A Linear-dependence-based Approach to Design

Proactive Credit Scoring Models

Roberto Saia and Salvatore Carta

Dipartimento di Matematica e Informatica, Universit

`

a di Cagliari, Cagliari, Italy

Keywords:

Business Intelligence, Credit Scoring, Fraud Detection, Data Mining, Metrics.

Abstract:

The main aim of a credit scoring model is the classification of the loan customers into two classes, reliable and

unreliable customers, on the basis of their potential capability to keep up with their repayments. Nowadays,

credit scoring models are increasingly in demand, due to the consumer credit growth. Such models are usually

designed on the basis of the past loan applications and used to evaluate the new ones. Their definition repre-

sents a hard challenge for different reasons, the most important of which is the imbalanced class distribution

of data (i.e., the number of default cases is much smaller than that of the non-default cases), and this reduces

the effectiveness of the most widely used approaches (e.g., neural network, random forests, and so on). The

Linear Dependence Based (LDB) approach proposed in this paper offers a twofold advantage: it evaluates a

new loan application on the basis of the linear dependence of its vector representation in the context of a ma-

trix composed by the vector representation of the non-default applications history, thus by using only a class

of data, overcoming the imbalanced class distribution issue; furthermore, it does not exploit the defaulting

loans, allowing us to operate in a proactive manner, by addressing also the cold-start problem. We validate our

approach on two real-world datasets characterized by a strong unbalanced distribution of data, by comparing

its performance with that of one of the best state-of-the-art approach: random forests.

1 INTRODUCTION

The actions related to a lending process typically in-

volve two entities: the institution that provides the

loan, and the customer that benefits from it. Such

process starts from a loan application and it ends with

the repayment (or not repayment) of the loan. If, on

the one hand, the retail lending represents one of the

most profitable source for the financial operators, on

the other hand, the increase of the loans is directly re-

lated to the increase of the number of defaulted cases,

i.e., fully or partially not repaid loans.

Briefly, the credit scoring is used to classify the

loan customers into two classes, accepted or rejected,

on the basis of the available information. It is there-

fore an important tool for the financial operators,

since it allows them to reduce the financial losses,

as stated in (Henley et al., 1997). More formally,

credit scoring can be defined as a statistical technique

aimed to predict the probability that a loan applica-

tion (from now on named as instance) leads toward a

default (Mester et al., 1997), thus it is used to decide

if a loan should be granted to a customer (Morrison,

2004).

The analysis performed by the credit scoring is

also useful to evaluate the credit risk (i.e., probabil-

ity of loss from a customer's default), because it takes

into account all the factors that contribute to determi-

nate it (Fensterstock, 2005). It presents some other

advantages, such as the reduction of the credit analy-

sis cost, a quick response time in the credit decisions,

and the possibility to perform a punctual monitoring

of the credit activities (Brill, 1998).

indent Such as it occurs in other similar contexts, e.g.,

fraud detection (Pozzolo et al., 2014), the develop-

ment of effective approaches for credit scoring comes

up against a big problem: the unbalanced distribu-

tion of data. It happens because the number of neg-

ative cases (i.e., default instances) is typically much

smaller than the positive ones (i.e., non-default in-

stances), configuring a highly unbalanced distribution

of data (Batista et al., 2004) that reduces the effec-

tiveness of the machine learning strategies (Japkow-

icz and Stephen, 2002).

The vision behind this paper is to represent the in-

stances as a vector space, and to define a metric able

to evaluate, in this space, the correlation between a

new instance and the other previous non-default ones,

Saia, R. and Carta, S.

A Linear-dependence-based Approach to Design Proactive Credit Scoring Models.

DOI: 10.5220/0006066701110120

In Proceedings of the 8th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2016) - Volume 1: KDIR, pages 111-120

ISBN: 978-989-758-203-5

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

111

in order to evaluate its level of reliability.

This metric is based on the concept of linear de-

pendence between vectors, considering that a set of

vectors is linearly independent if no vector in it can

be defined as a linear combination

1

of the other ones,

we believe that if the vector representation of a new

instance is linearly dependent to the vector represen-

tations of the previous non-default ones, we can con-

sider it as reliable.

We perform this process by calculating the deter-

minant of the matrix composed by the vector repre-

sentation of the past non-default instances and that of

a new instance to evaluate, by placing its vector rep-

resentation as the last row of the matrix. Whereas the

determinant does not exist for the non-square matri-

ces, we introduce a criterion that allows us to extend

this calculation even to these cases.

Given that in most of the cases reported in the

literature (Lessmann et al., 2015; Brown and Mues,

2012; Bhattacharyya et al., 2011) the Random Forests

approach outperforms the other ones in this context,

we will compare the proposed approach only to this

one.

The main contributions of this paper to the state

of the art are the following:

(i) formalization of the Average of Sub-matrices

Determinants (ASD) criterion used to evaluate

the linear dependence of the vector representa-

tion of an instance in a vector space, also when

it configures a non-square matrix that not allows

us to calculate its determinant;

(ii) calculation of the Reliability Band β, which

gives us information about the linear depen-

dence variations in an ASD process that only in-

volves non-default instances;

(iii) definition of the Linear Dependence Based

(LDB) approach of evaluation of new instances,

performed by exploiting the β information to

classify them as accepted or rejected;

(iv) demonstration of how the LDB approach is

able to achieve very similar (or better) results

in terms of performance, when compared to

a state-of-the-art approach such as Random

Forest, by working in a proactive manner (i.e.,

without using default cases), overcoming the

cold-start and the imbalanced class distribution

problems.

This paper is organized as follows: Section 2 dis-

cusses the background and related work; Section 3

1

When one of the vectors is a scalar multiple of the

other.

provides a formal notation and defines the problem

faced in this paper; Section 4 describes the implemen-

tation of our credit scoring system; Section 5 provides

details on the experimental environment, the adopted

datasets and metrics, as well as on the used strat-

egy and the experimental results; Some concluding

remarks and future work are given in Section 6.

2 BACKGROUND AND RELATED

WORK

A large number of credit scoring classification tech-

niques has been proposed in literature (Doumpos and

Zopounidis, 2014), as well as many studies aimed

to compare their performance on the basis of several

datasets, such as in (Lessmann et al., 2015), where

a large scale benchmark of 41 classification meth-

ods has been performed, across eight credit scoring

datasets.

The problem of choosing the most suitable ap-

proach of classification, and tuning its parameters in

the best way, has been faced in (Ali and Smith, 2006),

which also reports some interesting considerations

about the canonical metrics of performance used in

this context (Hand, 2009).

