Stock Price Prediction based on Stock Big Data and Pattern Graph

Analysis

Seungwoo Jeon

1

, Bonghee Hong

1

, Juhyeong Kim

1

and Hyun-jik Lee

2

1

Dept. of Electrical and Computer Engineering, Pusan National University, Busan, South Korea

2

Division of Chronic disease control, Korea centers for disease control & prevention, Cheongju, South Korea

Keywords:

Stock Price Prediction, Hierarchical Clustering, Pattern Matching, Feature Selection, Artificial Neural

Network.

Abstract:

Stock price prediction is extremely difficult owing to irregularity in stock prices. Because stock price some-

times shows similar patterns and is determined by a variety of factors, we present a novel concept of finding

similar patterns in historical stock data for high-accuracy daily stock price prediction with potential rules for

simultaneously selecting the main factors that have a significant effect on the stock price. Our objective is

to propose a new complex methodology that finds the optimal historical dataset with similar patterns accord-

ing to various algorithms for each stock item and provides a more accurate prediction of daily stock price.

First, we use hierarchical clustering to easily find similar patterns in the layer adjacent to the current pattern

according to the hierarchical structure. Second, we select the determinants that are most influenced by the

stock price using feature selection. Moreover, we generate an artificial neural network model that provides

numerous opportunities for predicting the best stock price. Finally, to verify the validity of our model, we use

the root mean square error (RMSE) as a measure of prediction accuracy. The forecasting results show that the

proposed model can achieve high prediction accuracy for each stock by using this measure.

1 INTRODUCTION

Stock price provided by Koscom consists of thirty-

two items (four groups: domestic buying, domestic

selling, foreign buying, and foreign selling) such as

domestic selling high price, foreign selling opening

price, and domestic buying completion amount. Even

if stock prices have the same value, their inside com-

binations may be different. For example, domestic

selling high price may show a downturn and domes-

tic buying completion amount may show an upturn

or vice versa. Because the items are highly variable,

the objective is to predict the next stock price pattern

graph using these items, which would be very useful.

Stock market analysis and prediction are being

studied using various methods such as machine learn-

ing and text mining. Data mining studies use daily

stock data. For example, prediction studies based on

support vector machines (SVMs) (Cao and Tay, 2001;

Ince and Trafalis, 2007) have been conducted to de-

termine whether the new pattern data belongs to a

certain pattern category. In addition, artificial neu-

ral networks (ANNs) (Kimoto et al., 1990; Kohara

et al., 1997) have been employed to achieve good pre-

dictions even in the case of complex relationships of

variables, while an autoregressive integrated moving

average (ARIMA) model (Pai and Lin, 2005; Wang

and Leu, 1996) has been used to identify and predict

time series variation. On the other hand, several pre-

diction studies are based on word analysis of news

articles (Mittermayer, 2004; Nikfarjam et al., 2010;

Kim et al., 2014).

These studies predict daily stock prices using the

daily closing price, which is not sufficient to make

predictions in a short period of time (e.g., 1 hour and

30 minutes). Moreover, even though these studies

have analyzed the significance of variables and in-

creased the prediction accuracy by eliminating unim-

portant variables, the error rates of the predictions are

high owing to the use of outliers.

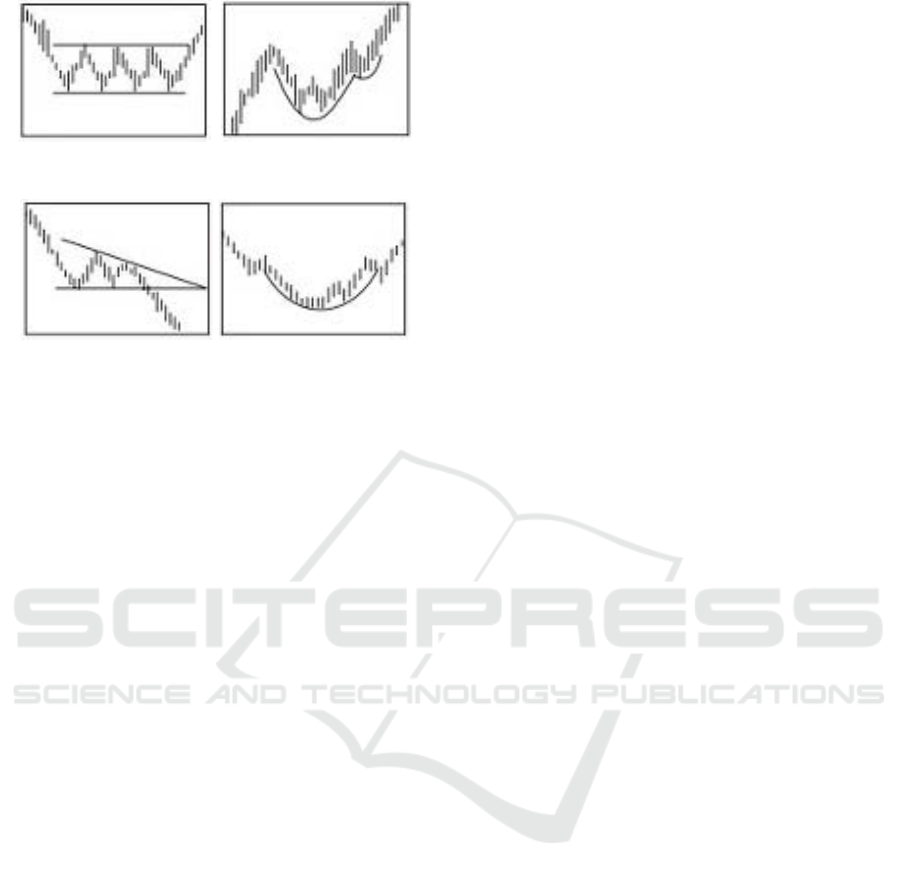

Stock price consists of several patterns such as

consolidation, cup with handle, double bottom, and

saucer, as shown in Figure 1. Because these patterns

appear repeatedly at time intervals, if we find a par-

allel pattern to the current pattern, we will be able to

predict the following pattern.

