabilizing the

market price for petroleum products.

2 RELATED WORKS

The theme of forecasting the price of petroleum

products is important for markets around the world.

In the past decades this topic was focused on by

many researchers in numerous countries around the

world (Lewis, 2003; Sadorsky, 2006; Perdiguero

García, 2010). In (Galczynski, 2014) have been

analyzed the comparative capabilities of different

statistical techniques and neural networks that use

historical data values of retail prices in terms of the

accuracy of short-term forecasting of the product oil

prices.

Many aspects of using the multi-agent approach

to competition in oligopolistic markets were studied

by (Tsvetovat and Carley, 2002; Happenstall et al.,

2004; Levin et al., 2009; Ramezani et al., 2011;

Galchynsky et al., 2011).

Also a number of studies focusing on using

neural networks for short-term forecasting of

commodity market prices have been conducted by

(Hinton et al., 2012), ( Wan. et al., 2013),( He et al.,

2015).

3 MODEL

Previous studies proved the possibility of

constructing agent-based models for the petroleum

product. However, having analyzed their use, a fair

number of deficiencies start to surface, such as the

lack of accurate short-term price forecasts. In our

opinion this is due to the heuristic nature of

describing agent behavior, which is linked to the

current retail prices.

Nonetheless, it is well known that the behavior

of market players, putting wholesale prices and price

competition aside, is affected by various economic

indicators of the network. At any given time period

the agent calculates a simplified set of economic

indicators: cost of sales per unit, current margin of

the retail network and where their own selling prices

stand compared to those of their competitors. In

addition to price indicators, an important factor in

making a decision to change prices for petroleum

products, thus resulting in market stress, is

additional non-price related information on various

threats that may appear on the market. For the

Ukrainian petroleum product these threats can be

grouped into the following classes:

changes in excise duty for manufacturing and

importing petroleum products;

changes in excise duty for retail sales of

petroleum products;

changes in petroleum prices;

significant fluctuations of petroleum product

prices in Europe and wholesale prices in

Ukraine;

rate hikes for rail transport and pipeline

transport;

changes in the legislative framework and/or

introduction of new taxes;

other threats that are potentially able to disrupt

the normal cycle of raw material supply.

Based on this list we can see that information

about threats can be obtained both through

numerical values, and via various textual

information reported by the media and other sources.

Depending on these groups of factors, one must first

predict price behavior, and only then should a

forecast be constructed.

Unlike previous agent-type models of the

petroleum product market, this model includes only

one type of agents - retail petrol station chains. The

model does not implement complex communication

mechanisms between agents, but the agents do share

information about their prices with other agents. The

only action that the agent is capable of is to change

the price.

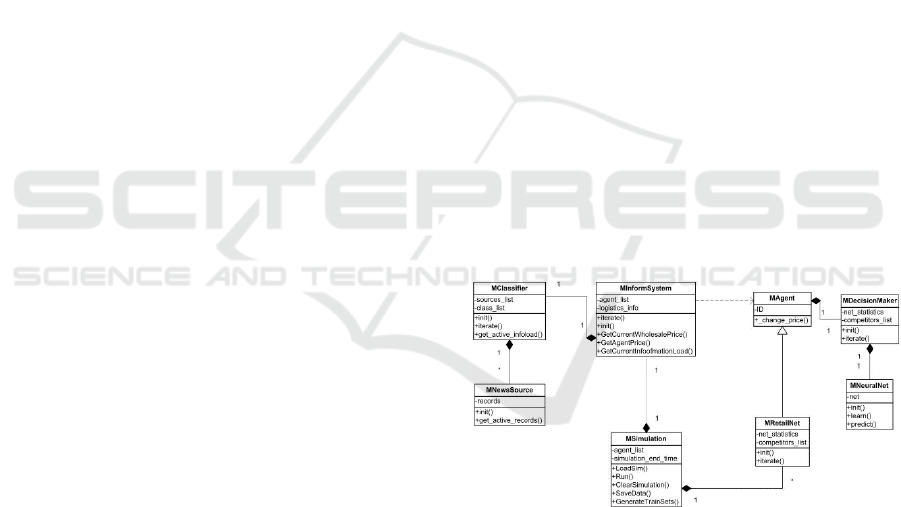

Figure 1: Model Structure.