2.1 Credit Scoring Models

Most of the statistical and data mining techniques

at the state of the art can be used in order to build

credit scoring models (Chen and Liu, 2004; Alborzi

and Khanbabaei, 2016), e.g., linear discriminant mod-

els (Reichert et al., 1983), logistic regression mod-

els (Henley, 1994), neural network models (Desai

et al., 1996; Blanco-Oliver et al., 2013), genetic pro-

gramming models (Ong et al., 2005; Chi and Hsu,

2012), k-nearest neighbor models (Henley and Hand,

1996) and decision tree models (Davis et al., 1992;

Wang et al., 2012).

These techniques can also be combined (Wang

et al., 2011) to create hybrid approaches of credit

scoring, as that proposed in (Lee and Chen, 2005),

based on a two-stage hybrid modeling procedure with

artificial neural networks and multivariate adaptive re-

gression splines, or that presented in (Hsieh, 2005),

based on neural networks and clustering methods.

2.2 Imbalanced Class Distribution

A complicating factor in the credit scoring process

is the imbalanced class distribution of data (He and

Garcia, 2009), caused by the fact that the default

classes (default instances) are much smaller than the

KDIR 2016 - 8th International Conference on Knowledge Discovery and Information Retrieval

112

other ones (non-default instances). Such distribution

of data reduces the performance of the classification

techniques, as reported in the study made in (Brown

and Mues, 2012).

Another study about the introduction of misclas-

sification costs during the processes of scorecard con-

struction and classification was performed in (Vin-

ciotti and Hand, 2003), where the authors have also

discussed the possibility of preprocessing the dataset

of training, by performing an over-sampling or an

under-sampling of the classes. The application of

the over-sampling and under-sampling processes has

been studied in depth in (Marqu

´

es et al., 2013; Crone

and Finlay, 2012).

In this paper we do not perform any class balanc-

ing, since our intention is to evaluate the proposed

approach in the context of an unaltered real-world

dataset.

2.3 Cold Start

The cold start problem (Zhu et al., 2008; Donmez

et al., 2007) arises when there are not enough infor-

mation to train a reliable model about a domain (Lika

et al., 2014; Son, 2016; Fern

´

andez-Tob

´

ıas et al.,

2016).

In the credit scoring context, this happens when

there are not many instances related to the credit-

worthy and non-credit-worthy customers (Attenberg

and Provost, 2010; Thanuja et al., 2011).

Considering that, during the model definition, the

proposed approach does not exploit the data about

the defaulting loans, it is able to reduce/overcome the

aforementioned issue.

2.4 Random Forests

Random Forests represent an ensemble learning

method for classification and regression that is based

on the construction of a number of randomized deci-

sion trees during the training phase and it infers con-

clusions by averaging the results. Since its formal-

ization (Breiman, 2001), it represents one of the most

common techniques for data analysis, because it of-

fers better performance in comparison with the other

state-of-the-art techniques.

It allows us to face a wide range of prediction

problems, without performing any complex configu-

ration, since it only requires the tuning of two param-

eters: the number of trees and the number of attributes

used to grow each tree.

2.5 Matrices, Linearity, and Vector

Spaces

The concepts of matrix determinant, linearity, and

vector spaces, cover a primary role in this paper, since

we use them to formalize and prove the correctness of

the proposed similarity metric based on the linear de-

pendence between vectors.

The matrix determinant (det) is a mathematical

function that assigns a number to every square ma-

trix, so its domain is the set of square matrices, and

its range is the set of numbers; more formally, we can

write that det : ℜ

n

× ... × ℜ

n

→ ℜ.

Regardless of the method used to calculate the de-

terminant of a square matrix N × N (e.g., by the Leib-

niz formula shown in Equation 1, where sgn is the

sign function of permutations σ in the permutation

group S

N

, which returns +1 and -1, respectively for

even and odd permutations), its value is related to the

relation of linear dependence between the vectors that

compose the matrix.

det

m

1,1

m

1,2

... m

1,N

m

2,1

m

2,2

... m

2,N

.

.

.

.

.

.

.

.

.

.

.

.

m

N,1

m

N,2

... m

N,N

=

∑

σ∈S

N

sgn(σ)

N

∏

i=1

m

i,σ

i

(1)

The dependence of the N vectors can be verified

by calculating the determinant of the N × N matrix

built by placing, one after the other, the n-tuples that

express the vectors in a certain base. The vectors

are independent when the determinant of the matrix

is different from zero.

A vector space (or linear space) is a mathemati-

cal structure composed by a collection of vectors that

may be added together and multiplied (or, more cor-

rectly, scaled) by numbers called scalars. In other

words, a vector space V is a set that is closed under fi-

nite vector addition and scalar multiplication. A vec-

tor sub-space (or linear sub-space) is a vector space

that represents a subset of some other vector space of

higher dimension.

3 NOTATION AND PROBLEM

DEFINITION

This section introduces the notation adopted and de-

fines the problem faced by our approach.

3.1 Notation

Given a set of classified instances T = {t

1

,t

2

,. .. ,t

N

},

and a set of fields F = { f

1

, f

2

,. .. , f

X

} that compose

A Linear-dependence-based Approach to Design Proactive Credit Scoring Models

113

each t, we denote as T

+

⊆ T the subset of non-default

instances, and as T

−

⊆ T the subset of default ones.

We also denote as

ˆ

T = {

ˆ

t

1

,

ˆ

t

2

,. .. ,

ˆ

t

M

} a set of un-

classified instances, and as E = {e

1

,e

2

,. .. , e

M

} these

instances after the classification process, thus |

ˆ

T | =

|E|.

Each instance can belong to one class c ∈C, where

C = {accepted,re jected}.

3.2 Problem Definition

On the basis of the linear dependence, measured by

calculating the determinant of the matrices composed

by the vector representation of the non-default in-

stances in T

+

and that of the unclassified instances in

ˆ

T , we classify each instance

ˆ

t ∈

ˆ

T as accepted or re-

jected, by exploiting a Band of Reliability β, defined

on the basis of the proposed LDB approach.