By focusing on this point, in this paper, we pro-

pose a new method for generating stock price pre-

Jeon, S., Hong, B., Kim, J. and Lee, H-j.

Stock Price Prediction based on Stock Big Data and Pattern Graph Analysis.

DOI: 10.5220/0005876102230231

In Proceedings of the International Conference on Internet of Things and Big Data (IoTBD 2016), pages 223-231

ISBN: 978-989-758-183-0

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

223

(a) Consolidation pattern. (b) Cup with handle pattern.

(c) Double bottom. (d) Saucer.

Figure 1: Various stock patterns (Bulkowski, 2011).

diction based on historical stock big data. First, un-

like existing studies that mostly use closing price data,

the present study uses tick-by-tick data for short-term

prediction and aggregates them to transform non-

continuous data into continuous data. Then, we make

some patterns similar to the current pattern by using a

hierarchical clustering algorithm and select important

features affecting the stock price by using stepwise

regression. Finally, we generate an ANN using the

data to be completed, similar patterns, and selected

features as input data for high prediction accuracy

through learning in order to derive the best results.

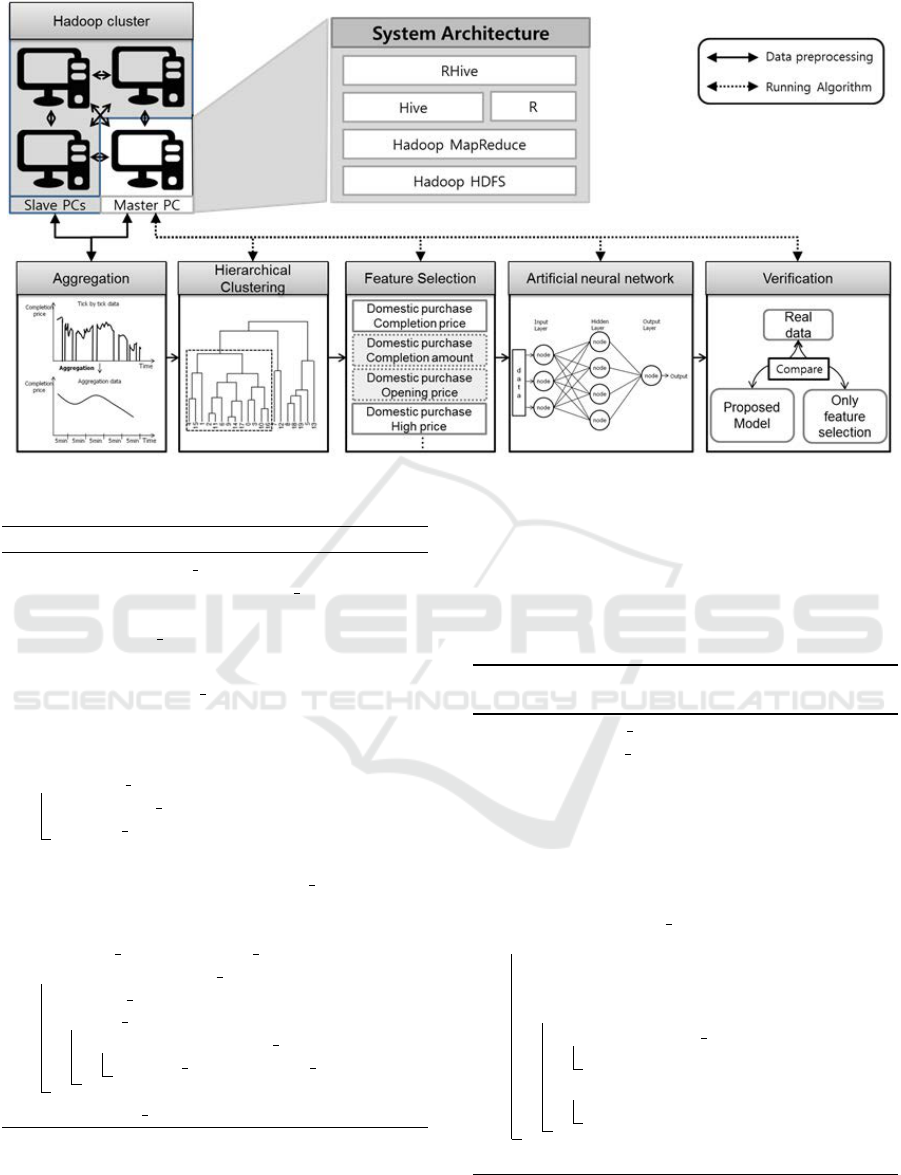

Thus, we propose a prediction system based on

big data processing (Hadoop, Hive, RHive) and anal-

ysis (R) tools for next stock price prediction. The

system consists of four connected computers and in-

cludes five steps. The first step is a preprocessing

step for transforming tick-by-tick data into aggregated

data at five-minute intervals in order to facilitate the

prediction and make daily patterns with five-minute

generation units using Hadoop and RHive query. The

second step is to find all similar patterns for one year

using hierarchical clustering provided by the R func-

tion. Then, the system repeatedly removes insignif-

icant variables through stepwise regression on the R

function. Next, the system uses an ANN to generate

the final prediction model according to numerous sim-

ulations. Finally, we verify the validity of the model

using root mean square error (RMSE) as a measure of

prediction accuracy.

