Decision Support for Structured Energy Procurement

Florian Maier

1

, Hicham Belhassan

2

, Nikolai Klempp

3

, Falko Koetter

1

, Elias Siehler

4

,

Daniel Stetter

1

and Andreas Wohlfrom

1

1

Fraunhofer-Institut f

¨

ur Arbeitswirtschaft und Organisation IAO, Nobelstr. 12, 70569 Stuttgart, Germany

2

Cologne Institute of Renewable Energy, Betzdorfer Straße 2, 50679 Cologne, Germany

3

Institute of Energy Economics and Rational Energy Use, Heßbr

¨

uhlstraße 49a, 70565 Stuttgart, Germany

4

Flughafen Stuttgart, Flughafenstraße 32, 70629 Stuttgart, Germany

Keywords:

Energy Management, Structured Energy Procurement, Infrastructures, Smart Energy.

Abstract:

Infrastructure operators in Germany such as airports or factories are confronted with rising energy costs throug-

hout the last years and consequently have to reconsider their energy supply and management. This competitive

pressure raises the question of an optimal procurement strategy, which takes into account the individual orga-

nizational framework and conditions. In the context of the SmartEnergyHub research project this problem was

addressed at the example of the Stuttgart Airport by the implementation of a decision support system to ma-

nage and evaluate long-term procurement plans. Uncertainties related to future price developments and load

fluctuations have been taken into account with the help of a Monte Carlo simulation. Ex-post analysis show,

that the cost of hedging has been between 10 - 15 % of stock procurement costs in the investigated scenarios

due to falling energy stock prices. This raises the question, how much certainty in budget may cost. The

developed software module creates transparency of the cost structure of historic procurements and facilitates

the comparison of different future procurement plans with regard to expected costs and risks. The focus of the

presented work lies on infrastructure operators, who follow a structured energy procurement strategy based on

a long-term contract with a single energy supplier.

1 INTRODUCTION

Within the last years continuously falling energy

stock prices could be observed in Germany, whe-

reas companies have to cope with increasing energy

costs due to taxes and levies (German Association

of Energy and Water e.V. BDEW, 2016). This leads

to a competitive pressure to optimize energy procu-

rement and consumption. On the other hand energy

providers have to restructure their grids in face of the

switch to renewable energies, necessitating new pri-

cing and participation models (Valipour et al., 2016).

Energy companies can thus use price incentives to

make their customers adapt their energy consumption

to supply (Mitra et al., 2016).

Within the research project SmartEnergyHub

1

a

holistic approach is pursued to support infrastructures

such as airports, harbors, industrial or chemical parks,

factories and public facilities to successfully procure

1

www.smart-energy-hub.de

energy in this changing market. In (Florian Maier and

Zech, 2016) an architectural concept for a software

platform is presented, showing which software com-

ponents are required to identify and realize energy op-

timization potentials. Whereas the internal optimiza-

tion module within this solution generates short-term

operating schedules taking into account current data

like daily production plans or current weather fore-

casts, the market optimization module has its focus

on supporting infrastructure operators to find procure-

ment plans which fit to their risk attitude with a long-

term perspective.

The German energy market offers a broad variety

of options for market participation for both producers

and consumers of energy. So the first step in defining

an energy procurement strategy is the choice of an ap-

propriate procurement model. In general three diffe-

rent procurement models can be distinguished, which

differ from one another with respect to costs, risks

and personnel expenditures. Especially small and me-

dium enterprises often conclude full supply contracts

Maier, F., Belhassan, H., Klempp, N., Koetter, F., Siehler, E., Stetter, D. and Wohlfrom, A.

Decision Support for Structured Energy Procurement.

DOI: 10.5220/0006361500770086

In Proceedings of the 6th International Conference on Smart Cities and Green ICT Systems (SMARTGREENS 2017), pages 77-86

ISBN: 978-989-758-241-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

77

with a one-time specified fixed price which minimi-

zes staff costs (1). As an alternative to these contracts

different kinds of structured energy supply contracts

are offered, which allow buying energy at the future

market in advance and trading at the spot market to

adjust the previously bought energy to the actual de-

mand (2). Thus the company is given the ability to

cope with price and volume risks. For large industrial

enterprises there is also the option to realize their own

portfolio management which offers the most degrees

of freedom but also requires a constant market obser-

vation (3).

One example of such a large enterprise is the Stutt-

gart Airport, which is a partner in the SmartEnergy-

Hub project. Based on this pilot user, this work des-

cribes the complex decision-making problem related

to energy procurement in large infrastructures. Ba-

sed on this, a simulation based decision support sy-

stem is developed to support the infrastructure opera-

tor to answer the following question: Which quantity

of energy should be bought at which time via which

product?

This work is structured as follows. Section 2 gives

an overview of models and approaches, which offer

solutions to the problem of finding optimal procure-

ment strategies either for SMEs, large companies or

energy suppliers. Section 3 takes a closer look at in-

dividual aspects of the procurement problem introdu-

cing a systematic methodology to describe the solu-

tion space. Following this methodology it is explai-

ned how this solution space is shaped in the example

of the Stuttgart Airport. In Section 4, the prototype

implementation of a decision support system based

on a Monte Carlo simulation is described. Section 5

describes how this software component, which is one

part of the SmartEnergyHub architecture, is used to

find appropriate procurement plans. Finally, Section 6

gives a conclusion and an outlook on future work.

2 RELATED WORK

In this section, we examine the areas of energy procu-

rement decisions both from the perspective of consu-

mers, energy suppliers and distributors.