Given a function eval(

ˆ

t,β) used to evaluate the

classification performed by exploiting the β informa-

tion, which returns a boolean value σ (0=wrong clas-

sification, 1=correct classification), our objective can

be formalized as the maximization of the results sum,

as shown in Equation 2.

max

0≤σ≤|

ˆ

T |

σ =

|

ˆ

T |

∑

m=1

eval(

ˆ

t

m

,β) (2)

4 OUR APPROACH

The implementation of our strategy is carried out

through the following steps:

1. Data Normalization: normalization of the F val-

ues in a range [0, 1], to make homogeneous the

range of involved values, regardless to the consid-

ered field or dataset, without losing information;

2. ASD Definition: definition of the Average of Sub-

matrices Determinants (ASD) criterion, used to

evaluate the linear dependence in a square and

non-square matrix of vectors;

3. Reliability Band Calculation: calculation of the

Reliability Band β, on the basis of the ASD crite-

rion, an information used to evaluate the level of

reliability of the new instances;

4. Instances Classification: formalization of the

Linear Dependence Based (LDB) process needed

to classify (as accepted or rejected) a set of

unevaluated instances, by exploiting the ASD

criterion and the β information.

Data

Normalization

ASD

Process

β

Calculation

ˆ

T

Classification

Variations

Calculation

T

+

ˆ

T

E

(T

+

,

ˆ

T )

(T

+

,T

+

)

(T

+

,T

+

)

β

(T

+

,

ˆ

T )

∆

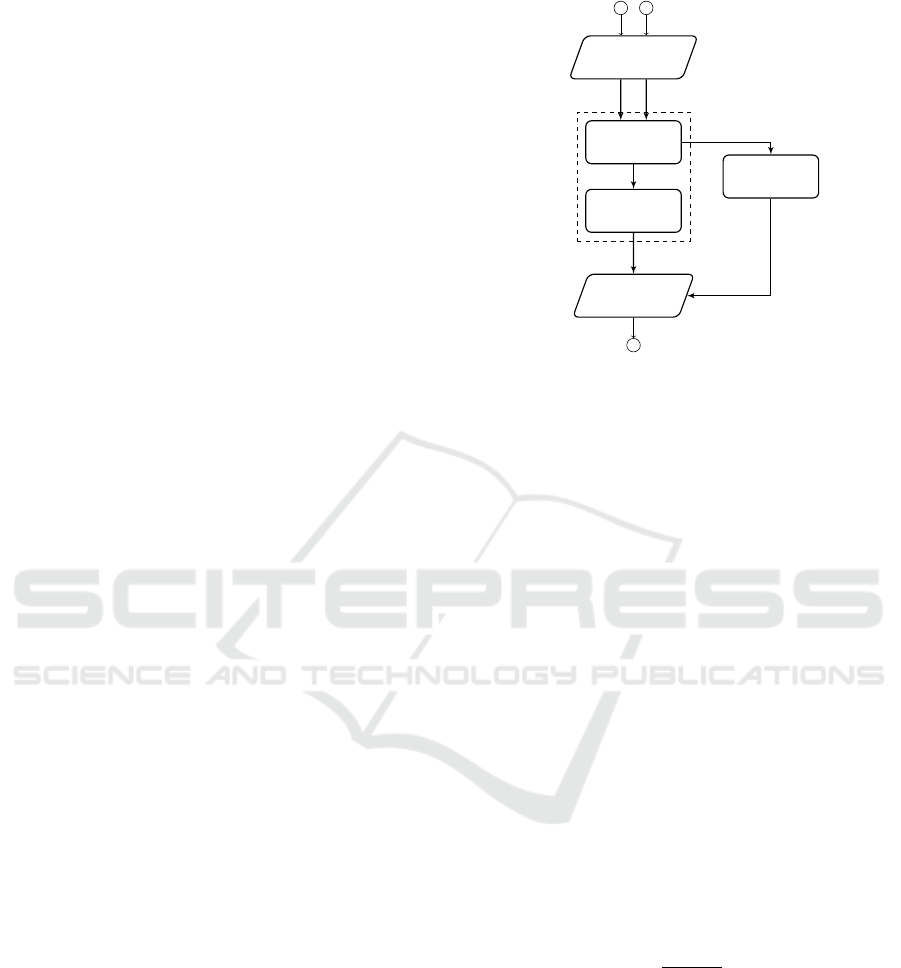

Figure 1: LDB - High-level Architecture.

In the following, we provide a detailed descrip-

tion of each of these steps, since we have introduced

the high-level architecture of the proposed LDB ap-

proach. It is presented in Figure 1, where T

+

,

ˆ

T ,

and E, denote, respectively, the set of non-default in-

stances, the set of instances to evaluate, and the set

of classified instances at the end of the process (i.e.,

those in

ˆ

T ).

4.1 Data Normalization

As first step, we normalize all values F in the datasets

T and

ˆ

T in a range [0, 1]. It allows us to make homo-

geneous the range of involved values, regardless to

the considered field or dataset. Such operation could

be also useful in order to avoid potential problems

during the determinant calculation, e.g., overflow, in

case of very large matrices, by using certain software

tools (Moler, 2004).

The process of normalization of a generic value

f

x

∈ F related to an instance t ∈ T is reported in Equa-

tion 3 (the same goes for the set

ˆ

T ).

f

x

=

1

∑

∀ f

x

∈T

f

x

· f

x

(3)

4.2 ASD Definition

Given that there is not a mathematical definition of de-

terminant of a non-square matrix, here we introduce

the Average of Sub-matrices Determinants criterion

(ASD), which allows us to extract this information in

all cases (square and non-square matrices).

It calculates the average of the determinants of

all square sub-matrices obtained by dividing the non-

KDIR 2016 - 8th International Conference on Knowledge Discovery and Information Retrieval

114

default instance history matrix of size |T

+

| × |F| in α

square sub-matrices, whose number depends on the

rule shown in Equation 4.

The additional element added to the set T

+

will

be used to evaluate an instance in the context of the

vector space of the other instances that composed the

matrix.

α =

j

|F|

(|T

+

| + 1)

k

, i f |F| ≥ (|T

+

| + 1)

j

|T

+

| + 1

|F|

k

, otherwise

(4)

In more detail, we calculate the determinant of

each sub-matrix defined by moving (without over-

laps) on the matrix |F| × (|T

+

| + 1) by using a step

|T

+

| + 1 (i.e., along the rows), or by moving on the

matrix by using a step |F| (i.e., along the columns).

The ASD value is given by the average of all sub-

matrices determinant.

By way of example, if the values are |T

+

| = 1 and

|F| = 6, we have α =

j

6

1 + 1

k

= 3 sub-matrices of

size 2 × 2, and the ASD value is calculated as shown

in the Equation 5.

ASD

a b c d e f

g h i l m n

=

det

a b

g h

+det

c d

i l

+det

e f

m n

3

(5)

From now on, we use the notation ASD(X,Y ) to

denote the Average of Sub-matrices Determinants cal-

culated by using as the last row of the sub-matrices the

vector (or vectors) in the set Y , and for the other rows

the vectors in the set X.