The main contributions of this paper can be sum-

marized as follows.

• We generate a model for predicting stock prices

by applying an ANN through hierarchical clus-

tering for pattern searching and stepwise regres-

sion for significant/insignificant variable distinc-

tion with real tick-by-tick stock data.

• We evaluate the proposed model using RMSE,

which is widely used in stock price forecasts; low

RMSE implies high prediction accuracy.

• To generate the predicted stock price automati-

cally, we build a new system based on big data

processing open-source tools such as Hadoop and

R.

The remainder of this paper is organized as fol-

lows. Section 2 reviews various existing studies on

stock price forecasting. Section 3 presents the speci-

fication of stock data. Sections 4 and 5 describe our

new complex methodology and system architecture

for handling the overall processes. Section 6 presents

our evaluation results. Finally, Section 7 summarizes

our findings and concludes the paper with a brief dis-

cussion on the scope for future work.

2 RELATED WORK

In this section, we introduce some related studies on

various methods such as ANN, feature selection, and

text mining for stock price prediction. ANN was the

most widely used method a few decades ago. Ini-

tially, it was used by itself, and later, attempts were

gradually made to combine it with other techniques in

order to achieve higher prediction accuracy. In (Ki-

moto et al., 1990), a buying and selling timing pre-

diction system was proposed using economic indexes

(foreign exchange rates) and technical indexes (vec-

tor curves) from the Tokyo Stock Exchange Prices In-

dexes (TOPIX). In another study, an echo state net-

work was used as a novel recurrent neural network to

forecast the next closing price (Lin et al., 2009).

The following method involves feature selection

for selecting significant input attributes, and it is

based on other methods that have been widely used

in recent years. In (Huang and Tsai, 2009), a com-

bination of support vector regression (SVR) with a

self-organizing feature map (SOFM) and feature se-

lection based on filtering was proposed for predicting

the next day’s price index using Taiwan index futures

(FITX). Important features were selected using the R-

squared value as input data for SVR. In (Lee, 2009),

a prediction model was developed on the basis of an

SVM with a hybrid feature selection method for find-

ing the original input features, using NASDAQ index

direction. In contrast to the above-mentioned study,

the f-score was used as a selection factor.

However, most of these studies have some limita-

tions for short-term prediction. First, given all histor-

IoTBD 2016 - International Conference on Internet of Things and Big Data

224

Table 1: Example of stock raw data.

Attribute Value

Date

(yyyymmddhhmmsss)

20140813090024

Type 0

Completion price (won) 77,500

Completion amount 37

Opening price (won) 78,900

High price (won) 78,900

Low price (won) 76,600

Price just before (won) 77,400

Accumulated completion

amount

475,021

Accumulated completion

price (won)

36,770,000,000

ical stock data as input data, because the next closing

price is predicted without removing the outliers, the

error rate is high. Second, although the total comple-

tion price is determined by a variety of factors such as

the foreign purchase closing price and domestic sell-

ing completion amount, it is insufficient to consider

such factors. In other words, it is necessary to con-

sider a combination of significant factors.

3 DATA SPECIFICATION

In this study, stock data that was gathered over twelve

consecutive months (August 2014 to July 2015) from

the Korea Composite Stock Price Index (KOSPI) was

used as the input .

The stock data was provided by Koscom. A data

sample is listed in Table 1; it consists of the date,

type, completion price, completion amount, opening

price, high price, low price, price just before, accu-

mulated completion amount, and accumulated com-

pletion price. Because there are four types (domestic

purchase price (0), domestic selling price (1), foreign

purchase price (2), and foreign selling price (3)), the

stock price is the sum of thirty-two items. The size of

each data set was 168 GB and the data was collected

during the one-year period from August 2014 to July

2015.

4 OUTLINE OF PROPOSED

MODEL

In this section, we describe the overall process, from

data preprocessing for making continuous data, the

search for similar pattern data, and the selection of

input data to the generation of the prediction model

from the perspective of data analysis and processing.

