A Dynamic Scheduling Problem in Cost Estimation

Process of EPC Projects

Nobuaki Ishii

1

, Yuichi Takano

2

and Masaaki Muraki

3

1

Faculty of Engineering, Kanagawa University, 3-27-1 Rokkakubashi, 221-8686, Kanagawa-ku, Yokoham, Japan

2

School of Network Information, Senshu University, 2-1-1, Higashimita, Tama-ku, Kawasaki, Kanagawa, Japan

3

Graduate School of Decision Science and Technology, Tokyo Institute of Technology, Tokyo, Japan

Keywords: Competitive Bidding, Discrete Event Simulation, Project Selection, Resource Allocation.

Abstract: The cost estimation process, carried out by the contractor before the start of a project, is a critical activity for

the contractor in accepting profitable EPC projects in competitive bidding situations. Thus, the contractor

should devote significant time and resources to the accurate cost estimation of project orders from clients.

However, it is impossible for any contractor to devote enough time and resources to all the orders because

such resources are usually limited. For this reason, the contractor must dynamically decide bid or no-bid on

the orders at each order arrival, and allocate the limited resources to the chosen orders. To maximize the

contractor’s profits, this study devises a heuristic scheduling method for dynamically selecting orders and

allocating the limited resources to them, on the basis of the resource requirement of the order, the contractor’s

resource utilization, and the expected profit from the order. The effectiveness of our method is demonstrated

through simulation experiments using a project cost estimation process model.

1 INTRODUCTION

In EPC (Engineering, Procurement, Construction)

projects (Pritchard and Scriven, 2011), the contractor

delivers unique facilities, such as process plants,

structures, information systems, and so on, based on

the client’s requirements for a limited period of time

under a lump sum turnkey basis. Since any EPC

project includes unique and non-repetitive activities,

many uncertainties exist in the project execution

process. Furthermore, since the project price is fixed

before the start of the project, the contractor often

faces eventual loss in EPC projects. Thus, it is

necessary for any contractor to precisely estimate the

project cost in order to determine the bidding price.

Namely, cost estimation in an EPC project is a critical

task for any contractor who seeks to increase profits

and reduce the possibility of realizing a loss, i.e.,

deficit risk, due to cost estimation error.

Cost estimation is also crucial for ensuring the

stable profits and the proper volume of accepted

orders. Inaccurate cost estimation could not only lead

to deficit orders but could also exhaust the

contractor’s resources, which are necessary to carry

out long-term deficit projects, as Ishii et al. (2014)

stated.

Moreover, a deficit order would have severely

harmful effects on the client’s business. For example,

it would generate an additional cost and/or delay the

project delivery date. Cost estimation, however, is a

complex task of predicting the costs and schedule of

projects based on the analysis of the client’s

requirements with limited data and time.

Since the quality and quantity of the data available

for cost estimation determine the accuracy of

estimated cost, a lot of high-quality data is required to

improve accuracy. In the process plant engineering,

for example,

the data and methods that are required to

attain the target accuracy of project cost estimation

have been studied

(AACE International, 2011). In any

cost estimation method, such as parametric, analogy,

and engineering (Kerzner, 2013), higher accuracy

needs more data and, accordingly, requires more

engineering Man-Hours (hereafter referred to as MH)

to acquire and analyse the data for cost estimation.

Thus, experienced and skilled human resources

who can acquire data for cost estimation and create

project plans, including uncertainties during the

project execution, are required for accurate cost

estimation.

Those resources are limited for any

contractor; furthermore, once the orders are

successfully accepted, the corresponding project

execution will also need considerable human

Ishii, N., Takano, Y. and Muraki, M.

A Dynamic Scheduling Problem in Cost Estimation Process of EPC Projects.

DOI: 10.5220/0005961101870194

In Proceedings of the 6th International Conference on Simulation and Modeling Methodologies, Technologies and Applications (SIMULTECH 2016), pages 187-194

ISBN: 978-989-758-199-1

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

187

resources. For these reasons, the contractor should

realize appropriate allocation of MH for cost

estimation to each order to maximize the total

expected profit under the constraint of the total MH.

The contractor should also consider the possibility of

realizing a loss, i.e., the deficit risk, due to cost

estimation error. This is because just a few deficit

orders, which produce an eventual loss due to cost

estimation error, would result in a significant

reduction of contractor’s profits when the number of

accepted orders is small.

This paper examines the cost estimation process

of EPC projects in dynamic order arrival situations

based on the previous study by Ishii et al. (2015 (b)).

Namely, we develop a heuristic method that

dynamically selects orders and allocates MH for cost

estimation to each selected order to maximize the

expected profits. For this purpose, we begin by

building a cost estimation process model, where the

cost estimation process is divided into four phases,

i.e., order selection, Class 4 estimate, Class 3 estimate,

and Class 2 estimate, based on the AACE cost

estimate classification system (AACE, 2011) that

indicates the methods, data, and the accuracy of cost

estimation in each class. We next establish the order

selection rules for deciding bid or no-bid on arrived

orders

based on the threshold function of MH

utilization with respect to the expected profit of

orders. This threshold function is created through

simulation experiments using our cost estimation

process model. We finally analyse the effectiveness

of our simulation-based heuristic method through

numerical examples.

2 RELATED WORK

A variety of studies have been conducted on project

cost estimation from the viewpoints of cost estimation

accuracy, resource allocation, order selection, and so

on.