Practically, the ASD value gives us information

about the linear dependence between vector seg-

ments that characterize the same subset of features,

as demonstrated in Theorem 4.2.

Theorem. Given the vector space of the features that

characterize the vector representation of transactions

in a domain, we can express it as sum of two or more

sub-spaces that characterize subsets of features.

Proof. A vector space can be defined as a combi-

nation of sub-spaces by using a decomposition ap-

proach, e.g., given a space ℜ

3

= x-axis+y-axis+

z-axis, we can write any ~w ∈ ℜ

3

as a linear combi-

nation c

1

~v

1

+c

2

~v

2

+c

3

~v

3

(where ~v is a member of the

axis, and c ∈ ℜ), as shown in Equation 6.

w

1

w

2

w

3

= 1·

w

1

0

0

+1·

0

w

2

0

+1·

0

0

w

3

(6)

On the basis of the consideration that ℜ

3

=

x-axis+y-axis+z-axis, we can prove the consistency

2

···

1

|∆|

b

L

min

avg

max

b

H

↑

β

↓

ASD Variations

Figure 2: Reliability Band.

of the proposed ASD approach, since it gives us the

mean value of the determinants calculated on a series

of square sub-matrices composed by segments of vec-

tors that belong to the same vector sub-space of the

items features space.

It simply means that, by the ASD information, we

are able to evaluate subsets of features (in terms of lin-

ear dependence between their vector representations),

and the calculation of the mean value of these results

gives us a single value that reports the relations of

similarity in the entire space of the features, as pre-

viously demonstrated.

It should also be observed that the previous con-

siderations remain valid in both cases considered by

the Equation 4, because the determinant of the trans-

pose of any square matrix is the same determinant of

the original matrix.

4.3 Reliability Band Calculation

Denoting as d(t) the ASD value obtained by using as

rows of the sub-matrices (except the last row) the non-

default instances in T

+

, and as last row a vector t ∈ T

+

,

in Equation 7 we define the set ∆ of ASD variations.

∆ = {d(t

2

)−d(t

1

),d(t

3

)−d(t

2

),... , d(t

N

)−d(t

N−1

)} (7)

The Reliability Band, denoted as β, is defined by

using the average (avg), the minimum (min) and the

maximum (max) value of ∆, as shown in Equation 8.

β = [b

L

,b

H

] = [

avg+min

2

,

avg+max

2

] (8)

It gives us information about the linear depen-

dence variations, when the ASD process involves only

non-default cases. We use it during the evaluation

process, by classifying the cases that generate ASD

variations outside the β band (the dotted area shown

in Figure 2) as potential default cases, according to

the process explained in the following Section 4.4.

A Linear-dependence-based Approach to Design Proactive Credit Scoring Models

115

4.4 Instances Classification

This section starts by formalizing the algorithm used

to perform the Linear Dependence Based (LDB) pro-

cess of classification of an evaluated set of instances

and it ends with the analysis of its asymptotic time

complexity.

4.4.1 Algorithm

The Algorithm 1 takes as input a set T

+

of non-default

instances occurred in the past and a set

ˆ

T of unevalua-

ted instances, returning as output a set E containing

all instances in

ˆ

T , classified as accepted or rejected

on the basis of the ASD process and the β band (i.e.,

by using the b

L

and b

H

values).

Algorithm 1: LDB Instances classi f ication.

Input: T

+

=Set of non-default instances,

ˆ

T =Set of instances to evaluate

Output: E=Set of classified instances

1: procedure INSTANCESCLASSIFICATION(T

+

,

ˆ

T )

2: ASD=getASD(T

+

,T

+

)

3: β=getReliabilityBand(ASD)

4: for each

ˆ

t in

ˆ

T do

5: δ=getASD(T

+

,

ˆ

t

m

) - getASD(T

+

,

ˆ

t

m−1

)

6: if δ ≥ β(b

L

) AND δ ≤ β(b

H

) then

7: E ← (

ˆ

t,accepted)

8: else

9: E ← (

ˆ

t,re jected)

10: end if

11: end for

12: return E

13: end procedure

In step 2 we calculate the ASD value by using

the non-default instances in T

+

as rows of the sub-

matrices (except the last row), and all vectors of the

same set as last row (one at a time), as described in

Section 4.2.

The Reliability Band β (Section 4.3) is calculated

in step 3.

The steps from 4 to 11, process the instances

ˆ

t ∈

ˆ

T ,

by using them to fill the last row of each sub-matrix in

the ASD process, calculating, in the step 5, the varia-

tion δ between two instances, following the criterion

described in Equation 7.

On the basis of the variation δ and the β band,

each instance is classified as accepted or rejected in

the steps from 6 to 10, and the result is placed in the

set E, which is returned at the end of the process (step

12).

Considering that the calculation of the linear de-

pendence variations (step 5) needs at least two in-

stances, when we evaluate the first instance of the set

ˆ

T (or when there is only an instance in this set), we

add an additional instance composed by using the av-

erage of each f ∈ F of the set T

+

, as first instance of

the set

ˆ

T .

For algorithm readability reasons, we omitted this

step, as well as that of the preliminary normalization

of the sets T and

ˆ

T .

4.4.2 Asymptotic Time Complexity Analysis

In view of a possible implementation of the LDB ap-

proach in a real-time scoring system (Quah and Srig-

anesh, 2008), where the response-time factor could

represent an important element, here we define the

theoretical complexity analysis of the Algorithm 1.

We denote as N = α the dimension of the input,

since it is related to the number of sub-matrices

involved in the ASD process, as shown in Equation 4.

Considering that:

(i) the complexity (Big O notation) of the step 2 is

O(N

2

), since it performs the ASD process by us-

ing N instances for N times, i.e., ASD(T

+

,T

+

);

(ii) the complexity of the step 3 is O(1), because it

obtains all needed information at the end of the

previous step 2;

(iii) the complexity of the cycle in the steps 4-11 is

the same of the step 2, because it performs the

same operation by using the items in the set

ˆ

T

instead of the ones of the set T

+

.

On the basis of the previous considerations, it is

clear that the asymptotic time complexity of the algo-

rithm is O(N

2

).

However, it should be noted that the computa-

tional time can be reduced by distributing the process

over different machines, by employing large scale

distributed computing models like MapReduce (Dean

and Ghemawat, 2008).

5 EXPERIMENTS

This section describes the experimental environment,

the used datasets and metrics, the adopted strategy,

and the results of the performed experiments.