(Kumbartzky and Werners, 2016) focus on op-

timal energy procurement strategies from the per-

spective of SMEs based on a two-stage optimiza-

tion model. Stochastic influences concerning prices

and energy demand are taken into account by the in-

troduction of a finite number of scenarios. For all

scenarios optimal procurement strategies are found

and compared by a minimax relative regret appro-

ach. Contract costs are split up to allow modeling

take-or-pay clauses as well as additional charges for

excess capacities consumed. In a case study the cost

saving potential of structured procurement strategies

are shown.

Monte Carlo simulations are a numerical simula-

tion technique and a wide spread approach for exam-

ple for the derivation of an optimal portfolio as des-

cribed in (Cvitani

´

c et al., 2003) and (Boyle et al.,

2008). Variants of Monte Carlo simulations like the

least squares Monte Carlo is used to determine energy

option value in (Nadarajah et al., 2017).

In (Prokopczuk et al., 2007) a Monte Carlo simu-

lation based model is developed to quantify risks re-

lated to wholesale electricity contracts from the per-

spective of an electricity supplier, who is able to di-

versify unsystematic risk through a large portfolio of

many customers. Within the model the Risk-adjusted-

Return-on-Capital is used as a risk measure. Price

risks are modeled using the SMaPS (Spot Market

Price Simulation) developed in (Burger et al., 2004).

Uncertainties related to the energy demand are de-

rived by correlating spot market prices to individual

load curves thus simulating individual load paths. It

is argued that a supplier will offer contracts at a price

reflecting risk premiums for the hourly spot market

price risk, a risk premium for the volume risk and a

risk premium related to the price-volume correlation.

In (Woo et al., 2004) procurement strategies for

local distribution companies are developed. Such a

company has three possibilities to satisfy customers’

electricity demand namely through self-generation,

spot market transactions and forward-contracting. A

heuristic procedure is presented to minimize expected

procurement costs for a given risk tolerance level re-

sulting in the determination of the energy amount

which will be bought in advance in future-contracts.

Price structures in German energy market are the

subject of (Pietz, 2009) where the presence of risk

premiums in German electricity market with a focus

on month futures is investigated. It is concluded that

there is evidence for positive risk premia, which de-

creases with increasing time-to-delivery. Similarly,

(Daskalakis et al., 2015) investigate electricity risk

premia in the European market and find a correlation

with the volatility of the spot market and carbon diox-

ide futures, concluding that carbon price fluctuations

are a factor in discounts for electricity consumers.

(Hong and Lee, 2013) focus on an energy con-

sumer who can choose among different suppliers to

meet the energy demand. A Monte Carlo simulation

is used to quantify each supplier’s risk and to allo-

cate orders among multiple suppliers. (Bessembinder

and Lemmon, 2002) focus on optimal forward posi-

tions for energy producing and retailing firms using

SMARTGREENS 2017 - 6th International Conference on Smart Cities and Green ICT Systems

78

an equilibrium approach. The existence and nature

of risk premium in forward market is also subject of

their investigations.

In (Conejo et al., 2010) the procurement decision

problem is modeled as a multi-stage stochastic pro-

blem for large consumers. The target function con-

sists of two components, namely the expected procu-

rement cost and the weighted risk measure Conditio-

nal Value at Risk (CVaR). This typically represents

the trade-off between scenarios with low expected

costs and higher risks and scenarios with higher ex-

pected costs for reduced risks.

Commercial software solutions address different

aspects of the procurement decision problem com-

monly supporting purchasing processes in portfo-

lio management teams. kWantera’s product Fara-

day

2

for example supports buyers and sellers of

energy to place bids and offers on energy markets.

Enernocs procurement platform

3

tracks market mo-

vements alerting traders and operators in case tran-

sactions need to be adjusted. In the context of po-

wer plant resource planning similar optimization pro-

blems have to be solved. Procom’s software Bofit

4

supports power plant operators in planning and opti-

mizing their energy production as well as trading. A

stochastic dynamic programming approach is applied

in Time-steps’ TS Energy

5

to optimize the operation

of pumped-storage power plants.

Overall, the related work shows the complexity of

finding optimal procurement plans under uncertainty

related to price and load fluctuations. However, a tool

for infrastructure operators is missing, which helps

to reduce this complexity by integrating external in-

formation sources and platforms without the need to

establish an own portfolio management team. The-

refore, to solve the energy procurement problem of

large infrastructure operators like Stuttgart Airport,

a solution must provide infrastructure operators with

the possibility to find procurement plans appropriate

for their risk attitude, which we will develop in the

following sections.

3 METHODOLOGY

The following steps have been developed in coope-

ration with the project partners and pilot users to de-

fine a systematic methodology with the goal of fin-

ding procurement plans, which are consistent with the

risk attitude of the company:

2

www.kwantera.com

3

www.enernoc.com

4

www.procom.de

5

www.time-steps.com

• Degrees of freedom: The first step consists of the

identification of controllable parameters within

the procurement strategy. From a long-term per-

spective the appropriate choice of a energy sup-

plier and a supply contract can be regarded as one

of the main degrees of freedom. If there is alre-

ady a structured supply contract, this contract al-

lows the choice of one or several of the following

parameters:

– Hedging quote: Defines the ratio of energy pro-

cured at the future market to the total energy

demand. The more energy is procured on the

future market (which results in higher hedging

quotes) in advance, the lower the price risk is.

– Product: On the energy exchange power future

market currently year, quarter, month, week,

weekend and day products are traded, each as

base and peak products. Year products can be

traded 6 years in advance whereas day products

can only be traded 1 day in advance. It has to

be determined which of those products should

be bought.