For example, Oberlender and Trost (2001) studied

determinants of cost estimation accuracy and

developed a system for predicting accuracy. Bertisen

and Davis (2008) analysed the costs of 63 projects

and evaluated the accuracy of estimated costs

statistically. Jørgensen et al. (2012) studied the

relationship between project size and cost estimation

accuracy. Uzzafer (2013) proposed a contingency

estimation model

in consideration of the distribution

of estimated cost and the risk of software projects to

estimate contingency resources.

In addition, AACE International (2011),

Humphreys (2004), and Towler and Sinnott (2008)

demonstrated the relationship in cost estimation

accuracy and the method and data used for cost

estimation in the field of process plant engineering

projects. Furthermore, they suggested that cost

estimation accuracy is positively correlated with the

volume of MH for cost estimation.

Regarding the volume of MH for cost estimation

and cost estimation accuracy, Ishii et al. (2015 (a))

developed an algorithm that determines the bidding

prices under the limited MH for cost estimation. Their

algorithm allocates MH so as to maximize expected

profits based on the cost estimation accuracy

determined by allocated MH. In addition, Takano et

al. (2014) developed a stochastic dynamic

programming model for establishing an optimal

sequential bidding strategy in a competitive bidding

situation. Their model determines the optimal markup

in consideration of the effect of inaccurate cost

estimates. Furthermore, Takano et al. (in press)

developed a multi-period resource allocation method

for estimating project costs in a sequential

competitive bidding situation. Their method allocates

resources for cost estimation by solving a mixed

integer programming problem that is formulated by

making a piecewise liner approximation of the

expected profit functions.

Regarding the order selection in the cost

estimation process, Shafahi and Haghani (2014)

propose an optimization model that combines project

selection decisions and markup selection decisions in

consideration of eminence and previous works as the

non-monetary evaluation criterion used by owners for

evaluating bids.

Based on the above literature review, we found

that most of the studies have paid little attention to the

project cost estimation process in practical situations.

More specifically, the contractor needs to allocate

MH for cost estimation dynamically to each arrived

orders with different attributes in practice. To the best

of our knowledge, however, none of the existing

studies have investigated the project cost estimation

process in dynamic order arrival situations. In light of

these facts, this paper develops a heuristic scheduling

method for selecting orders and determining MH

allocation dynamically in consideration of the

contractor’s available MH and the orders’

profitability.

3 A MODEL OF PROJECT COST

ESTIMATION PROCESS

The project cost estimation process can be recognized

SIMULTECH 2016 - 6th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

188

as a series of activities that starts with the arrival of

bid invitations and closes by the date of bidding. A

variety of orders arrive, and the cost of projects is

estimated through the project cost estimation process.

We decide the accuracy of cost estimation by

allocating MH to the cost estimation activities of

newly arrived orders in consideration of the MH

availability, expected profits, competitive bidding

situations, and so on. When the available MH is not

enough to estimate cost accurately, we must allocate

less MH, thereby reducing expected profit due to

inaccurate cost estimation, or no-bid on the order.

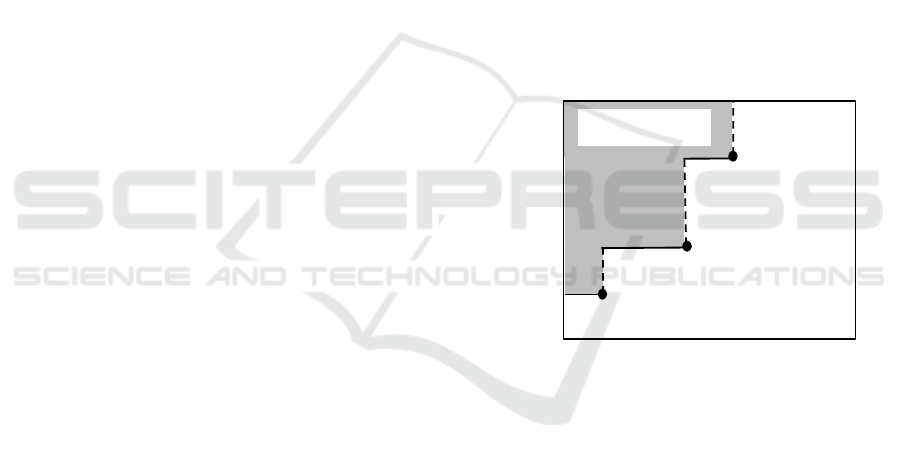

Based on the above observations, we propose a

project cost estimation process model as shown in

Figure 1 (Ishii et al. 2015 (b)). In the model, we

assume that the cost is estimated through three

classes: Class 4, Class 3, and Class 2 estimate. Each

class needs MH and a period of time for cost

estimation, and the accuracy of estimated cost

increases through the cost estimation activities in

each estimate class. The cost estimate classification

matrix (AACE, 2011) can be used as the cost

estimation accuracy in each class.

In the model, the order selection mechanism

decides whether to bid the newly arrived order or not

from the viewpoint of the volume of orders to be

accepted, the expected profits, MH availability for

cost estimation, and so on.