The agent’s behavior is based on results of the

calculation of the neural network. In every time

period the agent performs the following actions:

• gathers information on prices of other agents;

• receives information on wholesale prices and the

list of threats;

• decides on a price change.

Figure 1 shows the structure of the object model,

in fact for the real market, in this case the Ukrainian

petroleum product this amounts to 6 agents. The

current number of networks is dictated primarily by

The Multiagent Model for Predicting the Behaviour and Short-term Forecasting of Retail Prices of Petroleum Products

633

the national character of their actions and

relationships with other agents. Other agents have an

insignificant market share, that being said, the

networks are led by market leaders. Therefore,

increasing the number of agents will simply lead to a

significant increase in complexity, without providing

any significant improvement in forecast accuracy.

Per contra one must note that agent-based models

should also directly or indirectly consider the other

party of the market relations – the consumers. In the

latter case, the impact of consumers is considered

indirectly, mainly due to the lack of reliable data on

the dynamics of fuel consumption by individual

market players.

One of the conditions for proper functioning of

the neural network the stationarity of the input and

output data. However, studies show that retail prices

in the petroleum product are far from stationary.

This makes it impossible to use absolute price value

for input prices of the neural network. Having

analyzed the growth of retail prices thus as seen in

Table 1 the increment of the retail price is of the

first order, hence allowing us price surges as inputs

for the neural network.

Table 1: Assessment of stationarity of the retail prices and

their increments.

Temporal series

Dickey-

Fuller

p-value

Retail prices for gasoline A-95 in

the period 2010-2014

2,211 0,49

Growth rate of retail gasoline

prices in the period 2010-2014

-7.921 0,01

It is also important to consider lags related to

purchasing and selling the products. If we ignore lag

compensation this will lead to inconsistencies

between the value of net costs relative to the that of

the selling price. To compensate for the lag in

calculating the margin, we use the following current

lag cost determination algorithm:

Choose date t

0

with a stable wholesale price

t = t

0

lag[t] = L_typ

while t < t_cur

lag[t] = f_LAG((t-lag[t-1])..t)

if lag[t] - lag[t-1] > 1

lag[t] = lag[t-1] + 1

t = t + 1

end

The following algorithm is used to determine lag,

calculated separately for each network at a certain

period of time using the formula below:

lagtt

typ

PP

a

LLAGf

100

;min_

where P

t-lag

– is the price at the beginning of the

period, P

t

– is the price at the end of the period, L

typ

– is the default lag value for stable market

conditions. Indicators a and γ are evaluated

separately for each of the agents on the , based on

the analysis of the price surges and behaviour of the

market entities.

The cost is not only used for calculating the

margin, but is also used in a rule that limits the

behavior of the network: the selling price cannot be

lower than the cost of production. Under standard

conditions this rule is practically never used, but at

times of significant volatility of incoming data it

generally minimizes risk of experiencing situations

with delay in model response for the surges of

inputted data.

All incoming threat-related information is

assigned not only a class, but also a threat rank,

which corresponds to the threat level for the market.

In this study we have identified the following threat

ranks:

-2 – a significant impact on the market towards a

drop in prices;

-1 – a moderate impact on the market towards a

drop in prices;

0 – no impact on the market is observed;

1 – a moderate impact on the market towards a

hike in prices;

2 – a significant impact on the market towards a

hike in prices.