– Volume: Some contracts include the constraint

of minimum quantities which can be bought.

Apart from that, it has to be decided, if a certain

amount of energy should be bought in fixed or

variable tranches.

– Purchasing time: It has to be decided in which

period of time energy is bought on the future

market and at which point in time during this

period.

• External and stochastic influences: Apart from

controllable parameters within the procurement

process there are the following external stochas-

tic influences:

– Energy prices: Energy prices on the future mar-

ket as well as the spot market are not known in

advance and have to be modeled as stochastic

influences in the decision.

– Energy consumption: The actual energy con-

sumption is usually also not known in advance

because it depends on production plans and we-

ather conditions. However, to a certain degree

the energy consumption can be influenced, e.g.

by load shedding or self-generation. This short

term optimization is part of the internal optimi-

zation module and is not further covered here.

For the following considerations it is assumed

that the energy consumption is also stochastic.

• Notion of risk: It can be assumed that the security

of supply is ensured independently from the sup-

ply contract and the choices which are made by

Decision Support for Structured Energy Procurement

79

the company within the frame of the contract. De-

pending on the contract some decisions may lead

to higher costs or even penalties nevertheless. The

main risk can be derived from stochastic influen-

ces such as unexpected increases in energy prices

or deviations in the actual energy consumption.

Most of the companies not only try to minimize

expected procurement costs but try to minimize

procurement costs for a given risk level or try to

find an optimal combination of risks and costs.

• Finding appropriate procurement plans: After

modeling the controllable parameters, the exter-

nal and stochastic influences as well as choosing

an appropriate risk measurement, different procu-

rement plans can be compared according to their

risk and expected costs. This can be done re-

trospective to gain insight into past procurement

plans and decisions as well as for future procure-

ment periods.

The following section describes how the previ-

ously defined steps have been practically applied to

support the creation of the procurement process at

Stuttgart Airport.

The first step was to analyze the current situation

in several workshops to identify the framework con-

ditions as well as the degrees of freedom. Until the

end of 2013 the Stuttgart Airport procured energy ba-

sed on a full supply contract. Since 2014 a structured

energy procurement was introduced using an energy

service provider. This opens up new possibilities to

procure parts of the required energy in advance on the

future market in the form of year, quarter or month

products. With the purchase of those products for

base (0-24 hours) and peak time slots (8-20 hours) it

becomes necessary to replicate the actual load curve

by purchases and sales on the spot market. To miti-

gate the risk of purchases at high prices, those pur-

chases can be split up into several even tranches. Due

to internal operational requirements the procurement

starts 1 to 2 years before delivery. Within those fra-

mework specifications decisions can be made to de-

termine, when to buy which amount of energy in the

form of which product. So far a significant part of the

total required energy has been procured at the future

market in advance.

Uncertainties exist mainly with regard to the price

development at the spot and future market as well as

with regard to the load profile during delivery. Ha-

ving said that the module market functions is one part

of the SmartEnergyHub platform, existing modules

could be used to take into account these stochastic in-

fluences. In this way spot price forecasts provided by

the external company ICIS

6

can be used by appro-

priate import interfaces. ICIS is a market information

provider and offers e.g. forecasts for the German spot

market. The spot price forecasts are regularly upda-

ted allowing working with latest market information

in the market function module. Within this context

the question arises, whether the existence of positive

risk premiums can be assumed in the German energy

market, which has been examined from different per-

spectives (Pietz, 2009).

With the support of the SmartEnergyHub forecast

module load predictions based on historic load profi-

les have been generated. Workshops with the Stutt-

gart Airport allowed the distinction of different fore-

cast scenarios. It should be noted that estimates by

the infrastructure operator concerning changes com-

pared to previous years are an essential prerequisite

for accurate predictions. Changes occur for instance

with the installation of additional photovoltaic plants

or the construction of new buildings.

Assuming that there are positive risk premia ob-

servable on the future market and transaction costs

both on the future and on the spot market are equal,

an exclusive minimization of total expected procure-

ment costs results in a hedging quote of 0, which me-

ans that the total energy demand is covered through

transactions on the spot market. In practice an exclu-

sive minimization of total expected procurement costs

is rarely observed. Instead, a risk-aware procurement

strategy is usually pursued, which leads to hedging

quotes larger than 0. This is why the comparison of

procurement costs should be run in consideration of

expected costs and the related risk. Following (Pro-

kopczuk et al., 2007) CFaR has been chosen as a cen-

tral risk measurement and is defined as Q

σ

− E where

Q

σ

is the 95 % quantile of the procurement cost dis-

tribution and E represents the expected procurement

cost.

For the generation of procurement plans an ap-

proach has been developed, which allows the split-

ting of the total required energy amount, derived from

the load forecast, into individual products (see also

Section 4). Based on the spot price forecast a Monte

Carlo simulation is run to determine the expected pro-

curement cost E as well as the risk measure CFaR.

The aim of the developed software module is to visua-

lize the effects of different parametrization and allow

a comparison of several alternatives with respect to

costs and risks. For ex-post analysis of historic pro-

curement plans transactions were scaled to simulate

various hedging quotes.

6

www.icis.com

SMARTGREENS 2017 - 6th International Conference on Smart Cities and Green ICT Systems

80

4 IMPLEMENTATION

The procurement process entails four steps:

1. In the planning phase a procurement plan gets ge-

nerated based on load and price forecasts. It con-

sists of the planned future transactions in the pro-

curement period.

2. In the second step, the procurement phase, these

transactions are conducted with aid of the energy

provider.

3. In the delivery phase the power then gets delivered

and potential over and under coverages are coun-

terbalanced through spot transactions.