5.1 Experimental Setup

The proposed approach was developed in Java, while

the implementation of the state-of-the-art approach,

used to evaluate its performance, was made in R

2

, by

using the randomForest and ROCR packages.

2

https://www.r-project.org/

KDIR 2016 - 8th International Conference on Knowledge Discovery and Information Retrieval

116

Table 1: Datasets.

Dataset Total Cases Non-default Default Attributes Classes

Name |T | |T

+

| |T

−

| |F| |C|

DC 30,000 23,364 6,636 23 2

GC 1,000 700 300 21 2

The experiments have been performed by using

two real-world datasets characterized by a strong un-

balanced distribution of data, i.e., Default of Credit

Card Clients dataset and German Credit datasets,

both available at the UCI Repository of Machine

Learning Databases

3

.

5.2 Datasets

The two real-world datasets used during the experi-

ments have been chosen for two reasons: first, they

represent two benchmarks in this context; second,

they present a strong unbalanced distribution of data.

The datasets are released with all the attributes

modified to protect the confidentiality of the data, and

we use a version suitable for algorithms that, as the

one proposed, can not operate with categorical vari-

ables (i.e., a version with all numeric attributes).

It should be noted that, in case of other datasets

that contain categorical variables, their conversion in

numerical ones is usually a simple task.

5.2.1 Default of Credit Card Clients

The Default of Credit Card Clients dataset (DC) con-

tains 30,000 instances: 23,364 of them are credit-

worthy customers (77.88%) and 6,636 are non-credit-

worthy (22.12%) customers. Each instance contains

23 attributes and a binary class variable (accepted or

rejected).

5.2.2 German Credit

The German Credit (GC) dataset contains 1,000 in-

stances: 700 of them are credit-worthy customers

(70.00%) and 300 are non-credit-worthy (30.00%)

customers. Each instance contains 21 attributes and

a binary class variable (accepted or rejected).

5.3 Metrics

This section presents the metrics used in the experi-

ments.

5.3.1 Accuracy

The Accuracy metric reports the number of instances

correctly classified (i.e., true positives plus true nega-

3

ftp://ftp.ics.uci.edu/pub/machine-learning-databases/

tives), compared to the total number of them. It gives

an overview about the classification performance.

Formally, given a set of instances

ˆ

T to be classi-

fied, it is calculated as shown in Equation 9, where

|

ˆ

T | stands for the total number of instances, and

ˆ

T

(+)

stands for the number of those correctly classified.

Accuracy(

ˆ

T ) =

ˆ

T

(+)

|

ˆ

T |

(9)

5.3.2 F-measure

The F-measure (Powers, 2011) is the weighted aver-

age of the precision and recall metrics . It is a largely

used metric in the statistical analysis of binary classi-

fication and gives us a value in a range [0, 1], where 0

represents the worst value and 1 the best one.

Formally, given two sets X and Y , where X de-

notes the set of performed classifications of instances,

and Y the set that contains the actual classifications of

them, this metric is defined as shown in Equation 10.

F-measure(X,Y ) = 2·

(precision(X,Y )·recall(X ,Y ))

(precision(X,Y )+recall(X ,Y ))

with

precision(X,Y ) =

|Y ∩X |

|X|

, recall(X ,Y ) =

|Y ∩X |

|Y |

(10)

5.3.3 AUC

The Area Under the Receiver Operating Character-

istic curve (AUC) is a performance measure (Faraggi

and Reiser, 2002; Powers, 2011) used to evaluate a

predictive model of credit scoring. Its result is in a

range [0,1], where 1 indicates the best performance.

Given the subset T

+

of non-default instances in the

set T and the subset T

−

of default ones, all possible

comparisons Θ of the scores of each instance t are

reported in the Equation 11, and the AUC metric, by

averaging over these comparisons, can be written as

in Equation 12.

Θ(t

+

,t

−

) =

1, i f t

+

> t

−

0.5, i f t

+

= t

−

0, i f t

+

< t

−

(11)

AUC =

1

T

+

·T

−

|T

+

|

∑

1

|T

−

|

∑

1

Θ(t

+

,t

−

) (12)

5.4 Strategy

In order to minimize the impact of data depen-

dency and improve the reliability of the obtained re-

sults (Salzberg, 1997), the experiments have been per-

formed by following the k-fold cross-validation crite-

rion, with k=10: each dataset is randomly shuffled

and then divided in k subsets; each subset k is used as

A Linear-dependence-based Approach to Design Proactive Credit Scoring Models

117

test set, while the other k-1 subsets are used as training

set; at the end of the process, we consider the average

of results. The datasets' characteristics are summa-

rized in Table 1.

For reasons of reproducibility of the RF experi-

ments, we fix the seed of the random number genera-

tor by calling the R function set.seed().

About the tuning of the RF parameters, they have

been defined in experimental way, by researching

those that maximize the classification performance.

5.5 Experimental Results

The results reported in this section represent the aver-

age of the results of all experiments, according to the

adopted k-fold cross-validation criterion, exposed in

the previous Section 5.4.