Taking into account the price formulation factors

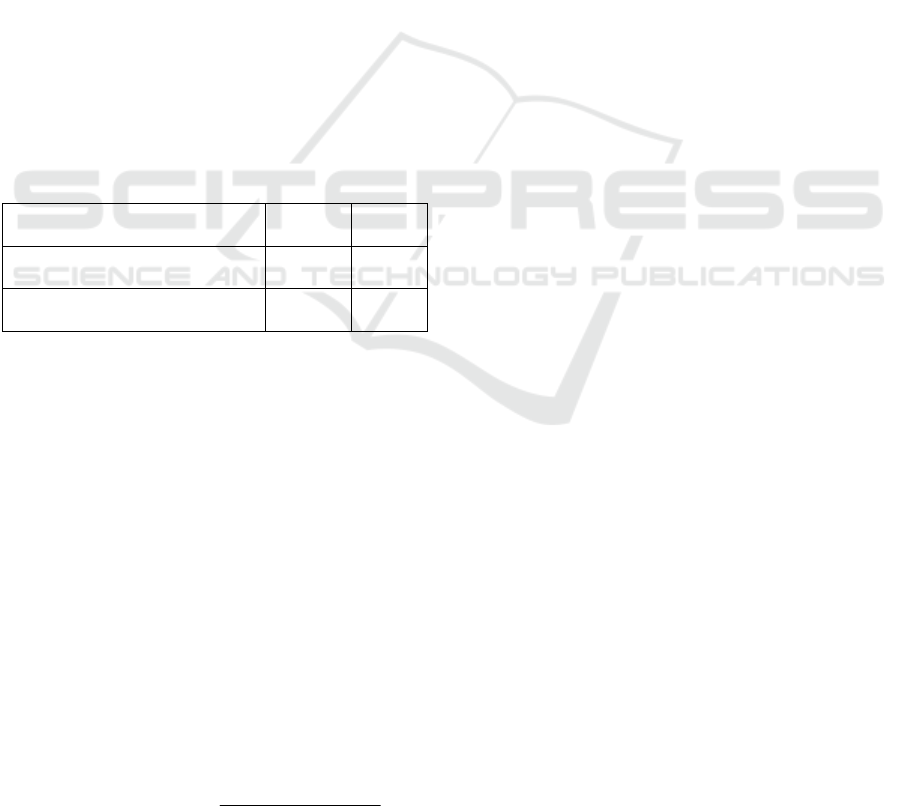

shown above, Figure 2 depicts the structure of the

neural network and the interpretation of the input. It

was found that the best form of neural networks for

solving this problem is a multilayer perceptron with

4 hidden layers. At the core of this network is a

fully-connected multilayer perceptron (layers 2-6).

The first layer has the activation ReLU (Rectified

Linear Unit) function and is intended to form linear

combinations of input. During the learning process it

generates indicators, based on which the retail

network acquires a behavioral classification. Unlike

the linear activation function, ReLU can reduce the

number of neurons per layer thanks to its non-linear

nature. Output has no activation function, but is

rather used as a multiplexer of the perceptron’s

output layer of price growth for the next time period.

Such network structure is dictated primarily by the

specificity of the input and output data.

About categorized under threat of impact forces

form the index of informational load. This index is

the sum of ranks of active threats at a time. This

approach takes into account both direct and indirect

impacts on the market with the formation of the

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

634

retail price.

Figure 2: The structure of the neural network.

4 LEARNING NETWORKS

Each agent’s neural network is trained separately.

To generate a set of input data we used a mock

launch of the agent model without the use of neural

networks. All values used for input to the neural

network will be calculated for each agent based on

real statistic data. Information on threats is

formulated beyond the agent model – in the threat

identifying system for the petroleum product, where

the corresponding information gathering,

classification and threat ranking are carried out.

To train the network we used daily prices of

retail chains, daily wholesale price on the Ukrainian

border and the total value of the active threats

broken down by day.

Training and testing was conducted based on the

data collected from the following 2 periods:

- January 2010 to June 2012 with verification on

data from July to December 2012 - a period of

normal market conditions

- June 2013 to May 2014 with verification on

data from June 2014 onwards - a period of

significant price volatility.

The main challenge in using neural networks for

economics-related tasks is the inhomogeneity of

data, thus over-educating the network. In an effort to

avoid such a scenario this model uses the Dropout

method.

5 EXPERIMENTAL RESULTS

The figure seen below depicts a comparison of price

forecast graphs calculated using the agent forecast

model and the real data for the period from 2010 to

2012.

Figure 3: Comparison of price forecasts for the described

model with real data for 2010-2012.