4.1 Aggregation of Stock Data

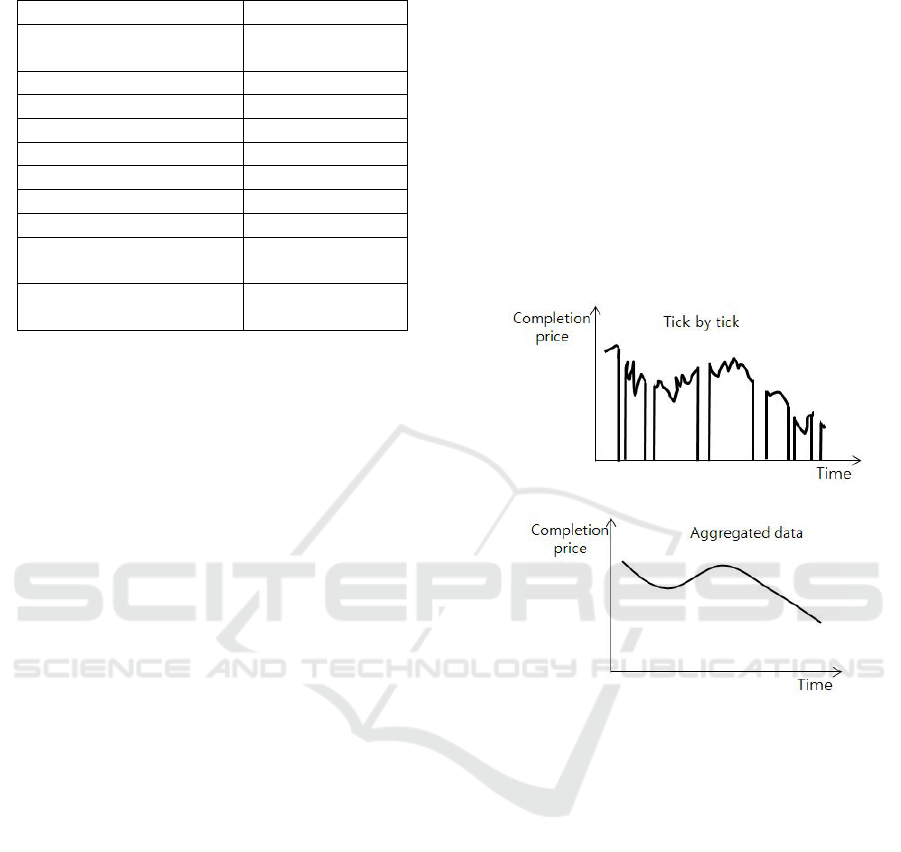

Because the tick-by-tick data we have are the data

generated per transaction, the completion price at the

time is zero if the transaction is not carried out, as

shown in Figure 2 (a). In other words, as the data

is non-continuous data, it is difficult to predict the

price. Consequently, we generate aggregated data at

five-minute intervals to obtain a continuous flow of

data, as shown in Figure 2 (b).

(a) Completion price per transaction.

(b) Completion price after aggregation.

Figure 2: The need for aggregation.

4.2 Searching for Similar Patterns

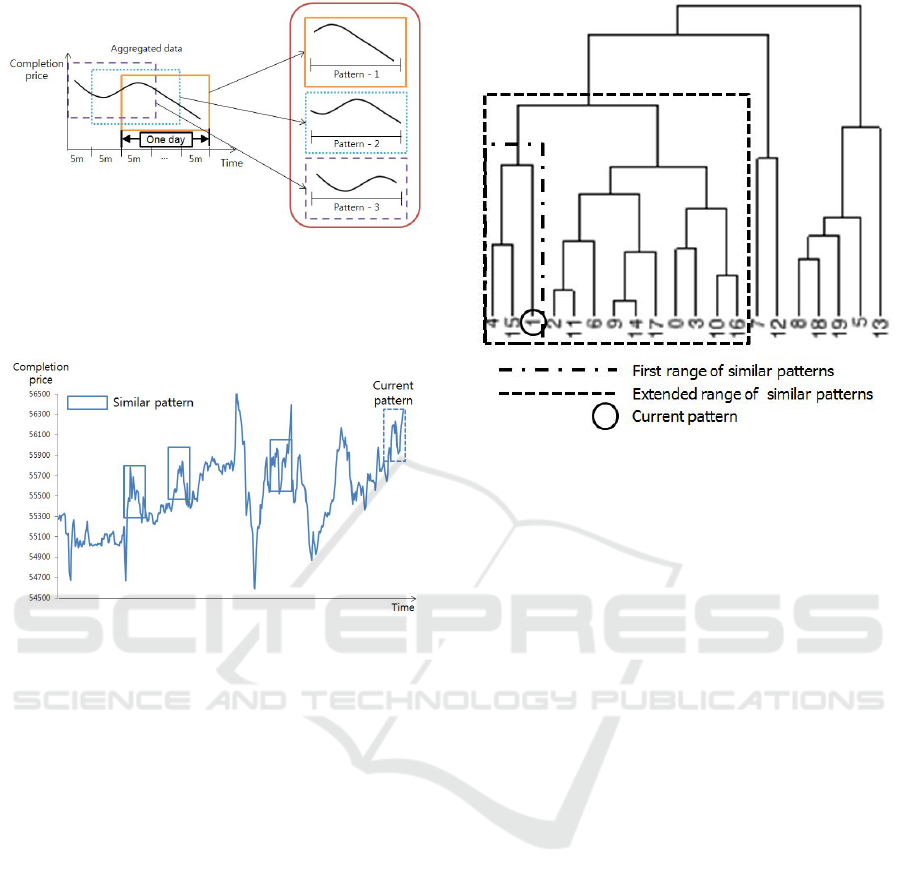

Above all, it is necessary to make patterns from ag-

gregated data for searching similar patterns. Figure 3

shows the processes of patterning the aggregated data.

The length of a pattern is one day and patterns are

generated at five-minute intervals, e.g., by the sliding

window method, for pattern matching analysis using

various patterns. The number of patterns for one hour

will be twelve.

Figure 4 shows similar patterns in the graph of

real stock price. The similar patterns can be found

by comparing historical patterns and the current pat-

tern. There are various methods for pattern match-

ing. We use a hierarchical clustering algorithm that

can find similar patterns quickly and simultaneously.

The patterns are structured by hierarchical clustering

and similar patterns are neighbor or sibling nodes of

the current pattern. If there are only a limited number

Stock Price Prediction based on Stock Big Data and Pattern Graph Analysis

225

Figure 3: Method of patterning the aggregated data.

of similar patterns, it is possible to extend the range

of the similar patterns.