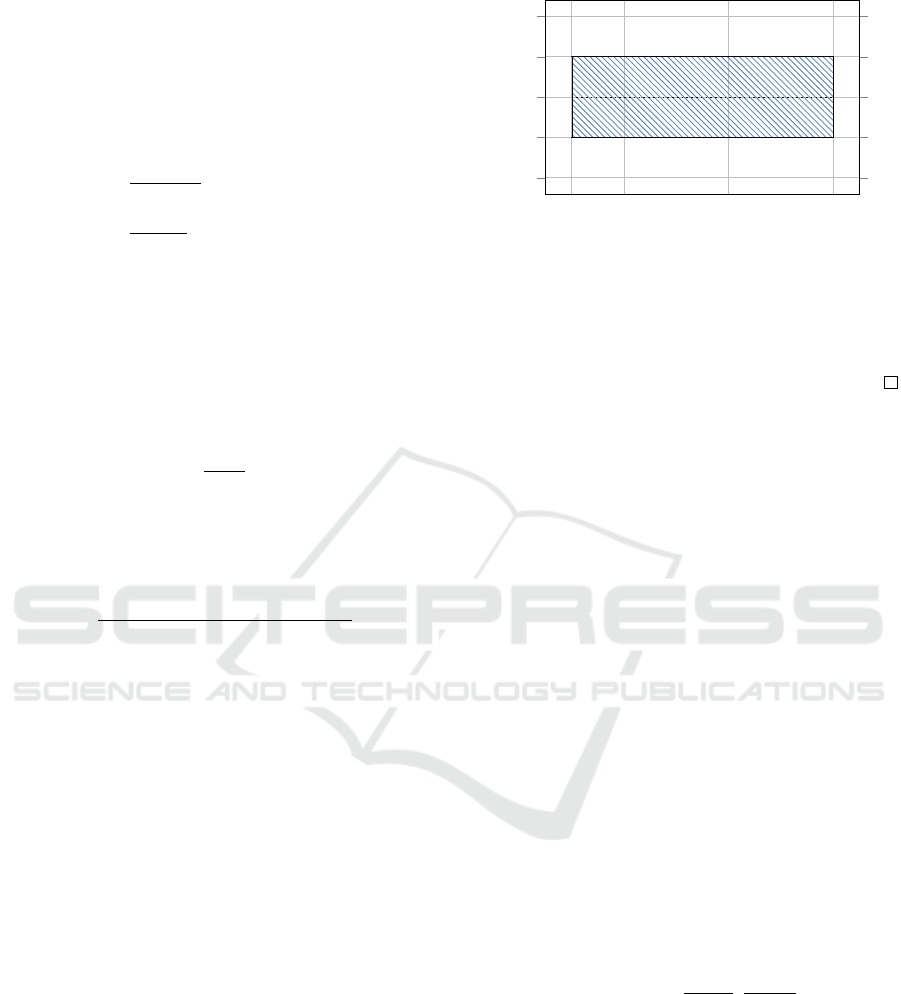

As we can observe in Figure 3 and Figure 4, the

performance of our LDB approach is very close to

those of RF in terms of Accuracy, as well as in terms

of F-measure, where we also obtain better results

(w.r.t. RF), by using the DC dataset.

The first and most important consideration when

examining the results is related to the fact that we get

these results by operating proactively, i.e., without us-

ing default instances during the training process, as it

occurs in RF.

A subsequent consideration arises from the obser-

vation of the F-measure results in Figure 4, which

show that the effectiveness of the LDB increases with

the number of non-default instances used during the

training process (as we can observe with the DC

dataset), differently from RF, where this does not

happen (although it exploits default and non-default

instances during the training process).

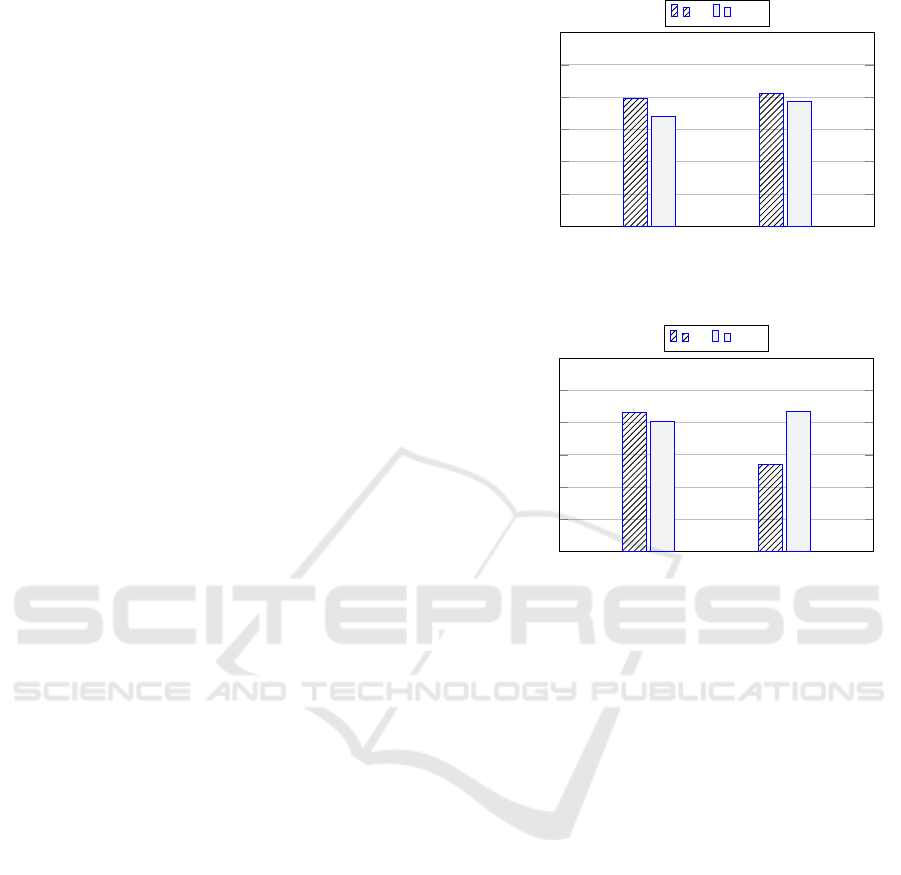

It should also be observed that, as shown in Fig-

ure 5 and Figure 6, the performance of our approach

remains quite stable with all subsets of data (i.e., the

k subsets used during the k-fold cross-validation).