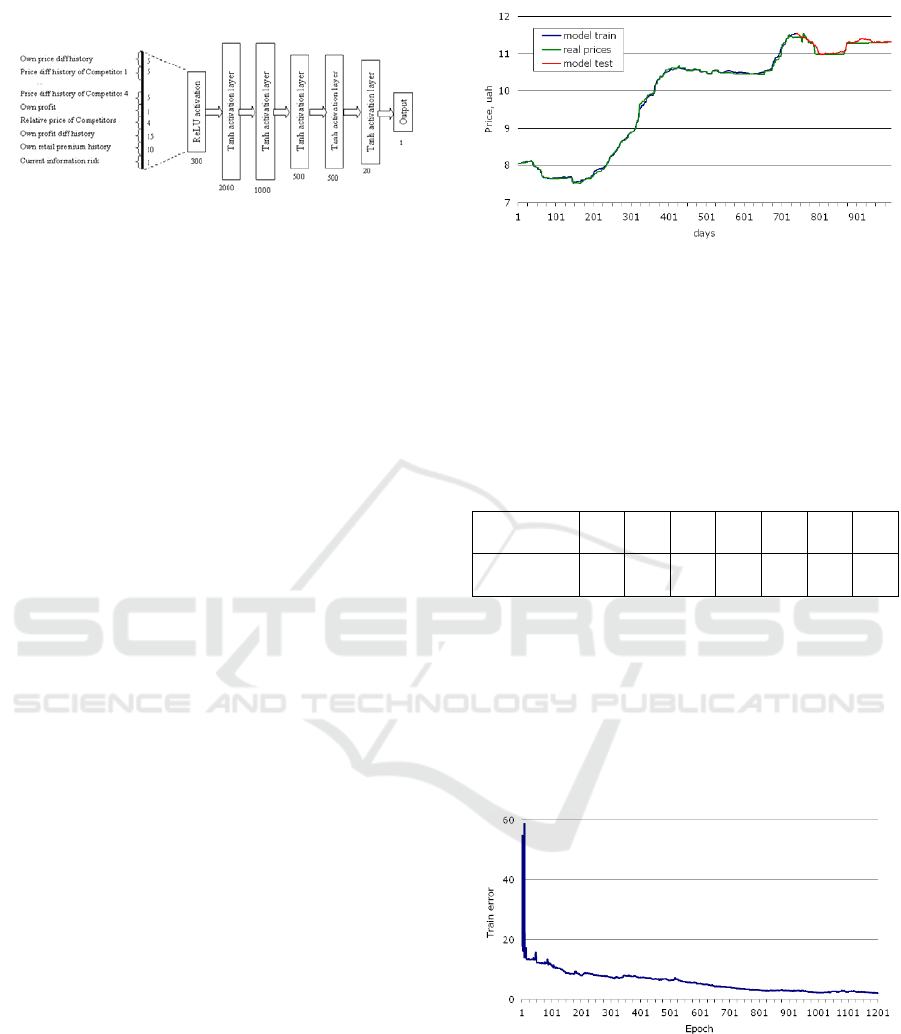

Shares of zeroing for our network are presented in

Table 2. Regularization was never carried out for the

last layer, since it serves solely to formulate linear

combinations of output data. For other layers the

ratio depends on the number of neurons in adjacent

layers.

Table 2: Regularization ratios for the Dropout method.

Number of

layer

1 2 3 4 5 6 7

dropout

ratio

0.5 0,5 0.5 0.3 0.3 0.3 -

To build and train a network we have used our own

software written in C++ based on the FANN library.

To train the system we used a packet method of

error backpropagation with a stochastic method of

gradient descent. Due to the significant size of

neural networks, the training algorithms were

modified to work in a multi-stream mode on video

display cards by utilizing CUDA.

Figure 4: Error margin dynamics during the training

process of the neural network.

It should be noted that when one constructs a

forecast for wholesale prices, the forecast horizon

remains unchanged. This is a certain simplification

dictated due to a wholesale price forecast requiring a

forecast of the exchange rate. The latter would be

quite challenging to acquire at times of market

The Multiagent Model for Predicting the Behaviour and Short-term Forecasting of Retail Prices of Petroleum Products

635

instability. Therefore the precision of the forecast

may be improved by using forecast values from

input data of the agent model.

We have made comparisons with real data and

other short-term forecast models in an effort to

assess the potential of the model’s forecasting

capabilities.