4. In the accounting phase the effected transactions

are billed based on the previously signed contract.

Hereafter we primarily focus on the first phase

of the procurement process despite the goal for the

module market functions to support the entirety of

the procurement phases. The module market functi-

ons interact with other system components and pro-

vides the infrastructure manager respectively its pro-

curement agent with a graphical interface for analy-

sing and executing procurement plans. To import data

into the database in a coherent format, external servi-

ces such as spot price forecasts, current EEX market

data and procurement platforms of energy providers

are integrated through the Non-Sensor import module

of SmartEnergyHub (Florian Maier and Zech, 2016).

Additionally long-term power forecasts, that are in-

ternally generated, are also provided through the da-

tabase. For a systematic access of these resources the

proxy pattern was used. A PriceService proxy for

accessing historic, current and predicted prices exists,

that caches time series on demand. An analogues Lo-

adCurveService proxy was created to encapsulate the

access to historic and predicted load curves. Historic

transactions are retrievable through a TransactionSer-

vice proxy for ex post analysis. Newly generated pro-

curement plans for prospective delivery periods can

be saved and managed using the module. For the ac-

tual execution of transactions an individual commu-

nication process with the energy provider is required,

for example by transmitting an order through mail or

using a graphical user interface supplied by the energy

provider.

4.1 Domain Model

A central domain object is the time series, which is

used for representing price forecasts and load curves

amongst others. The procurement plan is another es-

sential object, which is defined by its set of transacti-

ons. Each transaction is associated with exactly one

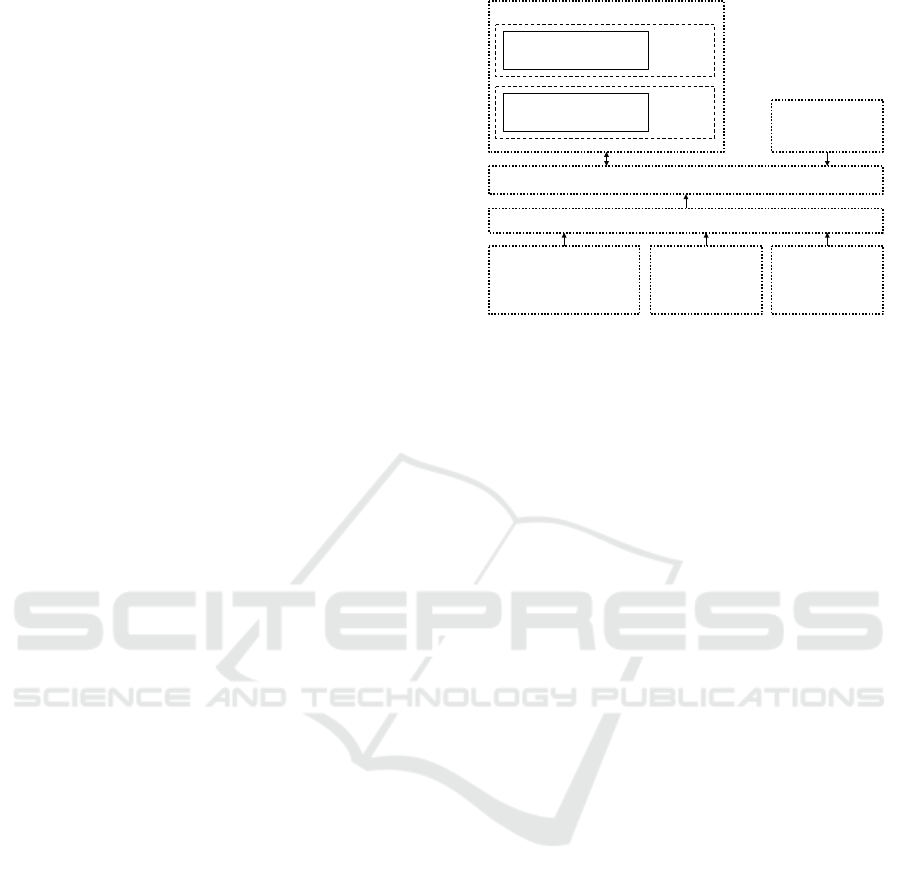

MarketfunctionsWeb

View

MarketfunctionsCore

Business

logic

Module market functions

Energy service

provider

transaction system

Data storage

Non-sensor imports

Price data

provider

stock price data

Price forecast provider

Hourly price forward curves

Forecasts

load forecasts

Figure 1: Overview of main components.

procurement plan and encapsulates the following pro-

perties: product type, power, delivery start and end,

timestamp of the transaction, cost as well as unit in-

formation. The sum of all transactions costs consti-

tutes the overall procurement cost of a procurement

plan. A procurement plan always refers to one de-

livery year and enables the coverage of a companies

energy requirements in this period.

4.2 Transaction Generation Procedure

In the following an approach for generating a valid

procurement plan is shown. This encompasses the

determination of the amount of energy to be bought

on the future market for each product type. Then, for

each product type times of purchase are determined,

which is a preliminary step for defining tranches. A

previously generated power forecast in hourly reso-

lution for the delivery year is required. Procurement

shall be separated into base and peak products to mo-

del the characteristic nightly load decrease.

1. In the first step the hedging quote is defined. Ba-

sed on a hourly load prediction the energy amount

to be procured on the future market can be deter-

mined by taking the sum over the hourly energy

consumption, which is then multiplied with the

hedging quote.