Figure 4: Similar stock patterns.

Figure 5 shows a hierarchical structure based on

the clustering algorithm; the numbers denote patterns.

Given 1 as the current pattern, 4 and 15 are similar

patterns in the initial range because of the neighbor

and sibling nodes. If we do not get satisfactory results

in the next steps, the range is extended and the number

of similar patterns is eventually increased from 2 to

12.

4.3 Feature Selection According to

Stepwise Regression Analysis

Although there are significant variables affecting the

stock price among the thirty-two variables, some vari-

ables do not have a major effect on the price. To dis-

tinguish these variables, we adopt feature selection,

which is performed using a bidirectional elimination

approach in stepwise regression, as a combination of

forward and backward approaches. Each step reviews

whether already selected variables are removed owing

to a new important variable, while the new variable is

selected one by one. The procedure is conducted as

follows.

• Repeatedly add and remove a variable among all

the variables; then conduct regression analysis

Figure 5: Similar patterns defined through hierarchical

structure.

with the remainder.

• Select the final variable association with the high-

est value of R-square as the explanatory power of

the regression model.

In this work, we consider the total completion

price as a dependent variable and thirty-two variables

as independent variables in the regression analysis,

which is provided as two functions in R as shown be-

low. We use the lm function to fit a linear model,

where y is a dependent variable and x

1

–x

32

are inde-

pendent variables.

fit <- lm(y˜x1+x2+x3+...+x32, data=stock_data)

After fitting, we use the step function for deter-

mining the final independent variables; the first factor

represents the linear model and the second factor de-

termines the direction of the stepwise process, which

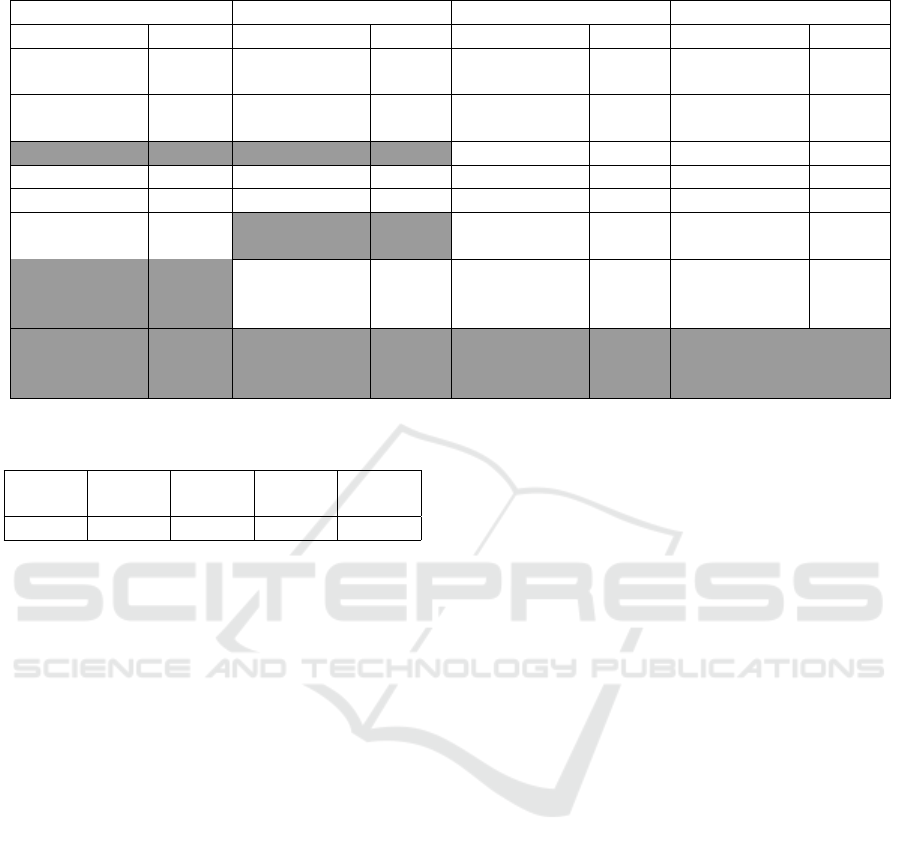

combines the forward and backward approaches. A

total of eight variables are removed after applying

stepwise regression, as can be seen in Table 2.

bidirectional <- step(fit, direction="both")

4.4 Prediction Model Generation using

Artificial Neural Network

After feature selection, to generate the predicted stock

data, we use an ANN algorithm, which is widely used

in stock price forecasts (Kuo et al., 2001; Kim and

Han, 2000; Cao et al., 2005). Moreover, it has the ad-

vantage of high prediction accuracy through learning

by iterative adjustment. The learning is performed in

IoTBD 2016 - International Conference on Internet of Things and Big Data

226

Table 2: Results of stepwise regression in real stock data of Hyundai Motor Company.

Domestic purchase price Domestic selling price Foreign purchase price Foreign selling price

Name Choice Name Choice Name Choice Name Choice

Completion

price

O

Completion

price

O

Completion

price

O

Completion

price

O

Completion

amount

O

Completion

amount

O

Completion

amount

O

Completion

amount

O

Opening price X Opening price X Opening price O Opening price O

High price O High price O High price O High price O

Low price O Low price O Low price O Low price O

Price

just before

O

Price

just before

X

Price

just before

O

Price

just before

O

Accumulated

completion

amount

X

Accumulated

completion

amount

O

Accumulated

completion

amount

O

Accumulated

completion

amount

O

Accumulated

completion

price

X

Accumulated

completion

price

X

Accumulated

completion

price

X

Accumulated

completion

price

X

Table 3: Explanatory powers according to hidden layers.