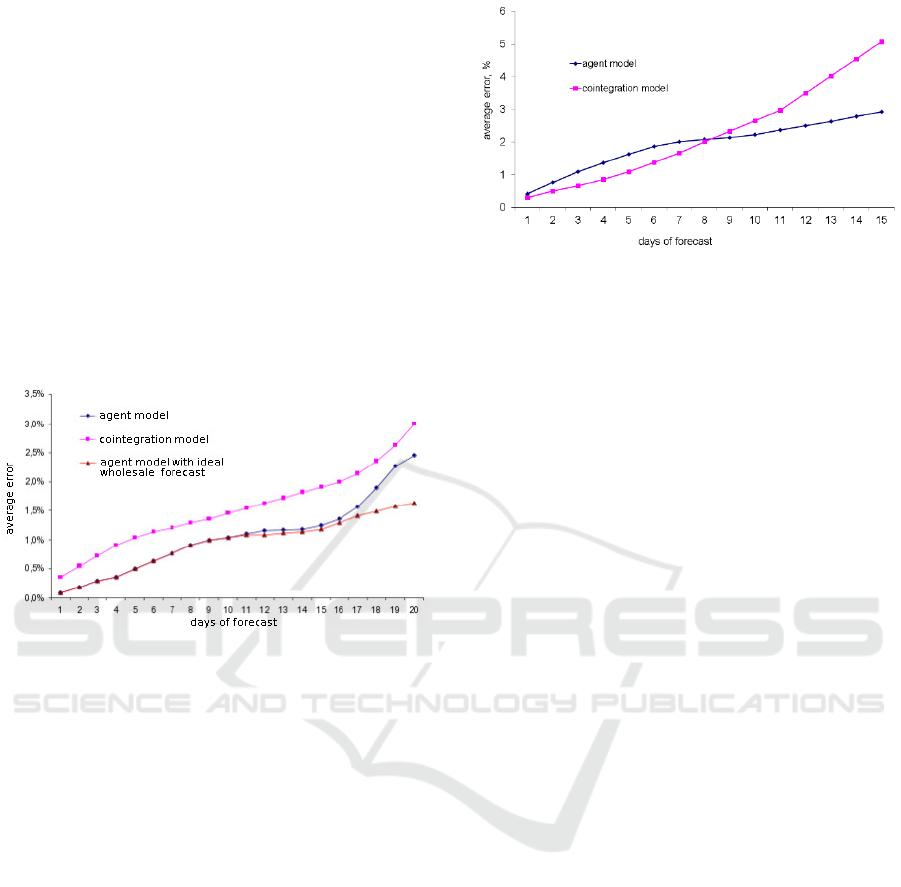

Figure 5 shows an error comparison between the

agent model and the co-integration model under

normal market conditions. In this situation, the agent

model shows the best result with an error rate of

1.1% for the forecasted two week period compared

to 1.8% for the co-integration model.

Short-term prediction accuracy measured by the

absolute standard deviation calculated from real data

within the prediction interval.

Figure 5: Comparison of prediction accuracy between the

agent model and the co-integration model under normal

market conditions.

We have also assessed the error margin if there had

been an "ideal" model capable of predicting the

behavior of wholesale prices, which are part of the

input data for the agent model. The results show that

by using third-party agent models the forecast model

can be increased to nearly 3 weeks, while

maintaining a reasonable result.

Figure 6 shows a comparison of average

forecasting errors for a period of considerable

volatility in market prices. As we can see, the co-

integration model displays a higher accuracy rate for

periods up to 1 week, while forecasts for periods

over 7 days are more accurate when using the neural

network model. In any case, the main cause of

disturbances for this period was the exchange rate.

The accuracy of the model granted with an ideal

wholesale forecast model was not conducted due to

absence of exchange rate forecasting models for an

unstable economic climate.

Figure 6: Comparison of prediction accuracy between the

agent model and the co-integration model, in the case of

significant market price volatility.