2. Afterwards the type of product with the shortest

delivery period is identified. This could be a quar-

ter, month or week product for example. Under

the assumption of a requested separation into base

and peak products, the sum of the hourly energy

consumption for Peak (8-20 hours) and Offpeak

(20 - 8 hours) time slots is calculated for the iden-

tified product with the shortest delivery period. In

the case of month products the following outcome

could be achieved:

Decision Support for Structured Energy Procurement

81

Table 1: Initial time slices.

time span work

(in

MWh)

power

(in

MW)

hours

of use

January peak 1104 4 276

January offpeak 936 2 468

February peak 1008 4,2 240

February offpeak 820,8 1,9 432

3. Based on the hours of use the power values can

be determined for each product. To transform

the peak-offpeak-split into base(0-24 hours) and

peak-products, the power of the offset hours is

used for the base product. The resulting power of

the peak product can then be calculated as the dif-

ference between the base product power and the

previous peak hours:

Table 2: Base and peak products.

product work

(in MWh)

power

(in MW)

hours

of use

January base 1488 2 744

January peak 552 2 276

February base 1276,8 1,9 672

February peak 552 2,3 240

4. The duration of the trading period for EEX stan-

dard products depends on the duration of the de-

livery period. If it is requested, that future tran-

sactions should begin 1 - 2 years before delivery,

month products with a maximum trading period

of 9 months before delivery are out of scope. Ne-

vertheless it is possible to partially substitute se-

veral products with a short delivery period with

a product with a longer delivery period, resulting

in potentially different costs. As an example one

can think of 3 month base products with a power

of 3 MW (April), 2 MW (Mai) and 4 MW (June),

which can be replaced by a quarter base product

with 2 MW and 2 month products with 1 MW

(April) and 2 MW (June). This substitution does

not change the amount of energy delivered, whe-

reas the purchase of the quarter product would be

possible 33 months in advance. This is why in

the following products with a short delivery pe-

riod are always replaced by products with longer

delivery periods thus increasing the flexibility to

choose the purchase time.

5. After splitting the expected energy amount for one

year into different kind of products with the goal

of an optimal approximation of the predicted load

curve, the next step consists of finding transaction

timestamps and purchase amounts. There are dif-

ferent alternatives for this task such as splitting

the amount of energy, which should be bought in

equal tranches, which are bought periodically du-

ring the procurement stage. Another possibility

is to determine the amount to purchase in a more

flexible way based on market observations, which

results in higher time efforts.

4.3 Graphical User Interface

The graphical user interface supports the infrastruc-

ture operator in managing procurement plans, con-

ducting retrospective analysis of finished procure-

ment plans and allowing the comparison of future

procurement plans with respect to expected costs and

risks.

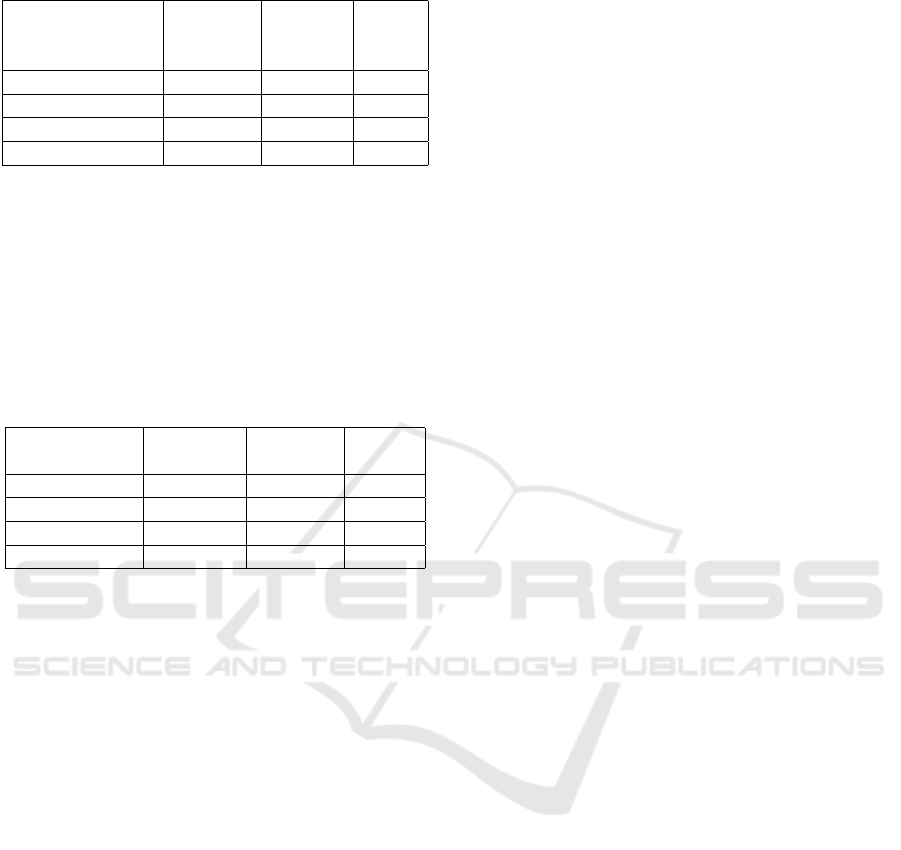

The screenshot 2 displays how a user can confi-

gure the creation of a procurement plan by selecting

the procurement period for year as well as quarter pro-

ducts and defining the number of tranches. On the

side there is a slider which allows setting the hedging

quote. Based on the user input a procurement plan

is generated in the backend based on the previously

described procedure.

The procurement plan is then displayed to the user

as a table (see Figure 3) and can be used as a schedule

for energy purchases.

5 EVALUATION

The developed decision support system was applied in

a use case to analyze historic procurement decisions

as well as to create future procurement plans at the

Stuttgart Airport.