The selected order is first

filed in the queue for the Class 4 estimate and waits

to be assigned the MH for cost estimation by the

mechanism of MH allocation for cost estimation. If

any MH is not assigned to the order until the bidding

date, the contractor does not bid for it due to the lack

of MH. If the MH is assigned to the order, its project

cost is estimated with the accuracy of the Class 4

estimate. This order is then filed in the queue of the

Class 3 estimate and waits for MH assignment for the

Class 3 estimate. If the MH is not further assigned to

the order until the bidding date, the contractor decides

the bidding price based on the accuracy of the Class

4 estimate. By contrast, if the MH is assigned to the

order waiting in the queue of the Class 3 estimate, its

project cost is estimated with the accuracy of the

Class 3 estimate, and filed in the queue of the Class 2

estimate. The same decision is made for the orders in

the queue of the Class 2 estimate.

The project cost estimation problem, addressed

in this paper, is a kind of dynamic scheduling problem

that determines the processes dynamically for each

order arriving at a system. In our problem, however,

the quality of the deliverables, i.e. accuracy of cost

estimation of each order, are determined dynamically

under the conditions of resource availability and due

date of the order so as to maximize the total profits.

On the contrary, in the standard scheduling problems

(Jacobs et al. 2011), the quality of the deliverables are

predetermined and orders are scheduled so as to

minimize the makespan. From this perspective, the

project cost estimation problem in this study can be

recognized as a new dynamic scheduling problem.

Figure 1: A project cost estimation process model.

4 HEURISTIC METHOD

This section shows a heuristic scheduling method

based on the project cost estimation process shown in

Figure 1. The heuristic method consists of two

mechanisms, i.e. order selection, and MH allocation

for cost estimation. The order selection mechanism

selects orders for cost estimation based on order

selection rules. The MH allocation mechanism

assigns the MH for cost estimation to each selected

order, so as to maximize the expected profits from

orders.

Our heuristic method is developed based on the

following assumptions:

Assumptions:

1) Orders for cost estimation arrive randomly;

2) Expected profit, required MH and periods for

cost estimation of each estimate class are

predetermined;

3) Probability of a successful bid of each order is

predetermined.

Since EPC contractors can collect their own data

on past projects and market situations, the

assumptions 2) and 3) are appropriate.

4.1 Order Selection Mechanism

(1) Order selection method

The order selection method is based on the financial

evaluation criteria and consists of the following two

steps:

Queue

for

Class 4

Class 4

estimate

Queue

for

Class 3

Class 3

estimate

Queue

for

Class 2

Class 2

estimate

MH allocation

for cost

estimation

Condition of MH

availability

MH for cost estimation

Bidding

price

decision

Order

selection

Decline bid

invitation

Results of cost estimation

Newly arrived

orders

Goal: The volume of orders, Expected profits

Condition of MH availability

Orders for bid

No-bid

orders due to

lack of MH

Total volume of MH

for cost estimation

No-bid orders

A Dynamic Scheduling Problem in Cost Estimation Process of EPC Projects

189

Step 1: Calculate the expected profit per MH for cost

estimation of the new arrival order i as follows:

EPPC

i

= EP

i

/ EM

i

(1)

where EPPC

i

is the expected profit per MH for

cost estimation of order i, EP

i

is the expected

profit of order i, and EM

i

is the volume of MH

required to estimate the cost of order i. In this

paper, EPPC

i

is calculated based on the Class 2

estimate in AACE cost estimate class (AACE,

2011).

Step 2: Make the bid/no-bid decision on the new

arrival order by considering EPPC

i

of the order

and the contractor’s MHU, which is the volume of

MH being utilized for cost estimation at the time

of new order arrival. For this purpose, we use a

threshold function MHU

up

(EPPC

i

), which

indicates the upper limit of MHU in selecting

order i for cost estimation, as follows:

- The contractor selects the new arrival order i for

cost estimation if MHU is

lower than

MHU

up

(EPPC

i

);

- Otherwise, the contractor decides not to bid on

the order.

The contractor can expect higher profits from the

order by estimating its project cost in a higher cost

estimate class. However, more MH is required for

estimating cost in a higher cost estimate class. In the

above steps, the new arrival orders with low expected

profits are not selected for cost estimation when large

volume of MH is being utilized for cost estimation.

This order selection method eliminates a possible

shortage of MH for cost estimation and, accordingly,

allows the contractor to focus on estimating cost of

profitable orders. In other words, our order selection

method works to maintain the balance between

order’s profitability and contractor’s MH utilization

so that the contractor’s expected profits are

maximized in dynamic order arrival situations.

(2) Determination of threshold function

In our model, orders with different attributes arrive

randomly in a project cost estimation process. Thus

the MH utilization changes dynamically and

unpredictably. Consequently, it is very difficult to

find a threshold function MHU

up

(EPPC

i

) for

maximizing contractor’s expected profits.

In view of these observations, we develop a

simulation-based heuristic method by using the

simulation model shown in Figure 1. This method

searches three threshold points, P1(E

1

, N

1

), P2(E

2

, N

2

)

and P3(E

3

, N

3

), sequentially by applying them in the

order selection mechanism. As shown in Figure 2, the

no-bid area is expressed as follows:

},|),{(

3

1 kkk

NMHUEEPPCMHUEPPCU

(2)

The threshold function MHU

up

(EPPC

i

) marks the

boundary between the no-bid area and cost estimation

area. The procedure of the simulation based method

is described as follows:

Step 1: Set all the threshold points to (0, 0).

Step 2: Search P2(E

2

, N

2

) that maximizes the

expected profit by running a simulation under the

current conditions, i.e., order arrival interval, cost

estimation period and required MH in each class

of cost estimate, and expected profit of each order.

Step 3: Search P1(E

1

, N

1

) that maximizes the

expected profit by running a simulation, where

P2(E

2

, N

2

) is fixed to the value searched in Step 2.