6 CONCLUSIONS

Results show that the combination of agent-based

models and neural networks in which the neural

network serves as a tool/method of price reactions

for each of the agents in response to the actions of

the competition allows for the best results when it

comes to predicting retail prices of petroleum

products compared to those taken separately from a

pricing forecast model based on separate multi-agent

model rules and a single neural network. This hybrid

model improves the solution of this nontrivial

problem primarily due to the consideration of the

petroleum product’s particular features as an

oligopolistic competitive environment and

incorporation of particular information, which is

used by retailers to formulate their prices. As a

result of combining several approaches to data

formulation: using information including threats as

input parameters and using parallel computing to

accelerate the training process of the neural network,

we were able to build a model capable of predicting

the short-term behavior of retail prices and

considering the pricing dynamics of each market

participant.

This hybrid model doesn’t just build a forecast

based on the historical data for the previous time

periods, but it also considers the ever-changing

market behavior. We were able to lower the forecast

uncertainty levels below what was possible with

statistical methods. This paper shows the results the

first proposed hybrid model for oligopolistic oil

product market based on multi-agent approach, in

which the algorithm is based on behavior calculation

agent by neural network. This allows to get a better

short-term prognosis with substantial volatility of oil

product prices than predictions based on historical

data.

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

636

ACKNOWLEDGEMENTS

The authors express their gratitude to the

management of consulting and analysis firm

"Psyche" for providing detailed data on the retail

prices of petroleum products on the Ukrainian

market.

REFERENCES

Matt Lewis "Asymmetric Price Adjustment and Consumer

Search: An Examination of the Retail Gasoline

Market" University of California, Berkeley

Department of Economics November 13, 2003.

Perry Sadorsky, Modeling and forecasting petroleum

futures volatility Energy Economics Volume 28, Issue

4, July 2006, Pages 467–488.

Perdiguero García, Jordi, 2010. "Dynamic pricing in the

spanish gasoline market: A tacit collusion

equilibrium," Energy Policy, Elsevier, vol. 38(4),

pages 1931-1937, April.

Leonid Galczynski The Short-Time Forecasts of Gasoline

Proces in Ukraine. ZESZYTY NAUKOWE

Uniwersytet Ekonomickij POZNAŃ № 242 с.44-56,

2014.

Alison Heppenstall, Andrew Evans and Mark Birkin

Using Hybrid Agent-Based Systems to Model

Spatially-Influenced Retail Markets Journal of

Artificial Societies and Social Simulation vol. 9, no. 3.

Tsvetovat, V. and Carley, K., 2002, Emergent

Specialisation in a Commodity Market: A Multi-Agent

Model, Computational and Mathematical

Organisation Theory, 8, pp. 221 – 234.

Dynamic pricing by software agents Jeffrey O. Kephart,

James E. Hanson, Amy R. Greenwald Computer

Networks 32 (2000) 731-752.

S. Ramezani, P. A. N., Bosman, J. A., La Poutré. Adaptive

Strategies for Dynamic Pricing Agents. Proceedings of

the 23rd Benelux Conference on Artificial Intelligence,

423–424, 2011.

Galchynsky, Leonid, Andrij Svydenko, and Iryna

Veremenko. "The agent-based model of regulation of

retail prices on the market of petroleum products."

Polish journal of management studies 3 (2011): 135-

146.

Y. Levin, J. McGill, and M. Nediak. Dynamic pricing in

the presence of strategic consumers and oligopolistic

competition. Management Science, 55(1):32–46,

2009.

Hinton G. E. Improving neural networks by preventing co-

adaption of feature detectors / Hinton G. E., Srivastave

N., Krizhevsky A., Sutskever I., Salakhutdinov R. R. -

arXiv:1207.0580 – 2012.

Wan, L., Zeiler, M., Zhang, S., Cun, Y. L., & Fergus, R.

(2013). Regularization of neural networks using

dropconnect. In Proceedings of the 30th International

Conference on Machine Learning (ICML-13) (pp.

1058-1066).

He, K., Zhang, X., Ren, S., & Sun, J. (2015). Delving deep

into rectifiers: Surpassing human-level performance

on imagenet classification. In Proceedings of the IEEE

International Conference on Computer Vision (pp.

1026-1034).

The Multiagent Model for Predicting the Behaviour and Short-term Forecasting of Retail Prices of Petroleum Products

637