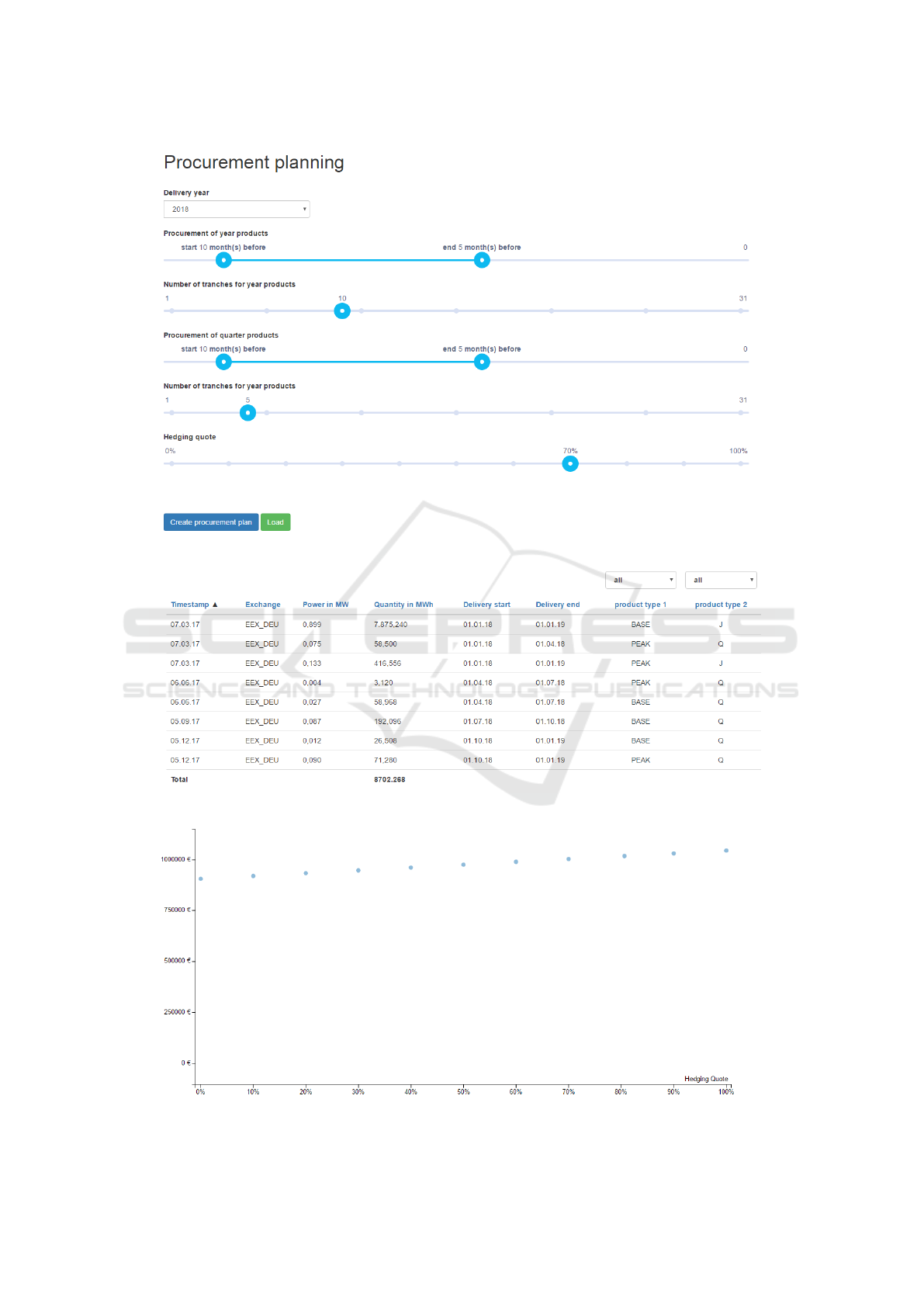

In retrospective procurement simulations for the

exemplary delivery year 2014 it is noticeable that the

hedging quote had a major impact on total procure-

ment costs as can be seen in Figure 4, which shows

hedging quotes ranging from 0 - 100 percent on the

x-axis, correlated with the resulting normalized total

procurement costs on the y-axis. A procurement stra-

tegy with a hedging quote of 100 percent would have

caused procurement costs which lie about 15 percent

higher compared to a hedging strategy with a zero

hedging quote. So an increase of 10 percent in the

hedging quote and thus higher price certainty resulted

in about 1.5 percent higher procurement costs. This

strong increase of costs with increasing hedging quo-

tes is mainly due to falling energy spot prices within

the relevant period. The picture is similar for the fol-

lowing year 2015 where the costs of hedging in a 100

percent hedging scenario were 12 percent higher com-

pared to a zero hedging quote strategy.

SMARTGREENS 2017 - 6th International Conference on Smart Cities and Green ICT Systems

82

Figure 2: Configuration of procurement plan generator.

Figure 3: Procurement plan.

Figure 4: Ex-post correlation between hedging quote and procurement costs 2014.

Decision Support for Structured Energy Procurement

83

To study the effects of various influence factors

on the resulting procurement costs and risks, different

kind of simulation scenarios have been defined. In

the first scenario the load curve was assumed as gi-

ven, whereas spot prices were assumed to be fluctua-

ting. The second scenario starts from the opposite as-

sumption with given spot prices and fluctuating load

curves. In the third scenario fluctuating spot prices

as well as fluctuating load curves were used to give a

realistic picture of the correlations.