Step 4: Search P3(E

3

, N

3

) that maximizes the

expected profit by running a simulation, where

P1(E

1

, N

1

) and P2(E

2

, N

2

) are fixed to the values

searched in Steps 2 and 3.

Step 5: Define MHU

up

(EPPC

i

) as the boundary

formed by P1(E

1

, N

1

), P2(E

2

, N

2

) and P3(E

3

, N

3

)

as shown in Figure 2.

Figure 2: Area of bid/no-bid decision.

4.2 Allocation of MH for Cost

Estimation

For the allocation of MH for cost estimation, we shall

use a dispatching approach, as is the case with the

dynamic scheduling problem in production systems

(Jacobs et al. 2011).

Specifically, when MH is released from cost

estimation of an order, this approach selects an order

based on the dispatching rules, which prioritize orders

in the queue of each estimate class. The selected order

is subsequently assigned the required MH for its

estimate class. If the required MH is more than the

MH available, the selected order waits in the queue

until the required MH is released.

One can use well-known dispatching rules for the

MHU [M MH]

0.0 0.5 1.0 ・・・・・・・・・・・・E

N

・

・

・

2

0

EPPC [$/MH ]

P1(E

1

, N

1

)

No-bid area

Cost estimation area

P2(E

2

, N

2

)

P3(E

3

, N

3

)

SIMULTECH 2016 - 6th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

190

allocation of MH, such as FIFO, SPT, and EDD

(Jacobs et al. 2011). In addition, dedicated rules for a

project cost estimation process can also be designed.

5 NUMERICAL EXAMPLES

This section evaluates the effectiveness of our

simulation-based heuristic scheduling method. For

the simulation experiments, we use a general-purpose

simulation system AweSim! (Pritsker and O’Reilly,

1998).

5.1 Design of Simulation Experiments

To determine the threshold function MHU

up

(EPPC

i

),

we use the scenario selection system developed by

Nelson et al. (2001). This system statistically

compares the results of simulation and chooses

sequentially the best threshold points P2(E

2

, N

2

),

P3(E

3

, N

3

), P1(E

1

, N

1

) from candidate points given by

us. The volume of MH is set to 16,000 MH per period,

i.e., 16 [M MH], and the simulation period is set to

1200.

It is supposed that there are orders of the three

sizes, i.e., Small, Medium, Large, in our simulation

experiments. For these orders, we consider three

cases—Case 1, Case 2, and Case 3—that have

different expected profit of the Class 3 estimate, as

shown in Table 1. In addition, we consider three sub-

cases—Case A, Case B, and Case C—based on the

order arrival intervals defined by the triangular

distribution, as shown in Table 2. In what follows,

Case 1.A means that Case 1 and Case A are

considered. Table 3 shows parameters of triangular

distribution that represents the probability of order

acceptance in each order size. It follows that by

bidding for an order, the expected profit shown in

Table 1 is gained with the associated probability of

order acceptance. Table 4 shows cost estimation

conditions of each cost estimate class, i.e., total

periods available for cost estimation (due date for

bidding), required periods for cost estimation, and

required MH for cost estimation.

Our simulation experiments evaluated each case

by using the following order selection rules and

dispatching rules:

1) Order selection rule

No selection: All the arrived orders are selected for

cost estimation.

MHU basis: Orders are selected for cost estimation

by the heuristic method described in Section 4.

2) Dispatching rule for allocating MH for cost

estimation

FIFO: Orders are selected for allocating MH on a

first-in first-out basis.

HEPF: Order of the largest increment of EPPC is

selected first for allocating MH.