Hidden

layer 1

Hidden

layer 2

Hidden

layer 3

Hidden

layer 4

Hidden

layer 5

37.6% 95.5% 95.9% 94.2% 95.3%

one or more hidden layers. The learning rate increases

with the number of hidden layers. However, the con-

nection point between input and output could be lost

if there are too many hidden layers, and the learning

could be disturbed (Dominic et al., 1991).

We employed five hidden layers to ensure that the

system can bear the processing load and created the fi-

nal model with a hidden number that shows the high-

est explanatory power (R-squared value) by perform-

ing learning in sequence from hidden layer 1 to hid-

den layer 5 for each stock item. Table 3 summarizes

the explanatory power in each hidden layer, and the

layer with the highest value is layer 3.

5 SYSTEM ARCHITECTURE FOR

STOCK PRICE PREDICTION

This section describes the series of operations that

were implemented when generating the final artificial

neural network model. All the processes were con-

ducted on a cluster consisting of four connected com-

puters (one master and three slaves) with Hadoop and

RHive installed.

5.1 Series of Operations for Generating

Predicted Stock Data

We propose the following steps to generate a predic-

tion model for big data processing and analysis tools,

as shown in Figure 6.

Step 1 (Stock Data Aggregation and Pattern

Generation as Data Preprocessing): We stored the

one-year stock data provided by Koscom in Hadoop

distributed file systems (HDFSs) of the Hadoop-based

cluster. Because we could not manually modify the

source code of MapReduce for extracting the desired

data from each HDFS of the Hadoop cluster, we used

the RHive tool to provide HiveQL, which facilitates

the search for the desired data, e.g., through select

query of RDBMS. After the data was extracted, it was

aggregated at five-minute intervals by using R based

on the tick-by-tick data. Then, patterns were gener-

ated from them because of concatenation of similar

patterns in R of the master computer. The size of a

pattern was one day and the generation unit was five

minutes. The total number of patterns was 17,323.

Step 2 (Pattern Matching with Hierarchical

Clustering): To retrieve similar patterns with the cur-

rent pattern, we used the hclust function in R, which

offers two advantages: it can quickly autodetect sim-

ilar patterns and freely determine the range of similar

patterns simultaneously. Algorithm 1 describes the

procedure for finding similar patterns. After insert-

ing the current pattern into the aggregated patterns as

a historical dataset, clustered patterns were generated

via the hclust function. Then, similar patterns of the

same level as the current pattern could be found.

Step 3 (Feature Selection using Stepwise Re-

Stock Price Prediction based on Stock Big Data and Pattern Graph Analysis

227

Figure 6: Dependent and independent variables should be defined in stepwise regression analysis.

Algorithm 1: Algorithm for pattern matching.

input : Aggregated patterns is a list of

aggregated data, current pattern

represents the current pattern

output: similar patterns is a list of similar

patterns after clustering

1 int last = Aggregated patterns.length()-1;

2 List<Integer> level = new

ArrayList<Integer>();

3 int level = 0; foreach count in

Aggregated patterns.length() do

4 Aggregated patterns[last][count] =

current pattern[count];

5 run(’sink()’);

6 run(’hc< −hclust(dist(Aggregated patterns),

method=’ave’)’);

7 run(’sink(’out.txt’)’);

8 List result patterns = Read File(’out.txt’);

9 foreach index in result patterns.length() do

10 if result patterns[index] ==

current pattern then

11 foreach level in result patterns do

12 similar patterns = find SP(index);

13 return similar patterns;

gression): Given several similar patterns of stock

price, insignificant variables among all the variables

constituting the price were removed. Algorithm 2 de-

scribes the steps for feature selection using stepwise

regression. Before selecting the variables, the time of

similar patterns was determined, and then, variables

at the time were brought. Variables with p value be-

low a specified threshold were judged as significant

variables.

Algorithm 2: Algorithm for feature selection in step-

wise regression.

input : similar patterns represents a list of

similar patterns, variables represents a

list of all variables constituting the

price

output: remainder is a list of variables

excluding the insignificant variables

1 boolean f lag = false;

2 variables =

getVariables(similar patterns.atTime());

3 while f lag == false do

4 remainder = run(’step(variables,

direction=’both’)’);

5 foreach i in remainder.length() do

6 if remainder[i].p value > 0.05 then

7 break;

8 else

9 f lag = true;

10 return remainder;

Step 4 (Predicted Data Generation on Artificial

Neural Network): To create the predicted data, we

IoTBD 2016 - International Conference on Internet of Things and Big Data

228

used an ANN after feature selection. Algorithm 3

describes the steps for generating the predicted data

using an ANN. Among the input data, we prepared

dependent and independent variables as training data

with another time zone because we would predict the

next day of the current pattern. Specifically, given

historical time of similar pattern ht, the time of the

dependent variable is ht + 1 and the time of the inde-

pendent variable is ht. After the independent and de-

pendent variables were bound, we generated an ANN-

based model using the neuralnet function provided by

R. Then, the independent variables at the current time

t in the model were input and the predicted data were

generated.