Figure 5 shows the cost distribution for different

hedging quotes based on a Monte Carlo simulation. It

is assumed that spot prices are on average lower than

future prices, which results in higher expected costs

for higher hedging quotes. At the same time one can

observe that the scattering is smallest for a hedging

quote of 100 percent, reflecting the lowest price risk.

Even with a hedging quote of 100 percent, the total

average procurement costs are not fully deterministic

as random variations in the energy demand make spot

market transactions inevitable.

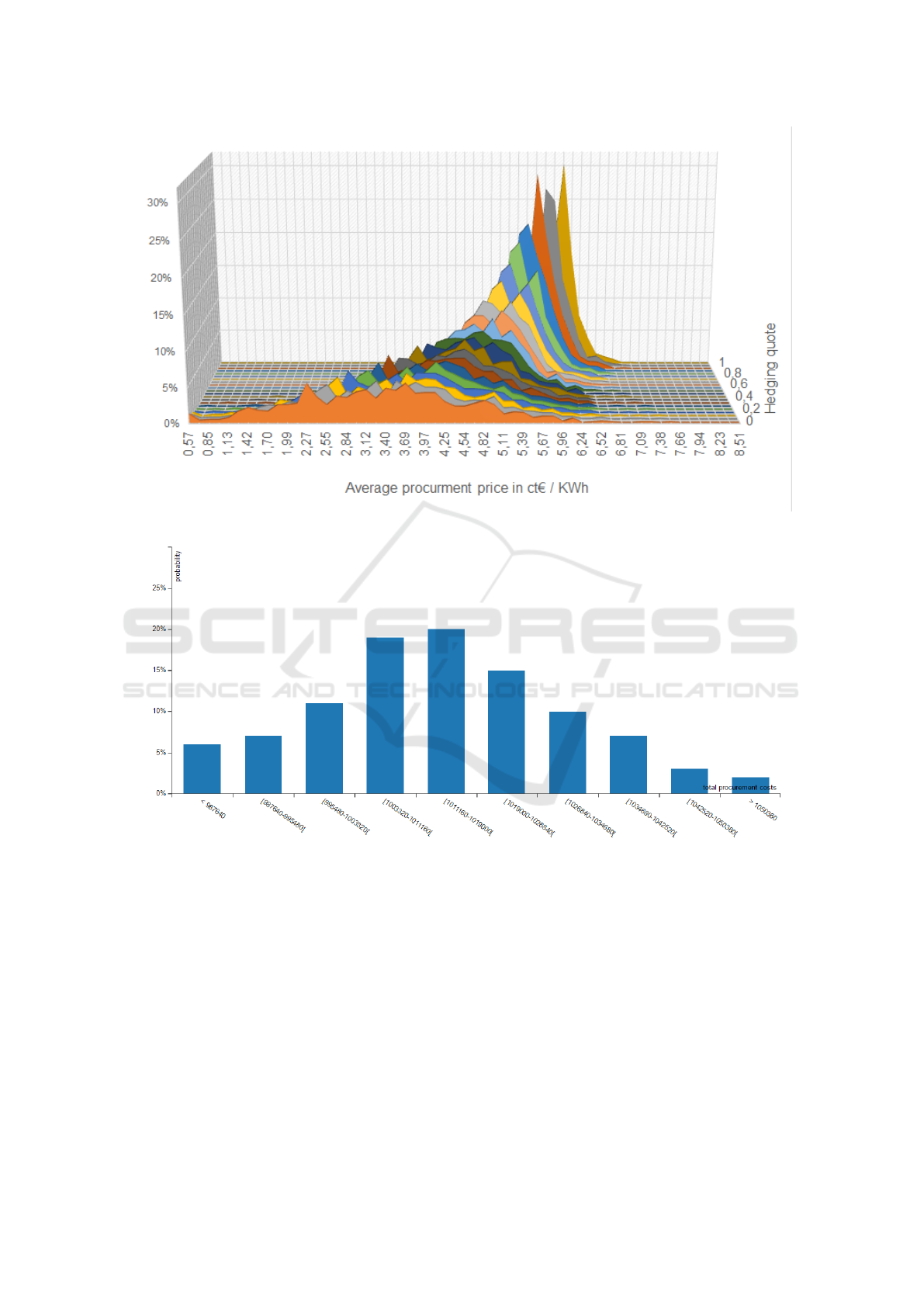

To provide the infrastructure operator with the

possibility to investigate the effects on costs and risks

of a specific parametrization, an interactive simula-

tion element has been integrated into the user inter-

face (see Figure 6), allowing the user to start a Monte

Carlo simulation and see an updated frequency chart

after each iteration step 6. After a simulation run the

user is provided with the aggregated results of the si-

mulation, essentially the expected total procurement

cost as well as the CFaR based on a confidence level

of 95 percent quantifying the risk of the procurement

plan. The outcome depends heavily on the assump-

tions made for the accuracy of the load prediction by

the prediction module and the integrated spot price fo-

recasts provided by ICIS. Under the assumption that

those estimates are unbiased on an hourly basis the si-

mulation over the 8760 hours within one year result in

frequency charts with low variances resulting in low

CFaRs for a hedging quote of 70 percent.

This heuristic approach offers an easy-to-use pos-

sibility to compare a manageable amount of alternati-

ves with regard to risk and expected costs. The tool

could be extended by the explicit solution of the de-

cision problem determining optimal values for all de-

grees of freedom.

After successful evaluation with historic and si-

mulation data with a focus on the years 2014 and

2015, the decision support system is in productive use

at Stuttgart Airport to determine the energy procure-

ment plan in 2018.