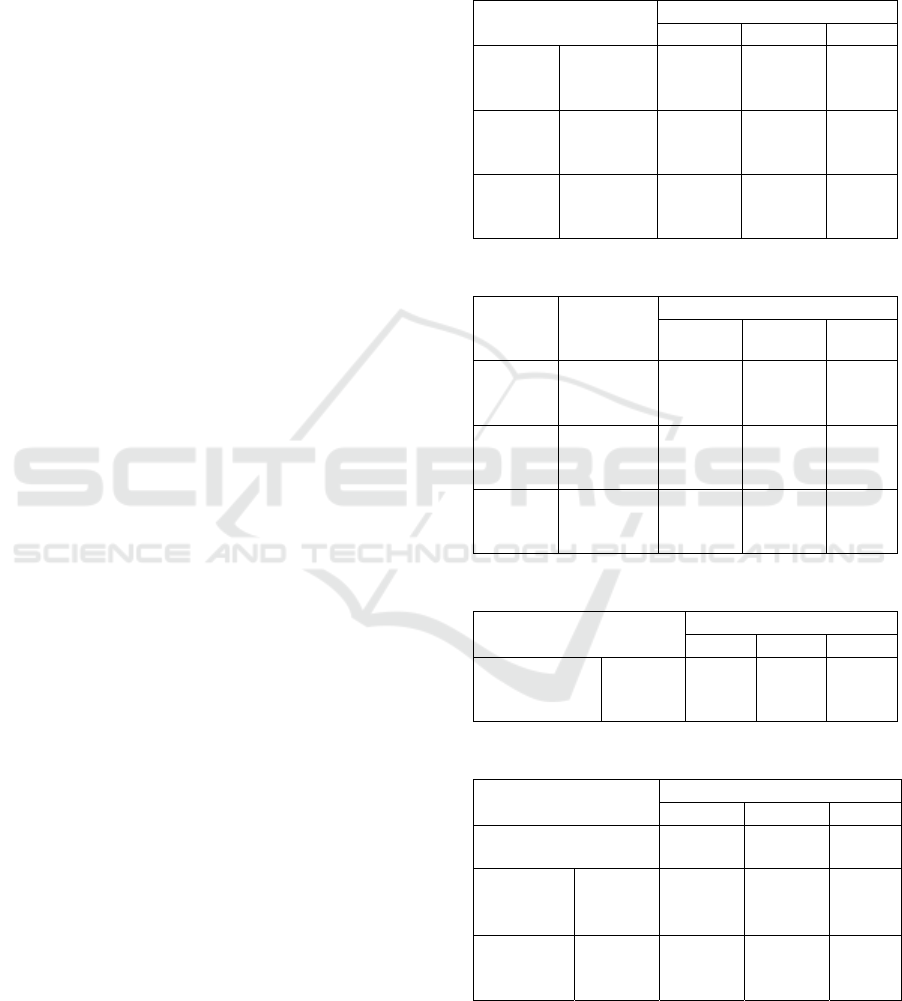

Table 1: Expected profit of orders (All cases) [MM$].

Order size

Small Medium Large

Case 1 Class 4

Class 3

Class 2

0.5

5

20

1

10

40

1.5

15

60

Case 2 Class 4

Class 3

Class 2

0.5

10

20

1

20

40

1.5

30

60

Case 3 Class 4

Class 3

Class 2

0.5

15

20

1

30

40

1.5

45

60

Table 2: Order arrival interval [Orders/Period].

Parameters

of triangular

distribution

Order size

Small Medium Large

Case A Min.

Mode

Max.

1.05

1.50

1.95

2.70

3.00

3.90

3.15

4.50

5.85

Case B Min.

Mode

Max

0.84

1.20

1.56

1.68

2.40

3.12

2.52

3.60

4.68

Case C Min.

Mode

Max

0.70

1.00

1.30

1.40

2.00

2.60

2.10

3.00

3.90

Table 3: Probability of order acceptance (All cases).

Order size

Small Medium Large

Parameters of

triangular

distribution

Min.

Mode

Max.

0.05

0.20

0.90

0.05

0.30

0.90

0.05

0.40

0.90

Table 4: Cost estimation conditions (All cases).

Order size

Small Medium Large

Total periods available

for cost estimation

8 8 8

Periods for

cost

estimation

Class 4

Class 3

Class 2

1

2

3

1

2

3

1

2

3

MH for cost

estimation

[M MH]