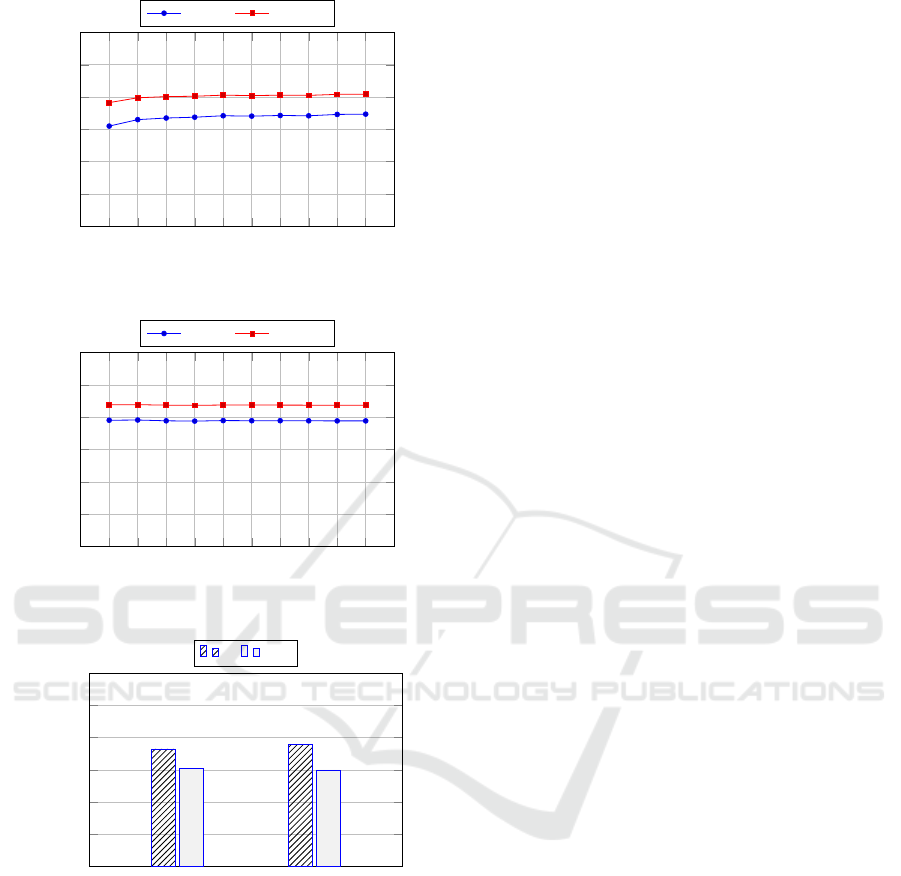

The performance of the proposed approach are

very interesting also in terms of the AUC metric, as

shown in Figure 7. It is a metric that evaluates the

predictive power of a classification approach, and its

results show that the LDB performance are similar to

those of RF, considering that we did not train our

model with both classes of instances.

In summary, all results show what we previously

stated, i.e., our approach is able to operate in a proac-

tive manner, by detecting default instances that have

been never used to train it. It allows us to use it as

a stand-alone approach, or as part of a non-proactive

approach, to overcome the cold-start problem.

It should be added that the independent-samples

two-tailed Student's t-tests highlighted that there is a

(GC) (DC)

0.20

0.40

0.60

0.80

1.00

Datasets

Accuracy

RF LDB

Figure 3: General Per f ormance : Accuracy.

(GC) (DC)

0.20

0.40

0.60

0.80

1.00

Datasets

F-measure

RF LDB

Figure 4: General Per f ormance : F-measure.

statistical difference between the results (p < 0.05).

6 CONCLUSIONS AND FUTURE

WORK

The credit scoring techniques are used in most forms

of consumer lending, e.g., credit cards, insurance

policies, personal loans, and so on. Financial opera-

tors use the customers' credit scores to evaluate the

potential risks of lending, attempting to reduce the

losses due to default.

This paper proposes a novel approach of credit

scoring that exploits a Linear Dependence Based

(LDB) criterion to classify a new instance as accepted

or rejected. Considering that it does not need to be

trained with the default instances occurred in the past,

it allows us to operate in a proactive manner, over-

coming at the same time the cold-start and the data

imbalance problems that affect the canonical machine

learning approaches.

The experimental results presented in Section 5.5

show two important aspects related to our approach:

on the one hand, it performs very similarly to one of

the most performing approaches at the state of the art

KDIR 2016 - 8th International Conference on Knowledge Discovery and Information Retrieval

118

1 2 3 4

5 6

7 8 9 10

0.2

0.4

0.6

0.8

1

k- f olds

Value

Accuracy F-measure

Figure 5: Per f ormance by k- f olds : GC Dataset.

1 2 3 4

5 6

7 8 9 10

0.2

0.4

0.6

0.8

1

k- f olds

Value

Accuracy F-measure

Figure 6: Per f ormance by k- f olds : DC Dataset.

(GC) (DC)

0.20

0.40

0.60

0.80

1.00

Datasets

AUC

RF LDB

Figure 7: AUC Per f ormance.

(i.e., RF), by operating proactively; on the other hand,

it is able to outperform RF, when in the training pro-

cess a large number of non-default instances are in-

volved, differently from RF, where the performance

does not improve further.

A possible follow up of this paper could be a new

series of experiments aimed at improving the non-

proactive state-of-the-art approaches, by introducing,

in the evaluation process, the information related to

the default cases, as well as the development and

evaluation of the proposed approach in heterogeneous

scenarios, which involve different type of financial

data, e.g., those generated in an E-commerce environ-

ment.

Finally, as part of a future research, we would also

like to compare our approach to those in literature,

issued after the writing of this paper.

ACKNOWLEDGEMENTS

This work is partially funded by Regione Sardegna

under project NOMAD (Next generation Open Mo-

bile Apps Development), through PIA - Pacchetti

Integrati di Agevolazione “Industria Artigianato e

Servizi” (annualit

`

a 2013).

REFERENCES

Alborzi, M. and Khanbabaei, M. (2016). Using data min-

ing and neural networks techniques to propose a new

hybrid customer behaviour analysis and credit scoring

model in banking services based on a developed RFM

analysis method. IJBIS, 23(1):1–22.

Ali, S. and Smith, K. A. (2006). On learning algo-

rithm selection for classification. Appl. Soft Comput.,

6(2):119–138.

Attenberg, J. and Provost, F. J. (2010). Inactive learn-

ing?: difficulties employing active learning in prac-

tice. SIGKDD Explorations, 12(2):36–41.

Batista, G. E., Prati, R. C., and Monard, M. C. (2004). A

study of the behavior of several methods for balancing

machine learning training data. ACM Sigkdd Explo-

rations Newsletter, 6(1):20–29.

Bhattacharyya, S., Jha, S., Tharakunnel, K. K., and West-

land, J. C. (2011). Data mining for credit card fraud:

A comparative study. Decision Support Systems,

50(3):602–613.

Blanco-Oliver, A., Pino-Mej

´

ıas, R., Lara-Rubio, J., and

Rayo, S. (2013). Credit scoring models for the mi-

crofinance industry using neural networks: Evidence

from peru. Expert Syst. Appl., 40(1):356–364.

Breiman, L. (2001). Random forests. Machine Learning,

45(1):5–32.

Brill, J. (1998). The importance of credit scoring models in

improving cash flow and collections. Business Credit,

100(1):16–17.

Brown, I. and Mues, C. (2012). An experimental compari-

son of classification algorithms for imbalanced credit

scoring data sets. Expert Syst. Appl., 39(3):3446–

3453.

Chen, S. Y. and Liu, X. (2004). The contribution of data

mining to information science. Journal of Information

Science, 30(6):550–558.

Chi, B. and Hsu, C. (2012). A hybrid approach to integrate

genetic algorithm into dual scoring model in enhanc-

ing the performance of credit scoring model. Expert

Syst. Appl., 39(3):2650–2661.

Crone, S. F. and Finlay, S. (2012). Instance sampling in

credit scoring: An empirical study of sample size

A Linear-dependence-based Approach to Design Proactive Credit Scoring Models

119

and balancing. International Journal of Forecasting,

28(1):224–238.