Algorithm 3: Algorithm for generation of predicted

data.

input : tr dependent represents the total

completion price at historical time

ht + 1, tr independent represents the

remaining variables excluding the total

completion price at historical time ht,

te dependent represents the remaining

variables excluding the total

completion price at current time t

output: predicted is a dataset generated by

ANN

1 run(’training < −

cbind(tr dependent,tr independent)’);

2 run(’colnames(training) < −

c(’output’,’input’)’);

3 run(’ANN result < − neuralnet(output input,

training, hidden=1∼5,act.fct=’tanh’)’);

4 run(predicted < − ’prediction(ANN result,

te dependent)’);

5 return predicted;

Step 5 (Verification using RMSE): To verify the

validity of the proposed model, we selected RMSE

as a measure of prediction accuracy; the function was

also provided in R. The measure was computed from

comparisons between real and predicted data.

6 EVALUATION

In this section, we describe the one-year test data pro-

vided by Koscom and evaluate the accuracy of each

stock item by computing the RMSE.

6.1 Dataset and Test Scenario

To prove the effectiveness of the proposed model, we

used a real historical stock dataset consisting of var-

ious items for the one-year period from August 2014

to July 2015. To measure the prediction accuracy, we

prepared three items (Hyundai Motor Company, KIA

Motors, and Samsung Electronics) as companies rep-

resenting the Republic of Korea, with their stock data

for August 1, 2014, to July 28, 2015, as the training

data, and their stock data for July 29–31, 2015, as the

test data. As a test scenario, first, two predicted stock

data for one day were generated according to the pro-

posed model and feature selection. Then, we checked

the prediction accuracy by using the RMSE values to

compare the predicted and real stock data.

6.2 Evaluation of Prediction Accuracy

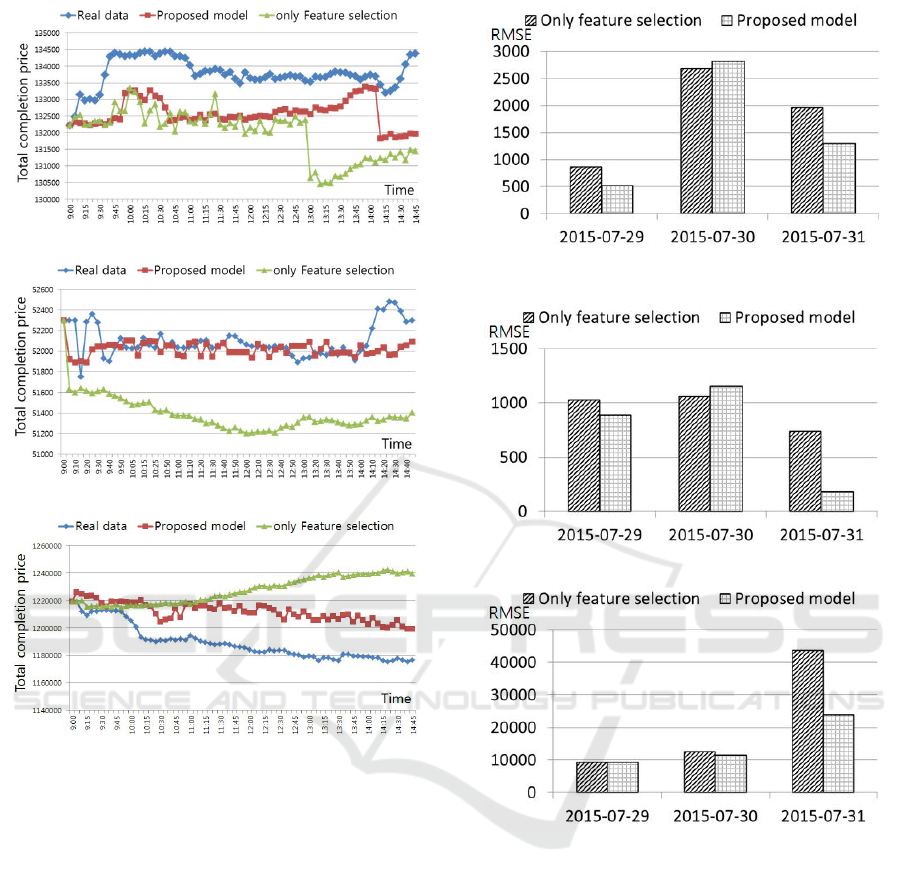

We performed experiments to compute the accuracy

of the proposed method. Figure 7 compares the actual

data and two data values predicted by the proposed

model with only feature selection for July 31, 2015.

The x-axis represents the time at five-minute intervals

and the y-axis represents the total completion price,

i.e., stock price according to the time. First, Figure 7

(a) compares the results of Hyundai Motor Company

stock; we can see that the stock movement change

of the proposed model is closer to the real stock data

than that of only feature selection. In particular, this

can be an especially clear view of the rising curve of

the morning and the declining curve of the afternoon.

Figure 7 (b) shows the stock data derived from the

real and predicted data for KIA Motors. In contrast to

Figure 7 (a), there are slight differences between the

stock movement change of the proposed model and

the real data, whereas there is no clear view of the

rising and declining curve in the graph. Lastly, Fig-

ure 7 (c) depicts the stock data derived from the real

and predicted data for Samsung Electronics. As com-

pared with only the feature selection graph, the stock

movement change of the proposed model is similarly

drawn to the real data despite a slight difference in

price.