6 CONCLUSIONS AND

OUTLOOK

In this work we developed a simulation based deci-

sion support system for energy procurement of large

infrastructure providers.

We evaluated this system based on historical data

of Stuttgart airport as well as simulation data, finding

that the ex-post cost of hedging lay with 15 percent

of the total procurement costs for 2014 and 12 per-

cent for 2015 due to falling spot prices. On the other

hand this system supports infrastructure operators to

investigate the effects of the parameter choice in the

creation process of future procurement costs. Higher

hedging quotes reduce the price risk resulting in hig-

her expected procurement costs.

Based on this specific use case it was assumed,

that the infrastructure operator makes procurement

decisions within the frame of a long term energy con-

tract with a single energy supplier. The selection pro-

cess of this energy supplier within a public tender or a

reverse auction process is not part of the investigation.

By taking into account multiple contracts with diffe-

rent energy suppliers at the same time the approach

could be extended.

The system is currently in productive use at Stutt-

gart Airport for 2018. This work is a part of the

market optimization module in the SmartEnergyHub

platform, which aims to optimize energy production,

consumption and procurement for large infrastructure

providers.

In future work we plan to compare the estimated

procurement costs and related risks based on our si-

mulations with the realized costs. This implies the

comparison with other algorithms like dynamic sto-

chastic optimization as well as the use of other risk

measures. Besides, it should be possible to realize

purchase decisions with the energy provider automa-

tically within the same module.

ACKNOWLEDGMENTS

The work published in this article was fun-

ded by the Bundesministerium f

¨

ur Wirtschaft und

Energie (BMWi) under the promotional reference

01MD15011C, www.smart-energy-hub.de). The

SmartEnergyHub project is a joint work of: Fichtner

IT Consulting AG, Flughafen Stuttgart GmbH, Faun-

hofer IAIS, Faunhofer IAO, in-integrierte informati-

onssysteme GmbH and Seven2one Informationssys-

teme GmbH.

SMARTGREENS 2017 - 6th International Conference on Smart Cities and Green ICT Systems

84

Figure 5: Procurement costs and influence factors.

Figure 6: Frequency chart.

REFERENCES

Bessembinder, H. and Lemmon, M. L. (2002). Equili-

brium pricing and optimal hedging in electricity for-

ward markets. the Journal of Finance, 57(3):1347–

1382.

Boyle, P., Imai, J., and Tan, K. S. (2008). Computation of

optimal portfolios using simulation-based dimension

reduction. Insurance: Mathematics and Economics,

43(3):327–338.

Burger, M., Klar, B., M ller, A., and Schindlmayr, G.

(2004). A spot market model for pricing derivatives in

electricity markets. Quantitative Finance, 4(1):109–

122.

Conejo, A. J., Carri

´

on, M., and Morales, J. M. (2010). Deci-

sion making under uncertainty in electricity markets,

volume 1. Springer.

Cvitani

´

c, J., Goukasian, L., and Zapatero, F. (2003). Monte

carlo computation of optimal portfolios in complete

markets. Journal of Economic Dynamics and Control,

27(6):971–986.

Daskalakis, G., Symeonidis, L., Markellos, R. N., et al.

(2015). Electricity futures prices in an emissions con-

strained economy: Evidence from european power

markets. The Energy Journal, 36(3):1–33.

Decision Support for Structured Energy Procurement

85

Florian Maier, Andreas Wohlfrom, F. K. S. M.-M. and Zech,

D. (2016). Smartenergyhub - a big-data approach for

the optimization of energy-intensive infrastructures.

ThinkMind Digital Library.

German Association of Energy and Water e.V. BDEW

(2016). Bdew-strompreisanalyse november 2016 (in

german). https://www.bdew.de/internet.nsf/id/bdew-

strompreisanalyse-de.

Hong, Z. and Lee, C. (2013). A decision support system for

procurement risk management in the presence of spot

market. Decision Support Systems, 55(1):67–78.

Kumbartzky, N. and Werners, B. (2016). Optimising energy

procurement for small and medium-sized enterpri-

ses. In Operations Research Proceedings 2014, pages

321–326. Springer.

Mitra, A., Touati, C., Ploix, S., Maulik, U., and Hadjsaid,

N. (2016). Economical analysis of flexibility in micro

grids. In Proceedings of the 5th International Confe-

rence on Smart Cities and Green ICT Systems - Vo-

lume 1: SMARTGREENS, pages 351–356.

Nadarajah, S., Margot, F., and Secomandi, N. (2017). Com-

parison of least squares monte carlo methods with ap-

plications to energy real options. European Journal of

Operational Research, 256(1):196–204.

Pietz, M. (2009). Risk premia in the german electricity fu-

tures market. Proceedings of ICEE 2009 3rd Interna-

tional Conference on Energy and Environment.

Prokopczuk, M., Rachev, S. T., Schindlmayr, G., and Tr

¨

uck,

S. (2007). Quantifying risk in the electricity busi-

ness: A raroc-based approach. Energy Economics,

29(5):1033–1049.

Valipour, S., Volk, F., Grube, T., Bck, L., Karg, L., and Mhl-

huser, M. (2016). A formal holon model for operating

future energy grids during blackouts. In Proceedings

of the 5th International Conference on Smart Cities

and Green ICT Systems - Volume 1: SMARTGREENS,

pages 146–153.

Woo, C.-K., Karimov, R. I., and Horowitz, I. (2004). Ma-

naging electricity procurement cost and risk by a local

distribution company. Energy Policy, 32(5):635–645.

SMARTGREENS 2017 - 6th International Conference on Smart Cities and Green ICT Systems

86