Davis, R., Edelman, D., and Gammerman, A. (1992).

Machine-learning algorithms for credit-card applica-

tions. IMA Journal of Management Mathematics,

4(1):43–51.

Dean, J. and Ghemawat, S. (2008). Mapreduce: simpli-

fied data processing on large clusters. Commun. ACM,

51(1):107–113.

Desai, V. S., Crook, J. N., and Overstreet, G. A. (1996).

A comparison of neural networks and linear scoring

models in the credit union environment. European

Journal of Operational Research, 95(1):24–37.

Donmez, P., Carbonell, J. G., and Bennett, P. N. (2007).

Dual strategy active learning. In Kok, J. N., Ko-

ronacki, J., de M

´

antaras, R. L., Matwin, S., Mladenic,

D., and Skowron, A., editors, Machine Learning:

ECML 2007, 18th European Conference on Machine

Learning, Warsaw, Poland, September 17-21, 2007,

Proceedings, volume 4701 of Lecture Notes in Com-

puter Science, pages 116–127. Springer.

Doumpos, M. and Zopounidis, C. (2014). Credit scoring.

In Multicriteria Analysis in Finance, pages 43–59.

Springer.

Faraggi, D. and Reiser, B. (2002). Estimation of the area un-

der the roc curve. Statistics in medicine, 21(20):3093–

3106.

Fensterstock, A. (2005). Credit scoring and the next step.

Business Credit, 107(3):46–49.

Fern

´

andez-Tob

´

ıas, I., Tomeo, P., Cantador, I., Noia, T. D.,

and Sciascio, E. D. (2016). Accuracy and diver-

sity in cross-domain recommendations for cold-start

users with positive-only feedback. In Sen, S., Geyer,

W., Freyne, J., and Castells, P., editors, Proceed-

ings of the 10th ACM Conference on Recommender

Systems, Boston, MA, USA, September 15-19, 2016,

pages 119–122. ACM.

Hand, D. J. (2009). Measuring classifier performance: a

coherent alternative to the area under the ROC curve.

Machine Learning, 77(1):103–123.

He, H. and Garcia, E. A. (2009). Learning from imbalanced

data. IEEE Trans. Knowl. Data Eng., 21(9):1263–

1284.

Henley, W. et al. (1997). Construction of a k-nearest-

neighbour credit-scoring system. IMA Journal of

Management Mathematics, 8(4):305–321.

Henley, W. and Hand, D. J. (1996). A k-nearest-neighbour

classifier for assessing consumer credit risk. The

Statistician, pages 77–95.

Henley, W. E. (1994). Statistical aspects of credit scoring.

PhD thesis, Open University.

Hsieh, N.-C. (2005). Hybrid mining approach in the design

of credit scoring models. Expert Systems with Appli-

cations, 28(4):655–665.

Japkowicz, N. and Stephen, S. (2002). The class imbal-

ance problem: A systematic study. Intell. Data Anal.,

6(5):429–449.

Lee, T.-S. and Chen, I.-F. (2005). A two-stage hybrid

credit scoring model using artificial neural networks

and multivariate adaptive regression splines. Expert

Systems with Applications, 28(4):743–752.

Lessmann, S., Baesens, B., Seow, H., and Thomas, L. C.

(2015). Benchmarking state-of-the-art classifica-

tion algorithms for credit scoring: An update of re-

search. European Journal of Operational Research,

247(1):124–136.

Lika, B., Kolomvatsos, K., and Hadjiefthymiades, S.

(2014). Facing the cold start problem in recommender

systems. Expert Syst. Appl., 41(4):2065–2073.

Marqu

´

es, A. I., Garc

´

ıa, V., and S

´

anchez, J. S. (2013). On the

suitability of resampling techniques for the class im-

balance problem in credit scoring. JORS, 64(7):1060–

1070.

Mester, L. J. et al. (1997). Whats the point of credit scoring?

Business review, 3:3–16.

Moler, C. B. (2004). Numerical computing with MATLAB.

SIAM.

Morrison, J. (2004). Introduction to survival analysis

in business. The Journal of Business Forecasting,

23(1):18.

Ong, C.-S., Huang, J.-J., and Tzeng, G.-H. (2005). Build-

ing credit scoring models using genetic programming.

Expert Systems with Applications, 29(1):41–47.

Powers, D. M. (2011). Evaluation: from precision, recall

and f-measure to roc, informedness, markedness and

correlation.

Pozzolo, A. D., Caelen, O., Borgne, Y. L., Waterschoot, S.,

and Bontempi, G. (2014). Learned lessons in credit

card fraud detection from a practitioner perspective.

Expert Syst. Appl., 41(10):4915–4928.

Quah, J. T. S. and Sriganesh, M. (2008). Real-time credit

card fraud detection using computational intelligence.

Expert Syst. Appl., 35(4):1721–1732.

Reichert, A. K., Cho, C.-C., and Wagner, G. M. (1983).

An examination of the conceptual issues involved in

developing credit-scoring models. Journal of Business

& Economic Statistics, 1(2):101–114.

Salzberg, S. (1997). On comparing classifiers: Pitfalls

to avoid and a recommended approach. Data Min.

Knowl. Discov., 1(3):317–328.

Son, L. H. (2016). Dealing with the new user cold-start

problem in recommender systems: A comparative re-

view. Inf. Syst., 58:87–104.

Thanuja, V., Venkateswarlu, B., and Anjaneyulu, G. (2011).

Applications of data mining in customer relationship

management. Journal of Computer and Mathematical

Sciences Vol, 2(3):399–580.

Vinciotti, V. and Hand, D. J. (2003). Scorecard construc-

tion with unbalanced class sizes. Journal of Iranian

Statistical Society, 2(2):189–205.

Wang, G., Hao, J., Ma, J., and Jiang, H. (2011). A compar-

ative assessment of ensemble learning for credit scor-

ing. Expert Syst. Appl., 38(1):223–230.

Wang, G., Ma, J., Huang, L., and Xu, K. (2012). Two credit

scoring models based on dual strategy ensemble trees.

Knowl.-Based Syst., 26:61–68.

Zhu, J., Wang, H., Yao, T., and Tsou, B. K. (2008). Active

learning with sampling by uncertainty and density for

word sense disambiguation and text classification. In

Scott, D. and Uszkoreit, H., editors, COLING 2008,

22nd International Conference on Computational Lin-

guistics, Proceedings of the Conference, 18-22 August

2008, Manchester, UK, pages 1137–1144.

KDIR 2016 - 8th International Conference on Knowledge Discovery and Information Retrieval

120