Class 4

Class 3

Class 2

1

2

3

2

3

4

3

4

6

5.2 Results of Simulation Experiments

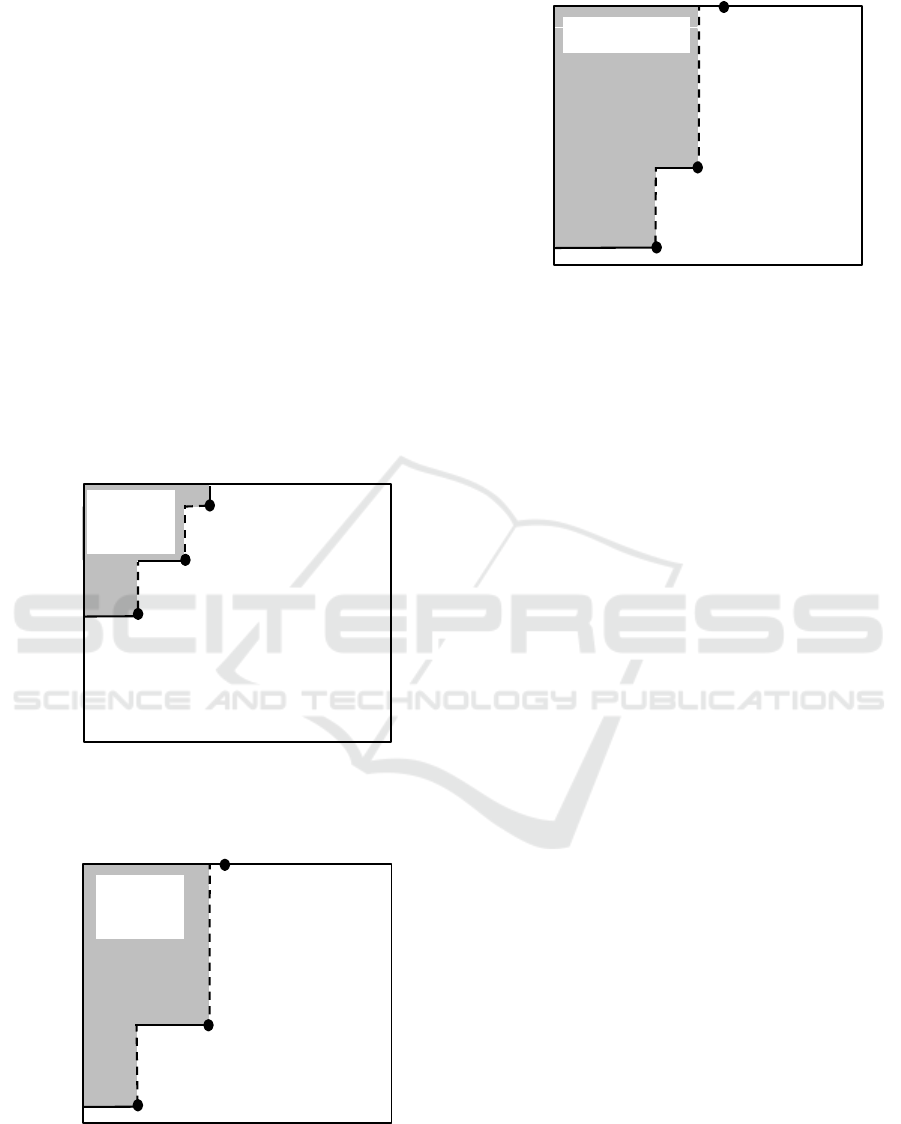

Figures 3, 4, and 5 depict the threshold function

A Dynamic Scheduling Problem in Cost Estimation Process of EPC Projects

191

MHU

up

(EPPC

i

) together with the threshold points

P1(E

1

, N

1

), P2(E

2

, N

2

) and P3(E

3

, N

3

) determined by

our simulation-based heuristic method for Cases 1.A,

1.B, and 1.C, respectively. For example, the arrived

order with 0.8 EPPC and 10 MHU is the one for the

cost estimation in Case 1.A, however, not the one for

the cost estimation in Cases 1.B and 1.C.

We can see in the figures that the no-bid area

becomes wider according to the increase of the

number of arrived orders in the cost estimation

process. Indeed, Case 1.C, where orders arrive most

frequently among all cases, has the widest no-bid area.

It is also found from the figures that in making

bid/no-bid decisions, Case 1.C puts a high priority on

the order’s expected profit, whereas Case 1.A takes

into account both the order’s expected profit and the

contractor’s MH utilization. This implies that

contractors should pay attention to its MH utilization

for cost estimation especially when the number of

arrival orders is limited.

Figure 3: Area of bid/no-bid decision in Case 1.A.

Figure 4: Area of bid/no-bid decision in Case 1.B.

Figure 5: Area of bid/no-bid decision in Case 1.C.

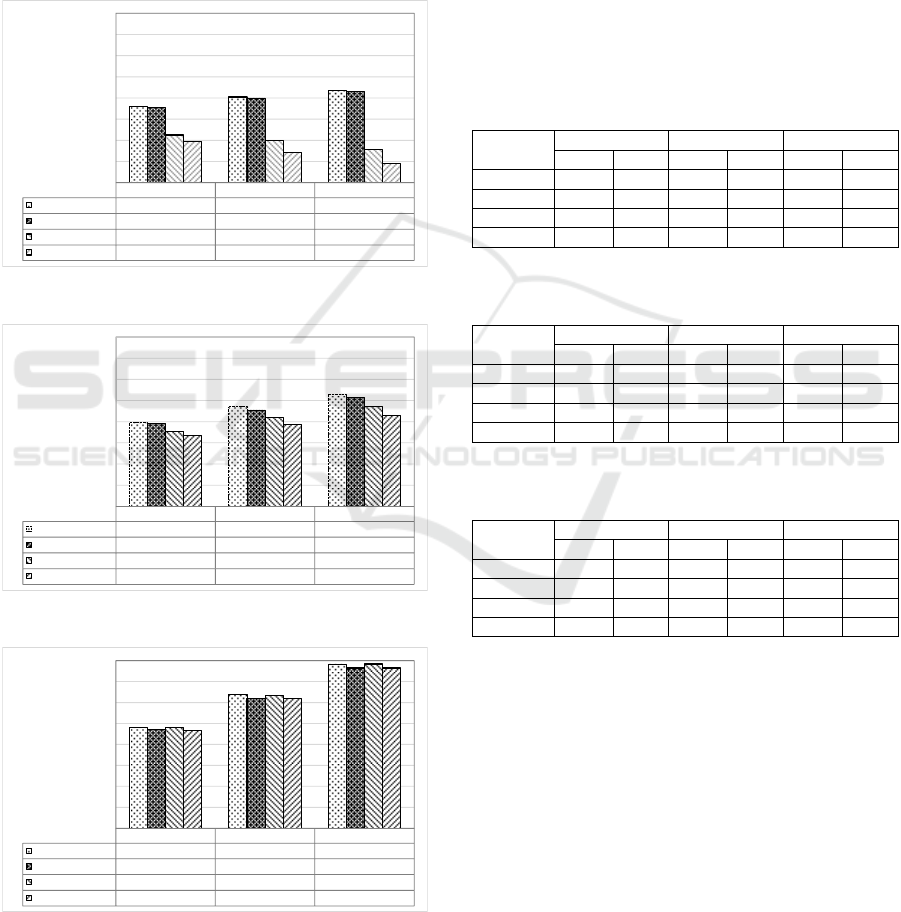

Figures 6, 7, and 8 show the expected profits of

each combination of order selectin rules and MH

allocation rules. Regarding the order selection rule,

the MHU basis rule gains larger expected profits than

the no selection rule does. For example, in Case 1.C,

the expected profit by MHU basis HEPF is 167

[MM$], and that by no selectin HEPF is 111 [MM$].

In addition, the improvement in the expected profits

by the MHU basis rule increases according to the

increase of the number of arrived orders in the project

cost estimation process. In fact, the ratio of

improvement in the expected profits by MHU basis

HEPF is about 22%, 34%, and 50% against the no

section rule, in Cases 1.A, 1.B and 1.C, respectively.