In this study, we selected RMSE as a measure of

prediction in order to verify the validity of our model

because this measure is frequently used in the stock

domain. Figure 8 shows the experimental results of

the proposed model and only feature selection us-

ing RMSE. In Figure 8 (a) and (b), we can see that

there are good predictions except on July 30, when

the interesting aspect is the same item. For this rea-

son, we can estimate that there are variables affect-

ing the same theme, not variables that affect individ-

Stock Price Prediction based on Stock Big Data and Pattern Graph Analysis

229

(a) Comparison results for Hyundai Motor Company stock.

(b) Comparison results for KIA Motors stock.

(c) Comparison results for Samsung Electronics stock.

Figure 7: Comparison results according to the proposed

model.

ual stocks; it is necessary to make up for this point.

Unlike Figure 8 (a) and (b), Figure 8 (c) shows good

prediction for all days. In particular, it shows good

predictions on the last day in all the graphs.

7 CONCLUSIONS

In this paper, we determined that stock prices sparsely

show similar patterns and that not all the variables

have a significant impact on the price. For short-

term prediction, we proposed a novel method based

on a combination of hierarchical clustering, stepwise

regression, and ANN model in order to find similar

historical patterns for each stock item and predict the

daily stock price using optimal significant variables

through feature selection. Moreover, we dealt with

the overall process using a big data processing frame-

(a) Comparison results for Hyundai Motor Company

stock.

(b) Comparison results for KIA Motors stock.

(c) Comparison results for Samsung Electronics stock.

Figure 8: RMSE results.

work based on Hadoop and R. Finally, we demon-

strated the prediction accuracy for three stock items

using RMSE.

In the future, we plan to enhance the reliability

of our model by further investigating big and small

pattern matching and analysis. In addition, we will

develop a distributed parallel algorithm and predict all

the stock items instead of only some of them.

ACKNOWLEDGEMENTS

This work was supported by the Research Program

funded by the Korea Centers for Disease Control and

Prevention(fund code#2015-E33016-00).

IoTBD 2016 - International Conference on Internet of Things and Big Data

230

REFERENCES

Bulkowski, T. N. (2011). Encyclopedia of chart patterns,

volume 225. John Wiley & Sons.

Cao, L. and Tay, F. E. (2001). Financial forecasting using

support vector machines. Neural Computing & Appli-

cations, 10(2):184–192.

Cao, Q., Leggio, K. B., and Schniederjans, M. J. (2005).

A comparison between fama and french’s model and

artificial neural networks in predicting the chinese

stock market. Computers & Operations Research,

32(10):2499–2512.

Dominic, S., Das, R., Whitley, D., and Anderson, C. (1991).

Genetic reinforcement learning for neural networks.

In Neural Networks, 1991., IJCNN-91-Seattle Inter-

national Joint Conference on, volume 2, pages 71–76.

IEEE.

Huang, C.-L. and Tsai, C.-Y. (2009). A hybrid sofm-svr

with a filter-based feature selection for stock mar-

ket forecasting. Expert Systems with Applications,

36(2):1529–1539.

Ince, H. and Trafalis, T. B. (2007). Kernel principal com-

ponent analysis and support vector machines for stock

price prediction. IIE Transactions, 39(6):629–637.

Kim, K.-j. and Han, I. (2000). Genetic algorithms approach

to feature discretization in artificial neural networks

for the prediction of stock price index. Expert systems

with Applications, 19(2):125–132.

Kim, Y., Jeong, S. R., and Ghani, I. (2014). Text opinion

mining to analyze news for stock market prediction.

Int. J. Advance. Soft Comput. Appl, 6(1).

Kimoto, T., Asakawa, K., Yoda, M., and Takeoka, M.

(1990). Stock market prediction system with modu-

lar neural networks. In Neural Networks, 1990., 1990

IJCNN International Joint Conference on, pages 1–6.

IEEE.

Kohara, K., Ishikawa, T., Fukuhara, Y., and Nakamura, Y.

(1997). Stock price prediction using prior knowledge

and neural networks. Intelligent systems in account-

ing, finance and management, 6(1):11–22.

Kuo, R. J., Chen, C., and Hwang, Y. (2001). An intelligent

stock trading decision support system through integra-

tion of genetic algorithm based fuzzy neural network

and artificial neural network. Fuzzy sets and systems,

118(1):21–45.

Lee, M.-C. (2009). Using support vector machine with a hy-

brid feature selection method to the stock trend predic-

tion. Expert Systems with Applications, 36(8):10896–

10904.

Lin, X., Yang, Z., and Song, Y. (2009). Short-term stock

price prediction based on echo state networks. Expert

systems with applications, 36(3):7313–7317.

Mittermayer, M.-A. (2004). Forecasting intraday stock

price trends with text mining techniques. In Sys-

tem Sciences, 2004. Proceedings of the 37th Annual

Hawaii International Conference on, pages 10–pp.

IEEE.

Nikfarjam, A., Emadzadeh, E., and Muthaiyah, S. (2010).

Text mining approaches for stock market prediction.

In Computer and Automation Engineering (ICCAE),

2010 The 2nd International Conference on, volume 4,

pages 256–260. IEEE.

Pai, P.-F. and Lin, C.-S. (2005). A hybrid arima and sup-

port vector machines model in stock price forecasting.

Omega, 33(6):497–505.

Wang, J.-H. and Leu, J.-Y. (1996). Stock market trend pre-

diction using arima-based neural networks. In Neural

Networks, 1996., IEEE International Conference on,

volume 4, pages 2160–2165. IEEE.

Stock Price Prediction based on Stock Big Data and Pattern Graph Analysis

231