On the other hand, as shown in Figure 8, the

effects of the MHU basis rule on the expected profits

are very small in Case 3. The main reason is that in

Case 3, the expected profits of the Class 3 estimate

are close to those of the Class 2 estimate as shown in

Table 1. No selection rules allocate MH for cost

estimation evenly to all the orders and, accordingly,

increase the number of Class 3 estimates. As a result,

this rule works well only in Case 3. By contrast, the

MHU basis rules make bid/no-bid decisions based on

the threshold functions as shown in Figures 3-5, and

thus, they work effectively in all the cases.

Regarding the dispatching rules for allocating MH,

HEPF rules perform slightly better than FIFO rules.

However, they make no significant difference in the

expected profits, especially when the MHU basis rule

is used for order selection.

Tables 5, 6, and 7 show the ratio of cost estimate

class determined by the HEPF rule. The MHU basis

rule makes many Class 2 estimates compared with the

no selection rule in Cases 1 and 2. Additionally, we

observe that the number of no-bid orders is also large

in the MHU basis rule. For example, the MHU basis

rule makes no-bid decisions on 38.7% of arrived

MHU [M MH]

0.0 0.5 1.0 1.5 2.0 2.5

16

14

12

10

8

6

4

2

0

EPPC [MM$/M MH ]

(0.4, 8)

(0.8, 11)

(1.0, 15)

No-bid

area

Cost estimation area

MHU [M MH]

0.0 0.5 1.0 1.5 2.0 2.5

16

14

12

10

8

6

4

2

0

EPPC [MM$/M MH ]

(0.4, 1)

(1.0, 6)

(1.2, 16)

No-bid

area

Cost estimation area

MHU [M MH]

0.0 0.5 1.0 1.5 2.0 2.5

16

14

12

10

8

6

4

2

0

EPPC [MM$/M MH ]

(0.8, 1)

(1.2, 6)

(1.4, 16)

No-bid area

Cost estimation area

SIMULTECH 2016 - 6th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

192

orders in Case 1.A as shown in Table 5. In the case of

the MHU basis rule, the ratio of no-bid orders

increases according to the increase of number of

arrived orders in the project cost estimation process.

Namely, the ratio of no-bid orders increases as 38.7%,

50.4%, and 62.0% according to the increase of the

number of arrived orders in Case 1.A, Case 1.B, and

Case 1.C. This maintain the number of the Class 2 and

Class 3 estimates, which bring more expected profits

than the Class 4 estimate.

Figure 6: Expected profits in Case 1.

Figure 7: Expected profits in Case 2.

Figure 8: Expected profits in Case 3.

In our simulation, the average number of arrived

orders is 1465, 1827, and 2195 in Cases A, B, and C,

respectively. In Case 3, however, the ratio of cost

estimate class provided by the MHU basis rules is

very similar to that provided by no selection rules as

shown in Table 7. Since the expected profits per MH

of the Class 3 estimate is higher than that of the Class

2 estimate in Case 3, the MHU basis rule focuses MH

for cost estimation on the Class 3 estimates.

These observations confirm that our heuristic

method for the order selection works well to allocate

MH for cost estimation appropriately so that the

expected profits from orders are maximized in the

dynamic order arrival situations.

Table 5: Ratio of cost estimate class in Case 1 HEPF rule

(MHU: MHU basis, No: No selection) [%].

Case 1.A Case 1.B Case 1.C

MHU No MHU No MHU No

No-bid 38.7 0.0 50.4 0.0 62.0 0.0

Class 4 0.0 0.0 0.0 0.1 0.0 0.6

Class 3 7.6 50.1 8.5 71.9 6.2 87.0

Class 2 53.7 49.9 41.2 28.1 31.8 12.3

Table 6: Ratio of cost estimate class in Case 2 HEPF rule

(MHU: MHU basis, No: No selection) [%].

Case 1.A Case 1.B Case 1.C

MHU No MHU No MHU No

No-bid 31.8 0.0 32.7 0.0 47.4 0.0

Class 4 0.0 0.0 0.0 0.1 0.0 0.6

Class 3 13.3 50.1 28.4 71.9 21.5 87.0

Class 2 54.9 49.9 38.9 28.1 31.1 12.3

Table 7: Ratio of cost estimate class in Case 3 HEPF rule

(MHU: MHU basis, No: No selection) [%].

Case 1.A Case 1.B Case 1.C

MHU No MHU No MHU No

No-bid 0.6 0.0 0.7 0.0 0.9 0.0

Class 4 0.0 0.0 0.1 0.1 0.6 0.6

Class 3 49.4 50.1 71.3 71.9 85.5 87.0

Class 2 50.0 49.9 28.0 28.1 13.0 12.3

6 CONCLUSIONS

This paper explores the project cost estimation

process of EPC projects in the dynamic order arrival

situations. Specifically, we develop a heuristic

method that selects orders for cost estimation based

on order selection rules and allocates MH for cost

estimation to each selected order to maximize the

expected profits from orders. The order selection

rules decide bid or no-bid on arrived orders by using

the threshold function MHU

up

(EPPC

i

). This function

is defined through simulation experiments using a

project cost estimation process model proposed based

Case 1.A Case 1.B Case 1.C

MHU basis HEPF

152 161 167

MHU basisi FIFO

151 160 166

No slection HEPF

125 120 111

No selection FIFO

119 109 98

80

100

120

140

160

180

200

220

240

Expected profit [MM$/12 Periods]

Case 2.A Case 2.B Case 2.C

MHU basis HEPF

159 174 186

MHU basisi FIFO

158 171 183

No slection HEPF

151 164 174

No selection FIFO

147 157 166

80

100

120

140

160

180

200

220

240

Expected profit [MM$/12 Periods]

Case 3.A Case 3.B Case 3.C

MHU basis HEPF

176 208 237

MHU basisi FIFO

174 204 233

No slection HEPF

176 207 237

No selection FIFO

173 204 233

80

100

120

140

160

180

200

220

240

Expected profit [MM$/12 Periods]

A Dynamic Scheduling Problem in Cost Estimation Process of EPC Projects

193

on the AACE cost estimate classification system

(AACE, 2011). We analyse the effectiveness of our

heuristic method in terms of the expected profit

through numerical examples.

The following conclusions can be drawn from the

analysis of the numerical examples:

Our heuristic method developed for the order

selection works well to allocate MH for cost

estimation appropriately so that the expected

profits from orders are maximized in the dynamic

order arrival situations.

HEPF and FIFO rules, which are used to dispatch

orders waiting for cost estimation, make no

significant difference in the expected profits,

especially when the MHU basis rule is used for

order selection.

There are several issues that require further

research. For example, dispatching rules that

significantly improve the expected profit should be

developed. An advanced procedure to effectively

determine the threshold function MHU

up

(EPPC

i

)

should be devised. In addition, a mechanism that

changes rules of the order selection and MH

allocation dynamically according to the change of

cost estimation conditions, such as order arrival

intervals, order sizes, and so on, should be developed.

In practice, there are dynamic scheduling

problems similar to the project cost estimation

problem, where profitable orders are selected and the

cost estimate class is determined under the conditions

of resource availability. Such examples are sales

activities, facility maintenance activities, and so on.

In these examples, the scope of work and the quality

level of deliverables can be determined dynamically

with limited resources. Research on the project cost

estimation problem can contribute to the development

of management technologies for such problems.

ACKNOWLEDGEMENTS

This work was supported by JSPS KAKENHI Grant

Number 16K01252.

REFERENCES

AACE International, 2011. Cost estimate classification

system – As applied in Engineering, Procurement, and

Construction for the process industries. AACE

International Recommended Practice No. 18R-97.

Bertisen, J., Davis, G. A., 2008. Bias and error in mine

project capital cost estimation. The Engineering

Economist, 53, 118-139.

Humphreys, K. K., 2004. Project and cost engineers’

handbook, CRC Press, Boca Raton.

Ishii, N., Takano, Y., Muraki, M., 2014. An order

acceptance strategy under limited engineering man-

hours for cost estimation in Engineering-Procurement-

Construction projects. International Journal of Project

Management, 32 (3), 519-528.

Ishii, N., Takano, Y., Muraki, M., 2015 (a). A Heuristic

bidding price decision algorithm based on cost

estimation accuracy under limited engineering man-

hours in EPC projects. Simulation and Modeling

Methodologies, Technologies and Applications,

Advances in Intelligent Systems and Computing, 319,

101-118.

Ishii, N., Takano, Y., Muraki, M., 2015 (b). A dynamic

scheduling problem for estimating project cost.

Proceedings of Scheduling Symposium 2015, Tokyo,

119-124.

Jacobs, F. R., Berry, W. L., Whybark, C. D., Vollmann, T.

E., 2011. Manufacturing planning and control for

supply chain management, McGraw-Hill, New York.

Jørgensen, M., Halkjelsvik, T., Kitchenham, B., 2012. How

does project size affect cost estimation error? Statistical

artifacts and methodological challenges, International

Journal of Project Management, 30 (7), 839-849.

Kerzner, H., 2013. Project management: a systems

approach to planning, scheduling, and controlling,

John Wiley & Sons, New Jersey.

Nelson, B. L., Swann, J., Goldsman, D., Song, W., 2001.

Simple procedures for selecting the best simulated

system when the number of alternatives is large,

Operations Research, 49 (6), 950–963.

Oberlender, G. D., Trost, S. M., 2001. Predicting accuracy

of early cost estimates based on estimate quality.

Journal of Construction Engineering and Management,

May/June, 173-182.

Pritchard, N., Scriven, J., 2011. EPC contracts and major

projects. Sweet & Maxwell, London, 2

nd

edition.

Pritsker, A. A. B., O’Reilly, J. J., 1998. AWESIM: The

integrated simulation system. Proceedings of the 1998

Winter Simulation Conference, 249-255.

Shafahi, A., Haghani, A., 2014. Modeling contractors'

project selection and markup decisions influenced by

eminence. International Journal of Project

Management, 32 (8), 1481–1493.

Takano, Y., Ishii N., Muraki, M., 2014. A sequential

competitive bidding strategy considering inaccurate

cost estimates. OMEGA, 42 (1), 132-140.

Takano, Y., Ishii, N., Muraki, M., in press. Multi-Period

resource allocation for estimating project costs in

competitive bidding, Central European Journal of

Operations Research, doi:10.1007/s10100-016-0438-7.

Towler, G., R. Sinnott, R., 2008. Chemical engineering

design principles, practice and economics of plant and

process design, Elsevier, Amsterdam.

Uzzafer, M., 2013. A contingency estimation model for

software projects, International Journal of Project

Management, 31 (7), 981–993.

SIMULTECH 2016 - 6th International Conference on Simulation and Modeling Methodologies, Technologies and Applications

194